Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HERTZ GLOBAL HOLDINGS, INC | q12018pressrelease.htm |

| 8-K - 8-K - HERTZ GLOBAL HOLDINGS, INC | q12018earnings8-k.htm |

1Q 2018 Earnings Call May 8, 2018 8:00 am ET 1

Safe Harbor Statement 1Q Certain statements made within this presentation contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of performance and by their nature are subject to inherent uncertainties. Actual results may differ materially. Any forward-looking information relayed in this presentation speaks only as of May 8, 2018 and Hertz Global Holdings, Inc. (the “Company”) undertakes no obligation to update that information to reflect changed circumstances. Additional information concerning these statements is contained in the Company’s press release regarding its First Quarter 2018 results issued on May 7, 2018, and the Risk Factors and Forward- Looking Statements sections of the Company’s 2017 Annual Report on Form 10-K filed on February 27, 2018 and First Quarter 2018 Quarterly Report on Form 10-Q filed on May 7, 2018. Copies of these filings are available from the SEC, the Hertz website, or the Company’s Investor Relations Department. 2

Key Metrics and Non-GAAP Measures 1Q THE FOLLOWING KEY METRICS AND NON-GAAP1 MEASURES WILL BE USED IN THE PRESENTATION: Adjusted corporate EBITDA Total RPD Adjusted corporate EBITDA margin Total RPU Adjusted pre-tax income (loss) Net depreciation per unit per month Adjusted net income (loss) Vehicle utilization Adjusted diluted earnings (loss) per share Transaction days (Adjusted diluted EPS) T&M rate 1Definitions and reconciliations of non-GAAP measures are provided in the Company’s first quarter 2018 press release issued on May 7, 2018 and as an exhibit to the Company’s Form 8-K filed on May 8, 2018. 3

Agenda 1Q BUSINESS Kathryn Marinello President & Chief Executive Officer OVERVIEW Hertz Global Holdings, Inc. FINANCIAL RESULTS Tom Kennedy Chief Financial Officer OVERVIEW Hertz Global Holdings, Inc. 4

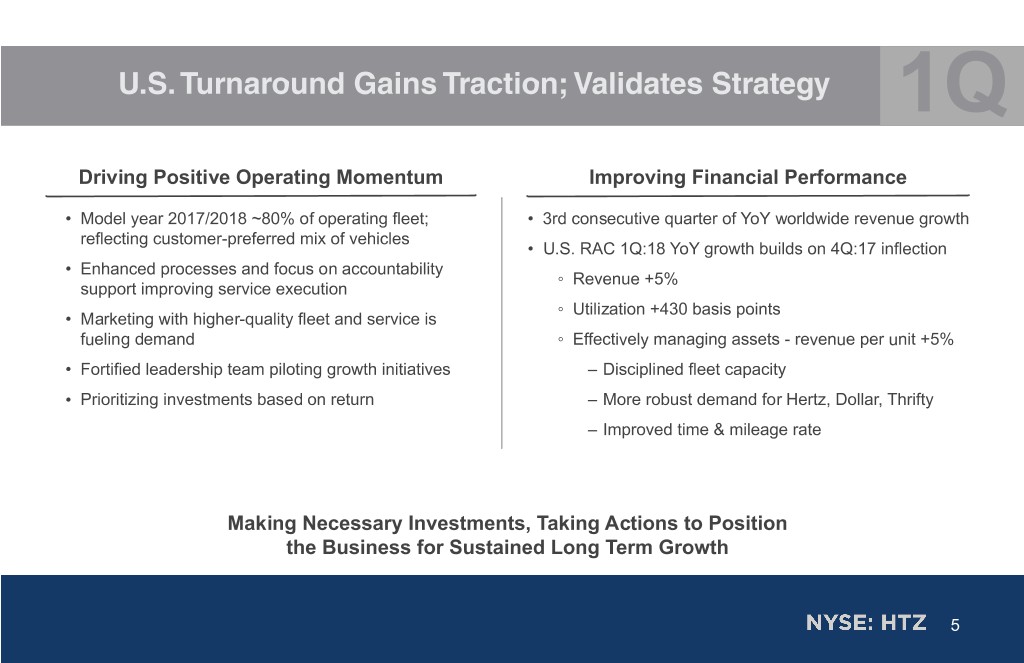

U.S. Turnaround Gains Traction; Validates Strategy 1Q Driving Positive Operating Momentum Improving Financial Performance • Model year 2017/2018 ~80% of operating fleet; • 3rd consecutive quarter of YoY worldwide revenue growth reflecting customer-preferred mix of vehicles • U.S. RAC 1Q:18 YoY growth builds on 4Q:17 inflection • Enhanced processes and focus on accountability ◦ Revenue +5% support improving service execution ◦ Utilization +430 basis points • Marketing with higher-quality fleet and service is fueling demand ◦ Effectively managing assets - revenue per unit +5% • Fortified leadership team piloting growth initiatives – Disciplined fleet capacity • Prioritizing investments based on return – More robust demand for Hertz, Dollar, Thrifty – Improved time & mileage rate Making Necessary Investments, Taking Actions to Position the Business for Sustained Long Term Growth 5

1Q Quarterly Overview Tom Kennedy CHIEF FINANCIAL OFFICER Hertz Global Holdings, Inc. 6

1Q:18 Consolidated Results 1Q (in $M USD, except per share data) 1Q:18 1Q:17 YoY GAAP Results Results Inc/(Dec) Total revenues $2,063 $1,916 8 % Income (loss) before income taxes $(231) $(294) (21)% Net income (loss) $(202) $(223) (9)% Diluted earnings (loss) per share $(2.43) $(2.69) (10)% Weighted average shares outstanding: diluted 83 83 n/c Non-GAAP1 Adjusted corporate EBITDA $(59) $(110) (46)% Adjusted corporate EBITDA margin (3)% (6)% 290 bps Adjusted pre-tax income (loss) $(175) $(213) (18)% Adjusted net income (loss) $(131) $(134) (2)% Adjusted diluted EPS $(1.58) $(1.61) (2)% 1Definitions and reconciliations of non-GAAP measures are provided in the Company’s first quarter 2018 press release issued on May 7, 2018 and as an exhibit to the Company’s Form 8-K filed on May 8, 2018. n/c equals no change 7

1Q:18 U.S. RAC Revenue Performance 1Q 1 U.S. RAC (YoY quarterly results ) 1Q:18 Performance Drivers Revenue Days Total RPD • Total RPD decreased 1% YoY, but increased 3% 5% 6% excluding value-added service revenues and 3% 1% 2% ride-hailing, reflecting strong leisure demand (2)% (1)% (2)% (1)% (1)% ◦ Modifying and introducing new value-added (4)% (3)% (4)% (3)% (5)% services and digital capabilities to re- :17 :17 :17 :17 :18 :17 :17 :17 :17 :18 :17 :17 :17 :17 :18 1Q 2Q 3Q 4Q 1Q 1Q 2Q 3Q 4Q 1Q 1Q 2Q 3Q 4Q 1Q energize sales T&M rate ex ride-hailing Total RPU • Transaction days increased 6% YoY as a result of growth in both airport and off-airport business 6% 5% 3% 3% 1% 2% • Total RPU increased 5% YoY, a key performance —% measure (2)% (8)% (4)% 7 7 7 7 8 :17 :17 :17 :17 :18 :1 :1 :1 :1 :1 1Q 2Q 3Q 4Q 1Q 1Q 2Q 3Q 4Q 1Q 1Revenue is defined as total revenue excluding ancillary retail vehicle sales revenue. 8

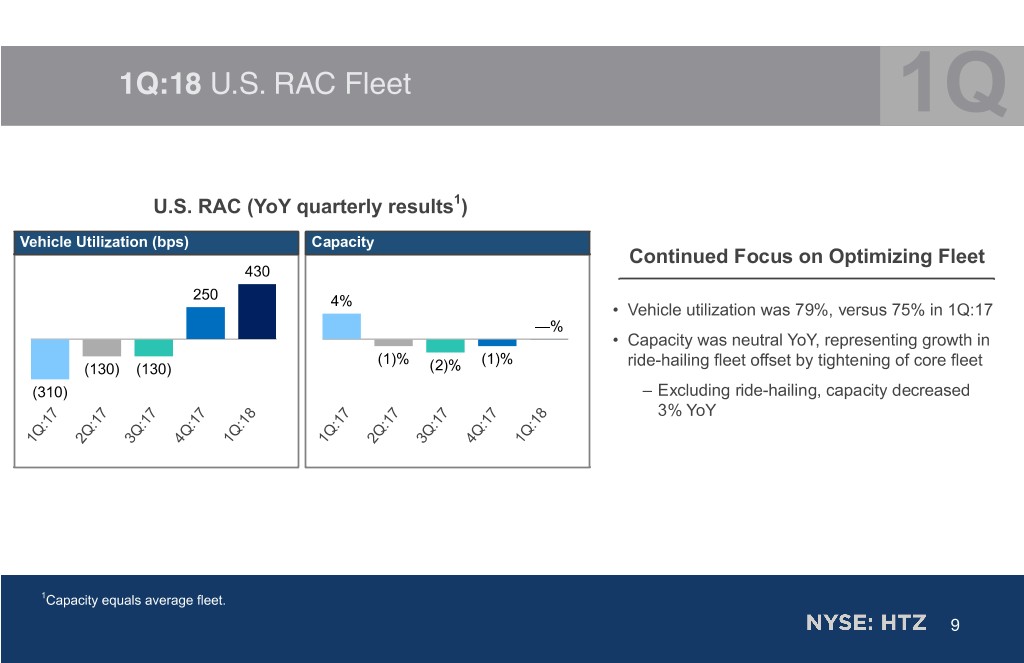

1Q:18 U.S. RAC Fleet 1Q U.S. RAC (YoY quarterly results1) Vehicle Utilization (bps) Capacity Continued Focus on Optimizing Fleet 430 250 4% • Vehicle utilization was 79%, versus 75% in 1Q:17 —% • Capacity was neutral YoY, representing growth in (1)% (1)% ride-hailing fleet offset by tightening of core fleet (130) (130) (2)% (310) – Excluding ride-hailing, capacity decreased 7 7 7 7 8 7 7 7 7 8 3% YoY :1 :1 :1 :1 :1 :1 :1 :1 :1 :1 Q Q Q Q Q Q Q Q Q Q 1 2 3 4 1 1 2 3 4 1 1Capacity equals average fleet. 9

1Q:18 U.S. RAC Monthly Depreciation Per Unit 1Q Current Year Prior Year +27% +15% $353 $348 $348 +1% (6)% $321 (13)% $303 $306 $304 $302 $302 $278 1Q:17 2Q:17 3Q:17 4Q:17 1Q:18 Year-Over-Year Trend Continues to Improve • Stabilizing residual values – still expecting 2% YoY decline in FY:18 • Incremental fleet costs from 1Q:17 re-balancing activity did not reoccur • Lower model year 2018 purchase prices (like-for-like vs. model year 2017) • Increased sales through higher yielding disposition channels • Continued transition to a richer, more preferred vehicle mix 10

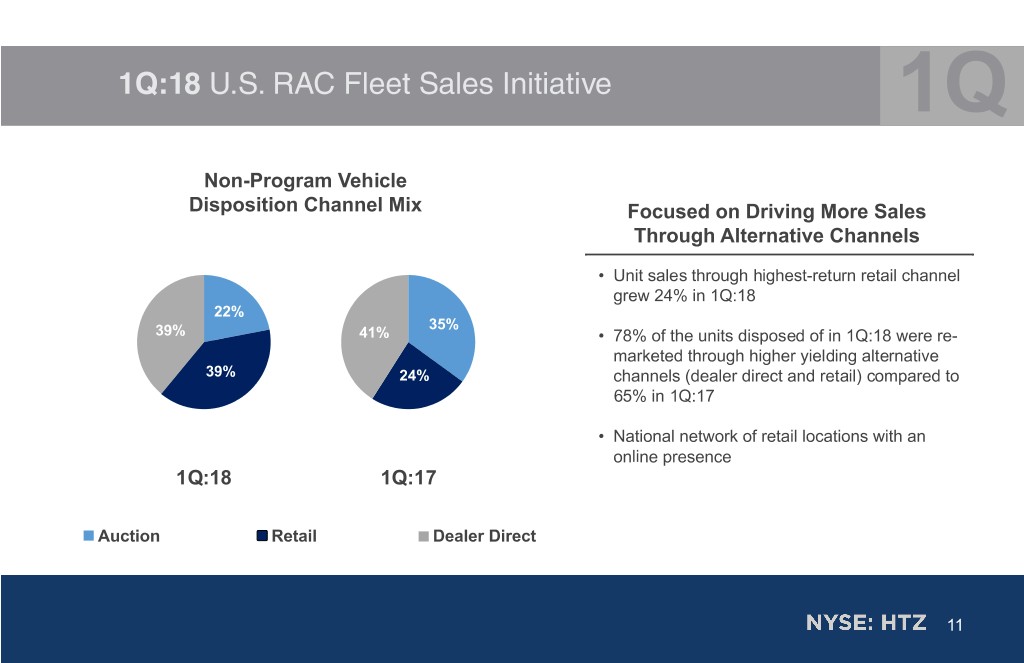

1Q:18 U.S. RAC Fleet Sales Initiative 1Q Non-Program Vehicle Disposition Channel Mix Focused on Driving More Sales Through Alternative Channels • Unit sales through highest-return retail channel grew 24% in 1Q:18 22% 35% 39% 41% • 78% of the units disposed of in 1Q:18 were re- marketed through higher yielding alternative 39% 24% channels (dealer direct and retail) compared to 65% in 1Q:17 • National network of retail locations with an online presence 1Q:18 1Q:17 Auction Retail Dealer Direct 11

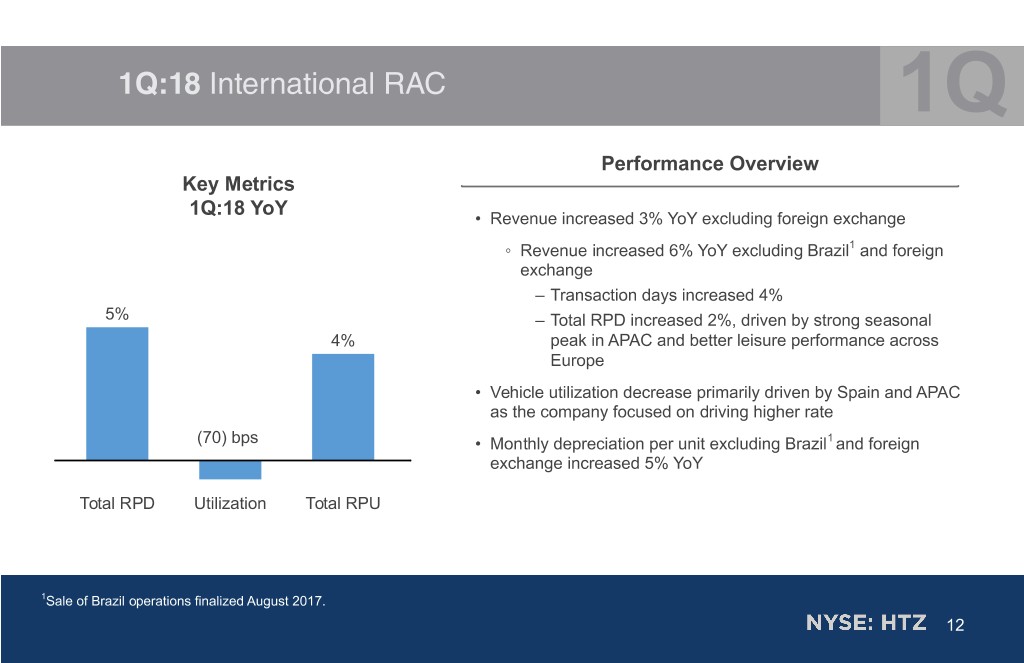

1Q:18 International RAC 1Q Performance Overview Key Metrics 1Q:18 YoY • Revenue increased 3% YoY excluding foreign exchange ◦ Revenue increased 6% YoY excluding Brazil1 and foreign exchange – Transaction days increased 4% 5% – Total RPD increased 2%, driven by strong seasonal 4% peak in APAC and better leisure performance across Europe • Vehicle utilization decrease primarily driven by Spain and APAC as the company focused on driving higher rate (70) bps • Monthly depreciation per unit excluding Brazil1 and foreign exchange increased 5% YoY Total RPD Utilization Total RPU 1Sale of Brazil operations finalized August 2017. 12

1Q LIQUIDITY / BALANCE SHEET OVERVIEW Tom Kennedy CHIEF FINANCIAL OFFICER Hertz Global Holdings, Inc. 13

1Q:18 Consolidated Debt Mix Excluding Donlen 1Q Fixed Rate Debt Floating Rate Debt 15% 35% 30% 65% 85% 70% Vehicle Debt Non-Vehicle Debt Total Debt 1Q:18 vehicle interest expense increased primarily due to higher rates and a shift towards fixed rate debt relative to prior year Excludes Donlen debt because Donlen is generally insulated from interest rate movements. Total U.S. debt fixed rate ratio is approximately 75%. 14

1Q:18 Liquidity Overview and Financing Activities 1Q Corporate Liquidity at March 31, 2018 • Quarter-end Corporate liquidity was relatively in-line with year- in $M USD end 2017 position of $1.6 billion Senior RCF Facility Size $1,167 • Issued $1.0 billion of 5 year term ABS in January 2018 less Outstanding Letters of Credit 648 • March issuance of €500 million notes funded April redemption plus Borrowings Outstanding — of €425 million of senior notes due 2019 and added incremental liquidity for European fleet needs Available under Senior RCF 519 • $550 million of term ABS issued in May to support Donlen plus Unrestricted Cash 1,046 fleet needs Corporate Liquidity $1,565 15

Corporate Debt Maturity Profile 1Q March 31, 2018 Hertz Global Non-Vehicle Debt Maturity Profile1 Senior Notes Senior Second Priority Secured Notes Term Loan Senior RCF $14 in $M USD $1,167 ) s n $1,250 o i l l i M ( $ $14 $14 $800 $700 $618 $500 $500 $10 $14 2018 2019 2020 2021 2022 2023 2024 No material near term maturities 1 Excludes $27M of promissory notes due 2028 and $11M of other non-vehicle debt. 16

First Lien Financial Maintenance Covenant 1Q Consolidated First Lien Leverage Ratio as of March 31, 2018 was 1.76x in $M USD Senior RCF Facility Size $1,167 Outstanding Letters of Credit - 648 Term Loan Outstanding + 684 Unrestricted Cash1 - 500 First Lien Secured Net Debt $703 TTM Adjusted Corporate EBITDA2 / $399 First Lien Leverage Ratio 1.76 x Our Consolidated First Lien Leverage Ratio is tested each quarter and must not exceed 3.0x 1 Actual unrestricted cash on the balance sheet as of 3/31/2018 was $1.0 billion. The credit facility limits netting of unrestricted cash to $500 million. 2 TTM adjusted corporate EBITDA defined as $318 million reported TTM adjusted corporate EBIDTA + $81 million 17 adjustments as per credit agreement.

Investments Impacting Adjusted Corporate EBITDA 1Q FY:18 Investments Impacting Consolidated Adjusted Corporate EBITDA U.S. RAC DOE & SG&A as a % of Revenue in $M USD 72% 2018 2017 YoY $ 70% Estimate Actual Inc/(Dec) 71% 67% Total Investments $300 $260 $40 Major Categories 63% Fleet 100 130 (30) IT/Operations 120 70 50 Sales/Marketing/Other 80 60 20 1Q 2Q 3Q 4Q Total $300 $260 $40 2017 2018 1Q:18 Investment spend impacting consolidated Adjusted Corporate DOE and SG&A as a % of revenue is expected to EBITDA increased $10 million versus prior year remain elevated in 2018 as compared to 2017 18

1Q Q&A 19