Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VICI PROPERTIES INC. | d587853d8k.htm |

| EX-99.1 - EX-99.1 - VICI PROPERTIES INC. | d587853dex991.htm |

Exhibit 99.2

TRANSACTION OVERVIEW: OCTAVIUS TOWER, HARRAH’S PHILADELPHIA, AND LEASE MODIFICATIONS MAY 9, 2018 INVEST IN THE EXPERIENCE VICI

DISCLAIMERS Forward-Looking Statements Certain statements in this presentation and that may be made in meetings are forward-looking statements. Forward-looking statements are based on the Company’s current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate to strictly historical and current facts and by the use of the words such as “expects”, “plans”, “opportunity” and similar words and variations thereof. Although the Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, its results, performance and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors including, among others: the closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all the Company’s dependence on subsidiaries of Caesars Entertainment Corporation (“Caesars”) as tenant of all of its properties and Caesars or its subsidiaries as guarantor of the lease payments and the consequences any material adverse effect on their business could have on the Company the Company’s dependence on the gaming industry the Company’s ability to pursue its business and growth strategies may be limited by its substantial debt service requirements and by the requirement that the Company distribute 90% of its real estate investment trust (“REIT”) taxable income in order to qualify for taxation as a REIT and that the Company distribute 100% of its REIT taxable income in order to avoid current entity level U.S. Federal income taxes the impact of extensive regulation from gaming and other regulatory authorities the ability of the Company’s tenants to obtain and maintain regulatory approvals in connection with the operation of the Company’s properties the possibility that the tenants may choose not to renew their lease agreements with the Company following the initial or subsequent terms of the leases restrictions on the Company’s ability to sell its properties subject to the lease agreements the Company’s substantial amount of indebtedness and ability to service and refinance such indebtedness the Company’s historical and pro forma financial information may not be reliable indicators of its future results of operations and financial condition the Company’s inability to achieve the expected benefits from operating as a company independent of Caesars limits on the Company’s operational and financial flexibility imposed by its debt agreements the possibility the Company’s separation from Caesars Entertainment Operating Company, Inc. (“CEOC”) fails to qualify as a tax-free spin-off, which could subject the Company to significant tax liabilities Market and Industry Data This presentation contains estimates and information concerning the Company’s industry, including market position, rent growth and rent coverage of the Company’s peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” section of the Company’s public filings with the SEC. Caesars Information The Company makes no representation as to the accuracy or completeness of the information regarding Caesars included in this presentation. The historical audited and unaudited financial statements of Caesars, as the parent and guarantor of CEOC, the Company’s significant lessee, have been filed with the SEC. Certain financial and other information for Caesars and CEOC included in this presentation have been derived from Caesars’ public filings and other publicly available presentations and press releases. 2

DISCLAIMERS (CONTINUED) Non-GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), Adjusted Funds From Operations (“AFFO”) and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). The Company believes FFO, AFFO and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. FFO is a non-GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by The National Association of Real Estate Investment Trusts (“NAREIT”), the Company defines FFO as net income (or loss) (computed in accordance with GAAP) excluding gains (or losses) from sales of property plus real estate depreciation. AFFO is a non-GAAP measure that is used as a supplemental operating measure to evaluate the Company’s operating performance. The Company calculates AFFO by adding or subtracting from FFO direct financing lease adjustments, transaction costs incurred in connection with the acquisition of real estate investments, non-cash stock-based compensation expense, amortization of debt issuance costs and original issue discount, other non-cash interest expense, non-real estate depreciation (which is comprised of the depreciation related to our golf course operations), impairment charges on non-real estate assets, amortization of capitalized leasing costs and debt extinguishment gains and losses. Because not all companies calculate FFO, AFFO and Adjusted EBITDA in the same way as the Company and other companies may not perform such calculations, those measures as used by other companies may not be consistent with the way the Company calculates such measures and should not be considered as alternative measures of operating income or net income. The presentation of these measures does not replace the presentation of the Company’s financial results in accordance with GAAP. 3

ACQUISITION HIGHLIGHTS AND RATIONALE $56MM of incremental NOI on a net purchase L L Meaningfully price of $590MM A R Accretive 9.5% net capitalization rate delivers meaningful E V to AFFO Per Share accretion O Funded with cash on balance sheet Octavius Tower at Caesars Palace - 668 hotel rooms Enhance Portfolio Harrah’s Philadelphia PURCHASE Quality and Improve - 2,448 slot machines and 110 tables Diversification 3.2MM Sq. Ft. of acquired real estate ASSET Increases Las Vegas strip and increases Philadelphia (7th largest in US) exposure N Near Term Addition of 1.5% escalators on non-CPLV master O I Accretion, Long Term lease generates $7MM of NOI E AT Reduces variable rent component tied to S Stability, while C A I potentially volatile property level net revenue E F Properly Aligning L I Combined changes incentivizes Caesars to invest D Caesars’ and VICI’s O in assets and generate growth within VICI assets M Interests 4 The closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all.

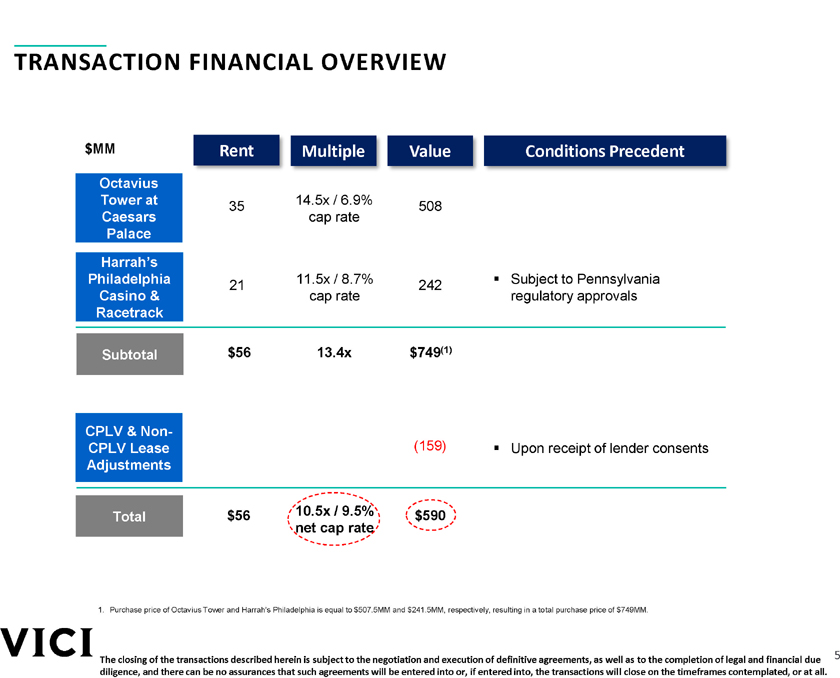

TRANSACTION FINANCIAL OVERVIEW $MM Rent Multiple Value Conditions Precedent Octavius Tower at 35 14.5x / 6.9% 508 Caesars cap rate Palace Harrah’s Philadelphia 21 11.5x / 8.7% 242 Subject to Pennsylvania Casino & cap rate regulatory approvals Racetrack Subtotal $56 13.4x $749(1) CPLV & Non- CPLV Lease (159) Upon receipt of lender consents Adjustments Total $56 10.5x / 9.5% $590 net cap rate 1. Purchase price of Octavius Tower and Harrah’s Philadelphia is equal to $507.5MM and $241.5MM, respectively, resulting in a total purchase price of $749MM. 5 The closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all. 4

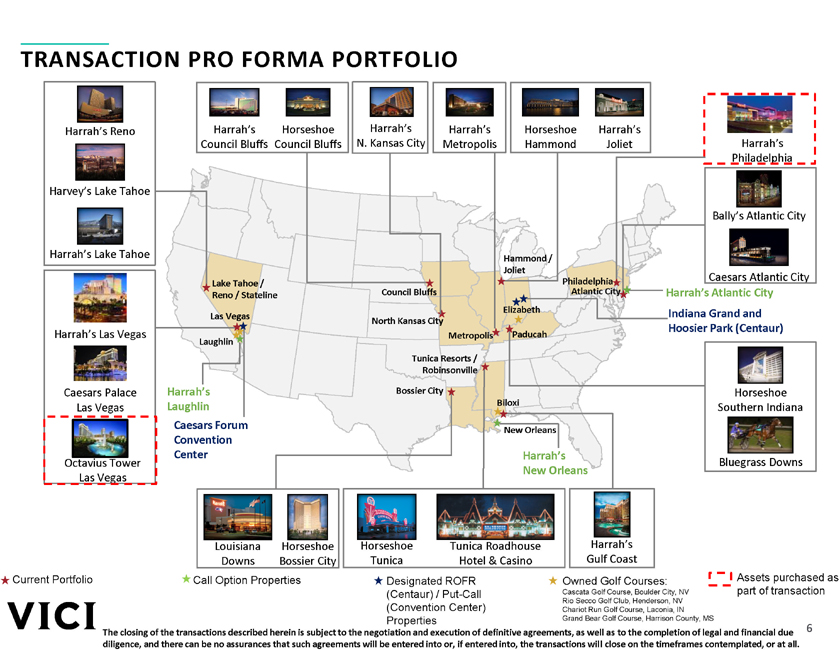

TRANSACTION PRO FORMA PORTFOLIO Harrah’s Reno Harrah’s Horseshoe Harrah’s Harrah’s Horseshoe Harrah’s Council Bluffs Council Bluffs N. Kansas City Metropolis Hammond Joliet Harrah’s Philadelphia Harvey’s Lake Tahoe Bally’s Atlantic City Harrah’s Lake Tahoe Hammond / Joliet Philadelphia Caesars Atlantic City Lake Tahoe / Council Bluffs Atlantic City Harrah’s Atlantic City Reno / Stateline Elizabeth Indiana Grand and Las Vegas North Kansas City Hoosier Park (Centaur) Harrah’s Las Vegas Laughlin Metropolis Paducah Tunica Resorts / Robinsonville Caesars Palace Harrah’s Bossier City Horseshoe Laughlin Biloxi Southern Indiana Las Vegas Caesars Forum New Orleans Convention Center Harrah’s Octavius Tower Bluegrass Downs New Orleans Las Vegas Louisiana Horseshoe Horseshoe Tunica Roadhouse Harrah’s Downs Bossier City Tunica Hotel & Casino Gulf Coast Current Portfolio Call Option Properties Designated ROFR Owned Golf Courses: Assets purchased as (Centaur) / Put-Call Cascata Golf Course, Boulder City, NV part of transaction Rio Secco Golf Club, Henderson, NV (Convention Center) Chariot Run Golf Course, Laconia, IN Properties Grand Bear Golf Course, Harrison County, MS 6 The closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all.

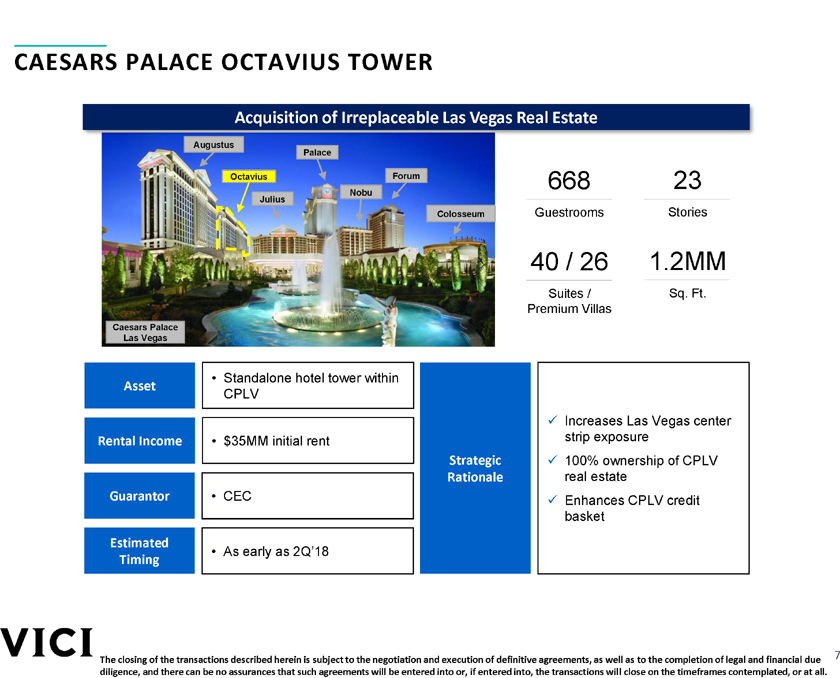

CAESARS PALACE OCTAVIUS TOWER Acquisition of Irreplaceable Las Vegas Real Estate Augus Palace Octavius Forum 668 23 Nobu Julius Colosseum Guestrooms Stories 40 / 26 1.2MM Suites / Sq. Ft. Premium Villas Caesars Palace Las Vegas Standalone hotel tower within Asset CPLV Increases Las Vegas center Rental Income $35MM initial rent strip exposure Strategic 100% ownership of CPLV Rationale real estate Guarantor CEC Enhances CPLV credit basket Estimated As early as 2Q’18 Timing 7 The closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all.

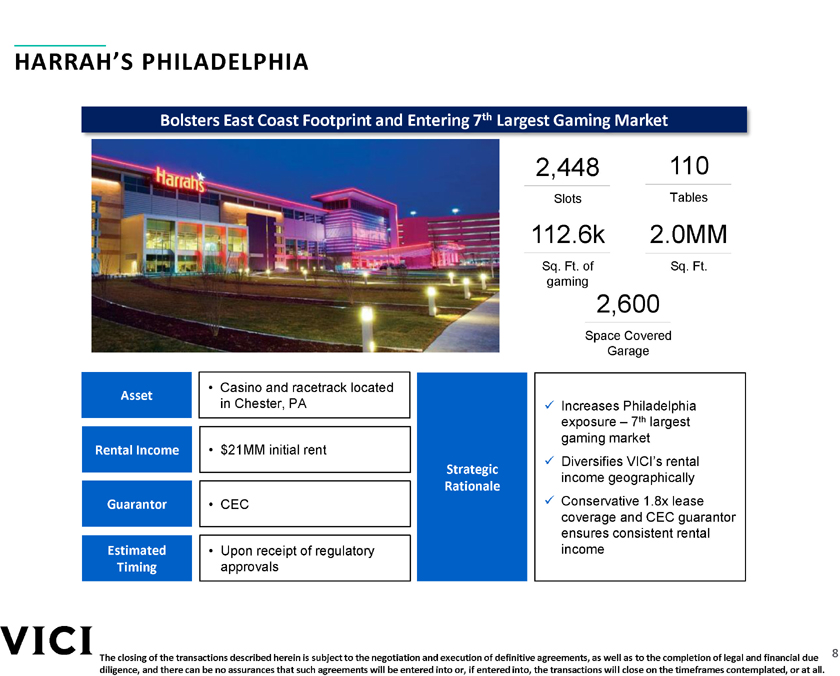

HARRAH’S PHILADELPHIA Bolsters East Coast Footprint and Entering 7th Largest Gaming Market 2,448 110 Slots Tables 112.6k 2.0MM Sq. Ft. of Sq. Ft. gaming 2,600 Space Covered Garage • Casino and racetrack located Asset in Chester, PA Increases Philadelphia exposure – 7th largest gaming market Rental Income • $21MM initial rent Diversifies VICI’s rental Strategic income geographically Rationale Guarantor • CEC Conservative 1.8x lease coverage and CEC guarantor ensures consistent rental Estimated • Upon receipt of regulatory income Timing approvals 8 The closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all.

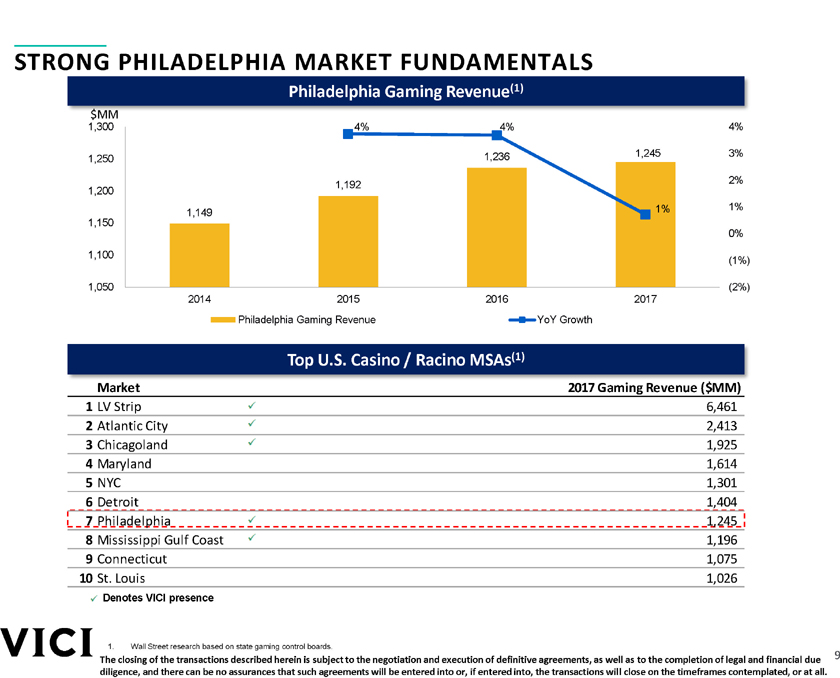

STRONG PHILADELPHIA MARKET FUNDAMENTALS Philadelphia Gaming Revenue(1) $MM 1,300 4% 4% 4% 1,236 1,245 3% 1,250 2% 1,192 1,200 1% 1% 1,149 1,150 0% 1,100 (1%) 1,050 (2%) 2014 2015 2016 2017 Philadelphia Gaming Revenue YoY Growth Top U.S. Casino / Racino MSAs(1) Market 2017 Gaming Revenue ($MM) 1 LV Strip 6,461 2 Atlantic City 2,413 3 Chicagoland 1,925 4 Maryland 1,614 5 NYC 1,301 6 Detroit 1,404 7 Philadelphia 1,245 8 Mississippi Gulf Coast 1,196 9 Connecticut 1,075 10 St. Louis 1,026 Denotes VICI presence 1. Wall Street research based on state gaming control boards. 9 The closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all.

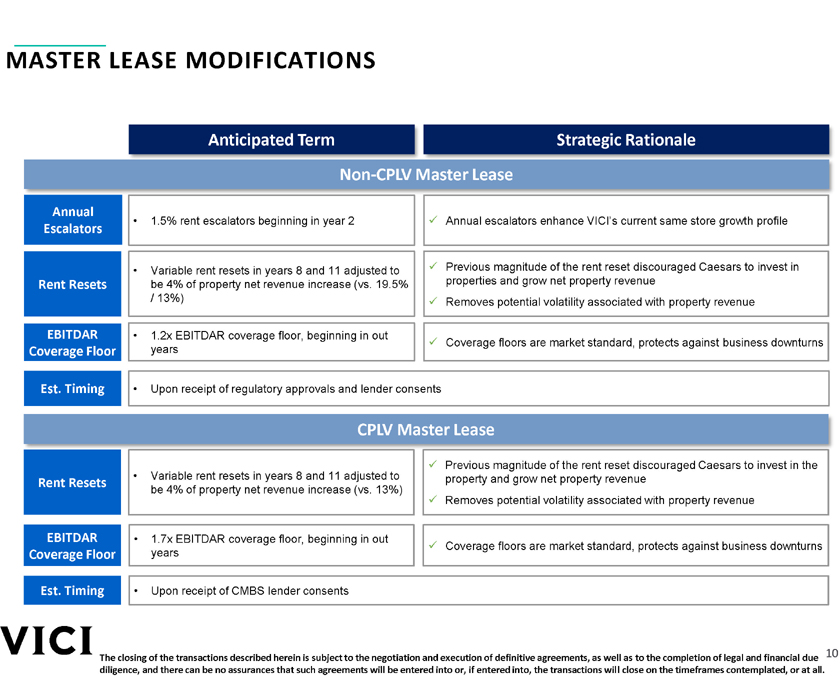

MASTER LEASE MODIFIATIONS Anticipated Term Strategic Rationale Non-CPLV Master Lease Annual • 1.5% rent escalators beginning in year 2 Annual escalators enhance VICI’s current same store growth profile Escalators • Variable rent resets in years 8 and 11 adjusted to Previous magnitude of the rent reset discouraged Caesars to invest in Rent Resets be 4% of property net revenue increase (vs. 19.5% properties and grow net property revenue / 13%) Removes potential volatility associated with property revenue EBITDAR • 1.2x EBITDAR coverage floor, beginning in out Coverage floors are market standard, protects against business downturns Coverage Floor years Est. Timing • Upon receipt of regulatory approvals and lender consents CPLV Master Lease Previous magnitude of the rent reset discouraged Caesars to invest in the • Variable rent resets in years 8 and 11 adjusted to property and grow net property revenue Rent Resets be 4% of property net revenue increase (vs. 13%) Removes potential volatility associated with property revenue EBITDAR • 1.7x EBITDAR coverage floor, beginning in out Coverage floors are market standard, protects against business downturns Coverage Floor years Est. Timing • Upon receipt of CMBS lender consents 10 The closing of the transactions described herein is subject to the negotiation and execution of definitive agreements, as well as to the completion of legal and financial due diligence, and there can be no assurances that such agreements will be entered into or, if entered into, the transactions will close on the timeframes contemplated, or at all.