Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRINITY INDUSTRIES INC | a052918q1investorpresentat.htm |

Exhibit 99.1 Investor Presentation May 2018 Investor Contact: TrinityInvestorRelations@trin.net Website: www.trin.net

Forward Looking Statements Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements, including, but not limited to, statements regarding the effect of The Tax Cuts and Jobs Act on Trinity's financial results, any non-cash tax benefits from the remeasurement of Trinity's net deferred tax liabilities, the anticipated separation of Trinity into two separate public companies, the expected timetable for completing the spin-off transaction, whether or not the spin-off transaction occurs, future financial and operating performance of each company, benefits and synergies of the spin-off transaction, strategic and competitive advantages of each company, future opportunities for each company and any other statements regarding events or developments that Trinity believes or anticipates will or may occur in the future. Trinity uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this presentation, and Trinity expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Trinity’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. There is no assurance that the proposed spin-off transaction will be completed, that the Company's Board of Directors will continue to pursue the proposed spin-off transaction (even if there are no impediments to completion), that the Company will be able to separate its businesses, or that the proposed spin-off transaction will be the most beneficial alternative considered. Forward looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to risks and uncertainties regarding economic, competitive, governmental, and technological factors affecting Trinity’s operations, markets, products, services and prices, as well as any changes in or abandonment of the proposed separation or the ability to effect the separation and satisfy the conditions to the proposed separation, and such forward-looking statements are not guarantees of future performance. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and “Forward-Looking Statements” in the Company's Annual Report on Form 10-K for the most recent fiscal year, and as may be revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 2

Agenda I. Trinity Industries, Inc. Overview Today II. Overview and Rationale for Planned Spin-off III. Spin-off Timeline and Progress Report IV. Appendix 3

I. Trinity Industries, Inc. Overview Today • Trinity Industries, Inc. is a diversified industrial company that owns complementary market-leading businesses providing products and services to the energy, chemical, agriculture, transportation, and construction sectors • Trinity operates through five business segments: • Rail Group • Railcar Leasing and Management Services Group (“Leasing”) • Inland Barge Group • Construction Products Group (“CPG”) • Energy Equipment Group (“EEG”) External Revenue by Business Group(1) • The Company serves its customers through $7,000 $6.00 manufacturing facilities located in North America and $6,000 $5.00 had approximately 15,605 employees at the end of $5,000 2017 $4.00 $4,000 EPS $3.00 • Total Revenue and EBITDA for LTM 03/18 was $3.6 $3,000 Revenue billion and $839 million, respectively $2.00 $2,000 $1,000 $1.00 $0 $0.00 ($mm) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM All share and per share information has been retroactively adjusted to reflect (2) (3) 03/18 the 2-for-1 stock split effective in June 2014. Rail Group Leasing Barge (3) CPG EEG All Other Please see Footnotes on Slides 30-31. EPS, Total Company-Diluted (3) 4

Leading Market Positions in North America Rail Group Leading manufacturer of railcars Leading manufacturer of railcar axles Leading manufacturer of railcar coupling devices Railcar Leasing and Leading provider of railcar leasing and management Management Services services Group Inland Barge Group Leading manufacturer of inland barges and fiberglass barge covers in the United States Construction Products Leading full-line manufacturer of highway guardrail and Group crash cushions in the United States Leading producer and distributor of lightweight and natural construction aggregates in certain regions in the United States Leading manufacturer of structural wind towers Energy Equipment Group Leading manufacturer of storage and distribution containers and tank heads for pressure and non- pressure vessels Leading manufacturer of steel utility structures for electricity transmission and distribution 5

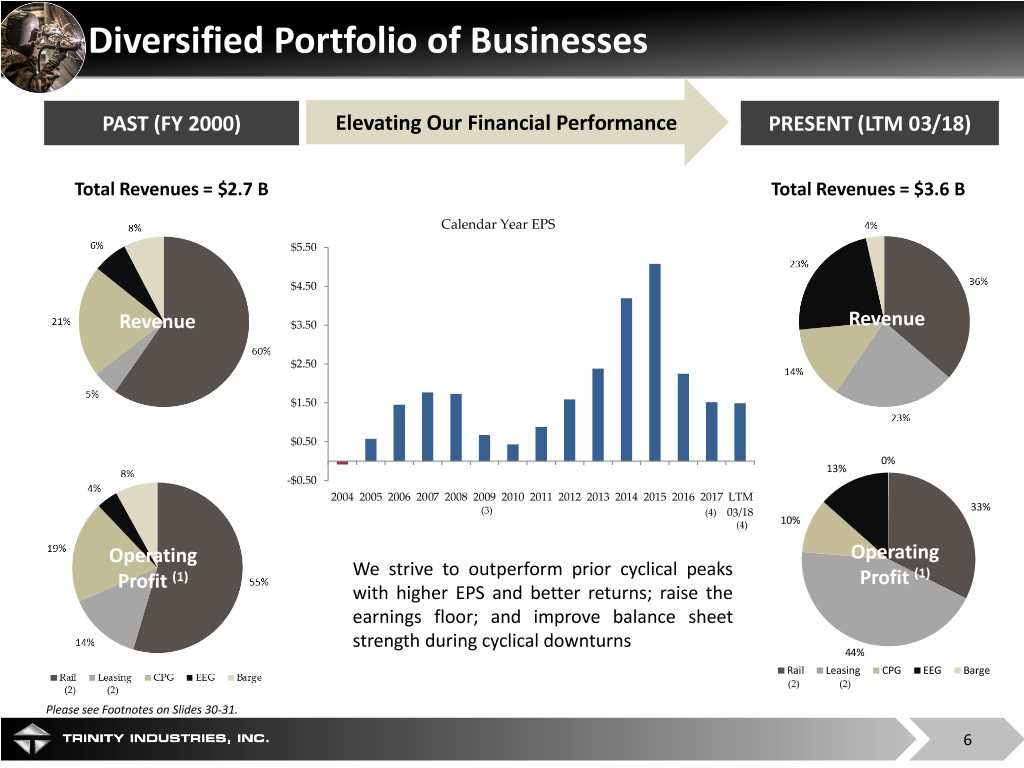

Diversified Portfolio of Businesses PAST (FY 2000) Elevating Our Financial Performance PRESENT (LTM 03/18) Total Revenues = $2.7 B Total Revenues = $3.6 B Calendar Year EPS $5.50 $4.50 Revenue $3.50 Revenue $2.50 $1.50 $0.50 0% 13% -$0.50 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM 33% (3) (4) 03/18 (4) 10% Operating Operating We strive to outperform prior cyclical peaks Profit (1) Profit (1) with higher EPS and better returns; raise the earnings floor; and improve balance sheet strength during cyclical downturns 44% Rail Leasing CPG EEG Barge (2) (2) (2) (2) Please see Footnotes on Slides 30-31. 6

Flexible and Cost-Effective Manufacturing Flexibility Trinity's manufacturing flexibility across products enhances our ability to opportunistically respond to changes in market demand Cost-Effective Trinity’s manufacturing scale, vertical integration, and presence in the Southern U.S. and Mexico provides cost effective benefits across multiple business segments In recent years, Trinity has invested significantly in its manufacturing footprint establishing a strong manufacturing platform and ability to respond to changes in market demand 7

Seasoned Performer Across Market Conditions . Incorporated in 1933 with a strong corporate culture and commitment to Company values . Seasoned management team knows how to assess the market, proactively plan for cycles and quickly adapt to changing market conditions . Cost-effective and flexible manufacturing footprint is a competitive advantage for many of our product lines . Significant liquidity position of approximately $2.0 billion and a strong balance sheet at quarter end March 31, 2018 . Track record of maintaining a healthy liquidity position across the business cycle 8

Healthy Financial Position to Complete Spin-off As of 03/31/18 Balance Sheet Debt ~ $3.3 B(1) Recourse Debt Working Capital Senior Notes(1) $400 Convertible Subordinated Notes(1, 3) 449 Capital Leasing Obligations(1) 27 Total Recourse $876 mm Maintain a Non-Recourse Leasing Debt(2) Capital Warehouse Facility(1) $155 conservative and Expenditures Long-term Financings: liquid balance Wholly-Owned(1) 872 Partially-Owned(1) 1,354 sheet to be Total Non-Recourse Leasing $2,381 mm attractively positioned to Available Liquidity ~ $2.0 B capitalize on Acquisitions Cash, Cash Equivalents, opportunities & Short Term Marketable Securities $846 Corporate Revolver Availability 521 Warehouse Availability 596 Total Available Liquidity $1,963 mm Shareholder Equity ~ $4.8 B Distributions Please see Footnotes on Slides 30-31. 9

Financial Highlights Trinity’s EPS Summary FY 2009 – LTM 03/18(3) LTM 03/18 vs. LTM 03/17(1) $6.00 . Revenues decreased 15.4% to $3.62 billion from $4.28 $5.08 $5.00 billion $4.19 $4.00 . Operating profit decreased 23.7% to $405.1 million from (2) $3.00 $530.7 million $2.38 $2.25 . EBITDA decreased 11.4% to $839.1 million from $947.3 $2.00 $1.59 $1.52 $1.49 $0.88 million $0.67 $1.00 $0.43 . Earnings per common diluted share decreased 22.0% to $0.00 (6) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM $1.49 from $1.91 per diluted share (4) (5) (6) 03/18 (6) Trinity’s EBITDA Summary FY 2009 – LTM 03/18(7) Call of Convertible Subordinated Notes On April 23, 2018, Trinity announced that it has given notice of its election to redeem all of the outstanding $449 million Convertible Subordinated Notes due 2036 on June 1, 2018. Trinity is required to settle the par amount in cash and has the option to settle the conversion payment in cash, stock or a combination. Trinity intends to make the entire conversion payment based on the average settlement period solely in cash funded with a combination of cash on hand and proceeds from one of more debt financing transactions on a non-recourse basis. For more details, please refer to the press release and 8K filing of the same date. Please see Footnotes on Slides 30-31. 10

FY 2018 Guidance and Outlook (As of April 26, 2018) Total EPS: ~ $0.95 - $1.20 EPS, excluding spin-off transaction costs: ~ $1.20 - $1.40 Corporate expense, excluding spin-off transaction costs: ~ $130 - $150mm Total Company Spin-off transaction costs: ~ $30 - $35mm Tax rate, excluding spin-off transaction costs: ~ 24% Manufacturing & Corporate CapEx: ~ $100 - $150mm Interest Expense, net: ~ $165mm Revenue: ~ $2.2B Rail Group Operating margin: ~ 8.0% Railcar deliveries: ~ 20,500 Revenue elimination from sales to Leasing Group: ~ $860mm Operating profit elimination from Sales to Leasing Group: ~ $95mm Leasing and management revenues: ~ $720mm Leasing Group Leasing and management operating profit: ~ $290mm Proceeds from sales of leased railcars: (not included in above ~ $350mm revenues and operating profit) Net investment in lease fleet: ~ $520mm Inland Barge Revenue: ~ $155mm Group Operating margin: ~ 0.0% Construction Revenue: ~ $545mm Products Operating margin: ~ 13.0% Group Energy Revenue: ~ $875mm Equipment Operating margin: ~ 8.5% Group Any forward-looking statements made by the Company speak only as of the date on which they are made. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise. 11

II. Overview and Rationale for Planned Spin-Off 12

Spin-off of Arcosa, Inc. • On December 12, 2017, Trinity Industries announced a plan to pursue the spin-off of its infrastructure-related businesses to shareholders • Trinity introduced , Arcosa Inc., as the new company in an initial Form 10 filing on May 15, 2018 • Transaction is expected to result in two separate public companies that will benefit from: – Leading positions in their respective industries – Strong cash flow generation – Compelling growth opportunities • Separation is planned as tax-free spin-off to shareholders for U.S. federal income tax purposes • Expected to be completed in the fourth quarter of 2018 13

Strategic Rationale • Enhances Overall Growth Potential through Focused Companies – Arcosa to focus on growing market opportunity in North American infrastructure spending – Trinity Industries to operate industry-leading integrated rail leasing, manufacturing, and services business, providing single source for comprehensive rail transportation solutions and services in North America • Enables Each Company to Optimize Balance Sheet and Capital Allocation Priorities – Standalone companies plan to pursue distinct business strategies and investment decisions best suited to enhance long-term growth and shareholder value creation • Enables Businesses to Advance Differentiated Investment Theses 14

CEO / CFO Management Teams post Spin-Off Management-Trinity Industries Management - Arcosa, Inc. . Current CEO/CFO to remain in place following the spin-off . Antonio Carrillo has accepted the future role of President and CEO of Arcosa . Timothy R. Wallace, Trinity’s Chairman, Chief Executive Officer and President, will remain in his current role with Trinity ⁻ Since 2012, Mr. Carrillo has served as CEO of Mexichem following completion of the spin-off S.A.B. de C.V. Prior to joining Mexichem, Mr. Carrillo spent 16 years at Trinity where he most recently served ⁻ Mr. Wallace joined Trinity in 1975 and has been as Senior Vice President and Group President of the Chairman, Chief Executive Officer, and President of Company’s Energy Equipment Group and was Trinity since 1999 responsible for Trinity’s Mexico operations. In 2014, he was elected to Trinity’s Board of Directors . James Perry, Trinity’s Senior Vice President and Chief Financial Officer, will remain in his current role with Trinity following . Scott Beasley has accepted the future role of CFO of Arcosa completion of the planned spin-off ⁻ Mr. Beasley is currently the Group Chief Financial Officer ⁻ Mr. Perry joined Trinity in 2004 and was appointed of Trinity’s Construction, Energy, Marine and Treasurer in April 2005. He was named a Vice President Components businesses, and has served in this role since of Trinity in 2006 and appointed Vice President, Finance 2017. Mr. Beasley joined the Company in 2014 and in 2007. Mr. Perry is in his eighth year as the Company’s previously served as Vice President of Corporate CFO Strategic Planning for Trinity Industries 15

Trinity Industries, Inc. (post Spin-off) • Trinity will be comprised primarily of our rail-related businesses • The spin-off maintains the benefits of TrinityRail®’s integrated business model and its expansive market platforms • As the premier provider of rail products and services, offers an unparalleled value proposition for customers as a premier provider of rail products and services • Creates a “one-stop-shop” experience and a comprehensive range of railcar services for industrial producers, railroads, lessors, and institutional investors • Gives the ability to pursue an optimized capital structure, efficiently allocate capital, and effectively leverage multiple rail platforms 16

Arcosa Positioned for Success • New growth-oriented company that provides critical infrastructure products for a broad spectrum of markets throughout construction, energy, and transportation • Strong market positions with established reputations for quality and service • Well positioned to benefit from North American economic growth and infrastructure spending • Proven ability to operate efficiently in cyclical markets • Balance sheet flexibility to pursue growth organically and through acquisitions • Opportunities to leverage extensive platform in Mexico • Experienced leadership team with track record of growth 17

Trinity business segments (post spin-off) Trinity Industries, Inc. (post spin-off) 2017 Revenues: $2.4B1 Rail Leasing and Rail Group All Other Eliminations Management Services Group ($ Millions) 2017 Revenues 1 $2,044 $843 $344 ($834) ▪ Tank and freight railcars ▪ TrinityRail Leasing Services ▪ Highway Products ▪ Eliminations, primarily of sale of Businesses ▪ Maintenance Services ▪ Asset management ▪ Trinity Logistics Group 2 railcars from Rail ▪ Railcar parts and heads ▪ Railcar investment vehicle Manufacturing to Rail (RIV) sales Leasing 3 Please see Footnotes on Slides 30- 31. 18

Arcosa business segments Arcosa, Inc. (per Form 10 Filing) 2017 Revenues: $1.5B1 Transportation Products Energy Equipment Group Construction Products Group Group ($ Millions) 2017 Revenues $259 $844 $363 2 ▪ Natural aggregates (sand and ▪ Wind towers ▪ Inland barges Products gravel) ▪ Utility structures ▪ Fiberglass covers and other barge 2 ▪ Lightweight aggregates components ▪ Pressurized and non-pressurized 3 ▪ Trench shields and shoring storage and distribution containers ▪ Axles & couplers products 3 ▪ Industrial and mining components * For more information please refer to the Information Statement Summary section of the Form 10 filed on May 15, 2018 Please see Footnotes on Slides 30- 31. 19

III. Spin-off Timeline and Progress Report Announcement • Continued analysis and planning December 2017 • Refinement of new corporate and organizational structures • Initial Form 10 filed May 15, 2018 • Organization preparation • IRS private letter ruling on tax-free status of transaction • Final approval by Board of Directors Expected • Distribution of SpinCo shares Completion Q4 2018 20

Separation Progress Report (As of 5/15/18) • Internal Separation Planning Teams identified, project plans defined, and teams working well to execute anticipated spin-off in the fourth quarter of 2018 • CEO/CFO announcements of both companies announced in January – Continued progress of reorganized senior management teams • Private letter ruling request filed with the IRS in early February • Announced anticipated alignment of businesses for the two stand-alone public companies in April • Introduced new company name and filed initial Form 10 with the SEC on May 15th that provides details related to business, strategy, and historical financial results for Arcosa (for a copy of the Form 10 refer to Trinity Spin-off section of Trinity’s website at www.trin.net) 21

IV. Appendix 22

Rail Group Market Positioning Current Performance(4) . . LTM 03/18 deliveries and orders totaling 20,350 and 16,635 railcars, Leading manufacturer of railcars, railcar axles, and coupling respectively; represents 42% and 37% of LTM 03/18 industry deliveries and devices in North America orders, respectively . Broadest product offering for railcar manufacturing in North . Trinity’s $2.1 billion order backlog of 21,365 railcars accounts for 39% of America industry backlog as of 03/18 and includes a broad mix of railcar types across many industrial sectors . Networking of customers between railcar sales and railcar . leasing Remain encouraged by improving industry fundamentals, continued . demand in select growth markets, and improved forecast for industrial Investment in maintenance services has expanded capabilities production. First quarter orders received of 4,705 railcars reflect a broad for our lease fleet and key customers mix of railcar types serving both replacement needs and select growth . Focus on new and advanced engineering designs markets . Believe demand for railcars improving and level of order inquiries reflect . Centralized sourcing provides cost savings positive momentum. However, we continue to expect 2018 performance . Streamlined manufacturing efficiencies will be primarily driven by orders taken in a weaker market environment (1) Business Conditions/Demand Outlook Rail Group Revenues and OP Margin 100,000 Railcar Deliveries (1958 - 2020P) Projections based on Third Party estimates(3) $5,000 24.0% 90,000 $4,462 $4,500 80,000 $3,817 20.0% $4,000 70,000 $3,500 16.0% $3,077 60,000 $3,000 $2,868 $2,204 12.0% 50,000 $2,500 $2,013 $2,084 40,000 $2,000 8.0% 30,000 $1,500 $1,275 4.0% 20,000 $1,000 $895 0.0% 10,000 $500 $522 0 $- -4.0% ($mm) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM (2) 03/18 Railcar Revenue Parts & Components Revenue OP Margin Please see Footnotes on Slides 30-31. 23

Railcar Leasing & Management Services Group Market Positioning Current Performance . Leading provider of comprehensive railcar leasing and . Solid financial performance during LTM 03/18 driven by lease fleet management services growth, higher asset management advisory fees, and disciplined cost management initiatives . Provider of operating leases offering ‘one stop shopping’ for . TrinityRail shipping customers Renewal rates have improved from recent levels. However, generally . speaking, lease rates remain below expiring levels Scale of operations facilitates active participation in secondary . market activities to create Railcar Investment Vehicles (“RIVs”) Sold $476 million of leased railcars in LTM 03/18, primarily through and asset management services for institutional investors the RIV platform, reflecting strong demand from institutional investors . . Total leased railcars under management was 119,025 as of Expect to continue growing the lease fleet in FY 2018, with 45% of our total railcar deliveries going to the lease fleet. Anticipate March 31, 2018, a 13% increase year-over-year supplementing organic fleet growth with selected purchases of leased railcars in the secondary market . Total expected net leasing investment of $520 million in 2018 Business Conditions/Demand Outlook Leasing Operating Revenues and Profit (Excludes Car Sales)(3) 140,000 $800 60.0% More Than Tripled the Size of Trinity’s Owned $744 $739 120,000 $700 $701 $700 and Managed Lease Fleet since 2006 $632 50.0% 100,000 $600 $587 $529 80,000 $493 $500 $461 40.0% 60,000 $400 $329 30.0% 40,000 $300 20,000 $200 20.0% - $100 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13 12/14 12/15 12/16 12/17 03/18 $0 10.0% (1) (2) ($mm) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM 03/18 Managed Fleet Wholly-Owned & Partially-Owned TILC Revenue Operations Margin PBT Margin Please see Footnotes on Slides 30-31. 24

Construction Products Group Market Positioning Current Performance . . Leading U.S. manufacturer of highway guardrail, crash LTM 03/18 revenues declined primarily due to lower volumes in cushions, and other protective barriers highway products, partially offset by increased acquisition-related volume in the trench shoring business . Leading producer and distributor of lightweight and . Operating margin remains above recent historical levels and reflects natural construction aggregates in certain regions in the the repositioning of the business portfolio to align with more United States consistent demand drivers . . Diversified exposure to commercial, residential, industrial, During 2017, we completed $63 million in acquisitions, expanding our and highway markets trench shoring manufacturing platform and acquiring the assets of two lightweight aggregates businesses . Demand tied to the North American infrastructure build . Since 2013, exited the concrete and galvanizing businesses, entered out and federal funding and expanded the lightweight aggregates and trench shoring products businesses, and continued to invest in the Company’s natural aggregates platform Business Conditions/Demand Outlook Construction Products Group Revenues and OP Margin(1) . Anticipate the infrastructure plan proposed by President $600 $552 $533 15.0% $525 $523 $505 $507 Trump will be a positive tailwind for needed infrastructure $484 14.0% $500 $453 investment throughout the U.S. 13.0% $400 $354 12.0% . $281 11.0% Fixing America’s Surface Transportation ACT (FAST), passed $300 in December 2015, authorized a $305 billion five-year 10.0% funding bill for highways and other related transit $200 9.0% 8.0% programs, providing much needed stability for public $100 7.0% agencies charged with planning transportation projects $0 6.0% . ($mm) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM Strong demand for aggregates in the southwestern U.S. (2) 03/18 market due to residential and non-residential investment Highway Products Aggregates Other OP Margin Please see Footnotes on Slides 30-31. 25

Energy Equipment Group Market Positioning Current Performance . Wind Towers and Utility Structures: Leading manufacturer of wind towers, steel utility . structures, storage and distribution containers in North Backlog of $810 million for wind towers and utility structures as of America 03/18 provides solid visibility and stable production into 2020 . Improved performance for the utility structures business during . Manufacturer of tank heads for pressure and non-pressure the LTM 03/18 and expectations for continued improvement in FY vessels, cryogenic equipment used to store and transport 2018; project sizes remain small, but bidding activity continues to liquefied gases as well as oil and gas processing equipment be strong Total Business Segment: . Operating Profit declined in LTM 03/18 compared to LTM 03/17 reflecting mixed demand conditions for the end markets the Group serves Business Conditions/Demand Outlook Energy Equipment Group Revenues and OP Margin . Five-year spending bill passed by the federal government in $1,200 16% December 2015 included a tax incentive for wind power energy $1,114 $1,013 14% through 2019; the multi-year incentive provides developers the $1,000 $992 $975 $946 necessary stable planning environment to develop wind 12% projects $800 $ 665 10% . Current demand levels and production visibility for utility structures continue to improve; long-term demand $600 $559 8% $510 $473 fundamentals remain positive as future growth in investment $420 6% spending, especially connecting renewable energy to the grid, is $400 expected 4% . $200 The storage container industry is highly competitive and 2% experiencing pricing pressure from current market conditions; $0 0% long-term demand fundamentals are positive given the ($mm) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM significant investment by chemical companies along the Gulf 03/18 Coast Wind Tower and Utility Structures Revenues Other Revenues OP Margin 26

Inland Barge Group Market Positioning Current Performance . . Revenues and profit down significantly again in LTM 03/18 Leading manufacturer of inland barges and fiberglass barge versus recent historic levels due to a substantial decline in covers in the United States barge deliveries and a weak pricing environment . Multiple barge manufacturing facilities on inland waterways . Backlog at March 31, 2018 was $124.5 million compared to enable rapid delivery $109.9 million at March 31,2017; received $57 million in orders during FY 2018 reflecting strategic buying decisions . Operating flexibility is a key differentiator . . Investments made over the past decade have enhanced Barge transportation has a cost advantage in high-cost fuel production flexibility positioning the barge business to environments respond effectively as market demand changes . Continue to remain focused on reducing costs in 2018 as the business is expected to produce break-even profit Business Conditions/Demand Outlook Inland Barge Group Revenues and OP Margin . Weak market conditions persist. An oversupply of inland barges in $800 24% North America continues to create headwinds, although utilization $700 $675 $653 21% levels for our customers appear to be improving. Second quarter $639 18% 2018 inquiries have been encouraging particularly on the liquids side $600 $577 $549 $527 15% (4) $500 Replacement demand driver (as of 03/31/18): $403 . 3,906 out of 18,819 hopper barges, or approximately 20.8%, are $422 12% $400 greater than 20 years old 9% . $300 840 out of 3,617 tank barges, or approximately 23.2%, are greater 6% than 20 years old $200 $158 3% . $126 From 2000 to 2017, the industry had a build-to-scrap ratio of 0.9x; in $100 0% 2017 the ratio was 0.5x $0 -3% ($mm) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM (1) (2) (3) 03/18 Revenues OP Margin Please see Footnotes on Slide s 30-31. 27

Reconciliation of EBITDA (1)(2) (in millions) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM 03/18 Income (loss) from continuing operations ($140.8) $69.4 $146.8 $251.9 $386.1 $709.3 $826.0 $364.7 $713.6 $703.5 Add: Interest expense 123.1 182.1 185.3 194.7 187.3 193.4 194.7 181.9 184.0 185.3 Provision/(Benefit) for income taxes (11.5) 37.3 92.2 134.0 204.4 354.8 426.0 202.1 (341.6) (347.6) Depreciation & amortization expense 147.1 180.9 187.7 193.7 211.5 244.6 266.4 283.0 295.4 297.9 Goodwill impairment 325.0 - - - - - - - - - Earnings from continuing operations before interest expense, income taxes, and depreciation and amortization expense $442.9 $469.7 $612.0 $774.3 $989.3 $1,502.1 $1,713.1 $1,031.7 $851.4 $839.1 “EBITDA” is defined as income (loss) from continuing operations plus interest expense, income taxes, and depreciation and amortization including goodwill impairment charges. EBITDA is not a calculation based on generally accepted accounting principles. The amounts included in the EBITDA calculation, however, are derived from amounts included in the historical statements of operations data. In addition, EBITDA should not be considered as an alternative to net income or operating income as an indicator of our operating performance, or as an alternative to operating cash flows as a measure of liquidity. We believe EBITDA assists investors in comparing a company’s performance on a consistent basis without regard to depreciation and amortization, which can vary significantly depending upon many factors. However, the EBITDA measure presented in this presentation may not always be comparable to similarly titled measures by other companies due to differences in the components of the calculation. (1) EBITDA for previous years has been adjusted as a result of the divestiture of the Company’s Concrete business (2) Includes results of operations related to TRIP starting January 1, 2010 28

Reconciliation of PBT Margin – Railcar Leasing and Management Services Group (in millions except for PBT Margin) 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM 03/18 From Leasing Operations: Revenue $ 329 $ 461 $ 493 $ 529 $ 587 $ 632 $ 700 $ 701 $ 744 $ 739 Operating Profit $ 129 $ 200 $ 225 $ 243 $ 267 $ 288 $ 331 $ 313 $ 341 $ 325 Less: Interest Expense (80) (139) (161) (174) (157) (153) (139) (125) (126) (127) Profit Before Tax (PBT) $ 48 $ 62 $ 64 $ 68 $ 110 $ 135 $ 192 $ 188 $ 215 $ 198 PBT Margin 15% 13% 13% 13% 19% 21% 27% 27% 29% 27% 29

Footnotes Slide 4 (1) Intersegment Revenues are eliminated and Leasing Revenues include revenues related to TRIP Holdings beginning in FY 2010; CPG Revenues for prior years have also been adjusted as a result of the divestiture of its Concrete business in March 2013 (2) FY 2009 EPS excludes a $325 million pretax Goodwill impairment amounting to $1.57 per share; reported FY 2009 EPS was $(0.91) (3) FY 2017 and LTM 03/18 exclude $476 million non-cash tax benefit related to the effects of the Tax Cuts and Jobs Act. Approximately, $14 million and $22 million of spin-off related transaction costs were also excluded for 2017 and LTM 03/18, respectively Slide 6 (1) Operating Profit Excludes All Other, Corporate and is reduced by Leasing Interest Expense of $7 million in FY 2000 and $126.7 million in LTM 03/18 (2) Rail percentage represents Operating Profit less all Intersegment Company Eliminations; Leasing percentage represents Operating Profit less Leasing Interest Expense (3) FY 2009 EPS excludes a $325 million pretax Goodwill impairment amounting to $1.57 per share; reported FY 2009 EPS was $(0.91) (4) FY 2017 and LTM 03/18 exclude $476 million non-cash tax benefit related to the effects of the Tax Cuts and Jobs Act. Approximately, $14 million and $22 million of spin-off related transaction costs were also excluded for 2017 and LTM 03/18, respectively Slide 9 (1) Excludes unamortized discount and/or unamortized debt issuance costs (2) Leasing railcar equipment has a net book value of $6.3 billion, excluding deferred profit and including partially-owned subsidiaries (3) On April 23, 2018, Trinity announced that it has given notice of its election to redeem all of the outstanding Convertible Subordinated Notes due 2036 on June 1, 2018 pursuant to the terms of the Indenture Slide 10 (1) LTM 03/18 vs LTM 03/17, all numbers on a Continuing Operations basis except for EPS, which reflects Total Company EPS (2) Operating Profit includes Leasing Interest Expense (3) EPS is for Total Company, including Discontinued Operations; LTM 03/18 per share amount consists of sum of individual quarters (4) Excludes $325 million pre-tax impact of impairment of Goodwill amounting to $1.57 per share; reported FY 2009 EPS was $(0.91) (5) Beginning in FY 2010, TRIP Holdings Revenues and Operating Profit were consolidated with the Leasing Group (6) FY 2017 and LTM 03/18 exclude $476 million non-cash tax benefit related to the effects of the Tax Cuts and Jobs Act. Approximately, $14 million and $22 million of spin-off related transaction costs were also excluded for 2017 and LTM 03/18, respectively (7) See Note in Appendix pg. 28 for Reconciliation of EBITDA; EBITDA for previous years has been adjusted as a result of the divestiture of the Company’s Concrete business Slide 18 (1) Revenues are unaudited and are based on management’s estimates and assumptions and include All Other and Revenue Eliminations post spin-off (2) For financial reporting purposes, a portion of this business (heads product line) is currently included within the financial results of the Energy Equipment Group (3) Eliminations include manufactured railcars sold to the leasing company Slide 19 (1) Revenues exclude All Other and Revenue Eliminations as provided in the initial Form 10 of Arcosa, Inc. filed May 15, 2018. Unaudited Pro-Forma adjustments have not been included (2) For financial reporting purposes, the results of operations of Inland Barge and its related components are currently reported as a separate segment by Trinity Industries, Inc. (3) For financial reporting purposes, the results of operations of the Components business, including axles and couplers, is currently included with the results of operations of the Rail Group by Trinity Industries, Inc. but will be included with the results of operations of the Transportation Products Group of Arcosa, Inc. following the spin-off 30

Footnotes (Continued) Slide 23 (1) Before eliminations for Intersegment Sales to Leasing and Intercompany Profit (2) Excludes $325 million pretax charge for impairment of Goodwill; reported FY 2009 operating loss margin was 39.8% (3) Sources: Historical data as reported per the Railway Supply Institute. 2017-2020 projections are an average of estimates provided by Global Insight (04/18) and Economic Planning Associates, Inc. (04/18) and are provided as a point of reference (4) Source: Industry total as reported per the Railway Supply Institute’s American Railway Car Institute Committee (ARCI) Slide 24 (1) Includes TRIP Holdings starting in 2007 (2) Includes Partially-Owned Subsidiaries (3) Operations Margin calculated using only revenues and profit from Leasing Operations including Partially Owned Subsidiaries and excludes Car Sales; PBT Margin calculated using Operating Profit from Leasing Operations less Leasing Interest Expense; See Appendix pg. 29 Slide 25 (1) Revenues and OP Margin in prior years have been adjusted as a result of the divestiture of the Concrete business in March 2013 (2) Acquired Quixote Corporation in February 2010 which increased Highway Products revenue by 31% during 2010 Slide 27 (1) OP Margin excludes a $5.1 million net gain due to flood-related insurance settlements; reported OP margin 16.3% (2) OP Margin excludes a $15.5 million net gain due to flood-related insurance settlements; reported OP margin 19.4% (3) OP Margin excludes a $3.8 million net gain due to flood-related insurance settlements and the sale of leased barges; reported OP margin 18.5% (4) Informa Economics (03/2018) 31