Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Cheniere Corpus Christi Holdings, LLC | exhibit321cch2018form10q1s.htm |

| EX-31.1 - EXHIBIT 31.1 - Cheniere Corpus Christi Holdings, LLC | exhibit311cch2018form10q1s.htm |

| EX-10.5 - EXHIBIT 10.5 - Cheniere Corpus Christi Holdings, LLC | exhibit105cch2018form10q1s.htm |

| EX-10.4 - EXHIBIT 10.4 - Cheniere Corpus Christi Holdings, LLC | exhibit104cch2018form10q1s.htm |

| EX-10.3 - EXHIBIT 10.3 - Cheniere Corpus Christi Holdings, LLC | exhibit103cch2018form10q1s.htm |

| EX-10.2 - EXHIBIT 10.2 - Cheniere Corpus Christi Holdings, LLC | exhibit102cch2018form10q1s.htm |

| EX-10.1 - EXHIBIT 10.1 - Cheniere Corpus Christi Holdings, LLC | exhibit101cch2018form10q1s.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Cheniere Corpus Christi Holdings, LLC

(Exact name of registrant as specified in its charter)

Delaware | 333-215435 | 47-1929160 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900 Houston, Texas | 77002 | |

(Address of principal executive offices) | (Zip Code) | |

(713) 375-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | |||

Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |||

Emerging growth company ¨ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of the issuer’s classes of common stock, as of the latest practicable date: Not applicable

CHENIERE CORPUS CHRISTI HOLDINGS, LLC

TABLE OF CONTENTS

i

DEFINITIONS

As used in this quarterly report, the terms listed below have the following meanings:

Common Industry and Other Terms

Bcf | billion cubic feet | |

Bcf/d | billion cubic feet per day | |

Bcf/yr | billion cubic feet per year | |

Bcfe | billion cubic feet equivalent | |

DOE | U.S. Department of Energy | |

EPC | engineering, procurement and construction | |

FERC | Federal Energy Regulatory Commission | |

FTA countries | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas | |

GAAP | generally accepted accounting principles in the United States | |

Henry Hub | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin | |

LIBOR | London Interbank Offered Rate | |

LNG | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state | |

MMBtu | million British thermal units, an energy unit | |

mtpa | million tonnes per annum | |

non-FTA countries | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted | |

SEC | U.S. Securities and Exchange Commission | |

SPA | LNG sale and purchase agreement | |

TBtu | trillion British thermal units, an energy unit | |

Train | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG | |

1

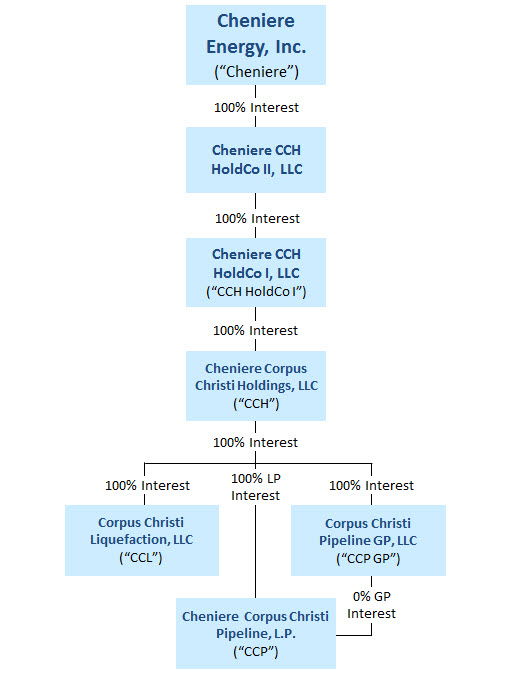

Abbreviated Legal Entity Structure

The following diagram depicts our abbreviated legal entity structure as of March 31, 2018, including our ownership of certain subsidiaries, and the references to these entities used in this quarterly report:

Unless the context requires otherwise, references to “CCH,” “the Company,” “we,” “us,” and “our” refer to Cheniere Corpus Christi Holdings, LLC and its consolidated subsidiaries.

2

PART I. | FINANCIAL INFORMATION |

ITEM 1. | CONSOLIDATED FINANCIAL STATEMENTS |

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands)

March 31, | December 31, | |||||||

2018 | 2017 | |||||||

ASSETS | (unaudited) | |||||||

Current assets | ||||||||

Cash and cash equivalents | $ | — | $ | — | ||||

Restricted cash | 82,767 | 226,559 | ||||||

Advances to affiliate | 36,267 | 31,486 | ||||||

Other current assets | 1,341 | 1,494 | ||||||

Other current assets—affiliate | 195 | 190 | ||||||

Total current assets | 120,570 | 259,729 | ||||||

Property, plant and equipment, net | 8,712,509 | 8,261,383 | ||||||

Debt issuance and deferred financing costs, net | 93,980 | 98,175 | ||||||

Non-current derivative assets | 49,364 | 2,469 | ||||||

Other non-current assets, net | 38,488 | 38,124 | ||||||

Total assets | $ | 9,014,911 | $ | 8,659,880 | ||||

LIABILITIES AND MEMBER’S EQUITY | ||||||||

Current liabilities | ||||||||

Accounts payable | $ | 4,647 | $ | 6,461 | ||||

Accrued liabilities | 134,394 | 258,060 | ||||||

Due to affiliates | 9,761 | 23,789 | ||||||

Derivative liabilities | 6,476 | 19,609 | ||||||

Other current liabilities | 2 | — | ||||||

Total current liabilities | 155,280 | 307,919 | ||||||

Long-term debt, net | 6,937,188 | 6,669,476 | ||||||

Non-current derivative liabilities | 475 | 15,209 | ||||||

Member’s equity | 1,921,968 | 1,667,276 | ||||||

Total liabilities and member’s equity | $ | 9,014,911 | $ | 8,659,880 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

3

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands)

(unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Revenues | $ | — | $ | — | |||

Expenses | |||||||

Operating and maintenance expense | 966 | 706 | |||||

Operating and maintenance expense—affiliate | 466 | 53 | |||||

Development expense | 34 | 92 | |||||

Development expense—affiliate | — | 8 | |||||

General and administrative expense | 850 | 1,415 | |||||

General and administrative expense—affiliate | 403 | 311 | |||||

Depreciation and amortization expense | 371 | 134 | |||||

Total expenses | 3,090 | 2,719 | |||||

Loss from operations | (3,090 | ) | (2,719 | ) | |||

Other income (expense) | |||||||

Derivative gain, net | 68,849 | 1,000 | |||||

Other expense | (67 | ) | (38 | ) | |||

Total other income | 68,782 | 962 | |||||

Net income (loss) | $ | 65,692 | $ | (1,757 | ) | ||

The accompanying notes are an integral part of these consolidated financial statements.

4

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF MEMBER’S EQUITY

(in thousands)

(unaudited)

Cheniere CCH HoldCo I, LLC | Total Member’s Equity | ||||||

Balance at December 31, 2017 | $ | 1,667,276 | $ | 1,667,276 | |||

Capital contributions | 189,000 | 189,000 | |||||

Net income | 65,692 | 65,692 | |||||

Balance at March 31, 2018 | $ | 1,921,968 | $ | 1,921,968 | |||

The accompanying notes are an integral part of these consolidated financial statements.

5

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities | |||||||

Net income (loss) | $ | 65,692 | $ | (1,757 | ) | ||

Adjustments to reconcile net income (loss) to net cash used in operating activities: | |||||||

Depreciation and amortization expense | 371 | 134 | |||||

Total gains on derivatives, net | (68,733 | ) | (1,000 | ) | |||

Net cash used for settlement of derivative instruments | (6,292 | ) | (10,736 | ) | |||

Changes in operating assets and liabilities: | |||||||

Accounts payable and accrued liabilities | (345 | ) | 303 | ||||

Due to affiliates | (147 | ) | 676 | ||||

Other, net | (143 | ) | (306 | ) | |||

Other, net—affiliate | (5 | ) | (566 | ) | |||

Net cash used in operating activities | (9,602 | ) | (13,252 | ) | |||

Cash flows from investing activities | |||||||

Property, plant and equipment, net | (589,061 | ) | (738,797 | ) | |||

Other | — | 36,341 | |||||

Net cash used in investing activities | (589,061 | ) | (702,456 | ) | |||

Cash flows from financing activities | |||||||

Proceeds from issuances of debt | 266,000 | 548,000 | |||||

Debt issuance and deferred financing costs | (129 | ) | (1,088 | ) | |||

Capital contributions | 189,000 | 41,029 | |||||

Net cash provided by financing activities | 454,871 | 587,941 | |||||

Net decrease in cash, cash equivalents and restricted cash | (143,792 | ) | (127,767 | ) | |||

Cash, cash equivalents and restricted cash—beginning of period | 226,559 | 270,540 | |||||

Cash, cash equivalents and restricted cash—end of period | $ | 82,767 | $ | 142,773 | |||

Balances per Consolidated Balance Sheet:

March 31, 2018 | |||

Cash and cash equivalents | $ | — | |

Restricted cash | 82,767 | ||

Total cash, cash equivalents and restricted cash | $ | 82,767 | |

The accompanying notes are an integral part of these consolidated financial statements.

6

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1—NATURE OF OPERATIONS AND BASIS OF PRESENTATION

We are developing and constructing a natural gas liquefaction and export facility at the Corpus Christi LNG terminal (the “Liquefaction Facility”), which is on nearly 2,000 acres of land that we own or control near Corpus Christi, Texas, and a 23-mile natural gas supply pipeline (the “Corpus Christi Pipeline” and together with the Liquefaction Facility, the “Liquefaction Project”) through wholly owned subsidiaries CCL and CCP, respectively. The Liquefaction Project is being developed in stages. The first stage includes Trains 1 and 2, two LNG storage tanks, one complete marine berth and a second partial berth and all of the Liquefaction Project’s necessary infrastructure facilities (“Stage 1”). The second stage includes Train 3, one LNG storage tank and the completion of the second partial berth (“Stage 2”). Trains 1 and 2 are currently under construction, and Train 3 is being commercialized and has all necessary regulatory approvals in place. The construction of the Corpus Christi Pipeline is expected to be completed in second quarter of 2018.

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements of CCH have been prepared in accordance with GAAP for interim financial information and with Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with the Consolidated Financial Statements and accompanying notes included in our annual report on Form 10-K for the year ended December 31, 2017. In our opinion, all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation, have been included. Certain reclassifications have been made to conform prior period information to the current presentation. The reclassifications did not have a material effect on our consolidated financial position, results of operations or cash flows.

On January 1, 2018, we adopted ASU 2014-09, Revenue from Contracts with Customers (Topic 606), and subsequent amendments thereto (“ASC 606”) using the full retrospective method. The adoption of ASC 606 represents a change in accounting principle that will provide financial statement readers with enhanced disclosures regarding the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. The adoption of ASC 606 did not impact our previously reported financial statements in any prior period nor did it result in a cumulative effect adjustment to retained earnings.

Results of operations for the three months ended March 31, 2018 are not necessarily indicative of the results of operations that will be realized for the year ending December 31, 2018.

We are a disregarded entity for federal and state income tax purposes. Our taxable income or loss, which may vary substantially from the net income or loss reported on our Consolidated Statements of Operations, is included in the consolidated federal income tax return of Cheniere. The provision for income taxes, taxes payable and deferred income tax balances have been recorded as if we had filed all tax returns on a separate return basis from Cheniere.

NOTE 2—RESTRICTED CASH

Restricted cash consists of funds that are contractually restricted as to usage or withdrawal and have been presented separately from cash and cash equivalents on our Consolidated Balance Sheets. As of March 31, 2018 and December 31, 2017, restricted cash consisted of the following (in thousands):

March 31, | December 31, | |||||||

2018 | 2017 | |||||||

Current restricted cash | ||||||||

Liquefaction Project | $ | 82,767 | $ | 226,559 | ||||

Pursuant to the accounts agreement entered into with the collateral trustee for the benefit of our debt holders, we are required to deposit all cash received into reserve accounts controlled by the collateral trustee. The usage or withdrawal of such cash is restricted to the payment of liabilities related to the Liquefaction Project and other restricted payments.

7

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 3—PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment, net consists of LNG terminal costs and fixed assets, as follows (in thousands):

March 31, | December 31, | |||||||

2018 | 2017 | |||||||

LNG terminal costs | ||||||||

LNG terminal construction-in-process | $ | 8,693,402 | $ | 8,242,520 | ||||

LNG site and related costs | 13,844 | 13,844 | ||||||

Total LNG terminal costs | 8,707,246 | 8,256,364 | ||||||

Fixed assets | ||||||||

Fixed assets | 6,618 | 6,042 | ||||||

Accumulated depreciation | (1,355 | ) | (1,023 | ) | ||||

Total fixed assets, net | 5,263 | 5,019 | ||||||

Property, plant and equipment, net | $ | 8,712,509 | $ | 8,261,383 | ||||

Depreciation expense was $0.3 million and $0.1 million during the three months ended March 31, 2018 and 2017, respectively.

NOTE 4—DERIVATIVE INSTRUMENTS

We have entered into the following derivative instruments that are reported at fair value:

• | interest rate swaps (“Interest Rate Derivatives”) to protect against volatility of future cash flows and hedge a portion of the variable-rate interest payments on our credit facility (the “2015 CCH Credit Facility”) and |

• | natural gas supply contracts for the commissioning and operation of the Liquefaction Project (“Liquefaction Supply Derivatives”). |

We recognize our derivative instruments as either assets or liabilities and measure those instruments at fair value. None of our derivative instruments are designated as cash flow hedging instruments, and changes in fair value are recorded within our Consolidated Statements of Operations to the extent not utilized for the commissioning process.

There have been no changes to our evaluation of and accounting for our derivative positions during the three months ended March 31, 2018. See Note 5—Derivative Instruments of our Notes to Consolidated Financial Statements in our annual report on Form 10-K for the year ended December 31, 2017 for additional information.

Interest Rate Derivatives

As of March 31, 2018, we had the following Interest Rate Derivatives outstanding:

Initial Notional Amount | Maximum Notional Amount | Effective Date | Maturity Date | Weighted Average Fixed Interest Rate Paid | Variable Interest Rate Received | |||||||

Interest Rate Derivatives | $28.8 million | $4.9 billion | May 20, 2015 | May 31, 2022 | 2.29% | One-month LIBOR | ||||||

8

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Our Interest Rate Derivatives are categorized within Level 2 of the fair value hierarchy and are required to be measured at fair value on a recurring basis. We value our Interest Rate Derivatives using an income-based approach, utilizing observable inputs to the valuation model including interest rate curves, risk adjusted discount rates, credit spreads and other relevant data. The following table shows the fair value and location of our Interest Rate Derivatives on our Consolidated Balance Sheets (in thousands):

March 31, | December 31, | |||||||

Balance Sheet Location | 2018 | 2017 | ||||||

Other current assets | $ | 263 | $ | — | ||||

Non-current derivative assets | 49,096 | 2,469 | ||||||

Total derivative assets | 49,359 | 2,469 | ||||||

Derivative liabilities | (6,476 | ) | (19,609 | ) | ||||

Non-current derivative liabilities | — | (15,118 | ) | |||||

Total derivative liabilities | (6,476 | ) | (34,727 | ) | ||||

Derivative asset (liability), net | $ | 42,883 | $ | (32,258 | ) | |||

The following table shows the changes in the fair value and settlements of our Interest Rate Derivatives recorded in derivative gain, net on our Consolidated Statements of Operations during the three months ended March 31, 2018 and 2017 (in thousands):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Interest Rate Derivatives gain | $ | 68,849 | $ | 1,000 | |||

Liquefaction Supply Derivatives

CCL has entered into index-based physical natural gas supply contracts to purchase natural gas for the commissioning and operation of the Liquefaction Project. The terms of the physical natural gas supply contracts range from approximately three to seven years, most of which commence upon the satisfaction of certain conditions precedent, if applicable, such as the date of first commercial delivery of specified Trains of the Liquefaction Project.

The fair value of the Liquefaction Supply Derivatives is predominantly driven by market commodity basis prices and our assessment of the associated conditions precedent, including evaluating whether the respective market is available as pipeline infrastructure is developed. Upon the satisfaction of conditions precedent, including completion and placement into service of relevant pipeline infrastructure to accommodate marketable physical gas flow, we recognize a gain or loss based on the fair value of the respective natural gas supply contracts.

Our Liquefaction Supply Derivatives are categorized within Level 3 of the fair value hierarchy and are required to be measured at fair value on a recurring basis. The fair value of our Liquefaction Supply Derivatives is determined using a market-based approach incorporating present value techniques, as needed, and is developed through the use of internal models which may be impacted by inputs that are unobservable in the marketplace.

The curves used to generate the fair value of the Liquefaction Supply Derivatives are based on basis adjustments applied to forward curves for a liquid trading point. In addition, there may be observable liquid market basis information in the near term, but terms of a Liquefaction Supply Derivatives contract may exceed the period for which such information is available, resulting in a Level 3 classification. In these instances, the fair value of the contract incorporates extrapolation assumptions made in the determination of the market basis price for future delivery periods in which applicable commodity basis prices were either not observable or lacked corroborative market data. As of March 31, 2018 and December 31, 2017, some of the Liquefaction Supply Derivatives existed within markets for which the pipeline infrastructure is under development to accommodate marketable physical gas flow. As of March 31, 2018 and December 31, 2017, CCL had secured up to approximately 2,057 TBtu and 2,024 TBtu, respectively, of natural gas feedstock through natural gas supply contracts supply contracts, a portion of which is subject to the achievement of certain project milestones and other conditions precedent. The forward notional natural gas buy position of the Liquefaction Supply Derivatives was approximately 1,052 TBtu and 1,019 TBtu as of March 31, 2018 and December 31, 2017, respectively.

9

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

The Level 3 fair value measurements of our Liquefaction Supply Derivatives could be materially impacted by a significant change in certain natural gas market basis spreads due to the contractual notional amount represented by our Level 3 positions, which is a substantial portion of our overall Physical Liquefaction Supply portfolio. The following table includes quantitative information for the unobservable inputs for our Liquefaction Supply Derivatives as of March 31, 2018:

Net Fair Value Liability (in thousands) | Valuation Approach | Significant Unobservable Input | Significant Unobservable Inputs Range | |||||

Liquefaction Supply Derivatives | $(207) | Market approach incorporating present value techniques | Basis Spread | $(0.725) - $0.050 | ||||

The following table shows the changes in the fair value of our Level 3 Physical Liquefaction Supply Derivatives during the three months ended March 31, 2018 and 2017 (in thousands):

Three Months Ended March 31, | ||||||||

2018 | 2017 | |||||||

Balance, beginning of period | $ | (91 | ) | $ | — | |||

Realized and mark-to-market gains: | ||||||||

Included in operating and maintenance expense | 351 | — | ||||||

Purchases | (467 | ) | — | |||||

Balance, end of period | $ | (207 | ) | $ | — | |||

Change in unrealized losses relating to instruments still held at end of period | $ | 351 | $ | — | ||||

Derivative assets and liabilities arising from our derivative contracts with the same counterparty are reported on a net basis, as all counterparty derivative contracts provide for net settlement. The use of derivative instruments exposes us to counterparty credit risk, or the risk that a counterparty will be unable to meet its commitments in instances when our derivative instruments are in an asset position. Additionally, we evaluate our own ability to meet our commitments in instances where our derivative instruments are in a liability position. Our derivative instruments are subject to contractual provisions which provide for the unconditional right of set-off for all derivative assets and liabilities with a given counterparty in the event of default.

The following table shows the fair value and location of our Liquefaction Supply Derivatives on our Consolidated Balance Sheets (in thousands):

March 31, | December 31, | |||||||

Balance Sheet Location | 2018 | 2017 | ||||||

Non-current derivative assets | $ | 268 | $ | — | ||||

Non-current derivative liabilities | (475 | ) | (91 | ) | ||||

Derivative liability, net | $ | (207 | ) | $ | (91 | ) | ||

The following table shows the changes in the fair value of our Liquefaction Supply Derivatives recorded in our Consolidated Statements of Operations during the three months ended March 31, 2018 and 2017 (in thousands):

Three Months Ended March 31, | |||||||||

Statement of Operations Location | 2018 | 2017 | |||||||

Liquefaction Supply Derivatives loss | Operating and maintenance expense | $ | 116 | $ | — | ||||

10

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Balance Sheet Presentation

Our derivative instruments are presented on a net basis on our Consolidated Balance Sheets as described above. The following table shows the fair value of our derivatives outstanding on a gross and net basis (in thousands):

Gross Amounts Recognized | Gross Amounts Offset in the Consolidated Balance Sheets | Net Amounts Presented in the Consolidated Balance Sheets | ||||||||||

Offsetting Derivative Assets (Liabilities) | ||||||||||||

As of March 31, 2018 | ||||||||||||

Interest Rate Derivatives | $ | 49,446 | $ | (87 | ) | $ | 49,359 | |||||

Interest Rate Derivatives | (6,945 | ) | 469 | (6,476 | ) | |||||||

Liquefaction Supply Derivatives | 347 | (79 | ) | 268 | ||||||||

Liquefaction Supply Derivatives | (1,249 | ) | 774 | (475 | ) | |||||||

As of December 31, 2017 | ||||||||||||

Interest Rate Derivatives | $ | 2,808 | $ | (339 | ) | $ | 2,469 | |||||

Interest Rate Derivatives | (34,747 | ) | 20 | (34,727 | ) | |||||||

Liquefaction Supply Derivatives | (130 | ) | 39 | (91 | ) | |||||||

NOTE 5—ACCRUED LIABILITIES

As of March 31, 2018 and December 31, 2017, accrued liabilities consisted of the following (in thousands):

March 31, | December 31, | |||||||

2018 | 2017 | |||||||

Interest costs and related debt fees | $ | 64,335 | $ | 136,283 | ||||

Liquefaction Project costs | 61,412 | 107,055 | ||||||

Other | 8,647 | 14,722 | ||||||

Total accrued liabilities | $ | 134,394 | $ | 258,060 | ||||

NOTE 6—DEBT

As of March 31, 2018 and December 31, 2017, our debt consisted of the following (in thousands):

March 31, | December 31, | |||||||

2018 | 2017 | |||||||

Long-term debt | ||||||||

7.000% Senior Secured Notes due 2024 (“2024 CCH Senior Notes”) | $ | 1,250,000 | $ | 1,250,000 | ||||

5.875% Senior Secured Notes due 2025 (“2025 CCH Senior Notes”) | 1,500,000 | 1,500,000 | ||||||

5.125% Senior Secured Notes due 2027 (“2027 CCH Senior Notes”) | 1,500,000 | 1,500,000 | ||||||

2015 CCH Credit Facility | 2,750,737 | 2,484,737 | ||||||

Unamortized debt issuance costs | (63,549 | ) | (65,261 | ) | ||||

Total long-term debt, net | 6,937,188 | 6,669,476 | ||||||

Current debt | ||||||||

$350 million CCH Working Capital Facility (“CCH Working Capital Facility”) | — | — | ||||||

Total debt, net | $ | 6,937,188 | $ | 6,669,476 | ||||

11

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Credit Facilities

Below is a summary of our credit facilities outstanding as of March 31, 2018 (in thousands):

2015 CCH Credit Facility | CCH Working Capital Facility | |||||||

Original facility size | $ | 8,403,714 | $ | 350,000 | ||||

Less: | ||||||||

Outstanding balance | 2,750,737 | — | ||||||

Commitments terminated | 3,832,263 | — | ||||||

Letters of credit issued | — | 288,575 | ||||||

Available commitment | $ | 1,820,714 | $ | 61,425 | ||||

Interest rate | LIBOR plus 2.25% or base rate plus 1.25% (1) | LIBOR plus 1.50% - 2.00% or base rate plus 0.50% - 1.00% | ||||||

Maturity date | Earlier of May 13, 2022 or second anniversary of CCL Trains 1 and 2 completion date | December 14, 2021, with various terms for underlying loans | ||||||

(1) | There is a 0.25% step-up for both LIBOR and base rate loans following the completion of Trains 1 and 2 of the Liquefaction Project as defined in the common terms agreement. |

Restrictive Debt Covenants

As of March 31, 2018, we were in compliance with all covenants related to our debt agreements.

Interest Expense

Total interest expense consisted of the following (in thousands):

Three Months Ended March 31, | ||||||||

2018 | 2017 | |||||||

Total interest cost | $ | 101,195 | $ | 80,188 | ||||

Capitalized interest, including amounts capitalized as an Allowance for Funds Used During Construction | (101,195 | ) | (80,188 | ) | ||||

Total interest expense, net | $ | — | $ | — | ||||

Fair Value Disclosures

The following table shows the carrying amount and estimated fair value of our debt (in thousands):

March 31, 2018 | December 31, 2017 | |||||||||||||||

Carrying Amount | Estimated Fair Value | Carrying Amount | Estimated Fair Value | |||||||||||||

Senior notes (1) | $ | 4,250,000 | $ | 4,441,250 | $ | 4,250,000 | $ | 4,590,625 | ||||||||

Credit facilities (2) | 2,750,737 | 2,750,737 | 2,484,737 | 2,484,737 | ||||||||||||

(1) | Includes 2024 CCH Senior Notes, 2025 CCH Senior Notes and 2027 CCH Senior Notes (collectively, the “CCH Senior Notes”). The Level 2 estimated fair value was based on quotes obtained from broker-dealers or market makers of the CCH Senior Notes and other similar instruments. |

(2) | Includes 2015 CCH Credit Facility and CCH Working Capital Facility. The Level 3 estimated fair value approximates the principal amount because the interest rates are variable and reflective of market rates and the debt may be repaid, in full or in part, at any time without penalty. |

12

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 7—REVENUES FROM CONTRACTS WITH CUSTOMERS

We have entered into numerous SPAs with third party customers for the sale of LNG on a Free on Board (“FOB”) (delivered to the customer at the Corpus Christi LNG terminal) basis. Our customers generally purchase LNG for a price consisting of a fixed fee per MMBtu of LNG (a portion of which is subject to annual adjustment for inflation) plus a variable fee per MMBtu of LNG equal to approximately 115% of Henry Hub. The fixed fee component is the amount payable to us regardless of a cancellation or suspension of LNG cargo deliveries by the customers. The variable fee component is the amount generally payable to us only upon delivery of LNG plus all future adjustments to the fixed fee for inflation. The SPAs and contracted volumes to be made available under the SPAs are not tied to a specific Train; however, the term of each SPA generally commences upon the date of first commercial delivery of a specified Train.

Revenues from the sale of LNG are recognized at a point in time when the LNG is delivered to the customer, at the Corpus Christi LNG terminal, which is the point legal title, physical possession and the risks and rewards of ownership transfers to the customer. Each individual molecule of LNG is viewed as a separate performance obligation. The stated contract price (including both fixed and variable fees) per MMBtu in each LNG sales arrangement is representative of the stand-alone selling price for LNG at the time the sale was negotiated. We have concluded that the variable fees meet the optional exception for allocating variable consideration. As such, the variable consideration for these contracts is allocated to each distinct molecule of LNG and recognized when that distinct molecule of LNG is delivered to the customer. Because of the use of the optional exception, variable consideration related to the sale of LNG is also not included in the transaction price.

Fees received pursuant to SPAs are recognized as LNG revenues only after substantial completion of the respective Train. Prior to substantial completion, sales generated during the commissioning phase are offset against the cost of construction for the respective Train, as the production and removal of LNG from storage is necessary to test the facility and bring the asset to the condition necessary for its intended use.

Transaction Price Allocated to Future Performance Obligations

Because many of our sales contracts have long-term durations, we are contractually entitled to significant future consideration which we have not yet recognized as revenue. The following table discloses the aggregate amount of the transaction price that is allocated to performance obligations that have not yet been satisfied as of March 31, 2018:

Unsatisfied Transaction Price (in billions) | Weighted Average Recognition Timing (years) (1) | |||||

LNG revenues | $ | 32.5 | 12.0 | |||

(1) | The weighted average recognition timing represents an estimate of the number of years during which we shall have recognized half of the unsatisfied transaction price. |

We have elected the following optional exemptions which omit certain potential future sources of revenue from the table above:

(1) | We omit from the table above all performance obligations that are part of a contract that has an original expected duration of one year or less. |

(2) | We omit from the table above all variable consideration that is allocated entirely to a wholly unsatisfied performance obligation or to a wholly unsatisfied promise to transfer a distinct good or service that forms part of a single performance obligation when that performance obligation qualifies as a series. The table above excludes all variable consideration under our SPAs. The amount of revenue from variable fees that is not included in the transaction price will vary based on the future prices of Henry Hub throughout the contract terms, to the extent customers elect to take delivery of their LNG, and adjustments to the consumer price index. Certain of our contracts contain additional variable consideration based on the outcome of contingent events and the movement of various indexes. The receipt of such variable consideration is considered constrained due to the uncertainty of ultimate pricing and receipt and we have not included such variable consideration in the transaction price. |

13

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

We have entered into contracts to sell LNG that are conditioned upon one or both of the parties achieving certain milestones such as reaching a final investment decision on a certain liquefaction Train or obtaining financing. These contracts are considered completed contracts for revenue recognition purposes and are included in the transaction price above.

We have elected the practical expedient to omit the disclosure of the transaction price allocated to future performance obligations and an explanation of when the entity expects to recognize the amount as revenue as of March 31, 2017.

NOTE 8—RELATED PARTY TRANSACTIONS

Below is a summary of our related party transactions as reported on our Consolidated Statements of Operations for the three months ended March 31, 2018 and 2017 (in thousands):

Three Months Ended March 31, | ||||||||

2018 | 2017 | |||||||

Operating and maintenance expense—affiliate | ||||||||

Services Agreements | $ | 233 | $ | — | ||||

Lease Agreements | 233 | 53 | ||||||

Total operating and maintenance expense—affiliate | 466 | 53 | ||||||

Development expense—affiliate | ||||||||

Services Agreements | — | 8 | ||||||

General and administrative expense—affiliate | ||||||||

Services Agreements | 403 | 311 | ||||||

We had $9.8 million and $23.8 million due to affiliates as of March 31, 2018 and December 31, 2017, respectively, under agreements with affiliates, as described below.

LNG Sale and Purchase Agreements

CCL has a fixed price 20-year SPA with Cheniere Marketing International LLP (“Cheniere Marketing”) (the “Cheniere Marketing Base SPA”) which allows Cheniere Marketing to purchase, at its option, (1) up to a cumulative total of 150 TBtu of LNG within the commissioning periods for Trains 1 through 3, (2) any LNG produced from the end of the commissioning period for Train 1 until the date of first commercial delivery of LNG from Train 1 and (3) any excess LNG produced by the Liquefaction Facility that is not committed to customers under third-party SPAs. Under the Cheniere Marketing Base SPA, Cheniere Marketing may, without charge, elect to suspend deliveries of cargoes (other than commissioning cargoes) scheduled for any month under the applicable annual delivery program by providing specified notice in advance.

Services Agreements

Gas and Power Supply Services Agreement (“G&P Agreement”)

CCL has a G&P Agreement with Cheniere Energy Shared Services, Inc. (“Shared Services”), a wholly owned subsidiary of Cheniere, pursuant to which Shared Services will manage the gas and power procurement requirements of CCL. The services include, among other services, exercising the day-to-day management of CCL’s natural gas and power supply requirements, negotiating agreements on CCL’s behalf and providing other administrative services. Prior to the substantial completion of each Train of the Liquefaction Facility, no monthly fee payment is required except for reimbursement of operating expenses. After substantial completion of each Train of the Liquefaction Facility, for services performed while the Liquefaction Facility is operational, CCL will pay, in addition to the reimbursement of operating expenses, a fixed monthly fee of $125,000 (indexed for inflation) for services with respect to such Train.

Operation and Maintenance Agreements (“O&M Agreements”)

CCL has an O&M Agreement (“CCL O&M Agreement”) with Cheniere LNG O&M Services, LLC (“O&M Services”), a wholly owned subsidiary of Cheniere, pursuant to which CCL receives all of the necessary services required to construct, operate and maintain the Liquefaction Facility. The services to be provided include, among other services, preparing and maintaining

14

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

staffing plans, identifying and arranging for procurement of equipment and materials, overseeing contractors, administering various agreements and other services required to operate and maintain the Liquefaction Facility. Prior to the substantial completion of each Train of the Liquefaction Facility, no monthly fee payment is required except for reimbursement of operating expenses. After substantial completion of each Train of the Liquefaction Facility, for services performed while the Liquefaction Facility is operational, CCL will pay, in addition to the reimbursement of operating expenses, a fixed monthly fee of $125,000 (indexed for inflation) for services with respect to such Train.

CCP has an O&M Agreement (“CCP O&M Agreement”) with O&M Services pursuant to which CCP receives all of the necessary services required to construct, operate and maintain the Corpus Christi Pipeline. The services to be provided include, among other services, preparing and maintaining staffing plans, identifying and arranging for procurement of equipment and materials, overseeing contractors and other services required to operate and maintain the Corpus Christi Pipeline. CCP is required to reimburse O&M Services for all operating expenses incurred on behalf of CCP.

Management Services Agreements (“MSAs”)

CCL has an MSA with Shared Services pursuant to which Shared Services manages the construction and operation of the Liquefaction Facility, excluding those matters provided for under the G&P Agreement and the CCL O&M Agreement. The services include, among other services, exercising the day-to-day management of CCL’s affairs and business, managing CCL’s regulatory matters, preparing status reports, providing contract administration services for all contracts associated with the Liquefaction Facility and obtaining insurance. Prior to the substantial completion of each Train of the Liquefaction Facility, no monthly fee payment is required except for reimbursement of expenses. After substantial completion of each Train, CCL will pay, in addition to the reimbursement of related expenses, a monthly fee equal to 3% of the capital expenditures incurred in the previous month and a fixed monthly fee of $375,000 for services with respect to such Train.

CCP has an MSA with Shared Services pursuant to which Shared Services manages CCP’s operations and business, excluding those matters provided for under the CCP O&M Agreement. The services include, among other services, exercising the day-to-day management of CCP’s affairs and business, managing CCP’s regulatory matters, preparing status reports, providing contract administration services for all contracts associated with the Corpus Christi Pipeline and obtaining insurance. CCP is required to reimburse Shared Services for the aggregate of all costs and expenses incurred in the course of performing the services under the MSA.

Lease Agreements

CCL has agreements with Cheniere Land Holdings, LLC (“Cheniere Land Holdings”), a wholly owned subsidiary of Cheniere, to lease approximately 85 acres of land owned by Cheniere Land Holdings for the Liquefaction Facility. The total annual lease payment is $0.4 million, and the terms of the agreements range from three to five years.

In February 2018, CCL entered into agreements with Cheniere Land Holdings which grants CCL a limited license to use certain roads on land owned by Cheniere Land Holdings for the Liquefaction Facility. The total annual lease payment is $0.1 million, and the term of each agreement is five years.

We had $0.2 million as of both March 31, 2018 and December 31, 2017 of prepaid expense related to these agreements in other current assets—affiliate.

Dredge Material Disposal Agreement

CCL has a dredge material disposal agreement with Cheniere Land Holdings that terminates in 2025 which grants CCL permission to use land owned by Cheniere Land Holdings for the deposit of dredge material from the construction and maintenance of the Liquefaction Facility. Under the terms of the agreement, CCL will pay Cheniere Land Holdings $0.50 per cubic yard of dredge material deposits up to 5.0 million cubic yards.

Tug Hosting Agreement

In February 2017, CCL entered into a tug hosting agreement with Corpus Christi Tug Services, LLC (“Tug Services”), a wholly owned subsidiary of Cheniere, to provide certain marine structures, support services and access necessary at the Liquefaction

15

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Facility for Tug Services to provide its customers with tug boat and marine services. Tug Services is required to reimburse CCL for any third party costs incurred by CCL in connection with providing the goods and services.

State Tax Sharing Agreements

CCL has a state tax sharing agreement with Cheniere. Under this agreement, Cheniere has agreed to prepare and file all state and local tax returns which CCL and Cheniere are required to file on a combined basis and to timely pay the combined state and local tax liability. If Cheniere, in its sole discretion, demands payment, CCL will pay to Cheniere an amount equal to the state and local tax that CCL would be required to pay if CCL’s state and local tax liability were calculated on a separate company basis. There have been no state and local taxes paid by Cheniere for which Cheniere could have demanded payment from CCL under this agreement; therefore, Cheniere has not demanded any such payments from CCL. The agreement is effective for tax returns due on or after May 2015.

CCP has a state tax sharing agreement with Cheniere. Under this agreement, Cheniere has agreed to prepare and file all state and local tax returns which CCP and Cheniere are required to file on a combined basis and to timely pay the combined state and local tax liability. If Cheniere, in its sole discretion, demands payment, CCP will pay to Cheniere an amount equal to the state and local tax that CCP would be required to pay if CCP’s state and local tax liability were calculated on a separate company basis. There have been no state and local taxes paid by Cheniere for which Cheniere could have demanded payment from CCP under this agreement; therefore, Cheniere has not demanded any such payments from CCP. The agreement is effective for tax returns due on or after May 2015.

Equity Contribution Agreements

Equity Contribution Agreement

We have an equity contribution agreement with Cheniere pursuant to which Cheniere has agreed to provide, directly or indirectly, at our request based on reaching specified milestones of the Liquefaction Project, cash contributions up to approximately $2.6 billion for Stage 1. As of March 31, 2018, we have received $1.9 billion in contributions from Cheniere under this agreement.

Early Works Equity Contribution Agreement

In December 2017, we entered into an early works equity contribution agreement with Cheniere pursuant to which Cheniere is obligated to provide, directly or indirectly, at our request based on amounts due and payable in respect of limited notices to proceed issued under the Stage 2 EPC Contract, cash contributions of up to $310.0 million to us for the early works related to Stage 2. The amount of cash contributions Cheniere provides may be increased by Cheniere in its sole discretion. As of March 31, 2018, we have received $135.0 million in contributions from Cheniere under this agreement.

NOTE 9—SUPPLEMENTAL CASH FLOW INFORMATION

The following table provides supplemental disclosure of cash flow information (in thousands):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Cash paid during the period for interest, net of amounts capitalized | $ | 64,656 | $ | 2,052 | |||

The balance in property, plant and equipment, net funded with accounts payable and accrued liabilities (including affiliate) was $134.0 million and $213.4 million as of March 31, 2018 and 2017, respectively.

16

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 10—RECENT ACCOUNTING STANDARDS

The following table provides a brief description of a recent accounting standard that had not been adopted by us as of March 31, 2018:

Standard | Description | Expected Date of Adoption | Effect on our Consolidated Financial Statements or Other Significant Matters | |||

ASU 2016-02, Leases (Topic 842), and subsequent amendments thereto | This standard requires a lessee to recognize leases on its balance sheet by recording a lease liability representing the obligation to make future lease payments and a right-of-use asset representing the right to use the underlying asset for the lease term. A lessee is permitted to make an election not to recognize lease assets and liabilities for leases with a term of 12 months or less. The standard also modifies the definition of a lease and requires expanded disclosures. This guidance may be early adopted, and must be adopted using a modified retrospective approach with certain available practical expedients. | January 1, 2019 | We continue to evaluate the effect of this standard on our Consolidated Financial Statements. This evaluation process includes reviewing all forms of leases, performing a completeness assessment over the lease population, analyzing the practical expedients and assessing opportunities to make certain changes to our lease accounting information technology system in order to determine the best implementation strategy. Preliminarily, we expect that the requirement to recognize all leases on our Consolidated Balance Sheets will be a significant change from current practice but will not have a material impact upon our Consolidated Balance Sheets. Because this assessment is preliminary and the accounting for leases is subject to significant judgment, this conclusion could change as we finalize our assessment. We have not yet determined the impact of the adoption of this standard upon our results of operations or cash flows. We expect to elect the package of practical expedients permitted under the transition guidance which, among other things, allows the carryforward of prior conclusions related to lease identification and classification. We also expect to elect the practical expedient to retain our existing accounting for land easements which were not previously accounted for as leases. We have not yet determined whether we will elect any other practical expedients upon transition. | |||

17

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Additionally, the following table provides a brief description of recent accounting standards that were adopted by us during the reporting period:

Standard | Description | Date of Adoption | Effect on our Consolidated Financial Statements or Other Significant Matters | |||

ASU 2014-09, Revenue from Contracts with Customers (Topic 606), and subsequent amendments thereto | This standard provides a single, comprehensive revenue recognition model which replaces and supersedes most existing revenue recognition guidance and requires an entity to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard requires that the costs to obtain and fulfill contracts with customers should be recognized as assets and amortized to match the pattern of transfer of goods or services to the customer if expected to be recoverable. The standard also requires enhanced disclosures. This guidance may be adopted either retrospectively to each prior reporting period presented subject to allowable practical expedients (“full retrospective approach”) or as a cumulative-effect adjustment as of the date of adoption (“modified retrospective approach”). | January 1, 2018 | We adopted this guidance on January 1, 2018, using the full retrospective method. The adoption of this guidance represents a change in accounting principle that will provide financial statement readers with enhanced disclosures regarding the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. The adoption of this guidance did not impact our previously reported financial statements in any prior period nor did it result in a cumulative effect adjustment to retained earnings. See Note 7—Revenues from Contracts with Customers for additional disclosures. | |||

ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory | This standard requires the immediate recognition of the tax consequences of intercompany asset transfers other than inventory. This guidance may be early adopted, but only at the beginning of an annual period, and must be adopted using a modified retrospective approach. | January 1, 2018 | The adoption of this guidance did not have an impact on our Consolidated Financial Statements or related disclosures. | |||

18

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 11—SUPPLEMENTAL GUARANTOR INFORMATION

Our CCH Senior Notes are jointly and severally guaranteed by our subsidiaries, CCL, CCP and CCP GP (each a “Guarantor” and collectively, the “Guarantors”). These guarantees are full and unconditional, subject to certain customary release provisions including (1) the sale, exchange, disposition or transfer (by merger, consolidation or otherwise) of the capital stock or all or substantially all of the assets of the Guarantors, (2) the designation of the Guarantor as an “unrestricted subsidiary” in accordance with the indenture governing the CCH Senior Notes (the “CCH Indenture”), (3) upon the legal defeasance or covenant defeasance or discharge of obligations under the CCH Indenture and (4) the release and discharge of the Guarantors pursuant to the Common Security and Account Agreement. See Note 6—Debt for additional information regarding the CCH Senior Notes.

The following is condensed consolidating financial information for CCH (“Parent Issuer”) and the Guarantors. We did not have any non-guarantor subsidiaries as of March 31, 2018.

Condensed Consolidating Balance Sheet | |||||||||||||||

March 31, 2018 | |||||||||||||||

(in thousands) | |||||||||||||||

Parent Issuer | Guarantors | Eliminations | Consolidated | ||||||||||||

ASSETS | |||||||||||||||

Current assets | |||||||||||||||

Cash and cash equivalents | $ | — | $ | — | $ | — | $ | — | |||||||

Restricted cash | 82,762 | 5 | — | 82,767 | |||||||||||

Advances to affiliate | — | 36,267 | — | 36,267 | |||||||||||

Other current assets | 342 | 999 | — | 1,341 | |||||||||||

Other current assets—affiliate | — | 196 | (1 | ) | 195 | ||||||||||

Total current assets | 83,104 | 37,467 | (1 | ) | 120,570 | ||||||||||

Property, plant and equipment, net | 748,394 | 7,964,115 | — | 8,712,509 | |||||||||||

Debt issuance and deferred financing costs, net | 93,980 | — | — | 93,980 | |||||||||||

Non-current derivative assets | 49,096 | 268 | — | 49,364 | |||||||||||

Investments in subsidiaries | 8,074,525 | — | (8,074,525 | ) | — | ||||||||||

Other non-current assets, net | — | 38,488 | — | 38,488 | |||||||||||

Total assets | $ | 9,049,099 | $ | 8,040,338 | $ | (8,074,526 | ) | $ | 9,014,911 | ||||||

LIABILITIES AND MEMBER’S EQUITY | |||||||||||||||

Current liabilities | |||||||||||||||

Accounts payable | $ | 139 | $ | 4,508 | $ | — | $ | 4,647 | |||||||

Accrued liabilities | 64,868 | 69,526 | — | 134,394 | |||||||||||

Due to affiliates | 661 | 9,100 | — | 9,761 | |||||||||||

Derivative liabilities | 6,476 | — | — | 6,476 | |||||||||||

Other current liabilities | — | 2 | — | 2 | |||||||||||

Total current liabilities | 72,144 | 83,136 | — | 155,280 | |||||||||||

Long-term debt, net | 6,937,188 | — | — | 6,937,188 | |||||||||||

Non-current derivative liabilities | — | 475 | — | 475 | |||||||||||

Deferred tax liability | — | 3,880 | (3,880 | ) | — | ||||||||||

Member’s equity | 2,039,767 | 7,952,847 | (8,070,646 | ) | 1,921,968 | ||||||||||

Total liabilities and member’s equity | $ | 9,049,099 | $ | 8,040,338 | $ | (8,074,526 | ) | $ | 9,014,911 | ||||||

19

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Condensed Consolidating Balance Sheet | |||||||||||||||

December 31, 2017 | |||||||||||||||

(in thousands) | |||||||||||||||

Parent Issuer | Guarantors | Eliminations | Consolidated | ||||||||||||

ASSETS | |||||||||||||||

Current assets | |||||||||||||||

Cash and cash equivalents | $ | — | $ | — | $ | — | $ | — | |||||||

Restricted cash | 226,559 | — | — | 226,559 | |||||||||||

Advances to affiliate | — | 31,486 | — | 31,486 | |||||||||||

Other current assets | 246 | 1,248 | — | 1,494 | |||||||||||

Other current assets—affiliate | — | 191 | (1 | ) | 190 | ||||||||||

Total current assets | 226,805 | 32,925 | (1 | ) | 259,729 | ||||||||||

Property, plant and equipment, net | 651,687 | 7,609,696 | — | 8,261,383 | |||||||||||

Debt issuance and deferred financing costs, net | 98,175 | — | — | 98,175 | |||||||||||

Non-current derivative assets | 2,469 | — | — | 2,469 | |||||||||||

Investments in subsidiaries | 7,648,111 | — | (7,648,111 | ) | — | ||||||||||

Other non-current assets, net | — | 38,124 | — | 38,124 | |||||||||||

Total assets | $ | 8,627,247 | $ | 7,680,745 | $ | (7,648,112 | ) | $ | 8,659,880 | ||||||

LIABILITIES AND MEMBER’S EQUITY | |||||||||||||||

Current liabilities | |||||||||||||||

Accounts payable | $ | 82 | $ | 6,379 | $ | — | $ | 6,461 | |||||||

Accrued liabilities | 136,389 | 121,671 | — | 258,060 | |||||||||||

Due to affiliates | — | 23,789 | — | 23,789 | |||||||||||

Derivative liabilities | 19,609 | — | — | 19,609 | |||||||||||

Total current liabilities | 156,080 | 151,839 | — | 307,919 | |||||||||||

Long-term debt, net | 6,669,476 | — | — | 6,669,476 | |||||||||||

Non-current derivative liabilities | 15,118 | 91 | — | 15,209 | |||||||||||

Deferred tax liability | — | 2,983 | (2,983 | ) | — | ||||||||||

Member’s equity | 1,786,573 | 7,525,832 | (7,645,129 | ) | 1,667,276 | ||||||||||

Total liabilities and member’s equity | $ | 8,627,247 | $ | 7,680,745 | $ | (7,648,112 | ) | $ | 8,659,880 | ||||||

20

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Condensed Consolidating Statement of Operations | |||||||||||||||

Three Months Ended March 31, 2018 | |||||||||||||||

(in thousands) | |||||||||||||||

Parent Issuer | Guarantors | Eliminations | Consolidated | ||||||||||||

Revenues | $ | — | $ | — | $ | — | $ | — | |||||||

Expenses | |||||||||||||||

Operating and maintenance expense | — | 966 | — | 966 | |||||||||||

Operating and maintenance expense—affiliate | — | 466 | — | 466 | |||||||||||

Development expense | — | 34 | — | 34 | |||||||||||

General and administrative expense | 99 | 751 | — | 850 | |||||||||||

General and administrative expense—affiliate | — | 403 | — | 403 | |||||||||||

Depreciation and amortization expense | 13 | 358 | — | 371 | |||||||||||

Total expenses | 112 | 2,978 | — | 3,090 | |||||||||||

Loss from operations | (112 | ) | (2,978 | ) | — | (3,090 | ) | ||||||||

Other income (expense) | |||||||||||||||

Derivative gain, net | 68,849 | — | — | 68,849 | |||||||||||

Other income (expense) | (68 | ) | 4,476 | (4,475 | ) | (67 | ) | ||||||||

Total other income | 68,781 | 4,476 | (4,475 | ) | 68,782 | ||||||||||

Income before income taxes | 68,669 | 1,498 | (4,475 | ) | 65,692 | ||||||||||

Income tax provision | — | (897 | ) | 897 | — | ||||||||||

Net income | $ | 68,669 | $ | 601 | $ | (3,578 | ) | $ | 65,692 | ||||||

Condensed Consolidating Statement of Operations | |||||||||||||||

Three Months Ended March 31, 2017 | |||||||||||||||

(in thousands) | |||||||||||||||

Parent Issuer | Guarantors | Eliminations | Consolidated | ||||||||||||

Revenues | $ | — | $ | — | $ | — | $ | — | |||||||

Expenses | |||||||||||||||

Operating and maintenance expense | — | 706 | — | 706 | |||||||||||

Operating and maintenance expense—affiliate | — | 53 | — | 53 | |||||||||||

Development expense | — | 92 | — | 92 | |||||||||||

Development expense—affiliate | — | 8 | — | 8 | |||||||||||

General and administrative expense | 311 | 1,104 | — | 1,415 | |||||||||||

General and administrative expense—affiliate | — | 311 | — | 311 | |||||||||||

Depreciation and amortization expense | — | 134 | — | 134 | |||||||||||

Total expenses | 311 | 2,408 | — | 2,719 | |||||||||||

Loss from operations | (311 | ) | (2,408 | ) | — | (2,719 | ) | ||||||||

Other income (expense) | |||||||||||||||

Derivative gain, net | 1,000 | — | — | 1,000 | |||||||||||

Other income (expense) | (40 | ) | 4,860 | (4,858 | ) | (38 | ) | ||||||||

Total other income | 960 | 4,860 | (4,858 | ) | 962 | ||||||||||

Net income (loss) | $ | 649 | $ | 2,452 | $ | (4,858 | ) | $ | (1,757 | ) | |||||

21

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Condensed Consolidating Statement of Cash Flows | |||||||||||||||

Three Months Ended March 31, 2018 | |||||||||||||||

(in thousands) | |||||||||||||||

Parent Issuer | Guarantors | Eliminations | Consolidated | ||||||||||||

Cash flows from operating activities | |||||||||||||||

Net income | $ | 68,669 | $ | 601 | $ | (3,578 | ) | $ | 65,692 | ||||||

Adjustments to reconcile net income to net cash used in operating activities: | |||||||||||||||

Depreciation and amortization expense | 13 | 358 | — | 371 | |||||||||||

Allowance for funds used during construction | — | (4,475 | ) | 4,475 | — | ||||||||||

Deferred income taxes | — | 897 | (897 | ) | — | ||||||||||

Total losses (gains) on derivatives, net | (68,849 | ) | 116 | — | (68,733 | ) | |||||||||

Net cash used for settlement of derivative instruments | (6,292 | ) | — | — | (6,292 | ) | |||||||||

Changes in operating assets and liabilities: | |||||||||||||||

Accounts payable and accrued liabilities | (111 | ) | (234 | ) | — | (345 | ) | ||||||||

Due to affiliates | — | (147 | ) | — | (147 | ) | |||||||||

Other, net | 167 | (310 | ) | — | (143 | ) | |||||||||

Other, net—affiliate | — | (5 | ) | — | (5 | ) | |||||||||

Net cash used in operating activities | (6,403 | ) | (3,199 | ) | — | (9,602 | ) | ||||||||

Cash flows from investing activities | |||||||||||||||

Property, plant and equipment, net | (165,851 | ) | (423,210 | ) | — | (589,061 | ) | ||||||||

Investments in subsidiaries | (426,414 | ) | — | 426,414 | — | ||||||||||

Net cash used in investing activities | (592,265 | ) | (423,210 | ) | 426,414 | (589,061 | ) | ||||||||

Cash flows from financing activities | |||||||||||||||

Proceeds from issuances of debt | 266,000 | — | — | 266,000 | |||||||||||

Debt issuance and deferred financing costs | (129 | ) | — | — | (129 | ) | |||||||||

Capital contributions | 189,000 | 426,414 | (426,414 | ) | 189,000 | ||||||||||

Net cash provided by financing activities | 454,871 | 426,414 | (426,414 | ) | 454,871 | ||||||||||

Net increase (decrease) in cash, cash equivalents and restricted cash | (143,797 | ) | 5 | — | (143,792 | ) | |||||||||

Cash, cash equivalents and restricted cash—beginning of period | 226,559 | — | — | 226,559 | |||||||||||

Cash, cash equivalents and restricted cash—end of period | $ | 82,762 | $ | 5 | $ | — | $ | 82,767 | |||||||

Balances per Condensed Consolidating Balance Sheet:

March 31, 2018 | |||||||||||||||

Parent Issuer | Guarantors | Eliminations | Consolidated | ||||||||||||

Cash and cash equivalents | $ | — | $ | — | $ | — | $ | — | |||||||

Restricted cash | 82,762 | 5 | — | 82,767 | |||||||||||

Total cash, cash equivalents and restricted cash | $ | 82,762 | $ | 5 | $ | — | $ | 82,767 | |||||||

22

CHENIERE CORPUS CHRISTI HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Condensed Consolidating Statement of Cash Flows | |||||||||||||||

Three Months Ended March 31, 2017 | |||||||||||||||

(in thousands) | |||||||||||||||

Parent Issuer | Guarantors | Eliminations | Consolidated | ||||||||||||

Cash flows from operating activities | |||||||||||||||

Net income (loss) | $ | 649 | $ | 2,452 | $ | (4,858 | ) | $ | (1,757 | ) | |||||

Adjustments to reconcile net income (loss) to net cash used in operating activities: | |||||||||||||||

Depreciation and amortization expense | — | 134 | — | 134 | |||||||||||

Allowance for funds used during construction | — | (4,858 | ) | 4,858 | — | ||||||||||

Total gains on derivatives, net | (1,000 | ) | — | — | (1,000 | ) | |||||||||

Net cash used for settlement of derivative instruments | (10,736 | ) | — | — | (10,736 | ) | |||||||||

Changes in operating assets and liabilities: | |||||||||||||||

Accounts payable and accrued liabilities | 269 | 34 | — | 303 | |||||||||||

Due to affiliates | — | 676 | — | 676 | |||||||||||

Other, net | 117 | (423 | ) | — | (306 | ) | |||||||||

Other, net—affiliate | — | (566 | ) | — | (566 | ) | |||||||||

Net cash used in operating activities | (10,701 | ) | (2,551 | ) | — | (13,252 | ) | ||||||||

Cash flows from investing activities | |||||||||||||||

Property, plant and equipment, net | (82,239 | ) | (656,558 | ) | — | (738,797 | ) | ||||||||

Investments in subsidiaries | (622,768 | ) | — | 622,768 | — | ||||||||||

Other | — | 36,341 | — | 36,341 | |||||||||||

Net cash used in investing activities | (705,007 | ) | (620,217 | ) | 622,768 | (702,456 | ) | ||||||||

Cash flows from financing activities | |||||||||||||||

Proceeds from issuances of debt | 548,000 | — | — | 548,000 | |||||||||||

Debt issuance and deferred financing costs | (1,088 | ) | — | — | (1,088 | ) | |||||||||

Capital contributions | 41,029 | 622,768 | (622,768 | ) | 41,029 | ||||||||||

Net cash provided by financing activities | 587,941 | 622,768 | (622,768 | ) | 587,941 | ||||||||||

Net decrease in cash, cash equivalents and restricted cash | (127,767 | ) | — | — | (127,767 | ) | |||||||||

Cash, cash equivalents and restricted cash—beginning of period | 270,540 | — | — | 270,540 | |||||||||||

Cash, cash equivalents and restricted cash—end of period | $ | 142,773 | $ | — | $ | — | $ | 142,773 | |||||||

23

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Information Regarding Forward-Looking Statements

This quarterly report contains certain statements that are, or may be deemed to be, “forward-looking statements.” All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

• | statements that we expect to commence or complete construction of our proposed LNG terminal, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates, or at all; |

• | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

• | statements regarding any financing transactions or arrangements, or our ability to enter into such transactions; |

• | statements relating to the construction of our Trains and pipeline, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any such EPC or other contractor, and anticipated costs related thereto; |

• | statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total natural gas liquefaction or storage capacities that are, or may become, subject to contracts; |

• | statements regarding our planned development and construction of additional Trains and pipeline, including the financing of such Trains; |

• | statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

• | statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change; |

• | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; and |

• | any other statements that relate to non-historical or future information. |

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this quarterly report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this quarterly report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this quarterly report and in the other reports and other information that we file with the SEC, including those discussed under “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2017. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

24

Introduction

The following discussion and analysis presents management’s view of our business, financial condition and overall performance and should be read in conjunction with our Consolidated Financial Statements and the accompanying notes. This information is intended to provide investors with an understanding of our past performance, current financial condition and outlook for the future. Our discussion and analysis includes the following subjects:

• | Overview of Business |

• | Overview of Significant Events |

• | Liquidity and Capital Resources |

• | Results of Operations |

• | Off-Balance Sheet Arrangements |

• | Summary of Critical Accounting Estimates |

• | Recent Accounting Standards |

Overview of Business

We were formed in September 2014 to develop, construct, operate, maintain and own a natural gas liquefaction and export facility (the “Liquefaction Facility”) and a 23-mile natural gas supply pipeline (the “Corpus Christi Pipeline” and together with the Liquefaction Facility, the “Liquefaction Project”) on nearly 2,000 acres of land that we own or control near Corpus Christi, Texas, through wholly-owned subsidiaries CCL and CCP, respectively.

The Liquefaction Project is being developed in stages for up to three Trains, with expected aggregate nominal production capacity, which is prior to adjusting for planned maintenance, production reliability and potential overdesign, of approximately 13.5 mtpa of LNG, three LNG storage tanks with aggregate capacity of approximately 10.1 Bcfe and two marine berths that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters. The first stage (“Stage 1”) includes Trains 1 and 2, two LNG storage tanks, one complete marine berth and a second partial berth and all of the Liquefaction Project’s necessary infrastructure facilities. The second stage (“Stage 2”) includes Train 3, one LNG storage tank and the completion of the second partial berth. The Liquefaction Project also includes the Corpus Christi Pipeline that will interconnect the Corpus Christi LNG terminal with several interstate and intrastate natural gas pipelines. Stage 1 and the Corpus Christi Pipeline are currently under construction, and Train 3 is being commercialized and has all necessary regulatory approvals in place. The construction of the Corpus Christi Pipeline is expected to be completed in second quarter of 2018.

Overview of Significant Events

Our significant accomplishments since January 1, 2018 and through the filing date of this Form 10-Q include the following:

Strategic

• | In February 2018, CCL entered into a 20-year SPA with PetroChina International Company Limited, a subsidiary of China National Petroleum Corporation, for the sale of LNG beginning in 2023. |

Financial

• | In April 2018, Cheniere engaged financial institutions to assist in the structuring and arranging of up to $6.4 billion of credit facilities for us through an amendment and upsize of our existing credit facilities (the “2015 CCH Credit Facility”), the proceeds of which will be used to fund a portion of the costs of developing, constructing and placing into service three Trains and related facilities of the Liquefaction Project, and the related pipeline being developed near Corpus Christi, Texas and for related business purposes. |

25

Liquidity and Capital Resources

The following table provides a summary of our liquidity position at March 31, 2018 and December 31, 2017 (in thousands):

March 31, | December 31, | ||||||

2018 | 2017 | ||||||

Cash and cash equivalents | $ | — | $ | — | |||

Restricted cash designated for the Liquefaction Project | 82,767 | 226,559 | |||||

Available commitments under the following credit facilities: | |||||||

2015 CCH Credit Facility | 1,820,714 | 2,086,714 | |||||

$350 million CCH Working Capital Facility (“CCH Working Capital Facility”) | 61,425 | 186,422 | |||||

For additional information regarding our debt agreements, see Note 6—Debt of our Notes to Consolidated Financial Statements in this quarterly report and Note 7—Debt of our Notes to Consolidated Financial Statements in our annual report on Form 10-K for the year ended December 31, 2017.

Liquefaction Facilities

Liquefaction Facilities

The Liquefaction Project is being developed and constructed at the Corpus Christi LNG terminal. In December 2014, we received authorization from the FERC to site, construct and operate Stages 1 and 2 of the Liquefaction Project. The following table summarizes the overall project status of Stage 1 of the Liquefaction Project as of March 31, 2018:

Stage 1 | ||

Overall project completion percentage | 85.7% | |

Completion percentage of: | ||

Engineering | 100% | |

Procurement | 100% | |

Subcontract work | 68.9% | |

Construction | 68.1% | |

Expected date of substantial completion | Train 1 | 1H 2019 |

Train 2 | 2H 2019 | |

Train 3 is being commercialized and has all necessary regulatory approvals in place. The DOE has authorized the export of domestically produced LNG by vessel from the Corpus Christi LNG terminal to FTA countries for a 25-year term and to non-FTA countries for a 20-year term up to a combined total of the equivalent of 767 Bcf/yr (approximately 15 mtpa) of natural gas. The terms of each of these authorizations begin on the earlier of the date of first export thereunder or the date specified in the particular order, which ranges from 7 to 10 years from the date the order was issued.

Customers