Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Usio, Inc. | pyds_8-kx2018x21x05present.htm |

Investor Presentation May 2018

Forward looking statements These slides and any accompanying oral presentation contain forward-looking information presently available to the Company’s management. The Company statements within the meaning of the Private Securities Litigation Reform Act of disclaims any obligation to update these forward-looking statements, except 1995 and other Federal securities laws. These forward-looking statements are as required by law. The Company has filed a Registration Statement (including identified by the use of words such as “believe,” “expect,” “prepare,” “anticipate,” a preliminary prospectus) with the Securities and Exchange Commission (SEC) “target,” “launch,” and “create,” or similar expressions are used, including for the offering for which this presentation relates. Before you invest, you statements about commercial operations, technology progress, growth and future should read the preliminary prospectus contained in the Company’s financial performance of Payment Data Systems, Inc. and its subsidiaries (the Registration Statement, any amendments or supplements thereto and other “Company”). Forward-looking statements in this presentation are subject to certain documents the Company has filed with the SEC for more complete risks and uncertainties inherent in the Company’s business that could cause actual information about the Company and this offering. The preliminary prospectus results to vary, including such risks that the Company’s security applications may be and the Registration Statement may be accessed through the SEC’s website at insufficient; the Company’s ability to adapt to rapid technological change; adverse www.sec.gov. Alternatively, the Company, any underwriter or any dealer effects on the Company’s relationships with Automated Clearing House, bank participating in the offering will arrange to send you the preliminary sponsors and credit card associations; the Company’s ability to comply with federal prospectus and any amendments or supplements thereto if you request it or state regulations; the Company’s exposure to credit risks, data breaches, fraud or through Maxim Group LLC, 405 Lexington Ave, New York, NY 10174, Attn: software failures, and other risks detailed from time to time in the company’s filings Prospectus Department or by Tel: (800) 724-0761. This presentation contains with the Securities and Exchange Commission including its annual report on Form statistics and other data that has been obtained from or compiled from 10-K for the year ended December 31, 2016. One or more of these factors have information made available by third parties service providers. The Company affected, and in the future could affect, the Company’s businesses and financial has not independently verified such statistics or data. The information results and could cause actual results to differ materially from plans and presented in this presentation is as of December 19, 2017 unless indicated projections. All forward-looking statements made in this release are based on otherwise. 5/21/2018 Payment Data Systems | paymentdata.com 2

Payment Data Systems is a leading integrated payment solutions provider, offering a wide range of payment solutions to merchants, billers, banks, service bureaus, and card issuers. We operate Overview credit, debit/prepaid and ACH payment processing platforms to deliver convenient, world-class payment solutions and service to our clients. Our strength lies in our ability to provide tailored solutions for card issuance, payment acceptance, and bill payments as well as in our unique technology in the prepaid sector. 5/21/2018 Payment Data Systems | paymentdata.com 3

Investor Highlights PRICE (5/18/18) $1.75 52 WEEK RANGE $1.17 - $4.10 MARKET CAP $28.35 mm SHARES 16.2 mm OUTSTANDING DEBT $0 CASH $3.5 mm 03/31/18 FISCAL YEAR END December 31 Year Founded 1998 Headquarters San Antonio, TX & office in Franklin, TN Number of Employees 33 Website www.paymentdata.com 5/21/2018 Payment Data Systems | paymentdata.com 4

Investor Highlights • NACHA (National Automated Clearing House • Positive adjusted EBITDA¹. Association) Certified – Meeting the standards for sounds practices relative to ACH • Blue chip customers; laser focus on three main payment processing. vertices with consistent payment streams (healthcare, real estate, utilities). • Strong Balance sheet and clean capital structure with no debt. • Sustainable competitive advantages in technology and custom solutions. • Recurring revenues and attractive margins. • Senior management with a combined 50 plus years • Record credit card transaction processing of experience in the payment processing industry. volumes for Q1 2018. 5/21/2018 Payment Data Systems | paymentdata.com 5

Public Peer Analysis PRICE MARKET ENTERPRISE EV/REV COMPANY TICKER REVENUE 2017 5/2/2018 CAP VALUE 2017 FIRST DATA CORP. FDC $18.01 $16.8 B $32.7 B $7.4 M 4.4 TOTAL SYSTEM SERVICES TSS $83.25 $15.13 B $18.7 B $3.4 M 5.5 GLOBAL PAYMENTS INC. GPN $112.57 $17.95 B $21.5 B $3.5 M 6.1 SQUARE INC. SQ $48.66 $19.48 B $19.2 B $967 K 19.8 GREEN DOT CORP. GDOT $61.29 $3.17 B $2.2 B $883 K 2.5 JETPAY CORP. JTPY $2.25 $34.67 M $40.9 M $76.4 K 0.5 PAYMENT DATA SYSTEMS PYDS $1.80 $28.57 M $21.5 M $ 14.57 K 1.5 PEER AVERAGE 6.5 5/21/2018 Payment Data Systems | paymentdata.com 6

What We Do ACH Credit Card Prepaid Card Electric Bill Processing Processing Issuing Presentment& Payment (EBPP) • ACH Origination • Credit/Debit • General Purpose • Account Card Processing Reloadable • Electronic Bill Verification • Debit Card ONLY • Corporate Delivery • Account Analysis Processing Incentives/ • Check Print and Mail • Risk Mitigation • PINLess Debit Rewards • Payment by web, • Same Day • POS/Card Swipe • Open Loop phone, text, and in Services Retail Issuance person • Payment • Card-to-Card • MasterCard RPPS Facilitator Transfer • Gateway 5/21/2018 Payment Data Systems | paymentdata.com 7

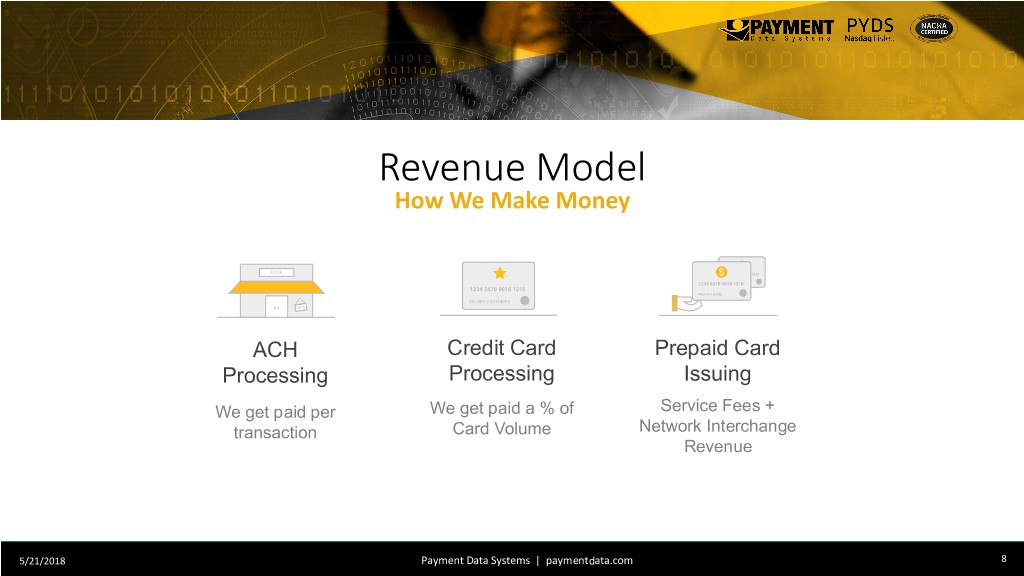

Revenue Model How We Make Money ACH Credit Card Prepaid Card Processing Processing Issuing We get paid per We get paid a % of Service Fees + transaction Card Volume Network Interchange Revenue 5/21/2018 Payment Data Systems | paymentdata.com 8

Sample Revenue Model Credit Card Acceptance - $100 Sale Processing Merchant Interchange Fee Card Brands Network Fee Net Spread Discount Rate 2.15% .11% + $.02 $.08/txn .48% 2.75% In a credit card or debit The MDR is the rate charged This is the fee paid to the After all costs Dues and Assessments card transaction, the to a merchant for payment banks who issue cards to associated with are paid directly to the Processor charges a fee processing services on debit cardholders who purchase processing a card Card Associations for the to authorize and settle and credit card transactions. goods and services from transaction have been use of the Card Brand, the funds from the The merchant must setup this merchants either on-line or satisfied, Payment and the ability to process transaction to the service and agree to the rate in brick & mortar locations. Data Systems is left credit and debit card merchant or PayFac who prior to accepting debit and with the net spread, transactions of the Visa, ultimately may have credit cards as payment. MasterCard, and in this example, .48%, responsibility for getting or $.48 out of $2.75 Discover payment funds to merchants net networks.. charged to the of costs. merchant. We Generate Revenue Across the Payment Processing Value Chain 5/21/2018 Payment Data Systems | paymentdata.com 9

Revenue Components Electronic Bill Presentment & Payment (EBPP) Card Mail Payments Flat % fee is charged against all The cost for mail is job $1 + 3% - 5% card payment volume dependent and is in addition processed to a postage pass-thru ACH/ eCheck Flat $ amount is charged for A fee is applied for all bills Email each ACH/eCheck payment delivered via email Payments $.07 - $.10 $.25 - $1 IVR Additional fee is charged on the A fee is applied for all bills Payments flat % or/and for each card or delivered via SMS/text SMS Text ACH/eCheck payment made via $.07 - $.10 $.50 - $1 IVR 5/21/2018 Payment Data Systems | paymentdata.com 10

Built for Scale < Card processing volume > < Card processing volume > Top Line Revenue Growth Contribution Margin for every $1MM x 2.65% = $26,500 = .50% x $1MM = $5,000 5/21/2018 Payment Data Systems | paymentdata.com 11

Tomorrow Today 10x increase Market Sizing Industry research shows that 3B+ 30B “payment enablement” of software cards ways to pay platforms and “internet connected” devices will dramatically expand the size of the payment landscape and growth opportunities over the next decade. 44M 400M Source: Visa Investor Day merchant locations ways to pay 5/21/2018 Payment Data Systems | paymentdata.com 12

ACH Transaction Flow ACH payments are electronic payments that are created when the customer gives an originating institution, corporation, or other customer (originator) authorization to debit directly from the customer's checking or saving account for the purpose of bill payment. Overall volume in 2016 amounted to 25.6 billion transactions and $43 Trillion in value.¹ ([1] Includes direct-send and on-us transactions reported to NACHA.) 5/21/2018 Payment Data Systems | paymentdata.com 13

• Strong sales pipeline which should result in improved revenues for the rest of 2018 • Launched Same Day ACH Debits in September 2017 (ideal for urgent bill pay, payroll, etc.) ACH Payment Summary • Late in 2017 PDS became only the 2nd processor to be NACHA Investment Highlights Certified, the first was TeleCheck • Electronic check transaction volumes during the first quarter of 2018 were up 5% over the fourth quarter of 2017, representing the third consecutive quarter of growth. • Returned check transactions processed during first quarter of 2018 were up 6% as compared to the fourth quarter of 2017. 5/21/2018 Payment Data Systems | paymentdata.com 14

Digital card platform, period. And, the first gift and incentive card available on Apple Pay, Android Pay, and Samsung. 5/21/2018 Payment Data Systems | paymentdata.com 15

Custom Prepaid Program Management – True Processor • Allows companies to launch their own next-generation Prepaid Card prepaid card solution Incentive, Promotional and Disbursement Cards Services • A fully digital way to send cards instantly by email or text, 90% cheaper than plastic cards, first prepaid card integrated with Apple Pay, Samsung Pay and Google Wallet Akimbo: Consumer Card Program • Allows consumer to share money instantly with other card holders, manage sub cards compatible with Apple Pay, Samsung Pay and Google Wallet 5/21/2018 Payment Data Systems | paymentdata.com 16

Innovative Digital Platform Deliver cards Card is immediately available Cards can be instantly by text Customer online or with Apple Pay, branded with or email collects card Android Pay & Samsung Pay logos 5/21/2018 Payment Data Systems | paymentdata.com 17

There’s Really a Prepaid Card for Everything! Refunds & Per Loan Sales Rebates Diems Disbursements Incentives Customer Corporate Insurance Employee Rewards Expenses Payments Appreciation Sales Contractor Focus Group Referral Promotions Payments Payments Rewards 5/21/2018 Payment Data Systems | paymentdata.com 18

Sample Prepaid Clients 5/21/2018 Payment Data Systems | paymentdata.com 19

Payment Facilitator Model 5/21/2018 Payment Data Systems 20

▪ Merchants rely on software to run their business, and increasingly to facilitate payment acceptance ▪ The future of payments is integrated!! PayFac Competitive ▪ PayFac does away with all the disparate systems in billing and streamlines the process of on- boarding customers (lengthy paper Value Proposition agreement down to a short click to accept). ▪ Software providers like our solutions because we allow them to participate in the revenue stream with a revenue share agreement from us, generating a stream of income where there was none before. 5/21/2018 Payment Data Systems | paymentdata.com 21

Upstream $30k+ monthly processing volume - Retail and Virtual Payments In-store On-line Retail Micro Ecommerce Micro merchants = merchants = $3k/month sales $3k/month sales volume volume 5/21/2018 Payment Data Systems 22

Key Differentiators Frictionless onboarding and enrollment Integrated payments into everyday solutions Mitigating double data entry Streamlined back office efficiencies Full bill presentment and payment solution 5/21/2018 Payment Data Systems | paymentdata.com 23

Growth Opportunity – Integrated Software Vendors (ISV’s) The U.S. has tens of < +122% / > Thousands of ISVS According to TSG’s database of The U.S. market holds a treasure 3.5 million merchants, trove of ISVs that are sought after processing through ISV by merchant acquirers for relationships grew 122% from partnership and acquisition 2010 to 2017, and that trend is expected to continue. 5/21/2018 Payment Data Systems | paymentdata.com 24

Our Vertical Focus Healthcare Insurance Utility/Government Other Bill Pay Verticals Property Management 5/21/2018 Payment Data Systems | paymentdata.com 25

Integration Environment Software providers are able to access needed payment solutions and technology through the PDS “Integration Layer”, providing for the most seamless, user-friendly, and cost-effective payment acceptance experience. 5/21/2018 Payment Data Systems | paymentdata.com 26

Competitive Landscape Setup Cost $0 $0 $0 $0 $0 Monthly Cost $0 $0 $0 $0 $0 Transaction Fees 2.9% + $0.30 2.9% + $0.30 3.5% + $0.15 3% + $0.12 $0.00 Total Monthly Cost $117 $117 $120 $102 $87 Effective Rate 3.90% 3.90% 4% 3.4% 2.89% FLAT Prepaid X X X X ACH X 0.8% · $5 cap X $0.37 $0.15 - $1.00* Batch Board Interface X X X X Total Monthly Cost is based on a $30 average ticket and $3k monthly sales volume. 5/21/2018 Payment Data Systems | paymentdata.com 27

Traditional Customer Acquisition Model (ISO) 5/21/2018 Payment Data Systems | paymentdata.com 28

PayFac Model 5/21/2018 Payment Data Systems | paymentdata.com 29

Growth Strategies Organic Strategic M&A 1. Expand ACH banking relationships 1. Acquire accretive credit card processing portfolios 2. Continuous innovation of our payment processing platform 2. Acquire companies that have complimentary or differentiated 3. Increase brand-awareness for products and services Prepaid Services (B2B and B2C) 3. Singular Acquisition closed in September 2017

Revenue Run Rate $30.00 *USD millions $25.00 $24.00 $20.00 $14.38 $14.57 $15.00 $13.40 $12.08 $10.00 $7.34 $5.18 $5.00 $- 2012 2013 2014 2015 2016 2017 2018 Revenue Run Rate (Million) 5/21/2018 Payment Data Systems 31

Transactions Processed per year 3500 3300 16 Millions 2978 2916 3000 2830 14 2500 12 10 2000 8 *Over $2.8 1500 6 Billion dollars processed in 1000 4 630 2017 and over 500 2 10.8 million in 0 0 transactions 2013 2014 2015 2016 2017 Dollars Processed Transactions Processed 5/21/2018 Payment Data Systems | paymentdata.com 32

• Established provider of ACH and credit card payment processing in niche verticals • Credit card transaction processing volumes continue to be at highest levels in the history of the company • Record last quarter $5.6MM – annual revenue run rate of $22 million Summary • Recurring revenues and attractive margins (23.2% gross margins, -4.2% EBTIDA margins) • Blue chip customers • Senior management with a combined 50 plus years of experience in the payment processing industry. • Strong balance sheet, clean capital structure, $41 million NOL 5/21/2018 Payment Data Systems | paymentdata.com 33

Louis Hoch Co-founder, Vice-Chairman, President, Chief Executive Officer, Chief Operating Officer Vaden Landers Senior Vice President, Chief Revenue Officer Tom Jewell Senior Vice President, Chief Financial Officer Houston Frost Senior Vice President, Prepaid Services 5/21/2018 Payment Data Systems | paymentdata.com 34

APPENDIX 5/21/2018 Payment Data Systems | paymentdata.com 35

Management Louis A. Hoch, Co-founder, Vice-Chairman, Chief Executive Officer, COO 25 years of senior management experience, expert in payment processing and service bureau operations. Previously co-founded Billserv, Inc., (the industry leader in Electronic Bill Presentment and Payment, acquired by American Express). Held various key management positions with U.S. Long Distance (NASDAQ:USLD), Billing Concepts (NASDAQ:BILL) and Andersen Consulting (NYSE:ACN). Holds inventor status on U.S. Patent “System and method for managing and processing stored-value cards and bill payment therefrom”. Mr. Hoch holds a BBA in computer information systems and a MBA in international business management, both from Our Lady of the Lake University. Vaden Landers, Executive Vice President, Chief Revenue Officer 30+ years of experience in the payments industry. Former Chairman of Singular Payments, currently serves as Strategic Advisor for MAPP Advisors. Held executive and board positions in multiple companies, including as director for SparkBase, as CEO for ProfitPoint, Inc., as Chief Marketing Officer for iPayment, Inc. (NASDAQ: IPMT), as President for Global Payments (NYSE: GPN) and as President and CEO for Bancard Consulting Group 5/21/2018 Payment Data Systems | paymentdata.com 36

Management Tom Jewell, CPA, Senior Vice President, Chief Financial Officer 35 years of business leadership experience focused on management, auditing, accounting, internal controls, and finance. Founder of LTJ Financial Consulting, formerly served as CFO for a multi-state photography studio chain, provided financial leadership to divisional units of RadioShack, Verizon and Kentucky Fried Chicken. Began his career at Touche Ross (Deloitte). Mr. Jewell holds a BBA in accounting from Marshall University and MBA in finance from Bellarmine University. Houston Frost, PhD Senior Vice President, Corporate and Prepaid Development Prior to joining PDS in December 2014, Mr. Frost served as President, Chief Executive Officer and Director of Akimbo Financial, Inc. since its inception in January 2010, worked on the fixed-income strategy team at JPMorgan Chase & Co., Ph.D. in Chemical and Biological Engineering from Northwestern University 5/21/2018 Payment Data Systems | paymentdata.com 37

USD Millions Account 12/31/17 Cash $4.8 Balance Sheet Restricted cash & Settlement funds $53.0 Total Assets $67.4 Highlights Short-term/long-term debt - Total Liabilities $54.3 Total Equity $13.1 ~$41 million in unused tax NOL carry-forward 5/21/2018 Payment Data Systems | paymentdata.com 38

Income Statement Highlights USD Millions Q4 2017 Annual 2017 Revenues $5.6 $14.6 Cost of sales 4.3 10.8 Gross Profit $1.3 $3.7 SG&A 1.9 4.3 Depreciation & Amortization .4 1.3 Income tax benefit (expense) (0.2) (.3) Net Loss $(1.3) $(3.0) Adjusted EBITDA $(274k) $(611k) See Non-GAAP Reconciliation in the Appendix

Non-GAAP Three Months Ended Twelve Months Ended Reconciliation December 31, December 31, December 31, December 31, 2017 2016 2017 2016 Reconciliation from Operating Income (Loss) to Adjusted EBITDA: Operating Income (Loss) $(1,073,942) $ (284,043) $ (2,837,016) $ (1,360,573) Depreciation and amortization 487,525 226,064 1,258,132 901,600 EBITDA (586,417) (57,979) (1,578,884) (458,973) Non-cash stock-based compensation expense, net 312,256 262,855 968,141 1,053,570 Adjusted EBITDA $ (274,161) $ 204,876 $ (610,743) $ 594,597 Calculation of Adjusted EBITDA margins: Revenues $ 5,621,120 $ 2,890,332 $ 14,571,158 $ 12,076,358 Adjusted EBITDA (274,161) 204,876 (610,743) 594,597 Adjusted EBITDA margins -4.9% 7.1% -4.2% 4.9% 5/21/2018 Payment Data Systems | paymentdata.com 40