Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Logistics LP | a2018mlpaconference8-k.htm |

Investor Presentation May 2018

Safe Harbor Statements This presentation contains forward-looking statements made by PBF Logistics LP (“PBFX”), PBF Energy Inc. (“PBF Energy” and together with PBFX, the “Companies”), PBF Holding Company LLC, and their subsidiaries, and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement and successful closing of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; unforeseen liabilities associated with any acquisition; inability to successfully integrate any acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date. See the Appendix for reconciliations of the differences between the non-GAAP financial measures used in this presentation, including various estimates of EBITDA, and their most directly comparable GAAP financial measures. 2

PBF Logistics LP Strategy and Growth PBF Logistics LP has successfully delivered ~530% revenue growth since inception Increased distributions to limited partners by over 63% since our initial public offering The Partnership is focused on a 3-pillared approach to delivering future growth . Developing a robust pipeline of organic projects . Targeting independent assets that complement existing relationships . Partnering with PBF Energy to maximize value of embedded logistics assets Measured distribution increases designed to reward unitholders, increase coverage and decrease reliance on external funding sources 3

PBFX Growing Asset Base is Ideally Situated Mid-Continent Assets PBFX is targeting logistics assets for Knoxville “Cummins” Terminals Toledo Storage Facility feedstock movement and product Toledo LPG Truck Rack Toledo Truck Terminal distribution that complement its existing Toledo Terminal operations Toledo Developing organic growth opportunities to PADD 4 Paulsboro enhance asset base and diversify revenue PADD PADD 5 streams 2 PADD 1 Strategic third-party acquisitions allow PBF Delaware City PADD Logistics to independently grow its revenue 3 base Torrance Chalmette West Coast Assets East Coast Assets Drop-downs from PBF Energy, as it grows, Torrance Valley Pipeline Paulsboro NG Pipeline East Coast Terminals remain a valuable source of future growth DC Products Pipeline DC Truck Rack (Products) Gulf Coast Assets DC Truck Rack (LPG) Chalmette Storage Facility DC Rail Terminal DC West Rack 4

Delivered Distribution Growth and Diversification Fifteen consecutive quarterly distribution increases $0.510 $0.460 $0.410 $0.360 $0.310 $0.260 Q2-14* Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 MQD Incremental *Distribution reflects pro forma full quarter amount 5

PBFX pursuing multiple growth channels Since inception, PBFX has delivered PBF Logistics EBITDA Growth over 200% EBITDA growth Completed 4 drop-down transactions with PBF Energy Completed 2 accretive organic 26% growth projects Completed 3 third-party acquisitions Targeting $100 million of EBITDA* from organic projects to be implemented over the next 4 years 74% Augment organic growth with third- party acquisitions and further drop- downs from PBF Energy Drops Organic + Acquistions *Due to the forward-looking nature of forecasted EBITDA, information to reconcile forecasted EBITDA to forecasted earnings and cash flow from operating activities is not available as management is unable to project financing terms and working capital changes for future periods at this time. 6

Organic Projects Deliver Incremental Growth Announced organic growth pipeline expected to generate $100 million of annualized EBITDA over the next four years Completed two organic projects with a total project costs of ~$82 million which are expected to contribute ~$12 million in annualized EBITDA 625,000 barrel crude oil storage tank constructed at PBF Energy’s Chalmette Refinery In-service as of November 1, 2017 24-inch Paulsboro natural gas pipeline (“PNGPL”) connects PBF Energy’s Paulsboro Refinery to natural gas sourced from Marcellus and Utica regions In-service as of August 2017 April announcement of organic projects to be completed in conjunction with Knoxville Terminals acquisition and drop-downs from PBF Energy 7

Third-Party Acquisitions Expand Asset Base Third-party transactions diversify PBFX asset and customer base Provide synergy opportunities with PBF Energy Extends PBF Logistics growth path by supplementing drop-down inventory Acquired the East Coast Terminals from Plains All American in April 2016 at a pro forma EBITDA multiple of ~7x Acquired the Toledo Terminal from Sunoco Logistics in April 2017 at a pro forma EBITDA multiple of less than ~3x Acquired the Knoxville Terminals in Knoxville, TN in April 2018 at a pro forma EBITDA multiple of ~8x following completion of organic expansion investments 8

Drop-downs provide valuable growth opportunities and synergies Drop-down transactions remain one of the pillars of PBF Logistics future growth trajectory and provide valuable synergies with PBF Energy Successfully completed 4 drop-down acquisitions Delaware West Rack Toledo Storage Delaware Pipeline and Truck Rack 50% interest in Torrance Valley Pipeline Drop-downs provide PBF Logistics with greater access to PBF Energy barrels and additional organic growth opportunities 9

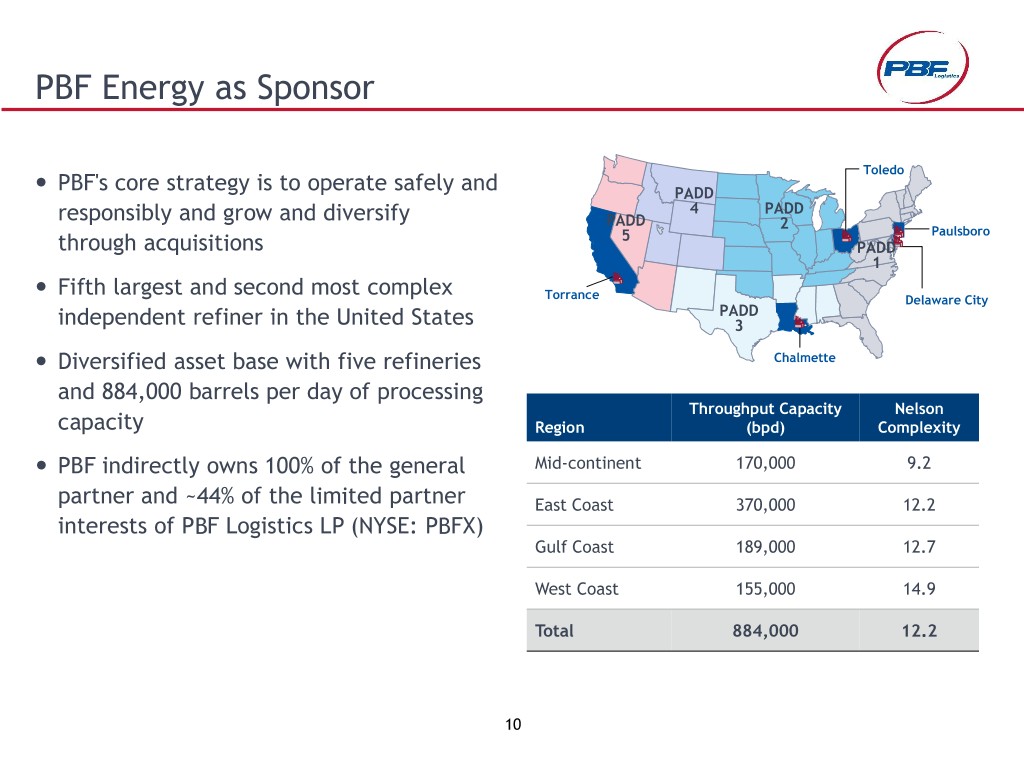

PBF Energy as Sponsor Toledo PBF's core strategy is to operate safely and PADD 4 PADD responsibly and grow and diversify PADD 2 5 Paulsboro through acquisitions PADD 1 Fifth largest and second most complex Torrance Delaware City PADD independent refiner in the United States 3 Diversified asset base with five refineries Chalmette and 884,000 barrels per day of processing Throughput Capacity Nelson capacity Region (bpd) Complexity PBF indirectly owns 100% of the general Mid-continent 170,000 9.2 partner and ~44% of the limited partner East Coast 370,000 12.2 interests of PBF Logistics LP (NYSE: PBFX) Gulf Coast 189,000 12.7 West Coast 155,000 14.9 Total 884,000 12.2 10

PBFX’s Investment Highlights Maintain stable cash flow generation through predominantly long-term Focus on Stable, contracts with minimum volume commitments Take-or-Pay Commitment to safe and reliable operations Business No direct commodity price exposure Conservative financial profile with an emphasis on liquidity Financial Flexibility Demonstrated ability to access capital markets Long-term net debt-to-EBITDA target of between 3x and 4x Invest in organic projects and asset optimization Grow the Business Pursue third-party acquisitions focused on traditional MLP assets Support growth of PBF through additional drop-down transactions Target 1.15x long-term annual coverage ratio Distributable Financial flexibility for continued distribution growth Cash Flow Retain earnings to grow business 11

Appendix

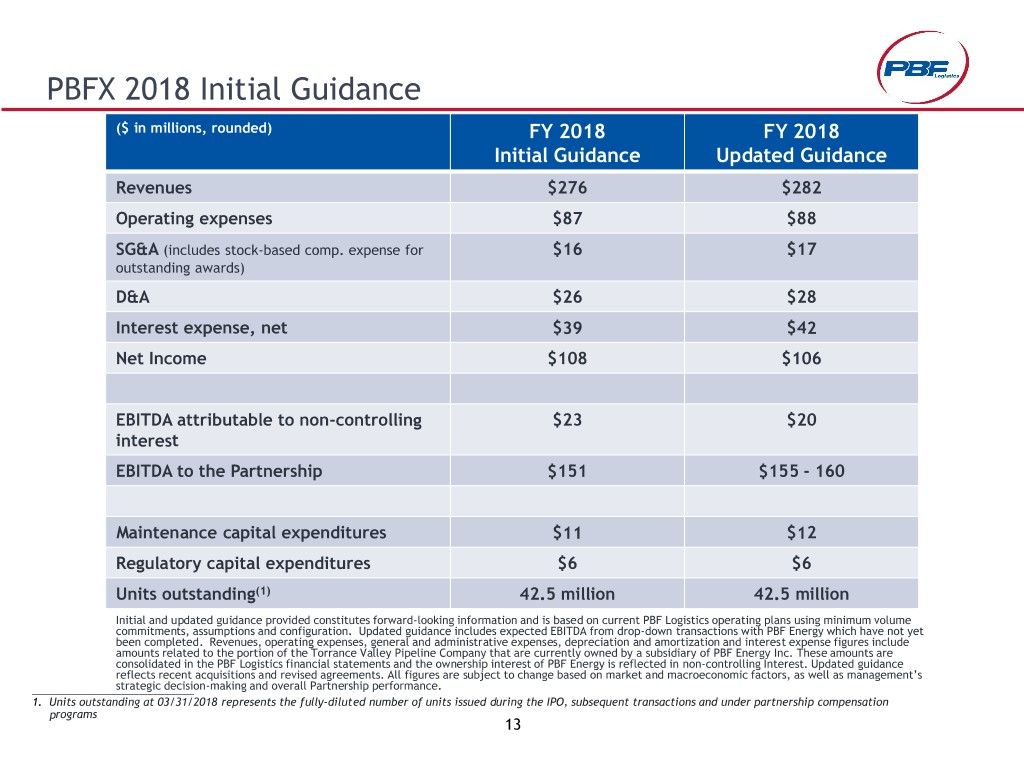

PBFX 2018 Initial Guidance ($ in millions, rounded) FY 2018 FY 2018 Initial Guidance Updated Guidance Revenues $276 $282 Operating expenses $87 $88 SG&A (includes stock-based comp. expense for $16 $17 outstanding awards) D&A $26 $28 Interest expense, net $39 $42 Net Income $108 $106 EBITDA attributable to non-controlling $23 $20 interest EBITDA to the Partnership $151 $155 - 160 Maintenance capital expenditures $11 $12 Regulatory capital expenditures $6 $6 Units outstanding(1) 42.5 million 42.5 million Initial and updated guidance provided constitutes forward-looking information and is based on current PBF Logistics operating plans using minimum volume commitments, assumptions and configuration. Updated guidance includes expected EBITDA from drop-down transactions with PBF Energy which have not yet been completed. Revenues, operating expenses, general and administrative expenses, depreciation and amortization and interest expense figures include amounts related to the portion of the Torrance Valley Pipeline Company that are currently owned by a subsidiary of PBF Energy Inc. These amounts are consolidated in the PBF Logistics financial statements and the ownership interest of PBF Energy is reflected in non-controlling Interest. Updated guidance reflects recent acquisitions and revised agreements. All figures are subject to change based on market and macroeconomic factors, as well as management’s ___________________________strategic decision-making and overall Partnership performance. 1. Units outstanding at 03/31/2018 represents the fully-diluted number of units issued during the IPO, subsequent transactions and under partnership compensation programs 13

Non-GAAP Financial Measures The Partnership defines EBITDA as net income (loss) before net interest expense, income tax expense, depreciation and amortization expense. We define EBITDA attributable to PBFX as net income (loss) attributable to PBFX before net interest expense, income tax expense, depreciation and amortization expense attributable to PBFX, which excludes the results attributable to noncontrolling interests and acquisitions from affiliate companies under common control prior to the effective dates of such transactions. We define distributable cash flow (“DCF”) as EBITDA attributable to PBFX plus non-cash unit-based compensation expense, less net cash paid for interest, maintenance capital expenditures and income taxes. Distributable cash flow will not reflect changes in working capital balances. EBITDA and DCF are non-GAAP supplemental financial measures that management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess: • our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; • the ability of our assets to generate sufficient cash flow to make distributions to our unit holders; • our ability to incur and service debt and fund capital expenditures; and • the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. The Partnership’s management believes that the presentation of EBITDA, EBITDA attributable to PBFX and DCF provide useful information to investors in assessing our financial condition and results of operations. EBITDA, EBITDA attributable to PBFX and distributable cash flow should not be considered alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA, EBITDA attributable to PBFX and distributable cash flow have important limitations as analytical tools because they exclude some but not all items that affect net income and net cash provided by operating activities. Additionally, because EBITDA, EBITDA attributable to PBFX and distributable cash flow may be defined differently by other companies in our industry, our definition of such matters may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Due to the forward- looking nature of forecasted or estimated EBITDA, information to reconcile forecasted or estimated EBITDA to forecasted cash flow from operating activities is not available as management is unable to project working capital changes for future periods at this time. 14

Non-GAAP Financial Measures PBF Logistics LP reconciliation of amounts under U.S. GAAP to estimated run-rate annualized EBITDA (unaudited, in millions), please see note below: Reconciliation of combined Toledo Products Terminal and announced organic projects estimated annualized net income to estimated run-rate EBITDA: Estimated net income $9.3 Add: Depreciation and amortization expense 4.7 Add: Interest expense, net and other financing costs 1.0 Forecasted annualized EBITDA $15.0 Reconciliation of East Coast Terminals estimated annualized net income to estimated run-rate annualized EBITDA: Estimated net income $8.7 Add: Depreciation and amortization expense 5.3 Add: Interest expense, net and other financing costs 1.0 Forecasted annualized EBITDA $15.0 Reconciliation of TVPC estimated annualized net income to forecasted estimated run-rate EBITDA: Estimated net income $9.4 Add: Depreciation and amortization expense 9.0 Add: Interest expense, net and other financing costs 1.6 Forecasted annualized EBITDA $20.0 Reconciliation of Knoxville Terminals, drop-downs and projects estimated annualized net income to estimated annualized run-rate EBITDA: Estimated net income $10.4 Add: Depreciation and amortization expense 3.8 Add: Interest expense, net and other financing costs 3.9 Forecasted annualized EBITDA $18.1 Reconciliation of two organic projects forecasted annual net income to forecasted annual EBITDA: Estimated net income $7.2 Add: Depreciation and amortization expense 4.1 Add: Interest expense, net and other financing costs 0.9 Forecasted annualized EBITDA $12.2 Note: Due to the forward-looking nature of forecasted or estimated EBITDA, information to reconcile forecasted or estimated EBITDA to forecasted cash flow from certain projects or organic growth opportunities is not available as management is unable to project working capital changes for future periods at this time. 15

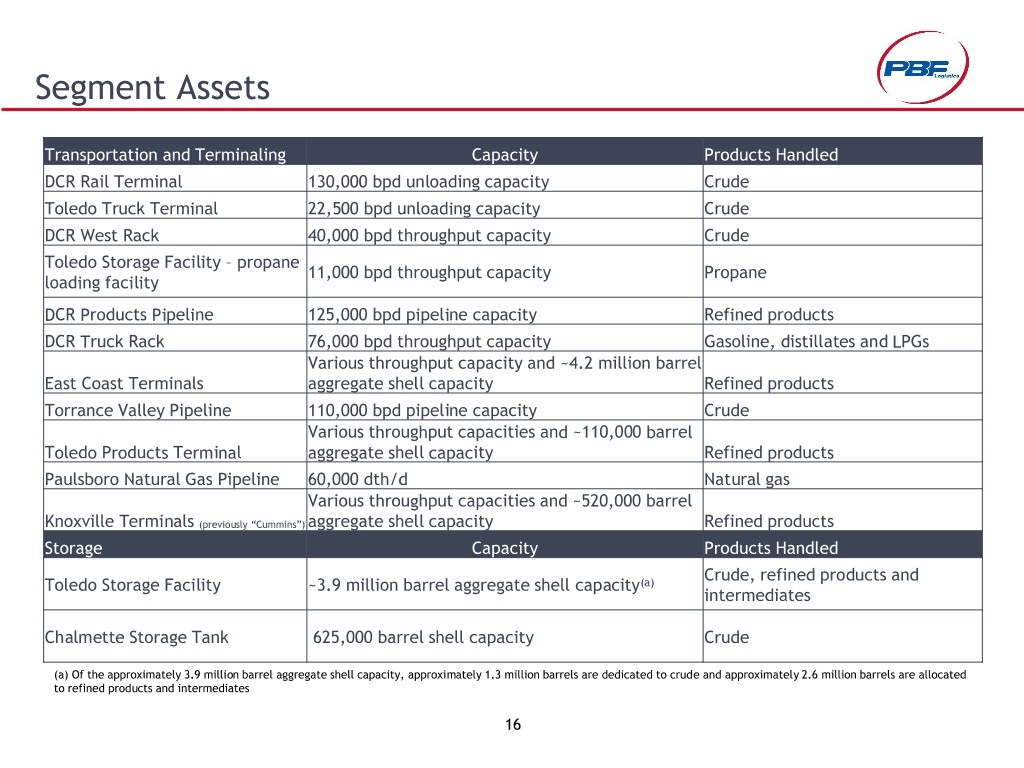

Segment Assets Transportation and Terminaling Capacity Products Handled DCR Rail Terminal 130,000 bpd unloading capacity Crude Toledo Truck Terminal 22,500 bpd unloading capacity Crude DCR West Rack 40,000 bpd throughput capacity Crude Toledo Storage Facility – propane 11,000 bpd throughput capacity Propane loading facility DCR Products Pipeline 125,000 bpd pipeline capacity Refined products DCR Truck Rack 76,000 bpd throughput capacity Gasoline, distillates and LPGs Various throughput capacity and ~4.2 million barrel East Coast Terminals aggregate shell capacity Refined products Torrance Valley Pipeline 110,000 bpd pipeline capacity Crude Various throughput capacities and ~110,000 barrel Toledo Products Terminal aggregate shell capacity Refined products Paulsboro Natural Gas Pipeline 60,000 dth/d Natural gas Various throughput capacities and ~520,000 barrel Knoxville Terminals (previously “Cummins”) aggregate shell capacity Refined products Storage Capacity Products Handled Crude, refined products and Toledo Storage Facility ~3.9 million barrel aggregate shell capacity(a) intermediates Chalmette Storage Tank 625,000 barrel shell capacity Crude (a) Of the approximately 3.9 million barrel aggregate shell capacity, approximately 1.3 million barrels are dedicated to crude and approximately 2.6 million barrels are allocated to refined products and intermediates 16

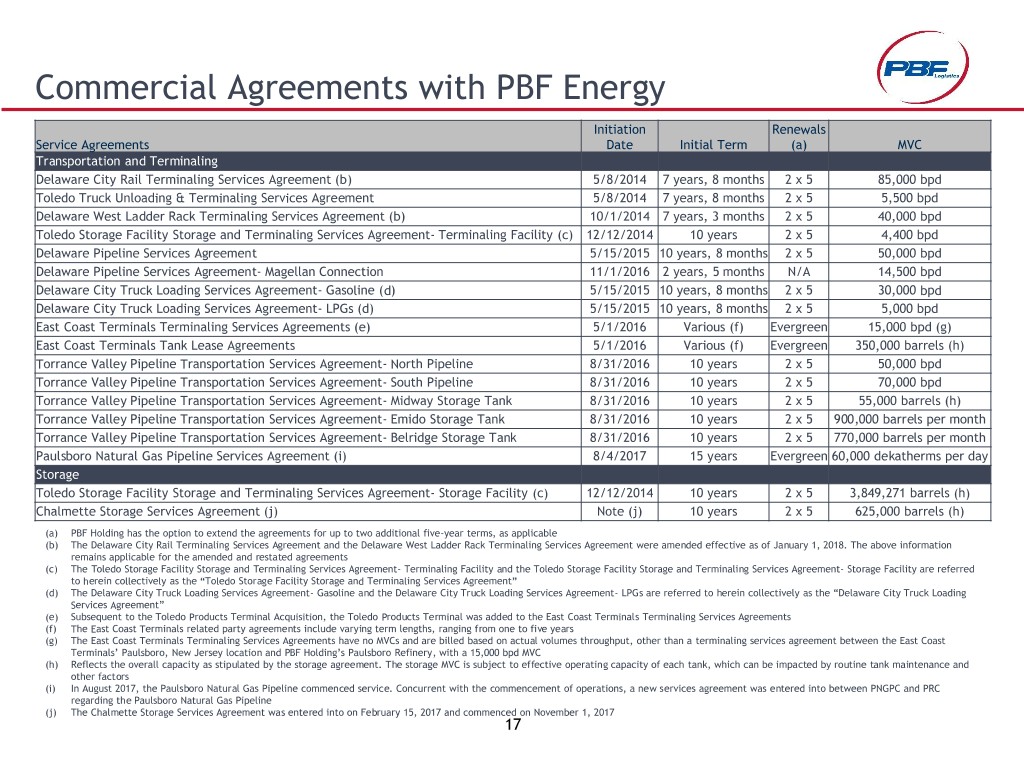

Commercial Agreements with PBF Energy Initiation Renewals Service Agreements Date Initial Term (a) MVC Transportation and Terminaling Delaware City Rail Terminaling Services Agreement (b) 5/8/2014 7 years, 8 months 2 x 5 85,000 bpd Toledo Truck Unloading & Terminaling Services Agreement 5/8/2014 7 years, 8 months 2 x 5 5,500 bpd Delaware West Ladder Rack Terminaling Services Agreement (b) 10/1/2014 7 years, 3 months 2 x 5 40,000 bpd Toledo Storage Facility Storage and Terminaling Services Agreement- Terminaling Facility (c) 12/12/2014 10 years 2 x 5 4,400 bpd Delaware Pipeline Services Agreement 5/15/2015 10 years, 8 months 2 x 5 50,000 bpd Delaware Pipeline Services Agreement- Magellan Connection 11/1/2016 2 years, 5 months N/A 14,500 bpd Delaware City Truck Loading Services Agreement- Gasoline (d) 5/15/2015 10 years, 8 months 2 x 5 30,000 bpd Delaware City Truck Loading Services Agreement- LPGs (d) 5/15/2015 10 years, 8 months 2 x 5 5,000 bpd East Coast Terminals Terminaling Services Agreements (e) 5/1/2016 Various (f) Evergreen 15,000 bpd (g) East Coast Terminals Tank Lease Agreements 5/1/2016 Various (f) Evergreen 350,000 barrels (h) Torrance Valley Pipeline Transportation Services Agreement- North Pipeline 8/31/2016 10 years 2 x 5 50,000 bpd Torrance Valley Pipeline Transportation Services Agreement- South Pipeline 8/31/2016 10 years 2 x 5 70,000 bpd Torrance Valley Pipeline Transportation Services Agreement- Midway Storage Tank 8/31/2016 10 years 2 x 5 55,000 barrels (h) Torrance Valley Pipeline Transportation Services Agreement- Emido Storage Tank 8/31/2016 10 years 2 x 5 900,000 barrels per month Torrance Valley Pipeline Transportation Services Agreement- Belridge Storage Tank 8/31/2016 10 years 2 x 5 770,000 barrels per month Paulsboro Natural Gas Pipeline Services Agreement (i) 8/4/2017 15 years Evergreen 60,000 dekatherms per day Storage Toledo Storage Facility Storage and Terminaling Services Agreement- Storage Facility (c) 12/12/2014 10 years 2 x 5 3,849,271 barrels (h) Chalmette Storage Services Agreement (j) Note (j) 10 years 2 x 5 625,000 barrels (h) (a) PBF Holding has the option to extend the agreements for up to two additional five-year terms, as applicable (b) The Delaware City Rail Terminaling Services Agreement and the Delaware West Ladder Rack Terminaling Services Agreement were amended effective as of January 1, 2018. The above information remains applicable for the amended and restated agreements (c) The Toledo Storage Facility Storage and Terminaling Services Agreement- Terminaling Facility and the Toledo Storage Facility Storage and Terminaling Services Agreement- Storage Facility are referred to herein collectively as the “Toledo Storage Facility Storage and Terminaling Services Agreement” (d) The Delaware City Truck Loading Services Agreement- Gasoline and the Delaware City Truck Loading Services Agreement- LPGs are referred to herein collectively as the “Delaware City Truck Loading Services Agreement” (e) Subsequent to the Toledo Products Terminal Acquisition, the Toledo Products Terminal was added to the East Coast Terminals Terminaling Services Agreements (f) The East Coast Terminals related party agreements include varying term lengths, ranging from one to five years (g) The East Coast Terminals Terminaling Services Agreements have no MVCs and are billed based on actual volumes throughput, other than a terminaling services agreement between the East Coast Terminals’ Paulsboro, New Jersey location and PBF Holding’s Paulsboro Refinery, with a 15,000 bpd MVC (h) Reflects the overall capacity as stipulated by the storage agreement. The storage MVC is subject to effective operating capacity of each tank, which can be impacted by routine tank maintenance and other factors (i) In August 2017, the Paulsboro Natural Gas Pipeline commenced service. Concurrent with the commencement of operations, a new services agreement was entered into between PNGPC and PRC regarding the Paulsboro Natural Gas Pipeline (j) The Chalmette Storage Services Agreement was entered into on February 15, 2017 and commenced on November 1, 2017 17