Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEOPLES FINANCIAL CORP /MS/ | d574333d8k.htm |

Exhibit 99.1 Peoples Financial Corporation Gulf South Bank Conference Presentation May 7, 2018

Peoples Financial Corporation OTCQX: PFBX

Safe Harbor Statement This presentation contains forward-looking statements and reflects industry conditions, company performance and financial results. These forward-looking statements are subject to a number of risk factors and uncertainties which could cause the Company’s actual results and experience to differ from the anticipated results and expectation expressed in such forward-looking statements.

Corporate Profile •The Peoples Bank founded 1896 •Headquarters -Biloxi, MS •Employees -151 •Branches -18 •ATMs -30

Market Statistics –3/31/2018 •Assets: $647 million •Market Cap: $70 million •Stock price 52 week range: $12.05 -$15.27 •Book value: $17.16 •Price/book: 0.81% •Shares outstanding: 5,072,794 •Insider Ownership: 35% •Institutional Ownership: 49%

FIRST QUARTER 2018 UPDATE •Net earnings totaled $292,000, a 395% increase over 1Q17 •Earnings for the year-ended December 31, 2017 totaled $2,758,000 vs $167,000 for the prior year •Net Interest Margin improved 25bps in 1Q18 vs 1Q17 •Loan volume decreased 9% in 1Q18 vs 1Q17 •Primary capital base of 14.24%, well in excess of regulatory minimums

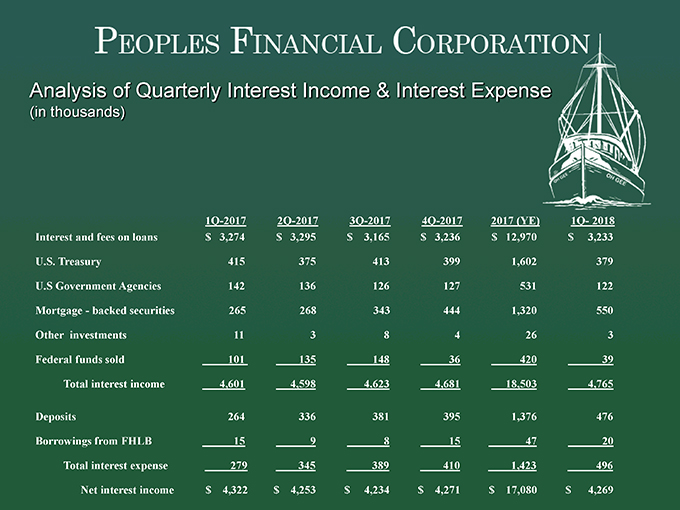

Analysis of Quarterly Interest Income & Interest Expense(in thousands) 1Q-20172Q-20173Q-20174Q-20172017 (YE)1Q-2018 Interest and fees on loans $ 3,274 $ 3,295 $ 3,165 $ 3,236 $ 12,970 $ 3,233 U.S. Treasury 415 375 413 399 1,602379 U.S Government Agencies142 136 126127531122 Mortgage -backed securities 265 268 3434441,320550 Other investments11384263 Federal funds sold 101 1351483642039 Total interest income4,6014,5984,6234,68118,5034,765 Deposits264 336 381 395 1,376 476 Borrowings from FHLB1598154720 Total interest expense 2793453894101,423496 Net interest income $ 4,322 $ 4,253 $ 4,234 $ 4,271 $ 17,080 $ 4,269

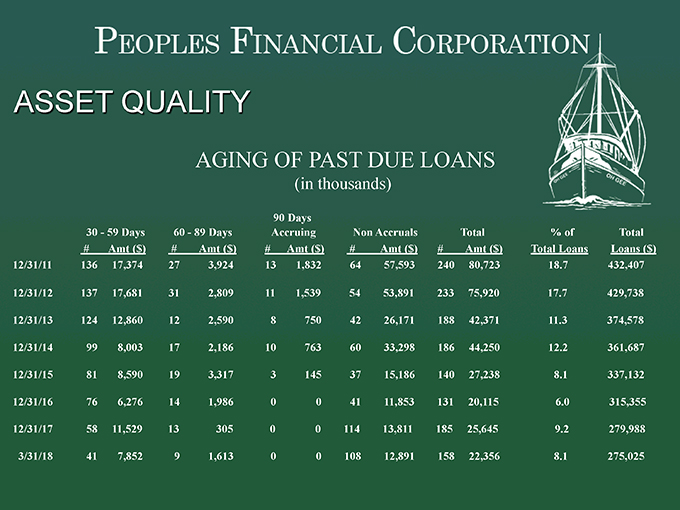

ASSET QUALITY AGING OF PAST DUE LOANS (in thousands) 90 Days 30 -59 Days 60 -89 Days Accruing Non Accruals Total % of Total # Amt ($)# Amt ($)# Amt ($)# Amt ($)# Amt ($)Total LoansLoans ($) 12/31/11 136 17,374 27 3,924 13 1,832 64 57,593 240 80,723 18.7 432,407 12/31/12137 17,681 31 2,809 11 1,539 54 53,891 233 75,920 17.7 429,738 12/31/13124 12,860 12 2,590 8 750 42 26,171 188 42,371 11.3 374,578 12/31/1499 8,003 17 2,186 10 763 60 33,298 186 44,250 12.2 361,687 12/31/1581 8,590 19 3,317 3 145 37 15,186 140 27,238 8.1 337,132 12/31/1676 6,276 14 1,986 0 0 41 11,853 131 20,1156.0 315,355 12/31/1758 11,529 13 305 0 0 114 13,811 185 25,645 9.2 279,988 3/31/1841 7,852 9 1,613 0 0 108 12,891 158 22,356 8.1 275,025

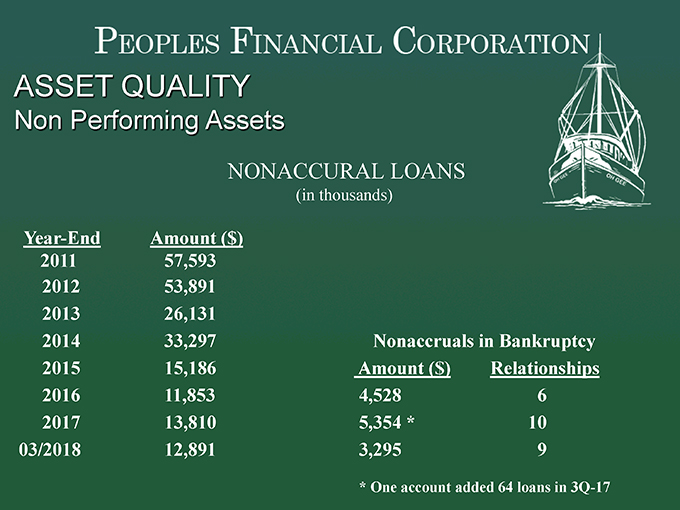

ASSET QUALITYNon Performing Assets NONACCURAL LOANS (in thousands) Year-EndAmount ($) 201157,593 201253,891 201326,131 201433,297Nonaccruals in Bankruptcy 201515,186Amount ($)Relationships 201611,8534,5286 201713,8105,354 *10 03/201812,8913,2959 * One account added 64 loans in 3Q-17

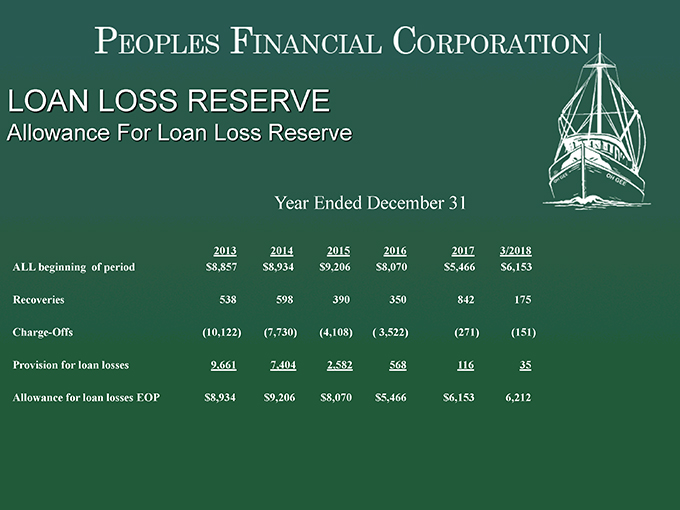

LOAN LOSS RESERVEAllowance For Loan Loss Reserve Year Ended December 31 201320142015201620173/2018 ALL beginning of period $8,857 $8,934 $9,206 $8,070 $5,466 $6,153 Recoveries538 598 390350842175 Charge-Offs(10,122) (7,730) (4,108) ( 3,522)(271)(151) Provision for loan losses9,6617,4042,58256811635 Allowance for loan losses EOP $8,934 $9,206 $8,070$5,466$6,1536,212

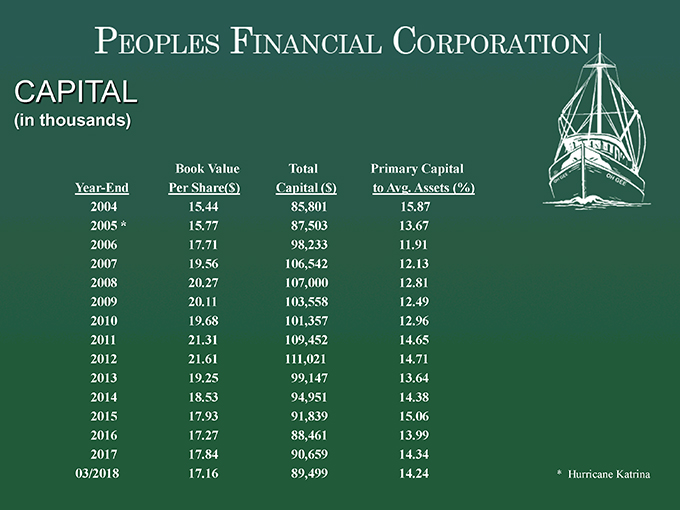

CAPITAL(in thousands) Book Value Total Primary Capital Year-EndPer Share($)Capital ($)to Avg. Assets (%) 200415.44 85,801 15.87 2005 * 15.7787,50313.67 200617.7198,23311.91 200719.56106,54212.13 200820.27107,00012.81 200920.11103,55812.49 201019.68101,35712.96 201121.31109,45214.65 201221.61111,02114.71 201319.2599,14713.64 201418.5394,95114.38 201517.9391,83915.06 201617.2788,46113.99 201717.8490,65914.34 03/201817.1689,49914.24 * Hurricane Katrina

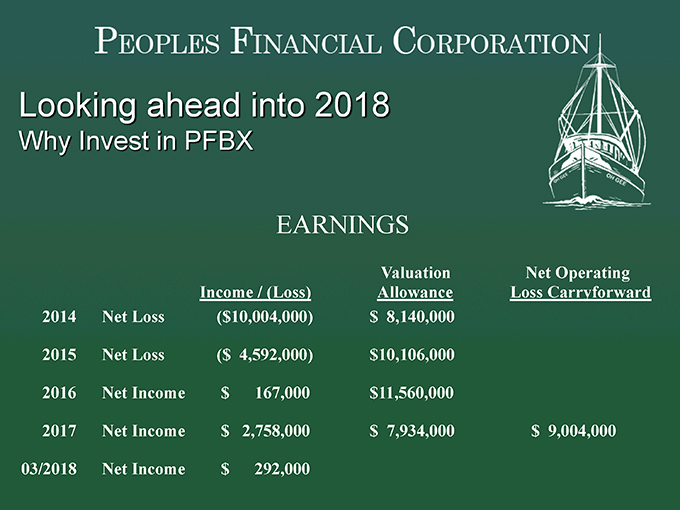

Looking ahead into 2018Why Invest in PFBX EARNINGS ValuationNet Operating Income / (Loss)AllowanceLoss Carryforward 2014Net Loss($10,004,000)$ 8,140,000 2015Net Loss($ 4,592,000)$10,106,000 2016Net Income$ 167,000$11,560,000 2017Net Income$ 2,758,000$ 7,934,000$ 9,004,000 03/2018Net Income$ 292,000

Looking ahead into 2018Why Invest in PFBX •MS Gulf Coast scheduled to receive bulk of BP Settlement -$600 million over 15 years •City of Biloxi expected to spend $200 million infrastructure improvements by YE-2019 •Current primary capital to average assets is 14.24% •Reestablishing regular dividend payment (5/10/18) •Stock repurchase plan fully funded; retired 50,392 shares of 110,000 share allocation

•Shareholder & Management interests are aligned •Net Interest Margin was 3.10% for 1Q18 vs 2.85% for 1Q17 •Cost of Funds was 0.24% (1Q18), lowest on MS Gulf Coast •Loan Loss Provision –Declining for past five years –2.19% as of 1Q18 –Lowest on the MS Gulf Coast Looking ahead into 2018Why Invest in PFBX

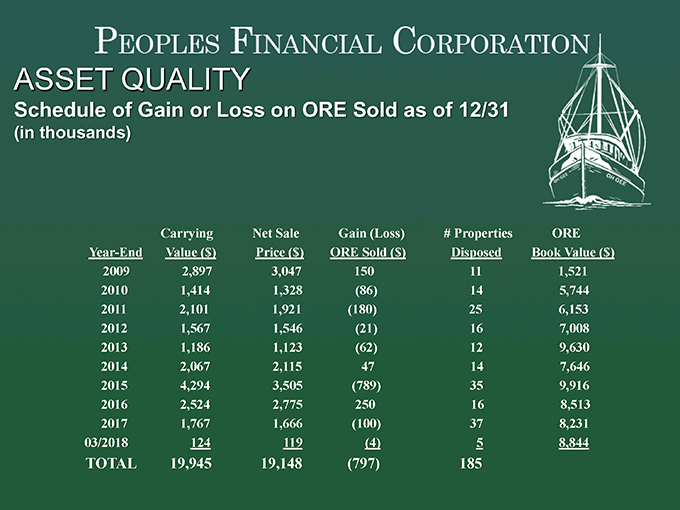

•Moved to OTCQX Best Market from NASDAQ Capital Market •Other Real Estate (“ORE”) –March/2008, eight properties totaling $8 –March/2015, ORE peaked totaling $12.3 million –Since Great Recession, sold 185 properties totaling $19.1 million Looking ahead into 2018Why Invest in PFBX

ASSET QUALITYSchedule of Gain or Loss on ORE Sold as of 12/31(in thousands) Carrying Net Sale Gain (Loss) # Properties ORE Year-EndValue ($)Price ($)ORE Sold ($)DisposedBook Value ($) 20092,897 3,047 150 11 1,521 2010 1,414 1,328 (86) 14 5,744 2011 2,101 1,921 (180) 25 6,153 2012 1,567 1,546 (21) 16 7,008 2013 1,186 1,123 (62) 12 9,630 2014 2,067 2,115 47 14 7,646 2015 4,294 3,505 (789) 35 9,916 2016 2,524 2,775 250 16 8,513 2017 1,767 1,666 (100) 37 8,231 03/2018 124119(4)58,844 TOTAL 19,945 19,148 (797) 185

Market Area

Information Corporate Office Mailing Address P.O. Box 529 Biloxi, MS 39533 Physical Address 152 Lameuse St. Biloxi, MS 39530 (228)435-8205 Website www.thepeoples.com Shareholder Information Asset Management & Trust Department The Peoples Bank P.O. Box 1416 Biloxi, MS 39533-1416 (228)435-8208 investorrelations@thepeoples.com S.E.C. Form 10-K Requests Lauri A. Wood, Chief Financial Officer Peoples Financial Corporation P.O. Box 529 Biloxi, MS 39533-0529 (228)435-8412 lwood@thepeoples.com