Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Invitation Homes Inc. | earningsrelease8-k051418.htm |

Seattle Southern California Northern California EARNINGS RELEASE AND SUPPLEMENTAL INFORMATION Denver Orlando South Florida FIRST QUARTER 2018

Table of Contents Earnings Press Release.............................................................................................................................................................. 2 Consolidated Financial Statements ........................................................................................................................................... 9 Schedule 1: Reconciliation of FFO, Core FFO, and AFFO ..................................................................................................... 11 Schedule 2: Capital Structure Information............................................................................................................................... 12 Schedule 3: Summary of Operating Information by Home Portfolio...................................................................................... 15 Schedule 4: Home Characteristics by Market.......................................................................................................................... 18 Schedule 5: Same Store Operating Information by Market..................................................................................................... 19 Schedule 6: Cost to Maintain and Capital Expenditure Detail ................................................................................................ 24 Schedule 7: Adjusted Property Management and G&A Reconciliation .................................................................................. 25 Schedule 8: Acquisitions and Dispositions .............................................................................................................................. 26 Glossary and Reconciliations.................................................................................................................................................... 27 Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 1

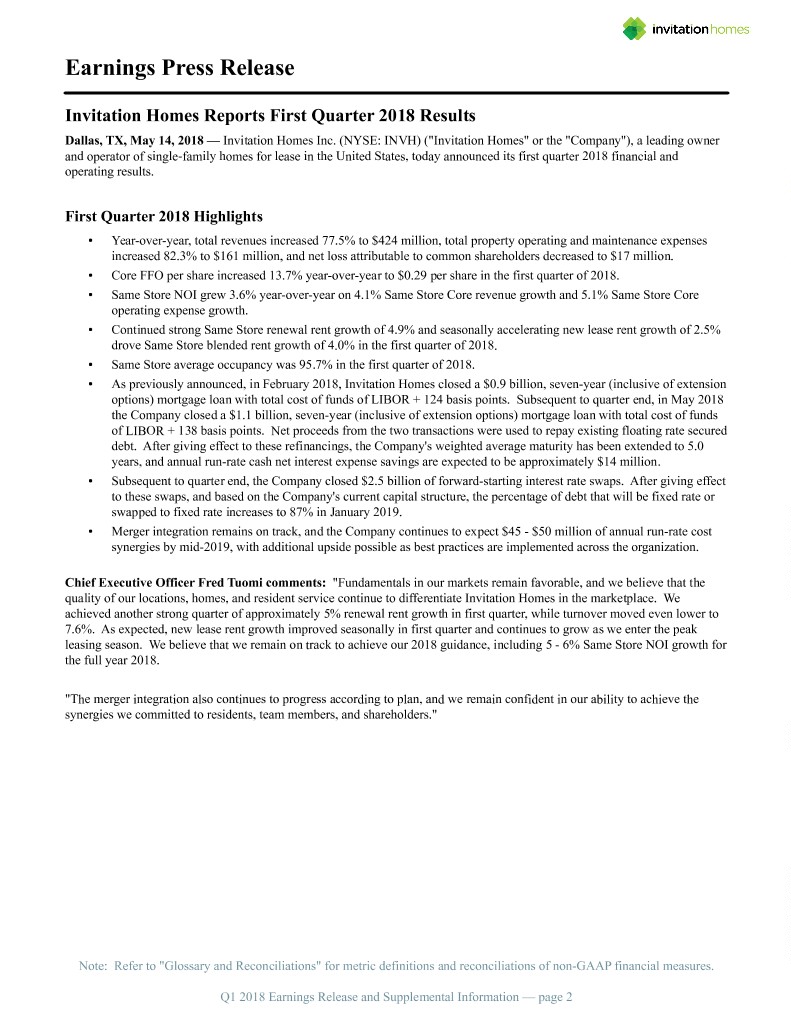

Earnings Press Release Invitation Homes Reports First Quarter 2018 Results Dallas, TX, May 14, 2018 — Invitation Homes Inc. (NYSE: INVH) ("Invitation Homes" or the "Company"), a leading owner and operator of single-family homes for lease in the United States, today announced its first quarter 2018 financial and operating results. First Quarter 2018 Highlights • Year-over-year, total revenues increased 77.5% to $424 million, total property operating and maintenance expenses increased 82.3% to $161 million, and net loss attributable to common shareholders decreased to $17 million. • Core FFO per share increased 13.7% year-over-year to $0.29 per share in the first quarter of 2018. • Same Store NOI grew 3.6% year-over-year on 4.1% Same Store Core revenue growth and 5.1% Same Store Core operating expense growth. • Continued strong Same Store renewal rent growth of 4.9% and seasonally accelerating new lease rent growth of 2.5% drove Same Store blended rent growth of 4.0% in the first quarter of 2018. • Same Store average occupancy was 95.7% in the first quarter of 2018. • As previously announced, in February 2018, Invitation Homes closed a $0.9 billion, seven-year (inclusive of extension options) mortgage loan with total cost of funds of LIBOR + 124 basis points. Subsequent to quarter end, in May 2018 the Company closed a $1.1 billion, seven-year (inclusive of extension options) mortgage loan with total cost of funds of LIBOR + 138 basis points. Net proceeds from the two transactions were used to repay existing floating rate secured debt. After giving effect to these refinancings, the Company's weighted average maturity has been extended to 5.0 years, and annual run-rate cash net interest expense savings are expected to be approximately $14 million. • Subsequent to quarter end, the Company closed $2.5 billion of forward-starting interest rate swaps. After giving effect to these swaps, and based on the Company's current capital structure, the percentage of debt that will be fixed rate or swapped to fixed rate increases to 87% in January 2019. • Merger integration remains on track, and the Company continues to expect $45 - $50 million of annual run-rate cost synergies by mid-2019, with additional upside possible as best practices are implemented across the organization. Chief Executive Officer Fred Tuomi comments: "Fundamentals in our markets remain favorable, and we believe that the quality of our locations, homes, and resident service continue to differentiate Invitation Homes in the marketplace. We achieved another strong quarter of approximately 5% renewal rent growth in first quarter, while turnover moved even lower to 7.6%. As expected, new lease rent growth improved seasonally in first quarter and continues to grow as we enter the peak leasing season. We believe that we remain on track to achieve our 2018 guidance, including 5 - 6% Same Store NOI growth for the full year 2018. "The merger integration also continues to progress according to plan, and we remain confident in our ability to achieve the synergies we committed to residents, team members, and shareholders." Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 2

Financial Results Net Loss, FFO, Core FFO, and AFFO Per Share — Diluted Q1 2018 Q1 2017 Net loss (1) $ (0.03) $ (0.08) FFO (2) 0.23 0.04 Core FFO (2) 0.29 0.25 AFFO (2) 0.24 0.22 (1) No shares of common stock were outstanding prior to the close of the Company's initial public offering. As such, net loss per share for Q1 2017 has been calculated based on operating results for the period from February 1, 2017 through March 31, 2017, and the weighted average number of shares outstanding during that same period, in accordance with GAAP. (2) No shares of common stock or OP Units were outstanding prior to the close of the Company's initial public offering. For Q1 2017, FFO, Core FFO, and AFFO per share have been calculated based on operating results for the full period from January 1, 2017 through March 31, 2017, and as if shares issued in connection with the IPO were issued on January 1, 2017. Net Loss Net loss attributable to common shareholders for the three months ended March 31, 2018 was $0.03 per share, compared to $0.08 per share for the prior year period during which the Company was public from February 1, 2017 to March 31, 2017. Core FFO Year-over-year, Core FFO for the three months ended March 31, 2018 increased 13.7% to $0.29 per share, primarily due to an increase in NOI per share, driven by higher revenues, and lower cash interest expense per share. AFFO Year-over-year, AFFO for the three months ended March 31, 2018 increased 7.3% to $0.24 per share, primarily driven by the increase in Core FFO described above. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 3

Operating Results Same Store Operating Results Snapshot Number of homes in Same Store portfolio: 72,109 Q1 2018 Q1 2017 Core revenue growth (year-over-year) 4.1% Core operating expense growth (year-over-year) 5.1% NOI growth (year-over-year) 3.6% Average occupancy 95.7% 95.8% Turnover rate 7.6% 8.1% Rental rate growth (lease-over-lease): New leases 2.5% 3.3% Renewals 4.9% 5.1% Blended 4.0% 4.4% Same Store NOI For the Same Store portfolio of 72,109 homes, first quarter 2018 Same Store NOI increased 3.6% year-over-year on Same Store Core revenue growth of 4.1% and Same Store Core expense growth of 5.1%. Same Store Core Revenues First quarter 2018 Same Store Core revenue growth of 4.1% was driven by a 4.0% increase in average monthly rent and a 10.0% increase in other property income, net of resident reimbursements, partially offset by a 0.1% decline in average occupancy to 95.7%. Same Store Core Operating Expenses First quarter 2018 Same Store Core operating expenses increased 5.1% year-over-year, driven primarily by a 7.3% increase in property taxes and a 24.5% increase in repair and maintenance expenses. The increase in repair and maintenance expenses was primarily one-time in nature, and related to a timing delay in completing routine, non-storm related service requests in markets impacted by the September 2017 hurricane. Service requests related to hurricane damage were prioritized in the fourth quarter of 2017, while other non-critical service requests that otherwise would have been resolved last year were completed in the first quarter of 2018. Harsher winter weather in the first quarter of 2018 compared to the first quarter of 2017 also contributed to higher repair and maintenance expenses in some markets. Investment Management Activity Invitation Homes acquired 190 homes for $52.6 million in the first quarter of 2018, including estimated renovation costs, and sold 251 homes for gross proceeds of $55.2 million, resulting in total portfolio home count of 82,509 homes at March 31, 2018. Merger Integration Update Merger integration efforts are progressing well and remain on track. The development of systems and technology to support the Company's future-state operating model is on schedule, and implementation of the new platform is expected to begin in the second half of 2018, as previously communicated. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 4

In-line with its initial estimate, the Company has identified $45 million to $50 million of projected annual run-rate cost synergies, and expects to realize 75% of those synergies on a run-rate basis by the end of 2018. Furthemore, the Company believes there could be additional upside from the implementation of best practices across the organization. As of May 14, 2018, approximately $24 million of annualized run-rate synergy savings had been realized, which includes approximately $9 million of share-based compensation expense. Balance Sheet and Capital Markets Activity At March 31, 2018, the Company had $1,120 million in availability through a combination of unrestricted cash and undrawn capacity on its revolving credit facility. The Company's total indebtedness at March 31, 2018 was $9,745 million, consisting of $7,655 million of secured debt and $2,090 million of unsecured debt. During the first quarter of 2018, as previously announced, on February 8, 2018, the Company closed a seven-year (inclusive of extension options), floating rate securitization loan (IH 2018-1) with a principal amount of $917 million, of which the Company retained $46 million to comply with risk retention requirements. Total cost of funds for the loan was LIBOR + 124 basis points. Net proceeds were used to repay in full the Company's last remaining 2019 secured debt maturities, CAH 2014-1 and CAH 2014-2. The securitization transaction and associated repayments are expected to result in cash net annual interest expense savings of approximately $4 million on a run-rate basis. Subsequent to quarter end, on May 8, 2018, the Company closed another seven-year (inclusive of extension options), floating rate securitization loan (IH 2018-2) with a principal amount of $1,057 million, of which the Company retained $53 million to comply with risk retention requirements. Total cost of funds for the loan was LIBOR + 138 basis points. Net proceeds and available cash were used to repay in full two of the Company's floating rate securitization loans maturing in 2020, IH 2015-1 and IH 2015-2. The securitization transaction and associated repayments are expected to result in cash net annual interest expense savings of approximately $10 million on a run-rate basis. After giving effect to the IH 2018-2 securitization and associated repayment activity, weighted average years to maturity at March 31, 2018 would have been 5.0 years, 79% of debt would have been fixed rate or swapped to fixed rate, and the weighted average interest rate on total debt during the quarter would have been 3.4%. Subsequent to quarter end, the Company also closed $2,520 million of forward-starting interest rate swaps at a weighted average swap rate of 2.91%. After giving effect to these swaps, and based on the Company's current capital structure, the percentage of debt that will be fixed rate or swapped to fixed rate increases to 87% beginning in January 2019. Dividend As previously announced, on May 4, 2018 the Company's Board of Directors declared a quarterly cash dividend of $0.11 per share of common stock. The dividend will be paid on or before May 31, 2018 to shareholders of record as of the close of business on May 15, 2018. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 5

Full Year 2018 Guidance 2018 guidance remains unchanged versus initial guidance set in February 2018, as outlined in the table below. 2018 Guidance FY 2018 Guidance Core FFO per share – diluted $1.13 - $1.21 AFFO per share – diluted $0.94 - $1.02 Same Store Core revenue growth 4 - 5% Same Store Core operating expense growth 2 - 3% Same Store NOI growth 5 - 6% Merger Synergy Impact Guidance is inclusive of anticipated synergy savings resulting from Invitation Homes' merger with Starwood Waypoint Homes. Of identifiable total cost synergies of $45 to $50 million, the Company expects 75% to be realized on a run-rate basis by the end of 2018, consistent with initial expectations. The majority of NOI synergies are expected to be realized after transitioning to one operating platform for the Company’s field and corporate teams, which the Company remains on track to complete later in the second half of 2018. As a result, the Company anticipates that synergy realization in 2018 will be almost entirely related to property management and G&A savings rather than NOI increases. Synergies are expected to be more impactful to earnings growth in 2019 than in 2018, consistent with initial expectations. Note: The Company does not provide guidance for the most comparable GAAP financial measures of net loss, total revenues, and property operating and maintenance, or a reconciliation of the forward-looking non-GAAP financial measures of Core FFO per share, AFFO per share, Same Store revenue growth, Same Store operating expense growth, and Same Store NOI growth to the comparable GAAP financial measures because it is unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company's ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net (gain)/loss on sale of previously depreciated real estate assets, share-based compensation, casualty loss, non-Same Store revenues, and non-Same Store operating expenses. These items are uncertain, depend on various factors, and could have a material impact on our GAAP results for the guidance period. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 6

Earnings Conference Call Information Invitation Homes has scheduled a conference call at 11:00 a.m. Eastern Time on Tuesday, May 15, 2018 to discuss results for the three months ended March 31, 2018. The domestic dial-in number is 1-888-317-6003, and the international dial-in number is 1-412-317-6061. The passcode is 6613112. An audio webcast may be accessed at www.invh.com. A replay of the call will be available through June 15, 2018, and can be accessed by calling 1-877-344-7529 (domestic) or 1-412-317-0088 (international) and using the replay passcode 10119340, or by using the link at www.invh.com. Supplemental Information The full text of the Earnings Release and Supplemental Information referenced in this release are available on Invitation Homes' Investor Relations website at www.invh.com. Glossary & Reconciliations of Non-GAAP Financial Operating Measures Financial and operating measures found in the Earnings Release and Supplemental Information include certain measures used by Invitation Homes management that are measures not defined under accounting principles generally accepted in the United States ("GAAP"). These measures are defined in the Glossary in the Supplemental Information and, as applicable, reconciled to the most comparable GAAP measures. About Invitation Homes Invitation Homes is a leading owner and operator of single-family homes for lease, offering residents high-quality homes across America. With over 80,000 homes for lease in 17 markets across the country, Invitation Homes is meeting changing lifestyle demands by providing residents access to updated homes with features they value, such as close proximity to jobs and access to good schools. The Company's mission statement, "Together with you, we make a house a home," reflects its commitment to high-touch service that continuously enhances residents' living experiences and provides homes where individuals and families can thrive. Investor Relations Contact Greg Van Winkle Phone: 844.456.INVH (4684) Email: IR@InvitationHomes.com Media Relations Contact Claire Parker Phone: 202.257.2329 Email: Media@InvitationHomes.com Forward-Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which include, but are not limited to, statements related to the Company’s expectations regarding the anticipated benefits of the merger with Starwood Waypoint Homes, the performance of the Company’s business, its financial results, its liquidity and capital resources, and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "projects," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks associated with achieving expected revenue synergies or cost savings from the merger, risks inherent to the single-family rental industry sector and the Company’s business model, macroeconomic factors beyond the Company’s control, competition in identifying and acquiring the Company’s properties, competition in the leasing market for quality residents, increasing property taxes, homeowners' association fees and insurance costs, the Company’s dependence on third parties for key services, risks related to evaluation of properties, poor resident selection and defaults and non-renewals by the Company’s residents, performance of the Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 7

Company’s information technology systems, and risks related to the Company’s indebtedness. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Additional factors that could cause the Company’s results to differ materially from those described in the forward-looking statements can be found under the section entitled "Part I. Item 1A. Risk Factors," of the Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed with the Securities and Exchange Commission (the "SEC"), as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at http:// www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in the Company’s filings with the SEC. The forward-looking statements speak only as of the date of this press release, and we expressly disclaim any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except to the extent otherwise required by law. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 8

Consolidated Balance Sheets ($ in thousands, except shares and per share data) March 31, December 31, 2018 2017 (unaudited) Assets: Investments in single-family residential properties, net $ 17,199,979 $ 17,312,264 Cash and cash equivalents 134,893 179,878 Restricted cash 255,855 236,684 Goodwill 258,207 258,207 Other assets, net 847,511 696,605 Total assets $ 18,696,445 $ 18,683,638 Liabilities: Mortgage loans, net $ 7,614,460 $ 7,580,153 Term loan facility, net 1,488,695 1,487,973 Revolving facility 15,000 35,000 Convertible senior notes, net 550,695 548,536 Accounts payable and accrued expenses 199,317 193,413 Resident security deposits 150,202 146,689 Other liabilities 41,179 41,999 Total liabilities 10,059,548 10,033,763 Equity: Shareholders' equity Preferred stock, $0.01 par value per share, 900,000,000 shares authorized, none outstanding at March 31, 2018 and December 31, 2017 — — Common stock, $0.01 par value per share, 9,000,000,000 shares authorized, 520,364,636 and 519,173,142 outstanding at March 31, 2018 and December 31, 2017, respectively 5,204 5,192 Additional paid-in-capital 8,612,110 8,602,603 Accumulated deficit (232,296) (157,595) Accumulated other comprehensive income 106,918 47,885 Total shareholders' equity 8,491,936 8,498,085 Non-controlling interests 144,961 151,790 Total equity 8,636,897 8,649,875 Total liabilities and equity $ 18,696,445 $ 18,683,638 Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 9

Consolidated Statements of Operations ($ in thousands, except per share amounts) (unaudited) Q1 2018 Q1 2017 Revenues: Rental revenues $ 395,792 $ 226,096 Other property income 27,877 12,654 Total revenues 423,669 238,750 Operating expenses: Property operating and maintenance 160,767 88,168 Property management expense 17,164 11,449 General and administrative 27,636 58,266 Depreciation and amortization 144,500 67,577 Impairment and other 6,121 1,204 Total operating expenses 356,188 226,664 Operating income 67,481 12,086 Other income (expenses): Interest expense (92,299) (68,572) Other, net 1,736 (226) Total other income (expenses) (90,563) (68,798) Loss from continuing operations (23,082) (56,712) Gain on sale of property, net of tax 5,502 14,321 Net loss (17,580) (42,391) Net loss attributable to non-controlling interests 311 — Net loss attributable to common shareholders $ (17,269) $ (42,391) For the Three February 1, 2017 Months Ended through March 31, 2018 March 31, 2017 Net loss available to common shareholders — basic and diluted $ (17,491) $ (25,512) Weighted average common shares outstanding — basic and diluted 519,660,998 311,651,082 Net loss per common share — basic and diluted $ (0.03) $ (0.08) Dividends declared per common share $ 0.11 N/A Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 10

Supplemental Schedule 1 Reconciliation of FFO, Core FFO, and AFFO ($ in thousands, except per share amounts) (unaudited) FFO Reconciliation Q1 2018 Q1 2017 Net loss available to common shareholders $ (17,491) $ (42,391) Net loss available to participating securities 222 — Non-controlling interests (311) — Depreciation and amortization on real estate assets 143,108 66,653 Impairment on depreciated real estate investments 603 1,037 Net gain on sale of previously depreciated investments in real estate (5,502) (14,321) FFO $ 120,629 $ 10,978 Core FFO Reconciliation Q1 2018 Q1 2017 FFO $ 120,629 $ 10,978 Noncash interest expense 8,495 15,134 Share-based compensation expense 9,498 44,244 IPO related expenses — 7,631 Merger and transaction-related expenses 4,367 — Severance expense 2,659 45 Casualty losses, net 5,518 167 Core FFO $ 151,166 $ 78,199 AFFO Reconciliation Q1 2018 Q1 2017 Core FFO $ 151,166 $ 78,199 Recurring capital expenditures (25,393) (9,229) AFFO $ 125,773 $ 68,970 Weighted average shares and units outstanding — diluted (1) 530,314,568 311,948,259 FFO per share — diluted (1) $ 0.23 $ 0.04 Core FFO per share — diluted (1) $ 0.29 $ 0.25 AFFO per share — diluted (1) $ 0.24 $ 0.22 (1) No shares of common stock or OP Units were outstanding prior to the close of the Company's initial public offering. For Q1 2017, FFO, Core FFO, and AFFO per share have been calculated based on operating results for the full period from January 1, 2017 through March 31, 2017, and as if shares issued in connection with the IPO were issued on January 1, 2017. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 11

Supplemental Schedule 2(a) Diluted Shares Outstanding (unaudited) Weighted Average Amounts for Net Loss (1) Q1 2018 Q1 2017 Total common shares — diluted 519,660,998 311,651,082 Weighted average amounts for FFO, Core FFO, and AFFO (2) Q1 2018 Q1 2017 Common shares — diluted 520,953,961 311,948,259 OP units 9,360,607 — Total common shares and units — diluted 530,314,568 311,948,259 Period end amounts for FFO, Core FFO, and AFFO March 31, 2018 Common shares — diluted 521,378,674 OP units 9,036,578 Total common shares and units — diluted 530,415,252 (1) No shares of common stock were outstanding prior to the close of the Company's initial public offering. As such, Q1 2017 weighted average shares outstanding for net loss are for the period from February 1, 2017 through March 31, 2017, in accordance with GAAP. (2) No shares of common stock or OP Units were outstanding prior to the close of the Company's initial public offering. As such, Q1 2017 weighted average shares and units outstanding for FFO, Core FFO, and AFFO are calculated as if shares issued in connection with the IPO were issued on January 1, 2017. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 12

Supplemental Schedule 2(b) Debt Structure and Leverage Ratios — March 31, 2018 ($ in thousands) (unaudited) Wtd Avg Wtd Avg Interest Years Debt Structure Balance % of Total Rate (1)(2) to Maturity (2) Secured: Fixed $ 999,628 10.3 % 4.2 % 9.2 Floating — swapped to fixed 4,620,000 47.4 % 3.4 % 3.1 Floating 2,035,254 20.9 % 3.0 % 6.0 Total secured 7,654,882 78.6 % 3.4 % 4.7 Unsecured: Fixed (Convertible) 574,993 5.9 % 3.3 % 2.8 Floating — swapped to fixed 1,500,000 15.4 % 3.7 % 3.9 Floating 15,000 0.1 % 3.6 % 3.9 Total unsecured 2,089,993 21.4 % 3.6 % 3.6 Total Debt: Fixed + floating swapped to fixed 7,694,621 79.0 % 3.6 % 4.0 Floating 2,050,254 21.0 % 3.0 % 5.9 Total debt 9,744,875 100.0 % 3.5 % 4.4 Unamortized discounts on notes payable (27,555) Deferred financing costs (48,470) Total Debt per Balance Sheet 9,668,850 Retained and repurchased certificates (427,608) Cash, ex-security deposits (3) (240,165) Deferred financing costs 48,470 Unamortized discounts on notes payable 27,555 Net debt $ 9,077,102 Leverage Ratios Q1 2018 Fixed charge coverage ratio 2.8x Net debt / annualized Adjusted EBITDA 9.7x (1) Includes the impact of interest rate swaps in place and effective as of March 31, 2018. (2) Numbers in this table do not take into account the impact of the IH 2018-2 securitization loan and repayments of the IH 2015-1 and IH 2015-2 securitization loans in May 2018. On a basis that gives effect to these transactions, the weighted average interest rate would have been 3.4%, and weighted average years to maturity would have been 5.0 years. (3) Represents cash and cash equivalents and the non-security deposit portion of restricted cash. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 13

Supplemental Schedule 2(c) Debt Maturity Schedule — March 31, 2018 (1) ($ in thousands) (unaudited) Revolving Wtd Avg Secured Unsecured Credit % of Interest Debt Maturities, with Extensions (2) Debt Debt Facility Balance Total Rate (3) 2018 $ — $ — $ — $ — —% —% 2019 — 229,993 — 229,993 2.4% 3.0% 2020 2,972,612 — — 2,972,612 30.5% 3.6% 2021 1,135,184 — — 1,135,184 11.6% 3.2% 2022 — 1,845,000 15,000 1,860,000 19.1% 3.6% 2023 769,754 — — 769,754 7.9% 2.7% 2024 863,263 — — 863,263 8.9% 3.4% 2025 914,441 — — 914,441 9.4% 3.0% 2026 — — — — —% —% 2027 999,628 — — 999,628 10.3% 4.2% 7,654,882 2,074,993 15,000 9,744,875 100.0% 3.5% Unamortized discounts on notes payable (3,257) (24,298) — (27,555) Deferred financing costs (37,165) (11,305) — (48,470) Total per Balance Sheet $ 7,614,460 $ 2,039,390 $ 15,000 $ 9,668,850 (1) Numbers in this table do not take into account the impact of the IH 2018-2 securitization loan and associated repayments of IH 2015-1 and IH 2015-2 in May 2018, which eliminated $1,154,932 of secured debt maturing in 2020. (2) Assumes all extension options are exercised. (3) Includes the impact of interest rate swaps in place and effective as of March 31, 2018. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 14

Supplemental Schedule 3(a) Summary of Operating Information by Home Portfolio ($ in thousands) (unaudited) Number of Homes, period-end Q1 2018 Same Store portfolio 72,109 Total portfolio 82,509 Core Revenues Q1 2018 Q1 2017 Change YoY Same Store portfolio $ 363,232 $ 348,986 4.1% Total portfolio 409,593 234,202 74.9% Core Operating expenses Q1 2018 Q1 2017 Change YoY Same Store portfolio $ 128,772 $ 122,567 5.1% Total portfolio 146,691 83,620 75.4% Net Operating Income Q1 2018 Q1 2017 Change YoY Same Store portfolio $ 234,460 $ 226,419 3.6% Total portfolio 262,902 150,582 74.6% Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 15

Supplemental Schedule 3(b) Same Store Portfolio Operating Detail ($ in thousands) (unaudited) Change Change Q1 2018 Q1 2017 YoY Q4 2017 Seq Revenues: Rental revenues $ 351,089 $ 337,947 3.9 % $ 347,360 1.1 % Other property income (1)(2) 24,230 18,400 31.7 % 21,575 12.3 % Total revenues 375,319 356,347 5.3 % 368,935 1.7 % Less: Resident recoveries (1)(2) (12,087) (7,361) 64.2 % (9,543) 26.7 % Core revenues 363,232 348,986 4.1 % 359,392 1.1 % Fixed Expenses: Property taxes 63,309 58,976 7.3 % 58,801 7.7 % Insurance expenses 6,982 7,089 (1.5)% 7,281 (4.1 )% HOA expenses 7,092 6,778 4.6 % 6,930 2.3 % Controllable Expenses: Repairs and maintenance (3) 18,798 15,096 24.5 % 15,841 18.7 % Personnel 17,698 17,652 0.3 % 16,696 6.0 % Turnover 11,165 10,881 2.6 % 10,075 10.8 % Utilities (1) 10,014 7,366 35.9 % 9,349 7.1 % Leasing and marketing (4) 2,889 3,487 (17.1)% 3,170 (8.9 )% Property administrative 2,912 2,603 11.9 % 3,102 (6.1 )% Property operating and maintenance expenses 140,859 129,928 8.4 % 131,245 7.3 % Less: Resident recoveries (1)(2) (12,087) (7,361) 64.2 % (9,543) 26.7 % Core operating expenses 128,772 122,567 5.1 % 121,702 5.8 % Net Operating Income $ 234,460 $ 226,419 3.6 % $ 237,690 (1.4)% (1) The increases in other property income, utilities, and resident recoveries are primarily attributable to the rollout of a new utility billing policy. Residents continue to be responsible for costs associated with their water, sewer, and waste removal services, but providers of these services now invoice Invitation Homes rather than the resident for payment. Invitation Homes pays the utility provider, and subsequently bills the resident for reimbursement, resulting in materially higher utility expense that is offset by materially higher resident recoveries. (2) In addition to the rollout of the utility billing policy, other property income and resident recoveries in Q1 2018 were higher as a result of a one-time item related to the timing by which resident utility recoveries are accrued. As part of the adoption of the utility program, the timing of resident utility bill-backs from the two merged companies was aligned by adopting a best practice that matches reimbursements with the period in which the corresponding expenses are booked. This resulted in a one-time increase in resident recoveries in Q1 2018 that we do not expect to recur in future quarters. (3) The increase in repair and maintenance expenses was primarily one-time in nature, and related to a timing delay in completing routine, non-storm related service requests in markets impacted by the September 2017 hurricane. Service requests related to hurricane damage were prioritized in the fourth quarter of 2017, while non-critical routine service requests that otherwise would have been resolved last year were completed in the first quarter of 2018. Harsher winter weather in the first quarter of 2018 compared to the first quarter of 2017 also contributed to higher repair and maintenance expenses in some markets. (4) Same Store leasing and marketing expense includes amortization of leasing commissions of $2,698, $3,252, and $2,877 for Q1 2018, Q1 2017, and Q4 2017, respectively. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 16

Supplemental Schedule 3(c) Same Store Quarterly Operating Trends (unaudited) Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Average occupancy 95.7% 95.3% 95.0% 95.7% 95.8% Turnover rate 7.6% 7.6% 9.8% 10.0% 8.1% Trailing four quarters turnover rate 35.0% 35.5% N/A N/A N/A Average monthly rent $ 1,706 $ 1,697 $ 1,682 $ 1,660 $ 1,641 Rental rate growth (lease-over-lease): New leases 2.5% 1.4% 3.3% 5.5% 3.3% Renewals 4.9% 4.9% 5.1% 5.3% 5.1% Blended 4.0% 3.5% 4.4% 5.4% 4.4% Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 17

Supplemental Schedule 4 Portfolio Characteristics — As of and for the Quarter Ended March 31, 2018 (1) (unaudited) Average Number of Average Average Monthly Percent of Homes Occupancy Monthly Rent Rent PSF Revenue Western United States: Southern California 8,361 95.1 % $ 2,229 $ 1.32 13.0 % Northern California 4,592 96.1 % 1,900 1.24 6.6 % Seattle 3,294 94.7 % 2,029 1.07 5.1 % Phoenix 7,435 96.4 % 1,241 0.76 6.8 % Las Vegas 2,709 96.5 % 1,490 0.75 3.0 % Denver 2,190 94.6 % 1,856 1.04 3.0 % Western US Subtotal 28,581 95.6 % 1,795 1.05 37.5 % Florida: South Florida 9,314 93.5 % 2,087 1.13 13.5 % Tampa 8,655 93.9 % 1,580 0.86 9.7 % Orlando 5,856 95.8 % 1,536 0.83 6.5 % Jacksonville 1,941 95.6 % 1,593 0.80 2.2 % Florida Subtotal 25,766 94.3 % 1,753 0.95 31.9 % Southeast United States: Atlanta 12,405 95.0 % 1,420 0.69 12.5 % Carolinas 4,958 91.6 % 1,495 0.71 5.0 % Nashville 782 81.4 % 1,839 0.85 0.9 % Southeast US Subtotal 18,145 93.5 % 1,456 0.70 18.4 % Texas: Houston 2,572 90.6 % 1,529 0.78 2.6 % Dallas 2,266 93.5 % 1,697 0.81 2.7 % Texas Subtotal 4,838 91.9 % 1,609 0.80 5.3 % Midwest United States: Chicago 4,005 94.0 % 1,930 1.18 5.3 % Minneapolis 1,174 95.7 % 1,798 0.91 1.6 % Midwest US Subtotal 5,179 94.4 % 1,900 1.11 6.9 % Total / Average 82,509 94.5% $ 1,704 $ 0.92 100.0% Same Store Total / Average 72,109 95.7% $ 1,706 $ 0.92 88.6% (1) All data is for the total portfolio, unless otherwise noted. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 18

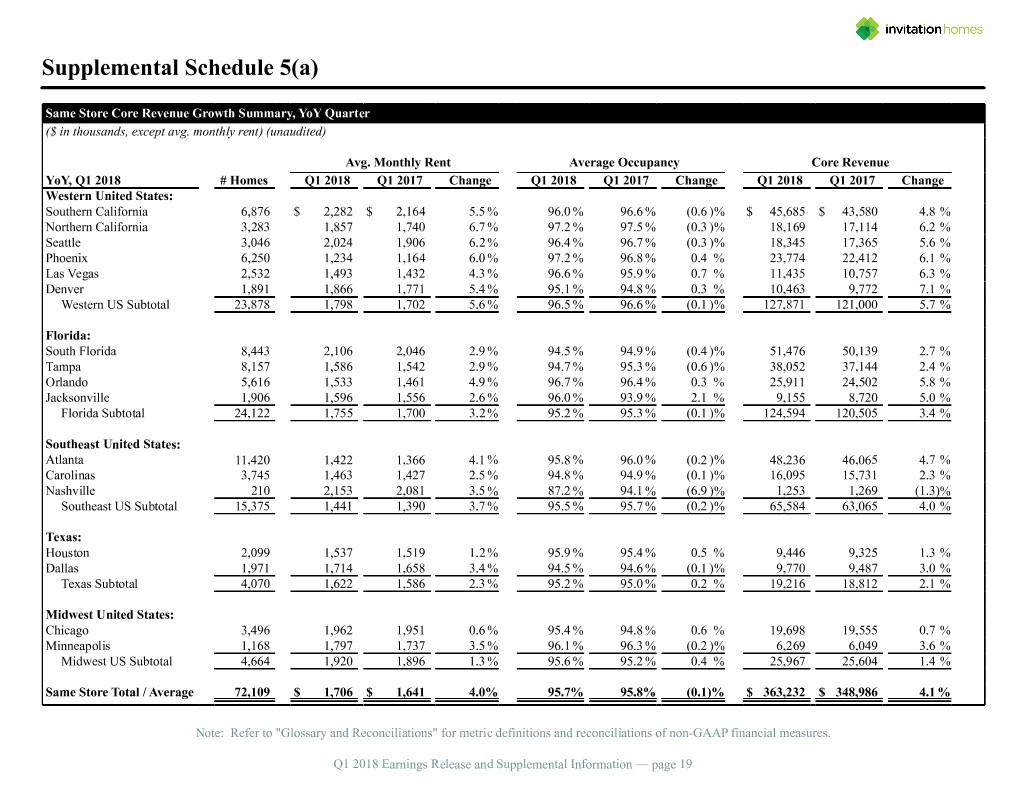

Supplemental Schedule 5(a) Same Store Core Revenue Growth Summary, YoY Quarter ($ in thousands, except avg. monthly rent) (unaudited) Avg. Monthly Rent Average Occupancy Core Revenue YoY, Q1 2018 # Homes Q1 2018 Q1 2017 Change Q1 2018 Q1 2017 Change Q1 2018 Q1 2017 Change Western United States: Southern California 6,876 $ 2,282 $ 2,164 5.5 % 96.0 % 96.6 % (0.6 )% $ 45,685 $ 43,580 4.8 % Northern California 3,283 1,857 1,740 6.7 % 97.2 % 97.5 % (0.3 )% 18,169 17,114 6.2 % Seattle 3,046 2,024 1,906 6.2 % 96.4 % 96.7 % (0.3 )% 18,345 17,365 5.6 % Phoenix 6,250 1,234 1,164 6.0 % 97.2 % 96.8 % 0.4 % 23,774 22,412 6.1 % Las Vegas 2,532 1,493 1,432 4.3 % 96.6 % 95.9 % 0.7 % 11,435 10,757 6.3 % Denver 1,891 1,866 1,771 5.4 % 95.1 % 94.8 % 0.3 % 10,463 9,772 7.1 % Western US Subtotal 23,878 1,798 1,702 5.6 % 96.5 % 96.6 % (0.1 )% 127,871 121,000 5.7 % Florida: South Florida 8,443 2,106 2,046 2.9 % 94.5 % 94.9 % (0.4 )% 51,476 50,139 2.7 % Tampa 8,157 1,586 1,542 2.9 % 94.7 % 95.3 % (0.6 )% 38,052 37,144 2.4 % Orlando 5,616 1,533 1,461 4.9 % 96.7 % 96.4 % 0.3 % 25,911 24,502 5.8 % Jacksonville 1,906 1,596 1,556 2.6 % 96.0 % 93.9 % 2.1 % 9,155 8,720 5.0 % Florida Subtotal 24,122 1,755 1,700 3.2 % 95.2 % 95.3 % (0.1 )% 124,594 120,505 3.4 % Southeast United States: Atlanta 11,420 1,422 1,366 4.1 % 95.8 % 96.0 % (0.2 )% 48,236 46,065 4.7 % Carolinas 3,745 1,463 1,427 2.5 % 94.8 % 94.9 % (0.1 )% 16,095 15,731 2.3 % Nashville 210 2,153 2,081 3.5 % 87.2 % 94.1 % (6.9 )% 1,253 1,269 (1.3)% Southeast US Subtotal 15,375 1,441 1,390 3.7 % 95.5 % 95.7 % (0.2 )% 65,584 63,065 4.0 % Texas: Houston 2,099 1,537 1,519 1.2 % 95.9 % 95.4 % 0.5 % 9,446 9,325 1.3 % Dallas 1,971 1,714 1,658 3.4 % 94.5 % 94.6 % (0.1 )% 9,770 9,487 3.0 % Texas Subtotal 4,070 1,622 1,586 2.3 % 95.2 % 95.0 % 0.2 % 19,216 18,812 2.1 % Midwest United States: Chicago 3,496 1,962 1,951 0.6 % 95.4 % 94.8 % 0.6 % 19,698 19,555 0.7 % Minneapolis 1,168 1,797 1,737 3.5 % 96.1 % 96.3 % (0.2 )% 6,269 6,049 3.6 % Midwest US Subtotal 4,664 1,920 1,896 1.3 % 95.6 % 95.2 % 0.4 % 25,967 25,604 1.4 % Same Store Total / Average 72,109 $ 1,706 $ 1,641 4.0% 95.7% 95.8% (0.1)% $ 363,232 $ 348,986 4.1 % Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 19

Supplemental Schedule 5(a) (Continued) Same Store Core Revenue Growth Summary — Sequential Quarter ($ in thousands, except avg. monthly rent) (unaudited) Avg. Monthly Rent Average Occupancy Core Revenue Seq, Q1 2018 # Homes Q1 2018 Q4 2017 Change Q1 2018 Q4 2017 Change Q1 2018 Q4 2017 Change Western United States: Southern California 6,876 $ 2,282 $ 2,260 1.0 % 96.0 % 96.4 % (0.4)% $ 45,685 $ 45,638 0.1 % Northern California 3,283 1,857 1,838 1.0 % 97.2 % 96.4 % 0.8 % 18,169 17,872 1.7 % Seattle 3,046 2,024 2,000 1.2 % 96.4 % 95.4 % 1.0 % 18,345 18,012 1.8 % Phoenix 6,250 1,234 1,220 1.1 % 97.2 % 96.3 % 0.9 % 23,774 23,298 2.0 % Las Vegas 2,532 1,493 1,485 0.5 % 96.6 % 95.8 % 0.8 % 11,435 11,183 2.3 % Denver 1,891 1,866 1,857 0.5 % 95.1 % 95.0 % 0.1 % 10,463 10,266 1.9 % Western US Subtotal 23,878 1,798 1,782 0.9 % 96.5 % 96.1 % 0.4 % 127,871 126,269 1.3 % Florida: South Florida 8,443 2,106 2,095 0.5 % 94.5 % 94.3 % 0.2 % 51,476 51,069 0.8 % Tampa 8,157 1,586 1,583 0.2 % 94.7 % 94.0 % 0.7 % 38,052 37,766 0.8 % Orlando 5,616 1,533 1,521 0.8 % 96.7 % 96.4 % 0.3 % 25,911 25,577 1.3 % Jacksonville 1,906 1,596 1,589 0.4 % 96.0 % 95.0 % 1.0 % 9,155 9,026 1.4 % Florida Subtotal 24,122 1,755 1,747 0.5 % 95.2 % 94.7 % 0.5 % 124,594 123,438 0.9 % Southeast United States: Atlanta 11,420 1,422 1,418 0.3 % 95.8 % 95.7 % 0.1 % 48,236 47,694 1.1 % Carolinas 3,745 1,463 1,459 0.3 % 94.8 % 94.6 % 0.2 % 16,095 15,905 1.2 % Nashville 210 2,153 2,162 (0.4)% 87.2 % 86.2 % 1.0 % 1,253 1,215 3.1 % Southeast US Subtotal 15,375 1,441 1,437 0.3 % 95.5 % 95.4 % 0.1 % 65,584 64,814 1.2 % Texas: Houston 2,099 1,537 1,538 (0.1)% 95.9 % 95.5 % 0.4 % 9,446 9,385 0.6 % Dallas 1,971 1,714 1,716 (0.1)% 94.5 % 94.4 % 0.1 % 9,770 9,782 (0.1)% Texas Subtotal 4,070 1,622 1,623 (0.1)% 95.2 % 95.0 % 0.2 % 19,216 19,167 0.3 % Midwest United States: Chicago 3,496 1,962 1,964 (0.1)% 95.4 % 94.4 % 1.0 % 19,698 19,565 0.7 % Minneapolis 1,168 1,797 1,789 0.4 % 96.1 % 94.9 % 1.2 % 6,269 6,139 2.1 % Midwest US Subtotal 4,664 1,920 1,920 — % 95.6 % 94.6 % 1.0 % 25,967 25,704 1.0 % Same Store Total / Average 72,109 $ 1,706 $ 1,697 0.5 % 95.7% 95.3% 0.4 % $ 363,232 $ 359,392 1.1 % Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 20

Supplemental Schedule 5(b) Same Store NOI Growth and Margin Summary — YoY Quarter ($ in thousands) (unaudited) Core Revenue Core Operating Expenses Net Operating Income Core NOI Margin YoY, Q1 2018 Q1 2018 Q1 2017 Change Q1 2018 Q1 2017 Change Q1 2018 Q1 2017 Change Q1 2018 Q1 2017 Western United States: Southern California $ 45,685 $ 43,580 4.8 % $ 14,789 $ 13,375 10.6 % $ 30,896 $ 30,205 2.3 % 67.6 % 69.3 % Northern California 18,169 17,114 6.2 % 5,562 4,868 14.3 % 12,607 12,246 2.9 % 69.4 % 71.6 % Seattle 18,345 17,365 5.6 % 5,144 5,538 (7.1)% 13,201 11,827 11.6 % 72.0 % 68.1 % Phoenix 23,774 22,412 6.1 % 6,424 5,857 9.7 % 17,350 16,555 4.8 % 73.0 % 73.9 % Las Vegas 11,435 10,757 6.3 % 2,836 2,832 0.1 % 8,599 7,925 8.5 % 75.2 % 73.7 % Denver 10,463 9,772 7.1 % 1,427 2,150 (33.6)% 9,036 7,622 18.6 % 86.4 % 78.0 % Western US Subtotal 127,871 121,000 5.7 % 36,182 34,620 4.5 % 91,689 86,380 6.1 % 71.7 % 71.4 % Florida: South Florida 51,476 50,139 2.7 % 22,656 21,797 3.9 % 28,820 28,342 1.7 % 56.0 % 56.5 % Tampa 38,052 37,144 2.4 % 16,153 14,335 12.7 % 21,899 22,809 (4.0)% 57.6 % 61.4 % Orlando 25,911 24,502 5.8 % 9,633 9,466 1.8 % 16,278 15,036 8.3 % 62.8 % 61.4 % Jacksonville 9,155 8,720 5.0 % 3,573 3,290 8.6 % 5,582 5,430 2.8 % 61.0 % 62.3 % Florida Subtotal 124,594 120,505 3.4 % 52,015 48,888 6.4 % 72,579 71,617 1.3 % 58.3 % 59.4 % Southeast United States: Atlanta 48,236 46,065 4.7 % 15,744 15,012 4.9 % 32,492 31,053 4.6 % 67.4 % 67.4 % Carolinas 16,095 15,731 2.3 % 4,844 4,818 0.5 % 11,251 10,913 3.1 % 69.9 % 69.4 % Nashville 1,253 1,269 (1.3)% 343 265 29.4 % 910 1,004 (9.4)% 72.6 % 79.1 % Southeast US Subtotal 65,584 63,065 4.0 % 20,931 20,095 4.2 % 44,653 42,970 3.9 % 68.1 % 68.1 % Texas: Houston 9,446 9,325 1.3 % 4,320 4,354 (0.8)% 5,126 4,971 3.1 % 54.3 % 53.3 % Dallas 9,770 9,487 3.0 % 4,250 3,721 14.2 % 5,520 5,766 (4.3)% 56.5 % 60.8 % Texas Subtotal 19,216 18,812 2.1 % 8,570 8,075 6.1 % 10,646 10,737 (0.8)% 55.4 % 57.1 % Midwest United States: Chicago 19,698 19,555 0.7 % 9,135 8,997 1.5 % 10,563 10,558 — % 53.6 % 54.0 % Minneapolis 6,269 6,049 3.6 % 1,939 1,892 2.5 % 4,330 4,157 4.2 % 69.1 % 68.7 % Midwest US Subtotal 25,967 25,604 1.4 % 11,074 10,889 1.7 % 14,893 14,715 1.2 % 57.4 % 57.5 % Same Store Total / Average $ 363,232 $ 348,986 4.1 % $ 128,772 $ 122,567 5.1 % $ 234,460 $ 226,419 3.6 % 64.5% 64.9% Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 21

Supplemental Schedule 5(b) (Continued) Same Store NOI Growth and Margin Summary — Sequential Quarter ($ in thousands) (unaudited) Core Revenue Core Operating Expenses Net Operating Income Core NOI Margin Seq, Q1 2018 Q1 2018 Q4 2017 Change Q1 2018 Q4 2017 Change Q1 2018 Q4 2017 Change Q1 2018 Q4 2017 Western United States: Southern California $ 45,685 $ 45,638 0.1 % $ 14,789 $ 14,423 2.5 % $ 30,896 $ 31,215 (1.0 )% 67.6 % 68.4 % Northern California 18,169 17,872 1.7 % 5,562 5,510 0.9 % 12,607 12,362 2.0 % 69.4 % 69.2 % Seattle 18,345 18,012 1.8 % 5,144 5,097 0.9 % 13,201 12,915 2.2 % 72.0 % 71.7 % Phoenix 23,774 23,298 2.0 % 6,424 5,720 12.3 % 17,350 17,578 (1.3 )% 73.0 % 75.4 % Las Vegas 11,435 11,183 2.3 % 2,836 2,694 5.3 % 8,599 8,489 1.3 % 75.2 % 75.9 % Denver 10,463 10,266 1.9 % 1,427 2,387 (40.2)% 9,036 7,879 14.7 % 86.4 % 76.7 % Western US Subtotal 127,871 126,269 1.3 % 36,182 35,831 1.0 % 91,689 90,438 1.4 % 71.7 % 71.6 % Florida: South Florida 51,476 51,069 0.8 % 22,656 21,148 7.1 % 28,820 29,921 (3.7 )% 56.0 % 58.6 % Tampa 38,052 37,766 0.8 % 16,153 14,644 10.3 % 21,899 23,122 (5.3 )% 57.6 % 61.2 % Orlando 25,911 25,577 1.3 % 9,633 8,554 12.6 % 16,278 17,023 (4.4 )% 62.8 % 66.6 % Jacksonville 9,155 9,026 1.4 % 3,573 3,130 14.2 % 5,582 5,896 (5.3 )% 61.0 % 65.3 % Florida Subtotal 124,594 123,438 0.9 % 52,015 47,476 9.6 % 72,579 75,962 (4.5 )% 58.3 % 61.5 % Southeast United States: Atlanta 48,236 47,694 1.1 % 15,744 14,225 10.7 % 32,492 33,469 (2.9 )% 67.4 % 70.2 % Carolinas 16,095 15,905 1.2 % 4,844 4,388 10.4 % 11,251 11,517 (2.3 )% 69.9 % 72.4 % Nashville 1,253 1,215 3.1 % 343 282 21.6 % 910 933 (2.5 )% 72.6 % 76.8 % Southeast US Subtotal 65,584 64,814 1.2 % 20,931 18,895 10.8 % 44,653 45,919 (2.8 )% 68.1 % 70.8 % Texas: Houston 9,446 9,385 0.6 % 4,320 4,254 1.6 % 5,126 5,131 (0.1 )% 54.3 % 54.7 % Dallas 9,770 9,782 (0.1)% 4,250 4,027 5.5 % 5,520 5,755 (4.1 )% 56.5 % 58.8 % Texas Subtotal 19,216 19,167 0.3 % 8,570 8,281 3.5 % 10,646 10,886 (2.2 )% 55.4 % 56.8 % Midwest United States: Chicago 19,698 19,565 0.7 % 9,135 9,273 (1.5)% 10,563 10,292 2.6 % 53.6 % 52.6 % Minneapolis 6,269 6,139 2.1 % 1,939 1,946 (0.4)% 4,330 4,193 3.3 % 69.1 % 68.3 % Midwest US Subtotal 25,967 25,704 1.0 % 11,074 11,219 (1.3)% 14,893 14,485 2.8 % 57.4 % 56.4 % Same Store Total / Average $ 363,232 $ 359,392 1.1 % $ 128,772 $ 121,702 5.8 % $ 234,460 $ 237,690 (1.4)% 64.5% 66.1% Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 22

Supplemental Schedule 5(c) Same Store Lease-Over-Lease Rent Growth (unaudited) Rental Rate Growth Q1 2018 Renewal New Blended Leases Leases Average Western United States: Southern California 6.4 % 4.9 % 5.9 % Northern California 6.8 % 7.3 % 7.0 % Seattle 7.0 % 4.8 % 6.1 % Phoenix 6.5 % 6.6 % 6.5 % Las Vegas 5.5 % 2.6 % 4.5 % Denver 6.1 % 1.8 % 4.4 % Western US Subtotal 6.5 % 5.0 % 5.9 % Florida: South Florida 4.0 % 0.9 % 2.9 % Tampa 4.1 % 0.9 % 2.8 % Orlando 5.2 % 5.6 % 5.3 % Jacksonville 3.4 % 3.5 % 3.4 % Florida Subtotal 4.2 % 2.0 % 3.4 % Southeast United States: Atlanta 4.6 % 2.9 % 4.0 % Carolinas 4.2 % 0.2 % 2.6 % Nashville 2.7 % (4.1)% (1.6)% Southeast US Subtotal 4.5 % 1.9 % 3.5 % Texas: Houston 3.6 % (1.7)% 2.0 % Dallas 4.5 % (1.8)% 1.9 % Texas Subtotal 4.0 % (1.8)% 1.9 % Midwest United States: Chicago 2.4 % (3.0)% 0.5 % Minneapolis 4.7 % 0.6 % 3.0 % Midwest US Subtotal 2.9 % (2.1)% 1.0 % Same Store Total / Average 4.9% 2.5 % 4.0 % Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 23

Supplemental Schedule 6 Same Store Cost to Maintain ($ in thousands, except per home amounts) (unaudited) Total ($ 000) Q1 2018 Recurring operating expenses (gross): R&M OpEx $ 18,798 Turn OpEx 11,165 Total recurring operating expense (gross) 29,963 R&M + Turn recoveries (2,368) Total recurring operating expenses (net) $ 27,595 Recurring capital expenditures: R&M CapEx $ 14,128 Turn CapEx 7,842 Total recurring capital expenditures $ 21,970 Cost to maintain (gross): R&M OpEx + CapEx $ 32,926 Turn OpEx + CapEx 19,007 Total cost to maintain (gross) 51,933 R&M + Turn recoveries (2,368) Total cost to maintain (net) $ 49,565 Per Home ($) Q1 2018 Total cost to maintain (gross) $ 720 R&M + Turn recoveries (33) Total cost to maintain (net) $ 687 Total Portfolio Capital Expenditure Detail ($ in thousands) (unaudited) Total ($ 000) Q1 2018 Recurring CapEx $ 25,393 Value Enhancing CapEx 4,876 Initial Renovation CapEx 13,429 Total Capital Expenditures $ 43,698 Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 24

Supplemental Schedule 7 Adjusted Property Management and G&A Reconciliation ($ in thousands) (unaudited) Adjusted Property Management Expense Q1 2018 Q1 2017 Property management expense (GAAP) $ 17,164 $ 11,449 Adjustments: Share-based compensation expense (1) (1,944) (3,973) Adjusted property management expense $ 15,220 $ 7,476 Adjusted G&A Expense Q1 2018 Q1 2017 G&A expense (GAAP) $ 27,636 $ 58,266 Adjustments: Share-based compensation expense (2) (7,554) (40,271) IPO related expenses — (7,631) Merger and transaction-related expenses (4,367) — Severance expense (2,659) (45) Adjusted G&A expense $ 13,056 $ 10,319 (1) For Q1 2018, includes $901 related to IPO and pre-IPO grants. For Q1 2017, consists entirely of IPO and pre-IPO grants. (2) For Q1 2018, includes $2,268 related to IPO and pre-IPO grants and $763 related to merger grants. For Q1 2017, consists entirely of IPO and pre-IPO grants. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 25

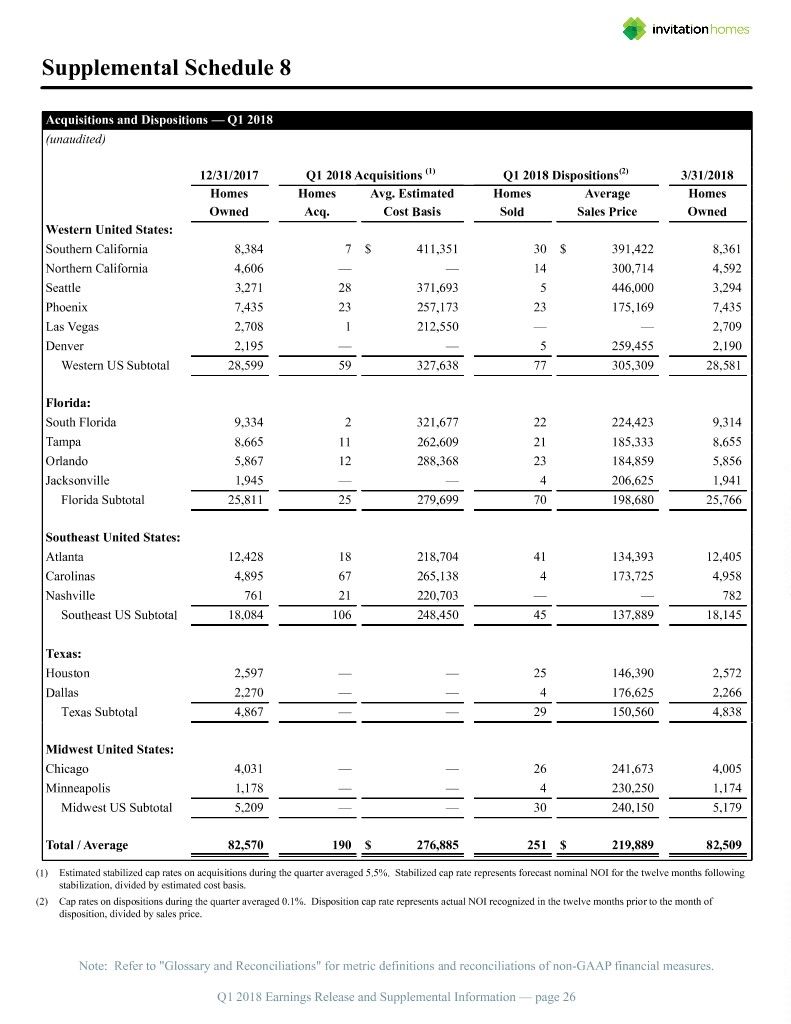

Supplemental Schedule 8 Acquisitions and Dispositions — Q1 2018 (unaudited) 12/31/2017 Q1 2018 Acquisitions (1) Q1 2018 Dispositions(2) 3/31/2018 Homes Homes Avg. Estimated Homes Average Homes Owned Acq. Cost Basis Sold Sales Price Owned Western United States: Southern California 8,384 7 $ 411,351 30 $ 391,422 8,361 Northern California 4,606 — — 14 300,714 4,592 Seattle 3,271 28 371,693 5 446,000 3,294 Phoenix 7,435 23 257,173 23 175,169 7,435 Las Vegas 2,708 1 212,550 — — 2,709 Denver 2,195 — — 5 259,455 2,190 Western US Subtotal 28,599 59 327,638 77 305,309 28,581 Florida: South Florida 9,334 2 321,677 22 224,423 9,314 Tampa 8,665 11 262,609 21 185,333 8,655 Orlando 5,867 12 288,368 23 184,859 5,856 Jacksonville 1,945 — — 4 206,625 1,941 Florida Subtotal 25,811 25 279,699 70 198,680 25,766 Southeast United States: Atlanta 12,428 18 218,704 41 134,393 12,405 Carolinas 4,895 67 265,138 4 173,725 4,958 Nashville 761 21 220,703 — — 782 Southeast US Subtotal 18,084 106 248,450 45 137,889 18,145 Texas: Houston 2,597 — — 25 146,390 2,572 Dallas 2,270 — — 4 176,625 2,266 Texas Subtotal 4,867 — — 29 150,560 4,838 Midwest United States: Chicago 4,031 — — 26 241,673 4,005 Minneapolis 1,178 — — 4 230,250 1,174 Midwest US Subtotal 5,209 — — 30 240,150 5,179 Total / Average 82,570 190 $ 276,885 251 $ 219,889 82,509 (1) Estimated stabilized cap rates on acquisitions during the quarter averaged 5.5%. Stabilized cap rate represents forecast nominal NOI for the twelve months following stabilization, divided by estimated cost basis. (2) Cap rates on dispositions during the quarter averaged 0.1%. Disposition cap rate represents actual NOI recognized in the twelve months prior to the month of disposition, divided by sales price. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 26

Glossary and Reconciliations Glossary: Average Estimated Cost Basis Average estimated cost basis on acquisition represents the sum of purchase price, any closing adjustments, and estimated initial renovation expenditure for an acquired home or population of homes. Average Monthly Rent Average monthly rent represents average monthly rental income per home for occupied properties in an identified population of homes over the measurement period, and reflects the impact of non-service rental concessions and contractual rent increases amortized over the life of the lease. Average Occupancy Average occupancy for an identified population of homes represents (i) the total number of days that the homes in such population were occupied during the measurement period, divided by (ii) the total number of days that the homes in such population were owned during the measurement period. Core NOI Margin Core NOI margin for an identified population of homes is calculated by dividing NOI by Core revenues attributable to such population. Core Operating Expenses Core operating expenses for an identified population of homes reflect property operating and maintenance expenses, excluding any expenses recovered from residents. Core Revenues Core revenues for an identified population of homes reflects total revenues, net of any resident recoveries. Cost to Maintain Cost to maintain a home represents the sum of recurring repairs and maintenance and recurring turnover expenses (gross or net of resident reimbursements, as indicated in tables presented) and recurring capital expenditures. EBITDA, EBITDAre, and Adjusted EBITDAre EBITDA, EBITDAre and Adjusted EBITDAre are supplemental, non-GAAP measures often utilized to evaluate the performance of real estate companies. We define EBITDA as net income or loss computed in accordance with accounting principles generally accepted in the United States (“GAAP”) before the following items: interest expense; income tax expense; and depreciation and amortization. National Association of Real Estate Investment Trusts ("Nareit") recommends as a best practice that REITs operating as real estate companies which report an EBIDA performance measure also report EBITDAre in all financial reports for periods beginning after December 31, 2017. We define EBITDAre, consistent with the Nareit definition, as EBITDA, further adjusted for gain on sale of property, net of tax and impairment on depreciated real estate investments. Adjusted EBITDAre is defined as EBITDAre before the following items: share- based compensation expense; IPO related expenses; merger and transaction-related expenses; severance; casualty losses, net; acquisition costs; and interest income and other miscellaneous income and expenses. EBITDA, EBITDAre and Adjusted EBITDAre are used as supplemental financial performance measures by management and by external users of our financial statements, such as investors and commercial banks. Set forth below is additional detail on how management uses EBITDA, EBITDAre and Adjusted EBITDAre as measures of performance. The GAAP measure most directly comparable to EBITDA, EBITDAre and Adjusted EBITDAre is net income or loss. EBITDA, EBITDAre and Adjusted EBITDAre are not used as measures of our liquidity and should not be considered alternatives to net income or loss or any other measure of financial performance presented in accordance with GAAP. Our EBITDA, EBITDAre and Adjusted EBITDAre may not be comparable to the EBITDA, EBITDAre and Adjusted EBITDAre of other companies due to the fact that not all Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 27

companies use the same definitions of EBITDA, EBITDAre and Adjusted EBITDAre. Accordingly, there can be no assurance that our basis for computing these non-GAAP measures is comparable with that of other companies. See "Reconciliation of Non-GAAP Measures" below for a reconciliation of GAAP net income (loss) to EBITDA, EBITDAre and Adjusted EBITDAre. Funds from Operations (FFO), Core Funds from Operations (Core FFO), and Adjusted Funds from Operations (AFFO) FFO, Core FFO, and Adjusted FFO are supplemental, non-GAAP measures often utilized to evaluate the performance of real estate companies. FFO is defined by Nareit as net income or loss (computed in accordance with GAAP) excluding gains or losses from sales of previously depreciated real estate assets, plus depreciation, amortization and impairment of real estate assets, and adjustments for unconsolidated partnerships and joint ventures. We believe that FFO is a meaningful supplemental measure of the operating performance of our business because historical cost accounting for real estate assets in accordance with GAAP assumes that the value of real estate assets diminishes predictably over time, as reflected through depreciation and amortization. Because real estate values have historically risen or fallen with market conditions, management considers FFO an appropriate supplemental performance measure as it excludes historical cost depreciation and amortization, impairment on depreciated real estate investments, gains or losses related to sales of previously depreciated homes, as well non-controlling interests, from GAAP net income or loss. The GAAP measure most directly comparable to Core FFO and Adjusted FFO is net income or loss. Core FFO and Adjusted FFO are not used as measures of our liquidity and should not be considered alternatives to net income or loss or any other measure of financial performance presented in accordance with GAAP. Our Core FFO and Adjusted FFO may not be comparable to the Core FFO and Adjusted FFO of other companies due to the fact that not all companies use the same definition of Core FFO and Adjusted FFO. Accordingly, there can be no assurance that our basis for computing this non-GAAP measures is comparable with that of other companies. Please see Supplemental Schedule 1 for a reconciliation of GAAP net income (loss) to FFO, Core FFO, and Adjusted FFO. Initial Renovation CapEx Initial renovation CapEx represents expenditures related to the first post-acquisition renovation of a home to bring the home to Invitation Homes standards and specifications. Net Operating Income (NOI) NOI is a non-GAAP measure often used to evaluate the performance of real estate companies. We define NOI for an identified population of homes as rental revenues and other property income less property operating and maintenance expense (which consists primarily of property taxes, insurance, HOA fees (when applicable), market-level personnel expenses, repairs and maintenance, leasing costs and marketing). NOI excludes: interest expense; depreciation and amortization; general and administrative expense; property management expense; impairment and other; acquisition costs; (gain) loss on sale of property, net of tax; and interest income and other miscellaneous income and expenses. The GAAP measure most directly comparable to NOI is net income or loss. NOI is not used as a measure of liquidity and should not be considered as an alternative to net income or loss or any other measure of financial performance presented in accordance with GAAP. Our NOI may not be comparable to the NOI of other companies due to the fact that not all companies use the same definition of NOI. Accordingly, there can be no assurance that our basis for computing this non-GAAP measure is comparable with that of other companies. We believe that Same Store NOI is also a meaningful supplemental measure of our operating performance for the same reasons as NOI and is further helpful to investors as it provides a more consistent measurement of our performance across reporting periods by reflecting NOI for homes in our Same Store portfolio. See "Reconciliation of Non-GAAP Measures" below for a reconciliation of GAAP net income (loss) to NOI for our total portfolio and NOI for our Same Store portfolio. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 28

PSF PSF means per square foot. Recurring Capital Expenditures or Recurring CapEx Recurring Capital Expenditures or Recurring CapEx represents general replacements and expenditures required to preserve and maintain the value and functionality of a home and its systems as a single-family rental. Rental Rate Growth Rental rate growth for any home represents the percentage difference between the monthly rent from an expiring lease and the monthly rent from the next lease, and, in each case, reflects the impact of any amortized non-service rent concessions and contractual rent increases. Leases are either renewal leases, where our current resident chooses to stay for a subsequent lease term, or a new lease, where our previous resident moves out and a new resident signs a lease to occupy the same home. Same Store / Same Store Portfolio Same Store or Same Store portfolio includes, for a given reporting period, homes that have been stabilized for at least 15 months prior to January 1st of the year in which the Same Store portfolio was established, excluding homes that have been sold, homes that have been identified for sale to an owner occupant and have become vacant, and homes that have been deemed inoperable or significantly impaired by casualty loss events or force majeure. Homes are considered stabilized if they have (i) completed an initial renovation and (ii) entered into at least one post-initial renovation lease. An acquired portfolio that is both leased and deemed to be of sufficiently similar quality and characteristics as the existing Invitation Homes Same Store portfolio may be considered stabilized at the time of acquisition. Additionally, homes acquired via the Starwood Waypoint Homes merger have been deemed to qualify for the Same Store portfolio beginning in 2018 if they were stabilized, according to the Invitation Homes criteria for stabilization, within Starwood Waypoint Homes' portfolio prior to the merger. We believe presenting information about the portion of our portfolio that has been fully operational for the entirety of a given reporting period and its prior year comparison period provides investors with meaningful information about the performance of our comparable homes across periods and about trends in our organic business. In order to provide meaningful comparative information across periods that, in some cases, pre-date the Starwood Waypoint Homes merger, all information regarding the performance of the Same Store portfolio for periods prior to December 31, 2017 is presented as though the Starwood Waypoint Homes merger was consummated on January 1, 2017. Total Homes / Total Portfolio Total homes or total portfolio refers to the total number of homes owned, whether or not stabilized, and excludes any properties previously acquired in purchases that have been subsequently rescinded or vacated. Turnover Rate Turnover rate represents the number of instances that homes in an identified population become unoccupied in a given period, divided by the number of homes in such population. Value Enhancing CapEx Value enhancing CapEx represents re-investment in stabilized homes, above and beyond general replacements to preserve and maintain the value and functionality of a home, for the purpose of enhancing expected risk-adjusted returns. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 29

Reconciliation of Non-GAAP Measures: Reconciliation of Total Revenues to Same Store Total Revenues and Same Store Core Revenues, Quarterly (in thousands) (unaudited) Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Total revenues (Invitation Homes total portfolio) $ 423,669 $ 329,954 $ 243,536 $ 242,216 $ 238,750 Starwood Waypoint Homes revenues (1) — 84,775 166,546 149,761 146,168 Pro Forma total revenues 423,669 414,729 410,082 391,977 384,918 Non-Same Store revenues (48,350) (45,794) (44,726) (28,702) (28,571) Same Store revenues 375,319 368,935 365,356 363,275 356,347 Same Store resident recoveries (12,087) (9,543) (9,413) (9,175) (7,361) Same Store Core revenues $ 363,232 $ 359,392 $ 355,943 $ 354,100 $ 348,986 (1) Represents revenues generated by Starwood Waypoint Homes prior to its merger with Invitation Homes, expressed using Invitation Homes' definition of total revenues. Reconciliation of Property Operating and Maintenance to Same Store Operating Expenses and Same Store Core Operating Expenses, Quarterly (in thousands) (unaudited) Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Property operating and maintenance expenses (total portfolio) $ 160,767 $ 117,220 $ 93,267 $ 92,840 $ 88,168 Starwood Waypoint Homes operating expenses (1) — 31,919 66,106 59,175 55,316 Pro Forma total operating expenses 160,767 149,139 159,373 152,015 143,484 Non-Same Store operating expenses (19,908) (17,894) (18,347) (13,553) (13,556) Same Store operating expenses 140,859 131,245 141,026 138,462 129,928 Same Store resident recoveries (12,087) (9,543) (9,413) (9,175) (7,361) Same Store Core operating expenses $ 128,772 $ 121,702 $ 131,613 $ 129,287 $ 122,567 (1) Represents property operating and maintenance expenses generated by Starwood Waypoint Homes prior to its merger with Invitation Homes, expressed using Invitation Homes' definition of property operating and maintenance expenses. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 30

Reconciliation of Net Income (Loss) to NOI and Same Store NOI, Quarterly (in thousands) (unaudited) Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Net income (loss) available to common shareholders $ (17,491) $ (46,236) $ (22,745) $ 5,420 $ (42,391) Net income (loss) available to participating securities 222 271 235 109 — Non-controlling interests (311) (489) — — — Interest expense 92,299 74,244 56,796 57,358 68,572 Depreciation and amortization 144,500 107,020 67,466 67,515 67,577 General and administrative 27,636 63,585 27,462 18,426 58,266 Property management expense 17,164 11,908 10,852 9,135 11,449 Impairment and other 6,121 7,611 14,572 706 1,204 Gain on sale of property, net of tax (5,502) (5,657) (3,756) (10,162) (14,321) Other (1,736) 477 (613) 869 226 NOI (total portfolio) 262,902 212,734 150,269 149,376 150,582 Starwood Waypoint Homes NOI (1) — 52,856 100,440 90,586 90,852 Pro Forma total NOI 262,902 265,590 250,709 239,962 241,434 Non-Same Store NOI (28,442) (27,900) (26,379) (15,149) (15,015) Same Store NOI $ 234,460 $ 237,690 $ 224,330 $ 224,813 $ 226,419 (1) Represents NOI generated by Starwood Waypoint Homes prior to its merger with Invitation Homes, expressed using Invitation Homes' definition of NOI. Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 31

Reconciliation of Net Loss to EBITDA, EBITDAre and Adjusted EBITDAre (in thousands) (unaudited) Q1 2018 Q1 2017 % Change Net loss available to common shareholders $ (17,491) $ (42,391) Net income available to participating securities 222 — Non-controlling interests (311) — Interest expense 92,299 68,572 Depreciation and amortization 144,500 67,577 EBITDA 219,219 93,758 Gain on sale of property, net of tax (5,502) (14,321) Impairment on depreciated real estate investments 603 1,037 EBITDAre 214,320 80,474 Share-based compensation expense 9,498 44,244 IPO related expenses — 7,631 Merger and transaction-related expenses 4,367 — Severance 2,659 — Casualty losses, net 5,518 167 Other, net (1,736) 226 Adjusted EBITDAre $ 234,626 $ 132,742 76.8% Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 32

Reconciliation of Net Debt / Annualized Adjusted EBITDAre (in thousands, except for ratio) (unaudited) As of March 31, 2018 Mortgage loans, net $ 7,614,460 Term loan facility, net 1,488,695 Revolving facility 15,000 Convertible senior notes, net 550,695 Total Debt per Balance Sheet 9,668,850 Retained and repurchased certificates (427,608) Cash, ex-security deposits (1) (240,165) Deferred financing costs 48,470 Unamortized discounts on note payable 27,555 Net Debt (A) $ 9,077,102 For the Three Months Ended March 31, 2018 Adjusted EBITDAre (B) $ 234,626 Annualized Adjusted EBITDAre (C = B x 4) $ 938,504 Net debt / annualized Adjusted EBITDAre (A / C) 9.7x (1) Represents cash and cash equivalents and the non-security deposit portion of restricted cash. Reconciliation of Fixed Charge Coverage Ratio (in thousands, except for ratio) (unaudited) For the Three Months Ended March 31, 2018 Interest expense $ 92,299 Noncash interest expense (8,495) Fixed charges (A) $ 83,804 Adjusted EBITDAre (B) $ 234,626 Fixed charge coverage ratio (B / A) 2.8x Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 33

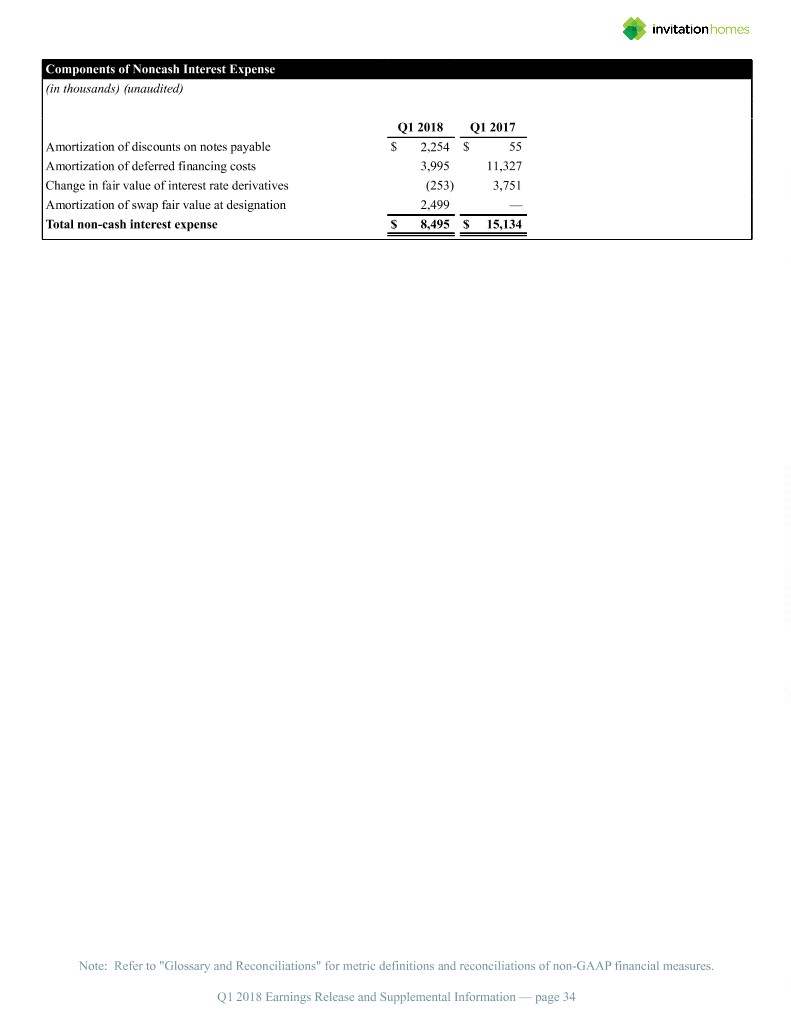

Components of Noncash Interest Expense (in thousands) (unaudited) Q1 2018 Q1 2017 Amortization of discounts on notes payable $ 2,254 $ 55 Amortization of deferred financing costs 3,995 11,327 Change in fair value of interest rate derivatives (253) 3,751 Amortization of swap fair value at designation 2,499 — Total non-cash interest expense $ 8,495 $ 15,134 Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures. Q1 2018 Earnings Release and Supplemental Information — page 34