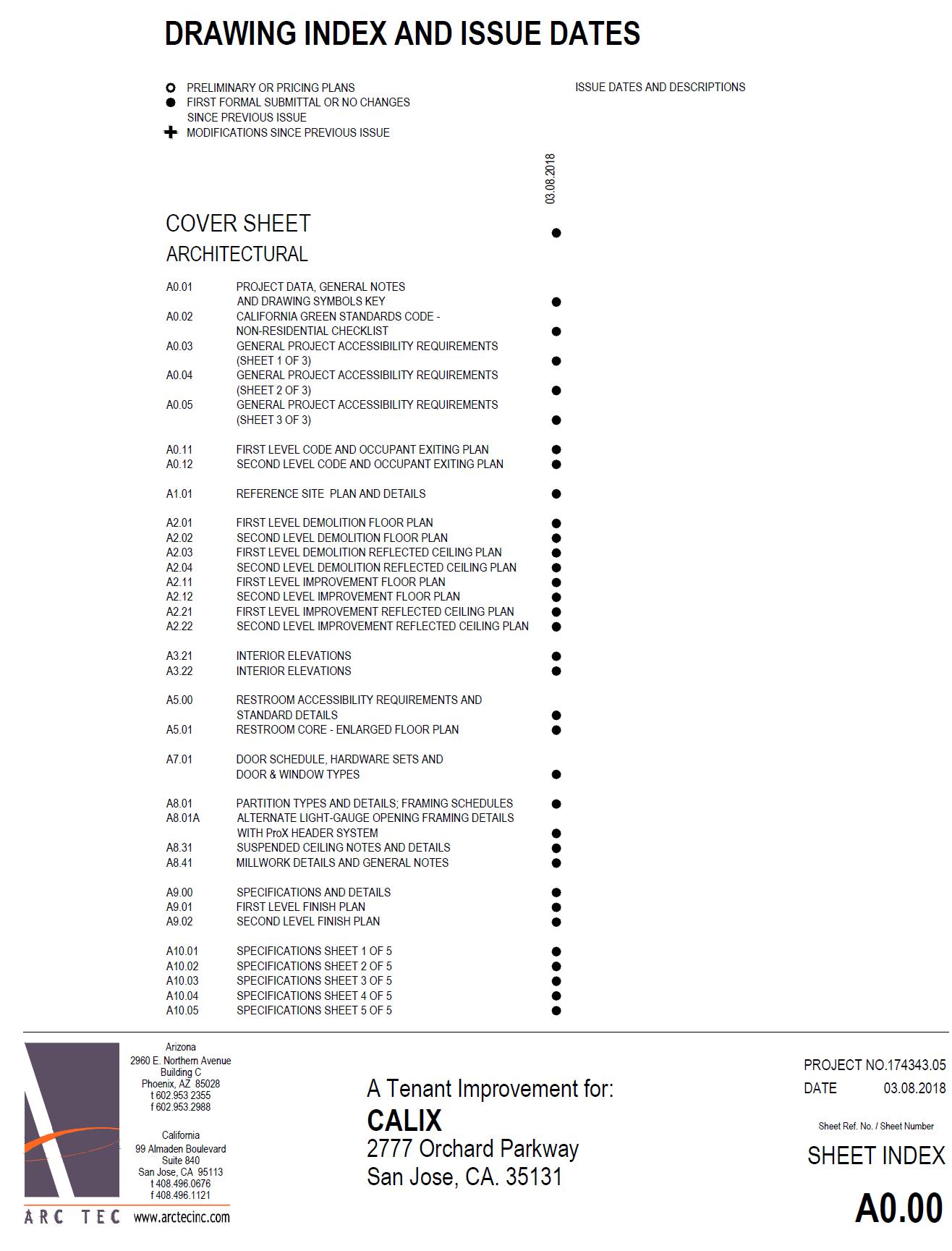

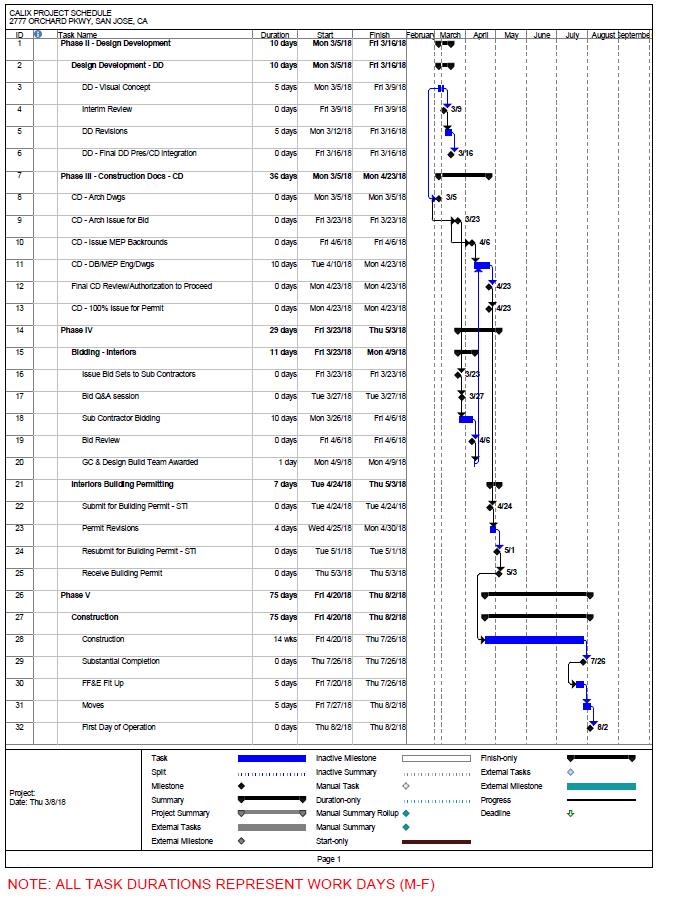

Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - CALIX, INC | calx_18q1ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - CALIX, INC | calx_18q1ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - CALIX, INC | calx_18q1ex311.htm |

| 10-Q - 10-Q - CALIX, INC | calx_18q1form10-q.htm |

Exhibit 10.2

NET LEASE AGREEMENT

(2777 Orchard Parkway, San Jose, California)

For and in consideration of the rentals, covenants, and conditions hereinafter set forth, Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the following described Premises for the term, at the rental and subject to and upon all of the terms, covenants and agreements set forth in this Net Lease Agreement (“Lease”):

1. Summary of Lease Provisions.

1.1 Tenant: Calix, Inc., a Delaware corporation (“Tenant”).

1.2 Landlord: Orchard Parkway San Jose, LLC, a California limited liability company (“Landlord”).

1.3 Effective Date: March 9, 2018.

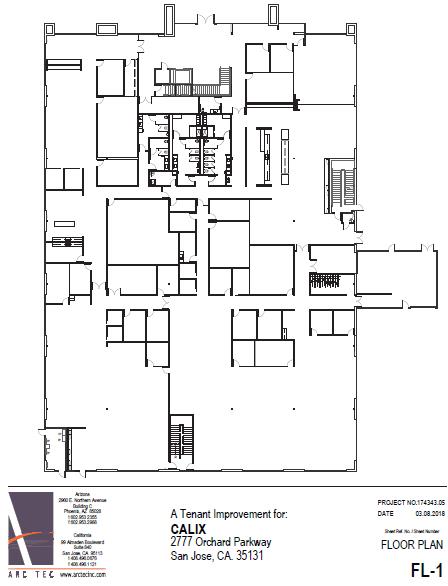

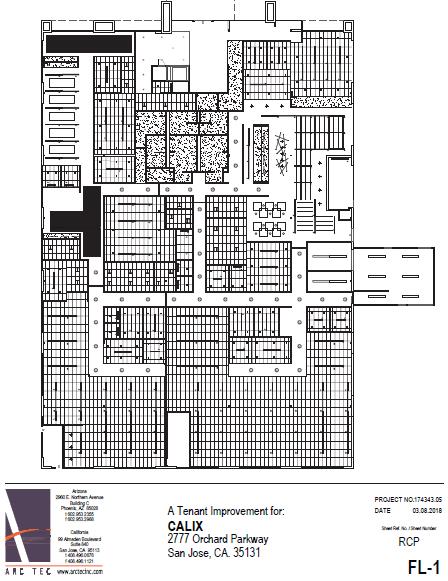

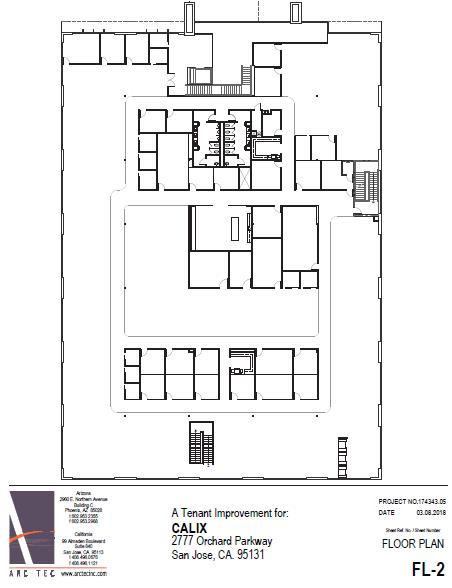

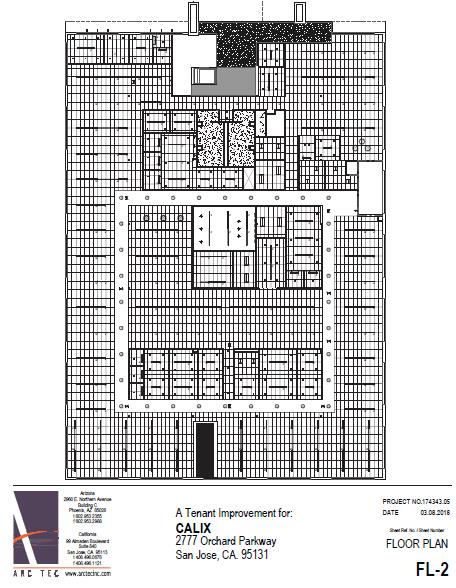

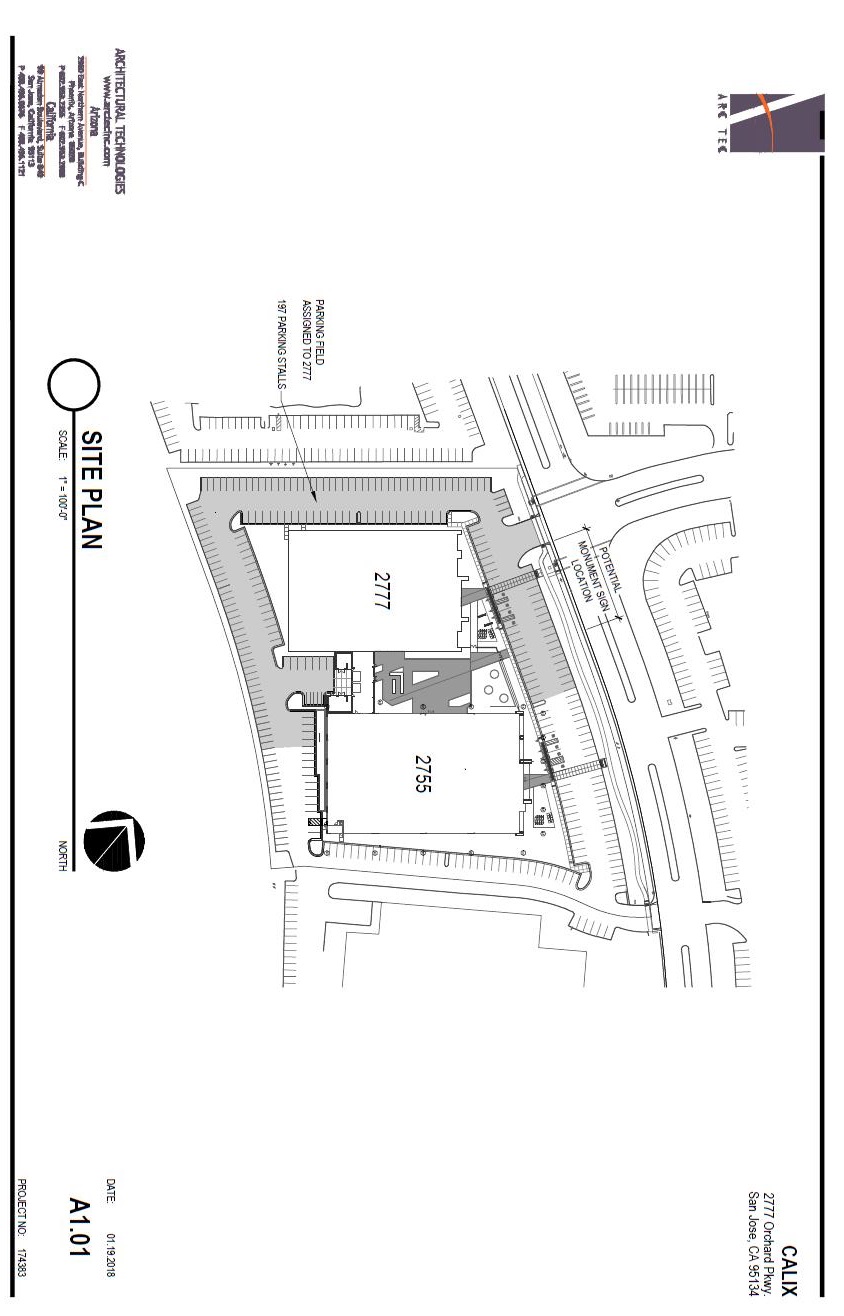

1.4 Premises/Building: That certain space shown cross-hatched (or otherwise identified) on the floor plan attached hereto as Exhibit A, consisting of approximately sixty-four thousand nine hundred ninety-one (64,991) rentable square feet, comprising all of the rentable area of that certain building commonly known as 2777 Orchard Parkway, San Jose, California (“Building”), the location of which Building is shown (or otherwise identified) on the site plan attached hereto as Exhibit B. The Building constitutes a portion of the “Project” described in Paragraph 2.1. (Paragraph 2.1)

1.5 Lease Term: Eighty-seven (87) months (plus the partial month following the Commencement Date if such date is not the first day of a month), unless sooner terminated pursuant to the terms of this Lease. If the Commencement Date is other than the first day of a calendar month, the first month of the Lease Term shall include the remainder of the calendar month in which the Commencement Date occurs plus the first full calendar month thereafter, provided, however, that the inclusion of any partial month in the first full calendar month shall not entitle Tenant to any additional free base Rent. Any free base Rent shall be applied on a daily basis so that Tenant does not receive additional free rent if the first month includes a full calendar month plus any partial month. Subject to the terms and conditions of Paragraph 1.8 below, the base Rent payable by Tenant for the first three (3) full calendar months (and not including any partial month included as part of the first month) of the Lease Term shall be conditionally abated. (Paragraph 3)

1.6 Commencement Date: August 1, 2018, subject to the provisions of Paragraph 3 below. (Paragraph 3)

1.7 Ending Date: The last day of the eighty-seventh (87th) full calendar month following the Commencement Date, unless sooner terminated pursuant to the terms of this Lease. (Paragraph 3)

1

1.8 | Rent: During the Lease Term, Tenant shall pay Rent for the Premises to Landlord in accordance with the schedule set forth immediately below: |

Lease Months During Term | Monthly Rent | Monthly Rental Rates Per Rentable Square Foot (NNN) |

01- 03 | $0.00* | $0.00* |

04-15 | $175,475.70 | $2.70/RSF |

16-27 | $180,674.98 | $2.78/RSF |

28-39 | $185,874.26 | $2.86/RSF |

40-51 | $191,723.45 | $2.95/RSF |

52-63 | $197,572.64 | $3.04/RSF |

64-75 | $203,421.83 | $3.13/RSF |

76-87 | $209,271.02 | $3.22/RSF |

*The Rent payable during each of the first three (3) full calendar months of the Lease Term is actually One Hundred Seventy-five Thousand Four Hundred Seventy-five and 70/100 Dollars ($175,475.70) per month; however, Landlord agrees that such monthly Rent during the first three (3) full months (not including any partial month included in the first month of the Lease Term if the Commencement Date is not the first day of a month) of the Lease Term shall be abated so long as there is no Default by Tenant beyond any applicable notice and cure period for which Landlord terminates this Lease in accordance with its terms as a result thereof. In the event there is a Default by Tenant beyond any applicable notice and cure period for which Landlord terminates this Lease in accordance with its terms as a result thereof, then the un-amortized portion of the abated Rent, and, if applicable, Converted Amount (as defined in the following grammatical paragraph) (which abated Rent and Converted Amount shall be amortized over a period of eighty-seven (87) months) shall become immediately due and payable following written demand of Landlord and Landlord shall be entitled to include such un-amortized portion of the abated Rent and Converted Amount in the amount of rentals that it is otherwise entitled to recover from Tenant under Paragraph 14.2.1; provided, however, that Landlord shall not be entitled to recover such unamortized abated Rent and Converted Amount to the extent that such recovery would be duplicative of amounts that Landlord is otherwise entitled to recover pursuant to California Civil Code §1951.2 and/or §1951.4, as applicable. Tenant’s obligation under this Lease to pay Tenant’s percentage share of Operating Expenses shall commence as of the Commencement Date of this Lease (or, if applicable, the commencement of the Beneficial Occupancy Period described in Paragraph 3.4 below) and shall not be conditionally abated as provided above.

Tenant shall have the one-time right, upon written notice (“Conversion Notice”) given to Landlord on or before the Commencement Date (time being of the essence), to “convert,” as contemplated in this grammatical paragraph below, a portion of the abated Rent described in the immediately-preceding grammatical paragraph, in an amount not

2

to exceed One Hundred Eighty Thousand Dollars ($180,000.00) (such amount being the “Converted Amount Maximum”), to defray any Change Order Costs and/or the cost of performing any Extra Work (both as defined in the Improvement Agreement attached hereto as Exhibit C (the “Improvement Agreement”)). The amount that Tenant elects to convert, if any, shall be set forth in the Conversion Notice (any such amount, subject to the Converted Amount Maximum, being the “Converted Amount”). If Tenant timely delivers a Conversion Notice in accordance with the terms and conditions of this grammatical paragraph above, then: (A) the Converted Amount shall be made available by Landlord to defray any Change Order Costs and/or the costs associated with any Extra Work; and (B) the last occurring installment(s) of abated base Rent shall be reduced, subject to any applicable proration, by the amount equal to the Converted Amount. Solely for purposes of illustration, if Tenant elects to use the Converted Amount Maximum, then: (x) Tenant shall be deemed to have converted the entire third installment of abated base Rent (i.e., One Hundred Seventy-five Thousand Four Hundred Seventy-five and 70/100 Dollars ($175,475.70)), and a portion of the second installment of abated base Rent, in an amount equal to Four Thousand Five Hundred Twenty-four and 30/100 Dollars ($4,524.30); (y) the abated base Rent shall be reduced by such Converted Amount; and (z) Tenant shall pay, on the first (1st) day of the third full calendar month of the Lease Term, (i) the monthly installment of Rent due and owing for the third full calendar month of the Lease Term (i.e., One Hundred Seventy-five Thousand Four Hundred Seventy-five and 70/100 Dollars ($175,475.70)), plus (ii) the amount of Four Thousand Five Hundred Twenty-four and 30/100 Dollars ($4,524.30), with the result that the monthly installments of base Rent shall be abated for only the first full calendar month, and a portion of the second full calendar month (but no portion of the third full calendar month) of the Lease Term.

Concurrently with the execution of this Lease, Tenant shall pay to Landlord the sum of $175,475.70 which shall be credited against the first full month’s Rent payable hereunder.

1.9 Use of Premises: General office, research and development and any other legally permitted uses so long as the Premises are used in each case in compliance with zoning ordinances and other applicable Laws (Paragraph 6)

1.10 Tenant’s percentage share of Operating Expenses: One hundred percent (100.00%) with respect to the Building and sixty-four and eleven one hundredths percent (64.11%) with respect to the Project (Paragraph 12)

1.11 Letter of Credit: Six Hundred Twenty-seven Thousand Eight Hundred Thirteen Dollars and 06/100 Dollars ($627,813.06) (Paragraph 5)

1.12 Addresses for Notices:

To Landlord: Orchard Parkway San Jose, LLC,

c/o South Bay Development Company

1690 Dell Avenue

Campbell, CA 95008

Attn: Scott Trobbe

With a courtesy copy to: Berliner Cohen, LLP

3

Ten Almaden Boulevard, Eleventh Floor

San Jose, CA 95113

Attn: Harry A. Lopez

To Tenant: Calix, Inc.

1035 N. McDowell Boulevard,

Petaluma, CA 94954

Attn: Jim Sanfillippo /Facilities Department

1035 N. McDowell Boulevard,

Petaluma, CA 94954

Attn: Jim Sanfillippo /Facilities Department

With a courtesy copy to:

Calix, Inc.

2777 Orchard Parkway

2777 Orchard Parkway

San Jose, CA 95131

Attn: General Counsel

Attn: General Counsel

CalixLegal@calix.com

1.13 Right to Use Parking Spaces: All of the parking spaces (i.e., one hundred ninety-seven (197) spaces) within the portion of the Common Area delineated as the “Tenant Parking Area” on the site plan attached hereto as Exhibit B (“Tenant Parking Area”). (Paragraph 11.2).

1.14 Summary Provisions in General. Parenthetical references in this Paragraph 1 to other paragraphs in this Lease are for convenience of reference, and designate some of the other Lease paragraphs where applicable provisions are set forth. All of the terms and conditions of each such referenced paragraph shall be construed to be incorporated within and made a part of each of the above referring Summary of Lease Provisions. In the event of any conflict between any Summary of Lease Provision as set forth above and the balance of the Lease, the latter shall control.

2. Property Leased.

2.1 Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord upon the terms and conditions herein set forth, those certain premises (“Premises”) referred to in Paragraph 1.4 above, consisting of the entire rentable area of the Building, and shown cross-hatched on the floor plan attached hereto as Exhibit A. In addition, Tenant shall have such rights in and to the Common Area (defined in Paragraph 11.1 below) as are more fully described in Paragraph 11.1 below.

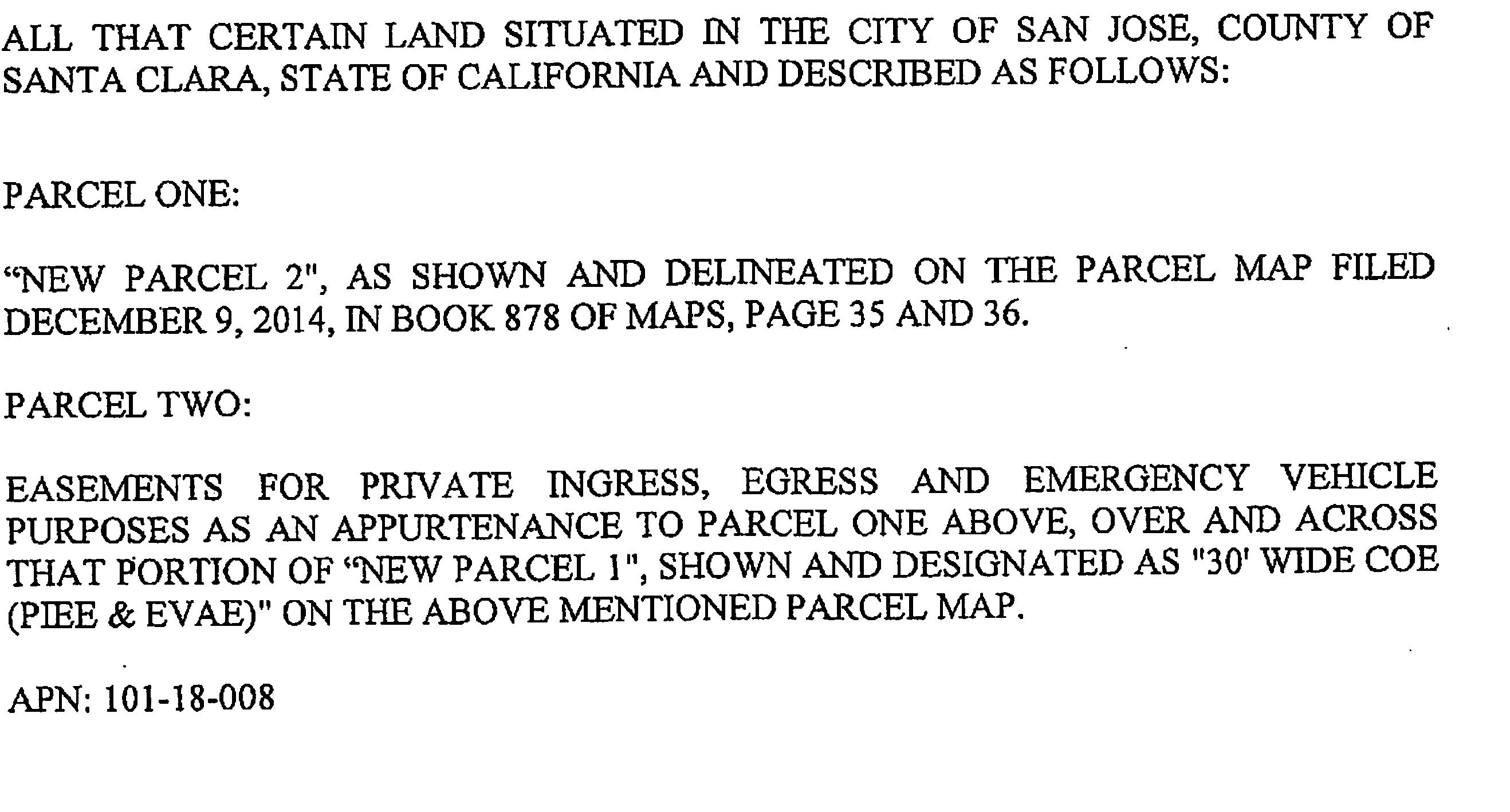

The Building (i.e., the building in which the Premises are located) is commonly known as 2777 Orchard Parkway, San Jose, California. The “Land” shall mean and refer to all of the real property described on Exhibit F attached hereto. Any reference in this Lease to the “Parcel” shall be deemed a reference to the Land. The Land, Building, the adjacent building, consisting of approximately thirty-six thousand three hundred eighty-three (36,383) rentable square feet, commonly known as 2755 Orchard Parkway (the “2755 Building”), and any other building(s) or improvement(s) now or hereafter located on the Land are referred to herein collectively as the “Project.” Landlord and Tenant agree that all measurements of area contained in this Lease, including, without limitation, the size of the Premises, Building and Project, are an approximation which Landlord and Tenant agree are reasonable. All such approximate measurements of area contained in this Lease also are conclusively agreed to be correct and

4

binding upon the parties, and any subsequent determination that the area is more or less than shown in this Lease shall not result in a change in any way in the computations of Rentals.

Subject to Tenant’s exclusive right to use the Tenant Parking Area in accordance with the terms and conditions of Paragraph 11.2 below, Landlord reserves the right to grant to tenants of the Project, and to the agents, employees, servants, invitees, contractors, guests, customers and representatives of such tenants or to any other user authorized by Landlord, the nonexclusive right to use the Land for pedestrian and vehicular ingress and egress and vehicular parking.

2.2 Improvements. The leasehold improvements to be constructed by Landlord for Tenant’s use in the Premises are set forth in detail in the Improvement Agreement and such leasehold improvements are collectively referred to therein as the “Tenant Improvement Work”. The Improvement Agreement is incorporated herein by reference. Landlord and Tenant each agree that it is bound by the terms and conditions of the Improvement Agreement and that it shall timely perform its respective obligations thereunder. If a transfer of Landlord’s interest in this Lease (other than as a result of a foreclosure) occurs prior to the substantial completion of the Tenant Improvement Work, Landlord shall cause the transferee thereunder to expressly assume Landlord’s obligation to complete such Tenant Improvement Work pursuant to its express obligations under the Improvement Agreement accruing after the date of such transfer. Except as otherwise expressly provided in this Lease or in the Improvement Agreement, Landlord shall not be obligated to construct or install any leasehold improvements in, on or around the Premises, Building or Project or to provide any tenant improvement allowance to Tenant.

Landlord represents and warrants the following to Tenant, as of the Effective Date:

(i) | Landlord has full power, authority and legal right to (1) execute and deliver this Lease and (2) perform and observe the express provisions of this Lease on the part of the “Landlord” to be performed or observed; |

(ii) | There are no conditions or circumstances, financial or otherwise, that will materially impair Landlord’s ability to perform its obligations under this Lease, including the Improvement Agreement; |

(iii) | Landlord’s execution, delivery, performance and observance of the provisions of this Lease will not result in a breach or violation of (1) any applicable law, (2) any provision of Landlord’s organizational documents, (3) any court order, judgement or decree, or (4) any material agreement or instrument to which Landlord is a party; and |

(iv) | No additional consent, approval or authorization is required for Landlord to enter into, deliver or perform its obligations under this Lease. |

2.3 Acceptance of Premises; Existing Violations; Warranty Period. By taking possession of the Premises, Tenant shall be deemed to have accepted the Premises as being in good and sanitary order, condition and repair and to have accepted the Premises in their condition existing as of the date Tenant takes possession of the Premises, subject to all applicable laws, covenants, conditions, restrictions, easements and other matters of public record and the reasonable rules and regulations from time to time promulgated by Landlord governing the use of any portion of the Project and further, to have accepted tenant improvements to be constructed by Landlord pursuant to the terms of the Improvement Agreement as being completed in accordance with the plans and specifications for such improvements subject only to completion of items on Landlord’s punch list, if applicable.

5

Landlord will use commercially reasonable efforts to complete all punch list items within thirty (30) days of the date of the punch list. Tenant acknowledges that, except as otherwise expressly provided in this Lease, neither Landlord nor any of Landlord’s agents, employees, affiliates, or property manager have made any representation or warranty (express or implied) as to the suitability of the Premises for the conduct of Tenant’s business, the condition of the Building or Premises, the compliance of the Premises with any codes, laws, ordinances, rules or regulations, or the use or occupancy which may be made thereof and Tenant has independently investigated and is satisfied that the Premises are suitable for Tenant’s intended use and that the Building and Premises meet all governmental requirements for such intended use.

Notwithstanding the foregoing, Tenant shall in no event be obligated to correct (and/or incur any cost in connection with the correction of) any Existing Violations (as defined below), to the extent such correction of Existing Violations was required to be performed with respect to the Base Building (as defined below), and/or with respect to the Tenant Improvement Work, in connection with the performance of the Tenant Improvement Work (i.e., at the time such Tenant Improvement Work was performed) pursuant to the terms and conditions of the Improvement Agreement. To the extent the (a) Building Systems and/or Building Structure (both as defined in the following grammatical paragraph) (for purposes hereof, collectively, the “Base Building”) and/or (b) the Tenant Improvement Work, fail(s) to comply with any applicable Laws (as defined in Paragraph 6.1 below) (including the Americans with Disabilities Act of 1990, as amended (“ADA”)) that were in effect with respect to the Base Building, and/or with respect to the Tenant Improvement Work, at the time the Tenant Improvement Work was performed, in all cases as then locally enforced and interpreted, and in all cases without regard to Tenant’s specific use of the Premises, then, solely to the extent any work (including any ADA work) relating to such non-compliance was required to be performed (or would have then been required to be performed had the violation been known by the applicable governmental authority) at the time the Tenant Improvement Work was performed (if applicable, any such required work being “Existing Violations”), then Landlord shall perform such work as may be necessary (in Landlord’s reasonable discretion) to correct any such Existing Violations. Notwithstanding the foregoing, (i) Landlord shall have the right, in Landlord’s reasonable discretion, and at Landlord’s sole cost, to contest the need to perform any work relating to such Existing Violations, including, without limitation, the right to apply for and obtain a waiver or deferment of compliance, the right to assert any and all defenses allowed by law and the right to appeal any decisions, judgments or rulings to the fullest extent permitted by law and (ii) Tenant’s right to enforce Landlord’s obligation to perform (or cause to be performed) any such work relating to Existing Violations shall be limited to circumstances in which non-compliance would (a) materially impair the safety of Tenant’s employees or create a health hazard for Tenant’s employees, (b) materially impair Tenant’s use and occupancy of, or access to, the Premises (or any material portion thereof) for typical and customary general office purposes, and/or (c) impose liability upon Tenant under applicable Laws.

In addition, Landlord hereby agrees, represents and warrants that, as of the Commencement Date (as defined in Paragraph 3.1 below) (“Warranty Commencement Date”) all of the following shall be in good working order and condition (“good working order and condition” shall mean that (i) with respect to sub-clause (y) below, the items in question are operating in accordance with the specifications therefor for normal and customary general office use (and without regard to Tenant’s particular use of the Premises) and (ii) with respect to sub-clauses (x) and (z) below, the items in question comply with the plans and specifications therefor, a copy of which has been provided to Tenant): (x) the structural elements of the Building, including the roof structure (and, for purposes hereof, the roof membrane), foundation, slabs, load-bearing walls, columns, shafts, windows, window frames and all exterior and common area glass and cladding (collectively, “Building Structure”); (y) the mechanical, electrical, plumbing, sanitary sewer, heating, ventilation and air conditioning, fire, life-safety and other systems in and serving the Building (collectively, “Building Systems”); and (z) the Common Area (as defined in Paragraph 11.1 below) (including the redwood trees located along the front of the Project (collectively, the “Redwood Trees”) and other landscaped

6

areas, and the Tenant Parking Area constituting a portion of such Common Area). Commencing upon the Warranty Commencement Date and continuing for a period of three hundred sixty (360) days after such Warranty Commencement Date (such period being the “Warranty Period”), except to the extent caused by or resulting from Tenant’s fault, neglect or misuse, Landlord shall, as Tenant’s sole and exclusive remedy, as soon as reasonably practicable following Landlord’s receipt of Tenant’s reasonably-detailed written notice during the Warranty Period (time being of the essence), perform (or cause to be performed) the repair, replacement, maintenance, adjustment, and/or other work reasonably necessary to address and/or correct, at Landlord’s sole cost and expense, any failure(s) of any of the items described in sub-clauses (x), (y) and (z) of the immediately preceding sentence to be in good working order and condition as of the Warranty Commencement Date (including, to the extent necessary (in the reasonable discretion of Landlord and Tenant), the removal and/or replacement of the Redwood Trees).

2.4 Certified Access Specialist. For purposes of California Civil Code Section 1938, Landlord hereby discloses to Tenant that, as of the Effective Date, to Landlord’s actual knowledge, the Premises have not undergone inspection by a Certified Access Specialist (“CASp”). Pursuant to California Civil Code Section 1938(e), Landlord hereby further discloses to Tenant the following: “A Certified Access Specialist (CASp) can inspect the subject premises and determine whether the subject premises comply with all of the applicable construction-related accessibility standards under state law. Although state law does not require a CASp inspection of the subject premises, the commercial property owner or lessor may not prohibit the lessee or tenant from obtaining a CASp inspection of the subject premises for the occupancy or potential occupancy of the lessee or tenant, if requested by the lessee or tenant. The parties shall mutually agree on the arrangements for the time and manner of the CASp inspection, the payment of the fee for the CASp inspection, and the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the premises.” Notwithstanding the foregoing and/or anything to the contrary contained in this Lease, Landlord and Tenant hereby agree and acknowledge that, in the event Tenant desires to obtain a CASp inspection, then:

(x) Tenant shall provide Landlord with no less than five (5) business days’ prior written notice and, upon receipt of such notice, Landlord shall have the right to, among other things, have one (1) or more representatives present during such inspection.

(y) Tenant hereby agrees and acknowledges that it shall (x) provide Landlord with a copy of any and all findings, reports and/or other materials (collectively, the “CASp Report”) provided by the CASp immediately following Tenant’s receipt thereof, (y) at all times maintain (and cause to be maintained) the CASp Report and its findings (and any and all other materials related thereto) confidential and (z) pay for the CASp inspection and CASp Report at Tenant’s sole cost and expense. If Tenant receives a disability access inspection certificate, as described in subdivision (e) of California Civil Code Section 55.53, in connection with or following any CASp inspection undertaken on behalf, or for the benefit, of Tenant, then Tenant shall cause such certificate to be provided immediately to Landlord.

(z) If the CASp Report identifies any violation(s) of applicable construction-related accessibility standards (“CASp Violation(s)”), Tenant shall immediately provide written notice to Landlord of any and all such CASp Violation(s) (any repairs, modifications and/or other work necessary to correct such CASp Violation(s) being collectively referred to herein as the “CASp Work”). If any CASp Violation(s) are identified in such CASp Report, then (i) to the extent such CASp Violation(s) constitute work that Landlord was required to perform in connection with the Tenant Improvement Work in order to comply with applicable Laws (including, but not limited to, the Americans with Disabilities Act of 1990, as amended and locally enforced) in effect as of the date that the Tenant Improvement Work was substantially completed (in all cases without regard to Tenant’s particular use of the Premises, and/or any alterations, additions and/or improvements installed by or on behalf of Tenant),

7

then Landlord shall, at Landlord’s sole cost and expense, perform, or cause to be performed any such CASp Work relating to the Tenant Improvement Work or (ii) with respect to any and all other CASp Violation(s) identified in such CASp Report, including, without limitation, any and all such CASp Violations relating to any alterations, additions and/or improvements installed by or on behalf of Tenant, Tenant shall, at Tenant’s sole cost and expense, perform, or cause to be performed, the CASp Work relating thereto. The party that is required to perform the CASp Work in question (the “Performing Party”) shall commence (or cause the commencement of) such CASp Work no later than fifteen (15) business days after Landlord’s receipt of the CASp Report in accordance with the terms and conditions of this Lease (including, without limitation, Paragraph 13 below). The Performing Party shall diligently prosecute (or cause to be diligently prosecuted) to completion all CASp Work which is the obligation of such Performing Party in a lien free, good and workmanlike manner, and, upon completion, obtain an updated CASp Report showing that the Premises then comply with all applicable construction-related accessibility standards. Any and all cost and expense associated with the CASp Work and/or the updated CASp Report (which the Performing Party shall provide to the other party immediately upon the Performing Party’s receipt thereof) shall be at the Performing Party’s sole cost and expense.

Without limiting the generality of the foregoing, Tenant hereby agrees and acknowledges that: (i) Tenant assumes all risk of, and agrees that Landlord shall not be liable for, any and all loss, cost, damage, expense and liability (including, without limitation, court costs and reasonable attorneys' fees) sustained as a result of the Premises not having been inspected by a Certified Access Specialist (CASp); and (ii) Landlord may require, as a condition to its consent to any alterations, additions or improvements, that the same be inspected and certified by a Certified Access Specialist (CASp) (following completion) as meeting all applicable construction-related accessibility standards pursuant to California Civil Code Section 55.53.

3. Term.

3.1 Commencement Date. The term of this Lease (“Lease Term”) shall be for the period specified in Paragraph 1.5 above, commencing on the later of (such later date being the “Commencement Date”): (A) August 1, 2018; or (B) the earlier of (i) the date that the Tenant Improvement Work is substantially completed or (ii) the date Tenant occupies the Premises (or any portion thereof) for the conduct of its business operations therein. Such improvements shall be deemed to be substantially completed upon the occurrence of the earlier of the following:

(a) The date on which all improvements to be constructed by Landlord have been substantially completed except for punch list items which do not prevent Tenant from using the Premises for its intended use, and either the appropriate governmental approvals for occupancy of the Premises (which shall include, without limitation, a temporary certificate of occupancy or its equivalent) have been issued or all building permits issued with respect to such improvements have been signed off by the applicable building inspectors; or

(b) The date on which all improvements to be constructed by Landlord would have been substantially completed except for such work as Landlord is required to perform but which is delayed because of any of the following (each, a “Tenant Delay”): (i) fault or neglect of Tenant, its agents, contractors and/or subcontractors (including, without limitation, delays caused by work done on the Premises by Tenant, its agents, contractors and/or subcontractors); (ii) delays caused by change orders requested by Tenant or required because of any errors or omissions in plans submitted by Tenant (except to the extent due to the fault or neglect of Landlord); (iii) such work as Landlord is required to perform but cannot complete until Tenant performs necessary portions of construction work it has expressly elected or is expressly required to do, in each case within the timeframe that Tenant has been expressly provided to complete such construction work; and (iv) any event constituting a Tenant

8

Delay as described in the Improvement Agreement attached hereto as Exhibit C. Notwithstanding the foregoing, no Tenant Delay shall be deemed to have occurred unless and until Landlord shall have sent Tenant a reasonably-detailed notice of the action, inaction or event that constitutes a Tenant Delay and Tenant shall not have cured the same within two (2) business days after Tenant receives such reasonably-detailed notice.

If, pursuant to the express terms and conditions of Paragraph 3.1(b) above, the improvements to be constructed by Landlord are deemed to be substantially completed before such improvements are actually substantially completed, then Tenant acknowledges that: (x) the Commencement Date shall be deemed to have occurred, and therefore Tenant’s obligation to pay Rentals (subject to the conditional abatement of base Rent referred to in Paragraph 1.8 above) shall be deemed to have commenced on such earlier date, and not the date of actual completion of such improvements (but in no event prior to August 1, 2018); (y) the improvements to be constructed by Landlord shall be deemed to be substantially completed one (1) day earlier than the date of actual substantial completion for each day that actual completion is delayed by reason of a Tenant Delay; and (z) as soon as possible following the actual Commencement Date, Landlord shall provide to Tenant a reasonably-detailed statement of the number of days of Tenant Delays, and the conditional abatement of base Rent referred to in Paragraph 1.8 above shall be shortened by the same number of days.

When the Commencement Date and Ending Date become ascertainable, Landlord and Tenant shall specify the same in writing, in the form of the attached Exhibit D, which writing shall be deemed incorporated herein. Tenant’s failure to execute and deliver the letter attached hereto as Exhibit D within ten (10) business days after Tenant receives written request from Landlord to do so (subject to any legitimate disagreement by Tenant with the terms thereof, which both parties shall use reasonable efforts to resolve) shall be a Default by Tenant hereunder. The expiration of the Lease Term or sooner termination of this Lease is referred to herein as the “Lease Termination.”

3.2 Delay of Commencement Date. Landlord shall not be liable for any damage or loss incurred by Tenant for Landlord’s failure for whatever cause to deliver possession of the Premises by any particular date (including the scheduled Commencement Date (i.e., August 1, 2018)), nor shall this Lease be void or voidable on account of such failure to deliver possession of the Premises to Tenant, on or before August 1, 2018, or any other date, with the Tenant Improvement Work substantially completed. Notwithstanding the foregoing, if the Commencement Date has not occurred on or before the later of (i) August 1, 2018 or (ii) the date that is one hundred twelve (112) days after the date that Landlord’s contractor shall have obtained any and all building permit(s) and/or approval(s) deemed necessary or desirable by Landlord to commence the performance of the Tenant Improvement Work (the expiration of such one hundred twelve (112) day period being the “One-For-One Rent Credit Trigger Date”) for any reason other than Tenant Delay and/or any Force Majeure Delay (as defined in Paragraph 7.1 of the Improvement Agreement) (it being the intent of the parties that such One-For-One Rent Credit Trigger Date shall be extended one (1) day for each day of any such Tenant Delay and/or Force Majeure Delay), then, as Tenant’s sole and exclusive remedy as a result thereof, Tenant shall receive a credit against the Rent due with respect to the Premises (any such amount being the “One-for-One Rent Credit”), which One-for-One Rent Credit shall be in the form of an extension of the conditional abatement of base Rent referred to in Paragraph 1.8 above, equal to one (1) day for each day that shall have elapsed between the One-For-One Rent Credit Trigger Date and the Commencement Date.

3.3 FF&E Installation Period. Prior to the Commencement Date of the Lease, Tenant and its approved contractors shall have the right to enter the Premises solely to (i) install Tenant’s furniture and furnishings and Tenant’s telephone and telecommunication wiring and cabling in the Premises, and (ii) subject to the provisions of Paragraph 13 below, construct or install in the Premises (a) the equipment, and related wiring and cabling, necessary to provide an uninterrupted power supply (also known as a “UPS” equipment) to all server room circuits

9

located in the Premises and/or (b) a Tenant Security System (as defined in Paragraph 13 below); provided that such entry or performance of work shall not delay or interfere in any manner with the construction of any remaining improvements required to be constructed by Landlord in the Premises pursuant to Exhibit C attached hereto. Any entry into the Premises by Tenant, its agents, contractors, and employees, prior to the Commencement Date of the Lease shall be at the sole risk of Tenant, and Tenant hereby releases Landlord, its agents, contractors, subcontractors and employees, from any and all liability, cost, damage, lien, action, cause of action, judgment, expense, and claim for injury (including bodily injury, death, or property damage) incurred or suffered by Tenant in or about the Premises during the construction of any improvements in the Premises by Landlord or its contractors or subcontractors prior to the Commencement Date of this Lease. If Tenant or any of its agents, employees or contractors enter the Premises prior to the Commencement Date solely for the purposes specifically described in this Paragraph 3.3 above, then such entry shall be upon all the terms and conditions of this Lease (including, without limitation, Tenant’s obligations regarding indemnity and insurance), except that Tenant shall not be obligated to pay monthly Rent or Tenant’s percentage share of Operating Expenses prior to the Commencement Date. The preceding to the contrary notwithstanding, if any work or other activities in the Premises by Tenant or any of its agents, employees, contractors or other representatives prior to the Commencement Date would actually and materially interfere with or delay the completion of the work to be performed by Landlord pursuant to Exhibit C attached hereto, Tenant shall, upon Landlord’s request, cease, or cause to be ceased, such work or activities, as the case may be, until such time that Tenant may resume its work or activities without so interfering with Landlord’s or its contractors’ or subcontractors’ completion of the work required to be performed by Landlord pursuant to such Exhibit C.

3.4 Beneficial Occupancy Period. If the Tenant Improvement Work is substantially complete before August 1, 2018, then (A) during the period elapsing between such date that the Tenant Improvement Work is substantially completed and July 31, 2018 (such period, if applicable, being the “Beneficial Occupancy Period”), Tenant shall be entitled, in Tenant’s sole and absolute discretion, to conduct business operations from the Premises and (B) the Commencement Date shall be conclusively deemed to be August 1, 2018. If Tenant elects to conduct business operations prior to August 1, 2018 in accordance with the immediately-preceding sentence, other than the obligation to pay Rent with respect to the Premises pursuant to Paragraph 1.8 of this Lease, during such Beneficial Occupancy Period, all of Tenant’s obligations hereunder with respect to the Premises (including, without limitation, Tenant’s obligation to pay (x) Tenant’s percentage share of Operating Expenses, (y) the cost and expense of any Services (as defined in Paragraph 9 below) and (z) any and all other Additional Rent) shall apply during such Beneficial Occupancy Period.

4. Rent.

4.1 Rent. Tenant shall pay to Landlord as rent for the Premises (“Rent”), in advance, on the first day of each calendar month, commencing on the Commencement Date (subject to the conditional Rent abatement referred to in Paragraph 1.8 above) and continuing throughout the Lease Term the Rent set forth in Paragraph 1.8 above. Rent shall be prorated, based on thirty (30) days per month, for any partial month during the Lease Term. Rent shall be payable without deduction, offset, prior notice or demand in lawful money of the United States to Landlord at the address herein specified for purposes of notice or to such other persons or such other places as Landlord may designate in writing.

4.2 Late Charge. Tenant hereby acknowledges that late payment by Tenant to Landlord of Rent will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult to ascertain. Such costs include, but are not limited to, processing and accounting charges and late charges which may be imposed on Landlord by the terms of any mortgage or deed of trust covering the Premises. Accordingly,

10

Tenant shall pay to Landlord, as Additional Rent (as defined in Paragraph 4.3 below), without the necessity of prior notice or demand, a late charge equal to five percent (5%) of any installment of Rent or other amount payable by Tenant under this Lease which is not received by Landlord within five (5) business days after the due date for such installment or payment. Notwithstanding the foregoing, Landlord will not assess a late charge until Landlord has given written notice of such late payment for the first late payment in any twelve (12) month period and after Tenant has not cured such late payment within five (5) business days from receipt of such notice. No other notices will be required during the following twelve (12) months for a late charge to be imposed or incurred. The parties hereby agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of late payment by Tenant. In no event shall this provision for a late charge be deemed to grant to Tenant a grace period or extension of time within which to pay any installment of Rent or other sum payable by Tenant to Landlord under this Lease or prevent Landlord from exercising any right or remedy available to Landlord upon Tenant’s failure to pay such installment of Rent or other sum when due, including without limitation the right to terminate this Lease. In the event any installment of Rent or other sum payable by Tenant to Landlord under this Lease is not received by Landlord by the due date for such installment, such installment shall bear interest at the annual rate set forth in Paragraph 34 below, commencing on the date such Rent installment or other sum payable under this Lease is due and continuing until such installment or other sum payable under this Lease is paid in full.

4.3 Additional Rent. All taxes, charges, costs and expenses and other sums which Tenant is required to pay hereunder (together with all interest and charges that may accrue thereon in the event of Tenant’s failure to pay the same), and all damages, costs and reasonable expenses which Landlord may incur by reason of any Default by Tenant shall be deemed to be additional rent hereunder (“Additional Rent”). Additional Rent shall accrue commencing on the Commencement Date. Unless otherwise expressly stated herein, all Additional Rent shall be due and payable by Tenant within thirty (30) days after the date of Landlord’s invoice for the same. In the event of nonpayment by Tenant of any Additional Rent, Landlord shall have all the rights and remedies with respect thereto as Landlord has for the nonpayment of Rent. The term “Rentals” as used in this Lease shall mean Rent and Additional Rent.

5. Letter of Credit. Within five (5) business days after Tenant’s execution of this Lease, Tenant shall deliver to Landlord an irrevocable, unconditional, transferable, standby letter of credit running in favor of Landlord issued by a bank satisfactory to Landlord in its sole and absolute discretion in the amount of Six Hundred Twenty-seven Thousand Eight Hundred Thirteen Dollars and 06/100 Dollars ($627,813.06) (“Letter of Credit Amount”). Tenant’s failure to deliver a letter of credit, in the Letter of Credit Amount, in accordance with the terms and conditions of this Paragraph 5, within such five (5) business day period shall be deemed an automatic “Default by Tenant” (as contemplated in Paragraph 14.1 below). The letter of credit shall be irrevocable for one (1) year and shall provide that it is automatically renewable for one (1) year periods ending not earlier than one hundred twenty (120) days after the expiration of the Lease Term (including, to the extent one or both Option(s) is/are exercised, the applicable Option Term(s) (both as defined in Paragraph 44 below)) without any action whatsoever on the part of Landlord; provided that the issuing bank shall have the right not to renew said letter of credit on written notice to Landlord received by Landlord not less than sixty (60) days prior to the expiration of the then current term thereof (it being understood, however, that the privilege of the issuing bank not to renew said letter of credit shall not, in any event, diminish the obligation of Tenant to maintain such irrevocable letter of credit with Landlord through the date which is sixty (60) days after the date of Landlord’s receipt of such notice). In the event the issuing bank elects not to renew the letter of credit, Tenant shall provide Landlord with a substitute letter of credit which meets all of the criteria contained herein. No fees applicable to the letter of credit shall be charged to Landlord.

The form and terms of the letter of credit shall be acceptable to Landlord in all respects in Landlord’s sole and absolute discretion and shall provide, among other things, in effect that:

11

1. Landlord, or its agent, member, manager, partner or other authorized party shall have the right to draw down an amount up to the face amount of the letter of credit upon the presentation to the issuing bank of a sight draft only in the form attached hereto as Exhibit G and incorporated herein by reference, which sight draft shall include a statement that such amount is due to Landlord or its then lender under the terms and conditions of this Lease.

2. The letter of credit shall permit partial draws, and provide that draws thereunder will be honored upon presentation by Landlord without conditions at a location in Santa Clara County.

3. The letter of credit will be honored by the issuing bank without inquiry as to the accuracy thereof and regardless of whether Tenant disputes the content of such statement.

4. In the event of a transfer of Landlord’s interest in the Lease, Landlord shall have the right to transfer the letter of credit to the transferee and thereupon Landlord shall, without any further agreement between the parties, be released by Tenant from all liability therefor, and it is agreed that the provisions hereof shall apply to every transfer or assignment of said letter of credit to a new Landlord.

If, as a result of any draw on the letter of credit the letter of credit shall be reduced, Tenant shall, within ten (10) business days thereafter, provide Landlord with additional letter(s) of credit in the form required hereunder and issued by a bank acceptable to Landlord in its sole and absolute discretion in an amount equal to the deficiency so that the letter(s) of credit shall be in the aggregate Letter of Credit Amount (i.e., Six Hundred Twenty-seven Thousand Eight Hundred Thirteen Dollars and 06/100 Dollars ($627,813.06)). Tenant’s failure to timely deliver such new letter(s) of credit shall be a Default by Tenant (or default) under this Lease and shall entitle Landlord to draw upon the balance of the letter of credit in full and retain the cash proceeds thereof in accordance with this Paragraph 5. Landlord shall not be required to keep any such amount separate from its general funds and Tenant shall not be entitled to interest on such funds.

If Tenant breaches or fails to perform any obligation or covenant under or of this Lease, including, but not limited to, the payment of monthly Rent or Additional Rent, or if Tenant has filed a voluntary petition (or an involuntary petition has been filed against Tenant) under any chapter of the U.S. Bankruptcy Code, or any similar state law, Landlord may (but shall not be required to) draw upon all or any part of the Letter of Credit and use, apply, or retain all or any part of the cash proceeds thereof for the payment of any sums in default, or to compensate Landlord for any other loss or damage which Landlord may suffer (or that Landlord reasonably estimates it may suffer) by reason of Tenant’s default, Landlord may (but shall not be required to) draw upon all or any part of the letter of credit and use, apply, or retain all or any part of the cash proceeds thereof for the payment of any sums in default, or to compensate Landlord for any other loss or damage which Landlord may suffer by reason of Tenant’s default. So long as Tenant is not in default at the expiration or termination of this Lease, the letter of credit, and/or any cash proceeds thereof, then held by Landlord shall be returned to Tenant (or any assignee of Tenant), not later than thirty (30) days after Tenant (and all persons and entities claiming an interest in the Premises by, under or through Tenant) have vacated the Premises, provided that subsequent to the expiration or earlier termination of this Lease, Landlord may draw upon the letter of credit and retain therefrom sums in default or breach by Tenant under this Lease, and/or amounts to compensate Landlord for any other loss or damage which Landlord may suffer by reason of Tenant’s default or breach, including, without limitation, (a) any and all amounts permitted by California Civil Code Section 1950.7, and (b) such sums as Landlord reasonably estimates will thereafter become due by reason of Tenant’s default or breach, if any, under this Lease. Landlord and Tenant hereby agree that Landlord may, in addition, claim those sums necessary to compensate Landlord for any other foreseeable or unforeseeable loss or damage caused by the act or omission of Tenant or Tenant’s officers, members, partners, agents, employees,

12

independent contractors or invitees or the default of Tenant under this Lease. Without limiting the generality of the preceding sentence, Landlord and Tenant hereby agree that Landlord may, in addition, claim and retain from the cash proceeds of the Letter of Credit those sums necessary to compensate Landlord for any other foreseeable or unforeseeable loss or damage caused by the act or omission of Tenant or Tenant’s officers, agents, employees, independent contractors or invitees or the default of Tenant under this Lease, including, without limitation, the unamortized portion of any leasing commissions and tenant improvement costs (which commissions and tenant improvement costs shall be amortized over the Lease Term) incurred by Landlord in connection with this Lease and any damages to which Landlord is entitled under applicable law (including, without limitation, §1951.2 of the California Civil Code) as a result of Tenant’s default under this Lease. Tenant hereby waives the provisions of California Civil Code § 1950.7, and all other provisions of law now or hereafter in force, that provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant, or to clean the Premises.

Without limiting the generality of the foregoing, if the letter of credit expires earlier than one hundred twenty (120) days after the expiration of the Lease Term (including, to the extent one or both Option(s) is/are exercised, the applicable Option Term(s)), or the issuing bank notifies Landlord that it shall not renew the letter of credit, Landlord will accept a renewal thereof or substitute letter of credit (such renewal or substitute letter of credit to be in effect and delivered to Landlord not later than thirty (30) days prior to the expiration of the letter of credit then held by Landlord), irrevocable and automatically renewable as above provided to one hundred twenty (120) days after expiration of the Lease Term (including, to the extent one or both Option(s) is/are exercised, the applicable Option Term(s)) upon the same terms as the expiring letter of credit or such other terms as may be acceptable to Landlord. Such replacement or substitute letter of credit shall be in a form and issued by a bank meeting the requirements above. However, (a) if the letter of credit is not timely renewed or a substitute letter of credit is not timely received, (b) or if Tenant fails to maintain the letter of credit in the amount and terms set forth in this Paragraph 5, Tenant, at least thirty (30) days prior to the expiration of the letter of credit, or immediately upon its failure to comply with each and every term of this Paragraph 5 must deposit with Landlord a substitute letter of credit in a form and from a bank or other financial institution acceptable to Landlord in its sole and absolute discretion in the Letter of Credit Amount. The letter of credit shall be held subject to and in accordance with, all of the terms and conditions set forth in this Paragraph 5. In the event Tenant does not timely deposit with Landlord the substitute letter of credit, Landlord, or its agent, member, manager, partner or other authorized party may present the current letter of credit to the issuing bank, in accordance with the terms of this Paragraph 5 and the entire sum secured thereby shall be paid to Landlord.

If the bank that issued the letter of credit then held by Landlord enters into any form of regulatory or governmental receivership or other similar regulatory or governmental proceeding, including any receivership instituted or commenced by the Federal Deposit Insurance Corporation (“FDIC”), or is otherwise declared insolvent or downgraded by the FDIC, then Tenant shall deliver to Landlord a substitute letter of credit in the same form and amount of the initial letter of credit and from a banking institution acceptable to Landlord in its sole and absolute discretion within five (5) business days following the date the bank that issued the letter of credit then held by Landlord enters into any form of regulatory or governmental receivership or other similar regulatory or governmental proceeding, including any receivership instituted or commenced by the FDIC, or is otherwise declared insolvent or downgraded by the FDIC. In the event Tenant does not timely deposit with Landlord the substitute letter of credit referred to in the immediately preceding sentence, Landlord, or its agent, member, manager, partner or other authorized party may present the current letter of credit to the issuing bank, in accordance with the terms of this Paragraph 5 and the entire sum secured thereby shall be paid to Landlord.

13

Tenant agrees that Landlord shall have the right to pledge any letter of credit received by it hereunder or otherwise grant a security interest therein to Landlord’s lender, and shall have the right to deliver the letter of credit or all or any portion of the proceeds of such letter of credit to Landlord’s lender in connection therewith, provided such letter of credit (or proceeds thereof) shall only be used in accordance with, and shall continue to be governed by, the terms and provisions of this Paragraph 5. At Landlord’s election, the letter of credit may name Landlord’s lender as a beneficiary, or as a co-beneficiary with Landlord and/or may require that Landlord’s lender sign the certification required to be presented for any draw against the letter of credit and shall contain such other provisions reasonably requested by Landlord or Landlord’s lender. In addition, upon termination or transfer of Landlord’s interest in this Lease, within ten (10) business days after request by Landlord or Landlord’s successor, Tenant shall, as Landlord or Landlord’s successor shall request, either cause the letter of credit to be amended to name Landlord’s successor as the party entitled to draw down on the letter of credit subject to the terms and conditions of this Paragraph 5 and deliver such amendment to the requesting party, or shall obtain and deliver to the requesting party a new letter of credit meeting the requirements of this Paragraph 5, naming Landlord’s successor as the party entitled to draw down on the letter of credit subject to the terms and conditions of this Paragraph 5. At Landlord’s election, within ten (10) business days after request by Landlord, Tenant shall either cause the letter of credit to be amended to name Landlord’s lender as the beneficiary, or as a co-beneficiary with Landlord, and/or as a cosigner of any certification presented for a draws down of the letter of credit, and to incorporate other changes to the letter of credit reasonably requested by Landlord’s lender which do not alter or increase in any material respect Tenant’s obligations under this Paragraph 5 or in connection with the letter of credit, or shall obtain a new letter of credit to effectuate such changes and otherwise meeting the requirements of this Paragraph 5 above. Any reasonable fee due in connection with the transfer of Landlord’s rights as beneficiary under the letter of credit to a successor Landlord or to Landlord’s lender, or in connection with an amendment to, or substitution of, a letter of credit, shall be paid by Tenant to the financial institution owed such fee upon demand. If Tenant fails to execute any documents necessary to transfer the letter of credit to Landlord’s successor-in-interest or Landlord’s lender within ten (10) business days after Landlord’s written request therefor, Landlord may draw upon the letter of credit and transfer the cash proceeds thereof to Landlord’s successor-in-interest or lender to be held as collateral for Tenant’s performance hereunder and applied, if applicable, in accordance with and subject to the terms and conditions of this Paragraph 5. Tenant agrees that Landlord shall be released from liability for the return of the letter of credit or the unapplied cash proceeds thereof or any accounting of such proceeds upon a transfer of the letter of credit or unapplied cash proceeds thereof to Landlord’s successor-in-interest or lender in accordance with the foregoing procedure.

Notwithstanding the foregoing, so long as no default by Tenant shall have occurred under this Lease, if Tenant shall have achieved three (3) consecutive quarters of net profit after taxes (but before non-cash items) (for purposes hereof, “Sustained Profitability”) (provided that Tenant shall have first provided written evidence reasonably satisfactory to Landlord (including, without limitation, audited financial statements) establishing that such Sustained Profitability has been achieved during the three (3) consecutive quarters in question), then, in such event, the Letter of Credit Amount required hereunder shall be reduced to the amount of Two Hundred Nine Thousand Two Hundred Seventy-one and 02/100 Dollars ($209,271.02) as of the first (1st) day of the calendar month following the date that Landlord shall have affirmatively and unequivocally confirmed in writing that Tenant has provided reasonably satisfactory evidence of such Sustained Profitability. Following such reduction (if applicable) in the Letter of Credit Amount, Tenant shall be entitled (in Tenant’s reasonable discretion) to deliver to Landlord either (i) an amendment to the then-existing Letter of Credit or (ii) a replacement Letter Credit, which amendment to, or replacement of, the Letter of Credit shall otherwise satisfy the terms and conditions of this Paragraph 5.

14

Landlord and Tenant acknowledge and agree that in no event or circumstance shall the Letter of Credit or any renewal thereof or any proceeds thereof be (a) deemed to be or treated as a “security deposit” within the meaning of California Civil Code Section 1950.7, (b) subject to the terms of such Section 1950.7, or (c) intended to serve as a “security deposit” within the meaning of such Section 1950.7. The parties acknowledge and agree that the Letter of Credit is not intended to serve as a security deposit, and that said Section 1950.7 and any and all other laws, rules and regulations applicable to security deposits (“Security Deposit Laws”) shall have no applicability or relevancy thereto. Each party waives any and all rights, duties and obligations such party may now or, in the future, will have relating to or arising from the Security Deposit Laws and all other provisions of law now or hereafter in force, that provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant, or to clean the Premises. Tenant hereby agrees and acknowledges that (a) the Letter of Credit constitutes a separate and independent contract between Landlord and the issuing bank, (b) Tenant is not a third party beneficiary of such contract, (c) Tenant has no property interest whatsoever in the Letter of Credit or the proceeds thereof, and (d) neither Tenant, any trustee, nor Tenant’s bankruptcy estate shall have the right to restrict or limit Landlord’s claims or rights to the Letter of Credit or the proceeds thereof by application of Section 502(b)(6) of the U.S. Bankruptcy Code, or otherwise.

6. Use of Premises.

6.1 Permitted Uses. Tenant shall use the Premises and the Common Area only in conformance with applicable governmental or quasi-governmental laws, statutes, orders, regulations, rules, ordinances and other requirements now or hereafter in effect (collectively, “Laws”) for the purposes set forth in Paragraph 1.9 above, and for no other purpose without the prior written consent of Landlord, which consent shall not be unreasonably withheld or delayed, provided that such other use is in conformance with applicable Laws. Landlord makes no representation or warranty that Tenant’s intended use of the Premises is permitted under zoning and/or other Laws applicable to the Premises and it is Tenant’s responsibility to ensure that Tenant’s intended use of the Premises is, in fact, permitted under such zoning and other Laws applicable to the Premises. Tenant acknowledges and agrees that Landlord has selected or will be selecting tenants for the Building and Project in order to produce a mix of tenant uses compatible and consistent with the design integrity of the Building and Project and with other uses of the Building and Project; provided, however, the selection of other tenants for the Building and Project shall be in Landlord’s sole discretion and Landlord in making such selection shall not be deemed to be warranting that any use of the Building or Project made by any such tenant is compatible or consistent with the design integrity of the Building or Project or other uses of the Building or Project. Any change in use of the Premises or the Common Area by Tenant without the prior written consent of Landlord shall be a Default by Tenant. Tenant and Tenant’s agents shall comply with the provisions of any Declaration of Covenants, Conditions, and Restrictions affecting the Premises and the Common Area.

During the Lease Term, Tenant shall be permitted to have access to the Premises 24 hours per day, 7 days per week, 365 days per year, unless such access is prohibited, limited or restricted by any governmental or quasi-governmental law, statute, ordinance, rule or regulation, damage to or destruction or condemnation of the Premises, Building or other portion of the Project or due to an emergency.

6.2 Tenant to Comply with Legal Requirements. To the extent that any of the following are triggered by (i) Tenant’s particular use of the Premises, (ii) any improvements to the Premises installed by or for Tenant during the Lease Term, (iii) Tenant’s application for any permit or governmental approval, or (iv) the negligence or willful misconduct of Tenant or any of its agents, employees, contractors, subcontractors, affiliates, licensees, invitees, sublessees or other representatives, Tenant shall, at its sole cost, promptly comply with all Laws relating to or affecting Tenant’s particular use or occupancy of the Premises or use of the Common Area,

15

now in force, or which may hereafter be in force, including without limitation those relating to utility usage and load or number of permissible occupants or users of the Premises, whether or not the same are now contemplated by the parties; with the provisions of all recorded documents affecting the Premises or the Common Area insofar as the same relate to or affect Tenant’s particular use or occupancy of the Premises or use of the Common Area; and with the requirements of any board of fire underwriters (or similar body now or hereafter constituted) relating to or affecting Tenant’s particular use or occupancy of the Premises or use of the Common Area. Tenant’s obligations pursuant to this Paragraph 6.2 shall include, without limitation, but only to the extent that any of the following are triggered by (i) Tenant’s particular use of the Premises, (ii) any improvements to the Premises installed by or for Tenant during the Lease Term, (iii) Tenant’s application for any permit or governmental approval, or (iv) the negligence or willful misconduct of Tenant or any of its agents, employees, contractors, subcontractors, affiliates, licensees, invitees, sublessees or other representatives, maintaining or restoring the Premises and making structural and non-structural alterations and additions in compliance and conformity with all Laws and recorded documents, each relating to Tenant’s particular use or occupancy of the Premises during the Lease Term, Tenant’s application for any permit or governmental approval or alterations, additions or improvements made to the Premises by Tenant. Any alterations or additions undertaken by Tenant pursuant to this Paragraph 6.2 shall be subject to the requirements of Paragraph 13.1 below. At Landlord’s option, Landlord may make the required alteration, addition or change, and Tenant shall pay the cost thereof as Additional Rent. With respect to any structural alterations or additions as may be hereafter required with respect to the Building, Premises, or Common Area due to a change in laws and unrelated to Tenant’s specific use of the Premises or the Common Area, Tenant’s application(s) for any permit or governmental approval or Tenant’s alterations, additions or improvements to the Premises, the cost thereof shall be amortized at the lesser of (i) the annual rate of interest charged on the loan obtained by Landlord to finance the applicable structural alteration(s), addition(s) or improvement(s) (or if Landlord does not obtain a loan to finance such structural alteration(s), addition(s) or improvement(s), then at three percent (3%) above the prime rate or reference rate published in the Wall Street Journal (or if such rate is not published in the Wall Street Journal, then the prime rate or reference rate established by a national bank selected by Landlord)), or (ii) the maximum rate permitted by law, over the useful life of the alteration or addition, and Tenant shall pay its percentage share (as defined in Paragraph 1.10 above) of such monthly amortized cost on the first day of each month (prorated for any partial month) from the date of installation or repair through Lease Termination.

At Tenant’s reasonable request and upon Landlord’s approval, which shall not be unreasonably withheld or delayed, Landlord shall without charge sign, but without any obligation to incur any expenses and without liability to Landlord, applications for all permits and other instruments that may be necessary or appropriate for the use of the Premises as contemplated herein and in accordance with Legal Requirements and the terms and conditions of this Lease. Tenant shall obtain prior to taking possession of the Premises any permits, licenses or other authorizations required for the lawful operation of its business at the Premises. The judgment of any court of competent jurisdiction or the admission of Tenant in any action or proceeding against Tenant, regardless of whether Landlord is a party thereto or not, that Tenant has violated such Law or recorded document relating to Tenant’s particular use or occupancy of the Premises or use of the Common Area shall be conclusive of the fact of such violation by Tenant.

6.3 Prohibited Uses. Tenant and Tenant’s agents shall not commit or suffer to be committed any waste upon the Premises. Tenant and Tenant’s agents shall not do or permit anything to be done in or about the Premises, Building, Project or Common Area which will in any way obstruct or interfere with the rights of any other tenants of the Project, other authorized users of the Common Area, or occupants of neighboring property, or injure or annoy them. Tenant shall not conduct or permit any auction or sale open to the public to be held or conducted on or about the Premises, Building, Project or Common Area. Tenant and Tenant’s agents shall not use or allow the Premises to be used for any unlawful, immoral or hazardous purpose or any purpose not permitted by

16

this Lease, nor shall Tenant or Tenant’s agents cause, maintain, or permit any nuisance in, on or about the Premises, Building, Project or Common Area. Tenant shall not overload existing electrical systems or other mechanical equipment servicing the Building, impair the efficient operation of the sprinkler system or the heating, ventilation or air conditioning equipment within or servicing the Building or damage, overload or corrode the sanitary sewer system. Tenant and Tenant’s agents shall not do or permit anything to be done in or about the Premises nor bring or keep anything in the Premises which will in any way increase the rate of any insurance upon any portion of the Project or any of its contents, or cause a cancellation of any insurance policy covering any portion of the Project or any of its contents, nor shall Tenant or Tenant’s agents keep, use or sell or permit to be kept, used or sold in or about the Premises any articles which may be prohibited by a standard form policy of fire insurance. In the event the rate of any insurance upon any portion of the Project or any of its contents is increased because of Tenant’s particular use of the Premises or that of Tenant’s agents, Tenant shall pay, as Additional Rent, the full cost of such increase; provided, however this provision shall in no event be deemed to constitute a waiver of Landlord’s right to declare a default hereunder by reason of the act or conduct of Tenant or Tenant’s agents causing such increase or of any other rights or remedies of Landlord in connection therewith. Tenant and Tenant’s agents shall not place any loads upon the floor, walls or ceiling of the Premises which would endanger the Building or the structural elements thereof or of the Premises, nor place any harmful liquids in the drainage system of the Building or Common Area. No waste materials or refuse shall be dumped upon or permitted to remain upon any part of the Project except in enclosed trash containers designated for that purpose by Landlord. No materials, supplies, equipment, finished products (or semi-finished products), raw materials, or other articles of any nature shall be stored upon, or be permitted to remain on, any portion of the Project outside the Premises.

6.4 Hazardous Materials. Neither Tenant nor Tenant’s agents shall permit the introduction, placement, use, storage, manufacture, transportation, release or disposition (collectively “Release”) of any Hazardous Material(s) (defined below) on or about any portion of the Project without the prior written consent of Landlord, which consent may be withheld in the sole and absolute discretion of Landlord without any requirement of reasonableness in the exercise of that discretion. Notwithstanding the immediately preceding sentence to the contrary, Tenant may use de minimis quantities of the types of materials which are technically classified as Hazardous Materials but commonly used in domestic or office use to the extent not in an amount, which, either individually or cumulatively, would be a “reportable quantity” under any applicable Law and such other Hazardous Materials as are commonly used in connection with, and necessary for the operation of, Tenant’s business and which Landlord receives notice prior to such Hazardous Materials being brought onto the Premises and which Landlord consents in writing may be brought onto the Premises, provided in each case such use is in compliance with all applicable Laws. Tenant covenants that, at its sole cost and expense, Tenant will comply, and cause its agents, employees, contractors, sublessees, licensees and invitees to comply, with all applicable Laws with respect to the Release by Tenant, its agents, employees, contractors, sublessees, licensees or invitees of such permitted Hazardous Materials. Any Release beyond the scope allowed in this paragraph shall be subject to Landlord’s prior consent, which may be withheld in Landlord’s sole and absolute discretion, and shall require an amendment to the Lease in the event Landlord does consent which shall set forth the materials, scope of use, indemnification and any other matter required by Landlord in Landlord’s sole and absolute discretion. Tenant shall indemnify, defend and hold Landlord and Landlord’s agents, members and lenders harmless from and against any and all claims, losses, damages, liabilities, actions, causes of action, clean up and remediation costs, penalties, liens, costs and/or expenses arising in connection with the Release of Hazardous Materials in violation of Hazardous Materials Laws by Tenant, Tenant’s agents or any other person using the Premises with Tenant’s knowledge and consent or authorization. Tenant’s obligation to defend, hold harmless and indemnify pursuant to this Paragraph 6.4 shall survive Lease Termination.

17

The foregoing indemnity shall not apply to, and Tenant shall not be responsible for, the presence of Hazardous Materials on, under, or about the Premises, Building or Common Area to the extent caused by any third parties (i.e. persons or entities other than Tenant or its agents, employees, affiliates, contractors, subcontractors, sublessees, licensees, invitees, and other representatives) or by Landlord or Landlord’s employees, agents or contractors unless and to the extent such Hazardous Materials are exacerbated by the acts of Tenant or any of Tenant’s agents, employees, affiliates, contractors, invitees, licensees, sublessees or other representatives.

As used in this Lease, the term “Hazardous Materials” means any chemical, substance, waste or material which has been or is hereafter determined by any federal, state or local governmental authority to be capable of posing risk of injury to health or safety, including without limitation, those substances included within the definitions of “hazardous substances,” “hazardous materials,” “toxic substances,” or “solid waste” under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, the Resource Conservation and Recovery Act of 1976, and the Hazardous Materials Transportation Act, as amended, and in the regulations promulgated pursuant to said laws; those substances defined as “hazardous wastes” in section 25117 of the California Health & Safety Code, or as “hazardous substances” in section 25316 of the California Health & Safety Code, as amended, and in the regulations promulgated pursuant to said laws; those substances listed in the United States Department of Transportation Table (49 CFR 172.101 and amendments thereto) or designated by the Environmental Protection Agency (or any successor agency) as hazardous substances (see, e.g., 40 CFR Part 302 and amendments thereto); such other substances, materials and wastes which are or become regulated or become classified as hazardous or toxic under any Laws, including without limitation the California Health & Safety Code, Division 20, and Title 26 of the California Code of Regulations; and any material, waste or substance which is (i) petroleum, (ii) asbestos, (iii) polychlorinated biphenyls, (iv) designated as a “hazardous substance” pursuant to section 311 of the Clean Water Act of 1977, 33 U.S.C. sections 1251 et seq. (33 U.S.C. § 1321) or listed pursuant to section 307 of the Clean Water Act of 1977 (33 U.S.C. § 1317), as amended; (v) flammable explosives; (vi) radioactive materials; or (vii) radon gas.

Landlord shall have the right, upon reasonable advance notice to Tenant, to inspect, investigate, sample and/or monitor the Premises, the Building and Common Area, including any soil, water, groundwater, or other sampling, to the extent reasonably necessary to determine whether Tenant is complying with the terms of this Lease with respect to Hazardous Materials. In connection therewith, Tenant shall provide Landlord with reasonable access to all portions of the Premises; provided, however, that Landlord shall avoid any unreasonable interference with the operation of Tenant’s business on the Premises. In the event Tenant has violated any of its covenants or agreements set forth in this Paragraph 6.4 or it is determined that Tenant has discharged or released Hazardous Materials in, on or under the Premises or any other portion of the Project, then all costs incurred by Landlord in performing such inspections, investigation, sampling and/or monitoring shall be reimbursed by Tenant to Landlord as Additional Rent within ten (10) days after Landlord’s demand for payment. Tenant’s obligations under the immediately preceding sentence shall survive the expiration or earlier termination of this Lease.

Landlord represents and warrants to Tenant that, except as otherwise disclosed in that certain Phase 1 Environmental Site Assessment report, dated May 6, 2015, prepared by Geoligica, Inc., to Landlord’s current actual knowledge, Landlord has not received any written notice from any governmental authority that any use, storage, treatment, or transportation of Hazardous Materials to, from, or on the Premises has been in material violation of any applicable environmental laws, ordinances, rules or regulations. For purposes of the immediately preceding sentence, the phrase “to Landlord’s current actual knowledge,” shall mean the current actual knowledge of David Andris as of the date of execution of this Lease by Landlord, without any investigation or duty of inquiry, and without any knowledge of any other person being imputed to David Andris. David Andris (i) has been an employee of South Bay Development Co., the entity engaged as the property manager that manages the Real Property, for

18

approximately twenty-two (22) years, which property management entity is an affiliate of the limited liability company constituting the Landlord under this Lease, (ii) is a member of the limited liability company constituting the Landlord under this Lease and (iii) is the member of such limited liability company who is most familiar with the environmental condition of the Premises. Neither Landlord nor David Andris shall be charged with constructive, inquiry, imputed or deemed knowledge. In the event of any breach of any representation or warranty of Landlord set forth in this paragraph, Tenant agrees that David Andris shall not be personally liable for any damages, losses, liabilities, claims, costs or expenses suffered or incurred by Tenant in connection with such breach of such representation or warranty.

7. Taxes.

7.1 Personal Property Taxes. Tenant shall cause Tenant’s trade fixtures, equipment, furnishings, furniture, merchandise, inventory, machinery, appliances and other personal property installed or located on the Premises (collectively the “personal property”) to be assessed and billed separately from the Land and the Building. Tenant shall pay before delinquency any and all taxes, assessments and public charges levied, assessed or imposed upon or against Tenant’s personal property. If any of Tenant’s personal property shall be assessed with the Land or the Building, Tenant shall pay to Landlord, as Additional Rent, the amounts attributable to Tenant’s personal property within thirty (30) days after receipt of a written statement from Landlord setting forth the amount of such taxes, assessments and public charges attributable to Tenant’s personal property. Tenant shall comply with the provisions of any Law which requires Tenant to file a report of Tenant’s personal property located on the Premises.

7.2 Other Taxes Payable Separately by Tenant. Tenant shall pay (or reimburse Landlord, as Additional Rent, if Landlord is assessed), prior to delinquency or within thirty (30) days after receipt of Landlord’s statement thereof, any and all taxes, levies, assessments or surcharges payable by Landlord or Tenant and relating to this Lease or the Premises (other than Landlord’s net income, succession, transfer, gift, franchise, estate or inheritance taxes, and Taxes, as that term is defined in Paragraph 7.3(a) below, payable as an Operating Expense), whether or not now customary or within the contemplation of the parties hereto, whether or not now in force or which may hereafter become effective, including but not limited to taxes:

(a) Upon, allocable to, or measured by the area of the Premises or the Rentals payable hereunder, including without limitation any gross rental receipts, excise, or other tax levied by the state, any political subdivision thereof, city or federal government with respect to the receipt of such Rentals;

(b) Upon or with respect to the use, possession occupancy, leasing, operation and management of the Premises or any portion thereof;