Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF CROWE HORWATH LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. - iPic Entertainment Inc. | f10k2017ex23-2_ipicentertain.htm |

| EX-23.1 - CONSENT OF CROWE HORWATH LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. - iPic Entertainment Inc. | f10k2017ex23-1_ipicentertain.htm |

| EX-32.1 - CERTIFICATION - iPic Entertainment Inc. | f10k2017ex32-1_ipicentertain.htm |

| EX-31.2 - CERTIFICATION - iPic Entertainment Inc. | f10k2017ex31-2_ipicentertain.htm |

| EX-31.1 - CERTIFICATION - iPic Entertainment Inc. | f10k2017ex31-1_ipicentertain.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - iPic Entertainment Inc. | f10k2017ex21-1_ipicentertain.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017.

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________________ to _____________________

Commission File Number 001-38380

iPic Entertainment

Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 82-3129582 | |

| (State

or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

Mizner Park, 433 Plaza Real, Ste. 335, Boca

Raton, Florida |

33432 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (561) 886-3232

| Securities registered pursuant to Section 12(b) of the Securities Exchange Act | ||

| Title of Class | Name of Exchange on which Registered | |

| Class A Common stock, par value $0.0001 per share | The NASDAQ Stock Market LLC | |

|

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: ☒ None | ||

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller Reporting Company | ☒ | |

| Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). ☐ Yes ☒ No

The aggregate market value of the common stock of the Registrant held by non-affiliates of the Registrant on February 1, 2018 was $18,897,127 (1,248,159 shares at a closing price per share of $15.14). The Registrant has elected to use February 1, 2018 as the calculation date, which was the initial trading date of the Registrant’s common stock on the Nasdaq, because on June 30, 2017 (the last business day of the Registrant’s most recently completed second fiscal quarter), the Registrant was a privately held company.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at May 1, 2018 | |

| Class A Common stock, par value $0.0001 per share | 1,248,159 shares | |

| Class B Common Stock, par value $0.0001 per share | 9,926,621 shares |

Documents Incorporated by Reference

None.

iPic Entertainment Inc.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2017

INDEX

____________________________________

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology, but the absence of these particular words does not mean that a statement is not forward-looking.

You should read this Annual Report on Form 10-K, and the documents that we reference herein, with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Annual Report on Form 10-K, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| ● | our inability to successfully identify and secure appropriate sites and timely develop and expand our operations in existing and new markets, including international markets; |

| ● | our inability to optimize our theater circuit through new construction and transforming our existing theaters; |

| ● | competition from other theater chains and restaurants; |

| ● | our inability to operate profitably; |

| ● | our dependence on a small number of suppliers for motion picture products; |

| ● | our inability to manage fluctuations in attendance in the motion picture exhibition industry; |

| ● | our inability to address the increased use of alternative film delivery methods or other forms of entertainment; |

| ● | our ability to serve menu items that appeal to our guests and to avoid food safety problems; |

| ● | our inability to obtain sufficient capital to open up new units, to renovate existing units and to deploy strategic initiatives; |

| ● | our ability to address issues associated with entering into long-term non-cancelable leases; |

| ● | our inability to protect against security breaches of confidential guest information; |

| ● | our inability to manage our growth; |

| ● | our inability to maintain sufficient levels of cash flow, or access to capital, to meet growth expectations; |

| ● | our inability to manage our substantial level of outstanding debt; |

| ● | our ability to continue as a going concern; |

| ● | our failure to meet any operational and financial performance guidance we provide to the public; and |

| ● | our ability to compete and succeed in a highly competitive and evolving industry. |

Although the forward-looking statements in this Annual Report are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained. Should one or more of the risks or uncertainties referred to above and elsewhere in this Annual Report materialize, or should any of our assumptions prove to be incorrect, our actual results may vary in material and adverse respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

| Item 1. | Business |

Overview

iPic Entertainment Inc. (“iPic”, the “Company”, “we”, “our” or “us”) was formed as a Delaware Corporation on October 18, 2017. The Company was formed for the purpose of completing an initial public offering (“IPO”) and related transactions in order to carry on the business of iPic-Gold Class Entertainment, LLC (“iPic-Gold Class”) and its subsidiaries. Additionally, iPic-Gold Class Holdings LLC (“Holdings”) was formed as a Delaware limited liability company on December 22, 2017, to hold the equity interests in iPic-Gold Class. As of the completion of the IPO and related transactions, the Company is the sole managing member of Holdings, and Holdings is the sole managing member of iPic-Gold Class and its subsidiaries. iPic-Gold Class and its subsidiaries, continue to conduct the business conducted by these subsidiaries prior to the IPO and related transactions.

iPic strives to be our guests’ favorite local destination for a night out on the town. Our newest locations blend three distinct areas — a polished-casual restaurant, a farm-to-glass full-service bar, and our world-class luxury theater auditoriums with in-theater dining — into a one-of-a-kind experience. Our team endeavors to deliver world class hospitality in innovative, one-of-a-kind theaters which we believe are among the finest in the world. Our chefs and mixologists create craveable food and drink offerings that are outstanding on a standalone basis, but it is the interplay between our movie-entertainment, dining and full-service bar areas that is the defining feature of a typical four-hour guest experience. We thoughtfully design the layout, ambiance, and energy-flow of each unit to maximize the crossover between these activities. With constantly changing movie content and menu offerings, each visit is different, providing our customers with a reason to visit us repeatedly. We believe we deliver an experience that is innovative, unique and cannot be easily replicated at home or elsewhere without the hassle of having to visit multiple destinations. Our locations also act as great venues for private events, family and business functions and other corporate-sponsored events. We believe our concept is well-positioned within today’s ever-increasing experiential economy.

We believe we pioneered the concept of polished-casual dining in a luxury theater auditorium and are one of the largest combined movie theater and restaurant entertainment destinations with locations engineered from the ground up to provide our guests with a luxurious movie-going experience at an affordable price. We currently operate 115 screens at 15 locations in 9 states, with an additional 4 locations under construction, and a pipeline of an additional 15 sites that either have a signed lease or are in lease negotiations.

Our iPic locations have three different formats.

Our Generation I locations: We have six initial locations that are designated as our First-Generation format (Redmond, WA; Pasadena, CA; South Barrington, IL; Bolingbrook, IL; Austin, TX; and Fairview, TX). These units were built between 2007 and 2010, and generally do not have a separate restaurant attached. These initial sites tested and validated the business-model for Premium-Plus seating and service, and, over time, began to showcase the synergistic opportunity of having a complementary restaurant and dining experience within the facility. In 2017, our Generation I locations averaged approximately $5.9 million of revenues, or about $812,400 per screen. The Company closed its Glendale, WI location, an original Generation I location, effective March 8, 2018. The decision to close the location was made during an all-hands conference call on March 5, 2018. The events giving rise to that decision include the mall entering receivership during the last quarter of 2017 and the underperformance of the site during the first quarter of 2018.

Our Generation II locations: We designated the next five iPic locations as our Second-Generation format (Scottsdale, AZ; Boca Raton, FL; Bethesda, MD; Westwood, CA; and Miami, FL). Built in 2011 to 2014, these units feature a Tuck Hospitality Group signature restaurant (City Perch, Tanzy, or Tuck Room Tavern). Among other things, these units further expand the quality and quantity of our Premium-Plus auditorium sections (which generally sell-out first, indicating growing consumer preference for added luxury and service), upgraded the in-theater dining experience with our redesigned iPic Express offerings, and launched the iPic Life program, which is a 20-minute on screen lifestyle program. In 2017, our Generation II locations averaged approximately $10.4 million of revenues, or about $1,372,700 per screen.

Our Generation III locations: The latest four iPic openings are representative of our Third-Generation format (Houston, TX; Ft. Lee, NJ; Fulton Market, NY; and Dobbs Ferry, NY) and represent our go-forward development design for the foreseeable future. These units include our perfected auditorium layout (six to eight screens, 500 seats, and elevated ratio of Premium-Plus seating) and introduced our patent-pending POD seating and patented chaise lounges. In 2017, our Generation III locations open for at least 12 months (Houston, TX; Ft. Lee, NJ; and Fulton Market, NY) averaged approximately $13.2 million of revenues, or about $1,653,400 per screen.

Our Strengths

iPic competes in what we believe to be the most profitable dining occasion: destination dining. We believe the most economic value within the U.S. restaurant industry is created from concepts that have comparatively high sales-mixes of dinner (vs. lunch), dine-in (vs. takeout) and female guests. iPic scores high on these metrics as our sales mix skews more toward dinner, dine-in, and female guests. We believe that return-on-capital is limited for lunch-centric brands given low barriers to entry and low consumer switching costs as evidenced by the high degree of franchise mixes for large-scale U.S. quick-service-restaurant operators. Additionally, we believe that the take-home dinner business presents significant risk of intrusion from digital-centric delivery players within grocery (e.g. Blue Apron, Amazon/Whole Foods) and restaurants (e.g. UberEats, DoorDash) that compete for a dining occasion that is consumed within one’s own home, which could further limit the value that the consumer places on the delivery or take-out brands.

1

iPic’s business model is similar to other disruptive concepts. We believe that within the destination dinner experience, there is growing evidence of strong performance being achieved by a handful of national brands that combine high-end restaurants with some form of entertainment, such as Dave and Busters, and Top Golf, that may indicate there is growing demand for affordable, luxurious, extended dinner-and-entertainment venues. Within this restaurant-and-entertainment segment, we believe iPic’s source of entertainment, showing content on a screen within an ultra-premium auditorium, provides our brand with a unique opportunity for long-term consumer relevancy as our content is refreshed continuously over time to match evolving consumer tastes — including the growing opportunity for alternative content such as eGaming, events, and corporate seminars. Additionally, our affluent customer base enables us to drive substantial ancillary revenue from sponsorship income and membership fees, which make up a substantial and growing portion of our revenues. Lastly, we believe that it could prove difficult for most existing stand-alone restaurants to gain access to our motion picture content, and for most existing theater operations to add iPic’s level of culinary expertise and hospitality culture.

Our Food: iPic’s culinary expertise. We deliver a unique food and beverage experience. Our team, led by chef Sherry Yard, designs and delivers an innovative and continuous new stream of menu items to delight our customers. As a Food Network personality herself, Sherry Yard, along with a monthly celebrity chef, go on screen to show our guests how they cook the latest menu creation. This allows our customers to experience the food of a different highly acclaimed chef each time they visit iPic. We bring the celebrity chefs to our customers, without our customers having to inconveniently travel to experience their creations.

Our Service: iPic’s empowered hospitality culture. We believe that the culture of our team is an important factor in our success. We train and empower our team to provide our guests with world-class customer service throughout our facility. However, we also recognize that within today’s highly-connected digital economy some of our guests, depending on the occasion, may view the best possible customer experience on a given day to be one that is digitally seamless with only a minimum amount of direct interaction with our team members, such as an Uber or Amazon transaction. As such, we have invested heavily in industry-leading digital technology that could, at our guest’s choosing, create a near frictionless theater experience by using our iPic app to, among other things: purchase and choose their seating ahead of time, open a check anywhere in our facility (like at our bar) and have it move with you throughout your stay, including ordering additional items (like at your theater seats). When a guest’s stay is over, our app technology will close-out the check automatically with a prompted or pre-set tip amount, depending on the setting. We have coined our service-model ethos “empowered hospitality” that strives to give our customers the power to choose their desired level of service on each particular visit.

Our Facilities: iPic’s world-class environment and ambiance. We have a history of designing architecturally unique and relevant entertainment destinations that successfully compete with not only other forms of out-of-home entertainment but also with the comfort and convenience of home entertainment options. Our patent-pending seating Pods enable our guests to watch a movie in an intimate setting within a shared environment. Our patented chaise lounges have transformed a historically less-desirable seating area to a highly sought-after section of the auditorium. Our pillows and blankets at each Premium Plus seat along with our non-disruptive table-top service turns movie watching at iPic into an affordable luxury experience available to the general population.

Our Brand: iPic’s differentiated lifestyle brand with broad adult guest appeal. We believe that the multi-faceted guest experience of dining, drinking and watching a movie in a comfortable and luxurious setting, supported by ever changing Hollywood movies and other non-traditional content, such as concerts and eGaming, and combined with our marketing campaigns have helped create a differentiated brand that is widely recognized and has no national direct competitor on the premium end of the market. Our brand’s connection with its guests is best evidenced by our guest loyalty program with over 1.8 million members. This membership program has increased approximately 100% over the last three years. Our guest research shows that our brand skews towards females (60%) that are primarily between the ages of 21 and 54, with only 3% of our guests under the age of 21. Based on guest surveys, the median household income of our frequent members is approximately $119,000, which we believe represents an attractive demographic.

Our multi-faceted guest experience is an affordable luxury that offers excellent value. The average spend of approximately $45 per guest for dinner-and-a-movie at an iPic is a fraction of the cost of other luxury experiences, such as a theatrical play or live sporting event. We believe that our combination of movie-theater entertainment, polished casual-dining and full-service beverage offerings, delivered in a one-of-a-kind curated environment with a local-club atmosphere is an aspirational experience to most Americans. Our multi-faceted guest experience cannot be replicated without visiting multiple destinations. We believe that the cost of visiting an iPic offers an attractive value proposition for our guests relative to pursuing separate dining and entertainment options.

2

Attractive store economic model with diversified cash flows and strong cash-on-cash returns. We have multiple drivers of traffic with desirable demographics that differentiate us from other food and entertainment concepts. New movies drive traffic to our theaters and restaurants while our ever-changing cast of celebrity chef-inspired creations also help drive incremental traffic. This ability to drive traffic gives us a structural advantage in our store economic model compared with traditional restaurant concepts and provides us with leverage to negotiate favorable economic deals for rent and tenant improvement allowances. In addition to traditional food and beverage revenue, we add additional revenue from our theater operations and, importantly, from non-traditional ancillary revenue such as sponsorships and membership fees. Approximately 54% and 52% of our total revenues for 2017 and 2016, respectively, were derived from food-and-beverage, and 44% and 46%, respectively, were derived from theater operations.

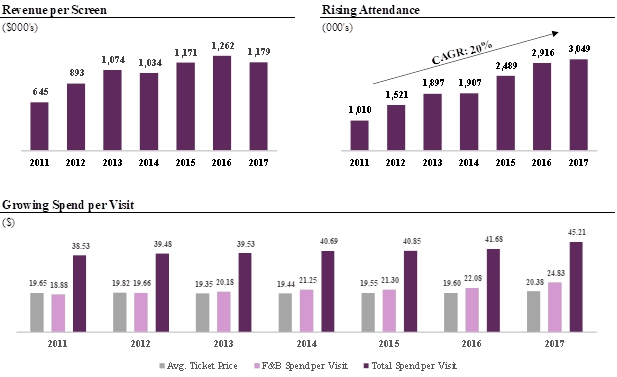

Our store economic model has led to a 20% compound annual growth rate in attendance since 2011, along with generally increasing revenues per screen and spend per visit over the same period.

History of successful product innovation and marketing initiatives. Our self-developed app enables our guests to purchase their tickets, select their seat, and order food and beverage from their mobile phones. Our fully-automated in-store tracking system signals the kitchen upon our guest’s arrival which eliminates the need for placing an order in person with a server. There is also no need for a presentation of the check at the end of the movies as our guests, who choose to do so, may simply stand up and leave as our app can seamlessly handle checkout. We have transformed the ordering and payment of food and beverage in our theaters to an Uber-like experience. We can target and implement marketing programs for our members based on their likes and dislikes, which we believe has increased their frequency of movie-going significantly. Our marketing team has developed a robust membership and rewards program that enables instant redemption of rewards points, which improves guest loyalty. In fact, based on information we collect from our guests, 85% of our guests recommend iPic as their destination of choice for a night out to their friends and our aggregated positive consumer sentiment is 81%. Our Access point rewards program provides members with special ticket pricing, priority access on all ticket purchases, advance screening events, complementary seating upgrades, and more. We have three membership tiers:

| ● | Access Silver Membership (Free): |

| ● | Provides access to members-only ticket pricing all week long |

| ● | Access Gold Membership ($29/year): |

| ● | Receive a free premium movie ticket at sign-up |

| ● | Start earning 1 access point on every dollar spent; redeemable at both iPic theaters & restaurants |

3

| ● | Priority access to ticket purchases for select new film releases |

| ● | Special member-priced weekday block ticket packages |

| ● | Invitations to exclusive iPic events |

| ● | Access Platinum Membership ($29/year + 2,000 access points earned each year) |

| ● | Start earning 1.5 access points on every dollar spent to redeem at both iPic theaters & restaurants |

| ● | Two free weekday upgrades to premium plus seating |

| ● | Premium movie ticket birthday gift |

Management team with proven track record. We are led by a strong management team with extensive experience from national brands in all aspects of casual dining and entertainment operations. Our founder and Chief Executive Officer, Hamid Hashemi, has been in the theatrical entertainment business for over 30 years. Several other executive officers have decades of experience in the theatrical entertainment and food service industries.

Strong commitment to our team, to our community, and to our guests. We recruit and develop team members that possess a high degree of empathy and who are genuinely warm, friendly, motivated, caring, self-aware and intellectually curious. Our team members strive to make every visit a memorable experience for our guests. iPic is a hospitality company with a focus on delivering an out-of-home entertainment experience perceived to be available only to the affluent, but is within reach to all segments of the population at an affordable price. While iPic’s face-value ticket prices are generally higher than other movie-theater options, we believe that the additional amenities included in our offering makes the value proposition substantially greater than other venues. For instance, unlike other movie-theaters, for all iPic seating sections, we do not charge a fee for booking tickets online and we never charge extra for 3D or any other premium-format film. Meanwhile, guests seated in Premium Plus seats are offered unlimited popcorn, signature iPic pillows and blankets, and dining service to the seats. Our ticket prices for our iPic Premium seats are comparable to the best theaters in their respective market and our guests can enjoy the same menu of food and drinks by visiting the iPic Express and Bar located on the same level as the auditoriums.

Growth Strategies and Outlook

Opening new iPic locations. This is our greatest immediate opportunity for growth. We believe that we are still in the very nascent stage of our growth story. We currently operate 115 screens at 15 locations in 9 states with an additional 4 locations under construction and a pipeline of an additional 15 sites that either have a signed lease or are in lease negotiation. We believe we currently control less than 0.5% market share of the theater business in the United States, based on data provided by the National Association of Theatre Owners and our financial results. We believe there is tremendous whitespace opportunity to expand in both existing and new U.S. markets, as well as overseas, and we have invested in our infrastructure through new hires at our home office to enable us to continue to grow with discipline. We plan to upgrade three of our six Generation I locations in 2018 and open at least four new domestic units per year starting in 2019. Based on our experience and analysis, along with research we engaged Eastern Consolidated Properties, Inc. to perform for us, we believe that over the long-term we have the potential to grow our iPic U.S. footprint to at least 200 U.S. units and to potentially expand overseas as well. The rate of future growth in any particular period is inherently uncertain and is subject to numerous factors that are outside of our control. As a result, we do not currently have an anticipated timeframe to reach our long-term potential. We plan to use a portion of the proceeds from the IPO to open new iPic locations and renovate existing iPic locations.

We will continue to pursue a disciplined new store growth strategy in both new and existing markets where we can achieve consistent high store revenues and attractive store-level cash-on-cash returns.

Pursuing international growth opportunities. We are actively exploring the potential to expand the iPic brand internationally through licensed or asset-light partnerships. iPic signed a non-binding Memorandum of Understanding with BAS Global Investments to develop one-of-a-kind, world-class luxurious restaurant-and-theater iPic locations throughout The Kingdom of Saudi Arabia. If we execute formal agreements and successfully obtain needed operating licenses, we believes there is the potential for 25 to 30 iPic locations within the next ten years, to be located in all parts of the country starting in Riyadh and Jeddah.

Growing our comparable-store sales. We intend to grow our comparable-store sales by continuing to differentiate the iPic brand from other food and entertainment alternatives, through the following strategies:

Differentiate our food and beverage offering. We frequently test new menu items and seek to improve our food offering to offer up-to-date culinary options and to best align with our customers’ evolving preferences and increasing sense of experimentation with new tastes.

4

Relentless efforts on hospitality. We strive to provide an engaging and differentiated guest experience that includes standards of excellence in hospitality. We believe there are opportunities to increase our sales and average check through continuous improvement of the server experience, including the dual-track effort of introducing new do-it-yourself technology, such as our order-and-pay app and boosting speed and accuracy of our ninja service model to include a new tablet ordering system.

Grow usage of alternative content. While Hollywood studios will remain our primary content providers for the foreseeable future, we are nevertheless focused on providing our customers with new and creative alternative content, including: live shows (including magic acts), Netflix programming, eSporting events (such as Minecraft gaming), concerts, educational and personal events, as well as corporate conferences and seminars.

Enhance brand awareness and drive incremental visits to our locations through innovative marketing and promotions. We plan to continue investing a significant portion of our marketing spend in social-media advertising. We have recently launched customized local store marketing programs to increase new visits and repeat visits to individual locations. Our guest loyalty program currently has approximately 1.8 million members, and we are aggressively improving our search engine and social marketing efforts. Our loyalty program and digital efforts allow us to communicate promotional offers directly to our most passionate brand fans. We also leverage our investments in technology across our marketing platform, including in-store marketing initiatives to drive incremental sales throughout the iPic location.

Grow our special events usage. We plan to continue to leverage and add resources to our special events sales effort to grow our corporate and personal event business. In addition to driving revenue, we believe our special events business is an important sampling opportunity for these guests because many are experiencing iPic for the first time.

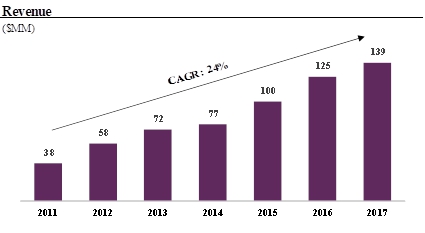

Since 2011, our revenues have been growing at a compound annual growth rate of 24%.

Improving profitability from existing locations. A significant revenue driver will be the remodeling of the Company’s Generation I legacy locations into Generation III designs that, among other things, will include the installation of predominately Premium-Plus seating, including iPic’s latest patent pending pod seats and patented chaise lounges. Premium-Plus seating currently comprises approximately 35% of seating in our Generation I auditoriums. Our Generation III designs, which contain significantly more Premium-Plus seating, generate significantly higher revenue per screen than our Generation I locations. iPic expects to complete a minimum of three remodels in 2018.

Improving our margins. We believe we are well-positioned to increase margins and believe we have additional opportunities to reduce costs. Based on the operating leverage generated by our business model, which has been enhanced by operating initiatives implemented by management in recent years, we believe we have the potential to improve margins and deliver greater earnings from potential future increases in comparable-store sales. Under our current cost structure, we generally estimate that about 30% of any comparable-store sales growth that exceeds the cost inflation in that store would flow through to our Adjusted EBITDA. We also believe that improved labor scheduling technology will allow us to increase labor productivity in the future. We believe that our continued focus on operating margins at individual locations and the deployment of best practices across our store base is expected to yield incremental margin improvements.

5

Increasing digital growth options (membership and sponsorship). The Company plans to leverage its growing membership network as the brand expands and increases its market presence. In 2017, iPic’s active users that have visited a location over the past year accounted for approximately 47% of revenue. In 2017, the Company earned $1.8 million from corporate sponsorships and believes that it has the opportunity to significantly grow its local and national sponsorship revenue.

Site Selection Process

iPic is focused on clustered growth in predominantly the top 50 metropolitan statistical areas including the densest urban areas as well as high population or high growth affluent suburban markets. Potential locations are sourced both internally through target market searches and relationships with hundreds of developers, and externally through our network of top retail brokers in each target region. In order to optimize new location productivity, we systematically screen potential sites based on the size and quality of the local population. We utilize multiple data platforms that provide sophisticated demographic analyses allowing us to evaluate not only population and income, but also spending patterns and psychographics of the markets surrounding each potential location.

Marketing, Advertising and Promotions

Our corporate marketing department manages all consumer outreach initiatives for iPic with the goal of driving sales through expanding our customer reach (guest base) and frequency. Our key areas of focus include:

| ● | Marketing and Advertising: Public-relations, media, social media, promotions, in-store merchandising, pricing, and digital programs; |

| ● | Food and Beverage: Continuous menu and product development and relentless focus on in-store execution; and |

| ● | Guest insights: Ongoing research into brand health and guest tracking. |

We have improved marketing effectiveness in 2017 through a number of initiatives designed to improve our local marketing plans, in-store promotions, digital loyalty programs and digital interfaces with consumers that included:

| ● | Performing research to better understand our guest base and fine-tune the brand positioning; |

| ● | Refining our marketing strategy to better reach our target audience of 21-54 year-olds; |

| ● | Creating a new advertising campaign; |

| ● | Launching a new website and app; |

| ● | Investing in menu research and development to differentiate our food offerings from our competition and improve execution; |

| ● | Developing product/promotional strategies to attract new guests and increase spending/length of stay; |

| ● | Leveraging our loyalty database to engage and motivate guests, including a newly formatted Membership Program; |

| ● | Investing more in digital social media to create stronger relationships with consumers; and |

| ● | Defining a consistent brand identity that reflects our unique positioning. |

Operations — Food and Beverage and Cinema

Management. Food and Beverage management is headed by our Chief Operating Officer. Supported by the National Beverage Director, our Advanced Sommelier and Master Barman, and the Vice President of Restaurant Operations, the Food and Beverage management team is responsible for developing and operating all of iPic’s foodservice operations. Each restaurant is headed by a Restaurant General Manager who reports to the site Senior General Manager. The cinema operations management of our store base is divided into two regions, each of which is overseen by a Regional Operations Director who reports to our Chief Operating Officer. Our Regional Operations Directors oversee seven to nine Company-owned stores each, which we believe enables them to better support the Senior General Managers and achieve sales and profitability targets for each store within their region. Our locations are generally open seven days a week, with hours of operation typically from 11:00 a.m. to 2:00 a.m.

Operational Tools and Programs. We utilize a customized food and beverage analysis program that determines the theoretical food and beverage costs for each store and provides additional tools and reports to help us identify opportunities, including waste management. Consolidated business intelligence and reporting tools are utilized by Regional Operations Directors and Senior General Managers to be able to identify issues, forecast more efficiently, and glean quicker insights for improved decision-making.

Management Information Systems. We utilize a number of proprietary and third party management information systems. These systems are designed to improve operating efficiencies, provide us with timely access to financial and enterprise data, and reduce store and corporate administrative time and expense. We believe our management information systems are sufficient to support our store expansion plans.

6

Training. We strive to maintain quality and consistency in each of our stores through the careful training and supervision of our team members and the establishment of, and adherence to, high standards relating to personnel performance, food and beverage preparation, and maintenance of our restaurants and cinemas. We provide all new team members with complete orientation and one-on-one training for their positions to help ensure they are able to meet our high standards. All of our new team members are trained by partnering with a certified trainer to assure that the training and information they receive is complete and accurate. Team members are certified by us for their positions by passing a series of tests, including alcohol awareness training. We require our new store managers to complete an 8-week training program that includes front of the house service, kitchen, amusements, and management responsibilities. Newly trained managers are then assigned to their home store where they receive additional training with their Senior General Manager.

Management Development. We place a high priority on our continuing management development programs in order to ensure that qualified managers are available for our future openings. We conduct semi-annual talent reviews with each manager to discuss prior performance and future performance goals. When we open a new store, we provide varying levels of training to team members in each position to ensure the smooth and efficient operation of the store from the first day it opens to the public. Prior to opening a new store, our dedicated training and opening team travels to the location to prepare for an intensive two week training program for all team members hired for the new store opening. Part of the training teams stay on site during the first week of operation. We believe this additional investment in our new stores is important, because it helps us provide our guests with a quality experience from day one. After a store opens and is operating smoothly, the managers supervise the training of new team members.

Recruiting and Retention. We seek to hire experienced General Managers and team members, and we believe we offer competitive wage and benefit programs. Our store managers all participate in a performance-based incentive program that is based on sales, profit and employee retention goals. In addition, our salaried employees are also eligible to participate in a 401(k) plan, medical/dental/vision insurance plans and also receive vacation/paid time off based on tenure.

Food Preparation, Quality Control and Purchasing. We strive to maintain high food quality standards. To ensure our quality standards are met, we negotiate directly with independent producers of food products. We provide detailed quality and yield specifications to suppliers for our purchases. Our systems are designed to protect the safety and quality of our food supply throughout the procurement and preparation process. Within each store, the Kitchen Manager is primarily responsible for ensuring the timely and correct preparation of food products, per the recipes we specify. We provide each of our stores with various tools and training to facilitate these activities.

Information Technology

Information Technology is focused on the customer experience and supporting the efficient operation of our restaurants and theaters, as well as the management of our business. We have implemented software and hardware solutions which provide for enhanced capabilities and efficiency within our restaurant and theater operations. We continue to focus on improving the customer experience of purchasing tickets by expanding our ability to sell tickets remotely via the web and our mobile application, while also offering self-service alternatives such as ticketing kiosks. Customers can choose their preferred ticketing option, which in many cases means they can pre-purchase tickets, scan their mobile device and proceed directly to their reserved seat without waiting in line. These solutions align with our goal of delivering a first-class customer experience and will drive incremental revenues and cash flows in a more cost-effective manner. In addition, we continue to strategically pursue technologies to improve the services we provide to our patrons and to provide information to our management allowing them to operate our sites efficiently. The sales and attendance information collected by our point-of-sale system is used directly for film booking and settlement as well as provides the primary source of data for our financial systems. We also use best-in-class inventory management systems to control costs, streamline operations, and reduce waste across our foodservice operations.

Intellectual Property

We rely on patent, trademark, service mark, copyright, and trade secret laws, as well as license agreements, nondisclosure agreements, and confidentiality and other contractual provisions to protect our intellectual property. We have registered and applied to register trademarks and service marks in the United States. We also have certain trade secrets, such as our recipes, processes, proprietary information and certain software programs.

We have thirty one utility and design patents issued, as well as several pending patent applications in the United States. Such patent applications are subject to the review and normal course prosecution before the U.S. Patent and Trademark Office, which may result in the application’s revision or non-approval. We also have registered or applied for utility and design patents in various foreign countries. As a result, we may not be able to adequately protect the inventions covered by these patent applications, and our competitors and others may benefit as a result of their publication.

7

The success of our business depends on our continued ability to use our existing trademarks and service marks to increase brand awareness and further develop our brand in the markets in which we operate. If our efforts to maintain and protect our intellectual property are inadequate, or if any third party misappropriates, dilutes or infringes on our intellectual property, the value of our brands may be harmed, which could have a material adverse effect on our business and might prevent our brands from achieving or maintaining market acceptance.

Competition

The out-of-home entertainment and dining markets are highly competitive. We compete for guests’ discretionary entertainment and dining dollars with theme parks, as well as with providers of out-of-home entertainment, including localized attraction facilities such as movie theaters, sporting events, bowling alleys, nightclubs and restaurants. We also face competition from local establishments that offer entertainment experiences similar to ours and restaurants that are highly competitive with respect to price, quality of service, location, ambience and type and quality of food.

The motion picture exhibition industry is fragmented and highly competitive with no significant barriers to entry. Our theaters are subject to varying degrees of competition in the geographic areas in which we operate. Competitors may be national circuits, regional circuits or smaller independent exhibitors. Moviegoers are generally not brand conscious and usually choose a theater based on its location, the films showing there, showtimes and its amenities. We also face competition from increasingly sophisticated home-based and on-the-go forms of entertainment, such as video-on-demand, video streaming services — such as Netflix, Amazon Prime and Hulu — internet and video gaming. In addition, many of our competitors have partnered with MoviePass Inc., a subscription-based movie ticketing service which enables subscribers to attend one movie per day for a monthly fee of $9.95.

Like the motion picture exhibition industry, the restaurant industry is fragmented and highly competitive with no significant barriers to entry. We compete in the restaurant industry with multi-unit national, regional and locally-owned and/or operated limited-service restaurants and full-service restaurants. Many of our competitors offer breakfast, lunch and dinner, as well as dine-in, carry-out and delivery services. In most cases, these competitors have existed longer than we have and may have a more established market presence, better locations and greater name recognition nationally or in some of the local markets in which we operate or plan to operate.

Seasonality

Our revenues are dependent upon the timing and popularity of film releases by distributors. The most marketable films are usually released during the summer and the calendar year-end holiday season. Therefore, our business is subject to significant seasonal fluctuations, with higher attendance and revenues generally occurring during the summer months and year-end holiday season. We license first-run motion pictures, the success of which has increasingly depended on the marketing efforts of the major motion picture studios. Poor performance of, or any disruption in the production of these motion pictures (including by reason of a strike or lack of adequate financing), or a reduction in the marketing efforts of the major motion picture studios, could hurt our business and results of operations. Conversely, the successful performance of these motion pictures, particularly the sustained success of any one motion picture, or an increase in effective marketing efforts of the major motion picture studios, may generate positive results for our business and operations in a specific quarter or year that may not necessarily be indicative of, or comparable to, future results of operations. Given the relatively small number of theaters and screens that we operate (particularly when compared to our larger competitors), if a major motion picture studio decides to delay the release of a first-run motion picture from one quarter to a subsequent quarter, that could have a material adverse effect on our results of operations in the earlier quarter. As movie studios rely on a smaller number of higher grossing “tent pole” films, there may be increased pressure for higher film licensing fees.

In addition, a change in the type and breadth of movies offered by motion picture studios may affect the demographic base of moviegoers. In certain periods, there are a higher percentage of children’s or animated films that do not generally appeal to our more adult clientele. For example, in 2016, industry reports noted that approximately 50% of industry sales for the Top-15 grossing films were from children’s or animated films (as opposed to 18% of industry sales from 2015’s Top-15 grossing films coming from children’s or animated films). In periods with a higher percentage of children’s or animated films, our results of operations are likely to be materially adversely affected. As a result of the foregoing factors, our results of operations may vary significantly from quarter to quarter and from year to year.

Government Regulation

We are subject to various federal, state and local laws, regulations and administrative practices affecting our business, and we must comply with provisions regulating antitrust, health and sanitation standards, employment, environmental, and licensing for the sale of food and alcoholic beverages. Our new theater openings could be delayed or prevented or our existing theaters could be impacted by difficulties or failures in our ability to obtain or maintain required approvals or licenses. Changes in existing laws or implementation of new laws, regulations and practices could have a significant impact on our business. A significant portion of our theater level employees are part time workers who are paid at or near the applicable minimum wage in the theater’s jurisdiction. Increases in the minimum wage, such as those that occurred in 18 states on January 1, 2018 and implementation of reforms requiring the provision of additional benefits will increase our labor costs.

The restaurant industry is subject to extensive federal, state, local and international laws and regulations. The development and operation of restaurants depend to a significant extent on the selection and acquisition of suitable sites, which are subject to building, zoning, land use, environmental, traffic and other regulations and requirements.

8

We are subject to licensing and regulation by state and local authorities relating to health, sanitation, safety and fire standards and the sale of alcoholic beverages. We are subject to laws and regulations relating to the preparation and sale of food, including regulations regarding product safety, nutritional content and menu labeling. We are subject to federal, state, and local laws governing employment practices and working conditions. These laws cover wage and hour practices, labor relations, paid and family leave, workplace safety, and immigration, among others. The myriad of laws and regulations being passed at the state and local level creates unique challenges for a multi-state employer as different standards apply to different locations, sometimes with conflicting requirements. We must continue to monitor and adapt our employment practices to comply with these various laws and regulations.

Provisions in the Affordable Care Act require restaurant companies such as ours to disclose calorie information on their menus and to make available more detailed nutrition information upon request; however, regulations implementing those statutory provisions have been delayed until May 2018. We do not expect to incur any material costs from compliance with these provisions, but cannot anticipate any changes to guest behavior resulting from the implementation of this portion of the law, which could have an adverse effect on our sales or results of operations.

We are subject to laws relating to information security, privacy, cashless payments and consumer credit, protection and fraud. An increasing number of governments and industry groups have established data privacy laws and standards for the protection of personal information, including social security numbers, financial information (including credit card numbers), and health information. Compliance with these laws and regulations can be costly, and any failure or perceived failure to comply with those laws or any breach of our systems could harm our reputation or lead to litigation, which could adversely affect our financial condition.

Our theaters that sell alcohol require each location to apply to a state authority and, in certain locations, county or municipal authorities for a license that must be renewed annually and may be revoked or suspended for cause at any time. Alcoholic beverage control regulations relate to numerous aspects of daily operations of our locations, including the minimum age of patrons and employees, hours of operation, advertising, trade practices, wholesale purchasing, other relationships with alcohol manufacturers, wholesalers and distributors, inventory control and handling, storage and dispensing of alcoholic beverages. We are also subject in certain states to “dram shop” statutes, which generally provide a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated person. We may decide not to obtain liquor licenses in certain jurisdictions due to the high costs associated with obtaining liquor licenses in such jurisdictions.

We are subject to the environmental laws and regulations of the respective jurisdictions, particularly laws governing the cleanup of hazardous materials and the management of properties. We might in the future be required to participate in the cleanup of a property that we lease, or at which we have been alleged to have disposed of hazardous materials from one of our locations. In certain circumstances, we might be solely responsible for any such liability under environmental laws, and such claims could be material.

Our theaters must comply with Title III of the Americans with Disabilities Act of 1990 (“ADA”). Compliance with the ADA requires that public accommodations “reasonably accommodate” individuals with disabilities and that new construction or alterations made to “commercial facilities” conform to accessibility guidelines unless “structurally impracticable” for new construction or technically infeasible for alterations. Non-compliance with the ADA could result in the imposition of injunctive relief, fines, and an award of damages to private litigants or additional capital expenditures to remedy such noncompliance, any of which could have a material adverse effect on our operations and financial condition.

The impact of current laws and regulations, the effect of future changes in laws or regulations that impose additional requirements and the consequences of litigation relating to current or future laws and regulations, or an insufficient or ineffective response to significant regulatory or public policy issues, could negatively impact our cost structure, operational efficiencies and talent availability, and therefore have a material adverse effect on our results of operations. Failure to comply with the laws and regulatory requirements of federal, state and local authorities could result in, among other things, revocation of required licenses, administrative enforcement actions, fines and civil and criminal liability. Compliance with these laws and regulations can be costly and can increase our exposure to litigation or governmental investigations or proceedings.

Employees

As of December 31, 2017, we employed a total of 237 full time and 1,961 part time employees. None of our employees are represented by a labor union, and we consider our company culture and employee relations to be strong.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the Securities and Exchange Commission (the “SEC”). We are subject to the informational requirements of the Exchange Act and file or furnish reports, proxy statements and other information with the SEC. The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549, and may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this Annual Report. Further, our references to the URLs for these websites are intended to be inactive textual references only. We also make the documents listed above available without charge through the Investors Section of our website at www.ipictheaters.com.

9

| Item 1A. | Risk Factors |

Risks Related to Our Business and Industry

Our long-term success is highly dependent on our ability to successfully identify and secure appropriate sites and timely develop and expand our operations in existing and new markets.

One of the key means of achieving our growth strategies will be through opening and operating new iPic locations on a profitable basis for the foreseeable future. We must identify target markets where we can enter or expand, taking into account numerous factors such as the location, demographics, traffic patterns and information gathered from our various contacts. We may not be able to open our planned new iPic locations within budget or on a timely basis, if at all, given the uncertainty of these factors, which could adversely affect our business, financial condition and results of operations. As we operate more iPic locations, our rate of expansion relative to the size of our location base will eventually decline.

The number and timing of new units opened during any given period may be negatively impacted by a number of factors including, without limitation:

| ● | the identification and availability of attractive sites for new iPic locations and the ability to negotiate suitable lease terms; | |

| ● | the lack of development and overall decrease in commercial real estate due to a macroeconomic downturn; | |

| ● | recruitment and training of qualified personnel in the local market; | |

| ● | our ability to obtain all required governmental permits, including zonal approvals, on a timely basis; | |

| ● | our ability to control construction and development costs of new units; | |

| ● | competition in new markets, including competition for appropriate sites; | |

| ● | failure of the landlords to timely deliver real estate to us; | |

| ● | the proximity of potential sites to an existing iPic, and the impact of cannibalization on future growth; | |

| ● | anticipated commercial, residential and infrastructure development near our new iPic locations; and | |

| ● | the cost and availability of capital to fund construction costs and pre-opening expenses. |

Accordingly, we cannot assure you that we will be able to successfully expand as we may not correctly analyze the suitability of a location or anticipate all of the challenges imposed by expanding our operations. Our growth strategy and the substantial investment associated with the development of each new location may cause our operating results to fluctuate and be unpredictable or adversely affect our profits. In addition, as has happened when other restaurant concepts have tried to expand, we may find that our concept has limited appeal in new markets or we may experience a decline in the popularity of our concept in the markets in which we operate. If we are unable to expand in existing markets or penetrate new markets, our ability to increase our revenues and profitability may be materially harmed or we may face losses.

Optimizing our theater circuit through new construction and the transformation of our existing theaters is subject to delay and unanticipated costs.

The availability of attractive site locations for new theater construction is subject to various factors that are beyond our control. These factors include:

| ● | local conditions, such as scarcity of space or increase in demand for real estate, demographic changes and changes in zoning and tax laws; and | |

| ● | competition for site locations from both theater companies and other businesses. |

We typically require 24 to 36 months from the time we reach an agreement with a landlord to when a new theater opens. In addition, improving our existing theaters is subject to substantial risks such as difficulty obtaining permits, landlord approvals and new types of operating licenses (e.g. liquor licenses). We may also experience cost overruns from delays or other unanticipated costs in both new construction and facility improvements. Furthermore, our new sites and transformed locations may not perform to our expectations.

Our failure to manage our growth effectively could harm our business and operating results.

Our growth plan includes a significant number of potential new iPic locations, including potential international locations. Our existing management systems, financial and management controls and information systems may not be adequate to support our planned expansion. Our ability to manage our growth effectively will require us to continue to enhance these systems, procedures and controls and to locate, hire, train and retain management and operating personnel, particularly in new markets. We may not be able to respond on a timely basis to all of the changing demands that our planned expansion will impose on management and on our existing infrastructure, or be able to hire or retain the necessary management and operating personnel, which could harm our business, financial condition or results of operations. These demands could cause us to operate our existing business less effectively, which in turn could cause deterioration in the financial performance of our existing units. If we experience a decline in financial performance, we may decrease the number of or discontinue new openings, or we may decide to close units that we are unable to operate in a profitable manner.

10

Our theaters and restaurants operate in highly competitive environments.

The motion picture exhibition industry is fragmented and highly competitive with no significant barriers to entry. Our theaters are subject to varying degrees of competition in the geographic areas in which we operate. Competitors may be national circuits, regional circuits or smaller independent exhibitors. Moviegoers are generally not brand conscious and usually choose a theater based on its location, the films showing there, showtimes and its amenities. Competition among theater exhibition companies is often intense with respect to the following factors:

| ● | Attracting patrons. The competition for patrons is dependent upon factors such as the availability of popular motion pictures, the location and number of theaters and screens in a market, the comfort and quality of the theaters and pricing. Many of our competitors have sought to increase the number of screens that they operate and provide a more luxurious experience by enhancing food and beverage options and installing recliner seating. Certain of the larger theater chains, such as AMC and Regal, have been converting some of their existing theaters to include in-theater dining and recliner seating, often at the same price or a marginally higher price than their traditional theaters. Should other theater operators in our markets choose to implement these or other initiatives, the performance of our theaters may be significantly and negatively impacted. | |

| ● | Licensing motion pictures. We believe that the principal competitive factors with respect to film licensing include licensing terms, number of seats and screens available for a particular picture, revenue potential and the location and condition of an exhibitor’s theaters. Should any of our existing principal competitive factors change, the performance of our theaters may be significantly and negatively impacted. | |

| ● | New sites and acquisitions. We must compete with exhibitors and others in our efforts to locate and acquire attractive new and existing sites for our iPic units. There can be no assurance that we will be able to acquire such new sites or existing theaters at reasonable prices or on favorable terms. Moreover, some of these competitors may be stronger financially than we are. As a result of the foregoing, we may not succeed in acquiring theaters or may have to pay more than we would prefer to make an acquisition. | |

| ● | Multiple competitors for both out-of-home and in-home entertainment. The theatrical exhibition industry faces competition from other forms of out-of-home entertainment, such as concerts, amusement parks and sporting events and from other distribution channels for filmed entertainment, such as cable television, pay-per-view, video on demand, subscription based video streaming services, such as Netflix, Amazon Prime and Hulu, and home video systems and from other forms of in-home or on-the-go entertainment. | |

| ● | New marketing approaches. Many of our competitors have partnered with MoviePass Inc. (“MoviePass”), a subscription-based movie ticketing service. For a monthly fee of $9.95, MoviePass subscribers can attend one movie per day at no additional cost. MoviePass’ growing popularity may negatively impact our theaters by providing patrons with a cheaper alternative to paying each time they go to the movies. | |

| ● | New technology. New innovations and technology will continue to impact our industry. If we are unable to respond to or invest in future technology and the changing preferences of our customers, we may not be able to compete with other exhibitors or other entertainment venues, which could also adversely affect our results of operations. |

Like the motion picture exhibition industry, the restaurant industry is fragmented and highly competitive with no significant barriers to entry. We compete in the restaurant industry with multi-unit national, regional and locally-owned and/or operated limited-service restaurants and full-service restaurants. Many of our competitors offer breakfast, lunch and dinner, as well as dine-in, carry-out and delivery services. Many of our competitors have existed longer than we have and may have a more established market presence, better locations and greater name recognition nationally or in some of the local markets in which we operate or plan to operate.

11

We face significant competition for restaurant guests, and our inability to compete effectively may affect our traffic, iPic sales and store-level operating profit margins.

We rely on our food and beverage service for a majority of our revenue. The restaurant industry is intensely competitive with many well-established companies that compete directly and indirectly with us with respect to food quality, service, price and value, design and location. Some of our competitors have significantly greater financial, marketing, personnel and other resources than we do. In addition, many of our competitors have greater name recognition nationally or in some of the local markets in which we have or plan to have an iPic. Any inability to successfully compete with the restaurants in our markets will place downward pressure on our guest traffic and may prevent us from increasing or sustaining our revenues and profitability.

New iPic locations, once opened, may not be profitable; recently, our comparable-store sales have declined and the performance of our units that we have experienced in the past may not be indicative of future results.

Our results have been, and in the future may continue to be, significantly impacted by the timing of new location openings (often dictated by factors outside of our control), including landlord delays, associated pre-opening expenses and operating inefficiencies, as well as changes in our geographic concentration due to the opening of new units. We typically incur the most significant portion of pre-opening expenses associated with a given location within the six months preceding the opening. Our experience has been that labor and operating costs associated with a newly opened location for the first several months of operation are materially greater than what can be expected after that time, both in aggregate dollars and as a percentage of sales. Our new units commonly take 16 to 20 weeks to reach planned operating expense levels due to inefficiencies typically associated with new openings, including the training of new personnel, new market learning curves, inability to hire sufficient qualified staff and other factors. We may incur additional costs in new markets, particularly for transportation and distribution, which may impact the profitability of those units. Accordingly, the volume and timing of new openings may have a material adverse impact on our profitability.

In recent periods, our comparable-store sales have declined, as have those of certain of our competitors. Specifically, in the year ended December 31, 2017 as compared to the year ended December 31, 2016, our comparable-store sales declined by $8.8 million. This was partly due to weaker film offerings, increased competition in key markets, and delaying some key remodel projects until 2018. For 2016, industry reports noted that approximately 50% of industry sales from 2016’s Top-15 grossing films were from children’s or animated films.

Although we target specified operating and financial metrics, new units may not meet these targets or may take longer than anticipated to do so. Any new location we open may not be profitable or achieve operating results similar to those of our existing units, which could adversely affect our business, financial condition or results of operations.

We may not achieve the expected benefits and performance from strategic theater acquisitions.

From time to time we evaluate strategic theater acquisitions. In any acquisition, we expect to benefit from cost savings through, for example, the reduction of overhead and theater level costs, and from revenue enhancements resulting from the acquisition. However, there can be no assurance that we will be able to generate sufficient cash flow from these acquisitions to service any indebtedness incurred to finance such acquisitions or realize any other anticipated benefits, nor can there be any assurance that our profitability will be improved by any one or more acquisitions. Any acquisition may involve operating risks, such as:

| ● | the difficulty of assimilating and integrating the acquired operations and personnel into our current business; | |

| ● | the potential disruption of our ongoing business; | |

| ● | the diversion of management’s attention and other resources; | |

| ● | the possible inability of management to maintain uniform standards, controls, procedures and policies; | |

| ● | the risks of entering markets in which we have little or no experience; | |

| ● | the potential impairment of relationships with employees; | |

| ● | the possibility that any liabilities we may incur or assume may prove to be more burdensome than anticipated; and | |

| ● | the possibility that the acquired theaters do not perform as expected. |

12

We have no control over distributors of the films and our business may be adversely affected if our access to motion pictures is limited or delayed.

We rely on distributors of motion pictures, over whom we have no control, for the films that we exhibit. Major motion picture distributors are required by law to offer and license film to exhibitors, including us, on a film-by-film and theater-by-theater basis. Consequently, we cannot assure ourselves of a supply of motion pictures by entering into long-term arrangements with major distributors, but must compete for our licenses on a film-by-film and theater-by-theater basis. Our business depends on maintaining good relations with these distributors, as this affects our ability to negotiate commercially favorable licensing terms for first-run films or to obtain licenses at all. With only seven distributors representing approximately 88% of the U.S. box office in 2017, there is a high level of concentration in the industry. Our business may be adversely affected if our access to motion pictures is limited or delayed because of deterioration in our relationships with one or more distributors, or for some other reason. To the extent that we are unable to license a popular film for exhibition in our theaters, our operating results may be materially adversely affected. In addition, changes to our licensing terms may cause the performance of our theaters to be significantly and negatively impacted.

We depend on motion picture production and performance.

Our ability to operate successfully depends upon the availability, diversity and appeal of motion pictures, our ability to license motion pictures and the performance of such motion pictures in our markets. Our revenues are dependent upon the timing and popularity of film releases by distributors. The most marketable films are usually released during the summer and the calendar year-end holiday seasons. Therefore, our business is subject to significant seasonal fluctuations, with higher attendance and revenues generally occurring during the summer months and holiday seasons. We license first-run motion pictures, the success of which has increasingly depended on the marketing efforts of the major motion picture studios. Poor performance of, or any disruption in the production of these motion pictures (including by reason of a strike or lack of adequate financing), or a reduction in the marketing efforts of the major motion picture studios, could hurt our business and results of operations. Conversely, the successful performance of these motion pictures, particularly the sustained success of any one motion picture, or an increase in effective marketing efforts of the major motion picture studios, may generate positive results for our business and operations in a specific quarter or year that may not necessarily be indicative of, or comparable to, future results of operations. Given the relatively small number of theaters and screens that we operate (particularly when compared to our larger competitors), if a major motion picture studio decides to delay the release of a first-run motion picture from one quarter to a subsequent quarter, that could have a material adverse effect on our results of operations in the earlier quarter. As movie studios rely on a smaller number of higher grossing “tent pole” films, there may be increased pressure for higher film licensing fees. In addition, a change in the type and breadth of movies offered by motion picture studios may adversely affect the demographic base of moviegoers. As a result of the foregoing factors, our results of operations may vary significantly from quarter to quarter and from year to year.

The motion picture exhibition industry has experienced fluctuations in attendance during recent years.

The U.S. motion picture exhibition industry has been subject to periodic short-term increases and decreases in attendance and box office revenues. According to the Motion Picture Association of America, attendance at movies in the United States and Canada was 1.24 billion during 2017, 1.32 billion during 2016, and 1.32 billion during 2015. During the past ten years, attendance at movies in the United States and Canada has ranged from a high of 1.42 billion in 2009 to a low of 1.24 billion in 2017. We expect the cyclical nature of the U.S. motion picture exhibition industry to continue for the foreseeable future, and any decline in attendance could materially adversely affect our results of operations. To offset any decrease in attendance, we plan to offer products unique to the motion picture exhibition industry, such as specially selected alternative programming and a luxury in-theater dining experience. We cannot assure you, however, that our offering of such content and services will offset any decrease in attendance that the industry may experience.

An increase in the use of alternative film delivery methods or other forms of entertainment may drive down our attendance and limit our ticket prices.

We compete with other film delivery methods, including network, syndicated cable and satellite television and DVDs, as well as video-on-demand, pay-per-view services, video streaming and downloads via the Internet. We also compete for the public’s leisure time and disposable income with other forms of entertainment, including sporting events, amusement parks, live music concerts and live theater. An increase in the popularity of these alternative film delivery methods and other forms of entertainment could reduce attendance at our theaters, limit the prices we can charge for admission and materially adversely affect our business and results of operations.

13

Our results of operations may be impacted by shrinking video release windows.