Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Zoetis Inc. | zoetis8-k2018merger5x16x18.htm |

| EX-99.1 - EXHIBIT 99.1 - Zoetis Inc. | ex99-12018mergerpressrelea.htm |

| EX-2.1 - EXHIBIT 2.1 - Zoetis Inc. | exhibit21mergeragreement.htm |

ZOETIS TO ACQUIRE ABAXIS May 16, 2018 1 1

ACCELERATING GROWTH TOGETHER 2 2

FORWARD-LOOKING STATEMENTS Statements included in this communication which are not historical in nature or do not relate to current facts are intended to be, and are hereby identified as, forward-looking statements for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “may,” “will,” “anticipate,” “could,” “should,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “project” and “intend,” as well as other similar words and expressions of the future, are intended to identify forward-looking statements. Zoetis Inc. (“Zoetis”) and Abaxis (“Abaxis”) caution readers that forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from anticipated results. Such risks and uncertainties, include, among others, the following possibilities: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Zoetis and Abaxis; the outcome of any legal proceedings that may be instituted against Zoetis or Abaxis; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) or Abaxis shareholder approval or to satisfy any of the other conditions to the transaction on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Zoetis and Abaxis do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; the ability to complete the acquisition and integration of Abaxis successfully; and other factors that may affect future results of Zoetis and Abaxis. Additional factors that could cause results to differ materially from those described above can be found in Zoetis’ Annual Report on Form 10-K for the year ended December 31, 2017, which is on file with the Securities and Exchange Commission (the “SEC”) and in other documents Zoetis files with the SEC, and in Abaxis’ Annual Report on Form 10-K for the year ended March 31, 2017 and, Quarterly Report on Form 10-Q for the quarter ended December 31, 2017, which are on file with the SEC, and in other documents Abaxis files with the SEC. 3 3

NON-GAAP FINANCIAL INFORMATION We use non-GAAP financial measures, such as adjusted net income, adjusted diluted earnings per share, adjusted operating expenses, adjusted gross margin, and operational results (which excludes the impact of foreign exchange) to assess and analyze our results and trends and to make financial and operational decisions. We believe these non-GAAP financial measures are also useful to investors because they provide greater transparency regarding our operating performance. The non-GAAP financial measures included in this presentation should not be considered alternatives to measurements required by GAAP, such as net income, operating income, and earnings per share, and should not be considered measures of liquidity. These non-GAAP financial measures are unlikely to be comparable with non-GAAP information provided by other companies. Reconciliation of non-GAAP financial measures and GAAP financial measures are included in the tables accompanying our earnings release and are posted on our website at www.zoetis.com. IMPORTANT ADDITIONAL INFORMATION In connection with the proposed transaction between Zoetis and Abaxis, Abaxis expects to file with the SEC a proxy statement of Abaxis, as well as other relevant documents concerning the proposed transaction. This communication is not a substitute for the proxy statement or for any other document that Abaxis may file with the SEC and send to its shareholders in connection with the proposed transaction. The proposed transaction will be submitted to Abaxis’ shareholders for their consideration. Before making any voting decision, Shareholders of Abaxis are urged to read the proxy statement regarding the transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about the proposed transaction. Shareholders of Abaxis will be able to obtain a free copy of the proxy statement, as well as other filings containing information about Zoetis and Abaxis, without charge, at the SEC’s website (http://www.sec.gov). Copies of the proxy statement and the filings with the SEC that will be incorporated by reference4 therein can also be obtained, without charge, by directing a request to Abaxis, Inc., 3240 Whipple Road, Union City, CA 94587, Attention: Corporate Secretary; telephone: (510) 675-6500, or from Abaxis’ website, www.abaxis.com. 4

PARTICIPANTS IN THE SOLICITATION Abaxis, Zoetis and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Abaxis’ directors and executive officers is available in Abaxis’ definitive proxy statement, which was filed with the SEC on September 19, 2017, and certain of its Current Reports on Form 8-K. Information regarding Zoetis’ directors is available in Zoetis’ definitive proxy statement, which was filed with the SEC on April 2, 2018, and information regarding Zoetis’ executive officers is available in Zoetis’ Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 15, 2018. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC in connection with the proposed transaction. Free copies of this document may be obtained as described in the preceding paragraph. 5 5

KEY TRANSACTION THEMES The second largest global provider of Veterinary Point-of-Care Diagnostic Instruments Purchase price of $83 per share, or approximately $2.0 billion of Equity Value and $1.8 billion of Enterprise Value, subject to the terms and conditions of the merger agreement Brings to Zoetis a proven line of diagnostic instruments and consumables, providing a new platform for growth that Zoetis can accelerate with its direct salesforce in approximately 45 countries Enables Zoetis to support veterinarians with comprehensive solutions to predict, prevent, detect and treat diseases in animals Expect an efficient, integrated salesforce covering a combined diagnostics, pharmaceuticals, and vaccines portfolio Affirms strategy to deploy capital in complementary, high-growth segments of animal health industry 1 Expect6 Adjusted Diluted EPS accretion in 2019, the first full year of the combination 1Adjusted Diluted EPS (non-GAAP financial measure) is defined as reported U.S. generally accepted accounting principles (GAAP) EPS excluding purchase accounting adjustments, acquisition-related 6 costs and certain significant items.

REVIEW OF THE GLOBAL COMPANION ANIMAL DIAGNOSTICS OPPORTUNITY THE INTERNATIONAL MARKET REMAINS UNDERSERVED WITH MEDICALIZATION RATES BELOW THE US… COMPANION ANIMAL POPULATION MEDICALIZED1 Key Takeaways 40% Medicalization 4x ~$3bn+ Global Market2 Larger 71% Medicalization ~10% Historical Growth2 4x1 Larger International Population than the US Population Medicalized Not Medicalized …A COMBINATION BRINGS INFRASTRUCTURE OF SCALE, CAPABLE OF SERVING GLOBAL CUSTOMERS ABAXIS SALES FOOTPRINT ZOETIS SALES FOOTPRINT (800+ FIELD FORCE) 7 Direct Sales Force Distributor Only Direct Sales Force Distributor Only 7 1Vetnosis data and internal estimates. 2Based on internal estimates and publicly available information.

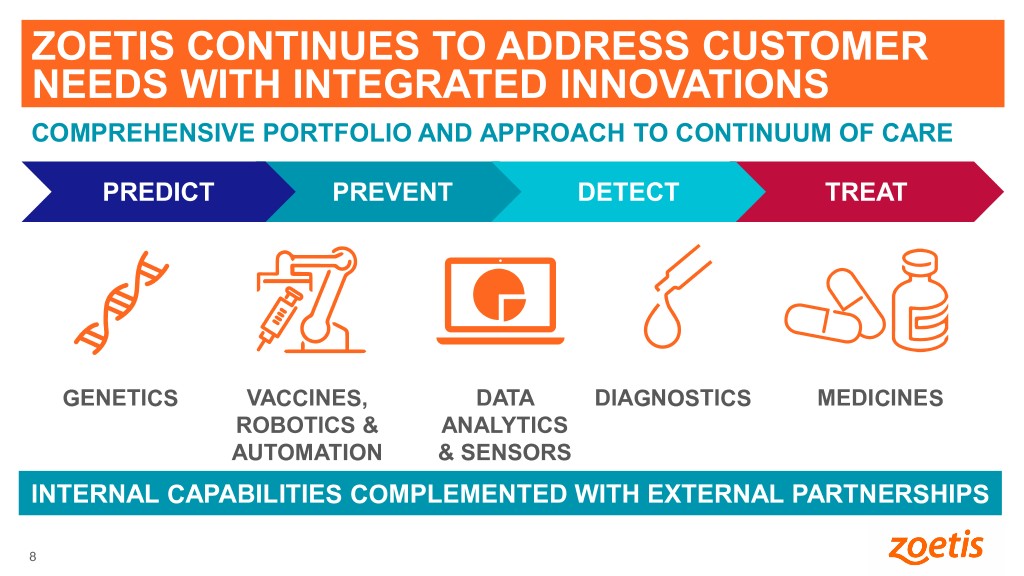

ZOETIS CONTINUES TO ADDRESS CUSTOMER NEEDS WITH INTEGRATED INNOVATIONS COMPREHENSIVE PORTFOLIO AND APPROACH TO CONTINUUM OF CARE PREDICT PREVENT DETECT TREAT GENETICS VACCINES, DATA DIAGNOSTICS MEDICINES ROBOTICS & ANALYTICS AUTOMATION & SENSORS INTERNAL8 CAPABILITIES COMPLEMENTED WITH EXTERNAL PARTNERSHIPS 8

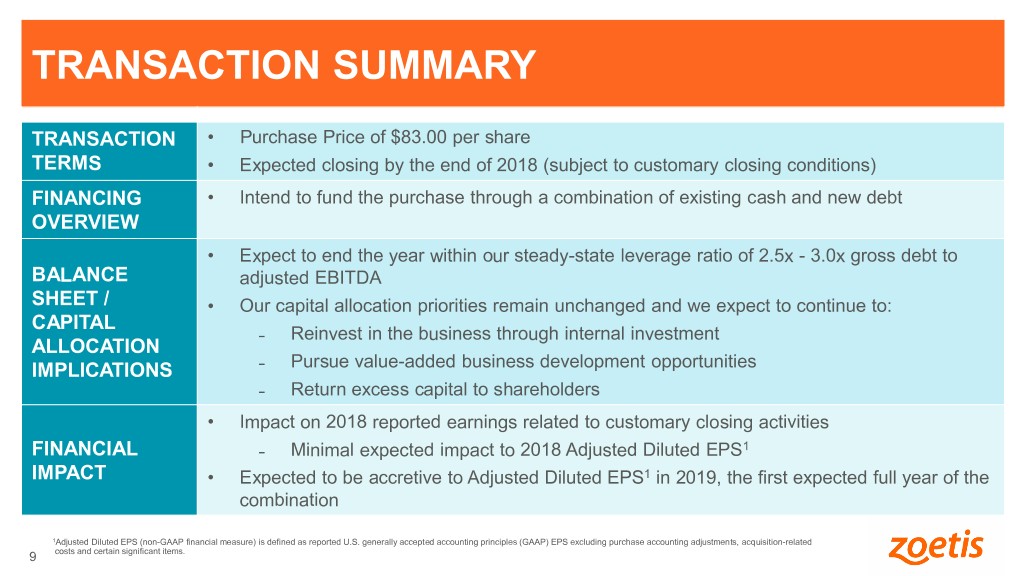

TRANSACTION SUMMARY TRANSACTION • Purchase Price of $83.00 per share TERMS • Expected closing by the end of 2018 (subject to customary closing conditions) FINANCING • Intend to fund the purchase through a combination of existing cash and new debt OVERVIEW • Expect to end the year within our steady-state leverage ratio of 2.5x - 3.0x gross debt to BALANCE adjusted EBITDA SHEET / • Our capital allocation priorities remain unchanged and we expect to continue to: CAPITAL ˗ Reinvest in the business through internal investment ALLOCATION ˗ Pursue value-added business development opportunities IMPLICATIONS ˗ Return excess capital to shareholders • Impact on 2018 reported earnings related to customary closing activities FINANCIAL ˗ Minimal expected impact to 2018 Adjusted Diluted EPS1 IMPACT • Expected to be accretive to Adjusted Diluted EPS1 in 2019, the first expected full year of the 9 combination 1Adjusted Diluted EPS (non-GAAP financial measure) is defined as reported U.S. generally accepted accounting principles (GAAP) EPS excluding purchase accounting adjustments, acquisition-related 9 costs and certain significant items.

Q&A 10 10