Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K FOR 2018 ASM SLIDE DECK - VIDLER WATER RESOURCES, INC. | form8-kfor2018asmslidedeck.htm |

1

PICO Holdings, Inc.

Annual Meeting of Shareholders

May 3, 2018

2 2

SAFE HARBOR STATEMENT

This presentation contains forward-looking statements made pursuant to the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-

looking statements often address current expected future business and financial

performance, including the demand and pricing for PICO’s real estate and water assets,

the completion of proposed monetization transactions, the return of proceeds to

shareholders, and the reduction of costs, and may contain words such as “expects,”

“estimates,” “anticipates,” “intends,” “plans,“ “believes,” “seeks,” or “will”. All forward-

looking statements included in this presentation are based on information available to

PICO as of the date hereof, and PICO assumes no obligation to update any such forward-

looking statements. Actual results could differ materially from those described in the

forward-looking statements. Forward-looking statements involve risks and

uncertainties, including, but not limited to, economic, competitive and governmental

factors outside of our control, that may cause our business, industry, strategy or actual

results to differ materially from the forward-looking statements. Factors that could

cause or contribute to such differences include, but are not limited to those discussed in

detail under the heading “Risk Factors” in PICO’s periodic reports filed with the U.S.

Securities and Exchange Commission.

3 3

Business Plan

OUR BUSINESS PLAN IS UNCHANGED AFTER THE

TERMINATION OF THE STRATEGIC REVIEW PROCESS

• Creatively monetize existing assets at

maximum possible present value

• Return proceeds to our shareholders

• Reduce costs

4 4

Accomplishments in the past Eighteen Months

• Monetized our entire 57% stake in UCP, Inc. for $114.5 million

through the merger and subsequent disposal of our shares in

Century Communities, Inc.

• Monetized a portion of our Arizona Long Term Storage Credits

for $25.9 million in 2017

• Returned $115.9 million to shareholders through a tax-free

return of capital

• Repurchased 489,878 shares on the open market as of March

31, 2018

5 5

Accomplishments in the past Eighteen Months (cont’d)

• Reduced G&A and other costs in 2017 versus 2016 by

approximately $20.4 million (this comparison includes the $10.4

million severance cost to our former CEO in 2016)

• Put in place a Tax Benefits Preservation Plan for our federal

NOLs of approximately $185.5 million at December 31, 2017

• Improved our corporate governance (for example, all Board

members now have annual board terms)

6 6

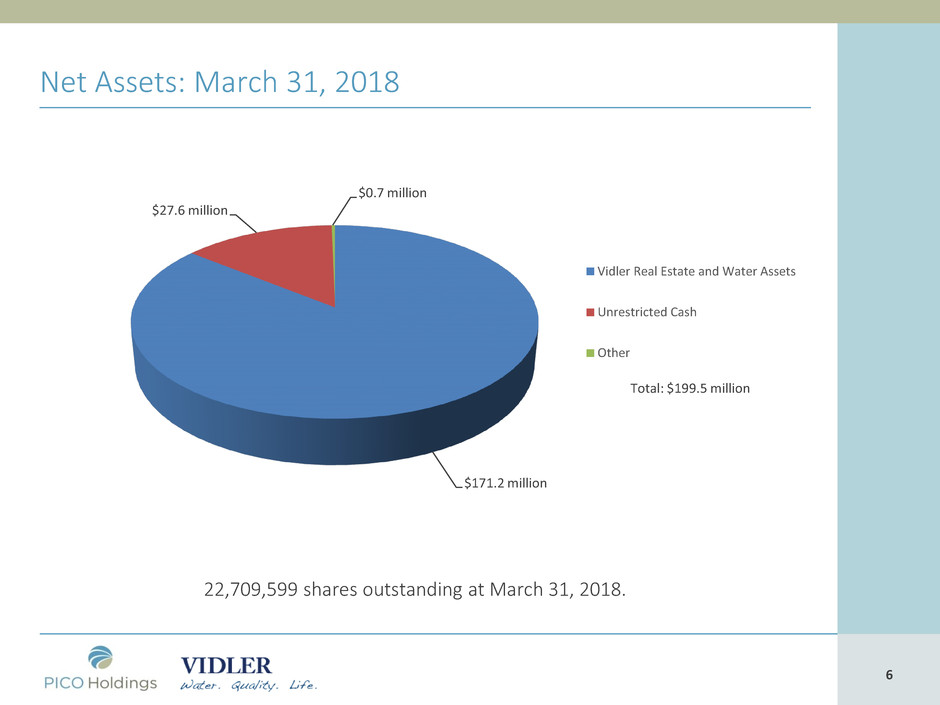

Net Assets: March 31, 2018

22,709,599 shares outstanding at March 31, 2018.

$171.2 million

$27.6 million

$0.7 million

Vidler Real Estate and Water Assets

Unrestricted Cash

Other

Total: $199.5 million

7 7

EPIC Report Update: Northern Nevada Study Area

Note: Scenario B of the EPIC Forecast projects an increase of 42,400 new residents to the Study Area between December 2014

and December 2019, while Scenario B2 forecasts 64,700 new residents.

Jobs Dec-14 Feb-18 # Change % Change

EPIC (B) 596,637 620,699 24,063 4.0%

EPIC (B2) 596,637 633,738 37,101 6.2%

Actual 596,637 625,516 28,879 4.8%

8 8

Note: Scenario B of the EPIC Forecast projects an increase of 52,400 new jobs to the Study Area between December 2014 and

December 2019

EPIC Report Update: Northern Nevada Study Area

Jobs Dec-14 Feb-18 # Change % Change

EPIC (B) 353,404 388,148 34,744 9.8%

Actual 353,404 400,321 46,917 13.3%

9 9

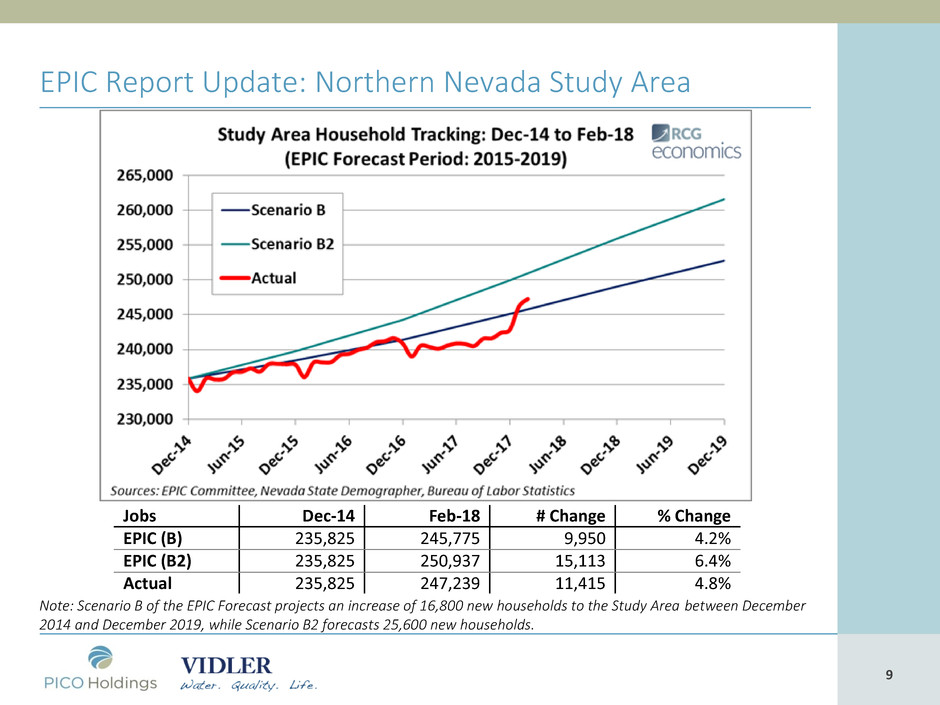

EPIC Report Update: Northern Nevada Study Area

Note: Scenario B of the EPIC Forecast projects an increase of 16,800 new households to the Study Area between December

2014 and December 2019, while Scenario B2 forecasts 25,600 new households.

Jobs Dec-14 Feb-18 # Change % Change

EPIC (B) 235,825 245,775 9,950 4.2%

EPIC (B2) 235,825 250,937 15,113 6.4%

Actual 235,825 247,239 11,415 4.8%

10 10

Sources: Washoe County Assessor and Department of Employment, Training, & Rehabilitation (CES data)

2005 = Peak of

New Units (6,004)

RENO-SPARKS REGIONAL ECONOMY – MARCH 2018

11 11

Source: Washoe County Assessor

RENO-SPARKS REGIONAL ECONOMY – MARCH 2018

12 12

Source: Northern Nevada Regional MLS

Jan-18 = $360,000 (19%↑)

Feb-18 = $370,000 (16%↑)

RENO-SPARKS REGIONAL ECONOMY – MARCH 2018

13 13

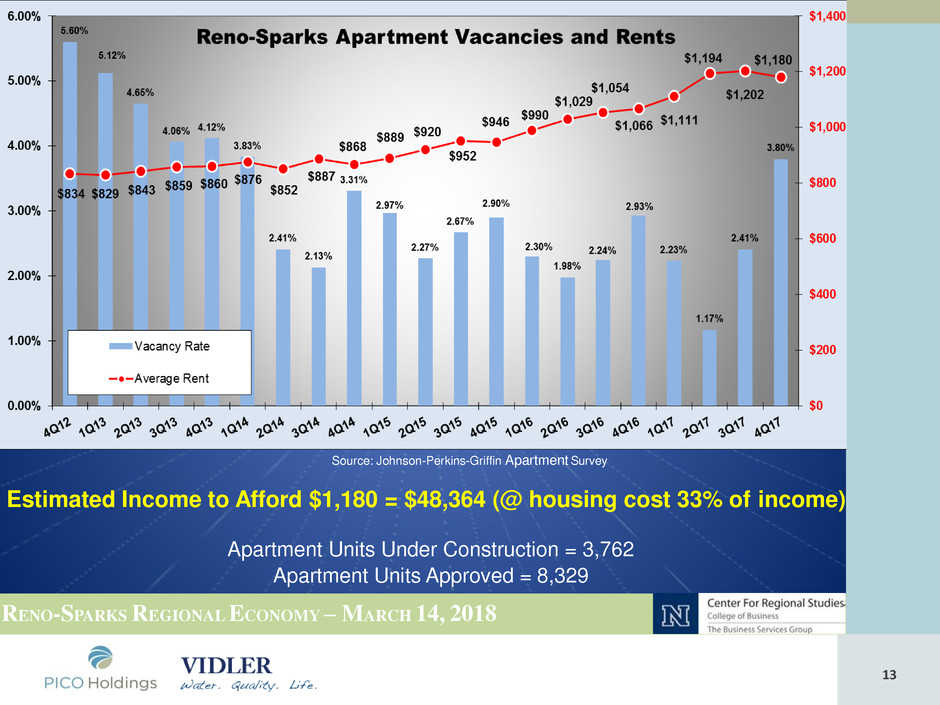

Source: Johnson-Perkins-Griffin Apartment Survey

Estimated Income to Afford $1,180 = $48,364 (@ housing cost 33% of income)

Apartment Units Under Construction = 3,762

Apartment Units Approved = 8,329

RENO-SPARKS REGIONAL ECONOMY – MARCH 14, 2018

14 14

Source: American Community Survey, US Census Bureau

RENO-SPARKS REGIONAL ECONOMY – MARCH 2018

15 15

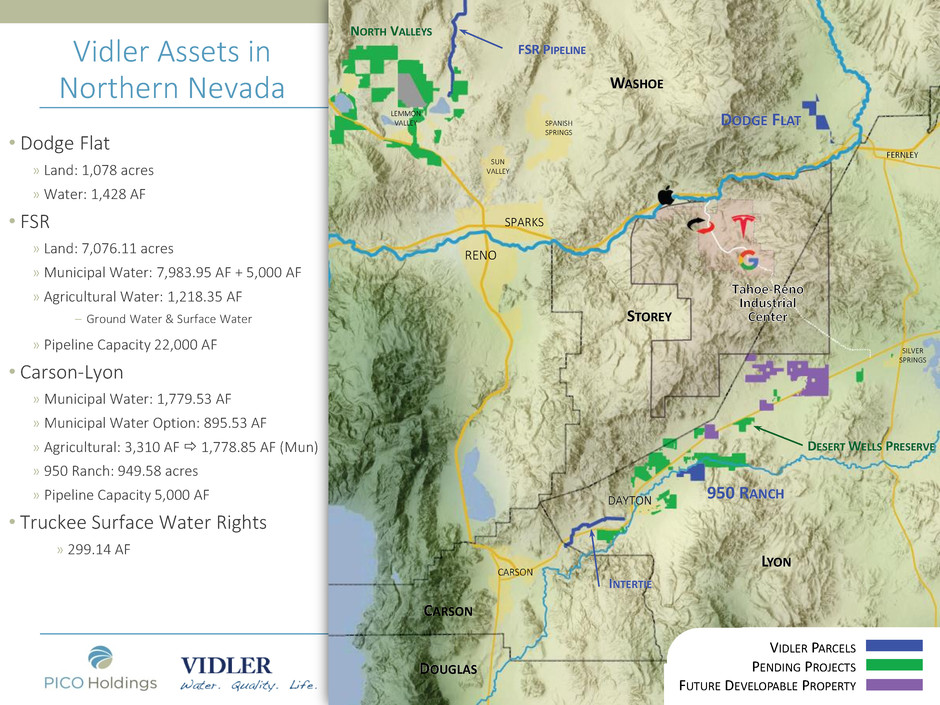

VIDLER PARCELS

PENDING PROJECTS

FUTURE DEVELOPABLE PROPERTY

WASHOE

DESERT WELLS PRESERVE

DODGE FLAT

RENO

SPARKS

FERNLEY

DAYTON

CARSON

950 RANCH

NORTH VALLEYS

STOREY

LYON

DOUGLAS

CARSON

SPANISH

SPRINGS

SUN

VALLEY

SILVER

SPRINGS

LEMMON

VALLEY

FSR PIPELINE

INTERTIE

Vidler Assets in

Northern Nevada

• Dodge Flat

» Land: 1,078 acres

» Water: 1,428 AF

• FSR

» Land: 7,076.11 acres

» Municipal Water: 7,983.95 AF + 5,000 AF

» Agricultural Water: 1,218.35 AF

– Ground Water & Surface Water

» Pipeline Capacity 22,000 AF

• Carson-Lyon

» Municipal Water: 1,779.53 AF

» Municipal Water Option: 895.53 AF

» Agricultural: 3,310 AF 1,778.85 AF (Mun)

» 950 Ranch: 949.58 acres

» Pipeline Capacity 5,000 AF

• Truckee Surface Water Rights

» 299.14 AF

16 16

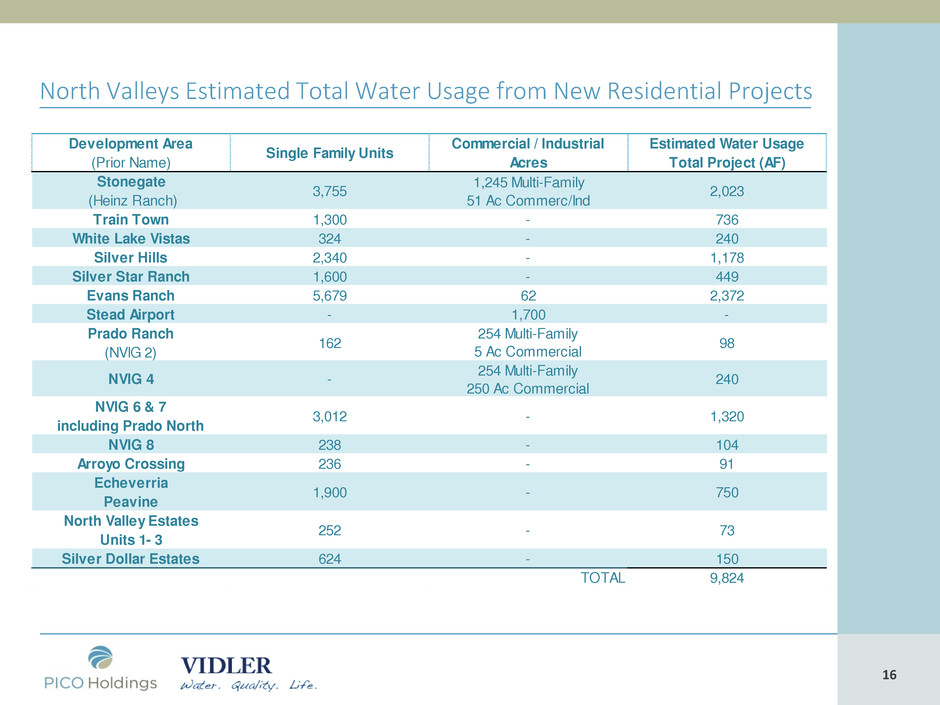

North Valleys Estimated Total Water Usage from New Residential Projects

Development Area

(Prior Name)

Single Family Units

Commercial / Industrial

Acres

Estimated Water Usage

Total Project (AF)

Stonegate

(Heinz Ranch)

3,755

1,245 Multi-Family

51 Ac Commerc/Ind

2,023

Train Town 1,300 - 736

White Lake Vistas 324 - 240

Silver Hills 2,340 - 1,178

Silver Star Ranch 1,600 - 449

Evans Ranch 5,679 62 2,372

Stead Airport - 1,700 -

Prado Ranch

(NVIG 2)

162

254 Multi-Family

5 Ac Commercial

98

NVIG 4 -

254 Multi-Family

250 Ac Commercial

240

NVIG 6 & 7

including Prado North

3,012 - 1,320

NVIG 8 238 - 104

Arroyo Crossing 236 - 91

Echeverria

Peavine

1,900 - 750

North Valley Estates

Units 1- 3

252 - 73

Silver Dollar Estates 624 - 150

TOTAL 9,824

17 17

Vidler Assets in Southern Nevada – Lincoln-Vidler Teaming Agreement

1. Garden Valley

2. Coal Valley

3. Pahroc Valley

4. Dry Lake Valley

5. Clover Valley

6. Tule Desert

7. Kane Springs Valley

1

2 3

4

5

6 7

18 18

Tule Desert and Clover Valley – Lincoln-Vidler Teaming Agreement

• Tule Desert

» 2,900 AF permitted water rights

– Additional water may be

awarded after 8 years of

pumping, up to 4,340 AF

• Clover Valley

» Applications filed

19 19

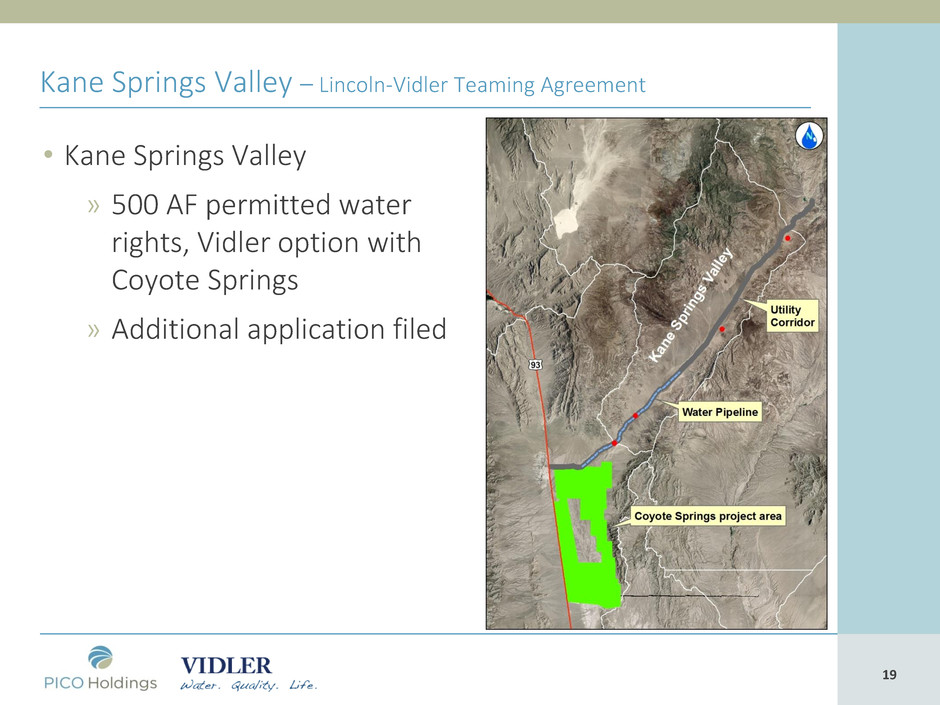

Kane Springs Valley – Lincoln-Vidler Teaming Agreement

• Kane Springs Valley

» 500 AF permitted water

rights, Vidler option with

Coyote Springs

» Additional application filed

20 20

Dry Lake Valley – Lincoln-Vidler Teaming Agreement

• Dry Lake Valley

» 1,009 AF certificated

agricultural water rights

» 600 acre parcel located

within BLM-designated solar

energy development zone

21 21

Garden Valley, Coal Valley & Pahroc Valley – Lincoln-Vidler Teaming Agreement

• Garden Valley

» Applications filed

• Coal Valley

» Applications filed

• Pahroc Valley

» Applications filed

22 22

Phoenix AMA

Harquahala INA

Vidler Assets in Arizona, Long-Term Storage Credits Location LTSC (AF)

Harquahala INA 250,682.53

Current Phoenix AMA 53,816.69

AMA under Contract -13,650.00

Total Phoenix AMA 40,166.69

Grand Total 290,849.22

California

Nevada

Utah

New

Mexico

Colorado

23 23

Long-Term Storage Credits Under Contract in Arizona

PHOENIX ACTIVE MANANGEMENT AREA RECHARGE CREDITS

» 13,650 Long-Term Storage Credits under Contract

– Apache Sun Golf: 1,150 LTSC pricing $306.26 to $375.18 per

credit, contract terminates 9/30/21

– Roosevelt Water Conservation District: 12,500 LTSC pricing

$367.50 to $423.50 per credit, contract terminates 12/31/19

24 24

Colorado River Basin Water Supply Forecast:

(Source: April 10, 2018 US Bureau of Reclamation, data provided by NRCS, Snow Pack Conditions Map)

• Snowpack conditions throughout Upper Basin – Approximately half of the

upper Colorado River Basin watershed at less than 50% of the median snow

water equivalent (“SWE” or the amount of water contained within the snow

pack).

• Lower Colorado River Basin (AZ, southern parts of UT, & western NM). Data

also indicates most of the watershed at 50% of the median SWE, or less.

• Based on the March 2018 USBR 24 month study, releases from Lake Powell

are projected to include an April 2018 equalization release for a total of 9.0

MAF in water year 2018.

• Current runoff projection into Lake Powell are forecasted to be ~50% of

average, April through July.

25 25

Vidler Assets in

New Mexico

• Lower Rio Grande

»Agricultural Water: 1,214.78 AF

• Middle Rio Grand

»Municipal Water: 99.09 AF

•Campbell Ranch (Application)

»Municipal Water: 350 AF

Albuquerque

Santa Fe

Las Cruces

Campbell Ranch

26 26

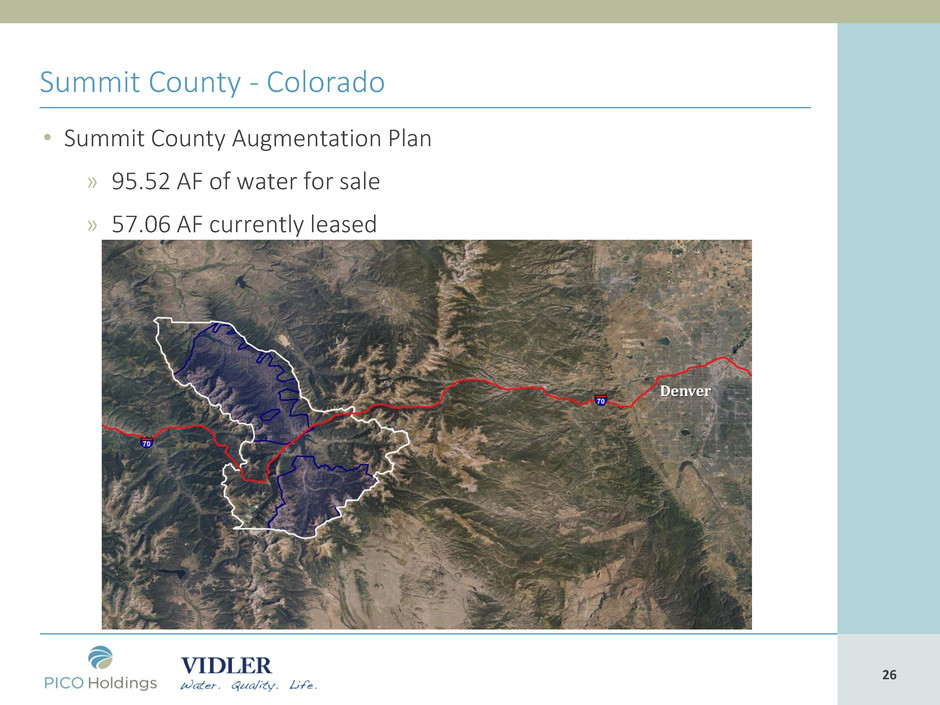

Summit County - Colorado

• Summit County Augmentation Plan

» 95.52 AF of water for sale

» 57.06 AF currently leased

Denver

27 27

Vidler’s Major Assets: Summary

Arizona Long-Term Storage Credits

» Resource driven: Pent-up demand exists in AZ due to the Colorado River Lower

Basin structural deficit and the lack of other significant sources of available

LTSCs.

Northern Nevada Assets (North Valleys, Reno and Dayton corridor areas)

» Market driven: Pent-up demand due to housing shortages and lack of available

water in the North Valleys and Dayton corridor: BUT actual monetization and

timing of sales is highly dependent on new residential and commercial demand

occurring as part of the “Reno/ Northern Nevada Growth” story.

28 28

Return of Monetization Proceeds to Shareholders

2017

• Special Dividend (tax-free return of capital) of $5 per share

(approximately $115.9 million)

• 47,450 shares repurchased on the open market

2018

• Open market repurchases of stock: 442,428 shares repurchased in

Q1 2018 for total cost of $5 million (average cost $11.29 per share)

• Any significant additional monetization proceeds anticipated to be

returned to shareholders through tender offer, and/or open market

repurchases, and/or special dividends depending on facts and

circumstances existing at the time of monetization

29 29

Reducing Net Costs

• In first quarter 2018 we revised director compensation so that

from May 3, 2018, aggregate annual Board compensation will

now be $105,000 if taken in cash or $131,250 if taken in the

form of restricted stock units (vs. 2017 total $755,318)

• Anticipated reduction in New Mexico project costs in the future

• Ongoing review of cost base as assets are monetized

• Sourcing recurring lease revenue on non-core assets (for

example, Fish Springs Ranch solar lease and CO & NV water

rights leases)

30 30

Reducing Net Costs (cont’d)

• Closing La Jolla, CA office: Transitioning and migrating all

functions (treasury, accounting, financial reporting, corporate

administration, IT & HR) to Vidler’s existing Carson City office

• Vidler’s existing Carson City office will become the new

headquarters of PICO Holdings, Inc.

• In process of reviewing overall group management function and

structure

31 31

Q. & A.