Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRAL VALLEY COMMUNITY BANCORP | a8-kirpresentationdadcomay.htm |

Investor Presentation D.A. Davidson & Co. 20th Annual FIG Summit and Financial Institutions Conference May 9-10, 2018 Jim Ford President & CEO Dave Kinross EVP CFO

Forward-Looking Statements Certain matters discussed herein constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained herein that are not historical facts, such as statements regarding the Company’s current business strategy and the Company’s plans for future development and operations, are based upon current expectations. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates, a decline in economic conditions at the international, national or local level on the Company’s results of operations, the Company’s ability to continue its internal growth at historical rates, the Company’s ability to maintain its net interest margin, and the quality of the Company’s earning assets; (3) changes in the regulatory environment; (4) fluctuations in the real estate market; (5) changes in business conditions and inflation; (6) changes in securities markets; (7) the expected cost savings, synergies and other financial benefits for the Folsom Lake Bank (“FLB”) acquisition might not be realized within the expected time frames or at all; and (8) the other risks set forth in the Company’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2017. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company. Central Valley Community Bancorp will undertake no obligation to revise or publically release any revision or update to the forward looking statements to reflect events or circumstances that occur after the date on which statements were made. 2

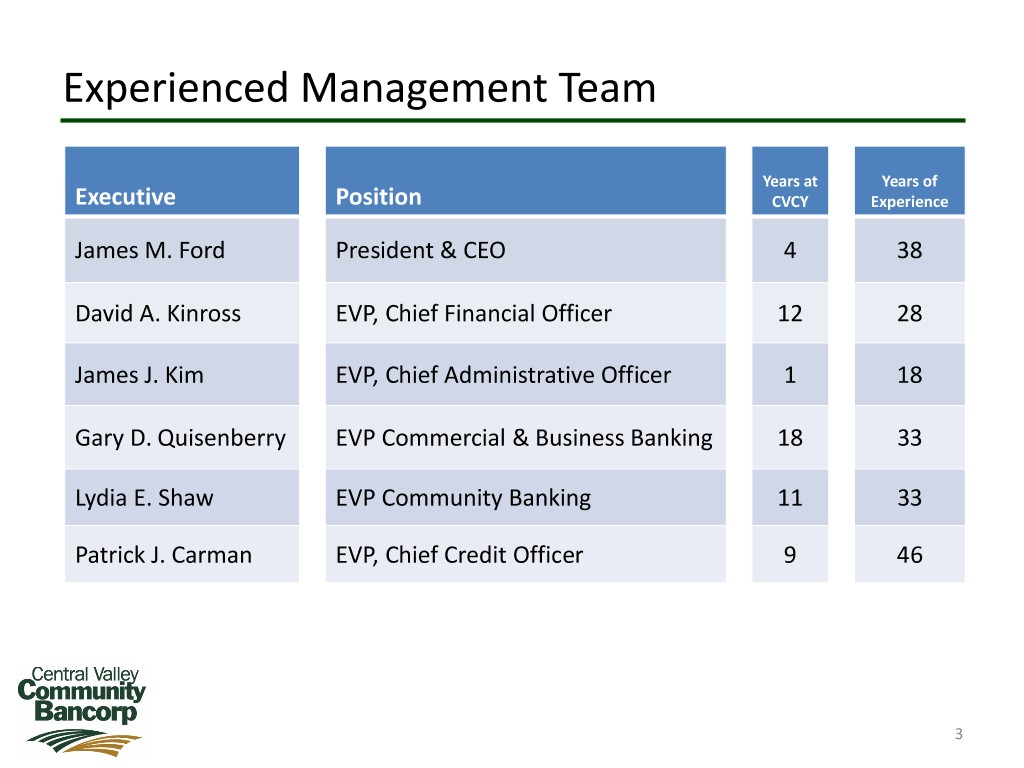

Experienced Management Team Years at Years of Executive Position CVCY Experience James M. Ford President & CEO 4 38 David A. Kinross EVP, Chief Financial Officer 12 28 James J. Kim EVP, Chief Administrative Officer 1 18 Gary D. Quisenberry EVP Commercial & Business Banking 18 33 Lydia E. Shaw EVP Community Banking 11 33 Patrick J. Carman EVP, Chief Credit Officer 9 46 3

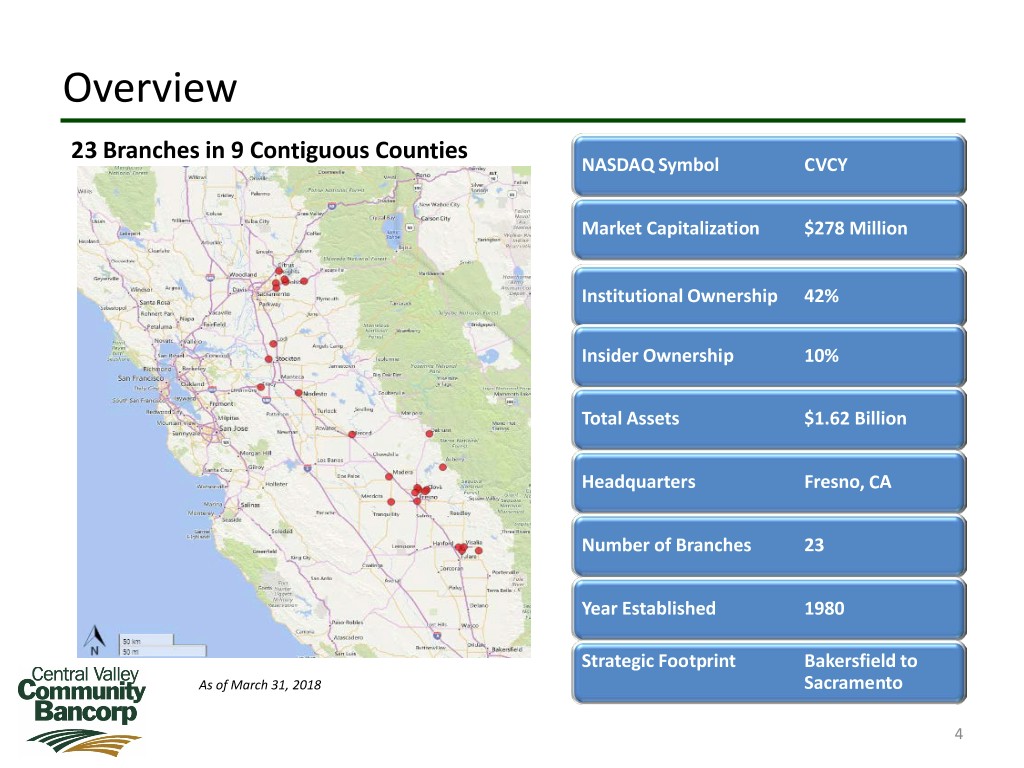

Overview 23 Branches in 9 Contiguous Counties NASDAQ Symbol CVCY Market Capitalization $278 Million Institutional Ownership 42% Insider Ownership 10% Total Assets $1.62 Billion Headquarters Fresno, CA Number of Branches 23 Year Established 1980 Strategic Footprint Bakersfield to As of March 31, 2018 Sacramento 4

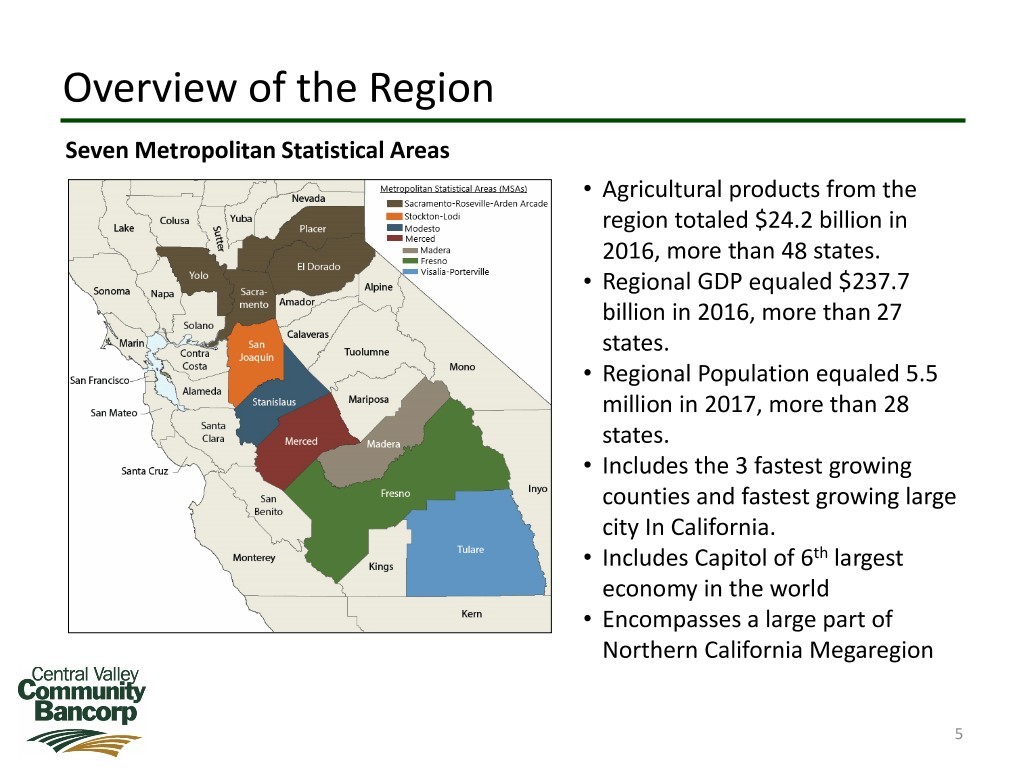

Overview of the Region Seven Metropolitan Statistical Areas • Agricultural products from the region totaled $24.2 billion in 2016, more than 48 states. • Regional GDP equaled $237.7 billion in 2016, more than 27 states. • Regional Population equaled 5.5 million in 2017, more than 28 states. • Includes the 3 fastest growing counties and fastest growing large city In California. • Includes Capitol of 6th largest economy in the world • Encompasses a large part of Northern California Megaregion 5

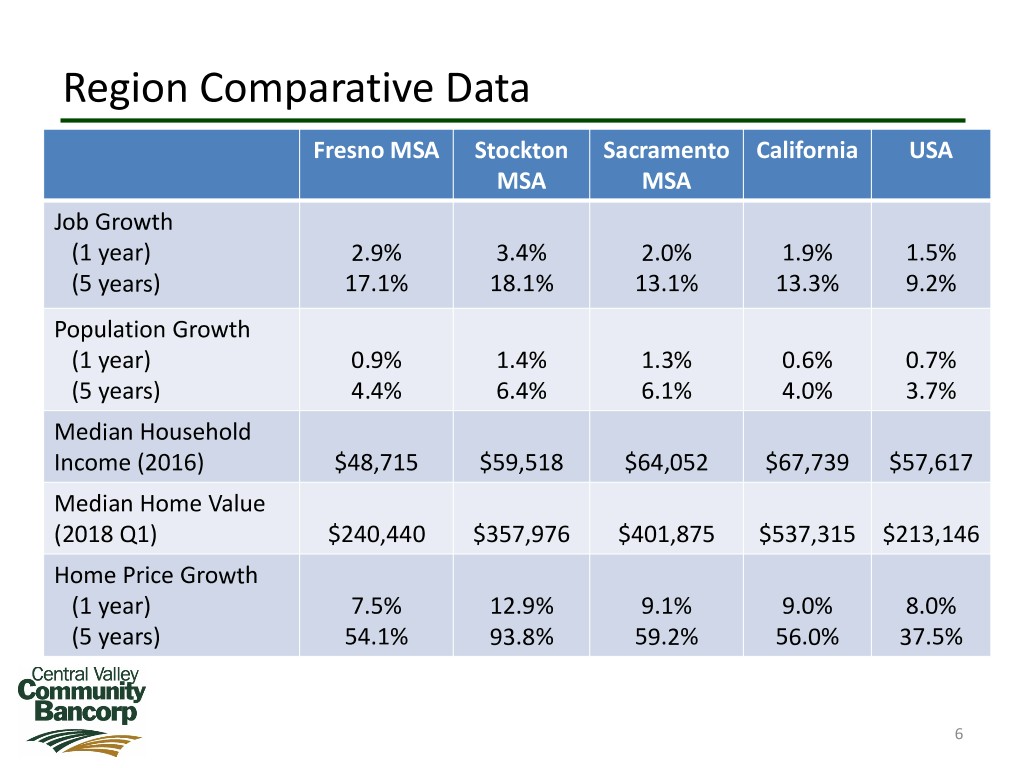

Region Comparative Data Fresno MSA Stockton Sacramento California USA MSA MSA Job Growth (1 year) 2.9% 3.4% 2.0% 1.9% 1.5% (5 years) 17.1% 18.1% 13.1% 13.3% 9.2% Population Growth (1 year) 0.9% 1.4% 1.3% 0.6% 0.7% (5 years) 4.4% 6.4% 6.1% 4.0% 3.7% Median Household Income (2016) $48,715 $59,518 $64,052 $67,739 $57,617 Median Home Value (2018 Q1) $240,440 $357,976 $401,875 $537,315 $213,146 Home Price Growth (1 year) 7.5% 12.9% 9.1% 9.0% 8.0% (5 years) 54.1% 93.8% 59.2% 56.0% 37.5% 6

Financial Highlights Q1 2018 2017 2016 Total Assets $1.62 Billion $1.66 Billion $1.44 Billion Net Income $5.29 Million $14.03 Million $15.18 Million Diluted EPS $0.38 $1.10 $1.33 Net Interest Margin 4.26% 4.41% 4.09% ROAA 1.30% 0.94% 1.15% ROAE 10.15% 7.69% 9.84% Cash Dividends per share $0.07 $0.24 $0.24 Total Cost of Funds 0.07% 0.08% 0.09% NPAs to Total Assets 0.25% 0.18% 0.18% Leverage Capital Ratio 10.11% 9.71% 8.75% Common Equity Tier 1 Ratio 14.02% 12.90% 12.48% Tier 1 Risk Based Capital Ratio 14.48% 13.28% 12.74% Total Risk Based Capital Ratio 15.31% 14.07% 13.72% 7

Attractive Investment Opportunity CVCY Stock Price 25 20 15 Price 10 5 0 1/1/2010 1/1/2011 1/1/2012 1/1/2013 1/1/2014 1/1/2015 1/1/2016 1/1/2017 1/1/2018 As of April 30, 2018 Source: NASDAQ Monthly Closing Price Data 8

Growing Franchise Average Total Assets 1,800,000 1,600,000 1,400,000 1,200,000 1,000,000 1,624,504 Thousands 800,000 1,491,696 1,321,007 1,222,526 600,000 1,157,483 986,924 400,000 200,000 0 2013 2014 2015 2016 2017 2018 Q1 Note: Acquisitions of Visalia Community Bank occurred on July 1, 2013, Sierra Vista Bank occurred on October 1, 2016, and Folsom Lake Bank occurred on October 1, 2017 9

Strong Net Income and NIM 20,000 4.50 4.41 4.41 18,000 4.40 16,000 14,000 4.26 4.30 12,000 4.20 10,000 4.11 4.09 4.09 Percent Thousands 17,561 4.10 8,000 15,182 4.01 14,026 6,000 4.00 10,964 4,000 8,250 5,294 5,291 3.90 2,000 0 3.80 2013 2014 2015 2016 2017 2017* 2018 Q1 Net Income Net Interest Margin * Excluding DTA revaluation 10

Solid Earnings ROAA / ROAE 1.60 14.00 11.56 1.40 12.00 10.15 1.20 9.84 10.00 1.00 8.12 7.69 8.00 6.89 0.80 1.41 6.00 ROAE Percent ROAE Percent ROAA 1.30 0.60 4.06 1.15 0.90 0.94 4.00 0.40 0.84 2.00 0.20 0.46 - - 2013 2014 2015 2016 2017 2017* 2018 Q1 ROAA ROAE * Excluding DTA revaluation 11

Steady Deposit Growth and Lowest Cost of Funds Average Total Deposits 1,600,000 0.15 0.16 1,400,000 0.14 1,200,000 0.12 0.11 1,000,000 0.09 0.10 0.09 0.08 800,000 0.07 0.08 Percent Thousands 600,000 1,384,653 0.06 1,284,305 1,065,798 1,144,231 1,006,560 400,000 848,493 0.04 200,000 0.02 0 0.00 2013 2014 2015 2016 2017 2018 Q1 Avg Deposits Cost of Funds 12

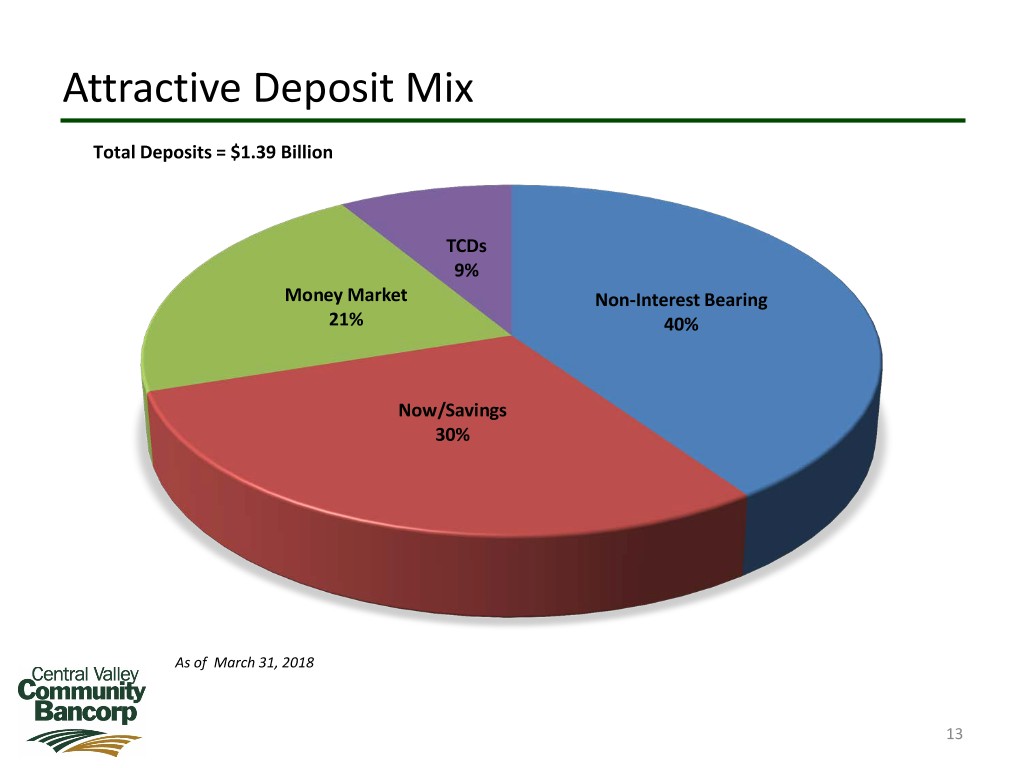

Attractive Deposit Mix Total Deposits = $1.39 Billion TCDs 9% Money Market Non-Interest Bearing 21% 40% Now/Savings 30% As of March 31, 2018 13

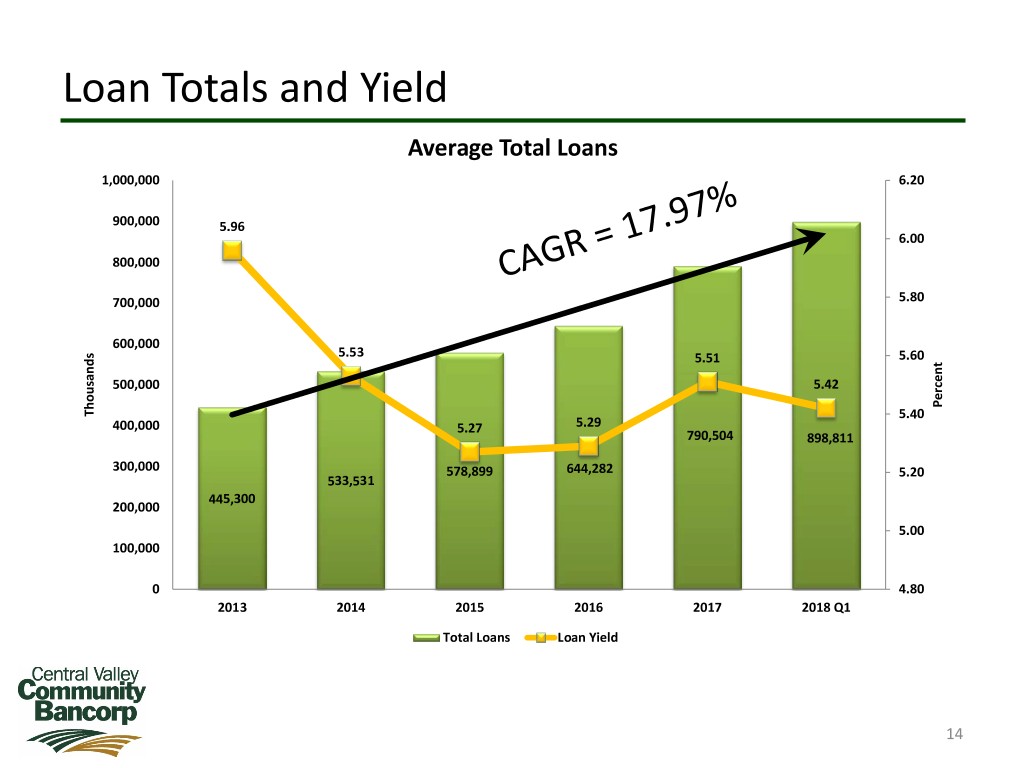

Loan Totals and Yield Average Total Loans 1,000,000 6.20 900,000 5.96 6.00 800,000 700,000 5.80 600,000 5.53 5.51 5.60 500,000 5.42 Percent Thousands 5.40 400,000 5.27 5.29 790,504 898,811 300,000 578,899 644,282 5.20 533,531 445,300 200,000 5.00 100,000 0 4.80 2013 2014 2015 2016 2017 2018 Q1 Total Loans Loan Yield 14

Well Diversified Loan Portfolio Consumer & Total Loans = $917 Million Equity Loans and Installment, 3% Lines, 8% Other Real Estate, 4% Commercial & Industrial, 11% Agriculture Production & Land, 10% Owner Occupied Commercial Real Real Estate, 22% Estate, 33% R/E Construction & Land, 10% As of March 31, 2018 Excludes Deferred Loan Fees 15

Agricultural Loan Commitments Nursery Citrus Tree Fruit 2% 1% 4% Pistachios 4% Almonds Cherries 20% 10% Table Grapes Raisins 4% 9% Tomatoes 1% Row Crops Open Land 3% Other 20% 4% Wine Grapes 7% Walnuts 11% As of March 31, 2018 16

Conservative Investment Portfolio Total = $561 Million Yield = 2.83% Duration 3.92Years Equity Mutual Funds Fed Funds Sold 1% US Government 3% Agencies 12% US Treasury Securities 6% Agency CMO, MBS & Other Securities Municipal Securities 53% 25% As of March 31, 2018 17

On the Horizon Organic Loan Growth Assimilate FOLB Acquisition in 2018 Improve Efficiencies Fee Income Improvements Execute Branch Footprint Optimization Strategy Monitor Agriculture Impacts from Water, Regulation, Labor and Global Pricing 18

Investing in Relationships 19