Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Independent Bank Group, Inc. | form8-kibgkbwtexasfieldtri.htm |

Exhibit 99.1 KBW Texas Field Trip May 2018 David Brooks, Chairman, CEO and President Michelle Hickox, EVP and CFO

Safe Harbor Statement From time to time, our comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements can be identified by words such as “believes,” “anticipates,” “expects,” “forecast,” “guidance,” “intends,” “targeted,” “continue,” “remain,” “should,” “may,” “plans,” “estimates,” “will,” “will continue,” “will remain,” variations on such words or phrases, or similar references to future occurrences or events in future periods; however, such words are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, and other financial items; (ii) statements of plans, objectives, and expectations of Independent Bank Group or its management or Board of Directors; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Forward-looking statements are based on Independent Bank Group’s current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Independent Bank Group’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Many possible events or factors could affect our future financial results and performance and could cause such results or performance to differ materially from those expressed in forward looking statements. These factors include, but are not limited to, the following: (1) The Company’s ability to sustain its current internal growth rate and total growth rate; (2) changes in geopolitical, business and economic events, occurrences and conditions, including changes in rates of inflation or deflation, nationally, regionally and in the Company’s target markets, particularly in Texas and Colorado; (3) worsening business and economic conditions nationally, regionally and in the Company’s target markets, particularly in Texas and Colorado, and the geographic areas in those states in which the Company operates; (4) the Company’s dependence on its management team and its ability to attract, motivate and retain qualified personnel; (5) the concentration of the Company’s business within its geographic areas of operation in Texas and Colorado; (6) changes in asset quality, including increases in default rates and loans and higher levels of nonperforming loans and loan charge-offs; (7) concentration of the loan portfolio of Independent Bank, before and after the completion of acquisitions of financial institutions, in commercial and residential real estate loans and changes in the prices, values and sales volumes of commercial and residential real estate; (8) the ability of Independent Bank to make loans with acceptable net interest margins and levels of risk of repayment and to otherwise invest in assets at acceptable yields and presenting acceptable investment risks; (9) inaccuracy of the assumptions and estimates that the managements of Independent Bank and the financial institutions that it acquires make in establishing reserves for probable loan losses and other estimates; (10) lack of liquidity, including as a result of a reduction in the amount of sources of liquidity, that the Company currently has; (11) material increases or decreases in the amount of deposits held by Independent Bank or other financial institutions that the Company acquires and the cost of those deposits; (12) the Company’s access to the debt and equity markets and the overall cost of funding its operations; (13) regulatory requirements to maintain minimum capital levels or maintenance of capital at levels sufficient to support the Company’s anticipated growth; (14) changes in market interest rates that affect the pricing of the loans and deposits of each of Independent Bank and the financial institutions that the Company acquires and the net interest income of each of Independent Bank and the financial institutions that the Company acquires; (15) fluctuations in the market value and liquidity of the securities the Company holds for sale, including as a result of changes in market interest rates; (16) effects of competition from a wide variety of local, regional, national and other providers of financial, investment and insurance services; (17) the institution and outcome of, and costs associated with, litigation and other legal proceedings against one of more of the Company, Independent Bank and financial institutions that the Company acquires or to which any of such entities is subject; (18) the occurrence of market conditions adversely affecting the financial industry generally; (19) the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations and their application by the Company’s regulators, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, specifically the Dodd-Frank Act stress testing requirements as the Company approaches $10 billion in total assets, and changes in federal government policies; (20) changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the SEC and the Public Company Accounting Oversight Board, or PCAOB, as the case may be; (21) governmental monetary and fiscal policies; (22) changes in the scope and cost of FDIC insurance and other coverage; (23) the effects of war or other conflicts, acts of terrorism (including cyber attacks) or other catastrophic events, including storms, droughts, tornadoes, hurricanes and flooding, that may affect general economic conditions; (24) the Company’s actual cost savings resulting from previous or future acquisitions are less than expected, it is unable to realize those cost savings as soon as expected, or it incurs additional or unexpected costs; (25) the Company’s revenues after previous or future acquisitions are less than expected; (26) the liquidity of, and changes in the amounts and sources of liquidity available to, us, before and after the acquisition of any financial institutions that the Company acquires; (27) deposit attrition, operating costs, customer loss and business disruption before and after the Company’s completed acquisitions, including, without limitation, difficulties in maintaining relationships with employees, may be greater than the Company expected; (28) the effects of the combination of the operations of financial institutions that the Company acquired in the recent past or may acquire in the future with the Company’s operations and the operations of Independent Bank, the effects of the integration of such operations being unsuccessful, and the effects of such integration being more difficult, time-consuming or costly than expected or not yielding the cost savings that the Company expects; (29) the impact of investments that the Company or Independent Bank may have made or may make and the changes in the value of those investments; (30) the quality of the assets of financial institutions and companies that the Company has acquired in the recent past or may acquire in the future being different than the Company determined or determine in its due diligence investigation in connection with the acquisition of such financial institutions and any inadequacy of loan loss reserves relating to, and exposure to unrecoverable losses on, loans acquired; (31) the Company’s ability to continue to identify acquisition targets and successfully acquire desirable financial institutions to sustain its growth, to expand its presence in its markets and to enter new markets; (32) technology-related changes are harder to make or are more expensive than expected; (33) attacks on the security of, and breaches of, the Company or Independent Bank’s digital information systems, the costs the Company or Independent Bank incur to provide security against such attacks and any costs and liability the Company or Independent Bank incurs in connection with any breach of those systems; (34) the potential impact of technology and “FinTech” entities on the banking industry generally, and (35) our success at managing the risks involved in the foregoing items; and (36) the other factors that are described in the Company’s Annual Report on Form 10-K filed on February 27, 2018, under the heading “Risk Factors”, and other reports and statements filed by the Company with the SEC. Any forward-looking statement made by the Company in this release speaks only as of the date on which it is made. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. 2

Company Snapshot Overview Branch Map as of March 31, 2018 • Headquartered in McKinney, Texas DFW Metropolitan Greater Austin • 100+ years of operating history • 70 banking offices • Dallas-Fort Worth metropolitan area • Greater Austin area • Houston metropolitan area • Colorado Front Range area • Acquired six financial institutions, adding $4.9 billion in assets, since IPO in 2013 • Eighth largest bank by deposits headquartered in Texas Financial Highlights as of and for the Quarter Ended March 31, 2018 Balance Sheet Highlights ($ in millions) Total Assets $ 8,811 Houston Metropolitan Colorado Total Loans Held for Investment 6,652 Total Deposits 6,795 Equity 1,355 Asset Quality Nonperforming Asset Ratio 0.23% Nonperforming Loans to Total Loans Held for Investment (1) 0.23 Net Charge-off Ratio (annualized) 0.01 Capital Ratios Tier 1 Risk Based 10.00% Total Risk Based 12.48 Tangible Common Equity to Tangible Assets (3) 8.49 Profitability Net Income $ 29.0 Adjusted Net Interest Margin (2)(3) 3.96% Adjusted Efficiency Ratio (3) 51.40 Adjusted Return on Average Assets (3) 1.37 (1) Excludes mortgage warehouse purchase loans (2) Excludes income recognized on acquired loans of $739 3 (3) Non-GAAP financial measure. See Appendix for reconciliation.

First Quarter Key Highlights • Adjusted (non-GAAP) net income was $29.2 million, or $1.03 per diluted share, compared to $25.3 million, or $0.90 per diluted share, for fourth quarter 2017 • Strong organic loan growth of 14.0% for the quarter (annualized) of loans held for investment • Continued strong credit quality metrics • Adjusted (non-GAAP) return on average assets increased to 1.37%, from fourth quarter 2017 of 1.15% • Positive increase in net interest margin to 4.00%, up from 3.97% for fourth quarter 2017 4

First Quarter Selected Financial Data ($ in thousands except per share data) As of and for the Quarter Ended Linked Quarter Balance Sheet Data March 31, 2018 December 31, 2017 March 31, 2017 Change Annual Change Total assets $ 8,811,014 $ 8,684,463 $ 6,022,614 1.5 % 46.3% Loans held for investment (gross, excluding mortgage warehouse purchase loans) 6,527,681 6,309,549 4,702,511 3.5 38.8 Mortgage warehouse purchase loans 124,700 164,694 — (24.3) 100.0 Total deposits 6,794,660 6,632,822 4,722,203 2.4 43.9 Total borrowings (excluding junior subordinated debentures) 617,636 667,578 568,115 (7.5) 8.7 Total stockholders' equity 1,354,699 1,336,018 688,469 1.4 96.8 Earnings and Profitability Data Net interest income $ 73,967 $ 75,254 $ 47,867 (1.7)% 54.5% Net interest margin 4.00% 3.97% 3.67% 0.8 9.0 Non-interest income $ 9,455 $ 13,579 $ 4,583 (30.4) 106.3 Non-interest expense 44,958 49,553 28,028 (9.3) 60.4 Net income (1) 28,964 19,193 15,671 50.9 84.8 Basic EPS 1.02 0.69 0.83 47.8 22.9 Diluted EPS 1.02 0.68 0.82 50.0 24.4 Adjusted net interest margin (2) (3) 3.96% 3.84% 3.66% 3.1 8.2 Adjusted net income (3) $ 29,231 $ 25,313 $ 15,990 15.5 82.8 Adjusted basic EPS (3) 1.03 0.91 0.85 13.2 21.2 Adjusted diluted EPS (3) 1.03 0.90 0.84 14.4 22.6 Return on average assets 1.35% 0.87% 1.08% 55.2 25.0 Adjusted return on average assets (3) 1.37 1.15 1.10 19.1 24.5 (1) The reduction of the corporate U.S. statutory tax rate to 21% from 35% as a result of the Tax Cuts and Jobs Act (TCJA) was effective January 1, 2018. The quarter ended December 31, 2017, includes a $5,528 charge to remeasure deferred taxes as a result of the enactment of the tax reform. (2) Non-GAAP financial measure. Excludes income recognized on acquired loans of $739, $2,463 and $123, respectively. 5 (3) See Appendix for non-GAAP reconciliation

Among Strongest Economies in USA Texas • Texas ranks #3 for Fortune 500 companies with 50 companies headquartered in Texas (2017) • Forbes list Texas #2 as best state for business and #1 in economic climate (2017) • Second fastest economic growth • Headquarters to 100 of the1,000 largest public and private companies in the United States • Population - 28.7 million, 2nd largest State (2018) • Third fastest-growing state with a growth rate of 1.80% in 2018 • Projected household income growth of 9.51% through 2023 versus 8.86% for the Nation (2017) • Texas unemployment rate of 4.0% which is more favorable than the United States at 4.1% (March 2018) • Home to six top universities and eleven professional sports teams • U.S. News ranks four of the major metro areas in their top 30 in the 100 Best Places to Live in the USA 2018 (#1) Austin (#14) San Antonio (#18) Dallas-Fort Worth (#26) Houston • Three out of four of Texas’ major metro areas were ranked in the top 15 on Forbes’ The Best Cities For Jobs 2017. (Forbes, May, 2017) (#1) Dallas (#7) Austin (#12) San Antonio Colorado • Forbes list Colorado #8 as best state for business and #3 in economic climate (2017) • Colorado is expected to have the second fastest job growth over the next five years per EMSI data. • Population - 5.7 million, 21st largest State (2018) • Second fastest-growing state with a growth rate of 1.85% in 2018 • Projected household income growth of 9.54% through 2021 versus 8.86% for the Nation (2017) • Colorado unemployment rate of 3.0% which is more favorable to United States at 4.1% (March 2018) • Home to six top universities and five professional sports teams • U.S. News ranks two of the major metro areas in their top 30 in the 100 Best Places to Live in the USA 2018 (#2) Colorado Springs (#3) Denver • Colorado consistently ranks among the top five states for business • High levels of education are a key factor in the booming growth of the area's economy and workforce. • Denver was ranked #11 in the top 15 on Forbes’ The Best Cities For Jobs 2017. (Forbes, May, 2017) Source: S&P Global Market Intelligence, Forbes, World Population Review, Texas Wide Open Spaces, U.S. Census Bureau, Bureau of Labor Statistics, Dallas Office of Economic Development, Dallas Chamber of Commerce, Austin Chamber of Commerce, Greater Houston Partnership, Denver.org., Choose Colorado, Select Georgia, Denver Post, U.S. News 6

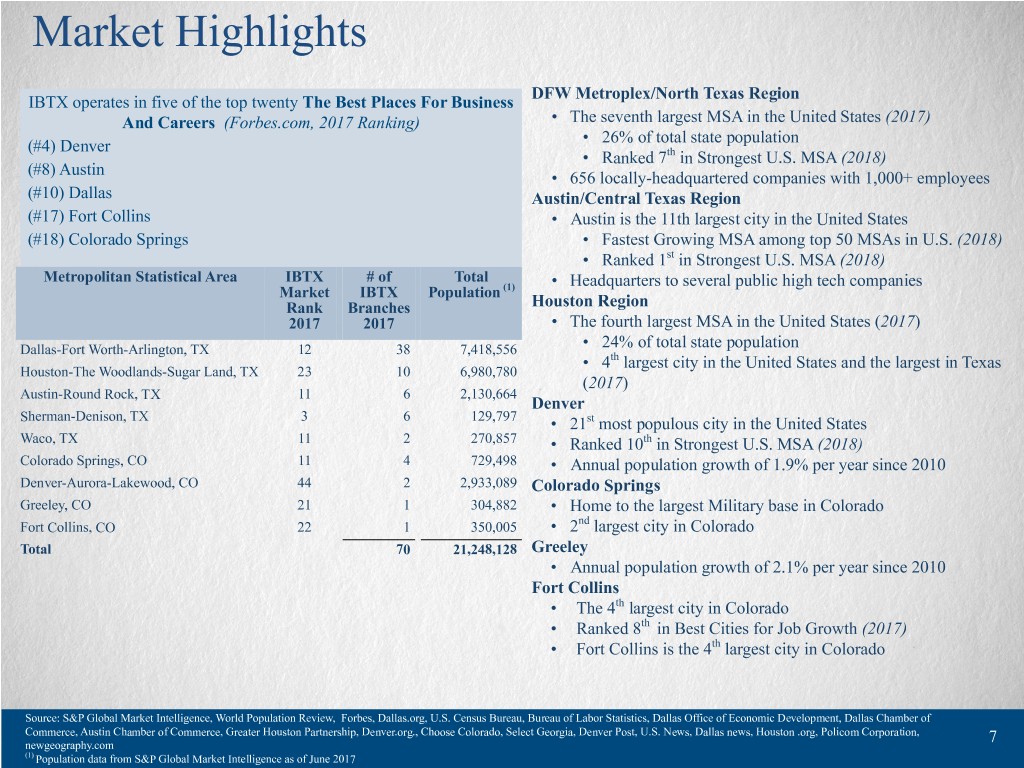

Market Highlights DFW Metroplex/North Texas Region IBTX operates in five of the top twenty The Best Places For Business And Careers (Forbes.com, 2017 Ranking) • The seventh largest MSA in the United States (2017) • 26% of total state population (#4) Denver • Ranked 7th in Strongest U.S. MSA (2018) (#8) Austin • 656 locally-headquartered companies with 1,000+ employees (#10) Dallas Austin/Central Texas Region (#17) Fort Collins • Austin is the 11th largest city in the United States (#18) Colorado Springs • Fastest Growing MSA among top 50 MSAs in U.S. (2018) • Ranked 1st in Strongest U.S. MSA (2018) Metropolitan Statistical Area IBTX # of Total • Headquarters to several public high tech companies Market IBTX Population (1) Rank Branches Houston Region 2017 2017 • The fourth largest MSA in the United States (2017) Dallas-Fort Worth-Arlington, TX 12 38 7,418,556 • 24% of total state population • 4th largest city in the United States and the largest in Texas Houston-The Woodlands-Sugar Land, TX 23 10 6,980,780 (2017) Austin-Round Rock, TX 11 6 2,130,664 Denver Sherman-Denison, TX 3 6 129,797 • 21st most populous city in the United States Waco, TX 11 2 270,857 • Ranked 10th in Strongest U.S. MSA (2018) Colorado Springs, CO 11 4 729,498 • Annual population growth of 1.9% per year since 2010 Denver-Aurora-Lakewood, CO 44 2 2,933,089 Colorado Springs Greeley, CO 21 1 304,882 • Home to the largest Military base in Colorado Fort Collins, CO 22 1 350,005 • 2nd largest city in Colorado Total 70 21,248,128 Greeley • Annual population growth of 2.1% per year since 2010 Fort Collins • The 4th largest city in Colorado • Ranked 8th in Best Cities for Job Growth (2017) • Fort Collins is the 4th largest city in Colorado Source: S&P Global Market Intelligence, World Population Review, Forbes, Dallas.org, U.S. Census Bureau, Bureau of Labor Statistics, Dallas Office of Economic Development, Dallas Chamber of Commerce, Austin Chamber of Commerce, Greater Houston Partnership, Denver.org., Choose Colorado, Select Georgia, Denver Post, U.S. News, Dallas news, Houston .org, Policom Corporation, 7 newgeography.com (1) Population data from S&P Global Market Intelligence as of June 2017

IBTX Demonstrated Growth Interest Income, Net Interest Income and NIM $307.9 $84.7 $87.4 $88.1 $79.9 $265.5 $75.3 $74.0 $69.5 $72.9 $210.0 $183.8 $55.9 $174.0 $47.9 $154.1 3.97% 4.00% 3.81% 3.85% 3.67% 4.05% 3.81% 3.84% 2015 2016 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Year Ending Quarter Ending NIM Interest income ($ in millions) Net interest income ($ millions) Earnings Per Share and Adjusted Earnings Per Share Trends (diluted) $3.45 $1.02$1.03 $3.04 $2.88 $2.97 $0.89 $0.90 $2.36 $0.84 $0.84 $2.21 $0.82 $0.82 $0.68 $0.65 2015 2016 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Year Ending Quarter Ending EPS (1) Adjusted EPS (2) 1) The reduction of the corporate U.S. statutory tax rate of 21% from 35% as a result of TCJA was effective January 1, 2018. The quarter ended December 31, 2017, includes a $5,528 charge to remeasure deferred taxes as a result of the enactment of the tax reform. 8 (2) See Appendix for non-GAAP reconciliation

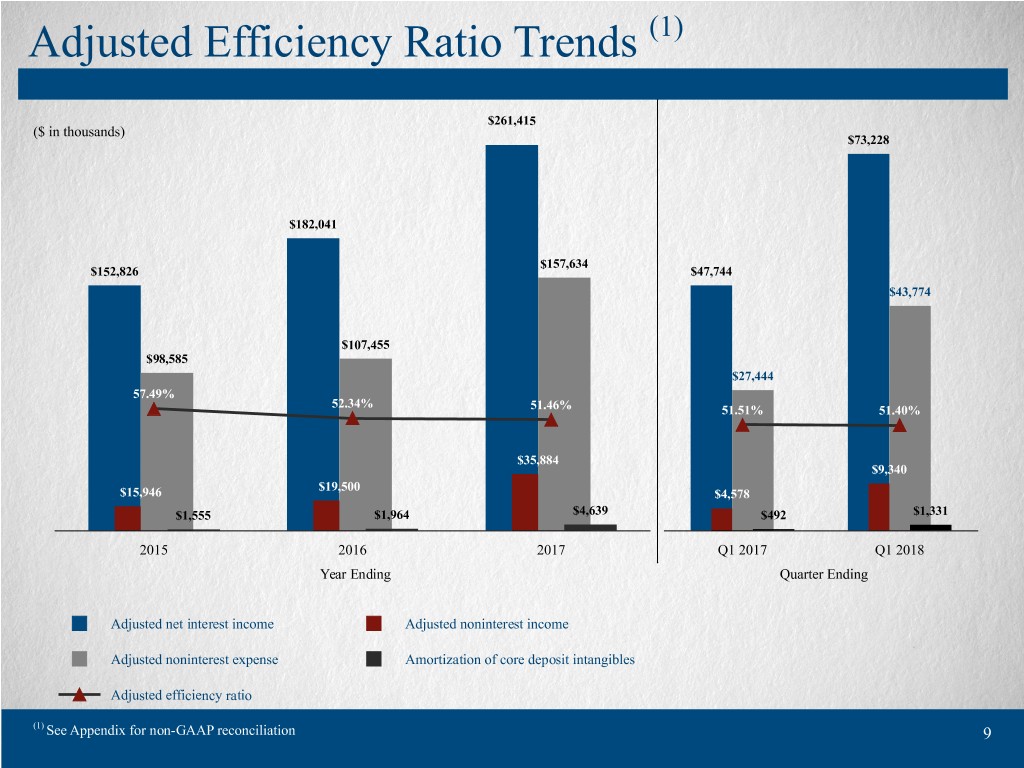

Adjusted Efficiency Ratio Trends (1) $261,415 ($ in thousands) $73,228 $182,041 $157,634 $152,826 $47,744 $43,774 $107,455 $98,585 $27,444 57.49% 52.34% 51.46% 51.51% 51.40% $35,884 $9,340 $19,500 $15,946 $4,578 $1,555 $1,964 $4,639 $492 $1,331 2015 2016 2017 Q1 2017 Q1 2018 Year Ending Quarter Ending Adjusted net interest income Adjusted noninterest income Adjusted noninterest expense Amortization of core deposit intangibles Adjusted efficiency ratio (1) See Appendix for non-GAAP reconciliation 9

Deposit Mix and Pricing Deposit Mix as of March 31, 2018 Deposit Growth versus Average Rate CDs < $100,000: ($ in millions) 1.9% IRAs: 0.8% CDs > $100,000: 6.4% 0.60% Money Market: Noninterest-bearing 0.46% demand: 27.1% 11.9% 0.38% 0.34% $6,633 $6,795 Savings: 4.2% $4,577 $4,028 Public funds interest- bearing accounts and CDs: 11.5% 2015 2016 2017 Q1 2018 Interest-bearing checking: Period Ending 36.2% Deposits Average YTD Rate (1) 2018 YTD Average Rate for Interest-bearing deposits: 0.82% (1) Average rate for total deposits 10

Loan Portfolio Composition Loan Composition at 03/31/2018 CRE Loan Composition at 03/31/2018 Multifamily: 9.3% 1-4 Family Const.: 4.2% Misc: 14.6% Consumer: 0.5% 1-4 Family: 14.1% Church: 3.4% Healthcare: 8.3% Ag: 1.2% C&I: 15.5% Office: 29.9% Daycare/School: 2.0% Industrial: 4.7% C&D: 12.1% Hotel/Motel: 5.4% Retail: 22.4% Loans by Region at 03/31/2018 Colorado: 5.7% CRE: 52.4% Central Texas: 20.2% Houston: 21.1% 2018 YTD adjusted loan yield: 5.11% (1) North Texas: 53.0% (1) Non-GAAP financial measure. Excludes $739 of income recognized on acquired loans. 11

Commercial Real Estate (CRE) and Construction and Development (C&D) CRE and C&D Concentrations at 03/31/2018 Retail CRE and C&D Composition at 03/31/2018 434% 391% 393% 374% 382% Retail/Office: 14.0% Big Box: 6.0% Loans > $500 thousand 142% Free Standing/ 127% 130% 119% 122% Single Tenant: Strip Center: 19.0% 61.0% 03/31/17 06/30/17 09/30/17 12/31/17 03/31/18 Period Ending Total construction and development to Bank regulatory • 611 Retail Loans capital • 38 Loans > $5MM • 1.89 AVG DSCR (1) Total non-owner occupied CRE to Bank regulatory capital • 58% AVG LTV (1) (1) Loans greater than $500 thousand 12

Energy Lending Outstanding Balances and Related Reserves (in millions) $17.6 $21.9 $8.8 $106.2 $19.2 $15.7 $99.7 $97.2 $90.3 $87.8 6.2% 6.2% 5.5% 5.0% 4.7% 03/31/17 06/30/17 09/30/17 12/31/17 03/31/18 Quarter Ending Exploration and Production Service loans Energy reserve % to total energy loans 13

Historically Strong Credit Culture NPLs / Loans NCOs / Average Loans 2.67% 2.67% 4.41% 4.15% 4.11% 3.43% 3.36% 1.64% 3.03% 2.91% 2.67% 1.22% 2.38% 1.05% 2.25% 1.13% 1.89% 0.74% 1.62% 1.83% 1.71% 1.57% 0.70% 0.49% 0.48% 0.48% 1.31% 1.31% 0.43% 0.46% 1.50% 1.49% 1.50% 0.31% 0.39% 0.28% 1.14% 0.91% 0.19% 0.16% 0.18% 0.18% 0.81% 0.06% 0.10% 0.21% 0.53% 0.91% 0.11% 0.09% 0.12% 0.03% 0.02% 0.01% 0.01% 0.32% 0.37% 0.39% 0.24% 0.23% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q1 2018 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q1 2018 Period Ending Period Ending TX Commercial Banks U.S. Commercial Banks TX Commercial Banks U.S. Commercial Banks IBTX IBTX Note: Financial data as of and for quarter ended December 31, 2017 for peer data and March 31, 2018 for IBTX. Interim charge-off data annualized. 14 Source: U.S. and Texas Commercial Bank numbers from S&P Global Market Intelligence.

Capital Total Capital, Tier 1 and TCE/TA Ratios 12.56% 12.48% 11.38% 11.14% 10.05% 10.00% 8.92% 8.55% 8.37% 8.49% 7.17% 6.87% 12/31/15 12/31/16 12/31/17 Q1 2018 Period Ending Total capital to risk-weighted assets Tangible common equity to tangible assets (1) Tier 1 capital to risk-weighted assets (1) See Appendix for non-GAAP reconciliation 15

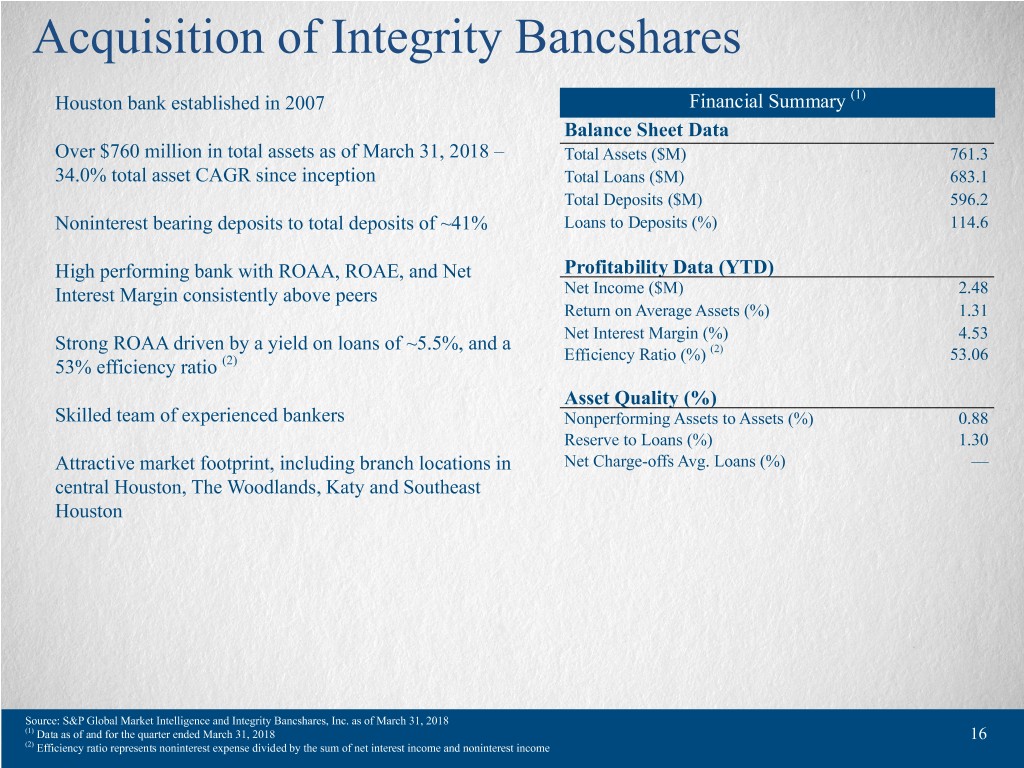

Acquisition of Integrity Bancshares Houston bank established in 2007 Financial Summary (1) Balance Sheet Data Over $760 million in total assets as of March 31, 2018 – Total Assets ($M) 761.3 34.0% total asset CAGR since inception Total Loans ($M) 683.1 Total Deposits ($M) 596.2 Noninterest bearing deposits to total deposits of ~41% Loans to Deposits (%) 114.6 High performing bank with ROAA, ROAE, and Net Profitability Data (YTD) Interest Margin consistently above peers Net Income ($M) 2.48 Return on Average Assets (%) 1.31 Net Interest Margin (%) 4.53 Strong ROAA driven by a yield on loans of ~5.5%, and a Efficiency Ratio (%) (2) 53.06 53% efficiency ratio (2) Asset Quality (%) Skilled team of experienced bankers Nonperforming Assets to Assets (%) 0.88 Reserve to Loans (%) 1.30 Attractive market footprint, including branch locations in Net Charge-offs Avg. Loans (%) — central Houston, The Woodlands, Katy and Southeast Houston Source: S&P Global Market Intelligence and Integrity Bancshares, Inc. as of March 31, 2018 (1) Data as of and for the quarter ended March 31, 2018 16 (2) Efficiency ratio represents noninterest expense divided by the sum of net interest income and noninterest income

Continued Houston Expansion • Integrity’s Central Houston/downtown headquarters Pro Forma Houston Footprint provides for close proximity and easy access to the central business district • New market expansion into Katy and Southeast Houston • Immediate accretion to earnings per share; tangible book value earnback of less than 1.5 years • Pro forma, Independent will be ranked 9th in deposit market share in the Houston MSA amongst Texas-based banks Houston MSA(1) Deposit Market Share 2017 2017 2017 2017 Deposits Market Rank Texas Institutions Branches ($M) Share (%) 1 Prosperity Bancshares Inc. 58 5,029 2.15 2 Cullen/Frost Bankers Inc. 35 4,404 1.88 3 Woodforest Financial Grp Inc. 103 3,347 1.43 4 Comerica Inc. 48 3,166 1.35 5 Cadence Bancorp. 10 3,096 1.32 6 Texas Capital Bancshares Inc. 2 2,539 1.09 7 Allegiance Bancshares Inc. 16 2,125 0.91 8 Green Bancorp Inc. 13 1,916 0.82 Pro Forma 14 1,661 0.71 9 CBTX Inc. 16 1,324 0.57 10 Post Oak Bancshares Inc. 12 1,114 0.48 12 Independent Bank Group Inc. 10 1,013 0.43 17 Integrity Bancshares Inc. 4 648 0.28 Source: S&P Global Market Intelligence (1) Houston MSA includes Houston, The Woodlands and Sugar Land; Texas headquartered banks only 17 Note: Deposit data as of June 30, 2017 per FDIC filings

Acquisition Terms and Merger Multiples Aggregate Deal Value $178.1 million (1) Shares Issued 2,072,131 shares of IBTX stock Aggregate Cash Consideration $31,600,000 Consideration Structured as 80% stock / 20% cash Minimum Tangible Common Equity $84 million required at close Approval Requirements Integrity Bancshares shareholders, as well as customary regulatory approvals Anticipated Closing Second quarter of 2018 Major Assumptions Cost Saves 35% Loan and OREO Mark $7.9 Million Integrity Bancshares - Transaction Multiples Negotiated Value (2) Current Value (1) $158.0 million $178.1 million Price / Tangible Book Value 1.88x 1.97x Price / LTM Net Income (3) 17.2x 22.8x Price / Est. 2018 Net Income 14.7x 16.5x Core Deposit Premium (4) 12.4% 16.4% (1) Based on an IBTX closing stock price of $70.70 on March 31, 2018 (2) Based on an IBTX stock price of $61.00 (3) LTM net income shown unadjusted for impact of TCJA 18 (4) Core deposits calculated as total deposits less CDs > $100,000

Impact of Potentially Crossing $10 Billion in Assets • We believe we will likely cross the $10 billion threshold by the fourth quarter of 2018 • The Durbin amendment is anticipated to take effect in July of 2019, with estimated current annual interchange revenue lost of $2.3 million • DFAST preparation currently in process with estimated total implementation costs of $2 million, and a total ongoing annual cost of $500,000 to $1 million • We continue to invest in the people, processes and systems necessary to operate successfully as a $10+ billion institution 19

Experienced Management Team Name / Title Background David R. Brooks -38 years in the financial services industry; 30 years at Independent Bank Chairman of the Board, CEO & President, Director -Active in community banking since the early 1980s - led the investor group that acquired Independent Bank in 1988 Daniel W. Brooks -35 years in the financial services industry; 29 years at Independent Bank Vice Chairman, Chief Risk Officer, Director -Active in community banking since the late 1980s Brian E. Hobart -24 years in the financial services industry; 13 years at Independent Bank Vice Chairman, Chief Lending Officer -Since 2009 has functioned as Chief Lending Officer of the Company Michelle S. Hickox -28 years in the financial services industry; 6 years at Independent Bank EVP, Chief Financial Officer -Previously a Financial Services Audit Partner at RSM US LLP -Over 30 years in the financial services industry James C. White -Previously served as EVP/COO of Texas Capital Bank EVP, Chief Operations Officer -12 years in the financial services industry; 7 years at Independent Bank James P. Tippit -Previously functioned as Community Reinvestment Officer of Independent Bank EVP, Corporate Responsibility -Over 35 years experience representing community banks in corporate, regulatory and Mark S. Haynie securities matters EVP, General Counsel -Previously an attorney, President and shareholder at Haynie Rake Repass & Kilmko, P.C., a law firm 20

Appendix 21

APPENDIX Supplemental Information - Non-GAAP Financial Measures (unaudited) Reconciliation of Adjusted Net Income, Adjusted Efficiency Ratio and Adjusted EPS--Quarterly Periods For the Quarters Ended ($ in thousands except per share data) March 31, 2018 December 31, 2017 September 30, 2017 June 30, 2017 March 31, 2017 Net Interest Income - Reported (a) 73,967 75,254 72,857 69,500 47,867 Income recognized on acquired loans (739) (2,463) (905) (572) (123) Adjusted Net Interest Income (b) 73,228 72,791 71,952 68,928 47,744 Provision Expense - Reported (c) 2,695 1,897 1,873 2,472 2,023 Noninterest Income - Reported (d) 9,455 13,579 12,130 10,995 4,583 Gain on sale of loans — — (338) (13) — (Gain) loss on sale of branch — (3,044) 127 — — (Gain) loss on sale of OREO and repossessed assets (60) (876) — 26 — (Loss) gain on sale of securities 224 (72) — (52) — Loss (gain) on sale of premises and equipment 8 6 21 (1) (5) Recoveries on charged off loans acquired (287) (65) (994) (123) — Adjusted Noninterest Income (e) 9,340 9,528 10,946 10,832 4,578 Noninterest Expense - Reported (f) 44,958 49,553 47,904 51,328 28,028 OREO impairment (85) (375) (917) (120) — IPO related stock grant (125) (128) (128) (127) (125) Acquisition expense (974) (6,509) (3,013) (7,278) (459) Adjusted Noninterest Expense (g) 43,774 42,541 43,846 43,803 27,444 Income Tax Expense Reported (1) (h) 6,805 18,190 11,696 8,561 6,728 Adjusted Net Income (2) (b) - (c) + (e) - (g) = (i) 29,231 25,313 24,829 22,746 15,990 Average shares for basic EPS (j) 28,320,792 27,933,201 27,797,779 27,782,584 18,908,679 Average shares for diluted EPS (k) 28,426,145 28,041,371 27,901,579 27,887,485 19,015,810 Adjusted Basic EPS (i) / (j) $ 1.03 $ 0.91 $ 0.89 $ 0.82 $ 0.85 Adjusted Diluted EPS (i) / (k) $ 1.03 $ 0.90 $ 0.89 $ 0.82 $ 0.84 EFFICIENCY RATIO Amortization of core deposit intangibles (l) $ 1,331 $ 1,328 $ 1,409 $ 1,410 $ 492 Reported Efficiency Ratio (f - l) / (a + d) 52.30% 54.29% 54.71% 62.01% 52.50% Adjusted Efficiency Ratio (g - l) / (b + e) 51.40% 50.06% 51.19% 53.15% 51.51% PROFITABILITY Total Average Assets (m) $ 8,675,596 $ 8,702,597 $ 8,726,847 $ 8,478,360 $ 5,880,473 Return on Average Assets (annualized) (a - c + d - f - h) / (m) 1.35% 0.87% 1.07% 0.86% 1.08% Adjusted Return on Average Assets (annualized) (i) / (m) 1.37% 1.15% 1.13% 1.08% 1.10% (1) The reduction of the corporate U.S. statutory tax rate to 21% from 35% as a result of TCJA was effective January 1, 2018. The quarter ended December 31, 2017, includes a $5,528 charge to remeasure deferred taxes as a result of the enactment of the tax reform. (2) Assumes an actual effective tax rate of 19.0% for the quarter ended March 31, 2018. The quarter ended December 31, 2017 excludes the charge to remeasure deferred taxes and assumes the resulting normalized effective tax 22 rate of 33.2% Assumes an actual effective tax rate of 33.2%, 32.1% and 30.0% for the quarters ended September 30, 2017, June 30, 2017 and March 31, 2017, respectively.

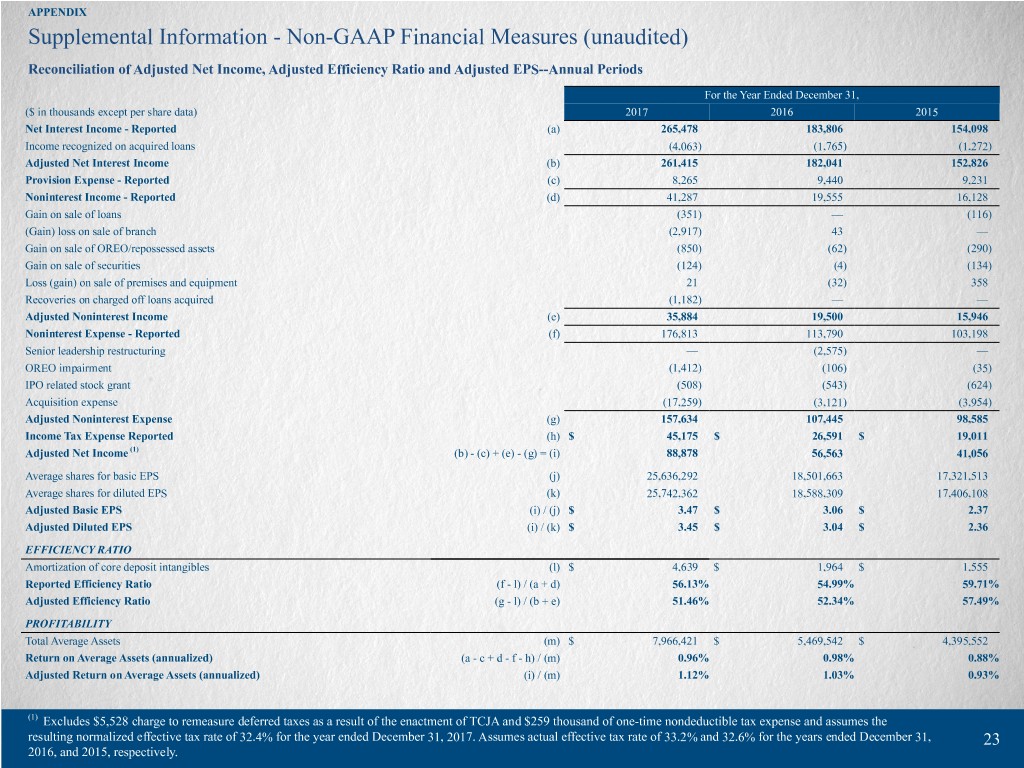

APPENDIX Supplemental Information - Non-GAAP Financial Measures (unaudited) Reconciliation of Adjusted Net Income, Adjusted Efficiency Ratio and Adjusted EPS--Annual Periods For the Year Ended December 31, ($ in thousands except per share data) 2017 2016 2015 Net Interest Income - Reported (a) 265,478 183,806 154,098 Income recognized on acquired loans (4,063) (1,765) (1,272) Adjusted Net Interest Income (b) 261,415 182,041 152,826 Provision Expense - Reported (c) 8,265 9,440 9,231 Noninterest Income - Reported (d) 41,287 19,555 16,128 Gain on sale of loans (351) — (116) (Gain) loss on sale of branch (2,917) 43 — Gain on sale of OREO/repossessed assets (850) (62) (290) Gain on sale of securities (124) (4) (134) Loss (gain) on sale of premises and equipment 21 (32) 358 Recoveries on charged off loans acquired (1,182) — — Adjusted Noninterest Income (e) 35,884 19,500 15,946 Noninterest Expense - Reported (f) 176,813 113,790 103,198 Senior leadership restructuring — (2,575) — OREO impairment (1,412) (106) (35) IPO related stock grant (508) (543) (624) Acquisition expense (17,259) (3,121) (3,954) Adjusted Noninterest Expense (g) 157,634 107,445 98,585 Income Tax Expense Reported (h) $ 45,175 $ 26,591 $ 19,011 Adjusted Net Income (1) (b) - (c) + (e) - (g) = (i) 88,878 56,563 41,056 Average shares for basic EPS (j) 25,636,292 18,501,663 17,321,513 Average shares for diluted EPS (k) 25,742,362 18,588,309 17,406,108 Adjusted Basic EPS (i) / (j) $ 3.47 $ 3.06 $ 2.37 Adjusted Diluted EPS (i) / (k) $ 3.45 $ 3.04 $ 2.36 EFFICIENCY RATIO Amortization of core deposit intangibles (l) $ 4,639 $ 1,964 $ 1,555 Reported Efficiency Ratio (f - l) / (a + d) 56.13% 54.99% 59.71% Adjusted Efficiency Ratio (g - l) / (b + e) 51.46% 52.34% 57.49% PROFITABILITY Total Average Assets (m) $ 7,966,421 $ 5,469,542 $ 4,395,552 Return on Average Assets (annualized) (a - c + d - f - h) / (m) 0.96% 0.98% 0.88% Adjusted Return on Average Assets (annualized) (i) / (m) 1.12% 1.03% 0.93% (1) Excludes $5,528 charge to remeasure deferred taxes as a result of the enactment of TCJA and $259 thousand of one-time nondeductible tax expense and assumes the resulting normalized effective tax rate of 32.4% for the year ended December 31, 2017. Assumes actual effective tax rate of 33.2% and 32.6% for the years ended December 31, 23 2016, and 2015, respectively.

APPENDIX Supplemental Information - Non-GAAP Financial Measures (unaudited) Reconciliation of Tangible Common Equity to Tangible Assets ($ in thousands) As of and for the Quarter Ended March 31, 2018 December 31, 2017 December 31, 2016 December 31, 2015 Tangible Common Equity Total common stockholders' equity $ 1,354,699 $ 1,336,018 $ 672,365 $ 603,371 Adjustments: Goodwill (621,458) (621,458) (258,319) (258,643) Core deposit intangibles, net (41,913) (43,244) (14,177) (16,357) Tangible Common Equity $ 691,328 $ 671,316 $ 399,869 $ 328,371 Tangible Assets Total Assets $ 8,811,014 $ 8,684,463 $ 5,852,801 $ 5,055,000 Adjustments: Goodwill (621,458) (621,458) (258,319) (258,643) Core deposit intangibles (41,913) (43,244) (14,177) (16,357) Tangible Assets $ 8,147,643 $ 8,019,761 $ 5,580,305 $ 4,780,000 Tangible Common Equity To Tangible Assets 8.49% 8.37% 7.17% 6.87% 24

Contact Information Corporate Headquarters Analysts/Investors: Independent Bank Group, Inc. Michelle Hickox 1600 Redbud Blvd Executive Vice President and Chief Financial Officer Suite 400 (972) 562-9004 McKinney, TX 75069 mhickox@ibtx.com Mark Haynie Executive Vice President and General Counsel (972) 562-9004 mhaynie@ibtx.com Media: 972-562-9004 Telephone Peggy Smolen 972-562-7734 Fax Marketing & Communications Director www.ibtx.com (972) 562-9004 psmolen@ibtx.com 25

About Us A Standard of Excellence Our unique brand of banking extends from the Gulf Coast of Texas to the Rocky Mountains. We are an $8 billion dollar community- centric institution providing a wide range of relationship-driven commercial banking products and services tailored to meet the needs of businesses, professional organizations, community groups and entrepreneurs. We also offer a full line of personal financial products and services to make banking easy for busy families and individuals. Our Core Values Principled financial decisions ~ Building strong, healthy communities ~ Leading with a courageous heart Resilient Solutions ~ Thriving relationships The Bank provides capital and guidance to foster growth, bring new ideas to life, and energize local businesses. We accomplish these goals by funding projects such as medical facilities, warehouse space, and hospitality and education venues. By developing strong relationships and a deep understanding of your industry, our team offers a proactive approach to business banking. We continue to be named Best Bank within many of the communities we serve. Recently, Independent Bank was named a Community Bankers Cup winner for the fifth consecutive year; a Top 75 Producing Lender Nationwide; a Top 50 Performer by the Dallas Business Journal; and one of the Healthiest Employers in both North Texas and Central Texas. The Bank builds community on two fronts: by helping create economic development and by partnering within the community. It all begins by empowering our employees. We encourage our people to follow their passion and volunteer. And we back that up through formal giving programs. Our Mission To make an impact on the communities we serve through high-performance, purpose-driven banking. 26