Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Kosmos Energy Ltd. | kos-3312018xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Kosmos Energy Ltd. | kos-3312018xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Kosmos Energy Ltd. | kos-3312018xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Kosmos Energy Ltd. | kos-3312018xex311.htm |

| EX-10.10 - EXHIBIT 10.10 - Kosmos Energy Ltd. | kos-03312018xex1010.htm |

| EX-10.9 - EXHIBIT 10.9 - Kosmos Energy Ltd. | kos-03312018xex1009.htm |

| EX-10.8 - EXHIBIT 10.8 - Kosmos Energy Ltd. | kos-03312018xex1008.htm |

| EX-10.7 - EXHIBIT 10.7 - Kosmos Energy Ltd. | kos-03312018xex1007.htm |

| EX-10.6 - EXHIBIT 10.6 - Kosmos Energy Ltd. | kos-03312018xex1006.htm |

| EX-10.4 - EXHIBIT 10.4 - Kosmos Energy Ltd. | kos-03312018xex1004.htm |

| EX-10.3 - EXHIBIT 10.3 - Kosmos Energy Ltd. | kos-03312018xex1003.htm |

| EX-10.2 - EXHIBIT 10.2 - Kosmos Energy Ltd. | kos-03312018xex1002.htm |

| EX-10.1 - EXHIBIT 10.1 - Kosmos Energy Ltd. | kos-03312018xex1001.htm |

| 10-Q - 10-Q - Kosmos Energy Ltd. | kos-33118x10q.htm |

Exhibit 10.05

PRODUCTION SHARING CONTRACT

BETWEEN

THE REPUBLIC OF EQUATORIAL GUINEA

AND

GUINEA ECUATORIAL DEPETROLEOS

AND

KOSMOS ENERGY EQUATORIAL GUINEA

FOR

BLOCK “EG 21”

BETWEEN

THE REPUBLIC OF EQUATORIAL GUINEA

AND

GUINEA ECUATORIAL DEPETROLEOS

AND

KOSMOS ENERGY EQUATORIAL GUINEA

FOR

BLOCK “EG 21”

TABLE OF CONTENTS

ARTICLE 1 | DEFINITIONS AND SCOPE | 2 | |

ARTICLE 2 | EXPLORATION PERIOD AND RELINQUISHMENTS | 9 | |

ARTICLE 3 | EXPLORATION WORK OBLIGATIONS | 12 | |

ARTICLE 4 | ANNUAL WORK PROGRAMS AND BUDGETS | 15 | |

ARTICLE 5 | APPRAISAL OF A DISCOVERY AND PRODUCTION PERIOD | 17 | |

ARTICLE 6 | CONDUCT OF PETROLEUM OPERATIONS | 21 | |

ARTICLE 7 | ROYAL TIES, RECOVERY OF PETROLEUM OPERATIONS COSTS, AND DISTRIBUTION OF PRODUCTION | 29 | |

ARTICLE 8 | PARTICIPATION INTERESTS | 31 | |

ARTICLE 9 | TAXATION | 32 | |

ARTICLE 10 | VALUATION OF CRUDE OIL | 33 | |

ARTICLE 11 | BONUSES AND SURFACE RENTAL | 35 | |

ARTICLE 12 | OBLIGATION TO SUPPLY DOMESTIC MARKET | 37 | |

ARTICLE 13 | NATURAL GAS | 37 | |

ARTICLE 14 | CUSTOMS REGULATIONS | 40 | |

ARTICLE 15 | FOREIGN CURRENCY | 41 | |

ARTICLE 16 | BOOKS, ACCOUNTS, AUDITS AND PAYMENTS | 43 | |

ARTICLE 17 | TRANSFER, ASSIGNMENT AND CHANGE OF CONTROL | 44 | |

ARTICLE 18 | INDEMNIFICATION, LIABILITY AND INSURANCE | 47 | |

ARTICLE 19 | TITLE OF GOODS, EQUIPMENT AND DATA | 48 | |

ARTICLE 20 | CONFIDENTIALITY | 49 | |

ARTICLE 21 | TERMINATION | 50 | |

ARTICLE 22 | UNITIZATION | 51 | |

ARTICLE 23 | LOCAL CONTENT AND SOCIAL PROGRAMS | 52 | |

ARTICLE 24 | DECOMMISSIONING | 55 | |

ARTICLE 25 | APPLICABLE LAW | 57 | |

ARTICLE 26 | RESOLUTION OF CONFLICTS AND ARBITRATION | 57 | |

ARTICLE 27 | FORCE MAJEURE | 59 | |

ARTICLE 28 | ASSISTANCE AND NOTICE | 61 | |

ARTICLE 29 | MISCELLANEOUS | 62 | |

ARTICLE 30 | INTERPRETATION | 63 | |

ARTICLE 31 | EFFECTIVE DATE | 64 | |

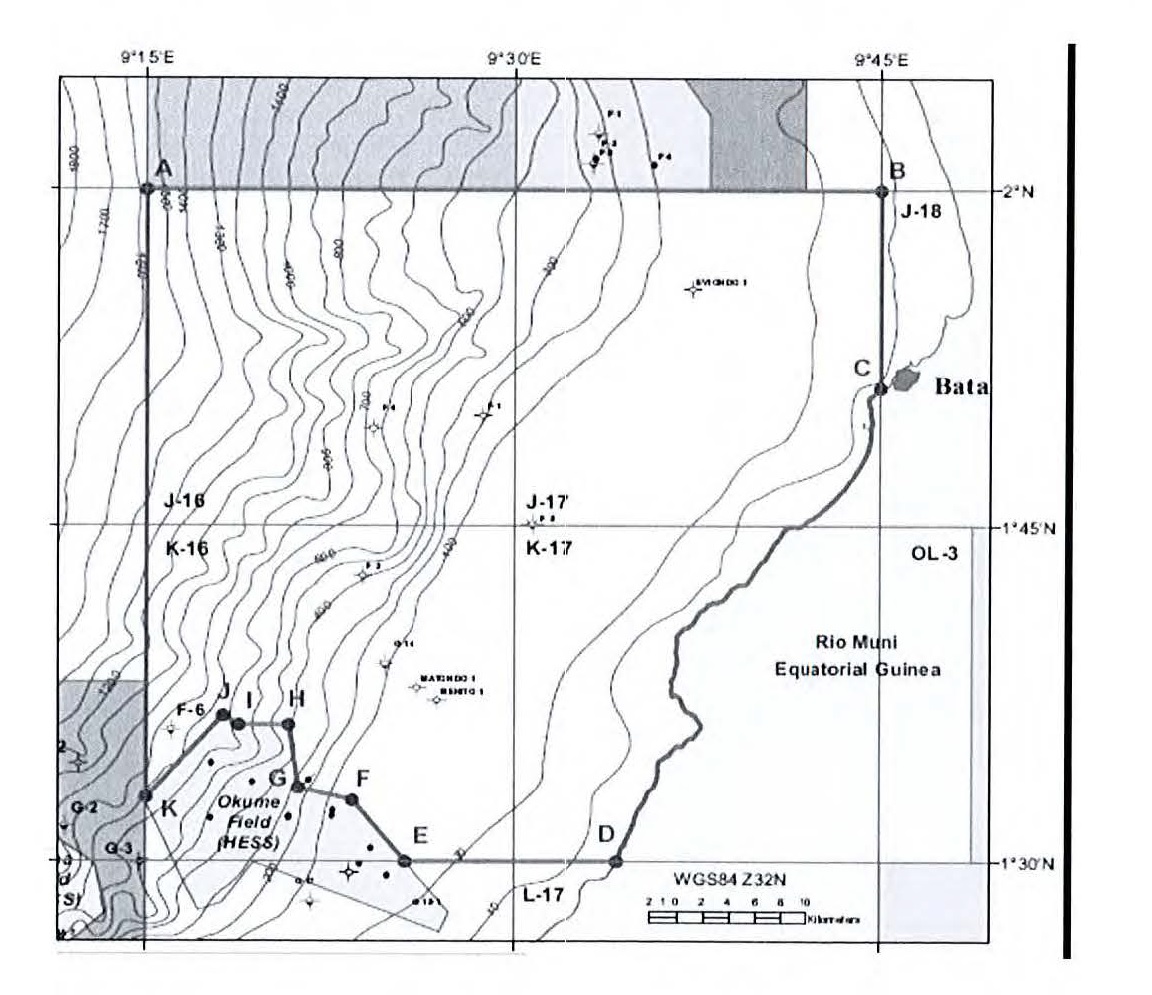

ANNEX A | CONTRACT AREA | 66 | |

ANNEX B | MAP OF THE CONTRACT AREA | 68 | |

ANNEX C | ACCOUNTING PROCEDURE | 69 | |

i

THIS PRODUCTION SHARING CONTRACT is dated this ____ day of _______ 2017

BETWEEN:

(1) | THE REPUBLIC OF EQUATORIAL GUINEA (hereinafter referred to as the State), represented for the purposes of this Contract by the Ministry of Mines and Hydrocarbons, represented for purposes of its execution by His Excellency Mr. Gabriel Mbaga OBIANG LIMA, the Minister; |

(2) | GUINEA ECUATORIAL DE PETRÓLEOS (hereinafter referred to as the National Company), acting in its own name and legal right for the purposes of this Contract and represented for purposes of its execution by Mr. Antonio OBURU ONDO, in his capacity as Director General; and |

(3) | KOSMOS ENERGY EQUATORIAL GUINEA, a company organized and existing under the laws of the Cayman Islands, under company registration number WT-269135 and having its registered office at do Circumference (Cayman), P.O. Box 32322, 4th Floor, Century Yard, Cricket Square, Elgin Avenue, George Town, Grand Cayman, KYI-1209, Cayman Islands (hereinafter referred to as Company), represented for the purposes of this Contract by [insert name Andrew G. Inglis], in his capacity as [insert position President]. |

RECITALS:

(A) | WHEREAS, all Hydrocarbons existing within the territory of the Republic of Equatorial Guinea, as set forth in the Hydrocarbons Law, are national resources owned exclusively by the. State; |

(B) | WHEREAS, the State wishes to promote the development of Hydrocarbon deposits within the Contract Area and the Contractor desires to associate itself with the State with a view to accelerating the Development and Production of Hydrocarbons within the Contract Area; |

(C) | WHEREAS, the Contractor has the financial ability, technical competence and professional skills necessary to carry out Petroleum Operations in accordance with this Contract and good oil field practices; and |

(D) | WHEREAS, the Parties desire to enter into this Contract in accordance with the Hydrocarbons Law, which allows for agreements to be entered into between the State and foreign investors in the form of a production sharing contract, through direct negotiation or by international public tender. |

NOW THEREFORE, in consideration of the undertakings and mutual covenants contained herein, the Parties agree as follows:

1

ARTICLE 1

DEFINITIONS AND SCOPE

DEFINITIONS AND SCOPE

1.1 | Definitions |

Except where the context otherwise indicates or as defined in the Hydrocarbons Law or Petroleum Regulations, the following words and expressions shall have the following meanings:

1.1.1 | Accounting Procedure means the accounting procedure set forth in Annex C. |

1.1.2 | Affiliated Company or Affiliate of any specified Person means any other Person directly or indirectly Controlling or Controlled by or under direct or indirect common Control of such specified Person or other Person. |

1.1.3 | Annual Budget means the expenditure of the Contractor with respect to an Annual Work Program. |

1.1.4 | Annual Work Program means an itemized statement of the Petroleum Operations to be carried out in the Contract Area during a Calendar Year. |

1.1.5 | Appraisal Area means an area within the Contract Area encompassing the geographical extent of a Discovery that is subject to an Appraisal work program and corresponding budget in accordance with Article 5.2. |

1.1.6 | Appraisal Well means a Well drilled following a Discovery, with the objective of delimiting and mapping the reservoir, and also to estimate the quantity of recoverable Hydrocarbons. |

1.1.7 | Associated Natural Gas means all Natural Gas produced from a reservoir the predominant content of which is Crude Oil and which is separated from Crude Oil in accordance with generally accepted international petroleum industry practice, including free gas cap, but excluding any liquid Hydrocarbons extracted from such gas either by normal field separation, dehydration or in a gas plant. |

1.1.8 | Barrel means a quantity or unit of Crude Oil equal to 158.9874 liters (forty-two (42) United States gallons) at a temperature of fifteen point five six degrees (15.56°) Centigrade (sixty degrees (60°) Fahrenheit) and at one (I) atmosphere of pressure. |

1.1.9 | BEAC means Banco de los Estados de Africa Central (Bank of the States of Central Africa). |

1.1.10 | Book Value means the value at which the asset is carried on the balance sheet prepared in accordance with generally accepted accounting practices used in the international petroleum industry. |

1.1.11 | Business Day means a day on which the banks are generally open for business in Equatorial Guinea and Dallas, Texas. |

2

1.1.12 | Calendar Year or Year means a period of twelve (12) months commencing on 1 January and ending on the following 31 December of the same year according to the Gregorian Calendar. |

1.1.13 | Change in Law means, with respect to Article 25, any change in the laws, decrees, regulations or standards of Equatorial Guinea, effective as of January 1, 2017, including with respect to any fiscal, taxes, Customs, or currency control, any change in the interpretation or application of, or in the customs and practices related to, such laws (the provisions of this Contract are deemed to conform to said interpretation and application from the date hereof) Decrees, regulations or rules of Equatorial Guinea and excludes all laws, decrees, regulations or standards which: (i) are related to health, safety, labor and the environment, (ii) are consistent with the international practices and standards of the oil and gas industry, and (iii) are applied on a non-discriminatory basis. |

1.1.14 | CIF has the meaning set out in the publication of the International Chamber of Commerce, INCOTERMS 2010. |

1.1.15 | Commercial Discovery means a Discovery that the Contractor has determined to be economically viable and so submits a Development and Production Plan for such Discovery for the approval of the Ministry. |

1.1.16 | Cost Recovery Oil has the meaning ascribed to it in Article 7.2.1. |

1.1.17 | Contractor means Company and the National Company. |

1.1.18 | Contract means this production sharing contract, including its Recitals and Annexes. |

1.1.19 | Contract Year means a period of twelve (12) consecutive months according to the Gregorian calendar, counted from the Effective Date of this Contract or from the anniversary of such Effective Date. |

1.1.20 | Contract Area or Area means the geographic area within the territory of Equatorial Guinea, which is the subject of this Contract. Such Contract Area shall be described in Annex .A and illustrated in Annex B, as it may be changed by relinquishments of the Contractor in accordance with this Contract. |

1.1.21 | Control, when used with respect to any specified Person, means the power to direct, administer and dictate policies of such Person through the ownership of a percentage of such Person’s equity sufficient to hold a majority of voting rights in an ordinary shareholders meeting. The terms Controlling and Controlled have meanings correlative to the foregoing. |

1.1.22 | Crude Oil means Hydrocarbons which are produced at the wellhead in a liquid state at atmospheric pressure including asphalt and ozokerites, and the liquid Hydrocarbons known as condensate and/or Natural Gas liquids obtained from Natural Gas by condensation or extraction through field separation units. |

1.1.23 | Dated Brent means a quote published daily in the Crude Oil Market Plans Bulletin that reflects the price of a North Sea Brent crude oil blend charge over a given period. |

3

1.1.24 | Development and Production Plan has the meaning ascribed to it in Article 5.5.1. |

1.1.25 | Delivery Point means that point located within the jurisdiction of Equatorial Guinea at which Hydrocarbons reach (i) the inlet flange at the FOB export 3 vessel, (ii) the loading facility metering station of a pipeline or (iii) such other point within the jurisdiction of Equatorial Guinea as may be agreed by the Parties. |

1.1.26 | Development and Production Area means an area within the Contract Area encompassing the geographical extent of a Commercial Discovery subject to a Development and Production Plan in accordance with Article 5.5. |

1.1.27 | Development and Production Costs means all costs, expenses and liabilities incurred by the Contractor in connection with Development and Production Operations in a Development and Production Area, excluding all Exploration Costs incurred in the Development and Production Area prior to the establishment of any Field, as determined in accordance with this Contract and the Hydrocarbons Law. |

1.1.28 | Development and Production Operations means all operations, other than Exploration Operations, conducted to facilitate the Development and Production of Hydrocarbons from the Contract Area to the Delivery Point, but excluding the refining and distribution of Hydrocarbon products. |

1.1.29 | Development Well means a Well, other than an Exploration Well or an Appraisal Well, drilled with the purpose of producing or improving the Production of Hydrocarbons, including Exploration Wells and Appraisal Wells completed as production or injection Wells. |

1.1.30 | Discovery means the finding by the Contractor of Hydrocarbons whose existence within the Contract Area was not known prior to the Effective Date or Hydrocarbons within the Contract Area which had not been declared a Commercial Discovery prior to the Effective Date and which are measurable by generally accepted international petroleum industry practices. |

1.1.31 | Dividend Withholding Tax has the meaning ascribed to it in Article 17.1.1. |

1.1.32 | Dollars or $ means the legal tender of the United States of America. |

1.1.33 | Effective Date means the date of receipt by the Contractor of the ratification by the State of this Contract pursuant to Article 31. |

1.1.34 | Equatorial Guinea means the Republic of Equatorial Guinea. |

1.1.35 | Exploration Operations include geological and geophysical studies, aerial mapping, investigations relating to subsurface geology, stratigraphic test drilling, Exploration Wells, Appraisal Wells and related activities such as drill site preparation, surveying and ail work connected therewith that is conducted in relation to the Exploration for and Appraisal of Hydrocarbon deposits in the Contract Area. |

4

1.1.36 | Exploration Costs means all costs, expenses and liabilities incurred by the Contractor in connection with Exploration Operations in the Contract Area, as determined in accordance with this Contract and the Hydrocarbons Law. |

1.1.37 | Extension Period means the First Extension Period and the Second Extension Period individually. |

1.1.38 | Exploration Periods means the Initial Exploration Period, an Extension Period and any further extensions thereof as set out in Article 2.2.1. |

1.1.39 | Exploration Well means any Well whose sole objective is to verify the existence of Hydrocarbons or to study all the necessary elements that might lead to a Discovery. |

1.1.40 | Field means a Discovery or an aggregation of Discoveries that is established as a Field in accordance with Article 5 and can be developed commercially after taking into account all pertinent operational, economic and financial data collected during the performance of the Appraisal work program or otherwise, in accordance with generally accepted international petroleum practices. A Field may consist of a Hydrocarbon reservoir or multiple Hydrocarbon reservoirs all grouped on or related to the same individual geological structural or stratigraphic conditions, or areas that are not related but will be developed by using a single Development and Production Plan. All deposits superimposed, adjacent to or underlying a Field in the Contract Area shall form part of the said Field. |

1.1.41 | FOB has the meaning set out in the publication of the International Chamber of Commerce, INCOTERMS 2010. |

1.1.42 | First Extension Period means the period of one (1) Contract Year commencing immediately after the conclusion of the Initial Exploration Period. |

1.1.43 | First Exploration Sub-Period means the first three (3) Contract Year(s) of the Initial Exploration Period. |

1.1.44 | First Oil means, in respect of each Development and Production Area, the date on which production of Hydrocarbons under a program of regular production, lifting and sale commences. |

1.1.45 | Gross Revenues means the total income from sales of Total Disposable Production plus the equivalent monetary value of any other disposal of Total Disposable Production from the Contract Area during any Calendar Year. |

1.1.46 | Hydrocarbons means all natural organic substances composed of carbon and hydrogen, including Crude Oil and Natural Gas that may be found and extracted from, or otherwise produced and saved from the Contract Area. |

1.1.47 | Hydrocarbons Law means Law No. 8/2006 dated 3 November 2006 of Equatorial Guinea, and any law that amends it or replaces it. |

1.1.48 | Initial Exploration Period means a period of five (5) Contract Years from the Effective Date, subdivided into two sub-periods of three (3) Contract Years for the First |

5

Exploration Sub-Period and two (2) Contract Years for the Second Exploration Sub-Period.

1.1.49 | Joint Operating Agreement or JOA means the joint operating agreement that regulates the internal relations of the Parties comprising the Contractor for the conduct of Petroleum Operations in the Contract Area. |

1.1.50 | LIBOR means the interest rate at which Dollar deposits of six (6) months duration are offered in the London Inter Bank Market, as published in the Financial Times of London. The applicable LIBOR rate for each month or part thereof within an applicable interest period shall be the interest rate published in the Financial Times of London on the last Business Day of the immediately preceding calendar month. If no such rate is quoted in the Financial Times of London during a period of five (5) consecutive Business Days, another rate (for example, the rate quoted in the Wall Street Journal) chosen by mutual agreement between the Ministry and the Contractor will apply. |

1.1.51 | Market Price means the FOB price for Crude Oil calculated in accordance with Article 10. |

1.1.52 | Material Contract means a contract with a value greater than five hundred thousand Dollars ($500,000) with respect to Exploration Operations or to one million Dollars ($1,000,000) in respect of Development Operations or Production Operations with (i) a Operator Affiliate, when the contract has not been previously and specifically approved in an Annual Budget as a contract to be carried out by an Affiliate or (ii) a non-Affiliate of the Operator. In the event that a law or regulation establishes a value higher than that stipulated in this definition for the supervision of contracts by the State, this definition will be amended to reflect the new higher limit. |

1.1.53 | Maximum Efficient Production Rate means the maximum efficient production rate of Hydrocarbons from a Field, that does not damage reservoir formations and does not cause excessive decline or loss of reservoir pressure in accordance with good oil field practice and as agreed in accordance with Article 6.4. |

1.1.54 | Member State of CEMAC means a country that is a member of the Central African Economic and Monetary Community. |

1.1.55 | Member State of the OHADA means a country that is a member of the Organization for the Harmonization of Commercial Law in Africa. |

1.1.56 | Minimum Retention means that the Operator and its Affiliates shall maintain a minimum deposit amount. This amount shall be measured annually and per Calendar Year, at one or more banks chosen by the Operator and operating in Equatorial Guinea. The amounts will be as follows: |

a) | From the effective date until the approval of the first Development and Production Plan, a deposit amount equivalent to ten per cent (10 %) of the Annual Budget applicable to such Calendar Year; |

6

b) | From the approval of the first Development and Production Plan, and until First Oil, a deposit amount equivalent to point five per cent (0.5 %) of the Annual Budget applicable to such Calendar Year; and |

c) | From First Oil until the end of Operations„ a deposit amount equivalent to a five per cent (5 %) of the Annual Budget applicable to such Calendar Year; provided that |

d) | If, at any time, a later Development and Production Plan is approved and should this Plan require a development operation, the deposit amount required shall return to a point five per cent (0.5 %) of the Annual Budget applicable to such Calendar Year, until the year following the year during which the development operations foreseen in such Development and Production Plan cease to exist. |

1.1.57 | Minimum Work Program has the meaning ascribed to it in Article 3.1. |

1.1.58 | Ministry means the Ministry of Mines and Hydrocarbons of Equatorial Guinea, the entity responsible for supervising Petroleum Operations in coordination with other Government bodies within the respective areas of their competence, and any successor. |

1.1.59 | National Company for the purposes of this Contract, means Equatorial Guinea of Petroleum (GEPetrol), as a national oil company of Equatorial Guinea; or any successor state company. |

1.1.60 | National Company’s Participation Interest means the Participation Interest of the National Company as set forth in Article 1.3. |

1.1.61 | Natural Gas means those Hydrocarbons that, at atmospheric conditions of temperature and pressure, are in a gaseous state including dry gas, wet gas and residual gas remaining after extraction, treatment, processing, or separation of liquid Hydrocarbons from wet gas, as well as gas or gases produced in association with liquid or gaseous Hydrocarbons. |

1.1.62 | Net Crude Oil has the meaning ascribed to it in Article 7.3. |

1.1.63 | Net Natural Gas has the meaning ascribed to in Article 13.3.5. |

1.1.64 | Parties or Party means the parties or a party to this Contract, as the context may require. |

1.1.65 | Participation Interest means for each Party comprising the Contractor, the undivided percentage share of such Party in the rights and obligations under this Contract, as is specified in Article 1.3. |

1.1.66 | Person means any individual, firm, company, corporation, society, trust, foundation, government, state or agency of the state or any association or partnership (whether or not having separate legal personality) or two or more of these. |

1.1.67 | Petroleum Operations means all operations related to Exploration, Development, Production, transportation, storage, conservation, decommissioning, sale and/or other disposal of Hydrocarbons from the Contract Area to the Delivery Point and any other |

7

work or activities necessary or ancillary to such operations; these operations and activities shall be carried out in accordance with this Contract and the Hydrocarbons Law and shall not include transport outside of Equatorial Guinea.

1.1.68 | Petroleum Operations Costs means Exploration Costs and/or Development and Production Costs (as the context may require) incurred by the Contractor in the carrying out of Petroleum Operations, as determined in accordance with this Contract and the Accounting Procedure. |

1.1.69 | Petroleum Regulations means all regulations promulgated by the Ministry pursuant to the Hydrocarbons Law. |

1.1.70 | Platts means Platts Crude Oil Marketwire, or if Platts Crude Oil Marketwire ceases to be published then another similar daily international publication that lists benchmark crude oil prices and which is agreed at the time between the Parties. |

1.1.71 | Quarter means a period of three (3) consecutive months beginning on I January, 1 April, 1 July or 1 October and ending on 31 March, 30 June, 30 September or 31 December, respectively. |

1.1.72 | Reserve Fund has the meaning ascribed to it in Article 24.3.1. |

1.1.73 | Royalties means an entitlement of the State over Hydrocarbons produced and saved from the Contract Area, and not utilized in Petroleum Operations, based on percentages calculated as a function of the daily rate of the Total Disposable Production as determined in accordance with Article 7.1. |

1.1.74 | Second Extension Period means the period of one (1) Contract Year commencing immediately after the end of the First Extension Period. |

1.1.75 | Second Exploration Sub-Period means the final two (2) Contract Year(s) of the Initial Exploration Period. |

1.1.76 | Taxes mean the coercive financial payments in accordance to the Tax Laws, that the State, local authorities and/ other public entities, demand in the exercise of their sovereign power. These taxes will be levied on each of the Parties comprising the Contractor and all other applicable Persons. |

1.1.77 | Tax Laws means Law No. 4/2004 dated 28 October 2004 of Equatorial Guinea, and Law No. 2/2007 dated 16 May 2007 of Equatorial Guinea, and any law that amends one or both of them or replaces one or both of them. |

1.1.78 | Transfer Fee has the meaning ascribed to in Article 17.2.1. |

1.1.79 | Total Disposable Production means all Hydrocarbons produced and saved from a Development and Production Area less the quantities used for Petroleum Operations. |

1.1.80 | Unassociated Natural Gas means all gaseous Hydrocarbons produced from Natural Gas reservoirs, and includes wet gas, dry gas and residual gas remaining after the extraction of liquid Hydrocarbons from wet gas. |

8

1.1.81 | Well means any opening in the ground or seabed made or being made by drilling or boring, or in any other manner, for the purpose of exploring and/or discovering, evaluating or producing Crude Oil or Natural Gas, or for the injection of any fluid or gas into an underground formation other than a seismic hole. |

1.1.82 | Withholding Tax Waiver has the meaning ascribed to it in Article 17.1.1. |

1.2 | Scope |

1.2.1 | This Contract is a production sharing contract awarded pursuant to Chapter IV of the Hydrocarbons Law. In accordance with the provisions of this Contract and the Hydrocarbons Law, the Ministry shall be responsible for supervising Petroleum Operations in the Contact Areas. |

1.2.2 | The State grants to the Contractor the sole and exclusive right and charge of conducting all Petroleum ‘Operations in the Contract Area during the term of this Contract. In consideration of this, the Contractor shall: |

a) | be responsible to the State as an independent contractor, for the execution of the Petroleum Operations in accordance with the provisions of this Contract and the Hydrocarbons Law; |

b) | provide all funds, machinery, equipment, technology and personnel prudent and necessary to conduct Petroleum Operations; and |

c) | diligently, with due regard to good oil field practice, perform at its exclusive responsibility and risk all investments and contractual obligations necessary for conducting Petroleum Operations in accordance with this Contract. |

1.2.3 | All Petroleum Operations Costs shall be recoverable and deductible for tax purposes in the manner set forth in this Contract and the Hydrocarbons Law. |

1.2.4 | During the term of this Contract, the total Production achieved as a consequence of Petroleum Operations shall be shared between the Parties in accordance with Article 7. |

1.3 | Participation Interests |

On the Effective Date the Participation Interests of the Parties comprising the Contractor are as follows:

Kosmos Energy | 80% |

The National Company (GEPetrol) | 20% |

Total | 100% |

ARTICLE 2

EXPLORATION PERIOD AND RELINQUISHMENTS

EXPLORATION PERIOD AND RELINQUISHMENTS

9

2.1 | Initial Exploration Period |

As of and from the Effective Date, the Contractor is authorized to conduct Exploration Operations in the Contract Area during the Initial Exploration Period.

2.1.1 | Upon the fulfillment by the Contractor of its Exploration obligations set forth in Article 3.1.1 with respect to the First Exploration Sub-Period, the Contractor may elect to enter the Second Exploration Sub-Period. |

2.1.2 | To elect to enter the Second Exploration Sub-Period, the Contractor shall file a request with the Ministry at least two (2) months prior to the expiry of the First Exploration Sub-Period. The Ministry shall not unreasonably withhold or delay the granting of such request; provided that the Contractor has complied with all of its obligations in the First Exploration Sub-Period and shall not be otherwise in breach of this Contract. |

2.2 | Extension Periods |

2.2.1 | Upon the fulfillment by the Contractor of its Exploration obligations set forth in Articles 3.1.1 and 3.1.2 with respect to the Initial Exploration Period, the Contractor may request up to two (2) extensions of one (1) year each of the Initial Exploration Period. |

2.2.2 | For each Extension Period, the Contractor shall file a request with the Ministry at least two (2) months prior to the expiry of the Initial Exploration Period, or as the case may be, the First Extension Period. The Ministry shall not unreasonably withhold or delay the granting of such Extension Period; provided that the Contractor has complied with all of its obligations in the Initial Exploration Period and the First Extension Period, as applicable, and shall not be otherwise in breach of this Contract. |

2.2.3 | Each request for an Extension Period shall be accompanied by a map specifying the Contract Area proposed to be retained by the Contractor, along with a report specifying any work performed in the proposed relinquished area since the Effective Date and the results obtained therefrom. |

2.2.4 | If upon expiry of the Initial Exploration Period, or of any Extension Period, any Appraisal work program with respect to a Discovery is still under progress or an Exploration Well is still under progress, the Contractor shall be entitled to an additional extension of the then current Exploration Period necessary to complete the work in progress. Furthermore, where Appraisal work has not yet been completed by the Contractor at the time at which a relinquishment contemplated by Article 2.4 is due, the requirement to relinquish shall be suspended until such time that the Contractor completes the said Appraisal work, commerciality is determined and, if applicable, the related establishment of a Field is approved or denied. Any additional extension granted under this Article 2.2.4 shall not exceed one ( I) Contract Year, or such longer period as may be approved by the Ministry, plus the period of time established under Article 5 necessary for the evaluation of a marketing plan, the preparation of a Development and Production Plan and the Ministry’s response. |

2.2.5 | In the event additional time is needed to complete said Appraisal work as set out in Article 2.2.4, the Contractor shall file a request for an extension with the Ministry at least two (2) months prior to the expiry of the current Initial Exploration Period or |

10

Extension Period, as applicable. In the event additional time is needed to complete an Exploration Well still under progress, the current Initial Exploration Period or Extension Period, as applicable, upon notification to the Ministry, will be extended automatically for such time necessary to complete said Exploration Well and an additional thirty (30) days to allow for the time to deliver the notice of Discovery as required in Article 5.1.

2.3 | Termination |

Should the Contractor decide:

(a) | not to extend the Initial Exploration Period (or not to enter the Second Exploration Sub-Period) and no Field has been established during such period; or |

(b) | to extend the Initial Exploration Period and no Field has been established during an Extension Period or any additional extension thereof, |

this Contract shall automatically terminate.

2.4 | Mandatory Relinquishments |

2.4.1 | The Contractor must relinquish to the State thirty percent (30%) of the initial surface area of the Contract Area by the end of the Initial Exploration Period, twenty-five percent (25%) of the remaining area by the end of the First Extension Period, and the remainder of the Contract Area by the end of the Second Extension Period, or at the end of the Initial Exploration Period or the First Extension Period, if no further extension is requested by the Contractor. To determine the area or areas which the Contractor shall relinquish, the following areas shall be excluded for the purposes of such calculation: |

(a) | areas designated as an Appraisal Area; |

(b) | Development and Production Areas; |

(c) | areas for which the approval of a Development and Production Plan is pending, until finally decided; |

(d) | the area of any Field, including any Field which may be subject to unitization pursuant to Article 22; and |

(e) | any area reserved for a possible Unassociated Natural Gas Appraisal in relation to which the Contractor is engaged in discussions with the Ministry in accordance with Article 13.1. |

2.4.2 | Upon expiry of the applicable final extension period indicated in Article 2.2, and subject to the provisions of Article 2.2.4, the Contractor shall relinquish the remainder of the Contract Area, with the exception of: |

(a) | Development and Production Areas; |

(b) | those areas for which an application for a Development and Production Area is pending, until finally decided; |

11

(c) | the area of any Field, including any Field which may be subject to unitization pursuant to Article 22; and |

(d) | any area reserved for a possible Unassociated Natural Gas Appraisal in relation to which the Contractor is engaged in discussions with the Ministry in accordance with Article 13. |

2.5 | Voluntary Relinquishments |

2.5.1 | Subject to the Contractor’s obligations under Article 24 and the Hydrocarbons Law, the Contractor may at any time notify the Ministry upon three (3) months prior notice that it relinquishes all of its rights over all or any part of the Contract Area. |

2.5.2 | In no event shall any voluntary relinquishment by the Contractor of rights over all or any part of the Contract Area reduce the Exploration obligations of the Contractor set forth in Article 3. |

2.6 | Involuntary Relinquishments |

2.6.1 | Should the Contractor, during the First Exploration Sub-Period (as may be extended), (i) be unable to fulfill its Minimum Work Program pursuant to Article 3.1.1(a) or (ii) be unable fulfill its Minimum Work Program pursuant to Article 3.1.1(b), excluding for reasons of Force Majeure or acts or failure to act by the State, including failure to deliver the data package referenced in Article 3.1.1(b), then the Contractor will relinquish all its rights on the whole of the Contract Area at the end of the First Exploration Sub-Period (as may be extended). |

2.7 | Relinquishments Generally |

2.7.1 | No relinquishment made in accordance with Articles 2.4 or 2.5 shall relieve the Contractor from its obligation to pay surface rentals accrued or make payments due and payable as a result of Petroleum Operations conducted up to the date of relinquishment. |

2.7.2 | The Contractor shall, in accordance with good oil field practice, propose the geographic location of the portion of the Contract Area that it proposes to retain, and which shall have a continuous geometric shape going from North to South and East to West delimited as a minimum by one minute (1’) of latitude or longitude or by natural boundaries and such area shall also be subject to the approval of the Ministry and shall be deemed approved after sixty (60) days. |

ARTICLE 3

EXPLORATION WORK OBLIGATIONS

EXPLORATION WORK OBLIGATIONS

3.1 | Minimum Work Program |

During the Exploration Period, the Contractor undertakes to carry out the following Minimum Work Program:

3.1.1 | During the First Exploration Sub-Period, the Contractor must: |

12

(a) | acquire, process, and interpret 2,250 square kilometers of new 3D seismic data; andacquire all existing data packages (both seismic and well) over the Area for $1,076,000. All costs of data acquisition shall be cost recoverable. |

(b) | The minimum expenditure for this Sub-Period shall be seven million Dollars ($7,000,000). |

3.1.2 | During the Second Exploration Sub-Period, the Contractor must drill a minimum of one (1) Exploration Well to a minimum depth of the deepest target interval in the approved well program. The minimum expenditure for this period shall be thirty million Dollars ($30,000,000). |

3.1.3 | If the Contractor elects to enter the First Extension Period, the Contractor must perform technical work on geological and geophysical studies and surveys. The minimum expenditure for this period shall be seven hundred thousand Dollars ($700,000). |

3.1.4 | If the Contractor elects to enter the Second Extension Period, the Contractor must drill a minimum of one (1) Exploration Well to a minimum depth of the deepest target interval in the approved well program. The minimum expenditure for this period shall be thirty million Dollars ($30,000,000). |

3.1.5 | However, if the Contractor has performed work exceeding the Minimum Work Program required of it under any of Articles 3.1.1, 3.1.2 or 3.1.3, then the excess work, including Wells, is carried over to the next Sub-Period or Extension Period, and shall be deducted from the Minimum Work Program and the minimum expenditure for such next Sub-Period or Extension Period. |

3.1.6 | If the Contractor fulfills the Minimum Work Program (as set out in Articles 3.1.1, 3.1.2, 3.1.3, and 3.1.4) as applicable for each such Sub-Period and Extension Period, then the Contractor shall be deemed to have satisfied the minimum expenditure for each such Sub-Period and Extension Period, as applicable. |

3.2 | Minimum Depth of Wells |

3.2.1 | Each Exploration Well set forth above must be drilled to the minimum depth specified above in Article 3.1.2 or 3.1.4, as the case may be, or to a lesser depth if authorized by the Ministry in accordance with this Article or if discontinuing drilling is justified by one of the following reasons: |

(a) | the economic basement is encountered at a depth less than the stipulated minimum contractual depth; |

(b) | continued drilling is clearly dangerous because of abnormal pressure in the formation; |

(c) | rock formations are encountered, the hardness of which makes it impracticable to continue drilling with appropriate equipment; or |

13

(d) | Hydrocarbon bearing formations are encountered that require the installation of protective casings which excludes the possibility of reaching the minimum contractual depth. |

3.2.2 | For the purposes of Article 3.2.1, economic basement means any stratum in and below which the geological structure or physical characteristics of the rock sequence do not have the properties necessary for the accumulation of Hydrocarbons in commercial quantities and which also reflects the maximum depth at which any accumulation of this type can be reasonably expected. |

3.3 | Cessation of Drilling |

In respect of Article 3.2.1(b) and to the extent practicable where a prudent operator would immediately cease drilling operations, the Contractor shall inform the Ministry prior to the interruption or cessation of any drilling. The Ministry shall respond as soon as practicable and in any event within three (3) days counted from the date of receipt of such request.

3.4 | Substitute Wells |

If any obligatory Exploration Well is abandoned due to events or problems as set out in Article 3.2.1 (a), (b), (c) and (d) and, at the time of such abandonment, the Exploration Costs for such Well have equaled or exceeded thirty million Dollars ($30,000,000), for all purposes of this Contract, the Contractor shall be deemed to have fulfilled the Minimum Work Program obligations for the relevant period. If any obligatory Exploration Well is abandoned due to insurmountable technical problems, and if at the time of such abandonment, the Exploration Costs for such Well are less than thirty million Dollars ($30,000,000) then the Contractor shall have the option to either:

(a) | drill a substitute Exploration Well at the same or another location to be agreed with the Ministry; or |

(b) | pay the Ministry an amount equal to the difference between thirty million Dollars ($30,000,000) and the amount of Exploration Costs actually spent in connection with such Exploration Well; and |

(c) | such substitute well or payment per Articles 3.4(a) or (b) shall be deemed to have fulfilled the Minimum Work Program obligations for the relevant Sub-Period or Extension Period. |

3.5 | Provision of Guarantee |

On or prior to the Effective Date, each of the Parties comprising the Contractor (other than the National Company) shall provide to the State, at the sole discretion of the Ministry, either (i) a parent company guarantee in the form set forth in Annex D from a company acceptable to the Ministry in the amount of two hundred million Dollars ($200,000,000), or (ii) an irrevocable standby letter of credit from a first class international financial institution acceptable to the Ministry in the amount of the minimum expenditure obligations of the Contractor corresponding to the Minimum Work Program of the then current Sub-Period or Extension Period, as applicable, and which

14

shall remain valid and effective for six (6) months after the end of the relevant Sub-Period, any Extension Period and any additional extension thereof, as applicable. If the Parties comprising the Contractor (other than the National Company) fail to deliver to the Ministry the required guarantee within fifteen (15) Business Days from the Effective Date, this Contract shall be considered null and void without any further procedure or notice.

3.6 | Participation Interest of the National Company |

For the purposes of this Article 3 any expenditure of the Parties comprising the Contractor (other than the National Company) under Article 8.2 shall be treated as an expenditure for the purpose of satisfying the minimum expenditure obligations set out herein.

ARTICLE 4

ANNUAL WORK PROGRAMS AND BUDGETS

ANNUAL WORK PROGRAMS AND BUDGETS

4.1 | Submission of Annual Work Program |

No later than ninety (90) days prior to the beginning of each Calendar Year, or for the first Calendar Year no later than sixty (60) days after the Effective Date, the Contractor shall prepare and submit for approval by the Ministry a detailed and itemized Annual Work Program divided into Quarters, along with the corresponding Annual Budget for the Contract Area setting forth the Petroleum Operations the Contractor proposes to carry out during such Calendar Year. The Annual Budget shall be presented in the official format of the Ministry.

4.2 | Form and Approval of Annual Work Program |

Each Annual Work Program and corresponding Annual Budget shall be broken down into the various Exploration Operations and, as applicable, the Appraisal operations for each Appraisal Area and the Development and Production Operations for each Development and Production Area. The Ministry may propose amendments or modifications to the Annual Work Program and corresponding Annual Budget, by giving notice to the Contractor and including reasons for such amendments or modifications, within sixty (60) days following receipt of such Annual Work Program and Annual Budget. In such event the Ministry and the Contractor shall meet as soon as possible to review the amendments or modifications proposed by the Ministry and establish by mutual agreement the Annual Work Program and corresponding Annual Budget. The parts of the Annual Work Program for which the Ministry does not require amendment or modification will be deemed approved and must be completed by the Contractor within the stated time period, provided they may be undertaken on an individual basis. With respect to the parts of the Annual Work Program for which the Ministry proposes any amendment or modification, the date of approval of the Annual Work Program and corresponding Annual Budget shall be the date on which the Ministry and the Contractor reach the aforementioned mutual agreement. In the event the Ministry and the Contractor do not reach an agreement regarding the amendments and modifications proposed by the Ministry before the end of the Calendar Year in which the Annual Work Plan and corresponding Annual Budget were submitted, the Contractor shall continue operating

15

pursuant to the most recent Annual Work Plan and corresponding Annual Budget approved by the Ministry until a mutual agreement is reached of Petroleum Operations.

4.3 | Conduct of Petroleum Operations |

The Contractor shall diligently and properly perform the Petroleum Operations with diligence, efficiency and economy, in accordance with accepted international petroleum industry practices under the same or similar circumstances and the terms of this Contract and the Hydrocarbons Law,

4.4 | Overexpenditures |

4.4.1 | It is acknowledged by the Ministry and the Contractor that the technical results acquired as work progresses or the occurrence of certain unforeseen changes in circumstances may justify modifications to an approved Annual Work Program and corresponding Annual Budget. In such circumstances, the Contractor shall promptly notify the Ministry of the proposed modifications. Such modifications are subject to review and approval by the Ministry within sixty (60) days after receipt of such notice. Failure of the Ministry to approve or reject such proposed modifications within such sixty (60) day period shall be deemed to be an approval of such proposed modifications. Notwithstanding the foregoing and in no event shall the Contractor incur any line item expenditure which exceeds an approved Annual Budget line item by more than ten percent (10%), provided that the cumulative total of all overexpenditures for a Calendar Year shall not exceed five percent (5%) of the total approved Annual Budget without the prior approval of the Ministry; otherwise such excess expenditures shall not be recoverable as a Petroleum Operations Cost or deductible for tax purposes. |

4.4.2 | At such time that the Contractor reasonably believes that the limits of an Annual Budget will be exceeded, the Contractor shall promptly notify the Ministry and shall provide the Ministry with full details of such overexpenditures, including reasons therefor. |

4.4.3 | The limitations set out in this Article 4.4 shall be without prejudice to the Contractor’s right to make expenditures in the event of an emergency or accident requiring urgent action under Article 4.5. |

4.4.4 | Save as otherwise provided in Article 4.5, should the Contractor incur any expenditure whose program and budget has not been approved within an Annual Work Program and corresponding Annual Budget or any amendment thereto approved by the Ministry, then such expenditure shall not be recoverable by the Contractor as a Petroleum Operations Cost or be deductible for tax purposes. |

4.5 | Emergency or Accident |

4.5.1 | In the event of an emergency or accident requiring urgent action, the Contractor shall take all steps and measures as may be prudent and necessary in accordance with good oil field practice for the protection of its interests and those of the State and the property, life and health of other Persons, the environment and the safety of Petroleum Operations. The Contractor shall promptly inform the Ministry of such emergency or accident. |

16

4.5.2 | All of the related costs incurred by the Contractor in accordance with this Article 4.5 shall be recoverable as Petroleum Operations Costs in accordance with this Contract. Notwithstanding the foregoing, all costs incurred by the Contractor in the cleaning up of pollution or damage to the environment caused by the gross negligence or willful misconduct of the Contractor, its subcontractors or any Person acting on its or their behalf shall not be recoverable as a Petroleum Operations Cost. |

ARTICLE 5

APPRAISAL OF A DISCOVERY AND PRODUCTION PERIOD

APPRAISAL OF A DISCOVERY AND PRODUCTION PERIOD

5.1 | Notification of Discovery |

If the Contractor discovers Hydrocarbons in the Contract Area it shall notify the Ministry as soon as possible, but not later than thirty (30) days after the date of such Discovery. This notice shall include all relevant information in accordance with generally accepted practice of the international petroleum industry including particulars of any production testing program which the Contractor has carried out or proposes to carry out during drilling operations.

5.2 | Appraisal Work Program |

5.2.1 | If the Contractor considers that the Discovery merits Appraisal it shall diligently submit to the Ministry a detailed Appraisal work program and corresponding budget no later than six (6) months following the date on which the Discovery was notified in accordance with Article 5.1. The Appraisal work program, corresponding budget and designated Appraisal Area are subject to the review and approval of the Ministry in accordance with the procedures set forth in Article 4. |

5.2.2 | The draft Appraisal work program shall specify the estimated size of the Hydrocarbon reserves of the said Discovery, the area proposed to be designated as the Appraisal Area and shall include all seismic, drilling, testing and Appraisal operations necessary to carry out an appropriate Appraisal of the Discovery. The Contractor shall diligently undertake the approved Appraisal work program, it being understood that the provisions of Article 4.4 shall apply to such program. |

5.2.3 | The duration of the Appraisal work program shall not exceed twenty-four (24) months for Crude Oil and in the case of Natural Gas the duration of the Appraisal work program shall be determined in accordance with the provisions of Article 13, unless as otherwise approved by the Ministry, such approval not to be unreasonably withheld or delayed. |

5.3 | Submission of Appraisal Report |

5.3.1 | Within six (6) months following completion of the Appraisal work program and in any event no later than thirty (30) days prior to the expiry of the Initial Exploration Period, or the First Extension Period or the Second Extension Period, including any additional extension in accordance with the provisions of Article 2.2, as may be the case, the Contractor shall subunit to the Ministry a detailed report giving all the technical and economic information associated with the Discovery so appraised and which shall confirm, in the Contractor’s opinion, whether such Discovery is a Commercial Discovery. |

17

5.3.2 | The above-referred report shall include geological and petrophysical characteristics of the Discovery, estimated geographical extent of the Discovery, results of the production tests yielded by the formation and the preliminary economic study with respect to the exploitation of the Discovery. |

5.4 | Determination of Commerciality |

For the purposes of Article 5.3, the Contractor shall determine whether it considers that a Discovery or aggregation of Discoveries can be developed commercially. The commercial viability of the Discovery or aggregation of Discoveries shall be determined after consideration of all pertinent operating, economic and financial data collected during the performance of the Appraisal work program and otherwise, including Crude Oil and Natural Gas recoverable reserves, sustainable Production levels and all other relevant economic factors, according to generally accepted international petroleum industry practice.

5.5 | Submission and Approval of Development and Production Plan |

5.5.1 | If the Contractor deems the Discovery or aggregation of Discoveries to be a Field it shall submit for the approval of the Ministry a development and production plan (the Development and Production Plan) for such Discovery or aggregation of Discoveries within twelve (12) months following the remittance of the report referred to in Article 5.3. |

5.5.2 | The Ministry may propose amendments or modifications to the aforementioned Development and Production Plan, and also to the Development and Production Area subject to such Development and Production Plan, by notice to the Contractor within ninety (90) days following receipt of the relevant plan. Such notification shall set out the reasons for the amendments or modifications proposed by the Ministry. In such event the Ministry and the Contractor shall meet as soon as possible to review the proposed amendments or modifications of the Ministry and establish by mutual agreement the Development and Production Plan. |

5.5.3 | If (i) the Contractor and the Ministry do not reach a written agreement within one hundred eighty (180) days following the submission of amendments and modifications by the Ministry, or (ii) the Ministry notifies the Contractor that it does not approve the Development and Production Plan, within thirty (30) Business Days of the occurrence of either (i) or (ii) above, the Parties shall meet to assess the discrepancies in accordance with articles 49 and 50 of the Petroleum Regulations; if an agreement is not reached, the points of discrepancies shall be referred to and shall be determined by an internationally recognized expert appointed by the International Chamber of Commerce in accordance with its Rules for Expertise (ICC Expertise Rules). The determination of the expert shall be final and binding upon the Parties, including the Ministry, and, if should it not be complied with pursuant to Equatorial Guinea legislation, either Parties may refer the matter to arbitration under Article 26 to reach a final and binding decision. . |

5.6 | Modifications to Development and Production Plan |

5.6.1 | When the results obtained during Development and Production Operations require certain modifications to the Development and Production Plan, such plan may be |

18

modified using the same procedure provided for with respect to the initial approval thereof. Subject to Article 4.4, the Contractor may not incur any expenditure which exceeds the approved Development and Production Plan without the prior approval of the Ministry; if prior approval is not obtained, such excess expenditures will not be recoverable by the Contractor as Petroleum Operations Costs or deductible for tax purposes.

5.6.2 | During a period of Development and Production, the Contractor may propose to the Ministry revisions to the Development and Production Plan at any time that additional Development and Production Operations are under consideration. Such revisions shall be submitted for approval by the Ministry, using the same procedure provided for with respect to the initial approval thereof. |

5.7 | Number of Fields |

If the Contractor discovers more than one (I) Field in the Contract Area which are not overlying, adjacent to or underlying an existing Field, each of them shall be the subject of a separate Development and Production Plan.

5.8 | Extension of Field beyond Contract Area |

5.8.1 | If, during work performed after approval of a Development and Production Plan, it appears that the geographical extent of a Field is larger than the Development and Production Area designated pursuant to Article 5.5, the Ministry may grant the Contractor the additional area, on condition that it is included in the Contract Area in effect at that time, and provided that the Contractor provides supporting evidence of the existence of the additional area applied for. |

5.8.2 | In the event that a Field extends beyond the boundaries of the Contract Area as delimited at any particular time, the Ministry may require the Contractor to exploit such Field in association with the contractor of the adjacent area in accordance with Article 22, the Hydrocarbons Law and generally accepted practice of the international petroleum industry. |

5.8.3 | When the area proposed to be unitized is not subject to any production sharing contract, the Ministry may grant the Contractor the additional area, on condition that it is included in the Contract Area in effect at that time, it being understood that any award of an additional area must be in accordance with the Hydrocarbons Law. |

5.9 | Commencement and Performance of Development and Production Operations |

5.9.1 | The Contractor shall commence Development and Production Operations within six (6) months from the date of approval of the Development and Production Plan and shall pursue such operations diligently. |

5.9.2 | The Contractor undertakes to perform all Development and Production Operations in accordance with generally accepted practice of the international petroleum industry, this Contract and the Hydrocarbons Law. |

5.10 | Duration of Operations |

19

5.10.1 | The duration of the Development and Production period during which the Contractor is authorized to exploit a Field is twenty-five (25) Years from the date of approval of the Development and Production Plan related to such Field. |

The Development and Production period defined above may be extended for an additional period of five (5) Years with prior approval of the Ministry, which approval shall not be unreasonably withheld or delayed, if the Contractor submits a request to this effect to the Ministry at least one (1) Year prior to its expiry and on the condition that the Contractor has fulfilled all of its obligations under this Contract and that it can demonstrate that commercial Production from the Field is still possible after the expiry of the initial Development and Production period.

5.11 | Risk and Expense of Contractor |

The Contractor undertakes to perform at its own expense and financial risk all the Petroleum Operations required to place a Field into Production in accordance with the Development and Production Plan so approved.

5.12 | Mandatory Relinquishment |

For the duration of the Initial Exploration Period, the Extension Periods and any additional extension thereof, the Ministry may, provided it gives at least six (6) months’ notice, require the Contractor to promptly relinquish, without any compensation or indemnification, all of its rights over the area encompassing a Discovery, including all of its rights over Hydrocarbons which may be produced from such Discovery, if the Contractor:

(a) | has not submitted, in accordance with Article 5.2, an Appraisal work program and corresponding budget with respect to such Discovery within six (6) months following the date on which such Discovery has been notified to the Ministry; or |

(b) | subject to Article 13.1 regarding Unassociated Natural Gas, does not establish the Discovery as a Field within one (1) Year after completion of Appraisal work with respect to such Discovery. |

5.13 | Future Operations |

In the event of a relinquishment under Article 5.12, the Ministry may perform or cause to be performed any petroleum operations with respect to any Discovery so relinquished without any compensation or indemnification to the Contractor, provided, however, that it shall not interfere with the Petroleum Operations undertaken by the Contractor in the part of the Contract Area retained by the Contractor, if any. The Ministry shall be permitted to use (free of charge) all facilities and equipment in the relinquished Discovery area of the Contractor that are not used for continuing Petroleum Operations in accordance with Article 51 of the Petroleum Regulations, Ministerial Order Number 4/2013, dated June 20 2013, as may be amended. If requested by the Ministry all continuing operations may be undertaken by the Contractor, if so agreed, for a fee and on terms to be agreed between the Ministry and the Contractor.

20

5.14 | Available Facilities |

In the event there are facilities and equipment in an area adjacent to or near the Contract Area which have excess capacity that could be utilized by Contractor, the Ministry may, considering the efficiency and economic management of existing resources, cause such facilities and equipment to be made available to Contractor for any Development and Production Operations, provided, however, that such Development and Production Operations shall not interfere with the ongoing operations in that area. The Ministry will then implement the process set out in Articles 50, 51, and 52 of the Hydrocarbons Law.

ARTICLE 6

CONDUCT OF PETROLEUM OPERATIONS

CONDUCT OF PETROLEUM OPERATIONS

6.1 | Obligations of Contractor |

In accordance with generally accepted practice of the international petroleum industry and the Hydrocarbons Law, the Contractor shall provide all funds necessary for the conduct of Petroleum Operations in the Contract Area including the purchase or rental of all facilities, equipment, materials and other goods required for the performance of such Petroleum Operations. It shall also supply all technical and operational expertise, including the use of foreign and national personnel required for implementing Annual Work Programs. The Contractor shall be responsible for the preparation and implementation of all Annual Work Programs which shall be performed in accordance with this Contract, the Hydrocarbons Law and generally accepted practice of the international petroleum industry.

6.2 | Joint Operating Agreement |

Within forty-five (45) days following the Effective Date, the Contractor shall provide the Ministry with a draft of the Joint Operating Agreement which shall be based upon the current model form operating agreement from the Association of International Petroleum Negotiators (AIPN). The Joint Operating Agreement and all amendments thereto shall be subject to the prior approval of the Ministry. The identity of the Operator and any change thereto shall be subject to the prior approval of the Ministry in accordance with the Hydrocarbons Law. The National Company shall be appointed as the administrative operator under the Joint Operating Agreement.

6.3 | Conduct of Petroleum Operations |

The Contractor shall diligently conduct Petroleum Operations in accordance with this Contract, the Hydrocarbons Law and generally accepted practice of the international petroleum industry.

6.4 | Maximum Efficient Production Rate |

The Contractor and the Ministry shall agree on the Production programs before Production begins in any Field and establish at that time the Maximum Efficient Production Rate for such Field, and will determine the dates on which such levels will be reexamined and potentially revised.

21

6.5 | Working Conditions |

The Contractor shall provide acceptable working conditions and access to medical attention and nursing care for all of its local and international personnel and those of its subcontractors while undertaking Petroleum Operations. The Contractor shall also provide living accommodation for personnel based on offshore installations and an additional accommodation allowance in the remuneration of personnel based onshore.

6.6 | Discovery of other Minerals |

The Contractor shall promptly notify the Ministry of the discovery of any minerals or other substances in the Contract Area. If any Persons are granted a permit or license within the Contract Area for the exploration and exploitation of any minerals or substances other than Hydrocarbons, the Ministry shall take all reasonable measures to ensure that the operations of such Persons will not obstruct the Contractor’s Petroleum Operations. The Contractor shall use all reasonable efforts to avoid any obstruction with such permit holders or licensees’ operations.

6.7 | Award of Contracts |

The Contractor shall award all the contracts, in accordance with the Local Content Regulation enacted by the Ministry in the Ministerial Decree N.° 1/2014, of 26th of September 2014, to the best qualified subcontractor or to other Person, including the Contractor’s affiliated Companies, on the basis of the cost and the capacity to comply with the contract’s provisions, as long as the Contractor abides by the Article 23.1.

6.7.1 | In all the Material Contracts, the Contractor shall: |

(a) | call a bid for the contract. |

(b) | give preference to the national companies the Contractor thinks that are qualified; |

(c) | before awarding a Material Contract, notify and inform the Ministry about the intention of the Contractor to present an offer for such contract; |

(d) | include the national companies that have been included in a list provided by the Ministry and that the Contractor regard as competent, in the list of bids for such Material Contract; |

(e) | include in the list of bids, any qualified Person the Ministry suggests to be included; |

(f) | finish the bid process within a reasonable period of time; |

(g) | consider and analyze the submitted offers; |

(h) | draft and send to the Ministry a competitive analysis of the offers submitted including the Contractor’s recommendation in terms of the Person that will be awarded with the contract, the underlying reasons and the technical, commercial and contractual conditions to be agreed; |

22

(i) | obtain the Ministry’s approval, which will be regarded as awarded if there is no response to an approval application thirty (30) days after since the reception of the written application; and |

(j) | Provide the Ministry with a final copy of the signed contract. |

All the amendments or modifications that per se abide by the definition of the Material Contract shall require the prior approval of the Ministry, approval that will be regarded as awarded if there is if there is no response to an approval application thirty (30) days after since the reception of the written application.

6.7.2 | Should the Contractor imports and/or use any service, material, equipment, consumables and other goods from a country other than Equatorial Guinea, aware of contravention of this Article or Article 23.1, or otherwise signs a contract aware of contravention of such Articles, their costs shall not be Petroleum Operational Costs and they shall not be recoverable costs by the Contractor. |

6.8 | Inspection of Petroleum Operations |

6.8.1 | All Petroleum Operations may be inspected and audited by the Ministry at such intervals as the Ministry deems necessary. The duly commissioned representatives of the Ministry shall have the right, among others, to monitor Petroleum Operations and inspect all equipment, facilities and materials relating to Petroleum Operations, provided that any such inspection shall not unduly delay or impede Petroleum Operations. The representatives of the Ministry inspecting and monitoring Petroleum Operations shall comply with the safety standards of the Contractor. |

6.8.2 | For the purposes of permitting the exercise of the above-mentioned rights, the Contractor shall provide reasonable assistance to the representatives of the Ministry, including transportation and accommodation, as set forth in Article 6.23. |

6.8.3 | All costs directly related to the technical inspection, verification and audit of Petroleum Operations or otherwise in connection with the exercise of the Ministry’s rights under this Contract or the performance of the Contractor’s obligations shall be borne by the Contractor and are recoverable as Petroleum Operations Costs in accordance with this Contract, including: |

(a) | outbound and return travel expenses; |

(b) | local transportation, as necessary, when there is no transportation available under Article 6.8.2; |

(c) | accommodation, when such accommodation is necessary to perform the official duties and is not provided under Article 6.8.2; and |

(d) | per diems, which shall be adjusted in accordance with such amounts assigned to the ranking of each agent of the Ministry as published in the general budget law of the State approved for such Calendar Year, applicable to all companies in the extraction sector of Hydrocarbons in Equatorial Guinea, as set out in Article 6.23 below. |

23

All travel expenses in (a) and (b) and accommodations in (c) above shall be arranged by Contractor and Contractor shall pay directly to the service providers such costs. As a consequence of the payment of the per diems noted above in (d), Contractor shall not make any payments to or on behalf of any Government of Equatorial Guinea travelers in relation to meals or other incidental or miscellaneous costs incurred by such travelers during such travel, and all such costs shall be for the sole account of such travelers.

6.9 | Provision of Information to Ministry |

6.9.1 | The Contractor shall keep the Ministry fully informed on the performance and status of Petroleum Operations at reasonable intervals and as required under this Contract and of any emergencies or accidents that may have occurred during such operations. Furthermore, the Contractor shall provide the Ministry with all documentation and information that is required to be provided under this Contract and the Hydrocarbons Law and as may otherwise be requested by the Ministry from time to time. |

6.9.2 | The Contractor shall keep the Ministry informed on a daily basis of the volumes of Hydrocarbons produced from the Contract Area. |

6.10 | Production of Energy for Own Use |

The Contractor shall not produce any energy for its own use unless national production is insufficient or not reliable enough for the demands of the Contractor in its conduct of Petroleum Operations. This restriction does not preclude Contractor from having appropriate and customary back-up generators to provide energy in its conduct of Petroleum Operation. In such event, the energy produced may not be sold to any Person. However, the Contractor may utilize the amounts of Crude Oil and/or Natural Gas necessary for the production of power for use in its offshore facilities.

6.11 | Standard of Equipment |

The Contractor shall ensure that all equipment, plants, installations and materials used by it comply with the Hydrocarbons Law and generally accepted engineering standards, and that they are duly constructed and maintained in good condition.

6.12 | Care of Contractor and the Environment |

6.12.1 | The Contractor shall take all prudent and necessary steps in accordance with generally accepted practice of the international petroleum industry, the Hydrocarbons Law and this Contract to: |

(a) | prevent pollution and protect the environment and living resources; |

(b) | ensure that any Hydrocarbons discovered or produced in the Contract Area are handled in a manner that is safe for the environment; |

(c) | avoid causing damage to overlying, adjacent and/or underlying formations trapping Hydrocarbon reserves; |

24

(d) | prevent the ingress of water via Wells into strata containing Hydrocarbon reservoirs; |

(e) | avoid causing damage to overlying, adjacent and/or underlying aquifers; |

(f) | ensure that Petroleum Operations are carried out in accordance with this Contract, the Hydrocarbons Law and all other laws of Equatorial Guinea; |

(g) | undertake the precautions necessary for the protection of maritime transportation and the fishing industry and to avoid contamination of the ocean and rivers; |

(h) | drill and exploit each Field in such a manner that the interests of Equatorial Guinea are protected; and |

(i) | ensure prompt, fair and full compensation for injury to Persons or property caused by the effects of Petroleum Operations. |

6.12.2 | If the Contractor’s actions result in any pollution or damage to the environment, any Person, living resources, property or otherwise, the Contractor shall immediately take all prudent and necessary measures to remedy such damages and effects thereof and/or any additional measures as may be directed by the Ministry. If the pollution or damage is caused as a result of the negligence or willful misconduct of the Contractor, its subcontractors or any Persons acting on its or their behalf all costs in relation thereof shall not be recoverable as a Petroleum Operations Cost. If the Contractor does not act promptly so as to control or clean-up any pollution or make good any damage caused, the Ministry may, after giving the Contractor reasonable notice in the circumstances, carry out the actions which are prudent or necessary hereunder and under Article 4.5 and all reasonable costs and expenses of such actions shall be borne by the Contractor and shall not be recoverable as a Petroleum Operations Cost. |

6.12.3 | If the Ministry determines that any works or installations built by the Contractor or any activity undertaken by the Contractor threatens the safety of any Persons or property or causes pollution or harm to the environment, the Ministry shall promptly advise the Contractor of its determination, and may require the Contractor to take all appropriate mitigating measures, consistent with generally accepted practice of the international petroleum industry, to repair any damage caused by the Contractor’s conduct or activities. Furthermore, if the Ministry deems it necessary, it may demand that the Contractor suspend totally or partially the affected Petroleum Operations until the Contractor has taken the appropriate mitigating measures or repaired any damage. |

6.12.4 | The Contractor shall undertake comprehensive environmental impact assessment studies prior to, during and after major drilling operations. The Contractor shall assume the costs of these studies and such costs shall be recoverable. This requirement is mandatory and the first study shall be presented to the Ministry before the start of the drilling of the first Well in the Contract Area. However, an environmental impact assessment must also be completed prior to undertaking any seismic work in any areas of particular environmental sensitivity specified by the State. |

6.13 | Re-injection and Flaring of Natural Gas |

25

The Natural Gas that the Contractor does not develop in accordance with this Contract and the Hydrocarbons Law or use in its own operations within the Contract Area shall be re-injected into the structure of the subsoil, and all costs of such reinjection shall be recoverable as a Petroleum Operations Cost. Notwithstanding the foregoing, the Ministry may authorize the combustion of Natural Gas for short periods of time in accordance with the Hydrocarbons Law. The Contractor shall compensate the State for the value of the gas volumes flared without authorization. All such Natural Gas not used in. Petroleum Operations by the Contractor or not developed in accordance with this Contract and the Hydrocarbons Law shall remain the sole property of the State.

6.14 | Design and Identification of Wells |

6.14.1 | The Contractor shall conform to the practices generally accepted in the international petroleum industry in the design and drilling of Wells, including their casing and cementation. |

6.14.2 | Each Well shall be identified by a name or number agreed with the Ministry, which shall be indicated on all maps, plans and other similar records produced by or on behalf of the Contractor. |

6.15 | Vertical Projection Wells |

No Well may be drilled to an objective which is outside the vertical projection of the boundaries of the Contract Area. Controlled direction Wells drilled within the Contract Area from adjacent terrain not covered by this Contract will be considered for all purposes of this Contract as Wells drilled from territory included in the Contract Area, and whose drilling may only be undertaken with the prior approval of the Ministry, and on such terms and conditions as the Ministry may establish. Nothing in this Article has the intention or should be interpreted as a grant of a right of lease, license, servitude or any other right that the Contractor must obtain from the Ministry or other Persons.

6.16 | Notification of Commencement of Drilling |

The Contractor shall notify the Ministry at least ten (10) Business Days in advance of the commencement of any drilling of any Well set out in an approved Annual Work Program and corresponding Annual Budget or before the resumption of works on any Well whose works have been suspended for more than six (6) months.

6.17 | Construction of Facilities |

The Contractor shall build and maintain all facilities necessary for the proper performance of this Contract and the conduct of Petroleum Operations. In order to occupy land necessary for the exercise of its rights and obligations under this Contract, the Contractor shall request the authorization of the Ministry and/or other applicable governmental authorities, which authorization shall be subject to and granted in accordance with Article 6.19, the Hydrocarbons Law and other applicable laws of Equatorial Guinea. The Contractor shall repair any and all damage caused by such circumstances.

6.18 | Occupation of Land |

26

6.18.1 | In order to carry out Petroleum Operations, the Contractor shall have the right to: |

(a) | subject to Articles 6.17 and 6.18.2, occupy the necessary land for the performance of Petroleum Operations and associated activities as set out in paragraphs (b) and (c) below, including lodging for personnel; |

(b) | undertake or procure the undertaking of any infrastructure work necessary in normal technical and economic conditions for the carrying out of Petroleum Operations and associated activities such as transport, storage of equipment, materials and extracted substances, establishment of telecommunications equipment and communication lines necessary for the conduct of Petroleum Operations at installations located both offshore and onshore; |

(c) | undertake or ensure the undertaking of works necessary for the supply of water to personnel and installation works in accordance with water supply regulations; and |

(d) | extract and use or ensure the extraction and utilization of resources (other than Hydrocarbons) from the subsoil necessary for the activities stipulated in paragraphs (a), (b) and (c) above in accordance with relevant regulations. |

6.18.2 | Occupation of land as mentioned in Article 6.18.1 shall become effective after the Ministry or other applicable governmental authority approves the request submitted by the Contractor indicating and detailing the location of such land and how the Contractor plans to use it, taking the following into consideration: |

(a) | if the land belongs to the State, the State shall grant it to the Contractor for occupation and to build its fixed or temporary facilities during the term of this Contract for a fee and on terms to be agreed and such amount shall be considered a Petroleum Operations Cost; |