Attached files

| file | filename |

|---|---|

| 8-K - 8-K FIRST QUARTER 2018 EARNINGS RELEASE - TWO HARBORS INVESTMENT CORP. | two8kq1-2018earningsrelease.htm |

| EX-99.1 - PRESS RELEASE OF TWO HARBORS INVESTMENT CORP., DATED MAY 8, 2018. - TWO HARBORS INVESTMENT CORP. | twoq1-2018earningspressrel.htm |

First Quarter 2018 Earnings Call MAY 9, 2018

Safe Harbor Statement FORWARD-LOOKING STATEMENTS This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2017, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the concentration of credit risks we are exposed to; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to effectively execute and to realize the benefits of strategic transactions and initiatives we have pursued or may in the future pursue; our proposed acquisition of CYS and our ability to realize the benefits related thereto; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage servicing rights (MSR) and successfully operate our seller-servicer subsidiary and oversee our subservicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. 2

Quarterly Summary STRONG QUARTER FOR CORE EARNINGS • Reported book value of $15.63 per common share, representing a (1.3%) total quarterly return on book value(1) • Incurred a Comprehensive Loss of ($23.7) million, or ($0.14) per weighted average basic common share • Reported Core Earnings including dollar roll income of $83.8 million, or $0.48 per weighted average basic common share, representing a return on average common equity of 11.8%(2) – Dollar roll income of $3.4 million, or $0.02 per weighted average basic common share • Added $13.6 billion unpaid principal balance (UPB) of MSR through both a bulk purchase and monthly flow-sale arrangements, bringing total holdings to $111.7 billion UPB • Increased the capacity of an MSR financing facility by $100 million, to a total of $400 million, and continued to advance discussions with other potential MSR financing counterparties (1) Return on book value for the quarter ended March 31, 2018 is defined as the decrease in book value per common share from December 31, 2017 to March 31, 2018 of $0.68, plus the dividend declared of $0.47 per common share, divided by December 31, 2017 book value of $16.31 per common share. (2) Core Earnings and Core Earnings including dollar roll income are non-GAAP measures. Please see Appendix slide 20 of this presentation for a definition of Core 3 Earnings and Core Earnings including dollar roll income and a reconciliation of GAAP to non-GAAP financial information.

Proposed Acquisition of CYS Investments, Inc. UNIQUE OPPORTUNITY TO DRIVE STOCKHOLDER VALUE • CYS stockholders will receive Two Harbors shares as well as an aggregate cash consideration of $15 million • Expect to redeploy capital from the acquisition in substantially the same allocation as Two Harbors’ Rates and Credit strategies as of March 31, 2018 • Combination of Two Harbors and CYS should create cost efficiencies and decrease our other operating expense ratio by 30 to 40 basis points • Larger capital base supports continued growth in target assets • Anticipate improved Agency spreads in 2018; if so, believe this deal will be accretive to earnings and endorses the capital raising attendant to this transaction • Enhanced scale and liquidity has potential for premium valuation • Expect to maintain $0.47 per share quarterly dividend, subject to market conditions and the discretion and approval of Two Harbors’ Board of Directors 4

Two Harbors Strategic Overview KEY DIFFERENTIATING FACTORS ü Utilize variety of instruments to hedge interest rate exposure ü Strategy of pairing MSR with Agency RMBS ü Unique portfolio of legacy non-Agency securities AREAS OF FOCUS IN 2018 Acute focus on Rates(1) and Credit(2) strategies – Leverage competitive advantages in MSR and legacy non-Agency RMBS Maintain sophisticated approach to risk management Manage balance sheet composition to optimize earnings and stockholder returns Emphasis on technology efficiencies to grow MSR platform ü Deliver strong results and book value stability through a variety of rate environments (1) Assets in “Rates” include Agency RMBS, MSR and other interest rate sensitive assets. 5 (2) Assets in “Credit” include non-Agency securities and other credit sensitive assets.

Book Value Q1-2018 Q1-2018 Book Value per (Dollars in millions, except per share data) Book Value share Beginning common stockholders’ equity $2,845.1 $16.31 Comprehensive GAAP Net Income: Loss (GAAP) Core Earnings, net of tax(1) 94.1 Incurred Q1-2018 Comprehensive Dividend declaration - preferred (13.7) Loss of $23.7 million. Core Earnings attributable to common stockholders, net of tax(1) 80.4 Declared Q1-2018 Dollar roll income 3.4 dividends of $0.47 Core Earnings attributable to common stockholders, including dollar roll income, net of tax(1) 83.8 per common share and Series A, B and Realized and unrealized gains and losses, net of tax 237.3 C preferred stock dividends totaling Other comprehensive loss, net of tax (344.8) $13.7 million. Dividend declaration - common (82.5) Other 2.4 Balance before capital transactions 2,741.3 Issuance of common stock, net of offering costs 0.1 Ending common stockholders’ equity $2,741.4 $15.63 Total preferred stock liquidation preference 726.3 Ending total equity $3,467.7 (1) Please see Appendix slide 20 for a definition of Core Earnings and Core Earnings including dollar roll income and a reconciliation of GAAP to non-GAAP financial 6 information.

Core Earnings Summary(1) (Dollars in millions, except per share data) Q4-2017 Q1-2018 Variance ($) • Core Earnings, including dollar roll Interest income $195.1 $194.0 ($1.1) income of $0.02, was $0.48 per Interest expense 94.8 96.6 (1.8) weighted average basic common share, Net interest income 100.3 97.4 (2.9) representing a return on average Gain on investment securities 0.7 0.6 (0.1) common equity of 11.8% Servicing income, net of amortization on MSR 19.8 28.3 8.5 – (Loss) gain on swaps and swaptions 2.0 3.8 1.8 Management believes Core Earnings including dollar roll income is a meaningful Gain on other derivatives 2.8 2.5 (0.3) indicator of underlying earnings power Other 1.1 0.7 (0.4) Total other income 26.4 35.9 9.5 Expenses 31.1 38.1 (7.0) • Core Earnings driven by MSR portfolio Provision for income taxes 2.4 1.1 1.3 growth and additional servicing income, Core Earnings(1) 93.2 94.1 0.9 as well as favorable spread income on Dividends on preferred stock 11.9 13.7 (1.8) swaps Core Earnings attributable to common stockholders(1) $81.3 $80.4 ($0.9) Dollar roll income 3.4 • Other operating expense ratio, excluding Core Earnings, including dollar roll income, non-cash LTIP amortization, of 1.4% attributable to common stockholders(1) $83.8 Basic weighted average Core EPS $0.47 $0.46 ($0.01) Basic weighted average Core EPS, including dollar roll income $0.48 Core Earnings as a % of average common equity 11.3% (2) 11.3% Core Earnings as a % of average common equity, including dollar roll income 11.8% (1) Core Earnings and Core Earnings including dollar roll income are non-GAAP measures. Please see Appendix slide 20 for a definition of Core Earnings and Core Earnings including dollar roll income and a reconciliation of GAAP to non-GAAP financial information. 7 (2) Core Earnings return on average common equity for the quarter ended December 31, 2017 excludes the company’s controlling interest in Granite Point equity.

Optimizing Financing Profile and Capital Structure DEBT-TO-EQUITY • 5.9x at March 31, 2018, unchanged from December 31, 2017 • Maintain substantial liquidity to opportunistically take advantage of market opportunities PREFERRED STOCK ISSUANCES • $726 million issued with weighted average dividend rate of 7.6% • Accounts for approximately 20% of capital base RATES – AGENCY RMBS • Outstanding repurchase agreements of $17.1 billion with 24 active counterparties • Outstanding secured FHLB advances of $865.0 million with weighted average borrowing rate of 2.13% • Repo markets functioning efficiently for RMBS with new counterparties entering market CREDIT – NON-AGENCY SECURITIES • Outstanding borrowings of $2.0 billion with 14 active counterparties • Market for non-Agency securities has seen improvement in both advance rates and spreads; recently seeing spreads of 100-125 basis points over LIBOR RATES – MSR • Increased capacity of an MSR financing facility, announced in Q4-17, by $100 million, bringing total capacity to $400 million – Financial terms are 48.75% advance rate at LIBOR +225 basis points(1) • Outstanding borrowings of $20.0 million under revolving credit facilities; additional available capacity of $70.0 million • Continue to advance other MSR financing discussions 8 (1) Excludes non-usage, commitment and other fees associated with facility.

Portfolio Composition PORTFOLIO COMPOSITION(1) HISTORICAL CAPITAL ALLOCATION $22.4 BILLION PORTFOLIO AS OF MARCH 31, 2018 March 31, December 31, March 31, Non-Agency 2017 2017 2018 $3.0b Rates(2) 58% 68% 69% MSR $1.3b Credit(3) 27% 32% 31% Rates(3) $10,766 Agency Commercial(4) 15% —% —% $18.1b Rates(2) $19.4b Credit(3) $3.0b (1) For additional detail on the portfolio, see Appendix slides 21-25. (2) Assets in “Rates” include Agency RMBS, MSR and other interest rate sensitive assets. (3) Assets in “Credit” include non-Agency securities and other credit sensitive assets. 9 (4) Commercial consists of the consolidated financial results of Granite Point and its subsidiaries, which is now reflected in discontinued operations.

Expected Portfolio Strategy into 2019 REALLOCATE CAPITAL FROM CYS ACQUISITION INTO TARGET ASSETS • Anticipate reallocating capital from CYS acquisition into Agency RMBS (primarily 30-year fixed and specified pools), MSR and residential credit • Expect approximately 50% of Two Harbors’ total capital will be allocated to MSR and credit MAINTAIN LOW INTEREST RATE RISK • Intend to implement additional hedges to bring overall interest rate exposure in-line with current low level of exposure March 31, Projected at closing Projected 12 2018 of transaction months forward Rates(1) 69% 79% 70% Credit(2) 31% 21% 30% (1) Assets in “Rates” include Agency RMBS, MSR and other interest rate sensitive assets. (2) Assets in “Credit” include non-Agency securities and other credit sensitive assets. 10

Portfolio Performance DRIVING SUPERIOR PORTFOLIO PERFORMANCE Q1-2018 PERFORMANCE SUMMARY PORTFOLIO METRICS RATES December 31, March 31, Three Months Ended 2017 2018 • Positive performance from hedges and MSR in rising rate environment Annualized portfolio yield from continuing operations during the quarter 3.69% 3.77% • Higher coupon Agencies and specified pools underperformed during overall spread widening Rates Agency RMBS, Agency Derivatives and MSR 3.2% 3.2% CREDIT Credit (1) • Residential credit benefitted from stable spreads, Non-Agency securities, Legacy 7.8% 7.5% generating a positive return each month of the first Non-Agency securities, New issue(1) 6.6% 10.9% quarter Net economic interest in securitization trusts 11.2% —% Residential mortgage loans held-for-sale 3.9% 4.7% POST QUARTER-END UPDATE Annualized cost of funds from continuing operations on average borrowings during the • Modest reversal of underperformance of higher quarter(2) 1.72% 1.84% coupons and specified pools benefitted book value in Annualized interest rate spread for aggregate April portfolio during the quarter 1.97% 1.93% (1) “Legacy” non-Agency securities includes non-Agency bonds issued up to and including 2009. “New issue” non-Agency securities includes bonds issued after 2009. 11 (2) Cost of funds includes interest spread expense associated with the portfolio’s interest rate swaps.

Rates Update STRATEGY OF PAIRING MSR WITH AGENCY RMBS IS DISTINGUISHING FACTOR • Added $13.6 billion UPB of MSR through a bulk purchase and through flow-sale arrangements • Pairing MSR with Agency RMBS results in a portfolio that has higher return potential with lower mortgage spread risk – Mitigates adverse impact to book value in spread widening scenario • Low-to-mid double digit expected returns • Addition of financing for MSR is beneficial to growing portfolio and enhancing returns • Opportunity to capitalize on Fed's tapering of RMBS • Expect attractive investment opportunities in wider spread environment 12

Protecting Book Value and Income • Utilize a variety of hedging tools including MSR, swaps and swaptions/mortgage options to reduce book value sensitivity to changes in interest rates and mortgage spreads HEDGING ACROSS THE CURVE Book value exposure to changes in rates(1) Net income exposure to changes in rates(2) +25 basis points 0.7% +25 basis points (1.6%) +50 basis points (1.0%) +50 basis points (3.2%) BOOK VALUE SENSITIVITY TO MORTGAGE SPREADS(3) Change in Agency RMBS and Total overall Rates strategy Mortgage spreads mortgage derivatives Change in MSR change 25 basis points wider ($180) $47 ($133) / (3.8%) 15 basis points wider ($111) $29 ($82) / (2.4%) 15 basis points tighter $105 ($33) $72 / 2.1% 25 basis points tighter $167 ($55) $112 / 3.2% Note: The above scenario is provided for illustration purposes only and is not necessarily indicative of Two Harbors’ financial condition and operating results, nor is it necessarily indicative of the financial condition or results of operations that may be expected for any future period or date. (1) Represents estimated change in equity value for theoretical parallel shift in interest rates. (2) Represents estimated percentage change in net interest income for theoretical parallel shifts in interest rates. (3) Dollars in millions. The information presented in this table projects the potential impact on book value of instantaneous changes in mortgage spreads. Spread sensitivity is 13 based on results from third party models in conjunction with inputs from our internal investment professionals. Actual results could differ materially from these estimates.

Credit Update UNIQUE NON-AGENCY PORTFOLIO DRIVES ATTRACTIVE TOTAL RETURNS • Non-Agency securities holdings of $3.0 billion; primarily positioned in deeply discounted legacy subprime non-Agency RMBS • Continue to add deeply discounted legacy non-Agencies • Average legacy market price of ~$76 creates opportunity to capture additional upside(1) RESIDENTIAL CREDIT TAILWINDS • Continued re-equification has potential to result in strong performance for deeply discounted holdings – Drives increased prepayments, and lower LTVs, delinquencies, defaults and severities SUBPRIME CPR(3) 3-Year Horizon(2) 7 Current Upside LTV Base Assumptions Scenario 6 5 Amortization 4 Effect 63 63 R P C 3 69 2 HPA Effect 63 57 1 0 Combined 57 53 Jan-10 Mar-11 May-12 Jul-13 Sep-14 Nov-15 Jan-17 Mar-18 (1) Weighted average market price utilized current face for weighting purposes. Please see slide 25 in the Appendix for more information on our legacy non-Agency securities portfolio. (2) LTV scenario is provided for illustration purposes only. Actual results of the portfolio may differ materially. HPA in base and bullish scenarios assume approximately 3% and 6% HPA per year, respectively. Metrics associated with legacy non-Agency P&I portfolio only. 14 (3) Source: Nomura research, through March 31, 2018.

Appendix

Return on Book Value Return on common book value Q1-2018 (Per common share amounts, except for percentage) Book value at December 31, 2017 $16.31 Book value at March 31, 2018 15.63 Decrease in book value (0.68) Dividend declared in Q1-2018 0.47 Return on book value Q1-2018 ($0.21) Percent return on book value Q1-2018(1) (1.3)% (1) Return on book value for the three-month period ended March 31, 2018 is defined as the decrease in book value per common share from December 31, 2017 to March 31, 2018 of $0.68 per common share, plus the dividend declared of $0.47 per common share, divided by December 31, 2017 book value of $16.31 per 16 common share.

Financial Performance COMPREHENSIVE INCOME BOOK VALUE AND DIVIDEND PER COMMON SHARE(1) 18.5% $150 16.9% 20% $25.00 9.9% $100 8.5% 10% $145.7 $161.6 $20.00 $0.50 $0.52 $0.52 $50 $85.9 $65.7 $4.14(2) (3.3)% 0% $0 $0.47 $(23.7) $15.00 $19.82 $19.74 $20.12 -10% $16.31 -$50 $15.63 $10.00 -$100 -20% Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 Comp. Income ($M) Comp. Income ROACE (%) Book Value ($) Dividend Declared ($) DIVIDENDS(1) GAAP NET INCOME $0.60 15.0% $400 $0.52 $0.52 $1.83 $0.50 $2.00 $0.50 $0.47 $0.47 $300 $0.88 $0.41 $0.53 $0.02 $0.50 $0.40 $200 10.4% 10.5% 10.3% 12.2% $321.1 11.6% $100 -$1.00 $0.30 10.0% $154.0 $72.0 $4.3 $93.2 -$2.50 $0.20 $0 -$100 -$4.00 $0.10 Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 $0.00 5.0% Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 GAAP Net Inc. ($M) Dividend per common share ($) Divided Yield (%) GAAP Earnings per basic common share ($) (1) Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the relevant quarter. 17 (2) Includes the special dividend of Granite Point common stock of $3.67 per common share.

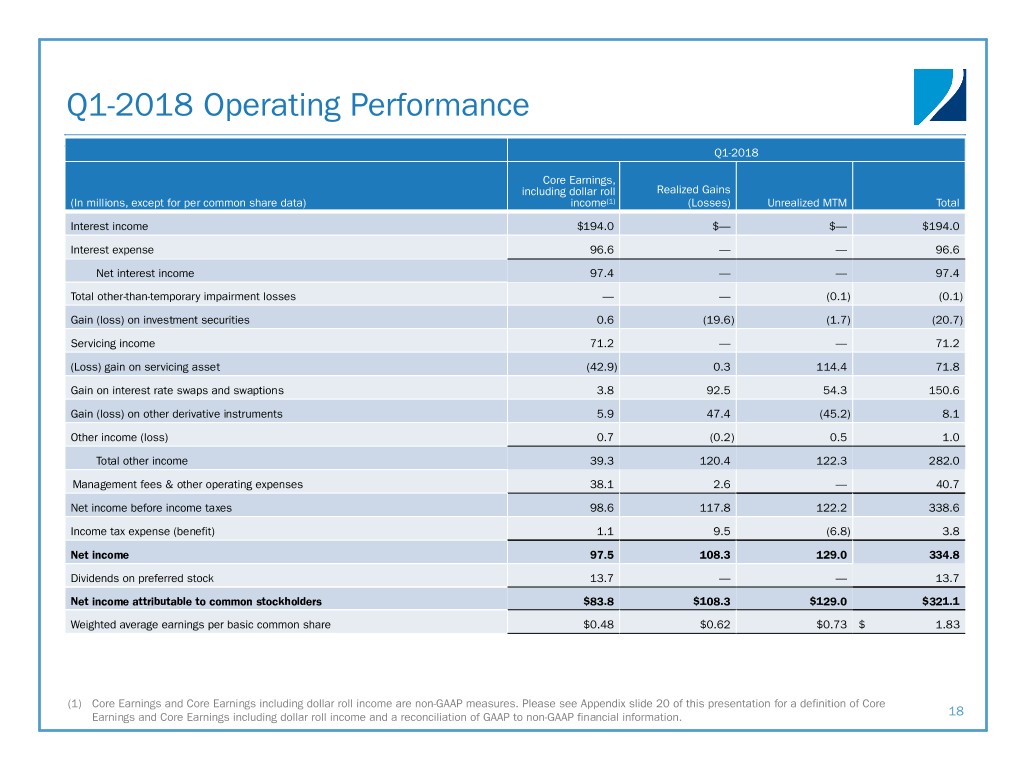

Q1-2018 Operating Performance Q1-2018 Core Earnings, including dollar roll Realized Gains (In millions, except for per common share data) income(1) (Losses) Unrealized MTM Total Interest income $194.0 $— $— $194.0 Interest expense 96.6 — — 96.6 Net interest income 97.4 — — 97.4 Total other-than-temporary impairment losses — — (0.1) (0.1) Gain (loss) on investment securities 0.6 (19.6) (1.7) (20.7) Servicing income 71.2 — — 71.2 (Loss) gain on servicing asset (42.9) 0.3 114.4 71.8 Gain on interest rate swaps and swaptions 3.8 92.5 54.3 150.6 Gain (loss) on other derivative instruments 5.9 47.4 (45.2) 8.1 Other income (loss) 0.7 (0.2) 0.5 1.0 Total other income 39.3 120.4 122.3 282.0 Management fees & other operating expenses 38.1 2.6 — 40.7 Net income before income taxes 98.6 117.8 122.2 338.6 Income tax expense (benefit) 1.1 9.5 (6.8) 3.8 Net income 97.5 108.3 129.0 334.8 Dividends on preferred stock 13.7 — — 13.7 Net income attributable to common stockholders $83.8 $108.3 $129.0 $321.1 Weighted average earnings per basic common share $0.48 $0.62 $0.73 $ 1.83 (1) Core Earnings and Core Earnings including dollar roll income are non-GAAP measures. Please see Appendix slide 20 of this presentation for a definition of Core Earnings and Core Earnings including dollar roll income and a reconciliation of GAAP to non-GAAP financial information. 18

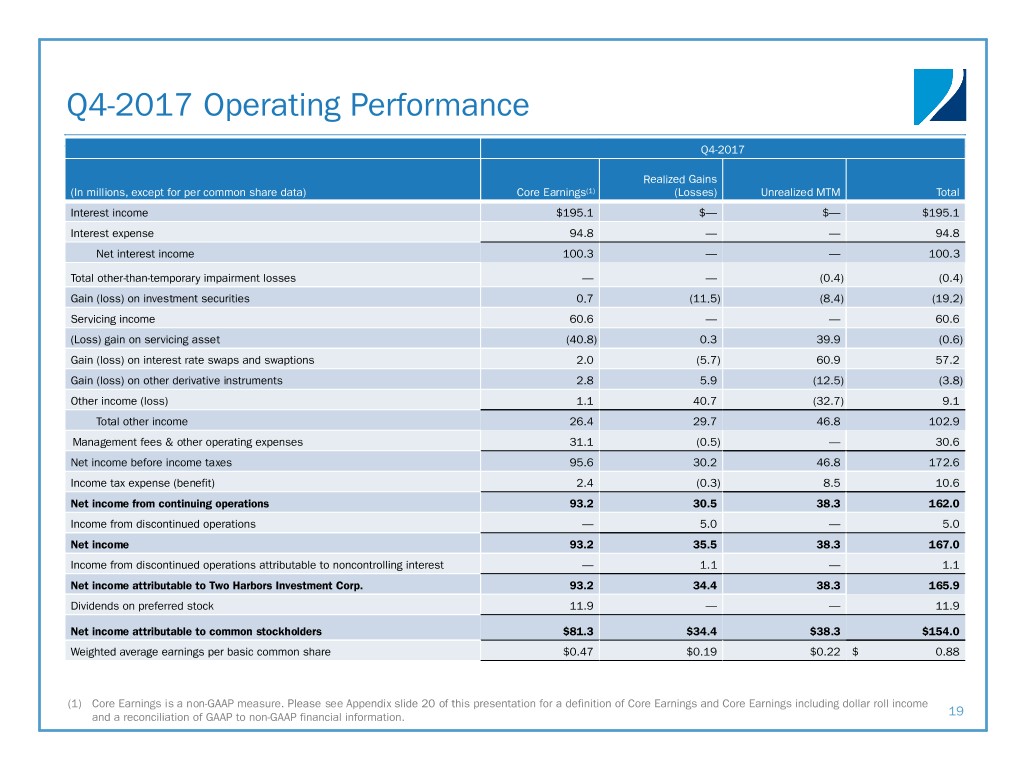

Q4-2017 Operating Performance Q4-2017 Realized Gains (In millions, except for per common share data) Core Earnings(1) (Losses) Unrealized MTM Total Interest income $195.1 $— $— $195.1 Interest expense 94.8 — — 94.8 Net interest income 100.3 — — 100.3 Total other-than-temporary impairment losses — — (0.4) (0.4) Gain (loss) on investment securities 0.7 (11.5) (8.4) (19.2) Servicing income 60.6 — — 60.6 (Loss) gain on servicing asset (40.8) 0.3 39.9 (0.6) Gain (loss) on interest rate swaps and swaptions 2.0 (5.7) 60.9 57.2 Gain (loss) on other derivative instruments 2.8 5.9 (12.5) (3.8) Other income (loss) 1.1 40.7 (32.7) 9.1 Total other income 26.4 29.7 46.8 102.9 Management fees & other operating expenses 31.1 (0.5) — 30.6 Net income before income taxes 95.6 30.2 46.8 172.6 Income tax expense (benefit) 2.4 (0.3) 8.5 10.6 Net income from continuing operations 93.2 30.5 38.3 162.0 Income from discontinued operations — 5.0 — 5.0 Net income 93.2 35.5 38.3 167.0 Income from discontinued operations attributable to noncontrolling interest — 1.1 — 1.1 Net income attributable to Two Harbors Investment Corp. 93.2 34.4 38.3 165.9 Dividends on preferred stock 11.9 — — 11.9 Net income attributable to common stockholders $81.3 $34.4 $38.3 $154.0 Weighted average earnings per basic common share $0.47 $0.19 $0.22 $ 0.88 (1) Core Earnings is a non-GAAP measure. Please see Appendix slide 20 of this presentation for a definition of Core Earnings and Core Earnings including dollar roll income and a reconciliation of GAAP to non-GAAP financial information. 19

GAAP to Core Earnings Reconciliation(1) Reconciliation of GAAP to non-GAAP Information Three Months Ended Three Months Ended (In thousands, except for per common share data) December 31, 2017 March 31, 2018 Reconciliation of Comprehensive income to Core Earnings: Comprehensive income (loss) attributable to common stockholders $65,728 ($23,715) Adjustment for other comprehensive loss attributable to common stockholders: Unrealized losses on available-for-sale securities attributable to common stockholders 88,227 344,777 Net income attributable to common stockholders $153,955 $321,062 Adjustments for non-core earnings: Realized losses on securities and residential mortgage loans 11,552 19,731 Unrealized losses on securities and residential mortgage loans held-for-sale 8,130 1,253 Other-than-temporary impairment loss 360 94 Unrealized gains on interest rate swaps and swaptions hedging interest rate exposure (or duration) (60,878) (54,257) Realized loss (gain) on termination or expiration of swaps and swaptions 5,685 (92,479) Losses (gains) on other derivative instruments 6,616 (5,599) Realized and unrealized gains on financing securitizations (7,767) — Realized and unrealized gains on mortgage servicing rights (40,148) (114,692) Change in servicing reserves (131) 265 Non-cash equity compensation (income) expense (372) 2,341 Income from discontinued operations (3,877) — Net provision for income taxes on non-Core Earnings 8,217 2,652 Core Earnings attributable to common stockholders(1) $81,342 80,371 Dollar roll income 3,454 Core Earnings attributable to common stockholders, including dollar roll income(1) $83,825 Weighted average basic common shares outstanding 174,490,106 175,145,964 Core Earnings per weighted average basic common share outstanding $0.47 $0.46 Dollar roll income per weighted average basic common share outstanding $0.02 Core Earnings including dollar roll income per weighted average basic common share outstanding $0.48 (1) Core Earnings is a non-U.S. GAAP measure that we define as comprehensive (loss) income attributable to common stockholders, excluding “realized and unrealized gains and losses” (impairment losses, realized and unrealized gains and losses on the aggregate portfolio, reserve expense for representation and warranty obligations on MSR and non-cash compensation expense related to restricted common stock). As defined, Core Earnings includes interest income or expense and premium income or loss on derivative instruments and servicing income, net of estimated amortization on MSR. Dollar roll income is the economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. We believe the presentation of Core Earnings including dollar roll income provides investors greater 20 transparency into our period-over-period financial performance and facilitates comparisons to peer REITs.

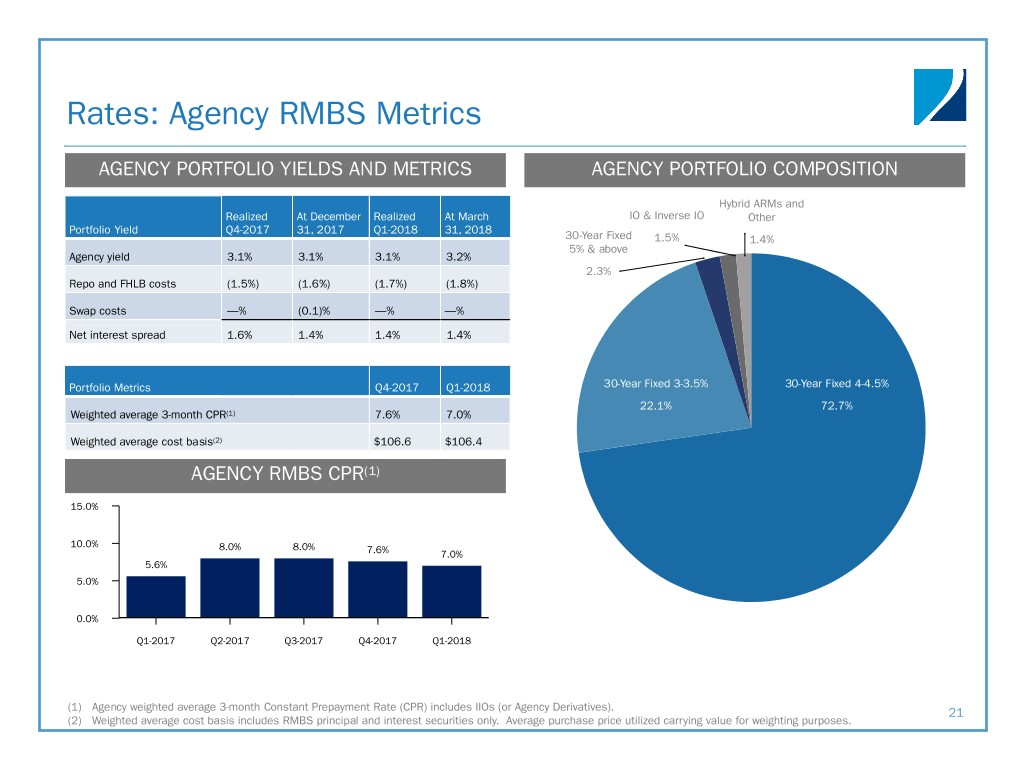

Rates: Agency RMBS Metrics AGENCY PORTFOLIO YIELDS AND METRICS AGENCY PORTFOLIO COMPOSITION Hybrid ARMs and Realized At December Realized At March IO & Inverse IO Other Portfolio Yield Q4-2017 31, 2017 Q1-2018 31, 2018 30-Year Fixed 1.5% 1.4% 5% & above Agency yield 3.1% 3.1% 3.1% 3.2% 2.3% Repo and FHLB costs (1.5%) (1.6%) (1.7%) (1.8%) Swap costs —% (0.1)% —% —% Net interest spread 1.6% 1.4% 1.4% 1.4% Portfolio Metrics Q4-2017 Q1-2018 30-Year Fixed 3-3.5% 30-Year Fixed 4-4.5% 22.1% 72.7% Weighted average 3-month CPR(1) 7.6% 7.0% Weighted average cost basis(2) $106.6 $106.4 AGENCY RMBS CPR(1) 15.0% 10.0% 8.0% 8.0% 7.6% 7.0% 5.6% 5.0% 0.0% Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 (1) Agency weighted average 3-month Constant Prepayment Rate (CPR) includes IIOs (or Agency Derivatives). 21 (2) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes.

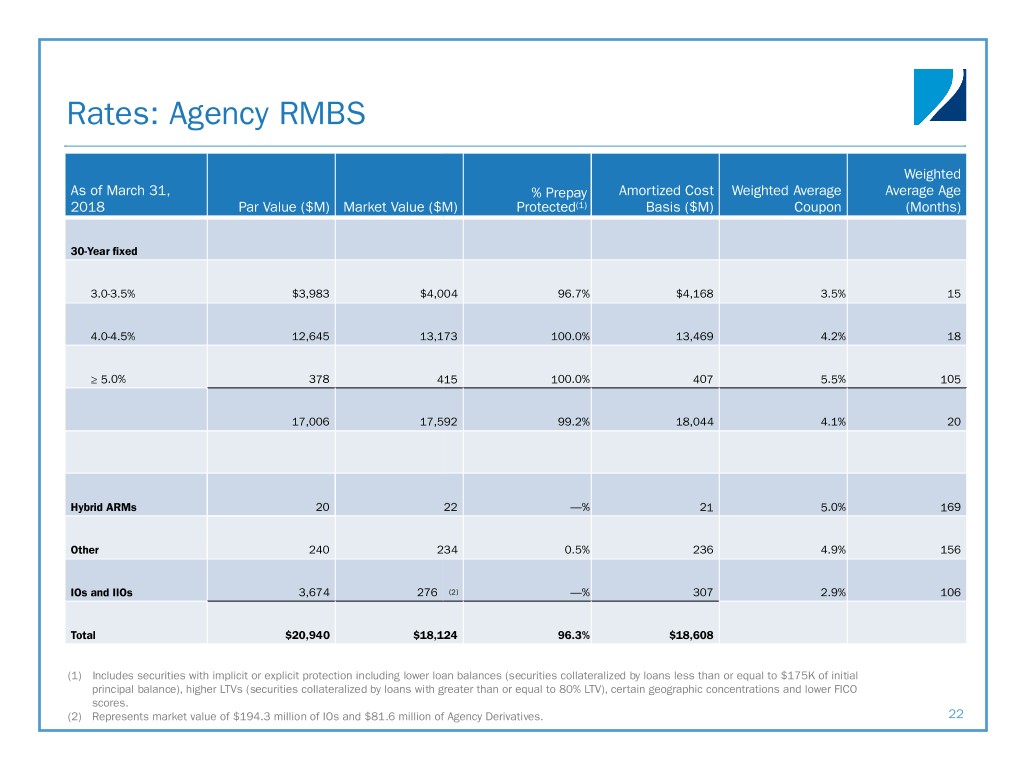

Rates: Agency RMBS Weighted As of March 31, % Prepay Amortized Cost Weighted Average Average Age 2018 Par Value ($M) Market Value ($M) Protected(1) Basis ($M) Coupon (Months) 30-Year fixed 3.0-3.5% $3,983 $4,004 96.7% $4,168 3.5% 15 4.0-4.5% 12,645 13,173 100.0% 13,469 4.2% 18 ≥ 5.0% 378 415 100.0% 407 5.5% 105 17,006 17,592 99.2% 18,044 4.1% 20 Hybrid ARMs 20 22 —% 21 5.0% 169 Other 240 234 0.5% 236 4.9% 156 IOs and IIOs 3,674 276 (2) —% 307 2.9% 106 Total $20,940 $18,124 96.3% $18,608 (1) Includes securities with implicit or explicit protection including lower loan balances (securities collateralized by loans less than or equal to $175K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations and lower FICO scores. (2) Represents market value of $194.3 million of IOs and $81.6 million of Agency Derivatives. 22

Rates: Mortgage Servicing Rights(1) As of December 31, 2017 As of March 31, 2018 Fair value ($M) $1,086.7 $1,301.0 Unpaid principal balance ($M) $101,344.1 $111,703.2 Weighted average coupon 3.9% 4.0% Original FICO score(2) 753 752 Original LTV 74% 74% 60+ day delinquencies 0.5% 0.5% Net servicing spread 25.3 basis points 25.5 basis points Vintage: Pre-2009 0.3% 0.3% 2009-2012 13.1% 11.5% Post 2012 86.6% 88.2% (1) Excludes residential mortgage loans for which the company is the named servicing administrator. 23 (2) FICO represents a mortgage industry accepted credit score of a borrower.

Credit: Non-Agency Securities Metrics NON-AGENCY PORTFOLIO YIELDS AND METRICS LEGACY NON-AGENCY PORTFOLIO COMPOSITION At Realized December Realized At March Portfolio Yield Q4-2017 31, 2017 Q1-2018 31, 2018 Non-Agency: Loan Type December 31, 2017 March 31, 2018 Non-Agency yield 7.6% 7.5% 8.0% 7.6% Sub-prime 81% 80% Repo and FHLB costs (3.0%) (3.0%) (3.1%) (3.2%) Swap income —% —% —% 0.1% Option-ARM 9% 9% Net interest spread 4.6% 4.5% 4.9% 4.5% LEGACY NON-AGENCY CPR Prime 1% 1% 10.0% Alt-A 9% 10% 6.7% 6.2% 6.4% 6.4% 5.7% Portfolio Metrics Q4-2017 Q1-2018 5.0% Weighted average 3-month CPR 6.4% 5.7% 0.0% Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 Weighted average cost basis(1) $59.9 $59.5 (1) Weighted average cost basis includes legacy non-Agency principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. If current face were utilized 24 for weighting purposes, total legacy non-Agency securities excluding the company’s non-Agency interest-only portfolio would have been $57.00 at March 31, 2018.

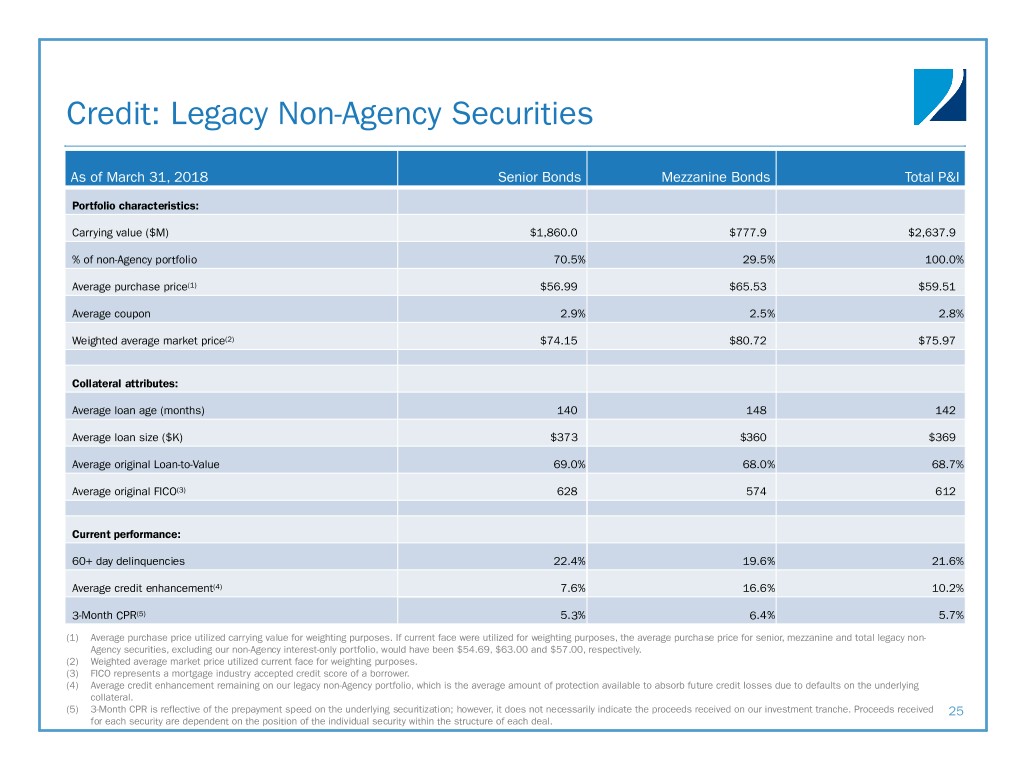

Credit: Legacy Non-Agency Securities As of March 31, 2018 Senior Bonds Mezzanine Bonds Total P&I Portfolio characteristics: Carrying value ($M) $1,860.0 $777.9 $2,637.9 % of non-Agency portfolio 70.5% 29.5% 100.0% Average purchase price(1) $56.99 $65.53 $59.51 Average coupon 2.9% 2.5% 2.8% Weighted average market price(2) $74.15 $80.72 $75.97 Collateral attributes: Average loan age (months) 140 148 142 Average loan size ($K) $373 $360 $369 Average original Loan-to-Value 69.0% 68.0% 68.7% Average original FICO(3) 628 574 612 Current performance: 60+ day delinquencies 22.4% 19.6% 21.6% Average credit enhancement(4) 7.6% 16.6% 10.2% 3-Month CPR(5) 5.3% 6.4% 5.7% (1) Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, the average purchase price for senior, mezzanine and total legacy non- Agency securities, excluding our non-Agency interest-only portfolio, would have been $54.69, $63.00 and $57.00, respectively. (2) Weighted average market price utilized current face for weighting purposes. (3) FICO represents a mortgage industry accepted credit score of a borrower. (4) Average credit enhancement remaining on our legacy non-Agency portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (5) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received 25 for each security are dependent on the position of the individual security within the structure of each deal.

Financing $ in millions Repurchase Revolving Credit Total Outstanding Outstanding Borrowings and Maturities(1) Agreements FHLB Advances Facilities Convertible Notes Borrowings Percent (%) Within 30 days $ 4,027.3 $ — $ — $ — $ 4,027.3 19.8% 30 to 59 days 3,901.3 — — — 3,901.3 19.2% 60 to 89 days 3,102.3 — — 3,102.3 15.3% 90 to 119 days 2,111.8 — — — 2,111.8 10.4% 120 to 364 days 5,756.0 — 20.0 — 5,776.0 28.4% One to three years 250.0 815.0 — — 1,065.0 5.2% Three to five years — — — 283.1 283.1 1.4% Ten years and over(2) — 50.0 — — 50.0 0.3% $ 19,148.7 $ 865.0 $ 20.0 $ 283.1 $ 20,316.8 100.0% Repurchase Revolving Credit Total Collateral Collateral Pledged for Borrowings(3) Agreements FHLB Advances Facilities(4) Convertible Notes Pledged Percent (%) Available-for-sale securities, at fair value $ 19,955.7 $ 903.0 $ — n/a $ 20,858.7 95.8% Derivative assets, at fair value 81.6 — — n/a 81.6 0.4% Mortgage servicing rights, at fair value 688.1 — 138.4 n/a 826.5 3.8% $ 20,725.4 $ 903.0 $ 138.4 n/a $ 21,766.8 100.0% (1) Weighted average of 4.7 months to maturity. (2) Includes FHLB advances of $50 million with original maturities of 20 years. (3) Excludes FHLB membership and activity stock totaling $40.8 million. 26 (4) Revolving credit facilities over-collateralized due to operational considerations.

Interest Rate Swaps Average Maturity Maturities Notional Amounts ($B)(1) Average Fixed Pay Rate(2) Average Receive Rate(2) Years(2) Payers 2018 $2.0 1.289% 1.885% 0.6 2019 4.3 1.769% 1.802% 1.5 2020 2.9 1.785% 1.952% 2.6 2021 2.4 1.788% 2.198% 3.7 2022 and after 5.8 2.200% 1.936% 7.9 $17.4 1.831% 1.936% 3.7 Average Fixed Receive Average Maturity Maturities Notional Amounts ($B) Average Pay Rate Rate (Years) Receivers 2020 $0.5 1.984% 1.763% 2.0 2021 1.4 2.096% 1.774% 2.8 2022 and after 4.3 2.389% 1.985% 7.8 $6.2 2.292% 1.921% 6.2 (1) Notional amount includes $1.4 billion in forward starting interest rate swaps as of March 31, 2018. (2) Weighted averages exclude forward starting interest rate swaps. As of March 31, 2018, the weighted average fixed pay rate on interest rate swaps starting in 2018 27 was 2.5%.

Interest Rate Swaptions Option Underlying Swap Average Notional Average Average Cost Fair Value Months to Amount Average Pay Receive Term Swaption Expiration ($M) ($M) Expiration ($M) Rate Rate (Years) Purchase Contracts: Payer <6 Months $8.5 $10.8 3.7 $4,095 2.98% 3M LIBOR 5.0 Sale Contracts: Payer >6 Months ($6.8) ($6.8) 11.2 ($280) 2.99% 3M LIBOR 10.0 Receiver <6 Months ($23.6) ($9.3) 2.5 ($9,710) 3M LIBOR 2.32% 5.0 Receiver >6 Months ($7.0) ($6.5) 11.2 ($280) 3M LIBOR 2.99% 10.0 28