Attached files

As filed with the Commission on May 29, 2018

File No. 333-___________

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

RISE

GOLD CORP.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 1000 | 30-0692325 |

| (State or other jurisdiction of incorporation) | (Primary

Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

Suite

650 - 669 Howe Street

Vancouver, BC V6C 0B4

Canada

(604) 260-4577

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nevada

Business Center, LLC

701 South Carson Street, Suite 200

Carson City, Nevada 89701

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Dale

A. Rondeau, Esq.

Thomas, Rondeau LLP

Suite 1780 - 400 Burrard Street

Vancouver, British Columbia V6C 3A6

Canada

J.

Brad Wiggins, Esq.

SecuritiesLawUSA, PC

1875 Century Park East, 6th Floor

Los Angeles, California 90067

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company:

| Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated

Filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company x |

| Emerging Growth Company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section (7)(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE*

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock offered by selling stockholders | 42,927,517 | $ | 0.08185 | (2) | $ | 3,513,617 | (2) | $ | 437.45 | (2) | ||||||

| Common Stock issuable upon exercise of common stock purchase warrants held by selling stockholders exercisable at CDN$0.40 per share | 2,655,184 | $ | 0.3103 | (3) | $ | 823,904 | (3) | $ | 102.58 | (3) | ||||||

| Common Stock issuable upon exercise of common stock purchase warrants held by selling stockholders exercisable at CDN$0.25 per share | 5,516,333 | $ | 0.1939 | (4) | $ | 1,069,617 | (4) | $ | 133.17 | (4) | ||||||

| Common Stock issuable upon exercise of common stock purchase warrants held by selling stockholders exercisable at CDN$0.15 per share | 35,161,000 | $ | 0.1164 | (5) | $ | 4,092,740 | (5) | $ | 509.55 | (5) | ||||||

| Total | 86,260,034 | $ | 9,499,876 | $ | 1,182.75 | (6) | ||||||||||

| (1) | Pursuant to Rule 416 under the Securities Act, the shares of Common Stock being registered hereunder include such indeterminate number of shares as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. | |

| (2) | Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(c) under the Securities Act. The proposed maximum offering price per share and proposed maximum aggregate offering price are based upon the average of the high and low prices of the Common Stock as of May 24, 2018 as quoted on the OTCQB of $0.08185. |

| (3) | Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(g) based on the highest exercise price of the warrants of CDN$0.40 per share converted into United States dollars based on the exchange rate of one Canadian dollar to U.S. dollars as reported by the Bank of Canada on May 24, 2018 of CDN$ to US$0.7757. |

| (4) | Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(g) based on the highest exercise price of the warrants of CDN$0.25 per share converted into United States dollars based on the exchange rate of one Canadian dollar to U.S. dollars as reported by the Bank of Canada on May 24, 2018 of CDN$1.00 to US$0.7757. |

| (5) | Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(g) based on the highest exercise price of the warrants of CDN$0.15 per share converted into United States dollars based on the exchange rate of one Canadian dollar to U.S. dollars as reported by the Bank of Canada on May 24, 2018 of CDN$1.00 to US$0.7757. |

| (6) | A fee of $1,182.75 is being paid concurrently with the filing of this registration statement. |

| * | All dollar amounts in this table refer to U.S. Dollars unless otherwise noted. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

2

The information contained in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject To Completion, Dated May 29, 2018

86,260,034 Shares of Common Stock

This prospectus relates to the resale or other disposition from time to time by certain selling stockholders, as further described in this prospectus, of up to an aggregate of 86,260,034 shares of the Common Stock (the “Shares”) of Rise Gold Corp. (the “Company”, “Rise”, “we”, “us” or “our”). The Shares registered for sale are as follows:

| ● | 42,927,517 Shares held by selling stockholders; |

| ● | 2,138,000 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on December 23, 2016 and exercisable at a price per Share of $0.40; |

| ● | 517,184 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on May 5, 2017 and exercisable at a price per Share of $0.40; |

| ● | 5,383,000 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on December 27, 2017 and exercisable at a price per Share of $0.25; |

| ● | 133,333 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on January 3, 2018 and exercisable at a price per Share of $0.25; and |

| ● | 35,161,000 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on April 18, 2018 and exercisable at a price per Share of $0.15. |

The Shares and warrants held by the selling stockholders were issued to such selling stockholders pursuant to private transactions between our company and the selling stockholders. The selling stockholders may sell or otherwise dispose of the Shares covered by this prospectus or interests therein on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. Additional information about the selling stockholders, and the times and manner in which they may offer and sell Shares under this prospectus, is provided in the sections entitled “Selling Stockholders” and “Plan of Distribution” of this prospectus.

We will not receive any proceeds from the resale of the Shares by the selling stockholders.

Our Common Stock is listed on the Canadian Securities Exchange (the “CSE”) under the symbol “RISE” and quoted on the OTCQB under the symbol “RYES”. On May 18, 2018, the closing sales price of our Common Stock was $0.11 per share on the CSE and US$0.08 per share on the OTCQB. You are urged to obtain current market quotations of the Common Stock.

All dollar amounts reflected herein refer to Canadian dollars unless otherwise noted.

3

We are an “emerging growth company” as defined under federal securities laws and, as such, may elect to comply with certain reduced public company requirements for future filings.

Investing in the Shares involves a high degree of risk. See “Risk Factors” beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities offered hereby or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May _____, 2018

4

TABLE OF CONTENTS

| GLOSSARY OF TERMS | 6 | |

| SELECTIVE GLOSSARY OF TECHNICAL TERMS | 7 | |

| CURRENCY AND EXCHANGE RATES | 10 | |

| ABOUT THIS PROSPECTUS | 11 | |

| PROSPECTUS SUMMARY | 12 | |

| About the Company | 12 | |

| The Offering | 13 | |

| RISK FACTORS | 14 | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 24 | |

| SELLING STOCKHOLDERS | 25 | |

| PLAN OF DISTRIBUTION | 30 | |

| DESCRIPTION OF CAPITAL STOCK | 32 | |

| BUSINESS | 34 | |

| PROPERTIES | 40 | |

| LEGAL PROCEEDINGS | 62 | |

| MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS | 62 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 63 | |

| DIRECTORS AND EXECUTIVE OFFICERS | 67 | |

| EXECUTIVE COMPENSATION | 69 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 72 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 75 | |

| LEGAL MATTERS | 76 | |

| INTERESTS OF EXPERTS | 77 | |

| WHERE YOU CAN FIND MORE INFORMATION | 77 | |

| INFORMATION INCORPORATED BY REFERENCE | 77 | |

| INDEX TO FINANCIAL STATEMENTS | F1 |

5

GLOSSARY OF TERMS

“April 2018 Warrants” means common stock purchase warrants issued on April 18, 2018, exercisable at a price of $0.15 per share until April 18, 2021;

“Common Stock” means the issued and unissued shares of our common stock with a par value of US$0.001;

“CSE” means the Canadian Securities Exchange;

“December 2016 Warrants” means common stock purchase warrants issued on December 23, 2016, exercisable at a price of $0.40 per share until December 23, 2018;

“December 2017 Warrants” means common stock purchase warrants issued on December 27, 2017, exercisable at a price of $0.25 per share until December 27, 2019;

“Exchange Act” means the Securities Exchange Act of 1934, as amended;

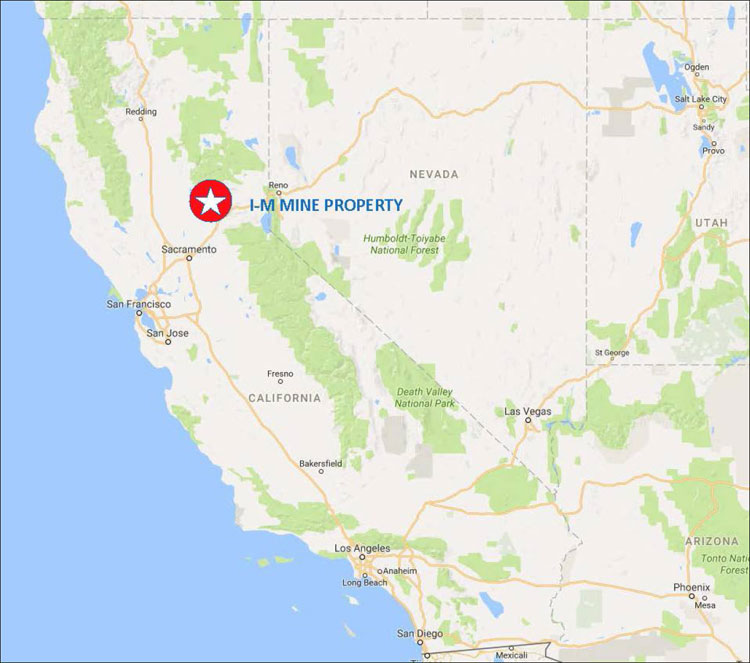

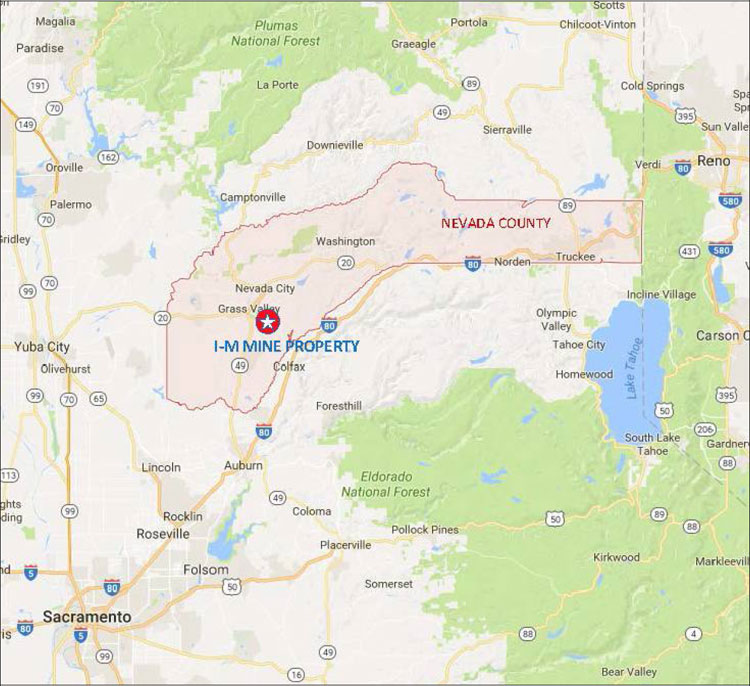

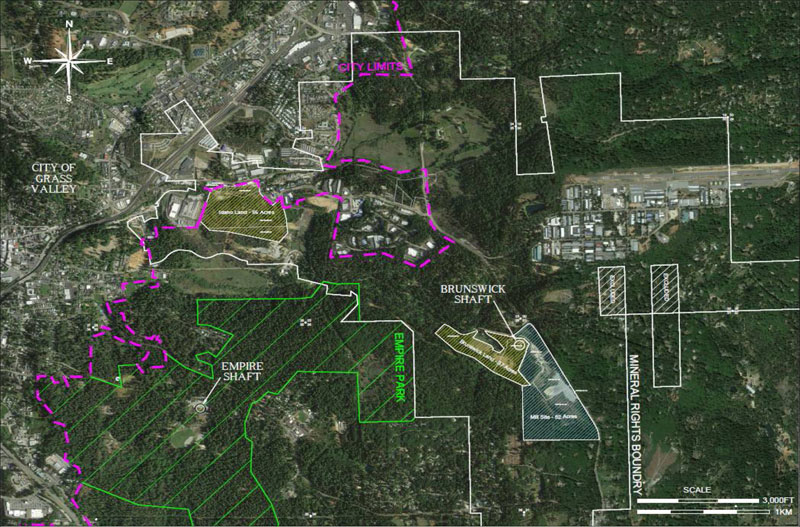

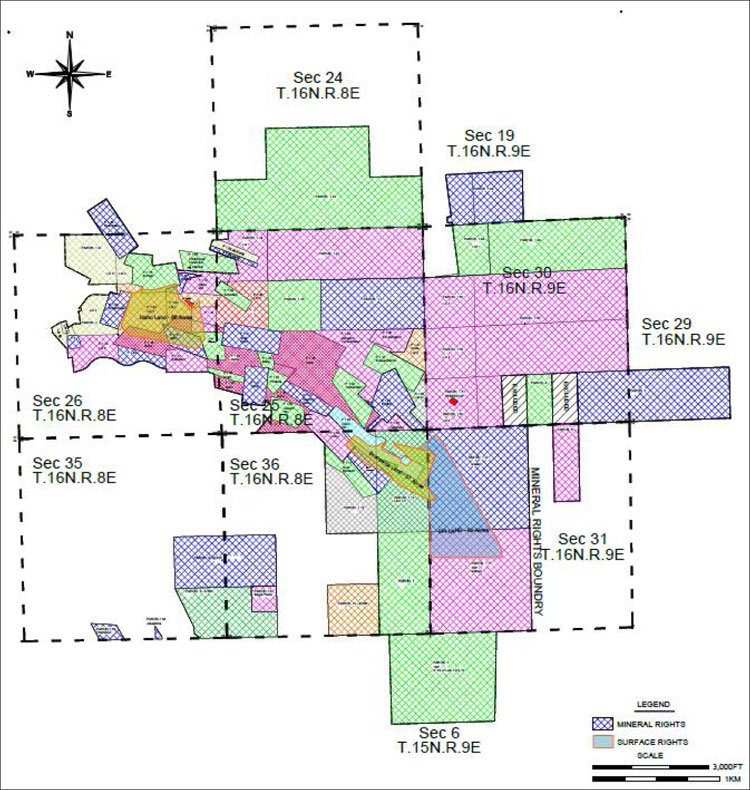

“I-M Mine Property” means the Idaho-Maryland Mine Property comprising approximately 93 acres (38 hectares) surface land and approximately 2,800 acres (1,133 hectares) mineral rights located near Grass Valley of Nevada County in northern California, USA.

“I-M Mine Project” means Rise’s gold project located on the I-M Mine Property;

“Indata Property” means certain mineral claims known as the Indata Property, located in the Omineca Mining Division in British Columbia, Canada in which the Company previously held an option to acquire up to a 75% interest;

“January 2018 Warrants” means common stock purchase warrants issued on January 3, 2018, exercisable at a price of $0.25 per share until January 3, 2020;

“Klondike Properties” means the portfolio of seven gold and base metal properties in southeast British Columbia, Canada consisting of 150 mineral claims over 28,000 hectares;

“May 2017 Warrants” means common stock purchase warrants issued on May 5, 2017, exercisable at a price of $0.40 per share until May 5, 2019;

“NI 43-101” means National Instrument 43-101 (Standards of Disclosure for Mineral Projects);

“OTCQB” means the U.S. OTCQB Venture Market administered by OTC Markets Group;

“Report” means the NI 43-101 compliant technical report entitled “Technical Report on the Idaho-Maryland Project, Grass Valley, California, USA” dated June 1, 2017 prepared by Greg Kulla, P.Geo. of Amec Foster Wheeler Americas Limited;

“Securities Act” means the United States Securities Act of 1933, as amended;

6

SELECTIVE GLOSSARY OF TECHNICAL TERMS

accretion – Process by which material is added to a tectonic plate or landmass. This material may be sediment, volcanic arcs, seamounts or other igneous features.

albite – A kind of plagioclase mineral within the feldspar group with formula NaAlSi3O8. Its colour is white to grey.

amphibolite – A gneiss or schist largely made up of amphibole and plagioclase minerals.

ankerite – A calcium, iron, magnesium, manganese carbonate mineral of the group of rhombohedral carbonates.

arsenic – Chemical element with the symbol As and occurs in many minerals, usually in combination with sulfur and metals, but also as a pure elemental crystal.

azimuth - The direction or bearing defined as a horizontal angle measured clockwise from true north

carbonate – Class of sedimentary rocks composed primarily of carbonate minerals; the two major types are limestone and dolomite.

chalcopyrite – A sulphide mineral of copper common in the zone of secondary enrichment.

chlorite – Group name for about 10 related minerals and a member of the mica group of minerals. Chlorite is very common, and is often an uninteresting green mineral coating the surface of more important minerals.

en-echelon – Roughly parallel but staggered structures.

epizonal – Depth of formation of an orogenic deposit (<6 km / <3.7 mi).

facies – The characteristics of a rock unit that reflect its environment of deposition and allow it to be distinguished from rock deposited in an adjacent environment.

foliation – Repetitive layering in metamorphic rocks; the thickness of the layers can vary.

footwall – The rock on the underside of a vein or mineralized structure.

free gold – Gold, uncombined with other minerals, found in a pure state.

free milling – Mineralized material of gold from which the precious metals can be recovered by concentrating methods without resorting to pressure leaching or other chemical treatment.

gabbro – A dark, coarse-grained igneous rock.

galena – Lead sulphide, the most common form of lead.

gangue – The worthless minerals in an mineralized deposit.

greenschist – Metamorphic rocks that formed under the lowest temperatures and pressures usually produced by regional metamorphism, typically 300–450 °C (570–840 °F) and 2–10 kilobars (14,500–58,000 psi).

hangingwall – The rock on the upper side of a vein or mineralized deposit.

hydrothermal – Relating to hot fluids circulating in the earth’s crust.

hydrothermal gold deposit – During the reaction between mineral-bearing hydrothermal fluids and wall-rocks, some elements are concentrated in specific locations to form hydrothermal gold deposits. They are usually controlled by faults or shear structures, occurring as veins and stockworks, or by strata.

hypozonal – Depth of formation of an orogenic deposit (>12 km / >7.5 mi).

intrusive – A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface.

Jura-Triassic arc belt – One of the geologic packages of the Sierra Nevada Foothills belt which consists of a Paleozoic basement of disrupted ophiolite, serpentinite mélange, and ultra-mafic rocks overlain by uppermost Triassic-Early Jurassic arc volcanics and coeval 200 Ma intrusive rocks.

lithology – Description of its physical characteristics of a rock unit at outcrop, in hard or core samples or with microscopy, such as colour, texture, grain size, or composition.

7

low-sulphide au-quartz vein – Gold-bearing quartz veins and veinlets with minor sulphides crosscutting a wide variety of host rocks and are localized along major regional faults and related splays. The wallrock is typically altered to silica, pyrite and muscovite within a broader carbonate alteration halo.

mafic – Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals.

mariposite – A mineral which is a chromium-rich variety of mica, which imparts an attractive green colour to the generally white dolomitic marble in which it is commonly found.

mélange – A large-scale breccia, a mappable body of rock characterized by a lack of continuous bedding and the inclusion of fragments of rock of all sizes, contained in a fine-grained deformed matrix.

matrix – Finer-grained mass of material wherein larger grains, crystals or clasts are embedded.

meta-volcanic rocks – A type of metamorphic rock that was first produced by a volcano, either as lava or tephra and then buried underneath subsequent rock and subjected to high pressure and temperatures, causing the rock to recrystallize.

mesothermal quartz vein – Also known as and are type-examples of low-sulfide Au-quartz vein deposits.

mesozonal – Depth of formation of an orogenic deposit (6–12 km / 3.7-7.5 mi).

metamorphosed – Rocks which have undergone a change in texture or composition as the result of heat and/or pressure.

mill head grade – The grade of the mineralized material which is fed into the processing plant to be concentrated into gold bullion. The mill head grade includes mining dilution from un-mineralized rock adjacent to the veins. The mill head grade does not account for metallurgical recovery of gold during the processing of the mineralized material.

ophiolitic rock – An assemblage of the Earth’s oceanic crust and the underlying upper mantle that has been uplifted and exposed above sea level and often emplaced onto continental crustal rocks.

orogeny – An episode of intense deformation of the rocks in a region, generally accompanied by metamorphism and plutonic activity.

orogenic gold deposit – Dominantly form in metamorphic rocks in the mid- to shallow crust (5-15 km depth), at or above the brittle-ductile transition, in compressional settings that facilitate transfer of hot gold bearing fluids from deeper levels. The term “orogenic” is used because these deposits likely form in accretionary and collisional orogens.

Paleozoic – Geological era that followed the Precambrian and during which began with the appearance of complex life, as indicated by fossils (from 245 to 570 million years ago).

pyrite – A yellow iron sulphide mineral, normally of little value. It is sometimes referred to as “fool’s gold”.

quartz – Common rock-forming mineral consisting of silicon and oxygen.

sedimentary rock – Secondary rocks formed from material derived from other rocks and laid down under water. Examples are limestone, shale, and sandstone.

serpentinite – Type of metamorphic rock composed mostly of mineral serpentine. It is usually dark green to green-black in colour, massive and macroscopically dense.

schistosity – Geological foliation (metamorphic arrangement in layers) with medium to large grained flakes in a preferred sheetlike orientation.

scheelite – A variously colored mineral, CaWO4, found in igneous rocks and a common form of tungsten.

sericite – A fine grained mica and a common alteration mineral of orthoclase or plagioclase feldspars in areas that have been subjected to hydrothermal alteration typically associated with hydrothermal deposits.

splay – A series of branching faults near the termination of a major fault which spread the displacement over a large area.

stope – An excavation in a mine from which mineralized material is, or has been extracted.

8

tectonism – Geological term used to describe major structural features and the processes that create them, including compressional or tensional movements on a planetary surface that produce faults, mountains, ridges, or scarps.

terrane – A crustal block or fragment that is typically bounded by faults and that has a geologic genesis distinct from those of surrounding areas.

Tertiary – Former term for the geologic period from 65 million to 2.6 million years ago, a timespan that occurs between the superseded Secondary period and the Quaternary.

thermal gradient – Rate of increasing temperature with respect to increasing depth in the Earth’s interior.

ultra-mafic – Igneous and meta-igneous rocks with a very low silica content, composed entirely or almost entirely of ferromagnesian minerals, and are composed of usually greater than 90% mafic minerals.

winze – A vertical or inclined underground working that has been excavated from the top downward.

ABBREVIATIONS

| Imperial | Metric | ||

| AC | acres | m | meter |

| SF | square foot | km | kilometer |

| lb | pound | ha | hectare |

| oz | ounce | g | grams |

| mi | mile | kg | kilogram |

| ft | foot | gpt | grams per tonne |

CONVERSIONS

| Imperial to Metric | Metric to Imperial | |||

| Imperial Measure | Metric Unit | Metric Measure | Imperial Unit | |

| 2.47 acres | 1 hectare | 0.4047 hectare | 1 acre | |

| 3.28 feet | 1 metre | 0.3048 metre | 1 foot | |

| 0.62 mile | 1 kilometre | 1.609 kilometres | 1 mile | |

| 0.03215 troy ounce | 1 gram | 31.1035 grams | 1 troy ounce | |

| 0.02917 troy ounce per ton | 1 gpt | 34.2857 gpt | 1 troy ounce per ton | |

| 1.102 short ton | 1 tonne | 0.907 tonne | 1 short ton | |

| 2.2046 pounds | 1 kilogram | 0.4536 kilogram | 1 pound | |

9

CURRENCY AND EXCHANGE RATES

All dollar amounts in this prospectus are expressed in Canadian dollars unless otherwise indicated. Our financial accounts are maintained in Canadian dollars and our financial statements are prepared in conformity with accounting principles generally accepted in the United States of America. Some of our material agreements use Canadian dollars and our Common Stock is traded on the CSE in Canadian dollars. As used herein “CDN$” represents Canadian dollars.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at the end of the periods indicated, the average of exchange rates in effect during such periods, and the high and low exchange rates during such periods based on daily mid-range exchange rates reported by OANDA Corporation which approximates the Bank of Canada rates for conversion of Canadian dollars into United States dollars:

| Six Months Ended January 31 | Fiscal Year Ended July 31 | |||||||

| Canadian Dollars to U.S. Dollars | 2018($) | 2017($) | 2016($) | 2015($) | ||||

| Rate at end of period | 0.8135 | 0.8014 | 0.7668 | 0.7677 | ||||

| Average rate for period | 0.7954 | 0.7555 | 0.7537 | 0.8423 | ||||

| High for period | 0.8245 | 0.8042 | 0.7978 | 0.9213 | ||||

| Low for period | 0.7756 | 0.7275 | 0.6848 | 0.7665 | ||||

10

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. This prospectus is offering to sell, and is seeking offers to buy, the securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus speaks only as of the date of this prospectus (unless the information specifically indicates that another date applies), regardless of the time of delivery of this prospectus or of any sale of the Shares.

We may provide a prospectus supplement containing specific information about the terms of a particular offering by the selling shareholders, or their transferees. The prospectus supplement may add, update or change information in this prospectus. If information in a prospectus supplement is inconsistent with the information in this prospectus, you should rely on the information in that prospectus supplement. You should read both this prospectus and, if applicable, any prospectus supplement hereto. See “Where You Can Find More Information” for more information.

This prospectus includes industry and market data and other information that we have obtained from, or which is based upon, market research, independent industry publications or other publicly available information. Any such data and other information is subject to change based on various factors, including those described below under the heading “Risk Factors” and elsewhere in this prospectus.

We have not, and the selling stockholders have not, authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or in any supplement to this prospectus or free writing prospectus, and neither we nor the selling stockholders take any responsibility for any other information that others may give you. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

11

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. It does not contain all of the information that you should consider before investing in our Common Stock. You should read this entire prospectus carefully, including the “Risk Factors” and the financial statements and related notes included herein. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.” References to “we,” “our,” “Rise,” and the “Company” refer to Rise Gold Corp.

About the Company

We are a mineral exploration stage company incorporated in the state of Nevada, United States. Our current business operations are focused on exploring the I-M Mine Property located near the community of Grass Valley in Nevada County in northern California. Our management team is headquartered in Vancouver, BC, Canada.

We acquired our interest in the I-M Mine Project by exercising an option granted pursuant to an option agreement dated August 30, 2016 (as amended November 11, 2016 and December 23, 2016) with the owners of the property. A more detailed discussion of the I-M Mine Project and of the current status of our business operations is provided under the sections entitled “Business” and “Properties”. We have prepared a technical report outlining an exploration plan which we are currently conducting. This report was created through processing historic data on the I-M Mine Property obtained from the vendors and from historic information in public databases in Nevada County.

12

| The Offering | |||

| Shares Offered By the Selling Stockholders | 86,260,034 Shares of our Common Stock, including: | ||

| ● | 42,927,517 Shares held by selling stockholders; | ||

| ● | 2,138,000 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on December 23, 2016 and exercisable at a price per Share of $0.40; | ||

| ● | 517,184 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on May 5, 2017 and exercisable at a price per Share of $0.40; | ||

| ● | 5,383,000 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on December 27, 2017 and exercisable at a price per Share of $0.25; | ||

| ● | 133,333 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on January 3, 2018 and exercisable at a price per Share of $0.25; and | ||

| ● | 35,161,000 Shares issuable upon exercise of common stock purchase warrants held by selling stockholders issued on April 18, 2018 and exercisable at a price per Share of $0.15. | ||

| Offering Price | Determined at the time of sale by the selling stockholders. | ||

| Use of Proceeds | We will not receive any proceeds from the sale of the Shares by selling stockholders covered by this prospectus. | ||

| Common Stock Outstanding as of May 18, 2018 | 116,105,982 shares of Common Stock. | ||

| Trading Symbols | Our Common Stock is listed on the CSE under the symbol “RISE” and quoted on the OTCQB under the symbol “RYES”. | ||

| Risk Factors | Investing in our securities involves a high degree of risk. See “Risk Factors”. | ||

13

RISK FACTORS

Investing in the Shares involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information contained in this prospectus, before deciding to invest in the Shares. If any of the following risks materialize, our business, financial condition, results of operations, and future prospects will likely be materially and adversely affected. In that event, the market price of the Shares could decline and you could lose all or part of your investment.

Risks Related to our Company

Our ability to operate as a going concern is in doubt.

The audit opinion and notes that accompany our financial statements for the years ended July 31, 2017 and 2016 disclose a going concern qualification to our ability to continue in business. The accompanying financial statements have been prepared under the assumption that we will continue as a going concern. We are an exploration stage company and we have incurred losses since our inception.

We currently have no historical recurring source of revenue and our ability to continue as a going concern is dependent on our ability to raise capital to fund our future exploration and working capital requirements or our ability to profitably execute our business plan. Our plans for the long-term return to and continuation as a going concern include financing our future operations through sales of our Common Stock and/or debt and the eventual profitable exploitation of our I-M Mine Property. Additionally, the volatility in capital markets and general economic conditions in the United States and elsewhere can pose significant challenges to raising the required funds. These factors raise substantial doubt about our ability to continue as a going concern.

Our consolidated financial statements do not give effect to any adjustments required to realize ours assets and discharge our liabilities in other than the normal course of business and at amounts different from those reflected in the accompanying financial statements.

We will require significant additional capital to fund our business plan.

We will be required to expend significant funds to determine whether proven and probable mineral reserves exist at our properties, to continue exploration and, if warranted, to develop our existing properties, and to identify and acquire additional properties to diversify our property portfolio. We anticipate that we will be required to make substantial capital expenditures for the continued exploration and, if warranted, development of our I-M Mine Property. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological, and geochemical analysis, assaying, and feasibility studies with regard to the results of our exploration at our I-M Mine Property. We may not benefit from some of these investments if we are unable to identify commercially exploitable mineral reserves.

As of January 31, 2018, we had cash of $143,375 and a working capital deficiency of $1,129, compared to cash of $337,099 and working capital of $185,429 on July 31, 2017. As of the date of this prospectus, our current planned operational needs are approximately $1,800,000 until July 31, 2018. We currently have sufficient cash on hand to meet these planned expenditures. We anticipate that we may need to raise up to $2,000,000 to continue planned operations for the next twelve months from the date of this prospectus. We are actively pursuing such additional sources of debt and equity financing, and while we have been successful in doing so in the past, there can be no assurance we will be able to do so in the future.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of metals. Capital markets worldwide were adversely affected by substantial losses by financial institutions, caused by investments in asset-backed securities and remnants from those losses continue to impact the ability for us to raise capital. We may not be successful in obtaining the required financing or, if we can obtain such financing, such financing may not be on terms that are favorable to us.

14

Our inability to access sufficient capital for our operations could have a material adverse effect on our financial condition, results of operations, or prospects. Sales of substantial amounts of securities may have a highly dilutive effect on our ownership or share structure. Sales of a large number of shares of our Common Stock in the public markets, or the potential for such sales, could decrease the trading price of the shares and could impair our ability to raise capital through future sales of Common Stock. We have not yet commenced commercial production at any of our properties and, therefore, have not generated positive cash flows to date and have no reasonable prospects of doing so unless successful commercial production can be achieved at our I-M Mine Property. We expect to continue to incur negative investing and operating cash flows until such time as we enter into successful commercial production. This will require us to deploy our working capital to fund such negative cash flow and to seek additional sources of financing. There is no assurance that any such financing sources will be available or sufficient to meet our requirements. There is no assurance that we will be able to continue to raise equity capital or to secure additional debt financing, or that we will not continue to incur losses.

We have a limited operating history on which to base an evaluation of our business and prospects.

Since our inception, we have had no revenue from operations. We have no history of producing products from any of our properties. Our I-M Mine Project is a historic, past-producing mine with very little recent exploration work. Advancing our I-M Mine Property into the development stage will require significant capital and time, and successful commercial production from the I-M Mine Property will be subject to completing feasibility studies, permitting and re-commissioning of the mine, constructing processing plants, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

| ● | completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient ore reserves to support a commercial mining operation; |

| ● | the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities; |

| ● | the availability and costs of drill equipment, exploration personnel, skilled labor, and mining and processing equipment, if required; |

| ● | the availability and cost of appropriate smelting and/or refining arrangements, if required; |

| ● | compliance with stringent environmental and other governmental approval and permit requirements; |

| ● | the availability of funds to finance exploration, development, and construction activities, as warranted; |

| ● | potential opposition from non-governmental organizations, local groups or local inhabitants that may delay or prevent development activities; |

| ● | potential increases in exploration, construction, and operating costs due to changes in the cost of fuel, power, materials, and other supplies; and |

| ● | potential shortages of mineral processing, construction, and other facilities related supplies. |

The costs, timing, and complexities of exploration, development, and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if commenced, development, construction, and mine start-up. In addition, our management and workforce will need to be expanded, and sufficient housing and other support systems for our workforce will have to be established. This could result in delays in the commencement of mineral production and increased costs of production. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our current or future properties, including our I-M Mine Property.

15

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception, have had negative cash flow from operating activities, and expect to continue to incur losses in the future. We have incurred the following losses from operations during each of the following periods:

| ● | $1,517,127 for the six month period ended January 31, 2018; |

| ● | $4,190,955 for the year ended July 31, 2017; and |

| ● | $633,466 for the year ended July 31, 2016. |

We expect to continue to incur losses unless and until such time as one of our properties enters into commercial production and generates sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses, and difficulties frequently encountered by companies at the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

Risks Related to Mining and Exploration

The I-M Mine Property is in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on the I-M Mine Property or any other properties we may acquire in commercially exploitable quantities. Unless and until we do so, we cannot earn any revenues from these properties and if we do not do so, we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, the exploration component of our business could fail.

We have not established that any of our mineral properties contain any mineral reserve according to recognized reserve guidelines, nor can there be any assurance that we will be able to do so.

A mineral reserve is defined by the SEC in its Industry Guide 7 as that part of a mineral deposit that could be economically and legally extracted or produced at the time of the reserve determination. In general, the probability of any individual prospect having a “reserve” that meets the requirements of the SEC’s Industry Guide 7 is small, and our mineral properties may not contain any “reserves” and any funds that we spend on exploration could be lost. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines and that we can extract those minerals. Both mineral exploration and development involve a high degree of risk, and few mineral properties that are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade, and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as processing facilities, roads, rail, power, and a point for shipping, government regulation, and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

Exploration for and the production of minerals is highly speculative and involves much greater risk than many other businesses. Most exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future development or mining operations we may conduct will be, subject to all of the operating hazards and risks normally incidental to exploring for and development of mineral properties, such as, but not limited to:

16

| ● | economically insufficient mineralized material; |

| ● | fluctuation in production costs that make mining uneconomical; |

| ● | labor disputes; |

| ● | unanticipated variations in grade and other geologic problems; |

| ● | environmental hazards; |

| ● | water conditions; |

| ● | difficult surface or underground conditions; |

| ● | industrial accidents; |

| ● | metallurgic and other processing problems; |

| ● | mechanical and equipment performance problems; |

| ● | failure of dams, stockpiles, wastewater transportation systems, or impoundments; |

| ● | unusual or unexpected rock formations; and |

| ● | personal injury, fire, flooding, cave-ins and landslides. |

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues, and production dates. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent that are not recoverable, or that result in additional expenses.

Commodity price volatility could have dramatic effects on the results of operations and our ability to execute our business plan.

The price of commodities varies on a daily basis. Our future revenues, if any, will likely be derived from the extraction and sale of base and precious metals. The price of those commodities has fluctuated widely, particularly in recent years, and is affected by numerous factors beyond our control including economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global and regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of our business, could negatively affect our ability to secure financing or our results of operations.

Estimates of mineralized material and resources are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineralized material and resources/reserves within the earth using statistical sampling techniques. Estimates of any mineralized material or resource/reserve on any of our properties would be made using samples obtained from appropriately placed trenches, test pits, underground workings, and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material and resources/reserves. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to commercially viable operations in the future.

Any material changes in mineral resource/reserve estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

As we have not completed feasibility studies on our I-M Mine Property and have not commenced actual production, mineralization resource estimates may require adjustments or downward revisions. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by future feasibility studies and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

17

Our exploration activities on our properties may not be commercially successful, which could lead us to abandon our plans to develop our properties and our investments in exploration.

Our long-term success depends on our ability to identify mineral deposits on our I-M Mine Property and other properties we may acquire, if any, that we can then develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks, and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment, or labor. The success of commodity exploration is determined in part by the following factors:

| ● | the identification of potential mineralization based on surficial analysis; |

| ● | availability of government-granted exploration permits; |

| ● | the quality of our management and our geological and technical expertise; and |

| ● | the capital available for exploration and development work. |

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors that include, without limitation, the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; commodity prices, which can fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. We may invest significant capital and resources in exploration activities and may abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of our securities and the ability to raise future financing.

We are subject to significant governmental regulations that affect our operations and costs of conducting our business and may not be able to obtain all required permits and licences to place our properties into production.

Our current and future operations, including exploration and, if warranted, development of the I-M Mine Property, do and will require permits from governmental authorities and will be governed by laws and regulations, including:

| ● | laws and regulations governing mineral concession acquisition, prospecting, development, mining, and production; |

| ● | laws and regulations related to exports, taxes, and fees; |

| ● | labor standards and regulations related to occupational health and mine safety; and |

| ● | environmental standards and regulations related to waste disposal, toxic substances, land use reclamation, and environmental protection. |

Companies engaged in exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations, and permits. Failure to comply with applicable laws, regulations, and permits may result in enforcement actions, including the forfeiture of mineral claims or other mineral tenures, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or costly remedial actions. We cannot predict if all permits that we may require for continued exploration, development, or construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms, if at all. Costs related to applying for and obtaining permits and licenses may be prohibitive and could delay our planned exploration and development activities. We may be required to compensate those suffering loss or damage by reason of our mineral exploration or our mining activities, if any, and may have civil or criminal fines or penalties imposed for violations of, or our failure to comply with, such laws, regulations, and permits.

Existing and possible future laws, regulations, and permits governing operations and activities of exploration companies, or more stringent implementation of such laws, regulations and permits, could have a material adverse impact on our business and cause increases in capital expenditures or require abandonment or delays in exploration.

18

Our I-M Mine Property is located in California and has numerous clearly defined regulations with respect to permitting mines, which could potentially impact the total time to market for the project.

Although we are currently focused on mineral exploration at the I-M Mine Project and are not contemplating the permitting or the re-opening of the I-M Mine at this time, Nevada County would likely be the lead agency for permitting of an underground mine based on our preliminary review of the regulatory framework. Both parcels fall within the City of Grass Valley’s Sphere of Influence. As such, the County of Nevada may consult with the City of Grass Valley before authorizing uses within the Sphere of Influence. During the process of certain permitting applications in the early 2000s, which were focussed on the Idaho land adjacent to the City of Grass Valley, the City of Grass Valley became the lead agency and proposed to annex the project into the City.

Subsurface mining is allowed in the Nevada County M1 Zoning District with approval of a “Use Permit”. Approval of a Use Permit for mining operations requires a public hearing before the County Planning Commission, whose decision may be appealed to the County Board of Supervisors. Use Permit approvals include conditions of approval, which are designed to minimize the impact of conditional uses on neighboring properties.

In 1975, the California Legislature enacted the Surface Mining and Reclamation Act (“SMARA”), which required that all surface mining operations in California have approved reclamation plans and financial assurances. SMARA was adopted to ensure that land used for mining operations in California would be reclaimed post-mining to a useable condition. Pursuant to SMARA, we would be required to obtain approval of a Reclamation Plan and financial assurances from the County for any surface component of the underground mining operation before mining operations could commence. Approval of a Reclamation Plan will require a public hearing before the County Planning Commission.

To approve a Reclamation Plan and Use Permit, the County would need to satisfy the requirements of California Environmental Quality Act (“CEQA”). CEQA requires that public agency decision makers study the environmental impacts of any discretionary action, disclose the impacts to the public, and minimize unavoidable impacts to the extent feasible. CEQA is triggered whenever a California governmental agency is asked to approve a “discretionary project”. The approval of a Reclamation Plan is a “discretionary project” under CEQA. Other necessary ancillary permits like the California Department of Fish and Wildlife (“CDFW”) Streambed Alteration Agreement (if applicable) also triggers CEQA compliance.

In this situation, the lead agency for the purposes of CEQA would be the County. Other public agencies (in charge of administering specific legislation) will also need to approve aspects of the Project, such as the CDFW (the California Endangered Species Act), the Air Pollution Control District (Authority to Construct and Permit to Operate), and the Regional Water Quality Control Board (National Pollutant Discharge Elimination System (authorized to state governments by the US Environmental Protection Agency) and Report of Waste Discharge). However, CEQA’s Guidelines provide that if more than one agency must act on a project, the agency that acts first is generally considered the lead agency under CEQA . All other agencies are considered “responsible agencies.” Responsible agencies do need to consider the environmental document approved by the lead agency, but will usually accept the lead agency’s document and use it as the basis for issuing their own permits.

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All phases of our operations are subject to environmental regulation in the jurisdictions in which we operate. Environmental legislation is evolving in a manner that may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors, and employees. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species, and reclamation of lands disturbed by mining operations. Compliance with environmental laws and regulations, and future changes in these laws and regulations, may require significant capital outlays and may cause material changes or delays in our operations and future activities. It is possible that future changes in these laws or regulations could have a significant adverse impact on our properties or some portion of our business, causing us to re-evaluate those activities at that time.

19

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating legislative and/or regulatory changes in response to concerns about the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, on our future venture partners, if any, and on our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting, and other costs necessary to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the emotional and political significance and uncertainty surrounding the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will ultimately affect our financial condition, operating performance, and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain, and could be particular to the geographic circumstances in areas in which we operate and may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels, and changing temperatures. These impacts may adversely impact the cost, production, and financial performance of our operations.

Land reclamation requirements for our properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

| ● | control dispersion of potentially deleterious effluents; |

| ● | treat ground and surface water to drinking water standards; and |

| ● | reasonably re-establish pre-disturbance land forms and vegetation. |

In order to carry out reclamation obligations imposed on us in connection with our potential development activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. We plan to set up a provision for our reclamation obligations on our properties, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

We face intense competition in the mining industry.

The mining industry is intensely competitive in all of its phases. As a result of this competition, some of which is with large established mining companies with substantial capabilities and with greater financial and technical resources than ours, we may be unable to acquire additional properties, if any, or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for qualified employees, our exploration and development programs may be slowed down or suspended. We compete with other companies that produce our planned commercial products for capital. If we are unable to raise sufficient capital, our exploration and development programs may be jeopardized or we may not be able to acquire, develop, or operate additional mining projects.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development operations. Any shortage of such supplies, equipment, and parts could have a material adverse effect on our ability to carry out our operations and could therefore limit, or increase the cost of, production.

20

Joint ventures and other partnerships, including offtake arrangements, may expose us to risks.

We may enter into joint ventures, partnership arrangements, or offtake agreements, with other parties in relation to the exploration, development, and production of the properties in which we have an interest. Any failure of such other companies to meet their obligations to us or to third parties, or any disputes with respect to the parties’ respective rights and obligations, could have a material adverse effect on us, the development and production at our properties, including the I-M Mine Property, and on future joint ventures, if any, or their properties, and therefore could have a material adverse effect on our results of operations, financial performance, cash flows and the price of our Common Stock.

We may experience difficulty attracting and retaining qualified management to meet the needs of our anticipated growth, and the failure to manage our growth effectively could have a material adverse effect on our business and financial condition.

We are dependent on a relatively small number of key employees and consultants, including our Chief Executive Officer, Chief Financial Officer and Corporate Secretary. The loss of any officer could have an adverse effect on us. We have no life insurance on any individual, and we may be unable to hire a suitable replacement for them on favorable terms, should that become necessary.

Our results of operations could be affected by currency fluctuations.

Our properties are currently all located in the United States and while most costs associated with these properties are paid in U.S. dollars, a significant amount of our administrative expenses are payable in Canadian dollars. There can be significant swings in the exchange rate between the U.S. dollar and the Canadian dollar, which can impact various aspects of our operations. There are no plans at this time to hedge against any exchange rate fluctuations in currencies.

Title to our properties may be subject to other claims that could affect our property rights and claims.

There are risks that title to our properties may be challenged or impugned. Our I-M Mine Property is located in California and may be subject to prior unrecorded agreements or transfers and title may be affected by undetected defects.

We may be unable to secure surface access or purchase required surface rights.

Although we obtain the rights to some or all of the minerals in the ground subject to the mineral tenures that we acquire, or have the right to acquire, in some cases we may not acquire any rights to, or ownership of, the surface to the areas covered by such mineral tenures. In such cases, applicable mining laws usually provide for rights of access to the surface for the purpose of carrying on mining activities; however, the enforcement of such rights through the courts can be costly and time consuming. It is necessary to negotiate surface access or to purchase the surface rights if long-term access is required. There can be no guarantee that, despite having the right at law to access the surface and carry on mining activities, we will be able to negotiate satisfactory agreements with any such existing landowners/occupiers for such access or purchase of such surface rights, and therefore we may be unable to carry out planned mining activities. In addition, in circumstances where such access is denied, or no agreement can be reached, we may need to rely on the assistance of local officials or the courts in such jurisdiction the outcomes of which cannot be predicted with any certainty. Our inability to secure surface access or purchase required surface rights could materially and adversely affect our timing, cost, or overall ability to develop any mineral deposits we may locate.

Our properties and operations may be subject to litigation or other claims.

From time to time our properties or operations may be subject to disputes that may result in litigation or other legal claims. We may be required to take countermeasures or defend against these claims, which will divert resources and management time from operations. The costs of these claims or adverse filings may have a material effect on our business and results of operations.

21

We do not currently insure against all the risks and hazards of mineral exploration, development, and mining operations.

Exploration, development, and mining operations involve various hazards, including environmental hazards, industrial accidents, metallurgical and other processing problems, unusual or unexpected rock formations, structural cave-ins or slides, flooding, fires, and periodic interruptions due to inclement or hazardous weather conditions. These risks could result in damage to or destruction of mineral properties, facilities, or other property, personal injury, environmental damage, delays in operations, increased cost of operations, monetary losses, and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums or at all. We may elect not to insure where premium costs are disproportionate to our perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration and production activities.

Risks Related to the Shares

Our share price may be volatile and as a result you could lose all or part of your investment.

In addition to volatility associated with equity securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of the Shares:

| ● | Disappointing results from our exploration efforts; |

| ● | Decline in demand for our Common Stock; |

| ● | Downward revisions in securities analysts’ estimates or changes in general market conditions; |

| ● | Technological innovations by competitors or in competing technologies; |

| ● | Investor perception of our industry or our prospects; and |

| ● | General economic trends. |

In the last 12 months, the price of our stock on the CSE has ranged from a low of $0.085 to a high of $0.315. In addition, stock markets in general have experienced extreme price and volume fluctuations, and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of the Shares. As a result, you may be unable to sell any Shares you acquire at a desired price.

We have never paid dividends on our Common Stock.

We have not paid dividends on our Common Stock to date, and we do not expect to pay dividends for the foreseeable future. We intend to retain our initial earnings, if any, to finance our operations. Any future dividends on Common Stock will depend upon our earnings, our then-existing financial requirements, and other factors, and will be at the discretion of the Board.

Investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share of Common Stock if we issue additional employee/director/consultant options or if we sell additional Common Stock and/or warrants to finance our operations.

In order to further expand our operations and meet our objectives, any additional growth and/or expanded exploration activity will likely need to be financed through sale of and issuance of additional Common Stock, including, but not limited to, raising funds to explore the I-M Mine Property. Furthermore, to finance any acquisition activity, should that activity be properly approved, and depending on the outcome of our exploration programs, we likely will also need to issue additional Common Stock to finance future acquisitions, growth, and/or additional exploration programs of any or all of our projects or to acquire additional properties. We will also in the future grant to some or all of our directors, officers, and key employees and/or consultants options to purchase Common Stock as non-cash incentives. The issuance of any equity securities could, and the issuance of any additional Common Stock will, cause our existing stockholders to experience dilution of their ownership interests.

22

If we issue additional Common Stock or decide to enter into joint ventures with other parties in order to raise financing through the sale of equity securities, investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share of Common Stock depending on the price at which such securities are sold.

The issuance of additional shares of Common Stock may negatively impact the trading price of our securities.

We have issued Common Stock in the past and will continue to issue Common Stock to finance our activities in the future. In addition, newly issued or outstanding options, warrants, and broker warrants to purchase Common Stock may be exercised, resulting in the issuance of additional Common Stock. Any such issuance of additional Common Stock would result in dilution to our stockholders, and even the perception that such an issuance may occur could have a negative impact on the trading price of the Common Stock.

We are subject to the continued listing criteria of the CSE, and our failure to satisfy these criteria may result in delisting of our Common Stock from the CSE and could also jeopardize our continued ability to trade in the United States on the OTCQB.

Our Common Stock is currently listed for trading on the CSE. In order to maintain the listing on the CSE or any other securities exchange we may trade on, we must maintain certain financial and share distribution targets, including maintaining a minimum number of public shareholders. In addition to objective standards, these exchanges may delist the securities of any issuer if, in the exchange’s opinion, our financial condition and/or operating results appear unsatisfactory; if it appears that the extent of public distribution or the aggregate market value of the security has become so reduced as to make continued listing inadvisable; if we sell or dispose of our principal operating assets or cease to be an operating company; if we fail to comply with the listing requirements; or if any other event occurs or any condition exists which, in their opinion, makes continued listing on the exchange inadvisable.

If the CSE or any other exchange were to delist the Common Stock, investors may face material adverse consequences, including, but not limited to, a lack of trading market for the Common Stock, reduced liquidity, decreased analyst coverage, and/or an inability for us to obtain additional financing to fund our operations. In addition, our inability to maintain our CSE listing and remain current in our Canadian public disclosure requirements could disqualify us from continuing to trade in the United States on either the OTCQB or the OTC Pink.

We are an “emerging growth company,” and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our Common Stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier, including if the market value of our Common Stock held by non-affiliates exceeds $700 million as of any July 31 before that time, in which case we would no longer be an emerging growth company as of the following January 31. We cannot predict if investors will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile. Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards and, therefore, will not be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

23

Broker-dealers may be discouraged from effecting transactions in our Common Stock because it is considered a penny stock and is subject to the penny stock rules.

Our Common Stock is currently considered a “penny stock.” The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share, subject to certain exceptions. Our Common Stock is covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our Common Stock and, as a result, the ability of broker-dealers to trade in our Common Stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information discussed in this prospectus includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical facts, included in this prospectus concerning, among other things, planned capital expenditures, future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other plans and objectives for future operations, future exploration activities, future mineral resource estimates, and future joint venture arrangements are forward-looking statements. These forward-looking statements are identified by the use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “will,” “continue,” “potential,” “should,” “could,” “would”, “might” and similar terms and phrases.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation, risks related to:

| ● | our requirement of significant additional capital; |

| ● | our limited operating history; |

| ● | our history of losses; |

| ● | our properties that are in the exploration stage; |

| ● | mineral exploration and production activities; |

| ● | our lack of mineral production from our properties; |

| ● | our exploration activities being unsuccessful; |

| ● | our ability to obtain permits and licenses for production; |

| ● | government and environmental regulations that may increase our costs of doing business or restrict our operations; |

| ● | proposed legislation that may significantly affect the mining industry; |

| ● | land reclamation requirements; |

| ● | competition in the mining industry; |

| ● | equipment and supply shortages; |

| ● | current and future joint ventures and partnerships; |

| ● | our ability to attract qualified management; |

24

| ● | currency fluctuations; |

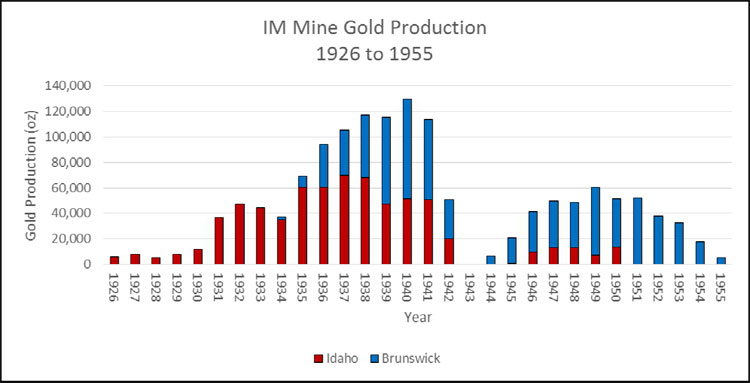

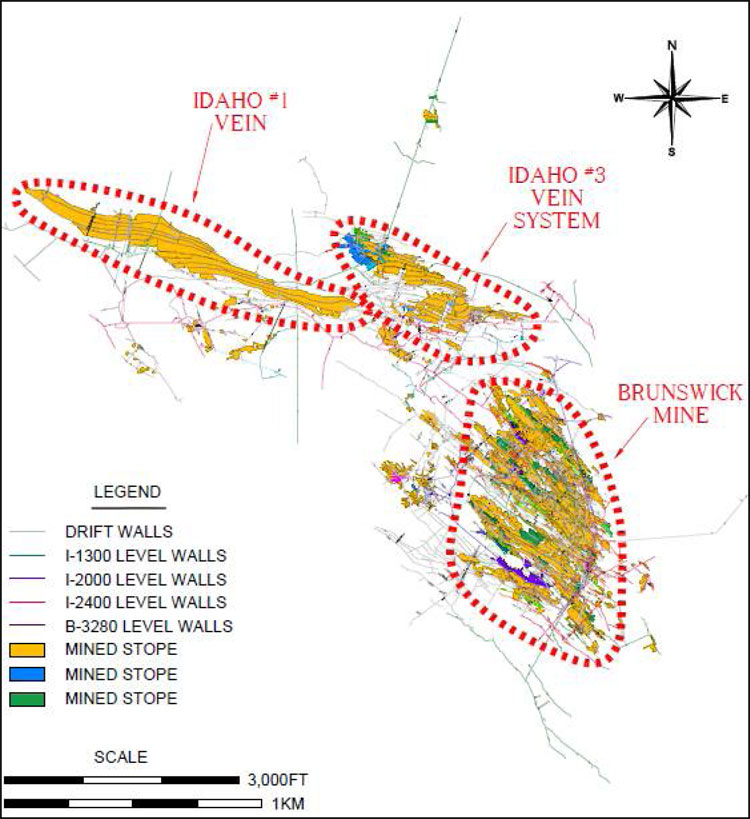

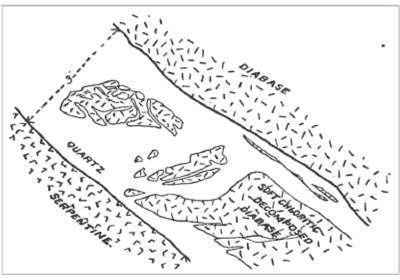

| ● | claims on the title to our properties; |