Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DuPont de Nemours, Inc. | enr8-k1q18.htm |

| EX-99.1 - EXHIBIT 99.1 - DuPont de Nemours, Inc. | exhibit991enrschedules1q18.htm |

DowDuPont

1Q18 Earnings Conference Call

May 3, 2018

Safe Harbor Statement

Regulation G

This presentation includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures include the Company's pro forma consolidated

results and pro forma earnings per share on an adjusted basis, which excludes the after-tax impact of pro forma significant items and the after-tax impact of pro forma amortization

expense associated with DuPont's intangible assets. Management uses these measures internally for planning, forecasting and evaluating the performance of the Company's

segments, including allocating resources. DowDuPont's management believes that these non-GAAP measures best reflect the ongoing performance of the Company during the periods

presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful

comparison of year-over-year results. These non-GAAP measures supplement the Company's U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP

measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Reconciliations of non-GAAP

measures to GAAP are provided in the financial schedules attached to the earnings news release and the Investor Relations section of the Company’s website. DowDuPont does not

provide forward-looking GAAP financial measures or a reconciliation of forward-looking non-GAAP financial measures to the most comparable GAAP financial measures on a forward-

looking basis because the Company is unable to predict with reasonable certainty the ultimate outcome of pending litigation, unusual gains and losses, foreign currency exchange gains

or losses, potential future asset impairments and purchase accounting fair value adjustments, as well as discrete taxable events, without unreasonable effort. These items are

uncertain, depend on various factors, and could have a material impact on GAAP results for the guidance period.

Operating EBITDA is defined as earnings (i.e.,” Income from continuing operations before income taxes”) before interest, depreciation, amortization and foreign exchange gains

(losses), excluding significant items. Pro forma Operating EBITDA is defined as pro forma earnings (i.e., pro forma “Income from continuing operations before income taxes”) before

interest, depreciation, amortization and foreign exchange gains (losses), excluding the impact of adjusted significant items.

Adjusted EPS is defined as “Earnings per common share from continuing operations – diluted” excluding the after-tax impact of significant items and the after-tax impact of amortization

expense associated with DuPont’s intangible assets. Pro forma Adjusted EPS is defined as “Pro forma earnings per common share from continuing operations – diluted” excluding the

after-tax impact of pro forma significant items and the after-tax impact of pro forma amortization expense associated with DuPont’s intangible assets. Full year and prior year

information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

Cautionary Statement about Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and

financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” and similar expressions and variations or

negatives of these words.

On December 11, 2015, The Dow Chemical Company (“Dow”) and E. I. du Pont de Nemours and Company (“DuPont”) entered into an Agreement and Plan of Merger, as amended on

March 31, 2017, (the “Merger Agreement”) under which the companies would combine in an all-stock merger of equals transaction (the “Merger”). Effective August 31, 2017, the Merger

was completed and each of Dow and DuPont became subsidiaries of DowDuPont (Dow and DuPont, and their respective subsidiaries, collectively referred to as the "Subsidiaries").

Forward-looking statements by their nature address matters that are, to varying degrees, uncertain, including the intended separation, subject to approval of the Company’s Board of

Directors, and customary closing conditions, of DowDuPont’s agriculture, materials science and specialty products businesses in one or more tax-efficient transactions on anticipated

terms (the “Intended Business Separations”). Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future

events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the Company’s control. Some of the important factors

that could cause DowDuPont’s, Dow’s or DuPont’s actual results to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) costs

to achieve and achieving the successful integration of the respective agriculture, materials science and specialty products businesses of Dow and DuPont, anticipated tax treatment,

unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, productivity actions, economic performance, indebtedness, financial condition, losses, future prospects,

business and management strategies for the management, expansion and growth of the combined operations; (ii) costs to achieve and achievement of the anticipated synergies by the

combined agriculture, materials science and specialty products businesses; (iii) risks associated with the Intended Business Separations, including conditions which could delay,

prevent or otherwise adversely affect the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances related to the Intended

2 ©2018 DowDuPont. All rights reserved.

Safe Harbor Statement, continued

Forward-Looking Statements, continued

Business Separations, associated costs, disruptions in the financial markets or other potential barriers; (iv) disruptions or business uncertainty, including from the Intended Business

Separations, could adversely impact DowDuPont’s business (either directly or as conducted by and through Dow or DuPont), or financial performance and its ability to retain and hire key

personnel; (v) uncertainty as to the long-term value of DowDuPont common stock; and (vi) risks to DowDuPont’s, Dow’s and DuPont’s business, operations and results of operations from:

the availability of and fluctuations in the cost of feedstocks and energy; balance of supply and demand and the impact of balance on prices; failure to develop and market new products

and optimally manage product life cycles; ability, cost and impact on business operations, including the supply chain, of responding to changes in market acceptance, rules, regulations

and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and other commitments and contingencies; failure to appropriately manage

process safety and product stewardship issues; global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation, interest and

currency exchange rates; changes in political conditions, including trade disputes and retaliatory actions; business or supply disruptions; security threats, such as acts of sabotage,

terrorism or war, natural disasters and weather events and patterns which could result in a significant operational event for the Company, adversely impact demand or production; ability to

discover, develop and protect new technologies and to protect and enforce the Company’s intellectual property rights; failure to effectively manage acquisitions, divestitures, alliances, joint

ventures and other portfolio changes; unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as

management’s response to any of the aforementioned factors. These risks are and will be more fully discussed in the current, quarterly and annual reports filed with the U. S. Securities

and Exchange Commission by DowDuPont. While the list of factors presented here is, considered representative, no such list should be considered to be a complete statement of all

potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in

results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to

third parties and similar risks, any of which could have a material adverse effect on DowDuPont’s, Dow’s or DuPont’s consolidated financial condition, results of operations, credit rating or

liquidity. None of DowDuPont, Dow or DuPont assumes any obligation to publicly provide revisions or updates to any forward-looking statements whether as a result of new information,

future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. A detailed discussion of some of the significant

risks and uncertainties which may cause results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” (Part I, Item 1A) of

DowDuPont’s 2017 annual report on Form 10-K.

The Dow Diamond, DuPont Oval logo, DuPont™, the DowDuPont logo and all products, unless otherwise noted, denoted with ™, ℠ or ® are trademarks, service marks or registered

trademarks of The Dow Chemical Company, E. I. du Pont de Nemours and Company, DowDuPont Inc. or their affiliates.

In order to provide the most meaningful comparison of results of operations and results by segment, supplemental unaudited pro forma financial information has been included in the

following financial schedules. The unaudited pro forma financial information is based on the historical consolidated financial statements and accompanying notes of both Dow and DuPont

and has been prepared to illustrate the effects of the Merger, assuming the Merger had been consummated on January 1, 2016. The results for the three months ended March 31, 2018,

are presented on a U.S. GAAP basis. For all other periods presented, adjustments have been made for (1) the preliminary purchase accounting impact, (2) accounting policy alignment, (3)

eliminate the effect of events that are directly attributable to the Merger Agreement (e.g., one-time transaction costs), (4) eliminate the impact of transactions between Dow and DuPont,

and (5) eliminate the effect of consummated divestitures agreed to with certain regulatory agencies as a condition of approval for the Merger. The unaudited pro forma financial information

was based on and should be read in conjunction with the separate historical financial statements and accompanying notes contained in each of the Dow and DuPont Quarterly Reports on

Form 10-Q and Annual Reports on Form 10-K for the applicable periods. The pro forma financial statements were prepared in accordance with Article 11 of Regulation S-X. The unaudited

pro forma financial information has been presented for informational purposes only and is not necessarily indicative of what DowDuPont's results of operations actually would have been

had the Merger been completed as of January 1, 2016, nor is it indicative of the future operating results of DowDuPont. The unaudited pro forma financial information does not reflect any

cost or growth synergies that DowDuPont may achieve as a result of the Merger, future costs to combine the operations of Dow and DuPont or the costs necessary to achieve any cost or

growth synergies.

Discussion of revenue, operating EBITDA and price/volume metrics on a divisional basis for Agriculture is based on the results of the Agriculture segment; for Materials Science is based

on the combined results of the Performance Materials & Coatings, Industrial Intermediates & Infrastructure, and Packaging & Specialty Plastics segments; and for Specialty Products is

based on the combined results of the Electronics & Imaging, Nutrition & Biosciences, Transportation & Advanced Polymers, and Safety & Construction segments. The divisional

discussions are for informational purposes only and do not purport to be indicative of results, including on a pro forma basis, for each of Agriculture, Materials Science and Specialty

Products on a standalone basis as if the Intended Business Separations had already occurred. Furthermore, the divisional discussions should not be construed as representative of future

results of operations or financial condition for each of Agriculture, Materials Science and Specialty Products on a standalone basis in connection with the Intended Business Separations.

3 ©2018 DowDuPont. All rights reserved.

First Quarter Highlights

4 ©2018 DowDuPont. All rights reserved.

Financial & Operational Highlights

– Sales grew 5% with gains in most segments and geographies

– Materials Science +17% and Specialty Products +11%, each with gains in

all regions

– Local price and volume gains in Materials Science and Specialty Products

more than offset weather-related declines in Ag

– Operating EBITDA increased 6%, up in all segments except Ag

– Materials Science +23% and Specialty Products +25%

– Adjusted EPS rose 7%

Cost Synergy Highlights

– >$300MM of cost synergy savings in 1Q

– On pace to deliver 75% of $3.3B run-rate by end of 3Q18

– Raising year-over-year cost savings target in 2018 to $1.2B

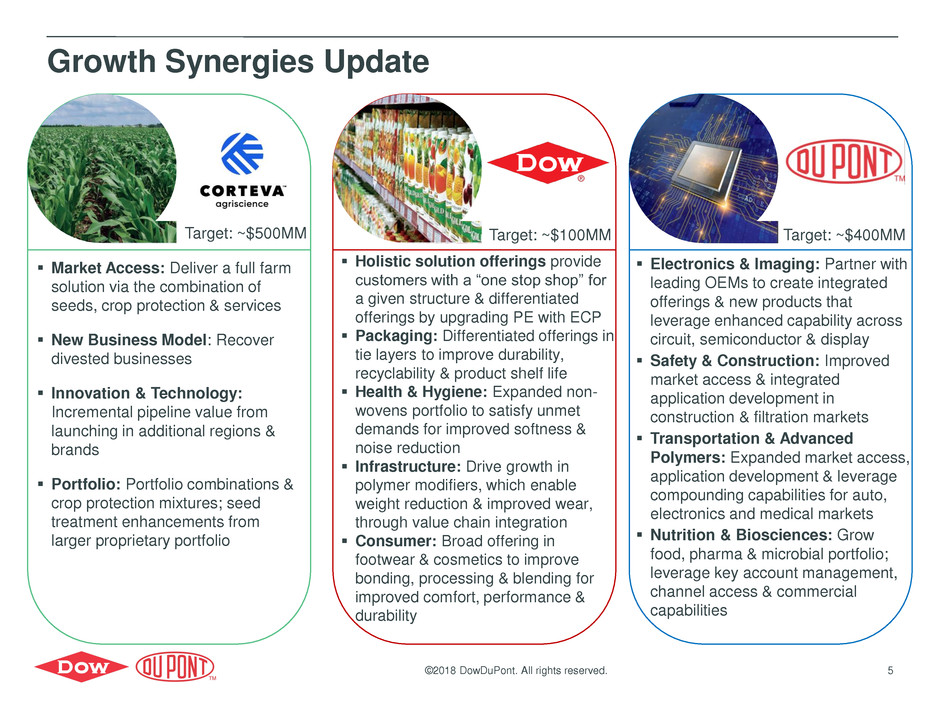

Market Access: Deliver a full farm

solution via the combination of

seeds, crop protection & services

New Business Model: Recover

divested businesses

Innovation & Technology:

Incremental pipeline value from

launching in additional regions &

brands

Portfolio: Portfolio combinations &

crop protection mixtures; seed

treatment enhancements from

larger proprietary portfolio

Target: ~$500MM

©2018 DowDuPont. All rights reserved.

Holistic solution offerings provide

customers with a “one stop shop” for

a given structure & differentiated

offerings by upgrading PE with ECP

Packaging: Differentiated offerings in

tie layers to improve durability,

recyclability & product shelf life

Health & Hygiene: Expanded non-

wovens portfolio to satisfy unmet

demands for improved softness &

noise reduction

Infrastructure: Drive growth in

polymer modifiers, which enable

weight reduction & improved wear,

through value chain integration

Consumer: Broad offering in

footwear & cosmetics to improve

bonding, processing & blending for

improved comfort, performance &

durability

Target: ~$100MM

Electronics & Imaging: Partner with

leading OEMs to create integrated

offerings & new products that

leverage enhanced capability across

circuit, semiconductor & display

Safety & Construction: Improved

market access & integrated

application development in

construction & filtration markets

Transportation & Advanced

Polymers: Expanded market access,

application development & leverage

compounding capabilities for auto,

electronics and medical markets

Nutrition & Biosciences: Grow

food, pharma & microbial portfolio;

leverage key account management,

channel access & commercial

capabilities

Target: ~$400MM

Growth Synergies Update

5

• Forms 10

• Complete equity roadshows

• Complete IT systems and

legal entity transitions

• File initial Forms 10

• Begin to deploy IT systems

and stand up legal entities

• Finalize assets and liabilities

by spin

• Finalize agreement terms

• Complete IT design and test

• Establish new legal entities in ~60 countries

• Secure right to operate

• Separate facilities by spin

• Design, test and implement IT systems; transfer IT

system to respective spin

• Set up public company-ready corporate functions,

employees and facilities in each spin

• Assign all assets and liabilities to spins

• Negotiate terms of agreements (site services,

material purchases, IP, separation agreements)

• Finalize capital structures of spins

• Draft, cycle and obtain effectiveness of Forms 10

with the SEC

• Name management teams for intended companies

• Hold equity roadshows

Materials Science by end of 1Q 2019

Specialty Products formed when Ag separates by June 1, 2019

©2018 DowDuPont. All rights reserved. 6

Anticipated Timeline to Expected Spins

S

e

p

arat

io

n

A

ct

iv

it

ie

s

T

ran

s

a

c

ti

o

n

A

ct

iv

it

ie

s

3Q19

3Q18 1Q19 1Q18

1Q 2018 Financial Highlights1

7 ©2018 DowDuPont. All rights reserved.

Highlights

• Price increases in all divisions

• Volume growth in Materials

Science and Specialty Products

• Accelerating cost synergies

• Favorable currency impact

• Lower pension & OPEB costs

• Higher equity earnings

• Weather-related declines in

Agriculture

• Higher feedstock costs

• Weather-related supply

disruptions in Materials Science

• Increased turnaround activity

$0.67

$1.08

1Q1

7

P

ri

ce

&

v

olu

m

e

C

os

t

sy

n

e

rg

ie

s

C

u

rr

e

n

cy

P

e

n

sion

/O

P

E

B

E

q

ui

ty

E

a

rni

n

g

s

T

a

x

Tu

rn

a

roun

d

s

&

w

e

a

th

e

r-

re

la

te

d

ou

ta

g

e

s

W

e

a

th

e

r-

re

la

te

d

A

g

se

a

son

d

e

la

ys 1Q1

8

$1.05

$1.12

Financial Performance Snapshot 1Q18 1Q17 B/(W)

Net Sales ($MM) 21,510 20,467 1,043

Operating EBITDA ($MM) 4,871 4,614 257

GAAP EPS from Continuing Operations ($/share) 0.47 0.72 (0.25)

Adjusted EPS ($/share) 1.12 1.05 0.07

1Q 2018 Pro Forma Adjusted EPS Variance

1. Prior year net sales and non-GAAP information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

Materials Science Highlights

Performance Materials & Coatings

• Sales up 12%, driven by local price

increases, a currency tailwind and

double-digit sales growth in Consumer

Solutions

• Consumer Solutions benefited from

strong price gains, robust demand

growth in personal & home care

markets, traction on growth synergies

and disciplined margin management in

silicone intermediates

• Op. EBITDA up 31% on higher pricing,

improved product mix and cost and

growth synergies

©2018 DowDuPont. All rights reserved.

Jen/Ann

YoY Sales Change: Vol -1%,

Local Price +9%, Currency +4%, Port./Other –

Division Highlights 1Q18 1Q17

Net Sales ($MM) 12,029 10,292

Op. EBITDA ($MM) 2,583 2,107

Op. EBITDA Margin 21.5% 20.5%

• Net sales up 17%; Op. EBITDA grew 23% with double-digit gains

in all segments; Op. EBITDA margin expanded 100 basis points

• $81MM benefit to equity earnings on improved Sadara results

YoY Sales Change: Vol +8%,

Local Price 0%, Currency +4%, Port./Other –

• Polyurethanes & CAV benefited from

improved pricing and customer wins

in downstream systems applications,

improved supply from new capacity

at Sadara and ongoing tight MDI and

caustic soda fundamentals

• Industrial Solutions sales grew in

consumer-led applications, including

electronics processing, crop defense

and food and pharma

• Op. EBITDA up 28% on higher price,

demand growth, cost synergies and

increased equity earnings

• Sales up 12%; volume grew 8% with

gains in all geographic regions

• Robust demand growth in food &

specialty, industrial & consumer and

rigid packaging end-markets

• Local price increases in ethylene

derivatives were offset by declines in

hydrocarbons prices

• Op. EBITDA up 17% as PE price

increases, volume gains supported

by growth projects, higher equity

earnings and cost synergies more

than offset increased feedstock costs

Industrial Intermediates & Infrastructure Packaging & Specialty Plastics

Division Sales Change

Vol +8%

Local Price +5%

Currency +4%

Port./Other –

8

1Q18 1Q17

Net Sales ($MM) 2,304 2,063

Op. EBITDA ($MM) 628 481

Op. EBITDA Margin 27.3% 23.3%

1Q18 1Q17

Net Sales ($MM) 3,715 2,847

Op. EBITDA ($MM) 654 512

Op. EBITDA Margin 17.6% 18.0%

1Q18 1Q17

Net Sales ($MM) 6,010 5,382

Op. EBITDA ($MM) 1,301 1,114

Op. EBITDA Margin 21.6% 20.7%

YoY Sales Change: Vol +14%,

Local Price +11%, Currency +5%, Port./Other –

Prior year information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

Specialty Products Highlights

Electronics & Imaging

1Q18 1Q17

Net Sales ($MM) 1,153 1,164

Op. EBITDA ($MM) 357 327

Op. EBITDA Margin 31.0% 28.1%

• Continued strong demand in

key end markets, led by

double-digit growth in semis

and interconnect solutions;

partially offset by declines in

PV & Adv. Materials

• Op. EBITDA up 9% as lower

pension/OPEB costs, cost

synergies, volume growth

and a currency benefit more

than offset a negative impact

from portfolio and higher unit

costs

9 ©2018 DowDuPont. All rights reserved.

Jen/Ann

YoY Sales change: Vol +1%, Local Price +1%

Currency +2%, Port./Other (5)%

Division Highlights 1Q18 1Q17

Net Sales ($MM) 5,597 5,052

Op. EBITDA ($MM) 1,566 1,257

Op. EBITDA Margin 28.0% 24.9%

• Volume gains delivered by all four segments in most regions

• Op. EBITDA margin expanded by 310 bps; growth in all segments

1Q18 1Q17

Net Sales ($MM) 1,720 1,424

Op. EBITDA ($MM) 418 317

Op. EBITDA Margin 24.3% 22.3%

YoY Sales change: Vol +4%, Local Price +1%

Currency +4%, Port./Other +12%

1Q18 1Q17

Net Sales ($MM) 1,425 1,251

Op. EBITDA ($MM) 437 321

Op. EBITDA Margin 30.7% 25.7%

YoY Sales change: Vol +3%, Local Price +5%

Currency +6% , Port./Other –

1Q18 1Q17

Net Sales ($MM) 1,299 1,213

Op. EBITDA ($MM) 354 292

Op. EBITDA Margin 27.3% 24.1%

YoY Sales change: Vol +3%, Local Price –

Currency +4%, Port./Other –

• Volume growth led by N&H

with double-digit growth in

probiotics and pharma,

coupled with gains in

systems & texturants

• Volume growth in IB led by

double-digits gains in

CleanTech, coupled with

growth in microbial control

solutions and bioactives

• Op. EBITDA up 32% on a

portfolio benefit, volume

growth, cost synergies and

lower pension/OPEB costs

• Gains in local price were

driven by nylon and

polyesters amid tight supply

and higher feedstock costs

• Volume gains led by

performance solutions for

electronics and aerospace

markets; performance

resins also up

• Op. EBITDA rose 36% on

lower pension/OPEB costs,

currency, sales gains and

cost synergies

• Volume gains were led by

Tyvek® and Nomex®

• Demand from industrial

markets remained strong;

construction sales reflected

weather-related delays

• Op. EBITDA increased 21%

primarily due to lower

pension/OPEB costs, cost

synergies, reliability

improvements and

currency; partially offset by

higher costs

Nutrition & Biosciences Transportation &

Advanced Polymers

Safety & Construction

Division Sales Change

Vol +3%

Local Price +2%

Currency +4%

Port./Other +2%

Prior year information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

©2018 DowDuPont. All rights reserved.

U.S. Weather Impact on Agriculture Segment

10

Key Business Data Points

Many seed reps provide deliveries to our farmer customers within a few days or less of

planting

A majority of Pioneer-branded seed in the U.S. is delivered over a 4-week period just ahead

of planting

Currently corn plantings are expected to be ~3-4

weeks delayed

Corn shipments through April 1 were ~1/3 of

previous year

Soil temps of 50 degrees are optimal for corn

planting

Majority of corn belt was still below 50 degrees on

April 1

Soil Temperatures April 1-7, 2018 U.S. Corn Planting Progress

Source: USDA

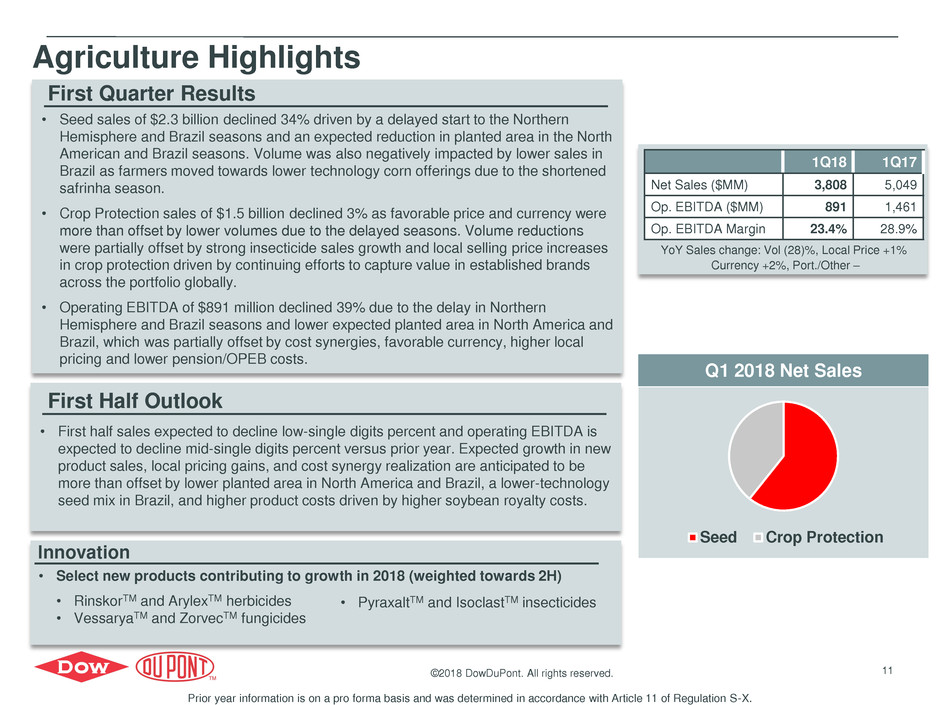

Agriculture Highlights

1Q18 1Q17

Net Sales ($MM) 3,808 5,049

Op. EBITDA ($MM) 891 1,461

Op. EBITDA Margin 23.4% 28.9%

YoY Sales change: Vol (28)%, Local Price +1%

Currency +2%, Port./Other –

First Quarter Results

First Half Outlook

Innovation

• Seed sales of $2.3 billion declined 34% driven by a delayed start to the Northern

Hemisphere and Brazil seasons and an expected reduction in planted area in the North

American and Brazil seasons. Volume was also negatively impacted by lower sales in

Brazil as farmers moved towards lower technology corn offerings due to the shortened

safrinha season.

• Crop Protection sales of $1.5 billion declined 3% as favorable price and currency were

more than offset by lower volumes due to the delayed seasons. Volume reductions

were partially offset by strong insecticide sales growth and local selling price increases

in crop protection driven by continuing efforts to capture value in established brands

across the portfolio globally.

• Operating EBITDA of $891 million declined 39% due to the delay in Northern

Hemisphere and Brazil seasons and lower expected planted area in North America and

Brazil, which was partially offset by cost synergies, favorable currency, higher local

pricing and lower pension/OPEB costs.

11

• First half sales expected to decline low-single digits percent and operating EBITDA is

expected to decline mid-single digits percent versus prior year. Expected growth in new

product sales, local pricing gains, and cost synergy realization are anticipated to be

more than offset by lower planted area in North America and Brazil, a lower-technology

seed mix in Brazil, and higher product costs driven by higher soybean royalty costs.

©2018 DowDuPont. All rights reserved.

• Select new products contributing to growth in 2018 (weighted towards 2H)

• RinskorTM and ArylexTM herbicides

• VessaryaTM and ZorvecTM fungicides

• PyraxaltTM and IsoclastTM insecticides

Q1 2018 Net Sales

Seed Crop Protection

Prior year information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

12

©2018 DowDuPont. All rights reserved.

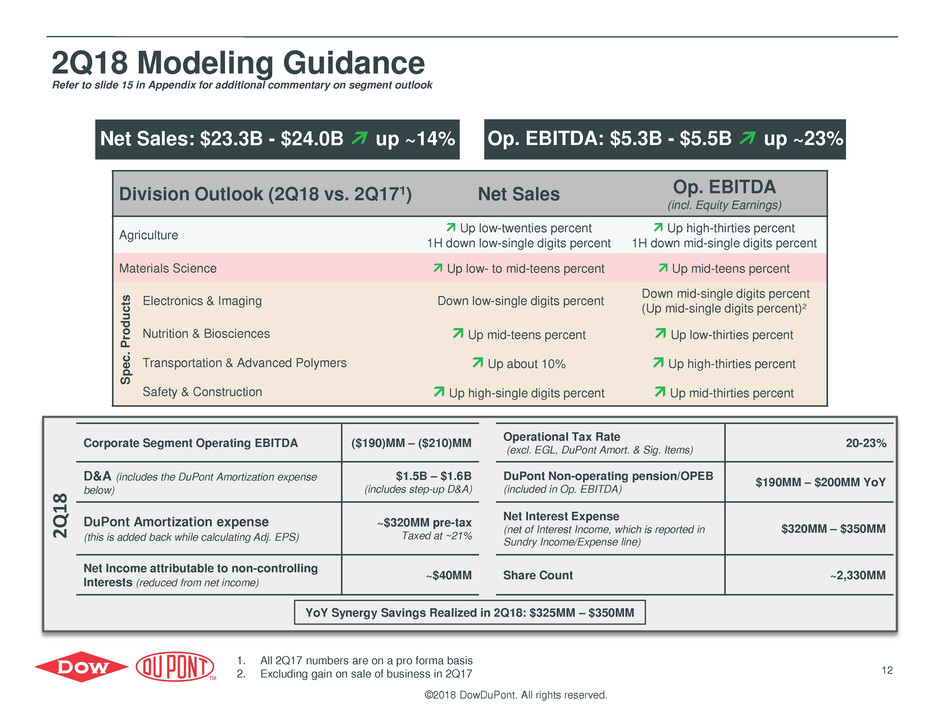

2Q18 Modeling Guidance

2

Q

1

8

Corporate Segment Operating EBITDA ($190)MM – ($210)MM

Operational Tax Rate

(excl. EGL, DuPont Amort. & Sig. Items)

20-23%

D&A (includes the DuPont Amortization expense

below)

$1.5B – $1.6B

(includes step-up D&A)

DuPont Non-operating pension/OPEB

(included in Op. EBITDA)

$190MM – $200MM YoY

DuPont Amortization expense

(this is added back while calculating Adj. EPS)

~$320MM pre-tax

Taxed at ~21%

Net Interest Expense

(net of Interest Income, which is reported in

Sundry Income/Expense line)

$320MM – $350MM

Net Income attributable to non-controlling

Interests (reduced from net income)

~$40MM Share Count ~2,330MM

Division Outlook (2Q18 vs. 2Q171) Net Sales Op. EBITDA

(incl. Equity Earnings)

Agriculture

Up low-twenties percent

1H down low-single digits percent

Up high-thirties percent

1H down mid-single digits percent

Materials Science Up low- to mid-teens percent Up mid-teens percent

Electronics & Imaging Down low-single digits percent

Down mid-single digits percent

(Up mid-single digits percent)2

Nutrition & Biosciences Up mid-teens percent Up low-thirties percent

Transportation & Advanced Polymers Up about 10% Up high-thirties percent

Safety & Construction Up high-single digits percent Up mid-thirties percent

Net Sales: $23.3B - $24.0B up ~14% Op. EBITDA: $5.3B - $5.5B up ~23%

1. All 2Q17 numbers are on a pro forma basis

2. Excluding gain on sale of business in 2Q17

Refer to slide 15 in Appendix for additional commentary on segment outlook

YoY Synergy Savings Realized in 2Q18: $325MM – $350MM

S

p

ec.

P

ro

d

u

ct

s

Appendix

15

2Q18 Segment Expectations

1. 2Q17 on a pro forma basis

Segments Key Sales and Operating EBITDA Outlook Drivers (2Q18 vs. 2Q171)

Safety & Construction

Sales to be up by the high-single digits percent on currency benefits and volume gains from building solutions, filtration and

Tyvek® enterprise. Operating EBITDA estimated to increase by the mid-thirties percent on lower pension/OPEB costs, sales

gains, cost synergies, and improved plant performance, partly offset by higher costs.

Transportation &

Advanced Polymers

Sales to rise by about 10 percent due to local price, currency benefits and volume gains, reflecting new product launches

and strong market demand. Operating EBITDA projected to increase by the high-thirties percent on gains from favorable

currency, cost synergies, lower pension/OPEB expense, higher local price and volume gains, partly offset by higher raw

materials costs.

Nutrition & Biosciences

Sales expected to be up mid-teens percent on benefits from portfolio-related actions (FMC acquisition), currency and local

price and volume gains. Operating EBITDA expected to be up in the low-thirty percent range on sales gains, cost synergies,

lower pension/OPEB costs, partially offset by higher costs due to growth investments.

Electronics & Imaging

Sales expected to be down low-single digits percent as volume growth and a benefit from currency will be more than offset

by a negative impact from portfolio-related actions and lower local price. Operating EBITDA expected to be down mid-single

digits percent as cost synergies, lower pension/OPEB costs and volume growth will be more than offset by the absence of a

prior year gain on the sale of a business ($48 million) and lower local price.

Refer in conjunction with slide 12.

©2018 DowDuPont. All rights reserved.

Agriculture

Second quarter sales expected to increase low-twenties percent driven by higher volumes from the delayed start to the

planting season in the Northern Hemisphere and higher local selling price partially offset by expected lower planted area in

the Northern Hemisphere. Second quarter Operating EBITDA expected to increase high-thirties percent driven by higher

volumes, cost synergies, higher local selling price, and lower pension/OPEB cost partially offset by higher soybean royalty

costs and higher commissions due to the timing of seed sales. First half sales expected to decline low-single digits and first

half Operating EBITDA to decline mid-single digits due to expected lower planted area in the Northern Hemisphere and

Brazil, weaker Brazil seed sales due to the shortened safrinha season, and higher soybean royalty costs partially offset by

higher local selling price, cost synergies, favorable currency and lower pension/OPEB costs.

Packaging & Specialty

Plastics

Sales growth supported by new capacity from the U.S. Gulf Coast and currency tailwinds. Operating EBITDA up modestly

as earnings contribution from new capacity, pricing gains, lower startup costs (~$20MM in 2Q18) and cost synergies are

partly offset by higher feedstock costs, increased turnaround activity ($130 to $150MM) and lack of a prior one time benefit

($23MM). 2Q18 equity earnings expected to improve (up ~$25MM), driven by a reduction in Sadara equity losses.

Industrial Intermediates

& Infrastructure

Sales and Operating EBITDA growth on volume from new Sadara capacity and pricing momentum supported by tight

supply-demand fundamentals and currency on top of ramping cost synergies. 2Q18 equity earnings expected to improve (up

~$110MM), driven by ramp up in Sadara volume and higher earnings from EQUATE.

Performance Materials

& Coatings

Sales up on pricing momentum and currency tailwinds with strong downstream market demand expected to continue.

Operating EBITDA growth driven by pricing gains and volume/mix, especially in upstream Silicone intermediates as well as

cost synergies. 2Q18 HSC equity earnings are expected to be ~$25MM.