Attached files

| file | filename |

|---|---|

| EX-32.2 - ASIA EQUITY EXCHANGE GROUP, INC. | ex32-2.htm |

| EX-32.1 - ASIA EQUITY EXCHANGE GROUP, INC. | ex32-1.htm |

| EX-31.2 - ASIA EQUITY EXCHANGE GROUP, INC. | ex31-2.htm |

| EX-31.1 - ASIA EQUITY EXCHANGE GROUP, INC. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number: 333-192272

ASIA EQUITY EXCHANGE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 46-3366428 | |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

Suite 2501A, 25/F, Skyline Tower,

39 Wang Kwong Road, Kowloon Bay, Hong Kong

(Address of Principal Executive Offices)

+852-2818 2998

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | ||

| Non-accelerated filer [ ] | Smaller reporting company [X] | ||

| (Do not check if a smaller reporting company) | |||

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided in Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes [ ] No [X]

The number of shares outstanding of each of the issuer’s classes of common stock, as of May 11, 2018 is as follows:

| Class of Securities | Shares Outstanding | |||

| Common Stock, $0.001 per value | [118,900,016] | |||

ASIA EQUITY EXCHANGE GROUP, INC.

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2018

TABLE OF CONTENTS

| PAGE | ||

| PART I - FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 4 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 25 |

| Item 4. | Controls and Procedures | 25 |

| PART II - OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 26 |

| Item 1A. | Risk Factors | 26 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 26 |

| Item 3. | Defaults Upon Senior Securities. | 26 |

| Item 4. | Mine Safety Disclosures. | 26 |

| Item 5. | Other Information | 26 |

| Item 6. | Exhibits | 26 |

| 2 |

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will,” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth; any projections of earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

| ● | “Company”, “we”, “us” and “our” are to the combined business of Asia Equity Exchange Group, Inc., a Nevada corporation, and its consolidated subsidiaries; | |

| ● | “AEEGCL” are to our Samoa subsidiary, Asian Equity Exchange Group Co., Ltd.; | |

| ● | “AEEX HK” are to AEEX (HK) International Financial Services Limited (formerly known as Yinfu International Enterprise Limited), a company formed in Hong Kong; | |

| ● | “AACCL” are to Asia America Consultants (Shenzhen) Co., Ltd., (formerly known as Yinfu Guotai Investment Consultant (Shenzhen) Co., Ltd.),our PRC subsidiary ; | |

| ● | “China” and “PRC” are to the People’s Republic of China; | |

| ● | “RMB” are to Renminbi, the legal currency of China; | |

| ● | “U.S. dollar”, “$” and “US$” are to the legal currency of the United States; | |

| ● | “SEC” are to the United States Securities and Exchange Commission; | |

| ● | “Securities Act” are to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended. |

| 3 |

PART I - FINANCIAL INFORMATION

ASIA EQUITY EXCHANGE GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| As of | ||||||||

| March 31, 2018 | December 31, 2017 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 1,420,377 | $ | 512,729 | ||||

| Accounts receivable | 1,279,087 | 994,500 | ||||||

| Loans receivable | 1,590,000 | 2,295,000 | ||||||

| Short-term investment | 15,900,000 | 15,300,000 | ||||||

| Prepaid expenses and other current assets | 858,272 | 432,262 | ||||||

| Total current assets | 21,047,736 | 19,534,491 | ||||||

| Property and equipment, net | 68,600 | 76,040 | ||||||

| Deferred tax assets | 97,010 | 93,349 | ||||||

| Total assets | $ | 21,213,346 | $ | 19,703,880 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Deferred revenue | $ | 2,105,934 | $ | 2,315,123 | ||||

| Accrued expense and other current liabilities | 152,748 | 297,405 | ||||||

| Taxes payable | 724,026 | 396,221 | ||||||

| Due to related party | 541,726 | 583,787 | ||||||

| Total current liabilities | $ | 3,524,434 | $ | 3,592,536 | ||||

| Income tax payable – noncurrent portion | 75,557 | 75,557 | ||||||

| Total liabilities | 3,599,991 | 3,668,093 | ||||||

| Commitments and contingencies | ||||||||

| Equity | ||||||||

| Preferred stock, 1,000,000 shares authorized; par value $0.001, none issued and outstanding | - | - | ||||||

| Common stock, 300 million shares authorized; par value $0.001, 118,900,016 shares issued and outstanding * | 118,900 | 118,900 | ||||||

| Additional paid in capital | 15,045,700 | 15,045,700 | ||||||

| Statutory reserve | 63,950 | 63,950 | ||||||

| Retained earnings | 1,676,576 | 756,192 | ||||||

| Accumulated other comprehensive income | 708,229 | 51,045 | ||||||

| Total equity | 17,613,355 | 16,035,787 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 21,213,346 | $ | 19,703,880 | ||||

* Giving retrospective effect of reverse merger transaction consummated on April 12, 2016 and the 1 for 10 reverse stock split effected on July 21, 2017

The accompanying notes are an integral parts to these unaudited condensed consolidated financial statements

| 4 |

ASIA EQUITY EXCHANGE GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

| For the Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Revenue | $ | 1,925,197 | $ | 354,447 | ||||

| Operating expenses | ||||||||

| Selling expenses | 424,512 | 7,805 | ||||||

| General and administrative expenses | 467,148 | 146,891 | ||||||

| Total Operating Expenses | 891,660 | 154,696 | ||||||

| Income (loss) from operations | 1,033,537 | 199,751 | ||||||

| Other income (expense) | ||||||||

| Interest income | 209,930 | - | ||||||

| Foreign currency transaction gain (loss) | (13,316 | ) | 182 | |||||

| Other expense | (8,765 | ) | (270 | ) | ||||

| Total other income (expense), net | 187,849 | (88 | ) | |||||

| Income before income tax | 1,221,386 | 199,663 | ||||||

| Provision for income taxes | 301,002 | 49,409 | ||||||

| Net income | 920,384 | 150,254 | ||||||

| Other comprehensive income | ||||||||

| Foreign currency translation gain | 657,184 | (1,313 | ) | |||||

| Comprehensive income | $ | 1,577,568 | $ | 148,941 | ||||

| Earnings per share Basic and diluted | $ | 0.01 | $ | 0.00 | ||||

| Weighted average number of shares Basic and diluted * | 118,900,016 | 114,600,000 | ||||||

* Giving retrospective effect of reverse merger transaction consummated on April 12, 2016 and the 1 for 10 reverse stock split effected on July 21, 2017

The accompanying notes are an integral parts to these unaudited condensed consolidated financial statements

| 5 |

ASIA EQUITY EXCHANGE GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net income | $ | 920,384 | $ | 150,254 | ||||

| Adjusted to reconcile net income to cash provided by operating activities: | ||||||||

| Depreciation | 5,364 | 3,065 | ||||||

| Gain from disposal of fixed assets | (505 | ) | - | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (244,506 | ) | (29,000 | ) | ||||

| Prepaid expenses and other current assets | (413,803 | ) | (117,736 | ) | ||||

| Deferred revenue | (293,838 | ) | - | |||||

| Other payables and accrued expenses | (152,932 | ) | 16,186 | |||||

| Income taxes payable | 313,025 | 58,443 | ||||||

| Net cash provided by operating activities | 133,189 | 81,212 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchases of property and equipment | (2,217 | ) | - | |||||

| Proceeds from disposal of fixed assets | 7,605 | - | ||||||

| Collection on third-party loans | 791,500 | - | ||||||

| Net cash provided by investing activities | 796,888 | - | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds received from related party | - | 28,002 | ||||||

| Repayments of related party loan | (40,013 | ) | - | |||||

| Net cash (used in) provided by financing activities | (40,013 | ) | 28,002 | |||||

| EFFECT OF EXCHANGE RATES ON CASH | 17,584 | 45 | ||||||

| NET INCREASE IN CASH | 907,648 | 109,259 | ||||||

| CASH, BEGINNING OF PERIOD | 512,729 | 55,371 | ||||||

| CASH, END OF PERIOD | $ | 1,420,377 | $ | 164,630 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Cash paid for interest expense | $ | - | $ | - | ||||

| Cash paid for income tax | $ | 15,364 | $ | - | ||||

The accompanying notes are an integral parts to these unaudited condensed consolidated financial statements

| 6 |

ASIA EQUITY EXCHANGE GROUP, INC.

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 1 -ORGANIZATION AND DESCRIPTION OF BUSINESS

Asia Equity Exchange Group, Inc. (“the Company” or “AEEX”) is a Nevada corporation incorporated on July 15, 2013, under the name “I In The Sky, Inc.” (“SYYF”). The Company filed a name change to AEEX with the state of Nevada on July 22, 2015.

The Company’s original business plan was to manufacture and market low cost GPS tracking devices and software to businesses and families. However, this business was not successful and the Company had no revenues generated from its business from its inception until April 12, 2016 when it completed the reverse acquisition of Asian Equity Exchange Group Company Limited (“AEEGCL”).

On November 30, 2015, the Company executed a Sale and Purchase Agreement (the “Purchase Agreement”) to acquire 100% of the shares and assets of AEEGCL (the “Acquisition”). Pursuant to the Purchase Agreement, the Company issued one billion (1,000,000,000) shares of common stock to the former owners of AEEGCL. The Acquisition was consummated on April 12, 2016. As a result, AEEGCL became a wholly-owned subsidiary of the Company. The Company had a total of 146,000,000 shares of common stock outstanding immediately prior to the closing of the Acquisition. Upon completion of the Acquisition, the Company had a total of 1,146,000,000 shares of common stock outstanding, with the former owners of AEEGCL controlled 87.3% of the total issued and outstanding shares of the Company’s common stock.

The acquisition of AEEGCL and its subsidiaries by us was accounted for as a reverse merger because there was a change of control, and on a post-merger basis, the former shareholders of AEEGCL held a majority of our outstanding common stock on a fully-diluted basis. As a result, AEEGCL is deemed to be the acquirer for accounting purposes. Accordingly, the consolidated financial statement data presented are those of AEEGCL, recorded at the historical basis of AEEGCL, for all periods prior to our acquisition of AEEGCL on April 12, 2016, and the financial statements of the historical operations of the consolidated companies from the effective date of the closing of the reverse merger.

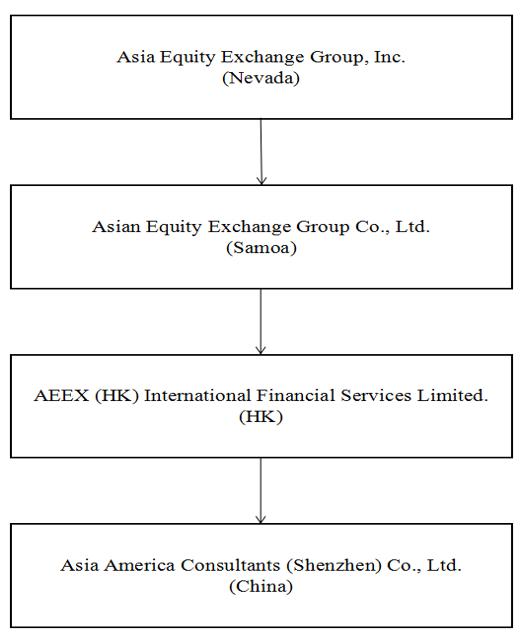

AEEGCL was incorporated under the laws of Samoa on May 29, 2015. It offers an international equity assistance and information service platform designed to provide listing assistance services, equity investment financing information and public relationship services to enterprises in Asia, mainly in China. AEEGCL owns 100% of AEEX (HK) International Financial Service Limited (formerly known as Yinfu International Enterprise Limited, “AEEX HK”), a, entity incorporated in Hong Kong on December 22, 2014. AEEX HK owns 100% of Asia America Consultants (Shenzhen) Co., Ltd. (formerly known as Yinfu Guotai Investment Consultant (Shenzhen) Co., Ltd., “AACCL”), a wholly-owned foreign enterprise organized under the laws of the People’s Republic of China (the “PRC”) on April 15, 2015.

The Company, through its subsidiaries AEEX HK and AACCL, engages in providing investment and corporate management consulting services to customers.

| 7 |

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the “Company have been prepared in accordance with generally accepted accounting principles (“U.S. GAAP”) for interim financial information pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary to make the financial statements not misleading have been included. Operating results for the interim period ended March 31, 2018 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2018. The information included in this Form 10-Q should be read in conjunction with Management’s Discussion and Analysis, and the financial statements and notes thereto included in the Company’s Form 10-K for the fiscal year ended December 31, 2017, filed with the SEC on April 13, 2018.

Principle of Consolidation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The consolidated financial statements of the Company reflect the principal activities of the following entities. All intercompany balances and transactions have been eliminated upon consolidation.

Use of Estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates required to be made by management, include, but are not limited to revenue recognition. Actual results could differ from these estimates.

| 8 |

Cash and Cash Equivalents

Cash includes cash on hand and demand deposits in accounts maintained with commercial banks. The Company considers all highly liquid investments with original maturities of three months or less when purchased to be cash equivalents. The Company maintained most of the bank accounts in the PRC. Cash balances in bank accounts in PRC are not insured by the Federal Deposit Insurance Corporation or other programs.

Accounts Receivable, net

Accounts receivable are recognized and carried at original invoiced amount less an estimated allowance for uncollectible amounts. The Company generally receives a cash payment before delivery of the services, but may extend unsecured credit to its customers in the ordinary course of business. The Company mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and recorded based on management’s assessment of the credit history of the customers and current relationships with them. At March 31, 2018 and December 31, 2017, there was no allowance recorded as the Company considers all of the accounts receivable fully collectible.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost. The straight-line depreciation method is used to compute depreciation over the estimated useful lives of the assets, as follows:

| Useful life | ||||

| Electronic equipment | 3 years | |||

| Office furniture | 5 years | |||

| Transportation vehicles | 4 years | |||

| Computer software | 5 years |

Impairment of Long-lived Assets

The Company reviews long-lived assets, including definitive-lived intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If the estimated cash flows from the use of the asset and its eventual disposition are below the asset’s carrying value, then the asset is deemed to be impaired and written down to its fair value. There were no events or changes in circumstances that triggered a review of impairments of long-lived assets as of March 31, 2018 and December 31, 2017.

Reclassification

Certain prior period amounts have been reclassified to conform to the current period presentation.

Fair Value of Financial Instruments

Fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A three-level fair value hierarchy prioritizes the inputs used to measure fair value. The hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

Level 1- Observable inputs such as unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2- Observable inputs (other than Level 1 quoted prices) such as quoted prices active markets for similar assets or liabilities, quoted prices in markets that are not active for identical or similar as or liabilities, or other inputs that are observable or can be corroborated by observable market data.

Level 3- Inputs are unobservable inputs which reflect management’s assumptions based on the best available information.

| 9 |

The Company considers the recorded value of its financial assets and liabilities, which consist primarily of cash and cash equivalents, accounts receivable, loans receivable, prepaid expenses and other current assets, short-term investment, deferred revenue, accrued and other liabilities, taxes payable and due to related party to approximate the fair value of the respective assets and liabilities based upon the short-term nature of the assets and liabilities.

Revenue recognition

The Company adopted Accounting Standards Codification (“ASC”) 606 in the first quarter of 2018 using the modified retrospective approach. The adoption of this standard did not have a material impact on the Company’s condensed consolidated financial statements, no adjustments to opening retained earnings were made as of January 1, 2018 as the Company’s revenue was recognized based on the amount of consideration expects to receive in exchange for satisfying the performance obligations.

ASC 606, Revenue from Contracts with Customers, establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services to customers. The core principle requires an entity to recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration that it expects to be entitled to receive in exchange for those goods or services recognized as performance obligations are satisfied.

ASC 606 requires the use of a new five-step model to recognize revenue from customer contracts. The five-step model requires that the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation. The application of the five-step model to the revenue streams compared to the prior guidance did not result in significant changes in the way the Company records its revenue. The Company has assessed the impact of the guidance by reviewing its existing customer contracts and current accounting policies and practices to identify differences that will result from applying the new requirements, including the evaluation of its performance obligations, transaction price, customer payments, transfer of control and principal versus agent considerations. Based on the assessment, the Company concluded that there was no change to the timing and pattern of revenue recognition for its current revenue streams in scope of Topic 606 and therefore there was no material changes to the Company’s consolidated financial statements upon adoption of ASC 606.

The Company’s revenue is recognized when performance obligations under the terms of a contract with a customer are satisfied and promised services have been rendered to the customers. Persuasive evidence of an arrangement is demonstrated via service contract and invoice; and the sales price to the customer is fixed upon acceptance of the contract and there is no separate rebate, discount, or volume incentive. The Company recognizes revenue when promised services are rendered and collectability of payment is reasonably assured.

The Company currently generates its revenue from the following main sources:

● Revenue from membership fee

The Company develops and attracts corporate enterprises to become members and join in the Company’s service platform www.aeexotcmarkets.com. To become a member, customer needs to pay a one-time non-refundable registration fee first. The Company recognizes revenue from membership fee when it posts member’s information and profiles on its platform www.aeexotcmarkets.com, which enables the member’s corporate information and specific needs exposed to the public.

| 10 |

● Revenue from consulting services

The Company also provides various consulting services to its members, especially to those who have the intention to be publicly listed in the stock exchanges in the United States and other countries. The Company categorizes its consulting services into three Phases:

Phase I consulting services primarily include due diligence review, market research and feasibility study, business plan drafting, accounting record review, and business analysis and recommendations etc. Management estimates that Phase I normally takes around three months to complete based on its past experiences.

Phase II consulting services primarily include reorganization, pre-listing education and tutoring, talent search, legal and audit firm recommendation and coordination, VIE contracts and other public-listing related documents review, merger and acquisition planning, investor referral and pre-listing equity financing source identification and recommendation, independent directors and audit committee candidates recommendation etc. Management estimates that Phase II normally takes about eight months to complete based its past experiences.

Phase III consulting services primarily include shell company identification and recommendation for customers expecting to become publicly listed through reverse merger transaction; assistance in preparation of customers’ registration statement under IPO transactions or Form 8-K under reverse merger transactions; assistance in answering comments and questions received from regulatory agencies etc. Management believes it is very difficult to estimate the timing of this phase of service as the completion of Phase III services is not within the Company’s control.

Each phase of consulting services are standalone and fees associated with each phase are clearly identified in service agreements. Revenue from providing Phase I and Phase II consulting services to customers is recognized ratably over the estimated completion period of each phase. Revenue from providing Phase III consulting services to customers is recognized upon completion of reverse merger transaction or IPO transaction, which is evidenced by filing of 8-K for reverse merger transaction or receipt of effective notice from regulatory agencies for IPO transaction. Revenue that has been billed and not yet recognized is reflected as deferred revenue on the balance sheet.

Depending on the complexity of the underlying service arrangement and related terms and conditions, significant judgments, assumptions and estimates may be required to determine when substantial delivery of contract elements has occurred, whether any significant ongoing obligations exist subsequent to contract execution, whether amounts due are collectible and the appropriate period or periods in which, or during which, the completion of the earnings process occurs. Depending on the magnitude of specific revenue arrangements, adjustment may be made to the judgments, assumptions and estimates regarding contracts executed in any specific period.

The table below presents the impact of applying the new revenue recognition standard to the components of total revenue within the unaudited condensed consolidated statement of income and comprehensive income for the three months ended March 31, 2018. The Company evaluated its revenue recognition policy for all revenue streams within the scope of the ASU under previous standards and using the five-step model under the new guidance and concluded that there were no differences in the pattern of revenue recognition:

| Three Months Ended March 31, 2018 | ||||||||||||

| As Reported | Financial Results Prior to Adoption of Revenue Recognition Standard | Impact of Adoption of Revenue Recognition Standard | ||||||||||

| Membership fee | $ | 37,736 | $ | 37,736 | $ | - | ||||||

| Consulting service fee | 1,887,461 | 1,887,461 | - | |||||||||

| Total revenue | $ | 1,925,197 | $ | 1,925,197 | $ | - | ||||||

| 11 |

Contract Balances and Remaining Performance Obligations

Contract balances typically arise when a difference in timing between the transfer of control to the customer and receipt of consideration occurs. Our contract assets, consist primarily of accounts receivable related to providing public listing related consulting services to our customers when revenue is recognized prior to payment and we have an unconditional right to payment. We had accounts receivable related to revenues from contracts with customers of $1,279,087 and $994,500 as of March 31, 2018 and December 31, 2017. We had no impairments related to these receivables during the three months ended March 31, 2018. Our contract liabilities, which are reflected in our unaudited condensed consolidated balance sheets as deferred revenue, consist primarily of customer payments for membership and public listing related consulting services in advance of satisfying our performance obligations. The Company’s performance obligations related to contract liabilities of $0.93 million as of January 1, 2018 were recognized as revenue during the first quarter of 2018. The Company’s performance obligations related to contract liabilities of approximately $1 million as of March 31, 2018 are expected to be recognized as revenue in the second quarter of 2018.

We do not disclose information about remaining performance obligations pertaining to service contracts that either (i) contracts with an original expected term of one year or less, or (ii) contracts for which revenue is recognized in proportion to the amount the Company has the right to invoice for services rendered.

Income Tax

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period including the enactment date. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The provisions of ASC 740-10-25, “Accounting for Uncertainty in Income Taxes,” prescribe a more-likely-than-not threshold for consolidated financial statement recognition and measurement of a tax position taken (or expected to be taken) in a tax return. This interpretation also provides guidance on the recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, and related disclosures. The Company does not believe that there was any uncertain tax position at March 31, 2018 and December 31, 2017.

To the extent applicable, the Company records interest and penalties as a general and administrative expense. The Company’s subsidiaries in China and Hong Kong are subject to the income tax laws of the PRC and Hong Kong. The statute of limitations for the Company’s U.S. federal income tax returns and certain state income tax returns remains open for tax years 2013 and after. As of March 31, 2018 the tax years ended December 31, 2015 through December 31, 2017 for the Company’s PRC subsidiary remain open for statutory examination by PRC tax authorities.

On December 22, 2017, the “Tax Cuts and Jobs Act” (“The Act”) was enacted. Under the provisions of The Act, the U.S. corporate tax rate decreased from 35% to 21%. Additionally, the Tax Act imposes a one-time transition tax on deemed repatriation of historical earnings of foreign subsidiaries, and future foreign earnings are subject to U.S. taxation. The change in rate has caused the Company to re-measure all U.S. deferred income tax assets and liabilities for temporary differences. Net operating loss (“NOL”) carryforwards are limited to 80% of taxable income and can be carried forward indefinitely.

Earnings Per Share

Basic earnings per share are computed by dividing income available to ordinary shareholders of the Company by the weighted average ordinary shares outstanding during the period. Diluted earnings per share takes into account the potential dilution that could occur if securities or other contracts to issue ordinary shares were exercised and converted into ordinary shares. There were no dilutive shares for the three months ended March 31, 2018 and 2017.

| 12 |

Foreign Currency Translation

The accounts of the Company and its subsidiaries are measured using the currency of the primary economic environment in which the entity operates (the “functional currency”). The Company’s functional currency is the U.S. dollar (“USD”) while its subsidiary in Hong Kong reports its financial positions and results of operations in Hong Kong Dollar and the Company’s subsidiary in China reports its financial position sand results of operations in Renminbi (“RMB”). The accompanying unaudited condensed consolidated financial statements are presented in United States Dollar (USD). The unaudited condensed consolidated statements of income and comprehensive income and cash flows denominated in foreign currency are translated at the average rate of exchange during the reporting period. Assets and liabilities denominated in foreign currencies at the balance sheet date are translated at the applicable rates of exchange in effect at that date. The equity denominated in the functional currency is translated at the historical rate of exchange at the time of capital contribution. Because cash flows are translated based on the average translation rate, amounts related to assets and liabilities reported on the unaudited condensed consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets. Translation adjustments arising from the use of different exchange rates from period to period are included as a separate component of accumulated other comprehensive income included in unaudited condensed consolidated balance sheets. Gains and losses from foreign currency transactions are included in the unaudited condensed consolidated statements of income and comprehensive income.

The following table outlines the currency exchange rates that were used in creating the consolidated financial statements in this report:

| March 31, | December 31, | Three months ended March 31, | ||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Foreign currency | Balance Sheet | Balance Sheet | Profits/Loss | Profits/Loss | ||||||||||||

| RMB:1USD | 0.1590 | 0.1530 | 0.1583 | 0.1454 | ||||||||||||

| HKD:1USD | 0.1274 | 0.1279 | 0.1277 | 0.1288 | ||||||||||||

Risks and Uncertainty

The Company’s major operations are conducted in the PRC. Accordingly, the political, economic, and legal environments in the PRC, as well as the general state of the PRC’s economy may influence the Company’s business, financial condition, and results of operations.

The Company’s major operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic, and legal environment. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things. Although the Company has not experienced losses from these situations and believes that it is in compliance with existing laws and regulations including its organization and structure disclosed in Note 1, this may not be indicative of future results.

| 13 |

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606) (ASU 2014-09), which supersedes the revenue recognition requirements in Topic 605, Revenue Recognition, including most industry-specific revenue recognition guidance throughout the Industry Topics of the Codification. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those goods or services. In August 2015, the FASB issued ASU 2015-14, which deferred the effective date of ASU 2014-09 to fiscal years beginning after December 31, 2017, and interim periods within those fiscal years, with early adoption permitted for reporting periods beginning after December 15, 2016. Subsequently, the FASB issued ASUs in 2016 containing implementation guidance related to ASU 2014-09, including: ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net), which is intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations; ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which is intended to clarify two aspects of Topic 606: identifying performance obligations and the licensing implementation guidance; ASU 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients, which contains certain provisions and practical expedients in response to identified implementation issues; and ASU 2016-20, Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers, which is intended to clarify the Codification or to correct unintended application of guidance. ASU 2014-09 allows for either full retrospective or modified retrospective adoption. The Company adopted ASU 2014-09 and the related ASUs on January 1, 2018 using the modified retrospective method, which will not result in a cumulative catch-up adjustment to the opening balance sheet of retained earnings at the effective date.

In February 2018, the FASB has issued Accounting Standards Update (ASU) No. 2018-02, “Reclassification of Certain Tax Effects From Accumulated Other Comprehensive Income.” The ASU amends ASC 220, Income Statement — Reporting Comprehensive Income, to “allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act.” In addition, under the ASU, an entity will be required to provide certain disclosures regarding stranded tax effects. The ASU is effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. The adoption of this guidance will not have a material impact on its consolidated financial statements.

In March 2018, the FASB issued ASU 2018-05 — Income Taxes (Topic 740): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118 (“ASU 2018-05”), which amends the FASB Accounting Standards Codification and XBRL Taxonomy based on the Tax Cuts and Jobs Act (the “Act”) that was signed into law on December 22, 2017 and Staff Accounting Bulletin No. 118 (“SAB 118”) that was released by the Securities and Exchange Commission. The Act changes numerous provisions that impact U.S. corporate tax rates, business-related exclusions, and deductions and credits and may additionally have international tax consequences for many companies that operate internationally. The Company has evaluated the impact of the Act as well as the guidance of SAB 118 and incorporated the changes into the determination of a reasonable estimate of its deferred tax liability and appropriate disclosures in the notes to its consolidated financial statements (See Note 9). The Company will continue to evaluate the impact this tax reform legislation may have on its results of operations, financial position, cash flows and related disclosures.

Except for the above-mentioned pronouncements, there are no new recent issued accounting standards that will have material impact on the unaudited condensed consolidated financial position, statements of operations and cash flows.

NOTE 3 - LOANS RECEIVABLE

From September to December 2017, the Company advanced a total of $2,295,000 (RMB 15 million) one year short-term loans to a former customer as working capital. Among the RMB 15 million loan, RMB 5 million is non-interest bearing and RMB 10 million are interest-bearing loans with interest rate of 5% per annum. The Company collected RMB 5 million (approximately $791,500) non-interest bearing portion of the loan from Shangyuan during the quarter ended March 31, 2018 and expects to fully collect the remaining RMB 10 million before June 30, 2018. Interest income of $19,603 was accrued and reflected in the unaudited condensed consolidated statements of income and comprehensive income for the three months ended March 31, 2018.

| 14 |

NOTE 4 - SHORT-TERM INVESTMENT

On November 21, 2017, the Company entered into an investment agreement with China Construction Bank (“the Bank”). The agreement allows the Company to invest RMB 100 million ($15.3 million) with the Bank for a six-month term maturing on May 20, 2018. The Bank invests the Company’s fund in certain financial instruments including money market funds, bonds or mutual funds. The rates of return on these instruments was guaranteed at 4.8% per annum. The Company’s investment is not subject to market fluctuation and therefore, the Company did not record any gain or loss on its investment. Interest income of $190,800 was accrued for the three months ended March 31, 2018.

NOTE 5 – DEFERRED REVENUE

Deferred revenue consists of amounts received from customers for membership and public listing related consulting services not yet completed as of the balance sheets date. The details of customer deposits are as follows:

| As of | ||||||||

| March 31, 2018 | December 31, 2017 | |||||||

| Customer deposit for membership | $ | 256,442 | $ | 53,077 | ||||

| Customer deposits for consulting services | 1,849,492 | 2,262,046 | ||||||

| Total deferred revenue | $ | 2,105,934 | $ | 2,315,123 | ||||

NOTE 6 - RELATED PARTY TRANSACTION

As of March 31, 2018 and December 31, 2017, the balances due to a major stockholder are comprised of non-interest bearing advances used for working capital. The balance due to stockholder is due upon demand and unsecured.

NOTE 7 – TAXES

The Company is subject to income taxes on an entity basis on income arising in or derived from the tax jurisdiction in which each entity is domiciled.

AEEX is incorporated in the United States and has accumulative net operating loss carry forwards of approximately $192,000 as of March 31, 2018. Such net operating loss is available for offsetting against future taxable U.S. income, expiring in 2037. Management believes that the realization of the benefits from these losses is uncertain due to its history of continuing losses in the United States. Accordingly, a full deferred tax asset valuation allowance has been provided and no deferred tax asset benefit has been recorded. The valuation allowance as of March 31, 2018 and December 31, 2017 was approximately $67,000 and $45,000, respectively.

AEEGCL was incorporated under the International Companies Act 1988 of Samoa as a non-resident company. Under current laws of Samoa, income earned is not subject to income tax.

AEEX HK is subject to Hong Kong profits tax at a rate of 16.5%, and did not have any assessable profits arising in or derived from Hong Kong for the three months ended March 31, 2018 and 2017, and accordingly no provision for Hong Kong profits tax made in these periods.

AACCL is incorporated in the PRC and is subject to PRC income tax, which is computed according to the relevant laws and regulations in the PRC. The applicable tax rate is 25% for the three months ended March 31, 2018 and 2017. The Company recorded $97,010 and $93,349 deferred income tax assets as of March 31, 2018 and December 31, 2017, respectively, derived from prior year net operating loss carryforward assessed and recognized by local tax authority.

| 15 |

On December 22, 2017, the Tax Cuts and Jobs Act of 2017 (the “Act”) was signed into law making significant changes to the Internal Revenue Code. Changes include, but are not limited to, a U.S. corporate tax rate decrease from 35% to 21% effective for tax years beginning after December 31, 2017, the transition of U.S international taxation from a worldwide tax system to a territorial system, and a one-time transition tax on the mandatory deemed repatriation of cumulative foreign earnings as of December 31, 2017.

On December 22, 2017, Staff Accounting Bulletin No. 118 (“SAB 118”) was issued to address the application of US GAAP in situations when a registrant does not have the necessary information available, prepared, or analyzed (including computations) in reasonable detail to complete the accounting for certain income tax effects of the Act. In accordance with SAB 118, the Company has recorded a provisional amount for its one-time transition tax for all of its foreign subsidiaries, resulting in an increase in income tax expense of $82,127 for the year ended December 31, 2017. The one-time transition tax was calculated using the Company’s total post-1986 overseas net earnings and profits which amounted to approximately $0.92 million. The one-time transition tax is taxed at the rate of 15.5% for the Company’s cash and cash equivalents and 8% for the other assets to be paid over 8 years.

The Company’s income tax expense for the three months ended March 31, 2018 and 2017 are as follows:

| For the three months ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Current income tax | ||||||||

| USA | $ | - | $ | - | ||||

| Samoa | - | - | ||||||

| Hong Kong | - | - | ||||||

| China | 301,002 | 49,409 | ||||||

| 301,002 | 49,409 | |||||||

| Deferred income tax | ||||||||

| China | - | - | ||||||

| - | - | |||||||

| Total income tax expense | $ | 301,002 | $ | 49,409 | ||||

The following table reconciles the statutory rates to the Company’s effective tax rate for the three months ended March 31, 2018 and 2017:

| For the three months ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Statutory PRC income tax rate | 25.0 | % | 25.0 | % | ||||

| Permanent difference | 0.2 | 0.0 | ||||||

| Rate exemption | (0.6 | ) | (0.3 | ) | ||||

| Effective tax rate | 24.6 | % | 24.7 | % | ||||

| 16 |

The Company’s deferred tax assets are comprised of the following:

| As of | ||||||||

| March 31, 2018 | December 31, 2017 | |||||||

| Net operating loss | $ | 211,599 | $ | 148,074 | ||||

| Total deferred tax assets | 211,599 | 148,074 | ||||||

| Valuation allowance | (114,589 | ) | (54,725 | ) | ||||

| Deferred tax assets, long-term | $ | 97,010 | $ | 93,349 | ||||

The Company’s taxes payable consists of the following:

| March 31, 2018 | December 31, 2017 | |||||||

| VAT tax payable | $ | 39,092 | $ | 14,470 | ||||

| Corporate income tax payable | 755,678 | 455,017 | ||||||

| Others | 4,813 | 2,291 | ||||||

| Total tax payable | 799,583 | 471,778 | ||||||

| Less: noncurrent portion | (75,557 | ) | (75,557 | ) | ||||

| Total tax payable- current portion | $ | 724,026 | $ | 396,221 | ||||

NOTE 8 – CONCENTRATIONS AND RISKS

The Company maintains certain bank accounts in the PRC and Hong Kong, which are not insured by Federal Deposit Insurance Corporation (“FDIC”) insurance or other insurance. As of March 31, 2018 and December 31, 2017, cash balances of $1,284,245 and $512,324, respectively, were maintained at financial institutions in the PRC and Hong Kong, which were not insured by any of the authorities. In addition, the Company’s short-term investment fund deposited with China Construction Bank is also not insured (Note 5).

For the three months ended March 31, 2018 and 2017, substantial of the Company’s assets were located in the PRC and substantial of the Company’s revenues were derived from its subsidiaries located in the PRC.

For the three months ended March 31, 2018, two customers accounted for approximately 47.6% and 26.0% of the Company’s total revenue. For the three months ended March 31, 2017, one customer accounted for approximately 15.4% of the Company’s total revenue.

For the three months ended March 31, 2018, two customers accounted for 80.8% and 11.4% of the Company’s outstanding accounts receivable. No single customer accounted for more than 10% of the Company’s outstanding accounts receivable for the three months ended March 31, 2017.

NOTE 9 – COMMITMENTS

Lease Obligation

The Company leases office spaces under operating leases. Operating lease expense amounted to $93,174 and $37,383 for the three months ended March 31, 2018 and 2017, respectively.

Future minimum lease payments under non-cancelable operating leases are as follows as of March 31, 2018:

| Twelve months ending March 31, | ||||

| 2019 | $ | 545,547 | ||

| 2020 | 258,164 | |||

| Thereafter | - | |||

| Total | $ | 803,711 | ||

Up-listing Commitment

November 21, 2017, the Company entered into a Subscription Agreement with an investor, pursuant to which the investor purchased 4.3 million shares of the Company’s common stock at $3.5 per share for an aggregate purchase price of $15,050,000(see Note 10).

Pursuant to the Subscription Agreement, the Company will apply to be listed on the NASDAQ Capital Market or similar national securities exchange as is reasonably acceptable to the Purchaser, so that the Company’s Common Stock will commence trading on one of the National Exchanges (the “Uplisting”) no later than December 31, 2018 (the “Uplisting Deadline”). If the Company does not complete Uplisting on or before the Uplisting Deadline, the Investor, within 30 days following the Uplisting Deadline, has the right to request the Company to buy back any number of the Shares, at the same price of the Purchase Price Per Share, subject to the terms and conditions of the Subscription Agreement.

NOTE 10 - SUBSEQUENT EVENTS

Management has evaluated all events and transactions that occurred after March 31, 2018 through the date of these unaudited condensed consolidated financial statements were issued, and concluded that no subsequent events required disclosure in the unaudited condensed consolidated financial statements.

| 17 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The following management’s discussion and analysis should be read in conjunction with our unaudited condensed consolidated financial statements and the notes thereto and the other financial information appearing elsewhere in this report. In addition to historical information, the following discussion contains certain forward-looking information. See “Special Note Regarding Forward Looking Statements” above for certain information concerning those forward looking statements. Our financial statements are prepared in U.S. dollars and in accordance with U.S. GAAP.

Overview

We derived our revenue from offering various consulting services to our customers through our international equity assistance and information service platform designed to provide member registration services, equity investment financing information to enterprises in Asia, mainly in China. Currently 61 companies are registered with us, and additional 47 companies are in the process of registration with us. In addition, we also provides various public listing aid consulting services to our members to be publicly listed in the stock exchanges in the United States and other countries. All companies currently registered with us are located in China, as are the additional companies in the process.

We generated revenue of $1,925,197 and $354,447 for the three months ended March 31, 2018 and 2017, respectively. We had a net income of $920,384 and $150,254 in the three months ended March 31, 2018 and 2017, respectively. As of March 31, 2018, we had retained earnings of $1,676,576 and net assets of $17,613,355.

Results of Operations- Comparison of Three Months Ended March 31, 2018 and 2017

| For the three months ended March 31, | ||||||||||||||||

| 2018 | 2017 | Variances | % of variance | |||||||||||||

| Revenue | $ | 1,925,197 | $ | 354,447 | $ | 1,570,751 | 443 | % | ||||||||

| Operating expenses | - | |||||||||||||||

| Selling expenses | 424,512 | 7,805 | 416,707 | 5,339 | % | |||||||||||

| General and administrative expenses | 467,148 | 146,891 | 320,257 | 218 | % | |||||||||||

| Total Operating Expenses | 891,660 | 154,696 | 736,963 | 476 | % | |||||||||||

| Income from operations | 1,033,537 | 199,751 | 833,785 | 417 | % | |||||||||||

| Other income (expense) | ||||||||||||||||

| Interest income | 209,930 | - | 209,930 | 100 | % | |||||||||||

| Foreign exchange gain(loss) | (13,316 | ) | 182 | (13,498 | ) | (7402 | )% | |||||||||

| Other expense | (8,765 | ) | (270 | ) | (8,495 | ) | 3147 | % | ||||||||

| Total other income (expense), net | 187,849 | (88 | ) | 187,937 | (214476 | )% | ||||||||||

| Income before income taxes | 1,221,386 | 199,663 | 1,021,724 | 512 | % | |||||||||||

| Provision for income taxes | 301,002 | 49,409 | 251,593 | 509 | % | |||||||||||

| Net income | $ | 920,384 | $ | 150,254 | $ | 770,131 | 513 | % | ||||||||

| 18 |

Revenues. Our revenue increased by $1,570,751 or 443% from $354,447 for the three months ended March 31, 2017 to $1,925,197 for the three months ended March 31, 2018, primarily due to increased public-listing related consulting services provided to customers during current quarter. In three months ended March 31, 2017, we only provided such consulting services to one customer for pre-listing knowledge education and tutoring, due diligence, market information analysis and business plan draft. In contrast, we provided more extended consulting services to four customers in current quarter, including but not limited to due diligence, market information collection and analysis, business plan, pre-listing education and tutoring, legal structure re-organization advisory services, shell company identification and recommendation, auditing and legal firm recommendation, investor referral and pre-listing financing coordination as well as many follow-up services. Through such comprehensive consulting services provided to customers, we enhanced public awareness of our service platform and developed more members and potential customers in current period. Our revenue increased accordingly as we completed the services.

Selling expenses. Our selling expense increased by $416,707 from $7,805 in three months ended March 31, 2017 to $424,512 in three months ended March 31, 2018. The increase in our selling expense was primarily because we developed more customers in current period for public listing consulting services, but we are short of competent in-house employees to handle related legal and accounting advisory services to be provided to customers, as a result, we increased outsourcing such services to several business partners. In addition, in response to our rapid market and customer development, we hired more employees and internally established four excellent service teams including the commerce, media, technology and legal department. Number of employees in these departments increased from 4 employees in three months ended March 31, 2018 to 28 employees in current period. The increase in employee hiring led to increased salary expense in current period as compared to the same period of last year. The overall increase in our selling expense reflected the above mentioned factors.

General and administrative expenses. General and administrative expenses increased by $320,257 or 218%, from $146,891 in three months ended March 31, 2017 to $467,148 in three months ended March 31, 2018. The increase in our general and administrative expense in current period as compared to the same comparative period of last year was largely due to increased audit, legal and other professional fee by $189,954 to maintain our public listing status, increased in salary expense by $127,471 due to increased administrative staff, and increased office lease expense by $61,493 due to larger office space leased to meet our business expansion demand.

Interest income: Our interest income increased by $209,930 or 100% when comparing three months ended March 31, 2018 to the same comparative period of 2017. In November 2017, we purchased a wealth management product from China Construction Bank. The investment bears an interest of 4.8% per annum. The related interest income of $190,237 has been accrued in current quarter. In addition, from September to December 2017, we advanced one year short-term loans of $2,295,000 (RMB 15 million) to a former customer for working capital. Among the RMB 15 million loan, RMB 5 million is non-interest bearing and the remaining RMB 10 million are interest-bearing loans with interest rate of 5% per annum. Related interest income of $19,603 has been accrued in current quarter. These factors led to our increased interest income for three months ended March 31, 2018.

Foreign exchange gain (loss): Foreign currency exchange loss increased by $13,497 when comparing three months ended March 31, 2018 to the same comparative period of 2017. We have operations in the Samoa, Hong Kong and the PRC, and our receipts and payments are mostly in currencies other than our reporting currency of U.S. Dollars. Our financial income for the three months ended March 31, 2018 and 2017 primarily reflects the foreign currency transaction gain or loss expressed in U.S. Dollars. We provide various consulting services to customers and received the customer payment in currencies other than USD. The foreign currency exchange gain or loss was mainly the result of the favorable or unfavorable USD against RMB for the periods indicated.

Provision for income taxes. Our income tax expense increased by $251,593 when comparing three months ended March 31, 2018 to the same period of 2017, primarily due to increased revenue and taxable income in current quarter.

Net income. As a result of the foregoing, we reported a net income of $920,384 for the three months ended March 31, 2018, compared to a net income of $150,254 for the three months ended March 31, 2017.

| 19 |

Plan of Operation

In 2018, we plan to enroll more qualified businesses in mainland China as well as other Asian countries to be listed in our website www.asiaotcmarkets.com for equity financing. We also plans to provide various consulting services to more customers who have the intentions to conduct initial public offerings and become public companies in the United States and other Asian stock exchanges. This is achieved by cooperating with authorized institutions in commercial roadshows and seeking support and assistance from local governments at all levels. Our ultimate goal in 2018 is to achieve a double-digit growth in the business and we anticipate our marketing efforts and high quality professional services will help us to generate increased revenue and cash flows in 2018.

Liquidity and Capital Resources

As of March 31, 2018, we had $1,420,377 cash and cash equivalents compared to $512,729 as of December 31, 2017. We also had $1,279,087 accounts receivable from several customers who had engaged with us for public listing related consulting services. We have rendered the contracted services and we believe we can collect such balance in the short term. In addition, we have a short-term investment of $15.9 million with China Construction Bank which will mature on May 20, 2018, it will be released from the investment account and become available for use in our operation as working capital if necessary. As of March 31, 2018, we also have deferred revenue of $2.1 million derived from customer deposits for our membership and consulting services. Such amount will be recognized as revenue as our consulting services are gradually provided, which will increase our operating cash flows in the near future.

Based on our current business development and expansion plan, we are expecting to generate additional cash flows in the near future from attracting more new customers and expanding our revenue through our service platform.

As of March 31, 2018, we had positive working capital of approximately $17.5 million. We have historically funded our working capital needs from operations, advance payments from customers, related-party loans and equity financing. Our working capital requirements are influenced by the level of our operations, the numerical volume and dollar value of our sales contracts, the progress of execution on our customer contracts, and the timing of accounts receivable collections. We believe that our current cash and cash flow from operations will be sufficient to meet our anticipated cash needs, including our cash needs for working capital for the next 12 months. We may, however, require additional cash resources due to changing business conditions or other future developments, including any investments or acquisitions we may decide to pursue. Our ability to maintain sufficient liquidity depends partially on our ability to achieve anticipated levels of revenue, while continuing to control costs. We continue to seek favorable additional financing to meet our capital requirements to fund our operations and growth plans in the ordinary course of business.

The following table sets forth a summary of our cash flows for the periods indicated:

| For the three months ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Net cash provided by operating activities | $ | 133,189 | $ | 81,212 | ||||

| Net cash provided by investing activities | $ | 796,888 | $ | - | ||||

| Net cash provided by (used in) financing activities | $ | (40,013 | ) | $ | 28,002 | |||

| Net increase in cash and cash equivalents | $ | 907,648 | $ | 109,259 | ||||

| Cash and cash equivalents at the beginning of period | $ | 512,729 | $ | 55,371 | ||||

| Cash and cash equivalents at the end of period | $ | 1,420,377 | $ | 164,630 | ||||

Operating Activities

Net cash provided by operating activities amounted to $133,190 for the three months ended March 31, 2018, including net income of $920,384 generated from provided member registration and various public-listing related consulting services to our customers. In addition, our accounts receivable increased by $244,506 representing a balance due from our customers which we believe we can collect in full in the near future. Our deferred revenue decreased by $293,838 because we received cash deposits from customers for our member registration and listing consulting services and we completed the service renderings during current period and such amount has been recognized as revenue when revenue recognition criteria have been met. Our taxes payable increased by $313,025 due to our increased taxable income in current period. The overall increase in our cash flow from operating activities reflected the above combined factors.

| 20 |

Net cash provided by operating activities amounted to $81,212 for the three months ended March 31, 2017, including our net operating income of $150,254 adjusted by an increase in other receivable and prepaid expense by $117,736, increased accounts receivable of $29,000 and increased income tax payable by $58,443 due to increased taxable income.

Investing Activities

Net cash provided by investing activities amounted to $796,888 for the three months ended March 31, 2018, including purchases of property and equipment of $2,217 and cash collection of third-party loans receivable of $791,500. In 2017, we advanced RMB 15 million loans to a third-party to generate interest income at an interest rate of 5% and we collected back RMB 5 million from this third-party during current quarter.

There was no cash used in investing activities for the three months ended March 31, 2017.

Financing Activities

Net cash used in financing activities amounted to $40,013 for the three months ended March 31, 2018 due to repayment of related party balance due in the same amount.

Net cash provided by financing activities for the three months ended March 31, 2017 amounted to $28,002 primarily include an increase in borrowing from a related party as working capital.

Off-Balance Sheet Transactions

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to investors.

Inflation

Inflation does not materially affect our business or the results of our operations.

Seasonality

The nature of our business does not appear to be affected by seasonal variations

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses, and related disclosures in the financial statements. Critical accounting policies are those accounting policies that may be material due to the levels of subjectivity and judgment necessary to account for highly uncertain matters or the susceptibility of such matters to change, and that have a material impact on financial condition or operating performance. While we base our estimates and judgments on our experience and on various other factors that we believe to be reasonable under the circumstances, actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies used in the preparation of our financial statements require significant judgments and estimates. For additional information relating to these and other accounting policies, see Note 2 to our unaudited condensed consolidated financial statements included elsewhere in this report.

Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates required to be made by management, include, but are not limited torevenue recognition. Actual results could differ from these estimates.

| 21 |

Accounts Receivable, net

Accounts receivable are recognized and carried at original invoiced amount less an estimated allowance for uncollectible amounts. The Company generally receives a cash payment before delivery of the services, but may extend unsecured credit to its customers in the ordinary course of business. The Company mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and recorded based on management’s assessment of the credit history of the customers and current relationships with them.

Fair Value of Financial Instruments

The Company follows the provision of Accounting Standards Codification (“ASC”) 820, “Fair Value Measurements and Disclosures,” which defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A three-level fair value hierarchy prioritizes the inputs used to measure fair value. The hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

Level 1- Observable inputs such as unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2- Observable inputs (other than Level 1 quoted prices) such as quoted prices active markets for similar assets or liabilities, quoted prices in markets that are not active for identical or similar as or liabilities, or other inputs that are observable or can be corroborated by observable market data.

Level 3- Inputs are unobservable inputs which reflect management’s assumptions based on the best available information.

The Company considers the recorded value of its financial assets and liabilities, which consist primarily of cash and cash equivalents, accounts receivable, loans receivable, prepaid expenses and other current assets, short-term investment, deferred revenue, accrued and other liabilities, taxes payable and due to related party to approximate the fair value of the respective assets and liabilities at March 31, 2018 and December 31, 2017 based upon the short-term nature of the assets and liabilities.

Revenue recognition

The Company adopted Accounting Standards Codification (“ASC”) 606 in the first quarter of 2018 using the modified retrospective approach. The adoption of this standard did not have a material impact on the Company’s condensed consolidated financial statements, no adjustments to opening retained earnings were made as of January 1, 2018 as the Company’s revenue was recognized based on the amount of consideration expects to receive in exchange for satisfying the performance obligations.

ASC 606, Revenue from Contracts with Customers, establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services to customers. The core principle requires an entity to recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration that it expects to be entitled to receive in exchange for those goods or services recognized as performance obligations are satisfied.

| 22 |

ASC 606 requires the use of a new five-step model to recognize revenue from customer contracts. The five-step model requires that the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation. The application of the five-step model to the revenue streams compared to the prior guidance did not result in significant changes in the way the Company records its revenue. The Company has assessed the impact of the guidance by reviewing its existing customer contracts and current accounting policies and practices to identify differences that will result from applying the new requirements, including the evaluation of its performance obligations, transaction price, customer payments, transfer of control and principal versus agent considerations. Based on the assessment, the Company concluded that there was no change to the timing and pattern of revenue recognition for its current revenue streams in scope of Topic 606 and therefore there was no material changes to the Company’s consolidated financial statements upon adoption of ASC 606.

The Company’s revenue is recognized when performance obligations under the terms of a contract with a customer are satisfied and promised services have been rendered to the customers. Persuasive evidence of an arrangement is demonstrated via service contract and invoice; and the sales price to the customer is fixed upon acceptance of the contract and there is no separate rebate, discount, or volume incentive. The Company recognizes revenue when promised services are rendered and collectability of payment is reasonably assured.

The Company currently generates its revenue from the following main sources:

● Revenue from membership fee

The Company develops and attracts corporate enterprises to become members and join in the Company’s service platform www.aeexotcmarkets.com. To become a member, customer needs to pay a one-time non-refundable registration fee first. The Company recognizes revenue from membership fee when it posts member’s information and profiles on its platform www.aeexotcmarkets.com, which enables the member’s corporate information and specific needs exposed to the public.

● Revenue from consulting services

The Company also provides various consulting services to its members, especially to those who have the intention to be publicly listed in the stock exchanges in the United States and other countries. The Company categorizes its consulting services into three Phases:

Phase I consulting services primarily include due diligence review, market research and feasibility study, business plan drafting, accounting record review, and business analysis and recommendations etc. Management estimates that Phase I normally takes around three months to complete based on its past experiences.

Phase II consulting services primarily include reorganization, pre-listing education and tutoring, talent search, legal and audit firm recommendation and coordination, VIE contracts and other public-listing related documents review, merger and acquisition planning, investor referral and pre-listing equity financing source identification and recommendation, independent directors and audit committee candidates recommendation etc. Management estimates that Phase II normally takes about eight months to complete based its past experiences.

Phase III consulting services primarily include shell company identification and recommendation for customers expecting to become publicly listed through reverse merger transaction; assistance in preparation of customers’ registration statement under IPO transactions or Form 8-K under reverse merger transactions; assistance in answering comments and questions received from regulatory agencies etc. Management believes it is very difficult to estimate the timing of this phase of service as the completion of Phase III services is not within the Company’s control.

Each phase of consulting services are standalone and fees associated with each phase are clearly identified in service agreements. Revenue from providing Phase I and Phase II consulting services to customers is recognized ratably over the estimated completion period of each phase. Revenue from providing Phase III consulting services to customers is recognized upon completion of reverse merger transaction or IPO transaction, which is evidenced by filing of 8-K for reverse merger transaction or receipt of effective notice from regulatory agencies for IPO transaction. Revenue that has been billed and not yet recognized is reflected as deferred revenue on the balance sheet.

| 23 |

Depending on the complexity of the underlying service arrangement and related terms and conditions, significant judgments, assumptions and estimates may be required to determine when substantial delivery of contract elements has occurred, whether any significant ongoing obligations exist subsequent to contract execution, whether amounts due are collectible and the appropriate period or periods in which, or during which, the completion of the earnings process occurs. Depending on the magnitude of specific revenue arrangements, adjustment may be made to the judgments, assumptions and estimates regarding contracts executed in any specific period.