Attached files

| file | filename |

|---|---|

| S-1 - REGISTRATION STATEMENT ON FORM S-1 - Forty Seven, Inc. | d523840ds1.htm |

| EX-23.1 - EX-23.1 - Forty Seven, Inc. | d523840dex231.htm |

| EX-16.1 - EX-16.1 - Forty Seven, Inc. | d523840dex161.htm |

| EX-10.16 - EX-10.16 - Forty Seven, Inc. | d523840dex1016.htm |

| EX-10.15 - EX-10.15 - Forty Seven, Inc. | d523840dex1015.htm |

| EX-10.14 - EX-10.14 - Forty Seven, Inc. | d523840dex1014.htm |

| EX-10.13 - EX-10.13 - Forty Seven, Inc. | d523840dex1013.htm |

| EX-10.12 - EX-10.12 - Forty Seven, Inc. | d523840dex1012.htm |

| EX-10.10 - EX-10.10 - Forty Seven, Inc. | d523840dex1010.htm |

| EX-10.9 - EX-10.9 - Forty Seven, Inc. | d523840dex109.htm |

| EX-10.8 - EX-10.8 - Forty Seven, Inc. | d523840dex108.htm |

| EX-10.1 - EX-10.1 - Forty Seven, Inc. | d523840dex101.htm |

| EX-4.1 - EX-4.1 - Forty Seven, Inc. | d523840dex41.htm |

| EX-3.4 - EX-3.4 - Forty Seven, Inc. | d523840dex34.htm |

| EX-3.3 - EX-3.3 - Forty Seven, Inc. | d523840dex33.htm |

| EX-3.2 - EX-3.2 - Forty Seven, Inc. | d523840dex32.htm |

| EX-3.1 - EX-3.1 - Forty Seven, Inc. | d523840dex31.htm |

Table of Contents

Exhibit 10.11

LEASE

BY AND BETWEEN

MENLO PREHC I, LLC, a Delaware limited liability company, MENLO PREPI I, LLC, a

Delaware limited liability company, and TPI INVESTORS 9, LLC,

a California limited liability company, LESSOR

AND

FORTY SEVEN, INC., a Delaware corporation, LESSEE

Menlo Business Park

1490 O’Brien Drive, Suites A, B and E

Menlo Park, California 94025

April 13, 2016

1.

Table of Contents

| Page | ||||||

| 1. | 1 | |||||

| 2. | 2 | |||||

| 3. | 3 | |||||

| 4. | 4 | |||||

| 5. | 5 | |||||

| 6. | 10 | |||||

| 7. | 10 | |||||

| 8. | 11 | |||||

| 9. | 11 | |||||

| 10. | 13 | |||||

| 11. | 13 | |||||

| 12. | 15 | |||||

| 13. | MARKET READY IMPROVEMENTS AND ADDITIONAL TENANT IMPROVEMENTS |

16 | ||||

| 14. | MAINTENANCE AND REPAIRS; ALTERATIONS; SURRENDER AND RESTORATION |

18 | ||||

| 15. | 22 | |||||

| 16. | 23 | |||||

| 17. | 23 | |||||

| 18. | 27 | |||||

| 19. | 27 | |||||

| 20. | 27 | |||||

| 21. | 29 | |||||

| 22. | 29 | |||||

| 23. | 31 | |||||

| 24. | 31 | |||||

| 25. | 32 | |||||

| 26. | 32 | |||||

| 27. | 33 | |||||

| 28. | 33 | |||||

| 29. | 33 | |||||

-i-

Table of Contents

Table of Contents

(continued)

| Page | ||||||

| 30. | 34 | |||||

| 31. | 34 | |||||

| 32. | 34 | |||||

| 33. | 34 | |||||

| 34. | 34 | |||||

| 35. | 34 | |||||

| 36. | 35 | |||||

| 37. | 36 | |||||

| 38. | 36 | |||||

SCHEDULE OF EXHIBITS

EXHIBIT “A” Legal Description of 1490 O’Brien Drive

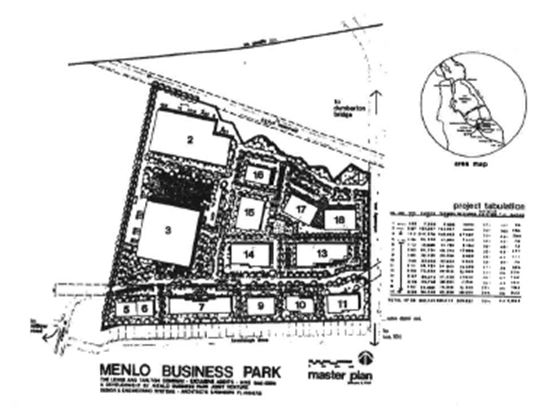

EXHIBIT “B” Menlo Business Park Master Plan

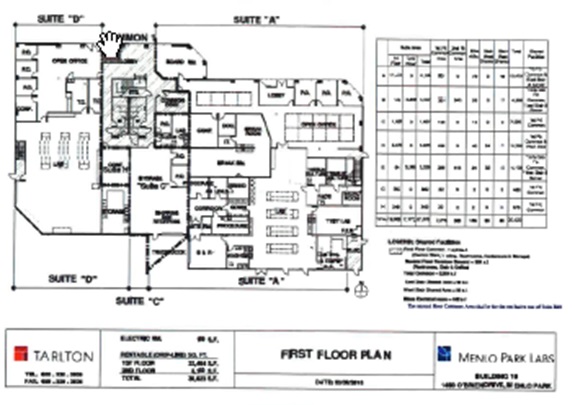

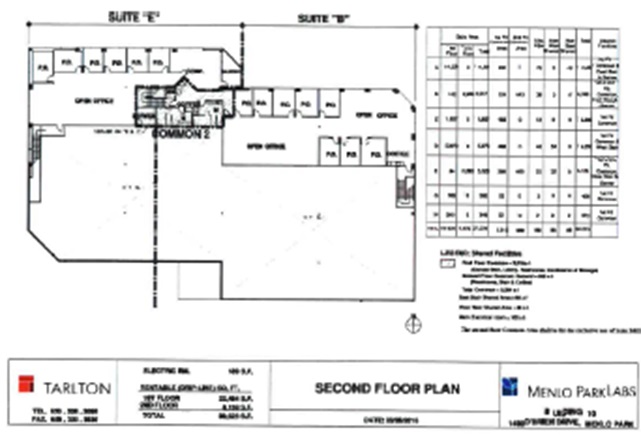

EXHIBIT “C” Floor Plan of Building #10

EXHIBIT “D” Commencement Memorandum

EXHIBIT “E” Lessee’s Hazardous Materials

EXHIBIT “F” Description of Market Ready Improvements

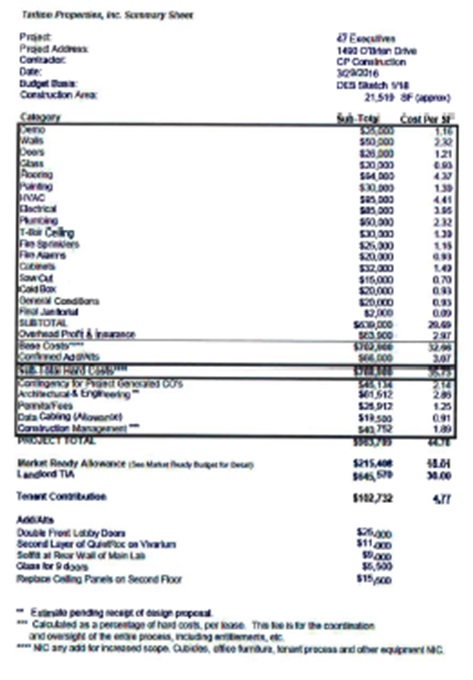

EXHIBIT “F-1” Estimate of Market Ready Improvements and Tenant Improvements

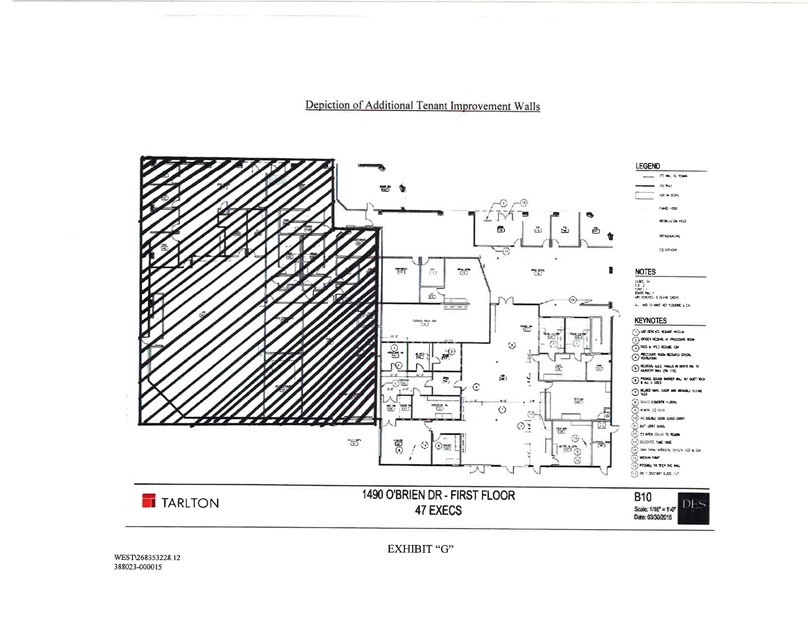

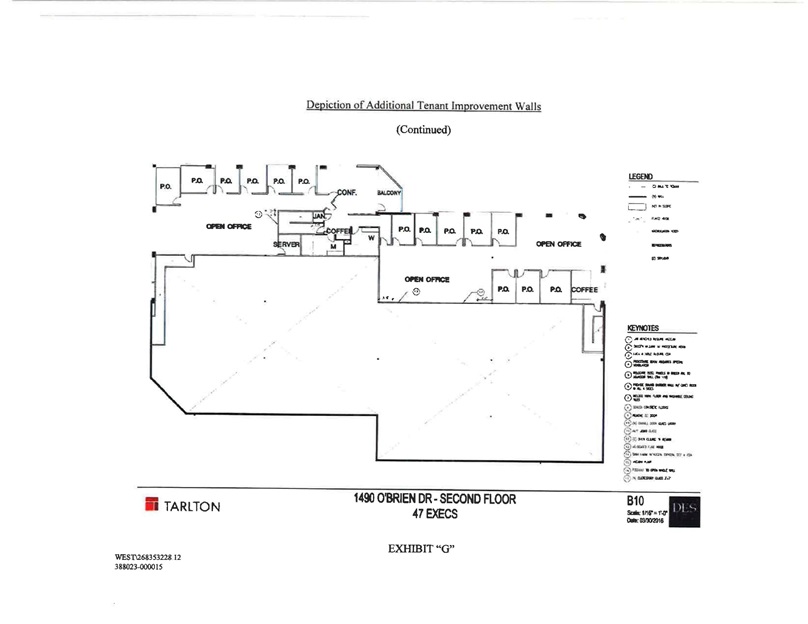

EXHIBIT “G” Description of Tenant Improvements

-ii-

Table of Contents

Menlo Business Park

Portion of Building #10

1490 O’Brien Drive, Suites A, B and E,

Menlo Park, California 94025

THIS LEASE, referred to herein as this “Lease,” is made and entered into as of April 13, 2016, by and between MENLO PREHC I, LLC, a Delaware limited liability company, MENLO PREPI I, LLC, a Delaware limited liability company, and TPI Investors 9, LLC, a California limited liability company, hereafter collectively referred to as “Lessor,” and FORTY SEVEN, INC., a Delaware corporation, hereafter referred to as “Lessee”.

RECITALS:

A. Lessor is the owner of the real property located in Menlo Business Park, Menlo Park, California, commonly referred to as 1490 O’Brien Drive, Menlo Park, California 94025 more particularly described on Exhibit “A” attached hereto and incorporated by reference herein, consisting of a parcel of land containing approximately 1.68 acres, together with all easements and appurtenances thereto (collectively, the “Land”) and the existing building thereon, referred to as Building #10, containing approximately thirty thousand six hundred twenty three (30,623) rentable square feet and all other improvements located thereon (collectively, the “Improvements”). The Land and Improvements are referred to herein collectively as the “Property.” The Menlo Business Park Master Plan is attached hereto as Exhibit “B” and incorporated by reference herein, and identifies the properties that comprise the Menlo Business Park. Building #10 is referred to herein as the “Building.” The floor plan of the Premises is attached hereto as Exhibit “C” and incorporated by reference herein.

B. Lessor and Lessee wish to enter into this Lease of the Premises defined in Paragraph 1 upon the terms and conditions set forth herein.

NOW, THEREFORE, the parties agree as follows:

1. Lease. Lessor hereby leases to Lessee, and Lessee leases from Lessor, at the rental rate and upon the terms and conditions set forth herein, the Premises (as hereinafter defined). Beginning on the Commencement Date (as defined in Paragraph 2(a)), Lessor hereby leases to Lessee, and Lessee leases from Lessor, the portion of the Building consisting of approximately twenty one thousand five hundred nineteen (21,519) rentable square feet as shown on the floor plan of the Building attached hereto as Exhibit “C” (the “Premises”). The Premises shall include the right to use Lessee’s share of the on-site parking spaces pursuant to Paragraph 28, the exclusive right to use the common areas on the second floor of the Building as depicted and described on Exhibit “C”, so long as the Premises includes both Suite “B” and Suite “E” of the Building, the non-exclusive right to use the common areas of the Building as depicted on Exhibit “C”, and the other Improvements on the Property intended for use in common by the tenants of the Building. Lessee’s Pro Rata Share of the Building shall mean 70.27% throughout the Term.

1.

Table of Contents

(a) The term of this Lease (the “Term”) shall commence on the sooner of (i) the date that Lessor delivers the Premises to Lessee in the required condition with the Tenant Improvements summarized on Exhibit “F” and Exhibit “G” attached hereto Substantially Completed (the “Commencement Date”) and (ii) the date Lessee first commences business operations in the Premises. Upon the Commencement Date, the Building and all of the systems of the Building (including lighting systems, the back-up generator and fume hoods), shall be in vacant, broom clean, good operating condition and repair, including the HVAC, mechanical, electrical, and plumbing systems. Notwithstanding anything to the contrary in this Lease, if the Building or any of the systems of the building are not delivered in good operating condition, and such condition is not due to Lessee’s use of, or activities or work in, the Premises or Building, Lessor shall (as Lessee’s sole remedy therefor) correct such condition at Lessor’s cost within a commercially reasonable time after Lessor’s receipt of written notice from Lessee (provided that such notice from Lessee must be received within sixty (60) days following the Commencement Date). The Commencement Date shall be confirmed in writing by Lessor and Lessee by the execution and delivery of the Commencement Memorandum in the form attached hereto as “Exhibit “D.”

(b) The Term of this Lease shall expire, unless sooner terminated in accordance with the provisions hereof or as permitted by law, on the last day of the sixtieth (60th) full calendar month after the Commencement Date.

(c) Lessee acknowledges that the applicable ordinance of the City of Menlo Park (the “City”) requires that Lessee must obtain a Conditional Use Permit (“CUP”) from the City if Lessee maintains on the Premises five (5) gallons or more of Hazardous Materials (as defined in Paragraph 9). Accordingly, for the period from the Commencement Date until the date Lessee obtains the CUP from the City permitting Lessee to maintain on the Premises five (5) gallons or more of Hazardous Materials, Lessee shall maintain less than five (5) gallons of Hazardous Materials on the Premises. Lessee shall promptly apply for and shall use its commercially reasonable good faith diligent efforts to comply with the City’s requirements for the issuance to Lessee of the CUP. Lessor shall not be responsible for the issuance of the CUP. Lessee shall deliver a copy of the CUP to Lessor and Lessee shall comply with the provisions thereof.

(d) If possession of the Premises is not delivered to Lessee in the required condition by November 1, 2016, Lessee may, at its option, by notice in writing received by Lessor after such date and before the date possession is so delivered, terminate this Lease, in which event Lessor shall refund to Lessee the prepaid Monthly Base Rent and the Security Deposit, and the parties shall be discharged from all further obligations hereunder, except for those obligations which by the express terms hereof survive the termination of this Lease. If such written notice is not received by Lessor on or before the date possession is so delivered, Lessee’s right to cancel this Lease pursuant to this Paragraph 2(d) shall terminate and be of no further force or effect.

2.

Table of Contents

(a) Lessor hereby grants to Lessee one (1) option to extend the term of this Lease (the “Option to Extend”) for a period of sixty (60) months (the “Extended Term”) immediately following the expiration of the Term. Lessee may exercise the Option to Extend by giving written notice of exercise to Lessor at least twelve (12) months but no more than fifteen (15) months prior to the expiration of the initial Term of this Lease (the “Option Exercise Period”), time being of the essence; provided that if Lessee is in a state of uncured default after the expiration of all applicable notice and cure periods under this Lease at either the time of the exercise of the Option to Extend or on the commencement date of the Extended Term, such notice shall be void and of no force or effect. The Extended Term, if the Option to Extend is exercised, shall be upon the same terms and conditions as the initial Term of this Lease, including the payment by Lessee of the Additional Rent pursuant to Paragraph 5, except that (1) Lessee shall pay Monthly Base Rent, as determined as set forth in this Paragraph 3, during the Extended Term, (2) there shall be no additional option to extend, and (3) Lessee shall accept the Premises in their then “as is” condition. If Lessee does not exercise the Option to Extend in a timely manner the Option to Extend shall lapse, time being of the essence.

(b) The Option to Extend granted to Lessee by this Paragraph 3 is granted for the personal benefit of Forty Seven, Inc., a Delaware corporation only, and shall be exercisable only by Forty Seven, Inc., a Delaware corporation or a Permitted Transferee. The Option to Extend may not be assigned or transferred to any assignee or sublessee other than a Permitted Transferee.

(c) The Monthly Base Rent for the Premises during the Extended Term shall be determined pursuant to the provisions of this Paragraph 3(c) and shall equal the then current fair market rental for the Premises on the commencement date of the Extended Term as determined by agreement between the Lessor and Lessee reached prior to the expiration of the Option Exercise Period, if possible, and by the process of appraisal if the parties cannot reach agreement.

(d) Upon the written request by Lessee to Lessor received by Lessor at any time during the thirty (30) day period prior to the expiration of the Option Exercise Period and prior to the exercise by Lessee of the Option to Extend, Lessor shall give Lessee written notice of Lessor’s good faith opinion of the amount equal to the fair market rental value of the Premises for the Extended Term. Thereafter, upon the request of Lessee, Lessor and Lessee shall enter into good faith negotiations during the remainder of the thirty (30) days prior to the expiration of the Option Exercise Period in an effort to reach agreement on the initial Monthly Base Rent for the Premises during the Extended Term.

If Lessor and Lessee are unable to agree upon the amount equal to the fair market rental value of the Premises for the Extended Term, and thereafter, prior to the expiration of the Option Exercise Period, Lessee exercises the Option to Extend, said amount shall be determined by appraisal. The appraisal shall be performed by one appraiser if the parties are able to agree upon one appraiser. If the parties are unable to agree upon one appraiser, then each party shall appoint an appraiser and the two appraisers shall select a third appraiser. Each appraiser selected shall be a member of the American Institute of Real Estate Appraisers (AIREA) with at least five (5) years of full-time commercial real estate appraisal experience in the Menlo Park office/R&D/manufacturing rental market.

3.

Table of Contents

If only one appraiser is selected, that appraiser shall notify the parties in simple letter form of its determination of the amount equal to the fair market Monthly Base Rent for the Premises on the commencement date of the Extended Term within fifteen (15) days following its selection. Said appraisal shall be binding on the parties as the appraised current “fair market rental” for the Premises which shall be based upon what a willing new lessee would pay and a willing lessor would accept at arm’s length for comparable premises in the Menlo Business Park of similar age, size, quality of construction and specifications (excluding the value of any improvements to the Premises made at Lessee’s cost with Lessor’s prior written consent except as otherwise permitted herein) for a lease similar to this Lease and taking into consideration that there will be no free rent, improvement allowance, or other rent concessions. If multiple appraisers are selected, each appraiser shall within ten (10) days of being selected make its determination of the amount equal to the fair market Monthly Base Rent for the Premises on the commencement date of the Extended Term in simple letter form. If two (2) or more of the appraisers agree on said amount, such agreement shall be binding upon the parties. If multiple appraisers are selected and two (2) appraisers are unable to agree on said amount, the amount equal to the fair market Monthly Base Rent for the Premises on the commencement date of the Extended Term shall be determined by taking the mean average of the appraisals; provided, that any high or low appraisal, differing from the middle appraisal by more than ten percent (10%) of the middle appraisal, shall be disregarded in calculating the average.

If only one appraiser is selected, then each party shall pay one-half of the fees and expenses of that appraiser. If three appraisers are selected, each party shall bear the fees and expenses of the appraiser it selects and one-half of the fees and expenses of the third appraiser.

(e) Thereafter, provided that Lessee has previously given timely notice to Lessor of the exercise by Lessee of the Option to Extend, Lessor and Lessee shall execute an amendment to this Lease stating that the initial Monthly Base Rent for the Premises during the Extended Term shall be equal to the determination by appraisal.

(a) Commencing on the Commencement Date and continuing on the first day of each calendar month thereafter until the end of the Term, Lessee shall pay to Lessor in monthly installments in advance the Monthly Base Rent for the Premises in lawful money of the United States as follows:

| Months |

Square Feet |

$/SF/Mo./NNN |

Monthly Base Rent | |||

| 1-12* | 21,519 | $4.10 | $88,227.90 | |||

| 13-24 | 21,519 | $4.22 | $90,874.74 | |||

| 25-36 | 21,519 | $4.35 | $93,600.98 | |||

| 37-48 | 21,519 | $4.48 | $96,409.01 | |||

| 49-60 | 21,519 | $4.61 | $99,301.28 |

* Notwithstanding the rental amounts set forth herein, during months 1-4, until such time as Lessee or a subtenant of Lessee occupies any portion of the Premises located on the second (2nd) floor of the Building, Monthly Base Rent shall be Sixty-Eight Thousand Two Hundred Twenty-Four and 00/100 Dollars ($68,224) per month.

4.

Table of Contents

(b) Upon the execution and delivery of this Lease by Lessee, Lessee shall pay to Lessor the cash sum of Sixty Eight Thousand Two Hundred Twenty Four and 00/100 Dollars ($68,224.00) representing the installment of Monthly Base Rent due for the first month following the Commencement Date. Thereafter, Monthly Base Rent shall be paid monthly in advance on the first day of each calendar month. Lessee shall also pay to Lessor upon execution and delivery of this Lease, the amount of Thirty Five Thousand Five Hundred Fifty-Nine and 00/100 Dollars ($35,559.00) which amount shall be applied to the Additional Rent (as hereinafter defined) for the first calendar month of the Term. Lessee shall also pay to Lessor upon the execution and delivery of this Lease the additional amount of Three Hundred Thousand Nine Hundred Eleven and 60/100 Dollars ($352,911.60) representing the Security Deposit (as defined in Paragraph 7 below).

5. Additional Rent; Operating Expenses and Taxes.

(a) In addition to the Monthly Base Rent payable by Lessee pursuant to Paragraph 4, commencing on the Commencement Date Lessee shall pay to Lessor, as “Additional Rent,” (1) Lessee’s Pro Rata Share of the Operating Expenses of the Property, (2) Lessee’s pro rata share of the operating expenses for the Menlo Business Park of which the Property is a part (the “Park Expenses”), and (3) Lessee’s Pro Rata Share of the Taxes (as defined in Paragraph 5(c) below). Lessee’s pro rata share of the operating expenses of Menlo Business Park is 2.5% based upon Lessee’s Pro Rata Share of the ratio of the number of square feet of the Land in the Property to the total number of square feet of land in Menlo Business Park, as shown on Exhibit “B.” The Park Expenses, of which the Property is a part, currently include maintenance of the common areas of Menlo Business Park, parking lot lighting (cost of electricity and maintenance of the fixtures), maintenance of the network conduit, all landscape maintenance and irrigation of Menlo Business Park, Lessor’s insurance coverages of Menlo Business Park, and security patrol. The Park Expenses may include other commercially reasonable and customary items from time to time during the term of this Lease. Monthly Base Rent and Additional Rent are referred to herein collectively as “rent.”

(b) “Operating Expenses,” as used herein, shall include all commercially reasonable and customary direct costs actually incurred by Lessor in the management, operation, maintenance, repair and replacement of the Property, including the cost of all maintenance, repairs, and restoration of the Property performed by Lessor pursuant to Paragraphs 14(b) and 14(c) hereof, as determined by generally accepted accounting principles (unless excluded by this Lease), including, but not limited to:

Personal property taxes related to the Premises; any parking taxes or parking levies imposed on the Premises in the future by any governmental agency; a management fee charged for the management and operation of Menlo Business Park, in an amount equal to four percent (4%) of the total gross income received by Lessor from the Lessee (including Monthly Base Rent and Additional Rent), and not just Lessee’s Pro Rata Share of this fee; water and sewer charges; waste disposal; insurance premiums for insurance coverages maintained by Lessor pursuant to Paragraph 11(b) hereof; license, permit, and inspection fees; charges for electricity, heating, air conditioning, gas, and any other utilities (including, without limitation, any temporary or permanent utility surcharge or other exaction); security; maintenance, repair, and replacement of the roof membrane; painting and repairing, interior and exterior; maintenance and replacement of floor and window coverings; repair, maintenance, and replacement of air-conditioning, heating,

5.

Table of Contents

mechanical and electrical systems, elevators, plumbing and sewage systems; janitorial service; landscaping, gardening, and tree trimming; glazing; repair, maintenance, cleaning, sweeping, striping, and resurfacing of the parking area; exterior Building lighting and parking lot lighting; supplies, materials, equipment and tools used in the maintenance of the Property; costs for accounting services incurred in the calculation of Operating Expenses and Taxes; and the cost of any other capital expenditures for any improvements or changes to the Building which are required by laws, ordinances, or other governmental regulations adopted after the Commencement Date, or for any items or capital expenditures voluntarily made by Lessor which are intended to reduce Operating Expenses; provided, however, that except for capital improvements required because of Lessee’s specific use of the Property, if Lessor is required to or voluntarily makes such capital improvements, Lessor shall amortize the cost of said improvements over the useful life of said improvements calculated in accordance with generally accepted accounting principles (together with interest on the unamortized balance at the rate equal to the effective rate of interest on Lessor’s bank line of credit at the time of completion of said improvements, but in no event in excess of ten percent (10%) per annum) as an Operating Expense in accordance with generally accepted accounting principles, except that with respect to capital improvements made to save Operating Expenses such amortization shall not be at a rate greater than the actual savings in Operating Expenses. Operating Expenses shall also include any other expense or charge, whether or not described herein not specifically excluded by other provisions of this Lease, which in accordance with generally accepted accounting principles would be considered an expense of managing, operating, maintaining, and repairing the Property.

(c) Real property taxes and assessments upon the Property, during each lease year or partial lease year during the term of this Lease are referred to herein as “Taxes.”

As used herein, “Taxes” shall mean:

(1) all real estate taxes, assessments, charges and any other taxes which are levied or assessed against the Property including the Land, the Building, and all improvements located thereon, including any increase in Taxes resulting from a reassessment following any transfer of ownership of the Property or any interest therein or following any improvements to the Property, or the Property’s pro rata share of improvements to Menlo Business Park which are for the benefit of all occupants of Menlo Business Park; and

(2) all other taxes which may be levied in lieu of real estate taxes, assessments, and other fees, charges, and levies, general and special, ordinary and extraordinary, unforeseen as well as foreseen, of any kind and nature by any authority having the direct or indirect power to tax, including without limitation any governmental authority or any improvement or other district or division thereof, for public improvements, services, or benefits which are assessed, levied, confirmed, imposed, or become a lien (1) upon the Property, and/or any legal or equitable interest of Lessor in any part thereof; or (2) upon this transaction or any document to which Lessee is a party creating or transferring any interest in the Property; and (3) any tax or excise, however described, imposed in addition to, or in substitution partially or totally of, any tax previously included within the definition of “Taxes” or any tax the nature of which was previously included in the definition “Taxes.”

6.

Table of Contents

Not included within the definition of “Taxes” or “Park Expenses” are any net income, profits, transfer, franchise, estate, gift, rental income, or inheritance taxes imposed by any governmental authority. “Taxes” also shall not include penalties or interest charges assessed on delinquent Taxes so long as Lessee is not in default in the payment of Monthly Base Rent or Additional Rent.

With respect to any assessments which may be levied against or upon the Property, which under the laws then in force may be evidenced by improvement or other bonds, or may be paid in annual installments, only the amount of such annual installment (with appropriate proration of any partial year) and statutory interest shall be included within the computation of the annual Taxes levied against the Property.

(d) The following costs (“Costs”) shall be excluded from the definition of Operating Expenses and Park Expenses:

(1) Costs occasioned by the act, omission or violation of law by Lessor, any other occupant of Menlo Business Park, or their respective agents, employees or contractors;

(2) Costs for which Lessor receives reimbursement from others, including reimbursement from insurance;

(3) Interest, charges and fees incurred on debt or payments on any deed of trust or ground lease on the Property, or Menlo Business Park;

(4) Advertising or promotional costs or other costs incurred by Lessor in procuring tenants for the Property or other portions of Menlo Business Park;

(5) Costs incurred in repairing, maintaining or replacing any structural elements of the Building for which Lessor is responsible pursuant to Paragraph 14(a) hereof or incurred in repairing, maintaining, or replacing any structural elements of other buildings in Menlo Business Park for which Lessor is contractually responsible;

(6) Any wages, bonuses or other compensation of employees above the grade of building manager and any executive salary of any officer or employee of Lessor or for employees to the extent not stationed at Menlo Business Park, including fringe benefits other than insurance plans and tax-qualified benefit plans, or any fee, profit or compensation retained by Lessor or its affiliates for management and administration of the Property in excess of the management fee referred to in Paragraph 5(b) of this Lease; if any building manager stationed at Menlo Business Park is less than full-time, only the pro rata portion of the compensation paid to such employee shall be included in Operating Expenses;

(7) General office overhead and general and administrative expenses of Lessor, except as specifically provided in Paragraph 5(b);

(8) Leasing expenses and broker commissions payable by Lessor;

7.

Table of Contents

(9) Costs occasioned by casualties or by the exercise of the power of eminent domain;

(10) Costs to correct any construction defect in the Building or the Premises existing on the Commencement Date, or to comply with any covenant, condition, restriction, underwriter’s requirement or Law applicable on the Commencement Date except to the extent that such costs to comply arise or result from the Tenant Improvements or any subsequent Alterations requested by Lessee hereunder except as otherwise set forth in Paragraph 13 below;

(11) Costs of any renovation, improvement, painting or redecorating of any portion of the Property or the Menlo Business Park not made available for Lessee’s use;

(12) Costs incurred in connection with negotiations or disputes with any other occupant of the Menlo Business Park and Costs arising from the violation by Lessor or any other occupant of the Menlo Business Park of the terms and conditions of any lease or other agreement;

(13) Costs incurred in connection with the presence of any Hazardous Materials on the Property or on other property in Menlo Business Park that were not caused by or the result of a release by Lessee or its employees, agents, contractors, invitees, sublessees, successors or assigns;

(14) Expense reserves; and

(15) Capital costs, except to the extent permitted in Paragraph 5(b) above; provided, however, that all capital costs shall be amortized as described in Paragraph 5(b).

Lessor shall at all times use its best efforts to operate the Property in an economically reasonable manner at costs not disproportionately higher than those experienced by other comparable premises in the market area in which the Property is located.

(e) Prior to the execution of this Lease, Lessor has delivered to Lessee Lessor’s estimate of 2016 Operating Expenses, Taxes and Park Expenses. Throughout the term of this Lease, as close as reasonably possible after the end of each calendar year thereafter but no later than April 1 of the following year, Lessor shall notify Lessee of the Operating Expenses, Taxes and Park Expenses estimated by Lessor for each following calendar year. Concurrently with such notice, Lessor shall provide a description of such Operating Expenses, Taxes and Park Expenses. Commencing on the Commencement Date, and on the first (1st) day of each calendar month thereafter, Lessee shall pay to Lessor, as Additional Rent, one-twelfth (1/12th) of the estimated Operating Expenses, Taxes and Park Expenses. If at any time during any such calendar year, it appears to Lessor that the Operating Expenses, Taxes or Park Expenses for such year will vary from Lessor’s estimate, Lessor may, by written notice to Lessee, revise Lessor’s estimate for such year and the Additional Rent payments by Lessee for such year shall thereafter be based upon such revised estimate. Lessor shall furnish to Lessee with such revised estimate written verification showing that the actual Operating Expenses, Taxes or Park Expenses are greater than or equal to Lessor’s estimate. The increase in the monthly installments of Additional Rent resulting from Lessor’s revised estimate shall not be retroactive, but the Additional Rent for each calendar year shall be subject to adjustment between Lessor and Lessee after the close of the calendar year, as provided below.

8.

Table of Contents

Within approximately ninety (90) days after the expiration of each calendar year of the term, Lessor shall furnish Lessee a statement certified by a responsible employee or agent of Lessor (the “Operating Statement”) with respect to such year, prepared by an employee or agent of Lessor, showing the actual Operating Expenses, Taxes and Park Expenses for such year broken down by component expenses, and the total payments made by Lessee for such year on the basis of any previous estimate of such Operating Expenses, Taxes and Park Expenses, all in sufficient detail for verification by Lessee. Unless Lessee raises any objections to the Operating Statement within ninety (90) days after receipt of the same, such statement shall conclusively be deemed correct and Lessee shall have no right thereafter to dispute such statement or any item therein or the computation of Operating Expenses and/or Taxes and/or Park Expenses. Upon giving Lessor five (5) days advance written notice, Lessee or its accountants shall have the right to inspect and audit Lessor’s books and records with respect to the Operating Statement in an office of Lessor, or Lessor’s agent, during normal business hours, once each Lease Year to verify actual Operating Expenses and/or Taxes and/or Park Expenses. Should Lessee retain any accountant or accounting firm to audit or inspect Lessor’s books and records pursuant to this Paragraph 5(e), such accountant or accounting firm shall be one of national standing and retained on an hourly rate basis or based upon a fixed fee and shall not be paid on a contingency basis. Lessor’s books and records shall be kept in accordance with generally accepted accounting principles. If Lessee’s audit of the Operating Expenses and/or Taxes and/or Park Expenses for any year reveals a net overcharge of more than five percent (5%), Lessor shall promptly reimburse Lessee for the cost of the audit; otherwise, Lessee shall bear the cost of Lessee’s audit. If Lessee reasonably objects to Lessor’s Operating Statement, Lessee shall nonetheless continue to pay on a monthly basis the Operating Expenses, Taxes and Park Expenses based upon the Lessor’s most current estimate until such dispute is resolved.

If Lessee’s Pro Rata Share of the Operating Expenses and Taxes and Lessee’s pro rata share of Park Expenses for any year as finally determined exceed the total payments made by Lessee for such year based on Lessor’s estimates, Lessee shall pay to Lessor the deficiency, within thirty (30) days after the receipt of Lessor’s Operating Statement. If the total payments made by Lessee based on Lessor’s estimate of the Operating Expenses and/or Taxes and/or Park Expenses exceed the Lessee’s Pro Rata Share of Operating Expenses and/or Taxes and/or Lessee’s pro rata share of Park Expenses, Lessee’s extra payment, plus the cost of an audit which is the responsibility of Lessor as set forth herein, if any, shall be credited against payments of Monthly Base Rent and Additional Rent next due hereunder or returned within thirty (30) days if the term has expired or this Lease has been terminated.

Notwithstanding the expiration or termination of this Lease, within thirty (30) days after Lessee’s receipt of Lessor’s Operating Statement or the completion of Lessee’s audit regarding the Operating Expenses and/or Taxes and/or Park Expenses for the calendar year in which this Lease terminates, Lessee shall pay to Lessor or shall receive from Lessor, as the case may be, an amount equal to the difference between the Operating Expenses and/or Taxes and/or Park Expenses for such year, as finally determined, and the amount previously paid by Lessee on account thereof (prorated to the expiration date or the termination date of this Lease).

9.

Table of Contents

(a) All rent shall be due and payable in lawful money of the United States of America, made payable to: Menlo Park Portfolio, and mailed to the following address of Lessor: Menlo Park Portfolio, Property 435010, P.O. Box 310300, Des Moines, IA 50331-0300, without deduction or offset and without prior demand or notice, unless otherwise specified herein. Monthly Base Rent and Additional Rent shall be payable monthly, in advance, on the first day of each month. Additional Rent shall be payable monthly, in advance, on the first day of each month for the entire Premises for the entire term of his Lease. Lessee’s obligation to pay rent for any partial month at the commencement of the term, for any partial month immediately prior to a rental adjustment date (if the rental adjustment date is other than the first day of the calendar month), and for any partial month at the expiration or termination of the term shall be based upon the number of days in such month.

(b) If any installment of Monthly Base Rent, Additional Rent or any other sum due from Lessee is not received by Lessor within five (5) days after the same is due, Lessee shall pay to Lessor an additional sum equal to five percent (5%) of the amount overdue as a late charge. The parties agree that this late charge represents a fair and reasonable estimate of the costs that Lessor will incur by reason of the late payment by Lessee. Acceptance of any late charge shall not constitute a waiver of Lessee’s default with respect to the overdue amount. Any amount not paid within ten (10) days after Lessee’s receipt of written notice that such amount is due shall bear interest from the date due until paid at the lesser rate of (1) the prime rate of interest as published in the “Wall Street Journal,” plus two percent (2%) or (2) the maximum rate allowed by law (the “Interest Rate”), in addition to the late payment charge.

Initials: Lessor Lessee

7. Security Deposit. Lessee shall deposit with Lessor upon execution hereof the sum of Three Hundred Fifty Two Thousand Nine Hundred Eleven and 60/100 Dollars ($352,911.60) (the “Security Deposit”), as security for Lessee’s faithful performance of Lessee’s obligations under this Lease. If Lessee fails to pay Monthly Base Rent or Additional Rent or charges due hereunder within applicable notice and cure periods, or otherwise defaults under this Lease (as defined in Paragraph 22), Lessor may use, apply or retain all or any portion of said Security Deposit to the extent reasonably necessary to cure the default, for the payment of any amount due Lessor, and to reimburse or compensate Lessor for any liability, cost, expense, loss or damage (including attorneys’ fees) which Lessor may suffer or incur by reason thereof. If Lessor uses or applies all or any portion of the Security Deposit, Lessee shall within ten (10) days after written request therefor deposit with Lessor the amount sufficient to restore the Security Deposit to the amount then required by this Lease. Provided that no default beyond applicable notice and cure periods has occurred and is continuing, the amount of the Security Deposit shall be reduced to Two Hundred Sixty-Four Thousand Six Hundred Eighty-Three and 70/100 Dollars ($264,683.70) on the first anniversary of the Commencement Date. On the second anniversary of the Commencement Date, provided that no default beyond applicable notice and cure periods under this Lease has occurred and is continuing, the amount of the Security Deposit shall be reduced to One Hundred Seventy-Six Thousand Four Hundred Fifty-Five and 80/100 Dollars ($176,455.80). Lessor shall not be required to keep all or any part of the Security Deposit separate from its general accounts. In no event or circumstance shall Lessee have the right to any use of the Security Deposit

10.

Table of Contents

and, specifically, Lessee may not use the Security Deposit as a credit or to otherwise offset any payments required hereunder, including, but not limited to, rent or any portion thereof. Lessee waives (i) California Civil Code Section 1950.7 and any and all other laws, rules and regulations applicable to security deposits in the commercial context (“Security Deposit Laws”), and (ii) any and all rights, duties and obligations either party may now has, or in the future will have, relating to or arising from the Security Deposit Laws. Notwithstanding anything to the contrary herein, the Security Deposit may be retained and applied by Lessor (a) to offset rent which is unpaid either before or after termination of this Lease, and (b) against other damages suffered by Lessor before or after termination of this Lease. No part of the Security Deposit shall be considered to be held in trust, to bear interest or other increment for its use, or to be prepayment for any moneys to be paid by Lessee under this Lease.

8. Use. Lessee may only use and occupy the Premises for general office uses, administrative purposes, research and development, laboratory, light manufacturing of medical devices and related legal uses which are permitted by applicable zoning ordinances and the covenants, conditions, and restrictions for Menlo Business Park and which are approved by Lessor in writing, and for no other use or purpose without Lessor’s prior written consent; provided, that the use of the Premises for the manufacture of integrated circuits is expressly prohibited. Any use of the Premises by Lessee or by any sublessee or assignee approved by Lessor pursuant to Paragraph 17 shall comply with the provisions of this Paragraph 8.

(a) The term “Hazardous Materials” as used in this Lease shall include any substance defined or regulated as radioactive, flammable, toxic, a biohazard, medical waste, “hazardous material”, “extremely hazardous material”, “hazardous waste”, “hazardous substance,” “toxic substance,” “industrial process waste,” or “special waste” in any Environmental Laws as hereafter defined. Hazardous Materials shall include, but not be limited to, petroleum, gasoline, natural gas, natural gas liquids, liquefied natural gas, synthetic gas, and/or crude oil or any products, by-products or fractions thereof.

(b) Lessee shall not engage in any activity in or on the Premises or the Property which constitutes a Reportable Use of Hazardous Materials without the express prior written consent of Lessor and timely compliance (at Lessee’s expense) with all Environmental Laws. “Reportable Use” shall mean (i) the installation or use of any above or below ground storage tank, (ii) the generation, possession, storage, use, transportation, or disposal of Hazardous Materials that require a permit from, or with respect to which a report, notice, registration or business plan is required to be filed with, any governmental authority, and/or (iii) the presence at the Premises or the Property of Hazardous Materials with respect to which any Environmental Law requires that a notice be given to persons entering or occupying the Premises, or the Property, or neighboring properties. Notwithstanding the foregoing, subject to the provision of Paragraph 2(d) (including the requirement that Lessee shall obtain a Conditional Use Permit from the City before Lessee maintains on the Premises five (5) gallons or more of any Hazardous Materials) Lessee may use the Hazardous Materials on the Premises that are listed on Exhibit “E” attached hereto and incorporated by reference herein, and any ordinary and customary office supplies, cleaning materials, and other materials reasonably required to be used in the normal course of Lessee’s agreed use of the Premises, so long as such use is in compliance with all Environmental Laws, and

11.

Table of Contents

does not expose the Premises, or the Property, or neighboring property to any risk of contamination or damage or expose Lessor to any unusual or atypical liability therefor. In addition, Lessor may condition its consent to any Reportable Use upon receiving such additional assurances as Lessor reasonably deems necessary to protect itself, the public, the Premises and the Property, and/or the environment against damage, contamination, injury and/or liability, including, but not limited to, the installation (and removal on or before Lease expiration or termination) of any protective modifications installed by Lessee (such as concrete encasements).

(c) “Environmental Laws” shall mean and include any Federal, State, or local statute, law, ordinance, code, rule, regulation, order, or decree regulating, relating to, or imposing liability or standards of conduct concerning, any hazardous, toxic, or dangerous waste, substance, element, compound, mixture or material, as now or at any time hereafter in effect including, without limitation, California Health and Safety Code §§25100 et seq., §§25300 et seq., Sections 25281(f) and 25501 of the California Health and Safety Code, Section 13050 of the Water Code, the Federal Comprehensive Environmental Response, Compensation and Liability Act, as amended, 42 U.S.C. §§9601 et seq. (“CERCLA”), the Superfund Amendments and Reauthorization Act, 42 U.S.C. §§9601 et seq., the Federal Toxic Substances Control Act, 15 U.S.C. §§2601 et seq., the Federal Resource Conservation and Recovery Act as amended, 42 U.S.C. §§6901 et seq., the Federal Hazardous Material Transportation Act, 49 U.S.C. §§1801 et seq., the Federal Clean Air Act, 42 U.S.C. §7401 et seq., the Federal Water Pollution Control Act, 33 U.S.C. §1251 et seq., the River and Harbors Act of 1899, 33 U.S.C. §§401 et seq., and all rules and regulations of the EPA, the California Environmental Protection Agency, or any other state or federal department, board or any other agency or governmental board or entity having jurisdiction over the environment, as any of the foregoing have been, or are hereafter amended.

(d) If Lessee knows, or has reasonable cause to believe, that Hazardous Materials have come to be located in, on, under or about the Premises or the Property, other than as previously consented to by Lessor, Lessee shall immediately give written notice of such fact to Lessor and provide Lessor with a copy of any report, notice, claim or other documentation which it has concerning the presence of such Hazardous Materials.

(e) Lessee and Lessee’s agents, employees, and contractors shall not cause any Hazardous Materials to be discharged or released into the Building or into the plumbing or sewage system of the Building or into or onto the Land underlying or adjacent to the Building in violation of any Environmental Laws. Lessee shall promptly, at Lessee’s expense, take all investigatory and/or remedial action reasonably recommended, whether or not formally ordered or required, for the cleanup of any contamination in violation of Environmental Laws or the terms of this Lease caused by Lessee or caused by any of Lessee’s employees, agents, or contractors, and for the maintenance, security and/or monitoring of the Premises, the Property, or neighboring properties if such contamination is caused by a release or emission of any Hazardous Materials by Lessee or by any of Lessee’s employees, agents, or contractors.

(f) Lessee shall indemnify, defend and hold Lessor and its agents, employees, and lenders and the Premises and the Property harmless from any and all claims, damages, fines, judgments, penalties, costs, liabilities or losses (including, without limitation, any and all sums paid for settlement of claims, attorneys’ fees, consultant and expert fees) arising during or after the term of this Lease out of or involving any Hazardous Materials brought on to the Premises, the

12.

Table of Contents

Property, or Menlo Business Park by or for Lessee or by anyone under Lessee’s control in violation of Environmental Laws or the terms of this Lease. Lessee’s obligations under this Paragraph 9(f) shall include, but not be limited to, the effects of any contamination or injury to person, property or the environment created or suffered by Lessee, and the cost of investigation (including consultants’ and attorneys’ fees and testing), removal, remediation, restoration and/or abatement thereof, or of any contamination therein involved, as required by Environmental Laws, and shall survive the expiration or earlier termination of this Lease. No termination, cancellation or release agreement entered into by Lessor and Lessee shall release Lessee from its obligations under this Lease with respect to Hazardous Materials, unless specifically so agreed by Lessor in writing at the time of such agreement.

(g) To the current actual knowledge and without any duty to make investigation or inquiry, of John C. Tarlton, President of Tarlton Properties, Inc., Lessor’s property manager, except as disclosed to Lessee in writing by Lessor or as contained in any environmental site assessment report delivered by Lessor to Lessee prior to the execution of this Lease, (1) no Hazardous Materials are present on the Property or the soil, surface water or groundwater thereof, (2) no underground storage tanks are present on the Property, and (3) Lessor has not received written notice of any action, proceeding or claim pending or threatened regarding the Property concerning any Hazardous Materials or pursuant to any environmental law. Lessee shall have no responsibility for Hazardous Materials present on the Premises prior to the Commencement Date and for Hazardous Materials not brought on to the Premises, the Property, or Menlo Business Park by or for Lessee or by anyone under Lessee’s control in violation of Environmental Laws or the terms of this Lease.

10. Taxes on Lessee’s Property. Lessee shall pay before delinquency any and all taxes, assessments, license fees, and public charges levied, assessed, or imposed and which become payable during the Term and any extension thereof upon Lessee’s equipment, fixtures, furniture, and personal property installed or located on the Premises.

(a) Lessee shall, at Lessee’s sole cost and expense, provide and keep in force commencing with the Commencement Date of the Term and continuing during the Term, (i) a commercial general liability insurance policy with a recognized casualty insurance company qualified to do business in California, insuring against any and all liability occasioned by any occurrence in, on, about, or related to the Premises, or arising out of the condition, use, occupancy, alteration or maintenance of the Premises and covering the contractual liability referred to in Paragraph 12(a) of this Lease, having a combined single limit for both bodily injury and property damage in an amount not less than Three Million Dollars ($3,000,000); (ii) an “all risk” property policy on all of its personal property in, on or about the Premises in an amount not less than one hundred percent (100%) of the full replacement cost valuation; (iii) workers’ compensation insurance, as required by law and (iv) business interruption insurance in such amounts as will reimburse Lessee for direct and indirect loss of earnings and incurred costs attributable to the perils commonly covered by Lessee’s property insurance described above but in no less than One Million Dollars ($1,000,000). All such insurance carried by Lessee shall be in a form reasonably satisfactory to Lessor and its mortgage lender and shall be carried with companies that have a general policyholder’s rating of not less than “A” and a financial rating of not less than Class “X”

13.

Table of Contents

in the most current edition of Best’s Insurance Reports or such similar rating as may be reasonably selected by Lessor; shall provide that such policies shall not be subject to reduction or cancellation except after at least thirty (30) days’ prior written notice to Lessor. On or before the earlier of (i) the date on which any Lessee party first enters the Premises for any reason or (ii) the Commencement Date and upon renewal of such policies not less than thirty (30) days prior to the expiration of the term of such coverage, Lessee shall deliver to Lessor certificates of insurance confirming such coverage and that all insurance requirements set forth herein have been met, together with evidence of the payment of the premium therefor. To the fullest extent permitted by law, the insurance policies required to be carried by Lessee hereunder shall name Lessor, Lessor’s property manager, Tarlton Properties, Inc., and such other persons as Lessor may reasonably request from time to time as additional insureds with respect to liability arising out of this Lease or the operations of Lessee by ISO form CG 20 11 or its equivalent (collectively, “Additional Insureds”). Such insurance shall provide primary coverage without contribution from any other insurance carried by or for the benefit of Lessor, Lessor’s property manager, or other Additional Insured. For avoidance of doubt, each primary policy and each excess/umbrella policy through which Lessee satisfies its obligations under this section must provide coverage to the Additional Insureds that is primary and noncontributory. Upon request by Lessor, a true and complete copy of any insurance policy required by this Lease shall be delivered within ten (10) days following Lessor’s request. If Lessee fails to procure and maintain the insurance required hereunder, Lessor may, but shall not be required to, order such insurance at Lessee’s expense and Lessee shall reimburse Lessor for all costs incurred by Lessor with respect thereto. Lessee’s reimbursement to Lessor for such amounts shall be deemed Additional Rent, and shall include all sums disbursed, incurred or deposited by Lessor, including Lessor’s costs, expenses and reasonable attorneys’ fees with interest thereon at the Interest Rate.

(b) Lessor shall obtain and carry in Lessor’s name, as insured, as an Operating Expense of the Property to the extent provided in Paragraph 5(b), during the lease term, “all risk” property insurance coverage (with rental loss insurance coverage for a period of one year), flood insurance, public liability and property damage insurance, and insurance against such other risks or casualties as Lessor shall reasonably determine, including, but not limited to, insurance coverages required of Lessor by the beneficiary of any deed of trust which encumbers the Property, including earthquake insurance coverage insuring Lessor’s interest in the Property (including the initial Tenant Improvements constructed in the Premises pursuant to Paragraph 13 and any other leasehold improvements to the Premises constructed by Lessor or by Lessee with Lessor’s prior written approval) in an amount not less than the full replacement cost of the Building and all other Improvements from time to time. The proceeds of any such insurance shall be payable solely to Lessor, and Lessee shall have no right or interest therein. Lessor shall have no obligation to insure against loss by Lessee to Lessee’s equipment, fixtures, furniture, inventory, or other personal property of Lessee in or about the Premises occurring from any cause whatsoever.

(c) Notwithstanding anything to the contrary contained in this Lease, the parties release each other, and their respective authorized representatives, employees, officers, directors, shareholders, managers, members, trustees, beneficiaries, assignees, subtenants, invitees, successors, agents, contractors and property managers, from any claims for damage to any person or to the Premises or the Property and to the fixtures, personal property, leasehold improvements and alterations of either Lessor or Lessee in or on the Premises or the Property, that are caused by or result from risks required by this Lease to be insured against or are actually insured against

14.

Table of Contents

under any property insurance policies carried by the parties that are in force at the time of any such damage, whichever is greater. This waiver applies whether or not the loss is due to the negligent acts or omissions of Lessor or Lessee or their respective authorized representatives, employees, officers, directors, shareholders, managers, members, trustees, beneficiaries, assignees, subtenants, invitees, successors, agents, contractors and property managers. Subject to the foregoing, this release and waiver shall be complete and total even if such loss or damage may have been caused by the negligence of the other party, its managers, members, employees, agents, contractors, property managers or invitees. Lessee covenants that the insurance policies required to be maintained by Lessee under this Lease will contain waiver of subrogation endorsements.

(a) Lessee shall indemnify, defend, and hold harmless Lessor from claims, suits, actions, or liabilities for personal injury, death or for loss or damage to property that arise from (1) any activity, work, or thing done by Lessee, its employees, agents, contractors or invitees in or about the Premises, the Property or the Park (except to the extent due to Lessor’s active negligence or willful misconduct or breach of this Lease), (2) bodily injury or damage to property which arises in or about the Property to the extent the injury or damage to property results from the acts or omissions of Lessee, its employees, agents or contractors, and (3) based on any event of default by Lessee in the performance of any obligation on Lessee’s part to be performed under this Lease. Lessee also waives all claims against Lessor and its employees, agents and contractors for damages to property, or to goods, wares, and merchandise stored in, upon, or about the Premises or the Property, and for injuries to persons in, upon, or about the Premises or the Property from any cause arising at any time, except to the extent caused by the active negligence or willful misconduct of Lessor or its employees, agents or contractors.

(b) Lessor shall indemnify, defend, and hold harmless Lessee from claims, suits, actions, or liabilities for personal injury, death or for loss or damage to property for bodily injury or damage to property which arises in or about the Property to the extent the injury or damage to property results from the active negligent acts of Lessor, its employees, agents or contractors.

(c) In the absence of comparative or concurrent negligence on the part of Lessee or Lessor, their respective agents, affiliates, and subsidiaries, or their respective officers, directors, members, employees or contractors, the foregoing indemnities by Lessee and Lessor shall also include reasonable costs, expenses and attorneys’ fees incurred in connection with any indemnified claim or incurred by the indemnitee in successfully establishing the right to indemnity. The indemnitor shall have the right to assume the defense of any claim subject to the foregoing indemnities with counsel reasonably satisfactory to the indemnitee. The indemnitee agrees to cooperate fully with the indemnitor and its counsel in any matter where the indemnitor elects to defend, provided the indemnitor shall promptly reimburse the indemnitee for reasonable costs and expenses incurred in connection with its duty to cooperate.

The foregoing indemnities shall survive the expiration or earlier termination of this Lease and are conditioned upon the indemnitee providing prompt notice to the indemnitor of any claim or occurrence that is likely to give rise to a claim, suit, action or liability that will fall within the scope of the foregoing indemnities, along with sufficient details that will enable the indemnitor to make a reasonable investigation of the claim.

15.

Table of Contents

When the claim is caused by the joint negligence or willful misconduct of Lessee and Lessor or by the indemnitor party and a third party unrelated to the indemnitor party (except indemnitor’s agents, officers, employees or invitees), the indemnitor’s duty to indemnify and defend shall be proportionate to the indemnitor’s allocable share of joint negligence or willful misconduct.

(d) Lessor shall not be liable to Lessee for any damage because of any act or negligence of any other occupant of the Building or any other owner or occupant of adjoining or contiguous property, nor for overflow, breakage, or leakage of water, steam, gas, or electricity from pipes, wires, or otherwise in the Premises or the Building, except to the extent caused by the gross negligence or willful misconduct of Lessor or Lessor’s employees, agents, or contractors. Except as otherwise provided herein, Lessee will pay for damage to the Premises or the Property caused by the misuse or neglect of the Premises or the Property by Lessee or its employees, agents, or contractors, including, but not limited to, the breakage of glass in the Building.

13. Market Ready Improvements and Additional Tenant Improvements

(a) Lessor shall cause to be constructed the interior tenant improvements and modifications to the Premises described on Exhibit “F” attached hereto, including the cost estimate therefor described on Exhibit “F-1” attached hereto (the “Market Ready Improvements”). The costs of the Market Ready Improvements shall be shared by Lessor and Lessee as set forth herein and paid on a pro rata basis. Lessor agrees to pay costs (hard and soft costs) to complete the Market Ready Improvements up to the amount of Two Hundred Fifteen Thousand One Hundred Ninety and 00/100 Dollars ($215,190.00) (“Market Ready Improvement Allowance”). Lessor shall disburse the Market Ready Improvement Allowance directly to the applicable design professional, contractor, materialman or other laborer in connection with the construction of the Market Ready Improvements. Lessee shall be liable for all fees and costs of the design and construction of the Market Ready Improvements in excess of the Market Ready Improvement Allowance or which are outside of the scope of work described on Exhibit “F” attached hereto (such amount referred to herein as the “Market Ready Improvement Shortfall”). Lessee shall pay the Market Ready Improvement Shortfall upon written request from Lessor accompanied by invoices reflecting such amounts due within thirty (30) days following Lessor’s delivery of such payment request.

(b) Lessor shall cause to be constructed the interior tenant improvements and modifications to the Premises described on Exhibit “C” attached hereto, including the cost estimate therefor described on Exhibit “F-1” attached hereto (the “Additional Tenant Improvements” and, collectively with the Market Ready Improvements, the “Tenant Improvements”). The costs of the Additional Tenant Improvements shall be shared by Lessor and Lessee as set forth herein and paid on a pro rata basis. Lessor agrees to pay costs to complete the Additional Tenant Improvements up to the amount of Six Hundred Forty Five Thousand Five Hundred Seventy and 00/100 Dollars ($645,570.00) (“Additional Tenant Improvement Allowance”). Lessor shall disburse the Additional Tenant Improvement Allowance directly to the applicable design professional, contractor, materialman or other laborer in connection with the construction

16.

Table of Contents

of the Additional Tenant Improvements. Lessee shall be liable for all fees and costs of the design and construction of the Additional Tenant Improvements in excess of the Additional Tenant Improvement Allowance or which are requested by Lessee and outside of the scope of work described on Exhibit “G” attached hereto (such amount referred to herein as the “Additional Tenant Improvement Shortfall”). Lessee shall pay the Additional Tenant Improvement Shortfall upon written request from Lessor accompanied by invoices reflecting such amounts due within thirty (30) days following Lessor’s delivery of such payment request. Lessor shall employ Tarlton Properties, Inc., as construction manager for the Tenant Improvements at a fee equal to five percent (5%) of hard construction costs (i.e., the amounts paid to any general contractor, subcontractors, vendors, and suppliers for labor and materials for the construction of the Additional Tenant Improvements). Notwithstanding any of the following, if the Market Ready Improvement Allowance is for any reason not fully applied toward the cost of the Market Ready Improvements, or the Additional Tenant Improvement Allowance is not fully applied toward the cost of the Additional Tenant Improvements, such unapplied amounts may be applied to the cost of the other portion of the Tenant Improvements.

(c) The terms “Substantially Complete,” “Substantially Completed” or “Substantial Completion” shall mean the date the Tenant Improvements are completed and the Premises are in the condition required hereunder and Landlord has received final governmental approval of the Tenant Improvements, excepting only minor Punch List items (as defined below), which do not unreasonably interfere with Lessee’s ability to commence business operations at the Premises.

(d) The Tenant Improvements shall be constructed in accordance with all applicable laws and the terms of this Lease, in a good and workmanlike manner, free of defects and using new materials and equipment of good quality. Upon delivery of the Premises to Lessee, Lessor and Lessee shall coordinate a walk through of the Premises and Lessor and Lessee shall complete a punch list indicating any deficiencies in the Tenant Improvements (“Punch List”). Lessor shall promptly cause such items set forth in the Punch List to be completed as required for compliance with the Tenant Improvements.

(e) Lessor shall cause to be prepared, as quickly as possible, final plans, specifications and working drawings of the Tenant Improvements (“Final Plans”), as well as an estimate of the total cost for the Tenant Improvements (“Final Cost Estimate”), all of which conform to or represent logical evolutions of or developments from the work described in Exhibits “F” and “G”. The Final Plans and Final Cost Estimate shall be delivered to Lessee immediately upon completion. Within three (3) days after receipt thereof, at its election (1) Lessee may approve the Final Plans and Final Cost Estimate, or (2) Lessee may deliver to Lessor the specific written changes to such plans that are necessary, in Lessee’s reasonable opinion, to conform such plans to the work described in the Preliminary Plans or to reduce costs. If Lessee desires changes, the parties shall confer and negotiate in good faith to reach agreement on modifications to the Final Plans. As soon as all such matters are approved by Lessor and Lessee, Lessor shall submit the Final Plans to all appropriate governmental agencies and thereafter the Lessor shall use its commercially reasonable efforts to obtain required governmental approvals. All change orders shall specify any change in the Final Cost Estimate and any change in the scheduled completion dates as a consequence of the change order.

17.

Table of Contents

(f) The cost of the Tenant Improvements shall not include (and Lessee shall have no responsibility for and none of Lessor’s or Lessee’s contributions referred to in Paragraph 13(a) or (b) shall be used for) and Lessor shall be solely responsible for the following: (i) costs in connection with the presence of Hazardous Materials existing on or prior to the Commencement Date; (ii) costs to bring the restroom on the second floor of the Building into compliance with Applicable Requirements and, to the extent required, costs to install a ramp outside of the Premises on the east side of the Building; (iii) construction management, profit and overhead charges in excess of the amount set forth in Paragraph 13(b); and (iv) costs in excess of the Final Cost Estimate, unless as a result of any change in the work requested by Lessee (and then in the amount set forth in the applicable change order). Notwithstanding the foregoing, Lessor and Lessee shall equally share in costs arising or resulting from the Tenant Improvements to bring the Premises or the Building into compliance with Applicable Requirements other than as specifically set forth in this subsection (f)(ii) above; provided, however, that if such costs to comply with Applicable Requirements are budgeted to exceed One Hundred Thousand and 00/100 Dollars ($100,000.00) (“Compliance Threshold”), then the parties shall meet to discuss revisions to the Tenant Improvements in an effort to reduce such costs. If the parties are unable modify the Tenant Improvements to reduce such costs below the Compliance Threshold, then either party may, at its option, by notice in writing received by the other party no later than May 15, 2016, terminate this Lease, in which event Lessor shall refund to Lessee the prepaid Monthly Base Rent and the Security Deposit, and the parties shall be discharged from all further obligations hereunder, except for those obligations which by the express terms hereof survive the termination of this Lease. If such written notice is not received on or before May 15, 2016, each party’s right to cancel this Lease pursuant to this Paragraph 13(f) shall terminate and be of no further force or effect.

(g) Subject to completion of the Tenant Improvements, Lessee waives all right to make repairs at the expense of Lessor, or to deduct the costs thereof from the rent, and Lessee waives all rights under Section 1941 and 1942 of the Civil Code of the State of California. At the expiration or sooner termination of this Lease, Lessee shall surrender the Premises in a clean and good condition (including the Tenant Improvements upon completion thereof which Lessee shall not be required to remove) and in accordance with Paragraph 14, except for ordinary wear and tear, damage caused by casualty, a taking by eminent domain, maintenance that is Lessor’s responsibility hereunder, Hazardous Materials not Lessee’s responsibility under Paragraph 9 of the Lease, and alterations or other improvements made by Lessee with Lessor’s prior written consent which Lessee is not required to remove as a condition to Lessor’s approval of such alterations or improvements.

14. Maintenance and Repairs; Alterations; Surrender and Restoration.

(a) Lessor shall, at Lessor’s sole expense, keep in good order, condition, and repair and replace when necessary, the structural elements of the roof (excluding the roof membrane which Lessor shall maintain, but the cost of which shall be included as an Operating Expense as permitted under Paragraph 5), the structural elements of the foundation and exterior walls (except the interior faces thereof) of the Building, and other structural elements of the Building and the Property as “structural elements” are defined in building codes applicable to the Building, excluding any alterations, structural or otherwise, made by Lessee to the Building which are not approved in writing by Lessor prior to the construction or installation thereof by Lessee. Lessor shall perform and construct, and Lessee shall not be responsible for performing or

18.

Table of Contents

constructing, any repairs, maintenance, or improvements (1) required as a result of any casualty damage, which shall be subject to Paragraph 20 below, or as a result of any taking pursuant to the exercise of the power of eminent domain, or (2) for which Lessor has a right of reimbursement from third parties based on construction or other warranties, contractor guarantees, or insurance claims.

(b) Lessor shall provide or cause to be provided and shall supervise the performance of, as an Operating Expense of the Property as permitted under Paragraph 5(b) hereof, all services and work relating to the operation, maintenance, repair, and replacement, as needed, of the Property, including the HVAC, mechanical, electrical, and plumbing systems in the Building; the interior of the Building; the roof membrane; the outside areas of the Property; the janitorial service for the Building; landscaping, tree trimming, resurfacing and restriping of the parking lot, repairing and maintaining the walkways; exterior building painting, exterior building lighting, parking lot lighting, and exterior security patrol. In the event Lessee provides Lessor with written notice of the need for any repairs, Lessor shall commence any such repairs promptly following receipt by Lessor of such notice and Lessor shall diligently prosecute such repairs to completion.

(c) Subject to the foregoing and except as provided elsewhere in this Lease, Lessee shall at all times use and occupy the Premises in a manner which keeps the Premises in good and safe order, condition, and repair. Lessor shall execute and maintain in full force and effect throughout the term as an Operating Expense of the Property pursuant to Paragraph 5(b) a service contract with a recognized air conditioning service company. Lessor may, if Lessor determines that it is necessary to do so, obtain on a semi-annual basis an inspection report of the HVAC system from a separate HVAC service firm designated by Lessor for the purpose of monitoring the performance of the HVAC maintenance and repair work performed by the HVAC service firm which performs the regular repair and maintenance. The cost of such inspection report shall be an Operating Expense pursuant to Paragraph 5. Subject to the release of claims and waiver of subrogation contained in Paragraphs 11(c) and 11(d), if Lessor is required to make any repairs to the Property by reason of Lessee’s negligent acts or omissions, Lessor may add the cost of such repairs to the next installment of rent which shall thereafter become due, and Lessee shall promptly pay the same upon receipt of an invoice therefor.

(d) Lessee may, from time to time, at its own cost and expense and without the consent of Lessor make nonstructural alterations to the interior of the Premises the cost of which in any one instance is Ten Thousand and 00/100 Dollars ($10,000.00) or less, and the aggregate cost of all such work during the Term this Lease does not exceed Twenty Thousand and 00/100 Dollars ($20,000.00), provided Lessee first notifies Lessor in writing of any such nonstructural alterations. Otherwise, Lessee shall not make any additional alterations, improvements, or additions to the Premises without delivering to Lessor a complete set of plans and specifications for such work, obtaining and delivering copies to Lessor of all permits or other governmental approvals required for such work and obtaining Lessor’s prior written consent thereto. All alterations and additions shall be installed by a licensed contractor approved by Lessor, at Lessee’s sole expense in compliance with all applicable laws, rules, regulations and ordinances. Lessee shall keep the Premises and the Property on which the Premises are situated free from any liens arising out of any work performed, materials furnished or obligations incurred by or on behalf of Lessee. If any nonstructural alterations to the interior of the Premises exceed Ten Thousand and 00/100

19.

Table of Contents

Dollars ($10,000.00) in cost in any one instance, or exceed the aggregate cost of Twenty Thousand and 00/100 Dollars ($20,000.00) during the Term of this Lease, Lessee shall employ, at Lessee’s expense, Tarlton Properties, Inc. as construction manager for such alterations at a fee equal to five percent (5%) of the first Two Hundred Fifty Thousand and 00/100 Dollars ($250,000.00) of hard construction costs (i.e., the amounts paid to any general contractor, subcontractors, vendors, and suppliers for labor and materials for the construction of the alterations or improvements) and then four percent (4%) of such hard construction costs in excess of Two Hundred Fifty Thousand and 00/100 Dollars ($250,000.00). Lessor may condition its consent to, among other things, Lessee agreeing in writing to remove any such alterations prior to the expiration of the Lease term and Lessee agreeing to restore the Premises to its condition prior to such alterations at Lessee’s expense. Upon Lessee’s written request, Lessor shall advise Lessee in writing at the time consent is granted whether Lessor reserves the right to require Lessee to remove any alterations from the Premises prior to the expiration or sooner termination of this Lease.

All alterations, trade fixtures and personal property installed in the Premises solely at Lessee’s expense shall during the term of this Lease remain Lessee’s property and Lessee shall be entitled to all depreciation, amortization and other tax benefits with respect thereto (excluding the Tenant Improvements). Upon the expiration or sooner termination of this Lease all alterations, fixtures and improvements to the Premises, whether made by Lessor or installed by Lessee at Lessee’s expense, shall be surrendered by Lessee with the Premises and shall become the property of Lessor; provided, however, that Lessee’s furniture and other personal property, not provided by or paid for by Lessor and not permanently affixed to the Premises which can be removed without damaging the Premises may be removed by Lessee. Lessee shall repair to Lessor’s reasonable satisfaction all damage to the Premises occasioned by removal of Lessee’s Property.

(e) Lessee shall, at Lessee’s sole cost and expense, fully, diligently and in a timely manner, comply with all present and future “Laws,” which term is used in this Lease to mean all laws, rules, regulations, ordinances, directives, orders, covenants, permits of all governmental agencies and authorities, easements and restrictions of record, the requirements of any applicable fire insurance underwriter or rating bureau or board of fire underwriters, relating in any manner to the Premises and/or Lessee’s use or occupancy of the Premises (including but not limited to matters pertaining to industrial hygiene, environmental conditions on, in, under or about the Premises, including soil and groundwater conditions, subject to the provisions of Paragraph 9 hereof, and the use, generation, manufacture, production, installation, maintenance, removal, transportation, storage, spill, or release of any Hazardous Materials (which are addressed in Paragraph 9 hereof)), now in effect or which may hereafter come into effect. Lessee shall, within five (5) days after receipt of Lessor’s written request, provide Lessor with copies of all documents and information, including but not limited to permits, registrations, manifests, applications, reports and certificates, evidencing Lessee’s compliance with any Laws specified by Lessor, and shall immediately upon receipt, notify Lessor in writing (with copies of any documents involved) of any threatened or actual claim, notice, citation, warning, complaint or report pertaining to or involving failure by Lessee or the Premises to comply with any Laws. Notwithstanding the foregoing, any structural changes or repairs or other changes or repairs to the Property of any nature which would be considered a capital expenditure under generally accepted accounting principles shall be made by Lessor at Lessee’s expense if such structural repairs or changes are required by reason of the specific nature of the use of the Premises by Lessee. If such changes or repairs are not required by reason of the specific nature of Lessee’s use of the Premises and are capital expenditures, the cost of such changes or repairs shall be treated as an Operating Expense and amortized in accordance with the provisions of Paragraph 5(b).

20.

Table of Contents

(f) Subject to Paragraph 30, Lessor, Lessor’s agents, employees, contractors and designated representatives, and the holders of any mortgages, deeds of trust or ground leases on the Premises (“Lenders”) shall have the right to enter the Premises at any time in the case of an emergency, and otherwise at reasonable times, for the purpose of inspecting the condition of the Premises and for verifying compliance by Lessee with this Lease and all Laws, and Lessor shall be entitled to employ experts and/or consultants in connection therewith to advise Lessor with respect to Lessee’s activities, including but not limited to Lessee’s installation, operation, use, monitoring, maintenance, or removal of any Hazardous Substance on or from the Premises. The costs and expenses of any such inspections shall be paid by the party requesting same, unless a default or breach of this Lease by Lessee or a violation of Laws or a contamination, caused or materially contributed to by Lessee, is found to exist or to be imminent, or unless the inspection is requested or ordered by a governmental authority as the result of any such existing or imminent violation or contamination. In such case, Lessee shall upon request reimburse Lessor or Lessor’s Lender, as the case may be, for the costs and expenses of such inspections.

(g) During the term of this Lease, Lessee shall comply, at Lessee’s expense, with all of the covenants, conditions, and restrictions affecting the Premises which are recorded in the Official Records of San Mateo County, California, and which are in effect as of the date of this Lease.