Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - IES Holdings, Inc. | d563278dex991.htm |

| 8-K - FORM 8-K - IES Holdings, Inc. | d563278d8k.htm |

Exhibit 99.2

IES Holdings, Inc.

Second Quarter 2018 Update

IES

Disclosures

Forward-Looking Statements

Certain statements in this document may be deemed

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, all of which are based upon various estimates and assumptions that the Company

believes to be reasonable as of the date hereof. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,”

“project,” “intend,” anticipate,” “believe,” “seek,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such

terms or other comparable terminology. These statements involve risks and uncertainties that could cause the Company’s actual future outcomes to differ materially from those set forth in such statements. Such risks and uncertainties include,

but are not limited to, the ability of our controlling shareholder to take action not aligned with other shareholders; the possibility that certain tax benefits of our net operating losses may be restricted or reduced in a change in ownership or a

further change in the federal tax rate; the potential recognition of valuation allowances or further write-downs on net deferred tax assets; the inability to carry out plans and strategies as expected, including underperformance of our acquisitions

or our inability to identify and complete acquisitions that meet our investment criteria in furtherance of our corporate strategy; competition in the industries in which we operate, both from third parties and former employees, which could result in

the loss of one or more customers or lead to lower margins on new projects; fluctuations in operating activity due to downturns in levels of construction, seasonality and differing regional economic conditions; and our ability to successfully manage

projects, as well as other risk factors discussed in this document, in the Company’s annual report on Form 10-K for the year ended September 30, 2017 and in the Company’s other reports on file with the SEC. You should understand that

such risk factors could cause future outcomes to differ materially from those experienced previously or those expressed in such forward-looking statements. The Company undertakes no obligation to publicly update or revise any information, including

information concerning its controlling shareholder, net operating losses, borrowing availability, or cash position, or any forward-looking statements to reflect events or circumstances that may arise after the date of this document. Forward-looking

statements are provided in this press document pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of the estimates, assumptions, uncertainties, and risks

described herein.

Non-GAAP Financial Measures and Other Adjustments

This

document includes adjusted net income attributable to IES and, in the non-GAAP reconciliation table included herein, adjusted net income before taxes, both of which are financial measures not calculated in accordance with generally accepted

accounting principles in the U.S. (“GAAP”). Management believes that these measures provide useful information to our investors by distinguishing certain noncash events such as our valuation allowances release and write-down of our net

deferred tax assets and that these measures, when reconciled to net income attributable to IES, which is the most directly comparable GAAP measure, help our investors to better identify underlying trends in the operations of our business and

facilitate easier comparisons of our financial performance with prior and future periods and to our peers. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance

with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures. A reconciliation of these non-GAAP financial measures to GAAP results has been provided in the

financial tables included in this document.

For further details on the Company’s financial results, please refer to the Company’s quarterly report on

Form 10-Q for the fiscal quarter ended March 31, 2018, to be filed with the Securities and Exchange Commission (“SEC”) by May 4, 2018, and any amendments thereto.

General information about IES Holdings, Inc. can be found at http://www.ies-co.com under “Investors.” The Company’s annual report on Form 10-K, quarterly reports on

Form 10-Q and current reports on Form 8-K, as well as any amendments to those reports, are available free of charge through the Company’s website as soon as reasonably practicable after they are filed with, or furnished to, the SEC.

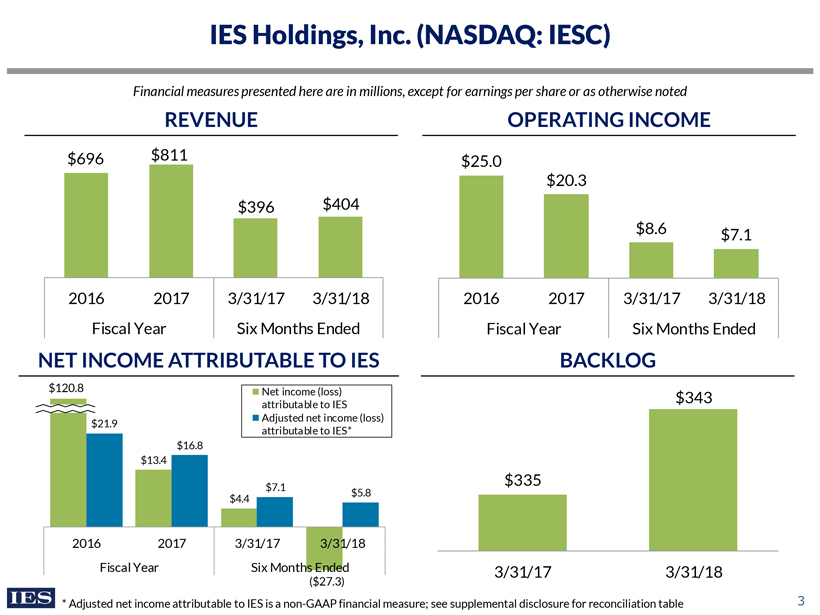

IES Holdings, Inc. (NASDAQ: IESC)

Financial measures presented here are in millions, except for earnings per share or as otherwise noted

REVENUE OPERATING INCOME

$696 $811 $25.0

$20.3 $396 $404

$8.6 $7.1

2016 2017 3/31/17 3/31/18 2016 2017 3/31/17 3/31/18 Fiscal Year Six Months Ended Fiscal Year Six Months Ended

NET INCOME ATTRIBUTABLE TO IES BACKLOG

$120.8 Net income (loss) attributable to IES $343

Adjusted net income (loss)

$21.9 attributable to IES*

$16.8

$13.4

$7.1 $5.8 $335

$4.4

2016 2017 3/31/17 3/31/18

Fiscal Year Six Months Ended 3/31/17 3/31/18

($27.3)

* Adjusted net income attributable to IES is a non-GAAP financial measure; see supplemental disclosure for reconciliation table

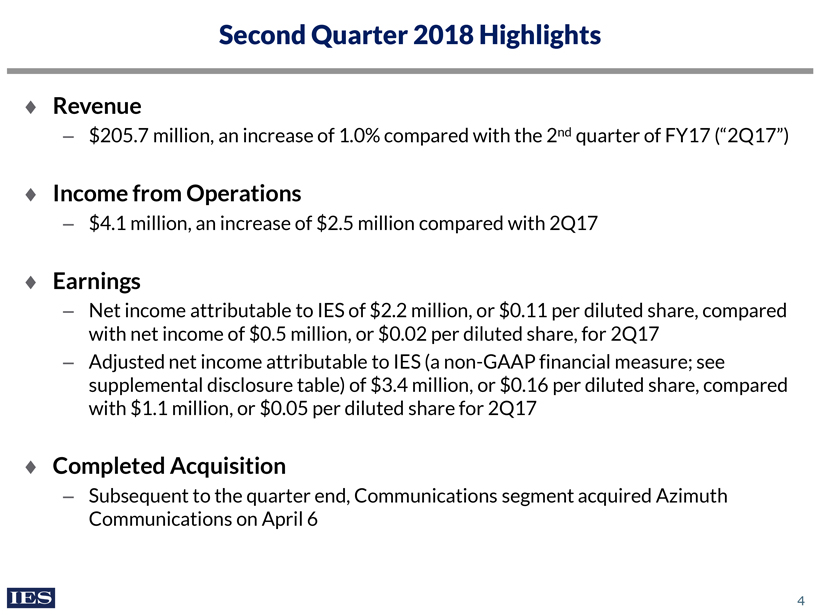

Second Quarter 2018 Highlights

Revenue

– $205.7 million, an increase of 1.0% compared with the 2nd quarter of FY17

(“2Q17”)

Income from Operations

– $4.1 million, an increase of

$2.5 million compared with 2Q17

Earnings

– Net income attributable to

IES of $2.2 million, or $0.11 per diluted share, compared with net income of $0.5 million, or $0.02 per diluted share, for 2Q17

– Adjusted net income

attributable to IES (a non-GAAP financial measure; see supplemental disclosure table) of $3.4 million, or $0.16 per diluted share, compared with $1.1 million, or $0.05 per diluted share for 2Q17

Completed Acquisition

– Subsequent to the quarter end, Communications segment acquired

Azimuth Communications on April 6

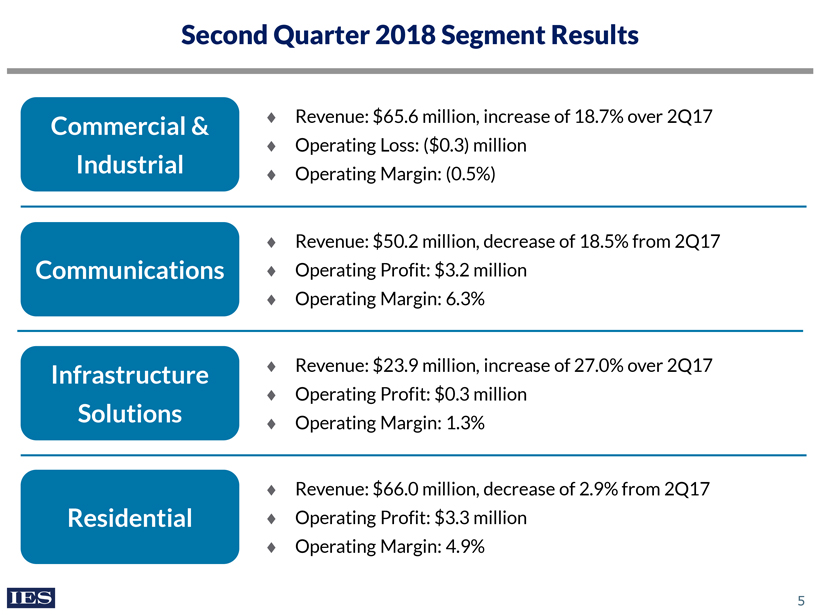

Second Quarter 2018 Segment Results

Commercial & Industrial Revenue: $65.6 million, increase of 18.7% over 2Q17 Operating Loss: ($0.3) million Operating Margin: (0.5%)

Revenue: $50.2 million, decrease of 18.5% from 2Q17 Communications Operating Profit: $3.2 million Operating Margin: 6.3%

Infrastructure Solutions Revenue: $23.9 million, increase of 27.0% over 2Q17 Operating Profit: $0.3 million Operating Margin: 1.3%

Revenue: $66.0 million, decrease of 2.9% from 2Q17 Residential Operating Profit: $3.3 million Operating Margin: 4.9%

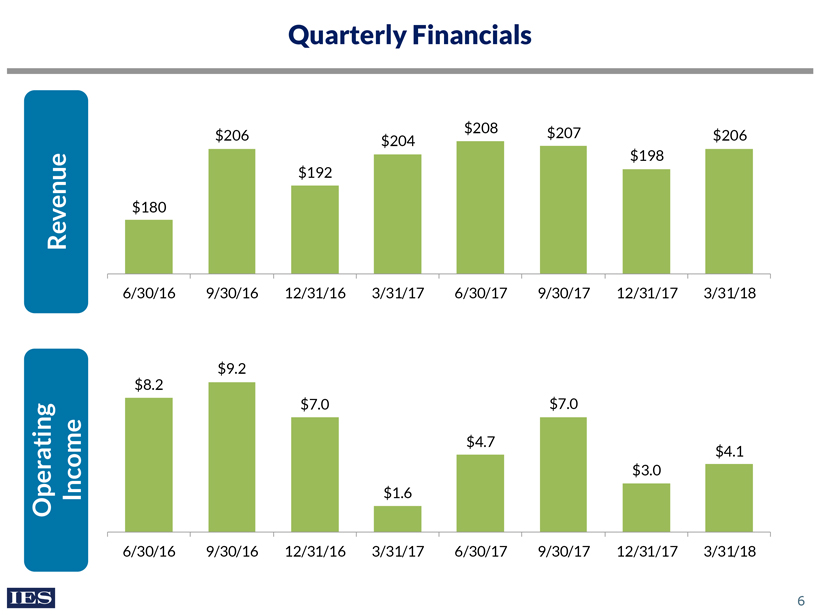

Quarterly Financials

$208 $207 $206 $206 $204 $198 $192

Revenue $180

6/30/16 9/30/16 12/31/16 3/31/17 6/30/17 9/30/17 12/31/17 3/31/18

$9.2

$8.2

$7.0 $7.0

$4.7

$4.1

$3.0

Operating Income $1.6

6/30/16 9/30/16 12/31/16 3/31/17 6/30/17 9/30/17 12/31/17 3/31/18

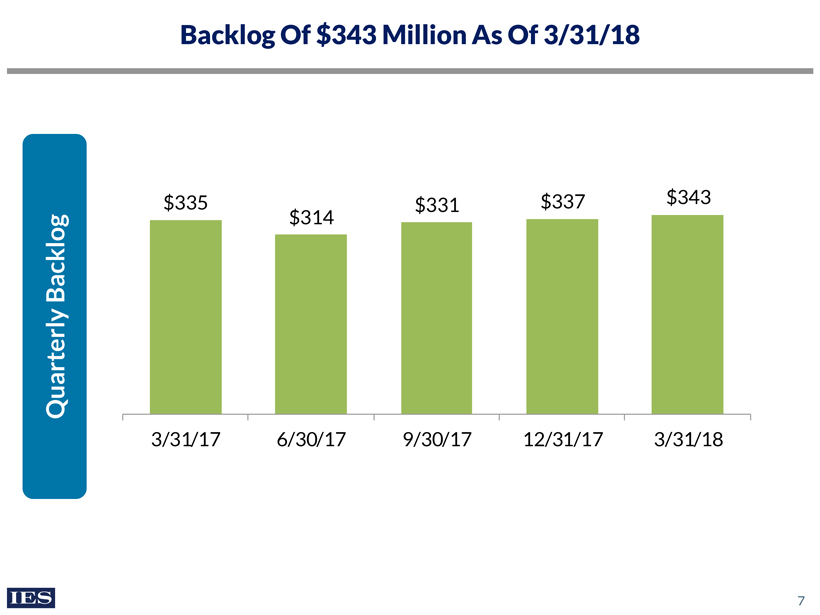

Backlog Of $343 Million As Of 3/31/18

$335 $331 $337 $343

Backlog $314 y Quarterl

3/31/17 6/30/17 9/30/17 12/31/17 3/31/18

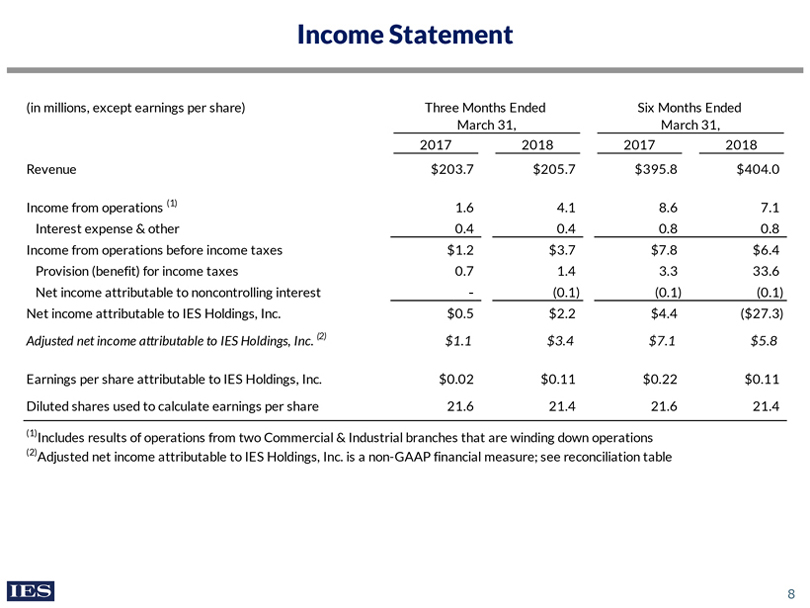

Income Statement

(in millions, except earnings per share) Three Months Ended Six Months Ended March 31, March 31, 2017 2018 2017 2018 Revenue $203.7 $205.7 $395.8 $404.0

Income from operations (1) 1.6 4.1 8.6 7.1 Interest expense & other 0.4 0.4 0.8 0.8 Income from operations before income taxes $1.2 $3.7 $7.8 $6.4 Provision (benefit)

for income taxes 0.7 1.4 3.3 33.6 Net income attributable to noncontrolling interest - (0.1) (0.1) (0.1) Net income attributable to IES Holdings, Inc. $0.5 $2.2 $4.4 ($27.3)

Adjusted net income attributable to IES Holdings, Inc. (2) $1.1 $3.4 $7.1 $5.8

Earnings

per share attributable to IES Holdings, Inc. $0.02 $0.11 $0.22 $0.11 Diluted shares used to calculate earnings per share 21.6 21.4 21.6 21.4

(1)Includes results of

operations from two Commercial & Industrial branches that are winding down operations (2)Adjusted net income attributable to IES Holdings, Inc. is a non-GAAP financial measure; see reconciliation table

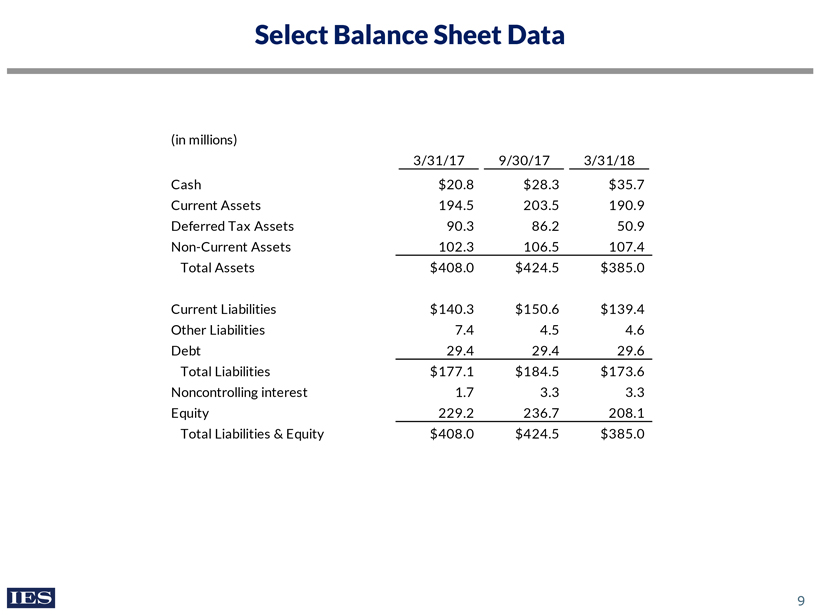

Select Balance Sheet Data

(in millions)

3/31/17 9/30/17 3/31/18 Cash $20.8 $28.3 $35.7 Current Assets 194.5 203.5 190.9

Deferred Tax Assets 90.3 86.2 50.9 Non-Current Assets 102.3 106.5 107.4 Total Assets $408.0 $424.5 $385.0

Current Liabilities $140.3 $150.6 $139.4 Other

Liabilities 7.4 4.5 4.6 Debt 29.4 29.4 29.6 Total Liabilities $177.1 $184.5 $173.6 Noncontrolling interest 1.7 3.3 3.3 Equity 229.2 236.7 208.1 Total Liabilities & Equity $408.0 $424.5 $385.0

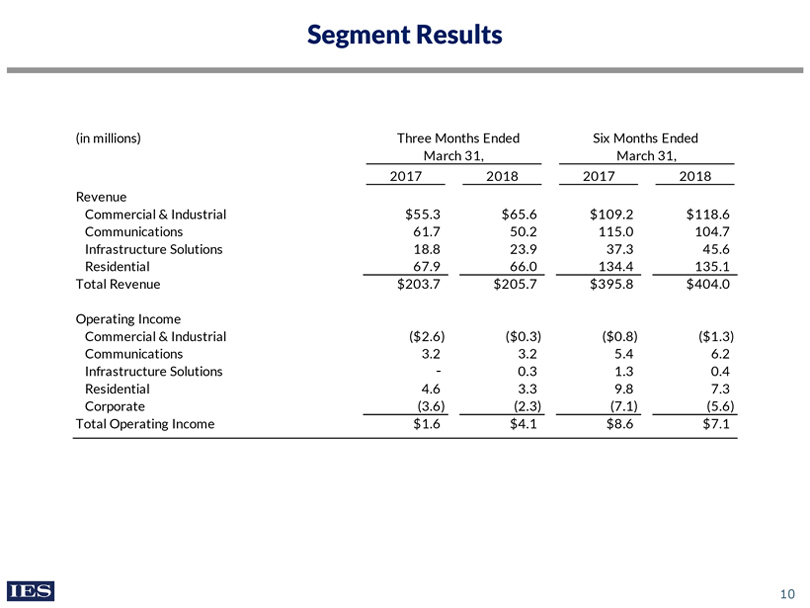

Segment Results

(in millions) Three Months Ended Six Months Ended March 31, March 31, 2017 2018 2017 2018 Revenue Commercial & Industrial $55.3 $65.6 $109.2 $118.6

Communications 61.7 50.2 115.0 104.7 Infrastructure Solutions 18.8 23.9 37.3 45.6 Residential 67.9 66.0 134.4 135.1 Total Revenue $203.7 $205.7 $395.8 $404.0

Operating Income

Commercial & Industrial ($2.6) ($0.3) ($0.8) ($1.3)

Communications 3.2 3.2 5.4 6.2 Infrastructure Solutions - 0.3 1.3 0.4 Residential 4.6 3.3 9.8 7.3 Corporate (3.6) (2.3) (7.1) (5.6) Total Operating Income $1.6 $4.1 $8.6 $7.1

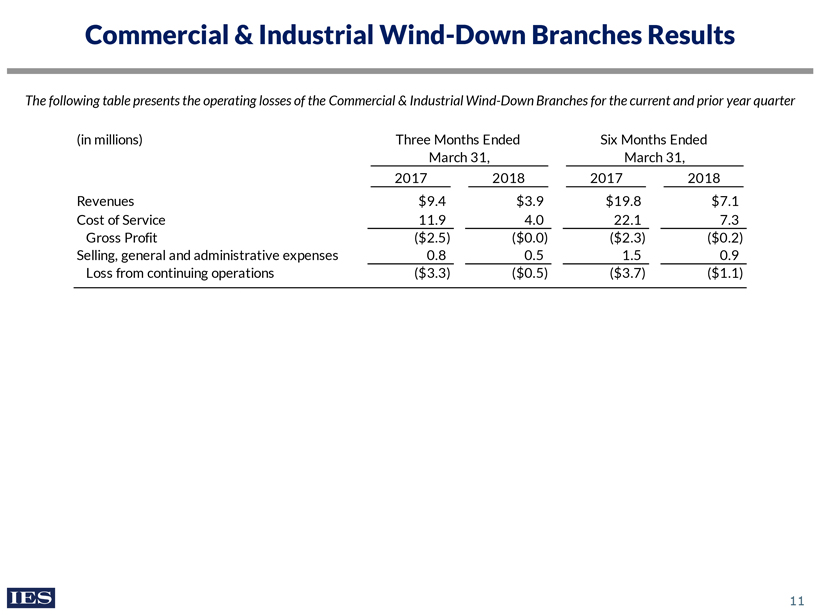

Commercial & Industrial Wind-Down Branches Results

The following table presents the operating losses of the Commercial & Industrial Wind-Down Branches for the current and prior year quarter

(in millions) Three Months Ended Six Months Ended March 31, March 31, 2017 2018 2017 2018 Revenues $9.4 $3.9 $19.8 $7.1 Cost of Service 11.9 4.0 22.1 7.3 Gross

Profit ($2.5) ($0.0) ($2.3) ($0.2) Selling, general and administrative expenses 0.8 0.5 1.5 0.9 Loss from continuing operations ($3.3) ($0.5) ($3.7) ($1.1)

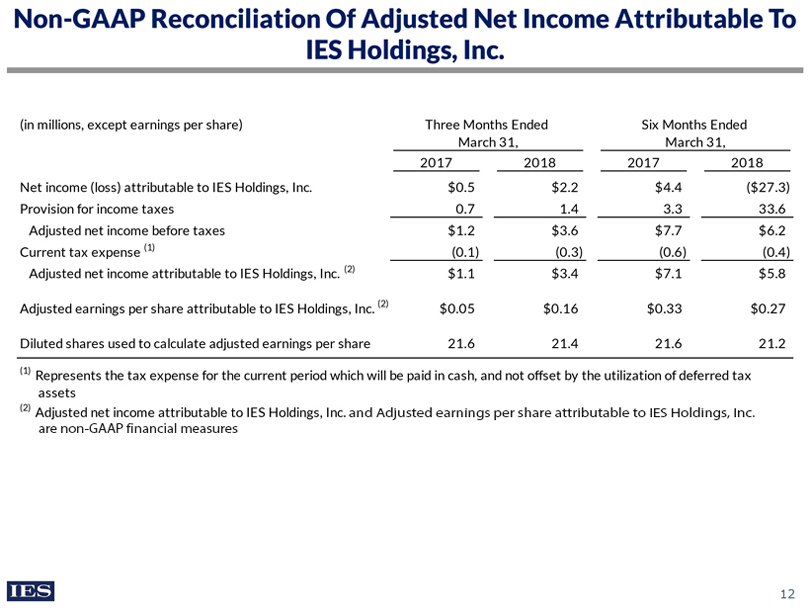

`Non-GAAP Reconciliation Of Adjusted Net Income Attributable To

IES Holdings, Inc.

(in millions, except earnings per share) Three Months Ended Six Months Ended March 31, March 31, 2017 2018 2017 2018 Net income

(loss) attributable to IES Holdings, Inc. $0.5 $2.2 $4.4 ($27.3) Provision for income taxes 0.7 1.4 3.3 33.6 Adjusted net income before taxes $1.2 $3.6 $7.7 $6.2 Current tax expense (1) (0.1) (0.3) (0.6) (0.4) Adjusted net income attributable

to IES Holdings, Inc. (2) $1.1 $3.4 $7.1 $5.8

Adjusted earnings per share attributable to IES Holdings, Inc. (2) $0.05 $0.16 $0.33 $0.27

Diluted shares used to calculate adjusted earnings per share 21.6 21.4 21.6 21.2

(1)

Represents the tax expense for the current period which will be paid in cash, and not offset by the utilization of deferred tax assets (2) Adjusted net income attributable to IES Holdings, Inc. And Adjusted earnings per share attributable to

IES Holdings, Inc. are non-GAAP financial measures

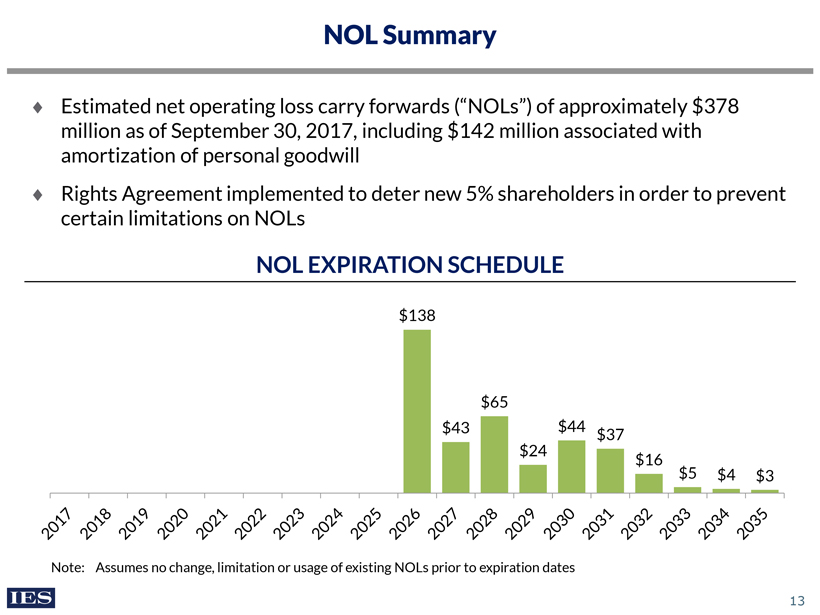

NOL Summary

Estimated net operating loss carry forwards (“NOLs”) of approximately $378 million as of September 30, 2017, including $142 million associated with amortization of

personal goodwill Rights Agreement implemented to deter new 5% shareholders in order to prevent certain limitations on NOLs

NOL EXPIRATION SCHEDULE

$138

$65

$43 $44

$24 $37 $16

$5 $4 $3

Note: Assumes no change, limitation or usage of existing NOLs prior to expiration

dates