Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | fbiz1q18ceoletter8-k.htm |

Exhibit 99.1

Dear Shareholders and Friends of First Business,

First quarter results displayed positive momentum at First Business. We kicked off 2018 with record first quarter loan growth, demonstrating the effectiveness of our expanded lending team and the execution of our strategy. Period-end gross loans and leases increased $62.1 million, or 17% annualized, to a record $1.6 billion. This marks the highest first quarter growth in First Business history and the second highest quarter ever.

The combination of robust loan growth and our continued success in managing funding costs contributed to net interest margin growing to 3.65%, up from 3.63% in the linked quarter and 3.51% in the first quarter of 2017. In contrast, peers saw a slight decline in margin - highlighting our differentiated performance.1 The current rising rate environment creates a challenge for many banks in their funding costs, and demonstrates the benefit of our strategy of using longer-term wholesale funding to match fund our fixed-rate loans and mitigate interest rate risk.

We grew top line revenue – defined as net interest income plus non-interest income – by 11% in the first quarter of 2018 on the strength of net interest income totaling $16.2 million, trust & investment services fees of a record $1.9 million, increased swap fee income totaling $633,000, and nascent growth in Small Business Administration ("SBA") loan sale gains to $269,000. This revenue growth more than offset an increase in compensation expense, as well as elevated credit costs in the quarter.

Operating expense – defined as non-interest expense less certain non-operating items – totaled $14.1 million in the first quarter of 2018, compared to $13.4 million in the first quarter of 2017.2 Compensation expense drove the increase, growing by $388,000 compared to the prior year quarter, primarily due to annual merit increases as we continue to invest in our team.

We recorded a net benefit of $295,000 in SBA recourse provision for estimated losses in the outstanding guaranteed portion of SBA loans sold, compared to an expense in previous quarters. The first quarter benefit resulted primarily from limited losses incurred during the past six months in connection with sold SBA loans, reducing the loss rate applied to the outstanding sold portfolio. While changes to SBA recourse reserves may be a source of non-interest expense volatility in future quarters, we believe the magnitude of this volatility should diminish over time.

Credit costs totaling $2.5 million were elevated due to net charge-offs of $2.6 million related to three legacy SBA loan relationships that were previously identified as impaired. Outside of the legacy SBA credits, asset quality continued to improve as we saw minimal migration of new credits into non-performing status. Non-performing assets totaled $21.5 million at quarter-end, declining by 22% compared to the linked quarter and by 45% compared to $39.0 million at March 31, 2017. The first quarter decline marked the third consecutive quarterly decrease and also marked the lowest level since the first quarter of 2016.

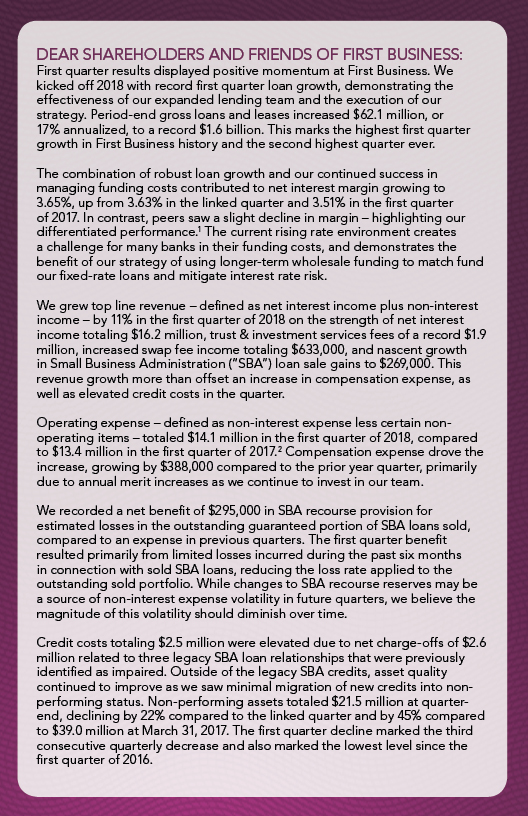

We remain relentless in our pursuit of superior asset quality. While the nature of our niche specialty lending and business banking relationships can result in uneven credit results quarter-to-quarter – particularly as it relates to non-performing asset levels – this is priced into our loan rates accordingly to enable us to achieve appropriate returns. We are comfortable with this model, our ability to withstand periodic credit costs, and our proven loss experience. Since the height of the credit crisis in 2008, our aggregate through-the-cycle net charge-offs have remained meaningfully below levels experienced by our proxy peers and U.S. commercial bank peers. We believe this relative net charge-off comparison substantiates our commitment to a strong credit culture and to safeguarding our shareholders' long-term investment.

Favorable first quarter trends demonstrate successful execution toward our targeted earnings catalysts. With continued success, we expect to drive improved valuation for our shareholders.

EARNINGS CATALYSTS

We believe three catalysts are pivotal to increasing our earnings growth trajectory:

1. | Organic loan and lease growth |

2. | SBA lending growth and profitability |

3. | Scaling our high-performing wealth management business |

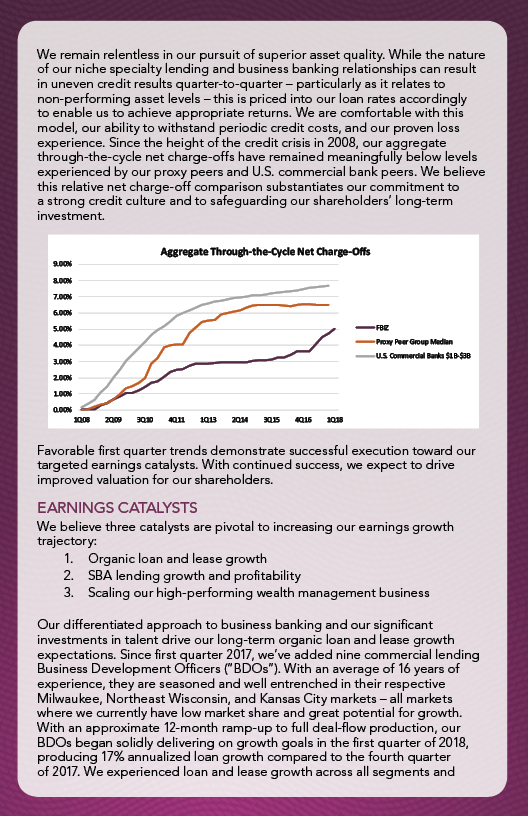

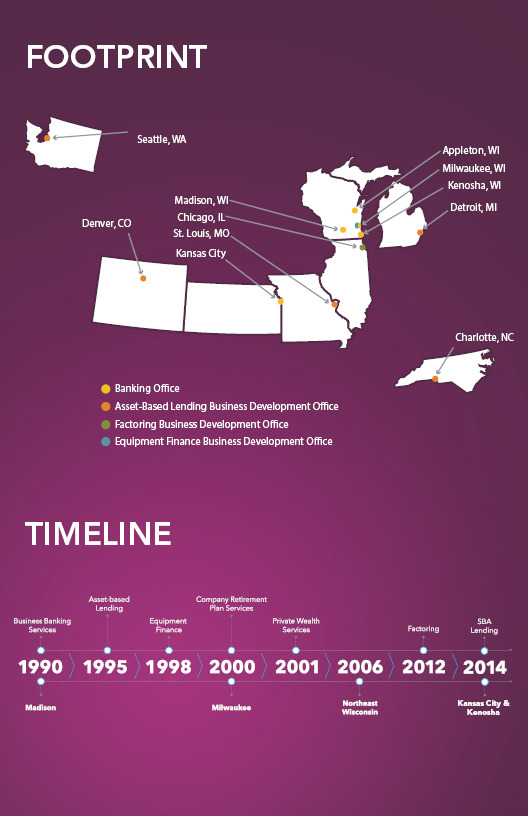

Our differentiated approach to business banking and our significant investments in talent drive our long-term organic loan and lease growth expectations. Since first quarter 2017, we’ve added nine commercial lending Business Development Officers (“BDOs”). With an average of 16 years of experience, they are seasoned and well entrenched in their respective Milwaukee, Northeast Wisconsin, and Kansas City markets – all markets where we currently have low market share and great potential for growth. With an approximate 12 month ramp-up to full deal-flow production, our BDOs began solidly delivering on growth goals in the first quarter of 2018, producing 17% annualized loan growth compared to the fourth quarter of 2017. We experienced loan and lease growth across all segments and expect to build on this momentum moving forward. Though we expect this unusually high rate of growth to moderate in coming quarters, we are pleased with the strength of our pipelines across the organization. We aim to increase commercial banking market share, particularly in our less mature markets, by continuing to invest in production talent as opportunities arise in 2018 and beyond.

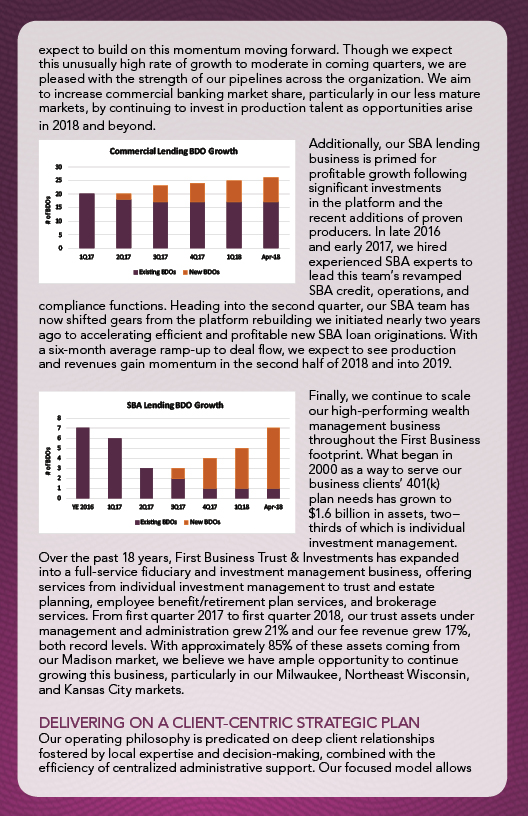

Additionally, our SBA lending business is primed for profitable growth following significant investments in the platform and the recent additions of proven producers. In late 2016 and early 2017, we hired experienced SBA experts to lead this team’s revamped SBA credit, operations, and compliance functions. Heading into the second quarter, our SBA team has now shifted gears from the platform rebuilding we initiated nearly two years ago to accelerating efficient and profitable new SBA loan originations. With a six-month average ramp-up to deal flow, we expect to see production and revenues gain momentum in the second half of 2018 and into 2019.

Finally, we continue to scale our high-performing wealth management business throughout the First Business footprint. What began in 2000 as a way to serve our business clients' 401(k) plan needs has grown to $1.6 billion in assets, two–thirds of which is individual investment management. Over the past 18 years, First Business Trust & Investments has expanded into a full-service fiduciary and investment management business, offering services from individual investment management to trust and estate planning, employee benefit/retirement plan services, and brokerage services. From first quarter 2017 to first quarter 2018, our trust assets under management and administration grew 21% and our fee revenue grew 17%, both record levels. With approximately 85% of these assets coming from our Madison market, we believe we have ample opportunity to continue growing this business, particularly in our Milwaukee, Northeast Wisconsin, and Kansas City markets.

DELIVERING ON A CLIENT-CENTRIC STRATEGIC PLAN

Our operating philosophy is predicated on deep client relationships fostered by local expertise and decision making, combined with the efficiency of centralized administrative support. Our focused model allows experienced staff to provide the level of financial expertise needed to develop and maintain long-term relationships with our clients. To ensure success, our strategic plan is structured to encourage long-term outcomes that are in the best interest of First Business clients and, in turn, our shareholders.

With successful execution of our earnings catalysts, we expect to achieve several specific financial targets. Over time, we believe our net interest margin can meet or exceed 3.50% - a target we consistently have met in recent years and continue to maintain. This is aided by above-market loan growth, continued improvement in our mix of in-market deposits and efficient use of wholesale funding sources. Our revenue streams are becoming more diversified as we work to grow fee income to at least 25% of total revenue, a level we previously met before our 2016 decision to pause SBA production.

By combining robust revenue growth with expense discipline, we expect to drive our efficiency ratio toward our target range of 58% to 62%. Efficiencies include the consolidation of our bank charters and our core system conversion, both completed in the past 12 months. Our new structure and operating system reduces redundancies, improves quality and speed of information and opens capacity within our existing team. By achieving our margin, revenue mix, and efficiency targets, and sustaining below-market credit losses, we expect to produce returns on average assets and average equity exceeding 1% and 12%, respectively. We will not be satisfied until our franchise consistently produces this level of profitability.

Compared to peers, we believe the current discount in First Business shares’ valuation and our meaningfully higher dividend yield offer a compelling investment opportunity. First Business is a scalable franchise positioned for sustainable growth and we look forward to reporting our successes throughout 2018. As always, thank you for your continued support.

Sincerely,

Corey Chambas, President and CEO