Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Rafina Innovations Inc. | ex321.htm |

| EX-31.1 - CERTIFICATION - Rafina Innovations Inc. | ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to ______

Commission File Number: 000-53089

|

HCI VIOCARE

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

30-0428006

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

Kintyre House, 209 Govan Road, Glasgow Scotland G51 1HJ

|

(Address of principal executive office)

Registrant's telephone number, including area code: +44 141 370 0321

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer

|

Accelerated filer

|

☐

|

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

|

|

|

|

Emerging growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ☒

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as at June 30, 2017 (the last business day of the registrant's most recently completed second quarter), was approximately $6,393,784 based on the $0.15 per share which was the last selling price of the Company's common stock, assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

|

|

256,133,852 shares of common stock issued and outstanding as of May 15, 2018

|

|

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes.

|

|

None

|

|

ii

TABLE OF CONTENTS

|

|

|

Page

|

|

|

PART I

|

|

|

|

|

|

|

1

|

||

|

20

|

||

|

30

|

||

|

30

|

||

|

31

|

||

|

31

|

||

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

32

|

||

|

34

|

||

|

34

|

||

|

37

|

||

|

37

|

||

|

|

|

|

|

38

|

||

|

38

|

||

|

39

|

||

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

40

|

||

|

42

|

||

|

45

|

||

|

47

|

||

|

50

|

||

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

51

|

||

|

|

|

|

|

|

52

|

iii

Forward Looking Statements

This Annual Report on Form 10-K ("Annual Report") contains forward-looking statements. These statements relate to future events or our future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" and the risks set out below, any of which may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the "Risk Factors" section of this annual report. These risks include, by way of example and not in limitation:

|

·

|

we have a limited operating history and have to generate net income from our operations. Our first Prosthetics and Orthotics clinic opened in fiscal 2014 and continues to operate at a loss. We have realized limited income by way of licensing fees relative to development of our technology, and we currently have no commercial products in the market;

|

|

·

|

we currently have several technologies and product prototypes which, while nearing commercialization, require further development to market the specific application.. Our ability to generate product revenues, which may not occur for several years, if ever, will depend on the successful development and commercialization of these technologies including the "Sensor" technology, the "Socketfit" technology and product applications derived from our "Smart Insole" product prototypes as well as our recently developed portable motion capture and gait analysis technology.

|

|

·

|

our current and any future collaborations with third parties for the development and commercialization of our current product or any newly acquired products or businesses may not be successful;

|

|

·

|

we intend to acquire and operate additional clinics related to our business, however, there can be no assurance that we will be successful in doing so or if that if we do acquire such clinics that they will be profitable;

|

|

·

|

risks related to the failure to successfully manage or achieve growth of our business if we are successful in the development of our technology or the acquisition of clinics; and

|

|

·

|

other risks and uncertainties related to our business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," "company," "our" and "Viocare" mean HCi Viocare, and our wholly-owned Scottish subsidiaries: HCi Viocare Technologies Limited and HCi Viocare Clinics UK Limited, unless otherwise indicated.

iv

PART I

1.1 BACKGROUND

The address of our principal executive office is Kintyre House, 209 Govan Road, Glasgow G511HJ, Scotland, United Kingdom. Our telephone number is +44 141 370 0321. The Company's web-site is http://www.hciviocare.com.

Our common stock is quoted on the OTC Markets Inc. owned and operated Inter-dealer Quotation System ("OTCQB") under the symbol "VICA".

We were incorporated in the State of Nevada on March 26, 2007 as a company intending to sell medical devices in the northern regions of China. Our intent was to seek strategic relationships with medical device manufacturers both in China and North America with the aim to be their sales and distribution agent in northern China. We also intended to assist Chinese medical device manufacturers on the development of the North American market. The Company did not find suitable relationships with which to progress its business until it undertook a change in management in September 2013. With the change in management, the Company determined that it would initially concentrate on the development and marketing of medical devices in Europe, more particularly initially in Scotland, where management had identified several opportunities for entry into the markets for prosthetics and orthotics. We are currently engaged in healthcare innovation in the fields of prosthetics and orthotics (P&O), and we intend to be engaged in the operation of P&O total rehabilitation clinics. We have two wholly-owned Scottish subsidiaries: HCi Viocare Technologies Limited and HCi Viocare Clinics UK Limited.

On December 27, 2013, pursuant to approval of the Board of Directors and the majority stock holder on November 28, 2013 and November 29, 2013 respectively, the Company filed a Certificate of Amendment to the Articles of Incorporation of the Company for the purpose of clearly providing the directors of the Company with the authority to issue both common and preferred stock without approval by the stockholders and to grant the authority of the directors of the Company to issue such shares of common and/or preferred stock in one or more series, with such voting power, designation, preferences and rights or qualifications, limitations or restrictions as they may determine by resolution of the Board of Directors.

On January 13, 2014, the Company filed a Certificate of Designation with the Secretary of State of the State of Nevada. The Certificate of Designation sets forth the rights, preferences and privileges of a class of the Company's preferred stock. Such class shall be designated as the "Series A Preferred Stock" and the number of shares constituting such series shall be 5,000,000 shares. The holders of Series A Preferred Stock will be entitled to a preference over all of the shares of the Company's common stock. The holders of common stock and the holders of Series A preferred stock vote together as a single class with the holders of the Series A preferred stock having 50 votes per share of Series A preferred stock and the holders of common stock having 1 vote per share of common stock. Holders of Series A Preferred Stock are entitled to notice of any stockholders' meeting. No shares of Series A preferred stock have been issued as of the filing date of this report.

On January 15, 2014, we formed our wholly-owned subsidiary, HCi Viocare Technologies Limited ("Viocare Technologies"), a corporation incorporated pursuant to the laws of Scotland, under registration number SC467480. Viocare Technologies undertakes research, development and commercialization of state of the art, new, innovative medical devices, methods and products in the fields of prosthetics, orthotics, rehabilitation, bioengineering, mobility, diabetes, diabetic foot, tissue mechanics, ultrasonics, medical signal processing and analysis, medical technology, orthopedics and robotic surgery. Viocare Technologies also plans to expand its research and development reach, to create a stable pipeline of new products and upgrades in the fields of prosthetics, orthotics, and diabetes.

On February 12, 2014 we acquired intellectual property rights ("IPR") over an innovative medical technology entitled 'SocketFit' from our Board Member Dr. Christos Kapatos, as well as over any additional technologies under development or that may be developed in the future. Consideration for the acquisition of the exclusive, perpetual, revocable, transferable, royalty free worldwide ownership of the IPR, and know how to develop and exploit the IPR was the issuance of 3,500,000 shares of the common stock of the Company to Kapatos. SocketFit is a system that will help overcome technical and resource hurdles endemic to the prosthetic sector. The system has been designed with the aim of offering optimally fitted prosthetic sockets that will reduce the number of prostheses made for, resulting in a reduced number of visits by the patient to the prosthetic, and also assisting in the rehabilitation of amputees.

On March 21, 2014, the Company's name changed from China Northern Medical Device, Inc. to HCi Viocare in regard to actions taken on November 28, 2013, when the Board of Directors of the Company approved, and recommended to the majority stockholder that they approve the name change. On November 29, 2013, the majority stockholder approved the name change by written consent in lieu of a meeting, in accordance with Nevada State Law. FINRA approved the name change with an effective date of March 21, 2014. Our trading symbol is "VICA". We filed an amendment to our Articles of Incorporation with the Secretary of State of Nevada changing our name to HCi Viocare to be effective on March 21, 2014.

On April 17, 2014, the Company, through our Scottish subsidiary, HCi Viocare Technologies Limited, entered into an acquisition agreement with Dr. Christos Kapatos, a director of both the Company and HCi Viocare Technologies ("Kapatos"), to acquire all rights and interest in and to the background IPR for a developing technology now known as "Flexisense". Kapatos has conceived and been working on a Smart Insole System which is believed to be a state-of-the-art, pressure and shear force sensing insole with an incorporated real-time global display application and a fully featured support web-space that suggests to the user and his podiatrist/physiotherapist when inappropriate or dangerous conditions are developing on the feet. The product is being designed to help mitigate diabetic foot complications, such as ulceration, infection and amputation.

1

The competing insoles that were commercially available at this time can only monitor vertical pressure on the foot and not shear and have a significantly higher cost, and are intended for use in clinical or research environments.

As consideration for the acquisition:

|

·

|

HCi Viocare Technologies shall cause the parent Company to issue to Kapatos a total of 3,500,000 shares of the common stock of the Company on execution of the agreement and 3,500,000 shares of the common stock of the Company for each and every new version of the technology (new version to mean any update or improvement to the initial commercial product to be developed from the technology, after the commercial development of the first Market Ready Insole from the technology acquired, should the new version be developed to commercial market ready stage);

|

|

·

|

a cash bonus in the amount of $10,000,000USD should the technology be sold at any stage of development for an amount equal or greater than five hundred million ($500,000,000) cash or the equivalent thereof by way of any other consideration.

|

On May 8, 2015, the Company through its wholly owned subsidiary company HCi Viocare Technologies Limited entered into an agreement with Dr. Christos Kapatos, to amend the acquisition agreement ("Amendment of Acquisition Agreement") dated April 17, 2014. Under the Amendment of Acquisition Agreement, the parties agreed, among certain other terms and conditions, to the issuance of 7,000,000 restricted shares of the common stock of the Company as additional consideration for all other applications of the Smart Insole technology. Furthermore, under the terms of the Amendment of Acquisition Agreement no cash bonus shall be provided to Kapatos.

On April 15, 2014, the Company established a scientific advisory board whereby the Company intends to appoint certain advisors that can contribute to the Company's overall business strategy and future direction.

On June 9, 2014, the Company, through our Scottish subsidiary, HCi Viocare Clinics, entered into a Share Purchase Agreement with Mr. William Donald Spence, Miss Catriona Ann Spence, and Mrs. Eilidh Isabel Malcolm (together the "vendors"), to acquire 100% of the issued capital of W D Spence Prosthetics Limited (the "Clinic"). The Clinic is incorporated in Scotland under company number SC307652, having its registered office at 8 Tomcroy Terrace, Pitlochry, Perthshire, PH16 5JA, UK. The Clinic is a private company limited by shares, with no registered charges, and the total issued share capital amounts to 1,000 ordinary shares par value of £1 each. The vendors to the Share Purchase Agreement are the beneficial owners and registered holders of all (100%) the shares of the Clinic, with Mr. William Donald Spence holding 520 ordinary shares, and Miss Catriona Ann Spence and Mrs. Eilidh Isabel Malcolm each holding 240 ordinary shares. Mr. Spence is also the director of the Clinic, and Miss Malcolm is the secretary. The Clinic has no employees or subsidiaries, and is not a subsidiary of another company.

The Clinic is located in Glasgow, Scotland, and is a fully operational prosthetics clinic. The acquisition of the Clinic is the first step to the Company's and HCi Viocare Clinics' intention to develop the first chain of prosthetics and orthotics (P&O) and diabetes clinics in the European market, covering Southern Europe, the Middle East and North Africa.

On March 2, 2015, the Company announced the conclusion of a lease agreement for a modern, stand-alone 5,300 square foot facility in Glasgow, Scotland with an entry date of March 1, 2015. The building hosts the Company's first Viocare center, a full service Prosthetic and Orthotic ("P&O") practice with a superior standard of personalized care. This new facility serves as the center of reference and training for the intended chain of Viocare P&O and diabetic foot centers across Europe, ensuring their adherence to British and International standards. The Company's Technologies subsidiary occupies the first floor of the building to continue to develop its portfolio of bioengineering innovations.

On March 31, 2015, the Company's wholly owned subsidiary HCi Viocare Clinics and its subsidiary W D Spence Prosthetics Limited completed a merger with the resulting combined entity having the name HCi Viocare Clinics UK Limited.

On July 8, 2015, the Company incorporated HCi Viocare Clinics (Hellas) S A in order to carry out operations for the planning and development of a P&O clinic in Athens, Greece. On August 2, 2017 the Company commenced the dissolution and liquidation of this corporation.

On August 8, 2015 FINRA approved a seven (7) new for one (1) old forward split of our authorized and issued and outstanding shares of common. A Certificate of Change for the stock split was filed and became effective with the Nevada Secretary of State on August 7, 2015. Consequently, our authorized share capital increased from 100,000,000 to 700,000,000 shares of common stock and our issued and outstanding common stock increased accordingly, all with a par value of $0.0001. Our preferred stock remained unchanged. All share and per share figures contained herein reflect the impact of the forward split.

On July 18, 2015, the Company appointed Mr. Yiannis Levantis as a member of the Board of Directors.

2

On September 1, 2015, the Board of Directors approved a consulting agreement with Sergios Katsaros and appointed Mr. Katsaros Vice President of HCi Viocare.

On September 25, 2015, the official opening of the Company's new Research and Development (R&D) center together with its first Prosthetics and Orthotics (P&O) clinic in the UK took place in Glasgow, Scotland with an official ribbon cutting by Scotland's First Minister, Nicola Sturgeon MSP. Additional information and updates on the Company's Clinic and R&D center can be found at the new Glasgow clinic website: www.hci-viocare.co.uk and on Twitter: @HCiVioClinic.

On April 11, 2016 the Company announced the branding of its unique smart insole technology as "FlexisenseTM".

On September 15, 2016, the Company appointed Mr. Nikolaos Kardaras as Director of its subsidiary HCi Viocare Clinics UK Ltd. and HCi Viocare Technologies, Inc. subsequent to the resignation of Dr. Christos Kapatos from both corporations effective June 27, 2016.

On September 23, 2016 the Company entered into a licensing agreement with respect to certain applications of its Flexisense™ Technology with Carilex Medical Inc. a leading medical mattresses manufacturer. Under the terms of the agreement the Company will receive a Technology Access Fee, as well as certain staggered success fee payments as each commercialized product under the scope of the agreement is completed. In addition, there are product based royalty fees payable to the Company on a sliding scale based on production levels for all commercial products sold into the marketplace.

On December 20, 2016, the Company appointed Mr. Brian Maguire as Director of its subsidiary HCi Viocare Clinics UK Ltd.

On October 9, 2017, the Company appointed Dr. Ioannis Doupis, to the Advisory Board of the Company originally formed on April 15, 2014. The advisory board appointment is for a term of one year.

On December 12, 2017, the Company approved the issuance of 18,500,000 common shares to Dr. Christos Kapatos, CTO and Director of the Company, as consideration for the transfer of certain complementary technological developments and work in progress in the form of a stock award which vested as of the date of grant.

On January 31, 2018 the Company announced that it will commence development of its own proprietary Blockchain based system for handling sensitive client records in its flagship Prosthetics and Orthotics clinic in Scotland. Furthermore, the team plans to develop a proprietary Blockchain based system for handling and storing the data produced from the medical applications of its FlexisenseTM technology.

On February 15, 2018, the Company entered into a Term Sheet with Mr. Georgios Thrapsaniotis and Mrs. Stella Thrapsanioti, his spouse ("Stella"), pursuant to which Mr. and Mrs. Thrapsaniotis will purchase certain securities of the Company at a fixed price of US$0.03 per share. Upon execution of the Term Sheet, one or multiple Private Placement Subscription Agreements are agreed to be entered into during the immediately following 10 days for total proceeds of USD $360,000 in respect of the issuance of a total of 12,000,000 shares of the restricted common stock of the Company. As at the date of the Term Sheet, Mr. and Mrs. Thrapsaniotis collectively owned 18,049,898 restricted shares of the Company's common stock.

The Term Sheet also provides that Mr. Thrapsaniotis, or his designee, shall be entitled to hold the position of Treasurer of the Company, provided that Mr. and Mrs. Thrapsaniotis hold in excess of 5% of the Company's issued and outstanding common stock collectively, until the conclusion of a full profitable year irrespective of the number of shareholdings held individually or collectively by them at the relevant time. Furthermore, it is agreed by and between the shareholders of the Company who hold as of the date of the Term Sheet in excess of 5% of the Company's common stock, and concurrently hold a position on the Company's Board, or act in the capacity of any officer of the Company or its subsidiaries, that he/she shall not be entitled to receive any repayment against pre-existing debt owed by the Company, as of February 15, 2018, as it is recorded in the Company's financial records, except as otherwise agreed in writing.

Effective February 15, 2018, Mr. Sotirios Leontaritis resigned from his position as the Treasurer of the Company. Concurrently, the Board of Directors appointed Mr. Georgios Thrapsaniotis ("Thrapsaniotis") as a member of the Board of Directors of the Company. Mr. Thrapsaniotis was also appointed Treasurer in accordance with the provisions of a Term Sheet more fully described above.

On February 16, 2018, Thrapsaniotis subscribed for a total of 12,000,000 shares of the Company's restricted common stock at US$0.03 per share for total cash proceeds of $360,000. Concurrently, Thrapsaniotis and Stella became affiliates of the Company, holding jointly a total of 30,049,898 shares of the Company's common stock or 11.99% percent of the total issued and outstanding share capital.

3

On March 27, 2018, the Company entered into a one-year advisory agreement with Mr. Ravi Vaidyanathan (the "Advisor"). Under the terms and conditions of the Agreement, the Advisor is appointed to the Company's Scientific Advisory Board and shall serve in the position of Biomechatronics and Human Augmentation Advisor.

On March 22, 2018 and March 30, 2018 respectively, Sotirios Leontaritis, the President, Chief Executive Officer and a Director of the Company, entered into a Share Purchase Agreement (the "SPA") and an amendment thereto (the "Addendum"), (collectively herein referred to herein as the "Agreement") with Maschari Ltd. ("Maschari"), a Company incorporated in Cyprus, pursuant to which Mr. Leontaritis sold 122,710,562 of his restricted common shares to Maschari. Mr. Leontaritis received in exchange a Promissory Note dated March 30, 2018, to reflect the terms of the Agreement, in the principal amount of US$7,362,633 or US$0.06 per share, which note shall come due on March 29, 2021. The parties agreed that in the event Maschari defaults on the obligation to pay the Purchase Price according to the terms of the Agreement and the Promissory Note, Maschari will surrender the shares and shall return ownership of said shares to Mr. Leontaritis. Further, under the terms of the Agreement, the common shares are to be registered in the name of Maschari, however, until such time as the Promissory Note is paid in full, or the parties agree by written addendum thereto to the release of shares on a pro-rata basis in such amounts as may equal installment payments received, the shares shall remain encumbered. Further, in the event of any reverse split, forward split, cancellation or class conversion, as may occur in the normal course, which impacts the Company's common shares, it is agreed by the parties that such replacement shares, regardless of class and number, will continue to remain in escrow and may not be sold until paid in full and/or the parties have agreed to their release on a pro-rata basis for consideration received.

The shares sold by Mr. Leontaritis represent approximately 49.1% of the Company's total outstanding shares of common stock. Mr. Leontaritis continues to hold 20,000,000 shares of the Company's common stock representing approximately 8% of the issued and outstanding shares.

Additional information on the Company's activities, technologies and management team can be found at the Company's website: http://www.hciviocare.com

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Our Current Business – Research & Development and commercialization of technology for healthcare innovation including various athletic applications, and the operation of Prosthetics and Orthotics clinics.

The Company intends to exploit the growing need for high quality care and prevention in the growing population of the obese, diabetic, amputated and/or movement impaired through development of:

|

-

|

Chain of Clinics: Prosthetic, Orthotic and (diabetic foot) rehabilitation centers in poorly served markets, such as Mediterranean Europe & the Middle East. Differentiation through British standards in clinical practice, qualifications and training.

|

|

-

|

Technologies: Suite of patented solutions to help prevent, monitor & alleviate complications across different patient and athletic populations. Collaboration with and licensing to established industry participants globally to facilitate rapid development, distribution and scale.

|

We commenced modest revenue generating operations in fiscal 2014 and are primarily engaged in the research and development, commercialization and marketing of innovative medical technologies including wearable devices and on body applications that have use in insoles, in shoes, in cushions, seats, mattresses, saddles and any other wearable devices such as smart apparel and sports equipment. Further we are in development for more far reaching applications including use in automotive tires and other targeted industries where sensor technology may have valuable application. Further we continue to operate and expand our brand of prosthetics and orthotics ("P&O") and diabetic foot total rehabilitation clinics. During fiscal 2016 our flagship prosthetics clinic in Glasgow Scotland completed its first full year of operations after relocation to a larger state of the art facility which allowed for a substantive increase in our year over year revenues. Presently our revenue stream is derived primarily from the Company's flagship P&O clinic located in Glasgow, Scotland, and with some initial commercial income from prospective licensing partners for the Technologies businesses.

The Company's technologies and R&D portfolio presently consists of:

|

•

|

Filing of 3 patents in the UK: pressure sensor system; pressure & shear; pressure & positioning (Dec 2014) (all of which patents were abandoned upon the filing of a new International (PCT) patent application in December 2015 which covers over 140 countries around the world, and includes further advances made to the sensor systems, and a wider range of applications in products that touch people's everyday lives;

|

|

•

|

2 further patents drafted and pending filing during fiscal 2018, with a further 4 patent applications currently in draft form;

|

|

•

|

In excess of 4 prototypes: pressure & shear insole; smart cushion, smart mattress, with several of these prototypes in the commercialization stage;

|

|

•

|

1 proof of concept device: robotic surgical assistive device;

|

|

•

|

High level diagrams or complex documentation and software for other innovations in the portfolio.

|

|

•

|

Various customized prototypes in testing and development with commercial partners.

|

4

1.2 OUR TECHNOLOGIES

Research and Development

Research and development costs were $1,290,345 and $340,782 for the year ended December 31, 2017 and 2016.

|

A.

|

The Sensor Technology

|

As part of our ongoing development efforts stemming from R&D related to our base technologies acquired in fiscal 2014 from Dr. Christos Kapatos, notably the Smart Insole technology, HCi Viocare has developed a sensor system that can be incorporated into any thin, flexible, bendable material and is capable of measuring direct force applied vertically and shear forces applied horizontally. Each sensor can connect with other sensors, creating a network, in order to monitor an entire area.

Due to the nature of the technology used, which is currently being kept confidential, the sensor is unaffected by bending, temperature, humidity and excess pressure, load, making it suable for medical applications, wearable devices and on-body applications. The sensor system has been designed to be used in insoles, in shoes, in cushions, seats, mattresses, saddles and any other wearable devices such as smart apparel and sports equipment. A key feature of the sensor system is its low cost, with the components for each one sensing point measuring pressure and shear forces at a cost of US$1.10, which is an order of magnitude lower than conventional pressure-only sensing solutions such as capacitance, resistance or strain gauges.

The sensor system has been integrated into a prototype of an insole which is an autonomous, non-invasive, stand-alone unit, with its own rechargeable power supply, microcontroller and wireless communication unit. The insole can connect with smartphones, tablet pcs and pcs, through a mobile application, in order to transmit the data collected to the end user. End users could be a diabetic patient, to monitor pressure and shear forces for the prevention of diabetic foot ulcers, athletes interested in the impact on their knees of their running style or wanting to monitor the totality of their golf swing, or clinicians such as physiotherapists, orthotists and prosthetists needing to evaluate a person's gait.

The Company believes that there are applications for its force sensing technology in many fields within healthcare and sports, as well as more industrial fields due to its relative low cost vs conventional pressure sensing, its ability to measure shear forces in addition to pressure, its bendability and its reliability in a wide range of environments.

During fiscal 2016 the Company branded its unique area of sensor based technologies, "FlexisenseTM". Please visit http://flexisense.hciviocare.com.

Flexisense is a thin, flexible, bendable, sensor drone micro-electro-mechanical system capable of measuring direct force applied vertically on both its sides, shear force applied on its surface and 3D position and velocity of the object attached to it. The sensor is an autonomous, non-invasive, stand-alone unit, with its own rechargeable power supply, micro-controller and wireless communication unit. The drone can wirelessly connect with other drones, creating a network, in order to monitor an entire area. It can also connect with smartphones, tablet and computers, through an application which has also been developed, in order to transmit the data collected to the end user.

Flexisense is unaffected by bending, temperature, humidity and excess pressure, load and shear, and completely insulated, making it suitable for medical applications, wearable devices and on-body applications. The drone can be made in a plethora of shapes and sizes, to fit any application/situation. The drone has been designed to be used in insoles, in shoes, in cushions, seats, mattresses, saddles and any other wearable devices such as smart apparel and sports equipment.

Flexisense has application in every operation that a "fusion" force/pressure, shear and 3D position and velocity sensor is required. However, it was designed and developed specifically as a non-invasive medical sensor to be used in wearable devices, smart garments, training apparatus and for medical applications such as on-body, non-invasive, real time force, pressure, shear and 3D position and velocity measurements. For example, such a sensor can be invaluable for use in the monitoring of a person's gait providing data about the pressures applied on the foot, the interaction between shoe and foot and the forces applied in the system and the angles of the joints and posture position.

The Company concentrated its R&D efforts during early fiscal 2016 on the expansion of the commercial development of Flexisense and the second half of 2016 on seeking licensing partners for Flexisense and mattress application of the technologies, with conversations taking place with various industry partners. During fiscal 2016, the Company entered into an agreement with Carilex Medical Inc. a leading medical mattresses manufacturer. Under the terms of the agreement the Company received a technology access fee, and will receive certain staggered success fee payments as each commercialized product under the scope of the agreement is completed. In addition, there are product based royalty fees payable to the Company on a sliding scale based on production levels for all commercial products sold into the marketplace.

5

In addition, we have entered into several cooperative agreements with industry partners across several other areas of application for our technologies and we have customized prototypes under review with various commercial partners proposed for commercialization in fiscal 2018.

Flexisense Application: Diabetic Insole

The Company has developed a prototype for a smart insole measuring pressure and shear forces that can communicate wirelessly to smartphones and could be worn by diabetic patients to alert them to risky behavior and provide them and their clinicians with information to help prevent the diabetic foot ulcers that can ultimately result in amputation.

Many complications can be associated with diabetes. Diabetes disrupts the vascular system, affecting many areas of the body such as the eyes, kidneys, legs, and feet. People with diabetes are more prone to infection. They can also develop neuropathy (damaged nerves) or peripheral vascular disease (blocked arteries) of the legs. This can cause diminished feeling in the feet leading to unnoticed cuts, scratches, and tissue breakdown. This may result in ulceration and infection. Infection and foot ulceration, alone or in combination, often lead to amputation.

In terms of market size of the opportunity: foot complaints are the leading cause of hospitalization of people with diabetes and is estimated that 30% of all diabetics will develop a serious foot complaint at some time (http://www.who.int/topics/diabetes_mellitus/en/). By region, the North America diabetic foot ulcer therapeutics market dominated the global diabetic foot ulcer therapeutics market in revenue terms in 2016 and the trend is projected to continue throughout the forecast period. Revenue from the North America market is anticipated to increase at a CAGR of 10.8% over 2016–2024 to reach a market valuation of more than US$ 3,100 Million by 2024. (https://www.persistencemarketresearch.com/mediarelease/diabetic-foot-ulcer-therapeutics-market.asp)

It is widely understood that pressure and shear forces on the feet cause ulcerations and due to diabetic patients having neuropathy (resulting in loss of sensation in the feet), feet are not offloaded or taken care of appropriately.

It is very important for diabetics to take the necessary precautions to prevent all foot related injuries. Due to the consequences of neuropathy, daily observation of the feet is critical. Theoretically, if diabetes is well controlled and monitored it should be possible to avoid these foot problems. However, whilst clinical advice to diabetics is to 'mind their feet' and monitor them daily, they are not provided with a usable tool to measure the stresses and strains on their feet where there is some loss of sensation. This is what the insole intends to address.

The resulting product(s) will be a Class 1 medical device, depending on claims and disclaimers. While default alert settings would be provided, based on existing academic and clinical research, users would be encouraged to get their physician to set parameters.

The Company is not alone in recognizing the importance of measuring pressure on the feet of diabetics. Orpyx in Canada has launched a consumer product priced at $2,400, which requires an additional on-shoe component and a dedicated watch vs. HCi Viocare's fully integrated insole which could be marketed at <$500. A few other start-up companies (FeetMe, Sensoria) and research groups are working on diabetic foot monitoring insoles, but all only measure pressure, ignoring shear forces which can greatly impact ulceration, and use conversional pressure sensing (capacitive or resistive technology) which the Company feels may not be as reliable in the hot and humid environment of a shoe. Because HCi Viocare's technology measures all three forces (pressure and 2 horizontal shear forces) we are able to model with reasonable accuracy the calorific expenditure of the wearer, thereby potentially contributing to the diabetic patient's glucose management.

The Company is presently seeking licensing partners in respect of the diabetic insole application. The license partner could be any company marketing products to diabetics (e.g. blood glucose monitors and lancets) or wearable technologies company wanting to extend its healthcare reach (iHealth, Samsung) or foot specialist already catering to diabetic foot market (eg Dr. Scholl).

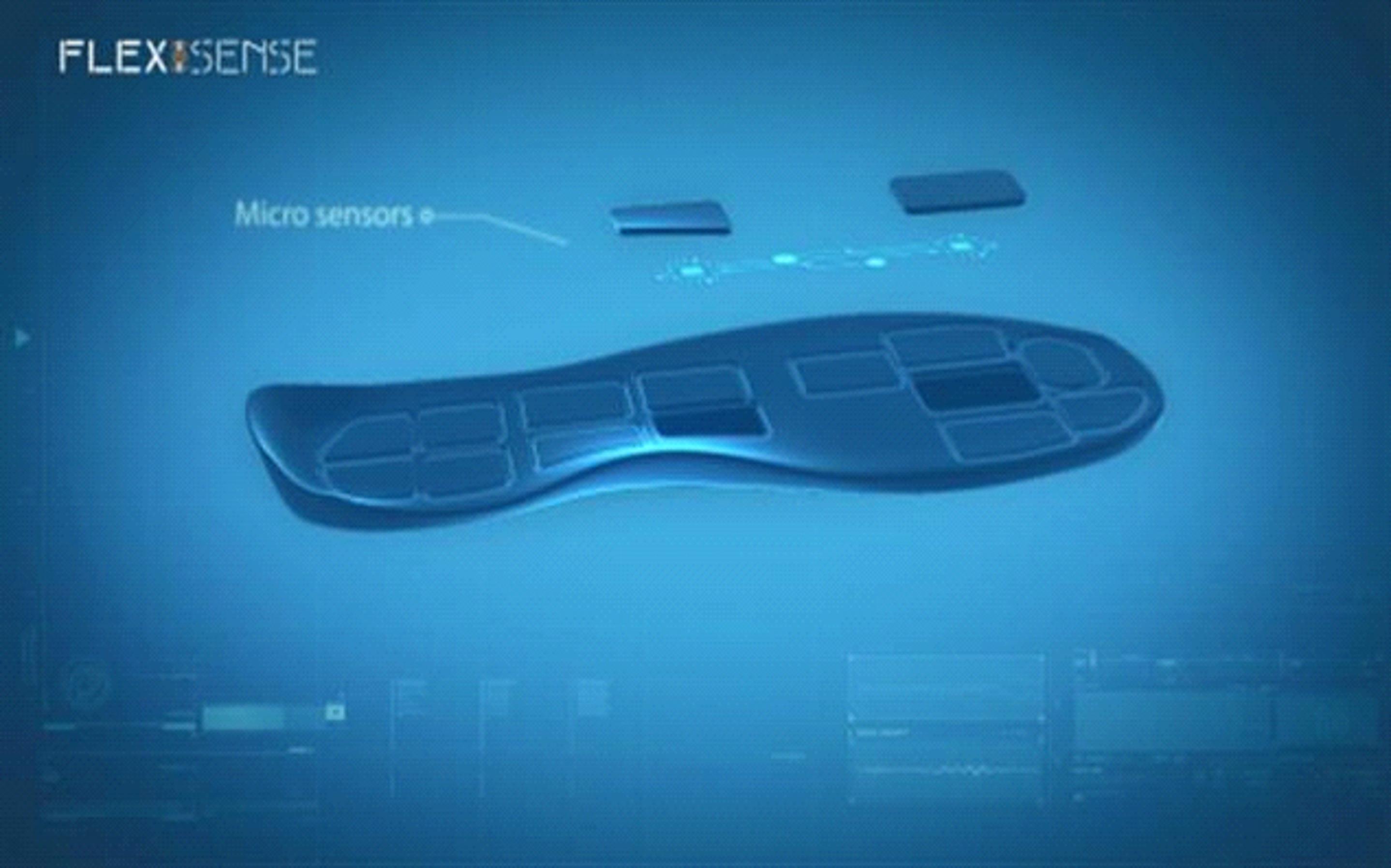

Figure: Flexisense application to smart insole

6

Flexisense Application: Medical gait analysis insoles

Orthotists, podiatrists, physiotherapists and prosthetists all require a good understanding of a patient's gait in order to diagnose biomechanical issues, provide appropriate rehabilitation and ensure appropriate alignment of the body when using orthoses (such as braces) or prosthetic limbs. Equally, researchers in these fields and biomedical engineering more generally are interested in the forces involved in gait and their impact on the body.

Academic and commercial researchers may have force plates at their disposal: metal plates built into the floor, which can capture the forces of a person walking or running over them. However, there are prohibitively priced (>$40,000) for most clinicians. There are therefore different systems on the market addressing clinicians and researchers:

|

·

|

optical gait analysis: whilst these can show movement very well, they do not yield any information on forces

|

|

·

|

pressure mats: these measure pressure but have a small surface meaning that one can only capture a snapshot of the gait

|

|

·

|

pressure sensing insoles: which can measure pressure more realistically over a larger distance

|

Presently we are aware of 3 devices that compete directly with the insole intended for clinical use only, each priced at in excess of $4,000: from Algeos (www.algeos.co.uk) which attaches sensors directly to the foot; and insoles from Tekscan (www.tekscan.com) , from Novel, (www.novel.de) and Moticon (www.moticon.de).

Management believes its medical insole would be unique in its ability to measure shear forces, and to operate for longer periods of time reliability and accurately due to limitations of the competing technologies (eg in humidity, when bent). Moreover, unlike the HCi Viocare prototype, existing insoles are not stand-alone, requiring ancillary componentry to communicate with the data capture unit and therefore making their use restricted to in-clinic. A cheaper, stand-alone insole could be given to patients to take away and record gait over time and over different surfaces.

The medical insole can also be expanded to become a combined 3D motion capture and gait analysis system for use by physiotherapists, orthotists, athletes and possibly in film and gaming.

Flexisense Application: Athletic insoles

Sports and fitness wearable devices have been in the market for more than 30 years. However, in the last 3 years the application of micro-electronics, wireless technology and the explosion of smartphones and mobile applications has revolutionized the market, with many established, as well as new, companies offering products applications for a wide range of sports.

Wearable wireless devices in the Sports, Fitness and Wellness market measure sports performance, daily activity, sleep patterns, and other related physical parameters. Another key factor that distinguishes this market is its consumer focus and that, unlike devices in the other healthcare markets, these devices usually do not require regulatory approval as a medical device.

The consumer market for wearable devices is exploding, and people appear to have an insatiable appetite for data to analyze their fitness and athletic performance. Nearly 50 million sports performance monitors were sold in 2014 and Worldwide revenue is forecast to reach $2.3 billion in 2017. http://cdn2.hubspot.net/hub/396065/file-2568104498-pdf/Blog_Resources/IHS-Wearable-Technology.pdf?t=1427903372862

Companies like Adidas-Salomon Ag, Nike Inc., Garmin, New Balance and Suunto invest millions of dollars every year for the development of wearable devices and material, and the market is booming as demand is ever increasing. The focus for most of these companies seems to be in the running shoes, apparel and equipment sector, as this sector is the fastest growing sports and fitness sector world-wide with billions of dollars of revenue every year. Under Armour has just launched its first smart shoe, monitoring only cadence.

The Company's sensor technology can be used in an insole or built into shoes to provide information to the wearer. It is the only pressure sensing technology that can work accurately in a warm and moist environment and with significant bending, like that experienced during running.

In keeping with the attractiveness of the market, there are a number of relatively new companies intending to launch insoles to give information to runners, together with coaching 'Apps'. Some of these measure only contact or movement (e.g., www.ambiorun.com) and others do measure pressure, usually not fully wireless/stand-alone (Medhab www.medhab.com; Arion www.ato-gear.com). Another competitor is Sensoria which markets a smart textile sock that measures pressure and pace. It also has a 'running coach' App. It requires an anklet to be worn, to house the battery and communication modules, and the socks require washing, potentially reducing their life span.

7

Note that the resistive or capacitive technologies used by competition struggle with bending and hot/humid environments and are therefore considered to be less reliable. Also, due to the cost associated with pressure sensing, competitors usually only have a small number of sensing points, limiting the value of the information. The Company's more cost effective sensing technology would permit a much greater number of points.

A further important differentiator from the competition is that the Company's sensor technology measures forces in three directions, giving not just plantar pressure information but also making the system capable of using industry accepted biomechanical modeling capabilities to project the impact on the knee of the wearer's running style. And the knee is an area of great focus for runners, who frequently experience injuries.

The athletic insoles could be coupled with other devices to give wearable performance information across a number of sports, including the high value tennis and golf markets. Golfers, for example would be able to link their swing (from an on-club sensor) to their weight displacement to optimize their performance. Currently on-racket or on-club sensors exist but fail to address this critical weight placement / foot force element for the athletes.

The Company is presently seeking licensing partners in respect of the athletic insole applications, with a number of discussions with market leaders in their fields ongoing and additional commercial prototypes under review.

Smart Mattress

Ulceration and skin (soft tissue) breakage is very common to people with tetraplegia or paraplegia and to most patients with limited movability that spend time in a bed, or in a wheelchair. It is caused by low continued pressure over time and/or high (peak) pressure points. The most commonly used method in a clinical environment, to avoid ulceration in such patients, is for a nurse to "turn" them, in better words; to change the position in which they lay in bed, frequently. This practice is supported by specialist therapeutic support surfaces (mattresses and overlays) to attempt to reduce pressure points. The more modern surfaces are powered air mattresses. There are different types of powered air mattresses, which can alternate pressure in their air cells on a pre-defined timetable.

In terms of market opportunity, hospitals are under tremendous pressure to address decubitus, particularly in the US where payers are moving away from covering "never events". Pressure ulcers affect a million patients in the USA alone each year and it costs the US healthcare system alone an est. $12 billion in direct treatment costs, not counting associated costs such as medical malpractice lawsuits;

Existing market solutions:

|

|

•

|

Adoption of pressure relieving overlays is increasing; these are generally not 'active' and merely made of a suitable material to reduce pressure, resulting in a lower cost; Whilst there is no direct clinical evidence for their effectiveness, there is a widespread belief and acceptance that they can reduce pressure ulcers;

|

|

|

•

|

Winncare's Axensor system is an example of an inflatable mattress with sections which goes through a standard cycle of in-/deflation to relieve pressure; these are increasingly common for high risk patients and are supplied by all leading therapeutic support surface manufacturers.

|

|

|

•

|

Israeli start-up Wellsense has the first pressure sensing mattress cover and their clinical evidence shows that the monitoring of pressure alone is already effective; however, it has low adoption because it is not breathable (which could aggravate ulcer formation) and it is costs >$3,000.

|

With the Company's sensor technology incorporated into mattresses and overlays, for which a prototype exists, technology licensees could develop a range of products with the following: lower production costs, sensors not affecting the properties of the mattresses, ability to measure shear in addition to pressure (shear forces being a recognized key contributor to ulceration).

Furthermore, with the sensor integrated into an inflatable mattress itself, we have developed a smart mattress that can respond intelligently to the pressure and shear data and inflate and deflate the mattress compartments automatically to reduce the risk of ulceration for patients, in between nursing interventions. This dynamic smart mattress adapts to the specific need of every patient and provides relief and adjustment only where and when is needed, maximizing the effectiveness of the treatment. This would be classed as a Class 1 medical device, and the license partner would need to pursue such registration prior to launch.

As noted above the Company has entered into an agreement with Carilex Medical Inc. a leading medical mattresses manufacturer where under the Company receives technology access fees and additional fees for each commercialized product under the scope of the agreement when completed. Further there are product based royalty fees payable to the Company on a sliding scale based on production levels for all commercial products sold into the marketplace.

8

Wheelchairs and medical chairs

The same technology as the Mattress can be used to provide pressure and shear monitoring integrated into wheelchair cushions and medical day-chairs to help prevent ulceration. This may be licensed to the same license partner as the mattress solutions.

Automotive

By incorporating the HCi Viocare sensor technology into automotive seating, professional drivers could be monitored automatically for posture, projected blood circulation, pressure and shear. Posture is important as back pain is a leading cause of absenteeism in the workplace, but in a driving environment, positioning can be an indicator of fatigue, a leading cause of accidents. Adoption of such technology could be driven by health and safety considerations and/or the insurance industry.

The Company is seeking partners in the automotive industry to discuss the potential of incorporating the technology into their vehicles.

|

B.

|

SocketFit

|

The Company will build on the work done by Dr. Kapatos in developing a scanning device to determine the optimal shape of an amputee's socket, capturing the internal geometry and the biomechanical properties of the tissues in the residual limb. This SocketFit technology was acquired in 2014. The intention is to partner with a leading scanning provider or manufacturer in the P&O market, through a development and license agreement, to produce a socket system for use by prosthetists worldwide.

Market opportunity

The number of amputees world-wide is estimated to be 20 million, and for most amputees finding a well-fitted prosthesis is far from easy. Traditional methods of design, manufacture and fitting of a prosthetic socket are typically carried out by "artisan" techniques but unfortunately often result in ill-fitting devices that make wearing a prosthesis almost intolerable for a large number of amputees.

A prosthetic socket is a custom-made "cone" that connects the rest of the prosthesis (foot, shank and knee) to an amputee's residual limb. Sockets generally need to be replaced every other year, though more frequently in the initial stages after amputation when the residual limb can still change shape significantly. While many significant technological advances have been made with the design and manufacture of prosthetic components, such as electronic knee assemblies and feet, socket design has not kept up. Over the past 20 years a great deal of research has been undertaken to automate the process of socket design and manufacturing, but it has been met with limited success. Most sockets continue to be created with hand-sculpted plaster moulds made by the Prosthetist or a technician hours or days after examining the amputee. The result is that, typically, one in four sockets are discarded because of their poor fit.

Many prosthetists, (if not all), are frustrated by the lack of an objective method that would ensure an optimum fit of the socket. This 'need' for assistance instigated the advent of industrial sector technologies to be taken up in the field, even though these systems, in reality, lack the necessary 'ingredient' to allow the optimum socket to be produced. They merely attempt to replicate current practices in a digital manner (CAD-CAM systems), without taking into account the biomechanical or anatomical characteristics of the residual limb.

The key element of the project is work done by Dr. Christos Kapatos to improve the nature of the data used in socket modeling software. Finite element analysis (FEA) has been used widely in a variety of applications, including prosthetics. But its prosthetics applications have suffered from the fact that only external boundary data and limited information on the nature of the internal tissue was provided. The results were not promising. By including far more data on the nature of the internal anatomy as well as, for the first time ever (to our knowledge) data on the bio-mechanical properties of the tissue to the FEA, a system can be created that enables Prosthetists to build a socket that evenly distributes weight, provides enhanced comfort, and raises the bar across the industry on socket creation.

SocketFit is a digital system for assessing an amputee's residual limb and for the production of truly functional and comfortable prosthetic sockets. It takes account of the external and internal geometry of the amputee's stump, the biomechanical properties of each individual soft tissue layer i.e. skin, fat, muscle and bone, and the boundary and loading conditions of a complete prosthesis to generate a virtual 3D model of the residual limb. It is then possible to produce an accurate, functional and comfortable prosthetic socket.

By minimizing the time and cost of socket production and by reducing the number of faulty sockets (it has been reported that a quarter of all prostheses are currently rejected due to poor fit), there will be a reduction in costs incurred by health services and insurance companies worldwide as well as great benefits to the amputee.

9

The technology

The intended Socket-Fit device consists of three modules:

|

1.

|

The Ring - a device to scan the residual limb and export data, which uses ultrasound technology.

The external geometry of the medium under examination, is acquired by the position data from the stepper instruments and the use of the rotary position sensors; as the ring moves vertically, spinning at the same time, the spring-supported arms comes in contact with the entire residual limb, mapping every detail and transmitting it to a PC.

The internal geometry is acquired with the use of the on-board ultrasound transducers. Information on the mechanical properties of the tissues has also been captured.

|

|

2.

|

Data Tools – software to analyze and collate the data into intelligible information.

All the data are sent to the control box for onward transmission to the PC. Software generates a 3D image of the stump's external and internal geometry.

|

|

3.

|

Socket Modeling – FEA simulation

FEA and optimization software generate the optimum design for the socket in order to obtain the best pressure distribution, and therefore the most comfortable prosthesis for the amputee.

|

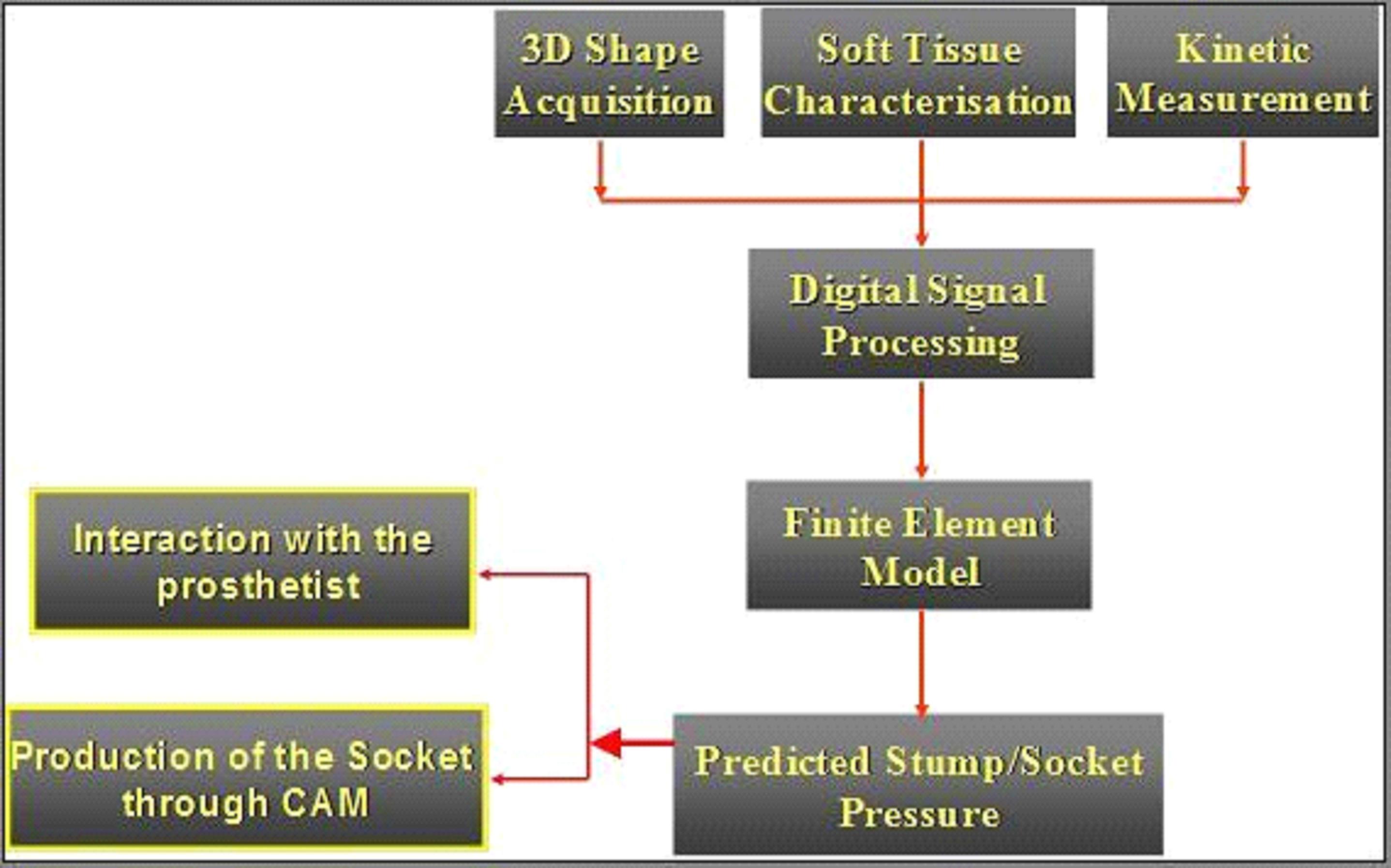

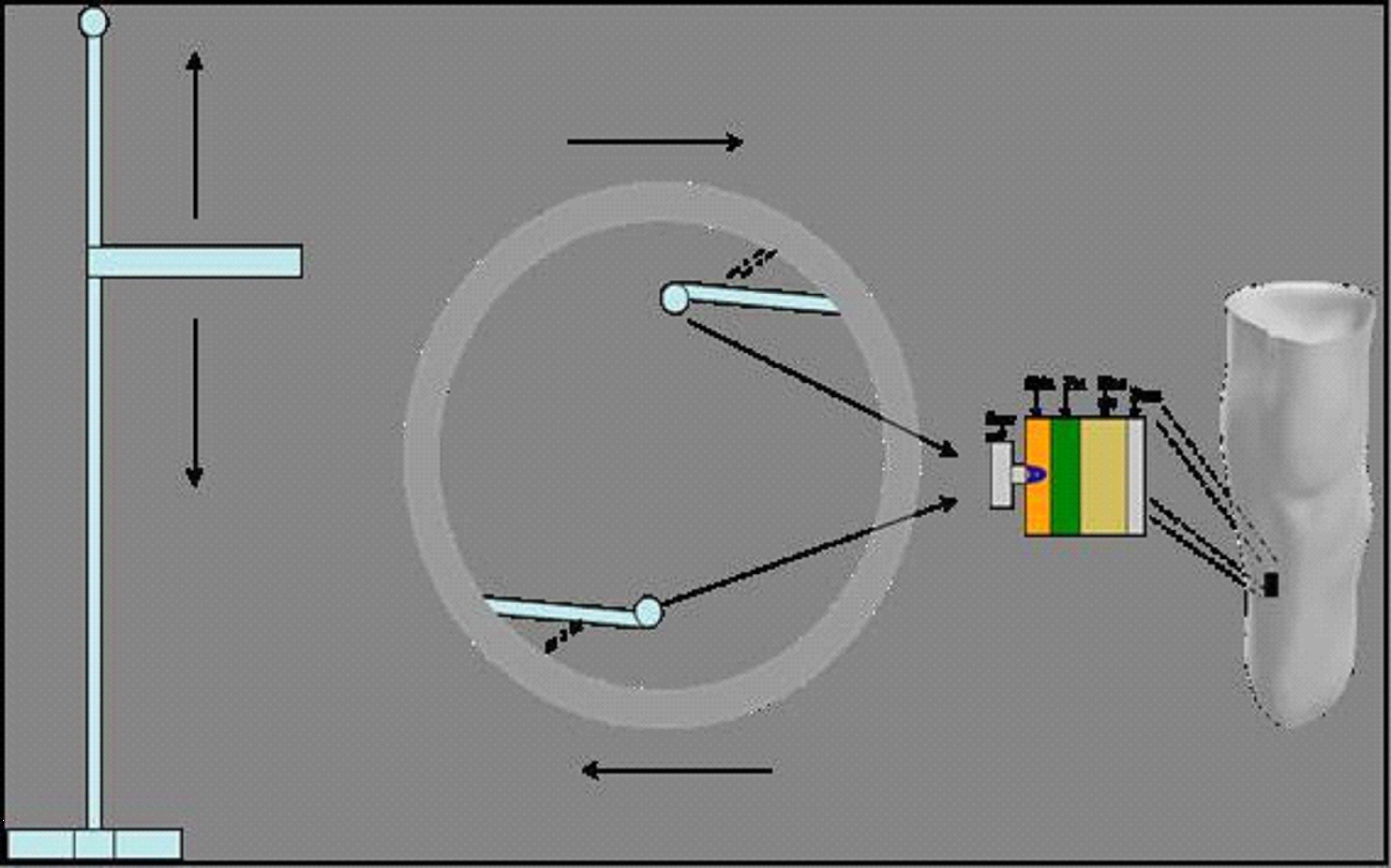

The process to getting to an optimized socket shape is shown in figure 2 and a schematic of the system in figure 3.

Figure 2: Process map of system

10

Figure 3: Schematic of the system

The greatest value provided by the acquired SocketFit technology rests in the algorithms that transform the data captured by the ultrasound transducers on the Ring to sanitized, usable data about the biomechanical properties of the tissues scanned. Specifically, the algorithms use data derived from the scans to generate stress-strain curves for the tissue layers within the limb.

This data is then used by the FEA software to simulate pressures onto the residual limb, similar to those experienced when walking, for different shapes of sockets, until the ultimate shape is found – meaning, the shape that provides uniform pressure where needed and avoids known pain areas (eg bone) to create a socket designed to have superior comfort in use.

Current Status of SocketFit

We plan to first find a commercialization partner, to help fund and/or conduct the required research and development and to launch the product within two years of commencement of the proposed research and development. This is to minimize risk but also because the technology could be designed to (retro-)fit into the partners' existing product suite, minimizing effort. While the Company focuses attention on its immediately marketable Sensor Technology and its varying applications, any additional development work for SocketFit is currently on hold.

11

|

C.

|

Other technology opportunities

|

Blood flow visualization:

The Company has developed a proof of concept device that permits the visualization of peripheral blood flow. This could be incorporated into a smart 'mat' for the diagnosis and progression monitoring of diabetic foot conditions. Diabetic patients can suffer from reduced peripheral blood flow in their feet. This contributes to neuropathy but also prevents the healing of diabetic foot ulcers, which can lead to amputation. Such a mat could shift the monitoring of diabetic foot care to primary care, away from podiatry specialists, but also provide essential health information to podiatrists which they would otherwise not have. With a relatively low manufacturing cost, patients could even monitor their own condition at home. It is hoped the product would be prescribed/reimbursed.

Blood Flow and Oxygenation Monitoring System

Soft tissue ulceration caused by pressure (over time) is an unwanted complication of illness (such as diabetes), injury, severe physical disability (tetraplegia) or increasing frailty. Ulceration is a serious, life-threatening injury that breaks down the skin and underlying tissue. It is caused when an area of skin is placed under pressure, over time, which causes a restriction in blood flow leading to "tissue starvation" and full thickness tissue loss, breakage and exposure of bone, tendon and/or muscle.

Skin cancer, also known as melanoma, is a type of cancer that begins in the skin and can spread to other organs in the body, leading to fatality. Melanoma occurs when some cells in the skin begin to develop abnormally. The cause of this abnormality is not fully understood yet, however it is thought that exposure to ultraviolet (UV) light from natural or artificial sources may be partly responsible.

Blood oxygen delivery and blood carbon dioxide flow is the common factor which links these two conditions.

We are currently investigating and designing a method for use in measuring continuous blood flow and oxygenation of peripheral soft tissues based on Bolometric Imaging. A bolometric array camera (a thermal camera) and light (LEDs or Lasers) of one spectrum only; infrared. In this process we will artificially and locally increase the temperature of blood for a few milliseconds, repeating the procedure every few milliseconds, "marking" blood as it moves and thus making its flow imaging and monitoring possible by use of the thermal camera and dedicated image processing software. This method can be further enhanced by combining a bolometric array camera with a CCD camera.

Sleep apnoea device (BiPAP)

|

|

•

|

The company has developed an early prototype of a small, silent, portable bidirectional airway device to assist sufferers of sleep apnoea

|

Robotic surgical assist

|

|

•

|

Working (miniature) prototype of robotic device to assist in orthopedic surgery, reducing number of staff in OR; uses proprietary sensor technology also used in Digital Health products

|

Adaptive socket

|

|

•

|

The 'Holy Grail' of prosthetic sockets, this technology would utilize our proprietary pressure and shear sensors to signal a smart material inside the socket to adapt its shape to the wearer's gait and daily fluctuations in the size and shape of the stump.

|

Photo acoustic imaging

|

|

•

|

The team is exploring a theory that would remove the barriers currently preventing the human adoption of photo acoustic imaging, producing a relatively low-cost non-contact, non-invasive methodology. This would be a substantial project but with the potential to transform medical imaging.

|

12

HCi Viocare Technologies - UltraMyoGragram (UMG)

A small, very low cost Ultramyogram sensor (UMG) that can (uniquely) provide proportional muscle contraction monitoring, as well as type of contraction and joint angle recognition, remaining unaffected by sweat, vibration and external noise has been designed. The sensor will have excellent signal to noise ratio, will not require complicated signal processing algorithms and it will have high repeatability and linearity.

The UMG sensor is specifically designed to provide proportional control on prosthetic, orthotic and exoskeleton (both civilian and combat) applications and devices, and can operate in harsh environments (humid, hot and e-noisy) with ease.

A comparison with existing myographic sensors is presented in the following table, clearly showing the advantages of the envisioned UMG technology over all other currently existing myographic technologies.

|

Description

|

EMG

|

AMG

|

MMG

|

UMG

|

|

Signal to Noise R

|

Medium

|

Bad

|

Good

|

Excellent

|

|

Complexity of Signal processing

|

Complex

|

Medium

|

Medium

|

Simple

|

|

Repeatability and linearity

|

Semi-repeatable

Not linear and difficult to characterize

|

Semi-repeatable

Not linear but relatively simpler to characterize

|

Mostly-repeatable

Can be characterized and is repeatable

|

Repeatable

Simple characterization

|

|

Signal classification accuracy

|

+ +

|

+

|

+ + +

|

+ + + +

|

|

Features

Rate of contraction, type, fatigue and intensity

|

Low specificity

Type cannot be found

|

Low specificity

Type cannot be found

|

Higher specificity

Type cannot be found

|

Very specific

Type of contraction can be found

|

|

Joint angle

|

-

|

-

|

-

|

Can be found

|

|

External noise

|

Electrical and motion

|

Acoustic, physical and electrical

|

Physical

|

High dielectric system. Not affected by external noise

|

|

Cost

|

$$$

|

$$

|

$

|

$

|

HCi Viocare Technologies – In-tyre Data and Power Transmission System

A new, high speed, wireless data transmission system for in-tyre use has been designed. The system utilizes the widely used RF protocols, with a signal boosting circuit, and takes advantage of the tyre's features to amplify and boost the signal. This technology removes the need for sensor wires getting in and out of the wheel and tyre, wires that are a source of frequent failures, and provides wireless capabilities to most in-tyre sensors and electrical equipment.

At the same time, following similar principles with the data transmission system described above, a wireless energy harvesting system for use within a tyre has been designed. The system is a hybrid energies generator that converts the values of energies abundant inside a tyre to electricity, continues powering up all electronic equipment in the tyre, while the vehicle is in motion.

Passive Robotic Leg Support System for Orthopedic Surgery

Regardless of the current advances in orthopedic medical technology, currently no single device dedicated to the basic function of holding and stabilizing a limb during surgery exists.

A passive robotic system for limb stabilization has been designed to address the above issue. The system is a type of active force amplification robotic platform. It has a number of actuators and a rotary plate which can rotate clockwise and/or anti- anticlockwise. The platform safely and accurately supports and holds the leg of the patient under surgery. Moreover, it has a simple control mechanism attached to the platform, opposite to the area where the leg is attached, containing force transducers for monitoring the direction of force exerted and for controlling the movement of the device when the surgeon needs to safely readjust the position of the leg.

The surgeon moves uses the simple control mechanism to reposition the limb and the robotic table follows the movement of the surgeon and self-locks itself in position, immediately after the surgeon removes his hand from the control. When the device locks, it consumes zero energy to maintain position.

The device will be attached to a surgical table/bed and used as a stand-alone unit. The device could also be used for training and education purposes to track and record the position of a limb and to simulate operation procedures.

13

Micro valve-less, motorless miniature pump

A micro valve-less, motor-less, pump the size of a fingernail, has been designed. Combining a number of micro pumps in parallel or in series, or both, micro-pump arrays can be created, not larger than a few centimeters, that can provide substantial airflow and pressure to inflate and/or deflate a medical mattress in minutes, or even a car tyre. It could also be used in micro BiPAP and cPAP devices or any system/device that requires active air in-flow or out-flow.

The technology is low cost, low power, low noise and can be easily combined with existing power-harnessing systems. Its life expectancy is ten-fold of this of traditional pumps and the micro pump has no moving parts

Blockchain based system for client records

The Company has commenced development of its own proprietary Blockchain based system for handling sensitive client records in its flagship Prosthetics and Orthotics clinic in Scotland. Furthermore, the team plans to develop a proprietary Blockchain based system for handling and storing the data produced from the medical applications of its FlexisenseTM technology.

|

D.

|

Intellectual property

|

We have acquired exclusive ownership of the innovative medical device 'SocketFit'. Dr. Kapatos in conjunction with another development company had prior filed a patent application which has been abandoned. Significant development of the technology has been undertaken since the filing of the abandoned patent and, after corresponding with our patent agents, it was deemed in the best interests of the Company not to revive the old patent, but to apply for new – multiple patents on the technology, and use the old patent as background technology, as new innovations have sprung out of the initial patent and additional fields of application have been identified.

We have acquired all rights and interest in and to the background IPR for a developing technology now known as "Flexisense". Dr. Kapatos has conceived and been working on various applications of Flexisense including a Smart Insole System which is believed to be a state-of-the-art, pressure and shear pressure sensing insole with an incorporated real-time global display application and a fully featured support web-space that tells the user and his podiatrist/physiotherapist when inappropriate or dangerous conditions are developing on the feet. The product is being designed to mitigate diabetic foot complications, such as ulceration, infection and amputation, as well as improve the total health of a person with diabetes, by incorporating the readings from the insole system to a specialized web-space that will help the user monitor not just the health of his feet but also his diabetes by looking after his diet and exercise. The Company has also identified various other applications. Presently we have filed three patents in the UK in respect of this IPR:

British Patent Application No. 1421952.1, HCI VIOCARE TECHNOLOGIES LTD. (abandoned December 2015)

- The first patent based on development of the "Insole" IP relates to the Company's pressure sensing system technology, which supports the development of very low cost, flexible and scalable pressure sensing devices in a range of sectors including wearable devices, Prosthetics & Orthotics, medical devices (e.g. for the diabetic foot), and automotive health and safety.

British Patent Application No. 1421950.5, HCI VIOCARE TECHNOLOGIES LTD. (abandoned December 2015)

- The second patent, also based on additional development of the "Insole" IP relates to the Company's ground-breaking shear sensing system technology, which is supports the development of low cost, flexible and scalable sensor systems in a range of sectors including wearable devices, medical devices (e.g. diabetic foot), Prosthetics & Orthotics and automotive health and safety

British Patent Application No. 1421953.9, HCI VIOCARE TECHNOLOGIES LTD. (abandoned December 2015)

- The third patent application also follows additional in-house development of the "Insole" intellectual property (IP) and relates to pioneering low-cost, portable motion capture and gait analysis technology, which has applications in a range of sectors, including athletic wearable devices, physiotherapy, orthotics and potentially also gaming and film.

International Patent Application No. PCT/GB2015/053785, HCI VIOCARE TECHNOLOGIES LTD.

On December 10, 2015 the Company through its subsidiary HCi Viocare Technologies Ltd. filed an international application according to the Patent Cooperation Treaty (PCT) which received a PCT application number PCT/GB2015/053785. The filed international patent covers over 140 countries around the world. The new patent builds on the company's three UK patent applications filed in December 2014 (as set out above), with further advances made to the sensor systems, and a wider range of applications in products that touch people's everyday lives.

The Company has drafted and performed preliminary patent searches on two new innovations during fiscal 2016 and 2017, with intent to progress into full patent applications in 2018.

14

|

E.

|

Regulatory Requirements

|

The Company's business model of licensing technology to commercialization partners means that it is the partner, who will be the manufacturer of the eventual products and therefore subjected to the regulations of manufacturing and marketing devices. However, as the Company will support its licensing partner in the development of the final products it has ensured that in understands the eventual requirements, and has identified suitable consultants to provide support, where required.

The products are expected to be marketed worldwide, with an initial commercialization in Europe and the USA, depending on the partner. Their regulatory systems are highlighted below, together with the anticipated implications for the products that may result from our technologies.

Europe

Products that will be marketed in Europe will be required to comply with the EU Directives regarding medical devices, which apply to all EU member states. The basic relevant EU Directive which applies to our case is Directive 93/42/EEC (as amended by 2007/47/EC) regulating medical devices, as well as Directive 98/68/EEC that requires the manufacturers to place CE marking on their products to demonstrate compliance with the above regulations.

The Directive on medical devices also lays down rules in Annex IX for the classification of devices based essentially on the potential risks involved, with class III devices having the highest potential risk and class I device the lowest.

With reference to the stated Rules to determine a product's classification, the anticipated classification of the products that could arise from the Company's technology are listed below. It is important to note that classification is determined only at the stage of a final product and with reference to its features and the claims made by the manufacturer. Hence, there classifications are dependent on the decisions of the license partner and may be subject to change:

|

·

|

Diabetic and Medical Insoles: Class I

|

|

·

|

SocketFit: Class IIa – because of the use of ultrasound, which applies energy to the body. This is the usual classification for imaging devices.

|

|

·

|

Photoacoustic imaging: Class IIa – because energy is applied to the body

|

|

·

|

Blood Flow visualization: Class IIs – because energy is applied to the body

|

|

·

|

BiPAP: Class IIb – as it is relied upon for breathing

|