Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - CIENA CORP | ex993pressrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - CIENA CORP | exhibit991-2018q2earningsp.htm |

| 8-K - 8-K - CIENA CORP | a8-k2018q2earningsrelease.htm |

Ciena Corporation Q2 FY 2018 Investor presentation Quarterly Period ended April 30, 2018 May 31, 2018 Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary.

Forward-looking statements and non-GAAP measures Information in this presentation and related comments of presenters contain a number of forward-looking statements. These statements are based on current expectations, forecasts, assumptions and other information available to the Company as of the date hereof. Forward-looking statements include Ciena’s long-term financial targets, prospective financial results, return of capital plans, business strategies, expectations about its addressable markets and market share, and business outlook for future periods, as well as statements regarding Ciena’s expectations, beliefs, intentions or strategies regarding the future. Often, these can be identified by forward-looking words such as “target” “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” and “would” or similar words. Ciena's actual results, performance or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Ciena's business, including: the effect of broader economic and market conditions on our customers and their business; changes in network spending or network strategy by our customers; seasonality and the timing and size of customer orders, including our ability to recognize revenue relating to such sales; the level of competitive pressure we encounter; the product, customer and geographic mix of sales within the period; supply chain disruptions and the level of success relating to efforts to optimize Ciena's operations; changes in foreign currency exchange rates affecting revenue and operating expense; the impact of the tax cuts and jobs act; and the other risk factors disclosed in Ciena’s periodic reports filed with the Securities and Exchange Commission (SEC) including Ciena’s Quarterly Report on Form 10-Q filed with the SEC on March 7, 2018 and Ciena’s Annual Report on Form 10-K filed with the SEC on December 22, 2017. All information, statements, and projections in this presentation and the related earnings call speak only as of the date of this presentation and related earnings call. Ciena assumes no obligation to update any forward-looking or other information included in this presentation or related earnings calls, whether as a result of new information, future events or otherwise. In addition, this presentation includes historical, and may include prospective, non-GAAP measures of Ciena’s gross margin, operating expense, operating profit, EBITDA net income, and net income per share. These measures are not intended to be a substitute for financial information presented in accordance with GAAP. A reconciliation of non-GAAP measures used in this presentation to Ciena’s GAAP results for the relevant period can be found in the Appendix to this presentation. Additional information can also be found in our press release filed this morning and in our reports on Form 10-Q filed with the Securities and Exchange Commission. Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 2

Diversification and growth through market share gains ▪ Non-telco represented 34% of total revenue ▪ Direct webscale was 17% of total revenue ▪ EMEA was up QoQ and YoY at 16.7% of total revenue ▪ APAC contributed over 20% of total revenue; India revenue was over 10% of total revenue at $79 million Forcing the pace of innovation with next generation solutions ▪ 400G-capable WaveLogic Ai: 21 total customers ▪ Waveserver: 84 customers ▪ Announced intent to acquire Packet Design, LLC to strengthen our Blue Planet software automation capabilities Delivering shareholder value and strengthening our balance sheet ▪ Repurchased approximately 1.4 million shares of common stock for an aggregate price of $33.4 million during the quarter ▪ Cash generation ▪ Cash flow from operations: $37.4 million ▪ Free cash flow: $31.1 million ▪ Stock Return for the quarter of 18% versus peer¹ average return of 6% Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 3 1. Peers include ACIA, ADTN, ADVA, CSCO, INFN, JNPR and NOKIA for the period 2/1/18-4/30/18

Q2 Fiscal 2018 Financial Highlights * A reconciliation of these non-GAAP measures to our GAAP results is included in the appendix to this presentation. Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 4

Q2 Fiscal 2018 Comparisons (Year-over-Year) Revenue Adj. Gross Margin* Adj. Operating Margin* Q2'18 Q2'17 Q2'18 Q2'17 Q2'18 Q2'17 $730.0 $707.0 45.7% 12.5% 40.7% 7.7% Adj. EBITDA* Cash flow from Operations Adj. EPS* Q2'18 Q2'17 Q2'18 Q2'17 Q2'18 Q2'17 $107.6 $72.0 $0.30 $77.1 $0.23 $37.4 Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. * A reconciliation of these non-GAAP measures to our GAAP results is included in the appendix to this presentation. 5

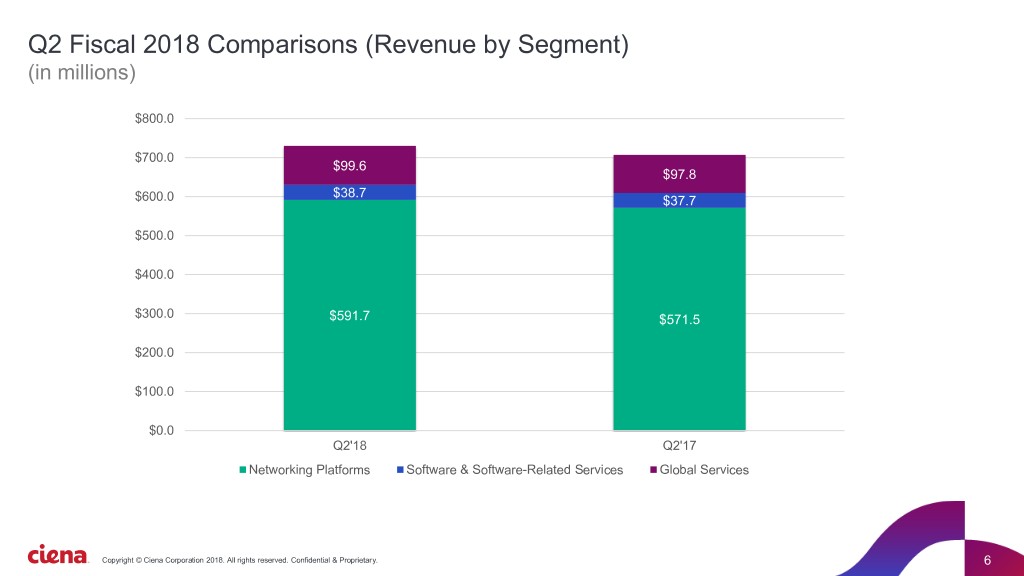

Q2 Fiscal 2018 Comparisons (Revenue by Segment) (in millions) $800.0 $700.0 $99.6 $97.8 $38.7 $600.0 $37.7 $500.0 $400.0 $300.0 $591.7 $571.5 $200.0 $100.0 $0.0 Q2'18 Q2'17 Networking Platforms Software & Software-Related Services Global Services Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 6

Q2 Fiscal 2018 Revenue by Segment (Amounts in millions) Q2 FY 2018 Q2 FY 2017 Revenue %* Revenue %* Networking Platforms Converged Packet Optical $527.9 72.4 $505.2 71.4 Packet Networking 63.8 8.7 66.3 9.4 Total Networking Platforms 591.7 81.1 571.5 80.8 Software and Software-Related Services Software Platforms 12.5 1.7 13.1 1.9 Software-Related Services 26.2 3.6 24.6 3.5 Total Software and Software- Related Services 38.7 5.3 37.7 5.4 Global Services Maintenance Support and Training 60.9 8.3 58.2 8.2 Installation and Deployment 28.2 3.9 28.7 4.1 Consulting and Network Design 10.5 1.4 10.9 1.5 Total Global Services 99.6 13.6 97.8 13.8 Total $730.0 100.0% $707.0 100.0% * Denotes % of total revenue Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 7

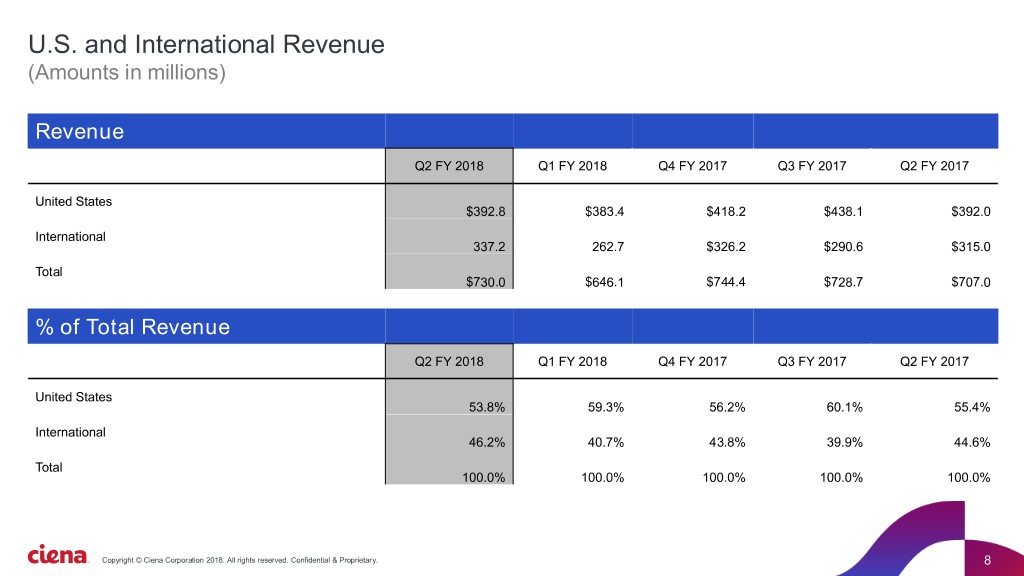

U.S. and International Revenue (Amounts in millions) Revenue Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 United States $392.8 $383.4 $418.2 $438.1 $392.0 International 337.2 262.7 $326.2 $290.6 $315.0 Total $730.0 $646.1 $744.4 $728.7 $707.0 % of Total Revenue Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 United States 53.8% 59.3% 56.2% 60.1% 55.4% International 46.2% 40.7% 43.8% 39.9% 44.6% Total 100.0% 100.0% 100.0% 100.0% 100.0% Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 8

Q2 Fiscal 2018 Revenue by Geographic Region 20.8% North America 3.4% Europe, Middle East and Africa Caribbean and Latin America 59.1% 16.7% Asia Pacific Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 9

Revenue by Geographic Region (Amounts in millions) Revenue Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 North America $431.2 $402.9 $440.5 $465.2 $424.4 Europe, Middle East and Africa 121.7 97.8 110.7 96.1 $105.8 Caribbean and Latin America 25.1 34.6 43.5 51.7 $33.9 Asia Pacific 152.0 110.8 149.7 115.7 $142.9 Total $730.0 $646.1 $744.4 $728.7 $707.0 Revenue Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 North America 59.1% 62.4% 59.2% 63.8% 60.0% Europe, Middle East and Africa 16.7% 15.1% 14.9% 13.2% 15.0% Caribbean and Latin America 3.4% 5.4% 5.8% 7.1% 4.8% Asia Pacific 20.8% 17.1% 20.1% 15.9% 20.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 10

Q2 Fiscal 2018 Balance Sheet and Operating Metrics DSO Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 11

Strengthening balance sheet Ciena has improved its leverage and reduced its debt position Leverage Trend Net Debt (Cash) Position (in millions) Gross debt-to-EBITDA leverage ratio Cash* Debt Net Debt 14.0x $1,600 13.2x $1,451 $1,400 12.0x $1,264 $1,254 $1,198 10.9x $1,200 $1,143 10.0x $1,021 $969 $980 $1,000 $936 8.0x $934 $777 $800 $712 $674 6.0x 6.0 $600 $486 4.4x 4.0x $400 $243 2.8x 2.7x 2.0x $200 $111 ($33) ($46) $0 0.0x 2013 2014 2015 2016 2017 Q2 2018 2013 2014 2015 2016 2017 Q2 2018 ($200) *Cash & cash equivalents Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 12

Delivering consistent financial performance Ciena has successfully managed periods of volatility that can impact the industry Normalized Revenue Normalized Adjusted OM 1.60 3.00 2.50 1.40 2.00 1.20 1.50 1.00 1.00 0.50 0.80 0.00 2014 2015 2016 2017 2014 2015 2016 2017 Ciena Industry Avg Ciena Industry Avg *Industry Average: ACIA, ADTN, ADVA, CSCO, INFN, JNPR and NOKIA IP Networks segment Ciena results for each fiscal year provided on a pro forma basis to represent a comparative 12/31 fiscal year Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 13

Market Growth Global Ex-China forecasted annual growth of 2.6% for 2018; Q1 2018 actuals flat Y/Y* China NA EMEA 17.4% 2.5% 2.6% 1.3% 1.9% 6.0% 5.6% (2.2% (6.7% ) 2017 2018 '18-'20 2017 Actual ) 2017 2018 '18-'20 Market Growth 2017 2018 '18-'20 2018 Forecasted Market Growth CALA Global Ex-China APAC Ex-China 2018-2020 2.9% CAGR 5.9% 4.8% 2.6% 14.1% 3.9% 5.0% (15.5%) (1.4%) 2017 2018 '18-'20 2017 2018 '18-'20 2017 2018 '18-'20 Ciena has a history of taking share and growing faster than the market *Cignal AI, 24 May 2018 Source: IHS, Dell’Oro, Cignal AI, Ovum, Ciena analysis Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 14

Convertible Debt Overview Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 15

Convertible Notes and Diluted Earnings Per Share (EPS) Analysis (GAAP) Memo: Additional Shares Ciena’s quarterly net income must be Underlying Quarterly Interest Par Value Conversion In Diluted EPS Diluted EPS equal to or greater than the below amounts Outstanding Convertible Notes Shares Expense Net of Tax (in thousands) Price Calculation Methodology(2) for the Underlying Shares to be included (in thousands) (in thousands) (in thousands) in Diluted EPS Calculation (in thousands) 3.75% Senior Convertible Notes due October 15, 2018 $ 288,730 14,318 $ 20.17 2,653(3) N/A Treasury Stock Method N/A (Issued 8/2/2017)(1) 3.75% Senior Convertible Notes due October 15, 2018 $ 61,270 3,038 $ 20.17 3,038 $ 466 If-Converted Method $ 22,688 (Issued 10/18/2010)(1) 4.0% Convertible Senior Notes due December 15, 2020 $ 187,500 9,198 $ 20.39 9,198 $ 2,605 If-Converted Method $ 42,296 Total $ 537,500 26,554 14,889 $ 2,701 (1) On August 2, 2017, a portion of our 3.75% Senior Convertible Notes due October 15, 2018 (Issued 10/18/2010) (the “Original 2018 Notes”) were exchanged by the holders thereof for 3.75% Senior Convertible Notes due October 15, 2018 (Issued 8/2/2017) (the “New 2018 Notes”). The New 2018 Notes give Ciena the option, at its election, to settle conversions of such notes for cash, shares of its common stock, or a combination of cash and shares. Except with respect to the additional cash settlement options upon conversion, the New 2018 Notes have substantially the same terms as the Original 2018 Notes. (2) Description of Diluted EPS Methodologies: Treasury Stock Method - Convertible debt instruments that may be settled entirely or partly in cash (such as the New 2018 Notes) may, in certain circumstances where the borrower has the ability and intent to settle in cash, be accounted for utilizing the Treasury Stock Method. Under this method, the underlying shares issuable upon conversion of the notes (the “Underlying Shares”) are excluded from the calculation of diluted EPS, except to the extent that the Conversion Value (as defined on the following slide) of the notes exceeds their par value. No adjustment is made to the EPS numerator for interest expense recorded. It is Ciena’s current intent, as of the date of this presentation, that upon conversion of the New 2018 Notes, the principal amount of these notes will be settled in cash, and therefore Ciena intends to use the Treasury Stock Method with respect to these notes in its diluted EPS calculation. See the following slide for an illustration of this method at varying stock prices and the “Additional EPS Shares” that would be included in calculating diluted EPS. If-Converted Method – Convertible debt instruments that must be settled in shares (such as the Original 2018 Notes and the 4.0% Convertible Senior Notes due December 15, 2020) are accounted for under the If-Converted Method. Under this method, diluted EPS is computed assuming the conversion of the notes at the beginning of the reporting period. Ciena adds back to the EPS numerator the recorded interest expense, net of tax, applicable to the notes for the relevant reporting period, and adds the Underlying Shares to the denominator to compute EPS under this method; provided that such adjustments do not increase diluted EPS. If such adjustments increase diluted EPS, then diluted EPS is computed with the interest expense as recorded and without any Additional EPS Shares for the Underlying Shares of such notes. (3) Computed for illustrative purposes using the Treasury Stock Method based on Ciena’s $24.76 average price per share during its fiscal second quarter. See the following slide for an illustration of the a calculation of Additional EPS Shares at varying stock prices. NOTE: Net income, earnings per share and stock price assumptions in these materials are for illustrative purposes only and for the sole purpose of further explaining how diluted EPS is calculated in regard to Ciena’s convertible notes. Such metrics do not reflect Ciena’s business outlook. Ciena makes no assumptions as to whether or when it could achieve the relevant metrics provided in this presentation. Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 16

Illustrative Treasury Stock Method for New 2018 Notes The following table (in thousands, except Stock Price Per Share) illustrates the treatment of Ciena’s New 2018 Notes in calculating diluted EPS in the future based on various hypothetical stock prices and using the Treasury Stock Method. The range of stock prices listed in the table are for illustrative purposes only. Additional EPS Shares would be issuable at Ciena stock prices above $35 per share with the calculation of such Additional EPS Shares to be determined using the same formula below. The actual number of shares of common stock, if any, issuable by Ciena upon conversion of any notes, will be governed by the terms of the indenture applicable to such notes. Additional Shares in Average Stock Underlying Conversion Par Conversion Value in Diluted EPS Calculation Price Per Share Shares Value Value Excess of Par Value (Additional EPS Shares) A B C = (A * B) D E = (C - D) E÷A Below $20.17 14,318 N/A N/A N/A - 21 14,318 $ 300,678 288,730 $ 11,948 569 22 14,318 314,996 288,730 26,266 1,194 23 14,318 329,314 288,730 40,584 1,765 24 14,318 343,632 288,730 54,902 2,288 25 14,318 357,950 288,730 69,220 2,769 26 14,318 372,268 288,730 83,538 3,213 27 14,318 386,586 288,730 97,856 3,624 28 14,318 400,904 288,730 112,174 4,006 29 14,318 415,222 288,730 126,492 4,362 30 14,318 429,540 288,730 140,810 4,694 31 14,318 443,858 288,730 155,128 5,004 32 14,318 458,176 288,730 169,446 5,295 33 14,318 472,494 288,730 183,764 5,569 34 14,318 486,812 288,730 198,082 5,826 $ 35 14,318 $ 501,130 288,730 $ 212,400 6,069 Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 17

Q2 Fiscal 2018 Appendix Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 18

Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 GAAP gross profit $293,307 $271,765 $325,685 $328,076 $318,240 Share-based compensation-products 824 672 694 709 708 Share-based compensation-services 722 625 561 619 679 Amortization of intangible assets 2,289 2,289 2,332 2,417 3,623 Total adjustments related to gross profit 3,835 3,586 3,587 3,745 5,010 Adjusted (non-GAAP) gross profit $297,142 $275,351 $329,272 $331,821 $323,250 Adjusted (non-GAAP) gross margin 40.7% 42.6% 44.2% 45.5% 45.7% Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 19

Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 GAAP operating expense $261,241 $255,029 $269,886 $246,077 $260,420 Share-based compensation-research and development 3,796 3,255 2,956 3,139 3,653 Share-based compensation-sales and marketing 3,760 3,328 3,218 3,242 3,513 Share-based compensation-general and administrative 5,109 4,474 4,130 4,321 3,417 Amortization of intangible assets 3,623 3,623 3,661 3,837 10,980 Significant asset impariments and restructuring costs 4,359 5,961 15,059 2,203 4,276 Total adjustments related to operating expense $20,647 $20,641 $29,024 $16,742 $25,839 Adjusted (non-GAAP) operating expense $240,594 $234,388 $240,862 $229,335 $234,581 Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 GAAP income from operations $32,066 $16,736 $55,799 $81,999 $57,820 Total adjustments related to gross profit 3,835 3,586 3,587 3,745 5,010 Total adjustments related to operating expense 20,647 20,641 29,024 16,742 25,839 Total adjustments related to income from operations 24,482 24,227 32,611 20,487 30,849 Adjusted (non-GAAP) income from operations $56,548 $40,963 $88,410 $102,486 $88,669 Adjusted (non-GAAP) operating margin 7.7% 6.3% 11.9% 14.1% 12.5% Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 20

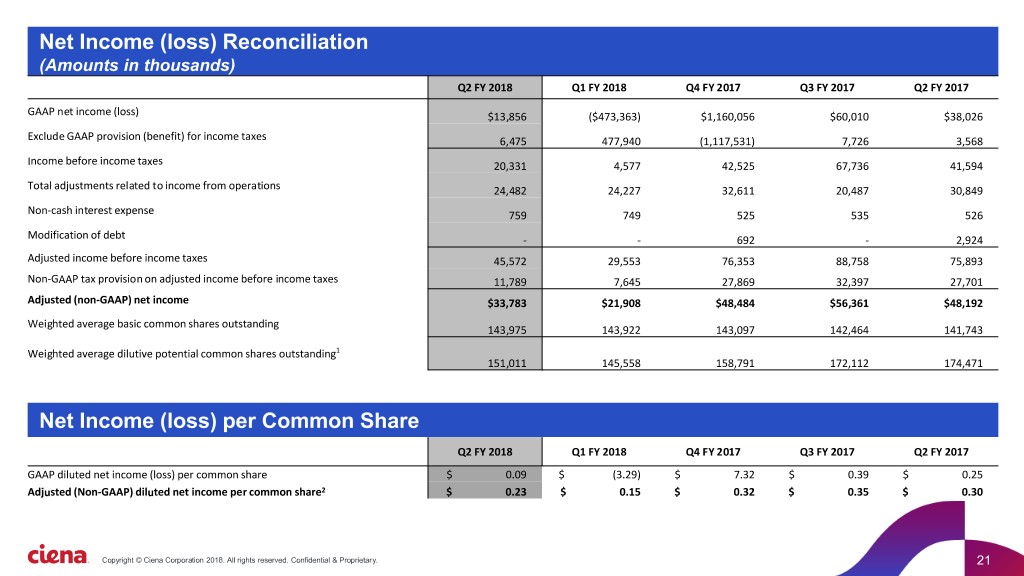

Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 GAAP net income (loss) $13,856 ($473,363) $1,160,056 $60,010 $38,026 Exclude GAAP provision (benefit) for income taxes 6,475 477,940 (1,117,531) 7,726 3,568 Income before income taxes 20,331 4,577 42,525 67,736 41,594 Total adjustments related to income from operations 24,482 24,227 32,611 20,487 30,849 Non-cash interest expense 759 749 525 535 526 Modification of debt - - 692 - 2,924 Adjusted income before income taxes 45,572 29,553 76,353 88,758 75,893 Non-GAAP tax provision on adjusted income before income taxes 11,789 7,645 27,869 32,397 27,701 Adjusted (non-GAAP) net income $33,783 $21,908 $48,484 $56,361 $48,192 Weighted average basic common shares outstanding 143,975 143,922 143,097 142,464 141,743 Weighted average dilutive potential common shares outstanding1 151,011 145,558 158,791 172,112 174,471 Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 GAAP diluted net income (loss) per common share $ 0.09 $ (3.29) $ 7.32 $ 0.39 $ 0.25 Adjusted (Non-GAAP) diluted net income per common share2 $ 0.23 $ 0.15 $ 0.32 $ 0.35 $ 0.30 Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 21

Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) Q2 FY 2018 Q1 FY 2018 Q4 FY 2017 Q3 FY 2017 Q2 FY 2017 Net income (loss) (GAAP) $13,856 ($473,363) $1,160,056 $60,010 $38,026 Add: Interest expense 13,031 13,734 13,926 13,415 13,308 Less: Interest and other income (loss), net 1,296 1,575 652 (848) (2,918) Add: Provision for income taxes 6,475 477,940 (1,117,531) 7,726 3,568 Add: Depreciation of equipment, building, furniture and fixtures, and amortization 20,567 20,833 21,316 20,325 18,849 of leasehold improvements Add: Amortization of intangible assets 5,912 5,912 5,993 6,254 14,602 EBITDA $58,545 $43,481 $83,108 $108,578 $91,271 Add: Shared-based compensation cost 14,166 12,393 11,517 12,014 12,005 Add: Significant asset impairments and restructuring costs 4,359 5,961 15,059 2,203 4,276 Adjusted EBITDA $77,070 $61,835 $109,684 $122,795 $107,552 Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 22

• • • • • • • • • Copyright © Ciena Corporation 2018. All rights reserved. Confidential & Proprietary. 23