Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WABASH NATIONAL Corp | tv494248_8k.htm |

Exhibit 99.1

ANNUAL SHAREHOLDERS MEETING May 16, 2018 Dick Giromini Chief Executive Officer

2 This presentation contains certain forward - looking statements, as defined by the Private Securities Litigation Reform Act of 1995. All statements other than historical facts are forward - looking statements, including without limit, those regarding shipment outlook, Operating EBITDA, backlog, demand level expectations, profitability and earnings capacity, margin opportunities, and potential benefits of any recent acquisitions. Any forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward - looking statements. Without limit, these risks and uncertainties include economic conditions, increased competition, dependence on new management, reliance on certain customers and corporate partnerships, shortages and costs of raw materials, manufacturing capacity and cost containment risks, dependence on industry trends, access to capital, acceptance of products, and government regulation. You should review and consider the various disclosures made by the Company in this presentation and in its reports to its stockholders and periodic reports on Forms 10 - K and 10 - Q. We cannot give assurance that the expectations reflected in our forward - looking statements will prove to be correct. Our actual results could differ materially from those anticipated in these forward - looking statements. All written and oral forward - looking statements attributable to us are expressly qualified in their entirety by the factors we disclose that could cause our actual results to differ materially from our expectations. S AFE H ARBOR S TATEMENT © 2018 Wabash National, L.P. All rights reserved. Wabash®, Wabash National®, Beall®, Benson®, Brenner® Tank, Bulk Tank International, DuraPlate ®, Extract Technology®, Garsite , Progress Tank , Supreme ® , Transcraft ®, Walker Engineered Products, and Walker Transport are marks owned by Wabash National Corporation.

3 W ABASH N ATIONAL C ORPORATION New Markets. New Innovation. New Growth. Wabash welcomes a new team in Little Falls, MN (October 2017)

4 1 Focus • Operational Excellence • People • Customer • Innovation • Growth T HE W ABASH J OURNEY New Markets. New Innovation. New Growth.

5 1 2 Focus Emphasis on Lean Manufacturing • Safety • Product Quality • On - Time Delivery • Productivity • Cost Reduction T HE W ABASH J OURNEY New Markets. New Innovation. New Growth.

6 1 2 3 Shift in Company Culture • Vision, Mission & Values • Integrity, Trust & Mutual Respect • Safety is Our #1 Priority Focus Emphasis on Lean Manufacturing T HE W ABASH J OURNEY New Markets. New Innovation. New Growth.

7 T HE W ABASH J OURNEY New Markets. New Innovation. New Growth. Wabash National’s cultural and lean transformation… • Reduced inventory by 60% • Reduced fork truck traffic by 150 miles per shift • Reduced warehouse costs by $ 20M • Improved productivity by 48% in first 18 months

8 5th Year as IW 50 Best 2017 C OMPANY H IGHLIGHTS Conexus Indiana Touchstone Award Winner Two TTMA Plant Safety Awards Kentucky Governor’s Safety and Health Award New Markets. New Innovation. New Growth.

9 Earned ISO 14001 Registrations for Environmental Management at Two More Locations 2017 C OMPANY H IGHLIGHTS Guanajuato, Mexico, Operation New! Portland, OR New! Guanajuato, Mexico New Markets. New Innovation. New Growth.

10 Over $1 Million to Support Our Communities 2017 C OMPANY H IGHLIGHTS Military Appreciation Event with Donations Supporting the Wounded Warrior Project Fond du Lac, WI (November 10, 2017) New Markets. New Innovation. New Growth.

11 1 2 3 4 Execution of a Strategic Plan for Growth and Diversification Shift in Company Culture Focus Emphasis on Lean Manufacturing T HE W ABASH J OURNEY New Markets. New Innovation. New Growth.

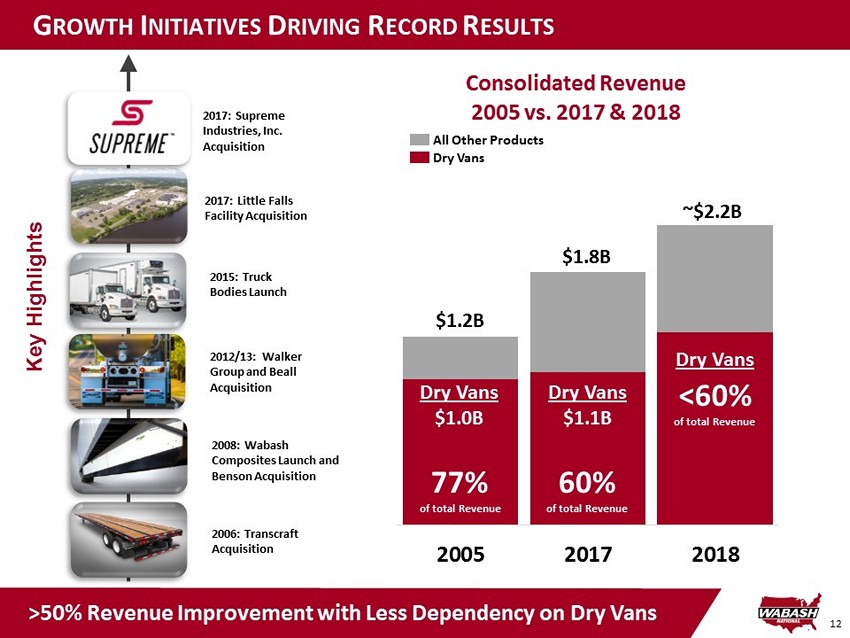

12 G ROWTH I NITIATIVES D RIVING R ECORD R ESULTS 2006: Transcraft Acquisition 2012/13: Walker Group and Beall Acquisition 2008: Wabash Composites Launch and Benson Acquisition 2015: Truck Bodies Launch 2017: Little Falls Facility Acquisition 2017: Supreme Industries, Inc. Acquisition Growing, Diversified Revenue Lowers Overall % of Dry Vans Key Highlights >50 % Revenue Improvement with Less Dependency on Dry Vans All Other Products Dry Vans 2005 2017 2018 Consolidated Revenue 2005 vs. 2017 & 2018 $1.8B $ 1.2B 77% of total Revenue 60% of total Revenue D ry Vans $1.0B D ry Vans $1.1B D ry Vans <60% of total Revenue ~$2.2B

13 F INANCIAL P ERFORMANCE Annual Revenue Annual Operating Income & Gross Margin $1,462 $1,636 $1,863 $2,027 $1,845 $1,767 $2,241 $0 $500 $1,000 $1,500 $2,000 $2,500 2012 2013 2014 2015 2016 2017 2018 Consensus ($ mils) $70 $103 $122 $180 $203 $131 $185 11.2% 13.2% 12.5% 15.0% 17.6% 14.8% 15.3% 0% 5% 10% 15% 20% $0 $50 $100 $150 $200 $250 $300 2012 2013 2014 2015 2016 2017 2018 Consensus ($ mils) $119 $150 $169 $230 $253 $189 $235 $0 $50 $100 $150 $200 $250 $300 2012 2013 2014 2015 2016 2017 2018 Consensus ($ mils) Operating EBITDA (1) 1 See Appendix for reconciliation of non - GAAP financial information Liquidity (2) 2 Defined as cash on hand plus available borrowing capacity on our revolving credit facility $224 $254 $290 $348 $333 $361 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 2013 2014 2015 2016 2017 ($ mils) Our Strong Financial Position Allows for Flexibility

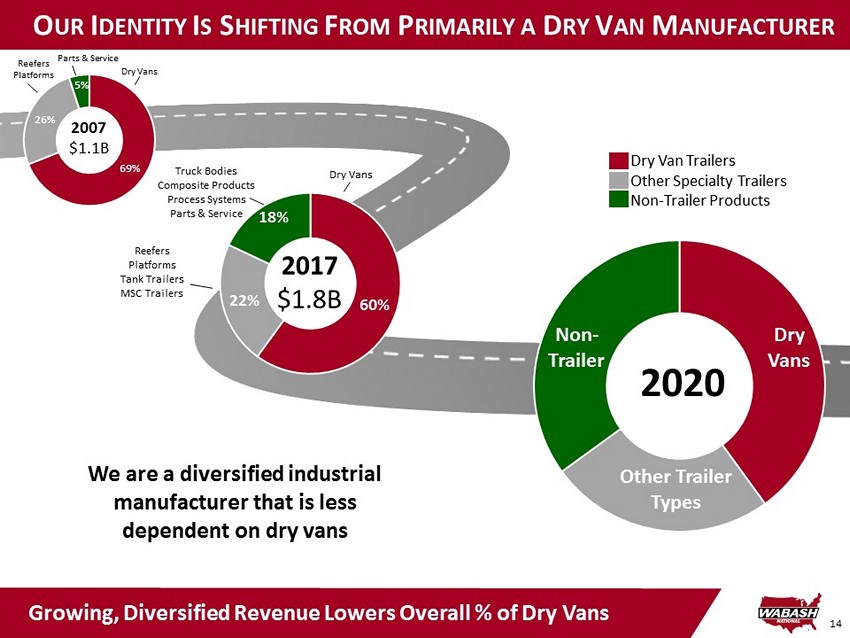

14 O UR I DENTITY I S S HIFTING F ROM P RIMARILY A D RY V AN M ANUFACTURER We are a diversified industrial manufacturer that is less dependent on dry vans 2007 $1.1B Dry Vans Dry Van Trailers Other Specialty Trailers Non - Trailer Products 2020 Dry Vans Non - Trailer Other Trailer Types 69% 26% 5% Reefers Platforms Parts & Service 2017 $1.8B Dry Vans 60% 22% 18% Reefers Platforms Tank Trailers MSC Trailers Truck Bodies Composite Products Process Systems Parts & Service Growing, Diversified Revenue Lowers Overall % of Dry Vans

15 T HE N EXT C HAPTER Welcome Incoming CEO Brent Yeagy New Markets. New Innovation. New Growth. ▪ Joined Wabash in 2003 as Vice President of Manufacturing ▪ Vice President and General Manager of Commercial Trailer Products (2010 - 2013) ▪ Group President, Commercial Trailer Products ( 2013 - 2016) ▪ President and COO (2016 - present) ▪ Prior experience at Delco Remy International and Rexnord Corporation in human resources, environmental engineering and safety management ▪ U.S. Navy veteran (1991 - 1994)

ANNUAL SHAREHOLDERS MEETING May 16, 2018 Brent Yeagy President & Chief Operating Officer

17 T HE P ATH F ORWARD B UILDS ON O UR L EGACY New Markets. New Innovation. New Growth.

18 S TRONG , D ISCIPLINED F INANCIAL P ERFORMANCE 1 2 3 4 Balanced Capital Allocation Margin Expansion Disciplined Balance Sheet Management Strong Earnings & Cash Generation New Markets. New Innovation. New Growth.

19 M EGA T RENDS D RIVE G ROWTH I NITIATIVES Urbanization, Final Mile & Home Delivery Expansion of Cold Chain/ Food Equipment Energy and Chemical Production, Storage & Transportation Increased Regulation (GHG, ELDs, Food Safety) New Markets. New Innovation. New Growth.

20 S TRATEGIC G ROWTH M OMENTUM ▪ New material technologies will improve durability, reduce weight and grow sales Honeycomb Core Molded Structural Composites ( MSC) Cell Core Our Innovative Technology Sets Us Apart from Other OEMs New Little Falls, MN, Operation Serves as Supplier Facility for MSC ▪ 53 acres, 600,000 sq. ft. ▪ State - of - the - art compression molding equipment for MSC technology, bulk resin system , bulk foam system

21 S TRATEGIC G ROWTH M OMENTUM Separate “Final Mile” Segment Increases Focus, Expands Reach Leading Brands in Diverse End Markets and Industries ▪ Dry and Refrigerated Van Trailers ▪ Platform Trailers ▪ Fleet Used Trailers ▪ Aftermarket Parts and Service ▪ Tank Trailers and Truck - Mounted Tanks ▪ Composite Panels and Products ▪ Food, Dairy and Beverage Equipment ▪ Containment and Aseptic Systems ▪ Aircraft Refueling Equipment ▪ Truck - Mounted Dry Bodies ▪ Truck - Mounted Refrigerated Bodies ▪ Service Bodies ▪ FRP Panel Sales ▪ Stake Bodies Commercial Trailer Products 2017 Sales: $ 1.3B Proforma 2017: $307M Q4 2017 Sales: $70M 2017 Sales: $361M Diversified Products Final Mile Products

22 1 2 3 4 Fostering Our Relentless Drive for Success Empowerment Alignment with the Mission Greater Investment in Our Human Capital T HE N EXT C HAPTER S TARTS WITH P EOPLE New Markets. New Innovation. New Growth.

23 New Markets. New Innovation. New Growth.

ANNUAL SHAREHOLDERS MEETING Appendix

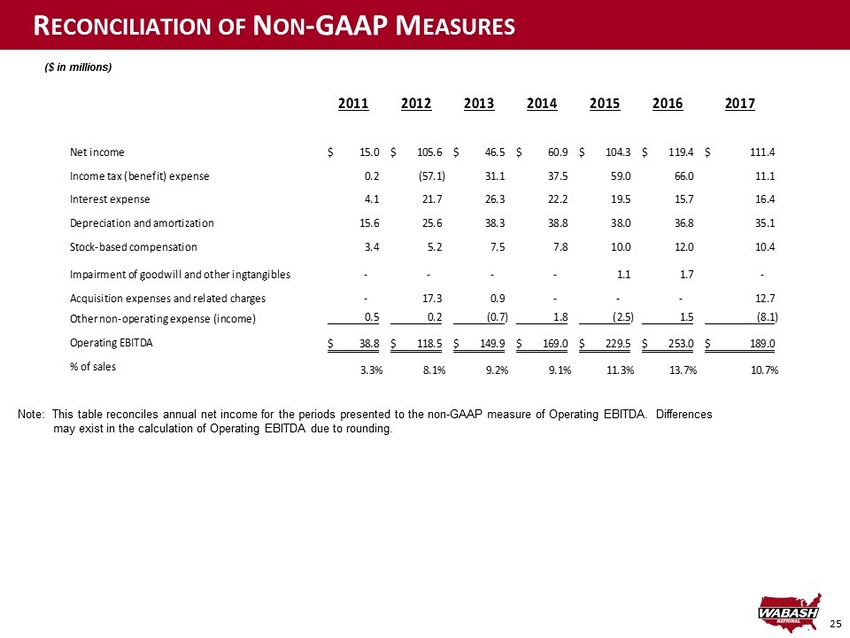

25 2011 2012 2013 2014 2015 2016 2017 Net income 15.0$ 105.6$ 46.5$ 60.9$ 104.3$ 119.4$ 111.4$ Income tax (benefit) expense 0.2 (57.1) 31.1 37.5 59.0 66.0 11.1 Interest expense 4.1 21.7 26.3 22.2 19.5 15.7 16.4 Depreciation and amortization 15.6 25.6 38.3 38.8 38.0 36.8 35.1 Stock-based compensation 3.4 5.2 7.5 7.8 10.0 12.0 10.4 Impairment of goodwill and other ingtangibles - - - - 1.1 1.7 - Acquisition expenses and related charges - 17.3 0.9 - - - 12.7 Other non-operating expense (income) 0.5 0.2 (0.7) 1.8 (2.5) 1.5 (8.1) Operating EBITDA 38.8$ 118.5$ 149.9$ 169.0$ 229.5$ 253.0$ 189.0$ % of sales 3.3% 8.1% 9.2% 9.1% 11.3% 13.7% 10.7% R ECONCILIATION OF N ON - GAAP M EASURES ($ in millions) Note: This table reconciles annual net income for the periods presented to the non - GAAP measure of Operating EBITDA. Differenc es may exist in the calculation of Operating EBITDA due to rounding.