Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 SECTION 906 CERTIFICATION - AMERICAN REBEL HOLDINGS INC | f10k123117_ex32z1.htm |

| EX-31.2 - EXHIBIT 31.2 SECTION 302 CERTIFICATION - AMERICAN REBEL HOLDINGS INC | f10k123117_ex31z2.htm |

| EX-31.1 - EXHIBIT 31.1 SECTION 302 CERTIFICATIONS - AMERICAN REBEL HOLDINGS INC | f10k123117_ex31z1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number 333-201607

AMERICAN REBEL HOLDINGS, INC. |

(Exact name of registrant as specified in its charter) |

CUBESCAPE, INC.

(Former name or former address, if changed since last report)

NEVADA |

| 47-3892903 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

718 Thompson Lane, Suite 108-199 Nashville, Tennessee 37204 |

| (913) 940-9919 |

(Address of principal executive offices) |

| (Registrant’s telephone number) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value |

(Title of Class) |

Copies of communications to: |

Anthony N. DeMint, Esq. DeMint Law, PLLC 3753 Howard Hughes Parkway Second Floor, Suite 314 Las Vegas, Nevada 89169 (702) 714-0889 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

1

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [ ] | Accelerated filer | [ ] |

Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

Emerging Growth Company | [ ] |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by the price at which common equity was last sold: $134,210 as of June 30, 2017.** (last price our common stock was sold at was $0.01 per share on December 11, 2015)

The number of shares of the registrant’s common stock outstanding as of May 1, 2018 was 24,137,667 shares.

Documents incorporated by reference: None

2

AMERICAN REBEL HOLDINGS, INC.

TABLE OF CONTENTS

|

|

| Page |

PART II | |||

ITEM 1. | Business |

| 5 |

ITEM 1A. | Risk Factors |

| 20 |

ITEM 1B. | Unresolved Staff Comments |

| 38 |

ITEM 2. | Properties |

| 38 |

ITEM 3. | Legal Proceedings |

| 38 |

ITEM 4. | Mine Safety Disclosures |

| 38 |

|

|

|

|

PART II | |||

ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| 39 |

ITEM 6. | Selected Financial Data |

| 40 |

ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation |

| 40 |

ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk |

| 43 |

ITEM 8. | Financial Statements and Supplementary Data |

| 43 |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

| 44 |

ITEM 9A. | Controls and Procedures |

| 44 |

ITEM 9B. | Other Information |

| 45 |

|

|

|

|

PART III | |||

ITEM 10. | Directors, Executive Officers and Corporate Governance |

| 45 |

ITEM 11. | Executive Compensation |

| 47 |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

| 48 |

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence |

| 50 |

ITEM 14. | Principal Accountant Fees and Services |

| 51 |

|

|

|

|

PART IV | |||

ITEM 15. | Exhibits and Financial Statement Schedules |

| 52 |

|

|

|

|

SIGNATURES |

| 53 | |

CERTIFICATIONS |

|

| |

3

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

the risks and other factors described under the caption “Risk Factors” under Item 1A of this Annual Report on Form 10-K;

our future operating results;

our business prospects;

any contractual arrangements and relationships with third parties;

the dependence of our future success on the general economy;

any possible financings; and

the adequacy of our cash resources and working capital.

Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, you should not place undue reliance on any such forward-looking statements. New factors emerge from time to time, and their emergence is impossible for us to predict. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

This Annual Report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this Annual Report are made as of the date of this Annual Report and should be evaluated with consideration of any changes occurring after the date of this Annual Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Except as otherwise indicated by the context, references in this report to “Company”, “American Rebel Holdings”, “we”, “us” and “our” are references to American Rebel Holdings, Inc. All references to “USD” or United States Dollar refer to the legal currency of the United States of America.

4

DESCRIPTION OF BUSINESS

American Rebel, Inc. was incorporated on December 15, 2014 in the state of Nevada and is authorized to issue 75,000,000 shares of Common Stock of $0.001 par value.

American Rebel is boldly positioning itself as “America’s Patriotic Brand” in a time when national spirit and American values are being rekindled and redefined. Its initial product offerings focus on concealed carry goods and apparel, but the brand will not solely be defined as a manufacturer of concealed carry products, it will more broadly position itself on personal safety and security. American Rebel has identified an opportunity in the marketplace to provide innovative and needed items the public is searching for. American Rebel will concentrate its efforts on imagining, designing, marketing, and selling products designed to keep you, your family, your neighbors, or even a room full of total strangers concealed and safe. “That need is in the forethought of every product we design,” says American Rebel CEO Andy Ross.

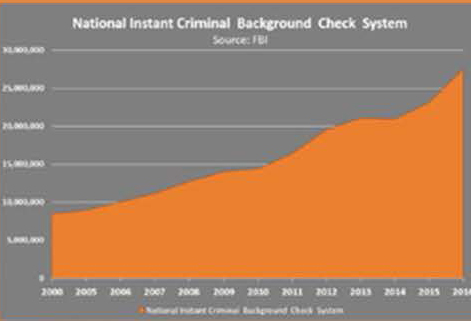

The firearms and gun ownership market within the U.S.A continues to grow with no sign of decline. Since 2010, the market for new gun purchases has increased by 60%, and at the end of 2016, it has been estimated that there will be over 400 million guns in the US. Some experts anticipated that the election of Donald Trump would initiate a downturn in gun sales, yet November 25, 2016 set the single day record for the number of background checks conducted by the National Instant Criminal Background Check System (NICS). It is estimated that 27 million guns were sold in 2016, approximately 4 million more than 2015, and twice as many guns as sold in 2009.

Interest in gun ownership and tactical/concealed carry clothing, backpacks and accessories is exploding. A current market leader in the tactical products category has grown its revenue from $80 million in 2007 to $200 million in 2011 to $400 million in 2015. This is a strong heartbeat for gun rights, gun ownership, tactical/concealed-carry products and enhances our opportunity to build the American Rebel brand.

The initial product offering introduced at the 2017 NRA show in Atlanta, GA includes four sizes and styles of concealed carry backpacks with a variety of available colors (20 SKUs), which include the Company’s patent-pending Protection Pocket and two styles of men’s overcoats. Products that will additionally be released through 2017 and 2018 will include additional apparel items, briefcases, travel bags, electronics, and other personal protection items developed by the Company.

The Company will also pursue strategic alliances with other companies for goods and services that supplement or complement the internally developed products. These products may be in the personal protection category, or may be everyday products that embody the reliable, competent and confident spirit of the American Rebel brand.

To maintain quality, low cost of goods, and continuity of inventory American Rebel is pursuing strategic manufacturing alliances, and intends to establish offices and personnel in China and Mexico. Apparel labor costs in Mexico are almost equal to China, and offer quick response with lower transportation costs for smaller production runs.

An early stage company such as American Rebel faces many risks that can impede its execution of its business plan. These risks include:

Undercapitalization: The Company is currently undercapitalized and intends to pursue the additional capital required to execute its business plan. Economic conditions beyond the Company’s control can change investor interest, and competitive entries could impact the probability of success.

Legislative and Government Intervention: The current legislative trends are favorable to the 2ndAmendment and personal protection, but a political movement, public opinion, or an unforeseen event could change the legislative’s stance, and restrict concealed-carry goods, negatively impacting sales. In addition, changes to international trade agreements could impact prices, margins, and continuity of supply.

Personal Protection: The Company’s intended focus on the broader personal protection market could insulate the Company to some degree, or not. In addition, any trade agreements changes would impact most all competitors equally.

Key Man: Andy Ross has an established public personality and is currently instrumental to the Company. American Rebel intends to establish additional “faces” of the company including Dede Day and other personalities that will complement Andy Ross’s contributions.

5

Security: As an Internet-based retailer the Company will be subject to the risks all online retailers face. The Company employs third-party services for credit card transactions, and as operations continue the Company will continually harden its online assets and deploy additional layers of protection for its customers, its assets, and its continued operations.

Product Acceptance: Fashion trends, competitive entries, and pricing can negatively impact the brand with little to no warning and with few immediate cures. Focus groups, one-on-one interviews, and test marketing suggest that the product is attractive and sellable, the brand is adaptable, and it represents a brand ego that generates self - confidence in its patrons.

ERM: The current staffing and board participation is minimal, as such, until funding is complete there is no formal Enterprise Risk Management process in place.

Additional expertise and processes will be added as funding occurs and key outside board additions have been identified to add competence in governance, compliance, and audit.

American Rebel, Inc. was incorporated on December 15, 2014 in the state of Nevada and is a natural evolution of the vision of its founder and CEO Charles A. “Andy” Ross, Jr. Mr. Ross is a natural entrepreneur having successfully designed and delivered a new line of law enforcement/security products to market during his tenure as CEO of Digital Ally, a company he founded in 2004. Digital Ally successfully accessed the public market as a public company and Digital Ally continues to trade on the NASDAQ stock exchange. Andy’s father, Bud Ross, also brought new and innovative products to market and accessed the public market as founder and CEO of the legendary music equipment company Kustom Electronics and pioneered the television receive only (TVRO) satellite dish industry with Birdview Satellite Communications.

The roots of American Rebel trace back to a song written and recorded by Andy Ross in response to the ongoing gun rights debate. Andy was completing his second CD and the dialog on television and online was suggesting that severe restrictions were needed in the right to bear arms. Andy reached out to his collaborators and wrote the song “Cold Dead Hand.” “Cold Dead Hand” harkens back to the iconic Charlton Heston public appearance where Charlton holds a rifle high over his head and proclaims, “Out of my cold dead hand….” This phrase has been a rallying cry for gun rights supporters ever since; but never has it been incorporated into such an effective song. Andy renamed his second CD Cold Dead Hand and the song was released nationally to country music radio stations. The song received significant airplay and an accompanying video to the song received hundreds of thousands of views. In addition to the country music radio station airplay, many talk radio stations picked up the song and promoted it as a 2nd Amendment anthem. Andy continues to conduct interviews on music and talk radio stations about the song and the gun rights debate.

It was the song “Cold Dead Hand” that inspired Danny “the Count” Koker to reach out to Andy to create the 2nd Amendment Muscle Car for his highly-rated Counting Cars television program on the History Channel. The story behind the creation, building, and presentation of the car to Andy is captured in the episode Rocked and Loaded which originally aired February 25, 2014 and continues to re-air and has appeared as a part of “best of” compilations of the shows episodes. The enduring popularity of the 2nd Amendment Muscle Car was evidenced by the excitement shown by 2017 NRA Convention attendees when they reviewed the car in the American Rebel booth. In fact, the car is so popular that the company is planning several collectible die-cast models of the car.

“Cold Dead Hand” placed Andy Ross directly in the public and political debate over gun rights and the right to bear arms as codified in the 2nd Amendment to the US Constitution. As Andy participated in the debate, he realized there was a market opportunity to provide innovative and effective designs for everyday use items that assisted the desire of customers to be concealed and safe during their normal course of everyday duties. The beginnings of American Rebel were starting to take shape and because Andy Ross’s music plays such an important part in the American Rebel story, it is helpful to trace the beginnings of Andy Ross’s music career.

Andy Ross started Ross Archery in 2005 and soon after started his ground-breaking Maximum Archery television show. Andy set out to make an archery show like no other that would appeal to a younger demographic. The X-Games were popular and Andy felt that archery programs needed to have this type of appeal to reach the younger audience. Andy believed one of the ways he could add value would be to create original music for the show. He had already developed relationships in Nashville and he set out to write and record the opener for the 2009 edition of Maximum Archery. While working the Ross Archery booth at the Iowa Deer Classic in early 2010, Andy was excited to meet fans that had downloaded the opening song to the TV show. Andy contacted the record producer that had produced the recording of the opener to Maximum Archery and reported that fans loved his music. The Nashville record producer and Andy decided it was time to write and record an entire CD. Andy’s first CD, You Ain’t Seen Crazy Yet, was released in 2011 and included that opener (“Three Legged Dog”) as well as “You Ain’t Seen Crazy Yet,” “Outlaw Women and Whiskey,” and many others. Andy’s You Ain’t Seen Crazy Yet was popular with Andy’s fan base and a second CD was started in late 2012. The Nashville record producer was Doug Grau. Doug and Andy had met because an artist that Doug had produced was a huge fan of Maximum Archery and the artist, Donnie Davisson of the Davisson Brothers, introduced Andy to Doug and the rest of the Davisson Brothers at a local Nashville bar where Doug and the Davissons were celebrating completing the debut Davisson Brothers Band CD.

6

Andy’s third CD, Time to Fight, has already launched the hit song “Back on the Backroads,” which features Little Texas. The second single off Time to Fight will be “Playing In The Mud” and will be featured as a theme song for the GNCC Racing Series. Accessing the GNCC fan base is an example of Andy’s music reaching a new target demographic for American Rebel products. Much in the same way “Cold Dead Hand” accessed the large fan base of Counting Cars, “Playing In The Mud” will access the large fan base of GNCC racing and off road and 4-wheeling in general.

After the airing of the Counting Cars episode that featured the building and presenting of the 2nd Amendment Muscle Car to Andy and the accompanying exposure from “Cold Dead Hand,” Andy began to imagine a product that would be perfect for everyday use while keeping the user concealed and safe. Range bags, bags and packs that were designed to carry firearms and ammo to the range, were on the market; but they weren’t versatile enough to satisfy everyday needs. These range bags were just that, range bags. Andy imagined a backpack that had designed areas to carry a laptop or tablet, a phone, sunglasses, files and important papers, chargers for electronics, anything needed in the normal course of the day, and a patent-pending Protection Pocket that could effectively carry most handguns. The patent-pending Protection Pocket utilizes a sandwich method which holds the handgun in place and is accessed by a zipper on either side of the rear bottom of the backpack. If a user of one of Andy’s backpacks needed to get to their firearm, they could rest easy knowing the gun was in place and they could access it easily and quickly.

During the same time period Andy was beginning the design of the concealed carry backpack, Andy was writing a new opener song for his television show. He wanted the television show to expand beyond a show exclusively about archery, to be a show that could feature tactical shooting and personal safety information as well as continue to cover his passion for hunting. He wanted the show to include hunts with firearms in addition to hunts with his bow. Andy wrote and recorded “American Rebel” to be the new opener for his new show and the response to the new song and the new show was extremely positive. As the new show aired and Andy performed “American Rebel” during his musical appearances, a trusted business consultant suggested to Andy that his new company should be called American Rebel. Andy agreed that American Rebel captured the spirit of what his new company was about.

With the features and benefits of the American Rebel backpack identified, Andy set out to create the specific design of the American Rebel Concealed Carry Backpack. A supplier was selected and samples were created and evaluated. These samples were tested, changes were proposed and new samples created and tested. An early prototype of the Double Compartment Backpack was presented at the 2016 NRA National Convention in Louisville, KY. Response to the Double Compartment Backpack was very positive and the information gathered was incorporated into the final designs of the American Rebel Concealed Carry Backpacks. Over the course of 2016 it was determined there would be four sizes of the Concealed Carry Backpack. The Double Compartment Backpack was originally named the Patriot backpack and this Double Compartment Backpack will continue to be a part of the line and eventually be renamed the Freedom X-Large Double Compartment Concealed Carry Backpack. The X-Large Double Compartment Concealed Carry Backpack will have two main compartment areas to carry a laptop or tablet, a phone, sunglasses, files and important papers, chargers for electronics, anything needed in the normal course of the day, and a patent-pending Protection Pocket that could effectively carry most handguns. The patent-pending Protection Pocket utilizes a sandwich method which holds the handgun in place and is accessed by a zipper on either side of the rear bottom of the backpack. If a user of one of Andy’s backpacks needed to get to their firearm, they could rest easy knowing the gun was in place and they could access it easily and quickly.

Data collected during the testing phase revealed an opportunity to include a ballistic panel in a backpack. The Large Freedom Concealed Carry Backpack has a specifically designed pocket for an optional ballistic panel. In addition to the pocket for the optional ballistic panel, the Large Freedom Concealed Carry Backpack also includes areas to carry a laptop or tablet, a phone, sunglasses, files and important papers, chargers for electronics, anything needed in the normal course of the day, and the patent-pending Protection Pocket that could effectively carry most handguns. The patent-pending Protection Pocket utilizes a sandwich method which holds the handgun in place and is accessed by a zipper on either side of the rear bottom of the backpack. If a user of one of Andy’s backpacks needed to get to their firearm, they could rest easy knowing the gun was in place and they could access it easily and quickly. The Freedom Large Backpack is available in six colors, including camo.

The Freedom Medium Concealed Carry Backpack is a unique design targeting consumers carrying today’s more compact electronics, computers, and tablets. Similar to the X-Large Double Compartment and Large Concealed Carry Backpacks, the Freedom Medium Concealed Carry Backpack is for everyday use while keeping you concealed and safe. The Freedom Medium also has the patent-pending Protection Pocket positioned in a similar fashion to the X-Large Double Compartment and the Large Backpacks. The Freedom Medium Concealed Carry Backpack is available in five colors, including camo.

The Freedom Small One Strap Pack takes advantage of the trend for a small one-shoulder pack that is perfect for people not carrying computers and relying on their phone or small tablet for communication. The Small One Strap Pack is available in six colors and features its own unique way to safely carry a handgun.

7

The entire line of Concealed Carry Backpacks debuted to rave reviews and brisk sales at the 2017 NRA Convention in Atlanta. In addition to the Concealed Carry Backpacks, American Rebel also debuted two jackets for men – the Defender and the Cartwright. The Defender is a stylish black jacket tailor-made for any setting that enables easy access to your firearm while remaining discreet, keeping you concealed and safe. The Cartwright is a sturdy, rugged canvas coat perfect for outdoor activities and rural America that enables easy access to your firearm while remaining discreet, also keeping you concealed and safe. The Cartwright is available in olive green and tan.

In addition to the products debuted at the 2017 NRA Convention, American Rebel will soon offer two women’s purses and a stylish women’s concealed carry jacket. There is great demand for women’s concealed carry products and American Rebel believes it can present offerings in these categories that improve upon available products functionality and style.

The company maintains its warehouse and shipping operations at 9641 Lackman Road, Lenexa, KS, 66219; but utilizes 718 Thompson Lane, Suite 108-199, Nashville, TN, 37204 as its primary address. The lease agreement at 9641 Lackman Road, Lenexa, KS, is in the name of American Rebel Holdings, Inc. The wholly-owned subsidiary American Rebel, Inc. maintains 718 Thompson Lane, Suite 108-199, Nashville, TN address. Our website address is www.americanrebel.com. The information on our website is not part of this Current Report, Form 10-K.

Description of Business

Company Overview

American Rebel is boldly positioning itself as America’s Patriotic Brand. The Company has identified the market opportunity to design, manufacture, and market innovative concealed carry products. American Rebel accesses its market uniquely through its positioning as America’s Patriotic Brand and the appeal of its products as well as through the profile and public persona of its founder and CEO Andy Ross. Andy has hosted his own television show for 12 years, has made multiple appearances over the years at trade shows, and is well-known in the archery world as the founder of Ross Archery, which was the world’s fastest growing bow company in 2007 and 2008. Andy has also released 3 CDs, done numerous radio and print interviews, and performed many concerts in front of tens of thousands of people. Andy has the ability to present American Rebel to large numbers of potential customers through the appeal of his music and other supporting appearances. For example, his appearance on the History Channel hit show Counting Cars in February 2014 has been viewed by over 2 million people. Bringing innovative products that satisfy an existing demand to the market through exciting means is the American Rebel blueprint for success.

Market Overview

The Concealed Carry product market is estimated at over $500 million in annual sales; but American Rebel’s market not only includes current consumers of concealed carry products but also includes anyone that has ever considered concealing and carrying a weapon. To many the Company’s products solve the problem of how to safely and responsibly carry a weapon. If they had our backpack, they would then conceal and carry a gun.

The US firearms and gun ownership market continues to grow with no sign of abatement. Since 2010, the market for new gun purchases has increased by 60%, and by the end of 2016, there will be over 400 million guns in the US. Seventeen days after the election, November 25, 2016 set the single-day record for the number of electronic background checks conducted by the NICS. The NICS processed 2,771,159 background checks in December, bringing 2016’s total to 27,538,673, according to FBI data. That dwarfs the firearms check record of 23,141,970 set in 2015

8

Interest in gun ownership and tactical/concealed carry clothing, backpacks and accessories is exploding. A current market leader in the tactical products category has grown its revenue from $80 million in 2007 to $200 million in 2011 to $400 million in 2015. This all sends a strong signal for gun rights, gun ownership, tactical/concealed carry products, and our American Rebel brand.

The obvious customer base for American Rebel Concealed Carry products would be any customer that conceals a handgun and any concealed carry permit holders; but we believe the market is much larger than that. Interviews of potential customers have revealed that our customer base would include any person who has thought they might one day want to conceal and carry a firearm and the availability of the American Rebel product will initiate their taking action on their desire to conceal and carry a firearm. These potential customers aren’t comfortable carrying a firearm holstered on their hip and they haven’t been introduced to a product that conceals the firearm properly, allows easy access to the firearm, and also provides everyday value for their daily routine.

9

2016 Increases in Firearm Sales & Conceal Carry Permits

|

|

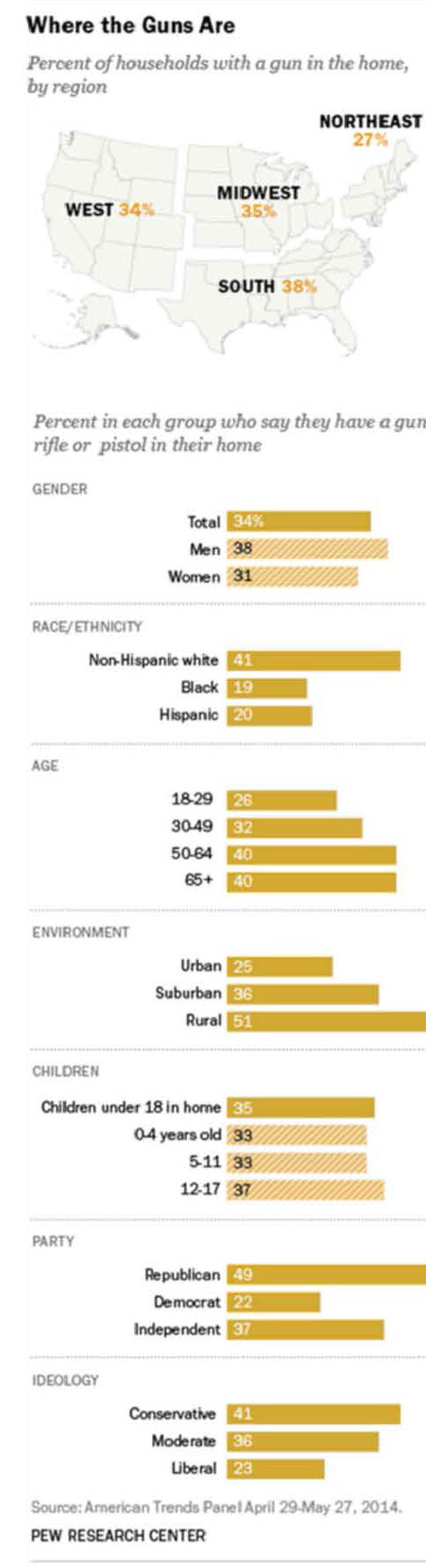

According to a recent Pew Research Report, a third of all Americans with children under 18 at home have a gun in their household, including 34% of families with children younger than 12. This is nearly identical to the share of childless adults or those with older children who have a firearm at home. | |

| |

The new research also suggests blacks are only about half as likely as whites to have a firearm in their home (41% vs. 19%). Hispanics are half as likely as whites to have a gun at home (20%). | |

| |

According to the survey, southerners are just about as likely as those living in the Midwest or the West to have a gun at home (38% vs. 35% and 34%, respectively). Regional differences emerge when race is factored into the analysis. White southerners are significantly more likely to have a gun at home (47%) than whites in other regions. Rural residents and older adults are disproportionately more likely than other Americans to have a gun at home. | |

| |

Americans who have a gun at home see themselves differently than do other adults. According to the survey, adults in gun-owning households are more likely to think of themselves as an “outdoor person” (68% vs. 51%) or “a typical American” (72% vs. 62%), and to say “honor and duty are my core values” (59% vs. 48%) About six-in-ten gun household members (64%) say they “often feel proud to be American.” In contrast, about half (51%) of other adults say this. Not surprisingly, members of gun-owning households are more than twice as likely to identify themselves as a “hunter, fisher or sportsman” (37% vs. 16%). | |

| |

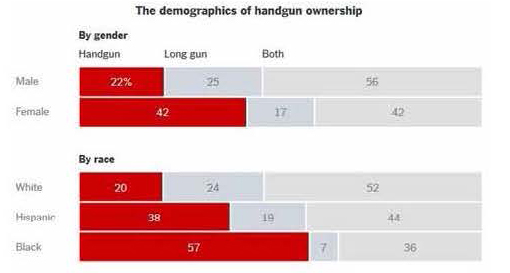

Handguns Are the New Personal Security | |

| |

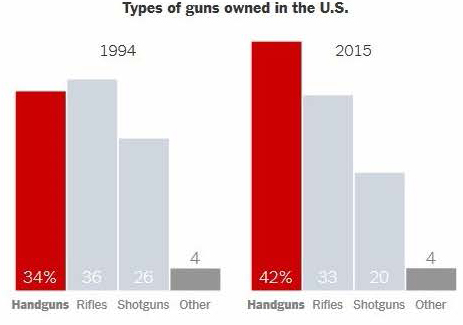

A new study of gun ownership in the United States notes a shift: Americans are increasingly interested in handguns, the types of small weapons that are easily hidden and used for self-defense, rather than rifles and shotguns used for hunting and shooting sports. | |

| |

The study, conducted in 2015 by researchers from Harvard and Northeastern, sought to better understand the size and composition of the country’s gun inventory. It found that handguns made up 42 percent of the country’s privately owned firearms, up from 34 percent in 1994. | |

| |

| |

| |

The survey indicates that a growing number of gun owners cite personal safety as a major incentive for owning a gun. In 1994, 46 percent of respondents chose protection as the primary reason to own a gun. Two decades later, 63 percent of respondents made that selection. | |

| |

Who owns the handguns? | |

| |

Academics and others watching the gun industry cite a number of reasons for the shift to handguns. A 24-hour news cycle has made the world feel more dangerous. A declining rural population and waning interest in hunting have pushed gun companies to look for new customers. Industry groups have heavily marketed the idea of concealed carry and personal protection as their growth strategy. | |

| |

|

10

A new study commissioned by the National Shooting Sports Foundation reports women owning guns as the fastest growing segment. The most commonly owned firearm by women in the study is a semiautomatic pistol, with 56 percent of women reporting they owned at least one. Women say their purchases are mainly influenced by Fit, Quality and Practicality.

Women purchasing a gun in the last 12 months spent on average $870 on firearms and more than $400 on accessories. More than 42 percent of women have a concealed carry permit for their state of residence. Placing a premium on safety, women say the single most important reason why they decided to purchase or own a firearm is protection—both personal and home protection.

Concealed Carry Permit Trends

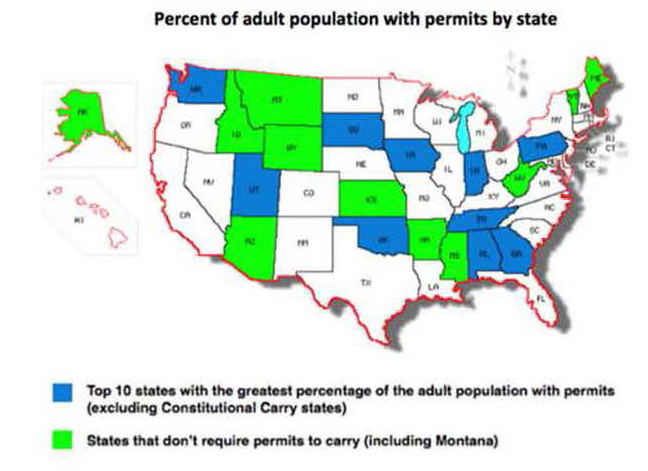

Current estimates show the number of individuals in possession of concealed carry permits to be around 15 million. According to Dr. John R. Lott, president of the Crime Prevention Research Center, this shows a 215% increase since 2007.

Dr. Lott has found that the states of Texas, Florida, and Pennsylvania each have over one million residents that legally carry. Overall, totals show over six percent of the U.S. adult population are concealed carry permit holders. In ten other states, over 10% of adults have concealed carry permits.

Analyzing this increase in carry permits, Dr. Lott points out that 15 million is a low estimate, as this figure does not fully encompass the numbers of those that legally carry firearms. This is because 12 states have now adopted laws that allow residents to legally carry concealed weapons without permits. These “permitless” carry states, including Missouri, West Virginia, Idaho, and Mississippi, tend to have lower numbers of carry permits issued annually, despite the fact that many more residents legally carry thanks to their “Constitutional Carry” laws.

As the numbers of permit holders and gun owners have rapidly increased in recent years, the majority of these increases were seen among women and minorities. The number of women obtaining carry permits since 2007 has grown at double the rate of men seeking carry permits. Further, according to the Crime Prevention Research Center, evidence suggests that the increases in permit holding have been more rapid among minority groups.

11

The Rise Of The 'Concealed-Carry Lifestyle'

The "concealed-carry lifestyle" refers to a set of products and a set of ideas around the decision to carry a gun everywhere you go.

The concealed-carry movement is central to the gun-rights platform of organizations like the National Rifle Association. "The idea that you should be allowed, legally and constitutionally, to carry a gun almost anywhere ... is actually sort of the heart of what the gun rights movement believes is the future."

Over the last 30 years a deep change has happened in American law and in American habit where state by state, places that once prohibited or strictly controlled the ability to carry a gun in everyday life have systematically relaxed those rules to the point that concealed carry is now legal in all 50 states.

General Backpack Industry Trends

The backpack is back. Sales of backpacks grew 9% in the past 12 months to $1.6 billion, according to data collected for Yahoo Finance by the consumer tracking service NPD Group. Sales of backpacks for use by adults (ages 18 and up) grew even more – 16% – and it was adult purchases that accounted for 69% of the overall market. In other words: the adult backpack is very hot right now.

The category is so popular that in 2014, backpack sales growth (up 18% that year among adult men and adult women) kept the $12 billion US bag market steady in a year when women’s handbags, the largest category, declined. In the face of the purse drop, backpacks gained popularity among women that year, and are still gaining.

This kind of market upswing creates new room for small, scrappy entrants. And indeed, smaller backpack players are carving out strong corners of an industry in which one giant, VF Corporation (VFC), enjoys more than 50% market share thanks to owning Timberland, The North Face, and Eastpak.

Fashion and function must come together to appeal to today’s always on-the-go consumer,” said Marshal Cohen, chief industry analyst, The NPD Group, Inc. “Male or female, consumers are carrying a lot of things around with them, and want a bag that looks good while also meeting their multifunctional needs.”

Bags worn by men accounted for $2.3 billion in sales in 2014, nearly one quarter of total industry results. Last year’s double-digit unit and dollar sales increases clearly make the men’s segment the one to watch in 2015. Men are purchasing more bags than ever before, and wearing bags of all types.

“The bag industry has an opportunity to continue to capture and keep the attention of male and female consumers alike by emphasizing designs that accommodate their lifestyles in both form and function,” added Cohen.

12

Consumer Needs Based Segments

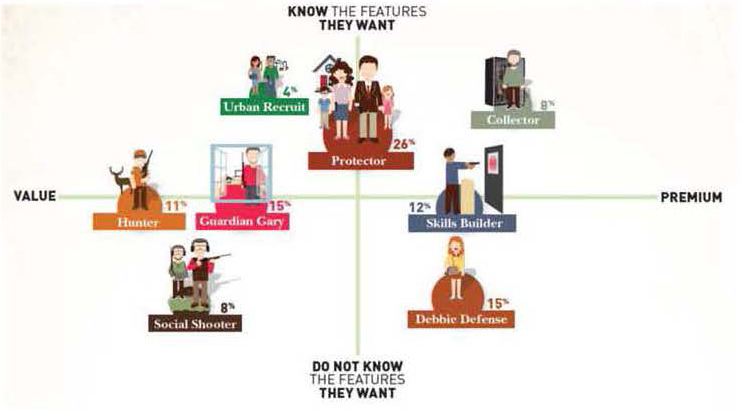

One size does not fit all. Gun owners are not the same

This consumer segmentation analysis identifies the uniquely distinct parts, or segments, of the market. In a needs-based segmentation, each segment shares a common set of motivations for wanting to buy a product and their preferred styles or features. It is not based on what the customer looks like or how they use their firearms. By understanding why consumers decide to buy a firearm, and the reasons why they selected specific firearm, we can improve our accessory products and customer interactions. For example, some consumers want premium quality and unquestionable precision – price is no object. Other consumers desire everyday functionality and acceptable workmanship all at a good value.

Based on a survey by National Shooting Sports Foundation of more than 6,000 U.S. households combined with extensive statistical analysis from Southwick Associates, this consumer segmentation data of the U.S. firearms market provides important insights which move beyond demographics and get into what really motivates people.

The largest segment which is 26% of gun buyers since 2000, the Protector is typically a family-oriented professional with slightly above average income. They do not describe themselves as outdoorsy, but strongly define themselves as protective of their families and home and know what they want in a firearm when they visit the retailer. This segment is 34% female and top motivators for purchases are protection, to develop proficiency, and to own before sales are restricted. Buyers in this segment are interested in specific styles and features of the firearms.

Guardian Gary, 15% of all gun buyers since 2000, is another distinctly different protection-oriented segment. This all-male segment is a slightly older buyer who is more likely to define himself as tech-savvy, analytical and old-fashioned. He is not a hunter but enjoys the outdoors. Personal protection away-from-home is a lesser concern than keeping the home front safe. This group is not interested in recreational shooting. Top motivators for purchase are protection, to develop proficiency, and to own before sales are restricted. Buyers in this segment are interested in price and versatility.

An all-female segment, Debbie Defense is interested in personal protection, at- and away from- home. Young and more ethnically diverse and 15% of all gun buyers since 2000, she enjoys the outdoors. Debbie Defense wants conceal-ability and light weight in a firearm, but is not set on specific product features or brands when she starts shopping for firearms. Recreational shooting is of little interest. Top motivators for purchase are protection, to develop proficiency, and to own before sales are restricted.

Suburban with modest incomes, the Skills Builder is not outdoorsy and is the youngest of all segments. With higher rates of female (43%) and minority participation, this segment does not own many firearms but wants to be proficient with the firearms they own. Conceal-ability and low weight reflect their interest in personal protection. Skills Builders, which comprise 12% of all gun buyers, are also interested in innovative equipment used by the pros that is easy to handle.

As the name implies, the Hunter owns firearms for the purpose of hunting and Hunters comprise 11% of all gun buyers, of which 25% are female. One of the older and most rural segments, the Hunter is not concerned about conceal-ability, but seeks quality while remaining price sensitive. Other than hunting, top motivators include protection and to develop shooting skills. Buyers in this segment are also interested in accuracy, reliability, and fit and feel.

Diverse in its rural versus suburban spread, the Social Shooter is interested in firearms as a way to spend time with friends. This segment is 25% female and makes up 8% of all gun buyers. Price is a concern, and versatility is desired in a firearm. After the Hunter segment, this group is more likely to purchase a long gun than other segments.

Not necessarily looking for rare or antique firearms, this mostly-male Collector segment wants to possess different types of firearms. Slightly older and wealthier than the other segments, they hunt and shoot, but are not avid participants. Price and versatility are not a concern as they are interested in specialized pieces and specific styles and features. This segment comprises 8% of all gun buyers since 2000.

Urban Recruits have lower income, are price conscious and seek versatility in their firearm purchases. Largely urban and suburban, these relatively new owners have the highest proportion of minorities (25%), low rates of target shooting participation, the highest rates of law enforcement and military background, and make up 4% of all gun buyers since 2000. This segment is 34% female and is interested in equipment that is recommended to them, easy to conceal and handle, and lightweight with specific styles and features.

13

Playing Field for the U.S. Firearms Market

Needs-based consumer segmentation reveals the ‘playing field’, mapping each distinct consumer segment based on their critical needs. The playing field below (graphically presenting U.S. firearms consumers since 2000) shows how big each segment is relative to each other, and which ones are more value sensitive (Hunter, Social Shooter and Guardian Gary), and which ones enter the market knowing the specific features they want in their next purchase (Collector, Protector and Urban Recruits). Consumer segmentation is based on peoples’ most recent purchases.

Their needs and motivations can vary from purchase to purchase. For example, not everyone who hunts belongs to the Hunter segment. But, if their most recent purchase was to satisfy a home protection need, that hunter could fall into the Guardian Gary segment. Consumer segmentation is best interpreted as reflecting the overall mix of consumers’ motivations and needs as they exist today, and not as a permanent classification for each individual consumer.

Consumer segmentation brings clarity to a complex market, and provides validated insight to our new business opportunity, develops a tighter bond with our consumers, increases our brand loyalty and develops longer lifetime value.

Competition

Current Alternatives

American Rebel competes with other concealed carry products as well as products that don’t offer concealed carry capabilities. For example any backpack manufacturer competes with American Rebel Concealed Carry Backpacks and American Rebel needs to differentiate its products and clearly present the features and benefits of its backpacks.

The market is dominated by 5.11 Tactical with the remaining companies competing for the rest of a growing market.

|

5.11 Tactical has recently shifted its focus to big box retailers such as BassPro, Cabella’s, and Academy Sporting Goods. The smaller companies compete for space in the mom & pop retail spaces and also sell direct to consumer. American Rebel will utilize the direct to consumer path of distribution.

|

5.11 Tactical is very successful and the other smaller companies share varying degrees of success. The Company believes that it will be ultimately successful developing its direct-to-consumer model to stay in closer contact with its customers to develop America’s Patriotic Brand.

14

5.11 Tactical was purchased for $400 million in 2016 by Compass Diversified Holdings (NYSE: CODI). 5.11 will continue to operate independently post-merger and maintain their headquarters in Irvine and Modesto, CA and operate international sales offices in Sweden, Mexico, Australia, China, and UAE. 5.11 Tactical is estimated to have an over 40% share of the concealed carry market. Interestingly, 5.11 describes themselves as “a leading designer and marketer of purpose-built tactical apparel and gear serving a wide range of global customers including law enforcement, military special operations and firefighters, as well as outdoor enthusiasts.” 5.11’s initial product was rock climbing pants which they discovered were popular with members of law enforcement which led 5.11 to design products specifically for law enforcement and grow their business.

5.11 Tactical Rush 12 Back Pack $129.99

| The RUSH12™ Backpack is a high performance multipurpose bag that fills multiple roles, from a tactical assault pack to a hunting backpack to an emergency go-bag. 16 total compartments provide a wide range of storage options, each one sized for a specific use.

|

Maxpedition® is the brainchild of founder and CEO Tim Tang, who in 2003 dropped out of medical school to start his own company in his parent's garage. Ten years (and several progressively larger warehouses) later, Maxpedition is now thriving in its own Los Angeles-based corporate and distribution compound

Innovative from the start, Maxpedition gained a competitive edge in its early years by creating bags and packs with superior durability and ergonomics, such as the Versipack® and Gearslinger® series. The first customers were military operators and law enforcement officers, but the civilian and concealed carry markets quickly caught on, selecting Maxpedition® as their preferred EDC (Every Day Carry).

Maxpedition Condor-II Backpack $169.00

| The popular CONDOR-II Backpack has a medium-sized design, but its surprisingly spacious interior can accommodate over 1350 cubic inches of gear and a 100oz/3L hydration reservoir with b-directional tube port (not included). However, what really makes the Condor II unique is that it's designed with more exterior PALS webbing than any Maxpedition backpack available.

|

15

| Rothco is a foremost supplier of military, tactical, survival and outdoor products. Founded in 1953, Rothco, a family-owned business run by Milton Somberg and Howard Somberg, has provided the military clothing and outdoor retailer with top quality merchandise and the finest service anywhere for over 60 years.

Today Rothco serves over 10,000 dealers globally. While Rothco's heritage is rooted in authentic military apparel and gear serving Army Navy dealers around the world; Rothco also serves the Tactical, Public Safety, Survival & Preparedness, Outdoor & Camping, Government Suppliers, Uniform & Work Wear, Promotions & Advertising, MilSim, Screen Printing & Embroidery, Gift & Hobby markets.

|

Rothco Global Assault Pack $134.99

| Rothco's Global Assault Pack Features, Extra Large Compartments, Ideal For Carrying All Your Tactical Gear. This Tactical Pack Has a Main Zippered Compartment With 2 Interior Zippered Mesh Pockets, 1 Interior Open Top Pocket With 3 Quick Release Cinch Straps, One Large Zippered Front Pouch With 2 Mesh Pockets & 5” X 5” Hook & Loop For Concealed Carry Holster Attachment, 2 Removable Side Zipper Pouches With Quick Release Buckles And Interior Pockets. |

Our Advantages

The American Rebel Concealed Carry patent-pending Protection Pocket is an innovative advantage over the competition. The patent-pending Protection Pocket utilizes a sandwich concept to hold the firearm in place and positioned properly for quick and effective access. American Rebel Concealed Carry products are designed for everyday use while keeping you concealed and safe. American Rebel Concealed Carry products enable easy access to your firearm while remaining discreet.

The key selling feature is innovation, style, and brand. Currently, innovation is the key selling feature as American Rebel enjoys a first-to-market status with its current assortment of Concealed Carry Backpacks.

Product innovations and first-to-market status currently insulate the Company from competitor’s influence. Changes in competition may influence pricing policies in the future.

American Rebel has applied for patent protection on several items of its products, including the patent-pending Protection Pocket. The Company believes it is an early adopter of providing SmartPack Bluetooth connectivity capabilities to its product lines. The SmartPack technology links the backpack with a SmartPhone app to provided added benefits. SmartPack technology will be offered as an optional feature within the next year.

Sales aren’t concentrated in a few customers as the company sells its products direct to the end consumer as opposed to selling wholesale to large distributors and retailers. Selling direct to consumer alleviates the potential problem of the Company being exposed to a high concentration of sales in a few customers. Large distributors or retailers do not have leverage over American Rebel since American Rebel sells direct to its customers.

16

Market Opportunity

The Company believes it has identified an unmet need – Customers aren’t comfortable carrying a firearm holstered on their hip and they haven’t been introduced to a product that conceals the firearm properly, allows easy access to the firearm, and provides everyday value and utility for their daily routine. In addition, many potential customers would be interested in carrying a concealed firearm if they knew about a product that conceals the firearm properly, allows easy access to the firearm, and was their primary backpack for everyday use. These potential customers need to know the availability of our product and the steps they need to take to protect themselves, their family, their neighbors, or even a room full of total strangers.

The American Rebel Concealed Carry product line’s key selling feature is innovation, style, and brand. Its patent-pending Protection Pocket is an innovative advantage over the competition. American Rebel enjoys a first-to-market status with its current assortment of Concealed Carry Backpacks designed for everyday use. Product innovations and first-to-market status currently insulate the Company from competitors’ influence. The Company believes contact with its customers through its direct sales initiatives, its social media, and its profile at consumer trade shows will increase the relevancy of American Rebel products in the lives of its customers. Contact with its customers will also provide an excellent source of information for product performance and improvement and innovation.

Market Strategy

The American Rebel brand strategy includes multiple pathways to success, all of which focus back to the Company’s core mission of providing innovative products and promoting responsible gun ownership while celebrating “The American Rebel Spirit” in all of us.

Superior designs, proprietary technology, and a unique marketing approach put American Rebel in a position to dominate the rapidly growing tactical/concealed carry market. American Rebel strongly supports the 2nd Amendment, and conveys a sense of responsibility to teach and preach good common practices of gun ownership. American Rebel products are designed to keep people safe, keep them aware, and give them the tools to defend and protect. “There’s a growing need to know how to protect yourself, your family, your neighbors or even a room full of total strangers,” says American Rebel’s CEO Andy Ross. “That need is in the forethought of every product we design.”

American Rebel directly benefits from the awareness and persona that founder Andy Ross has cultivated his entire life. His outdoorsman and adventurer status will serve the brand well as it addresses the customer through television, radio, and data-driven digital marketing initiatives. In addition, Andy has assembled a brand development team to guide the Company in its infancy. The team members are all tenured in their respective fields, and in total bring hundreds of years of experience to the brand and the Company.

American Rebel Concealed Carry products were designed due to the popularity of Andy Ross’s song “Cold Dead Hand” and Andy’s music continues to be an important part of American Rebel’s marketing and its connection with its customers. American Rebel utilizes social media to put its products in front of its customers and Andy’s music and television persona provide organic content to keep our social media “fans” and “followers” engaged.

American Rebel has applied for patent protection on several items of its products, including the patent-pending Protection Pocket. Product innovations and first-to-market status currently insulate the Company from competitor’s influence. Potential customers aren’t comfortable carrying a firearm holstered on their hip and they haven’t been introduced to a product that conceals the firearm properly, allows easy access to the firearm, and also provides everyday value for their daily routine.

Product and Technology

The American Rebel patent-pending Protection Pocket utilizes a sandwich concept to hold the firearm in place and positioned properly for quick and effective access. American Rebel Concealed Carry products are designed for everyday use while keeping you concealed and safe. In addition to the patent-pending Protection Pocket, American Rebel Concealed Carry Backpacks employ the finest materials available – Ripstop water-resistance fabric, YKK zippers and branded pull tabs, UTX branded clips. Practical design provides properly sized pockets for laptops and tablets, felt-lined pocket for sunglasses, compartments for cell phones, chargers, water bottles, and other daily needed accessories. American Rebel Concealed Carry Backpacks also contain a protected area for extra magazines and ammunition.

17

American Rebel will introduce its SmartPack technology within the next year which links the backpack with a SmartPhone app to provided added benefits. The added benefits of the SmartPhone app include notification when approaching airports and federal buildings. It would be easy to assume someone forgetting their handgun in their carry-on luggage and then going through security would be a rare occurrence, but 2012 TSA data show over 1,500 guns were revealed by TSA screener which was an increase from 1,300 the year before. 65 guns, of which 54 were loaded were found during one week in May 2013. Some of the patterns leading to a handgun being forgotten in a carry-on include:

A person who regularly carries a handgun in the glove box of their car taking their car in for repairs and removing the handgun and placing it in their backpack, then forgetting to return the handgun to the glove box after picking up the car and then flying in the next few days.

A person who regularly keeps their handgun on their nightstand at home, but they move the handgun to their briefcase when visited by relatives and they forget to return the handgun to its regular position when the relatives leave and then the person travels without going through their briefcase or backpack.

Someone packs the bags for the person flying and the person packing the bags assumes the person flying will stow the handgun when they get to the airport, but the person flying assumes the bag has been packed without the handgun.

A backpack has a discreet, almost hidden compartment for a handgun and the person carrying the bag doesn’t remember to check the compartment. American Rebel’s patent-pending Protection Pocket is a discreet, almost hidden compartment and the Protection Pocket is so effective at carrying the handgun the person carrying the backpack needs to be reminded to remove or stow the firearm before passing through security at an airport.

The American Rebel Concealed Carry Phone App will also notify the user if they forget their backpack or accidently leave it behind. An American Rebel Concealed Carry Backpack customer using the optional American Rebel Concealed Carry SmartPhone App will be notified on their phone if they leave their backpack behind under the table at the restaurant where they were dining and in an office building where they were attending a meeting or if someone picks up their backpack by accident. The American Rebel Concealed Carry SmartPhone App will also be able to determine if a firearm is stowed in the backpack or if the firearm is being removed from the backpack.

Tracking technology, such as the Tile Mate and other chip options, are fairly common today; but the American Rebel added benefits combined with the patent-pending Protection Pocket and everyday use utility provide a competitive advantage over the competition. Of course, there are many backpacks on the market, but they don’t have the patent-pending Protection Pocket. There are many tactical and range bags on the market, but they don’t provide the functionality for everyday use. Many of the tactical bags on the market have a military look and feel and a need exists for a backpack that appears to be a typical backpack with additional concealed carry features that are discreet.

Future Markets

American Rebel Concealed Carry Backpacks are designed for everyday use and the popularity of backpacks today make the American Rebel Concealed Carry Backpack an easy choice for most prospective customers interested in a backpack for everyday use that offers added features and benefits to keep them concealed and safe. For prospective customers interested in a traditional briefcase or computer bag, American Rebel will soon have a solution. The American Rebel Constitution line of products will include jackets, backpacks, brief cases and carry bags that provide concealed carry capabilities targeting business professionals and entrepreneurs in both a business and business casual setting. The Constitution line will feature traditional business stylings in appearance while providing the innovative American Rebel features and benefits that keep the user concealed and safe. The Constitution line will also offer Smart capabilities that have an added benefit to strictly assuring your handgun stays under your control. The SmartPhone App can be an application to assure the user that their possessions, such as laptops and files, stay under their control. Identity and personal data breaches are multi-million dollar problems in the business world and the SmartPack provides a solution to secure personal data and valuables stay with its responsible owner. The American Rebel SmartPack incorporates our proprietary SmartPhone app, our American Rebel cloud application and a Bluetooth device.

American Rebel is currently developing a tactical line of products to offer to customers in search of a range bag or a duffel bag as well as a backpack with a more combat appearance. Our product consultant, endorser, and trainer Rod Ryan is utilizing his 30+ years of experience in the military and law enforcement as well as his years as CEO of Storm Mountain, one of the top tactical training centers in the world. Rod is applying his years of experience to create a line of products that will combine many features of our Concealed Carry line with specific needs and features required by a customer looking for a great tactical product.

18

Intellectual Property

American Rebel has applied for patent protection for many of its proprietary features, including its patent-pending Protection Pocket and SmartPhone app. Company CEO Andy Ross has experience with intellectual property and values the protection and value IP can provide a company. We have and generally plan to continue to enter into non-disclosure, confidentially and intellectual property assignment agreements with all new employees as a condition of employment. In addition, we intend to also generally enter into confidentiality and non-disclosure agreements with consultants, manufacturers’ representatives, distributors, suppliers and others to attempt to limit access to, use and disclosure of our proprietary information. There can be no assurance, however, that these agreements will provide meaningful protection or adequate remedies for our trade secrets in the event of unauthorized use or disclosure of such information.

We also may from time to time rely on other intellectual property developed or acquired, including patents, technical innovations, laws of unfair competition and various other licensing agreements to provide our future growth and to build our competitive position. However, we can give no assurance that competitors will not infringe on our patent or other rights or otherwise create similar or non-infringing competing products that are technically patentable in their own right.

Research and Development

Our research and development programs are generally pursued by engineers and scientists employed by us or hired as consultants or through partnerships with industry leaders in manufacturing and design and researchers and academia. We are also working with subcontractors in developing specific components of our technologies. The primary objective of our research and development program is to advance the development of our existing and proposed products, to enhance the commercial value of such products.

Government Regulation

General

The right to bear arms is stated as the Second Amendment to the US Constitution and the trend of current laws and regulations is to reduce the burden on citizens desiring to bear arms. In spite of years of journalistic and public attention and debate, the United States has instituted few substantive changes in firearms policy over the past century. Opponents to increased gun control diluted a brief push by the Roosevelt administration in the 1930s and resulted in two minimalist federal statutes. A second effort to limit citizen’s access to firearms in the wake of the assassinations of John and Robert Kennedy and Martin Luther King produced the Gun Control Act of 1968, which largely remains the primary federal law. This modest control effort was subsequently diluted by the Firearms Owners Protection Act of 1986. The Clinton administration passed the Brady Act, requiring background checks on purchases from licensed firearms dealers, and a law directed at “assault weapons,” which sunset after ten years. For the past two decades, policy activity has shifted to the state legislatures and the courts, where concealed carry laws have granted more access to firearms and the Second Amendment has been recognized as an individual and fundamental right. Entrenched opposition to gun control in Congress and state legislatures, well-organized institutional opposition, and constitutional constraints have limited the risk of increased gun restrictions for the foreseeable future. It is important to note, though, that public sentiment is subject to change and voters could demand greater restrictions on access to firearms and influence Congress and state legislatures to enact tougher gun access legislation; but that is not the current mood or trend.

In addition to the above, the only regulations we encounter are the regulations that are common to all businesses, such as employment legislation, implied warranty laws, and environmental, health and safety standards, to the extent applicable. We could also encounter in the future industry-specific government regulations that would govern our products. It is highly unlikely but there is a remote chance that it may become the case that regulatory approvals will be required for the design and manufacture of our products and proposed products.

Foreign Regulation and Markets

The right to bear arms as stated in the Second Amendment to the US Constitution is uniquely American and American Rebel is uniquely “American,” especially considering the benefit of the concealed carry characteristics of our products. That being said, the Company has been approached by an exporter who believes because American Rebel products are uniquely “American” that they may have a receptive audience in Asia. The Company is not anticipating any revenue from foreign markets but will explore any proposals to partner with any companies specializing in foreign markets. If any substantive opportunities develop, American Rebel will address any foreign regulations that require the Company’s adherence.

19

Quality Management System

As the Company grows, we may also need to establish a suitable and effective quality management system, which establishes controlled processes for our product design, manufacturing, and distribution. We have a consultant with access to our current manufacturing facilities and the Company currently enjoys an excellent relationship with our manufacturing sources. Our products are not limited to a single source and the Company has access to a vast network of potential manufacturers.

Employees

The Company currently utilizes consultants and individual contractors to advance its business objectives and intends to hire full-time employees to oversee day-to-day operations of the Company and with the consultants, support management, engineering, manufacturing, and administration. The Company has no unionized employees.

Based on funding ability, the Company currently plans to hire 5 to 10 additional full-time employees within the next 12 months, whose principal responsibilities will be the support of our sales, marketing, research and development, and operational activities.

We consider relations with our consultants and contractors to be satisfactory.

Legal Matters

From time to time, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm business.

We are not currently a party in any legal proceeding or governmental regulatory proceeding nor are we currently aware of any pending or potential legal proceeding or governmental regulatory proceeding proposed to be initiated against us that would have a material adverse effect on us or our business.

The company maintains its warehouse and shipping operations at 9641 Lackman Road, Lenexa, KS 66219; but utilizes 718 Thompson Lane, Suite 108-199, Nashville, TN 37204 as its primary address. The lease agreement at 9641 Lackman Road, Lenexa, KS, is in the name of American Rebel Holdings, Inc. The wholly owned subsidiary American Rebel, Inc. maintains 718 Thompson Lane, Suite 108-199, Nashville, TN address. The Company believes these facilities are adequate for our needs, including providing the space and infrastructure to accommodate our development work based on our current operating plan.

Board of Directors

Currently our Board of Directors consists of one person, Mr. Charles A. Ross, Jr., our president and CEO. Mr. Ross has not received any compensation for being on our board separate from his compensation as our president and CEO. Mr. Ross may be compensated for his time and efforts as a board member; however, no specific board compensation agreement is in place at this time.

Advisory Board Members

The Advisory Board of the Company currently has no members. Each of our advisory board members, will have exceptional background in the industry and most likely become a highly valued member of the Company’s team. No compensation has been determined for advisory board members.

20

Recent Pronouncements

The Company evaluated recent accounting pronouncements through June 30, 2017 and believes that none have a material effect on the Company’s financial statements except for the following.

In August 2015, FASB issued ASU 2015-14, Revenue from Contracts with Customers: Deferral of Effective Date. In 2014 FASB issued ASU 2014-09, Revenue from Contracts with Customers, which provided a framework for addressing revenue recognition issues and replaces almost all existing revenue recognition guidance in current U.S. GAAP. The core principle of ASU 2014-09 is for companies to recognize revenue for the transfer of goods or services to customers in amounts that reflect the consideration to which the company expects to be entitled in exchange for those goods or services. ASU 2014-09 also resulted in enhanced disclosures about revenue, provide guidance for transactions that were not previously addressed comprehensively, and improve guidance for multiple-element arrangements. The amendments in ASU 2015-14 defer the effective date of the new revenue recognition guidance to annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Management is evaluating the future impact of this guidance on the Company’s financial statements and notes thereto.

In September 2015, the FASB issued ASU 2015-16, Business Combinations: Simplifying the Accounting for Measurement-Period Adjustments. The amendments in this ASU require that an acquirer recognize adjustments to provisional amounts that are identified during the measurement period in the reporting period in which the adjustment amounts are determined; calculated as if the accounting had been completed at the acquisition date. For public business entities, the amendments in this ASU are effective for fiscal years beginning after December 15, 2015, including interim periods within those fiscal years. The amendments in this ASU should be applied prospectively with earlier application permitted for financial statements that have not been issued. The adoption of this guidance did not have a material impact on the Company’s financial position, results of operations or cash flows.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). The objective of ASU 2016-02 is to recognize lease assets and lease liabilities by lessees for those leases classified as operating leases under previous U.S. GAAP. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Early adoption of ASU 2016-02 is permitted. The Company is evaluating the effects adoption of this guidance will have on its consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, Clarification on Classification of Certain Cash Receipts and Cash Payments on the Statement of Cash Flows, to create consistency in the classification of eight specific cash flow items. This standard is effective for calendar-year SEC registrants beginning in 2018. The Company is evaluating the effects adoption of this guidance will have on its consolidated financial statements.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows - Restricted Cash (Topic 230), which amends the existing guidance relating to the disclosure of restricted cash and restricted cash equivalents on the statement of cash flows. ASU 2016-18 is effective for the fiscal year beginning after December 15, 2017, and interim periods within that fiscal year, and early adoption is permitted. The Company is evaluating the impact of adoption of ASU 2016-18 on its Consolidated Statements of Cash Flows.

In May 2017, the FASB issued ASU 2017-09, Stock Compensation (Topic 718)-Scope of Modification Accounting, to provide guidance on determining which changes to terms and conditions of share-based payment awards require an entity to apply modification accounting under Topic 718. The ASU is effective for annual periods beginning after December 15, 2017, and interim periods within those annual periods. The Company is evaluating the effects adoption of this guidance will have on its consolidated financial statements.

In July 2017, the FASB issued ASU 2017-11, Earnings Per Share (Topic 260)-Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception. The amendments in Part I of the ASU change the classification analysis of certain equity-linked financial instruments (or embedded features) with down round features. When determining whether certain financial instruments should be classified as liabilities or equity instruments a down round feature no longer precludes equity classification when assessing whether the instrument is indexed to an entity’s own stock. The amendments in Part II recharacterize the indefinite deferral of certain provisions of Topic 480 with a scope exception and do not have an accounting effect. The ASU is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods. The Company is evaluating the effects adoption of this guidance will have on its consolidated financial statements.

In August 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815)-Targeted Improvements to Accounting for Hedging Activities. The new guidance is intended to more closely align hedge accounting with entities’ hedging strategies, simplify the application of hedge accounting, and increase the transparency of hedging programs. The ASU is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods. The Company is evaluating the effects adoption of this guidance will have on its consolidated financial statements.

21

ITEM 1A. Risk Factors

The following risk factors should be considered in connection with an evaluation of our business:

In addition to other information in this Report, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements. Additional risks and uncertainties not presently known to us, or that we currently consider to be immaterial, may also impact our business, result of operations, liquidity and financial condition. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, if and when a trading market for our securities is established, the trading price of our securities could decline, and you may lose all or part of your investment.

OUR SECURITIES INVOLVE A HIGH DEGREE OF RISK AND, THEREFORE, SHOULD BE CONSIDERED EXTREMELY SPECULATIVE. THEY SHOULD NOT BE PURCHASED BY PERSONS WHO CANNOT AFFORD THE POSSIBILITY OF THE LOSS OF THE ENTIRE INVESTMENT. PROSPECTIVE INVESTORS SHOULD READ ALL INVESTMENT MATERIALS, INCLUDING ALL EXHIBITS, AND CAREFULLY CONSIDER, AMONG OTHER FACTORS THE FOLLOWING RISK FACTORS.

Risks Related to the Business

1.American Rebel has limited financial resources. Our independent registered auditors’ report includes an explanatory paragraph stating that there is substantial doubt about our ability to continue as a going concern.

American Rebel is an early stage company and virtually no financial resources are currently available to it. Our independent registered auditors included an explanatory paragraph in their opinion on our financial statements as of and for the period ended December 31, 2017 that states that Company losses from operations raise substantial doubt about its ability to continue as a going concern. We will be required to seek additional financing. Financing sought may be in the form of equity or debt from sources yet to be identified. We will seek additional financing to further pursue and execute on our business steps. No assurances can be given that we will generate sufficient revenue or obtain the necessary financing to continue as a going concern.