Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - PROFIRE ENERGY INC | qmaster321ceosoxcertificat.htm |

| EX-10.4 - PDF COPY OF EXHIBIT 10.4 - PROFIRE ENERGY INC | a2018ltippsujayfugal.pdf |

| EX-10.3 - PDF COPY OF EXHIBIT 10.3 - PROFIRE ENERGY INC | a2018ltippsucamerontidball.pdf |

| EX-10.2 - PDF COPY OF EXHIBIT 10.2 - PROFIRE ENERGY INC | a2018ltippsuryanoviatt.pdf |

| EX-10.1 - PDF COPY OF EXHIBIT 10.1 - PROFIRE ENERGY INC | a2018annualincentivecompensa.pdf |

| EX-32.2 - EXHIBIT 32.2 - PROFIRE ENERGY INC | qmaster322cfosoxcertificai.htm |

| EX-31.2 - EXHIBIT 31.2 - PROFIRE ENERGY INC | qmaster312cforule13a.htm |

| EX-31.1 - EXHIBIT 31.1 - PROFIRE ENERGY INC | qmaster311ceorule13a.htm |

| EX-10.4 - EXHIBIT 10.4 - PROFIRE ENERGY INC | a2018ltippsujayfugal.htm |

| EX-10.3 - EXHIBIT 10.3 - PROFIRE ENERGY INC | a2018ltippsucamerontidba.htm |

| EX-10.1 - EXHIBIT 10.1 - PROFIRE ENERGY INC | a2018annualincentivecomp.htm |

| 10-Q - 10-Q - PROFIRE ENERGY INC | a10qmaster.htm |

95724938.3 0059466-00001

PROFIRE ENERGY, INC.

2014 EQUITY INCENTIVE PLAN

RESTRICTED STOCK UNIT AWARD AGREEMENT

This RESTRICTED STOCK UNIT AWARD AGREEMENT Agreement

made this 2nd day of March, 2018 Effective Date Profire Energy, Inc.,

Company Participant

used herein but not defined herein shall have the meanings given to them in the Profire Energy,

Inc. 2014 Equity Plan

1. Award. The Company hereby grants to Participant a restricted stock unit award (the

Award to 70,4231 Shares

share, of the Company according to the terms and conditions set forth herein and in the Plan.

Unit

vesting requirements of this Agreement and the terms of the Plan. The Units are granted under

Section 6(c) of the Plan. A copy of the Plan will be furnished upon request of Participant.

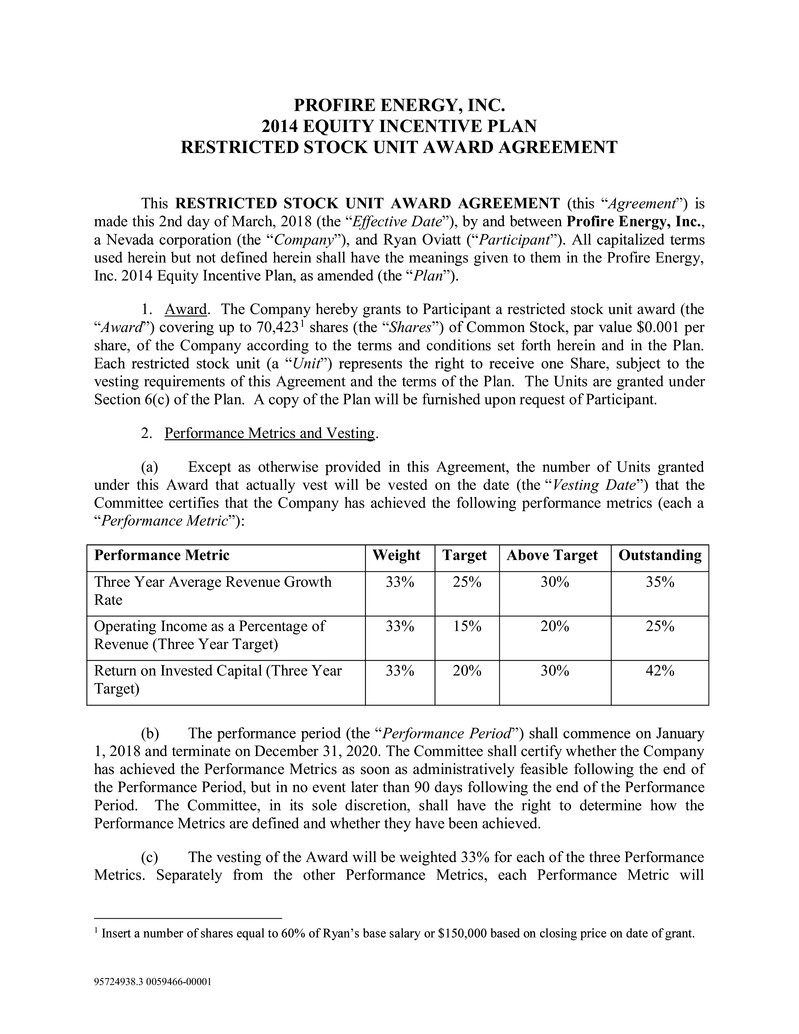

2. Performance Metrics and Vesting.

(a) Except as otherwise provided in this Agreement, the number of Units granted

under this Award that actually vest will be vested on the date (the Vesting Date

Committee certifies that the Company has achieved the following performance metrics (each a

Performance Metric

Performance Metric Weight Target Above Target Outstanding

Three Year Average Revenue Growth

Rate

33% 25% 30% 35%

Operating Income as a Percentage of

Revenue (Three Year Target)

33% 15% 20% 25%

Return on Invested Capital (Three Year

Target)

33% 20% 30% 42%

(b) Performance Period

1, 2018 and terminate on December 31, 2020. The Committee shall certify whether the Company

has achieved the Performance Metrics as soon as administratively feasible following the end of

the Performance Period, but in no event later than 90 days following the end of the Performance

Period. The Committee, in its sole discretion, shall have the right to determine how the

Performance Metrics are defined and whether they have been achieved.

(c) The vesting of the Award will be weighted 33% for each of the three Performance

Metrics. Separately from the other Performance Metrics, each Performance Metric will

1

determine the vesting for 23,4742 Units subject to this Award. The number of Units that will vest

for each Performance Metric on the Vesting Date shall be determined as follows: (i) if the

50% of the Units relating to such Performance M

for such Performance Metric is achieved, 75% of the Units relating to such Performance Metric

the Units relating to such Performance Metric will vest.

3. Restrictions on Transfer. Until the Units vest pursuant to Section 2 hereof or unless

the Committee determines otherwise, none of the Units may be transferred other than by will or

by the laws of descent and distribution and no Units may be pledged, alienated, attached or

otherwise encumbered, and any purported pledge, alienation, attachment or encumbrance thereof

shall be void and unenforceable against the Company or any Affiliate. The Committee may

establish procedures as it deems appropriate for Participant to designate a person or persons, as

beneficiary or beneficiaries, to exercise the rights of Participant and receive any property

4. Forfeiture. Except as otherwise determined by the Committee,

termination of providing service as an Eligible Person for the Company or any Affiliate

Service ee) prior to

vesting of the Units pursuant to Section 2 hereof, all unvested Units held by such Participant at

such time shall be forfeited and reacquired by the Company; provided, however, that the

Committee may waive in whole or in part any or all remaining restrictions with respect to the

unvested Units. Upon forfeiture, Participant will no longer have any rights relating to the

unvested Units.

5. Miscellaneous

(a) Issuance of Shares. As soon as administratively practicable following the Vesting

Date, and

later than 60 days following the Vesting Date), the Company shall cause to be issued and

delivered to Participant a certificate or certificates evidencing Shares registered in the name of

Participant (or applicable representative, beneficiary or heir). The number of Shares issued shall

equal the number of Units vested, reduced as necessary to cover applicable withholding

obligations in accordance with Section 5(c) hereof. If it is administratively impracticable to

issue Shares within the time frame described above because issuances of Shares are prohibited or

restricted pursuant to the policies of the Company that are reasonably designed to ensure

compliance with applicable securities laws or stock exchange rules, then such issuance shall be

delayed until such prohibitions or restrictions lapse.

(b) No Rights as Shareholder. Units are not actual Shares, but rather, represent a right to

receive Shares according to the terms and conditions set forth herein and the terms of the Plan.

2 Insert a number equal to 33% of the Award Shares.

Accordingly, the issuance of a Unit shall not entitle Participant to any of the rights or benefits

generally accorded to shareholders unless and until a Share is actually issued under Section 5(a)

hereof.

(c) Taxes. Participant hereby agrees to make adequate provision for any sums required

to satisfy the applicable federal, state, local or foreign employment, social insurance, payroll,

Withholding Obligations

connection with this Agreement. The Company may establish procedures to ensure satisfaction

of all applicable Withholding Obligations arising in connection with this Agreement, including

any means permitted in Section 8 of the Plan. Participant hereby authorizes the Company, at its

sole discretion and subject to any limitations under applicable law, to satisfy any such Tax

Obligations by (1) withholding a portion of the Shares otherwise to be issued in payment of the

Units having a value equal to the amount of Withholding Obligations in accordance with such

rules as the Company may from time to time establish; provided, however, that the amount of the

Shares so withheld shall not exceed the amount necessary to satisfy the required Withholding

Obligations using applicable minimum statutory withholding rates; (2) withholding from the

wages and other cash compensation payable to Participant or by causing Participant to tender a

brokerage firm determined acceptable to the Company for such purpose) a portion of the Shares

issued in payment of the Units as the Company determines to be appropriate to generate cash

proceeds sufficient to satisfy the Withholding Obligations; provided, however, that if Participant

is a Section 16 officer of the Company under the Exchange Act, then the Committee shall

establish the method of withholding from the above alternatives and, if the Committee does not

exercise its discretion prior to the withholding event, then Participant shall be entitled to elect the

method of withholding from the alternatives above. Participant shall be responsible for all

brokerage fees and other costs of sale, and Participant further agrees to indemnify and hold the

Company harmless from any losses, costs, damages or expenses relating to any such sale. The

obligations in connection with the Withholding Obligations described in this paragraph.

(d) Plan Provisions Control. This Award is subject to the terms and conditions of the

Plan, but the terms of the Plan shall not be considered an enlargement of any benefits under this

Agreement. In addition, this Award is subject to the rules and regulations promulgated pursuant

to the Plan, now or hereafter in effect. A copy of the Plan will be furnished upon request of

Participant. In the event that any provision of the Agreement conflicts with or is inconsistent in

any respect with the terms of the Plan, the terms of the Plan shall control. This Agreement (and

any addendum hereto) and the Plan together constitute the entire agreement between the parties

hereto with regard to the subject matter hereof.

(e) No Right to Employment. The issuance of the Award shall not be construed as

giving Participant the right to be retained in the employ, or as giving a director of the Company

or an Affiliate the right to continue as a director of the Company or an Affiliate, nor will it affect

in any way the right of the Company or an Affiliate to terminate such employment or position at

any time, with or without cause. In addition, the Company or an Affiliate may at any time

dismiss Participant from employment, or terminate the term of a director of the Company or an

Affiliate, free from any liability or any claim under the Plan or the Agreement. Nothing in the

Agreement shall confer on any person any legal or equitable right against the Company or any

Affiliate, directly or indirectly, or give rise to any cause of action at law or in equity against the

Company or an Affiliate. The Award granted hereunder shall not form any part of the wages or

salary of Participant for purposes of severance pay or termination indemnities, irrespective of the

reason for termination of employment. Under no circumstances shall any person ceasing to be an

employee of the Company or any Affiliate be entitled to any compensation for any loss of any

right or benefit under the Agreement or Plan which such employee might otherwise have enjoyed

but for termination of employment, whether such compensation is claimed by way of damages

for wrongful or unfair dismissal, breach of contract or otherwise. By participating in the Plan,

Participant shall be deemed to have accepted all the conditions of the Plan and the Agreement

and the terms and conditions of any rules and regulations adopted by the Committee (as defined

in the Plan) and shall be fully bound thereby.

(f) Governing Law. The validity, construction and effect of the Plan and the

Agreement, and any rules and regulations relating to the Plan and the Agreement, shall be

determined in accordance with the internal laws, and not the law of conflicts, of the State of

Nevada.

(g) Severability. If any provision of the Agreement is or becomes or is deemed to be

invalid, illegal or unenforceable in any jurisdiction or would disqualify the Agreement under any

law deemed applicable by the Committee, such provision shall be construed or deemed amended

to conform to applicable laws, or if it cannot be so construed or deemed amended without, in the

determination of the Committee, materially altering the purpose or intent of the Plan or the

Agreement, such provision shall be stricken as to such jurisdiction or the Agreement, and the

remainder of the Agreement shall remain in full force and effect.

(h) No Trust or Fund Created. Neither the Plan nor the Agreement shall create or be

construed to create a trust or separate fund of any kind or a fiduciary relationship between the

Company or any Affiliate and Participant or any other person.

(i) Section 409A Provisions. The payment of Shares under this Agreement are

intended to be exempt from the application of section 409A of the Internal Revenue Code, as

Section 409A he short-term deferral exemption set forth in Treasury

Regulation §1.409A-1(b)(4). Notwithstanding anything in the Plan or this Agreement to the

cipant under section 409A of the Internal Revenue Code, as amended

Section 409A

on

payable or distributable to Participant by reason of such circumstance unless the Committee

determines in good faith that (i) the circumstances giving rise to such disability or separation

from service meet the definition of disability, or separation from service, as the case may be, in

Section 409A(a)(2)(A) of the Code and applicable final regulations, or (ii) the payment or

distribution of such amount or benefit would be exempt from the application of Section 409A by

reason of the short-term deferral exemption or otherwise (including, but not limited to, a

payment made pursuant to an involuntary separation arrangement that is exempt from Section

409A under the -

would be made to a Participant who is a specified employee (as determined by the Committee in

good faith) on account of separation from service may not be made before the date which is six

Section 409A by reason of the short term deferral exemption or otherwise.

(j) Headings. Headings are given to the Sections and subsections of the Agreement

solely as a convenience to facilitate reference. Such headings shall not be deemed in any way

material or relevant to the construction or interpretation of the Agreement or any provision

thereof.

(k) Securities Matters. The Company shall not be required, and shall not have any

liability for failure, to deliver Shares until the requirements of any federal or state securities or

other laws, rules or regulations (including the rules of any securities exchange) as may be

determined by the Company to be applicable are satisfied.

(l) Consultation with Professional Tax and Investment Advisors. Participant

acknowledges that the grant, exercise, vesting or any payment with respect to this Award, and

the sale or other taxable disposition of the Shares acquired pursuant to the exercise thereof, may

have tax consequences pursuant to the Internal Revenue Code of 1986, as amended, or under

local, state or international tax laws. Participant further acknowledges that Participant is relying

respect to any and all such matters (and is not relying, in any manner, on the Company or any of

its employees or representatives). Finally, Participant understands and agrees that any and all tax

consequences resulting from the Award and its grant, exercise, vesting or any payment with

respect thereto, and the sale or other taxable disposition of the Shares acquired pursuant to the

Plan, is solely and exclusively the responsibility of Participant without any expectation or

understanding that the Company or any of its employees or representatives will pay or reimburse

Participant for such taxes or other items.

[Signature page follows]

IN WITNESS WHEREOF, the Company and Participant have executed this Agreement

as of the Effective Date.

PROFIRE ENERGY, INC.

By:

Name: Brenton W. Hatch

Title: Chief Executive Officer

PARTICIPANT:

Ryan W. Oviatt