Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - AES CORP | aes03312018exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - AES CORP | aes03312018exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - AES CORP | aes03312018exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - AES CORP | aes03312018exhibit311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________________________________________________

FORM 10-Q

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2018

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12291

THE AES CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 54 1163725 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

4300 Wilson Boulevard Arlington, Virginia | 22203 | |

(Address of principal executive offices) | (Zip Code) | |

(703) 522-1315

Registrant’s telephone number, including area code:

______________________________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ | |||

Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

______________________________________________________________________________________________

The number of shares outstanding of Registrant’s Common Stock, par value $0.01 per share, on May 1, 2018 was 661,399,753.

THE AES CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2018

TABLE OF CONTENTS

ITEM 1. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 5. | ||

ITEM 6. | ||

GLOSSARY OF TERMS

The following terms and acronyms appear in the text of this report and have the definitions indicated below:

Adjusted EPS | Adjusted Earnings Per Share, a non-GAAP measure |

Adjusted PTC | Adjusted Pretax Contribution, a non-GAAP measure of operating performance |

AFS | Available For Sale |

AOCI | Accumulated Other Comprehensive Income |

AOCL | Accumulated Other Comprehensive Loss |

ASC | Accounting Standards Codification |

ASU | Accounting Standards Update |

CAA | United States Clean Air Act |

CAMMESA | Wholesale Electric Market Administrator in Argentina |

CHP | Combined Heat and Power |

COFINS | Contribution for the Financing of Social Security |

DP&L | The Dayton Power & Light Company |

DPL | DPL Inc. |

EPA | United States Environmental Protection Agency |

EPC | Engineering, Procurement and Construction |

EURIBOR | Euro Interbank Offered Rate |

FASB | Financial Accounting Standards Board |

FX | Foreign Exchange |

GAAP | Generally Accepted Accounting Principles in the United States |

GHG | Greenhouse Gas |

GILTI | Global Intangible Low Taxed Income |

GW | Gigawatts |

IPALCO | IPALCO Enterprises, Inc. |

IPL | Indianapolis Power & Light Company |

ISO | Independent System Operator |

LIBOR | London Interbank Offered Rate |

MW | Megawatts |

MWh | Megawatt Hours |

NCI | Noncontrolling Interest |

NEK | Natsionalna Elektricheska Kompania (state-owned electricity public supplier in Bulgaria) |

NM | Not Meaningful |

NOV | Notice of Violation |

NOX | Nitrogen Oxides |

PIS | Program of Social Integration |

PPA | Power Purchase Agreement |

PREPA | Puerto Rico Electric Power Authority |

RSU | Restricted Stock Unit |

RTO | Regional Transmission Organization |

SBU | Strategic Business Unit |

SEC | United States Securities and Exchange Commission |

SO2 | Sulfur Dioxide |

U.S. | United States |

USD | United States Dollar |

VAT | Value-Added Tax |

VIE | Variable Interest Entity |

1

PART I: FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

THE AES CORPORATION

Condensed Consolidated Balance Sheets

(Unaudited)

March 31, 2018 | December 31, 2017 | ||||||

(in millions, except share and per share data) | |||||||

ASSETS | |||||||

CURRENT ASSETS | |||||||

Cash and cash equivalents | $ | 1,212 | $ | 949 | |||

Restricted cash | 415 | 274 | |||||

Short-term investments | 617 | 424 | |||||

Accounts receivable, net of allowance for doubtful accounts of $13 and $10, respectively | 1,498 | 1,463 | |||||

Inventory | 569 | 562 | |||||

Prepaid expenses | 66 | 62 | |||||

Other current assets | 703 | 630 | |||||

Current assets of discontinued operations and held-for-sale businesses | 358 | 2,034 | |||||

Total current assets | 5,438 | 6,398 | |||||

NONCURRENT ASSETS | |||||||

Property, Plant and Equipment: | |||||||

Land | 502 | 502 | |||||

Electric generation, distribution assets and other | 24,311 | 24,119 | |||||

Accumulated depreciation | (8,168 | ) | (7,942 | ) | |||

Construction in progress | 4,043 | 3,617 | |||||

Property, plant and equipment, net | 20,688 | 20,296 | |||||

Other Assets: | |||||||

Investments in and advances to affiliates | 1,282 | 1,197 | |||||

Debt service reserves and other deposits | 541 | 565 | |||||

Goodwill | 1,059 | 1,059 | |||||

Other intangible assets, net of accumulated amortization of $454 and $441, respectively | 362 | 366 | |||||

Deferred income taxes | 94 | 130 | |||||

Service concession assets, net of accumulated amortization of $0 and $206, respectively | — | 1,360 | |||||

Loan receivable | 1,474 | — | |||||

Other noncurrent assets | 1,635 | 1,741 | |||||

Total other assets | 6,447 | 6,418 | |||||

TOTAL ASSETS | $ | 32,573 | $ | 33,112 | |||

LIABILITIES AND EQUITY | |||||||

CURRENT LIABILITIES | |||||||

Accounts payable | $ | 1,317 | $ | 1,371 | |||

Accrued interest | 289 | 228 | |||||

Accrued and other liabilities | 1,182 | 1,232 | |||||

Non-recourse debt, includes $986 and $1,012, respectively, related to variable interest entities | 2,025 | 2,164 | |||||

Current liabilities of discontinued operations and held-for-sale businesses | 63 | 1,033 | |||||

Total current liabilities | 4,876 | 6,028 | |||||

NONCURRENT LIABILITIES | |||||||

Recourse debt | 4,060 | 4,625 | |||||

Non-recourse debt, includes $1,570 and $1,358, respectively, related to variable interest entities | 13,601 | 13,176 | |||||

Deferred income taxes | 1,207 | 1,006 | |||||

Pension and other postretirement liabilities | 189 | 230 | |||||

Other noncurrent liabilities | 2,264 | 2,365 | |||||

Total noncurrent liabilities | 21,321 | 21,402 | |||||

Commitments and Contingencies (see Note 8) | |||||||

Redeemable stock of subsidiaries | 851 | 837 | |||||

EQUITY | |||||||

THE AES CORPORATION STOCKHOLDERS’ EQUITY | |||||||

Common stock ($0.01 par value, 1,200,000,000 shares authorized; 816,331,182 issued and 661,364,449 outstanding at March 31, 2018 and 816,312,913 issued and 660,388,128 outstanding at December 31, 2017) | 8 | 8 | |||||

Additional paid-in capital | 8,397 | 8,501 | |||||

Accumulated deficit | (1,525 | ) | (2,276 | ) | |||

Accumulated other comprehensive loss | (1,808 | ) | (1,876 | ) | |||

Treasury stock, at cost (154,966,733 and 155,924,785 shares at March 31, 2018 and December 31, 2017, respectively) | (1,879 | ) | (1,892 | ) | |||

Total AES Corporation stockholders’ equity | 3,193 | 2,465 | |||||

NONCONTROLLING INTERESTS | 2,332 | 2,380 | |||||

Total equity | 5,525 | 4,845 | |||||

TOTAL LIABILITIES AND EQUITY | $ | 32,573 | $ | 33,112 | |||

See Notes to Condensed Consolidated Financial Statements.

2

THE AES CORPORATION

Condensed Consolidated Statements of Operations

(Unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

(in millions, except per share amounts) | |||||||

Revenue: | |||||||

Regulated | $ | 722 | $ | 813 | |||

Non-Regulated | 2,018 | 1,768 | |||||

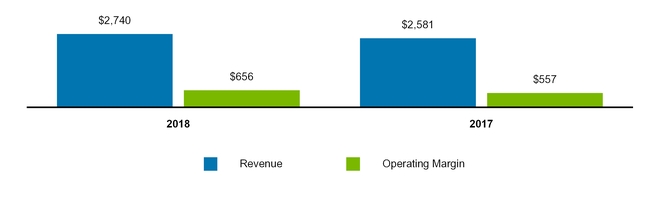

Total revenue | 2,740 | 2,581 | |||||

Cost of Sales: | |||||||

Regulated | (601 | ) | (703 | ) | |||

Non-Regulated | (1,483 | ) | (1,321 | ) | |||

Total cost of sales | (2,084 | ) | (2,024 | ) | |||

Operating margin | 656 | 557 | |||||

General and administrative expenses | (56 | ) | (54 | ) | |||

Interest expense | (281 | ) | (287 | ) | |||

Interest income | 76 | 63 | |||||

Gain (loss) on extinguishment of debt | (170 | ) | 17 | ||||

Other expense | (9 | ) | (24 | ) | |||

Other income | 13 | 73 | |||||

Gain on disposal and sale of businesses | 788 | — | |||||

Asset impairment expense | — | (168 | ) | ||||

Foreign currency transaction losses | (19 | ) | (20 | ) | |||

INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND EQUITY IN EARNINGS OF AFFILIATES | 998 | 157 | |||||

Income tax expense | (231 | ) | (67 | ) | |||

Net equity in earnings of affiliates | 11 | 7 | |||||

INCOME FROM CONTINUING OPERATIONS | 778 | 97 | |||||

Income (loss) from operations of discontinued businesses, net of income tax expense of $0 and $2, respectively | (1 | ) | 1 | ||||

NET INCOME | 777 | 98 | |||||

Noncontrolling interests: | |||||||

Less: Income from continuing operations attributable to noncontrolling interests and redeemable stocks of subsidiaries | (93 | ) | (121 | ) | |||

Less: Income from discontinued operations attributable to noncontrolling interests | — | (1 | ) | ||||

NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION | $ | 684 | $ | (24 | ) | ||

AMOUNTS ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS: | |||||||

Income (loss) from continuing operations, net of tax | $ | 685 | $ | (24 | ) | ||

Loss from discontinued operations, net of tax | (1 | ) | — | ||||

NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION | $ | 684 | $ | (24 | ) | ||

BASIC EARNINGS PER SHARE: | |||||||

NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 1.04 | $ | (0.04 | ) | ||

DILUTED EARNINGS PER SHARE: | |||||||

NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 1.03 | $ | (0.04 | ) | ||

DILUTED SHARES OUTSTANDING | 663 | 659 | |||||

DIVIDENDS DECLARED PER COMMON SHARE | $ | 0.13 | $ | 0.12 | |||

See Notes to Condensed Consolidated Financial Statements.

3

THE AES CORPORATION

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

(in millions) | |||||||

NET INCOME | $ | 777 | $ | 98 | |||

Foreign currency translation activity: | |||||||

Foreign currency translation adjustments, net of income tax benefit (expense) of $0 and $(1), respectively | 25 | 68 | |||||

Reclassification to earnings, net of $0 income tax | (16 | ) | 3 | ||||

Total foreign currency translation adjustments | 9 | 71 | |||||

Derivative activity: | |||||||

Change in derivative fair value, net of income tax benefit (expense) of $(15) and $8, respectively | 57 | (5 | ) | ||||

Reclassification to earnings, net of income tax benefit (expense) of $1 and $(1), respectively | 10 | 20 | |||||

Total change in fair value of derivatives | 67 | 15 | |||||

Pension activity: | |||||||

Reclassification to earnings due to amortization of net actuarial loss, net of income tax expense of $0 and $3, respectively | 2 | 6 | |||||

Total pension adjustments | 2 | 6 | |||||

OTHER COMPREHENSIVE INCOME | 78 | 92 | |||||

COMPREHENSIVE INCOME | 855 | 190 | |||||

Less: Comprehensive income attributable to noncontrolling interests | (122 | ) | (142 | ) | |||

COMPREHENSIVE INCOME ATTRIBUTABLE TO THE AES CORPORATION | $ | 733 | $ | 48 | |||

See Notes to Condensed Consolidated Financial Statements.

4

THE AES CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

(in millions) | |||||||

OPERATING ACTIVITIES: | |||||||

Net income | $ | 777 | $ | 98 | |||

Adjustments to net income: | |||||||

Depreciation and amortization | 254 | 291 | |||||

Gain on disposal and sale of businesses | (788 | ) | — | ||||

Asset impairment expense | — | 168 | |||||

Deferred income taxes | 180 | (6 | ) | ||||

Provisions for contingencies | — | 12 | |||||

Loss (gain) on extinguishment of debt | 170 | (17 | ) | ||||

Loss on sales of assets | 2 | 12 | |||||

Other | 72 | 48 | |||||

Changes in operating assets and liabilities | |||||||

(Increase) decrease in accounts receivable | (39 | ) | 50 | ||||

(Increase) decrease in inventory | (16 | ) | (16 | ) | |||

(Increase) decrease in prepaid expenses and other current assets | (33 | ) | 111 | ||||

(Increase) decrease in other assets | 19 | (43 | ) | ||||

Increase (decrease) in accounts payable and other current liabilities | (66 | ) | (65 | ) | |||

Increase (decrease) in income tax payables, net and other tax payables | — | 38 | |||||

Increase (decrease) in other liabilities | (17 | ) | 27 | ||||

Net cash provided by operating activities | 515 | 708 | |||||

INVESTING ACTIVITIES: | |||||||

Capital expenditures | (495 | ) | (474 | ) | |||

Proceeds from the sale of businesses, net of cash and restricted cash sold | 1,180 | 4 | |||||

Sale of short-term investments | 149 | 907 | |||||

Purchase of short-term investments | (345 | ) | (716 | ) | |||

Contributions to equity affiliates | (44 | ) | — | ||||

Other investing | (29 | ) | (38 | ) | |||

Net cash provided by (used in) investing activities | 416 | (317 | ) | ||||

FINANCING ACTIVITIES: | |||||||

Borrowings under the revolving credit facilities | 881 | 225 | |||||

Repayments under the revolving credit facilities | (783 | ) | (84 | ) | |||

Issuance of recourse debt | 1,000 | — | |||||

Repayments of recourse debt | (1,774 | ) | (341 | ) | |||

Issuance of non-recourse debt | 757 | 569 | |||||

Repayments of non-recourse debt | (510 | ) | (295 | ) | |||

Payments for financing fees | (14 | ) | (18 | ) | |||

Distributions to noncontrolling interests | (17 | ) | (33 | ) | |||

Contributions from noncontrolling interests and redeemable security holders | 11 | 29 | |||||

Dividends paid on AES common stock | (86 | ) | (79 | ) | |||

Payments for financed capital expenditures | (89 | ) | (26 | ) | |||

Other financing | (6 | ) | (26 | ) | |||

Net cash used in financing activities | (630 | ) | (79 | ) | |||

Effect of exchange rate changes on cash | 5 | 11 | |||||

(Increase) decrease in cash and restricted cash of discontinued operations and held-for-sale businesses | 74 | (35 | ) | ||||

Total increase in cash, cash equivalents and restricted cash | 380 | 288 | |||||

Cash, cash equivalents and restricted cash, beginning | 1,788 | 1,960 | |||||

Cash, cash equivalents and restricted cash, ending | $ | 2,168 | $ | 2,248 | |||

SUPPLEMENTAL DISCLOSURES: | |||||||

Cash payments for interest, net of amounts capitalized | $ | 207 | $ | 195 | |||

Cash payments for income taxes, net of refunds | $ | 71 | $ | 74 | |||

SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | |||||||

Non-cash contributions of assets and liabilities for Fluence acquisition | $ | 20 | $ | — | |||

Dividends declared but not yet paid | $ | 86 | $ | 79 | |||

Conversion of Alto Maipo loans and accounts payable into equity (see Note 10—Equity) | $ | — | $ | 279 | |||

See Notes to Condensed Consolidated Financial Statements.

5

THE AES CORPORATION

Notes to Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(Unaudited)

1. FINANCIAL STATEMENT PRESENTATION

The prior period condensed consolidated financial statements in this Quarterly Report on Form 10-Q (“Form 10-Q”) have been reclassified to reflect the businesses classified as discontinued operations as discussed in Note 16—Discontinued Operations. Certain prior period amounts have been reclassified to comply with newly adopted accounting standards. See further detail in the new accounting pronouncements discussion.

Consolidation — In this Quarterly Report the terms “AES,” “the Company,” “us” or “we” refer to the consolidated entity, including its subsidiaries and affiliates. The terms “The AES Corporation” or “the Parent Company” refer only to the publicly held holding company, The AES Corporation, excluding its subsidiaries and affiliates. Furthermore, VIEs in which the Company has a variable interest have been consolidated where the Company is the primary beneficiary. Investments in which the Company has the ability to exercise significant influence, but not control, are accounted for using the equity method of accounting. All intercompany transactions and balances have been eliminated in consolidation.

Interim Financial Presentation — The accompanying unaudited condensed consolidated financial statements and footnotes have been prepared in accordance with GAAP, as contained in the FASB ASC, for interim financial information and Article 10 of Regulation S-X issued by the SEC. Accordingly, they do not include all the information and footnotes required by GAAP for annual fiscal reporting periods. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of the results of operations, financial position, comprehensive income, and cash flows. The results of operations for the three months ended March 31, 2018, are not necessarily indicative of expected results for the year ending December 31, 2018. The accompanying condensed consolidated financial statements are unaudited and should be read in conjunction with the 2017 audited consolidated financial statements and notes thereto, which are included in the 2017 Form 10-K filed with the SEC on February 26, 2018 (the “2017 Form 10-K”).

Cash, Cash Equivalents, and Restricted Cash — The following table provides a summary of cash, cash equivalents, and restricted cash amounts reported on the Condensed Consolidated Balance Sheet that reconcile to the total of such amounts as shown on the Condensed Consolidated Statements of Cash Flows (in millions):

March 31, 2018 | December 31, 2017 | ||||||

Cash and cash equivalents | $ | 1,212 | $ | 949 | |||

Restricted cash | 415 | 274 | |||||

Debt service reserves and other deposits | 541 | 565 | |||||

Cash, Cash Equivalents, and Restricted Cash | $ | 2,168 | $ | 1,788 | |||

New Accounting Pronouncements Adopted in 2018 — The following table provides a brief description of recent accounting pronouncements that had an impact on the Company’s consolidated financial statements. Accounting pronouncements not listed below were assessed and determined to be either not applicable or did not have a material impact on the Company’s consolidated financial statements.

New Accounting Standards Adopted | |||

ASU Number and Name | Description | Date of Adoption | Effect on the financial statements upon adoption |

2017-07, Compensation — Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost | This standard changes the presentation of non-service costs associated with defined benefit plans and updates the guidance so that only the service cost component will be eligible for capitalization. Transition method: retrospective for presentation of non-service cost and prospective for the change in capitalization. | January 1, 2018 | No material impact upon adoption of the standard. |

2017-05, Other Income — Gains and Losses from the Derecognition of Nonfinancial Assets (Topic 610-20): Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets | This standard clarifies the scope and application of ASC 610-20 on the sale, transfer, and derecognition of nonfinancial assets and in substance nonfinancial assets to non-customers, including partial sales. It also provides guidance on how gains and losses on transfers of nonfinancial assets and in substance nonfinancial assets to non-customers are recognized. The standard also clarifies that the derecognition of businesses is under the scope of ASC 810. The standard must be adopted concurrently with ASC 606, however an entity will not have to apply the same transition method as ASC 606. Transition method: modified retrospective. | January 1, 2018 | As more transactions will not meet the definition of a business due to the adoption of ASU 2017-01, more dispositions or partial sales will be out of the scope of ASC 810 and will be under this standard. |

6

2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business | The standard requires an entity to first evaluate whether substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, and if that threshold is met, the set is not a business. As a second step, to be considered a business at least one substantive process should exist. The revised definition of a business will reduce the number of transactions that are accounted for as business combinations. Transition method: prospective. | January 1, 2018 | Some acquisitions and dispositions will now fall under a different accounting model. |

2016-18, Statement of Cash Flows (Topic 230): Restricted Cash (a consensus of the FASB Emerging Issues Task Force) | This standard requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. Transition method: retrospective. | January 1, 2018 | For the three months ending March 31, 2017, cash provided by operating activities increased by $5 million, cash used in investing activities decreased by $23 million, and cash used in financing activities was unchanged. |

2016-01, Financial Instruments — Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities | The standard significantly revises an entity’s accounting related to (1) classification and measurement of investments in equity securities and (2) the presentation of certain fair value changes for financial liabilities measured at fair value. Also it amends certain disclosures of financial instruments. Transition method: modified retrospective. Prospective for equity investments without readily determine fair value. | January 1, 2018 | No material impact upon adoption of the standard. |

2014-09, 2015-14, 2016-08, 2016-10, 2016-12, 2016-20, 2017-10, 2017-13, Revenue from Contracts with Customers (Topic 606) | See discussion of the ASU below. | January 1, 2018 | See impact upon adoption of the standard below. |

On January 1, 2018, the Company adopted ASU 2014-09, "Revenue from Contracts with Customers," and its subsequent corresponding updates ("ASC 606"). Under this standard, an entity shall recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The Company applied the modified retrospective method of adoption to the contracts that were not completed as of January 1, 2018. Results for reporting periods beginning January 1, 2018 are presented under ASC 606, while prior period amounts were not adjusted and continue to be reported in accordance with the previous revenue recognition standard. For contracts that were modified before January 1, 2018, the Company reflected the aggregate effect of all modifications when identifying the satisfied and unsatisfied performance obligations, determining the transaction price and allocating the transaction price.

The cumulative effect to our January 1, 2018 Condensed Consolidated Balance Sheet resulting from the adoption of ASC 606 was as follows (in millions):

Condensed Consolidated Balance Sheet | Balance at December 31, 2017 | Adjustments Due to ASC 606 | Balance at January 1, 2018 | ||||||||

Assets | |||||||||||

Other current assets | $ | 630 | $ | 61 | $ | 691 | |||||

Deferred income taxes | 130 | (24 | ) | 106 | |||||||

Service concession assets, net | 1,360 | (1,360 | ) | — | |||||||

Loan receivable | — | 1,490 | 1,490 | ||||||||

Equity | |||||||||||

Accumulated deficit | (2,276 | ) | 67 | (2,209 | ) | ||||||

Accumulated other comprehensive loss | (1,876 | ) | 19 | (1,857 | ) | ||||||

Noncontrolling interests | 2,380 | 81 | 2,461 | ||||||||

The Mong Duong II power plant in Vietnam is the primary driver of changes in revenue recognition under the new standard. This plant is operated under a build, operate, and transfer contract and will be transferred to the Vietnamese government after the completion of a 25-year PPA. Under the previous revenue recognition standard, construction costs were deferred to a service concession asset, which was expensed in proportion to revenue recognized for the construction element over the term of the PPA. Under ASC 606, construction revenue and associated costs are recognized as construction activity occurs. As construction of the plant was substantially completed in 2015, revenues and costs associated with the construction were recognized through retained earnings, and the service concession asset was derecognized. A loan receivable was recognized for the future expected payments for the construction performance obligation. As the payments for the construction performance obligation occur over a 25-year term, a significant financing element was determined to exist which is accounted for

7

under the effective interest rate method. The other performance obligation to operate and maintain the facility is measured based on the capacity made available.

The impact to our Condensed Consolidated Balance Sheet as of March 31, 2018 and Condensed Consolidated Statement of Operations for the period ended March 31, 2018 resulting from the adoption of ASC 606 as compared to the previous revenue recognition standard was as follows (in millions):

March 31, 2018 | |||||||||||

Condensed Consolidated Balance Sheet | As Reported | Balances Without Adoption of ASC 606 | Adoption Impact | ||||||||

Assets | |||||||||||

Other current assets | $ | 703 | $ | 640 | $ | 63 | |||||

Deferred income taxes | 94 | 118 | (24 | ) | |||||||

Service concession assets, net | — | 1,337 | (1,337 | ) | |||||||

Loan receivable | 1,474 | — | 1,474 | ||||||||

TOTAL ASSETS | 32,573 | 32,397 | 176 | ||||||||

Liabilities | |||||||||||

Accrued and other liabilities | 1,182 | 1,181 | 1 | ||||||||

Equity | |||||||||||

Accumulated deficit | (1,525 | ) | (1,601 | ) | 76 | ||||||

Accumulated other comprehensive loss | (1,808 | ) | (1,827 | ) | 19 | ||||||

Noncontrolling interest | 2,332 | 2,252 | 80 | ||||||||

TOTAL LIABILITIES AND EQUITY | 32,573 | 32,397 | 176 | ||||||||

Three Months Ended March 31, 2018 | ||||||||

Condensed Consolidated Statement of Operations | As Reported | Balances Without Adoption of ASC 606 | Adoption Impact | |||||

Total revenue | 2,740 | 2,751 | (11 | ) | ||||

Total cost of sales | (2,084 | ) | (2,090 | ) | 6 | |||

Operating margin | 656 | 661 | (5 | ) | ||||

Interest income | 76 | 61 | 15 | |||||

Income from continuing operations before taxes and equity in earnings of affiliates | 998 | 988 | 10 | |||||

Income tax expense | (231 | ) | (230 | ) | (1 | ) | ||

INCOME FROM CONTINUING OPERATIONS | 778 | 769 | 9 | |||||

NET INCOME | 777 | 768 | 9 | |||||

NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION | 684 | 675 | 9 | |||||

New Accounting Pronouncements Issued But Not Yet Effective — The following table provides a brief description of recent accounting pronouncements that could have a material impact on the Company’s consolidated financial statements once adopted. Accounting pronouncements not listed below were assessed and determined to be either not applicable or are expected to have no material impact on the Company’s consolidated financial statements.

New Accounting Standards Issued But Not Yet Effective | |||

ASU Number and Name | Description | Date of Adoption | Effect on the financial statements upon adoption |

2018-02, Income Statement — Reporting Comprehensive Income (Topic 220), Reclassification of Certain Tax Effects from AOCI | This amendment allows a reclassification of the stranded tax effects resulting from the implementation of the Tax Cuts and Jobs Act from AOCI to retained earnings. Because this amendment only relates to the reclassification of the income tax effects of the Tax Cuts and Jobs Act, the underlying guidance that requires that the effect of a change in tax laws or rates be included in income from continuing operations is not affected. | January 1, 2019. Early adoption is permitted. | The Company is currently evaluating the impact of adopting the standard on its consolidated financial statements. |

2017-12, Derivatives and Hedging (Topic 815): Targeted improvements to Accounting for Hedging Activities | The standard updates the hedge accounting model to expand the ability to hedge nonfinancial and financial risk components, reduce complexity, and ease certain documentation and assessment requirements. When facts and circumstances are the same as at the previous quantitative test, a subsequent quantitative effectiveness test is not required. The standard also eliminates the requirement to separately measure and report hedge ineffectiveness. For cash flow hedges, this means that the entire change in the fair value of a hedging instrument will be recorded in other comprehensive income and amounts deferred will be reclassified to earnings in the same income statement line as the hedged item. Transition method: modified retrospective with the cumulative effect adjustment recorded to the opening balance of retained earnings as of the initial application date. Prospective for presentation and disclosures. | January 1, 2019. Early adoption is permitted. | The Company is currently evaluating the impact of adopting the standard on its consolidated financial statements. |

8

2017-11, Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): Accounting for Certain Financial Instruments and Certain Mandatorily Redeemable Noncontrolling Interests | Part 1 of this standard changes the classification of certain equity-linked financial instruments when assessing whether the instrument is indexed to an entity’s own stock. Transition method: retrospective. | January 1, 2019. Early adoption is permitted. | The Company is currently evaluating the impact of adopting the standard on its consolidated financial statements. |

2017-08, Receivables — Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities | This standard shortens the period of amortization for the premium on certain callable debt securities to the earliest call date. Transition method: modified retrospective. | January 1, 2019. Early adoption is permitted. | The Company is currently evaluating the impact of adopting the standard on its consolidated financial statements. |

2017-04, Intangibles — Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment | This standard simplifies the accounting for goodwill impairment by removing the requirement to calculate the implied fair value. Instead, it requires that an entity records an impairment charge based on the excess of a reporting unit's carrying amount over its fair value. Transition method: prospective. | January 1, 2020. Early adoption is permitted as of January 1, 2017. | The Company is currently evaluating the impact of adopting the standard on its consolidated financial statements. |

2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments | The standard updates the impairment model for financial assets measured at amortized cost. For trade and other receivables, held-to-maturity debt securities, loans and other instruments, entities will be required to use a new forward-looking "expected loss" model that generally will result in the earlier recognition of allowance for losses. For available-for-sale debt securities with unrealized losses, entities will measure credit losses as it is done today, except that the losses will be recognized as an allowance rather than a reduction in the amortized cost of the securities. Transition method: various. | January 1, 2020. Early adoption is permitted only as of January 1, 2019. | The Company is currently evaluating the impact of adopting the standard on its consolidated financial statements. |

2016-02, 2018-01, Leases (Topic 842) | See discussion of the ASU below. | January 1, 2019. Early adoption is permitted. | The Company is currently evaluating the impact of adopting the standard on its consolidated financial statements. |

ASU 2016-02 and its subsequent corresponding updates will require lessees to recognize assets and liabilities for most leases, and recognize expenses in a manner similar to the current accounting method. For Lessors, the guidance modifies the lease classification criteria and the accounting for sales-type and direct financing leases. The guidance also eliminates the current real estate-specific provisions.

The standard must be adopted using a modified retrospective approach at the beginning of the earliest comparative period presented in the financial statements (January 1, 2017). The FASB proposed amending the standard to give another option for transition. The proposed transition method would allow entities to not apply the new lease standard in the comparative periods presented in their financial statements in the year of adoption. Under the proposed transition method, the entity would apply the transition provisions on January 1, 2019 (i.e., the effective date). At transition, lessees and lessors are permitted to make an election to apply a package of practical expedients that allow them not to reassess: (1) whether any expired or existing contracts are or contain leases, (2) lease classification for any expired or existing leases, and (3) whether initial direct costs for any expired or existing leases qualify for capitalization under ASC 842. These three practical expedients must be elected as a package and must be consistently applied to all leases. Furthermore, entities are also permitted to make an election to use hindsight when determining lease term and lessees can elect to use hindsight when assessing the impairment of right-of-use assets.

The Company has established a task force focused on the identification of contracts that would be under the scope of the new standard and on the assessment and measurement of the right-of-use asset and related liability. Additionally, the implementation team has been working on the configuration of a lease accounting system that will support the implementation and the subsequent accounting. The implementation team is in the process of evaluating changes to our business processes, systems and controls to support recognition and disclosure under the new standard.

As the Company has preliminarily concluded that at transition it would be using the package of practical expedients, the main impact expected as of the effective date is the recognition of the right to use asset and the related liability in the financial statements for all those contracts that contain a lease and for which the Company is the lessee. However, income statement presentation and the expense recognition pattern is not expected to change.

9

Under ASC 842, it is expected that fewer contracts will contain a lease. However, due to the elimination of today's real estate-specific guidance and changes to certain lessor classification criteria, more leases will qualify as sales-type leases and direct financing leases. Under these two models, a lessor will derecognize the asset and will recognize a lease receivable. According to ASC 842, the lease receivable does not include variable payments that depend on the use of the asset (e.g. Mwh produced by a facility). Therefore, the lease receivable could be lower than the carrying amount of the underlying asset at lease commencement, In such circumstances, the difference between the initially recognized lease receivable and the carrying amount of the underlying asset is recognized as a selling loss at lease commencement. The Company is assessing how this guidance will apply to new renewable contracts executed or modified after the effective date where all the payments are contingent on the level of production and is also evaluating the related impact to the allocation of earnings under HLBV accounting.

2. INVENTORY

The following table summarizes the Company’s inventory balances as of the periods indicated (in millions):

March 31, 2018 | December 31, 2017 | ||||||

Fuel and other raw materials | $ | 281 | $ | 284 | |||

Spare parts and supplies | 288 | 278 | |||||

Total | $ | 569 | $ | 562 | |||

3. FAIR VALUE

The fair value of current financial assets and liabilities, debt service reserves and other deposits approximate their reported carrying amounts. The estimated fair values of the Company’s assets and liabilities have been determined using available market information. By virtue of these amounts being estimates and based on hypothetical transactions to sell assets or transfer liabilities, the use of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair value amounts. For further information on our valuation techniques and policies, see Note 4—Fair Value in Item 8.—Financial Statements and Supplementary Data of our 2017 Form 10-K.

Recurring Measurements — The following table presents, by level within the fair value hierarchy, the Company’s financial assets and liabilities that were measured at fair value on a recurring basis as of the dates indicated (in millions). For the Company’s investments in marketable debt securities, the security classes presented are determined based on the nature and risk of the security and are consistent with how the Company manages, monitors and measures its marketable securities:

March 31, 2018 | December 31, 2017 | ||||||||||||||||||||||||||||||

Level 1 | Level 2 | Level 3 | Total | Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||||||||||

Assets | |||||||||||||||||||||||||||||||

DEBT SECURITIES: | |||||||||||||||||||||||||||||||

Available-for-sale: | |||||||||||||||||||||||||||||||

Unsecured debentures | $ | — | $ | 291 | $ | — | $ | 291 | $ | — | $ | 207 | $ | — | $ | 207 | |||||||||||||||

Certificates of deposit | — | 260 | — | 260 | — | 153 | — | 153 | |||||||||||||||||||||||

Total debt securities | — | 551 | — | 551 | — | 360 | — | 360 | |||||||||||||||||||||||

EQUITY SECURITIES: | |||||||||||||||||||||||||||||||

Mutual funds | 20 | 52 | — | 72 | 20 | 52 | — | 72 | |||||||||||||||||||||||

Other equity securities | — | 3 | — | 3 | — | — | — | — | |||||||||||||||||||||||

Total equity securities | 20 | 55 | — | 75 | 20 | 52 | — | 72 | |||||||||||||||||||||||

DERIVATIVES: | |||||||||||||||||||||||||||||||

Interest rate derivatives | — | 42 | — | 42 | — | 15 | — | 15 | |||||||||||||||||||||||

Cross-currency derivatives | — | 45 | — | 45 | — | 29 | — | 29 | |||||||||||||||||||||||

Foreign currency derivatives | — | 37 | 225 | 262 | — | 29 | 240 | 269 | |||||||||||||||||||||||

Commodity derivatives | — | 8 | 3 | 11 | — | 30 | 5 | 35 | |||||||||||||||||||||||

Total derivatives — assets | — | 132 | 228 | 360 | — | 103 | 245 | 348 | |||||||||||||||||||||||

TOTAL ASSETS | $ | 20 | $ | 738 | $ | 228 | $ | 986 | $ | 20 | $ | 515 | $ | 245 | $ | 780 | |||||||||||||||

Liabilities | |||||||||||||||||||||||||||||||

DERIVATIVES: | |||||||||||||||||||||||||||||||

Interest rate derivatives | $ | — | $ | 81 | $ | 129 | $ | 210 | $ | — | $ | 111 | $ | 151 | $ | 262 | |||||||||||||||

Cross-currency derivatives | — | 1 | — | 1 | — | 3 | — | 3 | |||||||||||||||||||||||

Foreign currency derivatives | — | 41 | — | 41 | — | 30 | — | 30 | |||||||||||||||||||||||

Commodity derivatives | — | 1 | — | 1 | — | 19 | 1 | 20 | |||||||||||||||||||||||

Total derivatives — liabilities | — | 124 | 129 | 253 | — | 163 | 152 | 315 | |||||||||||||||||||||||

TOTAL LIABILITIES | $ | — | $ | 124 | $ | 129 | $ | 253 | $ | — | $ | 163 | $ | 152 | $ | 315 | |||||||||||||||

As of March 31, 2018, all AFS debt securities had stated maturities within one year. For the three months ended March 31, 2018 and 2017, no other-than-temporary impairments of marketable securities were recognized in

10

earnings or Other Comprehensive Income (Loss). Gains and losses on the sale of investments are determined using the specific-identification method. The following table presents gross proceeds from the sale of AFS securities during the periods indicated (in millions):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Gross proceeds from sale of AFS securities | $ | 147 | $ | 429 | |||

The following tables present a reconciliation of net derivative assets and liabilities measured at fair value on a recurring basis using significant unobservable inputs (Level 3) for the three months ended March 31, 2018 and 2017 (presented net by type of derivative in millions). Transfers between Level 3 and Level 2 are determined as of the end of the reporting period and principally result from changes in the significance of unobservable inputs used to calculate the credit valuation adjustment.

Three Months Ended March 31, 2018 | Interest Rate | Foreign Currency | Commodity | Total | |||||||||||

Balance at January 1 | $ | (151 | ) | $ | 240 | $ | 4 | $ | 93 | ||||||

Total realized and unrealized gains (losses): | |||||||||||||||

Included in earnings | 14 | (6 | ) | 1 | 9 | ||||||||||

Included in other comprehensive income — derivative activity | 27 | — | — | 27 | |||||||||||

Settlements | 6 | (9 | ) | (2 | ) | (5 | ) | ||||||||

Transfers of liabilities into Level 3 | (8 | ) | — | — | (8 | ) | |||||||||

Transfers of liabilities out of Level 3 | (17 | ) | — | — | (17 | ) | |||||||||

Balance at March 31 | $ | (129 | ) | $ | 225 | $ | 3 | $ | 99 | ||||||

Total gains (losses) for the period included in earnings attributable to the change in unrealized gains (losses) relating to assets and liabilities held at the end of the period | $ | 16 | $ | (15 | ) | $ | 1 | $ | 2 | ||||||

Three Months Ended March 31, 2017 | Interest Rate | Foreign Currency | Commodity | Total | |||||||||||

Balance at January 1 | $ | (179 | ) | $ | 255 | $ | 5 | $ | 81 | ||||||

Total realized and unrealized losses: | |||||||||||||||

Included in earnings | — | (16 | ) | — | (16 | ) | |||||||||

Included in other comprehensive income — derivative activity | (12 | ) | — | — | (12 | ) | |||||||||

Settlements | 10 | (8 | ) | (3 | ) | (1 | ) | ||||||||

Transfers of liabilities into Level 3 | (4 | ) | — | — | (4 | ) | |||||||||

Transfers of assets out of Level 3 | 2 | — | — | 2 | |||||||||||

Balance at March 31 | $ | (183 | ) | $ | 231 | $ | 2 | $ | 50 | ||||||

Total gains (losses) for the period included in earnings attributable to the change in unrealized gains (losses) relating to assets and liabilities held at the end of the period | $ | 2 | $ | (24 | ) | $ | — | $ | (22 | ) | |||||

The following table summarizes the significant unobservable inputs used for Level 3 derivative assets (liabilities) as of March 31, 2018 (in millions, except range amounts):

Type of Derivative | Fair Value | Unobservable Input | Amount or Range (Weighted Average) | |||||

Interest rate | $ | (129 | ) | Subsidiaries’ credit spreads | 2.38% to 4.38% (3.54%) | |||

Foreign currency: | ||||||||

Argentine Peso | 225 | Argentine Peso to USD currency exchange rate after one year | 24.33 to 56.28 (38.75) | |||||

Commodity: | ||||||||

Other | 3 | |||||||

Total | $ | 99 | ||||||

For interest rate derivatives and foreign currency derivatives, increases (decreases) in the estimates of the Company’s own credit spreads would decrease (increase) the value of the derivatives in a liability position. For foreign currency derivatives, increases (decreases) in the estimate of the above exchange rate would increase (decrease) the value of the derivative.

Nonrecurring Measurements

The Company measures fair value using the applicable fair value measurement guidance. Impairment expense is measured by comparing the fair value at the evaluation date to the then-latest available carrying amount. The following table summarizes our major categories of assets and liabilities measured at fair value on a nonrecurring basis and their level within the fair value hierarchy (in millions):

11

Measurement Date | Carrying Amount (1) | Fair Value | Pretax Loss | ||||||||||||||||||

Three Months Ended March 31, 2017 | Level 1 | Level 2 | Level 3 | ||||||||||||||||||

Long-lived assets held and used: (2) | |||||||||||||||||||||

DPL | 02/28/2017 | $ | 77 | $ | — | $ | — | $ | 11 | $ | 66 | ||||||||||

Other | 02/28/2017 | 15 | — | — | 7 | 8 | |||||||||||||||

Held-for-sale businesses: (3) | |||||||||||||||||||||

Kazakhstan | 03/31/2017 | 171 | — | 29 | — | 94 | |||||||||||||||

_____________________________

(1) | Represents the carrying values at the dates of measurement, before fair value adjustment. |

(2) | See Note 14—Asset Impairment Expense for further information. |

(3) | Per the Company’s policy, pretax loss is limited to the impairment of long-lived assets. Any additional loss will be recognized on completion of the sale. See Note 17—Held-for-Sale Businesses and Dispositions for further information. |

Financial Instruments not Measured at Fair Value in the Condensed Consolidated Balance Sheets

The following table presents (in millions) the carrying amount, fair value and fair value hierarchy of the Company’s financial assets and liabilities that are not measured at fair value in the Condensed Consolidated Balance Sheets as of March 31, 2018 and December 31, 2017, but for which fair value is disclosed:

March 31, 2018 | ||||||||||||||||||||

Carrying Amount | Fair Value | |||||||||||||||||||

Total | Level 1 | Level 2 | Level 3 | |||||||||||||||||

Assets: | Accounts receivable — noncurrent (1) | $ | 156 | $ | 295 | $ | — | $ | — | $ | 295 | |||||||||

Liabilities: | Non-recourse debt | 15,626 | 16,006 | — | 14,250 | 1,756 | ||||||||||||||

Recourse debt | 4,065 | 4,173 | — | 4,173 | — | |||||||||||||||

December 31, 2017 | ||||||||||||||||||||

Carrying Amount | Fair Value | |||||||||||||||||||

Total | Level 1 | Level 2 | Level 3 | |||||||||||||||||

Assets: | Accounts receivable — noncurrent (1) | $ | 163 | $ | 217 | $ | — | $ | 6 | $ | 211 | |||||||||

Liabilities: | Non-recourse debt | 15,340 | 15,890 | — | 13,350 | 2,540 | ||||||||||||||

Recourse debt | 4,630 | 4,920 | — | 4,920 | — | |||||||||||||||

_____________________________

(1) | These amounts primarily relate to amounts due from CAMMESA, the administrator of the wholesale electricity market in Argentina, and are included in Other noncurrent assets in the accompanying Condensed Consolidated Balance Sheets. The fair value and carrying amount of these receivables exclude VAT of $30 million and $31 million as of March 31, 2018 and December 31, 2017, respectively. |

4. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

For further information on the derivative and hedging accounting policies see Note 1—General and Summary of Significant Accounting Policies—Derivatives and Hedging Activities of Item 8.—Financial Statements and Supplementary Data in the 2017 Form 10-K.

Volume of Activity — The following table presents the Company’s maximum notional (in millions) over the remaining contractual period by type of derivative as of March 31, 2018, regardless of whether they are in qualifying cash flow hedging relationships, and the dates through which the maturities for each type of derivative range:

Derivatives | Maximum Notional Translated to USD | Latest Maturity | ||||

Interest Rate (LIBOR and EURIBOR) | $ | 4,475 | 2041 | |||

Cross-Currency Swaps (Chilean Unidad de Fomento and Chilean Peso) | 419 | 2029 | ||||

Foreign Currency: | ||||||

Argentine Peso | 180 | 2026 | ||||

Chilean Peso | 388 | 2020 | ||||

Colombian Peso | 285 | 2019 | ||||

Others, primarily with weighted average remaining maturities of a year or less | 327 | 2020 | ||||

Accounting and Reporting — Assets and Liabilities — The following tables present the fair value of assets and liabilities related to the Company’s derivative instruments as of March 31, 2018 and December 31, 2017 (in millions):

12

Fair Value | March 31, 2018 | December 31, 2017 | |||||||||||||||||||||

Assets | Designated | Not Designated | Total | Designated | Not Designated | Total | |||||||||||||||||

Interest rate derivatives | $ | 41 | $ | 1 | $ | 42 | $ | 15 | $ | — | $ | 15 | |||||||||||

Cross-currency derivatives | 45 | — | 45 | 29 | — | 29 | |||||||||||||||||

Foreign currency derivatives | 13 | 249 | 262 | 8 | 261 | 269 | |||||||||||||||||

Commodity derivatives | — | 11 | 11 | 5 | 30 | 35 | |||||||||||||||||

Total assets | $ | 99 | $ | 261 | $ | 360 | $ | 57 | $ | 291 | $ | 348 | |||||||||||

Liabilities | |||||||||||||||||||||||

Interest rate derivatives | $ | 90 | $ | 120 | $ | 210 | $ | 125 | $ | 137 | $ | 262 | |||||||||||

Cross-currency derivatives | 1 | — | 1 | 3 | — | 3 | |||||||||||||||||

Foreign currency derivatives | 1 | 40 | 41 | 1 | 29 | 30 | |||||||||||||||||

Commodity derivatives | — | 1 | 1 | 9 | 11 | 20 | |||||||||||||||||

Total liabilities | $ | 92 | $ | 161 | $ | 253 | $ | 138 | $ | 177 | $ | 315 | |||||||||||

March 31, 2018 | December 31, 2017 | ||||||||||||||

Fair Value | Assets | Liabilities | Assets | Liabilities | |||||||||||

Current | $ | 70 | $ | 170 | $ | 84 | $ | 211 | |||||||

Noncurrent | 290 | 83 | 264 | 104 | |||||||||||

Total | $ | 360 | $ | 253 | $ | 348 | $ | 315 | |||||||

As of March 31, 2018, all derivative instruments subject to credit risk-related contingent features were in an asset position.

Credit Risk-Related Contingent Features (1) | December 31, 2017 | |||||||

Present value of liabilities subject to collateralization | $ | 15 | ||||||

Cash collateral held by third parties or in escrow | 9 | |||||||

_____________________________

(1) | Based on the credit rating of certain subsidiaries |

Earnings and Other Comprehensive Income (Loss) — The next table presents (in millions) the pretax gains (losses) recognized in AOCL and earnings related to all derivative instruments for the periods indicated:

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Effective portion of cash flow hedges | |||||||

Gains (losses) recognized in AOCL | |||||||

Interest rate derivatives | $ | 47 | $ | (22 | ) | ||

Cross-currency derivatives | 19 | 12 | |||||

Foreign currency derivatives | 6 | (15 | ) | ||||

Commodity derivatives | — | 12 | |||||

Total | $ | 72 | $ | (13 | ) | ||

Gains (losses) reclassified from AOCL into earnings | |||||||

Interest rate derivatives | $ | (16 | ) | $ | (24 | ) | |

Cross-currency derivatives | 10 | 4 | |||||

Foreign currency derivatives | 1 | (2 | ) | ||||

Commodity derivatives | (4 | ) | 1 | ||||

Total | $ | (9 | ) | $ | (21 | ) | |

Gains (losses) recognized in earnings related to | |||||||

Not designated as hedging instruments: | |||||||

Foreign currency derivatives | $ | 108 | $ | (32 | ) | ||

Commodity derivatives and other | 9 | (2 | ) | ||||

Total | $ | 117 | $ | (34 | ) | ||

AOCL is expected to decrease pretax income from continuing operations for the twelve months ended March 31, 2019, by $44 million, primarily due to interest rate derivatives.

5. FINANCING RECEIVABLES

Receivables with contractual maturities of greater than one year are considered financing receivables. The Company’s financing receivables are primarily related to amended agreements or government resolutions that are due from CAMMESA, the administrator of the wholesale electricity market in Argentina. The following table presents financing receivables by country as of the dates indicated (in millions):

March 31, 2018 | December 31, 2017 | ||||||

Argentina | $ | 174 | $ | 177 | |||

Other | 12 | 17 | |||||

Total | $ | 186 | $ | 194 | |||

Argentina — Collection of the principal and interest on these receivables is subject to various business risks and uncertainties, including, but not limited to, the operation of power plants which generate cash for payments of

13

these receivables, regulatory changes that could impact the timing and amount of collections, and economic conditions in Argentina. The Company monitors these risks, including the credit ratings of the Argentine government, on a quarterly basis to assess the collectability of these receivables. The Company accrues interest on these receivables once the recognition criteria have been met. The Company’s collection estimates are based on assumptions that it believes to be reasonable but are inherently uncertain. Actual future cash flows could differ from these estimates.

6. INVESTMENTS IN AND ADVANCES TO AFFILIATES

Summarized Financial Information — The following table summarizes financial information of the Company’s 50%-or-less-owned affiliates that are accounted for using the equity method (in millions):

Three Months Ended March 31, | |||||||

50%-or-less-Owned Affiliates | 2018 | 2017 | |||||

Revenue | $ | 206 | $ | 167 | |||

Operating margin | 28 | 32 | |||||

Net income | 12 | 11 | |||||

sPower — In February 2017, the Company and Alberta Investment Management Corporation (“AIMCo”) entered into an agreement to acquire FTP Power LLC (“sPower”). In July 2017, AES closed on the acquisition of its 48% ownership interest in sPower for $461 million. In November 2017, AES acquired an additional 2% ownership interest in sPower for $19 million. As the Company does not control sPower, it is accounted for as an equity method investment. The sPower portfolio includes solar and wind projects in operation, under construction, and in development located in the United States. The sPower equity method investment is reported in the US and Utilities SBU reportable segment.

Fluence — In July 2017, the Company entered into a joint venture with Siemens AG to form a global energy storage technology and services company under the name Fluence. On January 1, 2018, Siemens and AES closed on the creation of the joint venture with each party holding a 50% ownership interest. The Company contributed $7 million in cash and $20 million in non-cash assets from the AES Advancion energy storage development business as consideration for the transaction, and received an equity interest in Fluence with a fair value of $50 million. See Note 17—Held-for-sale Businesses and Dispositions for further discussion. As the Company does not control Fluence, it is accounted for as an equity method investment. The Fluence equity method investment is reported as part of Corp and Other.

7. DEBT

Recourse Debt

In March 2018, the Company repurchased via tender offers $671 million aggregate principal of its existing 5.50% senior unsecured notes due in 2024 and $29 million of its existing 5.50% senior unsecured notes due in 2025. As a result of these transactions, the Company recognized a loss on extinguishment of debt of $44 million for the three months ended March 31, 2018.

In March 2018, the Company issued $500 million aggregate principal of 4.00% senior notes due in 2021 and $500 million of 4.50% senior notes due in 2023. The Company used the proceeds from these issuances to repurchase via tender offer in full the $228 million balance of its 8.00% senior notes due in 2020 and the $690 million balance of its 7.375% senior notes due in 2021. As a result of these transactions, the Company recognized a loss on extinguishment of debt of $125 million for the three months ended March 31, 2018.

In March 2017, the Company repurchased via tender offers $276 million aggregate principal of its existing 7.375% senior unsecured notes due in 2021 and $24 million of its existing 8.00% senior unsecured notes due in 2020. As a result of these transactions, the Company recognized a loss on extinguishment of debt of $47 million for the three months ended March 31, 2017.

Non-Recourse Debt

During the three months ended March 31, 2018, the Company’s subsidiaries had the following significant debt transactions:

Subsidiary | Issuances | Repayments | Gain (Loss) on Extinguishment of Debt | |||||||||

Tietê | $ | 385 | $ | (231 | ) | $ | — | |||||

Southland | 194 | — | — | |||||||||

Total | $ | 579 | $ | (231 | ) | $ | — | |||||

14

AES Argentina — In February 2017, AES Argentina issued $300 million aggregate principal of unsecured and unsubordinated notes due in 2024. The net proceeds from this issuance were used for the prepayment of $75 million of non-recourse debt related to the construction of the San Nicolas Plant resulting in a gain on extinguishment of debt of approximately $65 million.

Non-Recourse Debt in Default — The current portion of non-recourse debt includes the following subsidiary debt in default as of March 31, 2018 (in millions).

Subsidiary | Primary Nature of Default | Debt in Default | Net Assets | |||||||

Alto Maipo | Covenant | $ | 629 | $ | 359 | |||||

AES Puerto Rico | Covenant | 334 | 124 | |||||||

AES Ilumina | Covenant | 35 | 16 | |||||||

$ | 998 | |||||||||

The above defaults are not payment defaults. All of the subsidiary non-recourse debt defaults were triggered by failure to comply with covenants and/or other conditions such as (but not limited to) failure to meet information covenants, complete construction or other milestones in an allocated time, meet certain minimum or maximum financial ratios, or other requirements contained in the non-recourse debt documents of the applicable subsidiary.

The AES Corporation’s recourse debt agreements include cross-default clauses that will trigger if a subsidiary or group of subsidiaries for which the non-recourse debt is in default provides more than 20% or more of the Parent Company’s total cash distributions from businesses for the four most recently completed fiscal quarters. As of March 31, 2018, the Company had no defaults which resulted in or were at risk of triggering a cross-default under the recourse debt of the Parent Company. In the event the Parent Company is not in compliance with the financial covenants of its senior secured revolving credit facility, restricted payments will be limited to regular quarterly shareholder dividends at the then-prevailing rate. Payment defaults and bankruptcy defaults would preclude the making of any restricted payments.

8. COMMITMENTS AND CONTINGENCIES

Guarantees, Letters of Credit and Commitments — In connection with certain project financings, acquisitions and dispositions, power purchases and other agreements, the Parent Company has expressly undertaken limited obligations and commitments, most of which will only be effective or will be terminated upon the occurrence of future events. In the normal course of business, the Parent Company has entered into various agreements, mainly guarantees and letters of credit, to provide financial or performance assurance to third parties on behalf of AES businesses. These agreements are entered into primarily to support or enhance the creditworthiness otherwise achieved by a business on a stand-alone basis, thereby facilitating the availability of sufficient credit to accomplish their intended business purposes. Most of the contingent obligations relate to future performance commitments which the Company or its businesses expect to fulfill within the normal course of business. The expiration dates of these guarantees vary from less than one year to more than 17 years.

The following table summarizes the Parent Company’s contingent contractual obligations as of March 31, 2018. Amounts presented in the following table represent the Parent Company’s current undiscounted exposure to guarantees and the range of maximum undiscounted potential exposure. The maximum exposure is not reduced by the amounts, if any, that could be recovered under the recourse or collateralization provisions in the guarantees.

Contingent Contractual Obligations | Amount (in millions) | Number of Agreements | Maximum Exposure Range for Each Agreement (in millions) | ||||||

Guarantees and commitments | $ | 795 | 24 | <$1 — 272 | |||||

Letters of credit under the unsecured credit facility | 52 | 4 | $2 — 26 | ||||||

Asset sale related indemnities (1) | 27 | 1 | $27 | ||||||

Letters of credit under the senior secured credit facility | 36 | 20 | <$1 — 13 | ||||||

Total | $ | 910 | 49 | ||||||

_____________________________

(1) | Excludes normal and customary representations and warranties in agreements for the sale of assets (including ownership in associated legal entities) where the associated risk is considered to be nominal. |

During the three months ended March 31, 2018, the Company paid letter of credit fees ranging from 1.33% to 3% per annum on the outstanding amounts of letters of credit.

Contingencies

Environmental — The Company periodically reviews its obligations as they relate to compliance with environmental laws, including site restoration and remediation. For each period ended March 31, 2018 and December 31, 2017, the Company had recognized liabilities of $5 million for projected environmental remediation costs. Due to the uncertainties associated with environmental assessment and remediation activities, future costs of

15

compliance or remediation could be higher or lower than the amount currently accrued. Moreover, where no liability has been recognized, it is reasonably possible that the Company may be required to incur remediation costs or make expenditures in amounts that could be material but could not be estimated as of March 31, 2018. In aggregate, the Company estimates the range of potential losses related to environmental matters, where estimable, to be up to $19 million. The amounts considered reasonably possible do not include amounts accrued as discussed above.

Litigation — The Company is involved in certain claims, suits and legal proceedings in the normal course of business. The Company accrues for litigation and claims when it is probable that a liability has been incurred and the amount of loss can be reasonably estimated. The Company has recognized aggregate liabilities for all claims of approximately $51 million and $50 million as of March 31, 2018 and December 31, 2017, respectively. These amounts are reported on the Condensed Consolidated Balance Sheets within Accrued and other liabilities and Other noncurrent liabilities. A significant portion of these accrued liabilities relate to regulatory matters and commercial disputes in international jurisdictions. There can be no assurance that these accrued liabilities will be adequate to cover all existing and future claims or that we will have the liquidity to pay such claims as they arise.

Where no accrued liability has been recognized, it is reasonably possible that some matters could be decided unfavorably to the Company and could require the Company to pay damages or make expenditures in amounts that could be material but could not be estimated as of March 31, 2018. The material contingencies where a loss is reasonably possible primarily include claims under financing agreements; disputes with offtakers, suppliers and EPC contractors; alleged violation of monopoly laws and regulations; income tax and non-income tax matters with tax authorities; and regulatory matters. In aggregate, the Company estimates the range of potential losses, where estimable, related to these reasonably possible material contingencies to be between $139 million and $172 million. The amounts considered reasonably possible do not include the amounts accrued, as discussed above. These material contingencies do not include income tax-related contingencies which are considered part of our uncertain tax positions.

9. REDEEMABLE STOCK OF SUBSIDIARIES

The following table summarizes the Company’s redeemable stock of subsidiaries balances as of the periods indicated (in millions):

March 31, 2018 | December 31, 2017 | ||||||

IPALCO common stock | $ | 618 | $ | 618 | |||

Colon quotas (1) | 173 | 159 | |||||

IPL preferred stock | 60 | 60 | |||||

Redeemable stock of subsidiaries | $ | 851 | $ | 837 | |||

_____________________________

(1) | Characteristics of quotas are similar to common stock. |

Colon — Our partner in Colon made capital contributions of $10 million during the three months ended March 31, 2018. No capital contributions were made during the three months ended March 31, 2017. Any subsequent adjustments to allocate earnings and dividends to our partner, or measure the investment at fair value, will be classified as temporary equity each reporting period as it is probable that the shares will become redeemable.

16

10. EQUITY

Changes in Equity — The following table is a reconciliation of the beginning and ending equity attributable to stockholders of The AES Corporation, NCI and total equity as of the periods indicated (in millions):

Three Months Ended March 31, 2018 | Three Months Ended March 31, 2017 | ||||||||||||||||||||||

The Parent Company Stockholders’ Equity | NCI | Total Equity | The Parent Company Stockholders’ Equity | NCI | Total Equity | ||||||||||||||||||

Balance at the beginning of the period | $ | 2,465 | $ | 2,380 | $ | 4,845 | $ | 2,794 | $ | 2,906 | $ | 5,700 | |||||||||||

Net income (loss) (1) | 684 | 93 | 777 | (24 | ) | 122 | 98 | ||||||||||||||||

Total foreign currency translation adjustment, net of income tax | 3 | 6 | 9 | 61 | 10 | 71 | |||||||||||||||||

Total change in derivative fair value, net of income tax | 44 | 23 | 67 | 12 | 3 | 15 | |||||||||||||||||

Total pension adjustments, net of income tax | 2 | — | 2 | (1 | ) | 7 | 6 | ||||||||||||||||

Cumulative effect of a change in accounting principle (2) | 86 | 81 | 167 | 31 | — | 31 | |||||||||||||||||

Fair value adjustment (3) | (6 | ) | — | (6 | ) | — | — | — | |||||||||||||||

Disposition of businesses (4) | — | (249 | ) | (249 | ) | — | — | — | |||||||||||||||

Distributions to noncontrolling interests | — | (9 | ) | (9 | ) | — | (19 | ) | (19 | ) | |||||||||||||

Contributions from noncontrolling interests | — | 1 | 1 | — | 17 | 17 | |||||||||||||||||

Dividends declared on common stock | (86 | ) | — | (86 | ) | (79 | ) | — | (79 | ) | |||||||||||||

Issuance and exercise of stock-based compensation | 1 | — | 1 | 1 | — | 1 | |||||||||||||||||

Sale of subsidiary shares to noncontrolling interests | — | 1 | 1 | (4 | ) | 22 | 18 | ||||||||||||||||

Acquisition of subsidiary shares from noncontrolling interests | — | — | — | 200 | 67 | 267 | |||||||||||||||||

Less: Net loss attributable to redeemable stock of subsidiaries | — | 5 | 5 | — | 3 | 3 | |||||||||||||||||

Balance at the end of the period | $ | 3,193 | $ | 2,332 | $ | 5,525 | $ | 2,991 | $ | 3,138 | $ | 6,129 | |||||||||||

_____________________________

(1) | Net income attributable to noncontrolling interest of $98 million and net loss attributable to redeemable stocks of subsidiaries of $5 million for the three months ended March 31, 2018. Net income attributable to noncontrolling interest of $125 million and net loss attributable to redeemable stock of subsidiaries of $3 million for the three months ended March 31, 2017. |

(2) | See Note 1—Financial Statement Presentation, New Accounting Standards Adopted for further information. |

(3) | Adjustment to record the redeemable stock of Colon at fair value. |

(4) | See Note 17—Held-for-Sale Businesses and Dispositions for further information. |

Equity Transactions with Noncontrolling Interests

Alto Maipo — On March 17, 2017, AES Gener completed the legal and financial restructuring of Alto Maipo. As part of this restructuring, AES indirectly acquired the 40% ownership interest of the noncontrolling shareholder, for a de minimis payment, and sold a 6.7% interest in the project to the construction contractor. This transaction resulted in a $196 million increase to the Parent Company’s Stockholders’ Equity due to an increase in additional-paid-in capital of $229 million, offset by the reclassification of accumulated other comprehensive losses from NCI to the Parent Company Stockholders’ Equity of $33 million. No gain or loss was recognized in net income as the sale was not considered to be a sale of in-substance real estate. After completion of the sale, the Company has an effective 62% economic interest in Alto Maipo. As the Company maintained control of the partnership after the sale, Alto Maipo continues to be consolidated by the Company within the South America SBU reportable segment.

Accumulated Other Comprehensive Loss — The following table summarizes the changes in AOCL by component, net of tax and NCI, for the three months ended March 31, 2018 (in millions):

Foreign currency translation adjustment, net | Unrealized derivative gains (losses), net | Unfunded pension obligations, net | Total | ||||||||||||

Balance at the beginning of the period | $ | (1,486 | ) | $ | (333 | ) | $ | (57 | ) | $ | (1,876 | ) | |||

Other comprehensive income before reclassifications | 19 | 37 | — | 56 | |||||||||||

Amount reclassified to earnings | (16 | ) | 7 | 2 | (7 | ) | |||||||||

Other comprehensive income | 3 | 44 | 2 | 49 | |||||||||||

Cumulative effect of a change in accounting principle | — | 19 | — | 19 | |||||||||||

Balance at the end of the period | $ | (1,483 | ) | $ | (270 | ) | $ | (55 | ) | $ | (1,808 | ) | |||

17

Reclassifications out of AOCL are presented in the following table. Amounts for the periods indicated are in millions and those in parenthesis indicate debits to the Condensed Consolidated Statements of Operations:

AOCL Components | Affected Line Item in the Condensed Consolidated Statements of Operations | Three Months Ended March 31, | ||||||||

2018 | 2017 | |||||||||

Foreign currency translation adjustment, net | ||||||||||

Gain on disposal and sale of businesses | $ | 16 | $ | (3 | ) | |||||

Net income (loss) attributable to The AES Corporation | $ | 16 | $ | (3 | ) | |||||

Unrealized derivative gains (losses), net | ||||||||||

Non-regulated revenue | $ | (4 | ) | $ | 10 | |||||

Non-regulated cost of sales | (1 | ) | (10 | ) | ||||||

Interest expense | (15 | ) | (23 | ) | ||||||

Foreign currency transaction losses | 11 | 2 | ||||||||

Income from continuing operations before taxes and equity in earnings of affiliates | (9 | ) | (21 | ) | ||||||

Income tax expense | (1 | ) | 1 | |||||||

Income from continuing operations | (10 | ) | (20 | ) | ||||||

Less: Net income from operations attributable to noncontrolling interests and redeemable stock of subsidiaries | 3 | — | ||||||||

Net income (loss) attributable to The AES Corporation | $ | (7 | ) | $ | (20 | ) | ||||

Amortization of defined benefit pension actuarial loss, net | ||||||||||

General and administrative expenses | $ | (1 | ) | $ | 1 | |||||

Income from continuing operations before taxes and equity in earnings of affiliates | (1 | ) | 1 | |||||||

Income from continuing operations | (1 | ) | 1 | |||||||

Net income (loss) from operations of discontinued businesses | (1 | ) | (7 | ) | ||||||

Net income | (2 | ) | (6 | ) | ||||||

Less: Net income from discontinued operations attributable to noncontrolling interest | — | 5 | ||||||||

Net income (loss) attributable to The AES Corporation | $ | (2 | ) | $ | (1 | ) | ||||

Total reclassifications for the period, net of income tax and noncontrolling interests | $ | 7 | $ | (24 | ) | |||||

Common Stock Dividends — The Parent Company paid dividends of $0.13 per outstanding share to its common stockholders during the first quarter of 2018 for dividends declared in December 2017.

On February 23, 2018, the Board of Directors declared a quarterly common stock dividend of $0.13 per share payable on May 15, 2018, to shareholders of record at the close of business on May 1, 2018.

11. SEGMENTS

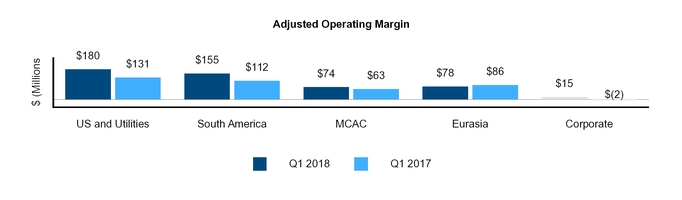

The segment reporting structure uses the Company’s management reporting structure as its foundation to reflect how the Company manages the businesses internally and is organized by geographic regions which provides a socio-political-economic understanding of our business. During the first quarter of 2018, the Andes and Brazil SBUs were merged in order to leverage scale and are now reported together as part of the South America SBU. Further, Puerto Rico and El Salvador businesses, formerly part of the MCAC SBU, were combined with the US SBU, which is now reported as the US and Utilities SBU. The management reporting structure is organized by four SBUs led by our President and Chief Executive Officer: US and Utilities, South America, MCAC, and Eurasia SBUs. Using the accounting guidance on segment reporting, the Company determined that its four operating segments are aligned with its four reportable segments corresponding to its SBUs. All prior period results have been retrospectively revised to reflect the new segment reporting structure.

Corporate and Other — The results of the Fluence equity affiliate are included in “Corporate and Other.” Also included are corporate overhead costs which are not directly associated with the operations of our four reportable segments, and certain intercompany charges such as self-insurance premiums which are fully eliminated in consolidation.

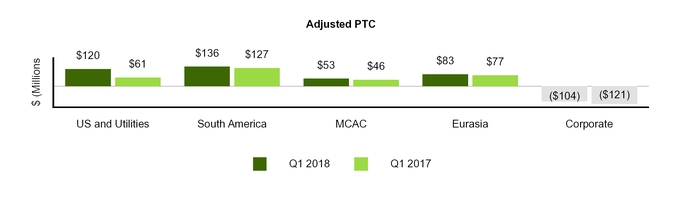

The Company uses Adjusted PTC as its primary segment performance measure. Adjusted PTC, a non-GAAP measure, is defined by the Company as pre-tax income from continuing operations attributable to The AES Corporation excluding gains or losses of the consolidated entity due to (a) unrealized gains or losses related to derivative transactions and equity securities; (b) unrealized foreign currency gains or losses; (c) gains, losses and associated benefits and costs due to dispositions and acquisitions of business interests, including early plant closures; (d) losses due to impairments; (e) gains, losses and costs due to the early retirement of debt; and (f) costs directly associated with a major restructuring program, including, but not limited to, workforce reduction efforts, relocations, and office consolidation. Adjusted PTC also includes net equity in earnings of affiliates on an after-tax basis adjusted for the same gains or losses excluded from consolidated entities. The Company has concluded that Adjusted PTC better reflects the underlying business performance of the Company and is the most relevant measure considered in the Company’s internal evaluation of the financial performance of its segments. Additionally, given its large number of businesses and complexity, the Company concluded that Adjusted PTC is a more

18

transparent measure that better assists investors in determining which businesses have the greatest impact on the Company’s results.