Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jernigan Capital, Inc. | tv495766_8k.htm |

Exhibit 99.1

1 Investor Presentation June 2018

2 Safe Harbor Disclosure Regarding Forward - Looking Statements This presentation includes "forward - looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Sect ion 21E of the Securities Exchange Act of 1934 and other federal securities laws, our future performance, future book value, rates of return, ability to obtain future financing, including our ability to increase the capacity under our credit facility, exit capitalization rates, ou r use of capital, the timing of our investment cycle, the expected timing of certificates of occupancy, our ability to acquire wholly - owned assets, fu ture profits from investments, our future stock price, our dividends to our common stockholders and the holders of our Series A and Series B Pr efe rred Stock, our loan pipeline, our anticipated loan closings, future funding of existing loan commitments, and components of our second quarter 2018 and full - year 2018 earnings guidance. The ultimate occurrence of events and results referenced in these forward - looking statements i s subject to known and unknown risks and uncertainties, many of which are beyond our control. Such risks include our ability to obtain add iti onal liquidity to fund our loan pipeline, our ability to make distributions at expected levels, the potential impact of interest rate fluctu ati ons, the uncertainty as to the value of our investments, the lack of liquidity in our investments and whether we can realize expected gains from our equ ity participation interests. These forward - looking statements are based upon our present intentions and expectations, but the events and results r eferenced in these statements are not guaranteed to occur. Investors should not place undue reliance upon forward - looking statements. There c an be no assurance that our expectations of the future performance of our investments will be achieved. This information provided here in is as of this date, and we undertake no duty to update any forward - looking statements contained herein. For a discussion of these and other ri sks facing our business, see the information under the heading “Risk Factors” in our Annual Report on Form 10 - K for the year ended December 31, 2017 and in other filings we make with the Securities and Exchange Commission (“SEC”) from time to time, which are accessible on the S EC’ s website at www.sec.gov . This presentation contains statistics and other data that has been obtained from or compiled from information made available by third parties. We have not independently verified such statistics or data. Unless otherwise indicated, all metrics presented herein are as of March 31, 2018 . Contact: Jernigan Capital, Inc. Investor Relations (901) 567 - 9580 investorrelations@jernigancapital.com

3 provides debt and equity capital to private developers, owners and operators of self - storage facilities. Our mission is to be the preeminent capital partner for self - storage entrepreneurs nationwide by offering creative solutions through an experienced team demonstrating the highest levels of integrity, dedication, excellence and community, while maximizing shareholder value.

4 ▪ $450+ million pipeline of investments in underwriting; $200 to $230 million new investments estimated for 2018 ▪ 2018 to date: ~$153 million loan commitments closed and additional $9 million invested in developer buyouts ▪ P otential for full asset ownership at compelling long - term yields through ROFRs and negotiated developer buyouts; five buyouts completed through 6/1/2018 at average stabilized cap rate > 8% (5) ▪ Additional earnings and balance sheet growth from ~$145 to ~$190 million of estimated remaining fair value marks (2 ) ▪ New bridge refinancing opportunity designed to further enhance growth and lead to more off - market acquisition opportunities Significant Identified and Potential Growth Opportunities Investment Highlights Compelling Investment Economics and Attractive Valuation ▪ Solely focused on self - storage – top performing real estate sector in total shareholder return since 1994 (1) ▪ 6.9%+ fixed return and profits interest = high IRRs, strong earnings and value growth ▪ Bridge program expected to produce additional acquisition opportunities in addition to strong earnings and value growth ▪ E stimated future earnings and balance sheet growth from fair value accretion on existing and projected investment commitments ranges from $10.18 to $13.13 per share (2) ▪ Current trading price of $19.78 is ~108% of book value at 3/31/2018 and ~63% to ~69% of intrinsic book value Flexible Capital Structure Supports Strong Future Growth ▪ Demonstrated capital access for external growth via public offerings of common and preferred stock, private preferred stock sale, ATM programs, senior participations, credit facility and Heitman JV ▪ Identified sources of capital to fund all current commitments and guided 2018 commitments ▪ Strong ownership by senior executives and board (~8.0%) and institutions (~75%) ▪ Stable $1.40 per share of common stock annualized dividend supported by GAAP earnings in 2018 (1) Source: NAREIT (2) Based on fair value estimates as of 3/31/2018 and closings as of 6/1/2018 . 2018 projected capital commitments per the midpoint of the Company’s 2018 guidance range. All amounts less Highland’s 25% share of book value accretion. Values are before consideration of changes in capital sources and the impact of future cash di vid ends. (3) Represents closed loan commitments and wholly - owned property investments as of 6/1/18, excluding closed investments that have be en repaid. (4) Represents closed loan commitments and wholly - owned property investments as of 6/1/18 , including closed investments that have been repaid. (5) Based on aggregate estimated stabilized NOI of ~$4.1 million and the Company’s aggregate $47.3 million cash investment in the five properties, which includes the sum of the fu nded principal balance of the loan (net of unamortized origination fees), cash consideration (inclusive of transaction costs), assumed liabilities, and net property working capital acquired, all as of the date of acquisition. High Quality Platform with Demonstrated Expertise ▪ 70 current investments totaling ~$ 821 million – $ 698 million on balance sheet and $123 million in joint venture with Heitman (“Heitman JV ”) (3) ▪ Closed $409 million of new development investments in 2017 ▪ Dedicated team with extensive knowledge of and contacts within the self - storage industry ▪ Disciplined investment process; closed on only ~8% of the investments evaluated since IPO (4) ▪ Scalable corporate platform and best - of - class third party management by powerful REIT platforms – e.g. CUBE

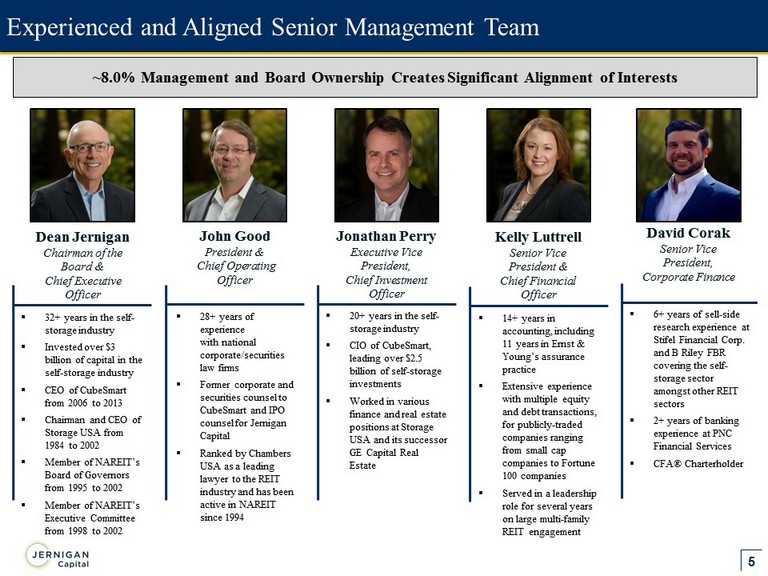

5 Experienced and Aligned Senior Management Team ~ 8.0% Management and Board Ownership Creates Significant Alignment of Interests ▪ 32+ years in the self - storage industry ▪ I nvested over $3 billion of capital in the self - storage industry ▪ CEO of CubeSmart from 2006 to 2013 ▪ Chairman and CEO of Storage USA from 1984 to 2002 ▪ Member of NAREIT’s Board of Governors from 1995 to 2002 ▪ Member of NAREIT’s Executive Committee from 1998 to 2002 Dean Jernigan Chairman of the Board & Chief Executive Officer Jonathan Perry Executive Vice President, Chief Investment Officer ▪ 20+ years in the self - storage industry ▪ CIO of CubeSmart, leading over $2.5 billion of self - storage investments ▪ Worked in various finance and real estate positions at Storage USA and its successor GE Capital Real Estate ▪ 14+ years in accounting, including 11 years in Ernst & Young’s assurance practice ▪ Extensive experience with multiple equity and debt transactions, for publicly - traded companies ranging from small cap companies to Fortune 100 companies ▪ Served in a leadership role for several years on large multi - family REIT engagement Kelly Luttrell Senior Vice President & Chief Financial Officer ▪ 6 + years of sell - side research experience at Stifel Financial Corp. and B Riley FBR covering the self - storage sector amongst other REIT sectors ▪ 2 + years of banking experience at PNC Financial Services ▪ CFA® C harterholder David Corak Senior Vice President, Corporate Finance ▪ 28+ years of experience with national corporate/securities law firms ▪ Former corporate and securities counsel to CubeSmart and IPO counsel for Jernigan Capital ▪ Ranked by Chambers USA as a leading lawyer to the REIT industry and has been active in NAREIT since 1994 John Good President & Chief Operating Officer

6 JCAP’s Competitive Advantages Limited Availability of Bank Financing ▪ Continued post - recession hangover of commercial banks ▪ Regulatory hurdles diminish the profitability of self - storage loans for banks ▪ Dodd - Frank, Basel III and HVCRE reserve requirements ▪ Allocation p reference to stabilized / pre - leased CRE (e.g. Industrial, Office, Multi - family) Unitranche Investment Structure Provides One - Stop Shop ▪ JCAP offers up to 97% loan - to - cost (“LTC”). Banks offer 60% to 65% ▪ JCAP can offer flexible transaction structures ▪ Developer freed of burden to raise capital from multiple sources ▪ Unitranche JCAP pricing (coupon + profits interest + ROFR) is highly competitive with pricing of component parts Non - Recourse ▪ JCAP capital is non - recourse to the developer (except for certain carve outs) Self - Storage Expertise and Focus ▪ JCAP adds value as a storage expert that can assist in avoiding costly common mistakes, such as selecting poor sites in saturated submarkets and selecting property managers who do not drive occupancy and control costs ▪ JCAP is reliable exit option – operating partnership units provide tax efficient means for developer exit

7 High ROI Business Model Executed in Top Self - Storage Markets Providing Innovative Financing Solutions for the Self - Storage Industry Attractive Risk - Adjusted Returns Through Equity Participations Deve l op m ent Investments G r ound - up C onstruction Major R e d eve lopm e nt ▪ F ocus on programmatic self - storage development of Generation V facilities in top - tier markets ▪ Partner with experienced developers who desire a reliable, highly - experienced and fair capital partner: – High character, financial stability and proven track record for picking great sites – Known to JCAP management – Loyalty ▪ Target projects expected to generate mid - to - high teens unlevered IRR (1) ▪ 90% LTC ▪ 6 year term ▪ Equity & cash flow participation ▪ 10% - 30% fund e d a t o r i g ination; b a l a n c e funded ov e r 9 - 16 months Typical Investment Terms Primary Investment Strategy Bridge Refinancing Investments Refinancing Existing Generation V Facilities ▪ P rovide professional developers with capital to refinance upcoming construction loan maturities and provide distributions to equity partners prior to stabilization of their self - storage projects ▪ Seeking: – Generation V facilities that were constructed and open for business within the last four years – Located in one of the top 50 MSAs – Owned by developers meeting same criteria as for JCAP development investments – IRR consistent with development investments with discount for lack of construction risk and reduced lease up risk ▪ 70% to 100% loan - to - value (“LTV”) ▪ 5 - 7 year term ▪ Equity & cash flow participation ▪ 90% - 95% funded at origination; balance funded over remaining lease - up period Typical Investment Terms Primary Investment Strategy (1) Projected IRR range assumes the following: 3 to 4 year lease - up period, a 9.0% development yield, a 5.5% exit cap rate and a sal e at stabilization

8 Development Project Investment Timeline ▪ Below is an example of a typical timeline for a 72,000 net rentable square feet development project with total cost of $10 million ▪ Key assumptions include: ▪ 9.0 % yield on cost and a 5.5% cap rate at stabilization ▪ JCAP lends 90% of total cost and receives fixed interest rate of 6.9% ($ 2.1 to $2.7 million depending on timing ) ▪ JCAP receives a 49.9% profits interest and Right of First Refusal (“ROFR”) ▪ JCAP receives 1.0 % origination fee ▪ Total fair value gain of ~$3.2 million ▪ ( Stabilized Value minus Total Cost) x 49.9% = ($16.4 million – $10.0 million) x 49.9% = $3.2 million ▪ Each development investment projected to generate mid - to - high teens unlevered IRR (1) Fair value a ccounting recognition of 1/3 estimated profit between 40% completion and C/O Fair value a ccounting recognition of balance of estimated profit over remaining term of investment using DCF method Term Sheet to Closed Investment Facility Construction ($10.0 million total cost; $9.0 million JCAP commitment) Lease - up Period Certificate of Occupancy (“C/O”) (~$12.9 million estimated fair value of underlying real estate) Investment Closing Stabilization (~$16.4 million estimated fair value of underlying real estate) Construction Start Stabilization ~ 4 - 5 years (~90% of JCAP commitment funded by C/O) 15 - 17 months 3 - 4 years ( Remaining ~10% of JCAP commitment funded over first 12 to 18 months of lease - up) 2 - 4 months Cumulative % of Total Fair Value Gain Recognized ~33% ~45% - 50% 100% Note: C/O value estimate based on a 150bp spread to exit cap rate (7 %) (1) Projected IRR range assumes the following: 3 to 4 year lease - up period, a 9.0% development yield, a 5.5% exit cap rate and a sal e at stabilization

9 Significant Built - in Fair Value Accretion Source: Company estimates (1) Based on fair value estimates as of 3/31/2018 and closings as of 6/1/2018. 2018 projected capital commitments per the midpoint of the Company’s 2018 guidance range. All amounts less Highland’s 25% share of book value accretion. Values are before consideration of changes in capital sources and the impact of future cash dividends. ▪ As of 6/1/2018, only ~13% of estimated fair value accretion (~$26 million of ~$192 million estimated) has been recognized on ~$725 million of existing and projected on - balance sheet development property and bridge investment commitments (1) ▪ Fair market value determined using: ▪ Current market rental rates provided by independent third parties ▪ Cap rates supported by third party reports of submarket comparative sales; as well as implied cap rates for self - storage REITs % of Estimated Fair Value Profit Recognized ( 1 ) Potential FMV Accretion Bridge by Closing Year (1) Recognized Profit ~ 13% Future Profit to be Recognized ~ 87% $0.35 $0.27 $7.21 $3.76 $18.35 $29.94 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 Current BV 3/31/2018 Remaining FMV 2015 Closings Remaining FMV 2016 Closings Remaining FMV 2017 Closings Remaining FMV 2018 Closings Intrinsic Value

10 Value Accretion Sensitivities (1) Closed loans as of 6/1/2018 (2) All amounts less Highland’s 25% share of book value accretion ▪ Tables display potential future fair market value (“FMV”) accretion and intrinsic value per common share ▪ Using current fair market value estimates for closed loans plus remaining projected capital commitments in 2018 per the midpoint of the Company’s 2018 guidance range (1) ▪ Sensitizes development yield and exit cap rate for future fair value accretion ▪ Drivers of potential development yield movements: ▪ Higher (lower) property NOI as a result of i ) higher (lower) rental rates, ii) higher (lower) NRSF efficiency and/or iii) lower (higher) operating expenses compared to underwriting ▪ Hard and soft cost savings compared to budgeted costs ▪ Interest reserve savings compared to underwriting as a result of differences in timing of draws and construction completion ▪ Drivers of potential exit cap rate movements: ▪ Market pricing conditions ▪ I nterest rate environment ▪ S upply / demand balance Potential Future FMV Accretion Per Common Share (2) Total Potential Intrinsic Value Per Common Share (2) Exit Cap Rate Development Yield 8.0% 8.5% 9.0% 9.5% 10.0% 10.5% 11.0% 5.00% $30.70 $32.02 $33.19 $34.23 $35.17 $36.02 $36.80 5.25% $29.00 $30.32 $31.48 $32.53 $33.47 $34.32 $35.09 5.50% $27.46 $28.77 $29.94 $30.98 $31.92 $32.77 $33.55 5.75% $26.04 $27.36 $28.53 $29.57 $30.51 $31.36 $32.13 6.00% $24.75 $26.06 $27.23 $28.28 $29.22 $30.07 $30.84 Exit Cap Rate Development Yield $11.59 8.0% 8.5% 9.0% 9.5% 10.0% 10.5% 11.0% 5.00% $12.35 $13.67 $14.84 $15.88 $16.82 $17.67 $18.45 5.25% $10.65 $11.97 $13.13 $14.18 $15.12 $15.97 $16.74 5.50% $9.11 $10.42 $11.59 $12.63 $13.57 $14.42 $15.20 5.75% $7.69 $9.01 $10.18 $11.22 $12.16 $13.01 $13.78 6.00% $6.40 $7.71 $8.88 $9.93 $10.87 $11.72 $12.49

11 0.5x 2.5x 2.4x 1.5x 0.4x 1.4x 0.8x 0.5x 0.3x 1.2x 1.5x (2) 1.6x 2.8x 2.6x 2.0x 0.6x 1.6x 1.0x 0.7x 1.0x 1.5x 2.2x (2) 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 1Q16-1Q18 2018E EPS Coverage AEPS Coverage Predictable Dividend That Tracks Value Creation (1) Quarterly diluted net income per common share and diluted adjusted earnings per common share per filings. For the definition of adjusted earnings per share and a reconcili ati on against net loss attributable to common stockholders, see our Annual Report on Form 10 - K for the year ended December 31, 2017 and our earnings re lease furnished on May 2, 2018. (2) D iluted net income per common share and diluted adjusted earnings per common share per midpoint of full year 2018 guidance released on May 2, 2018. ▪ Since the beginning of 2016, cumulative GAAP earnings have exceeded cumulative distributions to common stockholders – dividend i s economically covered ▪ Tax efficient cash return to shareholders while portfolio value and book value grow ▪ Stable quarterly dividend of $0.35 per share is preferable to lumpy distributions dependent on asset sales and realized gains Historical Diluted GAAP Earnings per Share ( EPS) and Adjusted EPS (1) and Common Dividends

12 Selective Underwriting $10.3 billion Investments Reviewed $ 1.3 billion Term Sheets Issued $921 million Signed Term Sheets $865 million (~8% of Evaluated) Closed Investments* Stringent Underwriting Process Based on Management’s Extensive Experience and Successful Track Record Investing in Self - Storage * Represents closed loan commitments and wholly - owned property investments as of 6/1/18, including closed investments that have been repaid

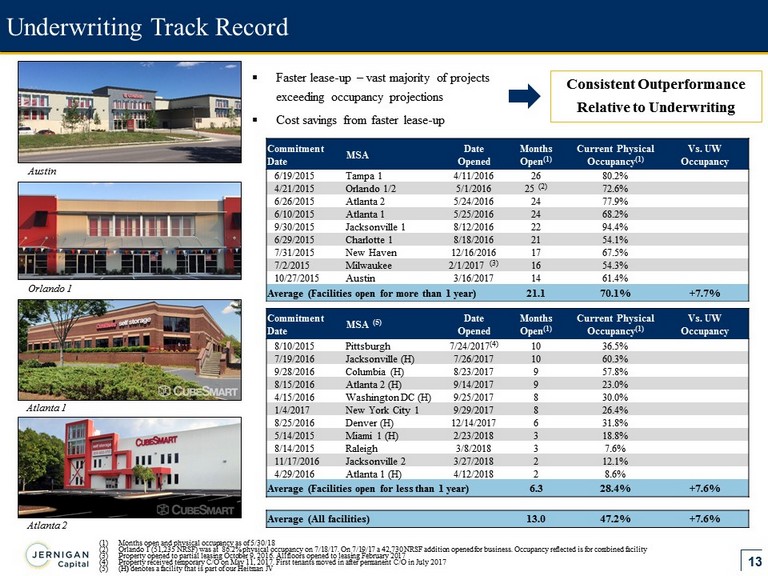

13 (1) Months open and physical occupancy as of 5/30/18 (2) Orlando 1 (51,235 NRSF) was at 86.2% physical occupancy on 7/18/17. On 7/19/17 a 42,730 NRSF addition opened for business. O ccu pancy reflected is for combined facility (3) Property opened to partial leasing October 9, 2016. All floors opened to leasing February 2017 (4) Property received temporary C/O on May 11, 2017. First tenants moved in after permanent C/O in July 2017 (5) ( H ) denotes a facility that is part of our Heitman JV Commitment Date MSA Date Opened Months Open (1) Current Physical Occupancy (1) Vs. UW Occupancy 6/19/2015 Tampa 1 4/11/2016 26 80.2% 4/21/2015 Orlando 1/2 5/1/2016 25 (2) 72.6% 6/26/2015 Atlanta 2 5/24/2016 24 77.9% 6/10/2015 Atlanta 1 5/25/2016 24 68.2% 9/30/2015 Jacksonville 1 8/12/2016 22 94.4% 6/29/2015 Charlotte 1 8/18/2016 21 54.1% 7/31/2015 New Haven 12/16/2016 17 67.5% 7/2/2015 Milwaukee 2/1/2017 (3) 16 54.3% 10/27/2015 Austin 3/16/2017 14 61.4% Average (Facilities open for more than 1 year) 21.1 70.1% +7.7% Commitment Date MSA (5) Date Opened Months Open (1) Current Physical Occupancy (1) Vs. UW Occupancy 8/10/2015 Pittsburgh 7/24/2017 (4) 10 36.5% 7/19/2016 Jacksonville (H) 7/26/2017 10 60.3% 9/28/2016 Columbia (H) 8/23/2017 9 57.8% 8/15/2016 Atlanta 2 (H) 9/14/2017 9 23.0% 4/15/2016 Washington DC (H) 9/25/2017 8 30.0% 1/4/2017 New York City 1 9/29/2017 8 26.4% 8/25/2016 Denver (H) 12/14/2017 6 31.8% 5/14/2015 Miami 1 (H) 2/23/2018 3 18.8% 8/14/2015 Raleigh 3/8/2018 3 7.6% 11/17/2016 Jacksonville 2 3/27/2018 2 12.1% 4/29/2016 Atlanta 1 (H) 4/12/2018 2 8.6% Average (Facilities open for less than 1 year) 6.3 28.4% +7.6% Average (All facilities ) 13.0 47.2% +7.6% Underwriting Track Record Atlanta 1 Atlanta 2 Austin Orlando 1 ▪ Faster lease - up – vast majority of projects exceeding occupancy projections ▪ Cost savings from faster lease - up Consistent Outperformance Relative to Underwriting

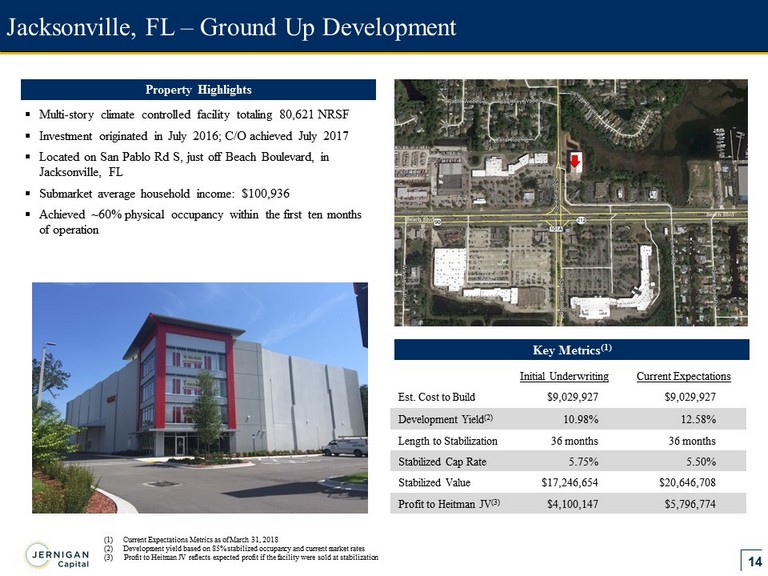

14 Jacksonville, FL – Ground Up Development Initial Underwriting Current Expectations Est. Cost to Build $9,029,927 $9,029,927 Development Yield (2) 10.98% 12.58% Length to Stabilization 36 months 36 months Stabilized Cap Rate 5.75% 5.50% Stabilized Value $17,246,654 $ 20,646,708 Profit to Heitman JV (3) $4,100,147 $ 5,796,774 Key Metrics (1) Property Highlights ▪ Multi - story climate controlled facility totaling 80,621 NRSF ▪ Investment originated in July 2016; C/O achieved July 2017 ▪ Located on San Pablo Rd S, just off Beach Boulevard, in Jacksonville, FL ▪ Submarket average household income: $100,936 ▪ Achieved ~60% physical occupancy within the first ten months of operation (1) Current Expectations Metrics as of March 31, 2018 (2) Development yield based on 85% stabilized occupancy and current market rates (3) Profit to Heitman JV reflects expected profit if the facility were sold at stabilization

15 Attractive Investment Portfolio % On Balance Sheet / % Joint Venture Status of Development Investments ▪ C/O LTV: 72% ▪ Stabilized LTV: 57% ▪ Development investments currently represent 81% of investment portfolio ▪ ~49% of development investments expecting C/O within the next 12 months Notes: Percentage of portfolio based on committed total investment amounts, developers’ interests acquired and loan balances outstanding at the time of acquisition. Portfolio overview statistics exclude pipeline investments, including those with executed term sheets (1) Represents closed loan commitments and wholly - owned property investments as of 6/1/18, excluding closed investments that have been repaid (2) JCAP maintains equity participation on development and bridge investments only (3) Represents developers’ interests acquired and loan balance outstanding at the time of acquisition $821 Million Committed (1 ) / 70 Investments (1 ) Investments by Type (2) Development 81% Bridge 10% Wholly - Owned (3) 6% Construction (C/O takeout) 2% Operating Property 1% On Balance Sheet 85% Joint Venture 15% C/O Expected 2018 36% C/O Expected 2019 36% C/O Expected 2020 6% C/O Achieved 22%

16 High Quality Self - Storage Properties Located in Attractive Markets Notes: Percentages and Company’s market average are weighted based on committed total investment amounts (1) Source: Census Bureau (2) Other markets include Austin, Baltimore, Charlotte, Chicago , Columbia, Fort Lauderdale, Houston, Kansas City, Knoxville, Los Angeles, Louisville , Milwaukee, New Haven, New Orleans, Newark, Philadelphia, Pittsburgh , Raleigh and Washington, DC ▪ Investments in a portfolio of newly built, multi - story climate controlled Class - A self - storage facilities primarily located with in the best submarkets of the top 50 MSAs – 97% of facilities located within the top 50 MSAs; 83% located within the top 25 MSAs (1) ▪ Target submarkets are characterized by strong projected population growth and below average self - storage supply ▪ Seek submarkets positioned for high return self - storage development – High density, population growth and household incomes – Concentration of renters (particularly millennials ) Portfolio Highlights Geographic Diversification Exposure to Top MSAs Miami 23% Atlanta 13% New York City 11% Minneapolis 4% Boston 4% Tampa 4% Jacksonville 4% Denver 4% Orlando 4% Other (2) 33% 83% 97% 0% 20% 40% 60% 80% 100% Top 25 Top 50

17 Supply / Demand Balance: Top 50 MSAs 26 42 53 66 199 254 352 400 - 440 390 - 430 190 - 230 132 134 135 136 138 139 141 142 143 145 - 50 100 150 200 250 300 350 400 450 2011 2012 2013 2014 2015 2016 2017 2018E 2019F 2020F Facility Count Facilities Delivered Generation V Deliveries Needed Source: Census Bureau and Yardi ® Matrix as of February 12, 2018 Note: Average Facility Size 75,000 NRSF, expansions excluded ▪ Estimated total of 150 facilities delivered in 4 - year period 2011 – 2014 (30 - 35 deliveries per year) ▪ Population growth > 1% annually – ~140 facilities per year needed to keep up with population growth ▪ Result – unprecedented high single digit same - store revenue growth during period 2013 - 2015 2015 – 2017 Supply Tide Turns 2011 – 2014 Period of Undersuppl y 2018 – 2020 Forecast: Soft Landing ▪ ~800 total deliveries led by largest markets (Texas, New York, Florida) compared to ~150 over prior 4 years ▪ Increased average size for new Generation V facilities ▪ Shortage of good data on supply – speculation ensues ▪ Deceleration from unsustainably good same - store comps ▪ ~1,100 total deliveries expected vs . ~ 570 facilities needed to match population growth = top line growth below historical norms ▪ Conclusion – d evelopment must stop to let absorption occur ▪ Silver lining – pipeline of prospective projects has shrunk meaningfully since August 2017 resulting in 50% fewer 2020 forecast deliveries

18 ▪ Executed term sheets for investments in 5 separate self - storage development projects for an aggregate capital commitment of approximately $54 million (1 ) ▪ Maintain a robust $450+ million pipeline of additional investment opportunities in top 50 U.S. markets ▪ Supported by strong developer network of over 23 programmatic developers in top - tier markets Current Investment Pipeline Atlanta Boston Miami New Orleans Orlando Los Angeles Development Markets Executed Term Sheet Pipeline Executed Term Sheet and Pipeline Washington DC Kansas City Baltimore Philadelphia Seattle Houston New York City Richmond Tampa Note: Executed term sheets are non - binding and remain subject to entry into definitive agreements (1) As of 6/1/2018

19 $42 $123 $123 $123 $81 $102 $511 $511 $200 - $230 $123 $225 $634 $ 834 - $ 864 14 24 56 0 15 30 45 60 75 $0 $200 $400 $600 $800 $1,000 $1,200 2015 2016 2017 2018E # of Investments Total Investments (3) $ Projected $ On Balance Sheet $ Heitman JV Cumulative # $1,743 $6,532 $12,191 $28,380 to $30,100 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2015 2016 2017 2018E Total Revenues Other Revenues Rental Income from Real Estate Owned Interest Income Well - Positioned for Growth Following Record Investment Year ▪ T op - line growth driven by 32 new investments in 2017, more than doubling JCAP’s portfolio of high - quality self - storage investment s ▪ Continued availability of high - returning development opportunities utilizing geographically diverse network of programmatic deve lopers ▪ Additional earnings growth and acquisition opportunities from bridge program supporting long - term strategy to own developed assets at compelling yields ($ in thousands) (1) Compound Annual Growth Rate (2) As of 6/1/2018 (3) Represents committed total investment amounts, excluding closed investments that have been repaid, Construction (C/O takeout) an d Operating Property investments and purchases of developers’ interests ($ in millions) 5 Executed Term Sheets 11 Closed (2) Significant Revenue Momentum Driven by Record Investment Growth

20 Bridge Refinancing Case Study: Miami Portfolio Investment Property Summary Investment Summary & Highlights ▪ Bridge financing provided to take out existing construction debt and certain equity capital partners on a portfolio comprised of three operating properties and two properties under construction ▪ ~ $ 77 million immediate investment by JCAP with attractive economic terms similar to the Company’s traditional development loans ▪ ~ $ 6 million in interest and operating reserves to be funded during portfolio lease up to bring total commitment to ~ $ 83 million ▪ Interest rates ▪ Three C/O projects – 6 . 9 % cash interest ▪ Two projects under construction – 6 . 5 % cash interest + 3 . 0 % interest paid in kind (“PIK interest”) ( 1 ) ▪ 49 . 9 % profits i nterest ▪ 90 . 5 % C/O LTV, 70 . 4 % Stabilized LTV ▪ Yield and unlevered IRR consistent with JCAP’s development transactions ▪ Provides immediate cash interest income compared to typical 12 - 24 month lag between initial funding and completion for traditional development loans ▪ Investing with experienced JCAP programmatic developer who has developed ~ 5 million square feet of self - storage projects during 34 years in the industry ▪ All five assets will be managed by CubeSmart (1) The two projects under construction will each also pay a $1 million preferred return to the developer after payment to JCAP of the PIK interest and before the 49.9% profits int ere st split . (2) Physical occupancy as of 5/30/2018 . West Doral $s in 000s Property Name Location Date Opened Current Physical Occupancy (2) NRSF Commitment Amount West Doral Miami, FL 8/12/2016 78.4% 76,665 $13,370 Brickell Miami, FL 10/9/2016 78.7% 74,685 20,201 Coconut Grove Miami, FL 12/12/2016 77.0% 51,923 13,553 Pembroke Pines Pembroke Pines, FL 3/26/2018 12.4% 85,280 18,462 Doral Miami, FL C/O expected 6/2018 N/A 77,237 17,738 Total $83,324

21 Five Wholly - Owned Properties Summary & Highlights ▪ 100% resulting ownership of one Orlando, one Jacksonville, one Pittsburgh, and two Atlanta facilities ▪ ~ $12 million aggregate purchase price for the developer interests in the five properties ▪ ~8.7% estimated weighted average cash investment yield on the five properties (1) ▪ Development loans on the five properties converted to equity ▪ 100% climate - controlled facilities ideally located in underserved , rapidly growing submarkets ▪ Recent acquisitions demonstrate JCAP’s ability to execute long - term strategy to own developed assets at compelling yields JCAP now has 100% ownership of five of its initial ten on - balance sheet development investments made during the first six months of the Company’s existence (1) Based on aggregate estimated stabilized NOI of ~$4.1 million and the Company’s aggregate $47.3 million cash investment in the five properties, which includes the sum of the funded principal balance of the loan (net of unamortized origination fees), cash consideration (inclusive of transaction costs), assumed liabilities, and ne t property working capital acquired, all as of the date of acquisition. (2) P hysical occupancy as of 5/30/2018. (3) Property received temporary C/O on May 11, 2017. First tenants moved in after permanent C/O in July 2017. Wholly - Owned Portfolio Summary $s in 000s Property Name MSA Date Opened Date Acquired NRSF Current Physical Occupancy (2) Projected Stabilized NOI Cash Investment Orlando 1/2 Orlando, FL 5/1/2016 8/9/2017 93,965 72.6% $1,095 $12,047 Atlanta 1 Atlanta, GA 5/25/2016 2/2/2018 71,718 68.2% 864 10,467 Atlanta 2 Atlanta, GA 5/24/2016 2/2/2018 66,137 77.9% 759 8,766 Jacksonville 1 Jacksonville, FL 8/12/2016 1/10/2018 59,848 94.4% 709 8,686 Pittsburgh Pittsburgh, PA 7/24/2017 (3) 2/20/2018 48,024 36.5% 688 7,360 Total $ 4,115 $47,326 Jacksonville 1 Atlanta 2

22 Guidance for Q2 2018 and FY 2018 JCAP Guidance for Q2 2018 and FY 2018 ($ in thousands, except per share) Key Assumptions ▪ ~$ 200 to $230 million of new investment commitments during the full - year 2018 ▪ ~$ 300 to $340 million of fundings on closed and projected investment commitments during the full - year 2018 ▪ Acquisition of 100% of developer interests in four development investments in January and February 2018 – Total of five wholly - owned self - storage facilities in 2018 ▪ $ 85 million proceeds from issuance of Series A Preferred Stock during first seven months of 2018 ▪ $37.5 million issuance of 7% Series B C umulative Redeemable Perpetual Preferred Stock in January 2018 ▪ Utilization of the Company’s credit facility over the course of the year as availability increases ▪ No change in the key assumptions used to value the Company’s investments other than the assumption of four 25 basis points interest rate increases in 2018 (1) For the three months ending June 30, 2018, we expect rental revenues to be $780,000 (low ) or $800,000 (high) and property operating expenses to be $(440,000) (low) and $(410,000) (high), and for the year ending December 31, 2018, we expect rental revenue to be $3.1 million (low) or $3.3 million (high) and property oper ati ng expenses to be $(1.6 million) (low) or $( 1.5 million) (high). Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REITs. We bel ieve that this measure provides an operating perspective not immediately apparent from GAAP operating income or net income . (2) For the definition of adjusted earnings per share and for a reconciliation against net loss attributable to common stockholde rs, see our Annual Report on Form 10 - K for the year ended December 31, 2017 and our earnings release furnished on May 2, 2018. Three Months Ending, Year Ending, June 30, 2018 December 31, 2018 Low High Midpoint Low High Midpoint Interest Income from Investments 6,050$ 6,150$ 6,100$ 25,200$ 26,700$ 25,950$ Property NOI from Real Estate Owned (1) 340$ 390$ 365$ 1,500$ 1,800$ 1,650$ Change in Fair Value of Investments 6,000$ 8,000$ 7,000$ 41,000$ 47,000$ 44,000$ Earnings (loss) per share - diluted (2) 0.18$ 0.35$ 0.27$ 1.76$ 2.54$ 2.15$ Adjusted earnings per share - diluted (2) 0.43$ 0.60$ 0.52$ 2.68$ 3.43$ 3.06$

23 Sources and Uses for Development Sources and Uses for Development - As of March 31, 2018 ($ in millions) ▪ $409 million total estimated cash investment through 2022 ▪ Funding in place for all 2018 commitments and a portion of 2019 commitments comprised of cash on hand, existing capacity on the Company’s secured credit line, Series A Preferred equity line and expected repayments of existing investments ▪ The Company has available $140 - $160 million from the following capital sources to fund $151 million of remaining capital needs: – Refinancing of JCAP mortgage and capital recycling (49.9% profits interest and ROFR retained; $60 - $70 million by Q1 2019) – Additional sales of assets that JCAP does not wish to own or acquire (~$20 million by Q1 2019) – Series B Preferred ATM issuances (~$10 million by Q1 2019) – Secured debt on individual properties ($25 - $30 million by Q1 2019) – Joint venture distributions ($5 - $10 million by Q1 2019) – Common stock issuances (ATM availability of ~$20 million; opportunistic underwritten offerings) Estimated Capital Uses: Contractual investment obligations Development property investments 291$ Bridge loan investments 6 Self-storage real estate venture 2 Total Committed Uses 299$ Remaining Prospective Commitments per FY 2018 guidance: 110 Total to Fund Investments 409$ Estimated Sources: Cash and Cash Equivalents as of March 31, 2018 15$ Remaining Series A Preferred Stock to be Issued (expected in Q2 2018) 50 Identified loan repayment (expected in Q2 2018) 17 Identified asset sale (expected in Q2 or Q3 2018) 6 Remaining credit facility capacity 170 Remaining capital needs 151 Total Sources 409$

24 Capital Structure & Allocation – Long Term Funding Plan (1) 2018 projected capital commitments per the midpoint of the Company’s 2018 guidance range. Estimated Funding per Year on Existing and Projected 2018 Commitments (1) ($ in millions) $198 $165 $46 $- $50 $100 $150 $200 $250 2018 Remaining 2019 2020-2022 Capital Structure as of March 31, 2018 ($ in thousands) Credit Facility Outstanding 30,000$ Series A Preferred Stock 75,000 Series B Preferred Stock 37,500 Common Stock 261,491 Total Capital 403,991$ Credit Facility Outstanding 7% Series A Preferred Stock 19% Series B Preferred Stock 9% Common Stock 65%

25 Appendix

26 Portfolio Detail Note: Represents portfolio as of 3/31/2018 (1) Cash investment represents the sum of the funded principal balance of the loan (net of unamortized origination fees), cash consideration (inclusive of transacti on costs), assumed liabilities, and net property working capital acquired, all as of the date of acquisition (2) Gross basis represents cash basis as defined above plus fair value appreciation recognized through the date of acquisition (3) Net operating i ncome (“NOI”) is a non - GAAP financial measure that excludes from operating income the impact of depreciation and general and adm inistrative expense. Projected stabilized NOI represents NOI at an expected time in the future when operations at the facility have stabilized from lease up oc cupancy and rental rates (1) Current Portfolio $ in 000s Fair Value Projected Date Acquired Location (MSA) Investment Type Date Opened Cash Investment (1) Recognized Through Date Acquired Gross Basis (2) Stabilized NOI (3) REIT Level Investments - as of 3/31/2018 8/9/2017 Orlando 1/2 Wholly-Owned 5/1/2016 12,047 3,780 15,827 1,095 2/2/2018 Atlanta 2 Wholly-Owned 5/24/2016 8,766 2,900 11,666 759 2/2/2018 Atlanta 1 Wholly-Owned 5/25/2016 10,467 2,704 13,171 864 1/10/2018 Jacksonville 1 Wholly-Owned 8/12/2016 8,686 2,947 11,633 709 2/20/2018 Pittsburgh Wholly-Owned 5/11/2017 7,360 1,976 9,336 688 Subtotal Wholly-Owned Properties $47,326 $14,307 $61,633 $4,115

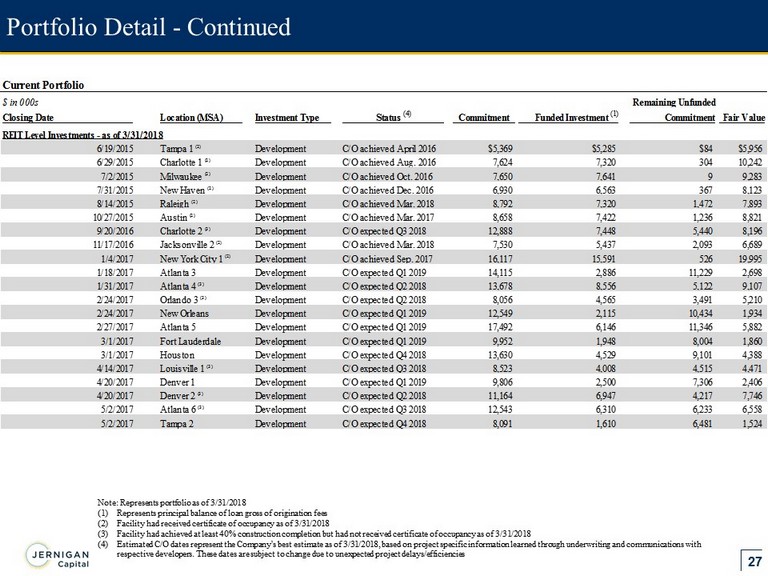

27 Portfolio Detail - Continued Note: Represents portfolio as of 3/31/2018 (1) Represents principal balance of loan gross of origination fees (2) Facility had received certificate of occupancy as of 3/31/2018 (3) Facility had achieved at least 40% construction completion but had not received certificate of occupancy as of 3/31/2018 (4) Estimated C/O dates represent the Company’s best estimate as of 3/31/2018, based on project specific information learned through underwriting and communications with respective developers. These dates are subject to change due to unexpected project delays/efficiencies (1) Current Portfolio $ in 000s Remaining Unfunded Closing Date Location (MSA) Investment Type Status (4) Commitment Funded Investment (1) Commitment Fair Value REIT Level Investments - as of 3/31/2018 6/19/2015 Tampa 1 (2) Development C/O achieved April 2016 $5,369 $5,285 $84 $5,956 6/29/2015 Charlotte 1 (2) Development C/O achieved Aug. 2016 7,624 7,320 304 10,242 7/2/2015 Milwaukee (2) Development C/O achieved Oct. 2016 7,650 7,641 9 9,283 7/31/2015 New Haven (2) Development C/O achieved Dec. 2016 6,930 6,563 367 8,123 8/14/2015 Raleigh (2) Development C/O achieved Mar. 2018 8,792 7,320 1,472 7,893 10/27/2015 Austin (2) Development C/O achieved Mar. 2017 8,658 7,422 1,236 8,821 9/20/2016 Charlotte 2 (3) Development C/O expected Q3 2018 12,888 7,448 5,440 8,196 11/17/2016 Jacksonville 2 (2) Development C/O achieved Mar. 2018 7,530 5,437 2,093 6,689 1/4/2017 New York City 1 (2) Development C/O achieved Sep. 2017 16,117 15,591 526 19,995 1/18/2017 Atlanta 3 Development C/O expected Q1 2019 14,115 2,886 11,229 2,698 1/31/2017 Atlanta 4 (3) Development C/O expected Q2 2018 13,678 8,556 5,122 9,107 2/24/2017 Orlando 3 (3) Development C/O expected Q2 2018 8,056 4,565 3,491 5,210 2/24/2017 New Orleans Development C/O expected Q1 2019 12,549 2,115 10,434 1,934 2/27/2017 Atlanta 5 Development C/O expected Q1 2019 17,492 6,146 11,346 5,882 3/1/2017 Fort Lauderdale Development C/O expected Q1 2019 9,952 1,948 8,004 1,860 3/1/2017 Houston Development C/O expected Q4 2018 13,630 4,529 9,101 4,388 4/14/2017 Louisville 1 (3) Development C/O expected Q3 2018 8,523 4,008 4,515 4,471 4/20/2017 Denver 1 Development C/O expected Q1 2019 9,806 2,500 7,306 2,406 4/20/2017 Denver 2 (3) Development C/O expected Q2 2018 11,164 6,947 4,217 7,746 5/2/2017 Atlanta 6 (3) Development C/O expected Q3 2018 12,543 6,310 6,233 6,558 5/2/2017 Tampa 2 Development C/O expected Q4 2018 8,091 1,610 6,481 1,524

28 Portfolio Detail - Continued (1) Note: Represents portfolio as of 3/31/2018 (1) Represents principal balance of loan gross of origination fees (2) Facility had achieved at least 40% construction completion but had not received certificate of occupancy as of 3/31/2018 (3) These investments contain a higher loan - to - cost ratio and a higher interest rate, some of which interest is payment - in - kind ("PI K") interest. The PIK interest, computed at the contractual rate specified in each debt agreement, is periodically added to the principal balance of the debt and is recorded as interest income. Thus, the actual collection of this interest may be deferred until the time of debt principal repayment (4) Estimated C/O dates represent the Company’s best estimate as of 3/31/2018, based on project specific information learned through underwriting and communications with respective developers. These dates are subject to change due to unexpected project delays/efficiencies Current Portfolio $ in 000s Remaining Unfunded Closing Date Location (MSA) Investment Type Status (4) Commitment Funded Investment (1) Commitment Fair Value REIT Level Investments - as of 3/31/2018 5/19/2017 Tampa 3 Development C/O expected Q4 2018 $9,224 $2,578 $6,646 $2,478 6/12/2017 Tampa 4 (2) Development C/O expected Q3 2018 10,266 3,697 6,569 3,821 6/19/2017 Baltimore (3) Development C/O expected Q3 2018 10,775 4,410 6,365 4,194 6/28/2017 Knoxville Development C/O expected Q4 2018 9,115 2,738 6,377 2,642 6/29/2017 Boston 1 (2) Development C/O expected Q3 2018 14,103 7,453 6,650 8,109 6/30/2017 New York City 2 (3) Development C/O expected Q4 2018 26,482 18,657 7,825 18,093 7/27/2017 Jacksonville 3 (2) Development C/O expected Q4 2018 8,096 2,658 5,438 2,640 8/30/2017 Orlando 4 Development C/O expected Q1 2019 9,037 2,446 6,591 2,335 9/14/2017 Los Angeles Development C/O expected Q3 2020 28,750 7,695 21,055 7,472 9/14/2017 Miami 1 Development C/O expected Q3 2019 14,657 6,429 8,228 6,268 9/28/2017 Louisville 2 Development C/O expected Q4 2018 9,940 3,241 6,699 3,129 10/12/2017 Miami 2 (3) Development C/O expected Q2 2019 9,459 1,038 8,421 837 10/30/2017 New York City 3 (3) Development C/O expected Q1 2019 14,701 3,557 11,144 3,237 11/16/2017 Miami 3 (3) Development C/O expected Q3 2019 20,168 3,773 16,395 3,332 11/21/2017 Minneapolis 1 Development C/O expected Q3 2019 12,674 1,202 11,472 1,065 12/1/2017 Boston 2 Development C/O expected Q4 2018 8,771 1,661 7,110 1,568 12/15/2017 New York City 4 Development C/O expected Q3 2019 10,591 1,000 9,591 887 12/27/2017 Boston 3 Development C/O expected Q4 2019 10,174 2,398 7,776 2,295 12/28/2017 New York City 5 Development C/O expected Q3 2019 16,073 4,765 11,308 4,612 2/8/2018 Minneapolis 2 Development C/O expected Q2 2019 10,543 4,599 5,944 4,534 3/30/2018 Philadelphia (3) Development C/O expected Q3 2019 14,338 2,787 11,551 2,508 Subtotal Development $499,094 $210,929 $288,165 $225,038

29 Portfolio Detail - Continued (1) Note: Represents portfolio as of 3/31/2018 (1) Represents principal balance of loan gross of origination fees (2) Facility had received certificate of occupancy as of 3/31/2018 (3) Facility had achieved at least 40% construction completion but had not received certificate of occupancy as of 3/31/2018 (4) Estimated C/O dates represent the Company’s best estimate as of 3/31/2018, based on project specific information learned through underwriting and communications with respective developers. These dates are subject to change due to unexpected project delays/efficiencies (5) These investments contain a higher loan - to - cost ratio and a higher interest rate, some of which interest is payment - in - kind ("PI K") interest. The PIK interest, computed at the contractual rate specified in each debt agreement, is periodically added to the principal balance of the debt and is recorded as interest income. Thus, the actual collection of this interest may be deferred until the time of debt principal repayment Current Portfolio $ in 000s Remaining Unfunded Closing Date Location (MSA) Investment Type Status (4) Commitment Funded Investment (1) Commitment Fair Value REIT Level Investments - as of 3/31/2018 12/23/2015 Miami Construction C/O expected Q2 2018 17,733 14,838 2,895 14,716 Subtotal Construction $17,733 $14,838 $2,895 $14,716 3/2/2018 Miami 4 (2) Bridge C/O achieved Oct. 2016 20,201 19,293 908 20,461 3/2/2018 Miami 5 (3)(5) Bridge C/O expected Q2 2018 17,738 15,734 2,004 13,637 3/2/2018 Miami 6 (2) Bridge C/O achieved Aug. 2016 13,370 13,161 209 16,691 3/2/2018 Miami 7 (2)(5) Bridge C/O achieved Mar. 2018 18,462 16,366 2,096 14,465 3/2/2018 Miami 8 (2) Bridge C/O achieved Dec. 2016 13,553 12,792 761 12,181 Subtotal Bridge $83,324 $77,346 $5,978 $77,435 7/7/2015 Newark Operating Property 3,480 3,480 - 3,415 12/22/2015 Chicago Operating Property 2,502 2,500 2 2,470 Subtotal Operating Property $5,982 $5,980 $2 $5,885 Total REIT Committed Investments - as of 3/31/2018 $606,133 $309,093 $297,040 $323,074 Total REIT Committed Investments + Wholly-Owned Properties - as of 3/31/2018 $653,459 NA NA NA

30 Portfolio Detail - Continued Note: Represents portfolio as of 3/31/2018 (1) Represents principal balance of loan gross of origination fees (2) Facility had received certificate of occupancy as of 3/31/2018 (3) Facility had achieved at least 40% construction completion but had not received certificate of occupancy as of 3/31/2018 (4) Estimated C/O dates represent the Company’s best estimate as of 3/31/2018, based on project specific information learned thro ugh underwriting and communications with respective developers. These dates are subject to change due to unexpected project delays/efficiencies (5) Total represents portfolio as of 3/31/2018 plus investments closed from 4/1/2018 - 6/1/2018 Current Portfolio $ in 000s Remaining Unfunded Closing Date Location (MSA) Investment Type Status (4) Size Funded Investment (1) Commitment Fair Value Heitman Joint Venture 5/14/2015 Miami 1 (2) Development C/O achieved Feb. 2018 13,867 11,571 2,296 14,227 5/14/2015 Miami 2 (3) Development C/O expected Q2 2018 14,849 11,640 3,209 12,805 9/25/2015 Fort Lauderdale (3) Development C/O expected Q2 2018 13,230 9,982 3,248 11,598 4/15/2016 Washington DC (2) Development C/O achieved Sep. 2017 17,269 16,146 1,123 18,539 4/29/2016 Atlanta 1 (3) Development C/O achieved Apr. 2018 10,223 8,332 1,891 9,094 7/19/2016 Jacksonville (2) Development C/O achieved Jul. 2017 8,127 7,253 874 11,241 7/21/2016 New Jersey Development C/O expected Q4 2018 7,828 2,383 5,445 2,228 8/15/2016 Atlanta 2 (2) Development C/O achieved Sep. 2017 8,772 7,846 926 9,077 8/25/2016 Denver (2) Development C/O achieved Dec. 2017 11,032 9,105 1,927 11,009 9/28/2016 Columbia (2) Development C/O achieved Aug. 2017 9,199 8,419 780 9,405 12/22/2016 Raleigh (3) Development C/O expected Q2 2018 8,877 5,798 3,079 6,657 Total Heitman JV Investments $123,273 $98,475 $24,798 $115,880 Total REIT + Heitman JV Committed Investments + Wholly-Owned Properties - as of 3/31/2018 $776,732 $407,568 $321,838 $438,954 Recent REIT Level Investments - Closed 3/31/18 - 6/1/18 4/6/2018 Minneapolis 3 Development C/O expected Q2 2020 12,883 NA NA NA 5/1/2018 Miami 9 Development C/O expected Q4 2019 12,421 NA NA NA 5/15/2018 Atlanta 6 Development C/O expected Q3 2019 9,418 NA NA NA 5/23/2018 Kansas City Development C/O expected Q3 2019 9,968 NA NA NA Total Recent REIT Level Investments - Closed 3/31/18 - 6/1/18 $44,690 NA NA NA Total REIT + Heitman JV Committed Investments + Wholly-Owned Properties + Recent Committed Investments (5) $821,422 NA NA NA Total REIT + Heitman JV Committed Investments + Wholly-Owned Properties as of March 31, 2018 $776,732 NA NA NA

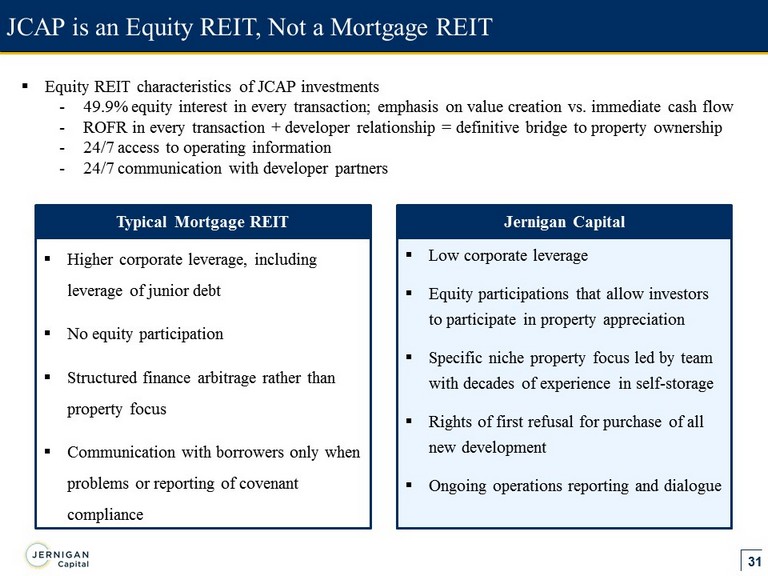

31 JCAP is an Equity REIT, Not a Mortgage REIT Typical Mortgage REIT ▪ Higher corporate leverage, including leverage of junior debt ▪ No equity participation ▪ Structured finance arbitrage rather than property focus ▪ Communication with borrowers only when problems or reporting of covenant compliance Jernigan Capital ▪ Low corporate leverage ▪ Equity participations that allow investors to participate in property appreciation ▪ Specific niche property focus led by team with decades of experience in self - storage ▪ Rights of first refusal for purchase of all new development ▪ Ongoing operations reporting and dialogue ▪ Equity REIT characteristics of JCAP investments - 49.9% equity interest in every transaction; emphasis on value creation vs. immediate cash flow - ROFR in every transaction + developer relationship = definitive bridge to property ownership - 24/7 access to operating information - 24/7 communication with developer partners

32 Heitman Capital Management Joint Venture Overview ▪ On March 7, 2016, JCAP, through its operating company, entered into a limited liability company agreement to form a real esta te venture (“JV”) partnership with an investment vehicle of Heitman Capital Management for an initial total commitment by the parties of up to $122.2 million, which was later increased to $123.3 million ▪ Heitman recognizes JCAP’s self - storage knowledge, experience and relationships and will rely on JCAP to source all investments, manage the relationships with developers, process and service all investments and make decisions regarding financial and tax accounting JV Partner Heitman Capital Management LLC Initial Investment Structure 90% Heitman / 10% JCAP Maximum and Current JV Commitment $123.3 million (Fully Committed) JCAP Fee Overview A. Acquisition Fee: 1% on new equity investments above $41.9 million initial contribution B. Administrative Fee (Capped) C. Promote: (i) 90% / 10% split through 14% IRR (ii) 80% / 20% split through 17% IRR (iii) 70% / 30% split through 20% IRR (iv) 60% / 40% split after 20% IRR Substantial Advantages of this Structure Match funding, no dilution, favorable promote structure Heitman Joint Venture is Fully Committed

33 Highland Capital Series A Preferred Overview ▪ On July 27, 2016, JCAP entered into an agreement with NexPoint Advisors, L.P., an affiliate of Highland Capital Management, LP, to issue up to $125 million of Series A Preferred Stock Investor Funds managed by NexPoint Advisors, L.P. Structure of the Investment Series A Preferred Stock Investment Size Up to $125 million of equity capital through July 2018 Current Balance $110 million as of June 1, 2018 Investment Term JCAP has the right to redeem Series A Preferred Stock after August 1, 2021 Funding Schedule Drawn in $5 million minimum increments to match fund JCAP investments for an aggregate minimum amount of $50 million by July 2018 Cost of Capital 7% cash dividend and Payment in Kind (“PIK”) dividend (common or additional Series A P referred Stock, at investor’s election) up to 25% of incremental increase in book value; total return limited to 14% IRR In January 2018, executed amendment to the agreement which has the effect of leveling out the PIK dividend through the second quarter of 2021 Substantial Advantages of this Structure Match funding, limited dilution, alignment of interests

34 Credit Facility Overview Investor KeyBank Capital Markets, Inc. and Raymond James Bank, N.A. Structure of the Investment Senior secured revolving credit facility Investment Size Up to $100 million debt capital, e xpandable up to $200 million with accordion feature, upon satisfaction of certain conditions Current Balance As of June 1, 2018, the Company has an outstanding balance of $30.0 million on the credit facility Term Three years, expiring July 24, 2020 Capacity As of June 1, 2018, the Company has a borrowing capacity of $90.8 million and, based on expected C/Os, anticipates its borrowing base to increase over the balance of 2018 Cost of Capital Interest at rates between 275 and 375 basis points over 30 - day LIBOR Substantial Advantages of this Structure Match funding, no dilution, lower - cost capital ▪ In July 2017, JCAP obtained a secured credit facility for up to $100 million of attractively priced debt capital, led by KeyBank Capital Markets, Inc. and Raymond James Bank, N.A.

35 Series B Preferred Stock Overview ▪ On January 26, 2018, JCAP issued $37.5 million of Series B cumulative redeemable perpetual preferred stock (“Series B Preferred Stock”) through a public offering ▪ On March 29, 2018, JCAP entered into a Distribution Agreement among JCAP, the Operating Company and B. Riley FBR, Inc., as sales agent, pursuant to which it may offer, from time to time, up to $45 million of Series B Preferred Stock NYSE Symbol JCAP - PB Structure of the Investment Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share with a liquidation preference of $25.00 per share Current Investment Size $ 38.4 million or 1,539,664 shares (1) Investment Term JCAP has the right to redeem Series B Preferred Stock on or after January 26, 2023 Cost of Capital 7% cash dividend Use of Proceeds Fund existing or future investments in the Company’s development portfolio and operating property loan portfolio, including the Miami portfolio investment, and for general corporate purposes (1) Outstanding as of June 1 , 2018