Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ASHLAND GLOBAL HOLDINGS INC | ash-ex991_6.htm |

| 8-K - ASH - 8-K 2ND QTR EARNINGS - ASHLAND GLOBAL HOLDINGS INC | ash-8k_20180501.htm |

Second-Quarter Fiscal 2018 Earnings May 1, 2018 / efficacy usability allure integrity profitability Exhibit 99.2

Forward-Looking Statements This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Ashland has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “objectives,” “may,” “will,” “should,” “plans” and “intends” and the negative of these words or other comparable terminology. Ashland may from time to time make forward-looking statements in its annual reports, quarterly reports and other filings with the SEC, news releases and other written and oral communications. These forward-looking statements are based on Ashland’s expectations and assumptions, as of the date such statements are made, regarding Ashland’s future operating performance and financial condition, as well as the economy and other future events or circumstances. Ashland’s expectations and assumptions include, without limitation, internal forecasts and analyses of current and future market conditions and trends, management plans and strategies, operating efficiencies and economic conditions (such as prices, supply and demand, cost of raw materials, and the ability to recover raw-material cost increases through price increases), and risks and uncertainties associated with the following: the program to eliminate certain existing corporate and Specialty & Ingredients expenses (including the possibility that such cost eliminations may not occur or may take longer to implement than anticipated), the expected divestiture of its Composites segment and for the butanediol (BDO) manufacturing facility in Marl, Germany, and related merchant Intermediates and Solvents (I&S) products (including, in each case, the possibility that a transaction may not occur or that, if a transaction does occur, Ashland may not realize the anticipated benefits from such transaction), the impact of acquisitions and/or divestitures Ashland has made or may make, including the acquisition of Pharmachem (including the possibility that Ashland may not realize the anticipated benefits from such transactions); Ashland’s substantial indebtedness (including the possibility that such indebtedness and related restrictive covenants may adversely affect Ashland’s future cash flows, results of operations, financial condition and its ability to repay debt); Ashland’s ability to generate sufficient cash to finance its stock repurchase plans; the potential that Ashland does not realize all of the expected benefits of the separation of its Valvoline business; the potential that the Tax Cuts and Jobs Act enacted on December 22, 2017, will have a negative impact on Ashland’s financial results; and severe weather, natural disasters, cyber events and legal proceedings and claims (including product recalls, environmental and asbestos matters). Various risks and uncertainties may cause actual results to differ materially from those stated, projected or implied by any forward-looking statements, including, without limitation, risks and uncertainties affecting Ashland that are described in Ashland’s most recent Form 10-K (including Item 1A Risk Factors) filed with the SEC, which is available on Ashland’s website at http://investor.Ashland.com or on the SEC’s website at http://www.sec.gov. Ashland believes its expectations and assumptions are reasonable, but there can be no assurance that the expectations reflected herein will be achieved. Unless legally required, Ashland undertakes no obligation to update any forward-looking statements made in this news release whether as a result of new information, future events or otherwise. Regulation G: Adjusted Results The information presented herein regarding certain unaudited adjusted results does not conform to generally accepted accounting principles in the United States (U.S. GAAP) and should not be construed as an alternative to the reported results determined in accordance with U.S. GAAP. Ashland has included this non-GAAP information to assist in understanding the operating performance of the company and its reportable segments. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP information related to previous Ashland filings with the SEC has been reconciled with reported U.S. GAAP results. Although Ashland provides forward-looking guidance for adjusted EBITDA, adjusted EPS and free cash flow, Ashland is not reaffirming or providing forward-looking guidance for U.S. GAAP-reported financial measures or a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable U.S. GAAP measure because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items without unreasonable effort.

Second Quarter Summary

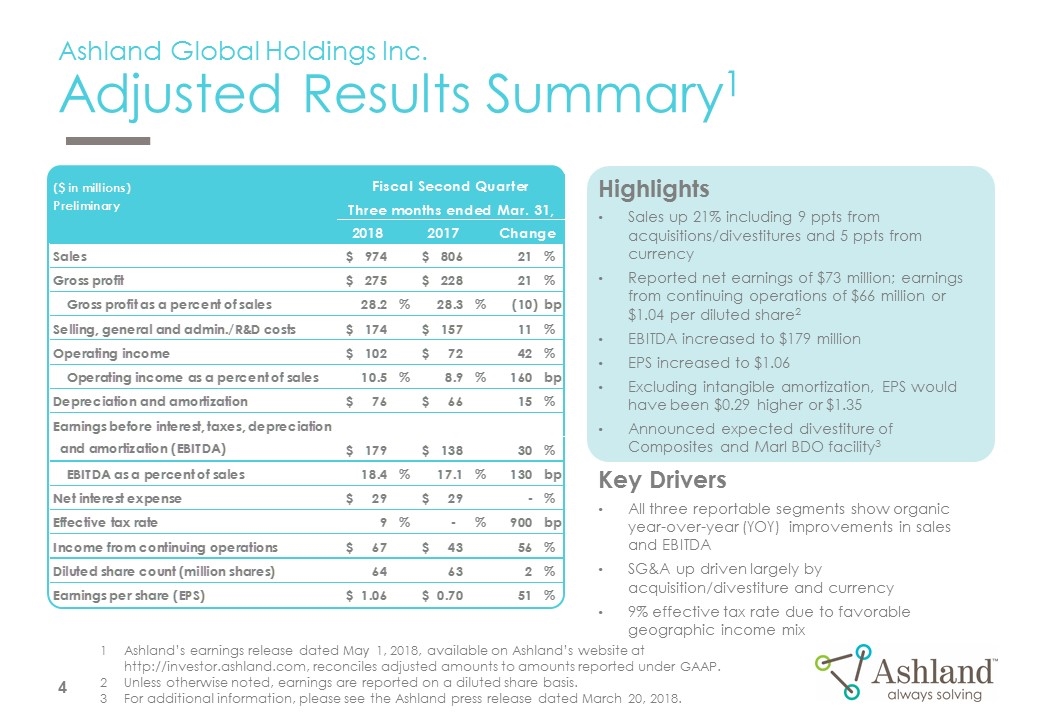

Ashland Global Holdings Inc. Adjusted Results Summary1 Highlights Sales up 21% including 9 ppts from acquisitions/divestitures and 5 ppts from currency Reported net earnings of $73 million; earnings from continuing operations of $66 million or $1.04 per diluted share2 EBITDA increased to $179 million EPS increased to $1.06 Excluding intangible amortization, EPS would have been $0.29 higher or $1.35 Announced expected divestiture of Composites and Marl BDO facility3 Key Drivers All three reportable segments show organic year-over-year (YOY) improvements in sales and EBITDA SG&A up driven largely by acquisition/divestiture and currency 9% effective tax rate due to favorable geographic income mix Ashland’s earnings release dated May 1, 2018, available on Ashland’s website at http://investor.ashland.com, reconciles adjusted amounts to amounts reported under GAAP. Unless otherwise noted, earnings are reported on a diluted share basis. For additional information, please see the Ashland press release dated March 20, 2018.

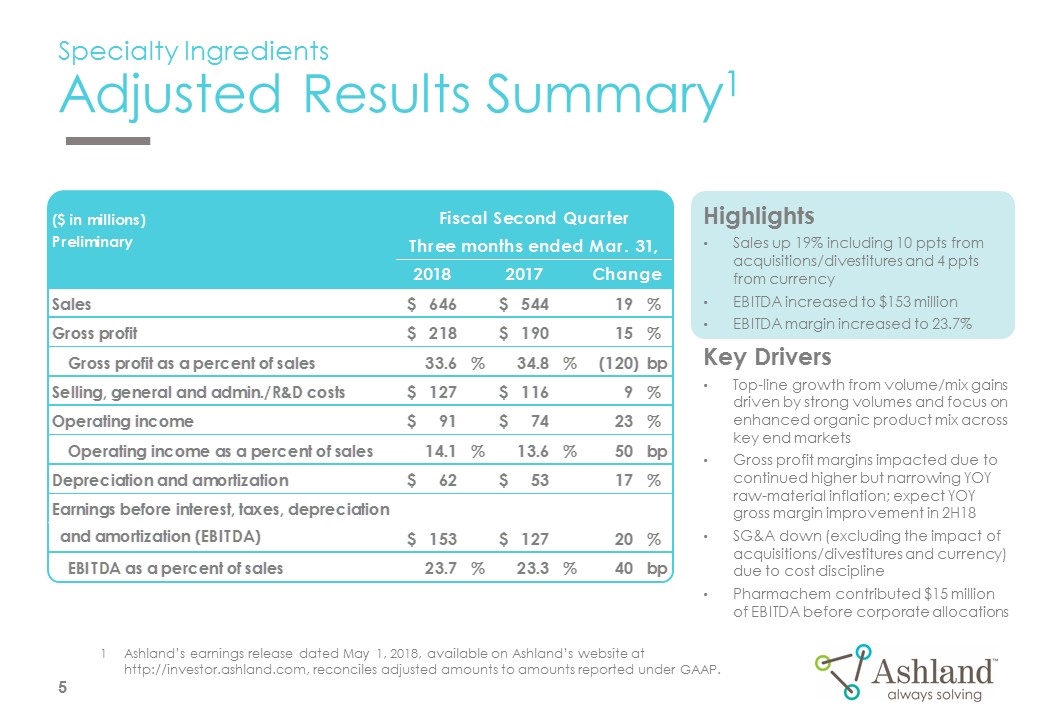

Specialty Ingredients Adjusted Results Summary1 Highlights Sales up 19% including 10 ppts from acquisitions/divestitures and 4 ppts from currency EBITDA increased to $153 million EBITDA margin increased to 23.7% Key Drivers Top-line growth from volume/mix gains driven by strong volumes and focus on enhanced organic product mix across key end markets Gross profit margins impacted due to continued higher but narrowing YOY raw-material inflation; expect YOY gross margin improvement in 2H18 SG&A down (excluding the impact of acquisitions/divestitures and currency) due to cost discipline Pharmachem contributed $15 million of EBITDA before corporate allocations Ashland’s earnings release dated May 1, 2018, available on Ashland’s website at http://investor.ashland.com, reconciles adjusted amounts to amounts reported under GAAP.

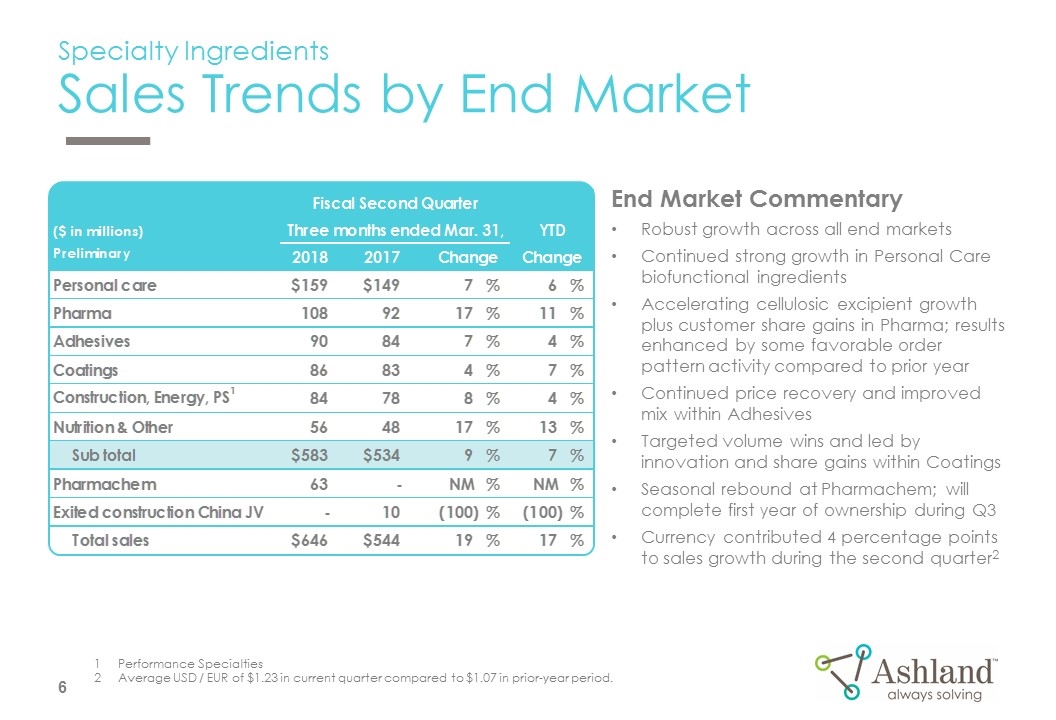

Specialty Ingredients Sales Trends by End Market End Market Commentary Robust growth across all end markets Continued strong growth in Personal Care biofunctional ingredients Accelerating cellulosic excipient growth plus customer share gains in Pharma; results enhanced by some favorable order pattern activity compared to prior year Continued price recovery and improved mix within Adhesives Targeted volume wins and led by innovation and share gains within Coatings Seasonal rebound at Pharmachem; will complete first year of ownership during Q3 Currency contributed 4 percentage points to sales growth during the second quarter2 Performance Specialties Average USD / EUR of $1.23 in current quarter compared to $1.07 in prior-year period.

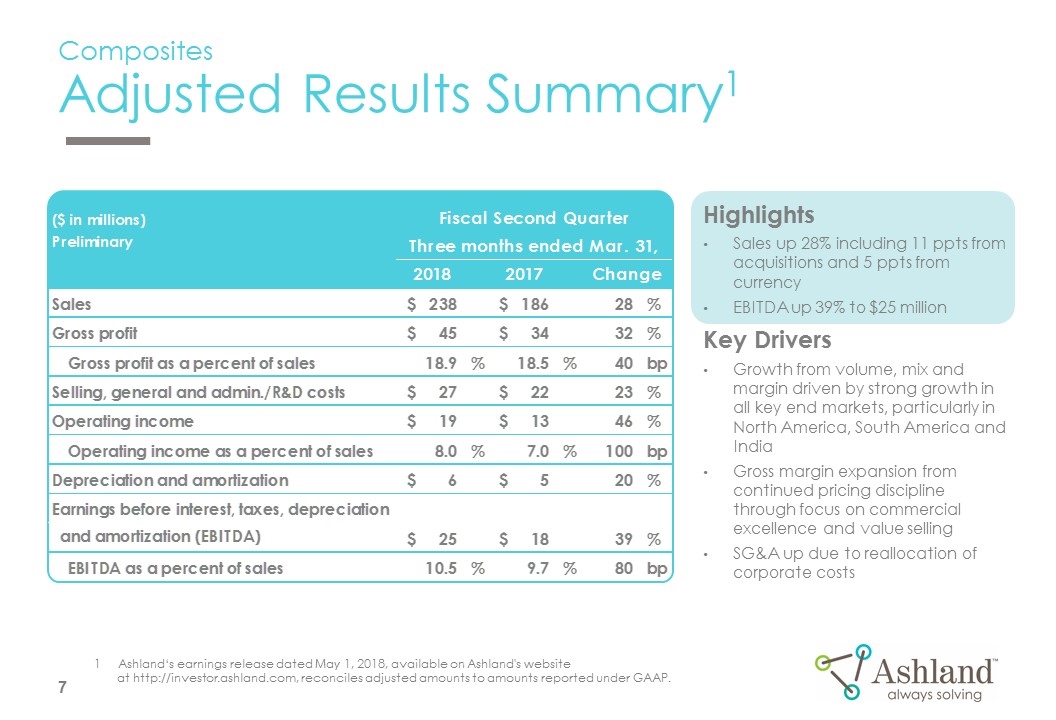

Composites Adjusted Results Summary1 Ashland‘s earnings release dated May 1, 2018, available on Ashland's website at http://investor.ashland.com, reconciles adjusted amounts to amounts reported under GAAP. Highlights Sales up 28% including 11 ppts from acquisitions and 5 ppts from currency EBITDA up 39% to $25 million Key Drivers Growth from volume, mix and margin driven by strong growth in all key end markets, particularly in North America, South America and India Gross margin expansion from continued pricing discipline through focus on commercial excellence and value selling SG&A up due to reallocation of corporate costs

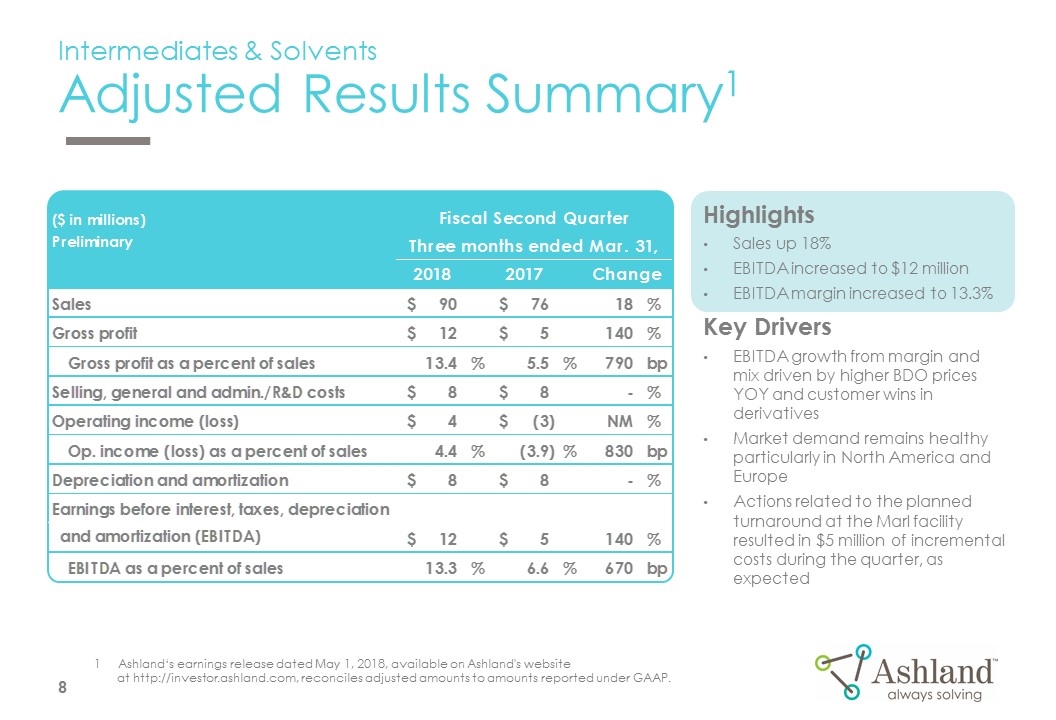

Intermediates & Solvents Adjusted Results Summary1 Ashland‘s earnings release dated May 1, 2018, available on Ashland's website at http://investor.ashland.com, reconciles adjusted amounts to amounts reported under GAAP. Highlights Sales up 18% EBITDA increased to $12 million EBITDA margin increased to 13.3% Key Drivers EBITDA growth from margin and mix driven by higher BDO prices YOY and customer wins in derivatives Market demand remains healthy particularly in North America and Europe Actions related to the planned turnaround at the Marl facility resulted in $5 million of incremental costs during the quarter, as expected

Outlook Summary

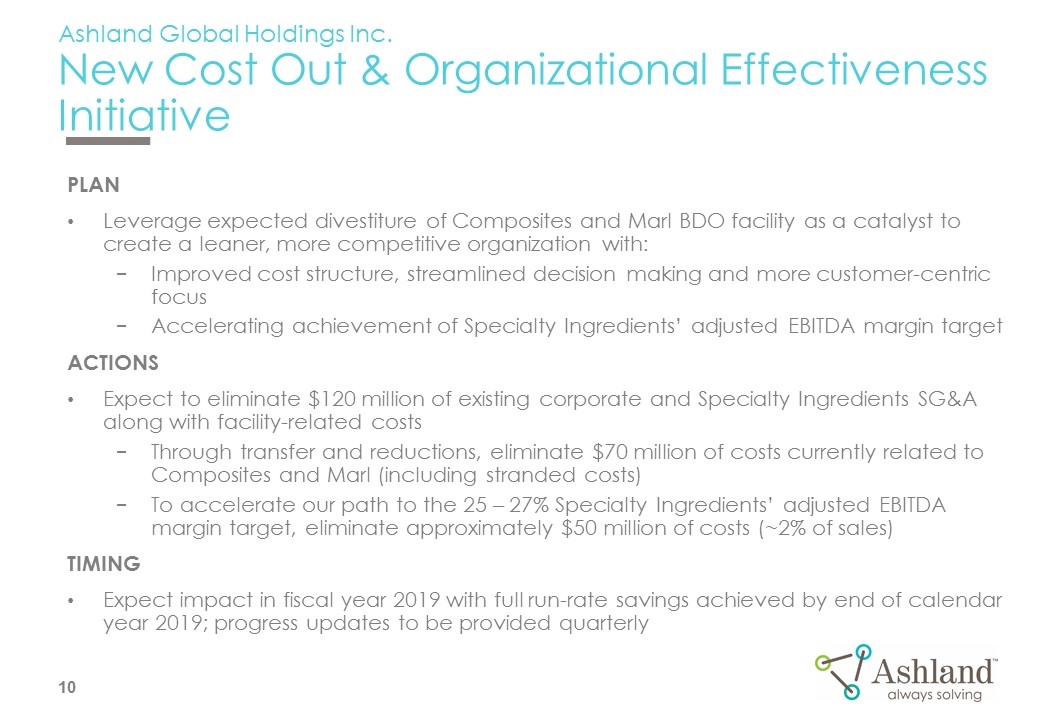

Ashland Global Holdings Inc. New Cost Out & Organizational Effectiveness Initiative PLAN Leverage expected divestiture of Composites and Marl BDO facility as a catalyst to create a leaner, more competitive organization with: Improved cost structure, streamlined decision making and more customer-centric focus Accelerating achievement of Specialty Ingredients’ adjusted EBITDA margin target ACTIONS Expect to eliminate $120 million of existing corporate and Specialty Ingredients SG&A along with facility-related costs Through transfer and reductions, eliminate $70 million of costs currently related to Composites and Marl (including stranded costs) To accelerate our path to the 25 – 27% Specialty Ingredients’ adjusted EBITDA margin target, eliminate approximately $50 million of costs (~2% of sales) TIMING Expect impact in fiscal year 2019 with full run-rate savings achieved by end of calendar year 2019; progress updates to be provided quarterly

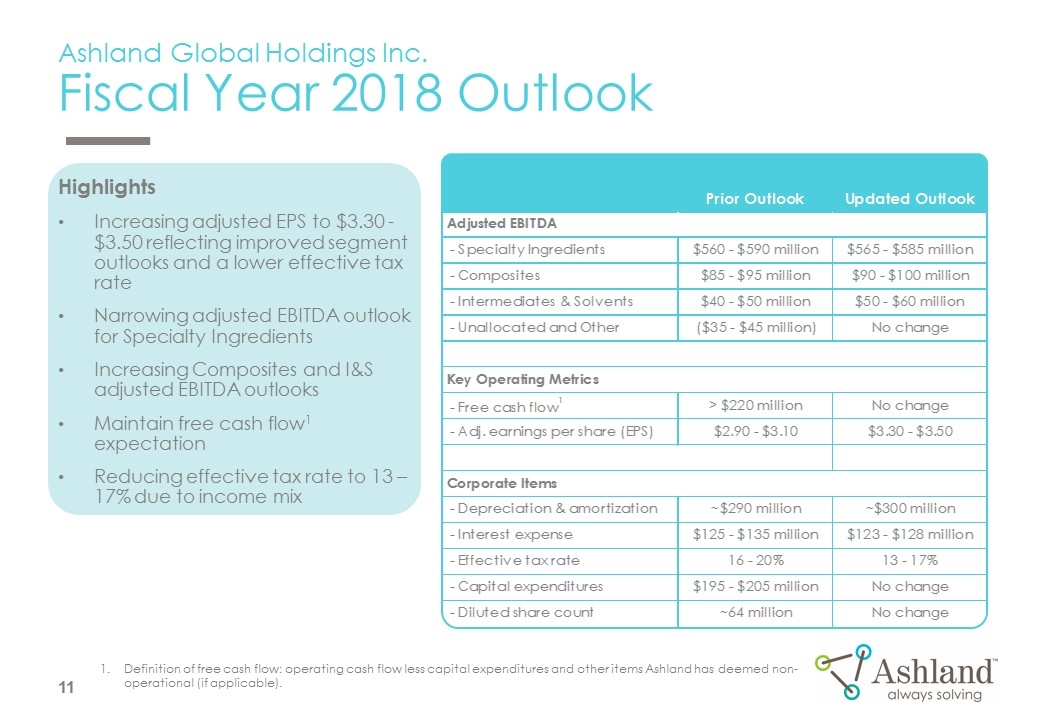

Ashland Global Holdings Inc. Fiscal Year 2018 Outlook Definition of free cash flow: operating cash flow less capital expenditures and other items Ashland has deemed non-operational (if applicable). Highlights Increasing adjusted EPS to $3.30 - $3.50 reflecting improved segment outlooks and a lower effective tax rate Narrowing adjusted EBITDA outlook for Specialty Ingredients Increasing Composites and I&S adjusted EBITDA outlooks Maintain free cash flow1 expectation Reducing effective tax rate to 13 – 17% due to income mix

Highlights Expect Q3 adjusted EPS in the range of $0.95 - $1.05 vs. $0.83 prior year Outlook assumes effective tax rate of 17% vs. 11% prior year Key Drivers Strong year-over-year sales and EBITDA growth in Specialty Ingredients Asset utilization program contributing to YOY growth Composites and I&S contribution consistent with recent results Ashland Global Holdings Inc. Third-Quarter Fiscal 2018 Outlook

Appendix A: Key Items and Balance Sheet

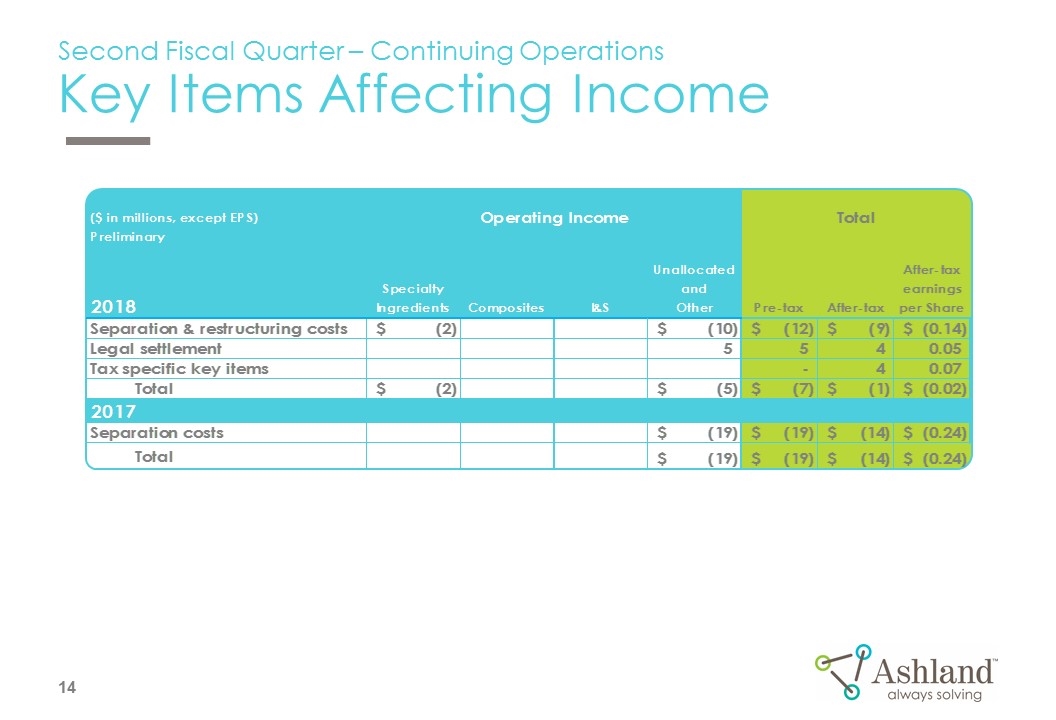

Second Fiscal Quarter – Continuing Operations Key Items Affecting Income

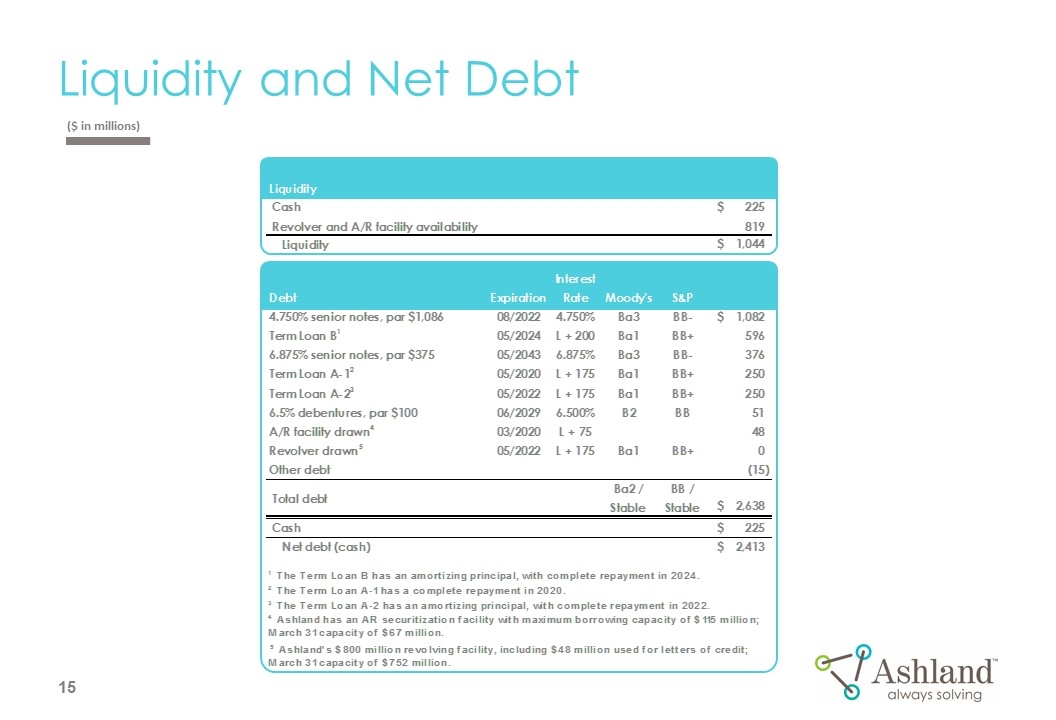

Liquidity and Net Debt ($ in millions)

Appendix B: Business Profiles 12 Months Ended March 31, 2018

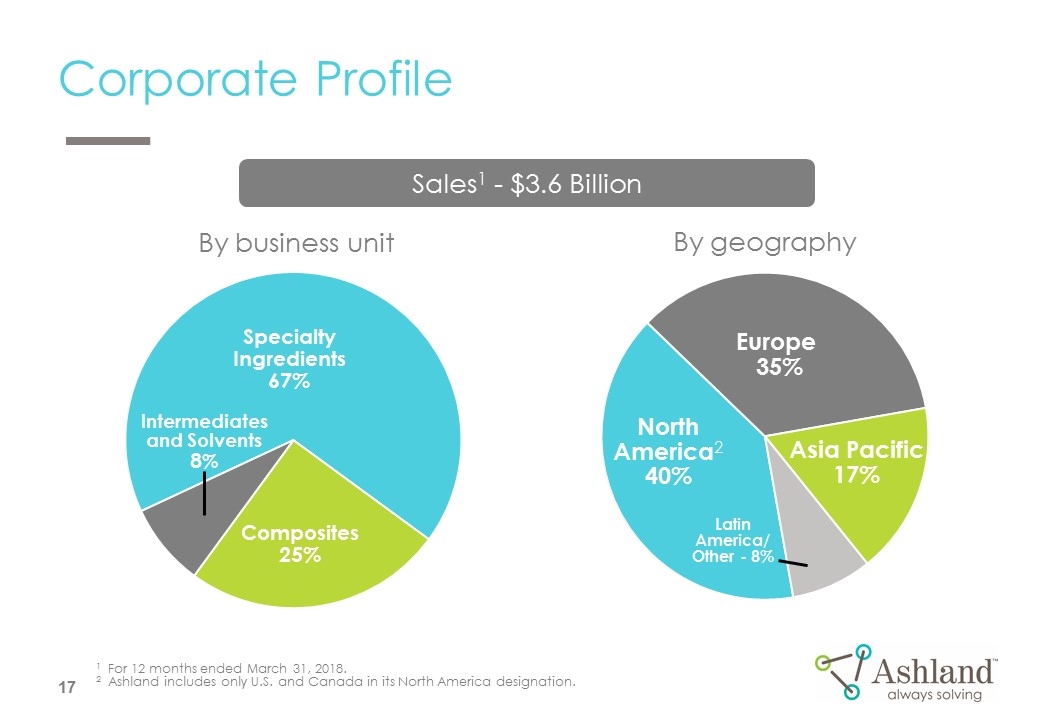

Corporate Profile By business unit By geography 1For 12 months ended March 31, 2018. 2Ashland includes only U.S. and Canada in its North America designation. North America2 40% Asia Pacific 17% Latin America/ Other - 8% Europe 35% Specialty Ingredients 67% Intermediates and Solvents 8% Composites 25% Sales1 - $3.6 Billion

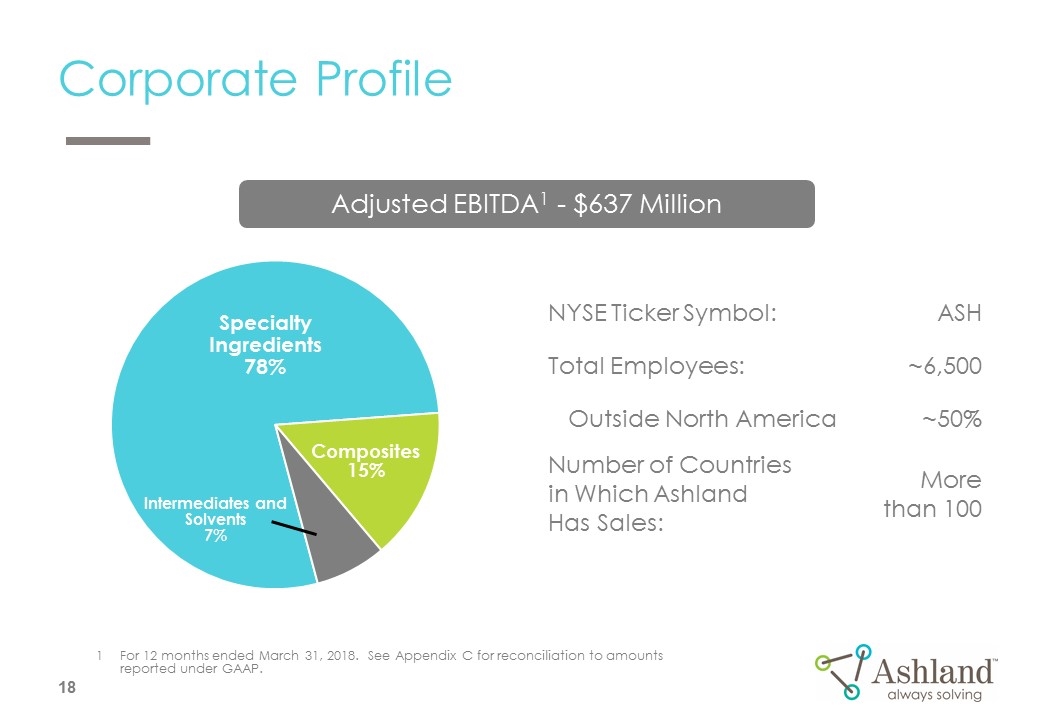

Corporate Profile For 12 months ended March 31, 2018. See Appendix C for reconciliation to amounts reported under GAAP. NYSE Ticker Symbol: ASH Total Employees: ~6,500 Outside North America ~50% Number of Countries in Which Ashland Has Sales: More than 100 Specialty Ingredients 78% Intermediates and Solvents 7% Adjusted EBITDA1 - $637 Million

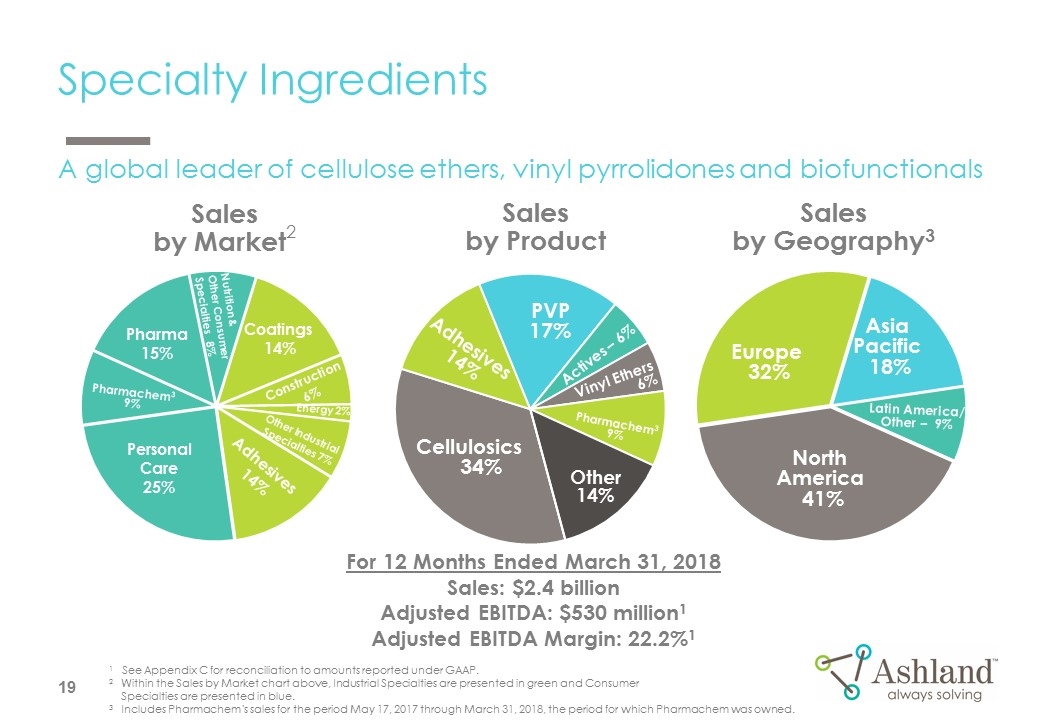

Specialty Ingredients Sales by Market2 For 12 Months Ended March 31, 2018 Sales: $2.4 billion Adjusted EBITDA: $530 million1 Adjusted EBITDA Margin: 22.2%1 Sales by Product Cellulosics 34% PVP 17% Adhesives 14% North America 41% Asia Pacific 18% Europe 32% Latin America/ Other – 9% Actives – 6% Vinyl Ethers 6% Sales by Geography3 A global leader of cellulose ethers, vinyl pyrrolidones and biofunctionals Pharmachem3 9% Pharmachem3 9% 1 See Appendix C for reconciliation to amounts reported under GAAP. 2 Within the Sales by Market chart above, Industrial Specialties are presented in green and Consumer Specialties are presented in blue. 3 Includes Pharmachem’s sales for the period May 17, 2017 through March 31, 2018, the period for which Pharmachem was owned.

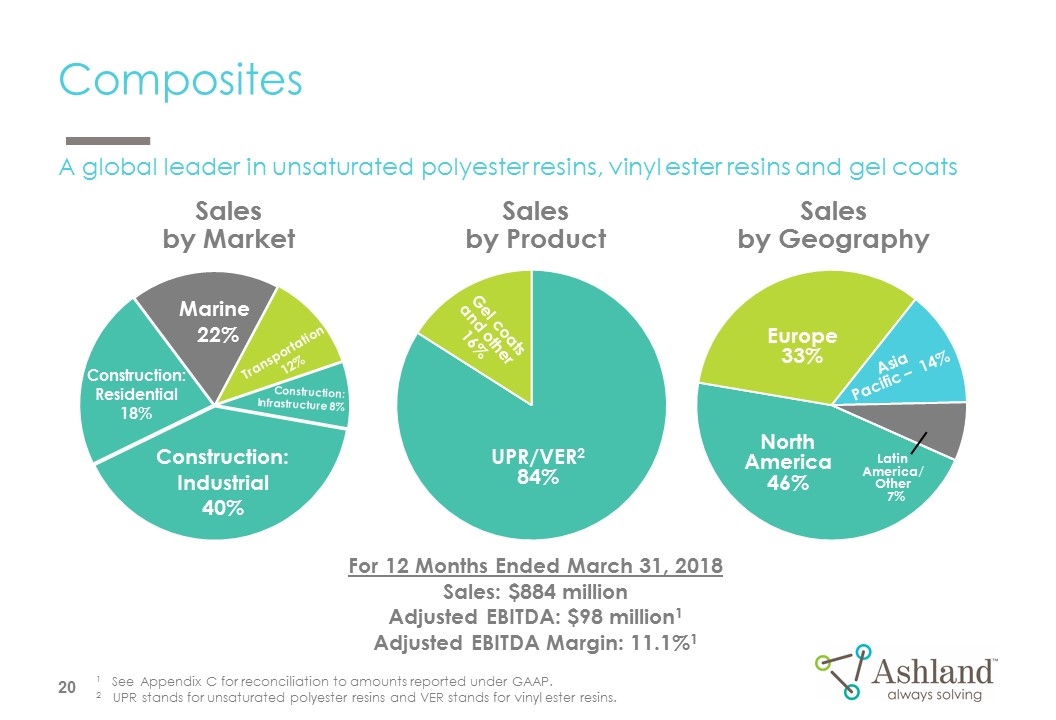

Composites Sales by Geography For 12 Months Ended March 31, 2018 Sales: $884 million Adjusted EBITDA: $98 million1 Adjusted EBITDA Margin: 11.1%1 Sales by Product UPR/VER2 84% Gel coats and other 16% Construction: Residential 18% Marine 22% Construction: Industrial 40% Sales by Market North America 46% Asia Pacific – 14% Europe 33% Latin America/ Other 7% Transportation 12% Construction: Infrastructure 8% 1 See Appendix C for reconciliation to amounts reported under GAAP. 2 UPR stands for unsaturated polyester resins and VER stands for vinyl ester resins. A global leader in unsaturated polyester resins, vinyl ester resins and gel coats

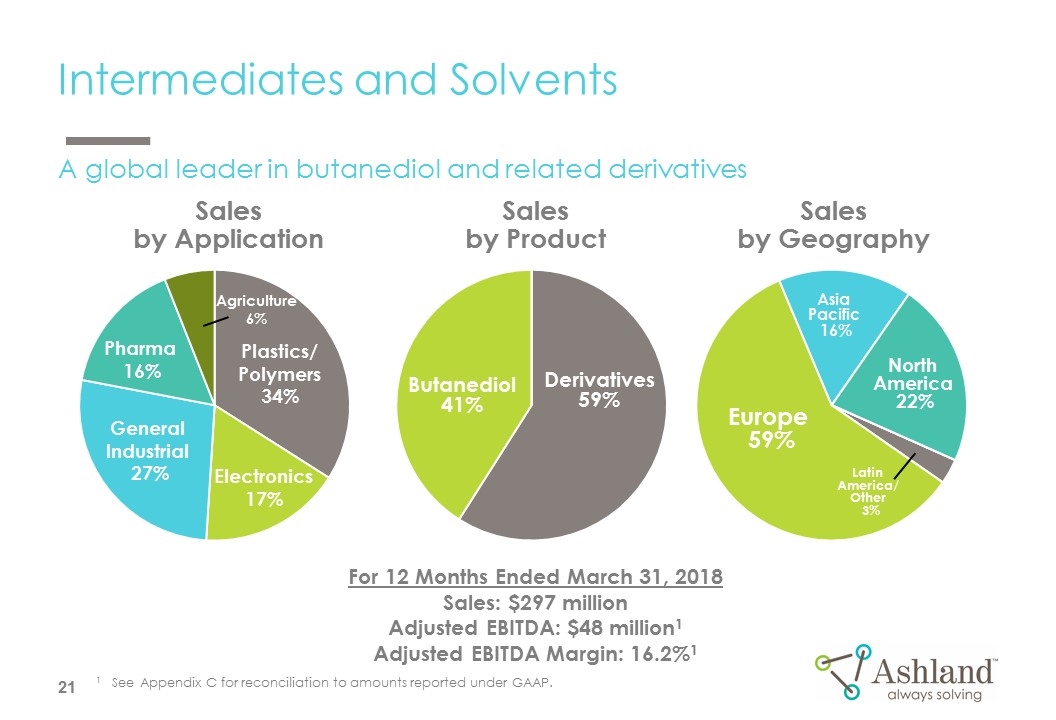

Intermediates and Solvents Sales by Geography For 12 Months Ended March 31, 2018 Sales: $297 million Adjusted EBITDA: $48 million1 Adjusted EBITDA Margin: 16.2%1 Sales by Product Butanediol 41% Derivatives 59% General Industrial 27% Plastics/ Polymers 34% Sales by Application North America 22% Asia Pacific 16% Europe 59% Latin America/ Other 3% 1 See Appendix C for reconciliation to amounts reported under GAAP. A global leader in butanediol and related derivatives Pharma 16% Agriculture 6%

Appendix C: Non-GAAP Reconciliation1 Although Ashland provides forward-looking guidance for adjusted EBITDA, free cash flow and adjusted diluted earnings per share, Ashland is not reaffirming or providing forward-looking guidance for U.S. GAAP-reported financial measures or a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable U.S. GAAP measure. Such reconciliations have not been included because Ashland is unable, without unreasonable efforts, to estimate and quantify the most directly comparable U.S. GAAP components, largely because predicting our future operating results is subject to many factors not in Ashland’s control and not readily predictable and that are not part of Ashland’s routine operating activities, including various domestic and international economic, political, legislative, regulatory and legal factors.

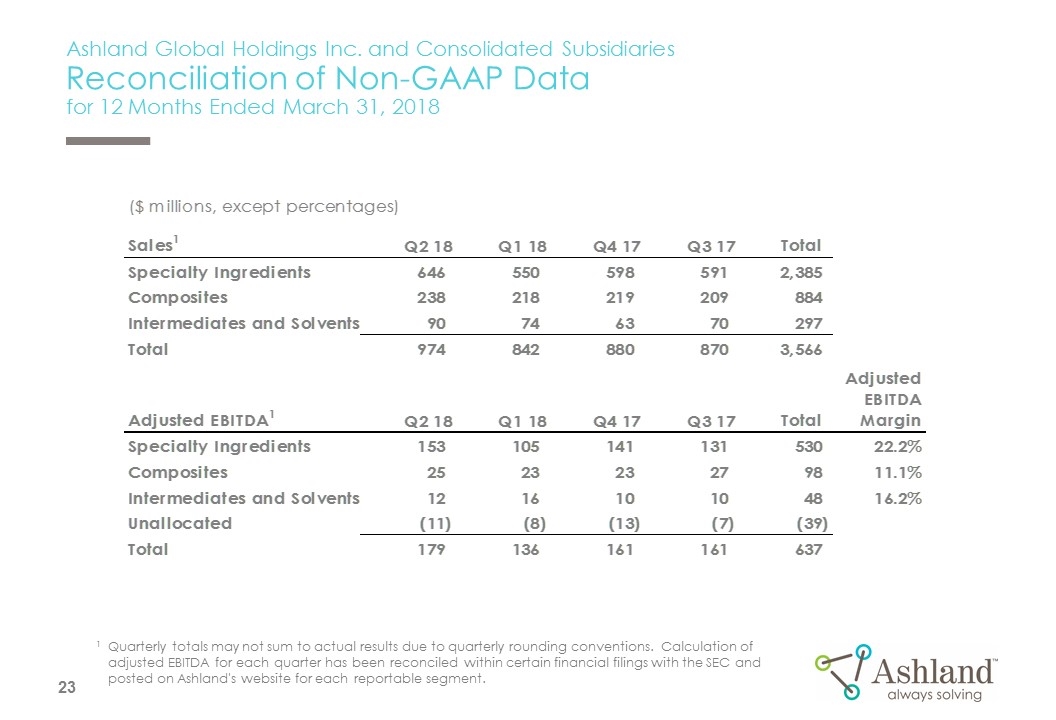

Ashland Global Holdings Inc. and Consolidated Subsidiaries Reconciliation of Non-GAAP Data for 12 Months Ended March 31, 2018 North America2 __% Asia Pacific __% Latin America/ Other - _% Europe __% Ashland Specialty Ingredients __% Ashland Performance Materials __% Valvoline __% 1Quarterly totals may not sum to actual results due to quarterly rounding conventions. Calculation of adjusted EBITDA for each quarter has been reconciled within certain financial filings with the SEC and posted on Ashland's website for each reportable segment.

® Registered trademark, Ashland or its subsidiaries, registered in various countries ™ Trademark, Ashland or its subsidiaries, registered in various countries