Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 6/4/2018 - KITE REALTY GROUP TRUST | form8-k642018.htm |

THE KITE WAY PORTFOLIO FACTS • High-quality portfolio with Number of Properties 115 June 2018 diverse tenant base Total GLA (SF) 22.5mm INVESTOR UPDATE Total Retail Operating 94.6% • Self-funded redevelopment, Portfolio Leased repurpose, and reposition Percent Leased Anchors 96.6% Percent Leased Shops ("3-R") programŸ 90.5% Annualized Base Rent (ABR) Per SF, Including 3-R $16.57 • Investment grade, flexible Properties1 COMPANY balance sheet gives access Average Center Size (SF) ~200,000 SNAPSHOT to capital markets Dividend Yield„ 8.2% FFO Payout 62.5% Necessity-Driven Moody's / S&P Ratings Baa3 / BBB- Open-Air • Well-covered dividend with Shopping attractive yield ANNUAL DIVIDEND PER SHARE€ Centers $1.23 • Experienced Leasing and Asset Management teams $1.17 focused on operational excellence $1.09 $1.04 27.6 % GROWTH $0.96 2013 2014 2015 2016 2017 Note: Unless otherwise indicated, the source of all Company data is publicly available information that has been filed with the Securities and Exchange Commission as of March 31, 2018. (1) 3-R Properties are assets that are in the process of being developed, repositioned, or repurposed, as described in our Quarterly Financial Supplement. (2) Dividend yield calculated as most recent quarterly dividend, annualized and expressed as a percentage of the share price. Future dividends will be declared solely at the discretion of the Board of Trustees. (3) Dividend rounded to two decimals. 2

BUILDING VALUE AND CRITICAL MASS AROUND REGIONAL FOOTPRINTS June 2018 of ABR derived from top 50 MSAs INVESTOR UPDATE % 76 and destination locations’ 93% of tenants are internet resistant / multi-channel of ABR derived from community centers / HIGH-QUALITY % neighborhood centers / lifestyle centers PORTFOLIO 81 Focused on adding experiential tenants consisting of food, fitness, entertainment, and service CORE STRATEGY of additional cash NOI from in-process mm 3-R and transitional projects Gearing Up $5.2 average annual same-property NOI growth OPERATIONS % Shareholder Value over the last four years„ AND GROWTH 3.2 the Kite Way OPPORTUNITIES % annualized return on completed Q1'18 11.5 3-R project Top-tier operating e˜ciency metrics $48.7mm in debt maturities through 2020 INVESTMENT % GRADE 11 floating rate debt exposure BALANCE SHEET 3.4x debt service coverage Recast line of credit to extend maturity to April 2023, increase capacity, and improve terms (1) Destination locations include Naples, FL properties and college markets. (2) Historical numbers adjusted to include bad debt expense. 3

HIGH-QUALITY STRATEGIC PORTFOLIO Disposition Efforts Strengthen Portfolio DISPOSITIONS $155 MILLION IN DISPOSITIONS OVER THE LAST SIX QUARTERS IMPROVED ABR IMPROVED HOUSEHOLD INCOME IMPROVED POPULATION DENSITY $89,206 167,479 $16.57 $64,430 114,530 $11.78 DISPOSITIONS KRG Q1’18 OPERATING DISPOSITIONS KRG Q1’18 OPERATING DISPOSITIONS KRG Q1’18 OPERATING RETAIL PORTFOLIO RETAIL PORTFOLIO RETAIL PORTFOLIO Note: Demographic data source: STI: Popstats based on estimated 2017 data on a 5-mile radius from the US Census Bureau. Dispositions during this period were Publix at St. Cloud, Cove Center, Clay Marketplace, The Shops at Village Walk, Wheatland Town Crossing, Trussville Promenade I & II, and Memorial Commons. 4

HIGH-QUALITY GEOGRAPHIC Focus on Portfolio Optimization PORTFOLIO DIVERSITY 76% OF ABR FROM TOP 50 MSAs AND DESTINATION LOCATIONS, INCLUDING ASSETS IN SUPERIORLY-POSITIONED MARKETS NEW YORK AVERAGE PROJECTED HOUSEHOLD INCOME: POPULATION GROWTH: $143,700 1.6% INDIANAPOLIS AVERAGE PROJECTED HOUSEHOLD INCOME: POPULATION GROWTH: $97,700 6.0% CHARLOTTE/RALEIGH AVERAGE PROJECTED LAS VEGAS HOUSEHOLD INCOME: POPULATION GROWTH: AVERAGE PROJECTED $102,400 13.9% HOUSEHOLD INCOME: POPULATION GROWTH: $74,600 6.9% NAPLES AVERAGE PROJECTED HOUSEHOLD INCOME: POPULATION GROWTH: DALLAS/ $95,900 11.0% NATIONAL AVERAGE FORT WORTH/ AVERAGE PROJECTED HOUSTON HOUSEHOLD INCOME: POPULATION GROWTH: AVERAGE PROJECTED $77,500 4.0% HOUSEHOLD INCOME: POPULATION GROWTH: $97,800 7.6% Note: Demographic data source: STI: Popstats based on estimated 2017 data on a 5-mile radius from the US Census Bureau, weighted by ABR. (1) Projected Population Growth 2017-2022. 5

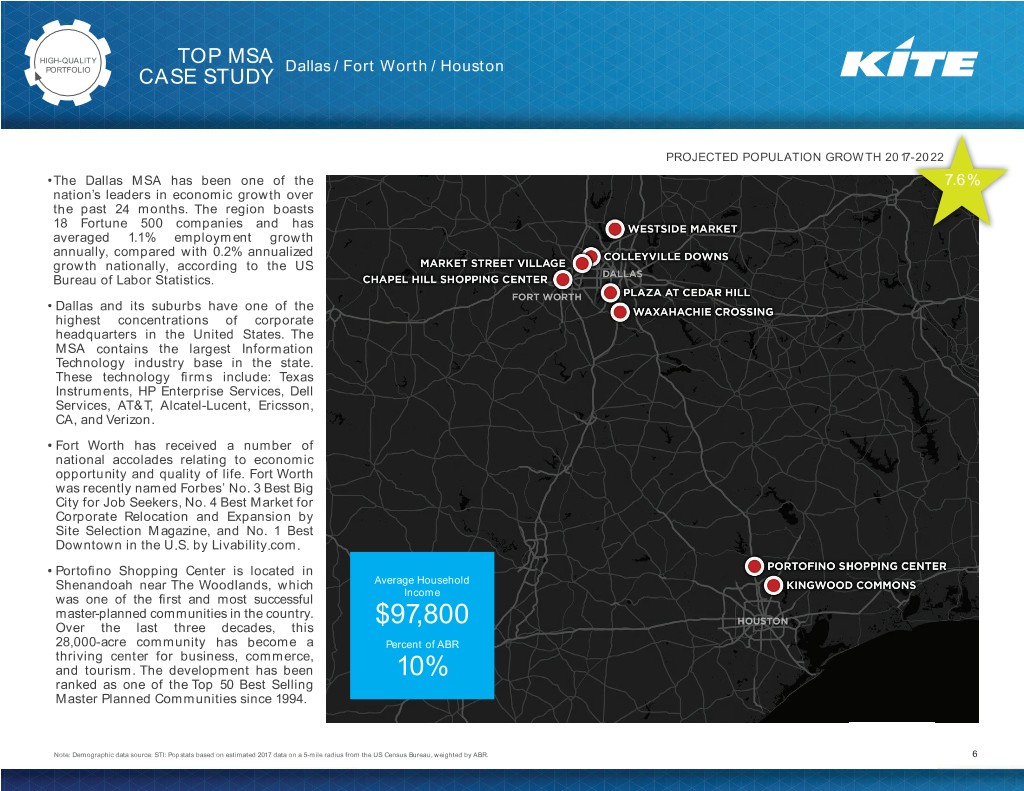

HIGH-QUALITY TOP MSA Dallas / Fort Worth / Houston PORTFOLIO CASE STUDY PROJECTED POPULATION GROWTH 2017-2022 • The Dallas MSA has been one of the 7.6% nation’s leaders in economic growth over the past 24 months. The region boasts 18 Fortune 500 companies and has averaged 1.1% employment growth annually, compared with 0.2% annualized growth nationally, according to the US Bureau of Labor Statistics. • Dallas and its suburbs have one of the highest concentrations of corporate headquarters in the United States. The MSA contains the largest Information Technology industry base in the state. These technology firms include: Texas Instruments, HP Enterprise Services, Dell Services, AT&T, Alcatel-Lucent, Ericsson, CA, and Verizon. • Fort Worth has received a number of national accolades relating to economic opportunity and quality of life. Fort Worth was recently named Forbes’ No. 3 Best Big City for Job Seekers, No. 4 Best Market for Corporate Relocation and Expansion by Site Selection Magazine, and No. 1 Best Downtown in the U.S. by Livability.com. • Portofino Shopping Center is located in Shenandoah near The Woodlands, which Average Household Income was one of the first and most successful master-planned communities in the country. Over the last three decades, this $97,800 28,000-acre community has become a Percent of ABR thriving center for business, commerce, and tourism. The development has been 10% ranked as one of the Top 50 Best Selling Master Planned Communities since 1994. Note: Demographic data source: STI: Popstats based on estimated 2017 data on a 5-mile radius from the US Census Bureau, weighted by ABR. 6

HIGH-QUALITY TOP MSA Indianapolis / Northern Suburbs PORTFOLIO CASE STUDY PROJECTED POPULATION GROWTH 2017-2022 • Hamilton County, the state’s fastest 6.0% growing and most affluent metropolitan area, is nationally recognized for its exceptional standard of living. The county has distinguished itself through its considerable investments in public infrastructure, outstanding public schools, and ability to attract high-growth industries and highly educated professionals to the area. • In 2017, Money Magazine ranked Fishers the No. 1 Best Place to Live in the country, while Carmel was ranked at No. 16. The financial publication cited the area’s low unemployment and high eco- nomic growth as critical factors in their selection. • Hamilton County's population has grown at an annualized rate of more than 2.3% since 2010 – 3x the national average. • Residents of Hamilton County have the highest education levels in the state, with 56% of all adult residents having a bachelor’s degree or higher and 78% of the county’s population employed in white-collar industries. Average Household Income $97,700 Percent of ABR 9% Note: Demographic data source: STI: Popstats based on estimated 2017 data on a 5-mile radius from the US Census Bureau, weighted by ABR. 7

HIGH-QUALITY TOP MSA Las Vegas PORTFOLIO CASE STUDY PROJECTED POPULATION GROWTH 2017-2022 • The city of Las Vegas has experienced a 6.9% 73% increase in growth over the last 10 years, bringing its current population to approximately 633,000. • According to the US Census Bureau, Las Vegas is the nation’s 14th fastest growing metro area by population, and 25th fastest growing area by percentage growth. • Clark County ranks 2nd in the country in population growth, according to the US Census Bureau. From July 2016 to July 2017, Clark County added 47,355 new residents, a 2.2% annual increase. • Las Vegas is currently experiencing the most significant expansion of single- family housing construction since the Great Recession of 2007. Metrostudy estimates that annual new home starts increased 15% last year and that the average price for a single-family home is now $455,000, a 7% year-over-year increase. Average Household Income $74,600 Percent of ABR 9% Note: Demographic data source: STI: Popstats based on estimated 2017 data on a 5-mile radius from the US Census Bureau, weighted by ABR. 8

HIGH-QUALITY TOP MSA Naples PORTFOLIO CASE STUDY PROJECTED POPULATION GROWTH 2017-2022 • Naples recently witnessed a surge in 11.0% tourist activity. Collier County reported a 2.4% increase in tourism in 2017, with nearly 3 million people visiting the beach-side destination annually. Tourism contributes more than $1.5 billion to the local economy every year. • The Naples MSA encompasses all of Collier County and includes the cities of Naples, Immokalee, and Marco Island. The Naples MSA is in the 93rd percentile of growth nationally. This ranks it ahead of much larger Florida MSAs, including Jacksonville and Miami, and just behind Orlando. • Collier County consistently ranks as one of the most affluent counties in Florida. Its average household income is 2nd highest in the state, 39% higher than the state average. Likewise, Collier County has the 3rd highest percentage of households earning more than $75,000 annually, at 41.6%, which is higher than Palm Beach County. Average Household Income $95,900 Percent of ABR 4% Note: Demographic data source: STI: Popstats based on estimated 2017 data on a 5-mile radius from the US Census Bureau, weighted by ABR. 9

HIGH-QUALITY TOP MSA Raleigh / Cary / Charlotte PORTFOLIO CASE STUDY PROJECTED POPULATION GROWTH 2017-2022 • Raleigh was ranked No. 4 on the Realtor. 13.9% com list of “Next Top Tech Cities” and No. 3 on USA Today’s list of “Best Cities for Job Seekers” in 2017. Both lists analyzed a number of critical factors, including job market favorability, salaries weighted for cost-of-living, and other lifestyle factors. • Raleigh ranks No. 15 among large metros for the percentage of adults with a bachelor’s degree or higher, according to the U.S. Census Bureau’s American Community Survey. • The Raleigh-Cary MSA is the 5th most educated metropolitan area in the country based on bachelor and higher graduation attainment rates. 43.6% of adults have at least a bachelor’s degree, while the average nationwide is just 31.3%. • 60% of households in the city of Cary earn incomes exceeding $75,000 per year. • Charlotte is the nation’s 3rd largest financial center behind New York and San Francisco. There are six Fortune 500 companies head- quartered in Mecklenburg County, including Bank of America, Lowe’s, and Duke Energy. • Mecklenburg County is the most populated county in North Carolina. Charlotte’s ability Average Household to attract large international corporations Income has caused steady growth in the number of highly- educated white-collar workers in $102,400 the county over recent years. Mecklenburg County has the second highest rate of both Percent of ABR educational attainment and white-collar employment in North Carolina. 9% Note: Demographic data source: STI: Popstats based on estimated 2017 data on a 5-mile radius from the US Census Bureau, weighted by ABR. 10

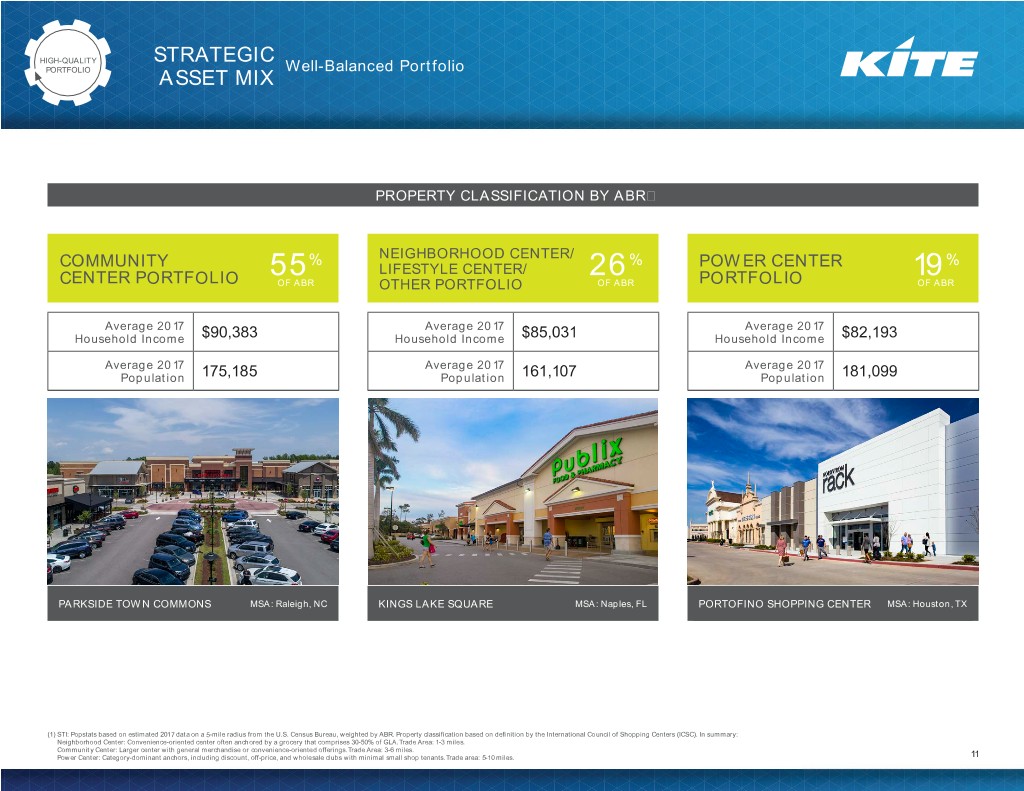

HIGH-QUALITY STRATEGIC Well-Balanced Portfolio PORTFOLIO ASSET MIX PROPERTY CLASSIFICATION BY ABRŸ COMMUNITY % NEIGHBORHOOD CENTER/ % POWER CENTER % 55 LIFESTYLE CENTER/ 26 19 CENTER PORTFOLIO OF ABR OTHER PORTFOLIO OF ABR PORTFOLIO OF ABR Average 2017 Average 2017 Average 2017 Household Income $90,383 Household Income $85,031 Household Income $82,193 Average 2017 Average 2017 Average 2017 Population 175,185 Population 161,107 Population 181,099 PARKSIDE TOWN COMMONS MSA: Raleigh, NC KINGS LAKE SQUARE MSA: Naples, FL PORTOFINO SHOPPING CENTER MSA: Houston, TX (1) STI: Popstats based on estimated 2017 data on a 5-mile radius from the U.S. Census Bureau, weighted by ABR. Property classification based on definition by the International Council of Shopping Centers (ICSC). In summary: Neighborhood Center: Convenience-oriented center often anchored by a grocery that comprises 30-50% of GLA. Trade Area: 1-3 miles. Community Center: Larger center with general merchandise or convenience-oriented offerings. Trade Area: 3-6 miles. Power Center: Category-dominant anchors, including discount, off-price, and wholesale clubs with minimal small shop tenants. Trade area: 5-10 miles. 11

HIGH-QUALITY DIVERSE Strong Mix of High-Quality Tenants PORTFOLIO TENANT BASE Across Our Diversified Portfolio Top 10 Tenants by ABR’ Credit Rating„ # Stores % ABR RECENT LEASE ACTIVITY EXAMPLES 1 Publix Supermarkets, Inc. NR 14 2.5% 2 The TJX Companies, Inc. A+ 21 2.5% 3 Bed Bath & Beyond, Inc. BBB- 19 2.3% 4 Petsmart, Inc. CCC+ 18 2.1% 5 Ross Stores, Inc. A- 17 2.1% 6 Lowe's Companies, Inc. A- 5 1.9% 7 Dick's Sporting Goods, Inc. NR 8 1.6% 8 Nordstrom, Inc. BBB+ 6 1.5% 9 Ascena Retail Group B 32 1.5% 10 Michaels Stores, Inc. BB- 14 1.4% TOTAL 154 19.4% (1) Per the Q1'18 supplemental. (2) Credit Rating from S&P. 12

HIGH-QUALITY DIVERSE Internet-Resistant Retail Base PORTFOLIO TENANT BASE INTERNET-RESISTANT 54.2% KITE’S TENANT BASE IS 93% INTERNET-RESISTANT / MULTI-CHANNEL Services, Entertainment 22.3% Restaurants 16.7% Grocer, Specialty Stores 15.2% MULTI-CHANNEL 39.0% Soft Goods 14.1% 54.2% TENANT TYPE 39.0% Home Improvement Goods 11. 4 % INTERNET- COMPOSITION MULTI- RESISTANT BY ABR CHANNEL Discount Retailers 10.2% Sporting Goods 3.3% % % 6.8 INTERNET COMPETITION 6.8 INTERNET COMPETITION Electronic / Books 4.9% Well-Positioned to Manage Evolving Consumer Preferences Office Supplies 1.9 % 13

EMBEDDED NOI GROWTH OPPORTUNITIES IN PORTFOLIO June 2018 INVESTOR UPDATE OPERATING • Attractive NOI Margin: 74.3%, trailing twelve months PROPERTIES • Efficient G&A / Revenues: 6.2%, trailing twelve months • Opportunity Areas: Operating expense savings, overage rent, OPERATIONS AND GROWTH and ancillary income OPPORTUNITIES CONTRACTUAL • ABR of leases executed in last four quarters is 11.8% higher than the RENT STEPS / ABR for the operating retail portfolio, including 3-R properties FIXED CAM INCREASING RECOVERY • Embedded average contractual rent bumps of ~1.4% VALUE • Fixed CAM recovery initiative, ~25% of operating portfolio currently with goal to increase to ~50% 3-R INITIATIVE / DEVELOPMENT / • $5.2mm of additional cash NOI from $62mm - $67mm ACQUISITIONS in-process 3-R and transitional projects • Four future 3-R opportunities with a total cost of $40mm - $56mm • 2018 Big Box Surge Initiative lease-up of vacant anchor boxes • A 1% increase in anchor lease percentage at average ABR would OCCUPANCY create additional revenue of $1.2mm GROWTH • Small shops leased at 90.5%, with a new goal of 92% • Signed new lease with a 56,000 SF office tenant at 30 South Meridian headquarters building 14

KITE’S 3-R PLATFORM HAS GENERATED ATTRACTIVE RISK-ADJUSTED RETURNS AND IMPROVED CASH FLOW AND ASSET QUALITY RESULTING IN INCREASED SHAREHOLDER VALUE June 2018 INVESTOR UPDATE REDEVELOP REPURPOSE REPOSITION Substantial renovations, Significant property Less substantial asset including teardowns, alterations, including enhancements, generally remerchandising, product-type changes representing investment and exterior/interior of $5mm or less improvements IDENTIFIED OPERATIONS AND GROWTH COMPLETED IN-PROCESS OPPORTUNITIES OPPORTUNITIES One Q1'18 $8.9mm 3-R $61.5mm - $66.5mm of $40mm - $56mm of project with 11.5% Return projects with 8-9% ROI projects with 9-11% ROI on Investment (ROI) 3-R OVERVIEW Redevelopment RAMPART COMMONS MSA: Las Vegas, NV BURNT STORE MARKETPLACE MSA: Punta Gorda, FL Execution and Opportunity SOURCE OF CAPITAL Free cash flow + strategic property sales 15

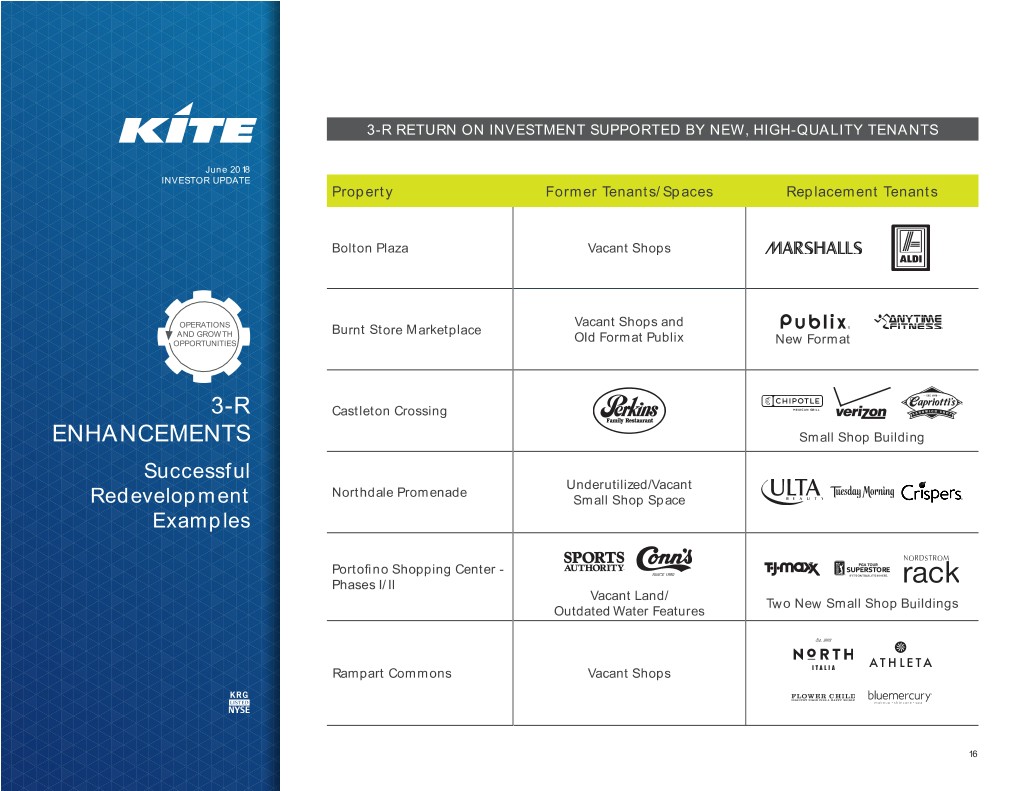

3-R RETURN ON INVESTMENT SUPPORTED BY NEW, HIGH-QUALITY TENANTS June 2018 INVESTOR UPDATE Property Former Tenants/Spaces Replacement Tenants Bolton Plaza Vacant Shops OPERATIONS Vacant Shops and AND GROWTH Burnt Store Marketplace OPPORTUNITIES Old Format Publix New Format 3-R Castleton Crossing ENHANCEMENTS Small Shop Building Successful Underutilized/Vacant Northdale Promenade Redevelopment Small Shop Space Examples Portofino Shopping Center - Phases I/II Vacant Land/ Two New Small Shop Buildings Outdated Water Features Rampart Commons Vacant Shops 16

INVESTMENT STRONG GRADE BALANCE BALANCE Well-Staggered Debt Maturity Profile SHEET SHEET SCHEDULE OF DEBT MATURITIES ($ IN MILLIONS)1 200.0 200.0 375.0 95.0 46.6 213.9 214.9 Only $48.7mm of debt 167.6 maturing through 2020 80.0 44.3 4.4 4.2 10.6 2018 2019 2020 2021 2022 2023 2024 2025 2026+ MORTGAGE DEBT LINE OF CREDIT UNSECURED TERM LOAN UNSECURED DEBT (1) Excludes annual principal payments and net premiums on fixed rate debt. (2) Subsequent to quarter-end, the unsecured line of credit was recast with an extended loan maturity of April 2023. 17

DISCLAIMER FORWARD-LOOKING STATEMENTS This supplemental information package, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include but are not limited to: • national and local economic, business, real estate and other market conditions, particularly in light of low growth in the U.S. economy as well as economic uncertainty caused by fluctuations in the prices of oil and other energy sources and inflationary trends or outlook; • financing risks, including the availability of, and costs associated with, sources of liquidity; • our ability to refinance, or extend the maturity dates of, our indebtedness; • the level and volatility of interest rates; • the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; • the competitive environment in which the Company operates; • acquisition, disposition, development and joint venture risks; • property ownership and management risks; • our ability to maintain our status as a real estate investment trust for federal income tax purposes; • potential environmental and other liabilities; • impairment in the value of real estate property the Company owns; • the impact of online retail and the perception that such retail has on the value of shopping center assets; • risks related to the geographical concentration of our properties in Florida, Indiana and Texas; • insurance costs and coverage; • risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions; • other factors affecting the real estate industry generally; and • other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, and in our quarterly reports on Form 10-Q. The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. 18

NON-GAAP FINANCIAL MEASURES FUNDS FROM OPERATIONS Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. The Company calculates FFO, a non-GAAP financial measure, in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts ("NAREIT"). The NAREIT white paper defines FFO as net income (determined in accordance with GAAP), excluding gains (or losses) from sales and impairments of depreciated property, plus de- preciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Considering the nature of our business as a real estate owner and operator, the Company believes that FFO is helpful to investors in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. FFO should not be considered as an alternative to net income (determined in accordance with GAAP) as an indicator of our financial performance, is not an alternative to cash flow from operating activities (determined in accordance with GAAP) as a measure of our liquidity, and is not indicative of funds available to satisfy our cash needs, including our ability to make distribu- tions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. A reconciliation of net income (computed in accordance with GAAP) to FFO is included in the Q1'18 Financial Supplement. 19

NON-GAAP FINANCIAL MEASURES NET OPERATING INCOME AND SAME PROPERTY NET OPERATING INCOME The Company uses property net operating income (“NOI”), a non-GAAP financial measure, to evaluate the performance of our properties. The Company defines NOI as income from our real estate, including lease termination fees received from tenants, less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions and certain corporate level expenses. The Company believes that NOI is helpful to investors as a measure of our operating performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as depreciation and amortization, interest expense, and impairment, if any. The Company also uses same property NOI ("Same Property NOI"), a non-GAAP financial measure, to evaluate the performance of our prop- erties. Same Property NOI excludes properties that have not been owned for the full period presented. It also excludes net gains from outlot sales, straightline rent revenue, lease termination fees, amortization of lease intangibles and significant prior period expense recoveries and adjustments, if any. The Company believes that Same Property NOI is helpful to investors as a measure of our operating performance because it includes only the NOI of properties that have been owned and fully operational for the full quarters presented. The Company believes such presentation eliminates disparities in net income due to the acquisition or disposition of properties during the particular quarters presented and thus provides a more consistent comparison of our properties. The year-to-date results represent the sum of the individual quarters, as reported. NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indica- tors of our financial performance. Our computation of NOI and Same Property NOI may differ from the methodology used by other REITs, and therefore may not be comparable to such other REITs. When evaluating the properties that are included in the same property pool, the Company has established specific criteria for determining the in- clusion of properties acquired or those recently under development. An acquired property is included in the same property pool when there is a full quarter of operations in both years subsequent to the acquisition date. Development and redevelopment properties are included in the same property pool four full quarters after the properties have been transferred to the operating portfolio. A redevelopment property is first excluded from the same property pool when the execution of a redevelopment plan is likely and the Company begins recapturing space from tenants. For the quarter ended March 31, 2018, the Company excluded seven redevelopment properties and the recently completed Northdale Promenade and Burnt Store Marketplace redevelopments from the same property pool that met these criteria and were owned in both comparable periods. 20

APPENDIX – RECONCILIATION OF SAME PROPERTY NOI TO NET INCOME SAME PROPERTY NET OPERATING INCOME (NOI) ($ in thousands) Three Months Ended March 31, % 2018 2017 Change Number of properties for the quarter1 102 102 Leased percentage at period end 94.6% 95.1% 2 Economic Occupancy percentage 93.3% 94.0% Minimum rent $ 57,653 $ 57,128 Tenant recoveries 16,682 16,317 Other income 271 284 74,606 73,729 Property operating expenses (10,672) (10,517) Bad debt expense (364) (598) Real estate taxes (9,947) (9,771) (20,983) (20,886) Same Property NOI3 $ 53,623 $ 52,843 1.5% Reconciliation of Same Property NOI to Most Directly Comparable GAAP Measure: Net operating income - same properties $ 53,623 $ 52,843 Net operating income - non-same activity4 11,554 13,987 Other income (expense), net 1,234 (107) General, administrative and other (5,945) (5,470) Impairment charge (24,070) (7,411) Depreciation and amortization expense (38,556) (45,830) Interest expense (16,337) (16,445) Gains on sales of operating properties 500 8,870 Net loss (income) attributable to noncontrolling interests 80 (432) Net (loss) income attributable to common shareholders $ (17,917) $ 5 ____________________ 1 Same Property NOI excludes seven properties in redevelopment, the recently completed Northdale Promenade, Burnt Store Marketplace, and Parkside Town Commons - Phase II, as well as office properties (Thirty South Meridian and Eddy Street Commons). 2 Excludes leases that are signed but for which tenants have not yet commenced the payment of cash rent. Calculated as a weighted average based on the timing of cash rent commencement and expiration during the period. (1) Same Property NOI excludes seven properties in redevelopment, the recently completed Northdale Promenade, Burnt Store Marketplace, and Parkside Town Commons - Phase II, as well as office properties (Thirty South Meridian and Eddy Street Commons). (2) Excludes leases that are signed but for which tenants3 Same have Propertynot yet commenced NOI excludes the payment net of gains cash rent.from Calculated outlot sales, as a weighted straight-line average basedrent revenue, on the timing lease of cash termination rent commencement fees, amortization and expiration of during lease the intangibles period. and (3) Same Property NOI excludes net gains from outlot sales,significant straight-line prior rent period revenue, expense lease termination recoveries fees, and amortization adjustments, of lease ifintangibles, any. and significant prior period expense recoveries and adjustments, if any. (4) Includes non-cash activity across the portfolio, as well as net operating income from properties not included in the same property pool. 21 4 Includes non-cash activity across the portfolio as well as net operating income from properties not included in the same property pool. p. 16 Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18

30 S MERIDIAN STREET SUITE 1100 INDIANAPOLIS, IN 46204 888 577 5600 kiterealty.com