Attached files

Exhibit 10.4

Great Plains Energy Incorporated

Kansas City Power & Light Company

KCP&L Greater Missouri Operations Company

Annual Incentive Plan

Amended effective as of January 1, 2018

Objective

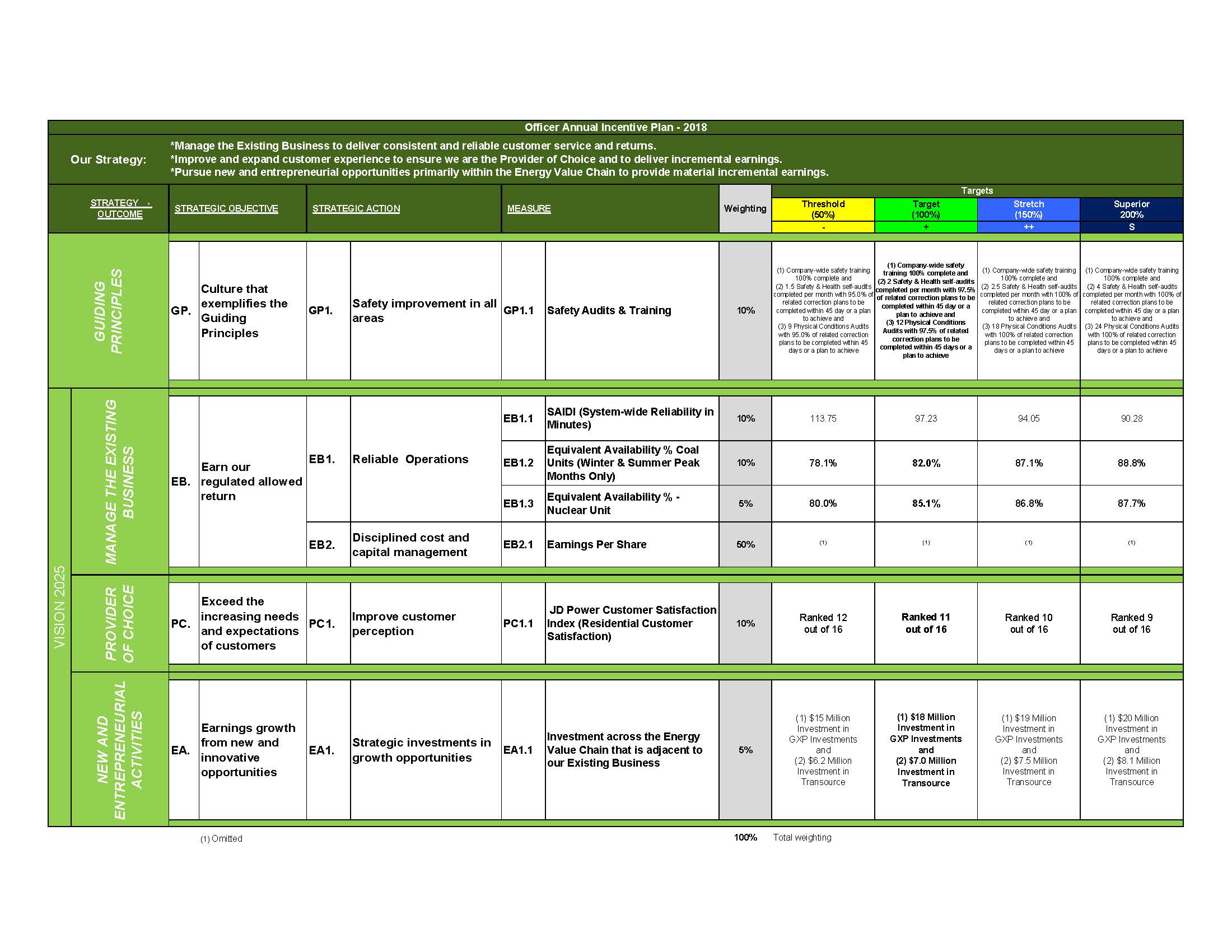

The Great Plains Energy Incorporated (“Great Plains Energy” or the “Company”), Kansas City Power & Light Company (“KCP&L”), and KCP&L Greater Missouri Operations Company (“GMO”) Annual Incentive Plan (the “Plan”) is designed to motivate and reward officers for the achievement of specific key financial and business goals. By providing market-competitive target awards, the Plan supports the attraction and retention of senior executive talent critical to achieving Great Plains Energy’s strategic business objectives.

Eligible participants shall be those officers of Great Plains Energy, KCP&L and/or GMO (“participants”), as approved by the Compensation and Development Committee (“Committee”) of the Board of Directors.

Awards

Awards are recommended by the Committee and approved by the independent members of the Board of Directors, and set as a percentage of the participant’s base salary. Percentages will vary based on level of responsibility, market data and internal comparisons.

Notwithstanding anything herein to the contrary and even in the event that none of the Primary Goal(s) or none of the Secondary Goal(s) is achieved, the Committee shall nevertheless retain the full discretion to pay bonus compensation outside of the parameters of this Plan for the 2018 Plan Year.

Plan Year and Incentive Objectives

For 2018, the Plan Year will initially be the fiscal year beginning on January 1 and ending on December 31. Within the first 90 days of the 2018 Plan Year, the Committee will recommend for approval by the independent members of the Board of Directors specific annual objectives and performance levels that are applicable to each participant. The amount of an individual participant’s award will be determined based on performance against the specific objectives and performance levels approved by the independent members of the Board of Directors. Objectives and performance levels for the 2018 Plan Year will be fixed for the Plan Year and, in addition to any possible changes to account for the anticipated merger with Westar Energy, Inc. (the “Merger”) and the potential for two contingent Stub Periods (as defined below), will be changed only upon the approval of the independent members of the Board of Directors.

Contingent Stub Period

During 2018 and in connection with the Merger, the Committee may modify and bifurcate the Plan Year (and related incentive objectives) to be two Contingent Stub Periods (each a "Stub Period"). In the Committee's discretion, one Stub Period may end on or shortly before the effective date of the Merger (the "First Stub Period") and the second Stub Period may begin on or shortly following the effective date of the Merger and end on December 31, 2018 (the "Second Stub Period"). The Committee may modify and establish any incentive objectives and the performance levels applicable to any participant for the First Stub Period no later than February 28, 2018 and establish any incentive objectives and performance levels applicable to

any participant for the Second Stub Period no later than 60th day following the commencement date of the Second Stub Period.

Each participant will be provided a copy of the applicable objectives and performance levels within the first 90 days of the 2018 year or any Stub Period.

"Umbrella" Plan Funding for any Plan Year or Stub Periods

The Committee will utilize an “umbrella" funding structure under the Plan to give the Committee additional structured flexibility with respect to determining bonus amounts. The Committee has elected to utilize this funding approach for the 2018 Plan Year, including for either or both of any Stub Period. Under this funding structure, if initial objective performance goal(s) are achieved, Plan award amounts will be "funded" at the superior (200%), subject to further reduction based on Company and individual performance. Individual awards under the Plan shall not exceed 200%. Umbrella funding allows the Committee to exercise negative discretion and to differentiate bonus amounts among executives based on individual performance and the Committee's assessment of the individual’s achievements and overall contributions to the Company. If the achievement level of the Primary Goal(s) does not meet threshold performance, umbrella funding at the 200% level will not occur, and earned awards will be paid based on the actual performance level of the Plan objectives for the Plan Year or applicable Stub Period. Determination of final awards under the Plan are subject to Committee discretion.

For each Plan year (or any Stub Period), the Committee will establish one or more initial performance objective(s) (the “Primary Goal(s)”) that must be met to fund the Plan at 200%. For 2018, there will be one Primary Goal: the Company's earnings per share (EPS). Achievement of the Primary Goal(s) at the threshold level will result in initial funding levels under the Plan at two hundred percent (200%) of all target bonus payout levels. All other Officer Annual Incentive Plan objective performance goals will be considered “Secondary Goals”. The Committee will approve the Primary and Secondary goals after reviewing management’s recommendations of objectives and targets and associated risks and discussing the applicable goals and goal levels with the independent members of the Board. The Committee will exercise negative discretion based on achievement levels of the Secondary Goals and any other subjective factors the Committee elects to take into account when determining earned awards.

Payment of Awards

Earned awards will be payable to each participant after the completion of the Plan Year or Stub Period, as applicable, following the determination by the Committee of the achievement level for the Primary Goal(s), the Secondary Goal(s) and each of the relevant objectives relating thereto and the date payment will be made. The awards will be paid, in the sole discretion of the Committee, in cash, Company stock (in the form of “Bonus Shares” under the Company’s Long-Term Incentive Plan, as may be amended or restated), or a combination of cash and stock, except to the extent receipt of payment is properly deferred under the Nonqualified Deferred Compensation Plan (the “NQDC Plan”). (Note that any earned award for which a deferral election has been made under the NQDC Plan will result in a cash award being deferred, as Bonus Shares are not eligible to be deferred under such plan.)

An award for a person who becomes a participant during a Plan Year or Stub Period, as applicable, will be prorated unless otherwise determined by the Committee. A participant who retires during a Plan Year or Stub Period, as applicable, will receive a prorated award unless otherwise determined by the Committee. Prorated awards will be payable in the event of death or disability of the participant. Proration shall be calculated using the number of months elapsed in the year or Stub Period, as applicable, prior to the event,

2

based on the following conventions: If the event occurs between the first and fifteenth day of a month, it shall be deemed to have occurred on the first of the month; and if the event occurs subsequent to the fifteenth day of a month, it shall be deemed to have occurred on the first day of the following month. A participant who terminates employment with the Company prior to the date awards are paid shall forfeit all awards unless otherwise determined by the Committee in its sole discretion.

The Company may deduct from the cash portion of the award all applicable withholding and other taxes applicable to the entire award. Such withheld amount must satisfy, but not exceed, the Company’s minimum tax withholding obligations for federal and state income tax purposes. No Company common stock will be paid under an award until the participant (or the participant’s successor) has paid to the Company the amount that must be withheld under federal, state and local income and employment tax laws or the participant and the Company have made satisfactory provision for the payment of such taxes. As an alternative to making a cash payment to satisfy the applicable withholding taxes, the participant or the participant’s successor may elect to have the Company retain that number of shares (valued at their Fair Market Value, as that term is defined in the Company’s Long-Term Incentive Plan, as may be amended or restated) that would satisfy the applicable withholding taxes, subject to the Committee’s continuing authority to require cash payment notwithstanding participant’s election.

To the extent the participant elects to have shares withheld to cover the applicable minimum withholding requirements, and has not already done so, the participant must complete a withholding election on the form provided by the Corporate Secretary of the Company and return it to the designated person set forth on the form no later than the date specified thereon (which shall in no event be more than thirty days from the grant date of the award). The participant may elect on such form to relinquish the minimum number of whole shares of Company common stock having an aggregate fair market value (as determined for tax purposes) on the applicable vesting or payment date that will fully cover the amount required to satisfy the Company’s minimum tax withholding obligations for federal and state income tax purposes arising on the applicable vesting or payment date. To the extent no withholding election is made before the date specified, the participant is required to pay the Company the amount of federal, state and local income and employment tax withholdings by cash or check at the time the participant recognizes income with respect to such shares, or must make other arrangements satisfactory to the Company to satisfy the tax withholding obligations after which the Company will release or deliver, as applicable, to the participant the full number of shares.

The Company will, to the full extent permitted by law, have the discretion based on the particular facts and circumstances, to require that each participant reimburse the Company for all or any portion of any awards if and to the extent the awards reflected the achievement of financial results that were subsequently the subject of a restatement, or the achievement of other objectives that were subsequently found to be inaccurately measured, and a lower award would have occurred based upon the restated financial results or inaccurately measured objectives. The Company may, in its discretion, (i) seek repayment from the participants; (ii) reduce the amount that would otherwise be payable to the participants under current or future awards; (iii) withhold future equity grants or salary increases; (iv) pursue other available legal remedies; or (v) any combination of these actions. The Company may take such actions against any participant, whether or not such participant engaged in any misconduct or was otherwise at fault with respect to such restatement or inaccurate measurement. The Company will, however, not seek reimbursement with respect to any awards paid more than three years prior to such restatement or the discovery of inaccurate measurements, as applicable.

Administration

3

The Committee has the full power and authority to interpret the provisions of the Plan. The independent members of the Board of Directors have the exclusive right to terminate, modify, change, or alter the plan at any time.

Adopted by the independent members of

the Board of Directors on February 13, 2018

By: /s/John J. Sherman

John J. Sherman

Chair, Compensation and Development Committee

4

Appendix

5