Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - Willbros Group, Inc.\NEW\ | d576827dex314.htm |

| EX-31.3 - EX-31.3 - Willbros Group, Inc.\NEW\ | d576827dex313.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-34259

Willbros Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 30-0513080 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

4400 Post Oak Parkway

Suite 1000

Houston, TX 77027

Telephone No.: 713-403-8000

(Address, including zip code, and telephone number, including area code, of principal executive offices of registrant)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.05 Par Value

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of the Regulation S-T during the preceding 12 months (or such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s Common Stock held by non-affiliates of the Registrant on the last business day of the Registrant’s most recently completed second fiscal quarter (based on the closing sales price on the New York Stock Exchange on June 30, 2017) was $127,979,239.

The number of shares of the Registrant’s Common Stock outstanding at March 26, 2018 was 63,221,610.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

FORM 10-K/A

YEAR ENDED DECEMBER 31, 2017

| Page | ||||||

| 3 | ||||||

| PART III | ||||||

| Item 10. |

4 | |||||

| Item 11. |

9 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

35 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

37 | ||||

| Item 14. |

41 | |||||

| PART IV | ||||||

| Item 15. |

41 | |||||

| 46 | ||||||

2

Table of Contents

This Amendment No. 1 to Form 10-K (the “Amendment”) amends Part III, Items 10 through 14, of the previously filed Annual Report on Form 10-K for the fiscal year ended December 31, 2017, originally filed on March 30, 2018 (the “Original Filing”) by Willbros Group, Inc. (“Willbros,” “WGI,” “we,” “us,” “our” or the “Company”). We are filing this Amendment to include information previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which provides that registrants may incorporate by reference certain information from a definitive proxy statement that involves the election of directors, provided that the definitive proxy statement is filed with the Securities and Exchange Commission (“SEC”) within 120 days after the end of the fiscal year. Due to the Company’s previously announced and pending merger with Primoris Services Corporation (“Primoris”), the Company does not anticipate that a definitive proxy statement that involves the election of directors will be filed within 120 days of the end of the Company’s fiscal year. Accordingly, Part III of the Original Filing is hereby amended as set forth below.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer and principal financial officer are filed as exhibits under Item 15 of Part IV to this Amendment. Accordingly, Item 15 of the Original Filing is also hereby amended as set forth below.

Except as stated herein, this Amendment does not reflect events occurring after the filing of the Original Filing and no attempt has been made in this Amendment to modify or update other disclosures presented in the Original Filing. Among other things, forward-looking statements made in the Original Filing have not been revised to reflect events that occurred or facts that became known to the Company after the Original Filing, and such forward-looking statements should be read in their historical context. Accordingly, this Amendment should be read in conjunction with the Original Filing and the Company’s other filings with the SEC subsequent to the filing of the Original Filing.

3

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

Directors

Our Certificate of Incorporation provides that the Board of Directors shall consist of not less than three or more than 12 directors, as determined from time to time by resolution of the Board of Directors. The number of directors is currently fixed at six. The Board of Directors is divided into three nearly equal classes: Class I directors, Class II directors and Class III directors. The terms of the current Class I directors (Messrs. Fournier and Lebens) and Class III directors (Messrs. Gates and Lonergan) will expire in June 2018, and the term of the current Class II directors (Messrs. Wedemeyer and Williams) will expire in June 2019.

In connection with our acquisition of InfrastruX Group, Inc., we entered into a Stockholder Agreement dated March 11, 2010 (as amended and restated, the “Stockholder Agreement”) with InfrastruX Holdings, LLC (“InfrastruX”). Pursuant to the Stockholder Agreement, Michael C. Lebens and Daniel E. Lonergan serve on the Board of Directors as designees of InfrastruX. For a more complete discussion of the Stockholder Agreement, see the caption “Certain Relationships and Related Transactions – Stockholder Agreement” under Item 13 below.

The following information, including principal occupation or employment for the past five or more years and a summary of each individual’s experience, qualifications, attributes or skills that have led to the conclusion that each individual should serve as a director in light of our current business and structure, is furnished with respect to each of the members of the Board of Directors.

Each of our directors possesses a combination of attributes that qualifies him for service on the Board of Directors. The directors were specifically recruited for these attributes, which include domestic and international business experience specifically related to the industries in which we operate, knowledge based on specialized education or training such as engineering, accounting and finance, and senior executive management experience that demonstrates leadership qualities and a practical understanding of organizations, processes, business strategies, risk management and how to drive change and growth.

Class I Directors

(Terms Expiring June 2018)

Michael J. Fournier, age 55, has been Chief Executive Officer and a Director of the Company since December 2015, President of the Company since October 2014 and Chief Operating Officer of the Company since July 2014. He joined Willbros in August 2011 as Chief Operating Officer of Canada operations and served as President of Canada operations from September 2012 to July 2014. Prior to joining Willbros, he filled successive roles starting as an Operations Manager and finishing as President of Aecon Lockerbie Construction Group, Inc., a construction and infrastructure development company, and its predecessor entities from 2005 to 2011. Mr. Fournier has more than 30 years of experience in the engineering and construction service industries. Mr. Fournier started his career in the Offshore Gulf Coast pipeline construction and platform fabrication sector, relocating to Canada in the early 90’s. Much of his career since then has been spent in the Canadian Oil, Gas and Petrochemical sector where he has held a succession of project management and executive management roles with heavy industrial construction firms culminating in business unit president roles. He has served on the Board of Directors for Construction Labour Relations - Alberta and on the Management Board of the Natural Sciences and Engineering Research Council of Canada (“NSERC”) Chair in Construction Management for the University of Alberta. He currently is a Director on the Board of the Progressive Contractors Association of Canada. Mr. Fournier graduated from the University of Alberta with a Bachelor of Science in Mechanical Engineering and is registered with the Association of Professional Engineers, Geologists and Geophysicists of Alberta.

As our President and Chief Executive Officer, Mr. Fournier provides a management representative on the Board of Directors with extensive knowledge of our day-to-day operations. As a result, he can facilitate the Board of Directors’ access to timely and relevant information and its oversight of management’s strategy, planning and performance. His direct participation in the engineering and construction service industries for more than 30 years makes him well suited to serve on the Board of Directors. His industry knowledge and executive leadership skills allow him to be a valuable contributor to the Board.

4

Table of Contents

Michael C. Lebens, age 66, was elected to the Board of Directors in May 2011. Mr. Lebens is a member of the Board of Stakeholders of Tenaska Energy, Inc., an independent energy company, and retired as President and Chief Executive Officer of Tenaska’s Engineering and Operations Group on August 1, 2012. During his tenure with Tenaska, Mr. Lebens had oversight responsibility for engineering, construction, operations and asset management for a portfolio of approximately 10,800 megawatts of power generating assets. He joined Tenaska in 1987 as project manager for a power plant being constructed in Texas. Between 1990 and 2012, Mr. Lebens directed project management and operations for all of Tenaska’s power generating projects. Mr. Lebens has more than 36 years of management experience in the energy industry, including the development, design and construction of major power generation facilities and other energy related projects. Before joining Tenaska, Mr. Lebens held positions with InterNorth, Inc., Gibbs and Hill, and Burns and McDonnell. Mr. Lebens earned his B.S. and M.S. degrees in Mechanical Engineering from the University of Nebraska.

Mr. Lebens’ extensive knowledge of the energy and power industries provides considerable insight to our Board of Directors with respect to our Utility Transmission & Distribution segment. His strong engineering background allows him to contribute significantly to our Board of Directors on matters related to our engineering operations within our Utility Transmission & Distribution segment.

Class III Directors

(Terms Expiring June 2018)

W. Gary Gates, age 67, was elected to the Board of Directors in February 2017. Mr. Gates was President and Chief Executive Officer of Omaha Public Power District from January 2004 to May 2015, when he retired. Omaha Public Power District is a public utility engaged in the generation, transmission and distribution of electric power and energy and other related activities. From November 1992 to January 2004, he served as Vice President with responsibility for Omaha Public Power District’s nuclear organization. Mr. Gates began his career at Omaha Public Power District in 1972 and served in a variety of positions in the organization, including reactor engineer, Supervisor of Operations and then Manager at the organization’s Fort Calhoun nuclear station, Executive Assistant to the President and Division Manager of Nuclear Operations. He currently serves as a director of Mutual of Omaha Insurance Company, a privately-held mutual insurance company, where he serves as Lead Director and as Chair of the Governance Committee. Over the years, he has served on various utility trade associations. Mr. Gates received a bachelor’s degree in Engineering Science from Iowa State University, a master’s degree in Industrial Engineering from the University of Nebraska, and an M.B.A. from Creighton University.

Mr. Gates has more than 40 years of experience in the utility and power industries and provides our Board of Directors with extensive expertise with respect to our Utility Transmission & Distribution segment. In addition, he has had extensive experience with energy construction projects gained during his service with Omaha Public Power District that he is able to contribute to our Board of Directors. His in-depth management, leadership as a Chief Executive Officer and corporate governance experience enables him to contribute his knowledge and insight to our Board of Directors with respect to the utility and power industries, strategic and operational planning, corporate governance and various oversight matters, including risk management.

Daniel E. Lonergan, age 61, was elected to the Board of Directors in July 2010. Mr. Lonergan is the Chief Executive Officer, a Senior Managing Director and a founding member of Tenaska Capital Management, LLC and has more than 30 years of experience in the energy and power industries in strategic planning, mergers, acquisitions, business development, finance, financial reporting and administration. Tenaska Capital Management manages power and energy-focused private equity investments and has executed over $6.5 billion of energy investments. Mr. Lonergan joined Tenaska in 1997 as Vice President of Tenaska’s finance division. Mr. Lonergan serves on the Investment Committee of Tenaska Capital Management and the Board of Stakeholders of Tenaska Energy, Inc., an independent energy company. He is also Chief Executive Officer and Senior Managing Director of Tenaska’s Strategic Development & Acquisitions Group, which pursues value-driven opportunities in today’s energy markets. Prior to joining Tenaska, Mr. Lonergan held a variety of executive positions in the energy sector, including Vice President of Finance for the non-regulated businesses of MidAmerican Energy Company, where he was responsible for all finance, accounting, planning and administrative functions; and a variety of other financial management positions with Iowa-Illinois Gas and Electric. Mr. Lonergan earned both his undergraduate and M.B.A. degrees from the University of Iowa.

5

Table of Contents

Mr. Lonergan’s extensive knowledge of the energy and power industries provides a considerable contribution to our Board of Directors. His experience in mergers and acquisitions, finance and business development also enable him to make significant contributions with respect to strategic and operational planning. His experience in finance and accounting positions provides the necessary financial reporting and accounting expertise to serve as a member of the Audit Committee of the Board of Directors and to be considered one of our audit committee financial experts as defined by the SEC.

Class II Directors

(Terms Expiring June 2019)

Phil D. Wedemeyer, age 68, was elected to the Board of Directors in April 2015. In July 2011, Mr. Wedemeyer retired as a partner from Grant Thornton LLP, an international accounting firm, where he had served since August 2007. From May 2003 to July 2007, Mr. Wedemeyer served in various capacities with the Public Company Accounting Oversight Board (“PCAOB”), including serving as the Director, Office of Research and Analysis, from August 2005 to July 2007 and as a Deputy Director, Division of Registration and Inspection, from March 2004 to August 2005. Prior to his service with the PCAOB, Mr. Wedemeyer spent more than 31 years at Arthur Andersen SC, an international accounting firm, including 22 years as a partner. Mr. Wedemeyer currently serves as a director of publicly-traded Ensco, plc, a global offshore drilling contractor, and Trinity Steel Fabricators, a privately-held fabricator of steel structures and vessels. Until May 2017, he was a member of the Deloitte Audit Quality Advisory Council and is a licensed Certified Public Accountant. He previously served as a director and audit committee chair of Atwood Oceanics, Inc. (acquired by Ensco plc in October 2017), and as a director of Powell Industries, Inc., Horizon Offshore, Inc. and HMS Income Fund, Inc.

Mr. Wedemeyer’s more than 35 years of public accounting firm experience and service with the PCAOB and the Auditing Standards Board of the AICPA provide the Board with extensive accounting and financial expertise. His in-depth knowledge of accounting rules and regulation, including expertise in SEC filings and international audit standards, as well as service on other publicly-traded company boards, including on audit and compliance committees, make him a valuable contributor of financial, accounting, audit, and risk management expertise to the Board. Mr. Wedemeyer qualifies as an audit committee financial expert as defined by the SEC, and has the necessary accounting expertise to serve as the Chairman of the Audit Committee of the Board of Directors.

S. Miller Williams, age 66, was elected to the Board of Directors in May 2004 and was appointed non-executive Chairman of the Board effective December 1, 2015. He served as Lead Independent Director of the Board from August 2014 to December 2015. From April 2011 to August 2013, he was Chief Operating Officer and Chief Financial Officer of LinkBermuda Ltd, a telecommunications services company based in Bermuda. He has been Managing Director of Willvest, an investment and corporate development advisory firm, since 2004. He was Executive Vice President of Strategic Development of Vartec Telecom, Inc., an international consumer telecommunications services company, from August 2002 until May 2004, and was appointed Chief Financial Officer of Vartec in November 2003. From 2000 to August 2003, Mr. Williams was Executive Chairman of the Board of PowerTel, Inc., a public company that provided telecommunications services in Australia. From 1991 to 2002, he served in various executive positions with Williams Communications Group, a subsidiary of The Williams Companies that provided global network and broadband media services, where his last position was Senior Vice President - Corporate Development, General Manager – International and Chairman of WCG Ventures, the company’s venture capital fund.

Mr. Williams’ prior service in corporate development positions and as executive chairman of a public company and a member of the boards of directors of businesses in the telecommunications industry enables him to contribute significantly to our Board of Directors with respect to strategic planning, acquisitions and various oversight matters, including enterprise risk management. His experience in accounting and finance positions, including prior service as a chief financial officer of a company with approximately $1.0 billion in revenues, provides the necessary financial reporting and accounting expertise to augment his role as non-executive Chairman of the Board.

6

Table of Contents

Executive Officers

Information regarding our executive officers is included in Part I of the Original Filing and is incorporated by reference herein.

Audit Committee

The Board of Directors has an Audit Committee. The Audit Committee is currently composed of Messrs. Wedemeyer (Chairman), Gates and Lonergan. Each of the current members of the Audit Committee qualifies as an “independent” director under the current listing standards of the New York Stock Exchange. The Board of Directors has determined that it has three audit committee financial experts serving on the Audit Committee, Messrs. Gates, Lonergan and Wedemeyer. The Audit Committee has a written charter, which is available on our website at http://www.willbros.com under the “Corporate Governance” caption on the Investor Relations page. We have in place and circulated a “whistleblower policy” entitled, “Procedure of the Audit Committee of the Board of Directors on Reporting and Investigating Complaints with Regard to Possible Accounting Irregularities.” The Audit Committee appoints the independent registered public accounting firm that serves each year as the independent auditor of our financial statements and performs services related to the completion of such audit. The Audit Committee also has the responsibility for:

| • | reviewing the scope and results of the audit with the independent auditor; |

| • | reviewing with management and the independent auditor our interim and year-end financial condition and results of operations; |

| • | considering the adequacy of our internal accounting, bookkeeping, and other control procedures; and |

| • | reviewing and pre-approving any non-audit services and special engagements to be performed by the independent auditor and considering the effect of such performance on the auditor’s independence. |

The Audit Committee also generally reviews and approves the terms of material transactions and arrangements, if any, between us and our directors, officers and affiliates.

Code of Conduct

The Board of Directors has adopted both a code of business conduct and ethics for our directors, officers and employees and an additional separate code of ethics for our Chief Executive Officer and senior financial officers. This information is available on our website at http://www.willbros.com under the “Corporate Governance” caption on the “Investor Relations” page. We intend to satisfy the disclosure requirements, including those of Item 406 of Regulation S-K, regarding certain amendments to, or waivers from, provisions of our code of business conduct and ethics and code of ethics for the Chief Executive Officer and senior financial officers by posting such information on our website. Additionally, our corporate governance guidelines and the charters of the Audit, Compensation, Executive, Finance and Nominating/Corporate Governance Committees of the Board of Directors are also available on our website. A copy of the codes, governance guidelines and charters will be provided to any of our stockholders upon request to: Secretary, Willbros Group, Inc., 4400 Post Oak Parkway, Suite 1000, Houston, Texas 77027.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own more than 10 percent of our common stock, to report their initial ownership of the common stock and any subsequent changes in that ownership to the Securities and Exchange Commission and the New York Stock Exchange, and to furnish us with a copy of each such report. The Securities and Exchange Commission regulations impose specific due dates for such reports, and we are required to disclose in this proxy statement any failure to file by these dates during and with respect to fiscal 2017.

7

Table of Contents

Based solely on review of the copies of such reports furnished to us and written representations that no other reports were required, during and with respect to fiscal 2017, all Section 16(a) filing requirements applicable to our officers, directors and more than 10 percent stockholders were complied with to our knowledge, except that, due to administrative errors, (i) Van A. Welch filed one report one day late, covering one transaction, (ii) Johnny M. Priest filed one report one day late, covering one transaction, (iii) Harry W. New filed one report one day late, covering one transaction, (iv) Jeremy R. Kinch filed one report one day late, covering one transaction, (v) Michael J. Fournier filed one report one day late, covering one transaction, and (vi) Linnie A. Freeman filed one report one day late, covering one transaction.

8

Table of Contents

| Item 11. | Executive Compensation |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

The following Compensation Discussion and Analysis provides information related to the 2017 compensation of our executive officers identified in the Summary Compensation Table, who we refer to as our “Named Executive Officers,” “Named Executives” or “NEOs.” We also refer to Michael J. Fournier, Jeffrey B. Kappel and Linnie A. Freeman as our “Corporate Executives,” and Johnny M. Priest and Harry W. New as our “Segment Presidents.”

Overview

After considering our 2017 shareholder returns, our 2015-2017 shareholder returns under our long-term incentive awards and our recent financial performance, which resulted in no payouts to the NEOs under our performance-based incentive program, we believe that our compensation program is aligned with the interests of our stockholders.

In 2017, the Compensation Committee of the Board of Directors, or “Committee” for purposes of this discussion, made a number of decisions in an effort to further align executive pay with our recent performance:

| • | The percentage of the long-term incentive, or “LTI,” award that is performance-based was increased significantly from 2016 levels. In 2016, 50 percent of the LTI award to Corporate Executives and 40 percent of the LTI award to Segment Presidents was performance-based. In 2017, 75 percent of the LTI award to the Corporate Executives and to Mr. Priest was performance-based, and 60 percent of the LTI award to Mr. New was performance-based. |

| • | For the third consecutive year, LTI awards were significantly curtailed in light of our low prevailing stock price and the unacceptable level of stockholder dilution that would have resulted if LTI awards had been granted at comparable value levels to years prior to 2015. |

| • | In connection with his promotion to CEO on December 1, 2015, Mr. Fournier received an increase in his base salary from $475,000 to $613,000. However, Mr. Fournier waived the payment of his base salary increase and continued to receive a base salary of $475,000 through May 31, 2017. Even after accepting his base salary increase 18 months after it was approved, Mr. Fournier’s base salary remains well below the salaries of his two predecessors. |

| • | In connection with his promotion to Chief Financial Officer on August 30, 2017, Mr. Kappel received a base salary of $300,000, significantly below that of his predecessor. In addition, Mr. Kappel received an initial LTI award of 32,500 shares, 30,000 of which represented performance-based RSUs at target and 2,500 of which represented service-based restricted stock. |

| • | In recognition of the recent sale of several business units, the Committee made several changes to the composition of our compensation peer group to reflect our smaller size. |

9

Table of Contents

Compensation Highlights

In recent years, the Committee has continued to focus on strengthening the link between executive pay and our performance. The following is a summary of compensation best practices employed by us:

| Best Practice Considerations | Our Practice | |

| Ratio of performance-based LTI compensation to total LTI compensation | 75 percent of the 2017 LTI awards granted to the Corporate Executives and to Mr. Priest were performance-based, and 60 percent of the 2017 LTI award granted to Mr. New was performance-based | |

| Rigor of performance goals | Our 2017 performance-based LTI awards measure stockholder returns both in relation to our peers and on an absolute basis over a three-year performance period (2017-2019) and require strong performance to earn a target payout | |

| Double trigger change of control severance in our severance plans | All change of control severance provisions in our severance plans for our Named Executives provide for a double trigger, which requires a change of control and the involuntary termination of the executive’s employment or resignation for “good reason” in order for severance compensation to be paid | |

| No excessive perquisites or excise tax gross-ups | We provide limited perquisites and do not provide any tax gross-ups to our Named Executives | |

| No egregious pension/supplemental executive retirement plan or additional medical coverage | We do not provide a defined benefit pension plan or excess plan, a supplemental executive retirement plan, additional medical coverage or post-retirement health benefits for highly compensated employees | |

| No executives using Willbros stock in hedging or pledging activities | All of our directors, Named Executives and other key employees are prohibited by Company policy from (1) using Willbros stock in hedging arrangements and (2) holding Willbros stock in a margin account or otherwise pledging Willbros stock | |

| Clawback policy | We have a formal clawback policy in place | |

| Stock Ownership and Retention Policy | Our Stock Ownership and Retention Policy requires our executive officers and directors to retain a number of shares equal to substantially all of the after-tax value of their recent awards | |

Stockholder Engagement and Committee Consideration of the 2017 Say-on-Pay Vote on Executive Compensation for 2016

Each year, we take into account the result of the say-on-pay advisory vote cast by our stockholders on our executive compensation. At our 2017 Annual Meeting, we achieved a significant improvement in support, with approval votes increasing from approximately 81 percent at the 2016 Annual Meeting to over 98 percent at the 2017 Annual Meeting. In addition, over the past year we have engaged with many of our stockholders to solicit their input on a range of topics, including executive compensation. The Committee determined that, based on such discussions and given the increasing level of support, no substantive changes to our executive compensation policies for 2017 were necessary. If our merger with Primoris is not completed, we intend to continue such dialogue with our stockholders, and the Committee intends to continue to make its executive compensation decisions, as it has in the past, by focusing on performance-based compensation, gauging competitive practices and authorizing compensation that is within the range of what is deemed to be competitive and appropriate in our industry while taking into account our recent operating performance and financial condition.

Role of the Compensation Committee

The Committee has responsibility for discharging the Board’s responsibilities with respect to compensation of our executives. In particular, the Committee:

| • | Reviews and approves corporate goals and objectives relevant to CEO compensation on an annual basis; |

| • | Evaluates the CEO’s performance in light of those goals and objectives; |

10

Table of Contents

| • | Determines and approves the CEO’s compensation based on this evaluation; |

| • | Approves non-CEO executive compensation; |

| • | Approves and administers incentive compensation plans and equity-based plans; and |

| • | Monitors compliance of directors and executive officers with our Stock Ownership and Retention Policy. |

Pursuant to its charter, the Committee has the sole authority to retain and terminate compensation consultants and internal and external legal, accounting and other advisors, including sole authority to approve the advisors’ fees and other engagement terms.

Role of the CEO in Compensation Decisions

The CEO periodically reviews the performance of each of the Named Executives, excluding himself, develops preliminary recommendations regarding salary adjustments and annual and long-term award amounts, and provides these recommendations to the Committee. The Committee can exercise its discretion in modifying any recommendation and makes the final decisions.

Role of the Compensation Consultant

The Committee has retained Mercer (US) Inc. to serve as its independent consultant, and in its role Mercer:

| • | Provides executive and director compensation consulting services to the Committee; |

| • | Attends Committee meetings; |

| • | Reports directly to the Committee on matters relating to compensation for our Named Executives; |

| • | Participates in executive sessions of the Committee without Named Executives present; and |

| • | Provides advice and analysis to the Committee on design and level of executive and director compensation. |

In connection with its services to the Committee, Mercer works with executive management and our Corporate Human Resources group to formalize proposals for the Committee.

The Committee has assessed the independence of Mercer pursuant to SEC and New York Stock Exchange rules and concluded that Mercer’s work for the Committee does not raise any conflict of interest.

Compensation Philosophy and Objectives

As a provider of construction, maintenance and facilities development services to the oil and gas and power industries, our long-term success has depended on our ability to attract, motivate and retain highly talented individuals at all levels of the organization in order to develop and expand our businesses and execute our business strategies.

The Committee has based its executive compensation decisions on the same objectives that guide us in establishing all of our compensation programs:

| • | Compensation should be based on the level of job responsibility, individual performance and Company performance. As employees progress to higher levels in the organization and are more able to affect our results, an increasing proportion of their pay should be linked to the Company’s and/or segment’s overall performance and to stockholder returns. |

11

Table of Contents

| • | Compensation should reflect the value of the job in the marketplace. To attract and retain a highly skilled work force, we must remain competitive with the compensation of other premier employers who compete with us for talent. |

| • | Compensation should incentivize and reward annual and long-term performance. Our programs should deliver compensation in the top tier when our employees and our Company perform accordingly; likewise, where individual performance falls short of expectations and/or our performance lags the industry, the programs should deliver lower-tier compensation. |

| • | Our objectives of pay for performance and retention must be balanced. Compensation should promote retention of high-performing executives while aligning the interests of our executives with those of our stockholders. Even in periods of downturns in our performance, the programs should continue to ensure that successful, high-achieving employees will remain motivated and committed to us. |

| • | Compensation should foster the long-term focus required for success in our industry. |

Setting Executive Compensation

A significant percentage of total compensation is allocated to incentives as a result of the philosophy mentioned above. There is no pre-established policy or target for the allocation between either cash and equity or annual and long-term incentive compensation. Rather, the Committee reviews competitive information provided by Mercer and management’s recommendations to determine the appropriate level and mix of incentive compensation.

For Named Executives, the Committee generally targets total direct compensation, consisting of base salary, the target annual incentive award and the annual long-term incentive grants, at a level which is designed to be competitive with compensation paid to similarly situated executives of companies comprising a peer group of publicly traded companies that have financial and operating characteristics and service markets similar to ours.

With the assistance of Mercer, the Committee reviews the composition of the peer group periodically to ensure the companies are relevant for comparative purposes. For purposes of setting 2017 compensation, the peer group consisted of the following 13 companies in the construction and engineering, oil and gas equipment and services, electrical transmission and distribution services and environmental and facilities services industries (the “2017 Peer Group”):

| Aegion Corporation | Northwest Pipe Company | |

| Comfort Systems USA | Orion Group Holdings, Inc. | |

| Granite Construction | Sterling Construction Company | |

| Great Lakes Dredge & Dock | Team Inc. | |

| Layne Christensen | Tetra Tech, Inc. | |

| Matrix Service Company | TRC Companies, Inc.* | |

| MYR Group |

| * | TRC Companies, Inc. was included in the 2017 Peer Group until it was taken private in June 2017. |

In selecting the 2017 Peer Group, the Committee considered various peer selection criteria, including: industries in which the company operates, company size (with specific focus on revenue), markets served, market value, market value to revenue ratio, and total assets. In addition, the Committee considered the competitive market for executive talent and gave special consideration to those companies from which we may recruit talent or to which we may lose talent.

12

Table of Contents

2017 Executive Compensation Components

For the fiscal year ended December 31, 2017, the principal components of compensation for our Named Executives were:

| • | Base salary; |

| • | Annual cash incentive awards; |

| • | Long-term incentive compensation; and |

| • | Benefits and perquisites. |

The chart below illustrates how our compensation design supports our compensation objectives:

| Compensation Element |

Compensation Objectives |

Key Features | ||

| Base Salary |

• Attract and retain executives by providing a stable income at a level that is consistent with the market and that compensates Named Executives for the day-to-day execution of their primary duties |

• Reviewed annually to ensure our compensation is competitive • Salary adjustments based on performance and the market | ||

| Annual Cash Incentives |

• Link pay to performance by directly tying bonuses to our business objectives • Align management with stockholders’ interests by rewarding achievement of annual performance goals • Reinforce corporate values through shared performance objectives |

• Any potential payout contingent on achieving a minimum level of Adjusted EBITDA for Corporate Executives and Operating Income for Segment Presidents • Target bonus levels were established at 50 percent of base salary for all NEOs, including the CEO | ||

| Long-term Incentives |

• Motivate performance by providing an opportunity for executives to share in long-term value creation • Link pay to performance and align management with stockholders’ interests by directly tying performance-based payouts to performance of our stock on both an absolute basis and relative to our peers • Provide a retentive element through the award of service-based restricted stock |

• Three quarters of the 2017 total LTI grant to Corporate Executives and Mr. Priest and 60 percent of the total 2017 grant to Mr. New tied to performance • Performance-based awards measure absolute and relative stock price performance over three years • Service-based awards generally vest over a period of three or four years | ||

| Benefits and Perquisites |

• Attract and retain individuals by offering market competitive benefits and perquisites |

• Reviewed periodically to ensure they are competitive with the market • Minimal amount of perquisites provided | ||

Following is a discussion of the Committee’s considerations in establishing each of the compensation components for the current NEOs.

Base Salary

The level of base salary paid is determined on the basis of performance, experience, job responsibility and such other factors as may be appropriately considered by the Committee. Each year, the Committee reviews the base salaries of the Named Executives and considers salary adjustments based on individual performance, our overall

13

Table of Contents

financial results, competitive position relative to the marketplace, duration of time since the last salary increase and industry merit practices. The Committee uses the independent consultant report with respect to the marketplace in general and the base salaries of executives within the 2017 Peer Group, including amounts budgeted for merit increases within our industry, in order to establish base salaries which are competitive in the marketplace.

Mr. Fournier was promoted to the position of Chief Executive Officer effective December 1, 2015 and maintained his previous duties as President and Chief Operating Officer. As part of his promotion, Mr. Fournier’s base salary was increased from $475,000 to $613,000, effective December 1, 2015. However, Mr. Fournier elected to waive the payment of the increase in his base salary for an 18-month period ending May 31, 2017. Mr. Kappel was promoted to the position of Senior Vice President and Chief Financial Officer on August 30, 2017. As part of his promotion, Mr. Kappel’s base salary was increased from $221,000 to $300,000, effective August 30, 2017. Ms. Freeman was promoted to the position of Senior Vice President and General Counsel, effective April 1, 2016. On the first anniversary of her promotion, the Committee approved an increase in her base salary from $325,000 to $350,000. In light of our disappointing performance in 2016 and as part of our efforts to control our overhead expenses, the base salaries of the other Named Executives were not increased in 2017. The following table shows the base salaries for each of the Named Executives as of December 31, 2016 and 2017 and the percentage change in base salary, if any:

| NEO |

Base Salary 12/31/16 | Base Salary 12/31/17 | Percentage Change | |||||||||

| Michael Fournier |

$ | 613,000 | * | $ | 613,000 | * | 0 | % | ||||

| Jeffrey Kappel |

$ | 221,000 | $ | 300,000 | 35.8 | % | ||||||

| Johnny Priest |

$ | 430,000 | $ | 430,000 | 0 | % | ||||||

| Linnie Freeman |

$ | 325,000 | $ | 350,000 | 7.7 | % | ||||||

| Harry New |

$ | 320,000 | $ | 320,000 | 0 | % | ||||||

| * | The amount of $555,500 shown in the Summary Compensation Table as salary for Mr. Fournier in 2017 represents an annual salary of $475,000 for the first five months of the year and an annual salary of $613,000 for the remainder of the year. The amount of $475,000 shown in the Summary Compensation Table as salary for Mr. Fournier in 2016 represents the amount actually paid to Mr. Fournier in 2016 due to his election to waive the increase in his base salary that the Committee approved in December 2015. |

Annual Incentive Compensation

Management Incentive Compensation (“MIC”) Program. Annual cash incentive awards for key employees are determined in accordance with our MIC Program, in which each of our Named Executives participates. The award opportunity established for the 2017 MIC Program for our NEOs, as a percent of base salary, was as follows:

| NEO |

Threshold | Target | Maximum | |||||||||

| Michael Fournier |

0 | % | 50 | % | 200 | % | ||||||

| Jeffrey Kappel |

0 | % | 50 | % | 150 | % | ||||||

| Johnny Priest |

0 | % | 50 | % | 150 | % | ||||||

| Linnie Freeman |

0 | % | 50 | % | 120 | % | ||||||

| Harry New |

0 | % | 50 | % | 150 | % | ||||||

Under the MIC Program, financial and operational performance measures are comprised of threshold, target and maximum performance levels. Payouts begin for performance above the threshold level for financial or operational measures. No amount is paid on an MIC Program award for performance at or below the threshold performance level of a financial or operational measure component. The Committee believed that improved financial performance was critical to our future success. Accordingly, for 2017, the Committee chose to use Adjusted EBITDA as the sole performance measure for our MIC Program for the Corporate Executives and Operating Income as the sole performance measure for our MIC Program for the Segment Presidents. Adjusted EBITDA is defined as income (loss) from continuing operations before interest expense, income tax expense (benefit) and depreciation and amortization (adjusted for certain unusual items) and is an important measure for comparing normalized operating results with corresponding historical periods and with the operational performance of other companies in our industry. Operating Income is an important measure of our operating profit before interest and taxes and is defined as contract income (loss) minus amortization of intangibles, general and administrative expenses and other charges.

14

Table of Contents

When determining performance ranges for each goal, the Committee first considered our 2016 performance and the 2017 budget approved by our Board of Directors. The Committee then focused discussions on the appropriate balance between our ability to achieve various performance levels and the appropriate amount of stretch performance to build into each goal and established challenging goals for 2017.

The specific 2017 Adjusted EBITDA performance measure at the Corporate level was as follows ($ in millions):

| Performance Measure |

Threshold | Target | Maximum | |||||||||

| Adjusted EBITDA |

$ | 37.08 | $ | 41.2 | $ | 55.56 | ||||||

The Company’s actual Adjusted EBITDA for 2017 was $(70.9) million.

In 2017, the Committee also authorized Operating Income performance measures at the segment level for the Segment Presidents. Segment level targets were authorized for Mr. Priest, who served as President of our Utility T&D segment and Mr. New, who served as President of our Oil & Gas segment.

The MIC Program award pool for the Corporate Executives is funded out of a percentage of Adjusted EBITDA in excess of a threshold amount ($37.08 million in 2017) and for the Segment Presidents is funded out of a percentage of consolidated Operating Income in excess of a threshold amount ($18.1 million in 2017). If Adjusted EBITDA or consolidated Operating Income falls below these levels for the performance year, bonuses are not paid to the Corporate Executives in the case of Adjusted EBITDA, or to the Segment Presidents in the case of Operating Income. Adjusted EBITDA for 2017 was $(70.9) million, which was below the threshold level. Operating Income for 2017 was $(91.3) million which was also below the threshold level. Accordingly, no bonuses were paid to the NEOs in respect of the 2017 MIC Program, as shown in the following table.

| Name |

Threshold Bonus Opportunity |

Target Bonus Opportunity |

Maximum Bonus Opportunity |

Amount Paid |

||||||||||||

| Michael Fournier |

$ | 0 | $ | 306,500 | $ | 1,226,000 | $ | 0 | ||||||||

| Jeffrey Kappel |

$ | 0 | $ | 150,000 | $ | 450,000 | $ | 0 | ||||||||

| Johnny Priest |

$ | 0 | $ | 215,000 | $ | 645,000 | $ | 0 | ||||||||

| Linnie Freeman |

$ | 0 | $ | 175,000 | $ | 420,000 | $ | 0 | ||||||||

| Harry New |

$ | 0 | $ | 160,000 | $ | 480,000 | $ | 0 | ||||||||

Long-term Incentive Compensation

The Willbros Group, Inc. 2017 Stock and Incentive Compensation Plan (the “2017 Stock Plan”), permits the Committee to grant various long-term incentive awards, including stock options, stock appreciation rights, restricted stock and restricted stock units, performance shares, performance units, and long-term cash-based awards to Named Executives and our key management employees.

Under the 2017 LTI award program:

| • | 75 percent of the total LTI award to the Corporate Executives and to Mr. Priest is performance-based and 25 percent is service-based. |

| • | 60 percent of the total LTI award to Mr. New is performance-based and 40 percent is service-based. |

| • | The performance period for performance-based awards is three years, with any earned award paid in March of the calendar year following the end of the three-year performance period. |

| • | Any payouts for performance-based awards are determined solely by the Company’s relative and absolute TSR performance. |

| • | Service-based awards vest in equal increments on the anniversary date of the award over a period of four years. |

15

Table of Contents

2017 Long-term Incentive Awards. In 2017, the Committee granted equity awards in the form of service-based restricted stock and performance-based restricted stock units (“RSUs”), to our Named Executives. Performance-based RSU awards provide an opportunity for the award recipient to receive up to 200 percent of the target number of performance-based RSUs granted if performance is achieved at the maximum level. Performance-based RSUs are only earned if we attain specific TSR results. We measure both relative TSR against our peers and absolute TSR as interdependent measures in determining the performance level achieved and the number of performance-based awards earned. Including absolute TSR ensures that we are delivering value to our stockholders, not simply performing well against our peers. Our relative TSR may rank at the top of our peers; however, if we have not delivered value to our stockholders, awards will be limited. Under this performance evaluation structure, which we refer to as the TSR Performance Matrix, for the three-year period covering calendar 2017 through 2019, a maximum payout is achieved only if we finish the period ranked in the top two companies against our 2017 Peer Group and achieve annualized absolute stock price growth of at least 35 percent from the beginning price for the performance period, which was $3.03. Moreover, if our relative TSR performance places us among the top two companies against our 2017 Peer Group but our stock price does not grow over the performance period above the beginning price of $3.03, then payouts are capped at target.

The following table shows the number of service-based restricted shares and performance-based RSUs awarded in 2017 to each of the NEOs:

| Name |

Total Shares Awarded (at Target) |

Service- Based Restricted Shares Awarded |

Performance- Based RSUs Awarded (at Target) |

|||||||||

| Michael Fournier |

250,000 | 62,500 | 187,500 | |||||||||

| Jeffrey Kappel |

40,000 | 10,000 | 30,000 | |||||||||

| Johnny Priest |

60,000 | 15,000 | 45,000 | |||||||||

| Linnie Freeman |

60,000 | 15,000 | 45,000 | |||||||||

| Harry New |

50,000 | 20,000 | 30,000 | |||||||||

In light of our low prevailing stock price and the unacceptable level of stockholder dilution that would have resulted from LTI awards commensurate with the grant date value of awards in years prior to 2015, the latest year when the grant date fair value of our awards was generally commensurate with median grant value levels of our peers, the total number of shares of restricted stock and performance-based RSUs awarded to each of the NEOs in 2017 was significantly curtailed. In order to provide a meaningful long-term incentive opportunity, the Committee first determined the grant date fair value of the award that would be appropriate for each executive in light of peer group data and other factors. Then, in order to minimize dilution to our stockholders, the Committee assumed a stock price of $4.00 per share to compute share grants to our NEOs. This assumed stock price was significantly higher than the closing stock price of $2.47 per share on the June 1, 2017 grant date. This methodology resulted in grant date values of the 2017 LTI awards that were less than the value that the Committee would have awarded but for the dilution concerns.

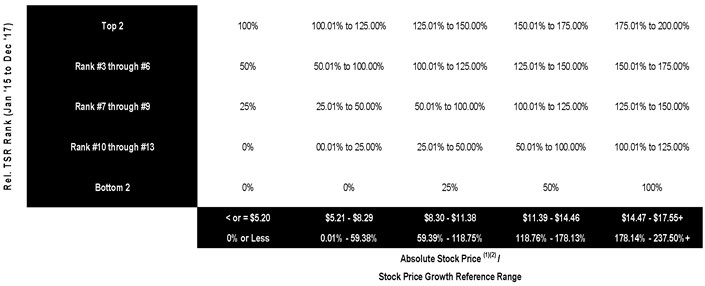

2015 Performance-Based LTI Awards. The following tables show (i) the TSR Performance Matrix for the three-year period that ended December 31, 2017 and (ii) the target number of performance-based RSUs awarded to our NEOs in 2015, other than Mr. Kappel, Ms. Freeman and Mr. New, who did not receive an award of performance-based RSUs in 2015. As shown in the table, no performance-based RSU awards were earned as a result of performance over the 2015-2017 period.

16

Table of Contents

Three-year Period Performance LTI Award – TSR Payout Matrix

Payout as a % of Target Award

Willbros Ranking

Against Peer Group

2015 Performance LTI Award – TSR Payout Matrix (Measuring 1/1/15 - 12/31/17 Performance)

Payout as a % of Target Award*

| Notes: (1) | Absolute stock price reflects the 20-day average adjusted closing price as of the end of the 2015-2017 performance period. Stock price growth percentages reflect rounded ranges for reference purposes only |

| (2) | The maximum performance level for absolute stock price of $17.55 reflects a required 50% annualized growth in the stock price over the performance period from the beginning price of $5.20 |

| * | Payout will be interpolated between the numerical TSR rankings and stock price ranges shown |

| Name |

Number of Performance-based RSUs Awarded in 2015 (at Target) |

Number of Performance- based RSUs Earned | ||

| Michael Fournier |

25,000 | 0 | ||

| Johnny Priest |

25,000 | 0 |

Retirement and Other Benefits

We have a 401(k) defined contribution plan that is funded by participating employee contributions and the Company and a Registered Retirement Savings Plan for Canadian employees. We provide an employer match on employee contributions under the 401(k) defined contribution plan, including contributions by our Named Executives, up to a maximum of two percent of salary, in the form of cash. Messrs. Kappel and New and Ms. Freeman participate in the 401(k) defined contribution plan. We provide two and one-half percent of salary in employer contributions, in the form of cash, under the Canadian Registered Retirement Savings Plan in which Mr. Fournier participates.

17

Table of Contents

Perquisites

We provide our Named Executives with a limited number of perquisites that the Committee believes are reasonable and in line with our overall compensation program and better enable us to attract and retain talented employees for executive positions. The Committee periodically reviews the type and levels of perquisites provided to our Named Executives.

| • | We reimbursed Mr. Fournier for his commuting expenses on commercial airlines from Mr. Fournier’s principal residence in Canada to our headquarters in Houston, Texas during 2017. We also reimbursed Mr. Priest for his commuting expenses from his principal residence in North Carolina to the headquarters of our Utility T&D segment in Fort Worth, Texas. |

| • | We provided Mr. Fournier with the use of a corporate apartment in Houston, Texas and Mr. Priest with the use of a corporate apartment in Fort Worth, Texas. |

| • | We provided Messrs. Priest and New with assigned Company vehicles during 2017. |

| • | We provided Mr. Fournier with car services during 2017. |

The Committee determined that the payment of commuting expenses and housing and auto expenses for certain executives who commute from remote locations was necessary in order to retain the services of these key executives.

Compensation of Former Executive

The base salary of Van A. Welch, our former Executive Vice President and CFO, was $475,000 during 2017, unchanged from 2016. Mr. Welch received no cash annual incentive award for 2017. Mr. Welch’s annual LTI award in June 2017 consisted of 60,000 shares of performance-based RSUs at target (120,000 shares at maximum) and 20,000 shares of service-based restricted stock. In connection with his voluntary resignation:

| • | Mr. Welch received no severance under the 2010 Willbros Group, Inc. Management Severance Plan for Executives (the “Management Severance Plan for Executives”). |

| • | All of Mr. Welch’s outstanding performance-based RSU awards were forfeited. |

| • | In connection with his agreement to delay the effective date of his resignation until August 30, 2017 and to ensure an orderly transition of his responsibilities, the Committee approved the accelerated vesting of 46,458 shares of Mr. Welch’s service-based restricted stock, representing all of his service-based stock awards for 2015 and a portion of his service-based stock awards for 2016, following the effective date of his resignation and upon satisfaction of certain conditions. These conditions were not satisfied, and the 46,458 shares of service-based restricted stock were ultimately forfeited. Mr. Welch also forfeited an additional 33,125 shares of service-based restricted stock, representing a portion of his service-based stock awards for 2016 and all of his service-based stock award for 2017. |

Stock Ownership and Retention Policy

In an effort to further align the interests of our executives and directors with our stockholders, the Board of Directors has approved stock ownership guidelines for the executive officers and directors that require them to acquire and retain a significant financial stake in our common stock. The purpose of the policy is to require our executive officers and directors to retain a number of shares equal to substantially all of the after-tax value of their recent awards, while enabling these individuals to dispose of a sufficient number of shares to cover the tax liability associated with the vesting of such shares.

18

Table of Contents

The following table illustrates our Stock Ownership and Retention Policy:

| CEO | Other Executive Officers |

Non-Employee Directors(1) | ||||

| Ownership Guideline—Retention Rate: |

60 percent(2) | 60 percent(3) | 60 percent(4) | |||

| Retention Rate Based on Total Awards Received in: |

Trailing 4 years(2) | Trailing 3 years(3) | Trailing 3 years(4) | |||

| Should be Achieved Within: |

3 years | 3 years | 3 years |

| (1) | The Stock Ownership and Retention Policy does not apply to any individual directors who are identified as “Investor Designees” of InfrastruX Holdings, LLC under the Stockholder Agreement between InfrastruX and us. |

| (2) | The CEO is expected to own and retain a number of shares of our common stock equal to 60 percent of the total number of stock awards received in the prior four years as long-term incentives. |

| (3) | All other executive officers are expected to own and retain a number of shares of our common stock equal to 60 percent of the total awards received in the prior three years as long-term incentives. |

| (4) | Non-employee directors are expected to own and retain a number of shares of our common stock equal to 60 percent of the total awards received in the prior three years. |

All of the NEOs are currently in compliance with the stock ownership guidelines.

Policy on Hedging and Pledging of Company Securities

Hedging transactions may permit a director, officer or employee to continue to own Willbros securities obtained through employee benefit plans or otherwise, but without the full risks and rewards of ownership. When that occurs, the director, officer or employee may no longer have the same objectives as our other stockholders. Our Policy for Securities Trades specifically prohibits our directors, Named Executives and other employees from engaging in any hedging activities with respect to our securities.

Securities held in a margin account as collateral for a margin loan may be sold by the broker without the customer’s consent if the customer fails to meet a margin call. Similarly, securities pledged as collateral for a loan may be sold in foreclosure if the borrower defaults on the loan. Because a margin sale or foreclosure sale may occur at a time when the pledgor is aware of material non-public information or otherwise is not permitted to trade in Willbros securities, our Policy for Securities Trades prohibits directors, Named Executives and other key employees from holding Willbros securities in a margin account or otherwise pledging Willbros securities.

Severance Plans

In 2010, the Board of Directors adopted the Management Severance Plan for Executives and the Willbros Group, Inc. 2010 Management Severance Plan for Senior Management (the “Senior Management MSP” and, collectively with the Management Severance Plan for Executives, the “U.S. Severance Plans”). The U.S. Severance Plans were adopted to provide assurance of severance benefits for terminated executive employees while better aligning our severance policies with current compensation trends. In 2014, the Board of Directors adopted the Management Severance Plan for Canadian Executives (the “Canadian MSP for Executives” and, collectively with the U.S. Severance Plans, the “Severance Plans”). Mr. Kappel, Mr. Priest and Ms. Freeman are participants in the Management Severance Plan for Executives. Prior to his resignation in January 2018, Mr. New was a participant in the Senior Management MSP. Mr. Fournier is a participant in the Canadian MSP for Executives. Under the Severance Plans, payment of change of control severance benefits is conditioned upon the occurrence of a “double trigger,” in which the executive is terminated not for cause or resigns for “good reason” within one year after a change of control. In addition, the U.S. Severance Plans provide that if the payments and benefits otherwise required under the plan would constitute an “excess parachute payment” under the Internal Revenue Code, then the payments and benefits will be “cut back” so that no portion of the amounts received by a participant will be subject to the excise tax imposed under Section 4999 of the Internal Revenue Code.

19

Table of Contents

Additional information with respect to payments which may be made under the Severance Plans is provided under “Potential Payments Upon Termination or Change in Control – Severance Plans.”

Clawback Policy

The Committee has adopted a clawback policy, which is intended to be interpreted in a manner consistent with any applicable rules or regulations to be adopted by the SEC or the New York Stock Exchange as contemplated by the Dodd-Frank Act. The policy provides that in the event of an accounting restatement due to material non-compliance with the financial reporting requirements under U.S. federal securities laws, the Committee has the right to use reasonable efforts to recover from any of our current or former executive officers who received incentive-based compensation during the three-year period preceding the date on which we are required to prepare an accounting restatement any excess incentive-based compensation awarded as a result of the misstatement.

Compensation Program as it Relates to Risk

We have reviewed our compensation policies and practices for both executives and non-executives as they relate to risk and have determined that they are not reasonably likely to have a material adverse effect on us. In reaching this conclusion, we considered the various elements of our compensation program that are designed to help mitigate excessive risk taking, including:

| • | Components of Compensation: We use a mix of compensation elements including base salary, annual incentives and long-term incentives to avoid placing too much emphasis on any one component of compensation. |

| • | Annual Incentive: Our MIC Program does not allow for unlimited payouts. For the 2017 program, annual incentive payments cannot exceed 200 percent of base salary for Mr. Fournier, 150 percent of base salary for Messrs. Kappel, Priest and New, and 120 percent of base salary for Ms. Freeman. |

| • | Equity Awards: Our long-term incentive awards drive a long-term perspective and typically vest over a period of three or four years. Our performance-based long-term incentive awards are capped and cannot exceed 200 percent of target levels. |

| • | Committee Oversight: The Committee reviews and administers all awards under annual and long-term incentive plans. |

| • | Performance Measures: Our performance goal setting process is aligned with our business strategy, our mission, vision and values and the interests of our stockholders. |

| • | Clawback Policy: We have the ability to recover any excess incentive-based compensation awarded to any of our executive officers as a result of an accounting restatement due to material non-compliance with the reporting requirements under federal securities laws. |

| • | Stock Ownership and Retention Policy: Our Stock Ownership and Retention Policy requires our senior management to maintain a significant portion of their personal wealth in our common stock for the duration of their employment with us. |

| • | Hedging Policy: Our hedging policy requires our senior management to retain the full risks and rewards associated with owning our common stock with respect to all of the shares they are required to retain. |

Our compensation program is designed to motivate our Named Executives and other Company officers to achieve business objectives that generate stockholder returns and to encourage behaviors that are consistent with our values.

20

Table of Contents

Policy Regarding Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code generally limits to $1 million annually the federal income tax deduction that a publicly held corporation may claim for compensation payable to certain of its respective current and former executive officers, but that deduction limitation historically did not apply to performance-based compensation that met certain requirements. As part of the tax legislation passed in December 2017, Section 162(m) was amended, effective for taxable years beginning after December 31, 2017, to expand the scope of executive officers subject to the deduction limitation and also to eliminate the performance-based compensation exception, though the exception generally continues to be available on a “grandfathered” basis to compensation payable under a written binding contract in effect on November 2, 2017.

In determining compensation for our executive officers, the Committee considers the extent to which the compensation is deductible, including the effect of Section 162(m). In prior years, the Committee generally sought to structure our executive incentive compensation awards so that they qualified as performance-based compensation exempt from the Section 162(m) deduction limitation where doing so was consistent with our compensation objectives, but it reserved the right to award nondeductible compensation and often did so. The Committee continues to evaluate the changes to Section 162(m) and their significance to our compensation programs, but in any event its primary focus in its compensation decisions will remain on furthering our business objectives and not on whether compensation is deductible. The Committee has not at this time made any significant changes to our executive compensation program in response to the tax code changes.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis included in this Form 10-K with management of Willbros, and based on such review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Form 10-K.

| THE COMPENSATION COMMITTEE |

| Michael C. Lebens, Chairman |

| Phil D. Wedemeyer |

21

Table of Contents

Summary Compensation Table

The following table summarizes the total compensation earned by, or paid or awarded to, each of the named executive officers for the fiscal years ended December 31, 2017, 2016 and 2015. Mr. Welch resigned as Executive Vice President and Chief Financial Officer on August 30, 2017. Mr. Kappel was promoted to Senior Vice President and Chief Financial Officer on the same date.

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($)(1) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($)(2) |

Total ($) |

|||||||||||||||||||||||||||

| Michael J. Fournier |

2017 | 555,500 | — | 805,000 | — | — | — | 72,454 | (3) | 1,432,954 | ||||||||||||||||||||||||||

| President, Chief Executive |

2016 | 475,000 | — | 315,000 | — | — | — | 90,017 | 880,017 | |||||||||||||||||||||||||||

| Officer and Chief Operating Officer |

2015 | 458,565 | — | 537,500 | — | — | — | 58,140 | 1,054,205 | |||||||||||||||||||||||||||

| Jeffrey B. Kappel |

2017 | 247,170 | — | 116,725 | — | — | — | 4,390 | 368,285 | |||||||||||||||||||||||||||

| Senior Vice President and Chief Financial Officer |

||||||||||||||||||||||||||||||||||||

| Johnny M. Priest |

2017 | 430,000 | — | 193,200 | — | — | — | 35,545 | (4) | 658,745 | ||||||||||||||||||||||||||

| Executive Vice President and |

2016 | 430,000 | 86,000 | 114,000 | — | — | — | 39,899 | 669,899 | |||||||||||||||||||||||||||

| President, Utility T&D |

2015 | 430,000 | — | 238,350 | — | — | — | 25,826 | 694,176 | |||||||||||||||||||||||||||

| Linnie A. Freeman |

2017 | 343,750 | — | 193,200 | — | — | — | 1,625 | 538,575 | |||||||||||||||||||||||||||

| Senior Vice President and General Counsel |

||||||||||||||||||||||||||||||||||||

| Harry W. New(5) |

2017 | 320,000 | — | 153,500 | — | — | — | 19,437 | (6) | 492,937 | ||||||||||||||||||||||||||

| Senior Vice President and |

2016 | 320,000 | 64,000 | 114,000 | — | — | — | 13,125 | 511,125 | |||||||||||||||||||||||||||

| President, Oil & Gas |

2015 | 298,256 | — | 173,450 | — | — | — | — | 471,706 | |||||||||||||||||||||||||||

| Van A. Welch |

2017 | 314,931 | — | 257,600 | — | — | — | 33,896 | (7) | 606,427 | ||||||||||||||||||||||||||

| Former Executive Vice President |

2016 | 475,000 | — | 162,400 | — | — | — | 36,631 | 674,031 | |||||||||||||||||||||||||||

| and Chief Financial Officer |

2015 | 458,178 | — | 253,250 | — | — | — | 27,456 | 738,884 | |||||||||||||||||||||||||||

| (1) | These amounts in the Stock Awards column reflect the aggregate grant date fair value of stock awards computed in accordance with FASB ASC Topic 718. Amounts have not been adjusted for expected forfeitures. The assumptions used to value the stock awards are included in Note 12 to our consolidated financial statements contained in the Original Filing. The amounts shown do not represent amounts paid to such executive officers. |

| (2) | The amounts shown for 2017 include contributions by the Company to our 401(k) Plan in the amount of $4,390 for Mr. Kappel, $1,625 for Ms. Freeman, $6,400 for Mr. New and $4,750 for Mr. Welch and contributions by the Company to our retirement savings plan for Canadian employees in the amount of $13,666 for Mr. Fournier. |

| (3) | In addition to the item included in footnote (2) above, the amount for Mr. Fournier includes expenses related to a corporate apartment in Houston, Texas paid by the Company and $41,037 of commuting expenses for travel between Houston, Texas and Mr. Fournier’s home in Calgary, Alberta, Canada. For compensation purposes, we calculate the aggregate incremental cost of travel expenses incurred in Canadian dollars based on the average exchange rate in effect for 2017. |

| (4) | The amount for Mr. Priest includes expenses related to a corporate apartment in Fort Worth, Texas paid by the Company, commuting expenses for travel between Fort Worth, Texas and Mr. Priest’s home in North Carolina and a leased vehicle. |

| (5) | Mr. New resigned as Senior Vice President and President, Oil & Gas on January 12, 2018. |

| (6) | In addition to the item included in footnote (2) above, the amount for Mr. New includes a leased vehicle. |

| (7) | In addition to the item included in footnote (2) above, the amount for Mr. Welch includes $28,304 of expenses related to a corporate apartment in Houston, Texas paid by the Company and payment of car services. |

22

Table of Contents

Grants of Plan-Based Awards During 2017

The following table provides information about stock and option awards and non-equity and equity incentive plan awards granted to our named executive officers during the year ended December 31, 2017. There can be no assurance that the Grant Date Fair Value of Stock and Option Awards will ever be realized.

| Name |

Grant Date |

Estimated Possible Payouts Under Non-Equity Incentive Plan Awards |

Estimated Future Payouts Under Equity Incentive Plan Awards |

All Other Stock Awards: Number of Shares of Stock |

All Other Option Awards: Number of Securities Underlying |

Exercise or Base Price of Option |

Grant Date Fair Value of Stock and Option |

|||||||||||||||||||||||||||||||||||||

| Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

or Units (#)(1) |

Options (#) |

Awards ($ / Sh) |

Awards ($) |

|||||||||||||||||||||||||||||||||||

| Michael J. Fournier |

0 | 306,500 | 1,226,000 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | 0 | 187,500 | 375,000 | — | — | — | 650,625 | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | — | — | — | 62,500 | — | — | 154,375 | ||||||||||||||||||||||||||||||||||

| Jeffrey B. Kappel |

0 | 150,000 | 450,000 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | — | — | — | 7,500 | — | — | 18,525 | ||||||||||||||||||||||||||||||||||

| 8/30/17 | — | — | — | 0 | 30,000 | 60,000 | — | — | — | 92,700 | ||||||||||||||||||||||||||||||||||

| 8/30/17 | — | — | — | — | — | — | 2,500 | — | — | 5,500 | ||||||||||||||||||||||||||||||||||

| Johnny M. Priest |

0 | 215,000 | 645,000 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | — | — | — | 15,000 | — | — | 37,050 | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | 0 | 45,000 | 90,000 | — | — | — | 156,150 | ||||||||||||||||||||||||||||||||||

| Linnie A. Freeman |

0 | 175,000 | 420,000 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | — | — | — | 15,000 | — | — | 37,050 | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | 0 | 45,000 | 90,000 | — | — | — | 156,150 | ||||||||||||||||||||||||||||||||||

| Harry W. New |

0 | 160,000 | 480,000 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | — | — | — | 20,000 | — | — | 49,400 | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | 0 | 30,000 | 60,000 | — | — | — | 104,100 | ||||||||||||||||||||||||||||||||||

| Van A. Welch |

0 | 237,500 | 712,500 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | — | — | — | 20,000 | — | — | 49,400 | ||||||||||||||||||||||||||||||||||

| 6/1/17 | — | — | — | 0 | 60,000 | 120,000 | — | — | — | 208,200 | ||||||||||||||||||||||||||||||||||

| (1) | These stock awards were granted under our 2017 Stock Plan and are described in the Outstanding Equity Awards at Fiscal Year-End for 2017 table below. |

23

Table of Contents

Outstanding Equity Awards at Fiscal Year-End for 2017

The following table summarizes the option and stock awards that we have made to our named executive officers, which were outstanding as of December 31, 2017.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#)(1) |

Market Value of Shares or Units of Stock That Have Not Vested ($)(1)(2) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)(1)(3) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(2) |