Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PlayAGS, Inc. | ex991.htm |

| 8-K - 8-K - PlayAGS, Inc. | a2018q1earningsrelease.htm |

May 2018

Social Casino

Table Games

Premium EGMs

Orion

Core EGMs

ICON

Specialty EGMs

Big Red

Table Equipment

Q1 2018 Results Presentation

Exhibit 99.2

2

This presentation and information contained herein constitutes confidential information and is provided to you on the condition that you will hold it in strict

confidence and not reproduce, disclose, forward or distribute it in whole or in part, other than to your directors, officers and employees who have a need to know such

information, without the prior written consent of AGS.

This presentation contains statements that constitute forward-looking statements which involve risks and uncertainties, including such risks and uncertainties

described in the Annual Report on Form 10-K of PlayAGS, Inc. (“AGS”) for the fiscal year ended December 31, 2017 filed with the Securities and Exchange Commission.

These statements include descriptions regarding the intent, belief or current expectations of AGS or its officers with respect to the consolidated results of operations

and financial condition, future events and plans of AGS. These statements can be recognized by the use of words such as "expects," "plans," "will," "estimates,"

"projects," or words of similar meaning. Such forward-looking statements are not guarantees of future performance and actual results may differ from those in the

forward-looking statements as a result of various factors and assumptions. These statements are subject to risks, uncertainties, changes in circumstances, assumptions

and other important factors, many of which are outside management’s control, that could cause actual results to differ materially from the results discussed in the

forward-looking statements. You are cautioned not to place undue reliance on these forward looking statements, which are based on the current view of the

management of AGS on future events. We undertake no obligation to publicly update or revise any forward-looking statement contained in this presentation, whether

as a result of new information, future events or otherwise, except as required by law. In light of the risks, uncertainties and assumptions, the forward-looking events

discussed in this presentation might not occur, and our actual results could differ materially from those anticipated in these forward-looking statements.

This presentation also contains references to Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and other measures that are

non-GAAP financial measures. Management believes that EBITDA and Adjusted EBITDA and related measures are commonly reported by companies and widely used

by investors as indicators of a company’s operating performance. There are other non-GAAP financial measures which should be considered only as a supplement to,

and not as a superior measure to, financial measures prepared in accordance with GAAP. Please refer to the last slide of this presentation for a reconciliation of certain

non-GAAP financial measures included in this presentation to the most directly comparable financial measure prepared in accordance with GAAP.

Unless otherwise noted, information included herein is presented as of the dates indicated. This presentation is not complete and the information contained herein

may change at any time without notice. Except as required by applicable law, we do not have any responsibility to update the presentation to account for such

changes.

Certain information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which

are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all

information available from public sources or which was provided to us by third parties. The information contained herein is subject to change, completion or

amendment and we are not under any obligation to keep you advised of such changes. We make no representation or warranty, express or implied, with respect to

the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties.

The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

3

SUMMARY OF Q1 AND FY 2018 FINANCIAL PERFORMANCE

Revenue Adjusted EBITDA

($ in mm) ($ in mm)

Tables: ($0.2)

Interactive: ($0.1)

Tables: $0.2

Interactive: $0.01

Table: ($0.3

Interactive: ($0.6)

Table: $0.2

Interactive: ($0.1)

Tables 1 4)

2 8

Tables: ($0.2)

3

Note: Adjusted EBITDA allows us to add back certain non-cash charges that are deducted in calculating net income and to deduct certain gains that are included in

calculating net income. However, these expenses and gains vary greatly, and are difficult to predict. They can represent the effect of long-term strategies as opposed

to short-term results. In addition, in the case of charges or expenses, these items can represent the reduction of cash that could be used for other corporate

purposes.

Recurring

Revenue

$49.6

Recurring

Revenue

$179.5

4

Q1 2018 BUSINESS HIGHLIGHTS

Achieved ~6% ship share(1)

Record adjusted EBITDA of $34.5 million, 39% year-over-year

Record recurring revenue of $49.6 million, 23% year-over-year

Record quarterly EGM equipment sales revenue of $15.2 million, 108% year-

over-year

838 EGMs sold in Q1 2018 vs 453 in Q1 2017, 85% year-over-year

Optimized 314 legacy EGM units in Q1 2018

Continued success of Orion Portrait premium cabinet; ended the quarter with over

2,830(2) units in the field

Orion Slant on trial at several locations – initial game performance ~2x HA

Record Table Products revenue of $1.7 million, 164% year-over-year

Table Products segment positive adjusted EBITDA in Q1 2018, 205% year-over-

year

Interactive segment positive adjusted EBITDA in Q1 2018, 108% year-over-year

(1) Q1 EILERS – FANTINI Quarterly Slot Survey

(2) Includes leased, trial and sold units

5

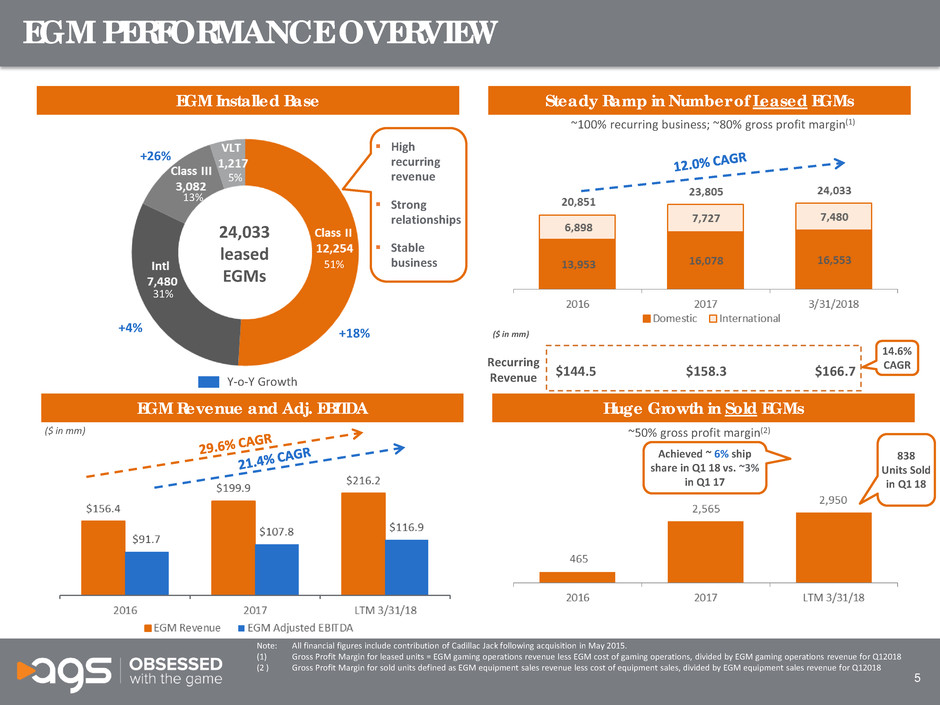

EGM PERFORMANCE OVERVIEW

EGM Installed Base

24,033

leased

EGMs

EGM Revenue and Adj. EBITDA

51%

Huge Growth in Sold EGMs

Achieved ~ 6% ship

share in Q1 18 vs. ~3%

in Q1 17

31%

13%

Steady Ramp in Number of Leased EGMs

~100% recurring business; ~80% gross profit margin(1)

+18%

+26%

+4%

Y-o-Y Growth

High

recurring

revenue

Strong

relationships

Stable

business

5%

Note: All financial figures include contribution of Cadillac Jack following acquisition in May 2015.

(1) Gross Profit Margin for leased units = EGM gaming operations revenue less EGM cost of gaming operations, divided by EGM gaming operations revenue for Q12018

(2 ) Gross Profit Margin for sold units defined as EGM equipment sales revenue less cost of equipment sales, divided by EGM equipment sales revenue for Q12018

($ in mm)

Recurring

Revenue $144.5 $158.3 $166.7

14.6%

CAGR

($ in mm)

838

Units Sold

in Q1 18

~50% gross profit margin(2)

6

Premium Leased Domestic Game Performance(1)Casino-Owned Domestic Game Performance(1)

Over 99% of customer trial Orion Portrait units resulted in conversion to a lease or sale

AGS casino-owned games generated win per day that was ~1.7x the house average, leading the

industry by a significant margin(1)

AGS premium leased games generated win per day that was ~2.4x the house average, second only

to Aristocrat(1)

Two large R&D studios in premier locations that continually produce top-performing game titles

EGM GAME PERFORMANCE OVERVIEW

(1) Q1 EILERS – FANTINI Quarterly Slot Survey

7

Table Products Installed Base and ALP

TABLE PRODUCTS PERFORMANCE OVERVIEW

~70% Side Bets

~25% Progressives

~5% Premium

Table Revenue Adj. EBITDA

($ in mm) ($ in mm)

ALP $194 $167 $220

Over 30 different products, including premium table

games (poker and blackjack derivatives), side bets,

progressive systems, card shufflers, and table

signage

170 Bonus Spin units in the field

More than quadrupled Buster Blackjack installed

base since acquisition in September 2015; 1,231

units as of Q1 18

Adjusted EBITDA positive in Q1 18

~100%

Recurring

$5.1

8

B2C - continued focus on optimizing marketing

spend by decreasing user acquisition fees

B2B focus presents new growth channel in 2018 and

beyond

Adjusted EBITDA positive in Q1 2018, 108%

year-over-year

Recently won an RFP with large operator to provide

Social WLC

INTERACTIVE PERFORMANCE OVERVIEW

Interactive Revenue Adj. EBITDA

($ in mm) ($ in mm)

9

12/31/17 3/31/18 Rate Maturity

Capitalization

Cash $19 $26

$30 million existing revolver – – L + 4.25% 6/6/2022

First lien term loan 513 511 L + 4.25% 2/15/2024

Other 3 2 Various –

Total first lien debt $515 $514

HoldCo PIK notes $153 – 11.25% 5/28/2024

Total debt $668 $514

Total net debt $649 $488

Capitalization

($ in mm)

CAPITAL STRUCTURE UPDATE

AGS priced its IPO on January 25th (NYSE: AGS)

• 10,250,000 shares offered at $16.00 per share

• Day 1 trading performance ( 15.6%), 38%+ since IPO(1)

• Greenshoe option was exercised on February 27, 2018

Repricing overview:

• On February 6, 2018, AGS repriced its existing $512.6 million term loan due February 2024

• Reprice from L + 550 bps to L + 425 bps, saving over $6 million in annual interest expense

(1) Closing price as of 5/2/18.

10

1. Continued Penetration of the Orion Portrait Cabinet and Securing Additional Banks of ICON

Opportunity to grow footprint in NV, Canada, CA, OH, MS, LA, MD, etc.

+15 unique new titles for Orion Portrait to launch in 2018

Orion Slant, Orion Portrait and ICON will help achieve 5% market share

2. New Market Entry for EGMs and Table Products

AGS obtained its gaming license in Ohio in Q1 2018

Prospective: MA, Canada, PA, CO

3. New Products to Drive Growth

Orion Slant official launch in Q2 2018; “Core Plus” cabinet

• +20 new titles for Orion Slant to launch in 2018

STAX multi-level progressive jackpot system and DEX S card shuffler

• B2B Social WLC and RMG opportunities

4. International Expansion Opportunities

Alora video bingo cabinet touched ground in Philippines in Q1 2018; anticipated go live in Q2

If legalization of regulated gaming is passed, Brazil presents additional upside

STRATEGIC INITIATIVES TO DRIVE GROWTH

11

Market

Stage Jurisdiction

Estimated Total

Units in State(1)

AGS Estimated

Current Market

Share

Established /

Class II

Texas 4,107 41.6%

Alabama 6,527 42.3%

Oklahoma 74,787 9.5%

Ramping

Florida 21,160 9.3%

Montana 17,684 3.3%

California 72,850 1.9%

Early Entry

Indiana 18,924 1.9%

Mississippi 30,347 0.9%

New York 35,132 0.8%

New Mexico 20,545 0.7%

Michigan 31,486 0.6%

Iowa 19,248 0.6%

Nevada 161,484 0.5%

Louisiana 41,837 0.5%

Ontario 22,834 0.2%

Alberta 20,495 0.0%

Ohio 18,733 0.0%

Quebec 17,400 0.0%

Other(2) 241,904 1.7%

Prospective Other(3) 105,207 0.0%

Total 982,691 2.3%

SIGNIFICANT WHITESPACE OPPORTUNITY

7%

6%

20%

AGS Q1 ship share

of ~6%

demonstrates path

to further market

share growth(1)

(1) Q1 EILERS – FANTINI Quarterly Slot Survey

(2) Other Early Entry jurisdictions include AZ, CT, DE, ID, IL, KS, MD, MN, ND, NE, NJ, NC, OR, SD, WA, WI, WY and the Canadian provinces of Manitoba and

Saskatchewan

(3) AGS is not currently licensed in U.S. states of AK, AR, CO, KY, ME, MA, MO, PA, RI, WV and Canadian provinces of British Columbia, New Brunswick,

Newfoundland & Labrador, Nova Scotia, and Prince Edward Island

Solid recurring revenue base and

market leadership in core markets of

TX, AL and OK

AGS has aggressively secured licenses

in, and begun to penetrate, key

Class III markets (e.g., NV, Canada, MS)

Orion Portrait and ICON are driving the

growth in early-entry markets

Recent ship share gains far in excess of

current market share; goal of 5%

AGS is not dependent on the

replacement cycle to grow

1% market share when excluding

established markets

4%

12

FY REVISED 2018 OUTLOOK

The Company expects to generate adjusted EBITDA, a non-GAAP financial measure defined below,

of $126 - $131 million in 2018, representing growth of approximately 18%-23% compared to the

prior year period.

AGS expects 2018 capital expenditures to be in the range of $55 - $60 million, compared to the

prior year period, reflecting an expectation for a continued increase in its installed base in both

existing and new markets.

($ in mm)

2017

Revised

2018 Guidance

Adj. EBITDA $106.8 $126 - $131

Capex $57.5 $55 - $60

APPENDIX

14

COMPREHENSIVE OPERATIONAL SUMMARY

($ in mm, except RPD, ASP, ALP and ARPDAU)

Operational and other data 2016 Q1 Q2 Q3 Q4 2017 Q1 LTM 3/31/18

Revenues by segment

EGM $156.4 $45.0 $47.4 $53.3 $54.2 $199.9 $61.3 $216.2

Table products 2.7 0.6 0.7 1.1 1.6 4.1 1.7 5.1

Interactive 7.7 2.1 2.0 2.0 1.9 8.0 1.9 7.8

Total revenue $166.8 $47.8 $50.1 $56.4 $57.7 $212.0 $64.9 $229.0

Adjusted EBITDA by segment

EGM $91.7 $25.2 $26.5 $29.8 $26.3 $107.8 $34.3 $116.9

% margin 58.6% 56.0% 55.9% 55.8% 48.6% 53.9% 56.0% 54.1%

Table products (1.7) (0.2) (0.3) (0.2) 0.2 (0.5) 0.2 (0.2)

Interactive (4.7) (0.1) (0.1) (0.1) (0.1) (0.4) 0.0 (0.3)

Total Adjusted EBITDA $85.3 $24.9 $26.1 $29.4 $26.4 $106.8 $34.5 $116.4

% margin 51.2% 52.1% 52.1% 52.1% 45.9% 50.4% 53.2% 50.8%

EGM segment

Total installed base units 20,851 21,204 21,479 22,015 23,805 23,805 24,033 24,033

Total revenue per day $19.78 $19.93 $19.99 $19.65 $19.95 $19.88 $20.94 $19.88

EGM units sold 465 453 574 842 696 2,565 838 2,950

Average sales price $14,897 $15,695 $15,840 $15,890 $17,676 $16,329 $17,758 $16,833

Table products segment

Table products install base 1,500 1,691 1,754 2,350 2,400 2,400 2,631 2,631

Average monthly lease price $194 $128 $125 $167 $226 $167 $220 $190

Interactive segment

Average MAU 209,840 192,560 183,912 194,239 200,628 192,835 224,183 200,741

Average DAU 41,478 38,534 37,191 36,906 37,536 37,542 40,720 38,088

ARPDAU $0.48 $0.57 $0.58 $0.59 $0.54 $0.57 $0.51 $0.55

15

2

Write downs and other includes items related to loss

on disposal or impairment of long lived assets, fair

value adjustments to contingent consideration and

acquisition costs

Loss on extinguishment and modification of debt

primarily relates to the refinancing of long-term debt,

in which deferred loan costs and discounts related to

old senior secured credit facilities were written off

Other adjustments are primarily composed of

professional fees incurred for projects, corporate and

public filing compliance, contract cancellation fees

and other transaction costs deemed to be non-

operating in nature

Other non-cash charges are costs related to non-cash

charges and losses on the disposition of assets, non-

cash charges on capitalized installation and delivery,

which primarily includes the costs to acquire contracts

that are expensed over the estimated life of each

contract and non-cash charges related to accretion of

contract rights under development agreements

New jurisdiction and regulatory license costs relates

primarily to one-time non-operating costs incurred to

obtain new licenses and develop products for new

jurisdictions

Legal & litigation expenses include of payments to

law firms and settlements for matters that are outside

the normal course of business

Acquisition and integration costs include

restructuring and severance and are related to costs

incurred after the purchase of businesses, such as the

acquisitions of Cadillac Jack and RocketPlay, to

integrate operations

Non-cash stock compensation are expenses related to

the value of stock options held by employees of

Cadillac Jack

1

2

3

4

5

6

7

3

4

5

6

7

1

TOTAL ADJUSTED EBITDA RECONCILIATION

($ in mm)

Adj. EBITDA reconciliation Q1

LTM

3/31/18

Net income ($9.5) ($42.3)

Income tax (benefit) expense (12.4) (16.6)

Depreciation and amortization 19.3 72.5

Other expense (income) 9.2 9.1

Interest income (0.1) (0.1)

Interest expense 10.4 50.8

Write downs and other 1.6 5.9

Loss on extinguishment and modification of debt 4.6 13.6

Other adjustments 0.4 2.6

Other non-cash charges 1.6 7.3

New jurisdiction and regulatory licensing costs – 1.8

Legal & litigation expenses including settlement payments – 0.1

Acquisition & integration related costs 1.2 3.5

Non-cash stock compensation 8.2 8.2

Adjusted EBITDA $34.5 $116.4

2

3

4

5

6

7

1

($ in mm)

Adj. EBITDA reconciliation Q1 Q2 Q3 Q4 2017

Net income ($12.4) ($20.1) ($4.1) ($8.5) ($45.1)

Income tax (benefit) expense 2.2 1.3 1.1 (6.5) (1.9)

Depreciation and amortization 18.5 18.2 16.9 18.1 71.6

Other expense (income) (2.8) (1.5) (0.5) 1.9 (2.9)

Interest income (0.0) (0.0) (0.0) (0.0) (0.1)

Interest expense 15.2 14.6 12.7 13.1 55.5

Write downs and other 0.2 1.9 0.5 1.8 4.5

Loss on extinguishment and modification of debt – 8.1 – 0.9 9.0

Other adjustments 0.6 0.9 0.5 0.8 2.9

Other non-cash charges 2.1 1.8 1.6 2.3 7.8

New jurisdiction and regulatory licensing costs 0.2 0.5 0.6 0.8 2.1

Legal & litigation expenses including settlement payment 0.4 0.2 0.2 (0.2) 0.5

Acquisition & integration related costs 0.6 0.2 0.1 2.0 2.9

Adjusted EBITDA $24.9 $26.1 $29.4 $26.4 $106.8

8

8

16

Unless otherwise indicated or the context otherwise requires, the following terms in this presentation have the

meanings set forth below:

Adjusted EBITDA: Total adjusted EBITDA is not a presentation made in accordance with GAAP. Our use of the term total adjusted

EBITDA may vary from others in our industry. Total adjusted EBITDA should not be considered as an alternative to operating income

or net income

Average Monthly Lease Price (ALP): Average monthly lease price is calculated by dividing (a) total revenues recognized and directly

attributable to Table Products by (b) the number of Table Products Installed Base and by (c) the number of months in such period

Average Revenue per Daily Active User (ARPDAU): ARPDAU is calculated by dividing (a) daily revenue by (b) the number of Daily

Active Users

Average Sales Price (ASP): Average sales price is calculated by dividing (a) total revenues recognized and directly attributable to

EGM unit sales in a period by (b) the number of EGM units sold over that same period

Daily Active Users (DAU): DAU is a count of daily unique visitors to a site

EGM Installed Base: EGM Installed Base is the number of recurring revenue EGM units installed on a specified date

Electronic Gaming Machine (EGM): EGMs include but are not limited to slot machines, Class II machines, video poker and video

lottery machines

Monthly Active Users (MAU): MAU is a count of monthly unique visitors to a site

Recurring Revenue: Equal to the Gaming Operations Revenue line of our audited financial statements

Revenue Per Day (RPD): RPD is calculated by dividing (a) total revenues over a specified period recognized and directly attributable

to units on lease (whether on a participation or daily fee arrangement) by (b) the number of units installed over that period and by

(c) the number of days in such period

Ship Share: Ship Share is the share of all slots sold in a specified period

Table Products Installed Base: Table Products Installed Base is the number of recurring revenue table products installed on a

specified date

TERMS USED IN THIS PRESENTATION

CONNECT WITH US