Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AIRGAIN INC | airg-8k_20180530.htm |

Enabling High Performance Wireless Connectivity NASDAQ:AIRG © Copyright 2018 Airgain, Inc. All Rights Reserved. Investor Presentation May 2018 Exhibit 99.1

This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding our future operating results, financial position and cash flows, our business strategy, our 2018 financial outlook, and plans and our objectives for future operations are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “plan,” “target,” “project,” “contemplate,” “predict,” “potential,” “would,” “could,” “should,” “intend” and “expect” or the negative of these terms or other similar expressions. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, without limitation: the market for our antenna products is developing and may not develop as we expect; our operating results may fluctuate significantly, including based on seasonal risk factors, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance; risks and uncertainties related to recent management changes and any difficulties or delays we encounter in identifying a successor CEO; a slower than anticipated rollout of certain customers' deployments; our products are subject to intense competition, including competition from the customers to whom we sell, and competitive pressures from existing and new companies may harm our business, sales, growth rates and market share; our future success depends on our ability to develop and successfully introduce new and enhanced products for the wireless market that meet the needs of our customers; risks that we may not fully realize the benefits associated with the partnerships we have entered into, or that existing partnerships may be terminated by either party; our business is characterized by short product development windows and short product lifecycles; we sell to customers who are extremely price conscious, and a few customers represent a significant portion of our sales, and if we lose any of these customers, our sales could decrease significantly; we rely on a few contract manufacturers to produce and ship all of our products, a single or limited number of suppliers for some components of our products and channel partners to sell and support our products, and the failure to manage our relationships with these parties successfully could adversely affect our ability to market and sell our products; if we cannot protect our intellectual property rights, our competitive position could be harmed or we could incur significant expenses to enforce our rights; our international sales and operations subject us to additional risks that can adversely affect our operating results and financial condition; our ability to identify and consummate strategic acquisitions, and risks associated with completed acquisitions adversely affecting our operating results and financial condition; and other risks described in our filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in our Annual Report on Form 10-K and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward looking statements, which speak only as of the date here of, and we undertake no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. All forward- looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. Important Caution Regarding Forward Looking Statements

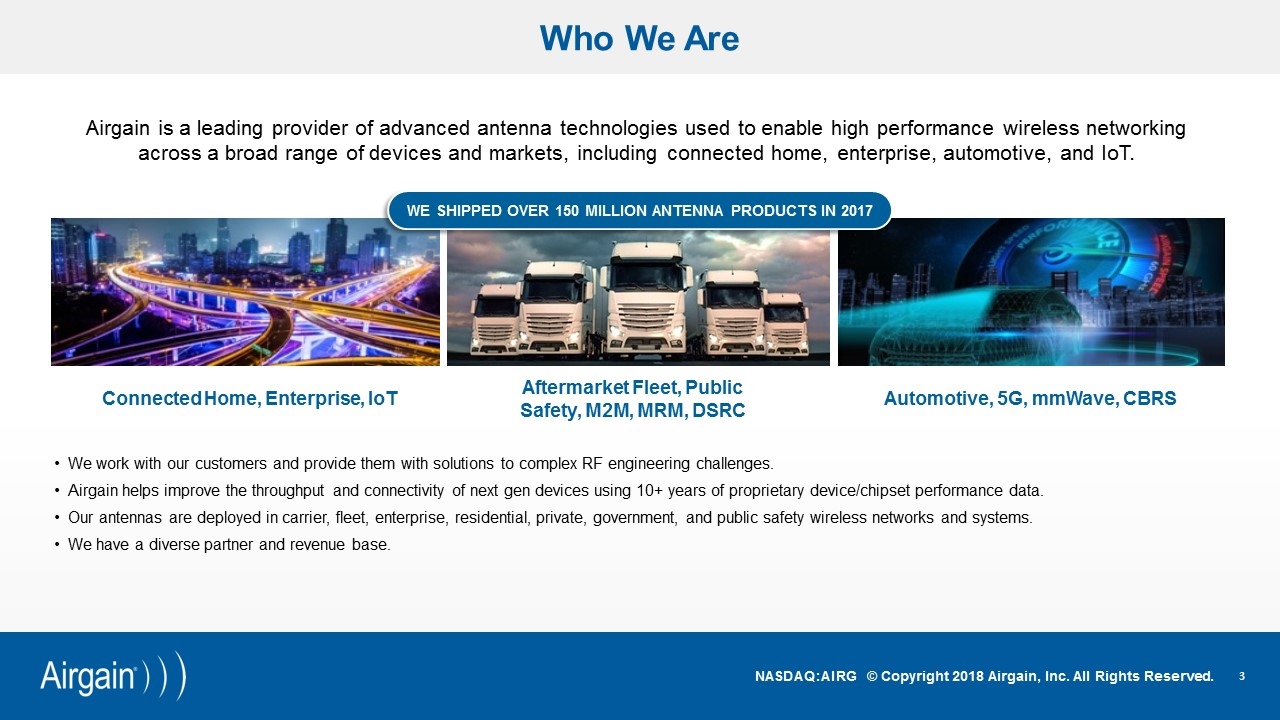

Who We Are Airgain is a leading provider of advanced antenna technologies used to enable high performance wireless networking across a broad range of devices and markets, including connected home, enterprise, automotive, and IoT. Connected Home, Enterprise, IoT Aftermarket Fleet, Public Safety, M2M, MRM, DSRC Automotive, 5G, mmWave, CBRS We work with our customers and provide them with solutions to complex RF engineering challenges. Airgain helps improve the throughput and connectivity of next gen devices using 10+ years of proprietary device/chipset performance data. Our antennas are deployed in carrier, fleet, enterprise, residential, private, government, and public safety wireless networks and systems. We have a diverse partner and revenue base. WE SHIPPED OVER 150 MILLION ANTENNA PRODUCTS IN 2017

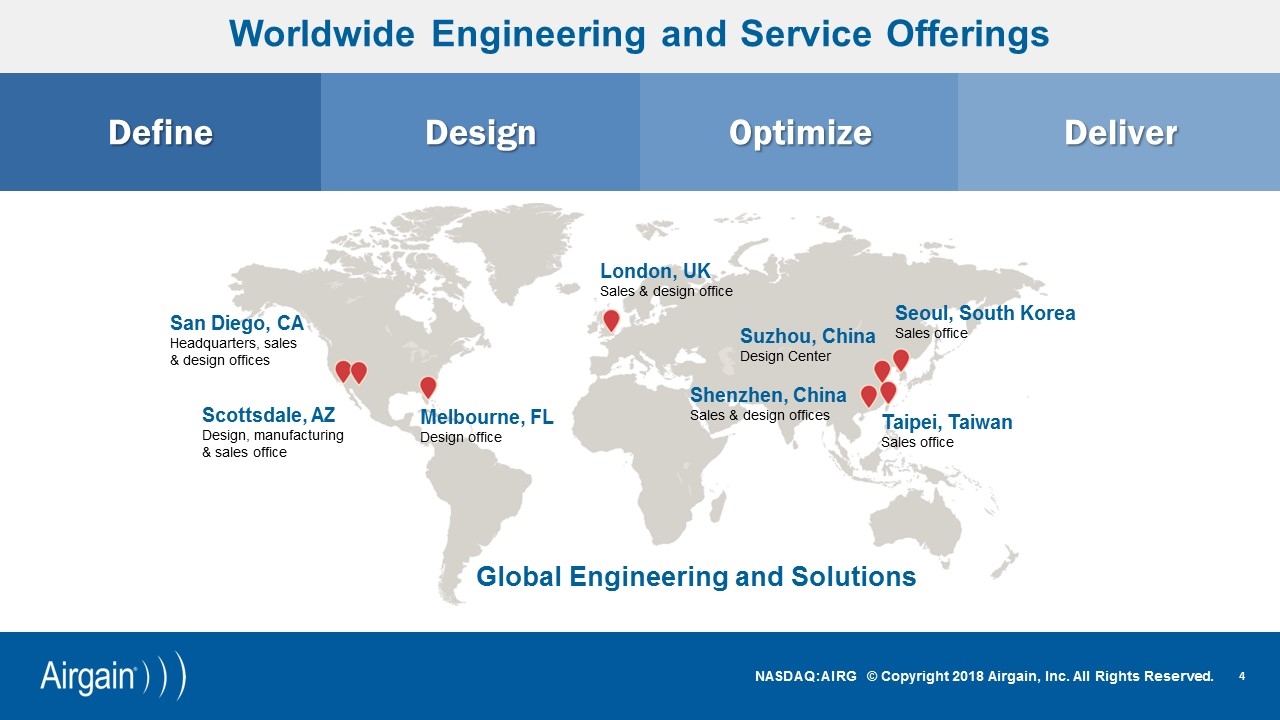

Worldwide Engineering and Service Offerings Scottsdale, AZ Design, manufacturing & sales office San Diego, CA Headquarters, sales & design offices London, UK Sales & design office Melbourne, FL Design office Suzhou, China Design Center Shenzhen, China Sales & design offices Seoul, South Korea Sales office Taipei, Taiwan Sales office Global Engineering and Solutions Design Deliver Optimize Define

Who We Work With

Global Megatrends – Connected Everything By 2020 there will be close to 7 times the number of connected devices as people on the planet* *Source: PwC, Technological Breakthroughs: https://www.pwc.co.uk/issues/megatrends/technological-breakthroughs.html

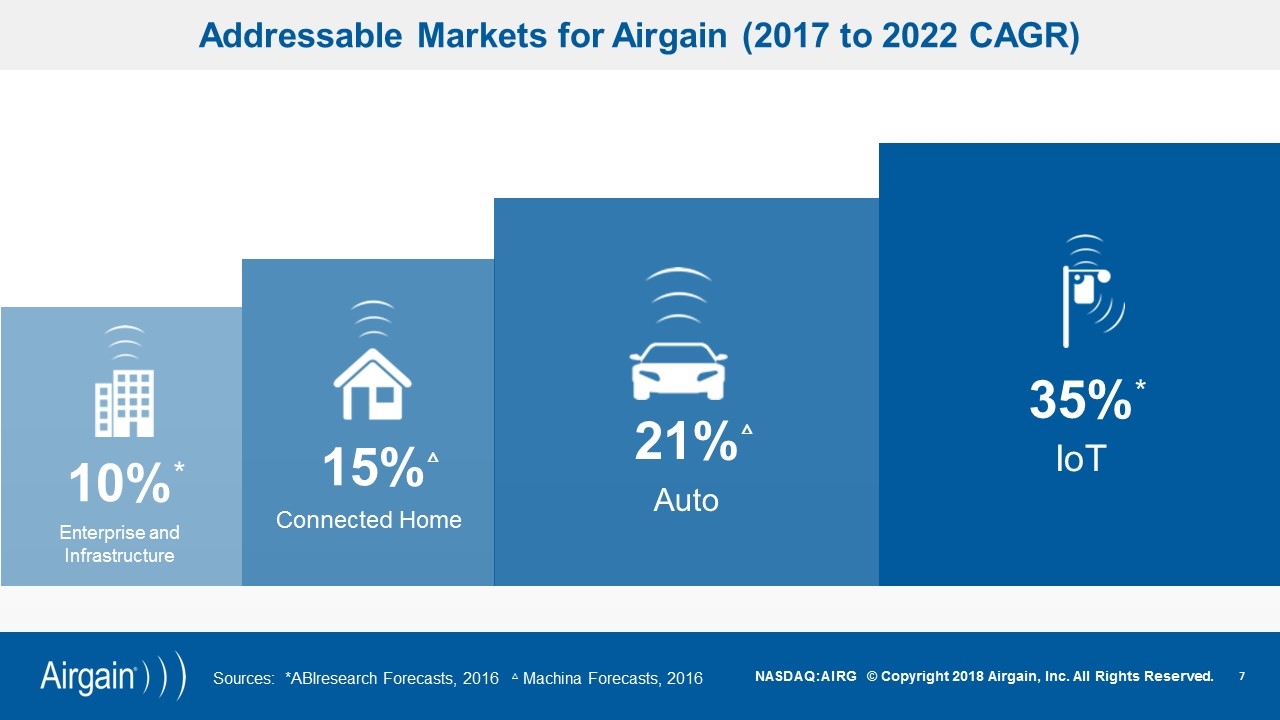

Addressable Markets for Airgain (2017 to 2022 CAGR) Sources: *ABIresearch Forecasts, 2016 Enterprise and Infrastructure 10% Auto 21% IoT 35% 15% Connected Home △ Machina Forecasts, 2016 △ △ * *

Airgain continues to be the essential value-added partner that our customers rely on, and our strong reputation is highly valued within the customer ecosystem Airgain's Critical Position in Value Chain Engage OEMs & ODMs Influence Customers Partner Chipset Suppliers

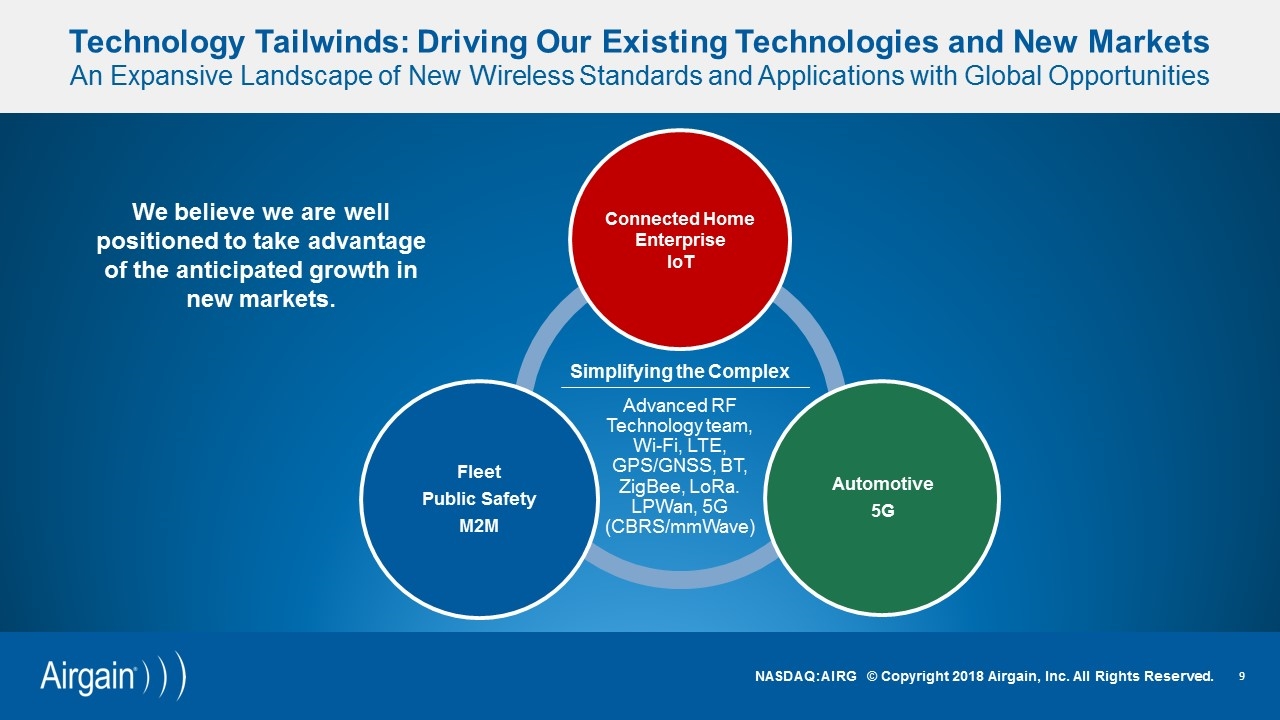

Global engineering and solutions Technology Tailwinds: Driving Our Existing Technologies and New Markets An Expansive Landscape of New Wireless Standards and Applications with Global Opportunities We believe we are well positioned to take advantage of the anticipated growth in new markets. Connected Home Enterprise IoT Advanced RF Technology team, Wi-Fi, LTE, GPS/GNSS, BT, ZigBee, LoRa. LPWan, 5G (CBRS/mmWave) Automotive 5G Fleet Public Safety M2M Simplifying the Complex

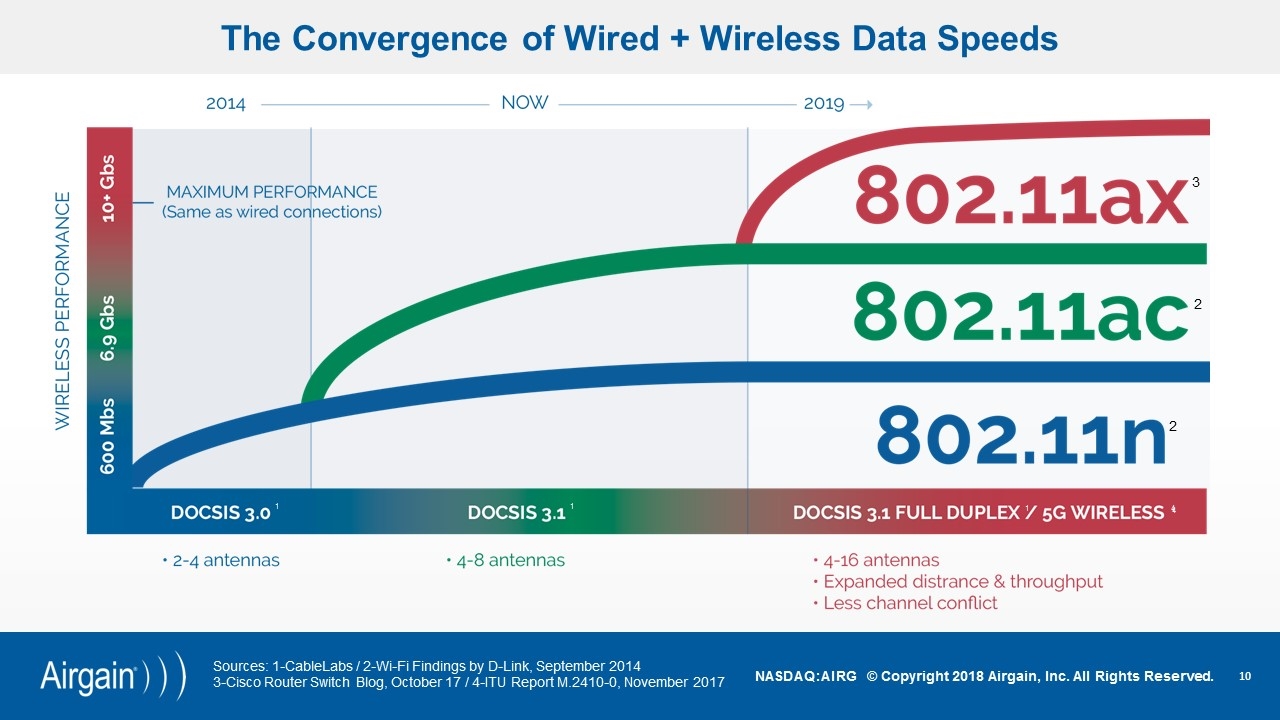

Sources: 1-CableLabs / 2-Wi-Fi Findings by D-Link, September 2014 3-Cisco Router Switch Blog, October 17 / 4-ITU Report M.2410-0, November 2017 The Convergence of Wired + Wireless Data Speeds 3 1 1 1 2 4 4 2

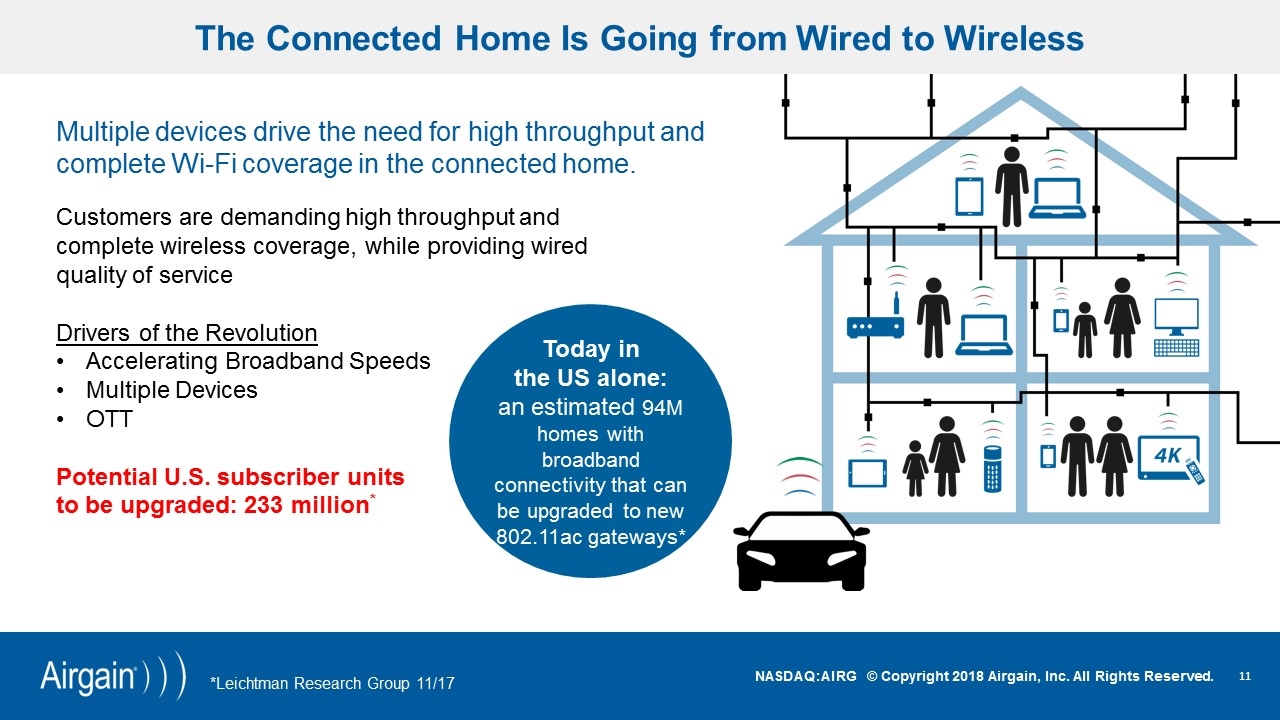

Customers are demanding high throughput and complete wireless coverage, while providing wired quality of service Drivers of the Revolution Accelerating Broadband Speeds Multiple Devices OTT Potential U.S. subscriber units to be upgraded: 233 million* Multiple devices drive the need for high throughput and complete Wi-Fi coverage in the connected home. *Leichtman Research Group 11/17 Today in the US alone: an estimated 94M homes with broadband connectivity that can be upgraded to new 802.11ac gateways* The Connected Home Is Going from Wired to Wireless

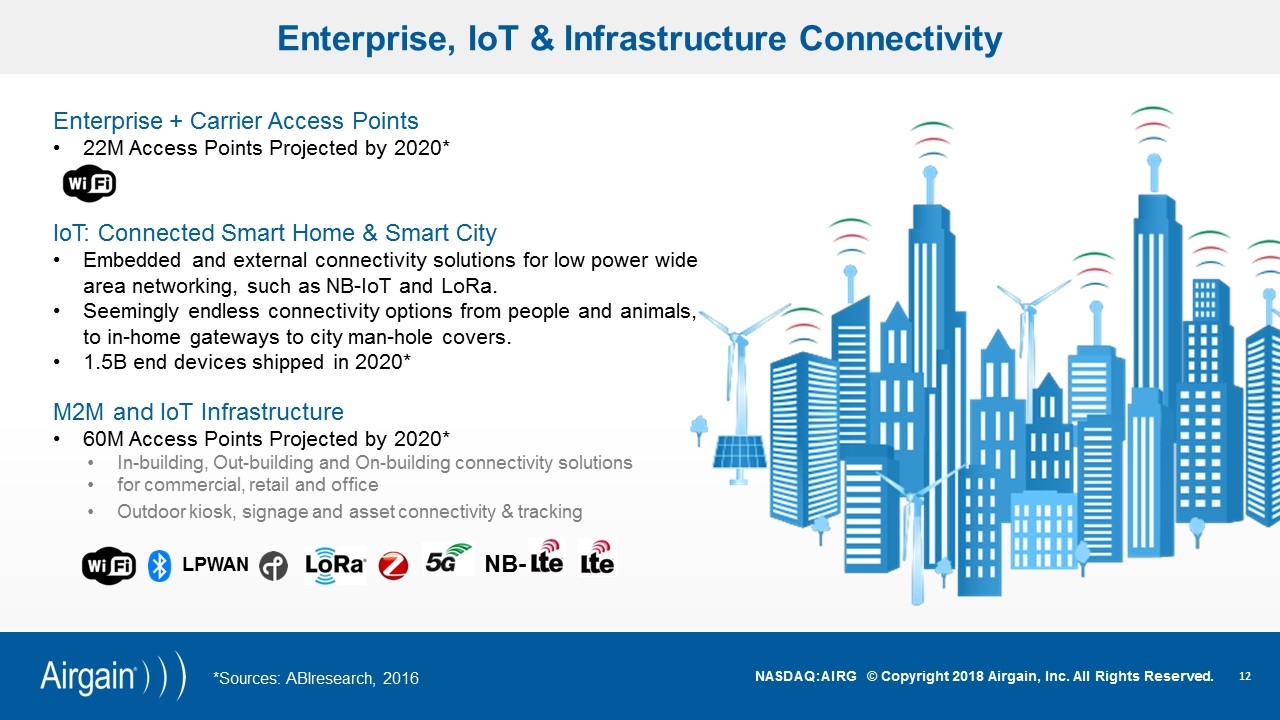

Enterprise, IoT & Infrastructure Connectivity *Sources: ABIresearch, 2016 Enterprise + Carrier Access Points 22M Access Points Projected by 2020* IoT: Connected Smart Home & Smart City Embedded and external connectivity solutions for low power wide area networking, such as NB-IoT and LoRa. Seemingly endless connectivity options from people and animals, to in-home gateways to city man-hole covers. 1.5B end devices shipped in 2020* M2M and IoT Infrastructure 60M Access Points Projected by 2020* In-building, Out-building and On-building connectivity solutions for commercial, retail and office Outdoor kiosk, signage and asset connectivity & tracking LPWAN NB-

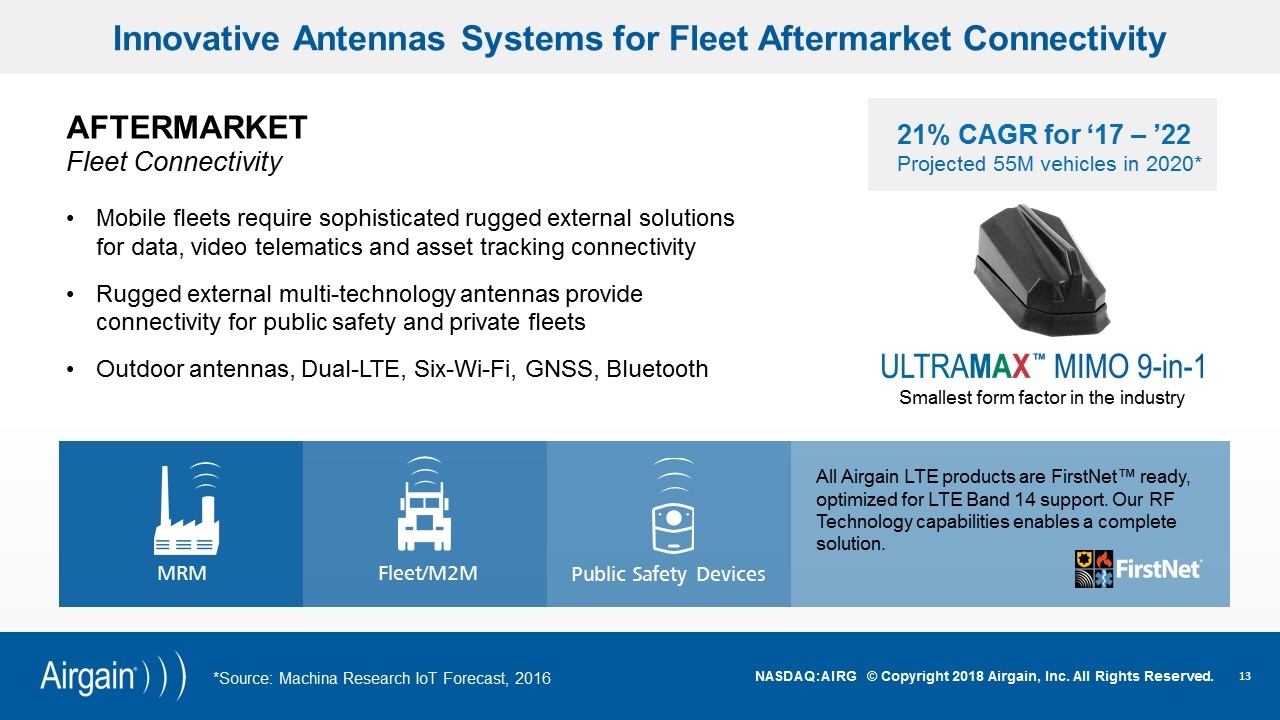

21% CAGR for ‘17 – ’22 Projected 55M vehicles in 2020* Innovative Antennas Systems for Fleet Aftermarket Connectivity *Source: Machina Research IoT Forecast, 2016 AFTERMARKET Fleet Connectivity Mobile fleets require sophisticated rugged external solutions for data, video telematics and asset tracking connectivity Rugged external multi-technology antennas provide connectivity for public safety and private fleets Outdoor antennas, Dual-LTE, Six-Wi-Fi, GNSS, Bluetooth Fleet/M2M MRM Public Safety Devices All Airgain LTE products are FirstNet™ ready, optimized for LTE Band 14 support. Our RF Technology capabilities enables a complete solution. Smallest form factor in the industry

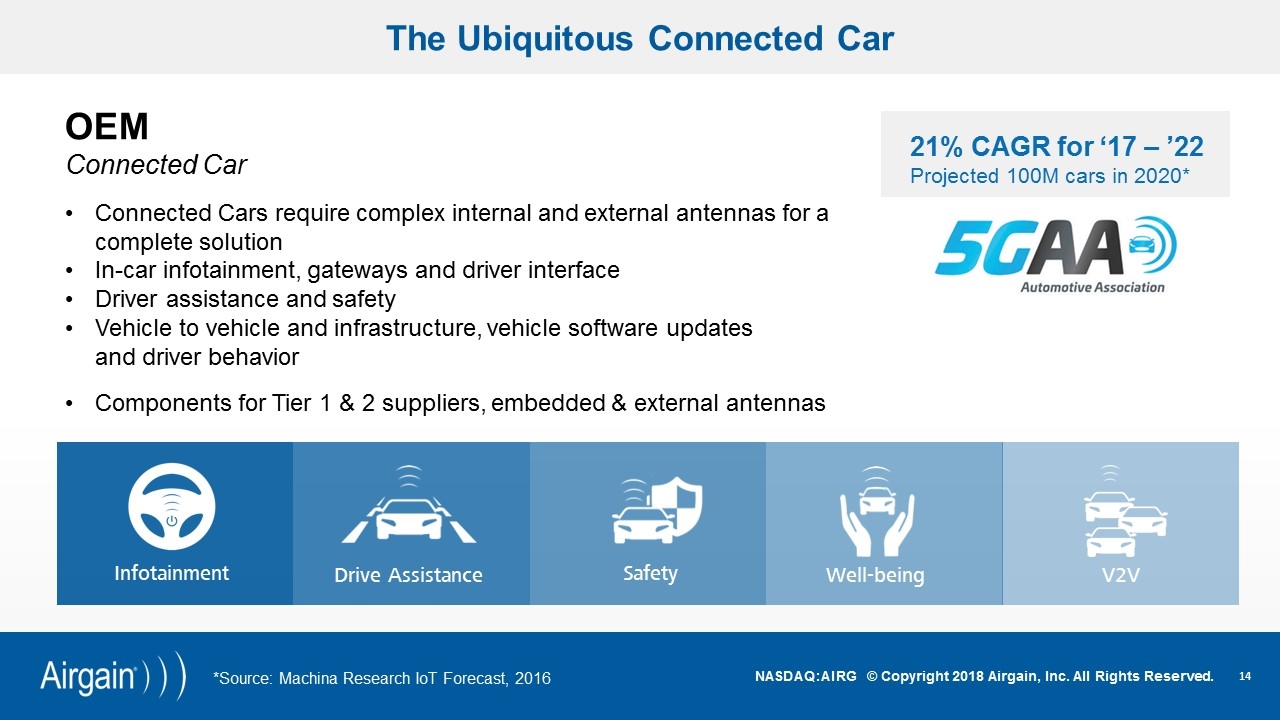

The Ubiquitous Connected Car 21% CAGR for ‘17 – ’22 Projected 100M cars in 2020* *Source: Machina Research IoT Forecast, 2016 OEM Connected Car Connected Cars require complex internal and external antennas for a complete solution In-car infotainment, gateways and driver interface Driver assistance and safety Vehicle to vehicle and infrastructure, vehicle software updates and driver behavior Components for Tier 1 & 2 suppliers, embedded & external antennas Drive Assistance Infotainment V2V Safety Well-being

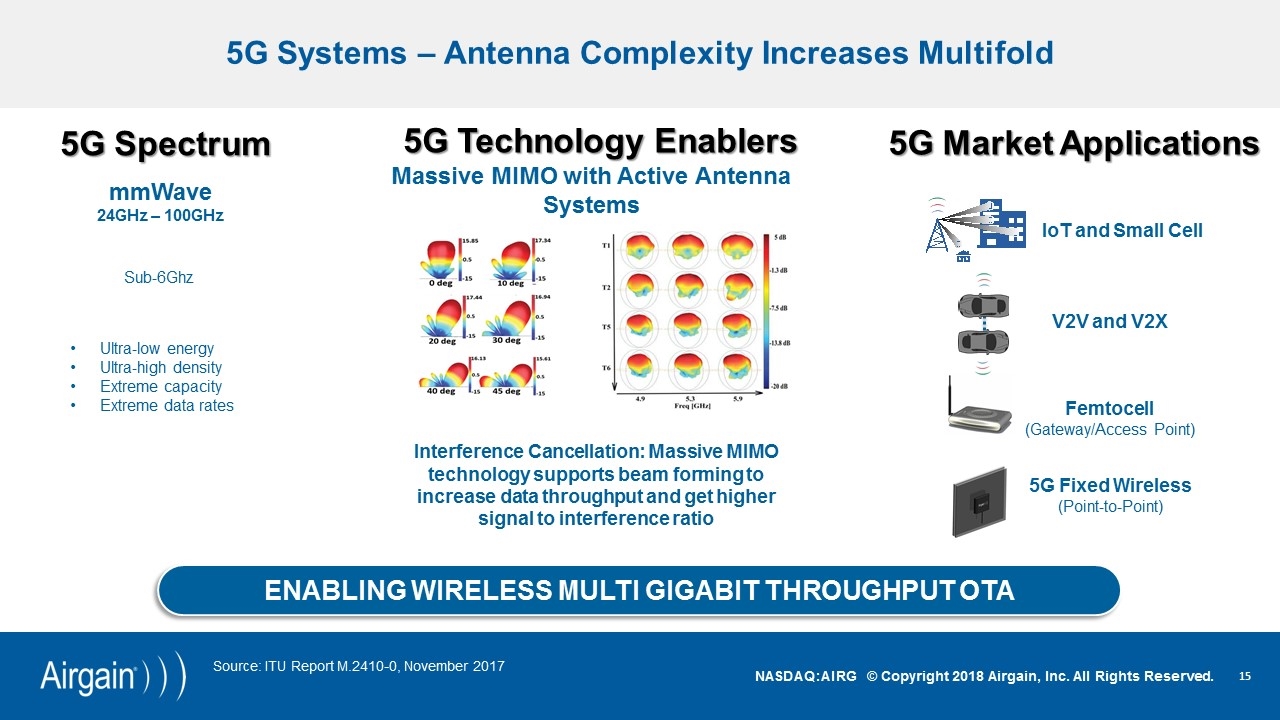

ENABLING WIRELESS MULTI GIGABIT THROUGHPUT OTA 5G Systems – Antenna Complexity Increases Multifold mmWave 24GHz – 100GHz Sub-6Ghz Femtocell (Gateway/Access Point) 5G Fixed Wireless (Point-to-Point) 5G Technology Enablers 5G Market Applications Massive MIMO with Active Antenna Systems 5G Spectrum Interference Cancellation: Massive MIMO technology supports beam forming to increase data throughput and get higher signal to interference ratio IoT and Small Cell Ultra-low energy Ultra-high density Extreme capacity Extreme data rates V2V and V2X Source: ITU Report M.2410-0, November 2017

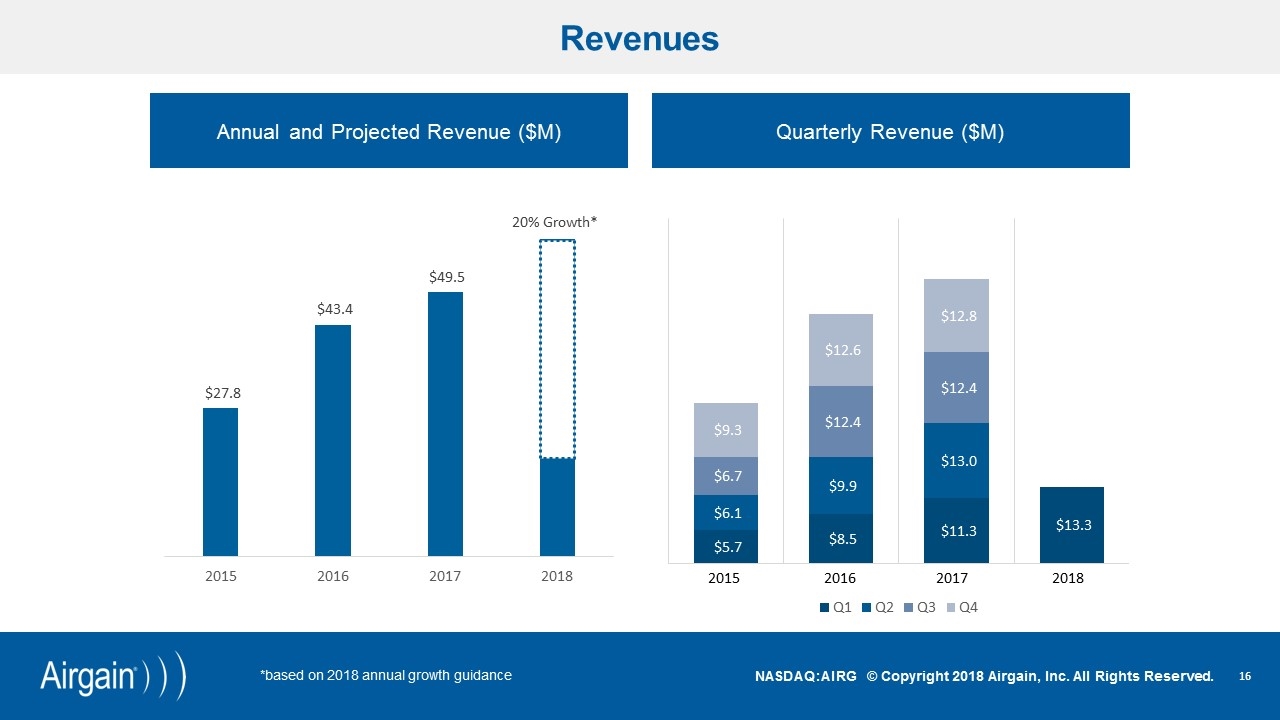

Revenues Annual and Projected Revenue ($M) Quarterly Revenue ($M) 2015 2016 2017 2018 *based on 2018 annual growth guidance

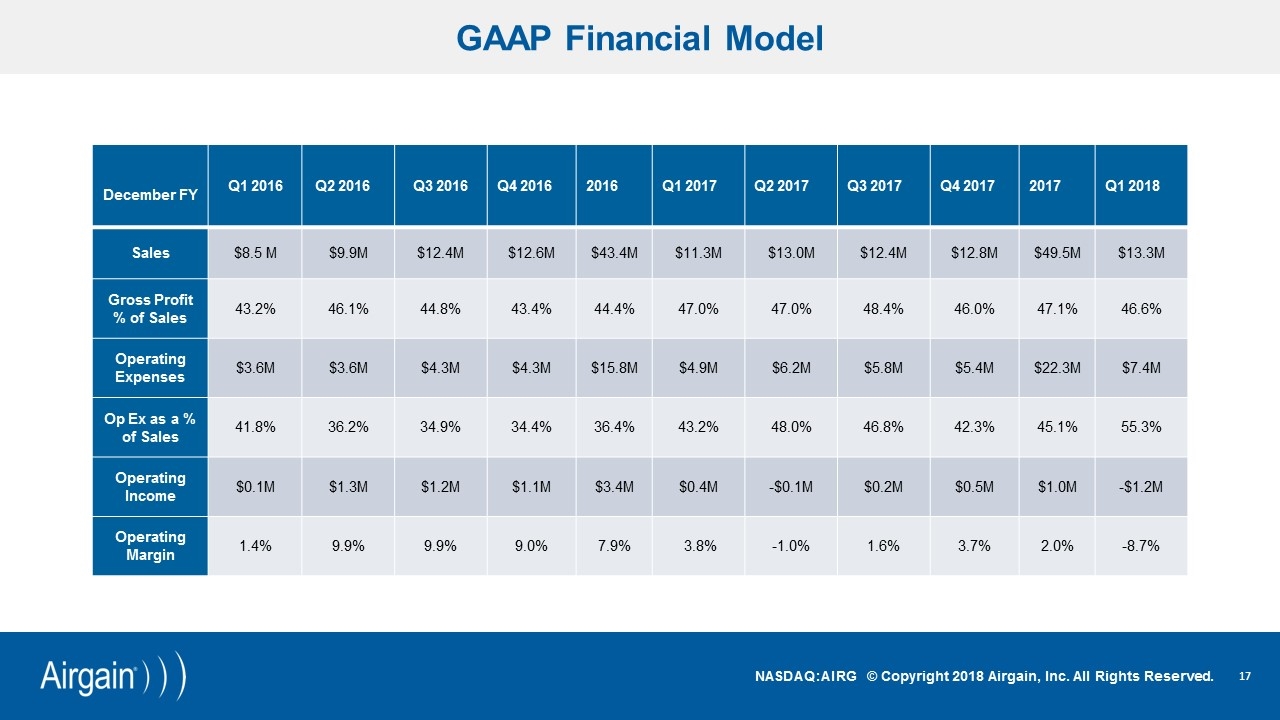

December FY Q1 2016 Q2 2016 Q3 2016 Q4 2016 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 2017 Q1 2018 Sales $8.5 M $9.9M $12.4M $12.6M $43.4M $11.3M $13.0M $12.4M $12.8M $49.5M $13.3M Gross Profit % of Sales 43.2% 46.1% 44.8% 43.4% 44.4% 47.0% 47.0% 48.4% 46.0% 47.1% 46.6% Operating Expenses $3.6M $3.6M $4.3M $4.3M $15.8M $4.9M $6.2M $5.8M $5.4M $22.3M $7.4M Op Ex as a % of Sales 41.8% 36.2% 34.9% 34.4% 36.4% 43.2% 48.0% 46.8% 42.3% 45.1% 55.3% Operating Income $0.1M $1.3M $1.2M $1.1M $3.4M $0.4M -$0.1M $0.2M $0.5M $1.0M -$1.2M Operating Margin 1.4% 9.9% 9.9% 9.0% 7.9% 3.8% -1.0% 1.6% 3.7% 2.0% -8.7% GAAP Financial Model

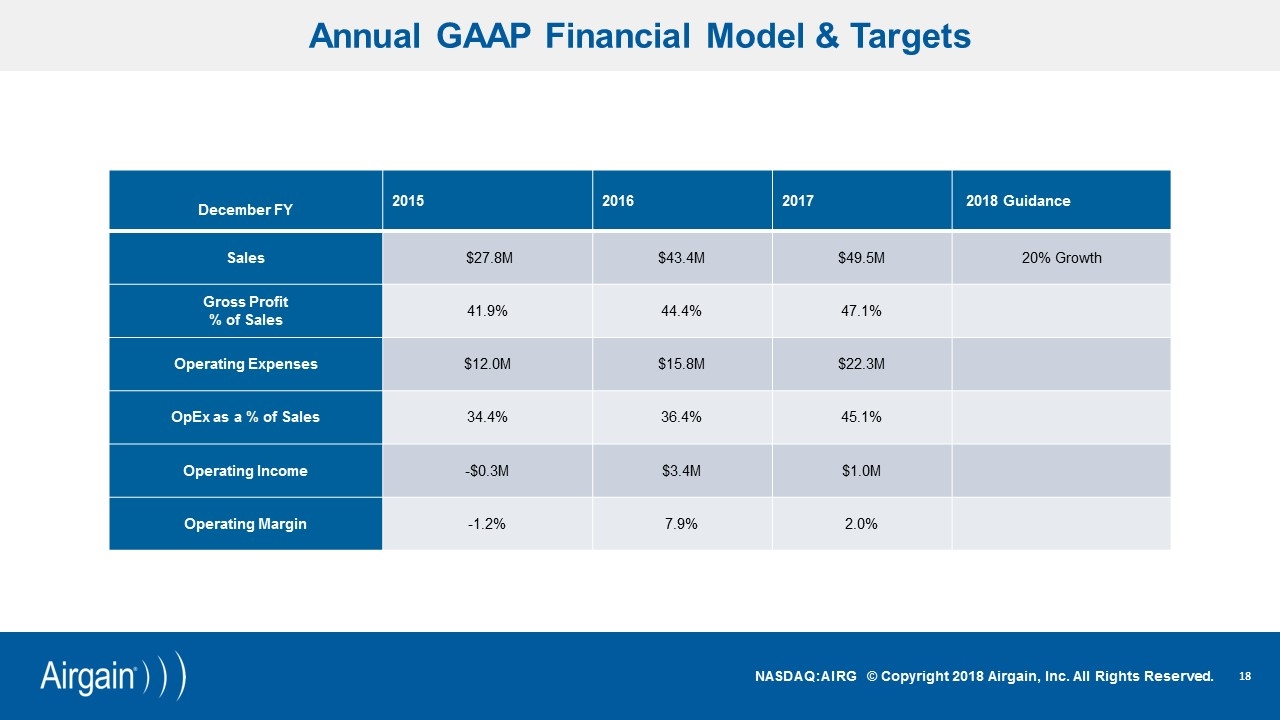

December FY 2015 2016 2017 2018 Guidance Sales $27.8M $43.4M $49.5M 20% Growth Gross Profit % of Sales 41.9% 44.4% 47.1% Operating Expenses $12.0M $15.8M $22.3M OpEx as a % of Sales 34.4% 36.4% 45.1% Operating Income -$0.3M $3.4M $1.0M Operating Margin -1.2% 7.9% 2.0% Annual GAAP Financial Model & Targets

Potential Growth Opportunities NEW PRODUCTS SaaS-based Wi-Fi monitoring solution for carriers NEW MARKET EXPANSION Automotive, enterprise and small cell LEVERAGE WINS IN EMERGING DEVICES Smart metering and IoT CREATE ADDITIONAL PULL FROM CARRIERS Demonstrate continued ROI of solutions to drive adoption GEOGRAPHIC EXPANSION CREATE ADDITIONAL PULL FROM CARRIERS Demonstrate continued ROI of solutions to drive adoption GEOGRAPHIC EXPANSION FAVORABLE TECHNOLOGY TAILWINDS 802.11ac, 802.11ax upgrade cycle and new communication technologies such as 5G and LPWAN NEW MARKET EXPANSION Automotive, 5G

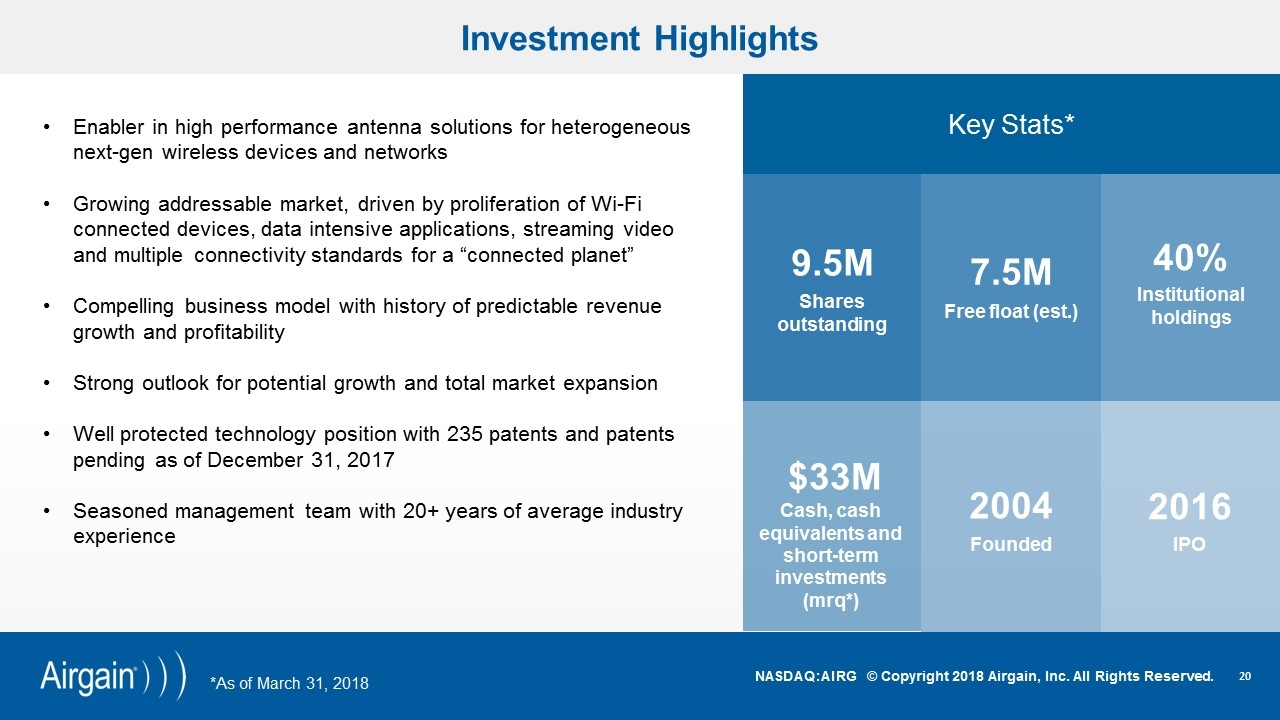

Investment Highlights Enabler in high performance antenna solutions for heterogeneous next-gen wireless devices and networks Growing addressable market, driven by proliferation of Wi-Fi connected devices, data intensive applications, streaming video and multiple connectivity standards for a “connected planet” Compelling business model with history of predictable revenue growth and profitability Strong outlook for potential growth and total market expansion Well protected technology position with 235 patents and patents pending as of December 31, 2017 Seasoned management team with 20+ years of average industry experience Key Stats* Shares outstanding Institutional holdings IPO 9.5M Free float (est.) 7.5M 40% Cash, cash equivalents and short-term investments (mrq*) $33M Founded 2004 2016 *As of March 31, 2018

Contact Us Anil Doradla CFO Alexis Waadt Director of Investor Relations investors@airgain.com Airgain, Inc. 3611 Valley Centre Drive Suite 150 San Diego, CA 92130