Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Advanzeon Solutions, Inc. | s107568_ex99-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Advanzeon Solutions, Inc. | s107568_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Advanzeon Solutions, Inc. | s107568_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Advanzeon Solutions, Inc. | s107568_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Advanzeon Solutions, Inc. | s107568_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Advanzeon Solutions, Inc. | s107568_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Advanzeon Solutions, Inc. | s107568_ex21-1.htm |

| EX-3.0 - EXHIBIT 3.0 - Advanzeon Solutions, Inc. | s107568_ex3-0.htm |

| 10-K - SUPER FORM 10-K - Advanzeon Solutions, Inc. | s107568_10k.htm |

Exhibit 10.20

COMMERCIAL LEASE

This COMMERCIAL LEASE (the “Lease”) made and entered into this 23 day of May, 2014 (the “Effective Date”) by and between Twin Lakes Office Park (“Lessor”) and Advanzeon Solutions, Inc a Delaware Corporation (“Lessee”), the foregoing sometimes being herein referred to individually as a “Party” or collectively as the “Parties”.

W I T N E S S E T H:

NOW, THEREFORE for and in consideration of the mutual promises and covenants container hereinbelow and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereto agree as follows:

1. Lease of Leased Premises. In consideration of the Rent (as defined hereinbelow) to be paid by Lessee to Lessor, and of the covenants terms and conditions to be kept and performed as herein provided, Lessor does hereby lease and rent unto Lessee and Lessee does hereby accept a lease upon the following described Leased Premises (the “Leased Premises”):

2901 W. BUSCH BOULEVARD, UNIT 701, TAMPA, FL 33618

This Lease shall include the nonexclusive right to use the parking areas, roadways, means of ingress and egress, sidewalks, and other areas, and surroundings of the project which are included for the common use and enjoyment of Lessee and third persons (the “Common Areas”).

2. Acceptance of Leased Premises. Lessee warrants and represents that it has had a sufficient opportunity to inspect the Leased Premises and that it has found the same to be suitable for Lessee’s intended use Lessee hereby accepts the Leased Premises in its AS IS, WHERE IS, WITH ALL FAULTS SUBJECT ONLY TO EXHIBIT A, LANDLORD’S WORK, condition, and further acknowledges and agrees that, other than Lessor’s warranty of title, Lessor makes and has made no warranties and/or representations concerning the condition of Leased Premises and specifically disclaims any and all warranties (statutory or otherwise) of merchantability, habitability and/or fitness for a particular use or purpose.

3. Term of Lease; Holding Over. The term of this Lease (the “Term”) shall be for five (5) years, commencing as of 12:01 AM on July 1, 2014 (the “Commencement Date”) and ending as of 11:59 PM on June 30, 2019 (the “Expiration Date”) unless sooner terminated as hereinafter provided. Each successive 12 month period during the Term is referred to herein as a “Lease Year”. Any holding over by Lessee after the expiration or termination of this Lease, by lapse of time or otherwise, shall not operate to extend or renew this Lease except by express mutual written agreement between the parties hereto; and in the absence of such agreement Lessee shall continue in possession as a month-to-month Lessee only, except that the monthly Rent shall be increased to an amount equal to 150% of the monthly installment paid in the month immediately preceding the termination of this Lease and either party may thereafter terminate such occupancy at the end of any calendar month by first giving to the other party at least 30 days prior written notice.

4. Rent. Lessee shall pay Lessor, as annual rent for the Leased Premises (hereafter the “Rent”), without demand, deduction or set off, during the entire Term of this Lease, the respective amount for each Lease Year, as set forth on the table below together with Florida state sales tax on such amounts, all of which shall be due and payable by Lessee to Lessor on the first day of each successive calendar month throughout the Term of this Lease. The first and last month’s rent ($5,949,58) will be due to Landlord upon the execution of this Lease together with the Security Deposit as defined herein.

| Lease Year | Monthly Installment1 | |

| Months 1-12 | $2,300.00 | .9978 Per SF |

| Months 13-24 | $3,358.87 | 1.4572 |

| Months 25-36 | $3,453.83 | 1.4984 |

| Months 37-48 | $3,551.65 | 1.5408 |

| Months 49-60 | $3,652.40 | 1.5846 |

1 Does not include the sales tax and or any other amounts due under this Lease

5. Late Fees and Interest. Any installment of Rent due hereunder that is not received by Lessor on or by the 10th day of the respective month in which it became due and payable, shall be assessed late payment fee of 5% of the unpaid amount due for each month or fraction thereof, or such lesser amount as may be the maximum amount permitted by law, until paid. All unpaid amounts due and owing as of the 11th day of the respective month in which they became due and payable shall accrue interest at a rate equal to the lesser of 18% per annum or the maximum non-usurious rate chargeable under applicable law. Any partial payments received by Lessor may, in Lessor’s sole and absolute discretion, be applied in the following order, first to the payment of any late fees then to the payment of any accrued interest, then to the payment of any attorneys’ fees and/or collection costs and lastly to any Rent due hereunder.

6. Lessor’s Lien for Rent. Lessee acknowledges and confirms that Lessor has and shall have, throughout the Term of this Lease, a lien upon all of Lessor’s goods, chattels, furnishings, equipment, fixtures and other personal property located from time to time, upon, within or about the Leased Premises, with such lien securing the payment of Rent and all other amounts due and owing from Lessee to Lessor hereunder. The foregoing lien may, upon default of Lessee hereunder, be enforced by Lessor, subject to applicable law. through distress proceedings, foreclosure suit or by taking and sale of such personal property in the such manner as may be exercised in connection with a chattel mortgage or other security agreement. Said lien in subordinate to Tenant’s shareholders and lenders. The exercise of rights by Lessor with respect to its lien hereunder shall not preclude Lessor from pursuing any and all other rights and/or remedies that it may have, in contract, at law or in equity, it being acknowledged and agreed that Lessor’s rights and remedies in the event of a default by Lessee shall be cumulative and not mutually exclusive.

7. Operating Expenses, Insurance, Property Tax & Other Additional Rent. Tenant shall pay to Landlord its Pro Rata Share of the amount by which the Operating Expenses (defined below) exceed the Operating Expenses for the Base Year (“Operating Expense Increase’’). As used in this Lease, the term “Operating Expenses” means all expenses and disbursements (subject to the limitations set forth below) that Landlord incurs in connection with the ownership, operation management, and maintenance of the Project, determined in accordance with sound accounting principles consistently applied, including the following costs: (i) wages and salaries of all on-site employees engaged in the operation, maintenance or security of the Project (together with Landlords reasonable allocation of expenses of off-site employees who perform a portion of their services in connection with the operation, maintenance or security of the Project), including taxes, insurance and benefits relating thereto; (ii) all supplies and materials used in the operation, maintenance repair, and security of the Project: (iii) costs for improvement made to the Project which, although capital in nature, are expected to reduce the normal operating costs (including all utility costs) of the Project, as amortized using a commercially reasonable interest rate over the time period reasonably estimated by Landlord to recover the costs thereof taking into consideration the anticipated cost savings, as determined by Landlord using its good faith, commercially reasonable judgment, as well as capital improvements made in order to comply with any Law hereafter promulgated or any interpretation hereafter rendered with respect to any existing Law, as amortized using a commercially reasonable interest rate over the useful economic life of such improvements as determined by Landlord in its reasonable description; (iv) cost of all utilities, except the cost of utilities for individual tenant spaces; (vi) repairs, and general maintenance of the Project including the roof sprinkler system, landscaping, drainage, lighting, signage. utilities, and similar systems and structures of the Project; (vii) fair market rental and other costs with respect to the management office for the Project; and (viii) service, maintenance and management contracts for the operation, maintenance, management repair, replacement, or security of the Project. Operating Expenses shall not include costs for (i) repair, replacements and general maintenance paid by proceeds of insurance or by Tenant or other third parties; (ii) interest, amortization or other payments on loans to Landlord; (iii) depreciation; (iv) leasing commissions; (v) legal expenses for services, other than those that benefit the Project tenants generally (e.g, tax disputes or Iiability issues); (vi) renovating or otherwise improving space for occupants of the Project or vacant space in the project; and (vii) federal income taxes imposed on or measured by the income of Landlord from the operation of the Project.

a. Tenant shall pay to Landlord its Pro Rata Share of the amount by which the Insurance Expense (defined below) exceed the Insurance Expense for the Base Year (“Insurance Expense Increase”) As used in this Lease, the term “Insurance Expense” means all insurance premiums and other charges for insurance on or in respect to the Project, including liability, property, flood, loss of rents and other coverage.

| Page 1 of 7 | ||||

| Lessee: |  |

Lessor: |  | |

b. Tenant shall pay to Landlord its Pro Rata Share of the amount by which the Tax Expense (defined below) exceed the Tax Expenses for the Base Year (“Tax Expense Increase”). As used in this Lease, the term “Tax Expense” shall mean all ad valorem real estate and tangible personal property taxes including all consulting fees paid in an effort to reduce the amount of taxes owed.

c. Landlord may make a good faith estimate of the Operating Expenses, Insurance Expense, and Tax Expense in be due by Tenant for any calendar year or part thereof during the Lease Term. During each calendar year or partial calendar year of the Lease Term (after the Base Year), Tenant shall pay to Landlord, in advance concurrently with each monthly installment of Base Monthly Rent, an amount equal to the estimated Operating Expense Increase, Insurance Expense Increase, and Tax Expense Increase for such calendar year or part thereof divided by the number of months therein, From time to time. Landlord may estimate and re-estimate the Operating Expense increase, Insurance Expense Increase, and Tax Expense increase payable by Tenant and deliver a copy of the estimate or re-estimate to Tenant Thereafter, the monthly installments of Operating Expense Increase, Insurance Expense increase, and Tax Expense Increase payable by Tenant shall be appropriately adjusted in accordance with the estimations so that, by the end of the calendar year in question, Tenant shall have paid all of the Operating Expense Increase. Insurance Expense Increase, and Tax Expense Increase as estimated by Landlord. Any amounts paid based on such an estimate shall be subject to adjustment as herein provided when actual Operating Expense Increase, Insurance Expense Increase, and Tax Expense Increase are available for such calendar year. All such Operating Expense Increase Insurance Expense Increase and Tax Expense. Increase shall be treated as Additional Rent. The Base Year is defined as calendar year in which the lease was executed.

d. By April 1 of each calendar year, or as soon thereafter as practicable, Landlord shall furnish to Tenant a statement of Operating Expenses. Insurance Expense, and Tax Expense for the previous calendar year or portion thereof, in each case adjusted as provided in. Section 2.f. (the “ Operating Expenses, Insurance Expense, and Tax Expense Statement”). If Tenant’s estimated payments of Operating Expense Increase, Insurance Expense Increase, and Tax Expense Increase under this Section 2 for the year or the portion thereof covered by the Operating Expense, insurance Expense, and Tax Expense Statement exceed Tenant’s Pm Rata Share of such items as indicated in the Operating Expenses. Insurance Expense. and Tax Expense Statement, then Landlord shall promptly credit or reimburse Tenant for such excess; Likewise, if Tenant s estimated payments of Operating Expense Increase. Insurance Expense Increase, and Tax Expense Increase under this Section 2 for such year are less than Tenant’s Pro Rata Share of such items as indicated in the Operating Expenses, Insurance Expense, and Tax Expense Statement, then Tenant shall pay Landlord such deficiency within ten (10) days after mailing of the Operating Expenses. Insurance Expense and Tax Expense Statement.

e. Tenant will pay Landlord all state and local sales, excise and use taxes imposed by law on all Base Rent, Additional Rent and other charges or services due from Tenant to Landlord under this Lease, Said taxes to be remitted together with the Base Rent, Additional Rent, charges, or service to which they pertain.

All amounts payable by Tenant according to this Section 8 will be payable as rent, without abatement, reduction, recoupment, deduction or offset. If Tenant fails to pay any amounts due according to this Section, Landlord will have all the rights and remedies available to it on account of Tenant’s failure to pay rent.

8. Security Deposit. Upon the execution of this Lease, Lessee shall deposit with lessor the sum of $3,500 (the “Security Deposit”) as the security for the performance of Lessee’s obligations under this Lease including, without limitation, the surrender of possession of the Leased Premises to Lessor as provided herein, it being expressly understood and agreed that such Deposit is not an advance Rent deposit or a measure of Lessor’s damages in case of Lessee’s default If Lessor applies any part of the Deposit to cure any default of lessee, Lessee shall, upon demand, remit to Lessor the amount so applied so that Lessor shall have the full Deposit on hand at all times during the Term of this Lease. Lessee agrees that the Deposit may be commingled with other deposits held by Lessor, that no interest shall be due in connection there with and that Lessor shall not be obligated to apply the Deposit in Rent and/or am other charges in arrears or to damages for Lessee’s failure to perform under the Lease; provided, however Lessor may so apply the Deposit, in Lessor’s sole and unfettered discretion, and Lessor’s right to possession of the Leased Premises for nonpayment of Rent or for any other reason shall not in any way be affected by reason of the fact that Lessor holds such Deposit.

9. Occupancy and Use. Lessee may use the Leased Premises for any lawful use permitted by the zoning designation of the Leased Premises and for no other purpose. Lessee shall he responsible for ascertaining that its proposed use is, in fact, permissible under the current zoning designation, and Lessee shall be responsible for obtaining any and all permits, licenses and/or other approvals governmental and/or regulatory agencies or entities having jurisdiction over the Leased Premises and/or lessee’s proposed business operations. Lessee’s use of the Leased Premises shall be conducted in compliance with all laws, orders and regulations of federal, state, county and municipal authorities, and with any direction or recommendation of and public officer or officers, pursuant to law and shall bear all costs of any kind or nature whatsoever occasioned by or necessary for compliance with the same Lessor shall cause the Leased Premises, and the common areas to comply with all laws, orders and regulations of federal, state, count) and municipal authorities, and with any direction or recommendation of any public officer or officers, except to the extent such compliance is necessitated solely by virtue of Lessee’s particular use of the Leased Premises.

10. Rules and Regulations. Lessee shall observe and fully comply (and cause all third parties under its control and/or direction to observe and fully comply) with any and all rules and regulations and/or use restrictions (the “Rules & Regulations”) concerning the Common Areas and the use and enjoyment thereof, as promulgated, from lime to time, by Lessor.

11. Signage. No signs, advertisement or notices of any kind shall be inscribed, painted or affixed upon, or be projected from any part of the Leased Premises, except as may be permitted by the Lessor in its sole and absolute discretion, and in any event, only such signs may only be located at the entrance of the Leased Premises.

12. Lessor’s Right of Entry. Lessor shall have the right, without charge or diminution of Rent, to enter the Leased Premises at all reasonable times. upon at least 24 hours advance notice. for the purpose of examining the Leased Premises and making its required repairs, alterations or improvements either to the Leased Premises or to utility lines or other facilities of the building in which the Leased Premises are located, or to install such lines or facilities Lessee shall, upon the discovery of any defect in or damage to the Leased Premises or any need for repairs, which are the responsibility of the Lessor, promptly report same to Lessor in writing, specifying such defect or damage. Lessor shall make such repairs, alterations, improvements and installations as arc its responsibility in a reasonable manner and with due diligence.

13. Services Provided by Lessor. Lessor agrees to furnish the following services “Services”) with respect to the Leased Premises and the Common Areas;

(a) Potable water service for drinking and lavatory purposes.

(b) Electric utility service to the Leased Premises for the operation of standard lighting fixtures and general office equipment, including computers and general service non-production type office cops machines (subject to Lessees payment of the utility service fees therefor); provided, however, that Lessor shall have no obligation to provide electric utility services in excess of that customarily required for the number of convenience outlets and electrical circuits existing in the Leased Premises as of the Effective Date hereof. if Lessee requires electrical services in excess of that deemed by Lessor to be standard, such services may he provided upon such conditions as Lessor may reasonably determine (including, without limitation, the requirement that sub meters be installed at Lessee’s expense), and Lessee shall bear the entire cost of such excess Service based upon actual consumption (if sub metered) or Lessors reasonable estimate of the cost of such excess service.

(c) Heating and air conditioning for the reasonably comfortable use and occupancy of the Leased Premises within an acceptable temperature range, as determined by Lessor in its sole reasonable discretion; provided, however, that heating and air conditioning service at any times other than normal business hours of 8:00 AM Eastern and 6:00 PM or no more than 50 hours during any seven (7) consecutive day period Eastern, Monday through Friday (weekends and national holidays being excepted) may be furnished, at Lessee’s cost, not to exceed $30.00 per hour, upon the written request of Lease delivered to Lessor no later than 48 hours in advance of the date on which such services are required.

(d) Illumination of Common Areas (including maintenance thereof and the replacement of lighting fixtures, bulbs and ballasts, if and when required) in the manner and to the extent deemed necessary by Lessor in us sole reasonable discretion; provided, however, that Lessor shall have no) Liability to Lessee its employees, agents, invitees, guests and/or licensees for Losses due to theft or burglary and/or damage, of vandalism caused by third parties.

(e) General maintenance and repair of all parking areas, sidewalks, landscape, hardscape and other improvements deemed or considered Common Areas.

| Page 2 of 7 | ||||

| Lessee: |  |

Lessor: |  | |

Notwithstanding the foregoing, Lessor shall not be liable to Lessee or others nor shall Lessee be entitled to an abatement of Rent on account of any disruption or interruption in the delivery or provision of the Services by Lessor hereunder, including, without limitation, any disruption or interruption on account of equipment malfunction, causes of force majeure, or otherwise.

14. Maintenance, Repairs and Alterations. Except as otherwise expressly provided in this Lease, Lessor shall maintain and rnake all repairs and replacements with respect to the building in which the Leased Premises are located, including the roof, foundations, exterior walls, interior structural walls, all structural components and all building systems, such as mechanical, electrical, HVAC and plumbing, except to the extent caused by the negligent acts or omissions of Lessee. Repairs or replacements shall be made within a reasonable time (depending on the nature of the repair or replacement needed) after receiving notice from Lessee or upon Lessor having actual knowledge of the need for a repair or replacement.

Lessee shall, throughout the Term of this Lease, keep and maintain the Leased Premises in good, clean and presentable condition and repair and shall commit no waste with respect thereto. Upon the expiration or sooner termination of this Lease, Lessee shall surrender the Leased Premises in as good condition as existed on the Cornmencernent Date of this Lease, failing which, Lessor may restore the same to their required condition and Lessee shall pay the cost thereof upon demand. All of Lessee’s personal property, furniture, trade fixtures, shelves, bins and machinery not removed from the Leased Premises when Lessee vacates the Leased Premises on termination of this Lease shall thereupon be conclusively presumed to have been abandoned by Lessee and forthwith become Lessor’s property; provided, however, that Lessor may require lessee to remove such personal property, furniture, trade fixtures, shelves, bins and machinery or may have such property removed at Lessee’s expense.

Lessee shall make no alterations, additions or physical improvements to the Leased Premises (including, but not limited to the installation of permanent or semi-permanent partitions, walls, panels, shelving, floor coverings, cabinets and similar items) without first obtaining the prior written consent of the lessor, which consent shall not be unreasonably withheld in the case of minor alterations to the Leased Premises to accommodate Lessee’s proposed use thereof. All costs and expense of such alterations, additions or improvements shall be borne solely by Lessee, and, if and to the extent that a building or alteration permit is required therefor, all such work shall be performed by a licensed, bonded contractor, approved, in advance, by Lessor (such approval not being unreasonably withheld). Upon completion all additions, alterations and improvements made by Lessee (excepting only movable office furniture, detached bookshelves and similar equipment) shall become the property of the Lessor and shall remain upon and be surrendered with the Leased Premises upon the expiration or sooner termination of this Lease, unless otherwise agreed or directed by Lessor.

Lessee agrees that it will make full and prompt payment of all sums necessary to pay for the cost of repairs, alterations, improvements, changes or other work done by Lessee to the Leased Premises and further agrees to indemnify and hold harmless Lessor from and against any and all mechanic’s, materialmen’s or laborer’s liens arising out of or from such work or the cost thereof which may be asserted, claimed or charged against the Leased Premises. Notwithstanding anything to the contrary contained in this Lease. IT IS AGREED THAT LESSOR’S INTEREST IN THE LEASER PREMISES SHALL NOT BE SUBJECT TO ANY LIENS UNDER CHAPTER 713, FLORIDA STATUTES AND NOTICE IS HEREBY GIVEN THAT LESSOR SHALL NOT BE LIABLE FOR ANY LABOR, SERVICES OR MATERIALS FURNISHED OR TO BE FURNISHED TO LESSEE, OR TO ANYONE HOLDING THE LEASED PREMISES OR ANY PART THEREOF THROUGH OR UNDER LESSEE, AND THAT NO MECHANIC’S OR OTHER LIENS FOR ANY SUCH LABOR. SERVICES OR MATERIALS SHALL ATTACH TO OR AFFECT THE INTEREST OF LESSOR IN AND TO THE LEASED PREMISES. All persons dealing with Lessee are hereupon placed upon notice of the foregoing prohibition provision.

In the event any notice or claim of lien shall be asserted of record against the interest of Lessor in the Leased Premises on account of or in connection with any improvement or work done by or for Lessee, or any person claiming by, through or under Lessee, or for improvements or work the cost of which is the responsibility of Lessee. Lessee agrees to have such notice or claim of lien canceled and discharged of record as a claim against the interest of Lessor in the Leased Premises, either by payment and satisfaction or by removal by transfer to bond or deposit as permitted by law, within thirty (30) days after notice to Lessee by Lessor, and in the event Lessec shall fail to do so Lessee shall be considered in default under this Lease.

15. Assignment and Subletting. Lessee shall not, without the prior written consent of Lessor (which shall not be unreasonably withheld) assign this Lease or sublease the Leased Premises, or any part thereof or grant any concession or license within the Leased Premises, and any attempt to do any of the foregoing shall be void and of no effect.

16. Default. Each and all of the following events shall be deemed and constitute events of default on the part of Lessee under the terms and conditions of this Lease:

(a) if any installment of Rent or any other sums required to be paid by Lessee hereunder, or any part thereof, shall at any time be in arrears and unpaid by the 5th day of the month;

(b) if there be any default on the part of Lessee in the observance or performance of any of the other covenants, agreements or conditions of this Lease on the part of Lessee to be kept and performed and said default shall continue for a period of 30 days after written notice thereof from Lessor to Lessee (unless such default cannot reasonably be cured within 30 days and Lessee shall have commenced to cure said default within said 30 days and continue diligently to pursue the curing of same);

(c) if Lessee shall file a petition in bankruptcy or be adjudicated a bankrupt, or file any petition or answer seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution or similar relief for itself under any present of future federal, state or other statute, law or regulation or make an assignment for the benefit of creditors, or if any trustee, receiver or liquidator of Lessee or of all of any substantial part of its properties or of the Leased Premises shall be appointed in any action, suit or proceeding by or against Lessee and such proceeding or action shall not have been dismissed or bonded within 30 days after such appointment;

(d) if the Leasehold estate hereby created shall be taken on execution or by other process of law, except eminent domain; or

(c) if Lessee shall vacate, abandon or fails to occupy the Leased Premises for a period in excess of 30 days

17. Lessor’s Remedies. In the event of any default set forth in Section 17 hereof. Lessor, may, at its option, exercise any and all of the following remedies, in addition to those that may be available to Lessor, at law:

(a) Lessor may, without terminating this Lease, enter upon the Leased Premises, without being liable for prosecution or any claim for damages therefore, and do whatever Lessee is obligated to do under the terms of this Lease, in which event Lessee shall reimburse Lessor on demand for any expenses which Lessor may incur thus effecting compliance with Lessee’s obligation under this Lease and Lessor shall not be liable for any damages resulting to Lessee from such action;

(b) Lessor may, if it elects to do so, bring suit for the collection of Rent and/or any damages resulting from Lessee’s default without entering into possession of the Leased Premises or voiding this Lease;

(c) Lessor may terminate this Lease after 15 days’ written notice to Lessee, whereupon Lessee shall quit and surrender the Leased Premises by said date, failing which, Lessor may enter upon the Leased Premises forthwith or at any subsequent time without additional notice or demand, (which additional notice or demand is hereby expressly waived by Lessee), without being liable for prosecution of any claim for damages therefore, and expel Lessee and those claiming under is and remove their effects without being guilty of any manner of trespass, whereupon, Lessor may: (i) accelerate and declare the entire remaining unpaid Rent and any and all other monies payable under this Lease for the balance of the term hereof to be immediately due and payable; or (ii) collect from Lessee, as liquidated damages, all past due Rent and other amounts due Lessor up to the date of termination, plus the difference between Rent provided for herein and the proceeds from any re-letting of the Leased Premises, payable in monthly installments over the period that would otherwise have constituted the remaining term, of this Lease, plus all expenscs in connection with such re-letting including without limitation all costs, fees and expenses of repossession, brokers, advertising, attorneys, courts, repairing, cleaning, repainting and remodeling the Leased Premises for re-letting, less the proceeds of any re-letting or the value of Lessor’s use of the Leased Premises.

(d) Without waiving its rights to terminate at any time as provided above, Lessor may retake possession of the Leased Premises, it being agreed that any such retaking or the commencement and prosecution of any action by Lessor in eviction, forcible entry and detainer, ejectment or otherwise, or any execution of any judgment or decree obtained in any action to recover possession of the Leased Premises shall not be construed as an election to terminate this Lease unless Lessor expressly exercises its option hereinbefore provided to declare the term hereof ended, whether or not such entry or reentry be, had or taken under summary proceedings or otherwise, and shall not be deemed to have absolved or discharged Lessee from any of its obligations and liabilities, for the remainder of the current term of the Lease; rather, this Lease shall continue in effect for the remainder of the then current term, and Lessee shall remain liable and obligated under all of the covenants and conditions hereof during the said period and shall pay as and when due the Rent and other amount, payable hereunder as if Lessee had not defaulted. Lessor may re-lease the Leased Premises for the account of Lessee, crediting the Rent received on such re-leasing first to the costs of such re-leasing and then to any other amounts owing by Lessee hereunder—Such continuance of this in case shall not constitute any waiver or consent by lessor of or to said default or any subsequent default.

| Page 3 of 7 | ||||

| Lessee: |  |

Lessor: |  | |

No remedy herein or otherwise conferred upon or reserved to Lessor shall be considered exclusive of any other remedy, but the same shall be cumulative and shall be in addition to every other remedy given hereunder or now or hereafter existing at law or in equity or by statute, and every power and remedy given by the Lease to Lessor may be exercised from time to time and as often as the occasion may rise or may be deemed expedient.

In addition to the foregoing remedies and regardless of which remedies Lessor pursues. Lessee covenants that it will indemnify Lessor from and against any reasonable loss and damage directly or indirectly sustained by reason of any termination resulting from any event of default as provided above or the enforcement or declaration of any rights and remedies of Lessor or obligations of Lessee, whether arising under this lease or granted, permitted or imposed by law or otherwise. Lessor’s damages hereunder shall include, but shall not be limited to. any loss of Rent prior to or after re-leasing the Leased Premises, brokers/salespersons commissions, advertising costs, reasonable costs of repairing, and remodeling, the Leased Premises for re-leasing, moving and storage charges incurred by Lessor in moving Lessees property and effects and legal costs and reasonable Attorney’s fees incurred by Lessor in any proceedings resulting from Lessee’s default, collecting any damages hereunder, obtaining possession of the Leased Premises by summary process or otherwise or re-leasing the Leased Premises, or the enforcement or declaration of any of the rights or remedies of Lessor or obligations of Lessee, whether arising under this Lease or granted, permitted or imposed by law or otherwise In the event that any court or governmental authority shall limit any amount, which Lessor may be entitled to recover under this paragraph. Lessor shall be entitled to recover the maximum amount permitted under law . Nothing in this paragraph shall be deemed to limit Lessor’s recovery from Lessee of the maximum amount permitted under law or of any other sums or damages which Lessor may be entitled to so recover in addition to the damages set forth herein

18. Non-waiver of Defaults. No delay or omission of Lessor to execute any right or power arising from any default shall impair any such right or power or shall be construed to be a waiver of any such default or any acquiescence therein. No waiver of any breach of any of the covenants of this Lease shall be construed, taken or held to be a waiver of any other breach or waiver or acquiescence in or consent to any further or succeeding breach of the same covenant. Receipt by Lessor of less than the full amount due from Lessee shall not be construed to be other than a payment on account of the amounts then due, nor shall any statement on Lessee’s check or any letter accompanying Lessee’s payment be deemed an accord and satisfaction, and Lessor may accept such payment as a partial payment only. The rights herein given to receive, collect, sue or distrain for any Rent or Rents, monies or payments, or to enforce the terms provisions and conditions of this Lease, or to prevent the breach of nonobservance thereof, or the exercise of any such right or of any other right or remedy hereunder or otherwise granted or arising, shall not in any way affect or impair or take away the right or power of Lessor to declare the term hereby granted ended and to terminate this Lease as herein provided because of any default in or breach of any of the covenants, provisions or conditions of this lease.

19. Fire and Casualty. In the event of the total destruction of the building by fire or otherwise, or so much thereof that Lessee shall be unable to operate its business, Lessor or Lessee, as the case may be, shall so notify Lessee or Lessor within 60 days of the casualty, the Rent shall be paid up to the date of the casualty, and from the date of the casualty, and henceforth, this Lease shall cease and come to an end. In the event the Leased Premises or the building in which the Leased Premises is located shall be partially damaged by fire or other casualty, the same, except as hereinafter provided, shall be repaired as speedily as possible by and at the expenses of Lessor, and the Rent shall be shared in proportion to that part of the Leased Premises which are untenable. However, if such damages resulted from or was contributed to by the act, omission, fault or neglect of lessee, or Lessee’s employees invitees or agents, then there shall be no abatement of Rent except to the extent recovered from Rental insurance. In the event the Leased Premises arc not repaired and tenable within 180 days after the damage or casually, Lessee shall have the option to terminate this Lease at any time thereafter but prior to the Leased Premises being repaired and made tenable. In the event the holder of any indebtedness secured by a mortgage or deed of trust covering the Leased Premises requires that the insurance proceeds be applied to such indebtedness, then Lessor shall have the right to terminate this Lease by delivering written notice of termination to Lessee within fifteen (15) days after such requirement is made by any such holder, whereupon all rights and obligations hereunder shall cease and terminate.

20. Indemnification. Lessee shall indemnify, defend and hold Lessor harmless against and from any and all claims, liabilities, demands, actions, losses, damages, orders, judgments, penalties, fines and any and all costs and expenses (including, without limitation, reasonable attorneys’ fees and costs of litigation) incurred as a result of, in connection with or arising, directly or indirectly, from Lessee’s occupation and/or use of the Leased Premises, including, without limitation, injury to any person or damage to any property occurring in, on or about the Leased Premises; provided, however, that Lessee shall not be liable to indemnify Lessor with respect to any of the foregoing arising out of the negligence gross negligence or intentional misconduct of Lessor or any of its contractors, agents, employees, officers, partners or other Lessees or their invitees.

21. Casualty and General Liability Insurance. Lessor shall keep and maintain, with respect to the Leased Premises and the building in which it is located, the following policies of insurance, in such amounts and having such deductibles as Lessor may, in its sole and absolute discretion, deem appropriate: (i) property and casualty insurance: and (ii) comprehensive general, public liability insurance. Commencing as of the second Lease Year. Lessee shall pay its prorata share (calculated by multiplying the amount of increase, if any, by a fraction, the numerator of which is the gross leasable area of the Leased Premises, and the denominator of which is the total gross leasable urea of all property insured by such policy or policies) of any increase in the costs of such policies over the annual premium amount paid or payable by Lessor as of the Effective Date hereof. Notwithstanding the foregoing, lessee shall have no right to receive all or any portion of the proceeds of such policies of insurance, with regard to any claims made thereunder on account of casualty, damage to or loss of the Leased Premises and/or the building which the Leased Premises is located.

22. Personal Property Insurance. Lessee shall, at all times during the Term of this Lease, keep and maintain, at Lessee’s sole cost and expense, such policy or policies of insurance providing Lessee coverage (in such amounts and having such deductibles as Lessee may deem appropriate) against loss or damage to its equipment and other personal property in the Leased Premises by fire and all other casualties usually covered under a fire and extended coverage policy of casualty insurance. Any and all deductibles due and payable in connection with covered losses hereunder shall be the responsibility of Lessee.

23. Environmental Indemnification. Lessee hereby represents, warrants, covenants and agrees to at all times to be, in all material respects, in compliance with all state, federal, and local laws and regulations governing or in any way relating to the generation, handling, manufacturing, treatment, storage use, transportation, spillage, leakage dumping, discharge, or disposal (weather legal or illegal, accidental or intentional) of any Hazardous Substance (as defined hereinbelow). Lessee hereby agrees to indemnify, protect, defend, (with counsel) and hold Lessor, its managers, officers, partners, directors, shareholders, agents, lenders, and employees harmless from and against any and all claims (including, without limitation, third party claims for personal injury or real or personal property damage), actions, administrative proceedings, judgments, damages, punitive damages, penalties, fines, costs, liabilities (including sums paid in settlements of claims) and expense of whatsoever kind and/or nature (including attorneys fees) arising out of or in connection with directly or indirectly, the release or suspected release during the Term of this Lease, of any Hazardous Substance in or into the air soil, surface water, groundwater or soil vapor at, on about, under or within the Leased Premises, or any portion thereof.

As used herein, the term “Hazardous Substances” means any hazardous or toxic substances materials or wastes including, but not limited to those listed in the United States Department of Transportation Tables, or by the Environmental Protection Agency as Hazardous substances, or such substances, materials, and wastes which are or become regulated under any applicable local, slate or federal law including, without limitation, any material, waste, or substance which is (i) petroleum, (ii) asbestos, (iii) polychlorinated biphenyls, (iv) designated as a Hazardous Substance pursuant to sections of the Clean Water Act defined as a Hazardous waste pursuant to Sections of the Resource Conservation and Recovery Act defined as a Hazardous substance pursuant to sections of the Comprehensive Environmental Response, Compensation and Liability Act, or defined as Hazardous Substances pursuant to Florida Statutes.

24. Eminent Domain. Should the Leased Premises or the building in which the Leased Premises are located, be taken. appropriated or condemned for public purposes, or voluntarily transferred in lieu of condemnation, in whole or in such substantial part as to render the building unsuitable for Lessor’s purposes or the Leased Premises unsuitable for Lessee’s purposes, the Term of this Lease shall, at the option of Lessor in the first instance and at the option of Lessee in the second instance, terminate when Lessee’s right to possession is terminated If neither party exercises this option to terminate within 10 days after the dale of such taking, or if the portion of the Leased Premises or the building taken, appropriated, condemned or voluntarily transferred in lieu of condemnation does not render the building unsuitable for lessor’s purposes or the Leased Premises unsuitable for Lessee’s purposes, then this Lease shall terminate only as to the part taken or conveyed on the date Lessee shall yield possession, and Lessor shall make such repairs and alterations as may be necessary to make the part not taken usable, and the Rental payable hereunder shall be reduced in proportion to the part of the Leased Premises taken. Lessee shall have the right to recover from the condemning authority, such compensation as may be awarded to Lessee on account of interruption of Lessee’s business, for moving and relocation expenses and for depreciation to and removal of Lessee’s goods and trade fixtures.

| Page 4 of 7 | ||||

| Lessee: |  |

Lessor: |  | |

25. Subordination. Lessor reserves the right to sell, assign, transfer, mortgage or convey any and all rights it may have in the building the Leased Premises or this Lease, and to subject this Lease to the lien of any mortgage [up to but not exceeding seventy-five percent (75%) of the fair market value of the Leased Premises] now or hereafter placed upon the building or the Leased Premises; provided, however, Lessee’s possession and occupancy shall not be disturbed or the Lease modified, so long as Lessee shall comply with the provisions of this Lease.

26. Notices. Any notice required or permitted to be given under this Lease shall be deemed to have been given if reduced to writing and delivered in person or mailed by certified mail, postage prepaid, or by overnight delivery service, to the party who is to receive such notice at the address set forth on the signature page of this Lease or to such other places as may be designated in writing by Lesser or Lessee. Delivery shall be deemed to have occurred upon receipt or refusal of service.

27. Estoppel Certificate. Lessee shall at any time and from time to time upon not less, than 20 days’ prior written request from Lessor, execute, acknowledge and deliver to Lessor a written certificate stating: (a) whether this Lease is in full force and effect; (b) whether this Lease has been modified or amended and, if so, identifying and describing any such modification or amendment; (c) the date to which Rent has been paid; (d) whether Lessee knows of any default on the part of Lessor and, if so, specifying the nature of such default; and (e) that the improvements have been fully completed by Lessor in accordance with the plans and specifications approved by Lessee, and that Lessee is in full and complete possession thereof.

28. Quiet Enjoyment. Lessor covenants with Lessee that Lessee, having performed its covenants and agreements herein set forth, shall have quiet and peaceable possession of the Leased Premises on the terms and conditions herein provided.

29 Governing Law. This Lease shall be interpreted under the laws of the state of Florida and venue for any litigation shall be proper in any county, state or federal court located in Hillsborough County, Florida.

30. Waivers. Neither party shall be considered to have waived any of the rights, covenants or conditions of this Lease unless evidenced by its written waiver; and the waiver of one default or right shall not constitute the waiver of any other. The acceptance of Rent shall not be construed to be a waiver of any breach or condition of this Lease.

31. Successors. The provisions of this Lease shall be binding upon and inure to the benefit of Lessor and Lessee, respectively, and their respective successors, assigns, heirs, executors and administrators.

32. Partial Invalidity. If any clause or provision of this Lease is illegal, invalid or unenforceable under present or future laws, the remainder of this Lease shall not be affected thereby; and there shall be added as part of this Lease a replacement clause or provision or similar in terms to such illegal, invalid or unenforceable clause or provisions as may be possible and be legal, valid and enforceable.

33. Relationship of the Parties. Lessor and Lessee agree that the relationship between them is that of Lessor and Lessee and that Lessor is leasing space to Lessee. It is not the intention of the parties, not shall anything herein be constructed to constitute Lessor as a partner or joint venture with Lessee, or as a “warehouseman” or a “bailee”.

34. Headings. The headings as to the contents of particular paragraphs herein are intended only for convenience and are in no way to be constructed as a part of this Lease of as a limitation of the scope of the particular paragraphs to which they refer.

35. Survival of Obligations. All obligations of any party hereunder not fully performed as of the expiration or earlier termination of the term of this Lease shall survive the expiration or earlier termination of the term hereof for a period commensurate with the applicable status of limitations that an action could be maintained with respect thereto.

36. Lessee Authority. Lessee represents and warrants to Lessor that Lessee has the full right, power and authority to enter into this Lease and to fully perform each and all of its obligations hereunder the party signing below has the due and proper authority to execute and deliver this Lease.

37. Redemption. Lessee hereby expressly waives any and all rights of redemption, if any, granted by or under am present or future law in the event Lessor shall obtain possession of the Leased Premises by virtue of the provisions of this Lease, or otherwise.

38. Waivee of Jury Trial. LESSOR, LESSEE AND GUARANTORS HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE THE RIGHT EITHER PARTY MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION BASED HEREON, OR ARISING OUT Of, UNDER OR IN CONNECTION WITH THIS AGREEMENT AND ANY AGREEMENT EXECUTED IN CONJUNCTION HEREWITH, OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER VERBAL OR WRITTEN) OR ACTIONS OF EITHER PARTY. THIS PROVISION IS A MATERIAL INDUCEMENT OF THE LESSOR ENTERING INTO THIS AGREEMENT.

39. Radon Gas. RADON IS A NATURALLY OCCURRING RADIOACTIVE GAS THAT, WHEN IT HAS ACCUMULATED IN A BUILDING IN SUFFICIENT QUANTITIES, MAY PRESENT HEALTH RISKS TO PERSONS WHO ARE EXPOSED TO IT OVER TIME. LEVELS OF RADON THAT EXCEED FEDERAL AND STATE GUIDELINES HAVE BEEN FOUND IN BUILDINGS IN FLORIDA. ADDITIONAL INFORMATION REGARDING RADON AND RADON TESTING MAY BE OBTAINED FROM YOUR COUNTY PUBLIC HEALTH UNIT. DISCLOSURE MADE PURSUANT TO §404.056(8), FLORIDA STATUES.

40. Multiple Counterparts. This Lease may be executed in one or more counterparts, each of which shall be deemed and original and all together shall constitute one and the same instrument.

41. Construction. The parties have participated jointly in the negotiation and drafting of this Lease. In the event that an ambiguity or question of intent or interpretation arises, this Lease shall be construed as if drafted jointly by the parties and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any of the provisions of this Lease.

42. Attorney’s Fees. In the event any litigation ensues with respect to the rights, duties and obligations of the parties under this Lease, the non-prevailing party in any such action or proceeding shall pay for all costs, expenses and reasonable attorney’s fees incurred by the prevailing party in enforcing the covenants and agreements of this Lease. The term “prevailing party” as used herein, shall include, without limitation, a party who obtains legal counsel and brings action against the other party by reason of the other Party’s breach or default and obtains substantially the relief sought, whether by compromise, settlement or judgment.

43. Time is of the Essence. Time is of the essence in the full and complete performance of each and every obligation of Lessee hereunder.

44. Entire Agreement. This Lease and the Exhibits attached hereto constitute the complete and entire understanding and agreement between Lessee and Lessor. All prior inconsistent arrangements, understandings and/or agreements whether oral or written, are hereby declared null and void.

INTENTIONALLY

LEFT BLANK

SIGNATURE PAGE TO FLLOW

| Page 5 of 7 | ||||

| Lessee: |  |

Lessor: |  | |

IN WITNESS WHEREOF, Lessor and Lessee have hereunto set their hands and seal on the day and year first above written.

| Witnesses: | LESSOR: | |||

| Twin Lakes Office Park | ||||

| /s/ Clark A. Marcus | ||||

| Name: | Clark A. Marcus | By: | /s/ Joseph A. Kennedy | |

| Joseph A. Kennedy, Manager | ||||

| /s/ Dagny Rivers | ||||

| Name: | Dagny Rivers | Address (for Notice purposes): | ||

| Twin Lakes Office Park Attn: Joseph A. Kennedy 3410 Henderson Boulevard, Suite 200 Tampa, FL 33608 | ||||

| LESSEE: | ||||||

| Advanzeon Solutions, Inc. | ||||||

| a(an) | ||||||

| /s/ James L. Koenig | ||||||

| Name: | James L. Koenig | By: | /s/ Clark A. Marcus | |||

| Name: | Clark A. Marcus | |||||

| Title: | ||||||

| FEIN: | ___ - ____________________ | |||||

| /s/ Dagny Rivers | ||||||

| Name: | Dagny Rivers | Address (for Notice purposes): | ||||

| Attn: | ||||||

| E-mail: | ||||||

| Page 6 of 7 | ||||

| Lessee: |  |

Lessor: |  | |

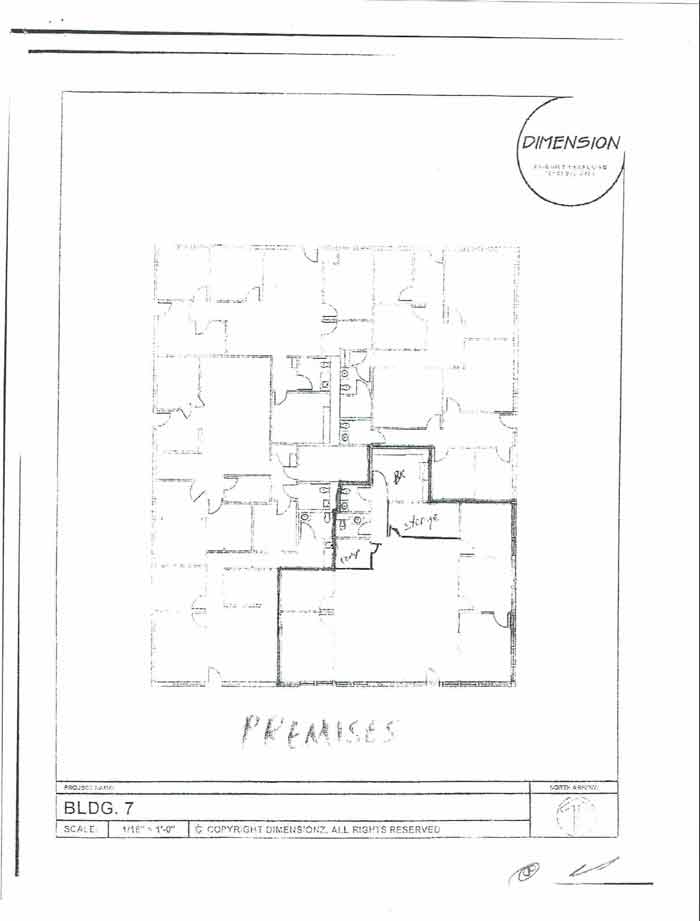

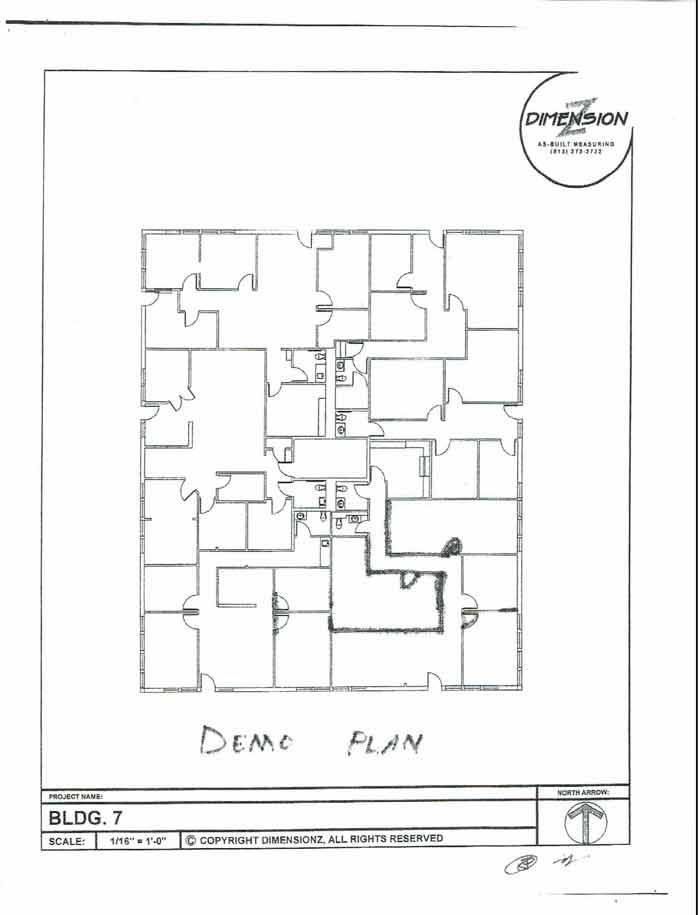

EXHIBIT A

Landlord work

| 1. | Landlord will demolish the walls as indicated on the attached Demo Plan. |

| 2. | Landlord will construct walls as indicated on the attached Premises plan. |

| 3. | New standard building paint & carpet throughout, wood floors to remain. |

| 4. | Replace damaged ceiling tiles and fix roof leaks. |

| 5. | HVAC to be in good working order. |

| 6. | All light bulbs and ballasts to be in good working order. |

For additional layout detail see attached Premises plan and DEMO PLAN.

| Page 7 of 7 | ||||

| Lessee: |  |

Lessor |  | |

AMENDMENT TO LEASE AGREEMENT

This amendment to lease agreement (the “amendment”) is made this 25th day of June, 2014, by and between Advanzeon Solutions, Inc. “Tenant”) and Twin Lakes Office Park (“Landlord”).

WITNESSETH

Whereas, Tenant and Landlord did enter into certain Lease Agreement (the “Original Lease”) dated May 23, 2014 pursuant to which Tenant does lease from Landlord Suite 701 in that office park in Tampa, Florida known as Twin Lakes Office Park (formerly Lincoln Garden) at 2910 W. Busch Blvd., Tampa, Florida (the “Premises”).

Whereas, Tenant and Landlord desire to modify and amend the Lease to add 1,008 rentable square feet to the Premises. Agreements of Original Lease will remain unaltered except for specific changes defined by this amendment and will apply to any succeeding tenant.

Now, therefore, Landlord and Tenant hereby covenant and agree as follows:

| 1. | The Premises as defined in paragraph 1 of the Lease shall be revised to be: |

2901 W. BUSCH BOULEVARD, UNITS 701 & 703, TAMPA, FL 33618

| 2. | In accordance with paragraph 4 of the Lease the revised Rent will be as follows: |

| Lease Year | Monthly Installment1 |

| Months 1-12 | $3,304.72 |

| Months 13-24 | $4,828.70 |

| Months 25-36 | $4,963.98 |

| Months 37-48 | $5,104.78 |

| Months 49-60 | $5,248.34 |

In witness whereof, the undersigned has caused this amendment to be executed and delivered, on the day and year first written.

| Landlord | |||||

| Twin Lakes Office Park | |||||

| Witness | |||||

| By: | |||||

| Witness | Joseph A Kennedy | ||||

| It’s President | |||||

| Date: |

| Tenant | |||||

| ADVANZEON SOLUTIONS, INC. | |||||

| Witness | /s/ Sharon Mandel | ||||

| By: | /s/ James L. Koenig | ||||

| Witness | /s/ Dan Kane | ||||

| It’s: | Acting CFO | ||||

| Date: | 06-25-14 |

1 of 1