Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - On Deck Capital, Inc. | ondk-3311810xqexhibit3223.htm |

| EX-32.1 - EXHIBIT 32.1 - On Deck Capital, Inc. | ondk-3311810xqexhibit3213.htm |

| EX-31.2 - EXHIBIT 31.2 - On Deck Capital, Inc. | ondk-3311810xqexhibit3123.htm |

| EX-31.1 - EXHIBIT 31.1 - On Deck Capital, Inc. | ondk-3311810xqexhibit3113.htm |

| EX-10.4 - EXHIBIT 10.4 - On Deck Capital, Inc. | exhibit104kampferletter.htm |

| EX-10.3 - EXHIBIT 10.3 - On Deck Capital, Inc. | exhibit103gellertletter.htm |

| EX-10.2 - EXHIBIT 10.2 - On Deck Capital, Inc. | exhibit102kenbrauseconfirm.htm |

| EX-10.1 - EXHIBIT 10.1 - On Deck Capital, Inc. | exhibit101surrenderagreeme.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2018

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36779

On Deck Capital, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 42-1709682 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1400 Broadway, 25th Floor, New York, New York | 10018 | |

(Address of principal executive offices) | (Zip Code) | |

(888) 269-4246

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Emerging growth company | x | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | x | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

YES ¨ NO x

The number of shares of the registrant’s common stock outstanding as of April 30, 2018 was 74,269,812.

On Deck Capital, Inc.

Table of Contents

Page | ||

PART I - FINANCIAL INFORMATION | ||

Item 1. | Financial Statements (Unaudited) | |

Unaudited Condensed Consolidated Balance Sheets | ||

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income | ||

Unaudited Condensed Consolidated Statements of Cash Flows | ||

Notes to Unaudited Condensed Consolidated Financial Statements | ||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 4. | Controls and Procedures | |

PART II - OTHER INFORMATION | ||

Item 1. | Legal Proceedings | |

Item 1A. | Risk Factors | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

Item 3. | Defaults Upon Senior Securities | |

Item 4. | Mine Safety Disclosures | |

Item 5. | Other Information | |

Item 6 | Exhibits | |

Signatures | ||

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

March 31, | December 31, | ||||||

2018 | 2017 | ||||||

Assets | |||||||

Cash and cash equivalents | $ | 70,415 | $ | 71,362 | |||

Restricted cash | 44,709 | 43,462 | |||||

Loans held for investment | 1,010,944 | 952,796 | |||||

Less: Allowance for loan losses | (118,921 | ) | (109,015 | ) | |||

Loans held for investment, net | 892,023 | 843,781 | |||||

Property, equipment and software, net | 17,455 | 23,572 | |||||

Other assets | 15,824 | 13,867 | |||||

Total assets | $ | 1,040,426 | $ | 996,044 | |||

Liabilities and equity | |||||||

Liabilities: | |||||||

Accounts payable | $ | 3,038 | $ | 2,674 | |||

Interest payable | 2,429 | 2,330 | |||||

Funding debt | 730,024 | 684,269 | |||||

Corporate debt | 7,969 | 7,985 | |||||

Accrued expenses and other liabilities | 29,499 | 32,730 | |||||

Total liabilities | 772,959 | 729,988 | |||||

Commitments and contingencies (Note 9) | |||||||

Stockholders’ equity (deficit): | |||||||

Common stock—$0.005 par value, 1,000,000,000 shares authorized and 77,752,143 and 77,284,266 shares issued and 74,264,491 and 73,822,001 outstanding at March 31, 2018 and December 31, 2017, respectively. | 389 | 386 | |||||

Treasury stock—at cost | (8,083 | ) | (7,965 | ) | |||

Additional paid-in capital | 496,588 | 492,509 | |||||

Accumulated deficit | (224,752 | ) | (222,833 | ) | |||

Accumulated other comprehensive loss | (118 | ) | (52 | ) | |||

Total On Deck Capital, Inc. stockholders' equity | 264,024 | 262,045 | |||||

Noncontrolling interest | 3,443 | 4,011 | |||||

Total equity | 267,467 | 266,056 | |||||

Total liabilities and equity | $ | 1,040,426 | $ | 996,044 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income

(in thousands, except share and per share data)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Revenue: | |||||||

Interest income | $ | 86,369 | $ | 87,111 | |||

Gain on sales of loans | — | 1,484 | |||||

Other revenue | 3,911 | 4,297 | |||||

Gross revenue | 90,280 | 92,892 | |||||

Cost of revenue: | |||||||

Provision for loan losses | 36,293 | 46,180 | |||||

Funding costs | 11,821 | 11,277 | |||||

Total cost of revenue | 48,114 | 57,457 | |||||

Net revenue | 42,166 | 35,435 | |||||

Operating expense: | |||||||

Sales and marketing | 10,598 | 14,819 | |||||

Technology and analytics | 11,007 | 15,443 | |||||

Processing and servicing | 5,221 | 4,535 | |||||

General and administrative | 17,725 | 11,887 | |||||

Total operating expense | 44,551 | 46,684 | |||||

Income (loss) from operations | (2,385 | ) | (11,249 | ) | |||

Other expense: | |||||||

Interest expense | (51 | ) | (353 | ) | |||

Total other expense | (51 | ) | (353 | ) | |||

Loss before provision for income taxes | (2,436 | ) | (11,602 | ) | |||

Provision for income taxes | — | — | |||||

Net income (loss) | (2,436 | ) | (11,602 | ) | |||

Net loss attributable to noncontrolling interest | 518 | 544 | |||||

Net income (loss) attributable to On Deck Capital, Inc. common stockholders | $ | (1,918 | ) | $ | (11,058 | ) | |

Net income (loss) per share attributable to On Deck Capital, Inc. common shareholders: | |||||||

Basic and diluted | $ | (0.03 | ) | $ | (0.15 | ) | |

Weighted-average common shares outstanding: | |||||||

Basic and diluted | 73,977,241 | 71,854,287 | |||||

Comprehensive loss: | |||||||

Net loss | $ | (2,436 | ) | $ | (11,602 | ) | |

Other comprehensive loss: | |||||||

Foreign currency translation adjustment | (113 | ) | 400 | ||||

Comprehensive loss | (2,549 | ) | (11,202 | ) | |||

Comprehensive loss attributable to noncontrolling interests | 50 | (180 | ) | ||||

Net loss attributable to noncontrolling interest | 518 | 544 | |||||

Comprehensive loss attributable to On Deck Capital, Inc. common stockholders | $ | (1,981 | ) | $ | (10,838 | ) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities | |||||||

Net income (loss) | $ | (2,436 | ) | $ | (11,602 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Provision for loan losses | 36,293 | 46,180 | |||||

Depreciation and amortization | 2,174 | 2,596 | |||||

Amortization of debt issuance costs | 1,230 | 797 | |||||

Stock-based compensation | 3,210 | 3,491 | |||||

Amortization of net deferred origination costs | 12,399 | 11,883 | |||||

Changes in servicing rights, at fair value | 131 | 701 | |||||

Gain on sales of loans | — | (1,484 | ) | ||||

Unfunded loan commitment reserve | 171 | 119 | |||||

Gain on extinguishment of debt | — | (229 | ) | ||||

Loss on disposal of fixed assets | 5,713 | — | |||||

Gain on lease termination | (1,481 | ) | — | ||||

Changes in operating assets and liabilities: | |||||||

Other assets | (3,484 | ) | 1,120 | ||||

Accounts payable | 364 | (1,231 | ) | ||||

Interest payable | 99 | 488 | |||||

Accrued expenses and other liabilities | (471 | ) | (8,053 | ) | |||

Originations of loans held for sale | — | (33,042 | ) | ||||

Capitalized net deferred origination costs of loans held for sale | — | (911 | ) | ||||

Proceeds from sale of loans held for sale | — | 33,326 | |||||

Principal repayments of loans held for sale | — | 722 | |||||

Net cash provided by operating activities | 53,912 | 44,871 | |||||

Cash flows from investing activities | |||||||

Purchases of property, equipment and software | (313 | ) | (145 | ) | |||

Proceeds from sale of fixed assets | (45 | ) | — | ||||

Capitalized internal-use software | (1,398 | ) | (1,219 | ) | |||

Originations of term loans and lines of credit, excluding rollovers into new originations | (499,775 | ) | (469,913 | ) | |||

Proceeds from sale of loans held for investment | — | 10,008 | |||||

Payments of net deferred origination costs | (14,193 | ) | (12,314 | ) | |||

Principal repayments of term loans and lines of credit | 417,034 | 389,976 | |||||

Purchase of loans | — | (13,518 | ) | ||||

Net cash used in investing activities | (98,690 | ) | (97,125 | ) | |||

Cash flows from financing activities | |||||||

Investments by noncontrolling interests | — | 3,443 | |||||

Purchase of treasury shares | (119 | ) | (205 | ) | |||

Proceeds from exercise of stock options and warrants | 39 | 195 | |||||

Issuance of common stock under employee stock purchase plan | 764 | 1,246 | |||||

Proceeds from the issuance of funding debt | 59,373 | 66,119 | |||||

Proceeds from the issuance of corporate debt | 10,000 | — | |||||

Payments of debt issuance costs | (74 | ) | (2,488 | ) | |||

5

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Repayments of funding debt principal | (14,602 | ) | (2,794 | ) | |||

Repayments of corporate debt principal | (10,000 | ) | — | ||||

Net cash provided by financing activities | 45,381 | 65,516 | |||||

Effect of exchange rate changes on cash and cash equivalents | (303 | ) | 421 | ||||

Net increase (decrease) in cash, cash equivalents, and restricted cash | 300 | 13,683 | |||||

Cash, cash equivalents, and restricted cash at beginning of year | 114,824 | 123,986 | |||||

Cash, cash equivalents, and restricted cash at end of period | $ | 115,124 | $ | 137,669 | |||

Reconciliation to amounts on consolidated balance sheets | |||||||

Cash and cash equivalents | $ | 70,415 | $ | 72,997 | |||

Restricted cash | 44,709 | 64,672 | |||||

Total cash, cash equivalents and restricted cash | $ | 115,124 | $ | 137,669 | |||

Supplemental disclosure of other cash flow information | |||||||

Cash paid for interest | $ | 10,483 | $ | 10,257 | |||

Supplemental disclosures of non-cash investing and financing activities | |||||||

Stock-based compensation included in capitalized internal-use software | $ | 68 | $ | 92 | |||

Unpaid principal balance of term loans rolled into new originations | $ | 90,810 | $ | 70,059 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Organization and Summary of Significant Accounting Policies

On Deck Capital, Inc.’s principal activity is providing financing to small businesses located throughout the United States, as well as Canada and Australia, through term loans and lines of credit. We use technology and analytics to aggregate data about a business and then quickly and efficiently analyze the creditworthiness of the business using our proprietary credit-scoring model. We originate most of the loans in our portfolio and also purchase loans from an issuing bank partner. We subsequently transfer most of our loan volume into one of our wholly-owned subsidiaries and also have the option to sell them through OnDeck Marketplace®.

Basis of Presentation and Principles of Consolidation

We prepare our condensed consolidated financial statements and footnotes in accordance with accounting principles generally accepted in the United States of America, or GAAP, as contained in the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC. All intercompany transactions and accounts have been eliminated in consolidation. Certain reclassifications have been made to the prior year amounts to conform to the current year presentation. When used in these notes to condensed consolidated financial statements, the terms "we," "us," "our" or similar terms refers to On Deck Capital, Inc. and its consolidated subsidiaries.

We consolidate the financial position and results of operations of these entities. The noncontrolling interest, which is presented as a separate component of our consolidated equity, represents the minority owners' proportionate share of the equity of the jointly owned entities. The noncontrolling interest is adjusted for the minority owners' share of the earnings, losses, investments and distributions.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts in the condensed consolidated financial statements and accompanying notes. Significant estimates include allowance for loan losses, stock-based compensation expense, capitalized software development costs, the useful lives of long-lived assets, servicing assets/liabilities, loans purchased, and valuation allowance for deferred tax assets. We base our estimates on historical experience, current events and other factors we believe to be reasonable under the circumstances. These estimates and assumptions are inherently subjective in nature; actual results may differ from these estimates and assumptions.

Recently Adopted Accounting Standards

In May 2014, the FASB issued ASU 2014-09, Revenue Recognition, which creates ASC 606, Revenue from Contracts with Customers, and supersedes ASC 605, Revenue Recognition. ASU 2014-09 requires revenue to be recognized in an amount that reflects the consideration to which the entity expects to be entitled in exchange for goods or services and also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows from customer contracts. The FASB subsequently issued numerous amendments including ASU 2016-08 - Principal versus Agent Considerations, ASU 2016-10 - Identifying Performance Obligations and Licensing, and ASU 2016-12 - Narrow-Scope Improvements and Practical Expedients. Each amendment has the same effective date and transition requirements as the new revenue recognition standard. We adopted the new standard effective January 1, 2018 and applied the modified retrospective method of adoption. The adoption of ASC 606 did not have a material effect on our condensed consolidated financial statements and disclosures, nor did it result in a cumulative effect adjustment at the date of initial application.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. ASU 2016-18 intends to reduce diversity in practice for the classification and presentation of changes in restricted cash on the statement of cash flows. ASU 2016-18 clarifies that transfers between cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents are not part of the entity’s operating, investing, and financing activities, and details of those transfers should not be reported as cash flow activities in the statement of cash flows. It requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. We adopted the new standard effective January 1, 2018 and no longer present restricted cash as a reconciling item in our consolidated statement of cash flows. For the three months ended March 31, 2017, cash flows from investing activities increased $20.2 million and the net decrease in cash and cash equivalents of $6.6 million became a net increase in cash, cash equivalents and restricted cash of $13.6 million.

7

Recent Accounting Pronouncements Not Yet Adopted

In February 2016, the FASB issued ASU 2016-02, Leases, which creates ASC 842, Leases, and supersedes ASC 840, Leases. ASU 2016-02 requires lessees to recognize a right-of-use asset and lease liability for all leases with terms of more than 12 months. Recognition, measurement and presentation of expenses will depend on classification as a finance or operating lease. The new guidance will be effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period and is applied retrospectively. Early adoption is permitted. We are currently assessing the impact that the adoption of this guidance will have on our consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. ASU 2016-13 will change the impairment model and how entities measure credit losses for most financial assets. The standard requires entities to use the new expected credit loss impairment model which will replace the incurred loss model used today. The new guidance will be effective for annual reporting periods beginning after December 15, 2019. Early adoption is permitted, but not prior to December 15, 2018. We are currently assessing the impact that the adoption of this guidance will have on our consolidated financial statements.

2. Net Loss Per Common Share

Basic and diluted net loss per common share is calculated as follows (in thousands, except share and per share data):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Numerator: | |||||||

Net loss | $ | (2,436 | ) | $ | (11,602 | ) | |

Less: net loss attributable to noncontrolling interest | 518 | 544 | |||||

Net loss attributable to On Deck Capital, Inc. common stockholders | $ | (1,918 | ) | $ | (11,058 | ) | |

Denominator: | |||||||

Weighted-average common shares outstanding, basic and diluted | 73,977,241 | 71,854,287 | |||||

Net loss per common share, basic and diluted | $ | (0.03 | ) | $ | (0.15 | ) | |

Diluted loss per common share is the same as basic loss per common share for all periods presented because the effects of potentially dilutive items were anti-dilutive given our net losses. The following common share equivalent securities have been excluded from the calculation of weighted-average common shares outstanding because the effect is anti-dilutive for the periods presented:

Three Months Ended March 31, | |||||

2018 | 2017 | ||||

Anti-dilutive common share equivalents | |||||

Warrants to purchase common stock | 22,000 | 22,000 | |||

Restricted stock units | 3,874,666 | 3,487,022 | |||

Stock options | 8,234,689 | 10,056,752 | |||

Employee stock purchase program | 32,449 | 51,491 | |||

Total anti-dilutive common share equivalents | 12,163,804 | 13,617,265 | |||

The weighted-average exercise price for warrants to purchase 2,007,846 shares of common stock was $10.70 as of March 31, 2018. For the three months ended March 31, 2018 and 2017, a warrant to purchase 1,985,846 and 1,985,846 shares of common stock, respectively, was excluded from anti-dilutive common share equivalents as performance conditions had not been met.

8

3. Loans Held for Investment and Allowance for Loan Losses

Loans Held for Investment and Allowance for Loan Losses

Loans held for investment consisted of the following as of March 31, 2018 and December 31, 2017 (in thousands):

March 31, 2018 | December 31, 2017 | ||||||

Term loans | $ | 847,403 | $ | 804,227 | |||

Lines of credit | 145,192 | 132,012 | |||||

Total unpaid principal balance | 992,595 | 936,239 | |||||

Net deferred origination costs | 18,349 | 16,557 | |||||

Total loans held for investment | $ | 1,010,944 | $ | 952,796 | |||

We include both loans we originate and loans originated by our issuing bank partners and later purchased by us as part of our originations. During the three months ended March 31, 2018 and 2017 we purchased loans in the amount of $139.2 million and $145.0 million, respectively.

The change in the allowance for loan losses for the three months ended March 31, 2018 and 2017 consisted of the following (in thousands):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Balance at beginning of period | $ | 109,015 | $ | 110,162 | |||

Recoveries of loans previously charged off | 3,345 | 2,617 | |||||

Loans charged off | (29,732 | ) | (40,884 | ) | |||

Provision for loan losses | 36,293 | 46,180 | |||||

Allowance for loan losses at end of period | $ | 118,921 | $ | 118,075 | |||

When loans are charged-off, we typically continue to attempt to recover amounts from the respective borrowers and guarantors, including, when we deem it appropriate, through formal legal action. Alternatively, we may sell previously charged-off loans to a third-party debt collector. The proceeds from these sales are recorded as a component of the recoveries of loans previously charged off. For the three months ended March 31, 2018 and 2017, previously charged-off loans sold accounted for $0.5 million and $1.9 million, respectively, of recoveries of loans previously charged off.

As of March 31, 2018 and December 31, 2017, our off-balance sheet credit exposure related to the undrawn line of credit balances was $209.6 million and $204.6 million, respectively. The related reserve on unfunded loan commitments was $4.6 million and $4.4 million as of March 31, 2018 and December 31, 2017, respectively. Net adjustments to the accrual for unfunded loan commitments are included in general and administrative expense.

The following table contains information, on a combined basis, regarding the unpaid principal balance of loans we originated and the amortized cost of loans purchased from third parties other than our issuing bank partner related to current, paying and non-paying delinquent loans as of March 31, 2018 and December 31, 2017 (in thousands):

March 31, 2018 | December 31, 2017 | ||||||

Current loans | $ | 904,660 | $ | 850,060 | |||

Delinquent: paying (accrual status) | 50,338 | 49,252 | |||||

Delinquent: non-paying (non-accrual status) | 37,597 | 36,927 | |||||

Total | $ | 992,595 | $ | 936,239 | |||

The portion of the allowance for loan losses attributable to current loans was $79.5 million and $74.0 million as of March 31, 2018 and December 31, 2017, respectively, while the portion of the allowance for loan losses attributable to delinquent loans was $39.4 million and $35.0 million as of March 31, 2018 and December 31, 2017, respectively.

9

The following table shows an aging analysis of the unpaid principal balance related to loans held for investment by delinquency status as of March 31, 2018 and December 31, 2017 (in thousands):

March 31, 2018 | December 31, 2017 | ||||||

By delinquency status: | |||||||

Current loans | $ | 904,660 | $ | 850,060 | |||

1-14 calendar days past due | 21,080 | 23,611 | |||||

15-29 calendar days past due | 12,068 | 12,528 | |||||

30-59 calendar days past due | 19,557 | 22,059 | |||||

60-89 calendar days past due | 13,850 | 12,809 | |||||

90 + calendar days past due | 21,380 | 15,172 | |||||

Total unpaid principal balance | $ | 992,595 | $ | 936,239 | |||

4. Servicing Rights

As of March 31, 2018 and December 31, 2017, the remaining unpaid principal balance of term loans we serviced that previously were sold was $191.0 million and $181.0 million, respectively. No loans were sold during the three months ended March 31, 2018. During the three months ended March 31, 2017, we sold through OnDeck Marketplace loans with an unpaid principal balance of $41.1 million.

For the three months ended March 31, 2018 and 2017, we earned $0.3 million and $0.3 million of servicing revenue, respectively.

The following table summarizes the activity related to the fair value of our servicing assets for the three months ended March 31, 2018 and 2017 (in thousands):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Fair value at the beginning of period | $ | 154 | $ | 1,131 | |||

Addition: | |||||||

Servicing resulting from transfers of financial assets | 52 | 430 | |||||

Changes in fair value: | |||||||

Change in inputs or assumptions used in the valuation model | — | — | |||||

Other changes in fair value (1) | (131 | ) | (701 | ) | |||

Fair value at the end of period (Level 3) | $ | 75 | $ | 860 | |||

(1) Represents changes due to collection of expected cash flows through March 31, 2018 and 2017.

10

5. Debt

The following table summarizes our outstanding debt as of March 31, 2018 and December 31, 2017 (in thousands):

Outstanding | |||||||||||||

Type | Maturity Date | Weighted Average Interest Rate at March 31, 2018 | March 31, 2018 | December 31, 2017 | |||||||||

Funding Debt: | |||||||||||||

ODAST II Agreement | Securitization | May 2020 (1) | 4.7% | $ | 250,000 | $ | 250,000 | ||||||

ODART Agreement | Revolving | March 2019 | 4.4% | 112,499 | 102,058 | ||||||||

RAOD Agreement | Revolving | November 2018 | 5.1% | 98,983 | 86,478 | ||||||||

ODAC Agreement | Revolving | May 2019 | 9.0% | 75,454 | 62,350 | ||||||||

ODAF Agreement | Revolving | February 2020 (2) | 8.9% | 75,000 | 75,000 | ||||||||

PORT II Agreement | Revolving | December 2018 | 4.3% | 72,630 | 63,851 | ||||||||

Other Agreements | Various | Various (3) | Various | 50,378 | 50,706 | ||||||||

734,944 | 690,443 | ||||||||||||

Deferred debt issuance cost | (4,920 | ) | (6,174 | ) | |||||||||

Total Funding Debt | 730,024 | 684,269 | |||||||||||

Corporate Debt: | |||||||||||||

Square 1 Agreement | Revolving | October 2018 | 6.0% | 8,000 | 8,000 | ||||||||

Deferred debt issuance cost | (31 | ) | (15 | ) | |||||||||

Total Corporate Debt | 7,969 | 7,985 | |||||||||||

(1) In April 2018, we issued $225 million of debt in a new securitization transaction. The net proceeds were used, together with other available funds, to voluntarily prepay in full all $250 million of the prior ODAST II Notes. See Note 10, "Subsequent Events" of Notes to Unaudited Condensed Consolidated Financial Statements.

(2) The period during which new borrowings may be made under this debt facility expires in February 2019.

(3) Maturity dates range from April 2018 through November 2020.

In April 2018, Loan Assets of OnDeck, LLC, a wholly-owned subsidiary of the Company, established a new asset-backed revolving debt facility with a commitment amount of $100 million. For additional information, see Note 10, "Subsequent Events" of Notes to Unaudited Condensed Consolidated Financial Statements.

Certain of our loans held for investment are pledged as collateral for borrowings in our funding debt facilities. These loans totaled $904.7 million and $852.3 million as of March 31, 2018 and December 31, 2017, respectively. Our corporate debt facility is collateralized by substantially all of our assets.

6. Fair Value of Financial Instruments

Assets and Liabilities Measured at Fair Value on a Recurring Basis Using Significant Unobservable Inputs (Level 3)

We evaluate our financial assets and liabilities subject to fair value measurements on a recurring basis to determine the appropriate level at which to classify them for each reporting period. Due to the lack of transparency and quantity of transactions related to trades of servicing rights of comparable loans, we utilize an income valuation technique to estimate fair value. We utilize industry-standard modeling, such as discounted cash flow models, to arrive at an estimate of fair value and may utilize third-party service providers to assist in the valuation process. This determination requires significant judgments to be made.

11

The following tables present information about our assets and liabilities that are measured at fair value on a recurring basis as of March 31, 2018 and December 31, 2017 (in thousands):

March 31, 2018 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Servicing assets | $ | — | $ | — | $ | 75 | $ | 75 | |||||||

Total assets | $ | — | $ | — | $ | 75 | $ | 75 | |||||||

December 31, 2017 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Servicing assets | $ | — | $ | — | $ | 154 | $ | 154 | |||||||

Total assets | $ | — | $ | — | $ | 154 | $ | 154 | |||||||

There were no transfers between levels for the three months ended March 31, 2018 or December 31, 2017.

The following tables presents quantitative information about the significant unobservable inputs used for certain of our Level 3 fair value measurement as of March 31, 2018 and December 31, 2017:

March 31, 2018 | ||||||||||

Unobservable input | Minimum | Maximum | Weighted Average | |||||||

Servicing assets | Discount rate | 30.00 | % | 30.00 | % | 30.00 | % | |||

Cost of service(1) | 0.04 | % | 0.13 | % | 0.13 | % | ||||

Renewal rate | 41.06 | % | 51.83 | % | 49.29 | % | ||||

Default rate | 10.63 | % | 10.92 | % | 10.71 | % | ||||

(1) Estimated cost of servicing a loan as a percentage of unpaid principal balance. | ||||||||||

December 31, 2017 | ||||||||||

Unobservable input | Minimum | Maximum | Weighted Average | |||||||

Servicing assets | Discount rate | 30.00 | % | 30.00 | % | 30.00 | % | |||

Cost of service(1) | 0.04 | % | 0.13 | % | 0.12 | % | ||||

Renewal rate | 41.06 | % | 51.83 | % | 49.59 | % | ||||

Default rate | 10.63 | % | 10.92 | % | 10.70 | % | ||||

(1) Estimated cost of servicing a loan as a percentage of unpaid principal balance. | ||||||||||

Changes in certain of the unobservable inputs noted above may have a significant impact on the fair value of our servicing asset. The following table summarizes the effect adverse changes in estimate would have on the fair value of the servicing asset as of March 31, 2018 and December 31, 2017 given a hypothetical changes in default rate and cost to service (in thousands):

12

March 31, 2018 | December 31, 2017 | ||||||

Servicing Assets | |||||||

Default rate assumption: | |||||||

Default rate increase of 25% | $ | (23 | ) | $ | (40 | ) | |

Default rate increase of 50% | $ | (43 | ) | $ | (76 | ) | |

Cost to service assumption: | |||||||

Cost to service increase by 25% | $ | (36 | ) | $ | (63 | ) | |

Cost to service increase by 50% | $ | (71 | ) | $ | (126 | ) | |

Assets and Liabilities Disclosed at Fair Value

Because our loans held for investment, loans held for sale and fixed-rate debt are not measured at fair value, we are required to disclose their fair value in accordance with ASC 825. Due to the lack of transparency and comparable loans, we utilize an income valuation technique to estimate fair value. We utilize industry-standard modeling, such as discounted cash flow models, to arrive at an estimate of fair value and may utilize third-party service providers to assist in the valuation process. This determination requires significant judgments to be made. The following tables summarize the carrying value and fair value of our loans held for investment and fixed-rate debt (in thousands):

March 31, 2018 | |||||||||||||||||||

Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||||

Assets: | |||||||||||||||||||

Loans held for investment | $ | 892,023 | $ | 989,477 | $ | — | $ | — | $ | 989,477 | |||||||||

Total assets | $ | 892,023 | $ | 989,477 | $ | — | $ | — | $ | 989,477 | |||||||||

Liabilities: | |||||||||||||||||||

Fixed-rate debt | $ | 300,377 | $ | 293,408 | $ | — | $ | — | $ | 293,408 | |||||||||

Total fixed-rate debt | $ | 300,377 | $ | 293,408 | $ | — | $ | — | $ | 293,408 | |||||||||

December 31, 2017 | |||||||||||||||||||

Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||||

Assets: | |||||||||||||||||||

Loans held for investment | $ | 843,781 | $ | 932,343 | $ | — | $ | — | $ | 932,343 | |||||||||

Total assets | $ | 843,781 | $ | 932,343 | $ | — | $ | — | $ | 932,343 | |||||||||

Liabilities: | |||||||||||||||||||

Fixed-rate debt | $ | 300,706 | $ | 293,512 | $ | — | $ | — | $ | 293,512 | |||||||||

Total fixed-rate debt | $ | 300,706 | $ | 293,512 | $ | — | $ | — | $ | 293,512 | |||||||||

13

7. Noncontrolling Interest

The following tables summarize changes in equity, including the equity attributable to noncontrolling interests, for the three months ended March 31, 2018 and 2017 (in thousands):

Three Months Ended March 31, 2018 | ||||||||||||

On Deck Capital, Inc's stockholders' equity | Noncontrolling interest | Total | ||||||||||

Balance as of January 1, 2018 | 262,045 | 4,011 | 266,056 | |||||||||

Net income (loss) | (1,918 | ) | (518 | ) | (2,436 | ) | ||||||

Stock based compensation | 3,122 | — | 3,122 | |||||||||

Exercise of options and warrants | 39 | — | 39 | |||||||||

Employee stock purchase plan | 918 | — | 918 | |||||||||

Cumulative translation adjustment | (63 | ) | (50 | ) | (113 | ) | ||||||

Purchase of shares for treasury | (119 | ) | — | (119 | ) | |||||||

Balance at March 31, 2018 | 264,024 | 3,443 | 267,467 | |||||||||

Comprehensive loss: | ||||||||||||

Net loss | (1,918 | ) | (518 | ) | (2,436 | ) | ||||||

Other comprehensive income (loss): | ||||||||||||

Foreign currency translation adjustment | (63 | ) | (50 | ) | (113 | ) | ||||||

Comprehensive income (loss): | (1,981 | ) | (568 | ) | (2,549 | ) | ||||||

Three Months Ended March 31, 2017 | ||||||||||||

On Deck Capital, Inc.'s stockholders' equity | Noncontrolling interest | Total | ||||||||||

Balance as of January 1, 2017 | $ | 259,525 | $ | 4,072 | $ | 263,597 | ||||||

Net income (loss) | (11,058 | ) | (544 | ) | (11,602 | ) | ||||||

Stock based compensation | 3,309 | — | 3,309 | |||||||||

Exercise of options and warrants | 195 | — | 195 | |||||||||

Employee stock purchase plan | 1,541 | — | 1,541 | |||||||||

Cumulative translation adjustment | 220 | 180 | 400 | |||||||||

Purchase of shares for treasury | (205 | ) | — | (205 | ) | |||||||

Investments by noncontrolling interests | — | 3,443 | 3,443 | |||||||||

Balance at March 31, 2017 | 253,527 | 7,151 | 260,678 | |||||||||

Comprehensive loss: | ||||||||||||

Net loss | (11,058 | ) | (544 | ) | (11,602 | ) | ||||||

Other comprehensive income (loss): | ||||||||||||

Foreign currency translation adjustment | 220 | 180 | 400 | |||||||||

Comprehensive income (loss): | $ | (10,838 | ) | $ | (364 | ) | $ | (11,202 | ) | |||

14

8. Stock-Based Compensation and Employee Benefit Plans

Options

The following is a summary of option activity for the three months ended March 31, 2018:

Number of Options | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||||||

Outstanding at January 1, 2018 | 7,918,853 | $ | 5.75 | — | — | ||||||||

Granted | 595,861 | $ | 5.19 | — | — | ||||||||

Exercised | (205,768 | ) | $ | 0.45 | — | — | |||||||

Forfeited | (5,853 | ) | $ | 13.08 | — | — | |||||||

Expired | (68,404 | ) | $ | 12.15 | — | — | |||||||

Outstanding at March 31, 2018 | 8,234,689 | $ | 5.79 | 6.5 | $ | 16,370 | |||||||

Exercisable at March 31, 2018 | 6,121,753 | $ | 5.42 | 5.8 | $ | 15,507 | |||||||

Vested or expected to vest as of March 31, 2018 | 8,119,911 | $ | 5.79 | 6.5 | $ | 16,329 | |||||||

Total compensation cost related to nonvested option awards not yet recognized as of March 31, 2018 was $5.2 million and will be recognized over a weighted-average period of approximately 1.9 years. The aggregate intrinsic value of employee options exercised during the three months ended March 31, 2018 and 2017 was $1.0 million and $2.3 million, respectively.

Restricted Stock Units

The following table summarizes our activities of Restricted Stock Units ("RSUs") and Performance Restricted Stock Units ("PRSUs") during the three months ended March 31, 2018:

Number of RSUs | Weighted-Average Grant Date Fair Value | |||||

Unvested at January 1, 2018 | 3,342,640 | $ | 6.18 | |||

RSUs and PRSUs granted | 703,492 | $ | 5.09 | |||

RSUs vested | (75,213 | ) | $ | 6.27 | ||

RSUs forfeited/expired | (96,253 | ) | $ | 5.70 | ||

Unvested at March 31, 2018 | 3,874,666 | $ | 5.99 | |||

Expected to vest after March 31, 2018 | 3,267,046 | $ | 6.12 | |||

As of March 31, 2018, there was $15 million of unrecognized compensation cost related to unvested RSUs and PRSUs, which is expected to be recognized over a weighted-average period of 2.7 years.

Stock-based compensation expense related to stock options, RSUs, PRSUs and the ESPP are included in the following line items in our accompanying consolidated statements of operations for the three months ended March 31, 2018 and 2017 (in thousands):

March 31, 2018 | March 31, 2017 | |||||||

Sales and marketing | 535 | $ | 771 | |||||

Technology and analytics | 597 | 783 | ||||||

Processing and servicing | 105 | 173 | ||||||

General and administrative | 1,973 | 1,764 | ||||||

Total | $ | 3,210 | — | $ | 3,491 | |||

15

9. Commitments and Contingencies

Commitments under Operating Leases

Effective February 1, 2018, we terminated our lease obligation for the 12th floor of our New York office which accounted for approximately 32% of our total New York office space. The lease of the 12th floor was previously scheduled to continue through December 2026. As part of the termination, we paid the landlord a cash surrender fee of approximately $2.6 million and recorded a net charge of approximately $3.2 million in the quarter ending March 31, 2018. The net charge includes the surrender fee and approximately $4.0 million related to the impairment of leasehold improvements and other fixed assets in the surrendered space, which were partially offset by other deferred credits.

On March 29, 2018, we terminated our lease obligation with respect to a portion of our Denver office which accounted for approximately 38% of our total Denver office space. Our lease of that space was previously scheduled to continue through April 2026. As part of the termination, we paid a surrender fee and related charges of approximately $900,000 and recorded a net charge of approximately $1 million in the quarter ended March 31, 2018. The net charge includes the surrender fee and the impairment of leasehold improvements and other fixed assets in the surrendered space, which were partially offset by other deferred credits.

The net charges related to these lease terminations were allocated to each of our operating expense line items on our condensed consolidated statement of operations with the exception of the aggregate impairment charges of leasehold improvements and other fixed assets in the surrendered spaces of approximately $5.7 million which were included in general and administrative expense.

In the aggregate, the termination of these two leases reduced future required rental payments by approximately $23 million through 2026.

Concentrations of Credit Risk

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash, cash equivalents, restricted cash and loans. We hold cash, cash equivalents and restricted cash in accounts at regulated domestic financial institutions in amounts that exceed or may exceed FDIC insured amounts and at non-U.S. financial institutions where deposited amounts may be uninsured. We believe these institutions to be of recognized standing and we have not experienced any related losses to date.

We are exposed to default risk on loans we originate and hold and that we purchase from our issuing bank partner. We perform an evaluation of each customer's financial condition and during the term of the customer's loan(s), we have the contractual right to limit a customer's ability to take working capital loans or other financing from other lenders that may cause a material adverse change in the financial condition of the customer.

Contingencies

From time to time we are subject to legal proceedings and claims in the ordinary course of business. The results of such matters cannot be predicted with certainty. However, we believe that the final outcome of any such current matters will not result in a material adverse effect on our consolidated financial condition, consolidated results of operations or consolidated cash flows.

10. Subsequent Events

On April 13, 2018, Loan Assets of OnDeck, LLC, a wholly-owned subsidiary of the Company, established a new asset-backed revolving debt facility with a commitment amount of $100 million and a 1 month LIBOR + 2.0% interest rate. The period during which new borrowings may be made under this facility expires on April 13, 2022 and the final maturity date is October 13, 2022.

On April 17, 2017, our wholly-owned subsidiary, OnDeck Asset Securitization Trust II LLC, issued $225 million in initial principal amount of fixed-rate asset backed offered notes in a securitization transaction. The notes were issued in four classes with a weighted average fixed interest rate of 3.75%. The revolving period expires on March 31, 2020 and the final maturity date is April 2022. The net proceeds of this transaction were used, together with other available funds, to voluntarily prepay in full all $250 million of notes from a prior securitization.

16

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and the related notes and other financial information included elsewhere in this report. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. You should review the “Cautionary Note Regarding Forward-Looking Statements” and Part II - Item 1A. "Risk Factors" sections of this report for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, objectives, plans and current expectations.

Forward-looking statements appear throughout this report including in Item 1. Business, Item 1A. Risk Factors, Item 3. Legal Proceedings and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. Forward-looking statements can generally be identified by words such as “will,” “enables,” “expects,” "intends," "may," “allows,” "plan," “continues,” “believes,” “anticipates,” “estimates” or similar expressions.

Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on our current beliefs, expectations and assumptions regarding the future of our business, anticipated events and trends, the economy and other future conditions. As such, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and in many cases outside our control. Therefore, you should not rely on any of these forward-looking statements. Our expected results may not be achieved, and actual results may differ materially from our expectations.

Important factors that could cause or contribute to such differences include risks relating to: our ability to attract potential customers to our platform and broaden our distribution capabilities and offerings; the degree to which potential customers apply for loans, are approved and borrow from us; anticipated trends, growth rates, loan originations, volume of loans sold and challenges in our business and in the markets in which we operate; the ability of our customers to repay loans and our ability to accurately assess creditworthiness; our ability to adequately reserve for loan losses; the impact of our decision to tighten our credit policies; our liquidity and working capital requirements, including the availability and pricing of new debt facilities, extensions and increases to existing debt facilities, increases in our corporate line of credit, securitizations and OnDeck Marketplace® sales to fund our existing operations and planned growth, including the consequences of having inadequate resources to fund additional loans or draws on lines of credit; our reliance on our third-party service providers and the effect on our business of originating loans without third-party funding sources; the impact of increased utilization of cash or incurred debt to fund originations; the effect on our business of utilizing cash for voluntary loan purchases from third parties; the effect on our business of the current credit environment and increases in interest rate benchmarks; our ability to hire and retain necessary qualified employees in a competitive labor market; practices and behaviors of members of our funding advisor channel and other third parties who may refer potential customers to us; changes in our product distribution channel mix and/or our funding mix; our ability to anticipate market needs and develop new and enhanced offerings to meet those needs; lack of customer acceptance of possible increases in interest rates and origination fees on loans; maintaining and expanding our customer base; the impact of competition in our industry and innovation by our competitors; our anticipated and unanticipated growth and growth strategies, including the possible introduction of new products or features, our strategy to expand the availability of our platform to other lenders through OnDeck-as-a-Service and possible expansion in new or existing international markets, and our ability to effectively manage that growth; our reputation and possible adverse publicity about us or our industry; the availability and cost of our funding, including challenges faced by the expiration of existing debt facilities; the impact on our business of funding loans from our cash reserves; locating funding sources for new types of loans that are ineligible for funding under our existing credit or securitization facilities and the possibility of reducing originations of these loan types; the effect of potential selective pricing increases; our expected utilization of OnDeck Marketplace and the available OnDeck Marketplace premiums; our failure to anticipate or adapt to future changes in our industry; the impact of the Tax Cuts and Jobs Act of 2017 and any related Treasury regulations, rules or interpretations, if and when issued; our ability to offer loans to our small business customers that have terms that are competitive with alternative sources of capital; our ability to issue new loans to existing customers that seek additional capital; the evolution of technology affecting our offerings and our markets; our compliance with applicable local, state and federal and non-U.S. laws, rules and regulations and their application and interpretation, whether existing, modified or new; our ability to adequately protect our intellectual property; the effect of litigation or other disputes to which we are or may be a party; the increased expenses and administrative workload associated with being a public company; failure to maintain an effective system of internal controls necessary to accurately report our financial results and prevent fraud; the estimates and estimate methodologies used in preparing our consolidated financial

17

statements; the future trading prices of our common stock, the impact of securities analysts’ reports and shares eligible for future sale on these prices; our ability to prevent or discover security breaks, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service our loans; and other risks, including those described in Part I - Item 1A. "Risk Factors" in our most recent Annual Report on Form 10-K and other documents that we file with the Securities and Exchange Commission, or SEC, from time to time which are available on the SEC website at www.sec.gov.

Except as required by law, we undertake no duty to update any forward-looking statements. Readers are also urged to carefully review and consider all of the information in this report, as well as the other documents we make available through the SEC’s website.

When we use the terms “OnDeck,” the “Company,” “we,” “us” or “our” in this report, we are referring to On Deck Capital, Inc. and its consolidated subsidiaries unless the context requires otherwise.

Overview

We are a leading online small business lender. We make it efficient and convenient for small businesses to access financing. Enabled by our proprietary technology and analytics, we aggregate and analyze thousands of data points from dynamic, disparate data sources to assess the creditworthiness of small businesses rapidly and accurately. Small businesses can apply for a term loan or line of credit on our website in minutes and, using our proprietary OnDeck Score®, we can make a funding decision immediately and, if approved, transfer funds as fast as the same day. Qualified customers may have both a term loan and line of credit concurrently, which we believe provides opportunities for repeat business, as well as increased value to our customers. We originated more than $8 billion of loans since we made our first loan in 2007.

We generate the majority of our revenue through interest income and fees earned on the loans we make to our customers. Our term loans, which we offer in principal amounts ranging from $5,000 to $500,000 and with maturities of 3 to 36 months, feature fixed dollar repayments. Our lines of credit range from $6,000 to $100,000, and are generally repayable within six months of the date of the most recent draw. We earn interest on the balance outstanding and lines of credit are subject to a monthly fee unless the customer makes a qualifying minimum draw, in which case the fee is waived for the first six months. The balance of our other revenue primarily comes from our servicing and other fee income, most of which consists of marketing fees from our issuing bank partner, fees generated by OnDeck-as-a-Service, and monthly fees earned from lines of credit.

We rely on a diversified set of funding sources for the loans we make to our customers. Our primary source of this financing has historically been debt facilities with various financial institutions. We have also used proceeds from operating cash flow to fund loans in the past and continue to finance a portion of our outstanding loans with these funds. As of March 31, 2018, we had $734.9 million of funding debt principal outstanding and $1.0 billion total borrowing capacity under such debt facilities. No loans were sold through OnDeck Marketplace during the three months ended March 31, 2018. During the three months ended March 31, 2017, we sold loans with an unpaid principal balance of $42.0 million. Of the total principal outstanding as of March 31, 2018, including our loans held for investment, plus loans sold to OnDeck Marketplace purchasers which had a balance remaining as of March 31, 2018, 60% were funded via our debt facilities, 30% were financed via proceeds raised from our securitization transaction, 9% were funded via cash on hand and 1% were funded via OnDeck Marketplace purchasers.

We originate loans throughout the United States, Canada and Australia, although, to date, substantially all of our revenue has been generated in the United States. These loans are originated through our direct marketing, including direct mail, social media and other online marketing channels, outbound sales team, referrals from our strategic partners, including banks, payment processors and small business-focused service providers, and through funding advisors who advise small businesses on available funding options.

Key Financial and Operating Metrics

We regularly monitor a number of metrics in order to measure our current performance and project our future performance. These metrics aid us in developing and refining our growth strategies and making strategic decisions.

18

As of or for the Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

(dollars in thousands) | |||||||

Originations | $ | 590,585 | $ | 573,015 | |||

Effective Interest Yield | 35.6 | % | 33.8 | % | |||

Cost of Funds Rate | 6.8 | % | 5.9 | % | |||

Net Interest Margin* | 31.3 | % | 30.0 | % | |||

Marketplace Gain on Sale Rate | N/A | 3.5 | % | ||||

Provision Rate | 6.1 | % | 8.7 | % | |||

Loan Reserve Ratio | 12.0 | % | 11.5 | % | |||

15+ Day Delinquency Ratio | 6.7 | % | 7.8 | % | |||

Net Charge-off Rate | 10.9 | % | 14.9 | % | |||

*Non-GAAP measure. Refer to "Non-GAAP Financial Measures" below for an explanation and reconciliation to GAAP.

Originations

Originations represent the total principal amount of the term loans we made during the period, plus the total amount drawn on lines of credit during the period. Many of our repeat term loan customers renew their term loan before their existing term loan is fully repaid. In accordance with industry practice, originations of such repeat term loans are presented as the full renewal loan principal, rather than the net funded amount, which would be the renewal term loan’s principal net of the unpaid principal balance on the existing term loan. Loans referred to, and originated by, our issuing bank partner and later purchased by us are included as part of our originations.

Effective Interest Yield

Effective Interest Yield is the rate of interest we achieve on loans outstanding during a period. It is calculated as our calendar day-adjusted annualized interest income divided by average Loans. Prior to the first quarter of 2018, annualization was based on 252 business days per year. Beginning with the three months ended March 31, 2018, annualization is based on 365 days per year and is calendar day-adjusted. All revisions have been applied retrospectively.

Net deferred origination costs in loans held for investment and loans held for sale consist of deferred origination fees and costs. Deferred origination fees include fees paid up front to us by customers when loans are originated and decrease the carrying value of loans, thereby increasing Effective Interest Yield. Deferred origination costs are limited to costs directly attributable to originating loans such as commissions, vendor costs and personnel costs directly related to the time spent by the personnel performing activities related to loan origination and increase the carrying value of loans, thereby decreasing Effective Interest Yield.

Recent pricing trends are discussed under the subheading “Key Factors Affecting Our Performance - Pricing.”

Cost of Funds Rate

Cost of Funds Rate is the interest expense, fees and amortization of deferred debt issuance costs we incur in connection with our lending activities across all of our funding debt facilities. For full years, it is calculated as our funding cost divided by average funding debt outstanding and for interim periods it is calculated as our annualized funding cost for the period divided by average funding debt outstanding. Annualization is based on four quarters per year and is not business or calendar day-adjusted.

Net Interest Margin

Net Interest Margin is calculated as annualized Net Interest Income divided by average Interest Earning Assets. Net Interest Income represents interest income less funding costs during the period. Interest income is net of fees on loans held for investment and held for sale. Net deferred origination costs in loans held for investment and loans held for sale consist of deferred origination costs as offset by corresponding deferred origination fees. Deferred origination fees include fees paid up front to us by customers when loans are funded. Deferred origination costs are limited to costs directly attributable to originating loans such as commissions, vendor costs and personnel costs directly related to the time spent by the personnel performing activities related to loan origination. Funding costs are the interest expense, fees, and amortization of deferred debt issuance costs we incur in connection with our lending activities across all of our debt facilities. Annualization is based on 365 days per year and is calendar day-adjusted.

19

Marketplace Gain on Sale Rate

Marketplace Gain on Sale Rate equals our gain on sale revenue from loans sold through OnDeck Marketplace divided by the carrying value of loans sold, which includes both unpaid principal balance sold and the remaining carrying value of the net deferred origination costs. A portion of loans regularly sold through OnDeck Marketplace are or may be loans which were initially designated as held for investment upon origination. The portion of such loans sold in a given period may vary materially depending upon market conditions and other circumstances.

Provision Rate

Provision Rate equals the provision for loan losses divided by the new originations volume of loans held for investment, net of originations of sales of such loans within the period. Because we reserve for probable credit losses inherent in the portfolio upon origination, this rate is significantly impacted by the expectation of credit losses for the period’s originations volume. This rate may also be impacted by changes in loss estimates for loans originated prior to the commencement of the period.

All other things equal, an increased volume of loan rollovers and line of credit repayments and re-borrowings in a period will reduce the Provision Rate.

The Provision Rate is not directly comparable to the net cumulative lifetime charge-off ratio because (i) the Provision Rate reflects estimated losses at the time of origination while the net cumulative lifetime charge-off ratio reflects actual charge-offs, (ii) the Provision Rate includes provisions for losses on both term loans and lines of credit while the net cumulative lifetime charge-off ratio reflects only charge-offs related to term loans and (iii) the Provision Rate for a period reflects the provision for losses related to all loans held for investment while the net cumulative lifetime charge-off ratio reflects lifetime charge-offs of term loans related to a particular cohort of term loans.

Loan Reserve Ratio

Loan Reserve Ratio is our allowance for loan losses as of the end of the period divided by the Unpaid Principal Balance as of the end of the period.

15+ Day Delinquency Ratio

15+ Day Delinquency Ratio equals the aggregate Unpaid Principal Balance for our loans that are 15 or more calendar days past due as of the end of the period as a percentage of the Unpaid Principal Balance. The Unpaid Principal Balance for our loans that are 15 or more calendar days past due includes loans that are paying and non-paying. Because our loans require weekly or daily repayments, excluding weekends and holidays, they may be deemed delinquent more quickly than loans from traditional lenders that require only monthly payments.

15+ Day Delinquency Ratio is not annualized, but reflects balances as of the end of the period.

Net Charge-off Rate

Net Charge-off Rate is calculated as our annualized net charge-offs for the period divided by the average Unpaid Principal Balance outstanding. Annualization is based on four quarters per year and is not business or calendar day-adjusted. Net charge-offs are charged-off loans in the period, net of recoveries.

20

On Deck Capital, Inc. and Subsidiaries

Consolidated Average Balance Sheets

(in thousands)

Three Months Ended March 31, | ||||||||

2018 | 2017 | |||||||

Assets | ||||||||

Cash and cash equivalents | $ | 49,812 | $ | 63,588 | ||||

Restricted cash | 53,007 | 50,811 | ||||||

Loans held for investment | 983,988 | 1,044,815 | ||||||

Less: Allowance for loan losses | (114,839 | ) | (115,597 | ) | ||||

Loans held for investment, net | 869,149 | 929,218 | ||||||

Loans held for sale | — | 856 | ||||||

Property, equipment and software, net | 20,866 | 28,812 | ||||||

Other assets | 14,026 | 19,717 | ||||||

Total assets | $ | 1,006,860 | $ | 1,093,002 | ||||

Liabilities and equity | ||||||||

Liabilities: | ||||||||

Accounts payable | $ | 2,853 | $ | 4,356 | ||||

Interest payable | 2,300 | 2,298 | ||||||

Funding debt | 698,825 | 763,833 | ||||||

Corporate debt | 4,482 | 27,969 | ||||||

Accrued expenses and other liabilities | 31,410 | 36,385 | ||||||

Total liabilities | 739,870 | 834,841 | ||||||

Total On Deck Capital, Inc. stockholders' equity | 263,195 | 253,345 | ||||||

Noncontrolling interest | 3,795 | 4,816 | ||||||

Total equity | 266,990 | 258,161 | ||||||

Total liabilities and equity | $ | 1,006,860 | $ | 1,093,002 | ||||

Memo: | ||||||||

Unpaid Principal Balance | $ | 966,327 | $ | 1,023,882 | ||||

Interest Earning Assets | $ | 966,327 | $ | 1,024,731 | ||||

Loans | $ | 983,988 | $ | 1,045,671 | ||||

Average Balance Sheet Items for the period represent the average as of the beginning of the month in the period and as of the end of each month in the period.

Non-GAAP Financial Measures

We believe that the non-GAAP metrics can provide useful supplemental measures for period-to-period comparisons of our core business and useful supplemental information to investors and others in understanding and evaluating our operating results. However, non-GAAP metrics are not calculated in accordance with GAAP, and should not be considered an alternative to any measures of financial performance calculated and presented in accordance with GAAP. Other companies may calculate these non-GAAP metrics differently than we do. The reconciliations below reconcile each of our non-GAAP metrics to their most comparable respective GAAP metric.

Adjusted Net Income (Loss)

21

Adjusted Net Income (Loss) represents our net income (loss) adjusted to exclude net income (loss) attributable to noncontrolling interest, stock-based compensation expense, real estate disposition charges, and department relocation and executive transition expenses. Stock-based compensation includes employee compensation as well as compensation to third-party service providers.

Our use of Adjusted Net Income has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• | Adjusted Net Income does not reflect the potentially dilutive impact of stock-based compensation; and |

• | Adjusted Net Income excludes charges we are required to incur in connection with real estate dispositions and severance obligations. |

The following table presents a reconciliation of net loss to Adjusted Net Income (Loss) for each of the periods indicated:

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

(in thousands) | |||||||

Reconciliation of Net Income (Loss) to Adjusted Net (Loss) Income | |||||||

Net loss | $ | (2,436 | ) | $ | (11,602 | ) | |

Adjustments: | |||||||

Net loss attributable to noncontrolling interest | 518 | 544 | |||||

Stock-based compensation expense | 3,210 | 3,491 | |||||

Real estate disposition charges | 4,187 | — | |||||

Department relocation and executive transition expenses | 911 | — | |||||

Adjusted Net Income (Loss) | $ | 6,390 | $ | (7,567 | ) | ||

Net Interest Margin

Net Interest Margin, is calculated as annualized Net Interest Income divided by average Interest Earning Assets. Net Interest Income represents interest income less funding costs during the period. Interest income is net of fees on loans held for investment and held for sale. Net deferred origination costs in loans held for investment and loans held for sale consist of deferred origination costs as offset by corresponding deferred origination fees. Deferred origination fees include fees paid up front to us by customers when loans are funded. Deferred origination costs are limited to costs directly attributable to originating loans such as commissions, vendor costs and personnel costs directly related to the time spent by the personnel performing activities related to loan origination. Funding costs are the interest expense, fees, and amortization of deferred debt issuance costs we incur in connection with our lending activities across all of our debt facilities. Annualization is based on 365 days per year and is calendar day-adjusted.

Our use of Net Interest Margin has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• | Net Interest Margin is the rate of net return we achieve on our Average Interest Earning Assets outstanding during a period. It does not reflect the return from loans sold through OnDeck Marketplace, specifically our gain on sale revenue. Similarly, Average Interest Earning Assets does not include the unpaid principal balance of loans sold through OnDeck Marketplace. Further, Net Interest Margin does not include servicing revenue related to loans previously sold, fair value adjustments to servicing rights, monthly fees charged to customers for our line of credit, and marketing fees earned from our issuing bank partners, which are recognized as the related services are provided. |

• | Funding costs do not reflect interest associated with debt used for corporate purposes. |

The following table presents a reconciliation of interest income to Net Interest Margin for each of the periods indicated:

22

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

(in thousands) | |||||||

Reconciliation of Interest Income to Net Interest Margin (NIM) | |||||||

Interest income | $ | 86,369 | $ | 87,111 | |||

Less: Funding costs | (11,821 | ) | (11,277 | ) | |||

Net interest income | 74,548 | 75,834 | |||||

Divided by: calendar days in period | 90 | 90 | |||||

Net interest income per calendar day | 828 | 843 | |||||

Multiplied by: calendar days per year | 365 | 365 | |||||

Annualized net interest income | 302,220 | 307,695 | |||||

Divided by: Average Interest Earning Assets | $ | 966,327 | $ | 1,024,731 | |||

Net Interest Margin (NIM) | 31.3 | % | 30.0 | % | |||

23

Key Factors Affecting Our Performance

Investment in Long-Term Growth

The core elements of our growth strategy include expanding our financing offerings, acquiring new customers, broadening our distribution capabilities through strategic partners and funding advisors, enhancing our technology, data and analytics capabilities, and extending customer lifetime value. We plan to continue to invest significant resources to accomplish these goals. We anticipate that our total operating expense will increase during 2018 as we plan to continue investing in marketing, technology and analytics, portfolio management and our collection capabilities. These investments are intended to contribute to our long-term growth, but they may affect our near-term operating performance.

Originations

During the three months ended March 31, 2018, December 31, 2017 and March 31, 2017, we originated $590.6 million, $546.4 million, and $573.0 million of loans, respectively. The increase in originations for the three months ended March 31, 2018 relative to the three months ended December 31, 2017 was largely driven by the increased average loan size and the addition of new customers. The increase in originations for the three months ended March 31, 2018 as compared to the three months ended March 31, 2017 was primarily due to the increase in business from repeat customers. In addition, during the first quarter of 2018 we continued to grow our line of credit originations, which made up 20.5%, 20.0%, and 18.0% of total dollar originations in the three months ended March 31, 2018, December 31, 2017 and March 31, 2017, respectively.

The number of weekends and holidays in a period can impact our business. Many small businesses tend to apply for loans on weekdays, and their businesses may be closed at least part of a weekend and on holidays. In addition, our loan fundings and automated customer loan repayments only occur on weekdays (excluding bank holidays).

We anticipate that our future growth will continue to depend in part on attracting new customers. As we continue to aggregate data on customers and prospective customers, we seek to use that data and our increasing knowledge to optimize our marketing spending to attract these customers as well as to continue to focus our analytics resources on better identifying potential customers. We have historically relied on all three of our channels for customer acquisition but remain focused on growing our direct and strategic partner channels. Collective originations through our direct and strategic partner channels made up 71% and 72% of total originations from all customers in the first quarter of 2018 and 2017, respectively. We plan to continue investing in direct marketing and sales, increasing our brand awareness and growing our strategic partnerships.

The following table summarizes the percentage of loans made to all customers originated by our three distribution channels for the periods indicated. From time to time management is required to make judgments to determine customers' appropriate channel distribution.

Three Months Ended March 31, | |||

Percentage of Originations (Dollars) | 2018 | 2017 | |

Direct and Strategic Partner | 71% | 72% | |

Funding Advisor | 29% | 28% | |

We originate term loans and lines of credit to customers who are new to OnDeck as well as to repeat customers. New originations are defined as new term loan originations plus all line of credit draws in the period, including subsequent draws on existing lines of credit. Renewal originations include term loans only. We believe our ability to increase adoption of our loans within our existing customer base will be important to our future growth. A component of our future growth will include increasing the length of our customer life cycle by expanding our product offerings. In the first quarter of 2018 and 2017 originations from our repeat customers, were 52% and 49%, respectively, of total originations to all customers. We believe our significant number of repeat customers is primarily due to our high levels of customer service and continued improvement in our types of loans and services. Repeat customers generally show improvements in several key metrics. From our 2015 customer cohort, customers who took at least three loans grew their revenue and bank balance, respectively, on average by 31% and 50% from their initial loan to their third loan. Similarly, from our 2016 customer cohort, customers who took at least three loans grew their revenue and bank balance, respectively, on average by 29% and 37%. In the first quarter of 2018, 28% of our origination volume from repeat customers was due to unpaid principal balance rolled from existing loans directly into such repeat originations. In order for a current customer to qualify for a new term loan while a term loan payment obligation remains outstanding, the customer must pass the following standards:

• | the business must be approximately 50% paid down on its existing loan; |

24

• | the business must be current on its outstanding OnDeck loan with no material delinquency history; and |

• | the business must be fully re-underwritten and determined to be of adequate credit quality. |

The extent to which we generate repeat business from our customers will be an important factor in our continued revenue growth and our visibility into future revenue. In conjunction with repeat borrowing activity, many of our customers also tend to increase their subsequent loan size compared to their initial loan size.

The following table summarizes the percentage of loans originated by new and repeat customers. Loans from cross-selling efforts are classified in the table as repeat loans.

Three Months Ended March 31, | |||

Percentage of Originations (Dollars) | 2018 | 2017 | |

New | 48% | 51% | |

Repeat | 52% | 49% | |

Credit Performance

Credit performance refers to how credit losses on a portfolio of loans performs relative to expectations. A certain amount of losses are expected so credit performance must be assessed relative to pricing and expectations. Pricing will be determined with the goal of allowing for estimated losses while still generating the desired rate of return after taking into account those estimated losses. When a portfolio has higher than estimated losses, the desired rate of return may not be achieved and that portfolio would be considered to have underperformed. Conversely, if the portfolio incurred lower than estimated losses, resulting in a higher than expected rate of return, the portfolio would be considered to have overperformed.

We originate and price our loans based on risk. When we originate our loans, we establish a reserve for estimated loan losses. As we gather more data as the portfolio performs, we may increase or decrease that reserve as deemed necessary to reflect our latest loss estimate. Some portions of our loan portfolio may be performing better than expected while other portions may perform below expectations. The net result of the underperforming and overperforming portfolio segments determines if we require an overall increase or decrease to our loan reserve related to those existing loans.

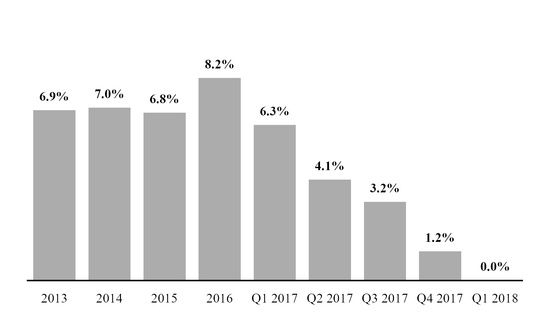

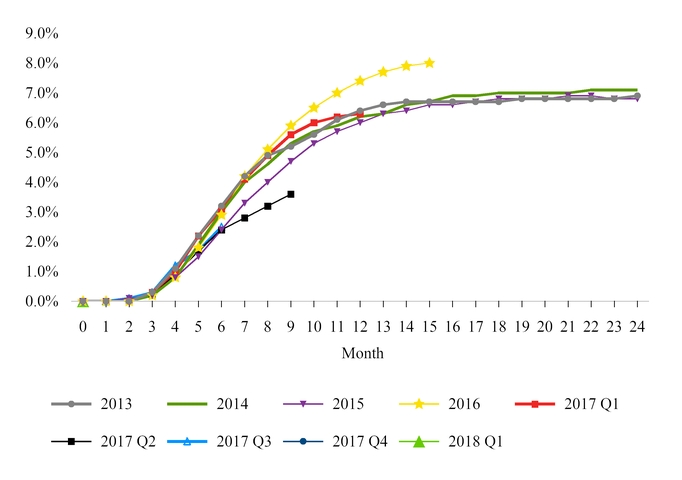

In accordance with our strategy to expand the range of our loan offerings, over time, we have expanded the offerings of our term loans by making available longer terms and larger amounts. When we begin to offer a new type of loan, we typically extrapolate our existing data to create an initial version of a credit model to permit us to underwrite and price the new type of loan. Thereafter, we begin to collect actual performance data on these new loans which allows us to refine our credit model based on actual data as opposed to extrapolated data. It often takes several quarters after we begin offering a new type of loan for that loan to be originated in sufficient volume to generate a critical mass of performance data. In addition, for loans with longer terms, it takes longer to acquire significant amounts of data because the loans take longer to season.