Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Commercial Vehicle Group, Inc. | a8kbrileymay2018.htm |

Patrick Miller Commercial Vehicle Group, Inc. President and CEO May 23, 2018 Tim Trenary Chief Financial Officer Terry Hammett Treasurer and VP Investor Relations

Forward Looking Statements This presentation contains forward-looking statements that are subject to risks and uncertainties. These statements often include words such as "believe", "expect", "anticipate", "intend", "plan", "estimate", or similar expressions. In particular, this presentation may contain forward-looking statements about Company expectations for future periods with respect to its plans to improve financial results and to enhance the Company, the future of the Company’s end markets, Class 8 and Class 5-7 North America build rates, performance of the global construction and agriculture equipment business, expected cost savings, the Company’s initiatives to address customer needs, organic growth, the Company’s economic growth plans to focus on certain segments and markets and the Company’s financial position or other financial information. These statements are based on certain assumptions that the Company has made in light of its experience as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including but not limited to: (i) general economic or business conditions affecting the markets in which the Company serves or intends to serve; (ii) the Company's ability to develop or successfully introduce new products; (iii) risks associated with conducting business in foreign countries and currencies; (iv) increased competition in the medium- and heavy-duty truck, construction, agriculture, aftermarket, military, bus and other markets; (v) the Company’s failure to complete or successfully integrate strategic acquisitions; (vi) the impact of changes in governmental regulations on the Company's customers or on the Company’s business; (vii) the loss of business from a major customer, a collection of smaller customers or the discontinuation of particular commercial vehicle platforms; (viii) security breaches and other disruptions to our information systems and/or our business; (ix) the Company’s ability to obtain future financing due to changes in the capital markets or Company’s financial position; (x) the Company’s ability to comply with the financial covenants in its debt facilities; (xi) fluctuation in interest rates relating to the Company's debt facilities; (xii) the Company’s ability to realize the benefits of its cost reduction and strategic initiatives; (xiii) a material weakness in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements; (xiv) volatility and cyclicality in the commercial vehicle market adversely affecting us; (xv) the geographic profile of our taxable income and changes in valuation of our deferred tax assets and liabilities impacting our effective tax rate; (xvi) changes to domestic manufacturing initiatives; (xvii) implementation of tax or other changes, by the United States or other international jurisdictions, related to products manufactured in one or more jurisdictions where we do business; and (xviii) various other risks as outlined under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for fiscal year ending December 31, 2017. There can be no assurance that statements made in this presentation relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements. pg | 1

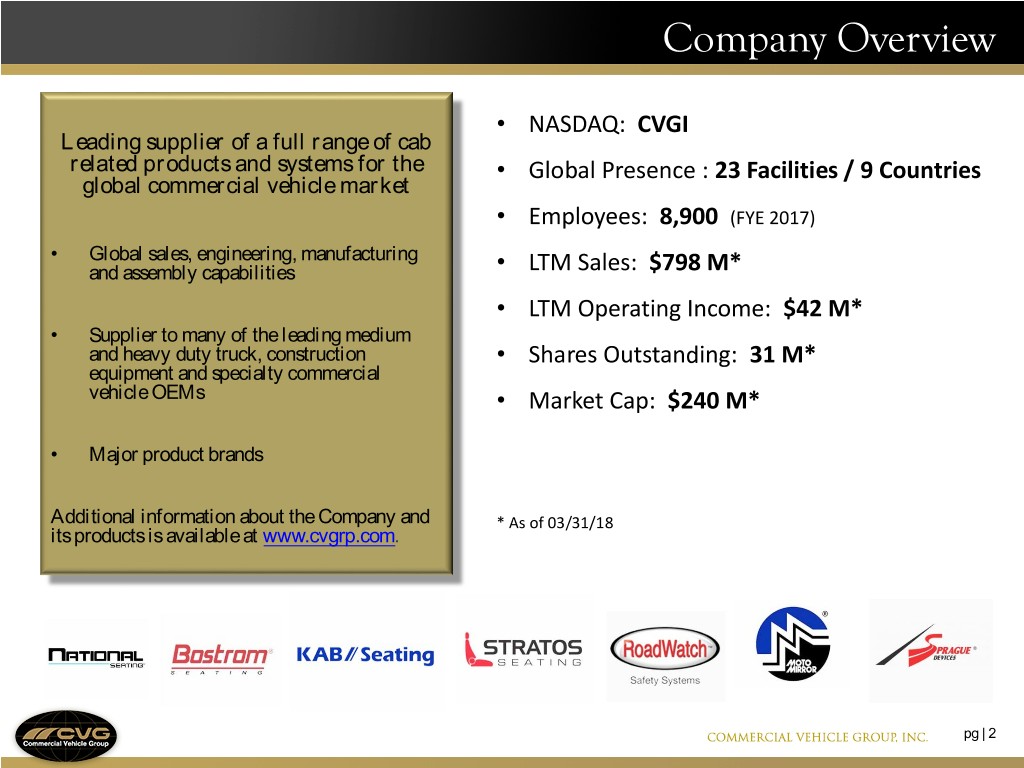

Company Overview • NASDAQ: CVGI Leading supplier of a full range of cab related products and systems for the • Global Presence : 23 Facilities / 9 Countries global commercial vehicle market • Employees: 8,900 (FYE 2017) • Global sales, engineering, manufacturing and assembly capabilities • LTM Sales: $798 M* • LTM Operating Income: $42 M* • Supplier to many of the leading medium and heavy duty truck, construction • Shares Outstanding: 31 M* equipment and specialty commercial vehicle OEMs • Market Cap: $240 M* • Major product brands Additional information about the Company and * As of 03/31/18 its products is available at www.cvgrp.com. pg | 2

Products Seats & Seating Wire Harnesses & Systems Controls Interior Trim Wiper Systems, Cabs and Sleeper Boxes Mirrors & Controls pg | 3

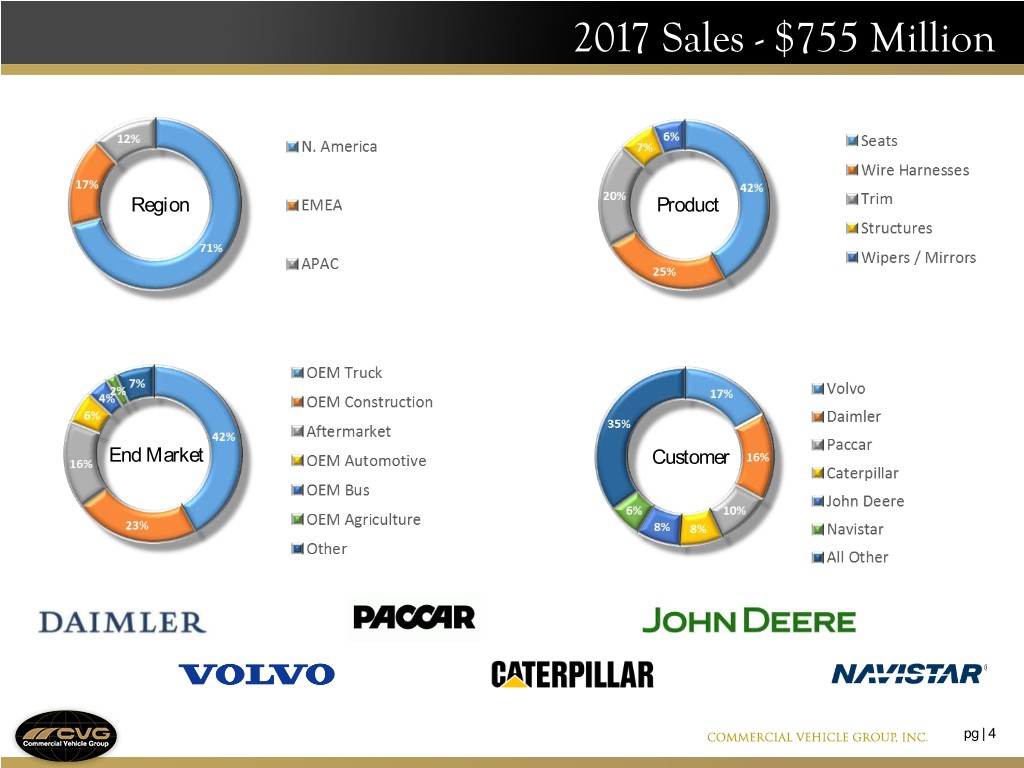

2017 Sales - $755 Million Region Product End Market Customer pg | 4

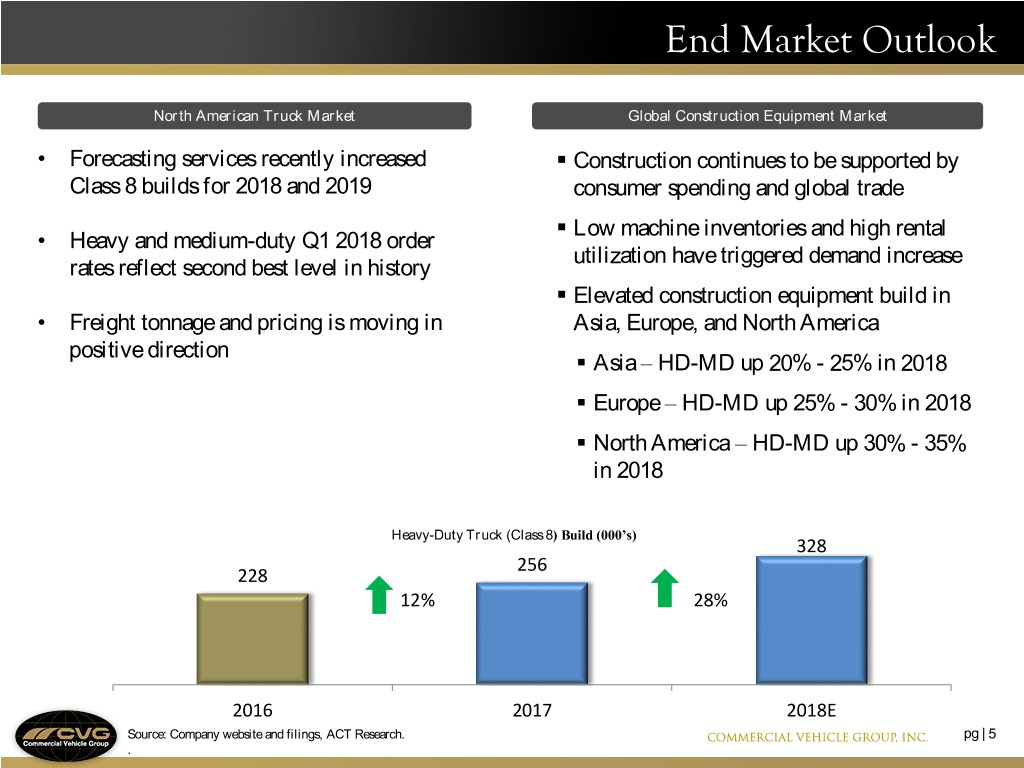

End Market Outlook North American Truck Market Global Construction Equipment Market • Forecasting services recently increased . Construction continues to be supported by Class 8 builds for 2018 and 2019 consumer spending and global trade . Low machine inventories and high rental • Heavy and medium-duty Q1 2018 order utilization have triggered demand increase rates reflect second best level in history . Elevated construction equipment build in • Freight tonnage and pricing is moving in Asia, Europe, and North America positive direction . Asia – HD-MD up 20% - 25% in 2018 . Europe – HD-MD up 25% - 30% in 2018 . North America – HD-MD up 30% - 35% in 2018 Heavy-Duty Truck (Class 8) Build (000’s) 328 256 228 12% 28% 2016 2017 2018E Source: Company website and filings, ACT Research. pg | 5 .

Driving Efficiencies CVG Digital . Digitalize process control, production reporting, and error proofing . Cloud-based manufacturing and engineering systems . Technology upgrades to wire harness production . Expect efficiency and quality improvements; reduction of working capital Process investments . Launched new interior trim automation in North America . High volume seat assembly cells in US and Europe . Wire harness capabilities in multiple regions . Lean Six Sigma program (Operational Excellence) – training and 18%program Fewer expansion continues globally Sales 18% Fewer Sales 18% Fewer Sales pg | 6

CVG Digital Actions Built-in Quality – Digital error proofing and smart processes Virtual Wiring Boards for rapid changeover Real time process Piloting improved process18% Fewer monitoring and applications using cobots andSales data tracking google glass technology 18% Fewer Sales 18% Fewer Sales pg | 7

Targets for Growth Global Truck and Bus Next Gen NA truck seat in production and quoting additional OEM platforms; Asia growth opportunities with locally produced products; Electronic options for seats, wipers, and interior trim. Wire harnesses – North America, Europe and Asia Expanding capacity in Wire Harness – Digital vehicle architecture New off-road seating product lines increasing harness needs; penetrating power train, power generation, Construction and Ag seats available now (“SCIOX”) and currently and industrial markets; exploring extension into digital components in development programs with major OEMs; modular product allows customization for various applications. M&A could facilitate growth pg | 8

Why CVGI? • Global capabilities • Strong customer relationships • Product design and customer support • Major product brands • Improved process discipline – Lean Six Sigma • CVG Digital • 2018 and 2019 market outlook is positive pg | 9

Finance Update

Financial Results (Dollars in millions) Q1 2017 Q1 2018 Sales $ 173.4 $ 215.7 Up 24% Gross Profit $ 21.5 $ 31.1 Build volumes, commodity prices and Margin 12.4 % 14.4 % labor markets SG&A $ 16.6 $ 15.3 Cost discipline in rising sales environment Operating Income $ 4.6 $ 15.5 Margin 2.6 % 7.2 % N.A. Class 8 Production (000's) 51 74 Up 45% N.A. Class 5 - 7 Production (000's) 64 65 pg | 11

Business Segments - GTB Global Truck & Bus (Dollars in millions) Q1 2017 Q1 2018 Sales $ 102.1 $ 128.3 Up 26% Gross Profit $ 14.0 $ 19.0 Build volumes and commodity prices Margin 13.8 % 14.8 % SG&A $ 5.5 $ 5.5 Cost discipline in rising sales environment Operating Income $ 8.3 $ 13.2 Margin 8.1 % 10.3 % pg | 12

Business Segments - GCA Global Construction and Agriculture (Dollars in millions) Q1 2017 Q1 2018 Sales $ 73.5 $ 91.2 Up 24% Gross Profit $ 7.8 $ 12.5 Sales volume, commodity prices and Margin 10.6 % 13.8 % labor markets SG&A $ 4.5 $ 4.3 Cost discipline in rising sales environment Operating Income $ 3.3 $ 8.2 Margin 4.5 % 9.0 % pg | 13

Capital Structure LTM (Dollars in millions) Q1 2018 Term Loan Principal Balance $ 172 Debt $ 179 Interest Rate LIBOR + 600 Less: Cash 38 Maturity April 2023 Net Debt $ 141 Interest Rate Swap $ 80 EBITDA $ 59 Interest Rate 8.07% Maturity April 2022 Gross Leverage 3.0 x Net Leverage 2.4 x Asset Based Credit Facility Commitment $ 65 Amount Borrowed $ 7 Liquidity: Letters of Credit $ 2 Cash $ 38 Availability $ 56 ABL Borrowing Base 58 Accordion $ 40 Less: LOC (2) Liquidity $ 94 Agency Ratings Moody's B2 / Stable S&P B / Stable Capital Allocation: 1.) liquidity 2.) growth 3.) de-leverage 4.) return capital to shareholders See appendix for reconciliation of GAAP to non-GAAP financial measures pg | 14

Patrick Miller Commercial Vehicle Group, Inc. President and CEO May 23, 2018 Tim Trenary Chief Financial Officer Terry Hammett Treasurer and VP Investor Relations

Appendix GAAP to Non-GAAP Reconciliation

GAAP to Non-GAAP Reconciliation EBITDA Reconciliation LTM (Dollars in millions) Q1 2018 Net Income $ 7.5 Interest Expense 16.8 Tax Provision 19.7 Depreciation 13.9 Amortization 1.3 EBITDA $ 59.2 pg | 17