Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FLAGSTAR BANCORP INC | exhibit991pressrelease2018.htm |

| EX-2.1 - EXHIBIT 2.1 - FLAGSTAR BANCORP INC | exhibit21purchaseandassump.htm |

| 8-K - 8-K - FLAGSTAR BANCORP INC | a8-kcurrentreport20180605.htm |

Flagstar Bancorp, Inc. (NYSE: FBC) Acquisition of Wells Fargo Branches June 5, 2018

Forward-looking statements This presentation contains forward-looking statements, in particular with respect to the proposed branch acquisition, within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of Flagstar Bancorp, Inc.’s management and are subject to significant risks and uncertainties, including risks and uncertainties relating to the acquired branches, completion of the transaction, regulatory approval for the transaction and integration of the acquired branches and related operations. The Company's actual results could differ materially from those described in the forward- looking statements depending upon various factors as described in periodic Flagstar reports filed with the U.S. Securities and Exchange Commission, which are available on the Company’s website (flagstar.com) and on the Securities and Exchange Commission's website (sec.gov). Other than as required under United States securities laws, Flagstar Bancorp does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward- looking statements. 2

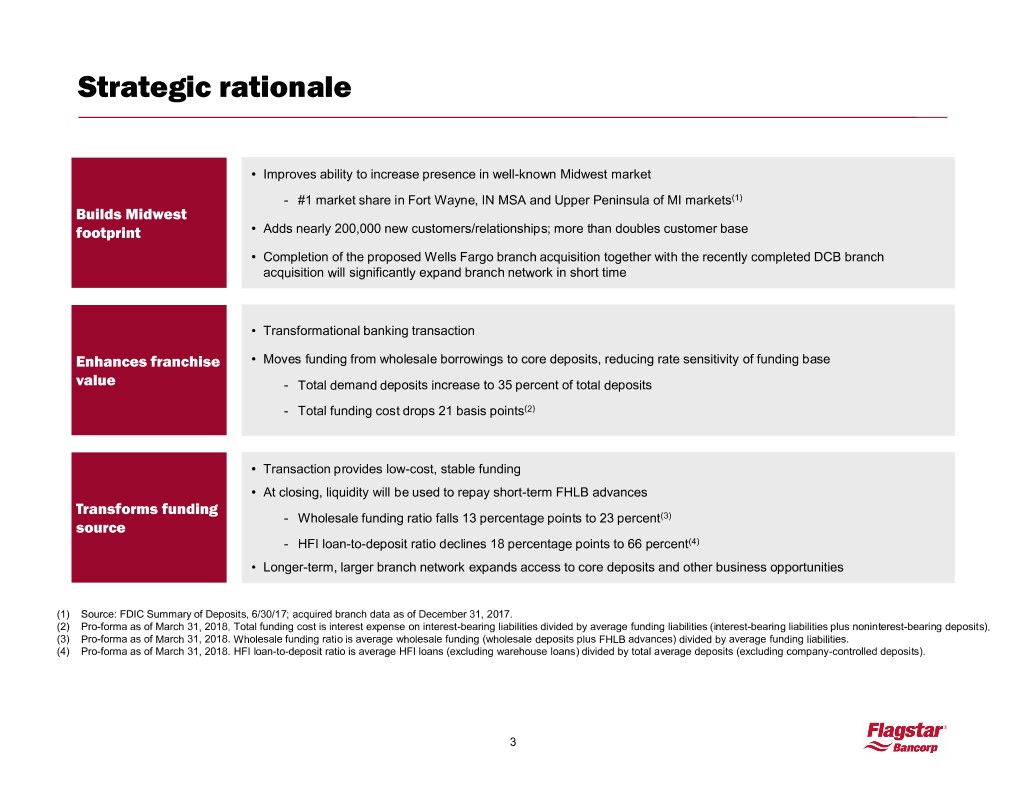

Strategic rationale • Improves ability to increase presence in well-known Midwest market - #1 market share in Fort Wayne, IN MSA and Upper Peninsula of MI markets(1) Builds Midwest footprint • Adds nearly 200,000 new customers/relationships; more than doubles customer base • Completion of the proposed Wells Fargo branch acquisition together with the recently completed DCB branch acquisition will significantly expand branch network in short time • Transformational banking transaction Enhances franchise • Moves funding from wholesale borrowings to core deposits, reducing rate sensitivity of funding base value - Total demand deposits increase to 35 percent of total deposits - Total funding cost drops 21 basis points(2) • Transaction provides low-cost, stable funding • At closing, liquidity will be used to repay short-term FHLB advances Transforms funding - Wholesale funding ratio falls 13 percentage points to 23 percent(3) source - HFI loan-to-deposit ratio declines 18 percentage points to 66 percent(4) • Longer-term, larger branch network expands access to core deposits and other business opportunities (1) Source: FDIC Summary of Deposits, 6/30/17; acquired branch data as of December 31, 2017. (2) Pro-forma as of March 31, 2018. Total funding cost is interest expense on interest-bearing liabilities divided by average funding liabilities (interest-bearing liabilities plus noninterest-bearing deposits). (3) Pro-forma as of March 31, 2018. Wholesale funding ratio is average wholesale funding (wholesale deposits plus FHLB advances) divided by average funding liabilities. (4) Pro-forma as of March 31, 2018. HFI loan-to-deposit ratio is average HFI loans (excluding warehouse loans) divided by total average deposits (excluding company-controlled deposits). 3

Transaction overview • Flagstar is acquiring 52 branches located in Indiana, Michigan, Wisconsin and Ohio from Wells Fargo - Approximately $2.3 billion of deposits at an average cost of 0.04%(1) Transaction - 66% of deposits are located in IN (33 branches); 26 branches in Fort Wayne, IN (#1 market share) summary - 27% are located in the Upper Peninsula of MI (14 branches); #1 market share - 7% are located in WI (4 branches) and OH (1 branch) - Approximately $130 million of loans(1) • Effective deposit premium of approximately 7 percent based on balances as of December 31, 2017 Financial • Expected to be moderately accretive to earnings per share in 2019 consideration • Tangible book value payback period of significantly less than 5 years • Conducted comprehensive due diligence • Transaction is subject to regulatory approval; closing is expected in early fourth quarter 2018 Other considerations • Will keep all branches and retain all employees • Target an 8 - 9 percent Tier 1 leverage ratio at close; any capital needed is expected to be met through a combination of earnings retention and balance sheet management (1) As of December 31, 2017. 4

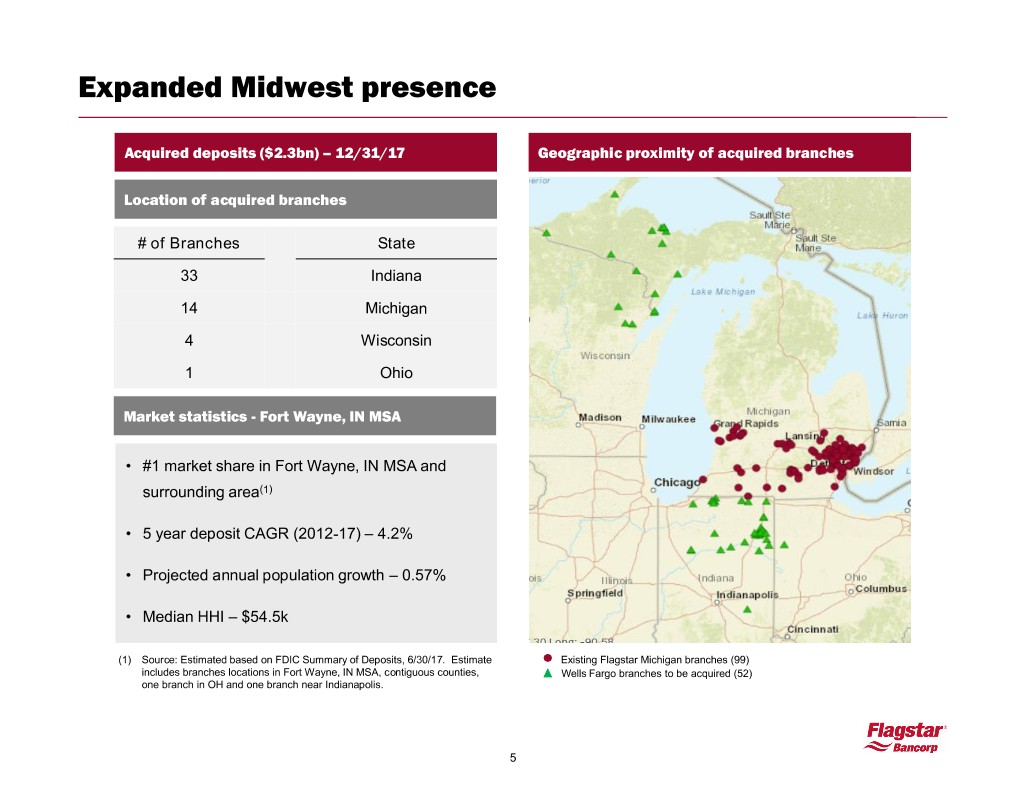

Expanded Midwest presence Acquired deposits ($2.3bn) – 12/31/17 Geographic proximity of acquired branches Location of acquired branches # of Branches State 33 Indiana 14 Michigan 4 Wisconsin 1 Ohio Market statistics - Fort Wayne, IN MSA • #1 market share in Fort Wayne, IN MSA and surrounding area(1) • 5 year deposit CAGR (2012-17) – 4.2% • Projected annual population growth – 0.57% • Median HHI – $54.5k (1) Source: Estimated based on FDIC Summary of Deposits, 6/30/17. Estimate Existing Flagstar Michigan branches (99) includes branches locations in Fort Wayne, IN MSA, contiguous counties, Wells Fargo branches to be acquired (52) one branch in OH and one branch near Indianapolis. 5

Improved deposit mix Pro forma total deposits ($mm) Interest-bearing Interest-bearing demand demand 8% 12% Interest- bearing demand Noninterest- Savings / 25% Savings / Noninterest- Savings / bearing MMDA MMDA bearing MMDA 24% 45% 49% 23% 45% Noninterest- bearing Certificates 20% Certificates of deposit of deposit 23% 20% Certificates of deposit 6% Flagstar(1) Wells Fargo(2) Pro forma $ bps $ bps $ bps Noninterest-bearing(3) $2,213 0.00% $454 0.00% $2,667 0.00% Interest-bearing demand 789 0.35% 565 0.03% 1,354 0.22% Savings / MMDA 4,178 0.83% 1,134 0.04% 5,312 0.66% Certificates of deposit(4) 2,191 1.44% 128 0.26% 2,319 1.37% (5) Total deposits $9,371 0.73% $2,280 0.04% $11,651 0.60% (1) Average balances for the quarter ended March 31, 2018. (2) Acquired branch data as of December 31, 2017. (3) Includes noninterest-bearing company-controlled deposits from mortgage servicing business. (4) Includes wholesale deposits. (5) Full impact of Desert Community Bank branch acquisition would reduce total pro forma deposit cost by 2 bps to 0.58%. 6

Appendix

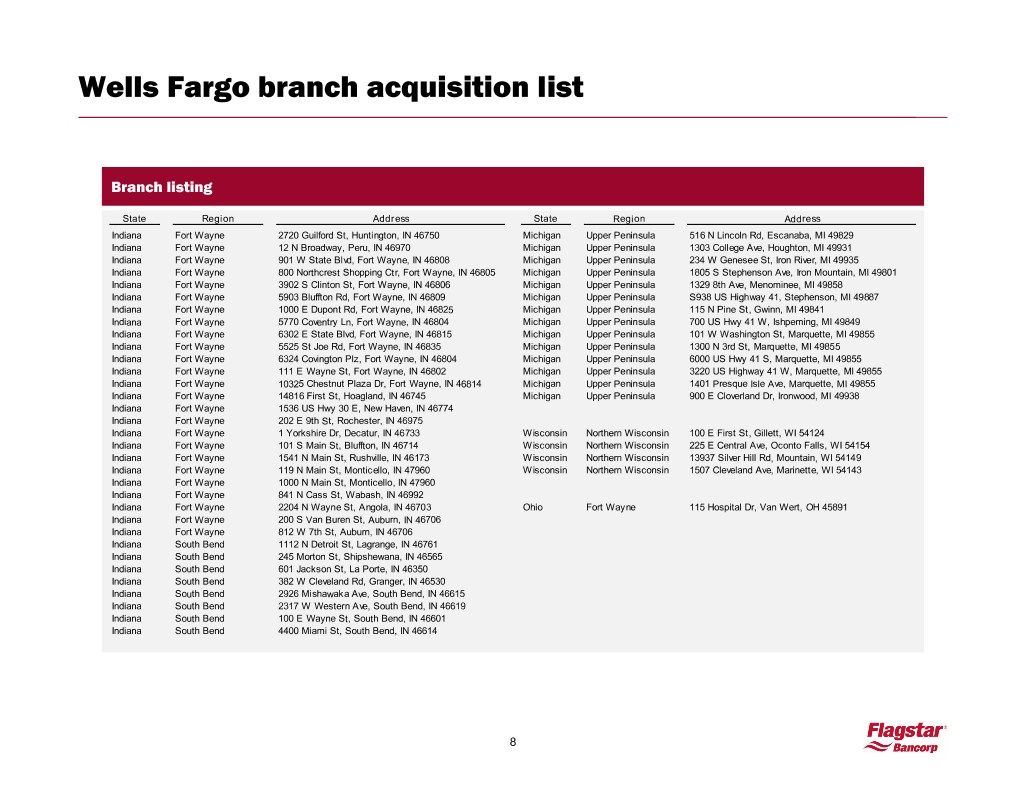

Wells Fargo branch acquisition list Branch listing State Region Address State Region Address Indiana Fort Wayne 2720 Guilford St, Huntington, IN 46750 Michigan Upper Peninsula 516 N Lincoln Rd, Escanaba, MI 49829 Indiana Fort Wayne 12 N Broadway, Peru, IN 46970 Michigan Upper Peninsula 1303 College Ave, Houghton, MI 49931 Indiana Fort Wayne 901 W State Blvd, Fort Wayne, IN 46808 Michigan Upper Peninsula 234 W Genesee St, Iron River, MI 49935 Indiana Fort Wayne 800 Northcrest Shopping Ctr, Fort Wayne, IN 46805 Michigan Upper Peninsula 1805 S Stephenson Ave, Iron Mountain, MI 49801 Indiana Fort Wayne 3902 S Clinton St, Fort Wayne, IN 46806 Michigan Upper Peninsula 1329 8th Ave, Menominee, MI 49858 Indiana Fort Wayne 5903 Bluffton Rd, Fort Wayne, IN 46809 Michigan Upper Peninsula S938 US Highway 41, Stephenson, MI 49887 Indiana Fort Wayne 1000 E Dupont Rd, Fort Wayne, IN 46825 Michigan Upper Peninsula 115 N Pine St, Gwinn, MI 49841 Indiana Fort Wayne 5770 Coventry Ln, Fort Wayne, IN 46804 Michigan Upper Peninsula 700 US Hwy 41 W, Ishpeming, MI 49849 Indiana Fort Wayne 6302 E State Blvd, Fort Wayne, IN 46815 Michigan Upper Peninsula 101 W Washington St, Marquette, MI 49855 Indiana Fort Wayne 5525 St Joe Rd, Fort Wayne, IN 46835 Michigan Upper Peninsula 1300 N 3rd St, Marquette, MI 49855 Indiana Fort Wayne 6324 Covington Plz, Fort Wayne, IN 46804 Michigan Upper Peninsula 6000 US Hwy 41 S, Marquette, MI 49855 Indiana Fort Wayne 111 E Wayne St, Fort Wayne, IN 46802 Michigan Upper Peninsula 3220 US Highway 41 W, Marquette, MI 49855 Indiana Fort Wayne 10325 Chestnut Plaza Dr, Fort Wayne, IN 46814 Michigan Upper Peninsula 1401 Presque Isle Ave, Marquette, MI 49855 Indiana Fort Wayne 14816 First St, Hoagland, IN 46745 Michigan Upper Peninsula 900 E Cloverland Dr, Ironwood, MI 49938 Indiana Fort Wayne 1536 US Hwy 30 E, New Haven, IN 46774 Indiana Fort Wayne 202 E 9th St, Rochester, IN 46975 Indiana Fort Wayne 1 Yorkshire Dr, Decatur, IN 46733 Wisconsin Northern Wisconsin 100 E First St, Gillett, WI 54124 Indiana Fort Wayne 101 S Main St, Bluffton, IN 46714 Wisconsin Northern Wisconsin 225 E Central Ave, Oconto Falls, WI 54154 Indiana Fort Wayne 1541 N Main St, Rushville, IN 46173 Wisconsin Northern Wisconsin 13937 Silver Hill Rd, Mountain, WI 54149 Indiana Fort Wayne 119 N Main St, Monticello, IN 47960 Wisconsin Northern Wisconsin 1507 Cleveland Ave, Marinette, WI 54143 Indiana Fort Wayne 1000 N Main St, Monticello, IN 47960 Indiana Fort Wayne 841 N Cass St, Wabash, IN 46992 Indiana Fort Wayne 2204 N Wayne St, Angola, IN 46703 Ohio Fort Wayne 115 Hospital Dr, Van Wert, OH 45891 Indiana Fort Wayne 200 S Van Buren St, Auburn, IN 46706 Indiana Fort Wayne 812 W 7th St, Auburn, IN 46706 Indiana South Bend 1112 N Detroit St, Lagrange, IN 46761 Indiana South Bend 245 Morton St, Shipshewana, IN 46565 Indiana South Bend 601 Jackson St, La Porte, IN 46350 Indiana South Bend 382 W Cleveland Rd, Granger, IN 46530 Indiana South Bend 2926 Mishawaka Ave, South Bend, IN 46615 Indiana South Bend 2317 W Western Ave, South Bend, IN 46619 Indiana South Bend 100 E Wayne St, South Bend, IN 46601 Indiana South Bend 4400 Miami St, South Bend, IN 46614 8