Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ModivCare Inc | a1q2018pressrelease.htm |

| 8-K - 8-K - ModivCare Inc | form8-kq12018earningspress.htm |

Q1 2018 Update May 10, 2018

Forward-looking Statements and Non-GAAP Financial Information Forward-looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “demonstrate,” “expect,” “estimate,” “forecast,” “anticipate,” “should” and “likely” and similar expressions identify forward-looking statements. In addition, statements that are not historical should also be considered forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. Such forward-looking statements are based on current expectations that involve a number of known and unknown risks, uncertainties and other factors which may cause actual events to be materially different from those expressed or implied by such forward-looking statements. These factors include, but are not limited to, our continuing relationship with government entities and our ability to procure business from them, our ability to manage growing and changing operations, the implementation of healthcare reform law, government budget changes and legislation related to the services that we provide, our ability to renew or replace existing contracts that have expired or are scheduled to expire with significant clients, and other risks detailed in Providence’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Providence is under no obligation to (and expressly disclaims any such obligation to) update any of the information in this press release if any forward-looking statement later turns out to be inaccurate whether as a result of new information, future events or otherwise. Non-GAAP Financial Information In addition to the financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release includes EBITDA, Adjusted EBITDA and Segment-level Adjusted EBITDA for the Company and its operating segments, and Adjusted Net Income and Adjusted EPS for the Company, which are performance measures that are not recognized under GAAP. EBITDA is defined as income (loss) from continuing operations, net of taxes, before: (1) interest expense, net, (2) provision (benefit) for income taxes and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before certain items, including (as applicable): (1) restructuring and related charges including costs related to the corporate reorganization, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) gain or loss on sale of equity investments, (6) management fees and (7) transaction and related costs. Segment-level Adjusted EBITDA is calculated as Adjusted EBITDA for the company excluding the Adjusted EBITDA associated with corporate and holding company costs reported as our Corporate and Other Segment. Adjusted Net Income is defined as income (loss) from continuing operations, net of tax, before certain items, including (1) restructuring and related charges, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) intangible amortization expense, (6) gain or loss on sale of equity investments, (7) the impact of the Tax Cuts and Jobs Act, (8) excess tax charges associated with long term incentive plans, (9) the impact of adjustments on non-controlling interests, (10) certain transaction and related costs and (11) the income tax impact of such adjustments. Adjusted EPS is calculated as Adjusted Net Income less (as applicable): (1) dividends on convertible preferred stock, (2) accretion of convertible preferred stock discount, and (3) income allocated to participating stockholders, divided by the diluted weighted-average number of common shares outstanding. We utilize these non- GAAP performance measures, which exclude certain expenses and amounts, because we believe the timing of such expenses is unpredictable and not driven by our core operating results, and therefore render comparisons with prior periods as well as with other companies in our industry less meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. In addition, our net earnings in equity investees are excluded from these measures, as we do not have the ability to manage these ventures, allocate resources within the ventures, or directly control their operations or performance. Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non- GAAP financial information is not meant to be considered in isolation from or as a substitute for the directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business. Page 2

Q1 2018 Highlights • Consolidated revenue up 1.6% (1) • NET Services: New MCO contracts as well as increased membership and rates Revenue • WD Services: Successful launch of Work and Health Program contracts Growth • Matrix (2): Strong in-home visit volume growth. Mobile visits added through acquisition of HealthFair • Consolidated Adjusted EBITDA (3) up 24.0% (1) on margins of 4.7% • NET Services: Value enhancement initiatives driving reduction in transportation costs and successful negotiation of higher rates Profitability • WD Services: Reduction in corporate costs offset by negative impact of new revenue standard adoption • Adjusted EPS (3) of $0.63 up 80% versus Q1 17 • Announced organizational consolidation of holding company activities and functions into NET Services Capital • Increased share repurchase capacity by $78mm; $99.5mm of remaining capacity as of 5/7/18 Allocation • Exploring strategic alternatives for WD Services • $86.2mm of cash; no long-term debt 1. As compared to Q1 2017. 2. Providence’s interest in Matrix is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue. 3. See appendix for a reconciliation of non-GAAP financial measures. Page 3

NET Services • Revenue growth driven by new MCO contracts in New York and Indiana and new state contracts in Texas as well as higher membership and rates across multiple regions Q1 2018 • Value Enhancement initiatives continuing to reduce transportation costs Highlights • Successful launch of multiple new contracts, including in Illinois, Indiana, and Oregon • Continued talent investment in key areas such as IT, Sales, and Strategy % FYE FYE LTM $Millions Q1:17 Q1:18 Growth 2016 2017 Q1:18 Key Financial Revenue 324.0 336.7 3.9% 1,233.7 1,318.2 1,330.9 Metrics Adjusted EBITDA (1) 16.2 23.9 92.4 85.3 93.0 (1) % Margin 5.0% 7.1% 7.5% 6.5% 7.0% Capex 3.7 2.6 10.8 15.3 14.2 • Continued implementation of Value Enhancement initiatives, including development of next generation reservation software, incorporation of route optimization technology, and nationwide deployment of real-time GPS capabilities 2018 Focus • Reinvest portion of Value Enhancement savings to drive organic growth and build further competitive advantages • Organic growth initiatives within NEMT and new adjacent markets and services 1. See appendix for a reconciliation of non-GAAP financial measures. Page 4

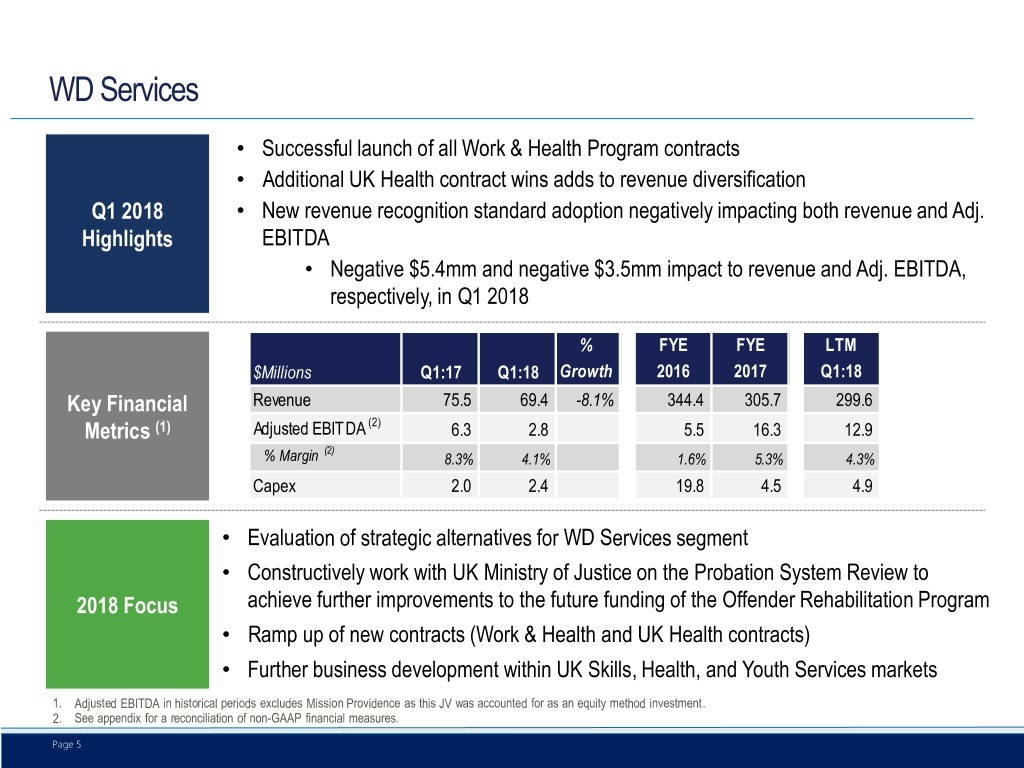

WD Services • Successful launch of all Work & Health Program contracts • Additional UK Health contract wins adds to revenue diversification Q1 2018 • New revenue recognition standard adoption negatively impacting both revenue and Adj. Highlights EBITDA • Negative $5.4mm and negative $3.5mm impact to revenue and Adj. EBITDA, respectively, in Q1 2018 % FYE FYE LTM $Millions Q1:17 Q1:18 Growth 2016 2017 Q1:18 Key Financial Revenue 75.5 69.4 -8.1% 344.4 305.7 299.6 Metrics (1) Adjusted EBITDA (2) 6.3 2.8 5.5 16.3 12.9 (2) % Margin 8.3% 4.1% 1.6% 5.3% 4.3% Capex 2.0 2.4 19.8 4.5 4.9 • Evaluation of strategic alternatives for WD Services segment • Constructively work with UK Ministry of Justice on the Probation System Review to 2018 Focus achieve further improvements to the future funding of the Offender Rehabilitation Program • Ramp up of new contracts (Work & Health and UK Health contracts) • Further business development within UK Skills, Health, and Youth Services markets 1. Adjusted EBITDA in historical periods excludes Mission Providence as this JV was accounted for as an equity method investment. 2. See appendix for a reconciliation of non-GAAP financial measures. Page 5

Matrix Investment • Revenue growth in excess of 20% supported by organic in-home visit volume growth and introduction of mobile visits from HealthFair acquisition Q1 2018 • Closed HealthFair acquisition and began integration process Highlights • Completed integration of LP Health • Contract start-up costs at HealthFair negatively impacted margins in the quarter % FYE FYE LTM $Millions Q1:17 Q1:18 Growth 2016 2017 Q1:18 Revenue 55.9 67.4 20.7% 207.7 227.9 239.4 Key Financial (2) Adjusted EBITDA 12.5 13.5 51.7 51.7 52.6 (1) Metrics (2) % Margin 22.4% 20.0% 24.9% 22.7% 22.0% Capex 1.8 2.3 12.5 11.0 11.6 Net Debt 310.4 • Integration of HealthFair acquisition and capture of associated revenue and cost synergies • Conversion of 2017 new customer wins at Matrix and HealthFair into strong organic growth 2018 Focus • Continued new sales momentum supported by introduction of additional ancillary services and tests, combined in-home and mobile offerings, and quality visits 1. Represents 100% of Matrix’s results of operations. Providence’s equity interest in Matrix is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated results of operations in any period presented. Results reflect HealthFair from its acquisition date of February 16, 2018, and no periods are presented on a pro- forma basis. See appendix for additional detail. 2. See appendix for a reconciliation of non-GAAP financial measures. Page 6

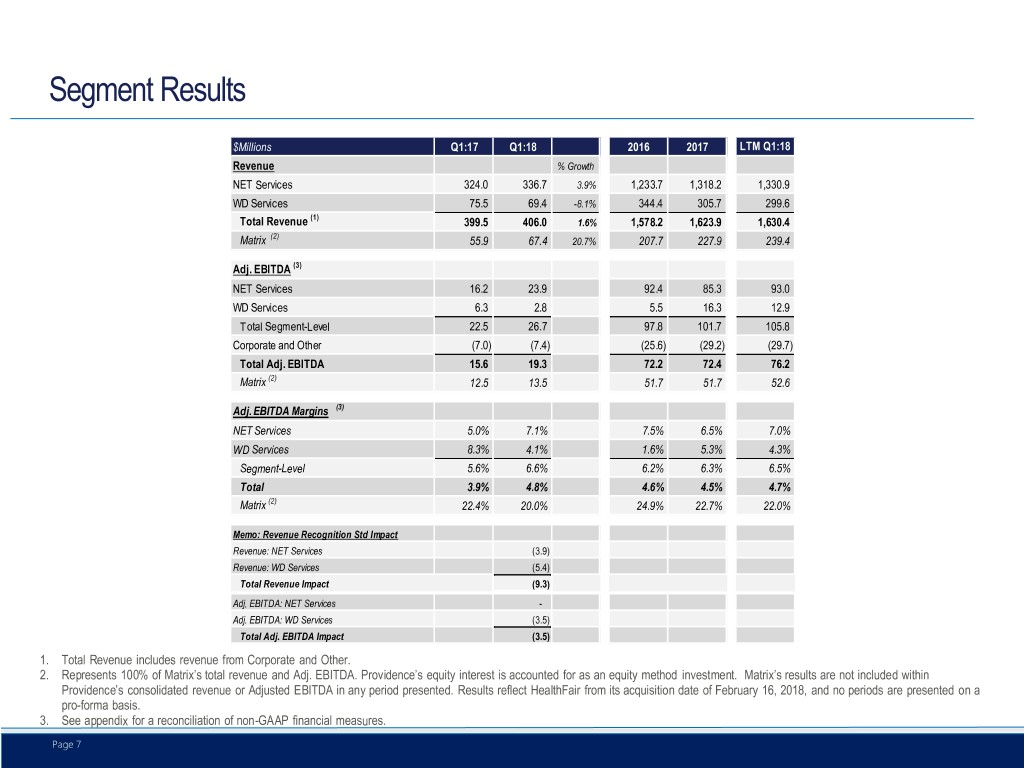

Segment Results $Millions Q1:17 Q1:18 2016 2017 LTM Q1:18 Revenue % Growth NET Services 324.0 336.7 3.9% 1,233.7 1,318.2 1,330.9 WD Services 75.5 69.4 -8.1% 344.4 305.7 299.6 (1) Total Revenue 399.5 406.0 1.6% 1,578.2 1,623.9 1,630.4 (2) Matrix 55.9 67.4 20.7% 207.7 227.9 239.4 Adj. EBITDA (3) NET Services 16.2 23.9 92.4 85.3 93.0 WD Services 6.3 2.8 5.5 16.3 12.9 Total Segment-Level 22.5 26.7 97.8 101.7 105.8 Corporate and Other (7.0) (7.4) (25.6) (29.2) (29.7) Total Adj. EBITDA 15.6 19.3 72.2 72.4 76.2 Matrix (2) 12.5 13.5 51.7 51.7 52.6 Adj. EBITDA Margins (3) NET Services 5.0% 7.1% 7.5% 6.5% 7.0% WD Services 8.3% 4.1% 1.6% 5.3% 4.3% Segment-Level 5.6% 6.6% 6.2% 6.3% 6.5% Total 3.9% 4.8% 4.6% 4.5% 4.7% Matrix (2) 22.4% 20.0% 24.9% 22.7% 22.0% Memo: Revenue Recognition Std Impact Revenue: NET Services (3.9) Revenue: WD Services (5.4) Total Revenue Impact (9.3) Adj. EBITDA: NET Services - Adj. EBITDA: WD Services (3.5) Total Adj. EBITDA Impact (3.5) 1. Total Revenue includes revenue from Corporate and Other. 2. Represents 100% of Matrix’s total revenue and Adj. EBITDA. Providence’s equity interest is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue or Adjusted EBITDA in any period presented. Results reflect HealthFair from its acquisition date of February 16, 2018, and no periods are presented on a pro-forma basis. 3. See appendix for a reconciliation of non-GAAP financial measures. Page 7

Cashflow Summary FYE FYE LTM $Millions Q1:17 Q1:18 2016 2017 Q1:18 Cash Earnings (1),(2) 3.4 14.9 57.0 42.8 54.3 Working Capital (1),(3) 32.8 10.7 6.8 12.3 (9.8) Cash Earnings (After Working Capital) 36.2 25.6 63.7 55.0 44.5 Capex (Continuing Operations) 5.7 5.0 32.0 19.9 19.2 1. Includes continuing and discontinued operations. 2. Cash earnings represents cash provided by operating activities prior to changes in operating assets and liabilities. 3. Working capital represents changes in operating assets and liabilities and excludes net taxes associated with sale of Human Services of $22.0mm for FYE 2016. Page 8

Balance Sheet / Capital Structure Summary $Millions 12/31/15 12/31/16 12/31/17 3/31/18 Cash (1) 84.8 72.3 95.3 86.2 Long-term Debt (1) 305.0 - - - Net Debt 220.2 (72.3) (95.3) (86.2) Matrix Carrying Value (2) - 157.2 169.7 166.0 Shares Outstanding (mm) (3) 17.3 15.9 15.4 15.0 Share Repurchase Activity • Since 12/31/17 have repurchased 589k shares for $37.4mm (4) • 22% of common shares repurchased since beginning of Q4 2015 (5) • $99.5mm of capacity remaining (4) under current share repurchase program 1. Includes Cash and Long-term Debt related to discontinued operations. 2. Represents the carrying value of Providence’s retained equity interest in Matrix. As of 3/31/18, Providence equity ownership in Matrix was 43.6%. 3. Shares outstanding equals common shares outstanding plus total preferred shares on an as-converted basis. As of 5/7/18 shares outstanding equaled 15.0mm. 4. As of 5/7/2018. 5. Represents repurchase of common shares through 5/7/18 as a percentage of common shares outstanding at the beginning of Q4 2015 Page 9

Appendix

Adjusted EBITDA Reconciliation (Segment-Level) NET Services WD Services Segment-Level FYE FYE LTM FYE FYE LTM FYE FYE LTM $Millions Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Revenue 324.0 336.7 1,233.7 1,318.2 1,330.9 75.5 69.4 344.4 305.7 299.6 399.5 406.0 1,578.1 1,623.9 1,630.4 Income from Cont Ops after Income Taxes 7.2 14.5 47.4 41.7 49.0 (0.2) (1.6) (46.2) 10.0 8.7 6.9 12.9 1.2 51.7 57.7 Interest Expense, Net 0.0 0.0 (0.0) 0.1 0.1 0.3 0.4 0.8 1.3 1.4 0.3 0.4 0.8 1.4 1.5 Provision (Benefit) For Income Taxes 4.6 5.0 29.7 24.0 24.4 0.8 (0.1) (1.2) 1.2 0.3 5.4 4.9 28.5 25.2 24.7 Depreciation and Amortization 3.2 3.5 12.4 13.3 13.6 3.0 3.2 13.8 12.9 13.0 6.2 6.7 26.2 26.1 26.6 EBITDA 15.0 23.1 89.5 79.0 87.1 3.9 1.8 (32.8) 25.4 23.4 18.8 24.9 56.7 104.5 110.5 Asset Impairment - - - - - - - 19.6 - - - - 19.6 - - Restructuring and Related Expense 0.2 - 0.9 0.2 0.0 0.7 1.6 9.0 2.8 3.6 0.9 1.6 9.8 3.0 3.7 Value Enhancement Initiative Implementation 1.1 0.8 2.0 6.1 5.8 0.3 - 2.6 0.8 0.5 1.4 0.8 4.6 6.9 6.3 Equity in Net Loss (Gain) of Investee - - - - - 1.4 (0.0) 8.5 1.4 (0.0) 1.4 (0.0) 8.5 1.4 (0.0) (Gain) on Sale of Mission Providence - - - - - - - - (12.4) (12.4) - - - (12.4) (12.4) Ingeus Acquisition Related Cost / Income - - - - - - - - (2.0) (2.0) - - - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - - - - - - - - Foreign Currency (Gain) / Loss - - - - - (0.1) (0.6) (1.4) 0.3 (0.2) (0.1) (0.6) (1.4) 0.3 (0.2) Litigation Expense - - - - - - - - - - - - - - - Adjusted EBITDA 16.2 23.9 92.4 85.3 93.0 6.3 2.8 5.5 16.3 12.9 22.5 26.7 97.8 101.7 105.8 % Margin 5.0% 7.1% 7.5% 6.5% 7.0% 8.3% 4.1% 1.6% 5.3% 4.3% 5.6% 6.6% 6.2% 6.3% 6.5% Page 11

Adjusted EBITDA Reconciliation (Total Continuing Operations) (1) Matrix Investment Corporate and Other Total Continuing Operations FYE FYE LTM FYE FYE LTM FYE FYE LTM $Millions Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Revenue - - - - - (0.0) - 0.1 (0.0) - 399.5 406.0 1,578.2 1,623.9 1,630.4 Income from Cont Ops after Income Taxes (0.4) (2.3) (1.1) 10.0 8.0 (4.6) (4.8) (19.0) (1.9) (2.1) 1.9 5.7 (18.9) 59.8 63.6 Interest Expense, Net - - - - - 0.1 (0.1) 0.8 (0.1) (0.3) 0.4 0.3 1.6 1.3 1.2 Provision (Benefit) For Income Taxes (0.2) - (0.7) 3.5 3.7 (2.7) (3.0) (10.8) (24.3) (24.7) 2.5 1.8 17.0 4.4 3.7 Depreciation and Amortization - - - - - 0.1 0.1 0.4 0.3 0.4 6.3 6.8 26.6 26.5 27.0 EBITDA (0.7) (2.3) (1.8) 13.4 11.8 (7.1) (7.9) (28.6) (26.0) (26.7) 11.1 14.7 26.3 92.0 95.6 Asset Impairment - - - - - - - 1.4 - - - - 21.0 - - Restructuring and Related Expense - - - - - - 0.4 - 1.7 2.2 0.9 2.1 9.8 4.7 5.8 Value Enhancement Initiative Implementation - - - - - - - - - - 1.4 0.8 4.6 6.9 6.3 Equity in Net Loss (Gain) of Investee 0.7 2.3 1.8 (13.4) (11.8) - - - - - 2.1 2.3 10.3 (12.1) (11.8) (Gain) on Sale of Mission Providence - - - - - - - - - - - - - (12.4) (12.4) Ingeus Acquisition Related Cost / Income - - - - - - - - - - - - - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - - - - - - - - Foreign Currency (Gain) / Loss - - - - - - - - - - (0.1) (0.6) (1.4) 0.3 (0.2) Litigation Expense - - - - - 0.1 - 1.6 (5.0) (5.1) 0.1 - 1.6 (5.0) (5.1) Adjusted EBITDA - - - - - (7.0) (7.4) (25.6) (29.2) (29.7) 15.6 19.3 72.2 72.4 76.2 % Margin 3.9% 4.7% 4.6% 4.5% 4.7% 1. Total Continuing Operations represents Segment-level results plus Matrix Investment and Corporate and Other. Page 12

Adjusted EBITDA Reconciliation (Matrix) (1) Matrix FYE 2016 Q4:2016 FYE FYE HA HA (3) (3) (2) (3) (2) (3) $Millions Q1:17 Q1:18 2016 2017 Services Matrix Total Services Matrix Total Revenue 55.9 67.4 207.7 227.9 166.1 41.6 207.7 10.7 41.6 52.3 Net Income (Loss) (1.9) (8.5) 110.1 26.7 114.3 (4.2) 110.1 109.0 (4.2) 104.8 Interest Expense, Net 3.6 10.3 12.9 14.8 9.9 2.9 12.9 0.6 2.9 3.6 Provision (Benefit) For Income Taxes (0.7) (2.6) 60.4 (29.6) 63.3 (2.8) 60.4 59.9 (2.8) 57.1 Depreciation and Amortization 8.0 9.1 27.5 33.5 21.1 6.4 27.5 - 6.4 6.4 EBITDA 9.0 8.3 210.9 45.4 208.6 2.3 210.9 169.5 2.3 171.8 Gain on Disposition - - (167.9) - (167.9) - (167.9) (167.9) - (167.9) Management Fee 0.5 3.1 - 2.3 - - - - - - Transaction Costs 3.0 2.1 6.4 3.9 0.0 6.3 6.4 (0.8) 6.4 5.6 Write-off of Deferred Financing Costs - - 2.3 - 2.3 - 2.3 2.3 - 2.3 Adjusted EBITDA 12.5 13.5 51.7 51.7 43.1 8.6 51.7 3.1 8.6 11.7 % Margin 22.4% 20.0% 24.9% 22.7% Reconciliation of Income / Loss from Equity Investment to Matrix Net Income (4) Equity in Net Gain (Loss) of Investee (0.7) (2.3) (1.9) (0.7) (0.7) Management Fee and Other (0.2) (1.4) (1.0) (0.2) (0.2) Net Gain (Loss) - Equity Investment (0.9) (3.7) (2.9) (0.9) (0.9) Divided by: Providence % Equity Investment in Matrix (5) 46.6% 43.6% 46.6% 46.8% 46.8% Matrix Net Income Standalone (1.9) (8.5) (6.3) (1.8) (1.8) 1. Represents 100% of Matrix’s results including the results of HealthFair since its acquisition of February 16, 2018. Providence’s retained equity interest is now accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue or Adjusted EBITDA in any period presented. 2. Represents Matrix's results of operation through the Matrix Transaction on October 19, 2016. These results are included within Discontinued Operations on the Company's consolidated financial statements. 3. Represents Matrix's results of operation from October 20, 2016 to December 31, 2017, as applicable. Providence accounts for its proportionate share of Matrix's results during this time period using the equity method. 4. A reconciliation has been provided to bridge from the income from Equity in net gain (loss) of investee to Matrix’s standalone Net Income for periods following the Matrix JV transaction. 5. For FYE 2017, % Equity Interest represents Providence’s equity interest in Matrix as of December 31, 2017. It should be noted that Providence’s equity interest in Matrix decreased from 46.8% to 46.6% primarily due to a rollover of management bonuses into equity during Q3:2017. In addition, Providence’s equity interest in Matrix decreased to 43.6% following the rollover of certain HealthFair equity interests related to the acquisition during Q1:2018. Page 13

Adjusted EPS Reconciliation $Millions, Except Per Share Amounts Q1:17 Q1:18 Income from Continuing Operations, Net of Tax 1.9 5.7 Net Loss (Income) Attributable to Non-Controlling Interest (0.4) (0.3) Amortization 2.0 2.1 Restructuring and Related Expense 0.9 2.1 Value Enhancement Initiative Implementation 1.4 0.8 Equity in Net Loss of Investee 2.1 2.3 Foreign Currency (Gain) / Loss (0.1) (0.6) Litigation Expense / (Income) 0.1 - Impact of Non-Controlling Interest (0.0) 0.0 Tax Impact of Adjustments (1.4) (1.4) Adjusted Net Income 6.6 10.7 Dividends on Convertible Preferred Stock (1.1) (1.1) Income Allocated to Participating Securities (0.7) (1.3) Adjusted Net Income to Common Stockholders 4.8 8.3 Adjusted EPS 0.35 0.63 Diluted Weighted-Average Common Shares Outstanding 13.8 13.2 Page 14