Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - NOBLE ENERGY INC | nbl-20180331xearningsrelea.htm |

| 8-K - 8-K - NOBLE ENERGY INC | nbl-20180331x8kearningsrel.htm |

First Quarter Supplement

May 2018

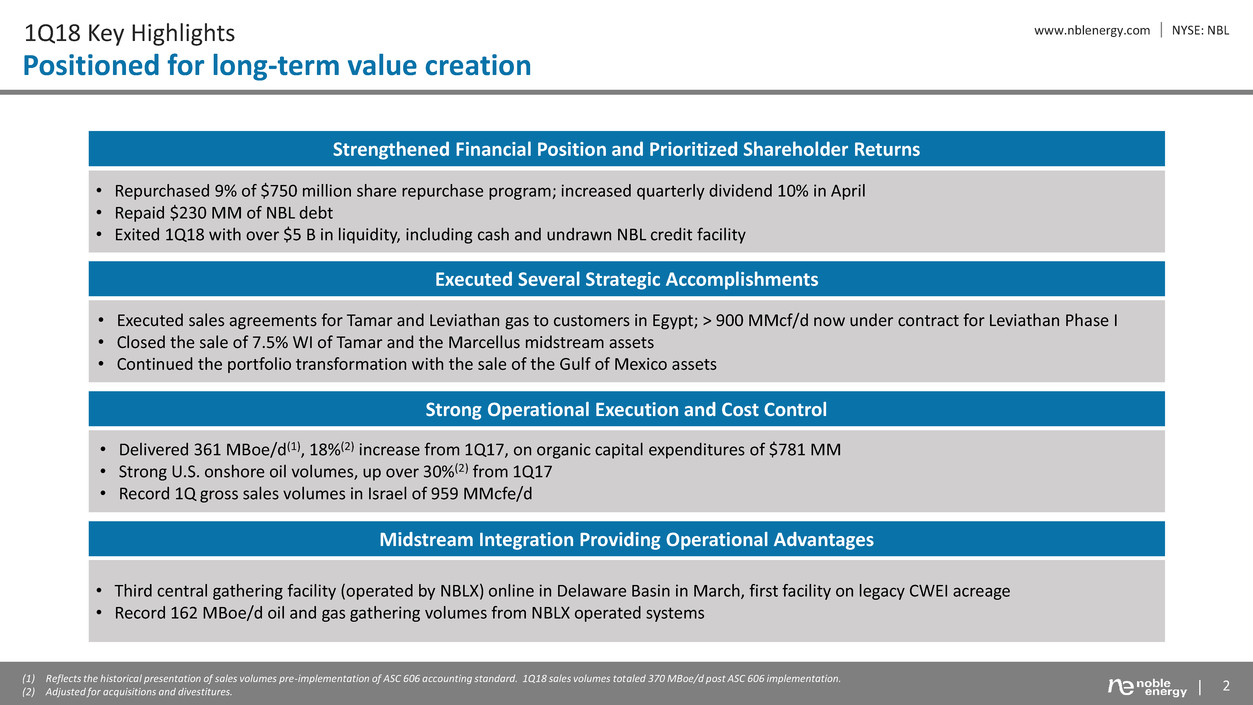

www.nblenergy.com NYSE: NBL 1Q18 Key Highlights

Positioned for long-term value creation

2

Strengthened Financial Position and Prioritized Shareholder Returns

Executed Several Strategic Accomplishments

Midstream Integration Providing Operational Advantages

Strong Operational Execution and Cost Control

• Repurchased 9% of $750 million share repurchase program; increased quarterly dividend 10% in April

• Repaid $230 MM of NBL debt

• Exited 1Q18 with over $5 B in liquidity, including cash and undrawn NBL credit facility

• Executed sales agreements for Tamar and Leviathan gas to customers in Egypt; > 900 MMcf/d now under contract for Leviathan Phase I

• Closed the sale of 7.5% WI of Tamar and the Marcellus midstream assets

• Continued the portfolio transformation with the sale of the Gulf of Mexico assets

• Delivered 361 MBoe/d(1), 18%(2) increase from 1Q17, on organic capital expenditures of $781 MM

• Strong U.S. onshore oil volumes, up over 30%(2) from 1Q17

• Record 1Q gross sales volumes in Israel of 959 MMcfe/d

• Third central gathering facility (operated by NBLX) online in Delaware Basin in March, first facility on legacy CWEI acreage

• Record 162 MBoe/d oil and gas gathering volumes from NBLX operated systems

(1) Reflects the historical presentation of sales volumes pre-implementation of ASC 606 accounting standard. 1Q18 sales volumes totaled 370 MBoe/d post ASC 606 implementation.

(2) Adjusted for acquisitions and divestitures.

www.nblenergy.com NYSE: NBL 1Q18 Actuals vs. Guidance

Strong earnings and cash flow start to 2018

3

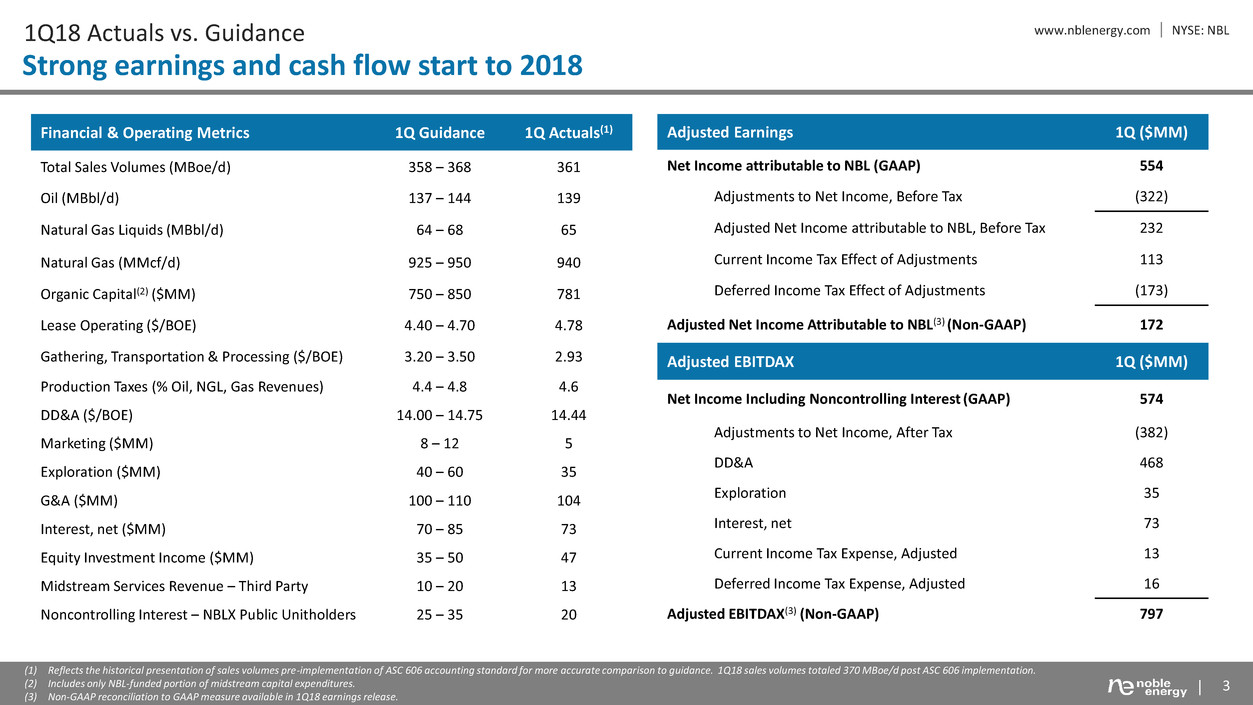

Financial & Operating Metrics 1Q Guidance 1Q Actuals(1)

Total Sales Volumes (MBoe/d) 358 – 368 361

Oil (MBbl/d) 137 – 144 139

Natural Gas Liquids (MBbl/d) 64 – 68 65

Natural Gas (MMcf/d) 925 – 950 940

Organic Capital(2) ($MM) 750 – 850 781

Lease Operating ($/BOE) 4.40 – 4.70 4.78

Gathering, Transportation & Processing ($/BOE) 3.20 – 3.50 2.93

Production Taxes (% Oil, NGL, Gas Revenues) 4.4 – 4.8 4.6

DD&A ($/BOE) 14.00 – 14.75 14.44

Marketing ($MM) 8 – 12 5

Exploration ($MM) 40 – 60 35

G&A ($MM) 100 – 110 104

Interest, net ($MM) 70 – 85 73

Equity Investment Income ($MM) 35 – 50 47

Midstream Services Revenue – Third Party 10 – 20 13

Noncontrolling Interest – NBLX Public Unitholders 25 – 35 20

Adjusted Earnings 1Q ($MM)

Net Income attributable to NBL (GAAP) 554

Adjustments to Net Income, Before Tax (322)

Adjusted Net Income attributable to NBL, Before Tax 232

Current Income Tax Effect of Adjustments 113

Deferred Income Tax Effect of Adjustments (173)

Adjusted Net Income Attributable to NBL(3) (Non-GAAP) 172

Adjusted EBITDAX 1Q ($MM)

Net Income Including Noncontrolling Interest (GAAP) 574

Adjustments to Net Income, After Tax (382)

DD&A 468

Exploration 35

Interest, net 73

Current Income Tax Expense, Adjusted 13

Deferred Income Tax Expense, Adjusted 16

Adjusted EBITDAX(3) (Non-GAAP) 797

(1) Reflects the historical presentation of sales volumes pre-implementation of ASC 606 accounting standard for more accurate comparison to guidance. 1Q18 sales volumes totaled 370 MBoe/d post ASC 606 implementation.

(2) Includes only NBL-funded portion of midstream capital expenditures.

(3) Non-GAAP reconciliation to GAAP measure available in 1Q18 earnings release.

www.nblenergy.com NYSE: NBL

4

Strengthened Financial Position

Prudent financial management: a pillar of NBL’s business success

Progressing Shareholder Return

• Repurchased $67.5 MM outstanding shares, 9% of $750 MM share

repurchase program

• 10% dividend increase with 1Q18 raise

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Accomplished Over $600 MM NBL Debt Reduction Objective

• Repaid $230 MM of NBL debt in 1Q18

• Additional $379 MM reduction in 2Q18 removes legacy ROSE debt

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Investment Grade Credit Rating Reaffirmed

• Fitch revised outlook to positive from stable

• S&P revised outlook to stable from negative

0.0

2.0

4.0

6.0

1Q17 4Q17 1Q18

Available NBL Revolver Cash

Increased Liquidity to Over $5 B $ B

> $2.5 B

NBL debt reduction since

beginning of 2016

> $600 MM

NBL debt reduction

YTD in 2018

www.nblenergy.com NYSE: NBL U.S. Onshore

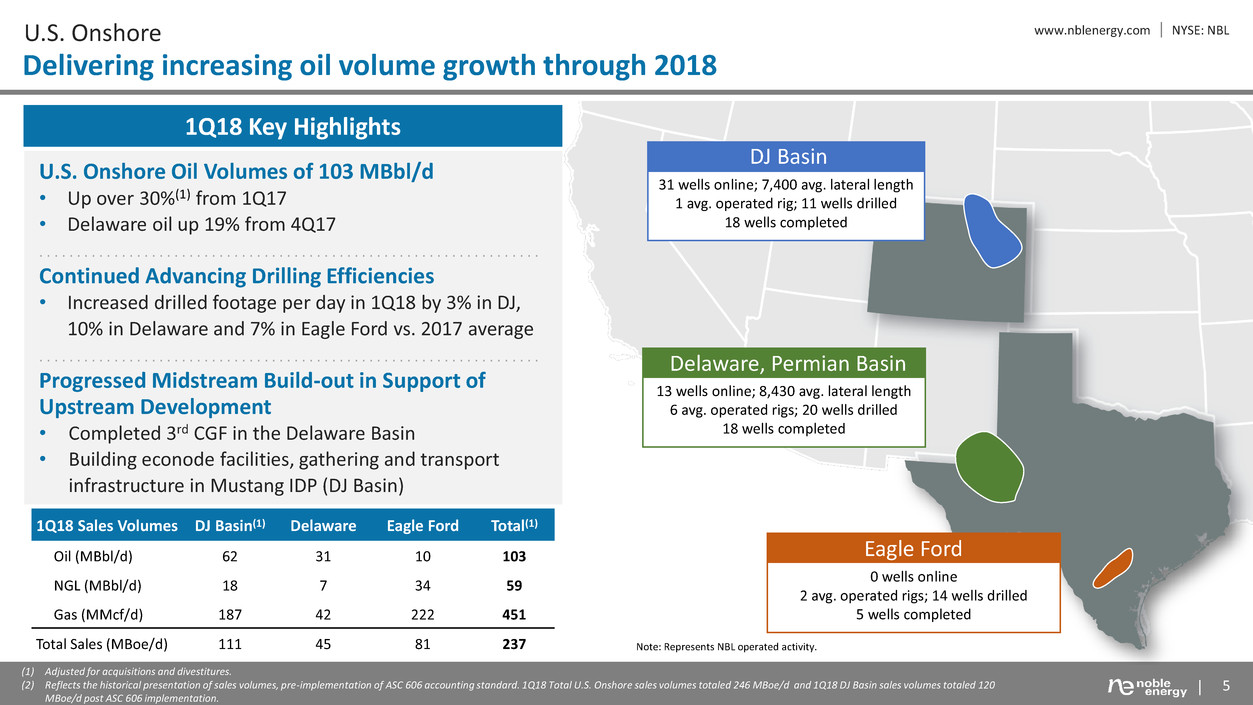

Delivering increasing oil volume growth through 2018

5

(1) Adjusted for acquisitions and divestitures.

(2) Reflects the historical presentation of sales volumes, pre-implementation of ASC 606 accounting standard. 1Q18 Total U.S. Onshore sales volumes totaled 246 MBoe/d and 1Q18 DJ Basin sales volumes totaled 120

MBoe/d post ASC 606 implementation.

1Q18 Key Highlights

U.S. Onshore Oil Volumes of 103 MBbl/d

• Up over 30%(1) from 1Q17

• Delaware oil up 19% from 4Q17

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Continued Advancing Drilling Efficiencies

• Increased drilled footage per day in 1Q18 by 3% in DJ,

10% in Delaware and 7% in Eagle Ford vs. 2017 average

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Progressed Midstream Build-out in Support of

Upstream Development

• Completed 3rd CGF in the Delaware Basin

• Building econode facilities, gathering and transport

infrastructure in Mustang IDP (DJ Basin)

0 wells online

2 avg. operated rigs; 14 wells drilled

5 wells completed

Eagle Ford

13 wells online; 8,430 avg. lateral length

6 avg. operated rigs; 20 wells drilled

18 wells completed

Delaware, Permian Basin

31 wells online; 7,400 avg. lateral length

1 avg. operated rig; 11 wells drilled

18 wells completed

DJ Basin

1Q18 Sales Volumes DJ Basin(1) Delaware Eagle Ford Total(1)

Oil (MBbl/d) 62 31 10 103

NGL (MBbl/d) 18 7 34 59

Gas (MMcf/d) 187 42 222 451

Total Sales (MBoe/d) 111 45 81 237 Note: Represents NBL operated activity.

www.nblenergy.com NYSE: NBL

6

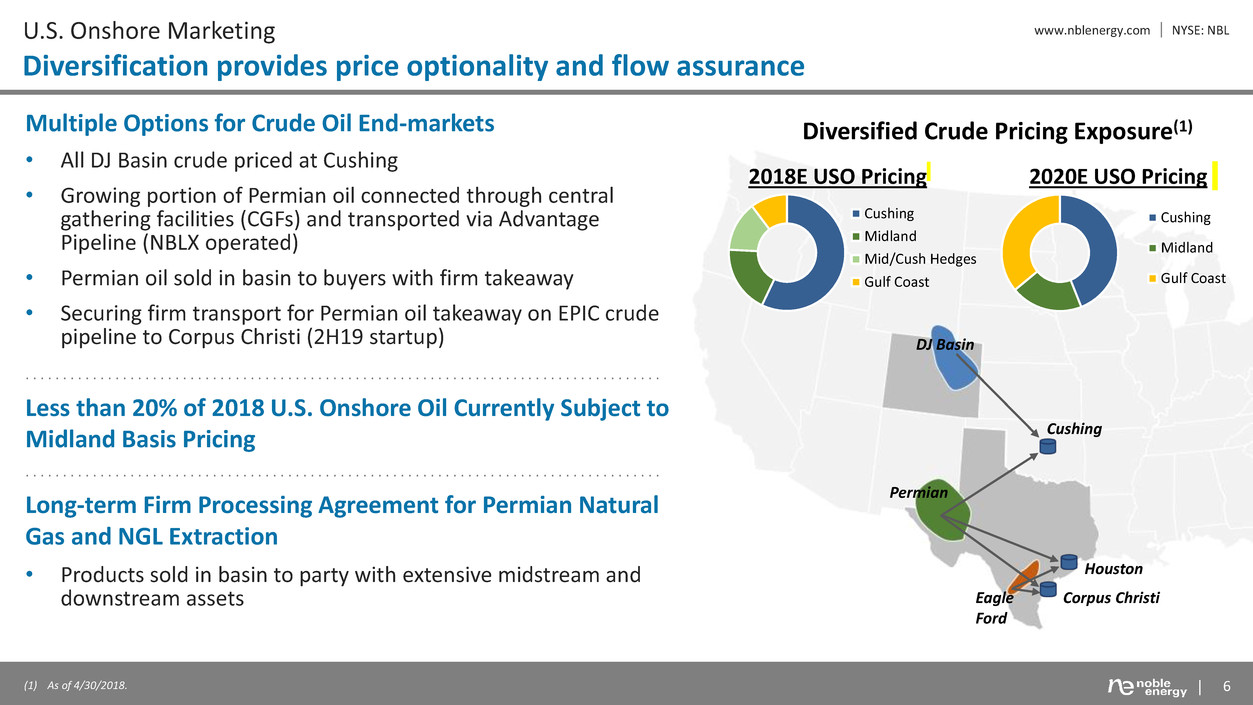

U.S. Onshore Marketing

Diversification provides price optionality and flow assurance

Multiple Options for Crude Oil End-markets

• All DJ Basin crude priced at Cushing

• Growing portion of Permian oil connected through central

gathering facilities (CGFs) and transported via Advantage

Pipeline (NBLX operated)

• Permian oil sold in basin to buyers with firm takeaway

• Securing firm transport for Permian oil takeaway on EPIC crude

pipeline to Corpus Christi (2H19 startup)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Less than 20% of 2018 U.S. Onshore Oil Currently Subject to

Midland Basis Pricing

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Long-term Firm Processing Agreement for Permian Natural

Gas and NGL Extraction

• Products sold in basin to party with extensive midstream and

downstream assets

Diversified Crude Pricing Exposure(1)

Permian

Eagle

Ford

DJ Basin

Cushing

Houston

Corpus Christi

Cushing

Midland

Mid/Cush Hedges

Gulf Coast

2018E USO Pricing 2020E USO Pricing

(1) As of 4/30/2018.

Cushing

Midland

Gulf Coast

www.nblenergy.com NYSE: NBL

117,000

Net acres

3,800

Gross locations(1)

7,800 ft

Average lateral Length

2 BBoe

Net unrisked resources(1)

1Q17 2Q17 3Q17 4Q17 1Q18

0

10

20

30

40

50

Total Oil (MBbl/d)

Delaware Basin

Progressing full-field development

7

Solid Execution Start to 2018

• 19% oil growth from 4Q17

• 13 wells online in 1Q, all multi-well pads and multi-zone

development with 9 wells flowing through CGFs

• Operating 6 rigs and 3 frac crews

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Progressing Midstream Infrastructure Build-out

• 3rd CGF completed in 1Q18, 1st servicing legacy CWEI acreage

• 2 additional CGFs online by end of 2Q18, expanding oil

takeaway capacity to 90 MBbl/d

• All CGFs connected and flowing through Advantage pipeline

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Driving Operating Efficiencies from Multi-well Pads and

Longer Laterals

• 26% reduction in completion cycle time from multi-well pads in

1Q18 vs. single well development in 2017

• Increased wells online lateral length by 24% vs. 2017 average

Delaware Basin Net Production

Delivering High Margin Growth

MBoe/d

Ward

Pecos

Reeves

NBL Acreage

(1) Locations and resources estimate effective as of beginning of 2018.

TX

www.nblenergy.com NYSE: NBL

8

Delaware Basin 1Q18 Activity

Multi-well pad development across multiple zones

Reeves

NBL Acreage

CGFs Online

2Q18 CGF

Calamity Jane 7-well Pad

2 3rd Bone Spring, avg. IP-90 ~2,000 Boe/d

3 Wolfcamp A Upper, avg. IP-90 ~1,620 Boe/d

2 Wolfcamp A Lower, avg. IP-90 ~730 Boe/d

Online late 4Q17, 7,000 ft avg. lateral length, 70% oil

1Q18 Multi-Well Pads

6 wells in North and 7 wells in South

5 Wolfcamp A Upper, 6 Wolfcamp A Lower, 1 3rd Bone

Spring and 1 Wolfcamp C

8,440 ft total avg. laterals

Extended Calamity Jane Results Exhibiting Flatter Declines

• Wolfcamp A Upper and 3rd Bone Spring continue to outperform expectations

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Continued Strong Well Results Across Acreage

• 9 of 11 Wolfcamp A wells ranged from 1,000 – 2,400 Boe/d IP-30 with 78%

average oil mix

• Managing flowback (IPs) on longer laterals

• Certain wells drilled to hold acreage

• Continue to be encouraged by initial results from other zones

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Extending Long Lateral and Multi-well Pad Development into Legacy

CWEI Acreage

• Pace of development aligned with infrastructure buildout

• First 3-well pad tied into 3rd NBLX operated CGF, 1st CGF servicing legacy

CWEI acreage

• First 10,000+ ft laterals showing flatter declines

1Q18 pads

www.nblenergy.com NYSE: NBL Delaware Basin Produced Water Management

Increasing operational flexibility and value

9

< [VALUE]

9%

> 30%

0%

10%

20%

30%

40%

50%

2017 Avg. 1Q18 YE18 Target

Substantially Increasing Use of Recycled

Water for Completions

Kingfisher Water Facility

Infrastructure Strategically Designed with Produced Water

Recycling and Disposal Options for Flow Assurance

• NBL recycle facilities and pond storage

• Increasing NBL operated vs. 3rd party SWD capacity

• Reduces footprint and removes truck usage for water hauling

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Establishing Water Pipeline Network Across Acreage Position

• Increasing ability to utilize recycled water in completions

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Expanding Recycling Efforts in 2018

• Over 1 MMBbl produced water recycled since late 2017

• Initial wells using recycled water performing in-line with

expectations

• Reduces need for disposal and use of fresh water in completions

www.nblenergy.com NYSE: NBL

335,000

Net acres

2,350

Gross locations(3)

9,800 ft

Average lateral Length

1.7 BBoe

Net unrisked resources(3)

10

DJ Basin

Strong execution and cash flow generation

0

25

50

75

100

1Q17 2Q17 3Q17 4Q17 1Q18

MBoe/d

(1) Before tax operating cash flow (not including corporate burden) less capital investments (excluding NBLX capital).

(2) Reflects the historical presentation of sales volumes, pre-implementation of ASC 606 accounting standard. 1Q18 DJ Basin oil mix totaled 52% post ASC 606 implementation.

(3) Locations and resources estimate effective as of beginning of 2018.

CO

Weld

Wells

Ranch

East

Pony

Mustang

NBL Acreage Municipalities

Low GOR: Mid High

Wells Ranch and East Pony Sales Volumes(2)

> 40% growth vs. 1Q17

Solid Operational Execution in 1Q18

• Over $100 MM asset level free cash flow(1)

• Record oil mix of 56%(2)

• Record combined volumes(2) of 88 MBoe/d from Wells

Ranch and East Pony

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Volumes Return to Growth in 2H18

• 2Q18 volumes expected slightly lower than 1Q18 with

planned third party processing turn-around

• Adding 2nd rig and 3rd frac crew in 2Q18

• Timing Mustang wells online in coordination with

infrastructure expansion

• Developing Wells Ranch to maximize CGF throughput

www.nblenergy.com NYSE: NBL

11

DJ Basin

Continued outstanding well results

Wells

Ranch

Mustang

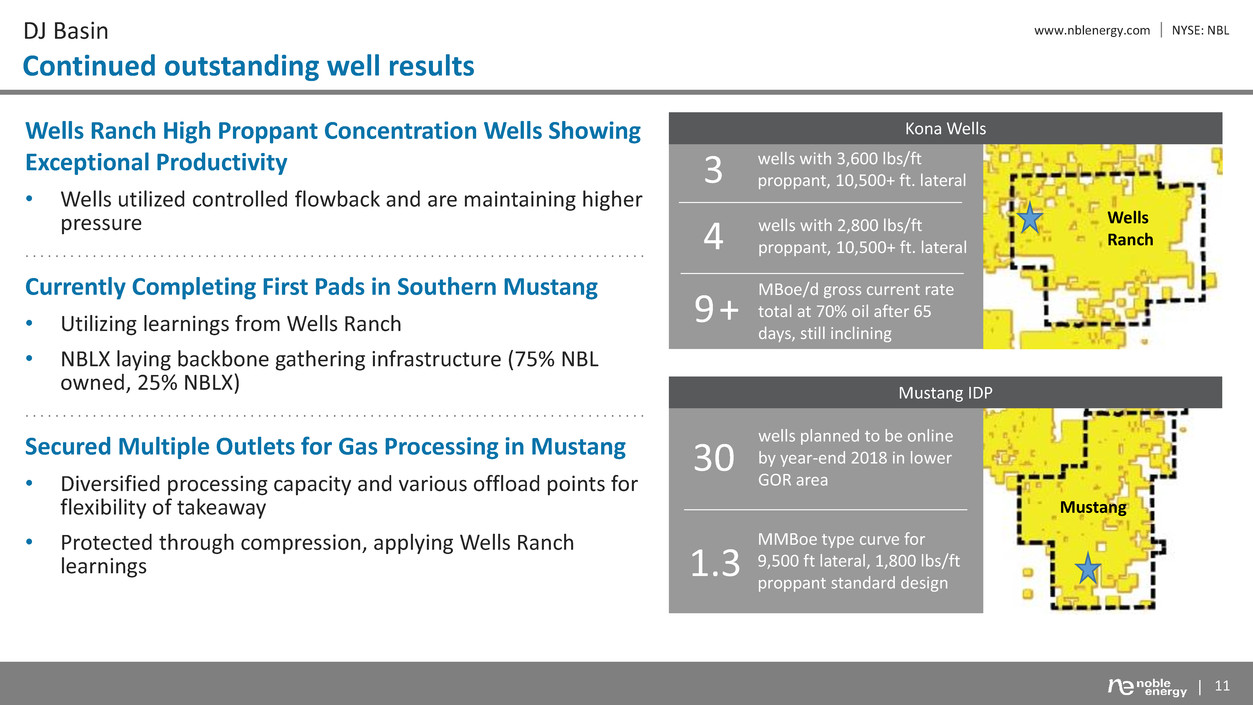

Kona Wells

3

4

9 +

wells with 3,600 lbs/ft

proppant, 10,500+ ft. lateral

wells with 2,800 lbs/ft

proppant, 10,500+ ft. lateral

MBoe/d gross current rate

total at 70% oil after 65

days, still inclining

30

Mustang IDP

1.3

MMBoe type curve for

9,500 ft lateral, 1,800 lbs/ft

proppant standard design

wells planned to be online

by year-end 2018 in lower

GOR area

Wells Ranch High Proppant Concentration Wells Showing

Exceptional Productivity

• Wells utilized controlled flowback and are maintaining higher

pressure

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Currently Completing First Pads in Southern Mustang

• Utilizing learnings from Wells Ranch

• NBLX laying backbone gathering infrastructure (75% NBL

owned, 25% NBLX)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Secured Multiple Outlets for Gas Processing in Mustang

• Diversified processing capacity and various offload points for

flexibility of takeaway

• Protected through compression, applying Wells Ranch

learnings

www.nblenergy.com NYSE: NBL

12

Noble Midstream (NBLX)

Peer-leading distribution growth and growing third-party services

DJ Basin Highlights Delaware Basin Highlights

24%

increase in 1Q18 fresh

water delivery

compared to 4Q17

20%

targeted

annual distribution

growth

2.3x

distribution coverage

with a strong

balance sheet

162

MBoe/d record quarterly oil

and gas volumes gathered

in 1Q

• Delivering CGF Construction to Plan in Support of NBL

Delaware Volume Growth

Coronado (3rd CGF in basin) online in 2Q18

Billy Miner II (4th CGF in basin) online in late April

Collier (5th CGF in basin) expected online by end of

2Q18

• All CGFs Connecting through Advantage System by

Mid-year

• Grew Advantage Pipeline Oil Throughput to 88 MBbl/d;

47% increase from 4Q17

• Expanding Advantage Pipeline Capacity to 200 MBbl/d by

End of 3Q18

• Record Wells Ranch and East Pony Volumes Gathered

• Construction Underway on Mustang IDP Gathering

Infrastructure, Online by Mid-2018

Began fresh water delivery in March

Spec oil, gas and water system expected online by

mid-year

• Closed Acquisition of Saddle Butte and Successfully

Integrated Operations

Planned connection for Mustang volumes

• Planning for Significant 2H18 Activity and Throughput

Ramp

www.nblenergy.com NYSE: NBL

33,000

Net acres

320

Gross locations(1)

6,400 ft

Average lateral Length

400 MMBoe

Net unrisked resources(1)

13

Eagle Ford

Maximizing cash flows

Eagle Ford Net Production

Volumes Trending as Expected

0

25

50

75

100

1Q17 2Q17 3Q17 4Q17 1Q18

MBoe/d

TX

Dimmit

Gates

Ranch

NBL Acreage

Webb

(1) Locations and resources estimate effective as of beginning of 2018.

Cash Flow Generation from Significant 2017 Volume

Ramp

• 1Q18 sales volumes of 81 MBoe/d, up nearly 2x vs. 1Q17

• ~3 MBoe/d facility down-time impacts to 1Q18

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2018 Wells Online in North Gates Ranch

• 5-well pad co-development of Upper and Lower Eagle

Ford wells online in 2Q18

• 4-well pad targeting Lower Eagle Ford expected online in

2Q18

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Strong Safety Performance

• 185 days no lost time or recordable incidents

www.nblenergy.com NYSE: NBL

14

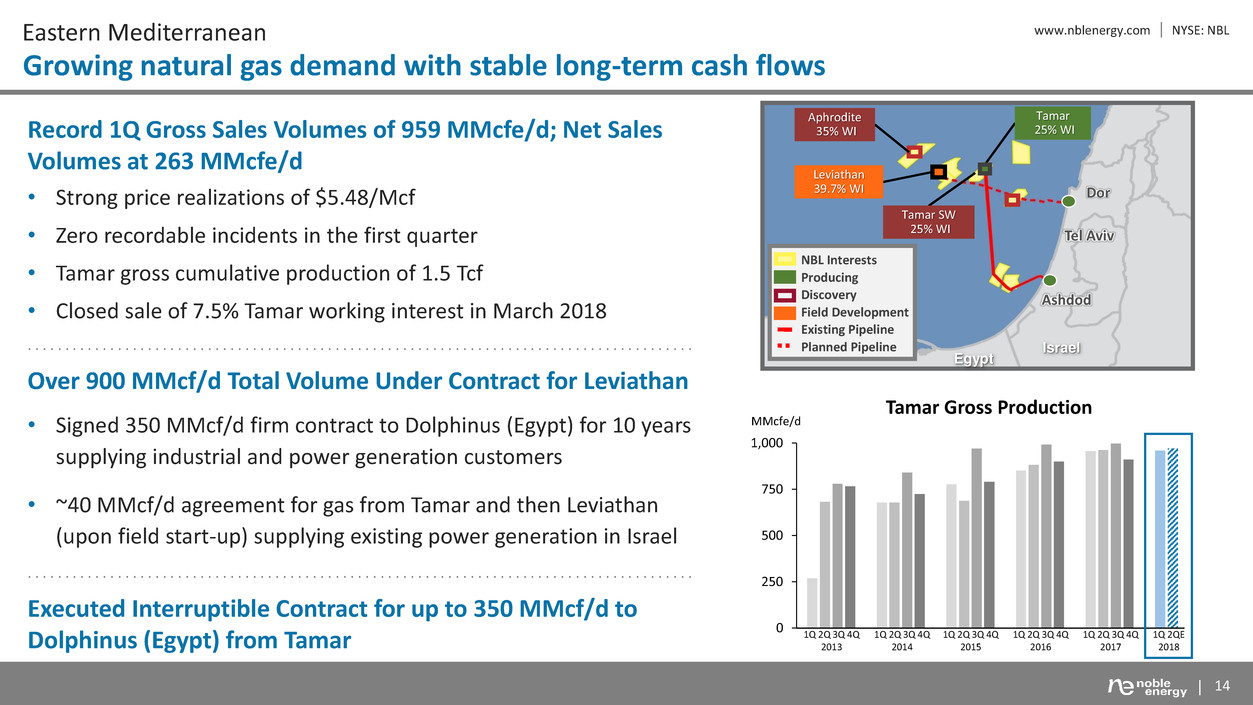

Eastern Mediterranean

Growing natural gas demand with stable long-term cash flows

Tamar

25% WI

Tamar SW

25% WI Tel Aviv

Ashdod

Israel

Egypt

Aphrodite

35% WI

Leviathan

39.7% WI Dor

Discovery

Existing Pipeline

Planned Pipeline

Field Development

NBL Interests

Producing

0

250

500

750

1,000

Tamar Gross Production

MMcfe/d

1Q 2Q 3Q 4Q

2014

1Q 2Q 3Q 4Q

2015

1Q 2Q 3Q 4Q

2016

1Q 2Q 3Q 4Q

2017

1Q 2QE

2018

1Q 2Q 3Q 4Q

2013

Record 1Q Gross Sales Volumes of 959 MMcfe/d; Net Sales

Volumes at 263 MMcfe/d

• Strong price realizations of $5.48/Mcf

• Zero recordable incidents in the first quarter

• Tamar gross cumulative production of 1.5 Tcf

• Closed sale of 7.5% Tamar working interest in March 2018

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Over 900 MMcf/d Total Volume Under Contract for Leviathan

• Signed 350 MMcf/d firm contract to Dolphinus (Egypt) for 10 years

supplying industrial and power generation customers

• ~40 MMcf/d agreement for gas from Tamar and then Leviathan

(upon field start-up) supplying existing power generation in Israel

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Executed Interruptible Contract for up to 350 MMcf/d to

Dolphinus (Egypt) from Tamar

www.nblenergy.com NYSE: NBL

15

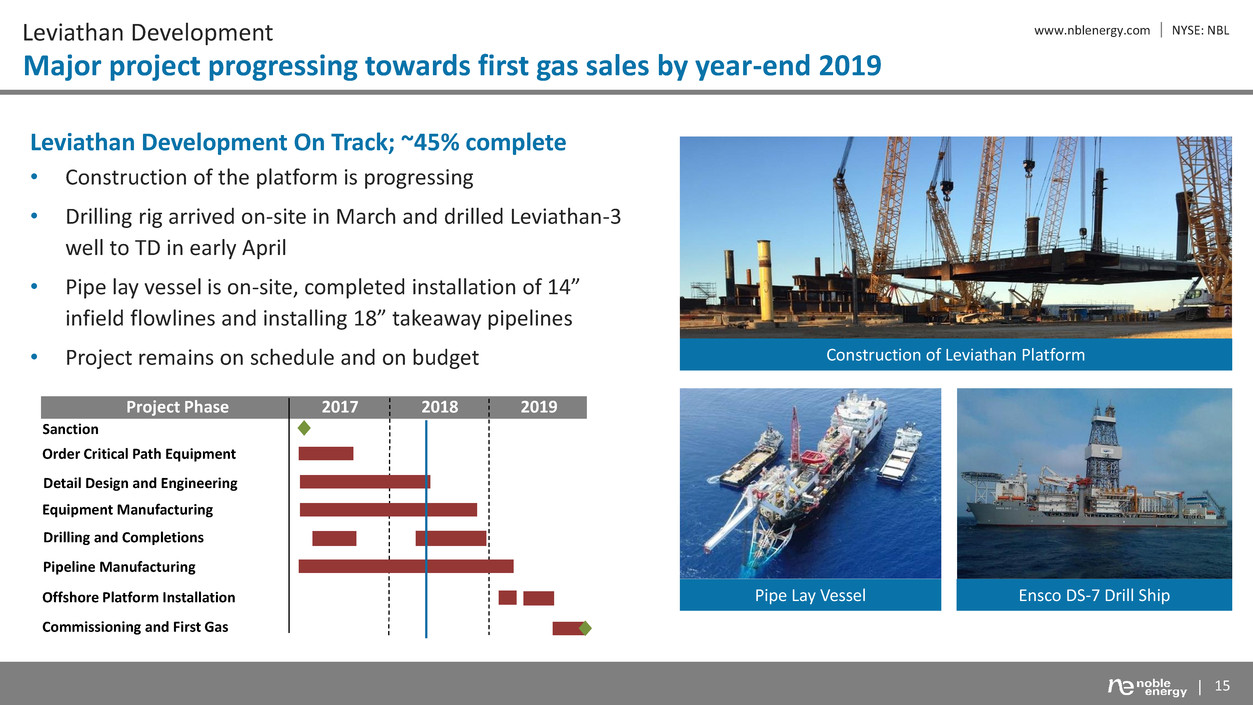

Leviathan Development

Major project progressing towards first gas sales by year-end 2019

Leviathan Development On Track; ~45% complete

• Construction of the platform is progressing

• Drilling rig arrived on-site in March and drilled Leviathan-3

well to TD in early April

• Pipe lay vessel is on-site, completed installation of 14”

infield flowlines and installing 18” takeaway pipelines

• Project remains on schedule and on budget Construction of Leviathan Platform

Project Phase 2017 2018 2019

Sanction

Order Critical Path Equipment

Detail Design and Engineering

Pipeline Manufacturing

Equipment Manufacturing

Commissioning and First Gas

Drilling and Completions

Offshore Platform Installation Pipe Lay Vessel Ensco DS-7 Drill Ship

www.nblenergy.com NYSE: NBL Other Global Offshore

Continued exceptional operational and safety performance

Reliable Performance at West Africa

• West Africa sales volumes of 56 MBoe/d (30% oil)

• Exceeded 2 years at Aseng and almost 4 years at Alen without a

recordable safety incident

• Strong West Africa volumes in 2Q expected from multiple liftings,

anticipated to be underlifted in 3Q

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Progressing Negotiations with all Stakeholders to Monetize

Significant Discovered Gas in EG and Cameroon

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Closed Sale of Gulf of Mexico Business on April 12th

• Earlier than anticipated closing due to Fieldwood’s successful

restructuring

• Volumes included in 2Q guidance through closing date

16

Equatorial

Guinea

Cameroon

Aseng

40% WI

Methanol Plant 45% WI

LPG Plant 28% WI

Bioko

Island

Alen

45% WI

Alba Field

33% WI

Producing

NBL Interests

Yoyo

Yolanda

Discoveries

Alen Platform, West Africa

www.nblenergy.com NYSE: NBL

17

Appendix

www.nblenergy.com NYSE: NBL

18

Forward-Looking Statements and Other Matters

This presentation contains certain "forward-looking statements" within the meaning of federal securities laws. Words such as "anticipates", "believes“, "expects", "intends", "will", "should",

"may", and similar expressions may be used to identify forward-looking statements. Forward-looking statements are not statements of historical fact and reflect Noble Energy's current views

about future events. Such forward-looking statements may include, but are not limited to, future financial and operating results, and other statements that are not historical facts, including

estimates of oil and natural gas reserves and resources, estimates of future production, assumptions regarding future oil and natural gas pricing, planned drilling activity, future results of

operations, projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given that the forward-looking statements

contained in this presentation will occur as projected and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates

and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without

limitation, the volatility in commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves, the ability to replace reserves, environmental risks, drilling and

operating risks, exploration and development risks, competition, government regulation or other actions, the ability of management to execute its plans to meet its goals and other risks

inherent in Noble Energy's businesses that are discussed in Noble Energy's most recent annual reports on Form 10-K, respectively, and in other Noble Energy reports on file with the

Securities and Exchange Commission (the "SEC"). These reports are also available from the sources described above. Forward-looking statements are based on the estimates and opinions of

management at the time the statements are made. Noble Energy does not assume any obligation to update any forward-looking statements should circumstances or management’s

estimates or opinions change.

The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be

economically and legally producible under existing economic and operating conditions. The SEC permits the optional disclosure of probable and possible reserves, however, we have not

disclosed our probable and possible reserves in our filings with the SEC. We may use certain terms in this presentation, such as “net unrisked resources”, which by their nature are more

speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly prohibit us

from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosures and risk factors in our most recent Form 10-K and in other reports on file with the

SEC, available from Noble Energy’s offices or website, http://www.nblenergy.com.

This presentation also contains certain non-GAAP measures of financial performance that management believes are good tools for internal use and the investment community in evaluating

Noble Energy’s overall financial performance. These non-GAAP measures are broadly used to value and compare companies in the crude oil and natural gas industry. Please see the attached

schedules for reconciliations of the differences between any historical non-GAAP measures used in this presentation and the most directly comparable GAAP financial measures.

www.nblenergy.com NYSE: NBL

19

Second Quarter 2018 Guidance

Capital & Cost Metrics

Capital Expenditures(2) ($MM)

Total Company Organic Capital $750 - $850

Cost Metrics LOW HIGH

Lease Operating Expense ($/BOE) 3.70 4.00

Gathering, Transportation & Processing ($/BOE) 3.30 3.60

Production Taxes (% Oil, Gas, NGL Revenues) 4.5 4.9

Marketing ($MM) 8 12

DD&A ($/BOE) 14.00 14.75

Exploration ($MM) 30 50

G&A ($MM) 100 110

Interest, net ($MM) 70 80

Other Guidance Items ($MM)

Equity Investment Income 35 50

Midstream Services Revenue – Third Party 10 20

Non-Controlling Interest – NBLX Public Unitholders 10 20

2Q 2018 Sales Volume

Crude Oil and

Condensate (MBbl/d)

Natural Gas Liquids

(MBbl/d)

Natural Gas

(MMcf/d)

Total Equivalent

(MBoe/d)

Low High Low High Low High Low High

United States Onshore 103 108 60 64 460 485 240 250

United States Gulf of Mexico(1) 4 4 - - 4 4 4 5

Israel - - - - 200 220 33 37

Equatorial Guinea 15 19 - - 205 225 51 56

Equatorial Guinea - Equity method investment 1 2 5 6 - - 6 7

Total Company 124 132 65 70 885 910 340 350

(1) U.S. Gulf of Mexico volumes are included in sales guidance through closing April 12, 2018.

(2) Includes only NBL-funded portion of midstream capital expenditures.

www.nblenergy.com NYSE: NBL

20

Full-Year 2018 Guidance

Capital & Cost Metrics

Capital Expenditures(2) ($MM)

Total Company Organic Capital $2,700 - $2,900

Cost Metrics LOW HIGH

Lease Operating Expense ($/BOE) 3.80 4.20

Gathering, Transportation & Processing ($/BOE) 3.15 3.50

Production Taxes (% Oil, Gas, NGL Revenues) 4.7 5.1

Marketing ($MM) 35 50

DD&A ($/BOE) 14.50 15.25

Exploration ($MM) 125 150

G&A ($MM) 400 430

Interest, net ($MM) 260 300

Other Guidance Items ($MM)

Equity Investment Income 160 200

Midstream Services Revenue – Third Party 60 80

Non-Controlling Interest – NBLX Public Unitholders 80 105

Full-Year 2018 Sales Volume

Crude Oil and

Condensate (MBbl/d)

Natural Gas Liquids

(MBbl/d)

Natural Gas

(MMcf/d)

Total Equivalent

(MBoe/d)

Low High Low High Low High Low High

United States Onshore 111 117 61 66 460 490 252 262

United States Gulf of Mexico(1) 5 6 - 1 6 7 6 7

Israel(1) - - - - 215 240 36 40

Equatorial Guinea 13 17 - - 185 210 45 50

Equatorial Guinea - Equity method investment 1 2 5 5 - - 6 7

Total Company 133 139 68 72 895 920 350 360

(1) U.S. Gulf of Mexico volumes are included in sales guidance through closing April 12, 2018. Israel sales volumes reflect divestment of 7.5% interest in Tamar on March 11, 2018.

(2) Includes only NBL-funded portion of midstream capital expenditures.

Investor Relations Contacts

Brad Whitmarsh Megan Dolezal Lauren Brown

281.943.1670 281.943.1861 281.872.3208

brad.whitmarsh@nblenergy.com megan.dolezal@nblenergy.com lauren.brown@nblenergy.com

Visit us on the Investor Relations Homepage at www.nblenergy.com