Attached files

| file | filename |

|---|---|

| EX-32.2 - REACH Genetics, Inc. | ex32-2.htm |

| EX-32.1 - REACH Genetics, Inc. | ex32-1.htm |

| EX-31.2 - REACH Genetics, Inc. | ex31-2.htm |

| EX-31.1 - REACH Genetics, Inc. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] Annual Report Pursuant to Section 13 or 15(D) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2017

[ ] Transition Report Under Section 13 or 15(D) of the Securities Exchange Act of 1934

for the transition period from _______________ to _______________

DOYEN ELEMENTS, INC.

(Exact name of small Business Issuer as specified in its charter)

| Nevada | 000-55836 | 47-5326352 | ||

| (State or other jurisdiction | (Commission | (IRS Employer | ||

| of incorporation) | File Number) | Identification No.) |

1880 Office Club Pointe, Suite 1240

Colorado Springs, CO 80920

Issuer’s telephone number, including area code: (855) 369-3687

Not applicable.

Former address if changed since last report

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] | Smaller Reporting Company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of April 9, 2018 there were 17,077,462 shares of the registrant’s common stock outstanding.

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. The Securities and Exchange Commission (the “Commission”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This report and other written and oral statements that we make from time to time contain such forward-looking statements that set out anticipated results based on management’s plans and assumptions regarding future events or performance. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance or results of current and anticipated sales efforts, expenses, the outcome of contingencies, such as legal proceedings, and financial results. Factors that could cause our actual results of operations and financial condition to differ materially are discussed in greater detail under Item 1A, “Risk Factors” of this annual report on Form 10-K.

We caution that the factors described herein and other factors could cause our actual results of operations and financial condition to differ materially from those expressed in any forward-looking statements we make and that investors should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

| 3 |

OVERVIEW

Doyen Elements, Inc. (the “Company”) was organized pursuant to the laws of the State of Nevada in October 21, 2015 as AdvantaMeds Solutions USA Fund I, Inc., and in May 16, 2017 the Company changed its name to Doyen Elements, Inc. The Company was organized for the purposes of providing consulting, incubator services, and accelerator services to companies operating internationally. We intend to focus our business operations on providing a wide range of ancillary services to the legal Industrial Hemp industry, including property leasing and management, equipment leasing, management consulting, genetic research, technology solutions, and logistical support functions, both in the United States and internationally, as well as to acquire existing companies which are currently engaged in providing various ancillary services to this industry. Our short term goal is to convert some of our current inventory into Hemp extract sales and the remainder will be utilized for research and development. We are a development-stage and emerging-growth Company and have conducted minimal business operations since our inception.

Doyen Elements, Inc. is driven far beyond the bottom-line, it’s the goal to provide products of the highest quality while contributing to the sustainability of the communities with the privilege of serving. Doyen’s management does not import mystery plants or buy seeds from unreliable sources. The Company is founded on the principal of organically grown hemp that shows promise for so many. Doyen’s own proprietary seed bank allows oversights on every plant, on every farm, from seed to harvest and beyond. Doyen Elements, Inc.’s plants have been developed to have a superior phytochemical profile known anywhere in the hemp industry with the purpose of creating healthy supplements and environments.

PRODUCTS AND SERVICES

We have organized our Company to provide a wide range of ancillary services to Industrial Hemp businesses, including real estate services, management consulting, genetic research, regulatory and compliance services, industrial equipment leasing, and working capital. We intend to be a “one- stop shop” for the legal Industrial Hemp industry. We expect that operators in this industry will be able to simplify their business operations, become more efficient, and maximize their profit potential by using our Company’s variety of ancillary products and services to replace duties that had previously been performed either in-house or by a multitude of outside contractors. We plan to help our clients not only save money, but also to save time and man-power that could be more efficiently used towards improving their business operations and product offerings and increasing their market share.

We believe that providing ancillary products and services to the licensed legal Industrial Hemp Industry puts us in the best position to tap the national and international market, because we will not be bound by the licensing and regulatory requirements which binds growers and dispensers to a single state or geographic area. Our goal, and our opportunity, is to provide our products and services to clients in every state in which Hemp products are legal.

Products and services will include:

Genetics

Doyen Elements, Inc.’s research lab will catalyze and restore regenerative hemp-based agriculture, food, fuel, and fiber economies for the health, safety and welfare of the planet. The research lab has developed cannabinoid hemp for extract sales, and has applied genetics and select breeding. Doyen’s scientific team harvested 40,000 hemp plants of over 40 cultivars, captured over 10,000 images of genetic variations, phylogenetic systematics, field preparation, soil amendments, permaculture, irrigation design, data compilation and storage. Additionally, Doyen’s “Hempcrete” products will be produced by utilizing hemp hurd and fiber from the rest of the plant. “Hempcrete” is mold/mildew resistant and insect/pest resistant. The product’s vapor permeability enables breathability that regulates temperature and humidity (carbon negative material) which creates a best natural insulator, and provides flame proofing (tested to 1800°F). The Company employs operators, having multiple years of experience, creating, sourcing, and using “Hempcrete” in various architectural structures.

Real Estate Services:

We intend to acquire real estate and assets facilities which we can develop or retro-fit for lease to licensed legal hemp growers and distributors. According to available industry information, there is a significant demand for such facilities which is not currently being met by the commercial real estate industry. In addition, the supply of legal hemp friendly facilities and agricultural real estate is rapidly increasing in value in key markets such as California. Through our pending acquisitions, we will be able to enter this market as a developer and lessor, as well as have the capabilities for construction management and facilities management.

| 4 |

Consulting and Management Services:

Through our pending acquisitions, we have acquired 4 scientists, each of whom has between 10 to 25 years of operational experience in the legal industrial hemp industry. We intend to offer both established industry participants as well as start-up operators a wide variety of management and operational services, including licensing, compliance, growth structure, facility build-out and expansion, security, transportation and logistics, and legal services.

Starting a grow site is typically extremely complex, with varying rules, regulations, and legal risks involved. Because of the experience of our management and employees, we believe that our Company can provide valuable assistance and guidance to entrepreneurs and companies who wish to get involved in this fledgling industry.

Our Corporate History

We were incorporated on October 21, 2015 in Nevada under the name Advantameds Solutions USA Fund I and engaged in the investigation and acquisition of a target company or business seeking the perceived advantages of being a publicly held corporation. We changed our name to Doyen Elements Inc. on May 16, 2017.

Acquisition of 7GENx LLC

Doyen Elements, Inc., on December 14, 2017, entered into an equity purchase agreement to acquire 7GENx LLC, a Boulder, Colorado based Hemp genetics research and Development Company for $4,200,000 pursuant to a promissory note due May 21, 2019.

7GENx LLC focuses on creating proprietary hemp cultivators to meet the current and emerging market demands for use in breeding for agricultural, industrial and medical purposes. Its team of scientists collect data and analysis the chemical, genetic and phenotypic profiles of hemp, allowing the company to create proprietary varieties of hemp that are targeted for specific uses for current or emerging markets. Additionally, 7GENx intends to restore regenerative hemp-based agriculture, food, fuel and fiber economies for the health, safety and welfare of the planet by providing small select farms in Colorado (and other states with state approved hemp programs) with hemp cultivation and harvesting techniques, elevated organic methods and practices, and proprietary rich hemp oil extract varieties that meet state hemp program standards.

Termination of Planned Acquisition of Colorado Companies Owned By Cassaundra McGinnis, Natalie Romolt, Angela Morton, Jeremy Pollock and Kyle Wendland

On January 26, 2018: Termination of Contract Based on recent developments within Doyen Elements Inc. and the Cannabis industry, we have determined that in order to maximize shareholder value we are going to more narrowly focus our efforts in the specific areas of hemp related products. Therefore, we will not be moving forward with the acquisition of the companies owned by Cassaundra McGinnis, Natalie Romolt, Angela Morton, Jeremy Pollock and Kyle Wendland; in various businesses related to the cannabis industry, pursuant to an agreement dated April 20, 2017.

Those companies operate within the overall cannabis space but outside our updated / more focused strategy. We are continuing to review other partners or acquisitions consistent with our objectives.

| 5 |

SALES AND MARKETING

Doyen Element, Inc.’s management is currently targeting hemp companies and certified organic real estate property, strategically positioning the Company across the globe. While Doyen Elements, Inc. intends to revolutionize the hemp industry through plant breeding and genetics, the expansion of its research labs and genetic scientists will enable trading on a global level through the distribution of popular hemp cultivars. The Company’s specialty CBD oils along with branded hemp retail products and “Hempcrete” construction goods, empowers a marketplace with unlimited solutions.

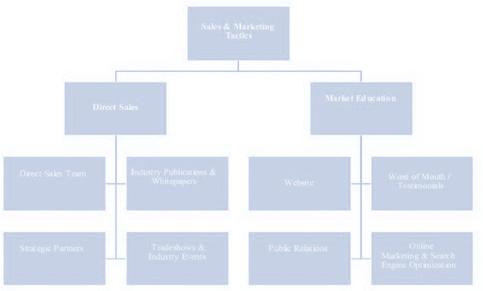

MARKETING TACTICS

We intend to utilize the following marketing channels and tactics to position ourselves appropriately to prospective industrial hemp business clients and customers. We believe that these strategies will ensure that our Company is able to generate a steady stream of new clients that will end up becoming ongoing recurring customers on a long-term basis.

Online Initiatives

| ● | The Doyen Elements website, www.doyenelementsus.com, will be the Company’s primary online marketing tool, and will be designed to serve as a powerful sales and promotional channel to reach our targeted industrial hemp businesses. The website will provide potential clients with key information that will enable them to make a positive decision and convert them into clients. The website will include: |

| ● An introductory video that grab the attention of prospective clients through explaining Doyen’s service offerings and value proposition. | |

| ● A modern logo and typeface that makes the website easy—to—read while establishing the Company’s brand identity. | |

| ● An “About Us” section that will provide an overview of the Company’s history, background, and team Live Chat / Contact Form |

Through these initiatives, Doyen Elements will create a personal and memorable experience for the potential client, increasing the chance of lead conversion and thereby generating potential revenues for the Company.

| 6 |

Search Engine Optimization (SEO)

The Company will utilize resources towards implementing an aggressive SEO strategy. Doyen will work to optimize the search engine rankings for all of its niche businesses. The Company will also focus on accumulating inbound links, listing on directories, instituting a blog, and establishing a social media presence with the goal of achieving a higher organic Google, Bing, and Yahoo search ranking for terms related to each of its different niche businesses. The organic ranking earned by Doyen’s subsidiary websites will bring authority to the Company as a leading and established industrial hemp platform and business. The Company will be very strategic in the search engine keywords it optimizes for and will specifically focus on keywords that have low ranking difficulty and have high purchase intent.

Pay-Per-Click Campaign

Doyen will pursue a pay-per-click (PPC) advertising campaign in which the Company can pay additional funds for visible ads on search engines like Google and Bing. These campaigns target high search volume terms relevant to the business in order to drive traffic to the website. Doyen must analyze and opt for keywords that are the most cost effective in terms of driving traffic to the website, enhancing the Company’s visibility on the market.

In order to do so, Doyen will establish a Google AdWords account in order to create targeted advertisements that will appear on the first page of a Google search. The Company can specifically create ad copy based on its targeted keywords, establish the geographical radius in which the ad will appear, and allocate a certain budget towards that ad. When potential consumers search for a phrase related to industrial hemp ancillary services, the ad appears near the top of the Google search page. When customers click on the ad, a certain dollar amount will be removed from the Company’s allocated budget; this dollar amount will be higher depending on the popularity of the search term.

Behavioral Retargeting

In addition to allocating a marketing budget to search and display banner ads, Doyen will also aim to convert prospective clients that have already visited one of its websites. A visit to one of Doyen’s websites typically indicates a specific interest in the Company’s service offerings. The Company will use its re-targeting algorithms to shift this initial interest into multiple up-sells, cross- sells, and conversions.

Whereas other sites are constantly marketing to completely new customers, Doyen has already established a profile on the customer from previous visits or visits to their other web properties to target the marketing to them based upon past activity or purchases. The Company’s network of different properties will allow Doyen to generate significantly more revenue from each customer as compared to its competitors.

Doyen will also use behavioral retargeting on external websites. Retargeting marks online users who visited any of its subsidiary websites with a pixel, and then serves banner ads on other websites visited by those same users. The cost of behavioral retargeting is typically a fraction of traditional banner advertising. Assuming a conservative $5 CPM, Doyen will show up to 10 impressions per retargeted user, therefore spending $0.05 in the attempt to bring back a user with an existing digital profile back to one of its properties.

E-mail Direct Marketing

Doyen Elements will hire a third-party company to gather email addresses for industrial hemp businesses across the country. Once it has created a substantial email list, the Company will send email blasts to these prospective clients on a continuous basis to direct them to the company website. Doyen Elements will also install a tracking code on all of its emails, similar to its retargeting strategy, which will automatically drop an anonymous cookie in the visitors’ browser and create lists of people who have visited the Doyen Elements website. The Company can then, again, utilize channels such as AdRoll and Bannersnack to identify previous visitors and display retargeting ads on the web. Determine the Market and Content: Emails will include various types of content that will attract and inform old and new clients; emails will be targeted and designed for specific markets. Email topics include:

| ● | Informative Emails: These emails will include helpful tips and information. For example, one email may inform clients what services are offered and, on average, how much it may cost. These emails will spread goodwill to customers and enhance the Company’s brand. | |

| ● | Value Proposition: These emails will inform clients on what makes Doyen Elements better than other competitors. The Company can highlight its experience, commitment to helping industrial hemp businesses grow their businesses, and overall positive ratings across online databases. | |

| ● | Promotional Material: These emails will include discounts and promotions that can be applied towards the Company’s services. |

| 7 |

Then, determine Sending Frequency and Goals: After determining the type of content for the market or campaign, the Company will determine the sending frequency and goals of the email campaign. By setting measurable goals such as amount of leads generated, the Company can track the progress and success of the campaign over time.

Finally, create Schedule: Doyen Elements will create a schedule for creating and sending out emails. Emails will be sent on a weekly or biweekly basis, according to this schedule. In addition, the Company will increase volume of email blasts depending on seasonality and market conditions. The Company can create email campaigns on platforms such as Mailchimp and Autopilot.

Doyen will establish a multi-faceted referral system to acquire active partners and economic alignment with a variety of referral relationships.

| ● | Through banner advertisements on third party websites: Doyen and its subsidiary companies will publish banner advertisements on referrals’ websites that will direct viewers straight to one of the subsidiary companies. | |

| ● | High traffic, high following websites: The Company will utilize high traffic websites that have a strong following to publicize Doyen’s service offerings. | |

| ● | Channel partners: Channel partners can either be specialized or general websites focused on the different sectors of the industrial hemp market. Doyen will become affiliated with these channel partners and will offer them a bonus when they recommend or drive a sale to a Doyen subsidiary. |

Referral and Advertising Partners

We will establish will establish a multi-faceted referral system to acquire active partners and economic alignment with a variety of referral relationships.

| ● | Through banner advertisements on third party websites: Doyen and its subsidiary companies will publish banner advertisements on referrals’ websites that will direct viewers straight to one of the subsidiary companies. | |

| ● | High traffic, high following websites: The Company will utilize high traffic websites that have a strong following to publicize Doyen’s service offerings. | |

| ● | Channel partners: Channel partners can either be specialized or general websites focused on the different sectors of the industrial hemp market. Doyen will become affiliated with these channel partners and will offer them a bonus when they recommend or drive a sale to a Doyen subsidiary. |

Offline Initiatives

Events and Trade Shows

The Company will attend major industry event, expos, and conferences across the United States as it increases market penetration. The attendance of Doyen at well-known events will help to grow the Company brand, develop potential strategic partners with professionals in the industry, and generate additional leads for the business.

| 8 |

Examples of Business-to-Business Events:

| ● | NCIA (Oakland) | |

| ● | West Tech Summit (San Francisco) | |

| ● | Las Vegas Annual Cannabis Conference | |

| ● | Big Show Industry (LA) | |

| ● | High Times Business Summit (LA) |

Print Advertising

Print advertising will also be an effective marketing campaign for the Company. This includes new feature, discount and product announcements in local newspapers and publications, which will drive traffic to the Company.

Public Relations

We will focus on securing editorial coverage with various media outlets targeting the industrial hemp business market. The team will reach out to relevant publication editors, high-traffic websites, and blogs in order to create a “buzz” about Doyen’s ancillary services and overall value.

The Company will rely heavily on an innovative public relations strategy, building strong relationships with magazine editors that focus on industrial hemp operators. The PR firm’s main responsibility consists of ongoing media outreach with top tier media sources in the industry as well as prominent online sites and bloggers. Public Relations efforts will also include quarterly creative programming ideas and pitches that will keep the Company in the media spotlight and provide the media with an ever-changing story angle, increasing the Company’s opportunity for consistent media coverage.

COMPETITION

We face significant competition in providing management consulting, business incubation services, and equipment, products, and technology to companies in the legal industrial hemp industry that we are targeting. Many of these competitors have significant experience in this industry, have been in operation for a greater period, and possess significantly greater resources than our Company. These competitors may prevent us from acquiring desirable properties or may cause an increase in the price we must pay for legal industrial hemp friendly properties. In particular, larger companies may enjoy significant economies of scale and therefore be in a competitive advantage in pricing products and services.

Many of our potential competitors are already publicly traded corporations, including companies engaged in real estate acquisition, financial services, agricultural supplies, and legal industrial hemp growers and marketers.

RISK FACTORS RELATED TO OUR COMPANY

Emerging Growth Company Status

The Company is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS ACT”). For as long as the Company is an emerging growth company, the Company may take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to other public companies. These exemptions include:

| ● | An exemption from providing an auditor’s attestation report on management’s assessment of the effectiveness of the Company’s systems of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002; | |

| ● | An exemption from compliance with any new requirements adopted by the Public Accounting Oversight Board (“PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to prove additional information about the audit and the financial statements of the issuer; |

| ● | An exemption from compliance with any other new auditing standards adopted by the PCAOB after April 5th, 2012, unless the United States Securities and Exchange Commission (“SEC”) determines otherwise; and | |

| ● | Reduced disclosure of executive compensation. |

| 9 |

In addition, Section 107 of the JOBS Act provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, the Company has chosen to “opt out” of such extended transition period and, as a result, the Company will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. The Company’s decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

The Company will cease to be an “emerging growth company” upon the earliest of (i) when the Company has 1.0 Billion or more in annual revenues, (ii) when the Company has at least 700 Million in market value of the Company’s Common Units held by non-affiliates, (iii) when the Company issues more than 1.0 Billion of non-convertible debt over a three-year period, or (iv) the last day of the fiscal year following the fifth anniversary of the Company’s Initial Public Offering.

We are a public company subject to the reporting requirements of the Securities Exchange Act of 1934. It is extremely expensive being a public company. In the event that a public market for our shares develops, and we are unable to pay these costs, then our share prices could be depressed and the market for our common stock could be limited.

Our Offering Circular under Regulation A was declared Qualified by the Securities and Exchange Commission on September 1, 2017 and we have been selling shares of our Common Stock pursuant to that Offering since the Qualification Date. Accordingly, we are required to comply with the reporting requirements of the Securities Exchange Act of 1934, including the obligation to timely file all Current, Quarterly, and Annual Reports, and to prepare and file quarterly (unaudited) and annual (audited) financial statements. We have engaged our current legal counsel and independent certifying the accountant to continue to provide these legal and audit services to our Company through our fiscal year ending December 31, 2017. The financial burden of being a public company, which will cost us between $75,000 and $125,000 per year in auditing fees and legal fees to comply with our reporting obligations under the Securities Exchange Act of 1934 and compliance with the Sarbanes-Oxley Act of 2002 will strain our finances and stretch our human resources to the extent that we may have to price our products higher than our non-publicly held competitors just to cover the costs of being a public company. Due to our limited funds, we may not be able to pay these costs of being a public company to the extent that we may not be able to file the reports required by the Securities Exchange Act of 1934, which could result in our stock being excluded from trading on any public market, and could result in only a limited market for our common stock.

If our primary business operations were to change in a manner that would require us to register under the Investment Company Act of 1940, we would have to comply with substantial regulation under that Act which could restrict the manner in which we operate our business and could materially and adversely affect our business operations and results.

Our business plan anticipates that we will acquire a number of currently operating companies, which will either be merged into our existing business operations or operated as subsidiaries of our Company. We will acquire and maintain voting control and direct control of all entities acquired, with an ownership range of at least 51%, to 100%, and as such we do not intend to register as an investment company under the Investment Company Act of 1940.

| 10 |

Because our auditors have issued a going concern opinion, there is substantial uncertainty that we will continue operations in which case you could lose your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such, we may have to cease operations and you could lose your investment.

We have a limited operating history and have losses that we expect to continue into the future. There is no assurance our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, we will cease operations and you will lose your investment.

We were incorporated on October 21, 2015 and we have had limited business operations to date. As of December 31, 2017, we have a shareholder deficit of $174,895 and accumulated losses from operations of $638,725.

We May Not be able to Effectively Manage our Growth, and any failure to do so may have an Adverse Effect on our Business and Operating Results.

We have a limited operating history, and we plan to grow our commercial real estate property portfolio and operations rapidly. Our future operating results depend on our ability to effectively manage our rapid growth, which is dependent, in part, upon our ability to:

| ● | Stabilize and manage a rapidly increasing number of properties and tenant relationships while maintaining a high level of tenant satisfaction and building and enhancing our brand; | |

| ● | Identify and supervise an increasing number of suitable third parties on which we rely to provide certain services to our properties; | |

| ● | Attract, integrate, and retain new management and operations personnel as our organization grows in size and complexity; | |

| ● | Continue to improve our operational and financial controls and reporting procedures and systems; and | |

| ● | Scale our technology and other infrastructure platforms to adequately service new properties. |

We cannot assure you that we will be able to achieve these results or that we may otherwise be able to manage our growth effectively. Any failure to do so may have an adverse effect on our business and operating results.

| 11 |

We May Rely on Local, Third-party Providers for Services that May Become Limited or Unavailable and May Harm our Brand, Reputation, and Operation Results

We may rely on local, third-party vendors and service providers, including third-party construction professionals, leasing agents, and property management companies in situations when it is cost-effective to do so or our internal staff is unable to perform these functions. We do not have exclusive or long-term contractual relationships with any of these third-party providers, and we can provide no assurance that we will have uninterrupted or unlimited access to their services. Furthermore, selecting, managing, and supervising these third-party providers requires significant management resources and expertise. If we do not select, manage, and supervise appropriate third parties for these services, our brand and reputations and operating results may suffer. Moreover, we may not successfully detect and prevent fraud, incompetence or theft by our third- party providers, which could subject us to material liability or responsibility for damages, fines, and/or penalties associated with such fraud, incompetence, or theft. In addition, any removal or termination of third-party providers would require us to seek new vendors or providers, which would create delays and adversely affect our operations. If we do not select appropriate third-party providers or if the third party providers we do select fail to deliver quality services, our brand, and reputation, operation results, and cash flows from our properties may be adversely affected, including entities in which our affiliates and we have an interest.

Our Evaluation of Commercial Real Estate Properties Involves a Number of Assumptions that May Prove Inaccurate, which could Result in us Paying Too Much for Properties we acquire or overvaluing our Properties, Resulting in them Failing to Perform as we Expect

In determining whether a particular commercial real estate property meets our acquisition criteria, the Company makes a number of assumptions, including assumptions related to estimated time of possession and any estimated renovation costs and time frames, annual operating costs, market rental rates and potential rent amounts, time from purchase to leasing and tenant default rates. These assumptions may prove inaccurate. As a result, we may pay too much for commercial real estate properties we acquire or overvalue our commercial real estate properties, or our commercial real estate properties may fail to perform as we expect. Adjustments to the assumptions we make in evaluating potential purchases may result in few commercial real estate properties qualifying under our investment criteria, including assumptions related to our ability to lease commercial real estate properties we have purchased. Reductions in the supply of commercial real estate properties that meet our investment criteria may adversely affect our ability to implement our investment strategy and operating results.

Furthermore, the commercial real estate properties that we acquire may vary materially in terms of time to possession, renovation, quality and type of construction, location, and hazards. Our success depends on our ability to acquire commercial real estate properties that can be quickly possessed, renovated, repaired, upgraded, and rented with minimal expense and maintained in rentable condition. Our ability to identify and acquire such commercial real estate properties is fundamental to our success. In addition, the recent market and regulatory environments relating to commercial real estate properties have been changing rapidly, making future trends difficult to forecast.

Dependence on Management

In the early stages of development, the Company’s business will be significantly dependent on the Company’s management team. The Company’s success will be particularly dependent upon the services of: Ms. Boerum the Company’s Chief Executive Officer and Chief Financial Officer; and Mr. Jeffrey Hranicka, the Company’s Chief Operating Officer.

Risks of Borrowing

Although the Company does not intend to incur any additional debt other than the investment commitments provided in this offering, should the company secure bank debt in the future, possible risks could arise. If the Company incurs additional indebtedness, a portion of the Company’s cash flow will have to be dedicated to the payment of principal and interest on such new indebtedness. Typical loan agreements also might contain restrictive covenants, which may impair the Company’s operating flexibility. Such loan agreements would also provide for default under certain circumstances, such as failure to meet certain financial covenants. A default under a loan agreement could result in the loan becoming immediately due and payable and, if unpaid, a judgment in favor of such lender which would be senior to the rights of members of the Company. A judgment creditor would have the right to foreclose on any of the Company’s assets resulting in a material adverse effect on the Company’s business, operating results or financial condition.

| 12 |

Unanticipated Obstacles to Execution of the Business Plan

The Company’s business plans may change significantly. Many of the Company’s potential business endeavors are capital intensive and may be subject to statutory or regulatory requirements. Management believes that the Company’s chosen activities and strategies are achievable in light of current economic and legal conditions with the skills, background, and knowledge of the Company’s principals and advisors. Management reserves the right to make significant modifications to the Company’s stated strategies depending on future events.

The Company May Not be Able to Satisfy Listing Requirements of the NYSE-MKT Exchange or the OTCQX Market, or be able to Maintain a Listing of the Company’s Common Stock on the New York Stock Exchange or the OTCQX Market.

The Company intends to file an application to have its Common Stock listed for public trading on both the NYSE-MKT Exchange and the OTCQX Over-the-Counter Market. If the Company’s Common Stock is accepted for listing on either or both of the NYSE-MKT Exchange and the OTCQX Market, of which there can be no assurance, the Company will be required to maintain certain financial and liquidity standards to maintain such listing. There can be no assurance that the Company will be able to maintain such listing. A de-listing of the Company’s Common Stock from the NYSE-MKT Exchange or Over-the-Counter Market may materially impair the ability of the Company’s Common Stockholders ability to buy and sell the Company’s Common Stock, and could have an adverse effect on the market price of the Company’s Common Stock as well as impair the Company’s ability to raise additional capital.

If the Company’s Shares of Common Stock Become Subject to the Penny Stock Rules, It Would Become More Difficult to Trade the Company’s Common Stock

The United States Securities and Exchange Commission has adopted rules that regulated broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price per share of less than $5.00, other than securities registered on certain national securities exchanges or authorized for quotation on certain automated quotation systems, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. If the Company does not obtain or retain a listing on the New York Stock Exchange, and if the price of the Company’s Common Stock is less than $5.00 per share, the Company’s Common Stock will be deemed a penny stock. The penny stock rules require a broker-dealer, before effecting a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document containing specified information. In addition, the penny stock rules require that, before effecting any such transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser’s written acknowledgement of the receipt of a risk disclosure statement; (ii) a written agreement to transaction involving penny stocks; and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for the Company’s Common Stock, and therefore stockholders may have difficulty selling their shares.

FINRA Sales Practice Requirements May Limit a Stockholder’s Ability to Buy and Sell the Company’s Stock

In addition to the “Penny Stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable ground for believing that the investment is suitable for that customer. Prior to recommending speculative, low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. The FINRA requirements may make it more difficult for broker- dealers to recommend that their customers buy the Common Stock, which may have the effect of reducing the level of trading activity in the Company’s Common Stock. As a result, fewer broker-dealers may be willing to make a market in the Company’s Common Stock, reducing a stockholder’s ability to resell their shares of Common Stock.

Raising Additional Capital by Issuing Securities May Cause Dilution to the Company’s Shareholders

The Company may need to, or desire to, raise substantial additional capital in the future. The Company’s future capital requirements will depend on many factors, including, among others:

| The Company’s degree of success in capturing a larger portion of the Industrial Hemp market. | ||

| ● | The costs of establishing or acquiring sales, marketing, and distribution capabilities for the Company’s services; | |

| ● | The extent to which the Company acquires or invests in businesses, products, or technologies, and other strategic relationships; and | |

| ● | The costs of financing unanticipated working capital requirements and responding to competitive pressures. |

| 13 |

If the Company raises additional funds by issuing equity or convertible debt securities, the Company will reduce the percentage of ownership of the then-existing shareholders, and the holders of those newly-issued equity or convertible debt securities may have rights, preferences, or privileges senior to those possessed by the Company’s then-existing shareholders. Additionally, future sales of a substantial number of shares of the Company’s Common Stock, or other equity-related securities in the public market could depress the market price of the Company’s Common Stock and impair the Company’s ability to raise capital through the sale of additional equity or equity-linked securities. The Company cannot predict the effect that future sales of the Company’s Common Stock, or other equity-related securities would have on the market price of the Company’s Common Stock.

If Equity Research Analysts Do Not Publish Research Reports about the Company, of if the Research Analysts Issue Unfavorable Commentary or Downgrade the Company’s Common Stock Shares, the Price of the Company’s Common Stock Shares Could Decline

The trading market for the Company’s Common Stock Shares will rely in part on the research and reports that equity research analysts publish about the Company, and the Company’s business. The Company does not have control over research analysts, and the Company does not have commitments from research analysts to write research reports about the Company. The price of the Company’s Common Stock Shares could decline if one or more equity research analysts downgrades the Company’s Common Stock Shares, issues an unfavorable commentary, or ceases publishing reports about the Company.

If the Company is Unable to Implement and Maintain Effective Internal Control Over Financial Reporting in the Future, Investors May Lose Confidence in the Accuracy and Completeness of the Company’s Financial Reports and the Market Price of the Company’s Common Stock May Decline

As a public company, the Company will be required to maintain internal control over financial reporting and to report any material weakness in such internal control. Further, the Company will be required to report any changes in internal controls on a quarterly basis. In addition, the Company would be required to furnish a report by management on the effectiveness of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. The Company will design, implement, and test the internal control over financial reporting required to comply with these obligations. If the Company identifies material weakness in these internal controls over financial reporting, if the Company is unable to comply with the requirements of Section 404 in a timely manner or assert that the Company’s internal control over financial reporting is effective, or if the Company’s independent registered public accounting firm is unable to express an opinion as to the effectiveness of its internal control over financial reporting when required, investors may lose confidence in the accuracy and completeness of the Company’s financial reports and the market price of the Company’s Common Stock could be negatively affected. The Company also could become subject to investigations by the Stock Exchange on which the securities are listed, the United States Securities and Exchange Commissions, or other regulatory authorities, which could require additional financial management resources.

As an Emerging Growth Company, the Company’s Auditor is Not Required to Attest to the Effectiveness of the Company’s Internal Controls

The Company’s Independent Registered Public Accounting Firm is not required to attest to the effectiveness of the Company’s internal control over financial reporting while the Company is an emerging growth company. This means that the effectiveness of the Company’s financial operation may differ from the Company’s “peer companies” in that they may be required to obtain independent registered public accounting firm attestations as to the effectiveness of their internal controls over financial reporting and the Company does not. While the Company’s management will be required to attest to internal control over financial reporting and the Company will be required to detail changes in its controls on a quarterly basis, the Company cannot provide assurance that the Independent Registered Public Accounting Firm’s review process in assessing the effectiveness of the Company’s internal controls over financial reporting, if obtained, would not find one or more material weaknesses or significant deficiencies. Further, once the Company ceases to be an emerging growth company, the Company will be subject to independent registered public accounting firm attestation regarding the effectiveness of the Company’s internal controls over financial reporting. Even if management finds such controls to be effective, the Company’s Independent Registered Public Accounting Firm may decline to attest to the effectiveness of such internal controls and issue a qualified report.

Future Sales of the Company’s Shares Could Reduce the Market Price of the Company’s Common Stock Shares

The price of the Company’s Common Stock could decline if there are substantial sales of the Company’s Common Stock, particularly by the Company’s Directors or its Executive Officer(s), or when there is a large number of Shares of the Company’s Common Stock available for sale. The perception in the public market that the Company’s Stockholders might sell the Company Shares could also depress the market price of the Company’s Shares. If this occurs, or continues to occur, it could impair the Company’s ability to raise additional capital through the sale of securities should the Company desire to do so

| 14 |

No Public Market for Our Shares Presently Exist

There is presently no public market for our shares of Common Stock or Preferred Stock. Although we intend to apply to list our Common Stock on the OTCQB Market, we cannot predict that our Common Stock will be accepted for listing. Even if we obtain a listing for our Common Stock, there can be no assurance as to the extent that a public market for our shares will develop or how liquid that market might become. The lack of a public market for our Common Stock, or a lack of liquidity in any public market for our Common Stock, may impair your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active public market for our shares may also reduce the market price of your shares. In addition, broad market and industry factors may decrease the market price of our shares, regardless of our Company’s actual operating performance. At the present time, the Company does not plan to list our shares of Preferred Stock on any Exchange or Alternative Trading System, and does not anticipate that a public market for trading of these shares

We Are Subject To Government Regulation In Our Business Operations

Our business operations, as well as properties that we may acquire, are subject to many federal, state, and local government laws and regulations, including land use, zoning, environmental regulations, operational licenses, and employment regulations. With our emphasis on the legal industrial hemp industry we, or our clients and customers, will also be subject to significant government regulations concerning the growing, processing, marketing, and distribution of legal hemp products.

Some of the properties that we plan to acquire will be used primarily for the cultivation and production of industrial hemp and will be subject to the laws, ordinances and regulations of the federal, state, and local governments involving land use, water rights, treatment methods, environmental disturbance, and eminent domain. In certain jurisdictions, land used for agricultural purposes are also subject to regulations governing the protection of endangered species and the protection of wetlands. Because certain of the properties that we will own will be used for growing legal industrial hemp, some jurisdictions have additional regulations regarding security and waste materials disposal.

At the present time, under federal law legal industrial hemp plants are classified by the Controlled Substances Act (CSA) as a Schedule I controlled substance. Even in those jurisdictions in which the growing, extraction, or sale of legal industrial hemp products has been legalized at the federal, state and/or local level, the transfer of legal industrial hemp plants remains a violation of federal law. At present, it is the policy of the federal government, as stated by the prior Obama Administration, that it is not an efficient use of federal resources to direct federal law enforcement to prosecute those lawfully abiding by state laws permitting the use and distribution of industrial hemp. However, absent any statutory changes to the CSA, federal law still criminalizes the transfer of legal industrial hemp plants and pre-empts any state laws to the contrary. If federal law enforcement policy with respect to state-legalized legal industrial hemp plants should change, such enforcement would seriously impact the business operations of our clients and customers, and thereby seriously impact our ability to execute our Company’s business plan. Under such circumstances, we would likely suffer significant losses with respect to our investment in industrial hemp facilities, including possible seizure and forfeiture of such assets.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

We maintain our corporate office at 1880 Office Club Pointe, Suite 1240, Colorado Springs, CO 80920. 7GENx operates from a 4,000 square foot leased facility located at 5757 Arapahoe Rd, Boulder, CO. which expires on October 31, 2018.

On December 22, 2017, Geoffrey Thompson, ex-employee and former CEO, CFO of Doyen Elements Inc., filed civil action [No. A-17-766644-B in the Eighth Judicial District Court in Clark County, Nevada, against the Company, as well as its CEO and COO, individually, Cynthia Boerum and Jeff Hranicka, seeking to rescind Thompson's Retirement Agreement, and alleging, among other things, breach of contract against the Company (the “First Action”). The Company, Boerum and Hranicka filed a motion to dismiss that was later withdrawn pending the outcome of ongoing settlement discussions with Mr. Thompson.

Thereafter, on January 16, 2018, Mr. Thompson filed another civil action, No. A-18-767861-C against the same defendants in the same Court (the “Second Action”). In this action, Mr. Thompson alleged, among other things, that the Company unethically secured business opportunities. As stated above, the parties are engaged in ongoing settlement discussions. The Company believes the claims of Mr. Thompson are without merit and the Company will prevail in this action.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 15 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Offering Circular under Regulation A was declared Qualified by the Securities and Exchange Commission on September 1, 2017, and we have been selling shares of our Common Stock pursuant to that Offering since the Qualification Date. Our shares of common stock are not at present listed on any Exchange or on the Over-The-Counter Market. The Company intends to file an application for listing of its Common Stock on the OTCQB Market maintained by OTC Markets, Inc. Our stock is not listed on an exchange at this time.

On March 10, 2018 the Company hereby offered for sale to Accredited Investors a maximum of 1,000,000 Shares of its Common Stock ($.0001 par value) at a purchase price of $1.00 per Share. The Shares will be sold pursuant to Regulation D, Rule 506(c), and Section 4(a)(2), exemptions from registration provided by the Securities Act of 1933, as amended. The Company has the right to withdraw, limit or terminate this Offering at any time and to reject any and all offers to purchase Shares. Proceeds from the sale of Shares will be immediately available to the Company when received and accepted. There is no minimum number of Shares required to be sold. The Offering will be terminated when the Company has sold the maximum Offering or if terminated sooner or extended, subject to the reserved right of the Company to extend the Offering.

As of April 9, 2018, there were approximately 305 record holders, and 17,077,462 shares of common stock issued and outstanding.

We have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors.

ITEM 6. SELECTED FINANCIAL DATA

A smaller reporting company is not required to provide the information in this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

| 16 |

Overview and History

Doyen Elements, Inc., formerly AdvantaMeds Solutions USA Fund I, Inc. (the “Company”) is a corporation, organized on October 21, 2015 under the laws of the State of Nevada. We have conducted limited business operations since our inception, and have had no revenues to date. The Company was originally organized for the purposes of providing consulting, incubator services, and accelerator services to companies operating in the legal cannabis business. Now we intend to focus our business operations on providing a wide range of ancillary services to the legal Industrial Hemp industry, including property leasing and management, equipment leasing, management consulting, genetic research, technology solutions, and logistical support functions, both in the United States and internationally.

In April 2017, we entered into an equity purchase agreement with several non-affiliated parties to acquire controlling interests (51% to 100%) of sixteen operating companies currently engaged in providing a wide variety of services to the legal medical-use and adult-use legal cannabis industry. The Equity Purchase Agreement was amended on July 25, 2017 to reflect the fact that up to 100% of all of these entities may be acquired. These acquisitions are scheduled to be completed on or before February 1, 2018. The total purchase of the sixteen entities will be approximately $16 million in cash and 9,000,000 shares of Common Stock of the Company. On January 29, 2018, the equity purchase agreement was canceled.

On December 14, 2017, we entered into an equity purchase agreement to acquire 7GENx LLC, a Boulder, Colorado based Hemp genetics research and Development Company for $4,200,000 pursuant to a promissory note due May 21, 2019. 7GENx LLC has had no prior operations.

7GENx LLC focuses on creating proprietary hemp cultivators to meet the current and emerging market demands for use in breeding for agricultural, industrial and medical purposes. Its team of scientists collect data and analysis the chemical, genetic and phenotypic profiles of hemp, allowing the company to create proprietary varieties of hemp that are targeted for specific uses for current or emerging markets. Additionally, 7GENx intends to restore regenerative hemp-based agriculture, food, fuel and fiber economies for the health, safety and welfare of the planet by providing small select farms in Colorado (and other states with state approved hemp programs) with hemp cultivation and harvesting techniques, elevated organic methods and practices, and proprietary rich hemp oil extract varieties that meet state hemp program standards.

The purchase consisted of a non-interest promissory note for $4,200,000 due on May 21, 2019. The present value of the promissory note was determined to be $3,400,000 which is the total consideration paid for 7GENx LLC. A summary of the purchase price allocations at fair value is below. The Company will convert some of the current inventory into Hemp extract sales and the remainder will be utilized for research and development.

| Allocation of purchase price | ||||

| Inventory | $ | 2,550,000 | ||

| Mother plants | 850,000 | |||

| Purchase price | $ | 3,400,000 | ||

Results of Operations

Comparison of Results of Operations for the Years ended December 31, 2017 and 2016

| Years Ended December 31, | Dollar | Percentage | ||||||||||||||

| 2017 | 2016 | Change | Change | |||||||||||||

| Revenue | $ | - | $ | - | $ | - | ||||||||||

| Professional fees | 99,037 | 698 | 98,339 | 14089.7 | % | |||||||||||

| General and administrative expenses | 560,311 | 6,281 | 554,030 | 8820.7 | % | |||||||||||

| Interest expense | 27,481 | - | 27,481 | |||||||||||||

| Net loss | $ | (686,829 | ) | $ | (6,979 | ) | $ | (679,850 | ) | 9741.4 | % | |||||

We generated no revenue for the years ended December 31, 2017 and 2016.

Professional fees for the years ended December 31, 2017 were $99,037 an increase of $98,339 or 14,090% from $698 for the same period in 2016. The significant increase is due to accounting and legal fees associated with the Company’s filings with the Securities and Exchange Commission (“SEC”).

General and administrative expenses for the years ended December 31, 2017 were $560,311 an increase of $554,030 or 8,821% from $6,281 for the same period in 2016. The increase was due to higher overhead costs during the years ended December 31, 2017 as compared to the same period in 2016 as we began to expand our operations.

Liquidity and Capital Resources

As of December 31, 2017, we had $21,992 in cash.

At December 31, 2017, we had current assets of $2,571,992 and current liabilities of $175,423 resulting in a working capital of $2,396,569. We have experienced losses since our inception. This raises substantial doubt about our ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Net cash used in operating activities was $338,339 during the years ended December 31, 2017, compared to $63,499 during the years ended December 31, 2016. The increase in cash used in operating activities is due to an increase in the net loss.

| 17 |

Cash flows provided by financing activities were $360,030 and $63,800 during the years ended December 31, 2017 and 2016, respectively. The increase in cash provided by financing activities is due to the sale of 46,233 shares of common stock during the years ended December 31, 2017 that generated proceeds of $323,631. During the years ended December 31, 2016 the Company sold preferred stock for an aggregate of $63,800.

To date, our operations have not generated any profits. We have funded our operating to date through the sales of our common stock and issuance of notes payable and convertible notes payable. Our ability to continue as a going concern is dependent upon use raising sufficient debt or equity capital to sustain operations until such time as we can generate a profit from our operations. We are currently working with investors to provide us with the necessary funding, but there can be no assurances we will obtain such funding in the future. Failure to obtain this additional financing will have a material negative impact on our ability to generate profits in the future.

Inflation

Although our operations are influenced by general economic conditions, we do not believe that inflation had a material effect on our results of operations during the years ended December 31, 2017.

Critical Accounting Estimates

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. It is possible that accounting estimates and assumptions may be material to the Company due to the levels of subjectivity and judgment involved.

Revenue Recognition

The Company recognizes revenue in accordance with FASB Accounting Standards Codification (“ASC”) 605, Revenue Recognition, only when the price is fixed or determinable, persuasive evidence of an arrangement exists, the services have been provided, and collectability is assured.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other relationships with unconsolidated entities that would be expected to have a material current or future effect upon our financial condition or results of operations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See Index to Financial Statements and Financial Statement Schedules beginning on page F-1 of this annual report on Form 10-K.

| 18 |

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

As required by Rule 13a-15(b) under the Exchange Act, we carried out an evaluation of the effectiveness of the design and operation of our disclosure controls as of the end of the period covered by this report, December 31, 2017. This evaluation was carried out under the supervision and with the participation of our principal executive officer and our principal financial officer (the “Certifying Officers”). Based upon that evaluation, our Certifying Officers concluded that as of the end of the period covered by this report, December 31, 2017, our disclosure controls and procedures were effective.

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control, as defined in the Exchange Act. These internal controls are designed to provide reasonable assurance that the reported financial information is presented fairly, that disclosures are adequate and that the judgments inherent in the preparation of financial statements are reasonable. There are inherent limitations in the effectiveness of any system of internal controls including the possibility of human error and overriding of controls. Consequently, an ineffective internal control system can only provide reasonable, not absolute, assurance with respect to reporting financial information.

Our internal control over financial reporting includes policies and procedures that: (i) pertain to maintaining records that, in reasonable detail, accurately and fairly reflect our transactions; (ii) provide reasonable assurance that transactions are recorded as necessary for preparation of our financial statements in accordance with generally accepted accounting principles and that the receipts and expenditures of company assets are made in accordance with our management and directors authorization; and (iii) provide reasonable assurance regarding the prevention of or timely detection of unauthorized acquisition, use or disposition of assets that could have a material effect on our financial statements.

Management has undertaken an assessment of the effectiveness of our internal control over financial reporting based on the framework and criteria established in the Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based upon this evaluation, our management concluded that our internal control over financial reporting was effective as of December 31, 2017.

We expect to be materially dependent upon a third party to provide us with accounting consulting services for the foreseeable future. Until such time as we have a chief financial officer with the requisite expertise in U.S. GAAP, there are no assurances that the controls and procedures and internal control over financial reporting will not result in errors in our financial statements which could lead to a restatement of those financial statements.

Our management, including our principal executive officer and our principal financial officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our Company have been detected.

This annual report on Form 10-K does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to SEC rules that permit the Company to provide only management’s report in this annual report on Form 10-K.

CHANGES IN CONTROL OF REGISTRANT

On November 3, 2017, Geoffrey Thompson resigned as an Officer and Director of the Registrant, and pursuant to the Retirement Agreement entered into between the Registrant and Mr. Thompson, a total of 16,000,000 shares of Common Stock of the Registrant previously issued to Mr. Thompson were returned to the Registrant and cancelled. As a result of this transaction, Mr. Thompson or his nominees now own or control 2,000,000 shares of Common Stock, representing 11.7% of the 17,024,229 shares of Common Stock now issued and outstanding. A copy of Mr. Thompson’s Resignation is annexed to The November 7, 2017 8K as Exhibit 17.1, and a copy of the Retirement Agreement is annexed thereto as Exhibit 99.1.

On November 6, 2017, the Registrant entered into an Amended Employment Agreement with Cynthia Boerum, pursuant to which Ms. Boerum was issued 2,000,000 shares of Common Stock of the Registrant. As a result of this transaction, Ms. Boerum presently owns or controls 11,000,000 shares of Common Stock of the Registrant, representing 64.6% of the shares of Common Stock now issued and outstanding.

On November 6, 2017, the Board of Directors appointed Cynthia Boerum as President and Chief Executive Officer of the Registrant, and Directors of the Registrant to serve until the next Annual Meeting of Shareholders. These are incorporated by reference to the 8K Filed on Nov 7, 2017.

| 19 |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Set forth below are the names and ages of our directors and executive officers and their principal occupations at present and for at least the past five years.

| Name | Age | Position(s) with the Company | Year

First Became a Director | |||

| Cynthia Boerum | 63 | Chief Executive Officer, Chief Financial Officer, Chairman of Board | 2017 | |||

| Jeffrey Hranicka | 58 | Chief Operating Officer | 2017 | |||

| Shane Davis | 48 | President of 7GENx |

2017 | |||

| OUTSIDE DIRECTORS | ||||||

| Ronald Van, Jr. | 57 | Director, Board of Directors | 2017 | |||

| Jeffrey Stroin | 62 | Director, Board of Directors | 2017 |

Ms. Cynthia Boerum Chief Executive Officer, Chief Financial Officer

Ms. Boerum became the Chief Executive Officer of the Company in November 2017, after serving as Chief Operating Officer since 2016. Ms. Boerum was Vice President of Sales and Consultant for Accentia International Outsourcing Company in Hyberdad, India, from 2009 to 2011. The leadership position included overseeing national and international sales teams.

Previously, Ms. Boerum held positions of Vice President of Sales for Opus Healthcare in Austin, TX. 2004 to 2007 and positioned the company for acquisition by NextGen. She also held the positions of Enterprise Vice President of National Accounts and Sales Manager for the top 32 health organizations nationally at McKesson from 1989 to 2003. During this time, she received various top performer awards, not only from McKesson, but also the state of Minnesota.

Mr. Jeff Hranicka Chief Operating Officer

Mr. Hranicka became the Chief Operating Officer of the Company in November 2017. Jeff joined Advantameds Solutions as the Capital Investment Manager in 2016 and has successfully completed the NASAA Series 65 Uniform Investment Advisor Law Examination; selected in June 2017 as Chief Technical Officer of Doyen Elements, Inc. Jeff is a proven business leader that delivers operational and financial commitments while developing profitability improvements through organizational leadership.

Beginning in 1998 he served multiple roles and was promoted to a Senior Sales and Operations Management Executive with leadership positions of increased responsibility and complexity for WESCO Distribution, Inc. As Director of the WESCO Midwest Region, 2008-2015, he led a world class sales organization approaching $200 million in revenues with responsibility for over 180 employees coordinating multiple resources in sales, operations, finance, human resources, purchasing, pricing and marketing as critical components of the field organization.

Mr. Shane Davis President 7GENx

Mr. Davis became the President of 7GENx of the Company in December 2017. Mr. Davis brings 26 years of biological experience, with a Biology and Molecular Genetics emphasis at the University of Maryland/Europe & Dickinson State University. Shane’s background and experiences includes plant breeder, genetics and permaculture expert - combining techniques from agronomy, plant breeding, plant spirit, population and phylogenetic genetics, and carbon biotechnology.

| 20 |

Outside Directors:

Ronald P. Van, Jr.

Professional Summary: Mr. Van recently held the position of Vice President and General Manager, Central U.S. with WESCO Distribution, Inc., a leading North American provider of electrical products and other maintenance, repair and operating (MRO) supplies. As Vice President and General Manager Mr. Van led a sales organization approaching one billion in revenues with responsibility for over 800 employees in 60 plus locations. He coordinated multiple resources in sales, operations, finance, human resources, pricing and marketing.

Mr. Van retired from WESCO in October 2015. He currently volunteers on a regular basis at PAWS Chicago no kill adoption center.

Jeff Stroin

Professional Summary: Mr. Stroin currently holds the position of Vice President & General Manager with Turtle & Hughes, Inc. He held the same position at WESCO Distribution, Inc. from 2005 through 2015. Previous to that he held various positions at General Electric Company from 1979 through 2004 concluding as Vice-President Pacific Region. Jeff is a competitive, creative business leader with 36 years of sales and management experience. He has a proven track record of driving profitable growth through strategic analysis and execution of key business initiatives while managing electrical wholesale organizations as large as $900M and 850 employees.

Director Compensation