Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - TerraForm Power NY Holdings, Inc. | exhibit993terpq120188-k.htm |

| EX-99.1 - EXHIBIT 99.1 - TerraForm Power NY Holdings, Inc. | exhibit991terpq120188-kpre.htm |

| 8-K - 8-K - TerraForm Power NY Holdings, Inc. | terp8-kq1201810xqmay12018.htm |

TERRAFORM POWER

Q1 2018 Supplemental

Three Months Ended March 31, 2018

Information

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements

involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words

such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,”

“potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance,

events, or developments that the Company expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected

cash available for distribution, earnings, revenues, capital expenditures, liquidity, capital structure, future growth, financing arrangements and other financial

performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or

descriptions of assumptions underlying any of the above. Forward-looking statements provide the Company’s current expectations or predictions of future

conditions, events, or results and speak only as of the date they are made. Although the Company believes its expectations and assumptions are reasonable, it

can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are listed below and further disclosed under

the section entitled Item 1A. Risk Factors: risks related to the transition to Brookfield Asset Management Inc. sponsorship, including our ability to realize the

expected benefits of the sponsorship; risks related to wind conditions at our wind assets or to weather conditions at our solar assets; risks related to the

effectiveness of our internal controls over financial reporting; pending and future litigation; the willingness and ability of counterparties to fulfill their obligations

under offtake agreements; price fluctuations, termination provisions and buyout provisions in offtake agreements; our ability to enter into contracts to sell power on

acceptable prices and terms, including as our offtake agreements expire; our ability to compete against traditional and renewable energy companies; government

regulation, including compliance with regulatory and permit requirements and changes in tax laws, market rules, rates, tariffs, environmental laws and policies

affecting renewable energy; risks related to the expected relocation of the Company’s headquarters; the condition of the debt and equity capital markets and our

ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness

going forward; operating and financial restrictions placed on us and our subsidiaries related to agreements governing indebtedness; risks related to the expected

timing and likelihood of completion of the tender offer for the shares of Saeta Yield, S.A., including the timing or receipt of any governmental approvals; risks

related to our financing of the tender offer for the shares of Saeta Yield, S.A., including our ability to issue equity on terms that are accretive to our shareholders

and our ability to implement our permanent funding plan; our ability to successfully identify, evaluate and consummate acquisitions; and our ability to integrate the

projects we acquire from third parties, including Saeta Yield, S.A., or otherwise and our ability to realize the anticipated benefits from such acquisitions.

The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or

expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results

to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and

uncertainties, which are described in our Annual Report on Form 10-K and any subsequent Quarterly Report on Form 10-Q, as well as additional factors we may

describe from time to time in other filings with the SEC. We operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from

time to time, and you should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a

complete set of all potential risks or uncertainties.

3

Q1 2018 HIGHLIGHTS

Activities Highlights

• Announced offer to acquire 100% of Saeta Yield, a leading, publicly-listed European owner and

operator of wind and solar assets, located primarily in Spain. Received Spanish regulatory approval

for the acquisition and for our offer price of €12.20 per share; launching tender offer in early May;

expecting to close the transaction in June or July

• We are in advanced negotiations with an original equipment manufacturer to provide a full-wrap long-

term service contract covering all our wind fleet, which features a fixed price that is consistent with our

business plan and attractive availability guarantees

• In late stage negotiations to acquire a fully contracted 6 MW DG solar portfolio; includes a ROFO on

an additional 15 MW with the same seller, which we may be able to exercise in phases over the next

9-18 months

• In January one of the towers at our Raleigh, Ontario facility collapsed due to a single faulty blade. In

order to determine the root cause of the blade failure, we removed from service all 70 turbines across

the fleet that utilize the same blades. After a thorough investigation to determine the root cause of the

blade failure and rigorous inspections of the blades, the turbines have been returned to normal service

• In early February 2018, we upsized our corporate revolving credit facility to $600 million, TERP now

has over $1 billion of liquidity under committed facilities

• Paid quarterly dividend of $0.19 per share, or $0.76 per share on an annualized basis – a 6% increase

over previous guidance

4

2018 2017

2,022 2,022

1,834 1,982

$ 139 $ 149

96 103

(76) (56)

23 19

$ 0.56 $ (0.37)

$ 0.16 $ 0.14

1,897 1,982

$ 102 $ 103

$ 29 $ 19

Adjusted for sale of our UK solar and Residential portfolios.

Total generation (GWh) (1)(5)

(5)

Adjusted EBITDA(3)(5)

CAFD(3)(5)

(4)

(1)

(2)

(3)

Earnings per share for the three months ended March 31, 2018 includes the impact of a $145.0 million net loss

allocated to non-controlling interests resulting from changes in tax rates effective January 1, 2018.

Loss per share calculated on weighted average basic and diluted Class A shares outstanding. CAFD per share

calculated on shares outstanding of Class A common stock and Class B common stock on March 31. For three

months ended March 31, 2018, Class A common stock shares outstanding totaled 148.1 million (three months

ended March 31, 2017: 92.2 million). For three months ended March 31, 2018, there is no Class B common stock

shares outstanding (three months ended March 31, 2017: 48.2 million).

Excluding impact of Raleigh outages in 2018.

Non-GAAP measures. See “Calculation and Use of Non-GAAP Measures” and “Reconciliation of Non-GAAP

Measures” sections. Amounts in 2017 adjusted for sale of our UK and Residential portfolios.

Three months ended

(MILLIONS, EXCEPT AS NOTED)

Total generation (GWh)(1)

Mar 31

LTA generation (GWh)

Adjusted EBITDA(3)

Adjusted Revenue(3)

CAFD(3)

Excluding impact of Raleigh outages

Earnings (loss) per share(2)

CAFD per share(3)(4)

Net loss

• Our portfolio performed broadly in-line with expectations,

excluding the impact of the Raleigh outages, delivering

Adjusted EBITDA and CAFD of $102 million and $29

million

• Adjusted EBITDA $1 million down mainly due to

congestion in Texas Wind, partially offset by stronger

resource in Utility Solar

• CAFD $10 million higher due to lower debt service

driven by refinancing executed in Q4 2017, and lower

distributions to non-controlling interests, partially

offset by lower Adjusted EBITDA

• Including the nonrecurring lost revenue related to the

Raleigh outages, Adjusted EBITDA and CAFD were $96

million and $23 million

• Excluding the impact of the Raleigh outages, total

generation in Q1 2018 of 1,897 GWh, ~4% lower than Q1

2017, primarily due to curtailment in our Wind segment.

We experienced fleet availability of 95%

• Net loss of ($76) million was $20 million greater than Q1

2017 primarily due to lower Adjusted EBITDA and asset

impairment in DG Solar of $15 million due to FirstEnergy

Solutions bankruptcy

• Robust liquidity with over $1 billion of corporate liquidity

available to fund growth

Q1 2018 HIGHLIGHTS (continued)

Key Performance Metrics

Key Balance Sheet Metrics

Performance Highlights

1,834 GWh

Generation

~$1,037 million

Corporate Liquidity

$23 million

CAFD

Mar 31 Dec 31

2018 2017

1,037 855

3,637 3,643

5,966 6,071

(1)

(IN $ MILLIONS)

Corporate liquidity

Total long-term debt

Total capitalization(1)

Total capitalization is comprised of total stockholders ’ equity, redeemable non-controlling interests ,

and Total long-term debt.

5

Our Business

TerraForm Power’s goal is to own and operate high-quality solar and wind

generation assets in North America and Western Europe

Performance Targets and Key Measures

• Our objective is to deliver an attractive total return in the low teens per annum to

our shareholders

• Expect to generate return from a dividend backed by stable cashflow from our

assets and 5-8% annual dividend per share increase that we believe is

sustainable over the long term

• We target a dividend payout of 80-85% of CAFD

• Over the next five years, expect growth to be driven primarily by cost

savings, accretion from Saeta acquisition, and organic investments

• Opportunistic, value-oriented acquisitions expected to provide upside to our

business plan

• Growth in CAFD per share is a key performance metric as it is a proxy for our

ability to increase distributions

6

20+ years

15%

15-20 years

28%

10-15 years

39%

<10 years

18%

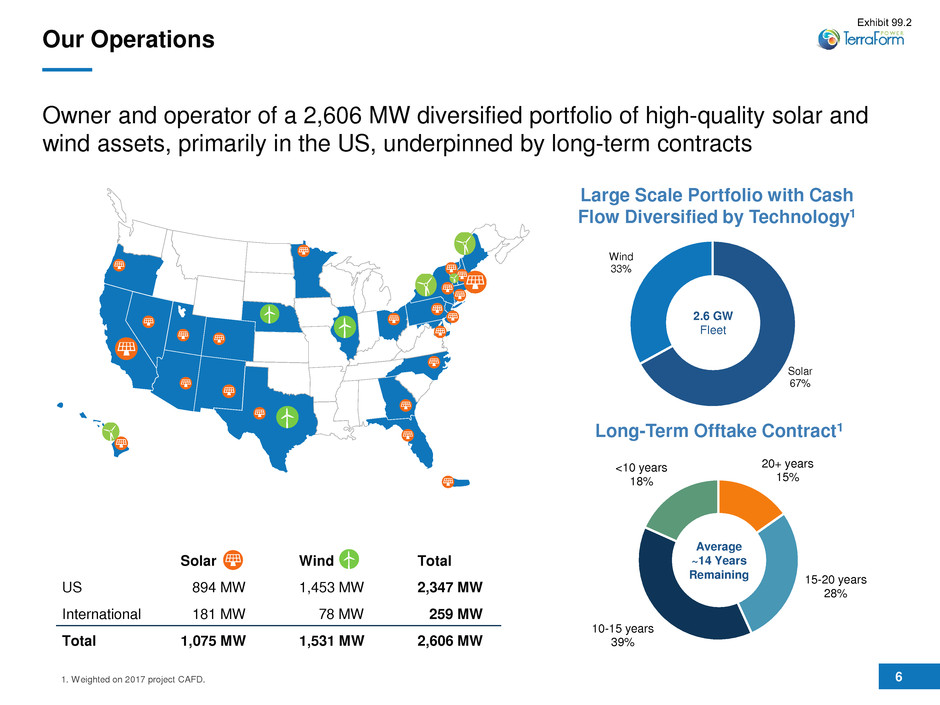

Our Operations

Owner and operator of a 2,606 MW diversified portfolio of high-quality solar and

wind assets, primarily in the US, underpinned by long-term contracts

Solar Wind Total

US 894 MW 1,453 MW 2,347 MW

International 181 MW 78 MW 259 MW

Total 1,075 MW 1,531 MW 2,606 MW

Solar

67%

Wind

33%

2.6 GW

Fleet

Large Scale Portfolio with Cash

Flow Diversified by Technology1

Long-Term Offtake Contract1

1. Weighted on 2017 project CAFD.

Average

~14 Years

Remaining

7

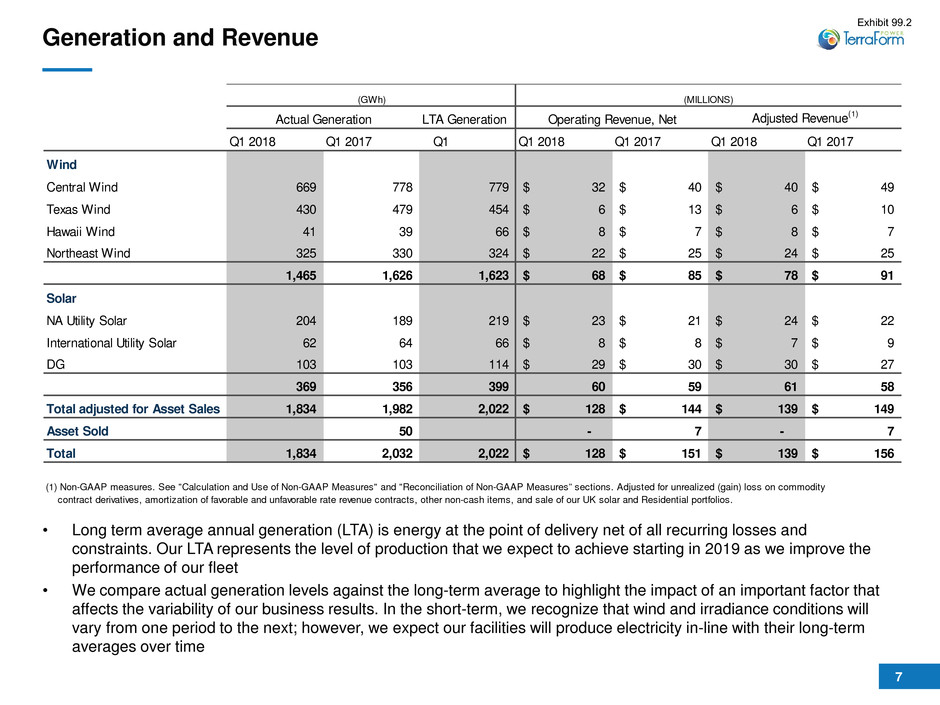

Generation and Revenue

• Long term average annual generation (LTA) is energy at the point of delivery net of all recurring losses and

constraints. Our LTA represents the level of production that we expect to achieve starting in 2019 as we improve the

performance of our fleet

• We compare actual generation levels against the long-term average to highlight the impact of an important factor that

affects the variability of our business results. In the short-term, we recognize that wind and irradiance conditions will

vary from one period to the next; however, we expect our facilities will produce electricity in-line with their long-term

averages over time

(GWh) (MILLIONS)

Actual Generation LTA Generation Operating Revenue, Net Adjusted Revenue(1)

Q1 2018 Q1 2017 Q1 Q1 2018 Q1 2017 Q1 2018 Q1 2017

Wind

Central Wind 669 778 779 32$ 40$ 40$ 49$

Texas Wind 430 479 454 6$ 13$ 6$ 10$

Hawaii Wind 41 39 66 8$ 7$ 8$ 7$

Northeast Wind 325 330 324 22$ 25$ 24$ 25$

1,465 1,626 1,623 68$ 85$ 78$ 91$

Solar

NA Utility Solar 204 189 219 23$ 21$ 24$ 22$

International Utility Solar 62 64 66 8$ 8$ 7$ 9$

DG 103 103 114 29$ 30$ 30$ 27$

369 356 399 60 59 61 58

Total adjusted for Asset Sales 1,834 1,982 2,022 128$ 144$ 139$ 149$

Asset Sold 50 - 7 - 7

Total 1,834 2,032 2,022 128$ 151$ 139$ 156$

(1) Non-GAAP measures. See "Calculation and Use of Non-GAAP Measures" and "Reconciliation of Non-GAAP Measures” sections. Adjusted for unrealized (gain) loss on commodity

contract derivatives, amortization of favorable and unfavorable rate revenue contracts, other non-cash items, and sale of our UK solar and Residential portfolios.

8

Selected Income Statement and Balance Sheet Information

The following tables present selected income statement and balance sheet information by operating

segment:

Income Statement Balance Sheet

2018 2017

(12) 6

(7) 5

(57) (67)

$ (76) $ (56)

49 47

54 65

(7) (9)

$ 96 $ 103

23 21

35 33

(35) (35)

$ 23 $ 19

Three months ended

Mar 31

(MILLIONS, UNLESS NOTED)

Net loss

Solar

Wind

Corporate

Total

Adjusted EBITDA

Solar

Wind

Corporate

Total

Total

CAFD

Solar

Wind

Corporate

2,814 2,897

3,342 3,401

103 89

$ 6,259 $ 6,387

1,101 1,145

882 884

1,946 1,929

$ 3,929 $ 3,958

1,713 1,752

2,460 2,517-

(1,843) (1,840)

$ 2,330 $ 2,429

Solar

Wind

Corporate

Total

Total

Total Equity and NCI

Solar

Wind

Corporate

Total

Total Liabilities

Solar

Wind

Corporate

As of

(MILLIONS) Mar 31, 2018 Dec 31, 2017

Total Assets

9

Operating Segments

10

Solar

The following table presents selected key performance metrics for our Solar segment:

Overview

• 1,075 MW of net capacity

• 515 Sites in diverse geographies

• Average remaining PPA life of 17 years

• Average offtaker credit rating of Aa3

• Diverse mix of high quality modules

Contracted cash flows

• Utility scale – generation contracted by

investment grade counterparties (such

as state utilities)

• Distributed generation – mostly behind

the meter generation contracted by

investment grade public offtakers

(municipalities, universities, schools,

hospitals), and commercial and

industrial offtakers

2018 2017

1,075 1,075

399 399

93% 93%

369 356

$ 61 $ 58

$ 166 $ 162

(1) Adjusted for sale of our UK solar and Residential portfolios.

(MILLIONS, UNLESS NOTED)

Average Adj. Revenue per MWh(1)

Adjusted Revenue (1)

Generation (GWh) (1)

LTA Generation (GWh)

Availability (%)

Capacity (MW)

Three months ended

Mar 31

11

Solar (continued)

• Adjusted EBITDA and CAFD were $49 million

and $23 million, respectively, versus $47

million and $21 million, respectively, in Q1

2017

• Adjusted EBITDA increased $2 million due

to higher average realized prices in DG

solar driven by greater SREC subscriptions

at strong prices in 2018, and higher

volumes in Utility Solar. These were

partially offset by an increase in costs

related to SunEdison sponsor subsidies,

which benefited 2017

• CAFD increased $2 million due to greater

Adjusted EBITDA, and lower distributions to

non-controlling interests than Q1 2017.

Project defaults in 2016 caused cash traps,

which increased distributions to non-

controlling interests in Q1 2017 as cash

was released

• Net loss of ($12 million) was $18 million lower

than Q1 2017 primarily due to an asset

impairment in DG Solar

• Availability was adversely impact in Q1 2018

primarily due to switch gear outages in Chile

Performance Highlights

2018 2017

61 58

(12) (11)

$ 49 $ 47

(14) (14)

(12) (12)

(3) (4)

3 4

$ 23 $ 21

49 47

(15) (20)

(30) (29)

(16) 8

$ (12) $ 6

(1 ) Adjusted for sale of our UK solar and Residential portfolios in 2017.

Depreciation and amortization

Other

Net (loss) income

(MILLIONS, UNLESS NOTED)

Adjusted revenue (1)

Direct operating costs (1)

Adjusted EBITDA (1)

Adjusted interest expense (1)

Levelized principal repayments

Distributions to NCI

Other

CAFD (1)

Adjusted EBITDA

Interest expense

Mar 31

Three months ended

Actual Generation (GWh) Average Adj. Revenue per MWh

(MILLIONS, EXCEPT AS NOTED) Q1 2018 Q1 2017 Q1 2018 Q1 2017

NA Utility Solar 204 189 118$ 116$

International Utility Solar 62 64 120 132

DG 103 103 289 266

Total 369 356 166$ 162$

12

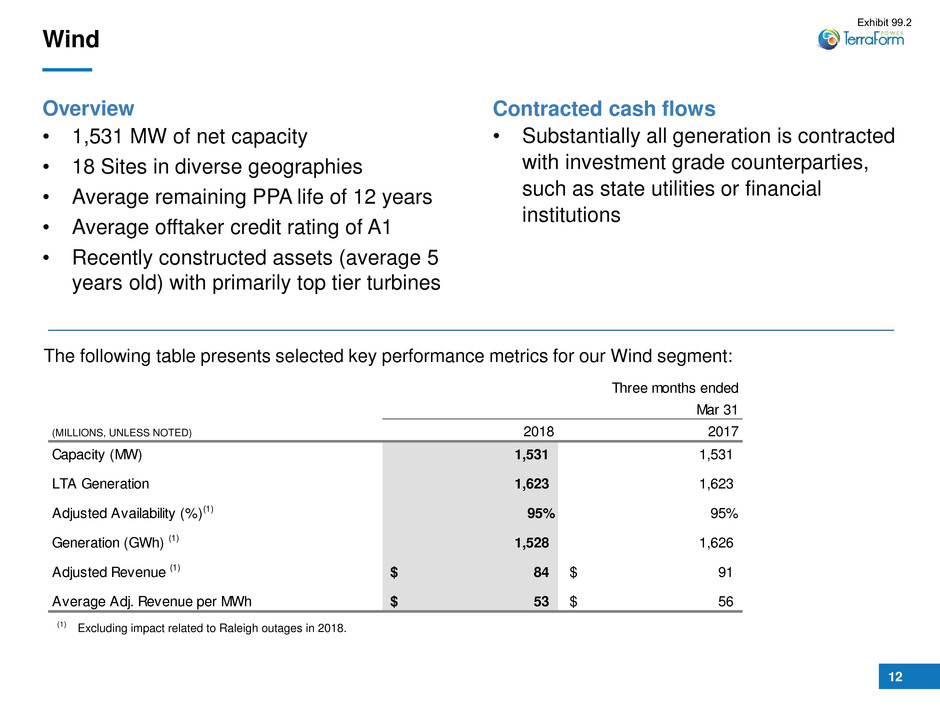

Wind

Overview

• 1,531 MW of net capacity

• 18 Sites in diverse geographies

• Average remaining PPA life of 12 years

• Average offtaker credit rating of A1

• Recently constructed assets (average 5

years old) with primarily top tier turbines

Contracted cash flows

• Substantially all generation is contracted

with investment grade counterparties,

such as state utilities or financial

institutions

The following table presents selected key performance metrics for our Wind segment:

2018 2017

1,531 1,531

1,623 1,623

95% 95%

1,528 1,626

$ 84 $ 91

$ 53 $ 56

Capacity (MW)

(1) Excluding impact related to Raleigh outages in 2018.

Three months ended

Mar 31

(MILLIONS, UNLESS NOTED)

Adjusted Revenue (1)

Average Adj. Revenue per MWh

LTA Generation

Adjusted Availability (%)(1)

Generation (GWh) (1)

13

Wind (continued)

Performance Highlights

• Excluding the impact of the Raleigh outages,

Adjusted EBITDA and CAFD were $60 million and

$41 million, respectively, versus $65 million and

$33 million, respectively, in Q1 2017

• Adjusted EBITDA decreased $5 million versus

Q1 2017, primarily due to scheduled grid

outage at Bishop Hill in January, partially

offset by lower major maintenance versus Q1

2017

• CAFD was $8 million higher than Q1 2017

due to refinancing of the MidCo term loan with

corporate level debt, partially offset by the

impacts to Adjusted EBITDA

• Including the nonrecurring lost revenue related to

the Raleigh outages, Adjusted EBITDA and CAFD

were $54 million and $35 million, respectively,

versus $65 million and $33 million, respectively, in

Q1 2017

• Net loss was ($7) million, $12 million lower than Q1

2017, due to lower Adjusted EBITDA, higher

depreciation, partially offset by repayment of the

MidCo term loan

• Sustaining capital expenditures are reported based

on long term averages starting in 2018. The wind

fleet will record $7 million annually ($2 million per

quarter), substantially higher than the $2 million

recorded in FY 2017

Actual Generation (GWh) Average Adj. Revenue per MWh

(MILLIONS, EXCEPT AS NOTED) Q1 2018 Q1 2017 Q1 2018 Q1 2017

Central Wind 669 778 60$ 62$

Texas Wind 430 479 14 20

Hawaii Wind 41 39 190 190

Northeast Wind 325 330 73 77

Total 1,465 1,626 53$ 56$

2018 2017

78 91

(24) (26)

$ 54 $ 65

(11) (20)

(12) (13)

(2) (6)

Sustaining capital expenditures (2) -

8 7

$ 35 $ 33

54 65

(11) (20)

(46) (41)

(4) 1

$ (7) ` 5

$ 60 $ 65

$ 41 $ 33

Adjusted EBITDA

CAFD

Excluding impact of Raleigh outages

Other

Net (loss) income

CAFD

Adjusted EBITDA

Interest expense

Depreciation and amortization

Adjusted EBITDA

Adjusted interest expense

Levelized principal repayments

Distributions to NCI

Other

(MILLIONS, UNLESS NOTED)

Adjusted revenue

Direct operating costs

Three months ended

Mar 31

14

Corporate

The following table presents our Corporate segment’s

financial results:

Performance Highlights

• Direct operating costs decreased by $2

million compared to Q1 2017 primarily

due to lower compensation

• Interest expense was broadly in line with

Q1 2017, primarily driven by refinancing

of our high yield bonds with interest

saving of ~200 bps, and lower interest

expense on our revolver due to a

significant lower balances, partially offset

by interest expense on the $350 million

Term Loan B issued in Q4 2017

• Non-operating general and administrative

expenses decreased by $7 million

primarily driven by higher legal fees and

consulting fees related to litigation and

transactions in Q1 2017

• Net loss of ($57) million was $10 million

lower than Q1 2017, primarily due to

reduction in non-operating costs

2018 2017

(7) (9)

$ (7) $ (9)

(3) -

(25) (26)-

$ (35) $ (35)

(7) (9)

(28) (28)-

1 1- -

(4) -- -

(18) (25)- -

(1) (6)

$ (57) $ (67)

Three months ended

Mar 31

(MILLIONS, UNLESS NOTED)

Direct operating costs

Adjusted EBITDA

Management fees

Income tax benefit

Acquisition and related costs

Other

Net loss

Adjusted interest expense

CAFD

Adjusted EBITDA

Interest expense

Non-operating general and administrative expens

15

Progress Versus Cost Savings Objectives

• On an annualized basis,

Q1 operating costs plus

base management fee of

$181 million, compared to

operating costs of $191

million on a same store

basis in 2017, illustrating

cost savings of $10 million

• Q1 Corporate operating

costs include $0.9 million

of audit fees, which were

concentrated in Q1 and

not reflective of the normal

quarterly run rate

Three months ended March 31

2018

(MILLIONS, UNLESS NOTED) Solar Wind Corp Total

Operating costs ($12) ($24) ($7) ($43)

Base management fee - - (2) (2)

Total operating costs ($12) ($24) ($9) ($45)

Annualized

2018

Solar Wind Corp Total

Operating costs ($48) ($97) ($25) ($171)

Base management fee - - (10) (10)

Total operating costs ($48) ($97) ($35) ($181)

Tw elve months ended December 31

2017

Solar Wind Corp Total

Operating costs (1) ($52) ($106) ($31) ($189)

Base management fee - - (2) (2)

Total operating costs ($52) ($106) ($33) ($191)

2018 vs 2017 total operating costs ($10)

(1) Operating costs in 2017 include $5.8 million of costs previously reported as

sustaining capex related to our w ind assets. These costs w ill largely be covered by

our recently signed FSA contracts and so are being reported for all periods as

operating costs.

16

We operate with sufficient liquidity to enable us to fund expected growth initiatives, capital expenditures, and distributions,

and to provide protection against any sudden adverse changes in economic circumstances or short-term fluctuations in

generation.

Principal sources of liquidity are cash flows from operations, our credit facilities, up-financings of subsidiary borrowings

and proceeds from the issuance of securities.

Corporate liquidity and available capital were $1,037 million and $1,210 million, respectively, as of March 31, 2018:

Liquidity

$ 73 $ 47

12 21

Cash available to corporate 85 68

Authorized credit facilities 600 450

Draws on credit facilities (70) (60)

Commitments under revolver (78) (103)

Undrawn Sponsor Line 500 500

952 787

$ 1,037 $ 855

73 60

95 97

5 3

$ 1,210 $ 1,015

Other project-level unrestricted cash

Project-level restricted cash

Project-level credit commitments, unissued

Available capital

(MILLIONS)

Unrestricted corporate cash

Project-level distributable cash

Credit facilities

Available portion of credit facilities

Mar 31

2018

Dec 31

2017

Corporate liquidity

17

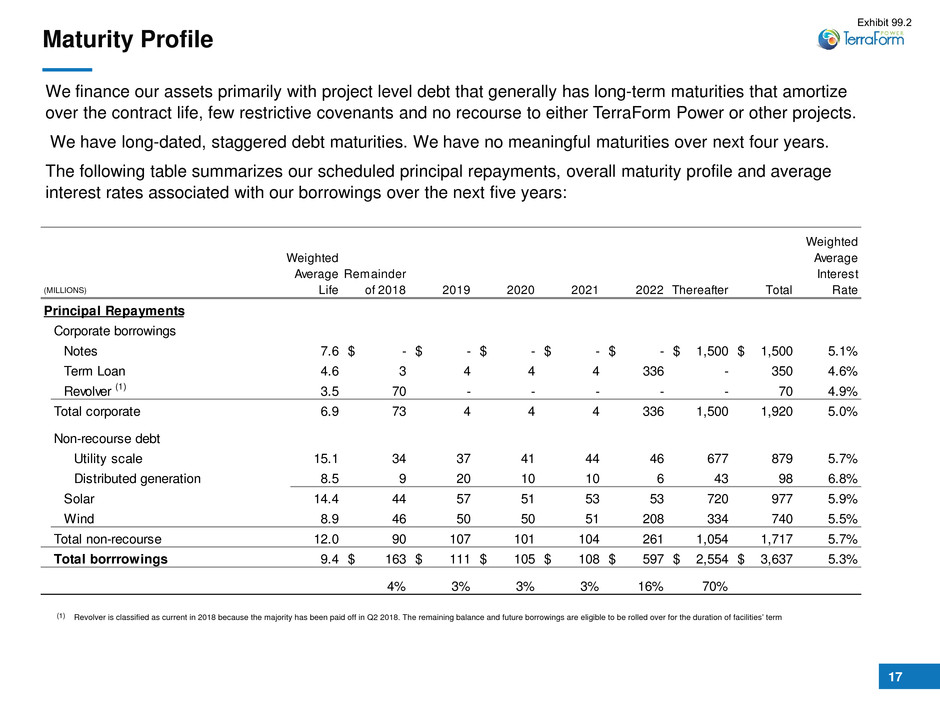

Maturity Profile

We finance our assets primarily with project level debt that generally has long-term maturities that amortize

over the contract life, few restrictive covenants and no recourse to either TerraForm Power or other projects.

We have long-dated, staggered debt maturities. We have no meaningful maturities over next four years.

The following table summarizes our scheduled principal repayments, overall maturity profile and average

interest rates associated with our borrowings over the next five years:

Notes 7.6 $ - $ - $ - $ - $ - $ 1,500 $ 1,500 5.1%

Term Loan 4.6 3 4 4 4 336 - 350 4.6%

Revolver (1) 3.5 70 - - - - - 70 4.9%

Total corporate 6.9 73 4 4 4 336 1,500 1,920 5.0%

Utility scale 15.1 34 37 41 44 46 677 879 5.7%

Distributed generation 8.5 9 20 10 10 6 43 98 6.8%

Solar 14.4 44 57 51 53 53 720 977 5.9%

Wind 8.9 46 50 50 51 208 334 740 5.5%

Total non-recourse 12.0 90 107 101 104 261 1,054 1,717 5.7%

Total borrrowings 9.4 $ 163 $ 111 $ 105 $ 108 $ 597 $ 2,554 $ 3,637 5.3%

4% 3% 3% 3% 16% 70%

Revolver is classified as current in 2018 because the majority has been paid off in Q2 2018. The remaining balance and future borrowings are eligible to be rolled over for the duration of facilities’ term

Principal Repayments

Corporate borrowings

Non-recourse debt

2021 2022 Thereafter Total

Weighted

Average

Interest

Rate(MILLIONS)

Weighted

Average

Life

Remainder

of 2018 2019 2020

(1)

18

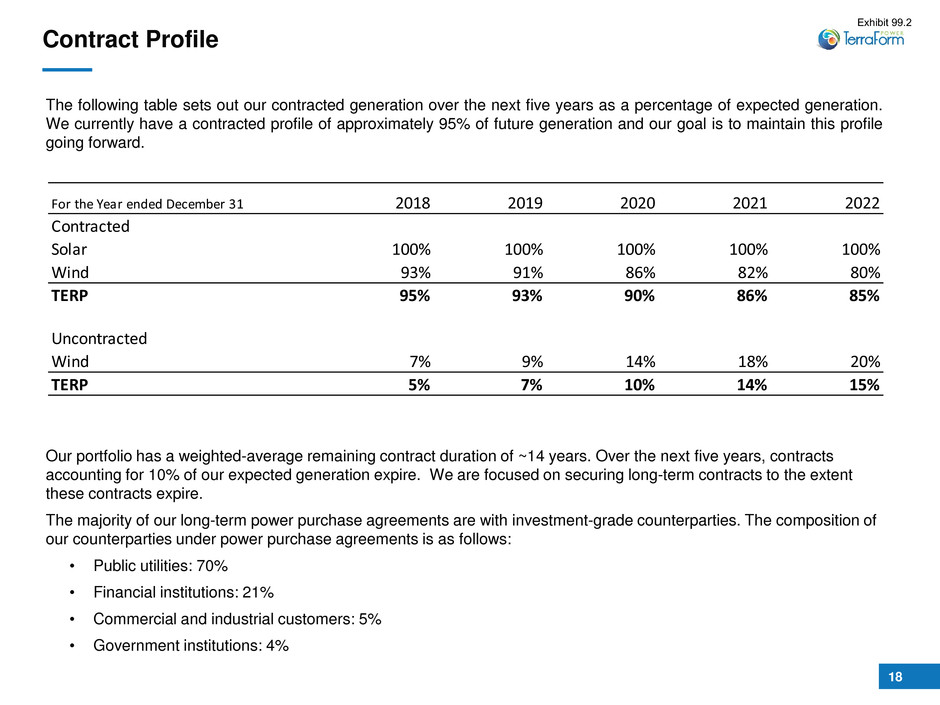

Our portfolio has a weighted-average remaining contract duration of ~14 years. Over the next five years, contracts

accounting for 10% of our expected generation expire. We are focused on securing long-term contracts to the extent

these contracts expire.

The majority of our long-term power purchase agreements are with investment-grade counterparties. The composition of

our counterparties under power purchase agreements is as follows:

• Public utilities: 70%

• Financial institutions: 21%

• Commercial and industrial customers: 5%

• Government institutions: 4%

The following table sets out our contracted generation over the next five years as a percentage of expected generation.

We currently have a contracted profile of approximately 95% of future generation and our goal is to maintain this profile

going forward.

Contract Profile

For the Year ended December 31 2018 2019 2020 2021 2022

Contracted

Solar 100% 100% 100% 100% 100%

Wind 93% 91% 86% 82% 80%

TERP 95% 93% 90% 86% 85%

Uncontracted

Wind 7% 9% 14% 18% 20%

TERP 5% 7% 10% 14% 15%

19

Appendix 1 - Reconciliation of Non-GAAP Measures

20

Reconciliation of Non-GAAP Measures

for the Three Months Ended March 31

(MILLIONS, EXCEPT AS NOTED) Solar Wind Corp Total Solar Wind Corp Total

Revenue $60 $68 $0 $128 $66 $85 $0 $151

Unrealized (gain) loss on commodity contract derivatives, net (a) - 2 - 2 - (2) - (2)

Amortization of favorable and unfavorable rate revenue contracts, net (b) 1 8 - 9 2 8 - 10

Other non-cash items (c) - - - - (3) - - (3)

Adjustment for asset sales - - - - (7) - - (7)

Adjusted revenues $61 $78 $0 $139 $58 $91 $0 $149

Direct operating costs (d) (12) (24) (7) (43) (11) (26) (9) (46)

Adjusted EBITDA $49 $54 ($7) $96 $47 $65 ($9) $103

Non-operating general and administrative expenses (e) - - (18) (18) - - (25) (25)

Stock-based compensation expense - - - - - - (3) (3)

Acquisition and related costs - - (4) (4) - - - -

Depreciation, accretion and amortization expense (f) (30) (46) - (76) (29) (41) (1) (71)

Impairment charges (15) - - (15) - - - -

Interest expense, net (15) (11) (28) (54) (20) (20) (28) (68)

Income tax benefit - - 1 1 - - 1 1

Adjustment for asset sales - - - - 3 - - 3

Other non-cash or non-operating items (g) (1) (4) (1) (6) 5 1 (2) 4

Net (loss) income ($12) ($7) ($57) ($76) $6 $5 ($67) ($56)

(MILLIONS, EXCEPT AS NOTED) Solar Wind Corp Total Solar Wind Corp Total

Adjusted EBITDA $49 $54 ($7) $96 $47 $65 ($9) $103

Fixed management fee - - (2) (2) - - - -

Variable management fee - - (1) (1) - - - -

Adjusted interest expense (h) (14) (11) (25) (50) (14) (20) (26) (60)

Levelized principal payments (i) (12) (12) - (24) (12) (13) - (25)

Cash distributions to non-controlling interests (j) (3) (2) - (5) (4) (6) - (10)

Sustaining capital expenditures (k) - (2) - (2) - - - -

Other (l) 3 8 - 11 4 7 - 11

Cash available for distribution (CAFD) (m) $23 $35 ($35) $23 $21 $33 ($35) $19

Three Months Ended Three Months Ended

March 31, 2018 March 31, 2017

Three Months Ended Three Months Ended

March 31, 2018 March 31, 2017

21

Reconciliation of Non-GAAP Measures

for the Three Months Ended March 31

a) Represents unrealized loss (gain) on commodity contracts associated with energy derivative contracts that are accounted for at fair value with the changes recorded in operating

revenues, net. The amounts added back represent changes in the value of the energy derivative related to future operating periods, and are expected to have little or no net economic

impact since the change in value is expected to be largely offset by changes in value of the underlying energy sale in the spot or day-ahead market.

b) Represents net amortization of purchase accounting related to intangibles arising from past business combinations related to favorable and unfavorable rate revenue contracts.

c) Primarily represents recognized deferred revenue related to the upfront sale of investment tax credits.

d) In the three months ended March 31, 2017, reclassifies $2.3 million wind sustaining capital expenditure into direct operating costs, which will now be covered under new Full Service

Agreement.

e) Pursuant to the management services agreement, SunEdison agreed to provide or arrange for other service providers to provide management and administrative services to us. In the

three months ended March 31, 2017, we accrued $0.4 million of costs incurred for management and administrative services that were provided by SunEdison under the Management

Services Agreement that were not reimbursed by TerraForm Power and were treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA. In addition, non-

operating items and other items incurred directly by TerraForm Power that we do not consider indicative of our core business operations are treated as an addback in the reconciliation

of net income (loss) to Adjusted EBITDA. These items include extraordinary costs and expenses related primarily to restructuring, legal, advisory and contractor fees associated with the

bankruptcy of SunEdison and certain of its affiliates (the “SunEdison bankruptcy”) and investment banking, legal, third party diligence and advisory fees associated with the Brookfield

transaction, dispositions and financings. The Company’s normal general and administrative expenses, paid by Terraform Power, are the amounts shown below and were not added back

in the reconciliation of net income (loss) to Adjusted EBITDA ($ in millions):

f) Includes reductions (increases) within operating revenues due to net amortization of favorable and unfavorable rate revenue contracts as detailed in the reconciliation of Adjusted

Revenue.

g) Represents other non-cash items as detailed in the reconciliation of Adjusted Revenue and associated footnote and certain other items that we believe are not representative of our core

business or future operating performance, including but not limited to: loss (gain) on foreign exchange (“FX”), unrealized loss on commodity contracts, loss on investments and

receivables with affiliate, loss on disposal of renewable energy facilities, and wind sustaining capital expenditure previously reclassified.

h) Represents project-level and other interest expense and interest income attributed to normal operations. The reconciliation from Interest expense, net as shown on the Unaudited

Condensed Consolidated Statement of Operations to adjusted interest expense applicable to CAFD is as follows:

Q1 2018 Q1 2017

$7 M $9 M

$ in millions Q1 2018 Q1 2017

Interest expense, net ($54) ($68)

Amortization of deferred financing costs and debt discounts 3 5

Adjustment for asset sales - 4

Other 1 (1)

Adjusted interest expense ($50) ($60)

22

i) Represents levelized project-level and other principal debt payments to the extent paid from operating cash.

j) Represents cash distributions paid to non-controlling interests in our renewable energy facilities. The reconciliation from Distributions to non-controlling interests as shown on the

Unaudited Condensed Consolidated Statement of Cash Flows to Cash distributions to non-controlling interests, net for the three months ended March 31, 2018 and 2017 is as follows:

k) Represents long-term average sustaining capex starting in 2018 to maintain reliability and efficiency of the assets.

l) Represents other cash flows as determined by management to be representative of normal operations including, but not limited to, wind plant “pay as you go” contributions received from

tax equity partners, interconnection upgrade reimbursements, major maintenance reserve releases or (additions), and releases or (postings) of collateral held by counterparties of energy

market hedges for certain wind plants.

m) CAFD in 2017 was recast as follows to present the levelized principal payments and adjusted interest expense in order to provide period to period comparisons that are consistent and

more easily understood. In the twelve months ended December 31, 2017, CAFD remained $88 million as reported previously.

Reconciliation of Non-GAAP Measures

for the Three Months Ended March 31 (Continued)

$ in millions Q1 2018 Q1 2017

Distributions to non-controlling interests ($6) ($10)

Adjustment for non-operating cash distributions 1 -

Cash distributions to non-controlling interests, net ($5) ($10)

$ in millions Q1 2017 Q2 2017 Q3 2017 Q4 2017 2017

Cash available for distribution (CAFD) before debt service reported $104 $120 $106 $91 $421

Levelized principal payments (25) (25) (25) (24) (99)

Adjusted interest expense (60) (61) (63) (50) (234)

Cash available for distribution (CAFD), recast $19 $34 $18 $17 $88

23

Appendix 2 – Additional Information

24

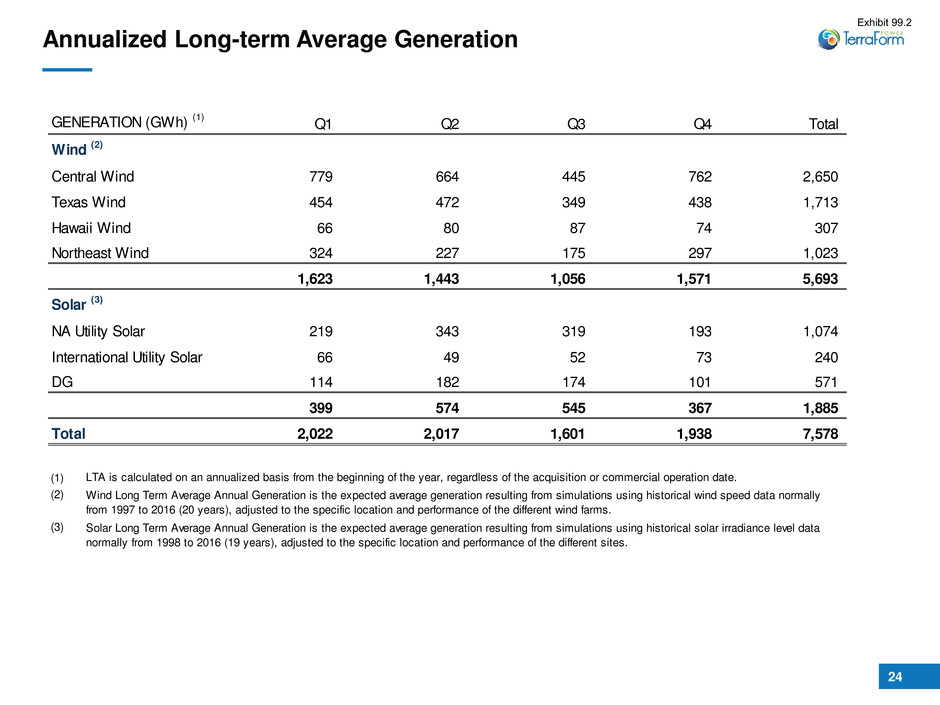

Annualized Long-term Average Generation

GENERATION (GWh) (1) Q1 Q2 Q3 Q4 Total

Wind (2)

Central Wind 779 664 445 762 2,650

Texas Wind 454 472 349 438 1,713

Hawaii Wind 66 80 87 74 307

Northeast Wind 324 227 175 297 1,023

1,623 1,443 1,056 1,571 5,693

Solar (3)

NA Utility Solar 219 343 319 193 1,074

International Utility Solar 66 49 52 73 240

DG 114 182 174 101 571

399 574 545 367 1,885

Total 2,022 2,017 1,601 1,938 7,578

(1)

(2)

(3)

LTA is calculated on an annualized basis from the beginning of the year, regardless of the acquisition or commercial operation date.

Wind Long Term Average Annual Generation is the expected average generation resulting from simulations using historical wind speed data normally

from 1997 to 2016 (20 years), adjusted to the specific location and performance of the different wind farms.

Solar Long Term Average Annual Generation is the expected average generation resulting from simulations using historical solar irradiance level data

normally from 1998 to 2016 (19 years), adjusted to the specific location and performance of the different sites.

25

Calculation and Use of Non-GAAP Measures

Adjusted Revenue, Adjusted EBITDA and CAFD are supplemental non-GAAP measures that should not be viewed as alternatives to GAAP measures of performance, including

revenue, net income (loss), operating income or net cash provided by operating activities. Our definitions and calculation of these non-GAAP measures may not necessarily be the

same as those used by other companies. These non-GAAP measures have certain limitations, which are described below, and they should not be considered in isolation. We

encourage you to review, and evaluate the basis for, each of the adjustments made to arrive at Adjusted Revenue, Adjusted EBITDA and CAFD.

Calculation of Non-GAAP Measures

We define adjusted revenue as operating revenues, net, adjusted for non-cash items including unrealized gain/loss on derivatives, amortization of favorable and unfavorable rate

revenue contracts, net and other non-cash revenue items.

We define adjusted EBITDA as net income (loss) plus depreciation, accretion and amortization, non-cash general and administrative costs, interest expense, income tax (benefit)

expense, acquisition related expenses, and certain other non-cash charges, unusual or non-recurring items and other items that we believe are not representative of our core business

or future operating performance.

We define “cash available for distribution” or “CAFD” as adjusted EBITDA (i) minus cash distributions paid to non-controlling interests in our renewable energy facilities, if any, (ii) minus

annualized scheduled interest and project level amortization payments in accordance with the related borrowing arrangements, (iii) minus average annual sustaining capital

expenditures (based on the long-sustaining capital expenditure plans) which are recurring in nature and used to maintain the reliability and efficiency of our power generating assets

over our long-term investment horizon, (iv) plus or minus operating items as necessary to present the cash flows we deem representative of our core business operations.

As compared to the preceding period, we revised our definition of CAFD to (i) exclude adjustments related to deposits into and withdrawals from restricted cash accounts, required by

project financing arrangements, (ii) replace sustaining capital expenditures payment made in the year with the average annualized long-term sustaining capital expenditures to maintain

reliability and efficiency of our assets, and (iii) annualized debt service payments. We revised our definition as we believe it provides a more meaningful measure for investors to

evaluate our financial and operating performance and ability to pay dividends. For items presented on an annualized basis, we will present actual cash payments as a proxy for an

annualized number until the period commencing January 1, 2018.

Furthermore, to provide investors with the most appropriate measures to assess the financial and operating performance of our existing fleet and the ability to pay dividends in the

future, we have excluded results associated with our UK solar and Residential portfolios, which were sold in 2017, from adjusted revenue, EBITDA and CAFD reported for all periods.

Use of Non-GAAP Measures

We disclose Adjusted Revenue because it presents the component of operating revenue that relates to energy production from our plants, and is, therefore, useful to investors and

other stakeholders in evaluating performance of our renewable energy assets and comparing that performance across periods in each case without regard to non-cash revenue items.

We disclose Adjusted EBITDA because we believe it is useful to investors and other stakeholders as a measure of financial and operating performance and debt service capabilities.

We believe Adjusted EBITDA provides an additional tool to investors and securities analysts to compare our performance across periods and among us and our peer companies

without regard to interest expense, taxes and depreciation and amortization. Adjusted EBITDA has certain limitations, including that it: (i) does not reflect cash expenditures or future

requirements for capital expenditures or contractual liabilities or future working capital needs, (ii) does not reflect the significant interest expenses that we expect to incur or any income

tax payments that we may incur, and (iii) does not reflect depreciation and amortization and, although these charges are non-cash, the assets to which they relate may need to be

replaced in the future, and (iv) does not take into account any cash expenditures required to replace those assets. Adjusted EBITDA also includes adjustments for goodwill impairment

charges, gains and losses on derivatives and foreign currency swaps, acquisition related costs and items we believe are infrequent, unusual or non-recurring, including adjustments for

general and administrative expenses we have incurred as a result of the SunEdison bankruptcy.

We disclose CAFD because we believe cash available for distribution is useful to investors in evaluating our operating performance and because securities analysts and other

stakeholders analyze CAFD as a measure of our financial and operating performance and our ability to pay dividends. CAFD is not a measure of liquidity or profitability, nor is it

indicative of the funds needed by us to operate our business. CAFD has certain limitations, such as the fact that CAFD includes all of the adjustments and exclusions made to Adjusted

EBITDA described above.

The adjustments made to Adjusted EBITDA and CAFD for infrequent, unusual or non-recurring items and items that we do not believe are representative of our core business involve

the application of management judgment, and the presentation of Adjusted EBITDA and CAFD should not be construed to infer that our future results will be unaffected by infrequent,

non-operating, unusual or non-recurring items.

In addition, these measures are used by our management for internal planning purposes, including for certain aspects of our consolidated operating budget, as well as evaluating the

attractiveness of investments and acquisitions. We believe these Non-GAAP measures are useful as a planning tool because it allows our management to compare performance

across periods on a consistent basis in order to more easily view and evaluate operating and performance trends and as a means of forecasting operating and financial performance

and comparing actual performance to forecasted expectations. For these reasons, we also believe these Non-GAAP measures are also useful for communicating with investors and

other stakeholders.

NASDAQ:

TERP

http://www.terraformpower.com

26