Attached files

| file | filename |

|---|---|

| EX-10.5 - EXHIBIT 10.5 - Ares Management Corp | exhibit105.htm |

| EX-99 - EXHIBIT 99 - Ares Management Corp | exhibit991.htm |

| EX-32.1 - EXHIBIT 32.1 - Ares Management Corp | a2018q1exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - Ares Management Corp | a2018q1exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - Ares Management Corp | a2018q1exhibit311.htm |

| EX-10.9 - EXHIBIT 10.9 - Ares Management Corp | exhibit109.htm |

| EX-10.8 - EXHIBIT 10.8 - Ares Management Corp | exhibi108.htm |

| EX-10.7 - EXHIBIT 10.7 - Ares Management Corp | exhibit107.htm |

| EX-10.6 - EXHIBIT 10.6 - Ares Management Corp | exhibit106.htm |

| EX-10.4 - EXHIBIT 10.4 - Ares Management Corp | exhibit104.htm |

| EX-10.3 - EXHIBIT 10.3 - Ares Management Corp | exhibit103.htm |

| EX-10.2 - EXHIBIT 10.2 - Ares Management Corp | exhibit102.htm |

| EX-10.1 - EXHIBIT 10.1 - Ares Management Corp | exhibit101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2018

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001‑36429

ARES MANAGEMENT, L.P.

(Exact name of Registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 80‑0962035 (I.R.S. Employer Identification Number) |

2000 Avenue of the Stars, 12th Floor, Los Angeles, CA 90067

(Address of principal executive office) (Zip Code)

(310) 201‑4100

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer ¨ | Non‑accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ¨ No x

The number of common shares representing limited partner interests outstanding as of April 27, 2018 was 97,522,827.

TABLE OF CONTENTS

Page | ||||

Financial Information - Unaudited | ||||

2

Forward‑Looking Statements

This report contains forward‑looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect our current views with respect to, among other things, future events and financial performance. You can identify these forward‑looking statements by the use of forward‑looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of those words or other comparable words. The forward‑looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward‑looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. Some of these factors are described in this report and in our Annual report on Form 10-K for the year ended December 31, 2017, under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” These factors should not be construed as exhaustive and should be read in conjunction with the risk factors and other cautionary statements that are included in this report and in our other periodic filings. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward‑looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward‑looking statements. Any forward‑looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward‑looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Under generally accepted accounting principles in the United States (“GAAP”), we are required to consolidate (a) entities other than limited partnerships and entities similar to limited partnerships in which we hold a majority voting interest or have majority ownership and control over the operational, financial and investing decisions of that entity, including Ares‑affiliates and affiliated funds and co‑investment entities, for which we are presumed to have controlling financial interests, and (b) entities that we concluded are variable interest entities (“VIEs”), including limited partnerships and collateralized loan obligations, for which we are deemed to be the primary beneficiary. When an entity is consolidated, we reflect the assets, liabilities, revenues, expenses and cash flows of the entity in our consolidated financial statements on a gross basis, subject to eliminations from consolidation, including the elimination of the management fees, performance income and other fees that we earn from the entity. However, the presentation of performance related compensation and other expenses associated with generating such revenues is not affected by the consolidation process. In addition, as a result of the consolidation process, the net income attributable to third‑party investors in consolidated entities is presented as net income attributable to redeemable interests and non‑controlling interests in Consolidated Funds in our Condensed Consolidated Statements of Operations.

In this quarterly report on Form 10-Q, in addition to presenting our results on a consolidated basis in accordance with GAAP, we present revenues, expenses and other results on a (i) “segment basis,” which deconsolidates these entities and therefore shows the results of our reportable segments without giving effect to the consolidation of the entities and (ii) “Unconsolidated Reporting basis,” which shows the results of our reportable segments on a combined segment basis together with our Operations Management Group. In addition to our three segments, we have an Operations Management Group (the “OMG”) that consists of five independent, shared resource groups to support our reportable segments by providing infrastructure and administrative support in the areas of accounting/finance, operations/information technology, business development/corporate strategy, legal/compliance and human resources. The OMG’s expenses are not allocated to our three reportable segments but we consider the cost structure of the OMG when evaluating our financial performance. This information constitutes non‑GAAP financial information within the meaning of Regulation G, as promulgated by the SEC. Our management uses this information to assess the performance of our reportable segments and our OMG, and we believe that this information enhances the ability of shareholders to analyze our performance. For more information, see “Notes to the Condensed Consolidated Financial Statements - Note 14. Segment Reporting.”

3

Glossary

When used in this report, unless the context otherwise requires:

• | “ARCC Part I Fees” refers to a quarterly performance income on the investment income from Ares Capital Corporation (NASDAQ: ARCC) (“ARCC”); |

• | “Ares Operating Group Unit” or an “AOG Unit” refer to, collectively, a partnership unit in each of the Ares Operating Group entities; |

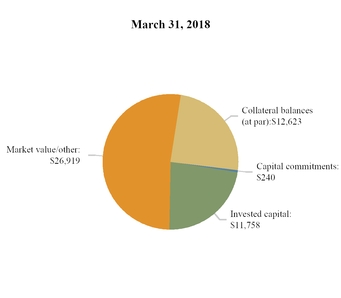

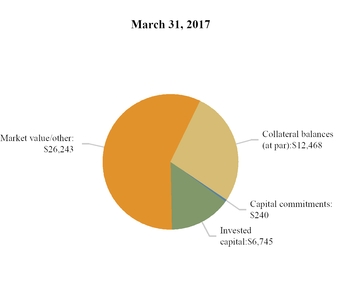

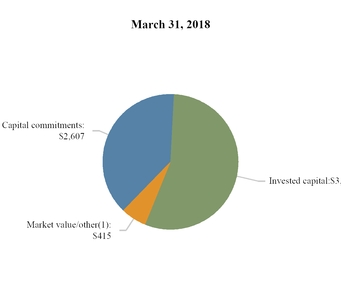

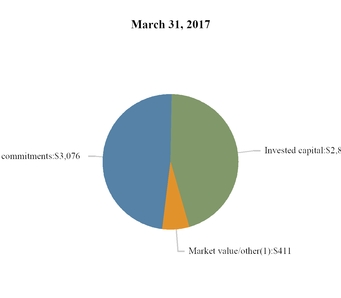

• | “assets under management” or “AUM” refers to the assets we manage. For our funds other than CLOs, our AUM represents the sum of the net asset value of such funds, the drawn and undrawn debt (at the fund‑level including amounts subject to restrictions) and uncalled committed capital (including commitments to funds that have yet to commence their investment periods). For our funds that are CLOs, our AUM represents subordinated notes (equity) plus all drawn and undrawn debt tranches; |

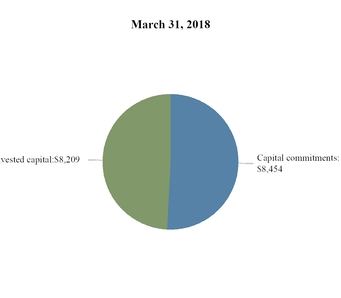

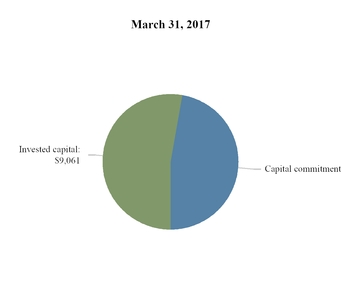

• | “available capital” is comprised of uncalled committed capital and undrawn amounts under credit facilities and may include AUM that may be canceled or not otherwise available to invest (also referred to as “dry powder”). |

• | “CLOs” refers to “our funds” which are structured as collateralized loan obligations; |

• | “Consolidated Funds” refers collectively to certain Ares‑ affiliated funds, related co‑investment entities and certain CLOs that are required under GAAP to be consolidated in our consolidated financial statements; |

• | “Co‑Founders” refers to Michael Arougheti, David Kaplan, John Kissick, Antony Ressler and Bennett Rosenthal; |

• | “Credit Facility” refers to the revolving credit facility of the Ares Operating Group; |

• | “economic net income” or “ENI”, a non-GAAP measure, is an operating metric used by management to evaluate total operating performance, a decision tool for deployment of resources, and an assessment of the performance of our business segments. ENI differs from net income by excluding (a) income tax expense, (b) operating results of our Consolidated Funds, (c) depreciation and amortization expense, (d) the effects of changes arising from corporate actions, and (e) certain other items that we believe are not indicative of our total operating performance. Changes arising from corporate actions include equity-based compensation expenses, the amortization of intangible assets, transaction costs associated with mergers, acquisitions and capital transactions, underwriting costs and expenses incurred in connection with corporate reorganization. Beginning in 2018, placement fees are no longer excluded but are amortized to match the period over which management fees are recognized. This change had an immaterial impact to FRE and RI for the current period; |

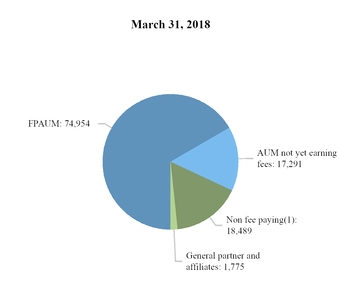

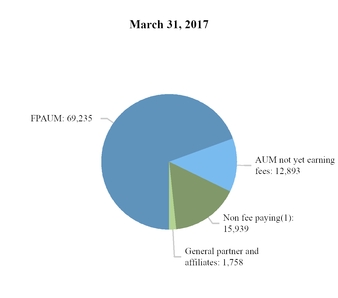

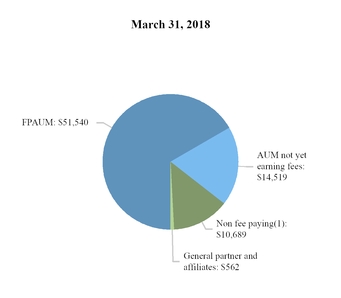

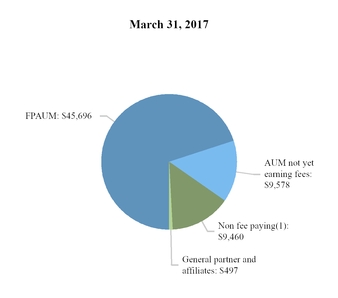

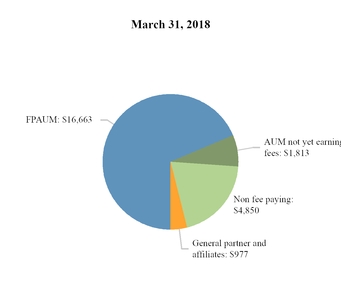

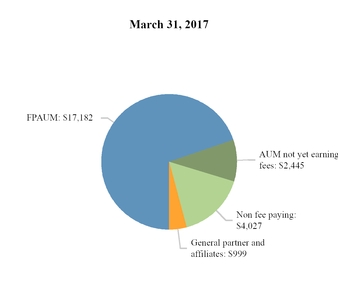

• | “fee paying AUM” or “FPAUM” refers to the AUM on which we directly earn management fees. Fee paying AUM is equal to the sum of all the individual fee bases of our funds that directly contribute to our management fees; |

• | “fee related earnings” or “FRE”, a non-GAAP measure, refers to a component of ENI that is used to assess core operating performance by determining whether recurring revenue, primarily consisting of management fees, is sufficient to cover operating expenses and to generate profits. FRE differs from income before taxes computed in accordance with GAAP as it adjusts for the items included in the calculation of ENI and excludes performance income, performance related compensation, investment income from our Consolidated Funds and non-consolidated funds and certain other items that we believe are not indicative of our core operating performance; |

• | “Holdco Members” refers to Messrs. Arougheti, Kaplan, Ressler and Rosenthal and Ryan Berry, R. Kipp deVeer and Michael McFerran; |

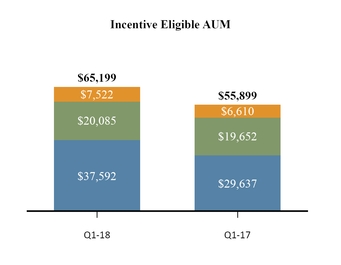

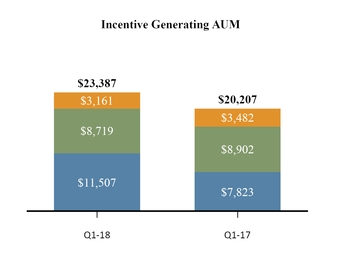

• | “Incentive generating AUM” or “IGAUM” refers to the AUM of our funds that are currently generating, on a realized or unrealized basis, performance income. It generally represents the NAV of our funds for which we are entitled to receive performance income, excluding capital committed by us and our professionals (which generally is not subject to performance income). With respect to ARCC, only ARCC Part II Fees can be generated from IGAUM; |

4

• | “Incentive eligible AUM” or “IEAUM” refers to the AUM of our funds that are eligible to produce performance income, regardless of whether or not they are currently generating performance income. It generally represents the NAV plus uncalled equity of our funds for which we are entitled to receive a performance income, excluding capital committed by us and our professionals (which generally is not subject to a performance income); |

• | “management fees” refers to fees we earn for advisory services provided to our funds, which are generally based on a defined percentage of fair value of assets, total commitments, invested capital, net asset value, net investment income, total assets or par value of the investment portfolios managed by us and also include ARCC Part I Fees that are classified as management fees as they are predictable and recurring in nature, not subject to contingent repayment and generally cash‑settled each quarter; |

• | “net inflows of capital” refers to net new commitments during the period, including equity and debt commitments and gross inflows into our open-ended managed accounts and sub-advised accounts, as well as equity offerings by our publicly traded vehicles minus redemptions from our open-ended funds, managed accounts and sub-advised accounts; |

• | “net performance income” refers to performance income net of performance related compensation, which is the portion of the performance income earned from certain funds that is payable to professionals; |

• | “our funds” refers to the funds, alternative asset companies, co-investment vehicles and other entities and accounts that are managed or co‑managed by the Ares Operating Group, and which are structured to pay fees. It also includes funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of ARCC, and a registered investment adviser; |

• | “permanent capital” refers to capital of our funds that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, which funds currently consist of ARCC, Ares Commercial Real Estate Corporation (“ACRE”) and Ares Dynamic Credit Allocation Fund, Inc. (“ARDC”). Such funds may be required, or elect, to return all or a portion of capital gains and investment income; |

• | “performance income” refers to income we earn based on the performance of a fund, which are generally based on certain specific hurdle rates as defined in the fund’s investment management or partnership agreements and may be either an incentive fee or carried interest; |

• | “performance related earnings” or “PRE”, a non-GAAP measure, is used to assess our investment performance net of performance related compensation. PRE differs from income (loss) before taxes computed in accordance with GAAP as it only includes performance income, performance related compensation and total investment and other income that we earn from our Consolidated Funds and non-consolidated funds; |

• | “realized income” or “RI”, a non-GAAP measure, is an operating metric used by management to evaluate performance of the business based on operating performance and the contribution of each of the business segments to that performance, while removing the fluctuations of unrealized income and expenses, which may or may not be eventually realized at the levels presented and whose realizations depend more on future outcomes than current business operations. RI differs from net income by excluding (a) income tax expense, (b) operating results of our Consolidated Funds, (c) depreciation and amortization expense, (d) the effects of changes arising from corporate actions, (e) unrealized gains and losses related to performance income and investment performance and (e) certain other items that we believe are not indicative of our operating performance. Changes arising from corporate actions include equity-based compensation expenses, the amortization of intangible assets, transaction costs associated with mergers, acquisitions and capital transactions, underwriting costs and expenses incurred in connection with corporate reorganization. Beginning in 2018, placement fees are no longer excluded but are amortized to match the period over which management fees are recognized. This change had an immaterial impact to FRE and RI for the current period. Prior to the introduction of RI, management used distributable earnings for this evaluation. Management believes RI is a more appropriate metric to evaluate the Company's current business operations; |

• | “SEC” refers to the Securities and Exchange Commission; |

• | “Senior Notes” or the "AFC Notes" refers to senior notes of a wholly owned subsidiary of Ares Holdings; and |

5

• | “Term Loans” refers to term loans of a wholly owned subsidiary of AM LLC. |

References in this Quarterly Report on Form 10-Q to (1) “common units” or “common shares” and “preferred units” or “preferred shares” outstanding prior to March 1, 2018 refer to our common units and preferred units, respectively, previously outstanding prior to March 1, 2018 and (2) “common unitholders” or “common shareholders” and “preferred unitholders” or “preferred shareholders” prior to March 1, 2018 refer to our common unitholders and preferred unitholders, respectively, prior to March 1, 2018. Note that the terms of our common shares and preferred shares, and the associated rights, remain unchanged.

Many of the terms used in this report, including AUM, FPAUM, ENI, FRE, PRE and RI, may not be comparable to similarly titled measures used by other companies. In addition, our definitions of AUM and FPAUM are not based on any definition of AUM or FPAUM that is set forth in the agreements governing the investment funds that we manage and may differ from definitions of AUM or FPAUM set forth in other agreements to which we are a party. Further, ENI, FRE, PRE and RI are not measures of performance calculated in accordance with GAAP. We use ENI, FRE, PRE and RI as measures of operating performance, not as measures of liquidity. ENI, FRE, PRE and RI should not be considered in isolation or as substitutes for operating income, net income, operating cash flows, or other income or cash flow statement data prepared in accordance with GAAP. The use of ENI, FRE, PRE and RI without consideration of related GAAP measures is not adequate due to the adjustments described above. Our management compensates for these limitations by using ENI, FRE, PRE and RI as supplemental measures to our GAAP results. We present these measures to provide a more complete understanding of our performance as our management measures it. Amounts and percentages throughout this report may reflect rounding adjustments and consequently totals may not appear to sum.

6

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

Ares Management, L.P.

Condensed Consolidated Statements of Financial Condition

(Amounts in Thousands, Except Share Data)

As of March 31, | As of December 31, | ||||||

2018 | 2017 | ||||||

(unaudited) | As adjusted | ||||||

Assets | |||||||

Cash and cash equivalents | $ | 115,540 | $ | 118,929 | |||

Investments (includes accrued carried interest of $1,113,435 and $1,077,236 and pledged collateral of $17,575 and $0, at March 31, 2018 and December 31, 2017, respectively) | 1,811,829 | 1,724,571 | |||||

Due from affiliates | 168,810 | 165,750 | |||||

Deferred tax asset, net | 50,986 | 8,326 | |||||

Other assets | 105,187 | 130,341 | |||||

Intangible assets, net | 37,178 | 40,465 | |||||

Goodwill | 143,968 | 143,895 | |||||

Assets of Consolidated Funds: | |||||||

Cash and cash equivalents | 532,470 | 556,500 | |||||

Investments, at fair value | 5,479,136 | 5,582,842 | |||||

Due from affiliates | 17,782 | 15,884 | |||||

Dividends and interest receivable | 12,096 | 12,568 | |||||

Receivable for securities sold | 83,718 | 61,462 | |||||

Other assets | 1,382 | 1,989 | |||||

Total assets | $ | 8,560,082 | $ | 8,563,522 | |||

Liabilities | |||||||

Accounts payable, accrued expenses and other liabilities | $ | 78,771 | $ | 81,955 | |||

Accrued compensation | 49,944 | 27,978 | |||||

Due to affiliates | 21,018 | 14,642 | |||||

Performance related compensation payable | 856,421 | 846,626 | |||||

Debt obligations | 590,169 | 616,176 | |||||

Liabilities of Consolidated Funds: | |||||||

Accounts payable, accrued expenses and other liabilities | 81,508 | 64,316 | |||||

Payable for securities purchased | 239,139 | 350,145 | |||||

CLO loan obligations, at fair value | 4,937,264 | 4,963,194 | |||||

Fund borrowings | 140,653 | 138,198 | |||||

Total liabilities | 6,994,887 | 7,103,230 | |||||

Commitments and contingencies | |||||||

Preferred equity (12,400,000 shares issued and outstanding at March 31, 2018 and December 31, 2017) | 298,761 | 298,761 | |||||

Non-controlling interest in Consolidated Funds | 544,380 | 528,488 | |||||

Non-controlling interest in Ares Operating Group entities | 348,820 | 358,186 | |||||

Controlling interest in Ares Management, L.P.: | |||||||

Shareholders' equity (97,514,500 shares and 82,280,033 shares issued and outstanding at March 31, 2018 and at December 31, 2017, respectively) | 377,235 | 279,065 | |||||

Accumulated other comprehensive loss, net of tax | (4,001 | ) | (4,208 | ) | |||

Total controlling interest in Ares Management, L.P. | 373,234 | 274,857 | |||||

Total equity | 1,565,195 | 1,460,292 | |||||

Total liabilities and equity | $ | 8,560,082 | $ | 8,563,522 | |||

See accompanying notes to the condensed consolidated financial statements.

7

Ares Management, L.P.

Condensed Consolidated Statements of Operations

(Amounts in Thousands, Except Share Data)

(unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

As adjusted | |||||||

Revenues | |||||||

Management fees (includes ARCC Part I Fees of $28,417 and $33,257 for the three months ended March 31, 2018 and 2017, respectively) | $ | 189,515 | $ | 172,045 | |||

Carried interest allocation | 54,129 | 52,007 | |||||

Incentive fees | 5,071 | 3,165 | |||||

Principal investment income | 4,909 | 2,587 | |||||

Administrative, transaction and other fees | 12,465 | 14,440 | |||||

Total revenues | 266,089 | 244,244 | |||||

Expenses | |||||||

Compensation and benefits | 134,639 | 124,339 | |||||

Performance related compensation | 25,878 | 40,702 | |||||

General, administrative and other expenses | 44,450 | 47,338 | |||||

Transaction support expense | — | 275,177 | |||||

Expenses of Consolidated Funds | 1,316 | 3,911 | |||||

Total expenses | 206,283 | 491,467 | |||||

Other income (expense) | |||||||

Net realized and unrealized gain (loss) on investments | (839 | ) | 888 | ||||

Interest and dividend income | 3,347 | 1,924 | |||||

Interest expense | (6,869 | ) | (4,879 | ) | |||

Other income (expense), net | (311 | ) | 16,496 | ||||

Net realized and unrealized gain (loss) on investments of the Consolidated Funds | (13,085 | ) | 32,036 | ||||

Interest and other income of Consolidated Funds | 64,422 | 41,492 | |||||

Interest expense of Consolidated Funds | (44,425 | ) | (31,322 | ) | |||

Total other income | 2,240 | 56,635 | |||||

Income (loss) before taxes | 62,046 | (190,588 | ) | ||||

Income tax benefit | (12,375 | ) | (34,264 | ) | |||

Net income (loss) | 74,421 | (156,324 | ) | ||||

Less: Net income attributable to non-controlling interests in Consolidated Funds | 367 | 15,855 | |||||

Less: Net income (loss) attributable to non-controlling interests in Ares Operating Group entities | 33,106 | (131,045 | ) | ||||

Net income (loss) attributable to Ares Management, L.P. | 40,948 | (41,134 | ) | ||||

Less: Preferred equity dividend paid | 5,425 | 5,425 | |||||

Net income (loss) attributable to Ares Management, L.P. common shareholders | $ | 35,523 | $ | (46,559 | ) | ||

Net income (loss) attributable to Ares Management, L.P. per common share: | |||||||

Basic | $ | 0.39 | $ | (0.58 | ) | ||

Diluted | $ | 0.28 | $ | (0.58 | ) | ||

Weighted-average common shares: | |||||||

Basic | 85,617,932 | 81,106,734 | |||||

Diluted | 213,852,928 | 81,106,734 | |||||

Dividend declared and paid per common share | $ | 0.40 | $ | 0.28 | |||

Substantially all revenue is earned from affiliated funds of the Company. See accompanying notes to the condensed consolidated financial statements.

8

Ares Management, L.P.

Condensed Consolidated Statements of Comprehensive Income

(Amounts in Thousands)

(unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

As adjusted | |||||||

Net income (loss) | $ | 74,421 | $ | (156,324 | ) | ||

Other comprehensive income: | |||||||

Foreign currency translation adjustments | 5,485 | 3,442 | |||||

Total comprehensive income (loss) | 79,906 | (152,882 | ) | ||||

Less: Comprehensive income attributable to non-controlling interests in Consolidated Funds | 3,542 | 15,856 | |||||

Less: Comprehensive income (loss) attributable to non-controlling interests in Ares Operating Group entities | 35,209 | (128,805 | ) | ||||

Comprehensive income (loss) attributable to Ares Management, L.P. | $ | 41,155 | $ | (39,933 | ) | ||

See accompanying notes to the condensed consolidated financial statements.

9

Ares Management, L.P.

Condensed Consolidated Statements of Changes in Equity

(Amounts in Thousands)

(unaudited)

Preferred Equity | Shareholders' Equity | Accumulated Other Comprehensive Loss | Non-controlling Interest in Ares Operating Group Entities | Non-controlling Interest in Consolidated Funds | Total Equity | |||||||||||||||||||

Balance at December 31, 2017 | $ | 298,761 | $ | 279,065 | $ | (4,208 | ) | $ | 358,186 | $ | 528,488 | $ | 1,460,292 | |||||||||||

Cumulative effect of the adoption of ASC 606 | — | (10,827 | ) | — | (17,117 | ) | 5,333 | (22,611 | ) | |||||||||||||||

As adjusted balance at January 1, 2018 | 298,761 | 268,238 | (4,208 | ) | 341,069 | 533,821 | 1,437,681 | |||||||||||||||||

Adoption of ASU 2018-02 | — | 1,202 | (1,202 | ) | — | — | — | |||||||||||||||||

Changes in ownership interests | — | (26,120 | ) | — | 18,809 | — | (7,311 | ) | ||||||||||||||||

Effects arising from allocation of shareholders' equity on deferred tax assets | — | 17,769 | — | 1 | — | 17,770 | ||||||||||||||||||

Contributions | — | 105,441 | — | — | 8,000 | 113,441 | ||||||||||||||||||

Distributions | (5,425 | ) | (33,103 | ) | — | (58,677 | ) | (983 | ) | (98,188 | ) | |||||||||||||

Net income | 5,425 | 35,523 | — | 33,106 | 367 | 74,421 | ||||||||||||||||||

Currency translation adjustment | — | — | 1,409 | 2,103 | 3,175 | 6,687 | ||||||||||||||||||

Equity compensation | — | 8,285 | — | 12,409 | — | 20,694 | ||||||||||||||||||

Balance at March 31, 2018 | $ | 298,761 | $ | 377,235 | $ | (4,001 | ) | $ | 348,820 | $ | 544,380 | $ | 1,565,195 | |||||||||||

See accompanying notes to the condensed consolidated financial statements.

10

Ares Management, L.P.

Condensed Consolidated Statements of Cash Flows

(Amounts in Thousands)

(unaudited)

For the Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

As adjusted | |||||||

Cash flows from operating activities: | |||||||

Net income (loss) | $ | 74,421 | $ | (156,324 | ) | ||

Adjustments to reconcile net income (loss) to net cash used in operating activities | (19,979 | ) | (18,522 | ) | |||

Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities allocable to non-controlling interests in Consolidated Funds | 152,375 | (81,753 | ) | ||||

Cash flows due to changes in operating assets and liabilities | (37,718 | ) | (135,303 | ) | |||

Cash flows due to changes in operating assets and liabilities allocable to non-controlling interests in Consolidated Funds | (88,592 | ) | 100,086 | ||||

Net cash provided by (used in) operating activities | 80,507 | (291,816 | ) | ||||

Cash flows from investing activities: | |||||||

Purchase of furniture, equipment and leasehold improvements, net | (2,857 | ) | (10,252 | ) | |||

Net cash used in investing activities | (2,857 | ) | (10,252 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from issuance of common shares | 105,441 | — | |||||

Proceeds from credit facility | 240,000 | 165,000 | |||||

Proceeds from term notes | 44,050 | 17,600 | |||||

Repayments of credit facility | (310,000 | ) | — | ||||

Repayments of term notes | (56 | ) | — | ||||

Distributions | (91,780 | ) | (68,595 | ) | |||

Preferred equity distributions | (5,425 | ) | (5,425 | ) | |||

Taxes paid in net settlement of vested common shares | (7,311 | ) | (3,913 | ) | |||

Stock option exercise | — | 1,036 | |||||

Tax from share-based payment | — | 81 | |||||

Other financing activities | — | 646 | |||||

Allocable to non-controlling interests in Consolidated Funds: | |||||||

Contributions from non-controlling interests in Consolidated Funds | 8,000 | 23,378 | |||||

Distributions to non-controlling interests in Consolidated Funds | (983 | ) | (7,822 | ) | |||

Borrowings under loan obligations by Consolidated Funds | 1,303 | 505,714 | |||||

Repayments under loan obligations by Consolidated Funds | (68,891 | ) | (566,919 | ) | |||

Net cash provided by (used in) financing activities | (85,652 | ) | 60,781 | ||||

Effect of exchange rate changes | 4,613 | 2,415 | |||||

Net change in cash and cash equivalents | (3,389 | ) | (238,872 | ) | |||

Cash and cash equivalents, beginning of period | 118,929 | 342,861 | |||||

Cash and cash equivalents, end of period | $ | 115,540 | $ | 103,989 | |||

See accompanying notes to the condensed consolidated financial statements.

11

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

1. ORGANIZATION

Ares Management, L.P. ("the Company"), a Delaware limited partnership treated as a corporation for U.S. federal income tax purposes, is a leading global alternative asset management firm that operates three distinct but complementary investment groups: the Credit Group, the Private Equity Group and the Real Estate Group. Information about segments should be read together with Note 14, “Segment Reporting.” Subsidiaries of the Company serve as the general partners and/or investment managers to various investment funds and managed accounts within each investment group (the “Ares Funds”). Such subsidiaries provide investment advisory services to the Ares Funds in exchange for management fees. Ares is managed and operated by its general partner, Ares Management GP LLC. Unless the context requires otherwise, references to “Ares” or the “Company” refer to Ares Management, L.P. together with its subsidiaries.

The Company is a holding company, and its sole assets are equity interests in Ares Holdings Inc. (“AHI”), Ares Offshore Holdings, Ltd., and Ares AI Holdings L.P., each of which is directly or indirectly wholly owned by the Company. In this quarterly report, the following of the Company’s subsidiaries are collectively referred to as the “Ares Operating Group”: Ares Offshore Holdings L.P. (“Ares Offshore”), Ares Holdings L.P. (“Ares Holdings”), and Ares Investments L.P. (“Ares Investments”). The Company, indirectly through its wholly owned subsidiaries, is the general partner of each of the Ares Operating Group entities. The Company operates and controls all of the businesses and affairs of and conducts all of its material business activities through the Ares Operating Group.

Non-Controlling Interests in Ares Operating Group Entities

The non-controlling interests in Ares Operating Group (“AOG”) entities represent a component of equity and net income attributable to the owners of the Ares Operating Group Units (“AOG Units”) that are not held directly or indirectly by the Company. These interests are adjusted for contributions to and distributions from AOG during the reporting period and are allocated income from the AOG entities based on their historical ownership percentage for the proportional number of days in the reporting period.

Change in Company Tax Status Election

Effective March 1, 2018, the Company elected to be treated as a corporation for U.S. federal income tax purposes. The Company’s legal structure remains a Delaware limited partnership. In connection with the tax election, the Company amended and restated its partnership agreement to, among other things, reflect the new tax classification and change the name of its common units and preferred units to common shares and preferred shares, respectively. The terms of such common shares and preferred shares, and the associated rights, otherwise remain unchanged. Further, other terminology has been modified to be consistent with a corporation's results. For example, distributions are now referred to as dividends, and earnings per common unit are now referred to as earnings per common share. Comparative periods conform with the current period's presentation.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed consolidated financial statements are prepared in accordance with the generally accepted accounting principles in the United States (“GAAP”) for interim financial information and instructions to the Quarterly Report on Form 10-Q. The condensed consolidated financial statements, including these notes, are unaudited and exclude some of the disclosures required in annual financial statements. Management believes it has made all necessary adjustments so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing its condensed consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC.

The condensed consolidated financial statements include the accounts and activities of the AOG entities, their consolidated subsidiaries and certain Consolidated Funds. These Consolidated Funds include certain Ares-affiliated funds, related co-investment entities and collateralized loan obligations (“CLOs”) (collectively, the “Consolidated Funds”) managed by Ares Management LLC (“AM LLC”) and its wholly owned subsidiaries. Including the results of the Consolidated Funds significantly increases the reported amounts of the assets, liabilities, revenues, expenses and cash flows in the accompanying condensed consolidated financial

12

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

statements; however, the Consolidated Funds results included herein have no direct effect on the net income attributable to controlling interests or on total controlling equity. Instead, economic ownership interests of the investors in the Consolidated Funds are reflected as non-controlling interests in Consolidated Funds in the accompanying condensed consolidated financial statements. Further, cash flows allocable to non-controlling interest in Consolidated Funds are specifically identifiable in the Condensed Consolidated Statements of Cash Flows. All intercompany balances and transactions have been eliminated upon consolidation.

The Company has reclassified certain prior period amounts to conform to the current year presentation.

Adoption of ASC 606

Effective January 1, 2018, the Company adopted the Financial Accounting Standards Board (“FASB”) Topic 606 (“ASC 606”), Revenue from Contracts with Customers. The Company adopted ASC 606 to all applicable contracts under the modified retrospective approach using the practical expedient provided for within paragraph 606-10-65-1(f)(3); therefore, the presentation of prior year periods has not been adjusted. The Company recognized the cumulative effect of initially adopting ASC 606 as an adjustment to the opening balance of components of equity as of January 1, 2018.

Pursuant to ASC 606, the Company recognizes revenue in a way that depicts the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. Under this standard, revenue is based on a contract with a determinable transaction price and distinct performance obligations with probable collectability. Revenues cannot be recognized until the performance obligation(s) are satisfied and control is transferred to the customer. The Company's adoption of ASC 606 impacted the timing and recognition of incentive fees in the Company’s consolidated statements of operations. The adoption of ASC 606 did not have an impact on the Company’s management fees, administrative fees, transaction fees or other fees. The details of the significant changes and quantitative impact of the adoption of ASC 606 are further discussed below.

The adoption of ASC 606 had the following impact on the Company’s revenue streams:

Revenues of the Company | Impact of ASC 606 |

Management fees | No Impact - Management fees are recognized as revenue in the period advisory services are rendered. |

Performance income - Carried interest allocation | No impact. See discussion below for change in accounting policy. |

Performance income - Incentive fees | See discussion below for impact. |

Administrative, transaction and other fees | No Impact - Administrative, transaction and other fees are recognized as revenue in the period in which the related services are rendered. |

Performance Income

Performance income consists of carried interest and incentive fees.

Carried Interest

In certain fund structures, typically in private equity and real estate equity funds, carried interest is allocated to the Company based on cumulative fund performance to date, subject to the achievement of minimum return levels in accordance with the respective terms set out in each fund’s governing documents. At the end of each reporting period, a fund will allocate carried interest applicable to the Company based upon an assumed liquidation of that fund's net assets on the reporting date, irrespective of whether such amounts have been realized. Carried interest is recorded to the extent such amounts have been allocated, and may be subject to reversal to the extent that the amount allocated ultimately exceeds the amount due to the Company based on a fund’s cumulative investment returns.

Carried interest is realized when an underlying investment is profitably disposed of and the fund’s cumulative returns are in excess of the specific hurdle rates as defined in the applicable governing documents. Since carried interest is subject to reversal, the Company may need to accrue for potential repayment of previously received carried interest. This accrual represents all amounts previously distributed to the Company that would need to be repaid to the funds if the funds were to be liquidated based on the current fair value of the underlying funds’ investments as of the reporting date. The actual repayment obligations, however, generally

13

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

do not become realized until the end of a fund’s life. As of March 31, 2018 and December 31, 2017, the Company had no accrued contingent repayment obligations that would need to be paid if the funds were liquidated at fair value at the reporting dates.

Prior to January 1, 2018, the Company accounted for carried interest under Method 2 described in ASC 605-20-S99-1, which provides guidance on accounting for incentive-based performance income, including carried interest. Since Method 2 is no longer available following the adoption of ASC 606, the Company has reassessed its accounting policy for carried interest, and has determined that carried interest is within scope of ASC 323, Investments-Equity Method and Joint Ventures, and out of scope under the scoping provision of ASC 606. Therefore, following the election of ASC 323, the Company accounted for carried interest, which represents a performance-based capital allocation from an investment fund to the Company, as earnings from financial assets within the scope of ASC 323. Accordingly, the Company recognizes carried interest allocation as a separate revenue line item in the Condensed Consolidated Statements of Operations. Uncollected carried interest as of the reporting date is recorded within investments in the Condensed Consolidated Statements of Financial Condition.

The Company has applied the change in accounting principle on a full retrospective basis, and prior periods presented have been recast to conform with the current period's presentation. The change in accounting principle did not change the timing or the amount of carried interest recognized. Instead, the change in accounting principle resulted in reclassification from performance income to carried interest allocation, and therefore did not have any impact on net income. See the tables below for the impact of the change in accounting principle of carried interest under ASC 323.

Incentive Fees

Incentive fees earned on the performance of certain fund structures, typically in credit funds, are recognized based on the fund’s performance during the period, subject to the achievement of minimum return levels in accordance with the respective terms set out in each fund’s investment management agreement. Incentive fees are realized at the end of a measurement period, typically annually. Once realized, such fees are no longer subject to reversal.

Prior to January 1, 2018, the Company accounted for incentive fees under Method 2 as described above. However, the accounting for incentive fees is separate and distinct from the accounting for carried interest because the incentive fees are contractual fee arrangements and do not represent allocations of returns from partners' capital accounts. Upon the adoption of ASC 606, the Company accounts for incentive fees in accordance with ASC 606. Accordingly, the Company will recognize incentive fee revenue only when the amount is realized and no longer subject to reversal. Therefore, the Company will no longer recognize unrealized incentive fees in revenues in the condensed consolidated financial statements. The adoption of ASC 606 results in the delayed recognition of unrealized incentive fees in the condensed consolidated financial statements until they become realized at the end of the measurement period, which is typically annually.

The Company adopted ASC 606 for incentive fees using the modified retrospective approach with effective date of January 1, 2018. The cumulative effect of the adoption resulted in the reversal of $22.6 million of unrealized incentive fees and is presented as a reduction to the opening balances of components of equity as of January 1, 2018.

14

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

The following tables present the adjustments made in connection with the Company's change in accounting principle related to carried interest under ASC 323, Investments-Equity Method and Joint Ventures on the financial statement line items for the periods presented in the condensed consolidated financial statements:

Condensed Consolidated Statement of Financial Condition | ||||||||||||

As of December 31, 2017 | ||||||||||||

As Previously Reported | Adjustments | As Adjusted | ||||||||||

(audited) | ||||||||||||

Assets | ||||||||||||

Investments ($1,077,236 of accrued carried interest, and $0 of pledged collateral) | $ | 647,335 | $ | 1,077,236 | $ | 1,724,571 | ||||||

Performance income receivable | 1,099,847 | (1,099,847 | ) | — | ||||||||

Other assets | 107,730 | 22,611 | (1) | 130,341 | ||||||||

(1) | Unrealized incentive fees receivable balance as of December 31, 2017. |

Condensed Consolidated Statement of Operations | ||||||||||||

For the Three Months Ended March 31, 2017 | ||||||||||||

As Previously Reported | Adjustments | As Adjusted | ||||||||||

Revenues | ||||||||||||

Performance fees | $ | 55,172 | $ | (55,172 | ) | $ | — | |||||

Carried interest allocation | — | 52,007 | 52,007 | |||||||||

Incentive fees | — | 3,165 | 3,165 | |||||||||

Principal investment income | — | 2,587 | 2,587 | |||||||||

Total revenues | 241,657 | 2,587 | 244,244 | |||||||||

Other income (expense) | ||||||||||||

Net realized and unrealized gain on investments | 2,655 | (1,767 | ) | 888 | ||||||||

Interest and dividend income | 2,744 | (820 | ) | 1,924 | ||||||||

The Company's change in accounting policy related to carried interest under ASC 323 did not impact the Condensed Consolidated Statements of Comprehensive Income, Condensed Consolidated Statements of Changes in Equity or Condensed Consolidated Statements of Cash Flows for the year ended December 31, 2017.

15

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

The following tables present the impact of incentive fees on the condensed consolidated financial statements upon the adoption of ASC 606 effective January 1, 2018:

As of January 1, 2018 | |||||||||||

As adjusted December 31, 2017 | Adjustments | As Adjusted for ASC 606 adoption | |||||||||

Investments | $ | 1,724,571 | $ | — | $ | 1,724,571 | |||||

Other assets | 130,341 | (22,611 | ) | (1) | 107,730 | ||||||

Total assets | 8,563,522 | (22,611 | ) | 8,540,911 | |||||||

Total liabilities | 7,103,230 | — | 7,103,230 | ||||||||

Cumulative effect adjustment to equity(2) | — | (22,611 | ) | (22,611 | ) | ||||||

Total equity | 1,460,292 | (22,611 | ) | 1,437,681 | |||||||

Total liabilities, non-controlling interests and equity | 8,563,522 | (22,611 | ) | 8,540,911 | |||||||

(1) | Unrealized incentive fees receivable balance as of December 31, 2017. |

(2) | See detail below. |

Condensed Consolidated Statement of Changes in Equity

Preferred Equity | Shareholders' Capital | Accumulated Other Comprehensive Loss | Non-controlling interest in Ares Operating Group Entities | Non-Controlling Interest in Consolidated Funds | Total Equity | |||||||||||||||||||

Balance at December 31, 2017 | $ | 298,761 | $ | 279,065 | $ | (4,208 | ) | $ | 358,186 | $ | 528,488 | $ | 1,460,292 | |||||||||||

Cumulative effect of the adoption of ASC 606 | — | (10,827 | ) | — | (17,117 | ) | 5,333 | (22,611 | ) | |||||||||||||||

As adjusted balance at January 1, 2018 | $ | 298,761 | $ | 268,238 | $ | (4,208 | ) | $ | 341,069 | $ | 533,821 | $ | 1,437,681 | |||||||||||

16

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

In accordance with the ASC 606 disclosure requirements, the following tables present the adjustments made by the Company to remove the effects of adopting ASC 606 on the condensed consolidated financial statements as of and for the three months ended March 31, 2018:

Condensed Consolidated Statement of Financial Condition | ||||||||||||

As of March 31, 2018 | ||||||||||||

As Reported | Adjustments | Balances without adoption of ASC 606 | ||||||||||

Assets | ||||||||||||

Deferred tax asset, net | $ | 50,986 | $ | (250 | ) | $ | 50,736 | |||||

Other assets | 105,187 | 23,704 | 128,891 | |||||||||

Total assets | 8,560,082 | 23,454 | 8,583,536 | |||||||||

Commitments and contingencies | ||||||||||||

Non-controlling interest in Consolidated Funds | 544,380 | (7,052 | ) | 537,328 | ||||||||

Non-controlling interest in Ares Operating Group entities | 348,820 | 18,803 | 367,623 | |||||||||

Controlling interest in Ares Management, L.P.: | ||||||||||||

Shareholders' equity (97,514,500 shares issued and outstanding) | 377,235 | 11,603 | 388,838 | |||||||||

Accumulated other comprehensive loss, net of tax | (4,001 | ) | 100 | (3,901 | ) | |||||||

Total controlling interest in Ares Management, L.P | 373,234 | 11,703 | 384,937 | |||||||||

Total equity | 1,565,195 | 23,454 | 1,588,649 | |||||||||

Total liabilities and equity | 8,560,082 | 23,454 | 8,583,536 | |||||||||

Condensed Consolidated Statement of Operations | ||||||||||||

For the Three Months Ended March 31, 2018 | ||||||||||||

As Reported | Adjustments | Balances without adoption of ASC 606 | ||||||||||

Revenues | ||||||||||||

Incentive fees | $ | 5,071 | $ | 856 | $ | 5,927 | ||||||

Total revenues | 266,089 | 856 | 266,945 | |||||||||

Other income (expense) | ||||||||||||

Other income (expense), net | (311 | ) | (12 | ) | (323 | ) | ||||||

Total other income | 2,240 | (12 | ) | 2,228 | ||||||||

Income before taxes | 62,046 | 844 | 62,890 | |||||||||

Income tax benefit | (12,375 | ) | 250 | (12,125 | ) | |||||||

Net income | 74,421 | 594 | 75,015 | |||||||||

Net income attributable to Ares Management, L.P. | 40,948 | 594 | 41,542 | |||||||||

Net income attributable to Ares Management, L.P. common shareholders | 35,523 | 594 | 36,117 | |||||||||

17

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Condensed Consolidated Statement of Comprehensive Income

Three Months Ended March 31, 2018 | |||||||||||

As Reported | Adjustments | Balances without adoption of ASC 606 | |||||||||

Net income | $ | 74,421 | $ | 594 | $ | 75,015 | |||||

Other comprehensive income: | |||||||||||

Foreign currency translation adjustments | 5,485 | 249 | 5,734 | ||||||||

Total comprehensive income | 79,906 | 843 | 80,749 | ||||||||

Less: Comprehensive income attributable to non-controlling interests in Consolidated Funds | 3,542 | (1,719 | ) | 1,823 | |||||||

Less: Comprehensive income attributable to non-controlling interests in Ares Operating Group entities | 35,209 | 1,686 | 36,895 | ||||||||

Comprehensive income attributable to Ares Management, L.P. | $ | 41,155 | $ | 876 | $ | 42,031 | |||||

Condensed Consolidated Statement of Cash Flows

For the Three Months Ended March 31, 2018 | ||||||||||||

As Reported | Adjustments | Balances without adoption of ASC 606 | ||||||||||

Cash flows from operating activities: | ||||||||||||

Net income | $ | 74,421 | $ | 594 | $ | 75,015 | ||||||

Cash flows due to changes in operating assets and liabilities | (37,718 | ) | (2,313 | ) | (40,031 | ) | ||||||

Cash flows due to changes in operating assets and liabilities allocable to non-controlling interests in Consolidated Funds | (88,592 | ) | 1,719 | (86,873 | ) | |||||||

18

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Recent Accounting Pronouncements

The Company considers the applicability and impact of all FASB ASUs issued. ASUs not listed below were assessed and either determined to be not applicable or expected to have minimal impact on the Company's condensed consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The objective of the guidance in ASU 2016-02 is to increase transparency and comparability among organizations by recognizing lease assets and liabilities in the balance sheet and disclosing key information. ASU 2016-02 amends previous lease guidance, which required a lessee to categorize and account for leases as either operating leases or capital leases, and instead requires a lessee to recognize a lease liability and a right-of-use asset on the entity’s balance sheet for all leases with terms that exceed one year. The lease liability and right-of-use asset are to be carried at the present value of remaining expected future lease payments. The guidance should be applied using a modified retrospective approach. ASU 2016-02 is effective for public entities for annual reporting periods beginning after December 15, 2018 and interim periods within those reporting periods, with early adoption permitted. The Company is currently compiling all leases and right–of–use terms to evaluate the impact of this guidance on its condensed consolidated financial statements.

In January 2018, the FASB issued ASU 2018-02, Income Statement-Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. ASU 2018-02 allows a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from Public Law No. 115-97 (the “Tax Cuts and Jobs Act”). Consequently, the amendments eliminate the stranded tax effects resulting from the Tax Cuts and Jobs Act and will improve the usefulness of information reported to financial statement users. However, because the amendments only relate to the reclassification of the income tax effects of the Tax Cuts and Jobs Act, the underlying guidance that requires that the effect of a change in tax laws or rates be included in income from continuing operations is not affected. This ASU also requires certain disclosures about stranded tax effects. ASU 2018-02 is effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted, including adoption in any interim period, (1) for public business entities for reporting periods for which financial statements have not yet been issued and (2) for all other entities for reporting periods for which financial statements have not yet been made available for issuance. The guidance should be applied either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act is recognized. The Company adopted ASU 2018-02 in the the three months ended March 31, 2018. As a result of the adoption of ASU 2018-02, $1.2 million of stranded tax effects resulting from the Tax Cuts and Jobs Act were reclassified from accumulated other comprehensive income to shareholders' equity during the three months ended March 31, 2018.

19

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

3. GOODWILL AND INTANGIBLE ASSETS

Finite Lived Intangible Assets, Net

The Company's intangible assets include acquired management contracts, client relationships, a trade name, and the future benefits of managing new assets for existing clients that were recognized at fair value as of their acquisition dates.

The following table summarizes the carrying value, net of accumulated amortization, for the Company's intangible assets:

Weighted Average Amortization Period as of March 31, 2018 | As of March 31, | As of December 31, | |||||||

2018 | 2017 | ||||||||

Management contracts | 2.2 years | $ | 42,335 | $ | 67,306 | ||||

Client relationships | 10.3 years | 38,600 | 38,600 | ||||||

Trade name | 4.3 years | 3,200 | 3,200 | ||||||

Total intangible assets | 84,135 | 109,106 | |||||||

Less: accumulated amortization | (46,957 | ) | (68,641 | ) | |||||

Intangible assets, net | $ | 37,178 | $ | 40,465 | |||||

Amortization expense associated with intangible assets was $3.3 million and $5.3 million for the three months ended March 31, 2018 and 2017, respectively, and is presented within general, administrative and other expenses within the Condensed Consolidated Statements of Operations. During the first quarter of 2018, the Company removed $25.0 million of intangible assets that were fully amortized.

Goodwill

The following table summarizes the carrying value of the Company's goodwill assets:

Credit | Private Equity | Real Estate | Total | ||||||||||||

Balance as of December 31, 2017 | $ | 32,196 | $ | 58,600 | $ | 53,099 | $ | 143,895 | |||||||

Foreign currency translation | — | — | 73 | 73 | |||||||||||

Balance as of March 31, 2018 | $ | 32,196 | $ | 58,600 | $ | 53,172 | $ | 143,968 | |||||||

There was no impairment of goodwill recorded during the three months ended March 31, 2018 and 2017. The impact of foreign currency translation is reflected within other comprehensive income.

20

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

4. INVESTMENTS

The Company’s investments are comprised of:

Percentage of total investments | |||||||||||||

March 31, | December 31, | March 31, | December 31, | ||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||

As adjusted | As adjusted | ||||||||||||

Private Investment Partnership Interests: | |||||||||||||

Equity method private investment partnership interests - principal (1) | $ | 347,406 | $ | 340,354 | 19.2 | % | 19.7 | % | |||||

Equity method - carried interest (1) | 1,113,435 | 1,077,236 | 61.4 | % | 62.5 | % | |||||||

Equity method private investment partnership interests - other | 69,342 | 74,439 | 3.8 | % | 4.3 | % | |||||||

Other private investment partnership interests | 37,266 | 35,748 | 2.1 | % | 2.1 | % | |||||||

Total private investment partnership interests | 1,567,449 | 1,527,777 | 86.5 | % | 88.6 | % | |||||||

Collateralized loan obligations | 242,984 | 195,158 | 13.4 | % | 11.3 | % | |||||||

Common stock | 1,396 | 1,636 | 0.1 | % | 0.1 | % | |||||||

Total investments | $ | 1,811,829 | $ | 1,724,571 | |||||||||

(1) | Interest or portion of the interest is denominated in foreign currency and is translated into U.S. dollars at each reporting date. |

Equity Method Investments

The Company’s equity method investments include investments that are not consolidated but over which the Company exerts significant influence. The Company evaluates each of its equity method investments to determine if any were significant under SEC guidance. For the three months ended March 31, 2018 and 2017, no individual equity method investment held by the Company met the significance criteria.

The Company recognized net gains of $3.5 million and $5.8 million related to its equity method investments for the three months ended March 31, 2018 and 2017, respectively, that are included within both principal investment income and within net realized and unrealized gain on investments within the Consolidated Statements of Operations.

The material assets of the Company's equity method investments are expected to generate long-term capital appreciation and/or interest income; the material liabilities are debt instruments collateralized by, or related to, the financing of the assets; and net income is materially comprised of the changes in fair value of these net assets.

21

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Investments of the Consolidated Funds

Investments held in the Consolidated Funds are summarized below:

Fair value at | Fair value as a percentage of total investments at | ||||||||||||

March 31, | December 31, | March 31, | December 31, | ||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||

United States: | |||||||||||||

Fixed income securities: | |||||||||||||

Consumer discretionary | $ | 1,303,537 | $ | 1,295,732 | 24.1 | % | 23.2 | % | |||||

Consumer staples | 56,917 | 55,073 | 1.0 | % | 1.0 | % | |||||||

Energy | 173,698 | 176,836 | 3.2 | % | 3.2 | % | |||||||

Financials | 270,317 | 270,520 | 4.9 | % | 4.8 | % | |||||||

Healthcare, education and childcare | 453,622 | 449,888 | 8.3 | % | 8.1 | % | |||||||

Industrials | 364,479 | 370,926 | 6.7 | % | 6.6 | % | |||||||

Information technology | 146,733 | 167,089 | 2.7 | % | 3.0 | % | |||||||

Materials | 170,309 | 185,170 | 3.1 | % | 3.3 | % | |||||||

Telecommunication services | 385,829 | 399,617 | 7.0 | % | 7.2 | % | |||||||

Utilities | 62,667 | 77,102 | 1.1 | % | 1.4 | % | |||||||

Total fixed income securities (cost: $3,393,506 and $3,459,318 at March 31, 2018 and December 31, 2017, respectively) | 3,388,108 | 3,447,953 | 62.1 | % | 61.8 | % | |||||||

Equity securities: | |||||||||||||

Energy | 60 | 126 | 0.0 | % | 0.0 | % | |||||||

Total equity securities (cost: $2,265 and $2,265 at March 31, 2018 and December 31, 2017, respectively) | 60 | 126 | 0.0 | % | 0.0 | % | |||||||

Partnership and interests | |||||||||||||

Partnership and interests | 252,700 | 232,332 | 4.6 | % | 4.2 | % | |||||||

Total partnership and LLC interests (cost: $200,000 and $190,000 at March 31, 2018 and December 31, 2017, respectively) | 252,700 | 232,332 | 4.6 | % | 4.2 | % | |||||||

22

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Fair value at | Fair value as a percentage of total investments at | ||||||||||||

March 31, | December 31, | March 31, | December 31, | ||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||

Europe: | |||||||||||||

Fixed income securities: | |||||||||||||

Consumer discretionary | $ | 603,516 | $ | 604,608 | 11.0 | % | 10.8 | % | |||||

Energy | 2,461 | 2,413 | 0.0 | % | 0.0 | % | |||||||

Consumer staples | 72,317 | 76,361 | 1.3 | % | 1.4 | % | |||||||

Financials | 116,836 | 81,987 | 2.1 | % | 1.5 | % | |||||||

Healthcare, education and childcare | 187,032 | 209,569 | 3.4 | % | 3.8 | % | |||||||

Industrials | 128,345 | 145,706 | 2.3 | % | 2.6 | % | |||||||

Information technology | 20,603 | 21,307 | 0.4 | % | 0.4 | % | |||||||

Materials | 184,625 | 213,395 | 3.4 | % | 3.8 | % | |||||||

Telecommunication services | 181,917 | 182,543 | 3.3 | % | 3.3 | % | |||||||

Total fixed income securities (cost: $1,507,741 and $1,545,297 at March 31, 2018 and December 31, 2017, respectively) | 1,497,652 | 1,537,889 | 27.2 | % | 27.6 | % | |||||||

Equity securities: | |||||||||||||

Healthcare, education and childcare | 61,065 | 63,155 | 1.1 | % | 1.1 | % | |||||||

Total equity securities (cost: $67,198 and $67,198 at March 31, 2018 and December 31, 2017, respectively) | 61,065 | 63,155 | 1.1 | % | 1.1 | % | |||||||

Asia and other: | |||||||||||||

Fixed income securities: | |||||||||||||

Consumer discretionary | 2,019 | 2,008 | 0.0 | % | 0.0 | % | |||||||

Financials | 22,476 | 12,453 | 0.4 | % | 0.2 | % | |||||||

Telecommunication services | 21,679 | 21,848 | 0.4 | % | 0.4 | % | |||||||

Total fixed income securities (cost: $46,287 and $36,180 at March 31, 2018 and December 31, 2017, respectively) | 46,174 | 36,309 | 0.8 | % | 0.6 | % | |||||||

Equity securities: | |||||||||||||

Consumer discretionary | 50,071 | 59,630 | 0.9 | % | 1.1 | % | |||||||

Consumer staples | 46,232 | 45,098 | 0.8 | % | 0.8 | % | |||||||

Healthcare, education and childcare | 44,637 | 44,637 | 0.8 | % | 0.8 | % | |||||||

Industrials | 16,578 | 16,578 | 0.3 | % | 0.3 | % | |||||||

Total equity securities (cost: $122,418 and $122,418 at March 31, 2018 and December 31, 2017, respectively) | 157,518 | 165,943 | 2.8 | % | 3.0 | % | |||||||

23

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Fair value at | Fair value as a percentage of total investments at | ||||||||||||

March 31, | December 31, | March 31, | December 31, | ||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||

Canada: | |||||||||||||

Fixed income securities: | |||||||||||||

Consumer discretionary | $ | 7,474 | $ | 6,757 | 0.1 | % | 0.1 | % | |||||

Consumer staples | 19,364 | 15,351 | 0.4 | % | 0.3 | % | |||||||

Energy | 14,103 | 33,715 | 0.3 | % | 0.6 | % | |||||||

Industrials | 18,667 | 18,785 | 0.3 | % | 0.3 | % | |||||||

Telecommunication services | 6,045 | 6,189 | 0.1 | % | 0.1 | % | |||||||

Total fixed income securities (cost: $65,501 and $80,201 at March 31, 2018 and December 31, 2017, respectively) | 65,653 | 80,797 | 1.2 | % | 1.4 | % | |||||||

Equity securities: | |||||||||||||

Consumer discretionary | — | 5,912 | — | % | 0.1 | % | |||||||

Total equity securities (cost: $0 and $17,202 at March 31, 2018 and December 31, 2017, respectively) | — | 5,912 | — | % | 0.1 | % | |||||||

Australia: | |||||||||||||

Fixed income securities: | |||||||||||||

Consumer discretionary | 8,587 | 10,863 | 0.2 | % | 0.2 | % | |||||||

Energy | 1,619 | 1,563 | 0.0 | % | 0.0 | % | |||||||

Total fixed income securities (cost: $10,446 and $12,714 at March 31, 2018 and December 31, 2017, respectively) | 10,206 | 12,426 | 0.2 | % | 0.2 | % | |||||||

Total fixed income securities | 5,007,793 | 5,115,374 | 91.5 | % | 91.6 | % | |||||||

Total equity securities | 218,643 | 235,136 | 3.9 | % | 4.2 | % | |||||||

Total partnership interests | 252,700 | 232,332 | 4.6 | % | 4.2 | % | |||||||

Total investments, at fair value | $ | 5,479,136 | $ | 5,582,842 | |||||||||

At March 31, 2018 and December 31, 2017, no single issuer or investment, including derivative instruments and underlying portfolio investments of the Consolidated Funds, had a fair value that exceeded 5.0% of the Company’s total assets.

24

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

5. FAIR VALUE

Fair Value Measurements

GAAP establishes a hierarchal disclosure framework that prioritizes the inputs used in measuring financial instruments at fair value into three levels based on their market observability. Market price observability is affected by a number of factors, including the type of instrument and the characteristics specific to the instrument. Financial instruments with readily available quoted prices from an active market or for which fair value can be measured based on actively quoted prices generally have a higher degree of market price observability and a lesser degree of judgment inherent in measuring fair value.

Financial assets and liabilities measured and reported at fair value are classified as follows:

• | Level I—Quoted prices in active markets for identical instruments. |

• | Level II—Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in inactive markets; and model‑derived valuations with directly or indirectly observable significant inputs. Level II inputs include prices in markets with few transactions, non-current prices, prices for which little public information exists or prices that vary substantially over time or among brokered market makers. Other inputs include interest rates, yield curves, volatilities, prepayment risks, loss severities, credit risks and default rates. |

• | Level III—Valuations that rely on one or more significant unobservable inputs. These inputs reflect the Company’s assessment of the assumptions that market participants would use to value the instrument based on the best information available. |

In some instances, an instrument may fall into more than one level of the fair value hierarchy. In such instances, the instrument’s level within the fair value hierarchy is based on the lowest of the three levels (with Level III being the lowest) that is significant to the fair value measurement. The Company’s assessment of the significance of an input requires judgment and considers factors specific to the instrument. The Company accounts for the transfer of assets into or out of each fair value hierarchy level as of the beginning of the reporting period.

Fair Value of Financial Instruments Held by the Company and Consolidated Funds

The tables below summarize the financial assets and financial liabilities measured at fair value for the Company and Consolidated Funds as of March 31, 2018:

Financial Instruments of the Company | Level I | Level II | Level III | Investments Measured at NAV | Total | |||||||||||||||

Assets, at fair value | ||||||||||||||||||||

Investments: | ||||||||||||||||||||

Fixed income-collateralized loan obligations | $ | — | $ | — | $ | 242,984 | $ | — | $ | 242,984 | ||||||||||

Equity securities | 377 | 1,019 | — | — | 1,396 | |||||||||||||||

Partnership interests | — | — | 44,769 | 37,266 | 82,035 | |||||||||||||||

Total investments, at fair value | 377 | 1,019 | 287,753 | 37,266 | 326,415 | |||||||||||||||

Derivatives—foreign exchange contracts | — | 230 | — | — | 230 | |||||||||||||||

Total assets, at fair value | $ | 377 | $ | 1,249 | $ | 287,753 | $ | 37,266 | $ | 326,645 | ||||||||||

Liabilities, at fair value | ||||||||||||||||||||

Derivatives—foreign exchange contracts | $ | — | $ | (4,229 | ) | $ | — | $ | — | $ | (4,229 | ) | ||||||||

Total liabilities, at fair value | $ | — | $ | (4,229 | ) | $ | — | $ | — | $ | (4,229 | ) | ||||||||

25

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Financial Instruments of the Consolidated Funds | Level I | Level II | Level III | Total | ||||||||||||

Assets, at fair value | ||||||||||||||||

Investments: | ||||||||||||||||

Fixed income investments: | ||||||||||||||||

Bonds | $ | — | $ | 67,741 | $ | 6,570 | $ | 74,311 | ||||||||

Loans | — | 4,648,235 | 234,193 | 4,882,428 | ||||||||||||

Collateralized loan obligations | — | 51,054 | — | 51,054 | ||||||||||||

Total fixed income investments | — | 4,767,030 | 240,763 | 5,007,793 | ||||||||||||

Equity securities | 58,221 | — | 160,422 | 218,643 | ||||||||||||

Partnership interests | — | — | 252,700 | 252,700 | ||||||||||||

Total investments, at fair value | 58,221 | 4,767,030 | 653,885 | 5,479,136 | ||||||||||||

Derivatives: | ||||||||||||||||

Asset swaps - other | — | — | 834 | 834 | ||||||||||||

Total assets, at fair value | $ | 58,221 | $ | 4,767,030 | $ | 654,719 | $ | 5,479,970 | ||||||||

Liabilities, at fair value | ||||||||||||||||

Asset swaps - other | $ | — | $ | — | $ | (748 | ) | $ | (748 | ) | ||||||

Loan obligations of CLOs | — | (4,937,264 | ) | — | (4,937,264 | ) | ||||||||||

Total liabilities, at fair value | $ | — | $ | (4,937,264 | ) | $ | (748 | ) | $ | (4,938,012 | ) | |||||

The tables below summarize the financial assets and financial liabilities measured at fair value for the Company and Consolidated Funds as of December 31, 2017:

Financial Instruments of the Company | Level I | Level II | Level III | Investments Measured at NAV | Total | |||||||||||||||

Assets, at fair value | ||||||||||||||||||||

Investments: | ||||||||||||||||||||

Fixed income-collateralized loan obligations | $ | — | $ | — | $ | 195,158 | $ | — | $ | 195,158 | ||||||||||

Equity securities | 520 | 1,116 | — | — | 1,636 | |||||||||||||||

Partnership interests | — | — | 44,769 | 35,998 | 80,767 | |||||||||||||||

Total investments, at fair value | 520 | 1,116 | 239,927 | 35,998 | 277,561 | |||||||||||||||

Derivatives—foreign exchange contracts | — | 498 | — | — | 498 | |||||||||||||||

Total assets, at fair value | $ | 520 | $ | 1,614 | $ | 239,927 | $ | 35,998 | $ | 278,059 | ||||||||||

Liabilities, at fair value | ||||||||||||||||||||

Derivatives—foreign exchange contracts | $ | — | $ | (2,639 | ) | $ | — | $ | — | $ | (2,639 | ) | ||||||||

Total liabilities, at fair value | $ | — | $ | (2,639 | ) | $ | — | $ | — | $ | (2,639 | ) | ||||||||

26

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Financial Instruments of the Consolidated Funds | Level I | Level II | Level III | Total | ||||||||||||

Assets, at fair value | ||||||||||||||||

Investments: | ||||||||||||||||

Fixed income investments: | ||||||||||||||||

Bonds | $ | — | $ | 82,151 | $ | 7,041 | $ | 89,192 | ||||||||

Loans | — | 4,755,335 | 260,848 | 5,016,183 | ||||||||||||

Collateralized loan obligations | — | 10,000 | — | 10,000 | ||||||||||||

Total fixed income investments | — | 4,847,486 | 267,889 | 5,115,375 | ||||||||||||

Equity securities | 72,558 | — | 162,577 | 235,135 | ||||||||||||

Partnership interests | — | — | 232,332 | 232,332 | ||||||||||||

Other | — | — | — | — | ||||||||||||

Total investments, at fair value | 72,558 | 4,847,486 | 662,798 | 5,582,842 | ||||||||||||

Derivatives: | ||||||||||||||||

Foreign exchange contracts | — | — | — | — | ||||||||||||

Asset swaps - other | — | — | 1,366 | 1,366 | ||||||||||||

Total derivative assets, at fair value | — | — | 1,366 | 1,366 | ||||||||||||

Total assets, at fair value | $ | 72,558 | $ | 4,847,486 | $ | 664,164 | $ | 5,584,208 | ||||||||

Liabilities, at fair value | ||||||||||||||||

Asset swaps - other | $ | — | $ | — | $ | (462 | ) | $ | (462 | ) | ||||||

Loan obligations of CLOs | — | (4,963,194 | ) | — | (4,963,194 | ) | ||||||||||

Total liabilities, at fair value | $ | — | $ | (4,963,194 | ) | $ | (462 | ) | $ | (4,963,656 | ) | |||||

The following tables set forth a summary of changes in the fair value of the Level III measurements for the three months ended March 31, 2018:

Level III Assets | |||||||||||||

Level III Assets and Liabilities of the Company | Fixed Income | Partnership Interests | Total | ||||||||||

Balance, beginning of period | $ | 195,158 | $ | 44,769 | $ | 239,927 | |||||||

Deconsolidation of fund | 78 | — | 78 | ||||||||||

Purchases(1) | 48,731 | — | 48,731 | ||||||||||

Sales/settlements(2) | (827 | ) | — | (827 | ) | ||||||||

Realized and unrealized depreciation, net | (156 | ) | — | (156 | ) | ||||||||

Balance, end of period | $ | 242,984 | $ | 44,769 | $ | 287,753 | |||||||

Decrease in unrealized appreciation/depreciation included in earnings related to financial assets and liabilities still held at the reporting date | $ | (610 | ) | $ | — | $ | (610 | ) | |||||

27

Ares Management, L.P.

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

Level III Assets of Consolidated Funds | Equity Securities | Fixed Income | Partnership Interests | Derivatives, Net | Total | |||||||||||||||

Balance, beginning of period | $ | 162,577 | $ | 267,889 | $ | 232,332 | $ | 904 | $ | 663,702 | ||||||||||

Deconsolidation of fund | — | (233 | ) | — | — | (233 | ) | |||||||||||||

Transfer in | — | 73,814 | — | — | 73,814 | |||||||||||||||

Transfer out | — | (102,045 | ) | — | — | (102,045 | ) | |||||||||||||

Purchases(1) | — | 52,984 | 10,000 | — | 62,984 | |||||||||||||||

Sales(2) | — | (50,935 | ) | — | — | (50,935 | ) | |||||||||||||

Settlements, net | — | — | — | (177 | ) | (177 | ) | |||||||||||||

Amortized discounts/premiums | — | 96 | — | 7 | 103 | |||||||||||||||

Realized and unrealized appreciation (depreciation), net | (2,155 | ) | (807 | ) | 10,368 | (648 | ) | 6,758 | ||||||||||||

Balance, end of period | $ | 160,422 | $ | 240,763 | $ | 252,700 | $ | 86 | $ | 653,971 | ||||||||||

Increase (decrease) in unrealized appreciation/depreciation included in earnings related to financial assets still held at the reporting date | $ | (2,156 | ) | $ | (1,831 | ) | $ | 10,368 | $ | (749 | ) | $ | 5,632 | |||||||