Attached files

May 2018 Investor Presentation

This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including any statements of the plans, strategies and objectives of management for future operations; any statements regarding product development, product extensions, product integration or product marketing; any statements regarding continued compliance with government regulations, changing legislation or regulatory environments; any statements of expectation or belief and any statements of assumptions underlying any of the foregoing. In addition, there are risks and uncertainties related to successfully integrating the products and employees of the Company, as well as the ability to ensure continued regulatory compliance, performance and/or market growth. These risks, uncertainties and other factors, and the general risks associated with the businesses of the Company described in the reports and other documents filed with the SEC, could cause actual results to differ materially from those referred to, implied or expressed in the forward-looking statements. The Company cautions readers not to rely on these forward-looking statements. All forward-looking statements are based on information currently available to the Company and are qualified in their entirety by this cautionary statement. The Company anticipates that subsequent events and developments will cause its views to change. The information contained in this presentation speaks as of the date hereof and the Company has or undertakes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. Safe Harbor Statement

STRATA Investment Highlights Providing physicians with a platform of growth by offering reimbursable solutions for psoriasis, vitiligo and eczema and is differentiated by its leading technologies and clinical superiority as well as its value added services - DTC, insurance reimbursement advocacy and field service - enhancing customer business outcomes SIGNIFICANT OPPORTUNITIES TO DRIVE DOMESTIC RECURRING REVENUE GROWTHReturn to DTC marketing, including cost-effective social mediaIncrease patient population - broaden targeted market to other approved indicationsIncrease protocol compliance, improve clinical outcomes and drive patient retentionIncrease installed base to improve market coverage BEST-IN-CLASS TECHNOLOGIES XTRAC, VTRAC,STRATAPEN, Optimal Therapeutic Dose (OTD) SIGNIFICANT OPPORTUNITIES TO DRIVE OUS REVENUE GROWTHManagement team with experience in company turnarounds

Product Roadmap Commercially Available *expanded indications 2001 K003705 Ultra & Ultra Plus AL8000 Ultra2 (AL10000)V400, V700 VTRAC Lamp V7 XTRAC XLAL7000 2003 K031451* 2004 K041943 2005 K051428 2008 K073659 2012 K073659 Medical Technology Development and SAB FULL PRODUCT LIFE CYCLE FDA Regulation Physician Adoption & Acceptance Patient Acquisition Patient Retention

Global Installed Base - Lasers In Service US: 887 OUS: 668 Over 1,550 Lasers Installed Worldwide* Marketed in the U.S. mainly under a recurring revenue model in which systems are placed in physicians’ offices for no upfront charge, revenues on a per-use basisMarketed OUS through distributors *As of December 31, 2017

Management Team Dr. Dolev Rafaeli President & CEO PhotoMedex, 2011-2017 & STRATA 2018 Shmuel Gov Executive VP & General Manager, PhotoMedex, 2014-2015 & STRATA 2015 - Matt Hill VP & CFO, 2018 Keith Simeone VP Sales, PhotoMedex, 2004-2015 & STRATA 2015 - Jay Sturm, Esq. General Counsel, 2015 Natalie Tucker Technology Development, 2012 RADIANCY

People, Intellectual Property, Facilities STRATA 10-K Annual Report; Dec 31, 2017 Customer Support Call Center & Reimbursement Support Center 2015 2016 2017 Leads 36,473 21,296 7,269 Appointments 10,032 6,524 2,563 RDX charts 22,991 21,456 17,551 Facilities IP Location Primary Purpose ISO Certification 29 Patents Issued Carlsbad, CA Manufacturing ISO:13486:2016 11 XTRAC & VTRAC Horsham, PA Management/Finance 18 MelaFind People (93)

Psoriasis Vitiligo & Leukoderma Eczema /Atopic Dermatitis Patient Population WW (% of WW population affected) 125M (2-3%) 65-95M (0.5%-2%) 580M (3% Adults, 20% children<18) Patient Population US 7.5M 1.6 - 6.5M 32M Eczema/ 18M AD # XTRAC patients treated (US, 2016 by consigned lasers) 16K 5K 929 % of XTRAC patients (US, 2016)* 71% 21% 4% % affected patient population treated by XTRAC (US) 0.01% 0.07% - 0.31% 0.000068% Disease Prevalence And Treatment Penetration *2016 data: 4% other, n=902

Xtrac®: Standard Of Care NB-UVB Treatment Of Psoriasis & Dermatological Conditions XTRAC excimer laser, uses a highly targeted (308nm) beam of UVB light to treat affected skin areas without damaging surrounding tissueFDA cleared for treatment of: psoriasis, vitiligo, atopic dermatitis, leukodermaPatients achieved > 95% clearance in just over 10 treatments1 and at least 75% clearing with an average of 6.2 treatments2In clinical trials, most patients saw at least 75% improvement and many were clear or almost 100% clear in just 4 weeks Clinical studies have shown 90% clearance in 5 weeks or less3No side effects, virtually pain free and no need for topicalsReimbursable procedure under three CPT codes. Covered by most major insurance companies and Medicare. Well-established reimbursement Endorsed by the National Psoriasis Foundation 2016 data: 4% other n=9021 Taneja A, Trehan M, Taylor C. 308–nm Excimer Laser for the Treatment of Psoriasis – J. Am Acad Dermatol, Vol 47, 2002 pp.701-708.2 Taneja A, Trehan M, Taylor C. 308–nm Excimer Laser for the Treatment of Psoriasis – Induration-Based Dosimetry. Arch Dermatol, Vol. 139, June 2003, pp. 759–764.3. Gerber W, Arheilger B, Ha TA, Hermann J and Ockenfels HM, Ultraviolet B 308-nm excimer laser treatment of psoriasis: a new phototherapeutic approach, British J Derm, vol. 149, December 2003, pp. 1250-1258.

Success Criteria for Good Clinical Results Common Guidelines Patient must have at least 8 treatments in 6 weeks (“8N6”) - Consistency of recurring appointments is critical Start with a high dose Increase dose at every treatment 01 02 03

Criteria For Optimal Clinical Outcomes: 8N6 Protocol 01 A few days between treatments: Minimum 8 visits in 6 weeks 02 Starting dose of at least 300 mj 03 Increase Dose over Time 04 Patient Returns: At least 8 visits per patient 05 …and management of the database to track results

Past Performance 2013 2014 2015 2016 2017 2012 Based on STRATA 10-k Annual Report; Dec 31, 2017* STRATA bought XTRAC business from PhotoMedex in 2015

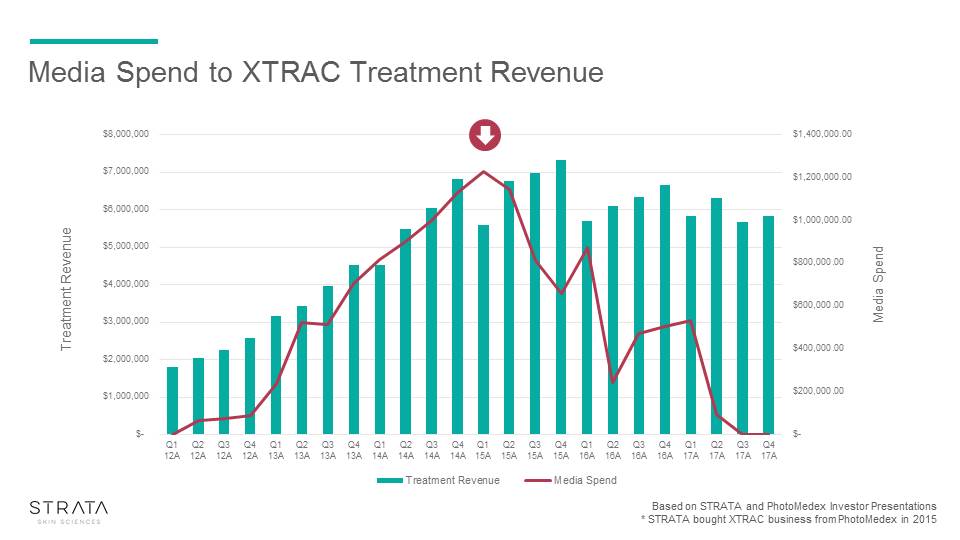

Media Spend to XTRAC Treatment Revenue Based on STRATA and PhotoMedex Investor Presentations* STRATA bought XTRAC business from PhotoMedex in 2015

Turnaround Strategy Domestic Market OUS Markets Enhance technology offeringExpand geographical reach in certain markets Rebuild XTRAC value proposition for physician accountsDTC as a revenue driver: Online and offline advertisement, in-house call centerPractice Development Programs: Improve office patient sign-up (increasing prescriptions for XTRAC)Patient Communication: For both referrals and enrollment patientsClinical Outcomes: Deploy Education for High Dose/OTD and 8N6 as driversNew Technologies for scalp psoriasis and faster, more efficient treatmentCurrent Excimer owners – Revisit “Comeback Program” (>250 dermatologists “came back” to recurring revenue model between 2012-2014)Expanding in-market network (location within 40 miles of every patient)Improving XTRAC market share within all disease indications Revenue = # of lasers x # of treatments/pt x # patients x cost x recurrence factor

XTRAC DTC Advertising

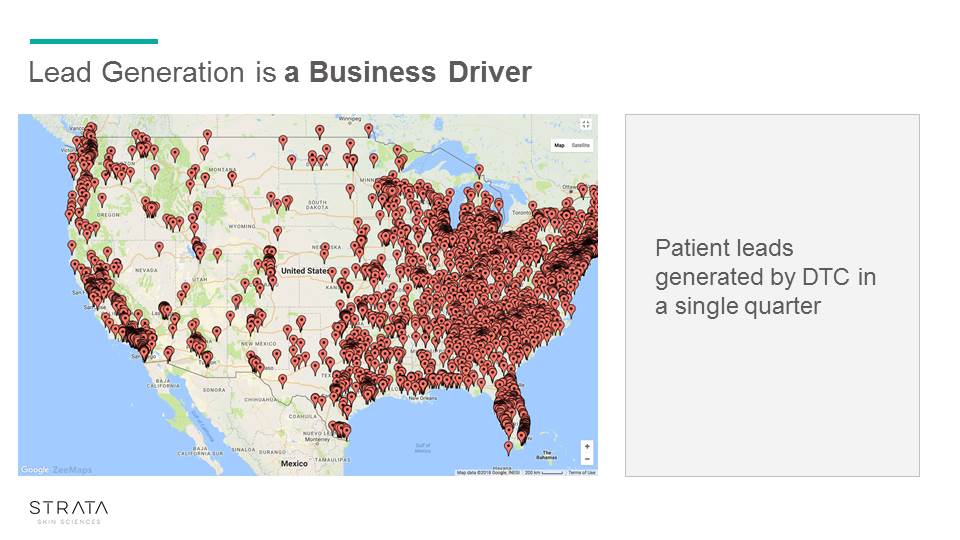

Lead Generation is a Business Driver Patient leads generated by DTC in a single quarter

Social Media Reach Initial Results Total Likes Total Reach

XTRAC State Of The Union (Q1 2018) Clinical Outcomes 40% of all patients treated have a regimen that provides NO clinical resultAdding all patients to 8N6 will increase Company revenue by $5.4M annually ($7k/account) Type of patient Number of Visits on Average Comply 8+6 11 Not Comply 4 Retention RatesPatient Retention Rate (more than 1 course of treatment): 13%Adding only 1 additional regimen, in just 50% of the accounts will increase revenue by $8M annually ($10k/account) Implication Of Compliance On Treatment Length Number of Treatment Regimens Assumptions: Number of Accts: 750, Number of visits 11, *Number Regimens 2 *Lifetime Patient Visits Average = 22 *If every 2nd patient has 2 regimens instead of 1 = 32% greater revenue per account Average Number Regimens: 1.19 Revenue = # of lasers x # of treatments/pt x # patients x cost x recurrence factor Avg. No. Patient Regimens 1 *2+ Per Acct Revenue Install Base Revenue Breakdown of Patient Population 87% 13% $31,510 $23,632,537.50 75% 25% $34,856 $26,142,187.50 50% 50% $41,828 $31,370,625.00 25% 75% $48,799 $36,599,062.50 0% 100% $55,770 $41,827,500.00

Coupons as a Promotion Tool and a Proxy For Treatment If all patients utilizing coupons were in the 8N6 or better, domestic revenue could increase by $5.4M ($7k/account) $40 per treatment co-pay reimbursement, max $400 in 120 days Revenue = # of lasers x # of treatments/pt x # patients x cost x recurrence factor

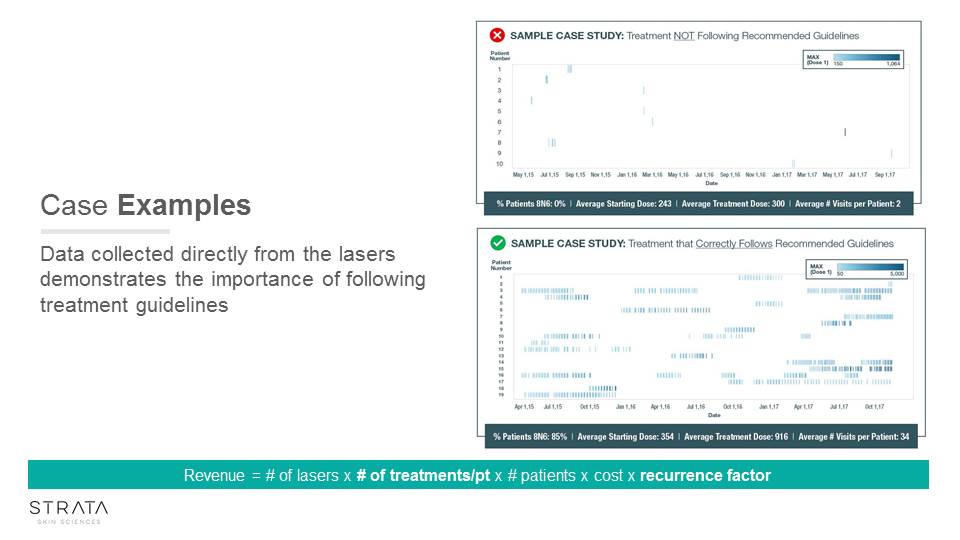

Case Examples Data collected directly from the lasers demonstrates the importance of following treatment guidelines Revenue = # of lasers x # of treatments/pt x # patients x cost x recurrence factor

Optimal Therapeutic Dose (“OTD”) MECHANISMTip applies 4 simultaneous doses of energy to the patient’s plaque PURPOSETo minimize number of treatments to clearance USEDose allows provider to determine blister threshold unique to each patient and each plaque. Expected submission planned for end of Quarter. 94% 60% 30% 45% Beam profile through filters Filter Specifications

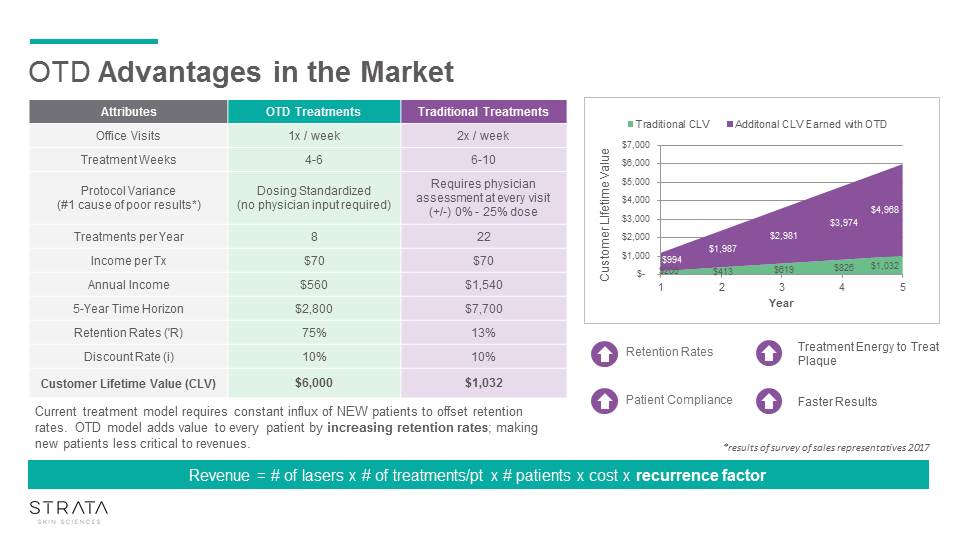

OTD Advantages in the Market Attributes OTD Treatments Traditional Treatments Office Visits 1x / week 2x / week Treatment Weeks 4-6 6-10 Protocol Variance(#1 cause of poor results*) Dosing Standardized (no physician input required) Requires physician assessment at every visit (+/-) 0% - 25% dose Treatments per Year 8 22 Income per Tx $70 $70 Annual Income $560 $1,540 5-Year Time Horizon $2,800 $7,700 Retention Rates ('R) 75% 13% Discount Rate (i) 10% 10% Customer Lifetime Value (CLV) $6,000 $1,032 *results of survey of sales representatives 2017 Current treatment model requires constant influx of NEW patients to offset retention rates. OTD model adds value to every patient by increasing retention rates; making new patients less critical to revenues. Retention Rates Patient Compliance Treatment Energy to Treat Plaque Faster Results Revenue = # of lasers x # of treatments/pt x # patients x cost x recurrence factor

Study 1: UCSF Dr. Tina Bhutani Study Details Metrics: mPASI & Physician Global Assessment (PGA) Endpoint: Protocol & Dose Varied Patients: 4 Study 2: Multi-Center Dr. Ben Lockshin Dr. Neal Bhatia Dr. Tina Bhutani Study Details Metrics: mPASI and Patient Response Surveys Endpoint: Percentage improvement in regional PASI score (mPASI) @ three effectiveness time points: 4 weeks, 8 weeks, 12 weeks. Patients: 15 Clinical Trials

Study #1 @ UCSF Nearly 100% clear in 4 treatments After 4 tx After 2 tx Baseline

XTRAC Revenue Growth Drivers Revenue = # of lasers x # of treatments/pt x # patients x cost x recurrence factor Increase number of accounts Better clinical outcomes DTC sends more patients to physicians’ offices Disease market penetration High Dose/OTD and 8N6 protocol help to retain patients for longer

Retention, Patient Pool, DTC & Sign-up Rate Standard Office:Low retention Standard Office: High retention “Center of Excellence” Patients per year 32 32 90 Retention rate 10% 50% 75% DTC per year 0 12 12 Avg. annual revenue $24,448 $47,200 $135,750 Growth Rate -69% 31% 39% Sign up rate 50% 50% 90% Year 1 32 patientsRevenue $38,400 32 patientsRevenue $38,400 90 patientsRevenue $108,000 Year 2 19 patientsRevenue $23,040 44 patientsRevenue $52,800 125 patientsRevenue $149,400 Year 3 10 patientsRevenue $11,904 42 patientsRevenue $50,400 125 patientsRevenue $149,400 Revenue = # of lasers x # of treatments/pt x # patients x cost x recurrence factor

Financial Profile Revenue And Gross Margins 2012-2017 Revenues Gross Margins * * Based on STRATA 10K and PhotoMedex Investor Presentations* STRATA bought XTRAC business from PhotoMedex in 2015

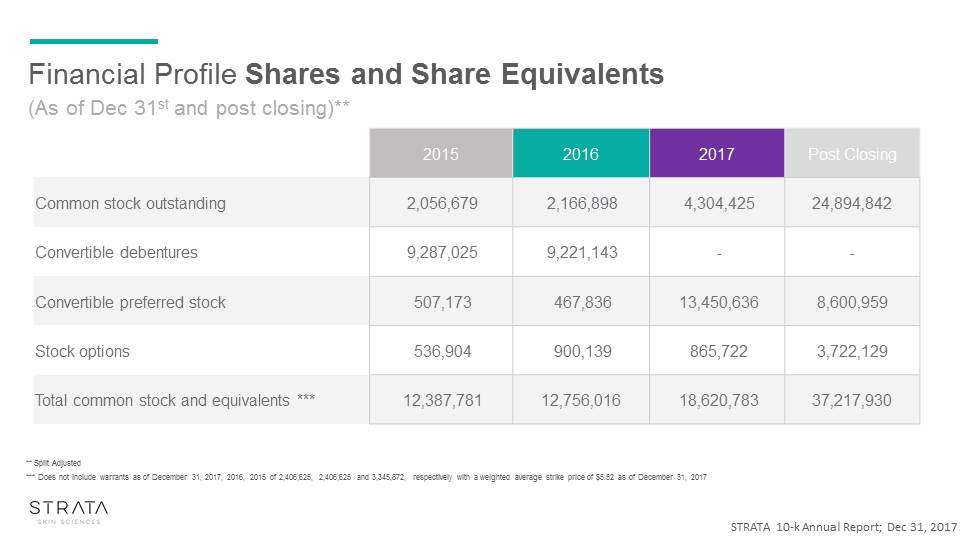

STRATA 10-k Annual Report; Dec 31, 2017 Financial Profile Shares and Share Equivalents 2015 2016 2017 Post Closing Common stock outstanding 2,056,679 2,166,898 4,304,425 24,894,842 Convertible debentures 9,287,025 9,221,143 - - Convertible preferred stock 507,173 467,836 13,450,636 8,600,959 Stock options 536,904 900,139 865,722 3,722,129 Total common stock and equivalents *** 12,387,781 12,756,016 18,620,783 37,217,930 ** Split Adjusted *** Does not include warrants as of December 31, 2017, 2016, 2015 of 2,406,625, 2,406,625 and 3,345,872, respectively with a weighted average strike price of $5.52 as of December 31, 2017 (As of Dec 31st and post closing)**

STRATA Investment Highlights Providing physicians with a platform of growth by offering reimbursable solutions for psoriasis, vitiligo and eczema and is differentiated by its leading technologies and clinical superiority as well as its value added services - DTC, insurance reimbursement advocacy and field service - enhancing customer business outcomes SIGNIFICANT OPPORTUNITIES TO DRIVE DOMESTIC RECURRING REVENUE GROWTHReturn to DTC marketing, including cost-effective social mediaIncrease patient population - broaden targeted market to other approved indicationsIncrease protocol compliance, improve clinical outcomes and drive patient retentionIncrease installed base to improve market coverage BEST-IN-CLASS TECHNOLOGIES XTRAC, VTRAC,STRATAPEN, Optimal Therapeutic Dose (OTD) SIGNIFICANT OPPORTUNITIES TO DRIVE OUS REVENUE GROWTHManagement team with experience in company turnarounds

Appendix

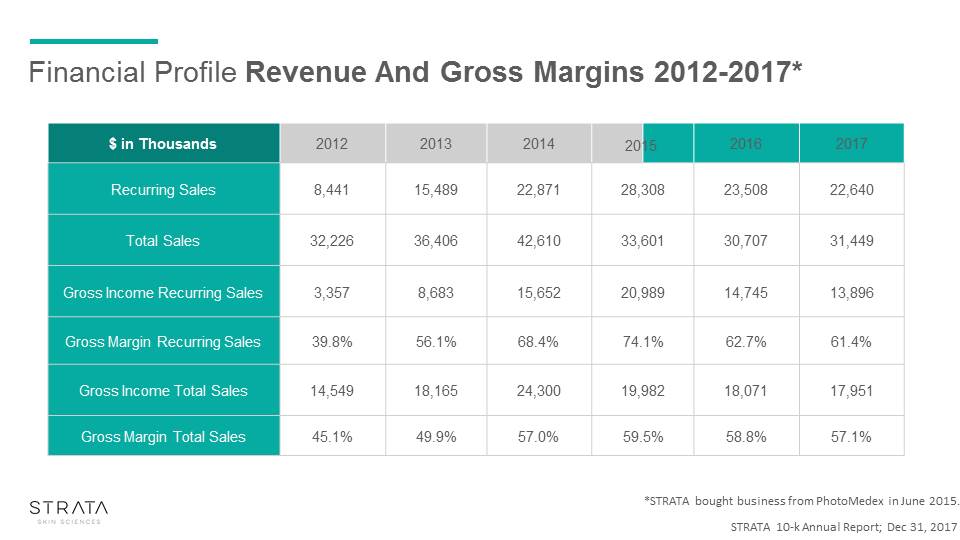

STRATA 10-k Annual Report; Dec 31, 2017 $ in Thousands 2012 2013 2014 2016 2017 Recurring Sales 8,441 15,489 22,871 28,308 23,508 22,640 Total Sales 32,226 36,406 42,610 33,601 30,707 31,449 Gross Income Recurring Sales 3,357 8,683 15,652 20,989 14,745 13,896 Gross Margin Recurring Sales 39.8% 56.1% 68.4% 74.1% 62.7% 61.4% Gross Income Total Sales 14,549 18,165 24,300 19,982 18,071 17,951 Gross Margin Total Sales 45.1% 49.9% 57.0% 59.5% 58.8% 57.1% Financial Profile Revenue And Gross Margins 2012-2017* 2015 *STRATA bought business from PhotoMedex in June 2015.

MMD Tip: Case Example CASE EXAMPLE: TEST DOSE 5000 MJ/CM2 5000 4000 3000 2000 1500 First Non-Blistering Dose = 2000 mj/cm2 Dose at 2000 mj/cm2 until scaling and induration subside

Board of Directors Dr. Uri GeigerChairman. Co-Founder and Managing Partner of Accelmed Growth Partners. Previously CEO of Exalenz Bioscience Ltd., GalayOr Networks and founding partner of Dragon Variation Fund. David GillServed as President & Chief Financial Officer of EndoChoice Inc., and previously served as CFO of INC Research and TransEnterix, Inc.Nachum (Homi) ShamirPresident & CEO of Luminex Corporation, previously served as President & CEO at Given Imaging and Scitex Corporation, and served as President of Eastman Kodak’s Transaction and Industrial Solutions Group. Samuel (Milky) RubinsteinOver 20 years of experience as CEO and General Manager of Taro Pharmaceuticals Industries.LuAnn ViaOver 20 years of experience in leadership roles, including President & CEO of Christopher & Banks Corporation, and Payless ShoeSource.Samuel NavarroCurrent Managing Partner at Gravitas Healthcare, LLC, previously a Managing Director at Cowen & Co., and Senior Portfolio Manager at healthcare investment fund.Dr. Dolev RafaeliOver 25 years of experience in the healthcare, medical device, consumer & industrial services fields. Current President & CEO of STRATA Skin Sciences, previously CEO of PhotoMedex, Inc., and President & CEO of Radiancy Inc.