Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Staffing 360 Solutions, Inc. | staf-ex991_6.htm |

| 8-K - 8-K 1Q2018 EARNINGS RESULTS AND SLIDES - Staffing 360 Solutions, Inc. | staf-8k_20180514.htm |

Ticker: STAF Q1 2018 Investor Call – May 14, 2018

Investor Call Agenda Introduction and Safe-Harbor Brendan Flood, Chairman & Chief Executive Officer Opening Remarks Brendan Flood, Chairman & Chief Executive Officer Financial Results David Faiman, Chief Financial Officer Q&A Brendan Flood, Chairman & Chief Executive Officer Closing Remarks Brendan Flood, Chairman & Chief Executive Officer

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding the business of the Company and its industry generally, business strategy and prospects. These statements are based on the Company’s estimates, projections, beliefs and assumptions and are not guarantees of future performance. These forward-looking statements are subject to various risks and uncertainties, which may cause actual results to differ materially from the forward-looking statements. The Company disclaims any obligation to update these forward-looking statements except as required by law.

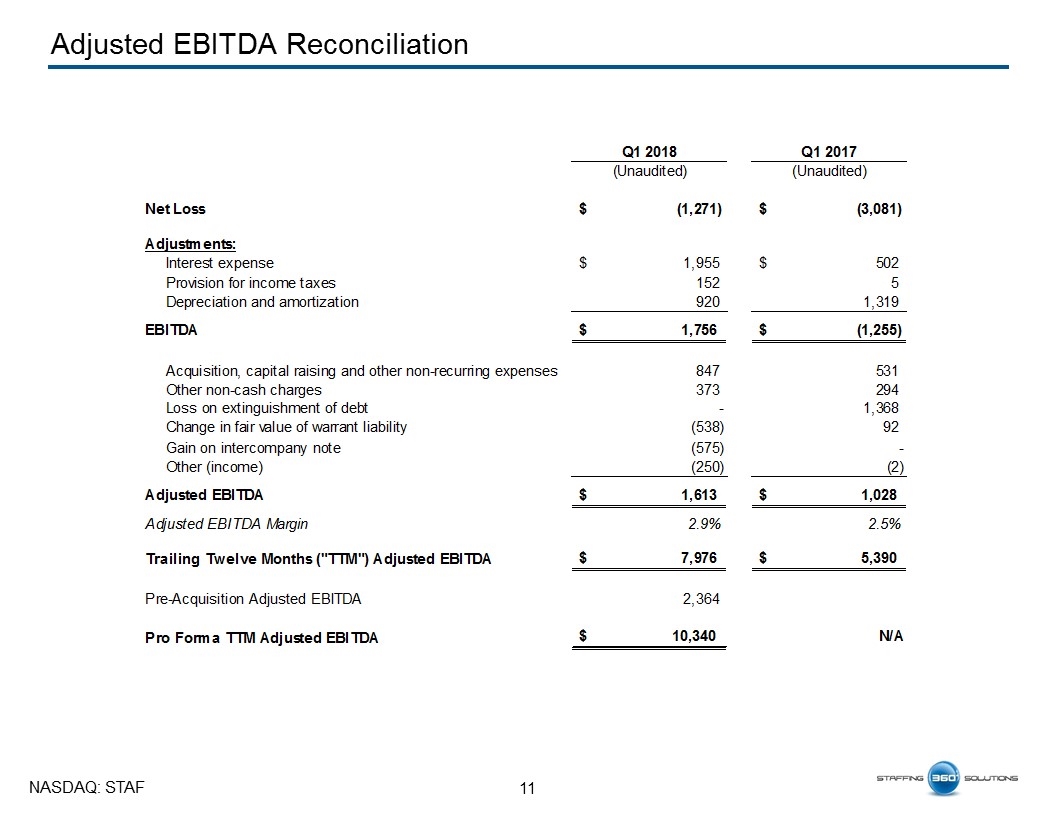

Remarks from the Chairman and Chief Executive Officer Record quarterly revenue Record gross profit and margin Improved efficiency and cash flow First Quarter 2018 Financial Highlights: Revenue growth of 37% to $55.8 million (~$240 million annualized) Gross profit growth of 58% to $11.6 million Gross margin strengthened to 20.8% Net loss decreased to approximately $1.3 million Adjusted EBITDA of $1.6 million TTM Pro Forma Adjusted EBITDA of $10.3 million

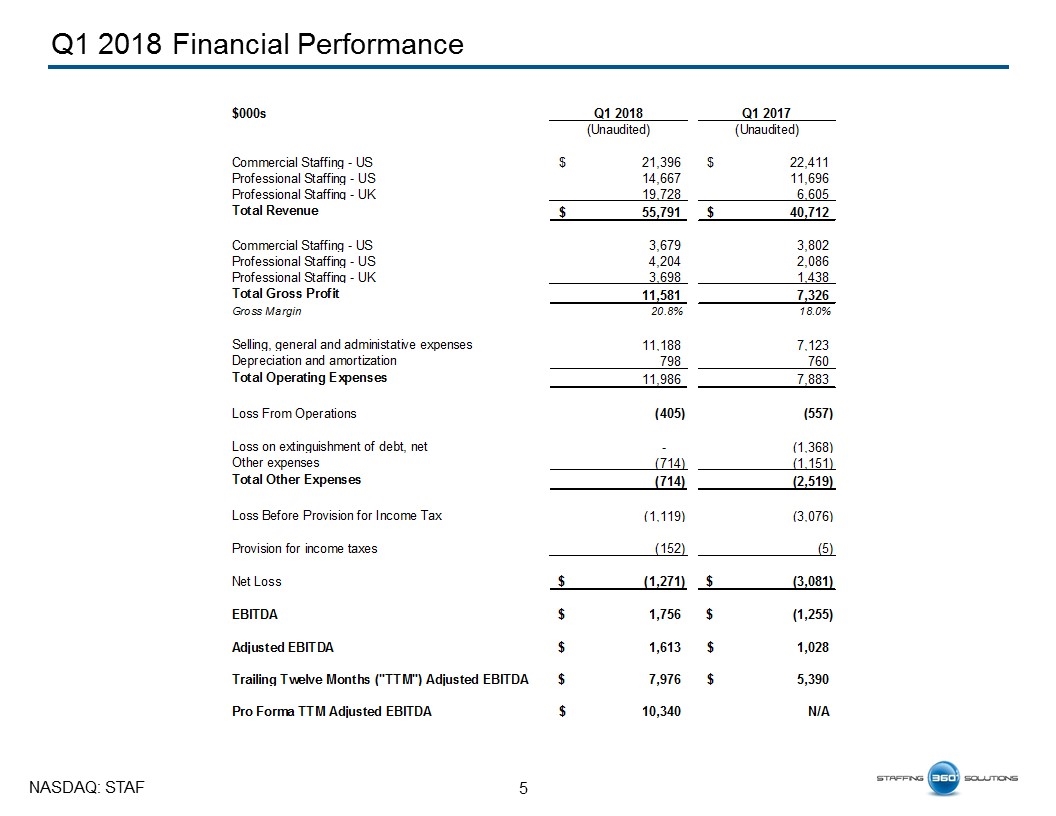

Q1 2018 Financial Performance

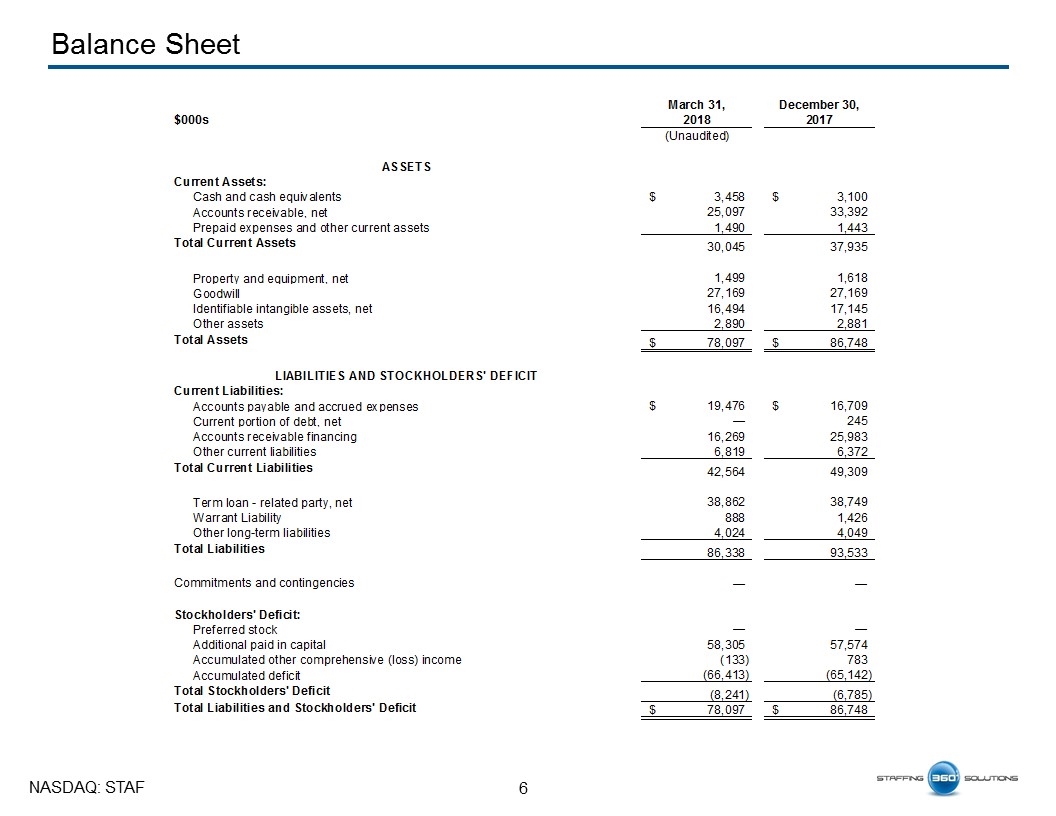

Balance Sheet

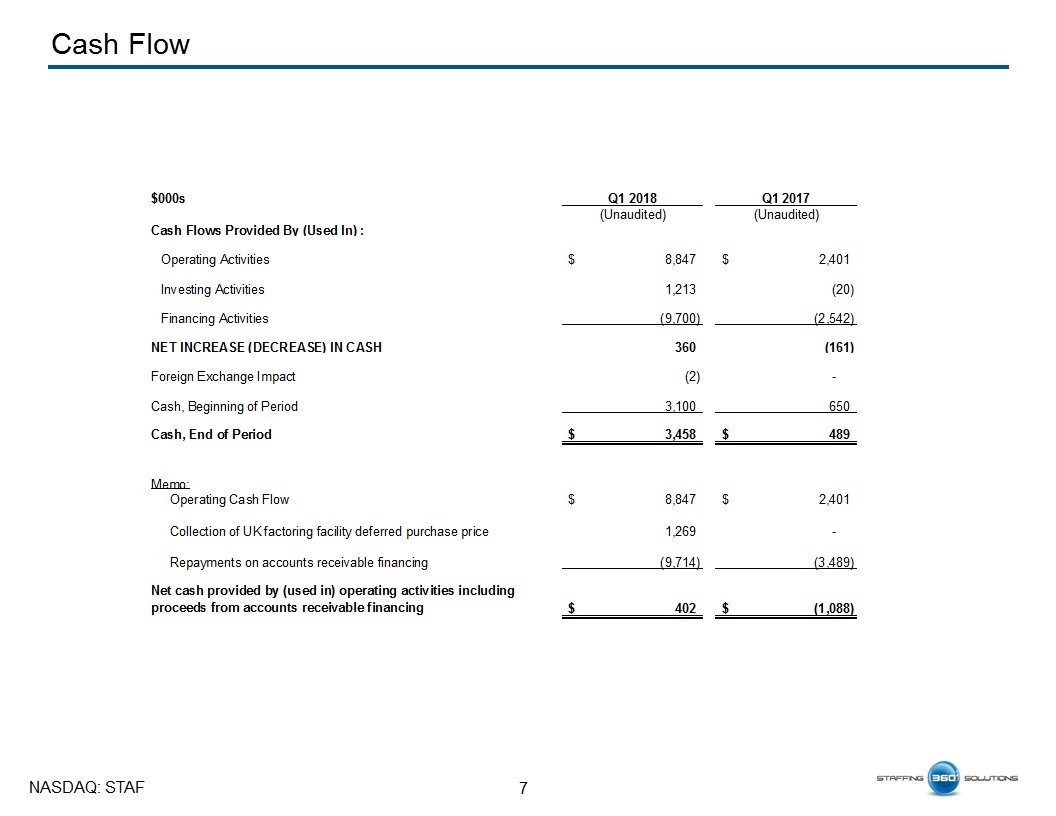

Cash Flow

Questions & Answers

Closing Remarks

Appendices

Adjusted EBITDA Reconciliation

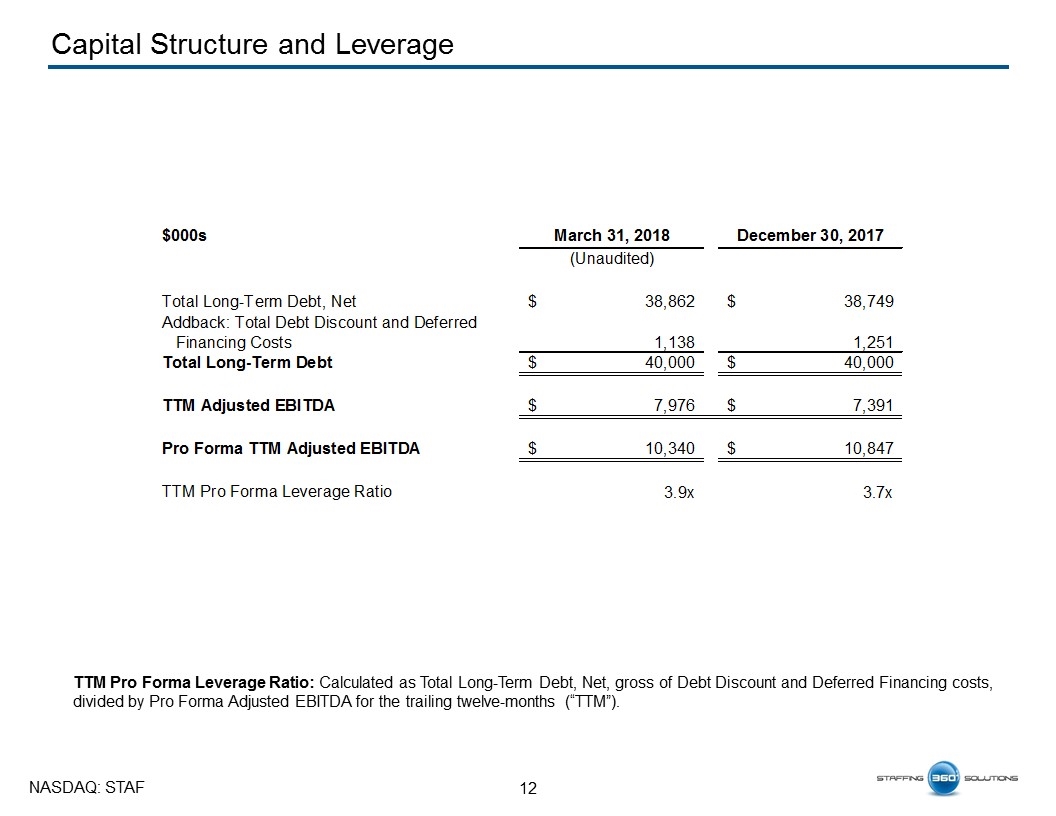

Capital Structure and Leverage TTM Pro Forma Leverage Ratio: Calculated as Total Long-Term Debt, Net, gross of Debt Discount and Deferred Financing costs, divided by Pro Forma Adjusted EBITDA for the trailing twelve-months (“TTM”).

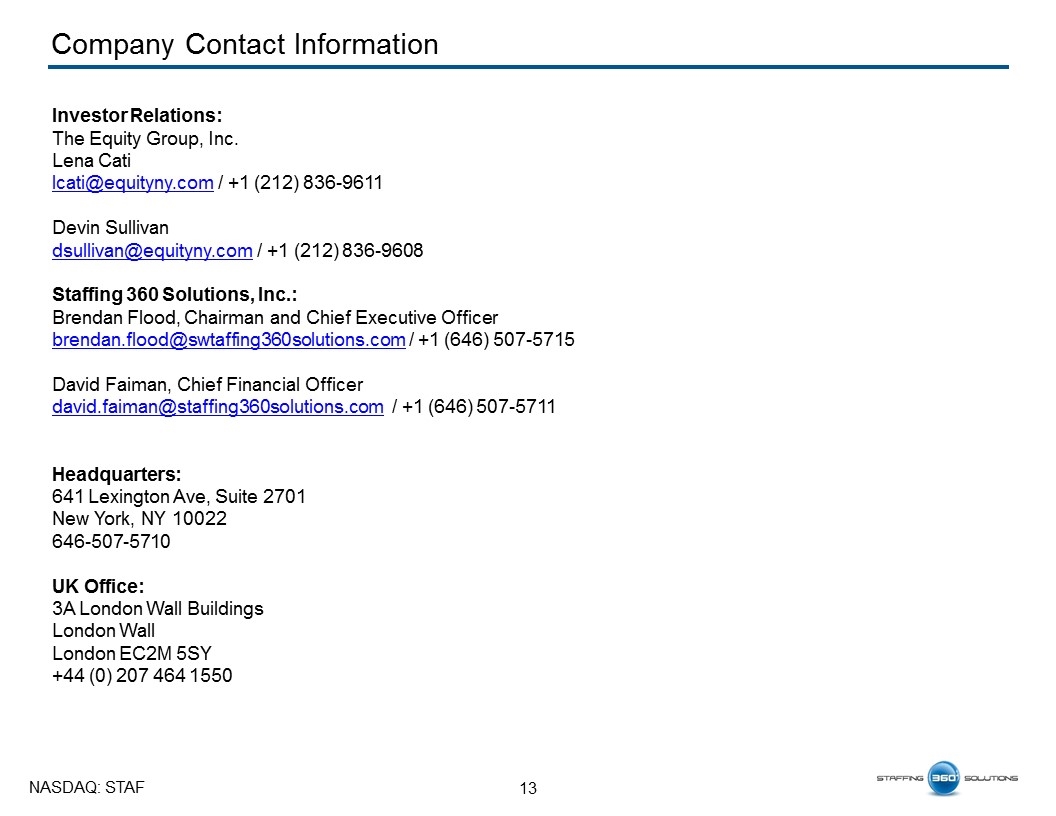

Company Contact Information Investor Relations: The Equity Group, Inc. Lena Cati lcati@equityny.com / +1 (212) 836-9611 Devin Sullivan dsullivan@equityny.com / +1 (212) 836-9608 Staffing 360 Solutions, Inc.: Brendan Flood, Chairman and Chief Executive Officer brendan.flood@swtaffing360solutions.com / +1 (646) 507-5715 David Faiman, Chief Financial Officer david.faiman@staffing360solutions.com / +1 (646) 507-5711 Headquarters: 641 Lexington Ave, Suite 2701 New York, NY 10022 646-507-5710 UK Office: 3A London Wall Buildings London Wall London EC2M 5SY +44 (0) 207 464 1550