Attached files

| file | filename |

|---|---|

| EX-99.3 - Q1 2018 NON-GAAP RECONCILIATIONS - Sabra Health Care REIT, Inc. | sbraex9932018q1.htm |

| EX-99.1 - Q1 2018 EARNINGS RELEASE - Sabra Health Care REIT, Inc. | sbraex9912018q1.htm |

| 8-K - 8-K - Sabra Health Care REIT, Inc. | sbra8-k2017q3.htm |

1Q 2018 SUPPLEMENTAL INFORMATION Dedicated to Value Creation. Committed to Our Operator Roots. Exhibit 99.2

CONTENT 03 COMPANY INFORMATION 04 OVERVIEW 05 PORTFOLIO Summary - Triple-Net Summary - Senior Housing Managed Summary - Loans and Other Investments Development Pipeline NOI Concentrations Geographic Concentrations Lease Expirations 14 INVESTMENT ACTIVITY Year-to-Date 15 CAPITALIZATION Overview Indebtedness Debt Maturity Credit Metrics and Ratings 19 FINANCIAL INFORMATION 2018 Outlook Update Condensed Consolidated Financial Statements - Statements of Income Condensed Consolidated Financial Statements - Balance Sheets Condensed Consolidated Financial Statements - Statements of Cash Flows FFO, Normalized FFO, AFFO and Normalized AFFO Pro Forma Information Components of Net Asset Value (NAV) 24 APPENDIX Disclaimer Reporting Definitions Discussion and Reconciliation of Certain Non-GAAP Financial Measures: http://www.sabrahealth.com/investors/financials/reports-presentations/non-gaap 2 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

COMPANY INFORMATION SENIOR MANAGEMENT Rick Matros Harold Andrews Jr. Talya Nevo-Hacohen Chairman of the Board, President Executive Vice President, Chief Executive Vice President, Chief and Chief Executive Officer Financial Officer and Secretary Investment Officer and Treasurer BOARD OF DIRECTORS Rick Matros Michael Foster Jeffrey Malehorn Chairman of the Board, President Lead Independent Director Director and Chief Executive Officer Craig Barbarosh Ronald Geary Milton Walters Director Director Director Robert Ettl Raymond Lewis Director Director CONTACT INFORMATION Sabra Health Care REIT, Inc. Transfer Agent 18500 Von Karman Avenue American Stock Transfer Suite 550 and Trust Company Irvine, CA 92612 6201 15th Avenue 888.393.8248 Brooklyn, NY 11219 sabrahealth.com 3 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

OVERVIEW Financial Metrics Dollars in thousands, except per share data Three Months Ended March 31, 2018 Revenues $ 166,086 Net operating income 163,333 Cash net operating income 151,086 Diluted per share data attributable to common stockholders: EPS $ 0.34 FFO 0.64 Normalized FFO 0.63 AFFO 0.59 Normalized AFFO 0.58 Dividends per common share 0.45 Capitalization and Market Facts Debt Ratios (2) March 31, 2018 March 31, 2018 Common shares outstanding 178.3 million Net Debt to Adjusted EBITDA 5.48x Common equity Market Capitalization $3.1 billion Including unconsolidated joint venture 5.97x Total Debt (1) $3.7 billion Interest Coverage 4.23x Total Enterprise Value (1) $7.0 billion Fixed Charge Coverage Ratio 3.72x Total Debt/Asset Value 49% Common stock closing price $17.65 Secured Debt/Asset Value 8% Common stock 52-week range $15.78 - $29.10 Unencumbered Assets/Unsecured Debt 224% Common stock ticker symbol SBRA Preferred stock ticker symbol SBRAP Portfolio (3) Dollars in thousands As of March 31, 2018 Property Count Investment Beds/Units Occupancy Percentage (4) Investment in Real Estate Properties, gross Triple-Net Portfolio: Skilled Nursing / Transitional Care 380 $ 4,384,312 42,972 80.9% Senior Housing - Leased 89 1,173,102 8,167 86.8 Specialty Hospitals and Other 22 617,440 1,085 83.4 Total Triple-Net Portfolio 491 6,174,854 52,224 Senior Housing - Managed 24 310,377 1,744 92.1 Consolidated Equity Investments 515 6,485,231 53,968 Unconsolidated joint venture Senior Housing - Managed 172 730,192 7,652 80.7 Total Equity Investments 687 7,215,423 61,620 Investment in Direct Financing Lease, net 1 23,084 Investments in Loans Receivable, gross (5) 21 50,953 Preferred Equity Investments, gross (6) 13 50,248 Includes 75 relationships in 45 U.S. states Total Investments 722 $ 7,339,708 and Canada (1) Includes Sabra's 49% pro rata share of the debt of its unconsolidated joint venture. (2) See page 18 of this supplement for important information about these debt ratios. (2) Excludes real estate properties held for sale. (3) Occupancy Percentage is presented for the trailing twelve month period and one quarter in arrears, except for Senior Housing - Managed, which is presented for the trailing three month period. (4) Three of our investments in Loans Receivable contain purchase options on three Senior Housing developments with 138 beds/units. (5) Our Preferred Equity investments include investments in entities owning 12 Senior Housing developments with 1,262 beds/units and one Skilled Nursing/Transitional Care development with 120 beds/ units. 4 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

PORTFOLIO Summary - Triple-Net Portfolio Triple-Net Portfolio Dollars in thousands Cash NOI Three Months Ended Property Type Number of Properties Investment March 31, 2018 December 31, 2017 Number of Beds/Units Skilled Nursing/Transitional Care 380 $ 4,384,312 $ 99,003 $ 105,940 42,972 Senior Housing - Leased 89 1,173,102 21,173 20,551 8,167 Specialty Hospitals and Other 22 617,440 11,832 11,699 1,085 Total 491 $ 6,174,854 $ 132,008 $ 138,190 52,224 Same Store Triple-Net Portfolio(1) Dollars in thousands Cash NOI Three Months Ended Property Type Number of Properties March 31, 2018 December 31, 2017 Skilled Nursing/Transitional Care 377 $ 94,466 $ 95,166 Senior Housing - Leased 87 20,470 20,368 Specialty Hospitals and Other 22 11,832 11,699 Total 486 $ 126,768 $ 127,233 Operating Statistics Triple-Net Portfolio(2) Coverage EBITDAR EBITDARM Occupancy Percentage Skilled Mix Property Type 1Q 2018 4Q 2017 1Q 2018 4Q 2017 1Q 2018 4Q 2017 1Q 2018 4Q 2017 Skilled Nursing/Transitional Care 1.33x 1.37x 1.80x 1.85x 80.9% 80.8% 37.6% 37.2% Senior Housing - Leased 1.09x 1.09x 1.26x 1.26x 86.8% 87.3% NA NA Specialty Hospitals and Other 3.45x 3.56x 3.75x 3.87x 83.4% 79.3% NA NA Same Store Operating Statistics Triple-Net Portfolio(3) Coverage EBITDAR EBITDARM Occupancy Percentage Skilled Mix Property Type 1Q 2018 4Q 2017 1Q 2018 4Q 2017 1Q 2018 4Q 2017 1Q 2018 4Q 2017 Skilled Nursing/Transitional Care 1.29x 1.29x 1.79x 1.80x 80.6% 80.7% 36.8% 36.8% Senior Housing - Leased 1.12x 1.13x 1.28x 1.30x 86.8% 87.3% NA NA Specialty Hospitals and Other 5.64x 4.99x 6.09x 5.42x 70.9% 70.0% NA NA (1) Same store triple-net portfolio includes all facilities owned for the full period in both comparison periods. (2) EBITDAR Coverage, EBITDARM Coverage, Occupancy Percentage and Skilled Mix (collectively, “Operating Statistics”) for each period presented include only Stabilized Facilities owned by the Company as of the end of the respective period. Operating Statistics are only included in periods subsequent to our acquisition except for the legacy CCP tenants, which are presented as if these real estate investments were owned by Sabra during the entire period presented and reflect the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP. In addition, Operating Statistics are presented for the twelve months ended at the end of the respective period and one quarter in arrears. As such, Operating Statistics exclude assets acquired after December 31, 2017. (3) Same store Operating Statistics are presented for the twelve months ended at the end of the respective period and one quarter in arrears for Stabilized Facilities owned for the full period in both comparison periods except for the legacy CCP tenants, which are presented as if these real estate investments were owned by Sabra during the entire period presented and reflect the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP. 5 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

PORTFOLIO Summary - Real Estate Continued Pro Forma Top 10 Relationships (1) Twelve Months Ended March 31, 2018 % of Pro Forma Tenant Primary Facility Type Number of Properties Lease Coverage (2) Annualized Cash NOI Senior Care Centers Skilled Nursing 38 1.04x 9.9% Genesis Healthcare, Inc. (3) Skilled Nursing 49 1.24x 8.5% Enlivant Assisted Living 183 NA 7.9% (4) Avamere Family of Companies Skilled Nursing 29 1.24x 6.8% Signature Healthcare Skilled Nursing 46 1.22x 5.9% Holiday AL Holdings LP (4)(5) Independent Living 21 1.11x 5.7% North American Healthcare (6) Skilled Nursing 23 1.34x 5.7% Signature Behavioral Behavioral Hospitals 6 1.61x 5.2% Cadia Healthcare Skilled Nursing 9 1.54x 4.9% The McGuire Group Skilled Nursing 7 1.65x 2.6% (1) Pro forma top 10 relationships assumes the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP was completed at the beginning of the period presented. (2) Lease Coverage is defined as the EBITDAR Coverage for Stabilized Facilities operated by the applicable tenant, unless there is a corporate guarantee and the guarantor level fixed charge coverage is a more meaningful indicator of the tenant’s ability to make rent payments. Lease Coverage is for the twelve months ended March 31, 2018 and is presented one quarter in arrears. Lease Coverage for legacy CCP tenants is presented as if these real estate investments were owned by Sabra during the entire period presented and reflects the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP. (3) Lease Coverage reflects guarantor level fixed charge coverage, pro forma for rent reductions from Sabra and other Genesis landlords and the impact of recent refinancings. (4) Lease Coverage reflects guarantor level fixed charge coverage for these relationships. (5) The Holiday AL Holdings LP portfolio consists of 21 independent living communities that the Company underwrote at a 1.10x EBITDAR Coverage. (6) The North American Healthcare portfolio coverage is presented on a trailing twelve month basis and consists of the EBITDAR Coverage for facilities owned by Sabra in periods subsequent to our acquisition and underwritten stabilized EBITDAR Coverage for periods preceding our acquisition. 6 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

PORTFOLIO Summary - Senior Housing Managed Senior Housing - Managed Portfolio Dollars in thousands, except REVPOR As of March 31, 2018 Three Months Ended March 31, 2018 Number of Number of Cash NOI Capital Occupancy Properties Units Investment Revenues Cash NOI Margin % REVPOR (1) Expenditures Percentage (1) Wholly-Owned AL 16 988 $ 182,829 $ 12,436 $ 3,233 26.0% $ 4,687 $ 483 92.4% IL 8 756 127,548 5,057 2,136 42.2% 2,428 42 91.8% 24 1,744 310,377 17,493 5,369 30.7% 3,643 525 92.1% Sabra's Share of Unconsolidated JV (2) AL 172 7,652 730,192 36,291 9,371 25.8% 3,998 974 80.7% Total 196 9,396 $ 1,040,569 $ 53,784 $ 14,740 27.4% $ 3,880 $ 1,499 84.2% Operator Enlivant 183 8,283 $ 855,682 $ 45,046 $ 11,715 26.0% $ 4,158 $ 1,446 82.4% Sienna 9 865 130,277 5,521 2,239 40.6% 2,316 49 91.9% Other 4 248 54,610 3,217 786 24.4% 5,833 4 91.1% Total 196 9,396 $ 1,040,569 $ 53,784 $ 14,740 27.4% $ 3,880 $ 1,499 84.2% Same Store Senior Housing - Managed Portfolio (3) Dollars in thousands, except REVPOR Cash NOI REVPOR Occupancy Percentage Three Months Ended Three Months Ended Three Months Ended Number of Property Type Properties March 31, 2018 December 31, 2017 March 31, 2018 December 31, 2017 March 31, 2018 December 31, 2017 Senior Housing - Managed 11 $ 2,889 $ 2,502 $ 2,786 $ 2,555 91.8% 91.8% (1) REVPOR and Occupancy Percentage include only Stabilized Facilities owned by the Company as of the end of the period presented. (2) Reflects Sabra's 49% pro rata share of applicable amounts related to its unconsolidated joint venture with Enlivant. (3) Same store Senior Housing - Managed portfolio includes all facilities owned for the full period in both comparison periods. Same store REVPOR and Occupancy Percentage are presented for Stabilized Facilities owned for the full period in both comparison periods. 7 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

PORTFOLIO Summary - Loans and Other Investments Loans Receivable and Other Investments Dollars in thousands As of March 31, 2018 Weighted Weighted Average Average Interest Income Number of Contractual Annualized Effective Three Months Ended Loan Type Loans Property Type Principal Balance Book Value Interest Rate Interest Rate March 31, 2018 (1) Maturity Date Skilled Nursing / 12/31/18- Mortgage 2 Senior Housing $ 18,028 $ 17,032 9.9% 11.0% $ 393 02/10/27 03/31/21- Construction 2 Senior Housing 3,047 3,114 8.0% 7.7% 59 05/31/22 Mezzanine 1 Skilled Nursing 25,000 2,548 10.0% 41.9% 278 05/25/20 Pre-development 1 Senior Housing 2,357 2,357 9.0% 8.4% 53 04/01/20 12/31/17- Other 15 Multiple 27,780 25,789 8.7% 10.6% 642 04/30/27 21 76,212 50,840 9.4% 12.0% $ 1,425 Loan loss reserve — (200) $ 76,212 $ 50,640 Other Income Number of Total Funding Total Amount Three Months Ended Other Investment Type Investments Property Type Commitments Funded Book Value Rate of Return March 31, 2018 (1) Skilled Nursing / Preferred Equity 13 Senior Housing $ 40,399 $ 39,763 $ 50,248 12.6% $ 1,496 (1) Includes income related to loans receivable and other investments held as of March 31, 2018. 8 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

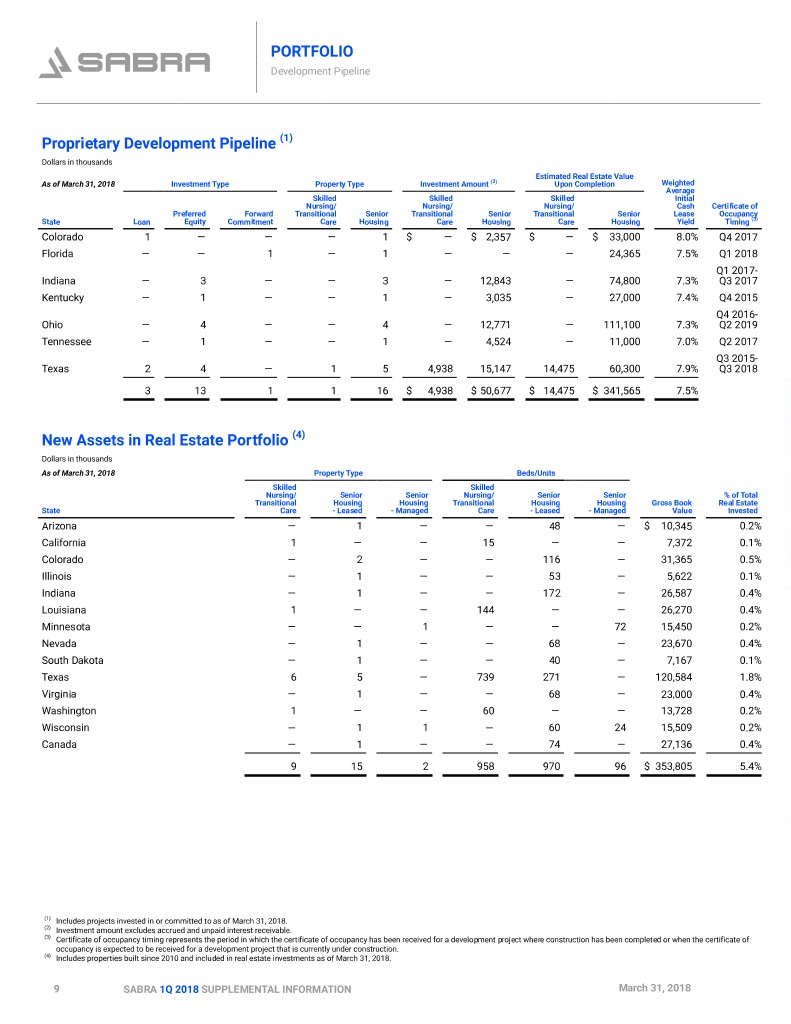

PORTFOLIO Development Pipeline Proprietary Development Pipeline (1) Dollars in thousands Estimated Real Estate Value As of March 31, 2018 Investment Type Property Type Investment Amount (2) Upon Completion Weighted Average Skilled Skilled Skilled Initial Nursing/ Nursing/ Nursing/ Cash Certificate of Preferred Forward Transitional Senior Transitional Senior Transitional Senior Lease Occupancy State Loan Equity Commitment Care Housing Care Housing Care Housing Yield Timing (3) Colorado 1 — — — 1 $ — $ 2,357 $ — $ 33,000 8.0% Q4 2017 Florida — — 1 — 1 — — — 24,365 7.5% Q1 2018 Q1 2017- Indiana — 3 — — 3 — 12,843 — 74,800 7.3% Q3 2017 Kentucky — 1 — — 1 — 3,035 — 27,000 7.4% Q4 2015 Q4 2016- Ohio — 4 — — 4 — 12,771 — 111,100 7.3% Q2 2019 Tennessee — 1 — — 1 — 4,524 — 11,000 7.0% Q2 2017 Q3 2015- Texas 2 4 — 1 5 4,938 15,147 14,475 60,300 7.9% Q3 2018 3 13 1 1 16 $ 4,938 $ 50,677 $ 14,475 $ 341,565 7.5% New Assets in Real Estate Portfolio (4) Dollars in thousands As of March 31, 2018 Property Type Beds/Units Skilled Skilled Nursing/ Senior Senior Nursing/ Senior Senior % of Total Transitional Housing Housing Transitional Housing Housing Gross Book Real Estate State Care - Leased - Managed Care - Leased - Managed Value Invested Arizona — 1 — — 48 — $ 10,345 0.2% California 1 — — 15 — — 7,372 0.1% Colorado — 2 — — 116 — 31,365 0.5% Illinois — 1 — — 53 — 5,622 0.1% Indiana — 1 — — 172 — 26,587 0.4% Louisiana 1 — — 144 — — 26,270 0.4% Minnesota — — 1 — — 72 15,450 0.2% Nevada — 1 — — 68 — 23,670 0.4% South Dakota — 1 — — 40 — 7,167 0.1% Texas 6 5 — 739 271 — 120,584 1.8% Virginia — 1 — — 68 — 23,000 0.4% Washington 1 — — 60 — — 13,728 0.2% Wisconsin — 1 1 — 60 24 15,509 0.2% Canada — 1 — — 74 — 27,136 0.4% 9 15 2 958 970 96 $ 353,805 5.4% (1) Includes projects invested in or committed to as of March 31, 2018. (2) Investment amount excludes accrued and unpaid interest receivable. (3) Certificate of occupancy timing represents the period in which the certificate of occupancy has been received for a development project where construction has been completed or when the certificate of occupancy is expected to be received for a development project that is currently under construction. (4) Includes properties built since 2010 and included in real estate investments as of March 31, 2018. 9 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

PORTFOLIO NOI Concentrations (1) Pro Forma as of March 31, 2018 (2) RELATIONSHIP CONCENTRATION Senior Care Centers: 9.9% Genesis Healthcare, Inc.: 8.5% Enlivant: 7.9% Other: 61.0% Avamere Family of Companies: 6.8% Signature Healthcare: 5.9% ASSET CLASS CONCENTRATION Senior Housing - Leased: 14.4% Senior Housing - Managed: 10.0% Specialty Hospital Skilled Nursing/ and Other: 8.0% Transitional Care: 65.5% Interest and Other Income: 2.1% PAYOR SOURCE CONCENTRATION (3) Private Pay: 39.5% Non-Private: 60.5% (1) Concentrations are calculated using Annualized Cash Net Operating Income for real estate investments, investments in loans receivable and other investments, and investment in unconsolidated joint venture. We define Annualized Cash NOI as Annualized Revenues less operating expenses and non-cash revenues. (2) Assumes the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP was completed at the beginning of the period presented. (3) Tenant and borrower revenue presented one quarter in arrears. 10 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

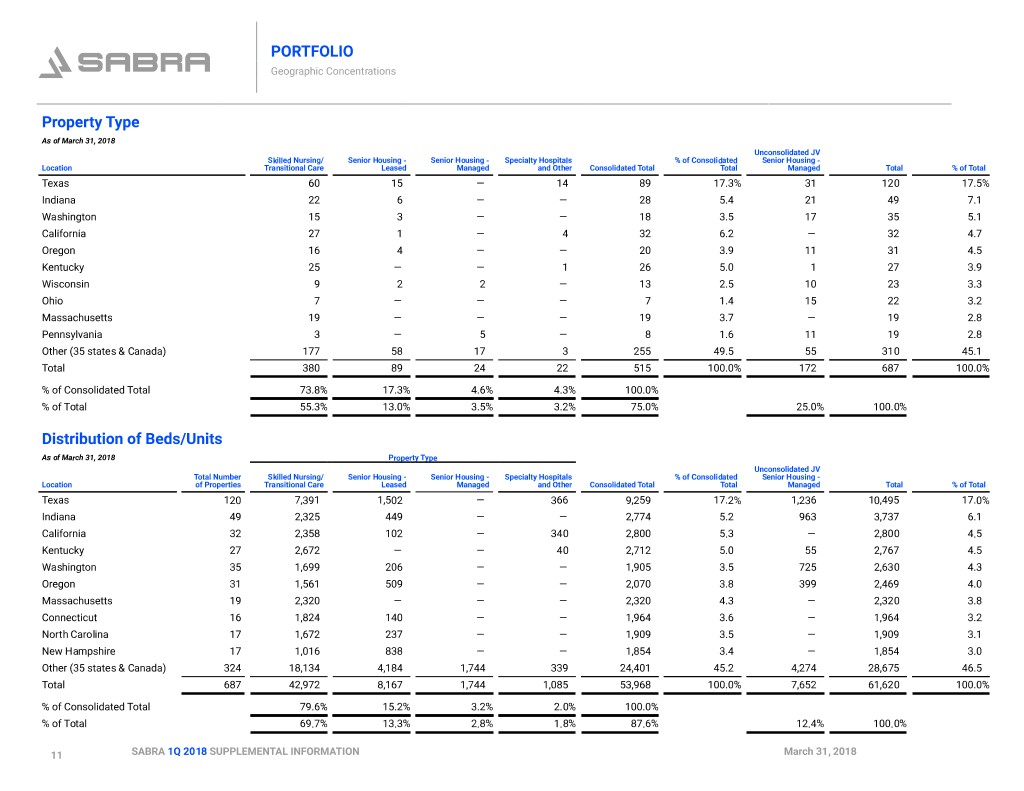

PORTFOLIO Geographic Concentrations Property Type As of March 31, 2018 Unconsolidated JV Skilled Nursing/ Senior Housing - Senior Housing - Specialty Hospitals % of Consolidated Senior Housing - Location Transitional Care Leased Managed and Other Consolidated Total Total Managed Total % of Total Texas 60 15 — 14 89 17.3% 31 120 17.5% Indiana 22 6 — — 28 5.4 21 49 7.1 Washington 15 3 — — 18 3.5 17 35 5.1 California 27 1 — 4 32 6.2 — 32 4.7 Oregon 16 4 — — 20 3.9 11 31 4.5 Kentucky 25 — — 1 26 5.0 1 27 3.9 Wisconsin 9 2 2 — 13 2.5 10 23 3.3 Ohio 7 — — — 7 1.4 15 22 3.2 Massachusetts 19 — — — 19 3.7 — 19 2.8 Pennsylvania 3 — 5 — 8 1.6 11 19 2.8 Other (35 states & Canada) 177 58 17 3 255 49.5 55 310 45.1 Total 380 89 24 22 515 100.0% 172 687 100.0% % of Consolidated Total 73.8% 17.3% 4.6% 4.3% 100.0% % of Total 55.3% 13.0% 3.5% 3.2% 75.0% 25.0% 100.0% Distribution of Beds/Units As of March 31, 2018 Property Type Unconsolidated JV Total Number Skilled Nursing/ Senior Housing - Senior Housing - Specialty Hospitals % of Consolidated Senior Housing - Location of Properties Transitional Care Leased Managed and Other Consolidated Total Total Managed Total % of Total Texas 120 7,391 1,502 — 366 9,259 17.2% 1,236 10,495 17.0% Indiana 49 2,325 449 — — 2,774 5.2 963 3,737 6.1 California 32 2,358 102 — 340 2,800 5.3 — 2,800 4.5 Kentucky 27 2,672 — — 40 2,712 5.0 55 2,767 4.5 Washington 35 1,699 206 — — 1,905 3.5 725 2,630 4.3 Oregon 31 1,561 509 — — 2,070 3.8 399 2,469 4.0 Massachusetts 19 2,320 — — — 2,320 4.3 — 2,320 3.8 Connecticut 16 1,824 140 — — 1,964 3.6 — 1,964 3.2 North Carolina 17 1,672 237 — — 1,909 3.5 — 1,909 3.1 New Hampshire 17 1,016 838 — — 1,854 3.4 — 1,854 3.0 Other (35 states & Canada) 324 18,134 4,184 1,744 339 24,401 45.2 4,274 28,675 46.5 Total 687 42,972 8,167 1,744 1,085 53,968 100.0% 7,652 61,620 100.0% % of Consolidated Total 79.6% 15.2% 3.2% 2.0% 100.0% % of Total 69.7% 13.3% 2.8% 1.8% 87.6% 12.4% 100.0% 11 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

PORTFOLIO Geographic Concentrations Continued Investment (1) Dollars in thousands As of March 31, 2018 Property Type Total Number Skilled Nursing/ Senior Housing - Senior Housing - Specialty Hospitals Location of Properties Transitional Care Leased Managed and Other Total % of Total Texas 89 $ 590,036 $ 234,838 $ — $ 195,929 $ 1,020,803 15.7% California 32 439,019 35,901 — 221,134 696,054 10.7 Oregon 20 264,892 86,250 — — 351,142 5.4 Maryland 9 320,426 6,566 — — 326,992 5.1 New York 10 297,066 19,235 — — 316,301 4.9 Indiana 28 213,438 59,888 — — 273,326 4.2 Kentucky 26 231,573 — — 30,313 261,886 4.0 Washington 18 188,632 36,900 — — 225,532 3.5 North Carolina 17 138,902 67,272 — — 206,174 3.2 Arizona 8 31,976 47,246 — 121,757 200,979 3.1 Other (33 states & Canada) (2) 258 1,668,352 579,006 310,377 48,307 2,606,042 40.2 Total 515 $ 4,384,312 $ 1,173,102 $ 310,377 $ 617,440 $ 6,485,231 100.0% % of Total investment 67.6% 18.1% 4.8% 9.5% 100.0% (1) Excludes unconsolidated joint venture. (2) Investment balance in Canada is based on the exchange rate as of March 31, 2018 of $0.7753 per CAD $1.00. 12 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

PORTFOLIO Lease Expirations Lease Expirations (1) Dollars in thousands As of March 31, 2018 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Thereafter Total Skilled Nursing/ Transitional Care Properties 6 — 37 9 21 54 24 20 20 68 118 377 Beds/Units 639 — 4,674 1,175 2,335 6,675 2,465 2,174 2,248 6,825 13,517 42,727 Annualized Revenues $4,682 $ — $36,189 $7,956 $22,575 $64,992 $26,092 $14,498 $22,990 $55,449 $194,270 $449,693 Senior Housing - Leased Properties — — — 2 15 3 6 13 1 13 36 89 Beds/Units — — — 163 1,027 393 411 920 100 692 4,461 8,167 Annualized Revenues $ — $ — $ — $1,070 $ 9,734 $ 2,787 $ 4,344 $10,452 $ 632 $ 9,787 $ 59,700 $ 98,506 Specialty Hospitals and Other Properties — — 12 — — — — — — 6 4 22 Beds/Units — — 258 — — — — — — 652 175 1,085 Annualized Revenues $ — $ — $ 5,301 $ — $ — $ — $ — $ — $ — $33,143 $ 12,973 $ 51,417 Total Properties 6 — 49 11 36 57 30 33 21 87 158 488 Total Beds/Units 639 — 4,932 1,338 3,362 7,068 2,876 3,094 2,348 8,169 18,153 51,979 Total Annualized Revenues $4,682 $ — $41,490 $9,026 $32,309 $67,779 $30,436 $24,950 $23,622 $98,379 $266,943 $599,616 % of Revenue 0.8% —% 6.9% 1.5% 5.4% 11.3% 5.1% 4.2% 3.9% 16.4% 44.5% 100.0% (1) Excludes Senior Housing - Managed communities, five assets held for sale, two skilled nursing/transitional care facilities with month-to-month leases and one non-operational skilled nursing/transitional care facility. 13 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

INVESTMENT ACTIVITY Year-to-Date Investment Activity Dollars in thousands Initial Number of 2018 Amounts Rate of Return/Initial Location Investment Date Property Type Properties Beds/Units Invested (1) Cash Yield Real Estate Investments Senior Housing - Enlivant 01/02/18 Managed 11 631 $ 125,019 6.30% North American Healthcare 01/10/18 & Skilled Nursing/ Portfolio II 01/19/18 Transitional Care 2 263 42,911 8.00% Senior Housing - Prairie View 01/31/18 Leased 1 30 4,076 8.00% Additions to Real Estate Various Multiple N/A N/A 11,411 7.50% Total Real Estate Investments 183,417 6.81% Preferred Equity Investments Leo Brown Group - Beavercreek II 03/21/18 Senior Housing 1 36 913 12.00% Loans Receivable McKinney Construction Loan 03/14/16 Senior Housing 1 27 323 8.00% Specialty Hospital River Vista Mortgage Loan 08/17/17 and Other 1 N/A 4,452 10.00% Skilled Nursing/ Meridian Promissory Note 01/23/18 Transitional Care 1 N/A 700 10.00% Total Loans Receivable 5,475 9.88% Unconsolidated Joint Venture Investment Senior Housing - Enlivant 01/02/18 Managed 172 7,652 352,749 6.30% All Investments $ 542,554 6.52% (1) Real estate investments include capitalized acquisition costs. 14 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

CAPITALIZATION Overview Debt Dollars in thousands Sabra's Share of As of March 31, 2018 Consolidated Debt Unconsolidated JV Debt Total Debt Secured debt $ 257,660 $ 384,243 $ 641,903 Revolving credit facility 611,000 — 611,000 Term loans 1,196,912 — 1,196,912 Senior unsecured notes 1,300,000 — 1,300,000 Total Debt 3,365,572 384,243 3,749,815 Deferred financing costs and premiums/discounts, net (4,466) (6,105) (10,571) Total Debt, Net $ 3,361,106 $ 378,138 $ 3,739,244 Revolving Credit Facility Dollars in thousands As of March 31, 2018 Credit facility availability $ 389,000 Credit facility capacity 1,000,000 Enterprise Value Dollars in thousands, except per share amounts As of March 31, 2018 Shares Outstanding Price Value Common stock 178,282,370 $ 17.65 $ 3,146,684 Preferred stock 5,750,000 25.14 144,555 Consolidated Debt 3,365,572 Cash and cash equivalents (46,352) Consolidated Enterprise Value 6,610,459 Sabra's share of unconsolidated joint venture debt 384,243 Total Enterprise Value $ 6,994,702 Common Stock and Equivalents Three Months Ended March 31, 2018 Weighted Average Common Shares EPS, FFO and Normalized FFO AFFO and Normalized AFFO Common stock 178,264,442 178,264,442 Common equivalents 30,163 30,163 Basic common and common equivalents 178,294,605 178,294,605 Dilutive securities: Restricted stock and units 221,783 972,378 Diluted common and common equivalents 178,516,388 179,266,983 15 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

CAPITALIZATION Indebtedness Fixed | Variable Rate Debt Dollars in thousands Weighted Average As of March 31, 2018 Principal Effective Rate (1) % of Total Fixed Rate Debt Secured debt $ 159,160 3.87% 4.2% Unsecured senior notes 1,300,000 5.33% 34.7% Sabra's share of unconsolidated joint venture fixed rate debt 2,158 4.76% 0.1% Total fixed rate debt 1,461,318 5.17% 39.0% Variable Rate Debt (2) Secured debt 98,500 3.68% 2.6% Revolving credit facility 611,000 3.13% 16.3% Term loans 1,196,912 2.80% 31.9% Sabra's share of unconsolidated joint venture variable rate debt 382,085 4.11% 10.2% Total variable rate debt 2,288,497 3.14% 61.0% Total Debt $ 3,749,815 3.93% 100.0% Secured | Unsecured Debt Dollars in thousands Weighted Average As of March 31, 2018 Principal Effective Rate (1) % of Total Secured Debt Secured debt $ 257,660 3.80% 6.9% Sabra's share of unconsolidated joint venture secured debt 384,243 4.11% 10.2% Total secured debt 641,903 3.98% 17.1% Unsecured Debt Unsecured senior notes 1,300,000 5.33% 34.7% Revolving credit facility 611,000 3.13% 16.3% Term loans 1,196,912 2.80% 31.9% Total unsecured debt 3,107,912 3.92% 82.9% Total Debt $ 3,749,815 3.93% 100.0% (1) Weighted average effective interest rate includes private mortgage insurance and impact of interest rate swap and cap agreements. (2) Term loans include $845.0 million subject to swap agreements that fix LIBOR at a weighted average rate of 1.19%, and $69.8 million (CAD $90.0 million) and $27.1 million (CAD $35.0 million) subject to swap agreements that fix CDOR at 1.59% and 0.93%, respectively. Excluding these amounts, variable rate debt was 35.9% of Total Debt as of March 31, 2018. Additionally, unconsolidated joint venture debt includes $368.4 million subject to interest rate cap agreements that cap LIBOR at a weighted average rate of 2.89%. 16 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

CAPITALIZATION Debt Maturity Debt Maturity Schedule (1) Sabra's Share of Dollars in thousands Secured Debt Unsecured Senior Notes Term Loans Revolving Credit Facility Consolidated Debt Unconsolidated JV Debt Total Debt As of March 31, 2018 Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) 4/1/18-12/31/18 $ 3,228 3.56% $ — — $ — — $ — — $ 3,228 3.56% $ 179 4.09% $ 3,407 3.59% 2019 102,930 3.48% — — — — — — 102,930 3.48% 248 4.09% 103,178 3.48% 2020 4,578 3.46% — — 200,000 3.33% — — 204,578 3.33% 3,186 4.09% 207,764 3.34% 2021 20,044 3.46% 500,000 5.50% — — 611,000 3.13% 1,131,044 4.18% 18,384 4.09% 1,149,428 4.18% 2022 4,285 3.44% — — 996,912 3.30% — — 1,001,197 3.30% 6,342 4.08% 1,007,539 3.30% 2023 4,427 3.45% 200,000 5.38% — — — — 204,427 5.33% 7,035 4.08% 211,462 5.29% 2024 4,573 3.45% — — — — — — 4,573 3.45% 7,290 4.08% 11,863 3.84% 2025 4,725 3.46% — — — — — — 4,725 3.46% 189,593 4.08% 194,318 4.06% 2026 4,882 3.47% 500,000 5.13% — — — — 504,882 5.11% 81,733 4.28% 586,615 4.99% 2027 5,044 3.48% 100,000 5.38% — — — — 105,044 5.29% 70,253 3.99% 175,297 4.77% Thereafter 98,944 3.60% — — — — — — 98,944 3.60% — — 98,944 3.60% Total Debt 257,660 1,300,000 1,196,912 611,000 3,365,572 384,243 3,749,815 Premium, net — 15,568 — — 15,568 284 15,852 Deferred financing costs, net (2,743) (9,002) (8,289) — (20,034) (6,389) (26,423) Total Debt, Net $ 254,917 $ 1,306,566 $ 1,188,623 $ 611,000 $ 3,361,106 $ 378,138 $ 3,739,244 Wtd. avg. maturity/years 14.8 5.8 4.0 3.4 5.4 7.4 5.6 Wtd. avg. effective interest rate (3) 3.80% 5.33% 2.80% 3.13% 3.91% 4.11% 3.93% (1) Revolving Credit Facility is subject to two six-month extension options. (2) Represents actual contractual interest rates excluding private mortgage insurance and impact of interest rate derivative agreements. (3) Weighted average effective interest rate includes private mortgage insurance and impact of interest rate derivative agreements. 17 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

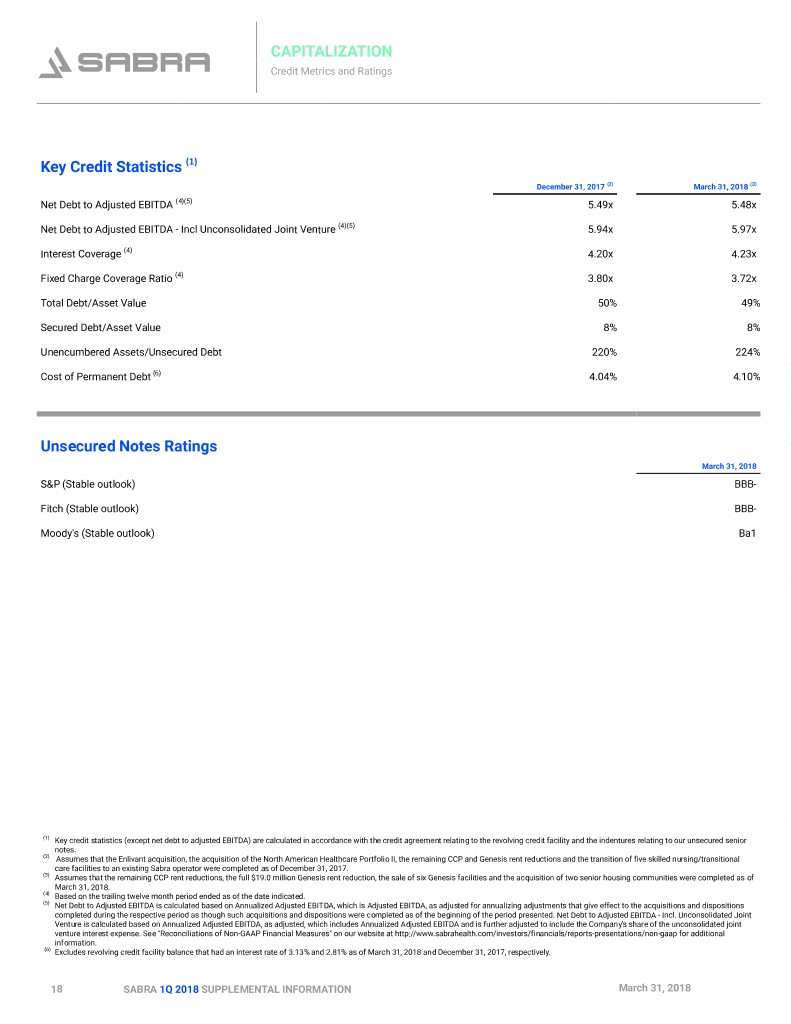

CAPITALIZATION Credit Metrics and Ratings Key Credit Statistics (1) December 31, 2017 (2) March 31, 2018 (3) Net Debt to Adjusted EBITDA (4)(5) 5.49x 5.48x Net Debt to Adjusted EBITDA - Incl Unconsolidated Joint Venture (4)(5) 5.94x 5.97x Interest Coverage (4) 4.20x 4.23x Fixed Charge Coverage Ratio (4) 3.80x 3.72x Total Debt/Asset Value 50% 49% Secured Debt/Asset Value 8% 8% Unencumbered Assets/Unsecured Debt 220% 224% Cost of Permanent Debt (6) 4.04% 4.10% Unsecured Notes Ratings March 31, 2018 S&P (Stable outlook) BBB- Fitch (Stable outlook) BBB- Moody's (Stable outlook) Ba1 (1) Key credit statistics (except net debt to adjusted EBITDA) are calculated in accordance with the credit agreement relating to the revolving credit facility and the indentures relating to our unsecured senior notes. (2) Assumes that the Enlivant acquisition, the acquisition of the North American Healthcare Portfolio II, the remaining CCP and Genesis rent reductions and the transition of five skilled nursing/transitional care facilities to an existing Sabra operator were completed as of December 31, 2017. (3) Assumes that the remaining CCP rent reductions, the full $19.0 million Genesis rent reduction, the sale of six Genesis facilities and the acquisition of two senior housing communities were completed as of March 31, 2018. (4) Based on the trailing twelve month period ended as of the date indicated. (5) Net Debt to Adjusted EBITDA is calculated based on Annualized Adjusted EBITDA, which is Adjusted EBITDA, as adjusted for annualizing adjustments that give effect to the acquisitions and dispositions completed during the respective period as though such acquisitions and dispositions were completed as of the beginning of the period presented. Net Debt to Adjusted EBITDA - Incl. Unconsolidated Joint Venture is calculated based on Annualized Adjusted EBITDA, as adjusted, which includes Annualized Adjusted EBITDA and is further adjusted to include the Company's share of the unconsolidated joint venture interest expense. See "Reconciliations of Non-GAAP Financial Measures" on our website at http://www.sabrahealth.com/investors/financials/reports-presentations/non-gaap for additional information. (6) Excludes revolving credit facility balance that had an interest rate of 3.13% and 2.81% as of March 31, 2018 and December 31, 2017, respectively. 18 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

FINANCIAL INFORMATION 2018 Outlook Update 2018 Full Year Guidance Low High Net income attributable to common stockholders $ 1.98 $ 2.06 Add: Depreciation and amortization (1) 1.17 1.17 Net gain on sales of real estate (0.67) (0.67) FFO attributable to common stockholders $ 2.48 $ 2.56 Write-off of capitalized preferred equity issuance costs 0.03 0.03 Write-off of above market lease intangibles (0.05) (0.05) CCP transition costs 0.01 0.01 Normalized FFO attributable to common stockholders $ 2.47 $ 2.55 FFO attributable to common stockholders $ 2.48 $ 2.56 Stock-based compensation expense 0.05 0.05 Straight-line rental income adjustments (0.28) (0.28) Amortization of above/below market lease intangibles (0.02) (0.02) Amortization of deferred financing costs 0.05 0.05 Write-off of above market lease intangibles (0.05) (0.05) Write-off of capitalized preferred equity issuance costs 0.03 0.03 Non-cash portion of loss on extinguishment of debt 0.02 0.02 Non-cash interest income adjustments (0.01) (0.01) Provision for doubtful straight-line rental income, loan losses and other reserves 0.01 0.01 AFFO attributable to common stockholders $ 2.28 $ 2.36 CCP transition costs 0.01 0.01 Provision for doubtful cash rents and interest (0.02) (0.02) Normalized AFFO attributable to common stockholders $ 2.27 $ 2.35 The updated 2018 outlook reflects revised timing for completing the Series A Preferred Stock redemption and the elimination of the previously anticipated refinancing of our $500 million of 5.5% senior unsecured notes due 2021 and $200 million of 5.375% senior unsecured notes due 2023. Except as otherwise noted above, the foregoing projections reflect management's view of current and future market conditions. There can be no assurance that the Company's actual results will not differ materially from the estimates set forth above. Except as otherwise required by law, the Company assumes no, and hereby disclaims any, obligation to update any of the foregoing projections as a result of new information or new or future developments. (1) Includes depreciation and amortization related to noncontrolling interests and unconsolidated joint venture. 19 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

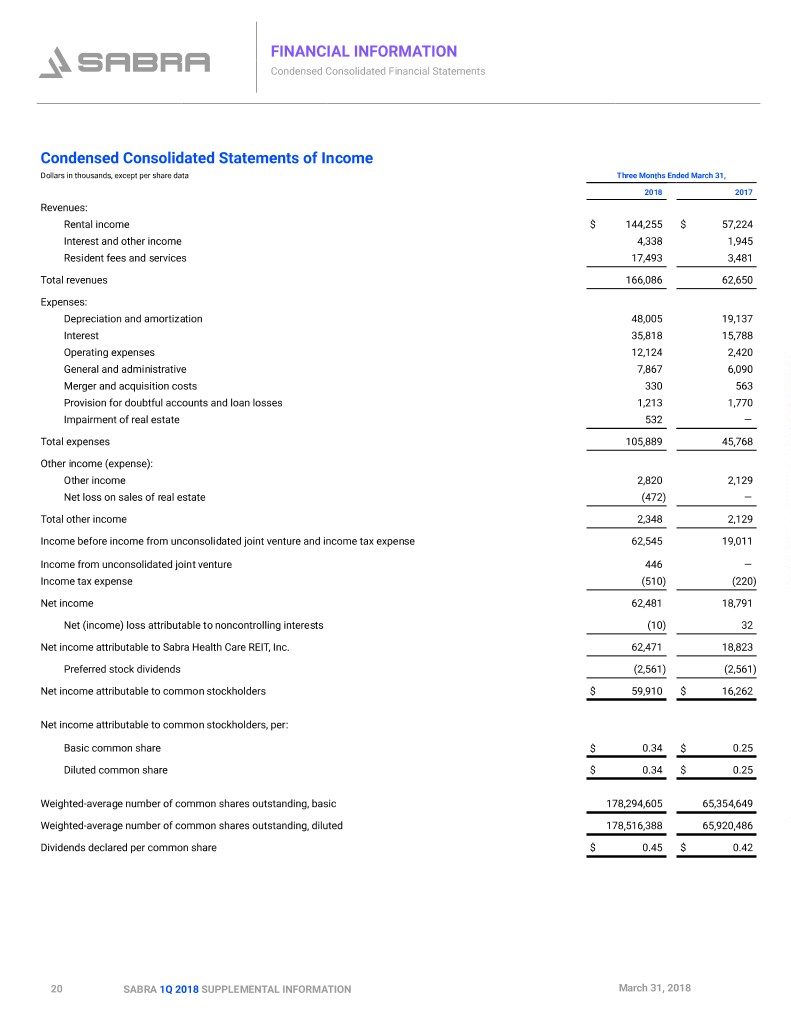

FINANCIAL INFORMATION Condensed Consolidated Financial Statements Condensed Consolidated Statements of Income Dollars in thousands, except per share data Three Months Ended March 31, 2018 2017 Revenues: Rental income $ 144,255 $ 57,224 Interest and other income 4,338 1,945 Resident fees and services 17,493 3,481 Total revenues 166,086 62,650 Expenses: Depreciation and amortization 48,005 19,137 Interest 35,818 15,788 Operating expenses 12,124 2,420 General and administrative 7,867 6,090 Merger and acquisition costs 330 563 Provision for doubtful accounts and loan losses 1,213 1,770 Impairment of real estate 532 — Total expenses 105,889 45,768 Other income (expense): Other income 2,820 2,129 Net loss on sales of real estate (472) — Total other income 2,348 2,129 Income before income from unconsolidated joint venture and income tax expense 62,545 19,011 Income from unconsolidated joint venture 446 — Income tax expense (510) (220) Net income 62,481 18,791 Net (income) loss attributable to noncontrolling interests (10) 32 Net income attributable to Sabra Health Care REIT, Inc. 62,471 18,823 Preferred stock dividends (2,561) (2,561) Net income attributable to common stockholders $ 59,910 $ 16,262 Net income attributable to common stockholders, per: Basic common share $ 0.34 $ 0.25 Diluted common share $ 0.34 $ 0.25 Weighted-average number of common shares outstanding, basic 178,294,605 65,354,649 Weighted-average number of common shares outstanding, diluted 178,516,388 65,920,486 Dividends declared per common share $ 0.45 $ 0.42 20 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

FINANCIAL INFORMATION Condensed Consolidated Financial Statements Condensed Consolidated Balance Sheets Dollars in thousands, except per share data March 31, 2018 December 31, 2017 (unaudited) Assets Real estate investments, net of accumulated depreciation of $377,063 and $340,423 as of March 31, 2018 and December 31, 2017, respectively $ 6,108,801 $ 5,994,432 Loans receivable and other investments, net 100,888 114,390 Cash and cash equivalents 46,352 518,632 Restricted cash 11,818 68,817 Lease intangible assets, net 161,423 167,119 Accounts receivable, prepaid expenses and other assets, net 200,380 168,887 Total assets $ 6,984,569 $ 7,032,277 Liabilities Secured debt, net $ 254,917 $ 256,430 Revolving credit facility 611,000 641,000 Term loans, net 1,188,623 1,190,774 Senior unsecured notes, net 1,306,566 1,306,286 Accounts payable and accrued liabilities 102,353 102,523 Lease intangible liabilities, net 94,544 98,015 Total liabilities 3,558,003 3,595,028 Equity Preferred stock, $.01 par value; 10,000,000 shares authorized, 5,750,000 shares issued and outstanding as of March 31, 2018 and December 31, 2017 58 58 Common stock, $.01 par value; 250,000,000 shares authorized, 178,282,370 and 178,255,843 shares issued and outstanding as of March 31, 2018 and December 31, 2017, respectively 1,783 1,783 Additional paid-in capital 3,638,109 3,636,913 Cumulative distributions in excess of net income (238,612) (217,236) Accumulated other comprehensive income 20,813 11,289 Total Sabra Health Care REIT, Inc. stockholders’ equity 3,422,151 3,432,807 Noncontrolling interests 4,415 4,442 Total equity 3,426,566 3,437,249 Total liabilities and equity $ 6,984,569 $ 7,032,277 21 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

FINANCIAL INFORMATION Condensed Consolidated Financial Statements Condensed Consolidated Statements of Cash Flows Dollars in thousands Three Months Ended March 31, 2018 2017 Cash flows from operating activities: Net income $ 62,481 $ 18,791 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 48,005 19,137 Amortization of above and below market lease intangibles, net (684) — Non-cash interest income adjustments (570) 26 Non-cash interest expense 2,481 1,591 Stock-based compensation expense 1,135 2,588 Straight-line rental income adjustments (11,563) (4,607) Provision for doubtful accounts and loan losses 1,213 1,770 Change in fair value of contingent consideration — (822) Net loss on sales of real estate 472 — Impairment of real estate 532 — Income from unconsolidated joint venture (446) — Changes in operating assets and liabilities: Accounts receivable, prepaid expenses and other assets (1,658) (1,791) Accounts payable and accrued liabilities 249 (5,096) Net cash provided by operating activities 101,647 31,587 Cash flows from investing activities: Acquisition of real estate (172,001) — Origination and fundings of loans receivable (13,232) (508) Origination and fundings of preferred equity investments (928) (51) Additions to real estate (11,539) (520) Repayments of loans receivable 28,805 118 Repayments of preferred equity investments 234 — Investment in unconsolidated joint venture (354,461) — Net proceeds from the sales of real estate 6,743 — Net cash used in investing activities (516,379) (961) Cash flows from financing activities: Net repayments of revolving credit facility (30,000) (9,000) Principal payments on secured debt (1,061) (1,021) Payments of deferred financing costs (6) (109) Issuance of common stock, net (499) (3,224) Dividends paid on common and preferred stock (82,789) (29,993) Net cash used in financing activities (114,392) (43,347) Net decrease in cash, cash equivalents and restricted cash (529,124) (12,721) Effect of foreign currency translation on cash, cash equivalents and restricted cash (155) 21 Cash, cash equivalents and restricted cash, beginning of period 587,449 34,665 Cash, cash equivalents and restricted cash, end of period $ 58,170 $ 21,965 Supplemental disclosure of cash flow information: Interest paid $ 42,623 $ 18,127 22 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

FINANCIAL INFORMATION FFO, Normalized FFO, AFFO and Normalized AFFO FFO, Normalized FFO, AFFO and Normalized AFFO Three Months Ended March 31, 2018 2017 Net income attributable to common stockholders $ 59,910 $ 16,262 Add: Depreciation of real estate assets 48,005 19,137 Depreciation and amortization of real estate assets related to noncontrolling interests (40) — Depreciation and amortization of real estate assets related to unconsolidated joint venture 4,552 — Net loss on sales of real estate 472 — Impairment of real estate 532 — FFO attributable to common stockholders $ 113,431 $ 35,399 Lease termination fee — (1,367) CCP merger and transition costs 966 531 (Recovery of) provision for doubtful accounts and loan losses, net (864) 1,727 Other normalizing items (1) (1,908) 71 Normalized FFO attributable to common stockholders $ 111,625 $ 36,361 FFO attributable to common stockholders $ 113,431 $ 35,399 Merger and acquisition costs (2) 330 563 Stock-based compensation expense 1,135 2,588 Straight-line rental income adjustments (11,563) (4,607) Amortization of above and below market lease intangibles, net (684) — Non-cash interest income adjustments (570) 26 Non-cash interest expense 2,481 1,590 Change in fair value of contingent consideration — (822) Provision for doubtful straight-line rental income, loan losses and other reserves 2,181 1,390 Other non-cash adjustments related to unconsolidated joint venture (336) — Other non-cash adjustments 15 60 AFFO attributable to common stockholders $ 106,420 $ 36,187 CCP transition costs 632 — Lease termination fee — (1,367) (Recovery of) provision for doubtful cash income (968) 381 Other normalizing items (1) (1,908) 12 Normalized AFFO attributable to common stockholders $ 104,176 $ 35,213 Amounts per diluted common share attributable to common stockholders: Net income $ 0.34 $ 0.25 FFO $ 0.64 $ 0.54 Normalized FFO $ 0.63 $ 0.55 AFFO $ 0.59 $ 0.55 Normalized AFFO $ 0.58 $ 0.53 Weighted average number of common shares outstanding, diluted: Net income, FFO and Normalized FFO 178,516,388 65,920,486 AFFO and Normalized AFFO 179,266,983 66,325,908 (1) Other normalizing items for FFO and AFFO include non-Senior Housing - Managed operating expenses. The three months ended March 31, 2018 also includes a contingency fee of $2.0 million earned during the period related to a CCP investment. (2) Merger and acquisition costs primarily relate to the CCP merger. 23 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

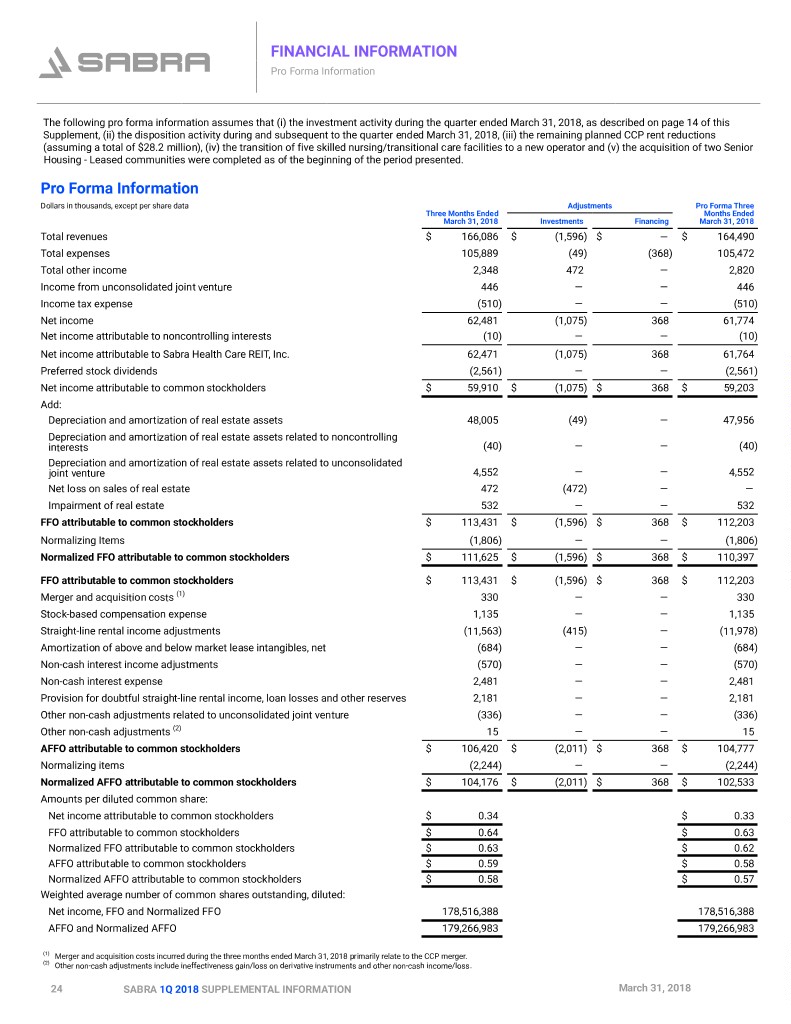

FINANCIAL INFORMATION Pro Forma Information The following pro forma information assumes that (i) the investment activity during the quarter ended March 31, 2018, as described on page 14 of this Supplement, (ii) the disposition activity during and subsequent to the quarter ended March 31, 2018, (iii) the remaining planned CCP rent reductions (assuming a total of $28.2 million), (iv) the transition of five skilled nursing/transitional care facilities to a new operator and (v) the acquisition of two Senior Housing - Leased communities were completed as of the beginning of the period presented. Pro Forma Information Dollars in thousands, except per share data Adjustments Pro Forma Three Three Months Ended Months Ended March 31, 2018 Investments Financing March 31, 2018 Total revenues $ 166,086 $ (1,596) $ — $ 164,490 Total expenses 105,889 (49) (368) 105,472 Total other income 2,348 472 — 2,820 Income from unconsolidated joint venture 446 — — 446 Income tax expense (510) — — (510) Net income 62,481 (1,075) 368 61,774 Net income attributable to noncontrolling interests (10) — — (10) Net income attributable to Sabra Health Care REIT, Inc. 62,471 (1,075) 368 61,764 Preferred stock dividends (2,561) — — (2,561) Net income attributable to common stockholders $ 59,910 $ (1,075) $ 368 $ 59,203 Add: Depreciation and amortization of real estate assets 48,005 (49) — 47,956 Depreciation and amortization of real estate assets related to noncontrolling interests (40) — — (40) Depreciation and amortization of real estate assets related to unconsolidated joint venture 4,552 — — 4,552 Net loss on sales of real estate 472 (472) — — Impairment of real estate 532 — — 532 FFO attributable to common stockholders $ 113,431 $ (1,596) $ 368 $ 112,203 Normalizing Items (1,806) — — (1,806) Normalized FFO attributable to common stockholders $ 111,625 $ (1,596) $ 368 $ 110,397 FFO attributable to common stockholders $ 113,431 $ (1,596) $ 368 $ 112,203 Merger and acquisition costs (1) 330 — — 330 Stock-based compensation expense 1,135 — — 1,135 Straight-line rental income adjustments (11,563) (415) — (11,978) Amortization of above and below market lease intangibles, net (684) — — (684) Non-cash interest income adjustments (570) — — (570) Non-cash interest expense 2,481 — — 2,481 Provision for doubtful straight-line rental income, loan losses and other reserves 2,181 — — 2,181 Other non-cash adjustments related to unconsolidated joint venture (336) — — (336) Other non-cash adjustments (2) 15 — — 15 AFFO attributable to common stockholders $ 106,420 $ (2,011) $ 368 $ 104,777 Normalizing items (2,244) — — (2,244) Normalized AFFO attributable to common stockholders $ 104,176 $ (2,011) $ 368 $ 102,533 Amounts per diluted common share: Net income attributable to common stockholders $ 0.34 $ 0.33 FFO attributable to common stockholders $ 0.64 $ 0.63 Normalized FFO attributable to common stockholders $ 0.63 $ 0.62 AFFO attributable to common stockholders $ 0.59 $ 0.58 Normalized AFFO attributable to common stockholders $ 0.58 $ 0.57 Weighted average number of common shares outstanding, diluted: Net income, FFO and Normalized FFO 178,516,388 178,516,388 AFFO and Normalized AFFO 179,266,983 179,266,983 (1) Merger and acquisition costs incurred during the three months ended March 31, 2018 primarily relate to the CCP merger. (2) Other non-cash adjustments include ineffectiveness gain/loss on derivative instruments and other non-cash income/loss. 24 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

FINANCIAL INFORMATION Components of Net Asset Value (NAV) We disclose components of our business relevant to calculate NAV. We consider NAV to be a useful supplemental measure that assists both management and investors to estimate the fair value of our Company. The calculation of NAV involves significant estimates and can be calculated using various methods. Each individual investor must determine the specific methodology, assumptions and estimates to use to arrive at an estimated NAV of the Company. The components of NAV do not consider the potential changes in revenue streams or our investment portfolio. The components include non-GAAP financial measures, such as Cash NOI. Although these measures are not presented in accordance with GAAP, investors can use these non-GAAP financial measures as supplemental information to evaluate our business. Pro Forma Annualized Cash NOI (1) Dollars in thousands Skilled Nursing/Transitional Care $ 387,018 42,972 beds Senior Housing - Leased 85,180 8,167 units Senior Housing - Managed 58,959 9,396 units Specialty Hospitals and Other 47,386 1,085 beds Pro forma Annualized Cash NOI (Excluding Loans Receivable and Other Investments) $ 578,543 Obligations Dollars in thousands Secured debt (2) $ 257,660 Unsecured senior notes (2) 1,300,000 Revolving credit facility 611,000 Term loans (2) 1,196,912 Sabra's share of unconsolidated JV debt (3) 384,243 Total Debt 3,749,815 Add (less): Cash and cash equivalents and restricted cash (58,170) Accounts payable and accrued liabilities 102,353 Preferred stock 144,555 Net obligations $ 3,938,553 Other Assets Dollars in thousands Loans receivable and other investments, net $ 100,888 Accounts receivable, prepaid expenses and other assets, net (4) 46,544 Total other assets $ 147,432 Common Shares Outstanding Total shares 178,282,370 (1) Assumes the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP was completed at the beginning of the period presented. (2) Amounts represent principal amounts due and exclude deferred financing costs, net and premiums/discounts, net. (3) Represents Sabra's 49% share of unconsolidated joint venture debt in the Enlivant investment. (4) Includes assets that impact cash or NOI and excludes non-cash items. 25 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

APPENDIX Disclaimer Disclaimer This supplement contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These statements may be identified, without limitation, by the use of “expects,” “believes,” “intends,” “should” or comparable terms or the negative thereof. Examples of forward- looking statements include all statements regarding our expected future financial position, results of operations, cash flows, liquidity, business strategy, growth opportunities, potential investments, and plans and objectives for future operations. Our actual results may differ materially from those projected or contemplated by our forward-looking statements as a result of various factors, including among others, the following: our dependence on the operating success of our tenants; operational risks with respect to our Senior Housing - Managed communities; the effect of our tenants declaring bankruptcy or becoming insolvent; our ability to find replacement tenants and the impact of unforeseen costs in acquiring new properties; the impact of litigation and rising insurance costs on the business of our tenants; the anticipated benefits of our merger with Care Capital Properties, Inc. (“CCP”) may not be realized; the anticipated and unanticipated costs, fees, expenses and liabilities related to our merger with CCP; our ability to implement the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP on the timing or terms we have previously disclosed; our ability to dispose of facilities currently leased to Genesis Healthcare, Inc. (“Genesis”) on the timing or terms we have previously disclosed; the possibility that Sabra may not acquire the remaining majority interest in the Enlivant joint venture; risks associated with our investments in joint ventures; changes in healthcare regulation and political or economic conditions; the impact of required regulatory approvals of transfers of healthcare properties; competitive conditions in our industry; our concentration in the healthcare property sector, particularly in skilled nursing/transitional care facilities and senior housing communities, which makes our profitability more vulnerable to a downturn in a specific sector than if we were investing in multiple industries; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to pay dividends, make investments, incur additional indebtedness and refinance indebtedness on favorable terms; increases in market interest rates; our ability to raise capital through equity and debt financings; changes in foreign currency exchange rates; the relatively illiquid nature of real estate investments; the loss of key management personnel or other employees; uninsured or underinsured losses affecting our properties and the possibility of environmental compliance costs and liabilities; the impact of a failure or security breach of information technology in our operations; our ability to maintain our status as a real estate investment trust ("REIT"); changes in tax laws and regulations affecting REITs (including the potential effects of the Tax Cuts and Jobs Act); compliance with REIT requirements and certain tax and tax regulatory matters related to our status as a REIT; and the ownership limits and anti-takeover defenses in our governing documents and under Maryland law, which may restrict change of control or business combination opportunities. Additional information concerning risks and uncertainties that could affect our business can be found in our filings with the Securities and Exchange Commission (the “SEC”), including Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2017. We do not intend, and we undertake no obligation, to update any forward-looking information to reflect events or circumstances after the date of this supplement or to reflect the occurrence of unanticipated events, unless required by law to do so. Note Regarding Non-GAAP Financial Measures This supplement includes the following financial measures defined as non-GAAP financial measures by the SEC: net operating income (“NOI”), Cash NOI, funds from operations attributable to common stockholders (“FFO”), Normalized FFO, Adjusted FFO (“AFFO”), Normalized AFFO, FFO per diluted common share, Normalized FFO per diluted common share, AFFO per diluted common share, Normalized AFFO per diluted common share and Adjusted EBITDA (defined below). These measures may be different than non-GAAP financial measures used by other companies, and the presentation of these measures is not intended to be considered in isolation or as a substitute for financial information prepared and presented in accordance with U.S. generally accepted accounting principles. An explanation of these non-GAAP financial measures is included under “Reporting Definitions” in this supplement and reconciliations of these non-GAAP financial measures to the GAAP financial measures we consider most comparable are included on the Investors section of our website at http://www.sabrahealth.com/investors/financials/reports-presentations/non-gaap. Tenant and Borrower Information This supplement includes information regarding certain of our tenants that lease properties from us and our borrowers, most of which are not subject to SEC reporting requirements. The information related to our tenants and borrowers that is provided in this supplement has been provided by, or derived from information provided by, such tenants and borrowers. We have not independently verified this information. We have no reason to believe that such information is inaccurate in any material respect. We are providing this data for informational purposes only. Sabra Information The information in this supplemental information package should be read in conjunction with the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information filed with the SEC. The Reporting Definitions and Reconciliations of Non-GAAP Measures are an integral part of the information presented herein. On Sabra's website, www.sabrahealth.com, you can access, free of charge, Sabra's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports file or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material is filed with, or furnished to, the SEC. The information contained on Sabra's website is not incorporated by reference into, and should not be considered a part of, this supplemental information package. All material filed with the SEC can also be accessed through its website, www.sec.gov. For more information, contact Investor Relations at (888) 393-8248 or investorrelations@sabrahealth.com. 26 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

APPENDIX Reporting Definitions Adjusted EBITDA* Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization (“EBITDA”) excluding the impact of merger-related costs, stock-based compensation expense under the Company's long-term equity award program, and loan loss reserves. Adjusted EBITDA is an important non- GAAP supplemental measure of operating performance. Ancillary Supported Tenant A tenant, or one of its affiliates, that owns an ancillary business that depends on providing services to the residents of the properties leased by the affiliated operating company (Sabra's tenant) for a meaningful part of the ancillary business's profitability and has below market EBITDAR coverage. Annualized Revenues The annual straight-line rental revenues under leases and interest and other income generated by the Company's loans receivable and other investments based on amounts invested and applicable terms as of the end of the period presented. Annualized Revenues do not include tenant recoveries or additional rents. Cash Net Operating Income (“Cash NOI”)* The Company believes that net income attributable to common stockholders as defined by GAAP is the most appropriate earnings measure. The Company considers Cash NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines Cash NOI as total revenues less operating expenses and non-cash rental income. Cash NOI excludes all other financial statement amounts included in net income. Consolidated Debt The principal balances of the Company’s revolving credit facility, term loans, senior unsecured notes, and secured indebtedness as reported in the Company's condensed consolidated financial statements. Consolidated Debt, Net The carrying amount of the Company’s revolving credit facility, term loans, senior unsecured notes, and secured indebtedness, as reported in the Company’s condensed consolidated financial statements. Consolidated Enterprise Value The Company believes Consolidated Enterprise Value is an important measurement as it is a measure of a company’s value. The Company calculates Consolidated Enterprise Value as market equity capitalization plus Consolidated Debt. Market equity capitalization is calculated as (i) the number of shares of common stock multiplied by the closing price of the Company's common stock on the last day of the period presented plus (ii) the number of shares of preferred stock multiplied by the closing price of the Company's preferred stock on the last day of the period presented. Consolidated Enterprise Value includes the Company's market equity capitalization and Consolidated Debt, less cash and cash equivalents. EBITDAR Earnings before interest, taxes, depreciation, amortization and rent (“EBITDAR”) for a particular facility accruing to the operator/tenant of the property (not the Company) for the period presented. EBITDAR includes an imputed management fee of 5.0% of revenues for Skilled Nursing/Transitional Care facilities and Senior Housing - Leased communities and an imputed management fee of 2.5% of revenues for Specialty Hospitals and Other facilities. The Company uses EBITDAR in determining EBITDAR Coverage. EBITDAR has limitations as an analytical tool. EBITDAR does not reflect historical cash expenditures or future cash requirements for facility capital expenditures or contractual commitments. In addition, EBITDAR does not represent a property's net income or cash flow from operations and should not be considered an alternative to those indicators. The Company utilizes EBITDAR as a supplemental measure of the ability of the Company's operators/tenants and relevant guarantors to generate sufficient liquidity to meet related obligations to the Company. EBITDAR Coverage Represents the ratio of EBITDAR to contractual rent for owned facilities (excluding Senior Housing - Managed). EBITDAR Coverage is a supplemental measure of an operator/tenant's ability to meet their cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDAR. EBITDAR Coverage includes only Stabilized Facilities and excludes significant tenants with meaningful credit enhancement through guarantees (which include Genesis, Holiday and three legacy CCP tenants), two Ancillary Supported Tenants and facilities for which data is not available or meaningful. EBITDARM Earnings before interest, taxes, depreciation, amortization, rent and management fees (“EBITDARM”) for a particular facility accruing to the operator/tenant of the property (not the Company), for the period presented. The Company uses EBITDARM in determining EBITDARM Coverage. The usefulness of EBITDARM is limited by the same factors that limit the usefulness of EBITDAR. Together with EBITDAR, the Company utilizes EBITDARM to evaluate the core operations of the properties by eliminating management fees, which vary based on operator/tenant and its operating structure. EBITDARM Coverage Represents the ratio of EBITDARM to contractual rent for owned facilities (excluding Senior Housing - Managed properties). EBITDARM coverage is a supplemental measure of a property's ability to generate cash flows for the operator/tenant (not the Company) to meet the operator's/tenant's related cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDARM. EBITDARM Coverage includes only Stabilized Facilities and excludes significant tenants with meaningful credit enhancement through guarantees (which include Genesis, Holiday and three legacy CCP tenants), two Ancillary Supported Tenants and facilities for which data is not available or meaningful. 27 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

APPENDIX Reporting Definitions Fixed Charge Coverage Ratio EBITDAR (including adjustments for one-time and pro forma items) for the period indicated (one quarter in arrears) for all operations of any entities that guarantee the tenants' lease obligations to the Company divided by the same period cash rent expense, interest expense and mandatory principal payments for operations of any entity that guarantees the tenants' lease obligation to the Company. Fixed Charge Coverage is a supplemental measure of a guarantor's ability to meet the operator/tenant's cash rent and other obligations to the Company should the operator/tenant be unable to do so itself. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDAR. Fixed Charge Coverage is calculated by the Company as described above based on information provided by guarantors without independent verification by the Company and may differ from similar metrics calculated by the guarantors. Funds From Operations Attributable to Common Stockholders (“FFO”) and Adjusted Funds from Operations Attributable to Common Stockholders (“AFFO”)* The Company believes that net income attributable to common stockholders as defined by GAAP is the most appropriate earnings measure. The Company also believes that Funds From Operations, or FFO, as defined in accordance with the definition used by the National Association of Real Estate Investment Trusts (“NAREIT”), and Adjusted Funds from Operations, or AFFO (and related per share amounts) are important non-GAAP supplemental measures of the Company's operating performance. Because the historical cost accounting convention used for real estate assets requires straight-line depreciation (except on land), such accounting presentation implies that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market and other conditions, presentations of operating results for a real estate investment trust that uses historical cost accounting for depreciation could be less informative. Thus, NAREIT created FFO as a supplemental measure of operating performance for real estate investment trusts that excludes historical cost depreciation and amortization, among other items, from net income attributable to common stockholders, as defined by GAAP. FFO is defined as net income attributable to common stockholders, computed in accordance with GAAP, excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization, net of amounts related to noncontrolling interests, the Company's share of depreciation and amortization related to our unconsolidated joint venture, and real estate impairment charges. AFFO is defined as FFO excluding merger and acquisition costs, stock-based compensation expense, straight-line rental income adjustments, amortization of above and below market lease intangibles, non-cash interest income adjustments, non-cash interest expense and our share of other non-cash adjustments related to our unconsolidated joint venture, as well as other non-cash revenue and expense items (including non-cash portion of loss on extinguishment of debt, change in fair value of contingent consideration, provision for doubtful straight-line rental income, loan losses and other reserves, ineffectiveness gain/loss on derivative instruments, and non-cash revenue and expense amounts related to noncontrolling interests). The Company believes that the use of FFO and AFFO (and the related per share amounts), combined with the required GAAP presentations, improves the understanding of the Company's operating results among investors and makes comparisons of operating results among real estate investment trusts more meaningful. The Company considers FFO and AFFO to be useful measures for reviewing comparative operating and financial performance because, by excluding the applicable items listed above, FFO and AFFO can help investors compare the operating performance of the Company between periods or as compared to other companies. While FFO and AFFO are relevant and widely used measures of operating performance of real estate investment trusts, they do not represent cash flows from operations or net income attributable to common stockholders as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. FFO and AFFO also do not consider the costs associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s computation of FFO and AFFO may not be comparable to FFO and AFFO reported by other real estate investment trusts that do not define FFO in accordance with the current NAREIT definition or that interpret the current NAREIT definition or define AFFO differently than the Company does. Investment Represents the carrying amount of real estate assets after adding back accumulated depreciation and amortization and excludes net intangible assets and liabilities. Investment also includes the Company's pro rata share of the real estate assets held in the Company's unconsolidated joint venture. Market Capitalization Total common shares of Sabra outstanding multiplied by the closing price per common share as of a given period. Net Operating Income (“NOI”)* The Company believes that net income attributable to common stockholders as defined by GAAP is the most appropriate earnings measure. The Company considers NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines NOI as total revenues less operating expenses. NOI excludes all other financial statement amounts included in net income. Normalized FFO and Normalized AFFO* Normalized FFO and Normalized AFFO represent FFO and AFFO, respectively, adjusted for certain income and expense items that the Company does not believe are indicative of its ongoing operating results. The Company considers Normalized FFO and Normalized AFFO to be useful measures to evaluate the Company’s operating results excluding these income and expense items to help investors compare the operating performance of the Company between periods or as compared to other companies. Normalized FFO and Normalized AFFO do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. Normalized FFO and Normalized AFFO also do not consider the costs associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s computation of Normalized FFO and Normalized AFFO may not be comparable to Normalized FFO and Normalized AFFO reported by other real estate investment trusts that do not define FFO in accordance with the current NAREIT definition or that interpret the current NAREIT definition or define FFO and AFFO or Normalized FFO and Normalized AFFO differently than the Company does. 28 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018

APPENDIX Reporting Definitions Occupancy Percentage Occupancy Percentage represents the facilities’ average operating occupancy for the period indicated. The percentages are calculated by dividing the actual census from the period presented by the available beds/units for the same period. Occupancy includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful. Occupancy Percentage for the Company's unconsolidated joint venture is weighted to reflect the Company's pro rata share. REVPOR REVPOR represents the average revenues generated per occupied room per month at Senior Housing - Managed communities for the period indicated. It is calculated as resident fees and services revenues divided by average monthly occupied room days. REVPOR includes only Stabilized Facilities. REVPOR for the Company's unconsolidated joint venture is weighted to reflect the Company's pro rata share. Senior Housing Senior Housing communities include independent living, assisted living, continuing care retirement and memory care communities. Skilled Mix Skilled Mix is defined as the total Medicare and non-Medicaid managed care patient revenue at Skilled Nursing/Transitional Care facilities divided by the total revenues at Skilled Nursing/Transitional Care facilities for the period indicated. Skilled Mix includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful. Skilled Nursing/Transitional Care Skilled Nursing/Transitional Care facilities include skilled nursing, transitional care, multi-license designation and mental health facilities. Specialty Hospitals and Other Includes acute care, long-term acute care, rehabilitation and behavioral hospitals, facilities that provide residential services, which may include assistance with activities of daily living, and other facilities not classified as Skilled Nursing/Transitional Care or Senior Housing. Stabilized Facility At the time of acquisition, the Company classifies each facility as either stabilized or pre-stabilized. In addition, the Company may classify a facility as pre- stabilized after acquisition. Circumstances that could result in a facility being classified as pre-stabilized include newly completed developments, facilities undergoing major renovations or additions, facilities being repositioned or transitioned to new operators, and significant transitions within the tenants’ business model. Such facilities will be reclassified to stabilized upon maintaining consistent occupancy (85% for Skilled Nursing/Transitional Care facilities and 90% for Senior Housing communities) but in no event beyond 24 months after the date of classification as pre-stabilized. Stabilized Facilities exclude (i) Senior Housing - Managed communities, (ii) facilities held for sale, (iii) facilities being sold pursuant to the Company's CCP portfolio repositioning, (iv) facilities being transitioned from leased by the Company to being operated by the Company, and (v) facilities acquired during the three months preceding the period presented. Total Debt Consolidated Debt plus the Company's pro rata share of the principal balances of the debt of the Company’s unconsolidated joint venture. Total Debt, Net Consolidated Debt, Net plus the Company's pro rata share of the carrying amount of the debt of the Company’s unconsolidated joint venture. Total Enterprise Value Consolidated Enterprise Value plus the Company's pro rata share of the principal balances of the debt of the Company's unconsolidated joint venture. *Non-GAAP Financial Measures Reconciliations, definitions and important discussions regarding the usefulness and limitations of the Non-GAAP Financial Measures used in this supplement can be found at http://www.sabrahealth.com/investors/financials/reports-presentations/non-gaap. 29 SABRA 1Q 2018 SUPPLEMENTAL INFORMATION March 31, 2018