Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Brookdale Senior Living Inc. | bkdq12018pressrelease.htm |

| 8-K - 8-K - Brookdale Senior Living Inc. | bkdq12018form-8k.htm |

Exhibit 99.2 Supplemental Information 1st Quarter 2018

Table of Contents Financial Overview 3 Segment Overview 7 Senior Housing 8 Ancillary Services 13 G&A Expense & Transaction Costs 14 Capital Expenditures 15 Cash Lease Payments 16 Unconsolidated Ventures 17 Debt & Liquidity 18 Net Asset Value Elements 20 Definitions 21 Appendix: Consolidated Statements of Cash Flows 24 Non-GAAP Financial Measures 25 2

Overview ($ in 000s, except Total RevPAR) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Resident fee and management fee revenue $ 1,032,821 $ 956,512 $ 941,030 $ 925,622 $ 924,947 (10.4)% Net income (loss) $ (126,361) $ (46,337) $ (413,929) $ 15,021 $ (457,234) 261.8 % Net cash provided by operating activities (2) $ 66,773 $ 133,759 $ 93,791 $ 84,036 $ 37,964 (43.1)% Adjusted EBITDA $ 198,296 $ 160,325 $ 141,829 $ 138,116 $ 130,000 (34.4)% Adjusted Free Cash Flow (2) $ 63,452 $ 40,610 $ 16,360 $ (11,174) $ 5,485 (91.4)% Brookdale's Proportionate Share of Adjusted EBITDA of Unconsolidated Ventures $ 17,126 $ 18,219 $ 16,788 $ 17,723 $ 16,749 (2.2)% Brookdale's Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures (2) $ 8,750 $ 7,920 $ 6,709 $ 12,037 $ 5,824 (33.4)% Total RevPAR $ 4,405 $ 4,392 $ 4,386 $ 4,463 $ 4,527 2.8 % As of March 31, 2018 Managed - 3rd Managed - 3rd Q1 2018 weighted average unit occupancy Party: 77 Party: 12,484 Community % of Period End Managed- Occupancy Band Count Communities Greater than 95% 196 19% Venture: Leased: 141 90% < 95% 187 19% 33,938 Managed- Leased: (1) 85% < 90% 193 19% 434 1,010 99,109 Venture : communities units 20,270 80% < 85% 132 13% Less than 80% 302 30% Total 1,010 Owned: 358 Consolidated Portfolio Average Owned: Asset Age ~22.3 years 32,417 (1) Brookdale’s weighted average unit ownership percentage is 27.1%. (2) Reflects the retrospective adoption of ASU 2016-15. Refer to page 25 for additional detail. Important Note Regarding Non-GAAP Financial Measures. Adjusted EBITDA, Adjusted Free Cash Flow, Brookdale's Proportionate Share of Adjusted EBITDA of Unconsolidated Ventures and Brookdale’s Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures are financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (GAAP). See the definitions of such measures under “Definitions” below and important information regarding such measures, including reconciliations to the most comparable GAAP financial measures, under “Non-GAAP Financial Measures” below. 3

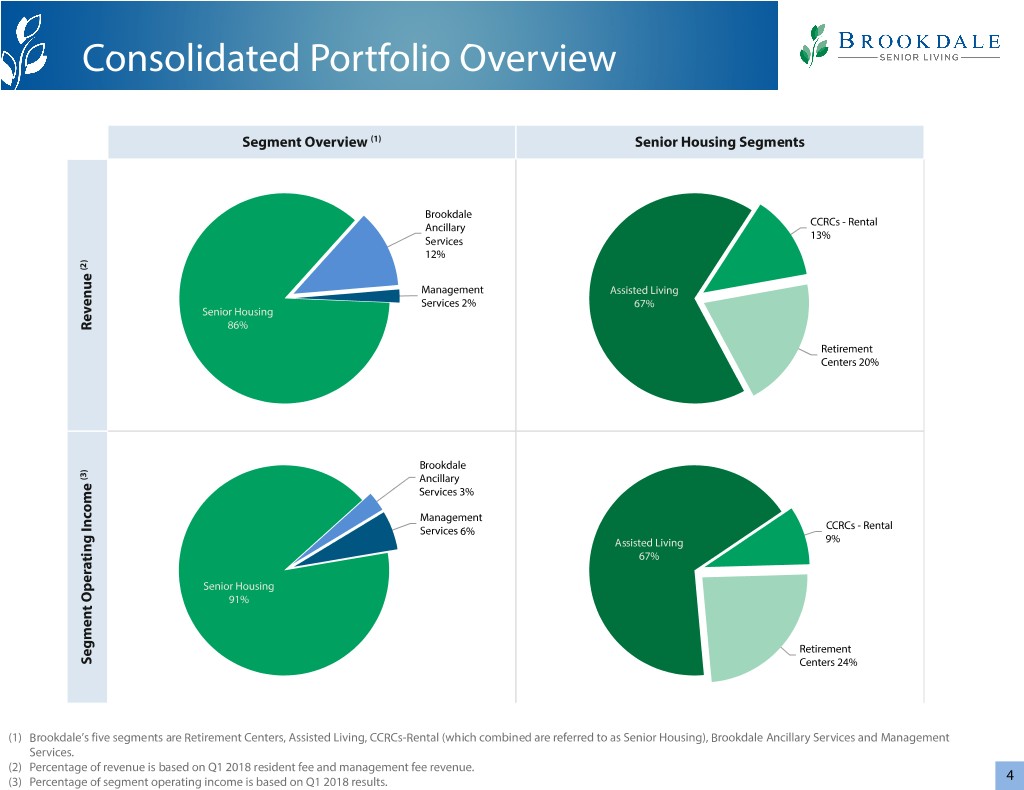

Consolidated Portfolio Overview Segment Overview (1) Senior Housing Segments Brookdale CCRCs - Rental Ancillary 13% Services 12% (2) Management Assisted Living Services 2% 67% Senior Housing Revenue Revenue 86% Retirement Centers 20% Brookdale (3) Ancillary Services 3% Management Services 6% CCRCs - Rental Assisted Living 9% 67% Senior Housing 91% Retirement Segment Operating Income Income Segment Operating Centers 24% (1) Brookdale’s five segments are Retirement Centers, Assisted Living, CCRCs-Rental (which combined are referred to as Senior Housing), Brookdale Ancillary Services and Management Services. (2) Percentage of revenue is based on Q1 2018 resident fee and management fee revenue. (3) Percentage of segment operating income is based on Q1 2018 results. 4

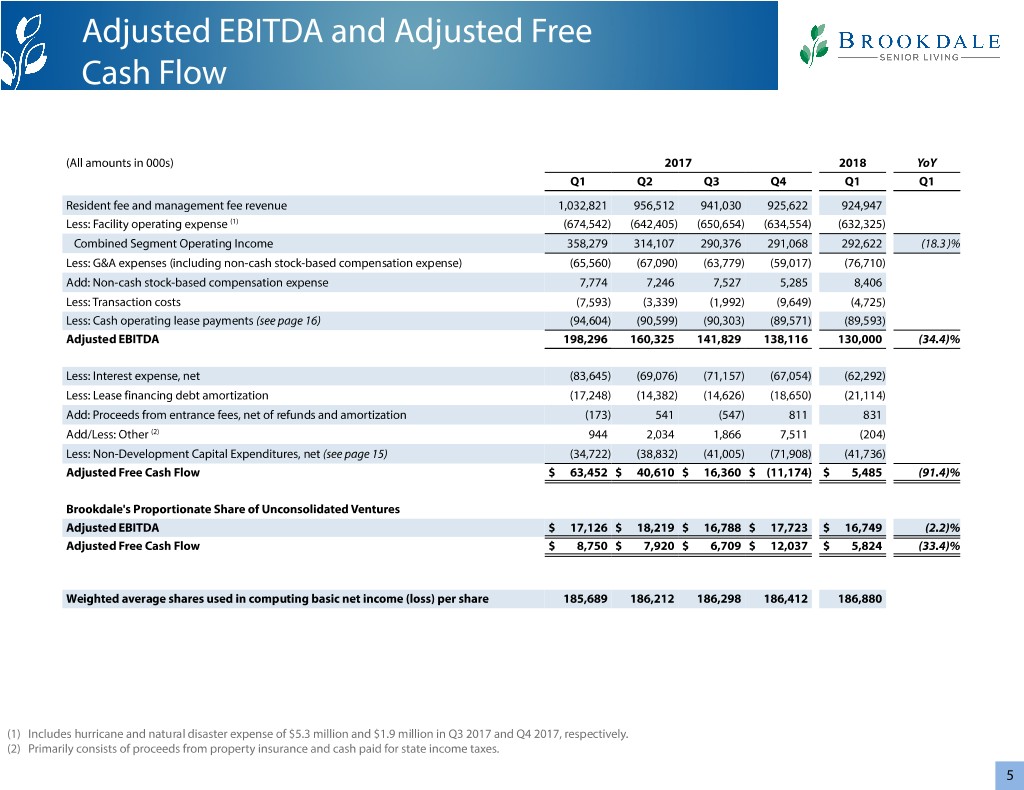

Adjusted EBITDA and Adjusted Free Cash Flow (All amounts in 000s) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Resident fee and management fee revenue 1,032,821 956,512 941,030 925,622 924,947 Less: Facility operating expense (1) (674,542) (642,405) (650,654) (634,554) (632,325) Combined Segment Operating Income 358,279 314,107 290,376 291,068 292,622 (18.3)% Less: G&A expenses (including non-cash stock-based compensation expense) (65,560) (67,090) (63,779) (59,017) (76,710) Add: Non-cash stock-based compensation expense 7,774 7,246 7,527 5,285 8,406 Less: Transaction costs (7,593) (3,339) (1,992) (9,649) (4,725) Less: Cash operating lease payments (see page 16) (94,604) (90,599) (90,303) (89,571) (89,593) Adjusted EBITDA 198,296 160,325 141,829 138,116 130,000 (34.4)% Less: Interest expense, net (83,645) (69,076) (71,157) (67,054) (62,292) Less: Lease financing debt amortization (17,248) (14,382) (14,626) (18,650) (21,114) Add: Proceeds from entrance fees, net of refunds and amortization (173) 541 (547) 811 831 Add/Less: Other (2) 944 2,034 1,866 7,511 (204) Less: Non-Development Capital Expenditures, net (see page 15) (34,722) (38,832) (41,005) (71,908) (41,736) Adjusted Free Cash Flow $ 63,452 $ 40,610 $ 16,360 $ (11,174) $ 5,485 (91.4)% Brookdale's Proportionate Share of Unconsolidated Ventures Adjusted EBITDA $ 17,126 $ 18,219 $ 16,788 $ 17,723 $ 16,749 (2.2)% Adjusted Free Cash Flow $ 8,750 $ 7,920 $ 6,709 $ 12,037 $ 5,824 (33.4)% Weighted average shares used in computing basic net income (loss) per share 185,689 186,212 186,298 186,412 186,880 (1) Includes hurricane and natural disaster expense of $5.3 million and $1.9 million in Q3 2017 and Q4 2017, respectively. (2) Primarily consists of proceeds from property insurance and cash paid for state income taxes. 5

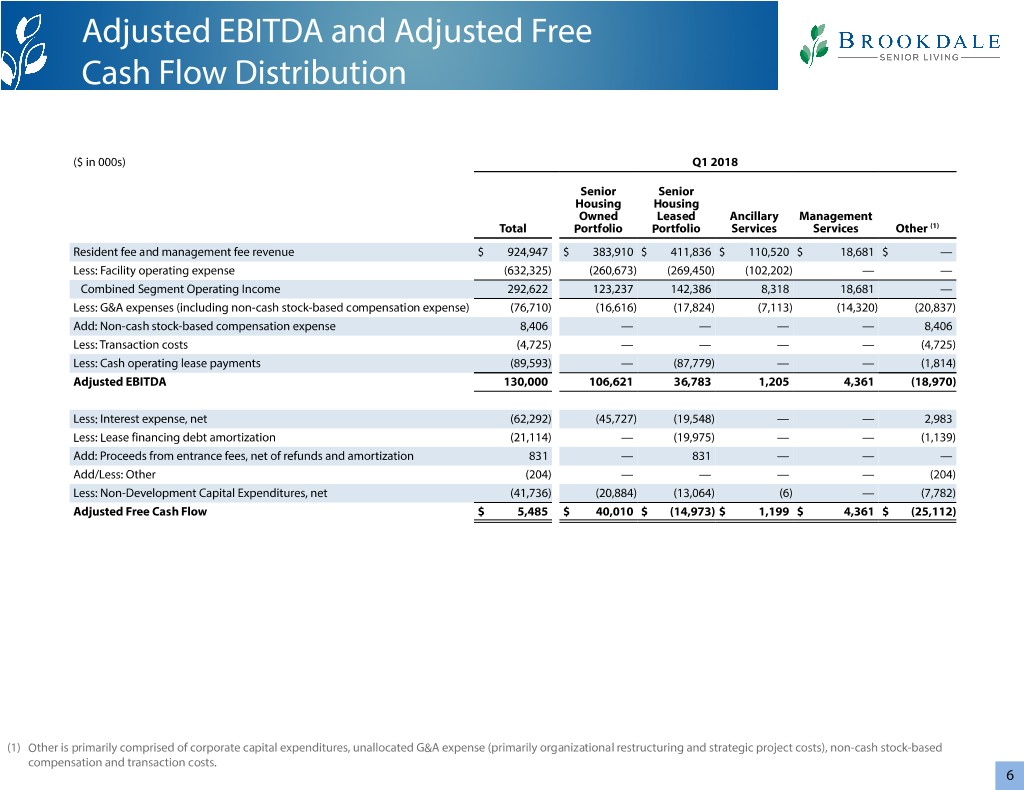

Adjusted EBITDA and Adjusted Free Cash Flow Distribution ($ in 000s) Q1 2018 Senior Senior Housing Housing Owned Leased Ancillary Management Total Portfolio Portfolio Services Services Other (1) Resident fee and management fee revenue $ 924,947 $ 383,910 $ 411,836 $ 110,520 $ 18,681 $ — Less: Facility operating expense (632,325) (260,673) (269,450) (102,202) — — Combined Segment Operating Income 292,622 123,237 142,386 8,318 18,681 — Less: G&A expenses (including non-cash stock-based compensation expense) (76,710) (16,616) (17,824) (7,113) (14,320) (20,837) Add: Non-cash stock-based compensation expense 8,406 — — — — 8,406 Less: Transaction costs (4,725) — — — — (4,725) Less: Cash operating lease payments (89,593) — (87,779) — — (1,814) Adjusted EBITDA 130,000 106,621 36,783 1,205 4,361 (18,970) Less: Interest expense, net (62,292) (45,727) (19,548) — — 2,983 Less: Lease financing debt amortization (21,114) — (19,975) — — (1,139) Add: Proceeds from entrance fees, net of refunds and amortization 831 — 831 — — — Add/Less: Other (204) — — — — (204) Less: Non-Development Capital Expenditures, net (41,736) (20,884) (13,064) (6) — (7,782) Adjusted Free Cash Flow $ 5,485 $ 40,010 $ (14,973) $ 1,199 $ 4,361 $ (25,112) (1) Other is primarily comprised of corporate capital expenditures, unallocated G&A expense (primarily organizational restructuring and strategic project costs), non-cash stock-based compensation and transaction costs. 6

Segment Overview ($ in 000s, except RevPAR and RevPOR) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Total Senior Housing, Brookdale Ancillary and Management Services(1) Revenue $ 1,032,821 $ 956,512 $ 941,030 $ 925,622 $ 924,947 (10.4)% Combined Segment Operating Income $ 358,279 $ 314,107 $ 290,376 $ 291,068 $ 292,622 (18.3)% Combined Segment Operating Margin 34.7% 32.8% 30.9% 31.4% 31.6% -310 bps Senior Housing (see page 8) Revenue $ 904,955 $ 823,880 $ 812,288 $ 792,755 $ 795,746 (12.1)% Senior Housing Operating Income $ 326,756 $ 278,562 $ 262,415 $ 258,904 $ 265,623 (18.7)% Senior Housing Operating Margin 36.1% 33.8% 32.3% 32.7% 33.4% -270 bps Number of communities (period end) 838 829 820 794 792 Period end number of units 71,186 70,263 69,675 66,641 66,355 Total Average Units 76,862 70,833 70,112 67,652 66,557 RevPAR $ 3,919 $ 3,873 $ 3,860 $ 3,904 $ 3,983 1.6 % Weighted average unit occupancy 85.3% 84.6% 84.8% 85.2% 84.4% -90 bps RevPOR $ 4,597 $ 4,580 $ 4,552 $ 4,584 $ 4,717 2.6 % Brookdale Ancillary Services Segment Revenue $ 111,972 $ 110,190 $ 110,604 $ 113,496 $ 110,520 (1.3)% Segment Operating Income $ 15,629 $ 13,103 $ 9,823 $ 12,793 $ 8,318 -46.8 % Segment Operating Margin 14.0% 11.9% 8.9% 11.3% 7.5% -650 bps Management Services Segment Segment Operating Income (comprised solely of management fees) $ 15,894 $ 22,442 $ 18,138 $ 19,371 $ 18,681 17.5 % G&A Allocation (see page 14) (11,238) (14,184) (13,134) (12,979) (14,320) 27.4 % Segment Operating Income (Adjusted to Include G&A Allocation) $ 4,656 $ 8,258 $ 5,004 $ 6,392 $ 4,361 (6.3)% Segment Operating Margin (Adjusted to Include G&A Allocation) 29.3% 36.8% 27.6% 33.0% 23.3% -600 bps Resident fee revenue under management $ 310,050 $ 371,381 $ 371,165 $ 386,253 $ 394,392 Number of communities (period end) 214 210 211 229 218 Period end number of units 31,284 31,454 31,527 33,941 32,754 Total Average Units 25,702 31,361 31,417 33,176 33,699 RevPAR $ 3,939 $ 3,876 $ 3,864 $ 3,804 $ 3,821 (3.0)% Weighted average occupancy 86.3% 84.8% 84.5% 84.7% 84.2% -210 bps RevPOR $ 4,549 $ 4,570 $ 4,566 $ 4,483 $ 4,531 (0.4)% (1) Excludes reimbursed costs on behalf of managed communities of $183,945, $229,960, $236,958, $240,268, and $262,287 (in thousands), respectively. 7

Senior Housing Segments ($ in 000s, except RevPAR and RevPOR) 2017 2018 YoY Retirement Centers Q1 Q2 Q3 Q4 Q1 Q1 Revenue $ 172,620 $ 162,248 $ 161,986 $ 157,342 $ 158,397 (8.2)% Segment Operating Income $ 74,002 $ 67,297 $ 65,907 $ 64,211 $ 64,422 (12.9)% Segment Operating Margin 42.9% 41.5% 40.7% 40.8% 40.7% -220 bps Number of communities (period end) 86 86 85 84 84 Period end number of units 16,071 16,071 15,961 15,042 15,045 Total Average Units 17,108 16,071 16,061 15,256 15,045 RevPAR $ 3,363 $ 3,365 $ 3,362 $ 3,438 $ 3,509 4.3 % Weighted average unit occupancy 88.0% 87.3% 87.6% 88.1% 87.7% -30 bps RevPOR $ 3,823 $ 3,857 $ 3,836 $ 3,905 $ 4,004 4.7 % Assisted Living Revenue $ 590,537 $ 547,430 $ 542,227 $ 530,494 $ 532,280 (9.9)% Segment Operating Income $ 217,439 $ 186,921 $ 173,576 $ 171,122 $ 176,538 (18.8)% Segment Operating Margin 36.8% 34.1% 32.0% 32.3% 33.2% -360 bps Number of communities (period end) 720 713 705 682 681 Period end number of units 47,296 46,999 46,520 44,773 44,728 Total Average Units 50,540 47,246 46,858 45,448 44,773 RevPAR $ 3,895 $ 3,862 $ 3,857 $ 3,891 $ 3,963 1.7 % Weighted average unit occupancy 84.7% 83.9% 84.2% 84.5% 83.4% -130 bps RevPOR $ 4,600 $ 4,602 $ 4,582 $ 4,604 $ 4,750 3.3 % CCRCs - Rental Revenue $ 141,798 $ 114,202 $ 108,075 $ 104,919 $ 105,069 (25.9)% Segment Operating Income $ 35,315 $ 24,344 $ 22,932 $ 23,571 $ 24,663 (30.2)% Segment Operating Margin 24.9% 21.3% 21.2% 22.5% 23.5% -140 bps Number of communities (period end) 32 30 30 28 27 Period end number of units 7,819 7,193 7,194 6,826 6,582 Total Average Units 9,214 7,516 7,193 6,948 6,739 RevPAR $ 5,086 $ 5,028 $ 4,989 $ 5,012 $ 5,172 1.7 % Weighted average unit occupancy 83.5% 83.0% 82.6% 83.2% 84.1% 60 bps RevPOR $ 6,091 $ 6,063 $ 6,046 $ 6,027 $ 6,160 1.1 % 8

Senior Housing: Same Community ($ in 000s, except RevPAR and RevPOR) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Revenue $ 764,130 $ 753,468 $ 749,104 $ 748,922 $ 759,361 (0.6)% Community Labor Expense (309,028) (315,861) (320,471) (324,537) (328,044) Other facility operating expense (164,964) (170,943) (173,825) (171,589) (173,532) Facility operating expense (1) (473,992) (486,804) (494,296) (496,126) (501,576) Same Community Operating Income $ 290,138 $ 266,664 $ 254,808 $ 252,796 $ 257,785 (11.2)% Same Community Operating Margin 38.0% 35.4% 34.0% 33.8% 33.9% -410 bps Number of communities (period end) 769 769 769 769 769 Total Average Units 63,200 63,191 63,185 63,168 63,166 RevPAR $ 4,028 $ 3,973 $ 3,950 $ 3,950 $ 4,005 (0.6)% Weighted average unit occupancy 86.1% 85.3% 85.5% 85.7% 84.8% -130 bps RevPOR $ 4,679 $ 4,658 $ 4,621 $ 4,610 $ 4,725 1.0 % Same Community Operating Income/Weighted average unit Same Community RevPAR occupancy 86.1% 85.7% 85.3% 85.5% 84.8% $290,138 $4,028 $4,005 $3,973 $3,950 $3,950 $266,664 $257,785 $254,808 $252,796 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 (1) Excludes hurricane and natural disaster expense. 9

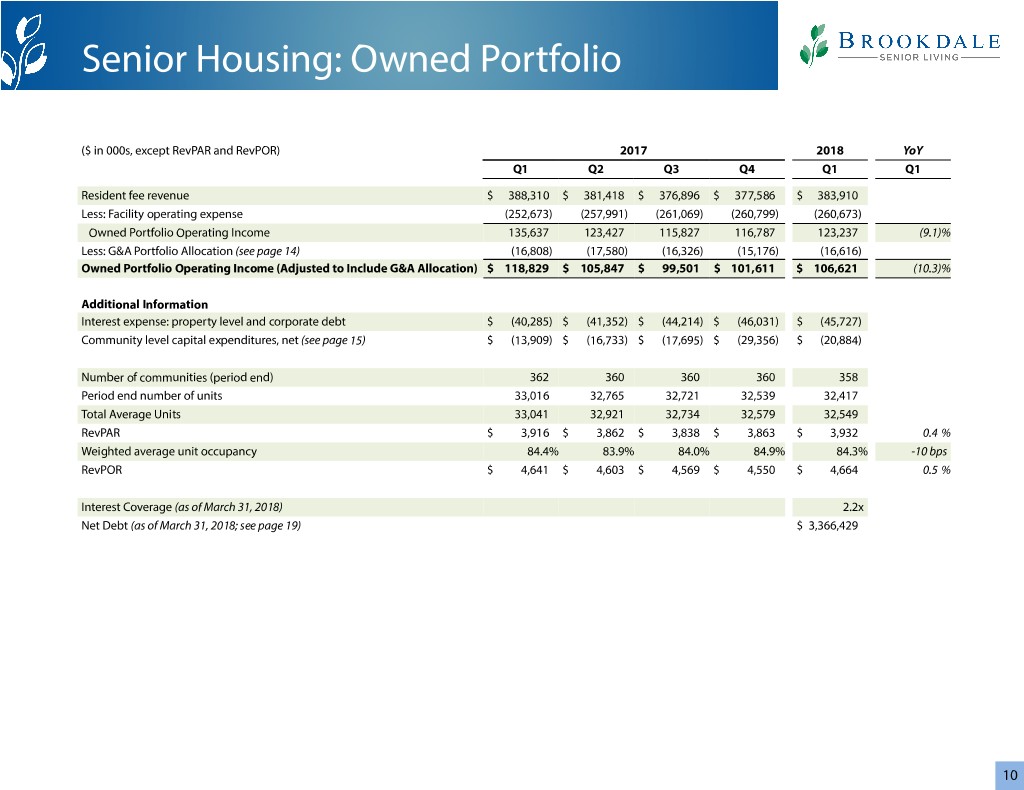

Senior Housing: Owned Portfolio ($ in 000s, except RevPAR and RevPOR) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Resident fee revenue $ 388,310 $ 381,418 $ 376,896 $ 377,586 $ 383,910 Less: Facility operating expense (252,673) (257,991) (261,069) (260,799) (260,673) Owned Portfolio Operating Income 135,637 123,427 115,827 116,787 123,237 (9.1)% Less: G&A Portfolio Allocation (see page 14) (16,808) (17,580) (16,326) (15,176) (16,616) Owned Portfolio Operating Income (Adjusted to Include G&A Allocation) $ 118,829 $ 105,847 $ 99,501 $ 101,611 $ 106,621 (10.3)% Additional Information Interest expense: property level and corporate debt $ (40,285) $ (41,352) $ (44,214) $ (46,031) $ (45,727) Community level capital expenditures, net (see page 15) $ (13,909) $ (16,733) $ (17,695) $ (29,356) $ (20,884) Number of communities (period end) 362 360 360 360 358 Period end number of units 33,016 32,765 32,721 32,539 32,417 Total Average Units 33,041 32,921 32,734 32,579 32,549 RevPAR $ 3,916 $ 3,862 $ 3,838 $ 3,863 $ 3,932 0.4 % Weighted average unit occupancy 84.4% 83.9% 84.0% 84.9% 84.3% -10 bps RevPOR $ 4,641 $ 4,603 $ 4,569 $ 4,550 $ 4,664 0.5 % Interest Coverage (as of March 31, 2018) 2.2x Net Debt (as of March 31, 2018; see page 19) $ 3,366,429 10

Senior Housing: Leased Portfolio ($ in 000s, except RevPAR and RevPOR) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Resident fee revenue $ 516,645 $ 442,462 $ 435,392 $ 415,169 $ 411,836 Less: Facility operating expense (325,526) (287,327) (288,804) (273,052) (269,450) Leased Portfolio Operating Income 191,119 155,135 146,588 142,117 142,386 (25.5)% Less: G&A Portfolio Allocation (see page 14) (22,362) (20,394) (18,860) (16,686) (17,824) Leased Portfolio Operating Income (adjusted to Include G&A Allocation) $ 168,757 $ 134,741 $ 127,728 $ 125,431 $ 124,562 (26.2)% Additional Information Total cash lease payments on leased portfolio (see page 16) $ (152,041) $ (129,853) $ (129,523) $ (127,647) $ (127,302) Proceeds from entrance fees, net of refunds and amortization $ (173) $ 541 $ (547) $ 811 $ 831 Community level capital expenditures, net (see page 15) $ (14,801) $ (14,205) $ (15,397) $ (29,119) $ (13,064) Number of communities (period end) 476 469 460 434 434 Period end number of units 38,170 37,498 36,954 34,102 33,938 Total Average Units 43,821 37,912 37,378 35,073 34,008 RevPAR $ 3,922 $ 3,883 $ 3,879 $ 3,942 $ 4,032 2.8 % Weighted average unit occupancy 85.9% 85.2% 85.5% 85.5% 84.6% -130 bps RevPOR $ 4,564 $ 4,557 $ 4,537 $ 4,610 $ 4,766 4.4 % Lease Coverage (as of March 31, 2018) 0.96x Lease Maturity Information as of March 31, 2018 Trailing twelve Leased communities with Leased communities months ended March purchase options without purchase options Total leased communities 31, 2018 Total Total Total Community average Community average Community average Total cash lease Initial lease maturities count units count units count units payments 2018 42 2,169 43 4,159 85 6,328 $ 93,226 2019 3 327 48 2,725 51 3,052 48,610 2020 2 133 84 4,513 86 4,646 58,793 2021 — — 23 1,559 23 1,559 20,530 2022 1 114 12 1,067 13 1,181 13,742 Thereafter 47 2,541 129 14,631 176 17,172 268,442 Total 95 5,284 339 28,654 434 33,938 $ 503,343 11

New Supply (1) Brookdale's Largest 20 Markets - Competitive Summary Brookdale in NIC Markets Competition Within 20 Minute Drive Q1 2018 Total Weighted IL/AL/MC 5 Yr 5 Yr Projected Average Average New 1 Yr Projected Projected Age 75 + Pop Community Units Unit Q1 2018 New Const. Const. Unit Opens % Current Total Pop w/ Inc. $50k + Market Count (IL/AL/MC) Occupancy RevPAR Properties(2) Units(2) of Supply(2) Saturation(3) Growth(4) Growth(4) Chicago, IL 16 2,602 90.1% $ 4,018 17 2,079 9.8% 19.6% 1.5% 24.1% Seattle, WA 25 2,426 86.8% 3,799 2 164 0.8% 25.2% 6.8% 37.3% Los Angeles, CA 20 2,145 83.5% 3,985 5 735 3.4% 8.1% 3.5% 24.0% Phoenix, AZ 22 1,769 89.5% 3,903 13 1,874 14.5% 23.3% 8.8% 43.5% Dallas, TX 23 1,635 83.5% 3,397 16 1,369 8.0% 21.5% 9.2% 39.7% Portland, OR 17 1,467 94.2% 3,841 5 655 6.0% 36.0% 6.5% 46.0% Charlotte, NC 18 1,403 87.4% 4,388 2 217 4.2% 33.1% 8.9% 41.5% Denver, CO 12 1,400 82.1% 4,432 9 1,025 11.4% 23.2% 8.5% 42.8% Miami, FL 8 1,269 79.2% 3,109 7 777 7.2% 16.6% 6.0% 36.5% Orlando, FL 13 1,080 87.4% 3,442 4 360 6.6% 20.7% 9.1% 46.3% Austin, TX 10 1,043 88.4% 5,557 7 1,098 15.7% 20.4% 13.3% 47.0% Houston, TX 12 990 83.4% 4,401 6 409 3.6% 15.6% 9.7% 41.2% Jacksonville, FL 9 974 87.1% 3,560 5 468 7.6% 25.6% 6.9% 45.4% San Antonio, TX 12 971 76.1% 3,139 — — —% 21.7% 8.4% 35.9% Detroit, MI 10 955 82.8% 3,223 11 939 7.8% 21.6% 1.5% 31.0% Riverside, CA 9 903 82.6% 3,363 4 511 5.6% 12.0% 5.0% 24.6% Atlanta, GA 9 858 89.0% 3,414 7 856 11.4% 29.0% 8.0% 46.7% Tampa, FL 8 853 74.9% 2,875 6 514 6.6% 19.1% 6.1% 40.9% Santa Rosa, CA 6 843 81.0% 4,335 — — —% 18.2% 3.6% 31.4% New York, NY 8 840 87.4% 6,623 8 647 6.0% 7.9% 3.6% 22.7% Top 20 Markets 267 26,426 85.4% $ 3,934 134 14,697 6.8% 20.9% 6.7% 37.4% All Other NIC Markets 306 24,769 82.6% $ 4,033 113 10,803 2.9% 20.4% 4.3% 32.1% (1) Data reflected is for the consolidated senior housing portfolio only. (2) NIC MAP Supply Set, Q1 2018 "New Construction" properties with projected open dates through Q1 2019. (3) Saturation is equal to units per population Age 75+ with income 50k+. (4) Percentage changes are based on data from ESRI for 2017-2022. 12

Ancillary Services ($ in 000s) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Resident fee revenue Home Health $ 92,241 $ 88,561 $ 87,315 $ 89,272 $ 85,490 Hospice 13,346 15,441 17,328 18,248 19,327 Outpatient Therapy 6,375 6,179 5,941 5,937 5,685 Other ancillary services 10 9 20 39 18 Segment resident fee revenue 111,972 110,190 110,604 113,496 110,520 (1.3)% Segment Operating Income 15,629 13,103 9,823 12,793 8,318 (46.8)% Segment Operating Margin 14.0% 11.9% 8.9% 11.3% 7.5% -650 bps Less: G&A Allocation (see page 14) (7,225) (7,128) (7,091) (7,630) (7,113) Segment Operating Income (Adjusted to Include G&A Allocation) $ 8,404 $ 5,975 $ 2,732 $ 5,163 $ 1,205 (85.7)% Segment Operating Margin (Adjusted to Include G&A Allocation) 7.5% 5.4% 2.5% 4.5% 1.1% -640 bps Additional Information Interest expense $ (288) $ (165) $ (168) $ (132) $ — Community level capital expenditures, net (see page 15) $ (22) $ (35) $ (277) $ (3) $ (6) Home Health average daily census 15,370 14,821 14,844 15,335 15,497 0.8 % Hospice average daily census 920 1,033 1,169 1,257 1,302 41.5 % Outpatient Therapy treatment codes 193,853 190,618 178,851 179,132 167,170 (13.8)% 13

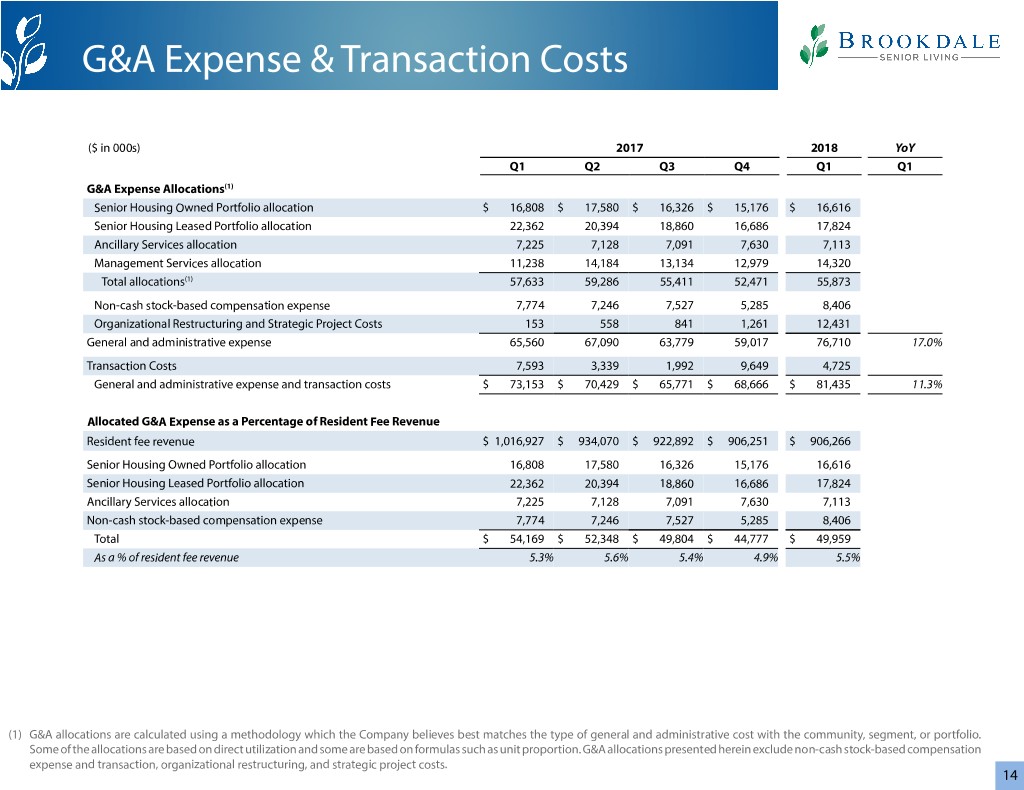

G&A Expense & Transaction Costs ($ in 000s) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 G&A Expense Allocations(1) Senior Housing Owned Portfolio allocation $ 16,808 $ 17,580 $ 16,326 $ 15,176 $ 16,616 Senior Housing Leased Portfolio allocation 22,362 20,394 18,860 16,686 17,824 Ancillary Services allocation 7,225 7,128 7,091 7,630 7,113 Management Services allocation 11,238 14,184 13,134 12,979 14,320 Total allocations(1) 57,633 59,286 55,411 52,471 55,873 Non-cash stock-based compensation expense 7,774 7,246 7,527 5,285 8,406 Organizational Restructuring and Strategic Project Costs 153 558 841 1,261 12,431 General and administrative expense 65,560 67,090 63,779 59,017 76,710 17.0% Transaction Costs 7,593 3,339 1,992 9,649 4,725 General and administrative expense and transaction costs $ 73,153 $ 70,429 $ 65,771 $ 68,666 $ 81,435 11.3% Allocated G&A Expense as a Percentage of Resident Fee Revenue Resident fee revenue $ 1,016,927 $ 934,070 $ 922,892 $ 906,251 $ 906,266 Senior Housing Owned Portfolio allocation 16,808 17,580 16,326 15,176 16,616 Senior Housing Leased Portfolio allocation 22,362 20,394 18,860 16,686 17,824 Ancillary Services allocation 7,225 7,128 7,091 7,630 7,113 Non-cash stock-based compensation expense 7,774 7,246 7,527 5,285 8,406 Total $ 54,169 $ 52,348 $ 49,804 $ 44,777 $ 49,959 As a % of resident fee revenue 5.3% 5.6% 5.4% 4.9% 5.5% (1) G&A allocations are calculated using a methodology which the Company believes best matches the type of general and administrative cost with the community, segment, or portfolio. Some of the allocations are based on direct utilization and some are based on formulas such as unit proportion. G&A allocations presented herein exclude non-cash stock-based compensation expense and transaction, organizational restructuring, and strategic project costs. 14

Capital Expenditures ($ in 000s, except for Community level capital expenditures per unit) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Community level capital expenditures, including allocations Senior Housing Owned Portfolio $ 13,909 $ 16,733 $ 17,695 $ 29,356 $ 20,884 Senior Housing Leased Portfolio 14,801 14,205 15,397 29,119 13,064 Ancillary Services 22 35 277 3 6 Community level capital expenditures, net 28,732 30,973 33,369 58,478 33,954 18.2% Corporate capital expenditures 5,990 7,859 7,636 13,430 7,782 29.9% Non-Development Capital Expenditures, net 34,722 38,832 41,005 71,908 41,736 20.2% Development Capital Expenditures, net 1,064 2,807 3,336 1,616 5,381 405.7% Total capital expenditures, net $ 35,786 $ 41,639 $ 44,341 $ 73,524 $ 47,117 31.7% Community level capital expenditures, net, per unit $ 374 $ 437 $ 476 $ 864 $ 510 36.4% Reconciliation to Additions to PP&E Total capital expenditures, net $ 35,786 $ 41,639 $ 44,341 $ 73,524 $ 47,117 Add: Total lessor reimbursements 8,044 5,545 4,379 8,218 2,379 Add: Change in related payables 5,098 (6,542) 1,754 (7,899) 17,096 Additions to property, plant and equipment and leasehold intangibles, net $ 48,928 $ 40,642 $ 50,474 $ 73,843 $ 66,592 15

Cash Lease Payments ($ in 000s) 2017 2018 YoY Q1 Q2 Q3 Q4 Q1 Q1 Operating Leases Facility lease expense $ 88,807 $ 84,690 $ 84,437 $ 81,787 $ 80,400 Less: Straight-line (income) expense, net 3,007 3,119 3,078 5,109 6,165 Less: Amortization of (above) below market lease, net 1,697 1,697 1,697 1,586 1,938 Add: Amortization of deferred gain 1,093 1,093 1,091 1,089 1,090 Cash operating lease payments(1) $ 94,604 $ 90,599 $ 90,303 $ 89,571 $ 89,593 (5.3)% Capital and Financing Leases Interest expense: capital and financing lease obligations $ 49,859 $ 32,228 $ 31,999 $ 26,578 $ 22,931 Less: Non-cash interest expense on financing lease obligations (6,156) (3,865) (3,939) (3,784) (3,383) Add: Lease financing debt amortization 17,248 14,382 14,626 18,650 21,114 Cash capital and financing lease payments $ 60,951 $ 42,745 $ 42,686 $ 41,444 $ 40,662 (33.3)% Total cash lease payments(1) $ 155,555 $ 133,344 $ 132,989 $ 131,015 $ 130,255 (16.3)% Interest Expense Reconciliation to Income Statement Interest expense: capital and financing lease obligations $ 49,859 $ 32,228 $ 31,999 $ 26,578 $ 22,931 Less: Non-cash interest expense on financing lease obligations (6,156) (3,865) (3,939) (3,784) (3,383) Interest expense: capital and financing lease obligations - cash payments 43,703 28,363 28,060 22,794 19,548 Less: Interest income (631) (804) (1,285) (1,903) (2,983) Interest expense: debt 40,573 41,517 44,382 46,163 45,727 Interest expense, net 83,645 69,076 71,157 67,054 62,292 Add: Amortization of deferred financing costs and debt premium (discount) 2,591 2,692 3,544 3,854 3,956 Add: Change in fair value of derivatives 46 39 74 15 (74) Add: Non-cash interest expense on financing lease obligations 6,156 3,865 3,939 3,784 3,383 Add: Interest income 631 804 1,285 1,903 2,983 Interest expense per income statement $ 93,069 $ 76,476 $ 79,999 $ 76,610 $ 72,540 (1) Includes cash lease payments of $3,514, $3,491, $3,466, $3,368 and $2,953 (in thousands), respectively, for leases of corporate offices and information technology systems and equipment. 16

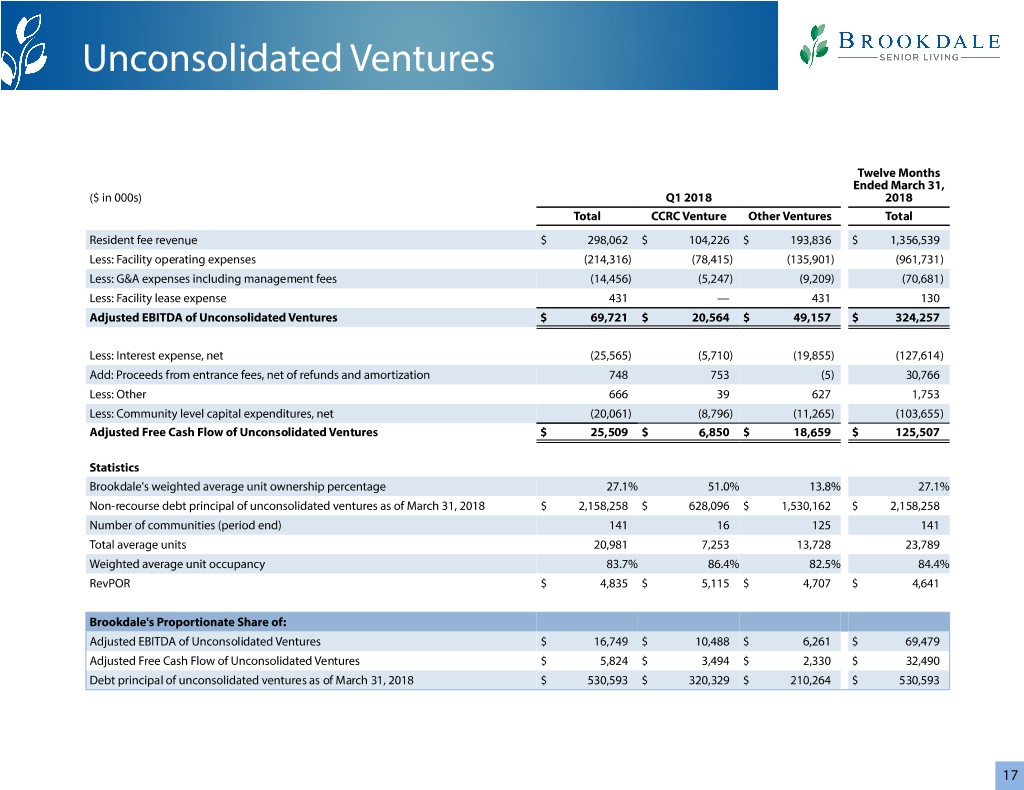

Unconsolidated Ventures Twelve Months Ended March 31, ($ in 000s) Q1 2018 2018 Total CCRC Venture Other Ventures Total Resident fee revenue $ 298,062 $ 104,226 $ 193,836 $ 1,356,539 Less: Facility operating expenses (214,316) (78,415) (135,901) (961,731) Less: G&A expenses including management fees (14,456) (5,247) (9,209) (70,681) Less: Facility lease expense 431 — 431 130 Adjusted EBITDA of Unconsolidated Ventures $ 69,721 $ 20,564 $ 49,157 $ 324,257 Less: Interest expense, net (25,565) (5,710) (19,855) (127,614) Add: Proceeds from entrance fees, net of refunds and amortization 748 753 (5) 30,766 Less: Other 666 39 627 1,753 Less: Community level capital expenditures, net (20,061) (8,796) (11,265) (103,655) Adjusted Free Cash Flow of Unconsolidated Ventures $ 25,509 $ 6,850 $ 18,659 $ 125,507 Statistics Brookdale's weighted average unit ownership percentage 27.1% 51.0% 13.8% 27.1% Non-recourse debt principal of unconsolidated ventures as of March 31, 2018 $ 2,158,258 $ 628,096 $ 1,530,162 $ 2,158,258 Number of communities (period end) 141 16 125 141 Total average units 20,981 7,253 13,728 23,789 Weighted average unit occupancy 83.7% 86.4% 82.5% 84.4% RevPOR $ 4,835 $ 5,115 $ 4,707 $ 4,641 Brookdale's Proportionate Share of: Adjusted EBITDA of Unconsolidated Ventures $ 16,749 $ 10,488 $ 6,261 $ 69,479 Adjusted Free Cash Flow of Unconsolidated Ventures $ 5,824 $ 3,494 $ 2,330 $ 32,490 Debt principal of unconsolidated ventures as of March 31, 2018 $ 530,593 $ 320,329 $ 210,264 $ 530,593 17

Debt & Liquidity Debt Structure(1) As of March 31, 2018 ($ in 000s) Weighted Rate Fixed rate debt 4.87% Variable rate debt (2) 4.20% Total debt and line of credit 4.64% $796,990 Balance(1) $2,549,570 $1,328,739 Total debt $ 3,878,310 $531,749 Fixed rate debt Total variable rate debt Variable rate debt with interest rate caps Variable rate debt- unhedged Total Liquidity ($ in 000s) $1,000,000 $899,435 $872,634 $868,228 $800,000 $600,000 $546,006 $537,930 $514,443 $510,061 $426,710 $181,307 $400,000 $59,237 $200,000 $367,473 $364,699 $361,505 $358,191 $358,167 $0 03/31/2017 06/30/2017 09/30/2017 12/31/2017 03/31/2018 Line of credit available to draw Cash and cash equivalents and marketable securities Total liquidity (available to draw + cash) (1) Includes the carrying value of mortgage debt, convertible notes, line of credit and other notes payable, but excludes capital and financing lease obligations. (2) Pertaining to variable rate debt, reflects a) market rates as of March 31, 2018 and b) applicable cap rates for hedged debt. 18

Debt Maturity & Leverage Weighted Rate (1) Debt Maturity Schedule Debt(2) ($ in 000s) 2018 3.41% $1,400,000 2019 6.36% 2020 5.34% 2021 5.86% $1,929,562 2022 4.28% $700,000 Thereafter 4.32% Total 4.64% Total Balance $459,710 $485,759 $325,763 $336,054 $341,461 Debt(2) $ 3,878,310 $0 2018 (1) 2019 2020 2021 2022 Thereafter (1) Includes carrying value of $313.6 million of convertible notes. Debt(2) (2) Includes mortgage debt, convertible notes and other notes payable, but excludes capital and financing leases and line of credit and recurring principal amortization. Leverage Ratios(3) ($ in 000s) (3) Leverage ratios include results of operations of communities disposed of through sale or lease Annualized termination through the disposition date. Twelve months ended March 31, 2018 Leverage (4) Amounts exclude transaction, organizational (4) Adjusted EBITDAR (A) $ 965,132 restructuring, and strategic project costs of $34.8 Less: Cash operating lease payments (see page 16) (360,066) million. Adjusted EBITDA(4) 605,066 Less: Cash capital and financing lease payments (see page 16) (167,537) Important Note Regarding Non-GAAP Financial Adjusted EBITDA(4) after cash capital and financing lease payments (B) 437,529 Measures. Adjusted EBITDAR, Adjusted EBITDA and As of March 31, 2018 Adjusted EBITDA after cash capital and financing lease payments (in each case excluding transaction, (2) Debt 3,878,310 organizational restructuring and strategic project costs), Line of credit — Net debt, and Adjusted net debt are financial measures Less: Cash and cash equivalents (335,412) that are not calculated in accordance with GAAP. See the Less: Marketable securities (174,649) definitions of such measures under “Definitions” below Less: Cash and escrow deposits - restricted held as collateral against existing debt (1,820) and important information regarding such measures, including reconciliations to the most comparable GAAP Net Debt (C) 3,366,429 7.7x (C/B) financial measures, under “Non-GAAP Financial Plus: Cash operating and capital and financing lease payments (see page 16) multiplied by 8 4,220,824 Measures” below. Adjusted Net Debt (D) $ 7,587,253 7.9x (D/A) 19

Net Asset Value Elements ($ in 000s and are for the trailing twelve months ending March 31, 2018 unless otherwise noted) Senior Housing: Owned Portfolio(1) Owned Portfolio Operating Income $ 479,278 Less: G&A Portfolio Allocation(2) (65,698) Owned Portfolio Operating Income (Adjusted to Include G&A Allocation) $ 413,580 Net Debt as of March 31, 2018 (see page 19) $ 3,366,429 Total Average Units 32,696 Senior Housing: Leased Portfolio(1) Leased Portfolio Operating Income (Adjusted to Include G&A Allocation)(2) $ 512,462 Total cash lease payments on leased portfolio (see page 16) $ (514,325) Proceeds from entrance fees, net of refunds and amortization $ 1,636 Total Average Units 36,093 Ancillary Services Segment Operating Income (Adjusted to Include G&A Allocation)(2) $ 15,075 Management Services Segment Operating Income (Adjusted to Include G&A Allocation)(2) $ 24,015 Unconsolidated Ventures Brookdale's Proportionate Share of Adjusted EBITDA $ 69,479 Brookdale's Proportionate Share of non-recourse debt principal as of March 31, 2018 $ 530,593 Total Average Units 23,789 Brookdale's weighted average unit ownership percentage 27.1% Shares outstanding (excluding 6,230,895 unvested restricted shares) as of March 31, 2018 187,566,803 (1) Includes results of operations of communities disposed through sale or lease termination through the disposal date. (2) See page 14. G&A allocations presented on this page exclude non-cash stock-based compensation expense of $28,464 and transaction, organizational restructuring, and strategic project costs of $34,796 for the twelve months ended March 31, 2018. 20

Definitions Adjusted EBITDA is a non-GAAP financial measure that the Company defines as net Combined Segment Operating Income is defined by the Company as resident fee income (loss) before provision (benefit) for income taxes; non-operating (income) and management fee revenue of the Company, less facility operating expenses. expense items; depreciation and amortization (including non-cash impairment Combined Segment Operating Income does not include general and administrative charges); (gain) loss on sale or acquisition of communities (including gain (loss) on expenses, transaction costs or depreciation and amortization. facility lease termination and modification); straight-line lease expense (income), net of amortization of (above) below market rents; amortization of deferred gain; non- Community Labor Expenses is a component of facility operating expense that cash stock-based compensation expense; and change in future service obligation. includes regular and overtime salaries and wages, bonuses, paid-time-off and holiday For purposes of the Company’s leverage ratios presented under “Debt Maturity & wages, payroll taxes, contract labor, employee benefits, and workers compensation. Leverage”, Adjusted EBITDA and Adjusted EBITDA after cash capital and financing Development Capital Expenditures means capital expenditures for community lease payments exclude transaction, organizational restructuring, and strategic expansions and major community redevelopment and repositioning projects, project costs. including the Company’s Program Max initiative, and the development of new communities. Amounts of Development Capital Expenditures are presented net of Adjusted EBITDAR is a non-GAAP financial measure that the Company defines as lessor reimbursements received or anticipated to be received. Adjusted EBITDA before cash operating lease payments. For purposes of the Company’s leverage ratios presented under “Debt Maturity & Leverage”, Adjusted Interest Coverage is calculated based on the trailing-twelve months Owned EBITDAR excludes transaction, organizational restructuring, and strategic project Portfolio Operating Income adjusted for 5% management fee and capital costs. expenditures at $350/unit, divided by the trailing-twelve months property level and corporate debt interest expense. Adjusted Free Cash Flow is a non-GAAP financial measure that the Company defines as net cash provided by (used in) operating activities before: changes in operating Lease Coverage is calculated based on the trailing-twelve months Leased Portfolio assets and liabilities; gain (loss) on facility lease termination and modification; and Operating Income, excluding resident fee revenue and facility operating expense of distributions from unconsolidated ventures from cumulative share of net earnings; communities disposed during such period adjusted for 5% management fee and plus: proceeds from refundable entrance fees, net of refunds; and property insurance capital expenditures at $350/unit, divided by the trailing-twelve months cash lease proceeds; less: lease financing debt amortization and Non-Development Capital payments for both operating leases and capital and financing leases, excluding cash Expenditures (next page). lease payments for leases of corporate offices and information technology systems and equipment. Adjusted Net Debt is a non-GAAP financial measure that the Company defines as Net Debt, plus cash operating and capital and financing lease payments for the Leased Portfolio Operating Income is defined by the Company as resident fee relevant period multiplied by 8. revenues (excluding Brookdale Ancillary Services segment revenue), less facility operating expenses for the Company’s Senior Housing Leased Portfolio. Leased Brookdale's Proportionate Share of Adjusted EBITDA of Unconsolidated Portfolio Operating Income does not include general and administrative expenses Ventures is a non-GAAP financial measure calculated based on the Company’s equity (unless otherwise noted), transaction costs or depreciation and amortization. ownership percentage and in a manner consistent with the Company’s definition of Adjusted EBITDA for its consolidated entities. The Company’s investments in its Net Debt is a non-GAAP financial measure that the Company defines as the total of unconsolidated ventures are accounted for under the equity method of accounting. its debt (mortgage debt, convertible notes and other notes payable) and the outstanding balance on the line of credit, less unrestricted cash, marketable Brookdale’s Proportionate Share of Adjusted Free Cash Flow of Unconsolidated securities, and cash held as collateral against existing debt. Ventures is a non-GAAP financial measure calculated based on the Company’s equity ownership percentage and in a manner consistent with the Company’s definition of NM means not meaningful and is used in the year-over-year variance column if either Adjusted Free Cash Flow for its consolidated entities. The Company’s investments in or both periods being compared are negative values. its unconsolidated ventures are accounted for under the equity method of accounting and, therefore, the Company’s proportionate share of Adjusted Free Cash Flow of unconsolidated ventures does not represent cash available to the Company’s consolidated business except to the extent it is distributed to the Company. 21

Definitions Non-Development Capital Expenditures is comprised of corporate and Segment Operating Income is defined by the Company as segment revenues less community-level capital expenditures, including those related to maintenance, segment facility operating expenses. Segment Operating Income does not include renovations, upgrades and other major building infrastructure projects for the general and administrative expenses (unless otherwise noted), transaction costs or Company’s communities. Non-Development Capital Expenditures does not include depreciation and amortization. Management Services segment operating income capital expenditures for community expansions and major community excludes revenue for reimbursements for which the Company is the primary obligor redevelopment and repositioning projects, including the Company’s Program Max of costs incurred on behalf of managed communities, and there are no facility initiative, and the development of new communities (i.e., Development Capital operating expenses associated with the Management Services segment. See the Expenditures). Amounts of Non-Development Capital Expenditures are presented Segment Information note to the Company’s consolidated financial statements for net of lessor reimbursements received or anticipated to be received. more information regarding the Company’s segments. Owned Portfolio Operating Income is defined by the Company as resident fee Senior Housing Leased Portfolio represents Brookdale leased communities and revenues (excluding Brookdale Ancillary Services segment revenue), less facility does not include owned, managed – 3rd party, or managed – venture communities. operating expenses for the Company’s Senior Housing Owned Portfolio. Owned Portfolio Operating Income does not include general and administrative expenses Senior Housing Operating Income is defined by the Company as segment revenues (unless otherwise noted), transaction costs or depreciation and amortization. less segment facility operating expenses for the Company’s Retirement Centers, Assisted Living and CCRCs–Rental segments on an aggregate basis. Senior Housing RevPAR, or average monthly senior housing resident fee revenues per available unit, Operating Income does not include general and administrative expenses, is defined by the Company as resident fee revenues, excluding Brookdale Ancillary transaction costs or depreciation and amortization. Services segment revenue and entrance fee amortization, for the corresponding portfolio for the period, divided by the weighted average number of available units Senior Housing Owned Portfolio represents Brookdale owned communities and rd in the corresponding portfolio for the period, divided by the number of months in does not include leased, managed – 3 party, or managed – venture communities. the period. Total Average Units represents the average number of units operated during the RevPOR, or average monthly senior housing resident fee revenues per occupied unit, period. is defined by the Company as resident fee revenues, excluding Brookdale Ancillary Total RevPAR, or average monthly resident fee revenues per available unit, is defined Services segment revenue and entrance fee amortization, for the corresponding by the Company as resident fee revenues, excluding entrance fee amortization, for portfolio for the period, divided by the weighted average number of occupied units the Company for the period, divided by the weighted average number of available in the corresponding portfolio for the period, divided by the number of months in units in the Company’s consolidated portfolio for the period, divided by the number the period. of months in the period. Same Community information reflects historical results from senior housing Transaction, Organizational Restructuring, and Strategic Project Costs are operations for same store communities (utilizing the Company's methodology for general and administrative expenses. Transaction costs include third party costs determining same store communities). directly related to acquisition and disposition activity, community financing and Same Community Operating Income is defined by the Company as resident fee leasing activity, our assessment of options and alternatives to enhance stockholder revenues (excluding Brookdale Ancillary Services segment revenue), less facility value, and stockholder relations advisory matters, and are primarily comprised of operating expenses (excluding hurricane and natural disaster expenses) for the legal, finance, consulting, professional fees and other third party costs. Company's Same Community portfolio. Same Community Operating Income does Organizational restructuring costs include those related to our efforts to reduce not include general and administrative expenses, transaction costs or depreciation general and administrative expenses and our senior leadership changes, including and amortization. severance and retention costs. Strategic project costs include costs associated with certain strategic projects related to refining our strategy, building out enterprise- wide capabilities (including the electronic medical records (“EMR”) roll-out project) and reducing costs and achieving synergies by capitalizing on scale. 22

Appendix Consolidated Statements of Cash Flows 24 Non-GAAP Financial Measures 25 Brookdale West Hartford West Hartford, CT 23

Consolidated Statements of Cash Flows ($ in 000s) 2017 2018 Q1 Q2 Q3 Q4 Q1 Cash Flows from Operating Activities Net income (loss) $ (126,361) $ (46,337) $ (413,929) $ 15,021 $ (457,234) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Debt modification and extinguishment costs 61 693 11,129 526 35 Depreciation and amortization, net 130,078 123,579 121,193 119,908 118,211 Goodwill and asset impairment 20,706 1,559 368,551 18,966 430,363 Equity in (earnings) loss of unconsolidated ventures (981) 4,570 6,722 4,516 4,243 Distributions from unconsolidated ventures from cumulative share of net earnings 439 453 473 6,893 408 Amortization of deferred gain (1,093) (1,093) (1,091) (1,089) (1,090) Amortization of entrance fees (1,198) (832) (427) (444) (501) Proceeds from deferred entrance fee revenue 1,927 2,025 567 1,193 1,109 Deferred income tax provision (benefit) 83,310 (2,937) (31,704) (63,978) 15,037 Straight-line lease (income) expense (3,007) (3,119) (3,078) (5,109) (6,165) Change in fair value of derivatives 46 39 74 15 (74) Loss (gain) on sale of assets, net 603 547 233 (20,656) (43,431) Loss on facility lease termination — 6,368 4,938 2,970 — Non-cash stock-based compensation expense 7,774 7,246 7,527 5,285 8,406 Non-cash interest expense on financing lease obligations 6,156 3,865 3,939 3,784 3,383 Amortization of (above) below market lease, net (1,697) (1,697) (1,697) (1,586) (1,938) Non-cash management contract termination fee — — — — (2,242) Other (1,398) (1,571) (1,730) (4,120) (156) Changes in operating assets and liabilities: Accounts receivable, net 3,556 8,401 (1,192) 1,982 3,488 Prepaid expenses and other assets, net (8,630) 27,609 4,344 (1,353) (24,807) Accounts payable and accrued expenses (51,627) 3,645 26,523 16,932 (21,370) Tenant refundable fees and security deposits (297) 82 (17) (190) (137) Deferred revenue 8,406 664 (7,557) (15,430) 12,426 Net cash provided by operating activities 66,773 133,759 93,791 84,036 37,964 Cash Flows from Investing Activities Change in lease security deposits and lease acquisition deposits, net (420) 425 (416) (1,702) (2,015) (Purchase) sale of marketable securities, net — (29,779) (216,597) (44,811) 118,273 Additions to property, plant and equipment and leasehold intangibles, net (48,928) (40,642) (50,474) (73,843) (66,592) Acquisition of assets, net of related payables and cash received — (400) — (4,796) (27,330) Investment in unconsolidated ventures (185,971) (195) (1,434) (11,417) (8,434) Distributions received from unconsolidated ventures 1,807 6,238 3,446 17,544 2,037 Proceeds from sale of assets, net 31,675 2,780 115 35,937 75,060 Property insurance proceeds 1,398 1,571 1,461 4,120 156 Other 696 251 15 13 — Net cash (used in) provided by investing activities (199,743) (59,751) (263,884) (78,955) 91,155 Cash Flows from Financing Activities Proceeds from debt 34,455 58,116 1,200,476 14,158 30,168 Repayment of debt and capital and financing lease obligations (52,273) (36,931) (869,499) (95,458) (44,001) Proceeds from line of credit — — 100,000 — — Repayment of line of credit — — (100,000) — — Payment of financing costs, net of related payables (328) (853) (15,738) (350) (248) Proceeds from refundable entrance fees, net of refunds (902) (652) (687) 62 223 Payments for lease termination — (552) — — — Payments of employee taxes for withheld shares (5,112) (208) (346) (223) (2,618) Other 599 455 532 457 372 Net cash (used in) provided by financing activities (23,561) 19,375 314,738 (81,354) (16,104) Net (decrease) increase in cash and cash equivalents and restricted cash and escrow deposits (156,531) 93,383 144,645 (76,273) 113,015 Cash and cash equivalents and restricted cash and escrow deposits at beginning of period 277,322 120,791 214,174 358,819 282,546 Cash and cash equivalents and restricted cash and escrow deposits at end of period $ 120,791 $ 214,174 $ 358,819 $ 282,546 $ 395,561 Reflects the retrospective adoption of ASU 2016-15 and 2016-18. Refer to page 25 for additional detail regarding the impact of ASU 2016-15. For ASU 2016-18, the Company identified that the inclusion of of the change in cash and escrow deposits restricted within the retrospective presentation of the statements of cash flows resulted in a $0.6 million, $1.1 million, $4.6 million and ($7.4 million) increase (decrease) to the amount of net cash used in investing activities for each of the three months ended March 31, 2017, June 30, 2017, September 30, 2017 and 24 December 31, 2017, respectively.

Non-GAAP Financial Measures This Supplemental Information contains financial measures utilized by management to evaluate the Company’s operating performance and liquidity that are not calculated in accordance with GAAP, including Adjusted EBITDA; the Company's Proportionate Share of Adjusted EBITDA of Unconsolidated Ventures; Adjusted EBITDAR, Adjusted EBITDA and Adjusted EBITDAR after cash lease payments (in each case excluding transaction, organizational restructuring and strategic project costs); Net Debt; Adjusted Net Debt; Adjusted Free Cash Flow; and the Company’s Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures, the Company’s definitions for which are included in the “Definitions” section above. These non-GAAP financial measures should not be considered in isolation from or as superior to or as a substitute for net income (loss), income (loss) from operations, net cash provided by (used in) operating activities, short-term debt, long-term debt, less current portion, current portion of long-term debt, or other financial measures determined in accordance with GAAP. Management uses these non-GAAP financial measures to supplement the Company’s GAAP results to provide a more complete understanding of the factors and trends affecting the business. Investors are urged to review the reconciliations set forth in this section of such non-GAAP financial measures to their most comparable GAAP financial measures and to review the information under “Reconciliation of Non-GAAP Financial Measures” in the Company’s earnings release dated May 7, 2018 for additional information regarding the Company’s use, and the limitations of, the Company’s non-GAAP financial measures. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP measures may not be comparable to similar measures disclosed by other companies, because not all companies calculate such measures in the same manner. The Company adopted ASU 2016-15, Statement of Cash Flows - Classification of Certain Cash Receipts and Cash Payments ("ASU 2016-15") on January 1, 2018 and applied ASU 2016-15 retrospectively for all prior periods presented. Among other things, ASU 2016-15 provides that debt prepayment and extinguishment costs will be classified within financing activities in the statement of cash flows. The Company identified $7, $651, $10,556, and $481 (in thousands) of cash paid for debt modification and extinguishment costs which have been retrospectively classified as cash flows from financing activities, resulting in a corresponding increase to the amount of net cash provided by operating activities for each of the three months ended March 31, 2017, June 30, 2017, September 30, 2017, and December 31, 2017, respectively. The Company did not change its definition of Adjusted Free Cash Flow upon the adoption of ASU 2016-15. Following the adoption of ASU 2016-15, the amount of Adjusted Free Cash Flow reflects a $7, $651, $10,556, and $481 (in thousands) increase for each the three months ended March 31, 2017, June 30, 2017, September 30, 2017, and December 31, 2017, respectively. 25

Non-GAAP Financial Measures (Continued) Adjusted EBITDA Reconciliation ($ in 000s) 2017 2018 Q1 Q2 Q3 Q4 Q1 Net income (loss) $ (126,361) $ (46,337) $ (413,929) $ 15,021 $ (457,234) Provision (benefit) for income taxes 84,028 (2,735) (31,218) (66,590) 15,585 Equity in (earnings) loss of unconsolidated ventures (981) 4,570 6,722 4,516 4,243 Debt modification and extinguishment costs 61 693 11,129 526 35 Loss (gain) on sale of assets, net 603 547 233 (20,656) (43,431) Other non-operating income (1,662) (2,236) (2,621) (4,899) (2,586) Interest expense 93,069 76,476 79,999 76,610 72,540 Interest income (631) (804) (1,285) (1,903) (2,983) Income (loss) from operations 48,126 30,174 (350,970) 2,625 (413,831) Depreciation and amortization 127,487 120,887 117,649 116,054 114,255 Goodwill and asset impairment 20,706 1,559 368,551 18,966 430,363 Loss on facility lease termination — 6,368 4,938 2,970 — Straight-line lease expense (income) (3,007) (3,119) (3,078) (5,109) (6,165) Amortization of above market lease, net (1,697) (1,697) (1,697) (1,586) (1,938) Amortization of deferred gain (1,093) (1,093) (1,091) (1,089) (1,090) Non-cash stock-based compensation expense 7,774 7,246 7,527 5,285 8,406 Adjusted EBITDA $ 198,296 $ 160,325 $ 141,829 $ 138,116 $ 130,000 26

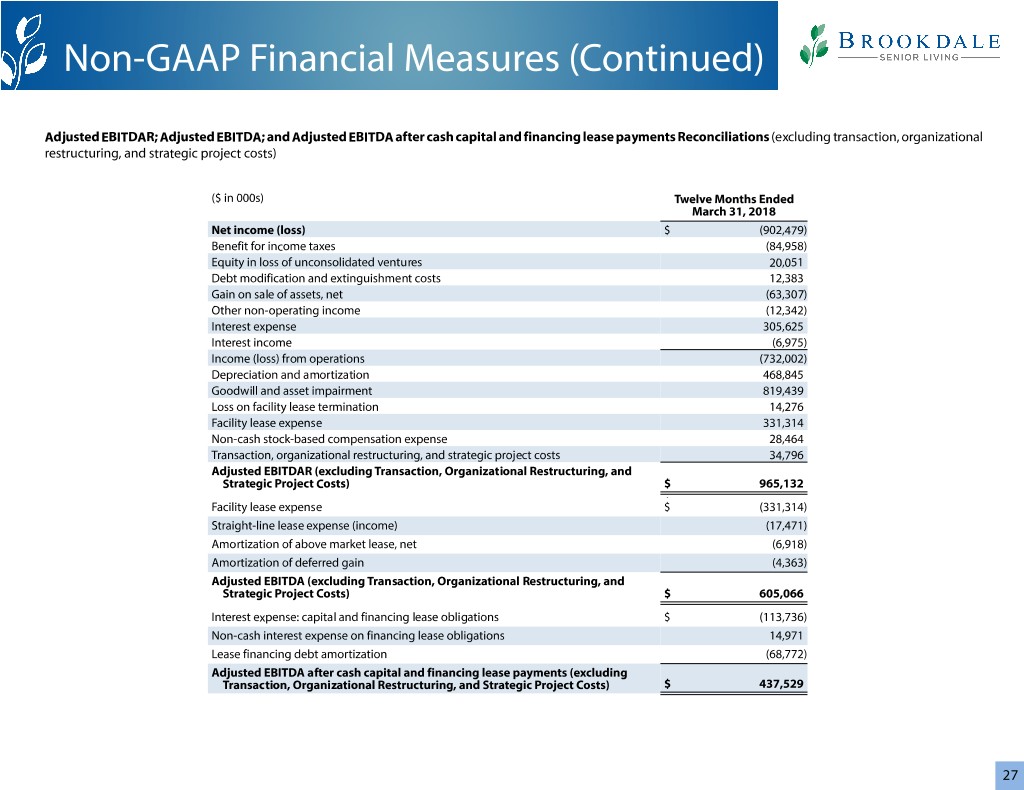

Non-GAAP Financial Measures (Continued) Adjusted EBITDAR; Adjusted EBITDA; and Adjusted EBITDA after cash capital and financing lease payments Reconciliations (excluding transaction, organizational restructuring, and strategic project costs) ($ in 000s) Twelve Months Ended March 31, 2018 Net income (loss) $ (902,479) Benefit for income taxes (84,958) Equity in loss of unconsolidated ventures 20,051 Debt modification and extinguishment costs 12,383 Gain on sale of assets, net (63,307) Other non-operating income (12,342) Interest expense 305,625 Interest income (6,975) Income (loss) from operations (732,002) Depreciation and amortization 468,845 Goodwill and asset impairment 819,439 Loss on facility lease termination 14,276 Facility lease expense 331,314 Non-cash stock-based compensation expense 28,464 Transaction, organizational restructuring, and strategic project costs 34,796 Adjusted EBITDAR (excluding Transaction, Organizational Restructuring, and Strategic Project Costs) $ 965,132 Facility lease expense $ (331,314—) Straight-line lease expense (income) (17,471) Amortization of above market lease, net (6,918) Amortization of deferred gain (4,363) Adjusted EBITDA (excluding Transaction, Organizational Restructuring, and Strategic Project Costs) $ 605,066 Interest expense: capital and financing lease obligations $ (113,736) Non-cash interest expense on financing lease obligations 14,971 Lease financing debt amortization (68,772) Adjusted EBITDA after cash capital and financing lease payments (excluding Transaction, Organizational Restructuring, and Strategic Project Costs) $ 437,529 27

Non-GAAP Financial Measures (Continued) Net Debt and Adjusted Net Debt Reconciliations ($ in 000s) As of March 31, 2018 Long-term debt (including current portion) $ 3,878,310 Line of credit — Less: cash and cash equivalents (335,412) Less: marketable securities (174,649) Less: cash held as collateral against existing debt (1,820) Net Debt 3,366,429 Plus: trailing twelve months cash lease payments multiplied by 8 4,220,824 Adjusted Net Debt $ 7,587,253 Adjusted Net Debt to Adjusted EBITDAR (excluding Transaction, Organizational Restructuring, and Strategic Project Costs) 7.9x Net Debt to Adjusted EBITDA after cash capital and financing lease payments (excluding Transaction, Organizational Restructuring, and Strategic Project Costs) 7.7x 28

Non-GAAP Financial Measures (Continued) Adjusted Free Cash Flow Reconciliation ($ in 000s) 2017 2018 Q1 Q2 Q3 Q4 Q1 Net cash provided by operating activities $ 66,773 $ 133,759 $ 93,791 $ 84,036 $ 37,964 Net cash (used in) provided by investing activities (199,743) (59,751) (263,884) (78,955) 91,155 Net cash (used in) provided by financing activities (23,561) 19,375 314,738 (81,354) (16,104) Net (decrease) increase in cash and cash equivalents and restricted cash and escrow deposits $ (156,531) $ 93,383 $ 144,645 $ (76,273) $ 113,015 Net cash provided by operating activities $ 66,773 $ 133,759 $ 93,791 $ 84,036 $ 37,964 Changes in operating assets and liabilities 48,592 (40,401) (22,101) (1,941) 30,400 Proceeds from refundable entrance fees, net of refunds (902) (652) (687) 62 223 Lease financing debt amortization (17,248) (14,382) (14,626) (18,650) (21,114) Distributions from unconsolidated ventures from cumulative share of net earnings (439) (453) (473) (6,893) (408) Non-development capital expenditures, net (34,722) (38,832) (41,005) (71,908) (41,736) Property insurance proceeds 1,398 1,571 1,461 4,120 156 Adjusted Free Cash Flow $ 63,452 $ 40,610 $ 16,360 $ (11,174) $ 5,485 29

Non-GAAP Financial Measures (Continued) Brookdale's Proportionate Share of Adjusted EBITDA of Unconsolidated Ventures For purposes of this presentation, amounts for each line item represent the aggregate amounts of such line items for all the Company's unconsolidated ventures. ($ in 000s) 2017 2018 TTM Q1 Q2 Q3 Q4 Q1 Q1 2018 Net income (loss) $ 8,118 $ (22,935) $ (40,233) $ (26,373) $ (22,662) $ (112,203) Provision for income taxes 263 327 323 292 234 1,176 Debt modification and extinguishment costs 13 16 80 21 (17) 100 (Gain) loss on sale of assets, net (372) 189 20 11 (1,045) (825) Other non-operating income (434) (837) (617) (590) (903) (2,947) Interest expense 26,391 35,304 36,119 34,035 26,827 132,285 Interest income (703) (750) (783) (804) (757) (3,094) Income (loss) from operations 33,276 11,314 (5,091) 6,592 1,677 14,492 Depreciation and amortization 47,528 79,695 79,884 77,189 67,885 304,653 Asset impairment 2 483 3,911 546 155 5,095 Straight-line lease expense (income) — 8 4 1 4 17 Adjusted EBITDA of unconsolidated ventures $ 80,806 $ 91,500 $ 78,708 $ 84,328 $ 69,721 $ 324,257 Brookdale's weighted average ownership percentage 21.2% 19.9% 21.3% 21.0% 24.0% 21.4% Brookdale's proportionate share of Adjusted EBITDA of unconsolidated ventures $ 17,126 $ 18,219 $ 16,788 $ 17,723 $ 16,749 $ 69,479 30

Non-GAAP Financial Measures (Continued) Brookdale's Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures For purposes of this presentation, amounts for each line item represent the aggregate amounts of such line items for all the Company's unconsolidated ventures. ($ in 000s) 2017 2018 TTM Q1 Q2 Q3 Q4 Q1 Q1 2018 Net cash provided by operating activities $ 59,924 $ 85,867 $ 62,054 $ 61,910 $ 50,262 $ 260,093 Net cash used in investing activities (1,144,115) (26,408) (16,476) (26,550) (14,642) (84,076) Net cash provided by (used in) financing activities 1,145,059 (37,686) (32,514) (52,315) (23,279) (145,794) Net increase (decrease) in cash and cash equivalents and restricted cash and escrow deposits $ 60,868 $ 21,773 $ 13,064 $ (16,955) $ 12,341 $ 30,223 Net cash provided by operating activities $ 59,924 $ 85,867 $ 62,054 $ 61,910 $ 50,262 $ 260,093 Changes in operating assets and liabilities 2,086 (16,559) (5,615) 6,904 1,119 (14,151) Proceeds from refundable entrance fees, net of refunds (4,365) (5,028) (6,309) (1,664) (6,712) (19,713) Non-development capital expenditures, net (17,027) (23,739) (28,659) (31,196) (20,061) (103,655) Property insurance proceeds 393 834 614 584 901 2,933 Adjusted Free Cash Flow of Unconsolidated Ventures $ 41,011 $ 41,375 $ 22,085 $ 36,538 $ 25,509 $ 125,507 Brookdale's weighted average ownership percentage 21.3% 19.1% 30.4% 32.9 % 22.8% 25.9% Brookdale’s Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures $ 8,750 $ 7,920 $ 6,709 $ 12,037 $ 5,824 $ 32,490 31

Brookdale Senior Living Inc. 111 Westwood Place, Suite 400 Brentwood, TN 37027 (615) 221-2250 www.brookdale.com