Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Kindred Biosciences, Inc. | a8-kmay242018.htm |

FORWARD LOOKING STATEMENTS This presentation contains forward- looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward- looking statements, including, but not limited to, statements regarding our expectations about the trials, regulatory approval, manufacturing, distribution and commercialization of our current and future product candidates, and statements regarding our anticipated revenues, expenses, margins, profits and use of cash. These forward- looking statements are based on our current expectations. These statements are not promises or guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results to be materially different from any future results expressed or implied by the forward- looking statements. These risks include, but are not limited to, the following: our limited operating history and expectations of losses for the foreseeable future; the absence of significant revenue from our product candidates for the foreseeable future; our potential inability to obtain any necessary additional financing; our substantial dependence on the success of our lead product candidates, which may not be successfully commercialized even if they are approved for marketing; the effect of competition; our potential inability to obtain regulatory approval for our existing or future product candidates; our dependence on third parties to conduct some of our development activities; our dependence upon third- party manufacturers for supplies of our product candidates; uncertainties regarding the outcomes of trials regarding our product candidates; our potential failure to attract and retain senior management and key scientific personnel; uncertainty about our ability to develop a satisfactory sales organization; our significant costs of operating as a public company; our potential inability to obtain patent protection and other intellectual property protection for our product candidates; potential claims by third parties alleging our infringement of their patents and other intellectual property rights; our potential failure to comply with regulatory requirements, which are subject to change on an ongoing basis; the potential volatility of our stock price; and the significant control over our business by our principal stockholders and management. For a further description of these risks and other risks that we face, please see the risk factors described in our filings with the U.S. Securities and Exchange Commission (the SEC), including the risk factors discussed under the caption "Risk Factors" in our Annual Report on Form 10- K and any subsequent updates that may be contained in our Quarterly Reports on Form 10- Q filed with the SEC. As a result of the risks described above and in our filings with the SEC, actual results may differ materially from those indicated by the forward- looking statements made in this presentation. Forward- looking statements contained in this presentation speak only as of the date of this presentation and we undertake no obligation to update or revise these statements, except as may be required by law. May 24, 2018

WE SPEND GENEROUSLY ON PETS $69.4 $ 1.5 $700 BILLION BILLION MILLION We spend $69.4 We spend $1.5 We spend $700 billion a year on billion a year on million a year on pets knee surgeries for Valentine’s Day dogs presents for pets 3

BECAUSE PETS ARE FAMILY 67 37 71 PERCENT PERCENT PERCENT 67% of pet 37% of pet 71% of pets sleep parents would parents would in bed with their give up their give up their pet parents vacation to pay cellphone to pay for pet emergency for pet emergency 4

KINDREDBIO’S STRATEGY: REPURPOSE HUMAN DRUGS FOR PETS Pursue molecules already $5-8M to develop each known to work drug in 3-6 years Reduce technical risk Reduce financial risk Reduce timelines Portfolio approach 5

DEEP PRODUCT PIPELINE Laboratory Field Pivotal Approval Molecule Indication Preclinical Pilot Studies Pilot Studies Study Management of Mirataz™ Approved weight loss in cats Rolling NADA Zimeta™ Injection Control of fever in horses Filed Positive Pivotal Zimeta™ Oral Control of fever in horses Study Control of non-regenerative epoCat™ anemia in cats IL31 Antibody Atopic dermatitis in dogs IL17 Antibody Atopic dermatitis in dogs IL4/13 SINK Atopic dermatitis in dogs 6

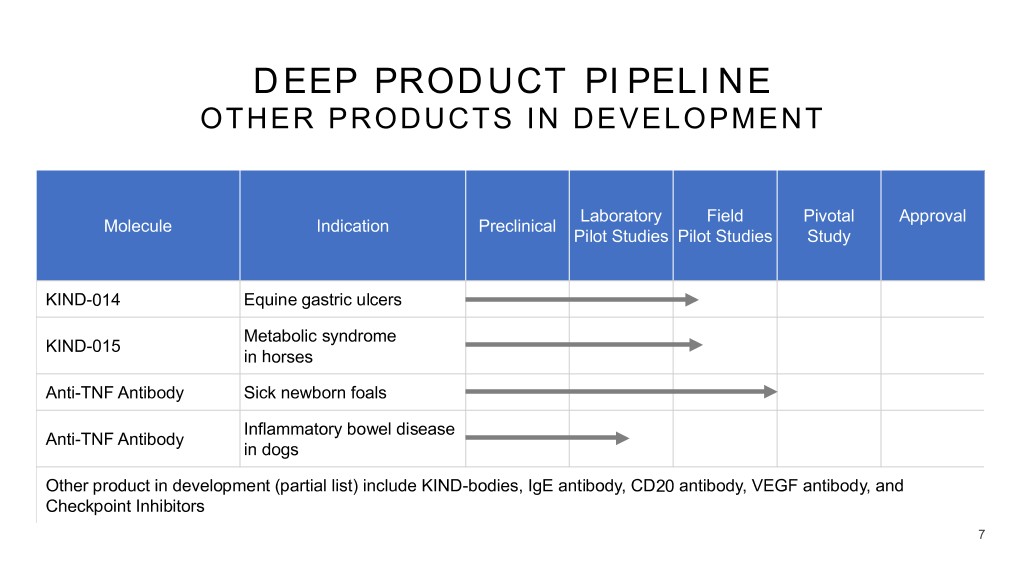

DEEP PRODUCT PIPELINE OTHER PRODUCTS IN DEVELOPMENT Laboratory Field Pivotal Approval Molecule Indication Preclinical Pilot Studies Pilot Studies Study KIND-014 Equine gastric ulcers Metabolic syndrome KIND-015 in horses Anti-TNF Antibody Sick newborn foals Inflammatory bowel disease Anti-TNF Antibody in dogs Other product in development (partial list) include KIND-bodies, IgE antibody, CD20 antibody, VEGF antibody, and Checkpoint Inhibitors 7

We expect two approvals this year and then an average of two approvals per year thereafter Market sizes are 10 times smaller than human markets but the cost of development is 100 times lower 8

VETERINARY MARKET IS GROWING RAPIDLY 68% 23% The veterinary care Animal health stocks market grew 68% have risen 23% in the from 2007 to 2017 previous year 9

THERE IS A HIGH WILLINGNESS TO PAY… $11,000 $10,000 $10,200.15 $10,329.99 A recent study found that, on average, pet $9,000 owners who have both dogs and cats $8,000 would spend over $10,000 to $7,000 save one of their pets from a life-threatening $6,000 v illness or disease $5,000 $4,000 $3,000 $2,000 $1,000 Cat Owners Dog Owners 10

THERE IS LOW GENERIC PENETRATION Generic Dispensing Rates There are very few generic companies, and no automatic substitution at the pharmacy 81% Human Many products reach peak sales several years after patent expiration 7% Companion There is no biosimilar pathway Animal 11

MIRATAZ™ (mirtazapine transdermal ointment)

Mirataz™(mirtazapine transdermal ointment) now available The first and only FDA-approved transdermal medication for the management of weight loss in cats Mirataz is classified pharmacologically as a weight-gain drug1 13 1.. Freedom of Information Summary, Original New Animal Drug Application, NADA 141-481, for MiratazTM (mirtazapine transdermal ointment). May, 2018.

MIRATAZ™ OPPORTUNITY 9 million cats are diagnosed with unintended weight loss each year Weight loss can lead to liver failure which can be fatal 3 million cats are currently treated for unintended weight loss each year 14

MIRATAZ™ OPPORTUNITY 49% of veterinarians report that ease of administering the medication and/or client medication compliance is a primary factor in selecting a medication for feline weight loss 15

OPPORTUNITY 71% of veterinarians use mirtazapine and the majority say they would switch to the transdermal gel formulation 59% 34% 7% 59% of 34% of Only 7% of veterinarians would veterinarians would veterinarians would replace most or all replace some of the not replace any mirtazapine mirtazapine mirtazapine 16

17 US-MAZ-1800017

ZIMETA™ (dipyrone injection)

ZIMETA™ IV PIVOTAL FIELD STUDY RESULTS 100.0 P<0.0001 90.0 80.0 76.8 Randomized, double-blind, placebo- controlled 70.0 60.0 Primary endpoint: improvement or resolution 50.0 v of fever 40.0 NADA filed, approval expected this year Success Rate (%) 30.0 20.0 19.4 10.0 0.0 Placebo Zimeta IV N=31 N=99 19

ZIMETA™ ORAL PIVOTAL FIELD STUDY RESULTS 100.0 P=0.0026 90.0 78.4 80.0 Randomized, double-blind, placebo- controlled 70.0 60.0 Primary endpoint: improvement or resolution 50.0 v of fever 40.0 Success Rate (%) 30.0 20.0 17.6 10.0 0.0 Placebo Zimeta Oral N=34 N=102 20

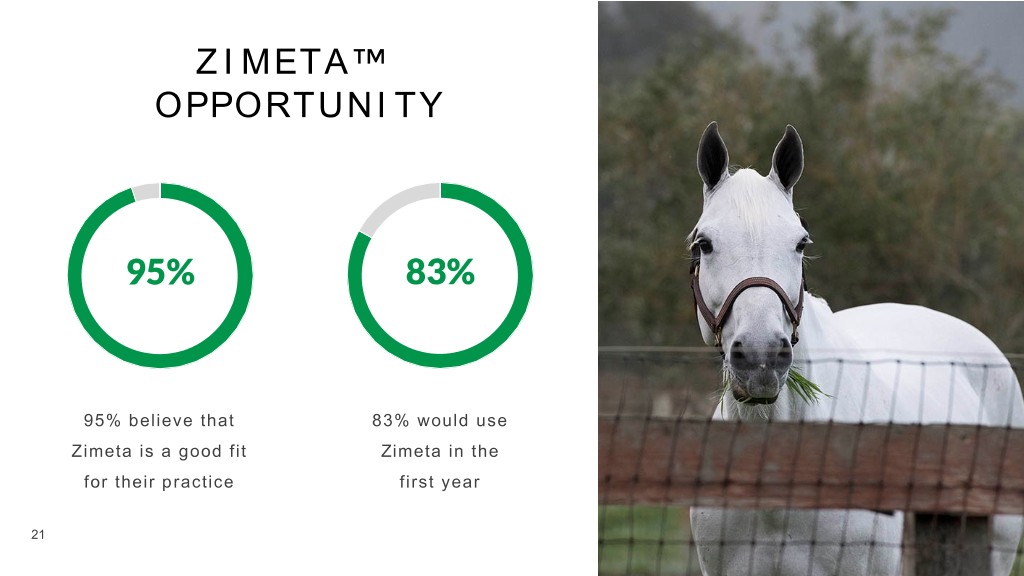

ZIMETA™ OPPORTUNITY 95% 83% 95% believe that 83% would use Zimeta is a good fit Zimeta in the for their practice first year 21

COMMERCIALIZATION

EQUINE COMMERCIALIZATION Commercialize with 3-5 person direct sales force, in conjunction with distributors COMPANION ANIMAL COMMERCIALIZATION Commercialize with 20-25 person direct sales force, in conjunction with distributors 23

WORLD-CLASS COMMERCIAL TEAM 15.7 > 50 TOP YEARS LAUNCHES COMPANIES Sales force has Team members The team comes average have launched from top experience of over 50 products veterinary 15.7 years companies 24 24

BIOLOGICS

BIOLOGICS Industry leading biologic programs State-of-the-art biologics manufacturing plant Highly experienced biologics team New technologies, including KIND-bodies 26

epoCat™ FELINE ERYTHROPOIETIN Recombinant long-acting feline erythropoietin for non-regenerative anemia in cats Half of elderly cats develop kidney disease which can cause anemia 27

epoCat™ Initial laboratory study has been completed and the results were positive, as evidenced by increase in new red blood cells Pilot field efficacy study is under way 28

KEY FOCUS AREA ATOPIC DERMATITIS Canine atopic dermatitis, an allergic skin disease, is a >$500M a year market KindredBio has an industry-leading portfolio of atopic dermatitis candidates 29

CANINE IL31 ANTIBODY Second generation antibody that blocks IL31, a mediator of itching Fully caninized and high affinity Successfully completed pilot safety study and pilot efficacy study underway 30

OTHER CANDIDATES ATOPIC DERMATITIS Initial pilots studies of IL17 antibody, and IL13/IL4 SINK have also been completed and the molecules were well tolerated KindredBio has multiple other preclinical candidates for atopic dermatitis 31

CORPORATE INFO

SELECT SUMMARY FINANCIALS March 31, 2018 Operating expenses Quarter Year Research and Development $5.3 $5.3 General and Administrative $4.9 $4.9 Total cash operating expenses $8.7 $8.7 (excluding stock-based compensation) Total operating expenses $10.2 $10.2 (including stock-based compensation) Total cash, cash equivalents, and $70.8 $70.8 investments 33

CAPITAL STRUCTURE AND STOCK HISTORY Shares outstanding1 28.2M Options2 5.6M Market Cap3 US$273.6M Analyst Coverage Kevin DeGeeter • Ladenburg Thalmann • kdegeeter@ladenburg.com Andrew D'Silva • B. Riley FBR • adsilva@brileyfbr.com Swayampakula Ramakanth • H.C. Wainwright & Co. • sramakanth@hcwresearch.com David Westenberg • CL King & Associates • dwestenberg@clking.com 1 As of May 4, 2018 2 As of March 31, 2018; avg. $6.98 3 As of close of market May 4, 2018 34

NEWS FLOW Zimeta IV approval in 2018 Pilot efficacy results from equine ulcer study in 2018 Pilot efficacy results from IL31 antibody study in 2018 Pilot efficacy results from epoCat study in early 2019 Pilot efficacy results from IL4/IL13 study in early 2019

SUMMARY

SUMMARY KindredBio develops innovative therapies for companion animals by leveraging validated human drugs. The markets are ten times smaller than human markets but the cost of development is a hundred times lower. KindredBio expects to launch average of two drugs per year.

SOURCES SLIDE 3 : 2017-2018 APPA National Pet Owners Survey Journal of the American Veterinary Medical Association, November 15, 2005, Vol. 227, No. 10, Pages 1604-1607, https://doi.org/10.2460/javma.2005.227.1604 Valentine’s Day Gift Spend: National Retail Foundation—http://consumerist.com/2015/01/28/americans-will-spend-703-million-on-valentines-day-gifts-for-pets SLIDE 4: American: Institute of Certified Public Accountants-https://www.aicpa.org/content/aicpa/press/pressreleases/2017/survey-explores-financial-sacrifices-americans-make-for-pets.html 2017-2018 APPA National Pet Owners Survey SLIDE 9: 2017-2018 APPA National Pet Owners Survey & 2007-2008 APPA National Pet Owners Survey https://www.motifinvesting.com/motifs/pet-passion SLIDE 10: https://lendedu.com/blog/how-much-are-dog-and-cat-owners-willing-to-spend/ SLIDE 11: Note: Companion Animal dispensing rate within the veterinary clinic. Source: IMS Health, Putney, BofA Merril Lynch Global Research SLIDE 14: 2012 U.S. Pet Ownership & Demographics Sourcebook American Veterinary Medical Association (n=50,000 U.S. Households) 2016 U.S. Veterinarian Mirtazapine Research, Wise Insights May 2016 (n=89 U.S. small animal Veterinarians). Data on file at Kindred Biosciences. SLIDE 15, 16: 2016 U.S. Veterinarian Mirtazapine Phase 3 Research, Ipsos, September 2016 (n=201 U.S. small animal Veterinarians). Data on file at Kindred Biosciences. SLIDE 21: Zimeta Pricing Research, Ipsos Ag & Animal Health, May 2016 (n=160 U.S. equine Veterinarians) . Data on file at Kindred Biosciences. SLIDE 24: Data on file at Kindred Biosciences.