Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Blue Apron Holdings, Inc. | a18-12686_18k.htm |

FORWARD LOOKING STATEMENTS AND USE OF NON-GAAP FINANCIAL INFORMATION This presentation includes statements concerning Blue Apron Holdings, Inc. and its future expectations, plans and prospects that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "may," "should," "expects," "plans," "anticipates," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential," or "continue," or the negative of these terms or other similar expressions. These statements involve known and unknown risks, uncertainties and other important factors that may cause Blue Apron’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements reflect Blue Apron’s current views about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to it and on assumptions it has made. Actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond Blue Apron’s control including, without limitation, Blue Apron’s anticipated growth strategies; its ability to achieve future revenue growth and manage future growth effectively; its expectations regarding competition and its ability to effectively compete; its ability to successfully build out and operate its fulfillment centers; its ability to expand its product offerings; its ability to cost-effectively attract new customers, retain existing customers and increase the number of customers it serves; seasonal trends in customer behavior; its expectations regarding, and the stability of, its supply chain; the size and growth of the markets for its product offerings and its ability to serve those markets; federal and state legal and regulatory developments; other anticipated trends and challenges in its business; and other risks and uncertainties discussed in Blue Apron’s filings with the U.S. Securities and Exchange Commission (“SEC”), including the risks set forth under the caption “Risk Factors” in its most recent Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 and in other filings that Blue Apron may make with the SEC in the future. Blue Apron assumes no obligation to update any forward-looking statements contained in this press release as a result of new information, future events or otherwise. This presentation also includes adjusted EBITDA, a non-GAAP financial measure, that is not prepared in accordance with, nor an alternative to, financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, adjusted EBITDA is not based on any standardized methodology prescribed by GAAP and is not necessarily comparable to similarly-titled measures presented by other companies. A reconciliation of these measures to the most directly comparable GAAP measure is included the Appendix to this presentation. Certain data in this presentation was obtained from various external sources, and neither Blue Apron nor its affiliates, advisors, or representatives make any representation as to the accuracy or completeness of that data or any commitment to update such data after the date of this presentation. Such data involve risks and uncertainties and are subject to change based on various factors.

We help households nationwide experience the joy of culinary experiences at home through our meal, wine and marketplace offerings Leader in brand awareness in our category1 550 original recipes and 50 wines created in 2017 through three FDA-regulated fulfillment centers Delivery to over 99% of the U.S. population $881M FY17 Net Revenue 1 1Category defined as certain companies specified by Blue Apron that deliver fresh, pre-portioned ingredients and recipes operating in the United States. Unaided brand awareness based on respondent’s answer when asked, “Please list any companies you're familiar with that deliver fresh, pre-portioned ingredients and step-by-step recipes?” Aided brand awareness based on respondent’s answer when asked, “Which of the following brands have you heard of or used: AmazonFresh, Blue Apron, FreshDirect, Green Chef, HelloFresh, Home Chef, Part N Parsley, PeaPod, Sun Basket or Other?” Respondents were limited to persons satisfying target audience criteria that Blue Apron believes are indicative of consumers who are most likely to be interested in fresh, pre-portioned ingredients and recipes. SOURCE: Brand Awareness Survey conducted by Lightspeed Research that was commissioned by Blue Apron in January 2018

Our Brand

WHO WE ARE Culinary BRAND POSITIONING Unlocking The BEST MOMENTS Of The Day Discovery Connected to the Source Trusted Authority OUR BRAND DNA OUR CUSTOMERS1 ENTHUSIAST “Help me feel challenged and fulfill my passion for cooking” ASPIRER “Help me make cooking a part of my busy and hectic life” AVOIDER “Help remove the burden of cooking” 3 1 Based on customer segmentation research conducted by IDEO that was commissioned by Blue Apron, February 2017

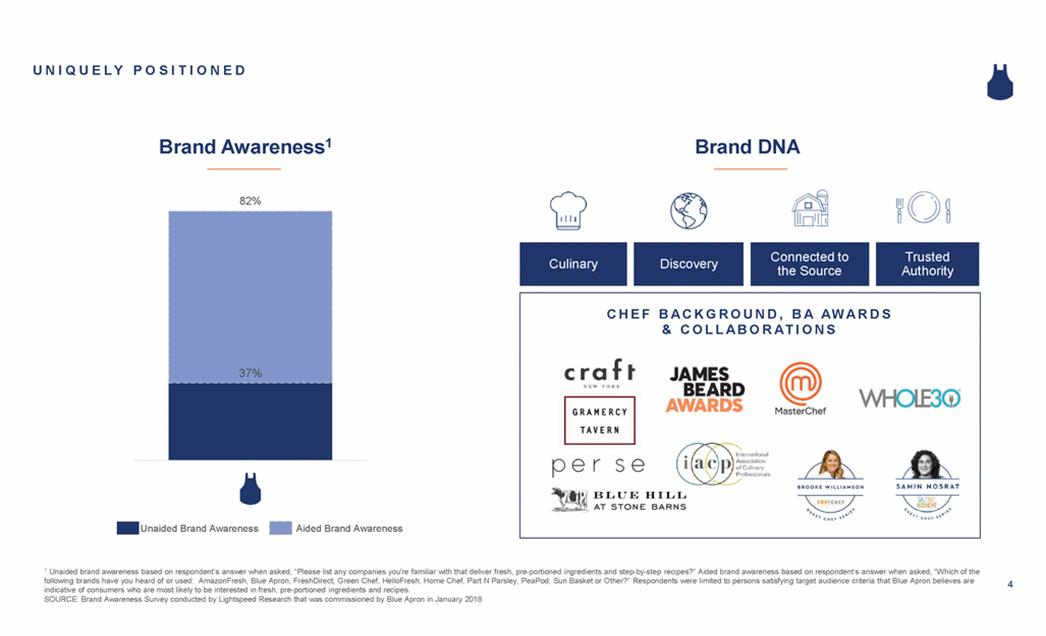

Culinary Discovery Connected to the Source Trusted Authority CHEF BACKGROUND, BA AWARDS & COLLABORATIONS UNIQUELY POSITIONED 1 Unaided brand awareness based on respondent’s answer when asked, “Please list any companies you're familiar with that deliver fresh, pre-portioned ingredients and step-by-step recipes?” Aided brand awareness based on respondent’s answer when asked, “Which of the following brands have you heard of or used: AmazonFresh, Blue Apron, FreshDirect, Green Chef, HelloFresh, Home Chef, Part N Parsley, PeaPod, Sun Basket or Other?” Respondents were limited to persons satisfying target audience criteria that Blue Apron believes are indicative of consumers who are most likely to be interested in fresh, pre-portioned ingredients and recipes. SOURCE: Brand Awareness Survey conducted by Lightspeed Research that was commissioned by Blue Apron in January 2018 Brand Awareness1 Brand DNA 4 Unaided Brand Awareness Aided Brand Awareness 37% 82% BA

REACHING AND ENGAGING CUSTOMERS ACROSS A BROAD RANGE OF DEMOGRAPHICS Age Geography Children The largest portion of customers are in the 25-34 age range followed by 35-44 21% are family plans Almost 30% of customers are cooking for children under 18 Cooking for kids (under 18) Not cooking for kids South West Northeast Midwest 79% of orders are 2-person plans Blue Apron account managers tend to be female, but we know that Blue Apron is often shared between partners Our customers come from all over the U.S. 18-24 25-34 35-44 45-54 55-64 65+ Male Female Majority of customers earning more than $50k a year $0-$49k $50k-$99k $100k+ Average Annual Household Income Gender Based on email survey of Blue Apron account holders conducted in April 2018 with 1,074 respondents. Based on the number of Orders in 2017 per plan type. Based on customers as of December 31, 2017. Based on email survey of Blue Apron account holders conducted in April 2018 with 1,074 respondents. Based on email survey of Blue Apron account holders conducted in April 2018 with 1,074 respondents. Based on email survey of Blue Apron account holders conducted in April 2018 with 1,074 respondents. NOTE: Does not add up to 100% because 1% identify as non-binary 5 4% 30% 25% 16% 18% 9% 32% 28% 23% 17% 27% 73% 17% 82% 11% 33% 56%

UNLOCKING NEW CHANNELS TO BE ACCESSIBLE TO CUSTOMERS WHERE THEY WANT TO MEET US Even though many people are excited about cooking... They are also overwhelmed by it How they interact with the product (service/delivery) makes a difference What’s the hardest part about cooking dinner? 6 Deciding what to make and having the time to cook make it difficult 71% 70% 68% 68% 69% 52% of people prefer to cook of people would like to cook more of people want to learn more about cooking if available without subscription if available in a grocery store if groceries can be added on to purchase 43% 8% 12% 16% Time Picky eaters Cost Deciding what to make Grocery shopping Lack of interest Not knowing how to cook Dietary restrictions SOURCE: Customer segmentation research that was conducted by IDEO, as commissioned by Blue Apron in February 2017 People say they are somewhat/much more likely to use meal kits

Our Foundation

INTEGRATED ECOSYSTEM Our supply-demand coordination activities – demand planning, recipe creation, recipe merchandising, fulfillment operations, and marketing – drive our end-to-end value chain Leverage data and analytics tools to help us forecast demand and make purchasing decisions accordingly Utilize insights from customer feedback to optimize our weekly portfolio of recipes to meet even more preferences, needs and lifestyles Work closely with suppliers to source high-quality, unique ingredients that meet our quality standards at efficient costs Package and cost-efficiently deliver to customers nationwide via tech-driven, FDA-regulated fulfillment centers and optimized in-bound and out-bound logistics network Intelligently design culinary-driven recipes using fresh, seasonal ingredients Flex operating platform That can accommodate different product and channels and adapt to variations in customer demand and supply Create supplementary in-box and digital content for an incredible and empowering kitchen experience 8

POWERFUL CONSUMER PRODUCTS PORTFOLIO INGREDIENTS Pre-portioned, fresh, high-quality ingredients with high ingredient standards1 RECIPES Original recipes with step-by-step instructions MARKET Curated selection of a la carte marketplace products featuring exclusive items with leading brands CONTENT Engaging content inspires both inside and outside the kitchen and strengthens our premium positioning 1 Non-GMO ingredients, frequent use of organic ingredients, animals are raised without added hormones or sub-therapeutic antibiotics, 100% sustainable seafood. We believe that Blue Apron beef standards are higher than 97% of beef sold, our chicken standards are higher than 92% of chicken sold, and our pork standards are higher than 99% of pork sold. (Based on our analysis of Nielsen retailer per pound data for fresh pork, beef, and chicken sold in the US in 2016.) WINE Monthly wine delivery featuring six high-quality, proprietary wines that perfectly pair with our meals, bottled in ideal weeknight portions (500ml bottles) 9

PROPRIETARY TECHNOLOGY AND DATA INFORM OUR BUSINESS Delivery calendar tools Inventory receiving software Customer Data & Analytics Production & Fulfillment Logistics Supply-Demand Customer-level preference data collection (e.g. menu selector) Customer feedback data (e.g. ratings, reviews) Labor scheduling & planning tools Optimization analytics and tools, like zip code routing software Machine learning models Proprietary demand forecast models Recipe recommendation algorithm Demand management tools Automation capabilities Manage an extensive ground-based delivery network of third-party partners Deliver to over 99% of U.S. population Kitchen prep software 10

LIFESTYLE BRAND WITH PERFORMANCE MARKETING DNA 11

MULTI-CHANNEL MERCHANDISING ENGINE TO DRIVE DEMAND 12

SELECT STRATEGIC BRAND PARTNERS 13

Our Growth Strategy

POISED FOR GROWTH U.S. $782B U.S. $543B $10b $12b Online Penetration: 1.2% Online Penetration: 2.2% Total market Online Sales 15 SOURCE: Euromonitor Study, Commissioned by Blue Apron, May 2016 NOTE: Grocery Retail includes retail sales of fresh foods, packaged foods, hot drinks, soft drinks and alcoholic drinks as of 2016. Channels included are grocery retailers, mixed retailers and internet retailing. Online Grocery Retail includes internet retailing sales from all grocery retailer channels. Restaurants includes food and drink sales in the following consumer foodservice outlets: 100% Home Delivery/Takeaway, Cafés/Bars, Full-Service Restaurants, Fast-food, Self-Service Cafeterias and Street stalls/Kiosks. Online Restaurants includes internet retailing sales in consumer foodservice outlets. Grocery Retail Restaurants

NEAR-TERM AND LONG-TERM OBJECTIVES 16 Continue to execute on our strategy to be multi-channel and multi-product Create additional value for our customers Optimize our operational and systems platforms Focusing on personalization and meeting customers where they want to be met Leveraging our brand, product expertise and infrastructure flexibility to enter new channels Constantly innovating to design the most unique and special cooking experiences Launching brand partnerships and improving merchandising of weekly recipes Efficiently delivering our products and services, regardless of delivery method Making the customer experience incredible and seamless whether in the digital or physical world

INDIRECT DIRECT OPPORTUNITIES TO EXPAND INTO NEW PRODUCTS AND CHANNELS Retail Core Product On-Demand/ Pickup Core Product Expansion 17

PRODUCTS CUSTOMIZED FOR SPECIFIC CUSTOMER SEGMENTS Standalone prepackaged meal kits Seasonally rotating selection of retail-ready meal kits in sustainable packaging for customers to pick up and cook at home 18 With a focus on quick, easy-to-prep cooking and crowd pleasing favorites, the retail meal kits provide an easy go-to solution for anyone looking to crack the “what to cook” conundrum

EXPERIENTIAL BRAND ACTIVATIONS WHERE CUSTOMERS CAN INTERACT AND ENGAGE WITH US Traveling Mobile Pop-Up Educate consumers about product offerings Community Events Strengthen brand via community-centric events Short-Term NYC Retail Pop-Up Create immersive experiences 19

Our Financials

FINANCIAL MODEL: SCALE, GROWTH, PATH TO PROFITABILITY 21 Net Revenue ($M) Revenue Less COGS Margin1 Adjusted EBITDA($M)2 1 Represents revenue less costs of goods sold excluding depreciation and amortization as a percentage of net revenue 2 Adjusted EBITDA is defined as net earnings (loss) before interest income (expense), net, other operating expense, other income (expense), net, benefit (provision) for income taxes, depreciation, amortization and share-based compensation expense. See appendix for reconciliation of net income (loss) to Adjusted EBITDA. 2015 2016 2017 2015 2016 2017 2015 2016 2017 $341 $795 $881 ($43) ($44) ($138) 22.7% 33.0% 28.7%

FINANCIAL MODEL: SCALE, GROWTH, PATH TO PROFITABILITY Q1 ‘17 22 Q2 ‘17 Q3 ‘17 Q4 ‘17 Q1 ‘18 Q1 ‘17 Q2 ‘17 Q3 ‘17 Q4 ‘17 Q1 ‘18 Net Revenue ($M) Revenue Less COGS Margin1 Adjusted EBITDA($M)2 Q1 ‘17 Q2 ‘17 Q3 ‘17 Q4 ‘17 Q1 ‘18 1 Represents revenue less costs of goods sold excluding depreciation and amortization as a percentage of net revenue 2 Adjusted EBITDA is defined as net earnings (loss) before interest income (expense), net, other operating expense, other income (expense), net, benefit (provision) for income taxes, depreciation, amortization and share-based compensation expense. See appendix for reconciliation of net income (loss) to Adjusted EBITDA. $245 $238 $211 $188 $197 ($46) ($24) ($48) ($20) ($17) 31.2% 31.3% 21.9% 29.9% 34.2%

STRATEGIC INVESTMENTS IN OPERATIONAL EFFICIENCY 2015 2016 2017 In 2017, we invested extensively to build our Linden, New Jersey fulfillment center. Linden is our most automated center and fulfills approximately 50% of our network’s volume. Our capital expenditure needs are expected to be significantly reduced compared to prior periods for the foreseeable future, with strategic investments focused on optimizing and driving efficiency in our operations. $5 Q1 2018 23 Capital Expenditures ($M) $12 $63 $124

KEY QUARTERLY CUSTOMER METRICS 24 Orders and Average Order Value Customers and Orders per Customer NOTE: Orders is defined as the number of paid orders by our Customers across our meal, wine and market products sold on our e-commerce platforms in any reporting period, inclusive of orders that may have eventually been refunded or credited to customers. We define Average Order Value as our net revenue from our meal, wine and market products sold on our e-commerce platforms in a given reporting period divided by the number of Orders in that period. We determine our number of Customers by counting the total number of individual customers who have paid for at least one Order from Blue Apron across our meal, wine or market products sold on our e-commerce platforms in a given reporting period. We define Orders per Customer as the number of Orders in a given reporting period divided by the number of Customers in that period. 841 1,247 1,763 1,970 2,903 3,399 3,597 3,674 4,273 4,033 3,605 3,196 3,474 $57.77 $58.74 $58.01 $59.28 $59.40 $57.12 $58.78 $57.23 $58.81 $58.16 $57.99 $56.58 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Orders (in thousands) Average Order Value 213 303 414 429 649 766 907 879 1,036 943 856 746 786 3.9 4.1 4.3 4.6 4.5 4.4 4.0 4.2 4.1 4.3 4.2 4.3 4.4 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Customers (in thousands) Orders per Customer

DIVERSIFIED MARKETING STRATEGY 25 37% 43% 45% 46% Marketing Spend (in $M) and Contribution to Total Marketing Spend 24.8% Q1 2017 % Net Revenue Referral Program Online Media Offline Media 14.5% 16.3% 13.4% 20.0% Q2 2017 Q3 2017 Q4 2017 Q1 2018 56% 51% 47% 37% 43% 29% 28% 31% 45% 46% 15% 21% 22% 18% 11% $61 $35 $34 $25 $39 NOTE: Online Media includes online video, social media, display, search engine marketing, and sponsored content. Offline Media includes national television commercials, direct mail, radio, and podcasts.

Appendix

RECONCILIATION OF ANNUAL NET INCOME (LOSS) TO ADJUSTED EBITDA Year Ended December 31, 2015 2016 2017 (in thousands) Net income (loss) $(46,965) $(54,886) $(210,143) Share-based compensation 1,105 2,965 11,270 Depreciation and amortization 2,917 8,217 26,838 Other operating expense - - 12,713 Interest (income) expense, net 6 (25) 6,384 Other (income) expense, net - - 14,984 Provision (benefit) for income taxes 61 108 15 Adjusted EBITDA $(42,876) $(43,621) $(137,939) 27

RECONCILIATION OF QUARTERLY NET INCOME (LOSS) TO ADJUSTED EBITDA Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 (in thousands) Net income (loss) $(52,194) $(31,628) $(87,201) $(39,120) $(31,665) Share-based compensation 1,238 1,754 5,760 2,518 4,215 Depreciation and amortization 4,180 5,383 8,774 8,501 8,404 Other operating expense - - 5,934 6,779 - Interest (income) expense, net 470 3,052 1,281 1,581 1,777 Other (income) expense, net - (2,567) 17,551 - - Provision (benefit) for income taxes 41 105 (133) 2 25 Adjusted EBITDA $(46,265) $(23,901) $(48,034) $(19,739) $(17,244) 28